SQI Diagnostics Plattform vor dem Durchbruch - 500 Beiträge pro Seite

eröffnet am 31.10.13 15:06:40 von

neuester Beitrag 22.11.17 14:16:01 von

neuester Beitrag 22.11.17 14:16:01 von

Beiträge: 120

ID: 1.187.833

ID: 1.187.833

Aufrufe heute: 0

Gesamt: 36.582

Gesamt: 36.582

Aktive User: 0

ISIN: CA78466B1085 · WKN: A0N9K5 · Symbol: SQIDF

0,0149

USD

+14,62 %

+0,0019 USD

Letzter Kurs 15.06.23 Nasdaq OTC

Neuigkeiten

Werte aus der Branche Gesundheitswesen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2800 | +73,21 | |

| 0,7400 | +38,58 | |

| 3,2100 | +24,90 | |

| 0,5501 | +18,33 | |

| 0,6080 | +18,06 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5925 | -15,36 | |

| 1,5500 | -19,27 | |

| 2,9500 | -20,05 | |

| 0,9102 | -42,03 | |

| 0,7500 | -48,98 |

Heute vermeldet SQI (http://www.sqidiagnostics.com/) eine Entwicklungskooperation mit ISIS Pharma, was der erste relevante Kunde für die über 5 Jahre lang entwickelte Plattform-Technologie ist.

Hintergrund:

SQI Diagnostics (SQD) reduces the development costs for large pharmaceuticals, labs and clinics. Using SQI’s multiplex and automation technology, it allows labs to generate test results faster, more accurately and with far less labor than current methods allow

The company has been running like a private deal for the last 4-5 years, as they have worked to develop their proprietary technology. Their technology has been approved by the FDA, Health Canada and has been CE Marked for Europe. This same, approved technology is the basis for the tests sold to drug companies and that is now ready to be sold. The time has finally come to market their products and start building some real revenues for the company and most importantly, increase valuations for shareholders.

This is a huge market. Industry analysts estimate that it takes well over $4 billion and many years to develop a new drug. Over this time, a pharma company will run 10,000s of tests examining 100s of blood-based biomarkers. As per the company’s latest news releases[1], they are currently undergoing talks and due diligence processes with several large global pharmaceutical companies. It has signed two master services agreements and appears to be poised to sign more in the coming quarters. One very large pharma company, Bristol Myers Squibb, invited SQI to its vendor only trade show (September 10-11, 2013) (2) and BMS is also presenting the results of evaluating SQI’s technology at an important industry trade show taking place October 7 to 9, 2013(2).

Hier die heutige Meldung:

SQI Diagnostics Announces Agreement with Isis Pharmaceuticals

http://finance.yahoo.com/news/sqi-diagnostics-announces-agre…

SQI ist somit nun in die Vermarktungsphase eingetreten und steht damit vor dem Durchbruch. Die Aktie erscheint entsprechend langfristig aussichtsreich.

xqx

Hintergrund:

SQI Diagnostics (SQD) reduces the development costs for large pharmaceuticals, labs and clinics. Using SQI’s multiplex and automation technology, it allows labs to generate test results faster, more accurately and with far less labor than current methods allow

The company has been running like a private deal for the last 4-5 years, as they have worked to develop their proprietary technology. Their technology has been approved by the FDA, Health Canada and has been CE Marked for Europe. This same, approved technology is the basis for the tests sold to drug companies and that is now ready to be sold. The time has finally come to market their products and start building some real revenues for the company and most importantly, increase valuations for shareholders.

This is a huge market. Industry analysts estimate that it takes well over $4 billion and many years to develop a new drug. Over this time, a pharma company will run 10,000s of tests examining 100s of blood-based biomarkers. As per the company’s latest news releases[1], they are currently undergoing talks and due diligence processes with several large global pharmaceutical companies. It has signed two master services agreements and appears to be poised to sign more in the coming quarters. One very large pharma company, Bristol Myers Squibb, invited SQI to its vendor only trade show (September 10-11, 2013) (2) and BMS is also presenting the results of evaluating SQI’s technology at an important industry trade show taking place October 7 to 9, 2013(2).

Hier die heutige Meldung:

SQI Diagnostics Announces Agreement with Isis Pharmaceuticals

http://finance.yahoo.com/news/sqi-diagnostics-announces-agre…

SQI ist somit nun in die Vermarktungsphase eingetreten und steht damit vor dem Durchbruch. Die Aktie erscheint entsprechend langfristig aussichtsreich.

xqx

Antwort auf Beitrag Nr.: 45.733.187 von M@trix am 31.10.13 15:06:40

Hört sich 'at a first glance' nicht uninteressant an(soweit ich weiss gibt es da auch noch einige ähnliche Firmen/Entwickler). Frage ist dann aber immer auch was/ob sich damit wirklich verdienen lässt.

Gruß

P.

Hört sich 'at a first glance' nicht uninteressant an(soweit ich weiss gibt es da auch noch einige ähnliche Firmen/Entwickler). Frage ist dann aber immer auch was/ob sich damit wirklich verdienen lässt.

Gruß

P.

SQI hat einen neuen Vertrag mit einem „globalen Pharmaunternehmen“ abgeschlossen:

http://finance.yahoo.com/news/sqi-diagnostics-wins-commercia…

Ich denke mal, es wird sich dabei um Allergan [AGN] handeln. Aus meiner Sicht ein weiterer wichtiger Schritt zur Kommerzialisierung der Produkte. 2014 könnte – wie im Titel des Threads geschrieben – der Durchbruch erfolgen. Das sieht auch der CEO so:

[...] "We believe that when we successfully complete this project, during the first calendar quarter of 2014, we will be in an excellent position to win the on-going consumable and instrument business for the human trials for this drug as well as additional ADA projects and biomarker business with this customer." The Company believes that the on-going conversion of previously announced major pharmaceutical customers in its sales pipeline that have evaluated, or who are in the process of evaluating SQI's custom and off-the-shelf biomarker products to be a catalyst leading to wider market adoption of its Diagnostics Tools and Services products. [...]

Mit einem Börsenwert von gerade mal 15 Mio. EUR ist das Unternehmen aus meiner Sicht recht günstig bewertet, wenn man sich klar macht, welche Zeit- und Kosteneinsparungen die marktreife Technologie den großen Pharma-Unternehmen ermöglicht. Näheres dazu auch in der Unternehmenspräsentation:

http://www.sqidiagnostics.com/about/files/sqi-ir-deck.pdf

Ich habe heute meine Position um 5.000 St. ausgebaut. Der Wert wird extrem dünn gehandelt, sodass bei Interesse in jedem Fall limitiert geordert werden sollte.

M@trix

http://finance.yahoo.com/news/sqi-diagnostics-wins-commercia…

Ich denke mal, es wird sich dabei um Allergan [AGN] handeln. Aus meiner Sicht ein weiterer wichtiger Schritt zur Kommerzialisierung der Produkte. 2014 könnte – wie im Titel des Threads geschrieben – der Durchbruch erfolgen. Das sieht auch der CEO so:

[...] "We believe that when we successfully complete this project, during the first calendar quarter of 2014, we will be in an excellent position to win the on-going consumable and instrument business for the human trials for this drug as well as additional ADA projects and biomarker business with this customer." The Company believes that the on-going conversion of previously announced major pharmaceutical customers in its sales pipeline that have evaluated, or who are in the process of evaluating SQI's custom and off-the-shelf biomarker products to be a catalyst leading to wider market adoption of its Diagnostics Tools and Services products. [...]

Mit einem Börsenwert von gerade mal 15 Mio. EUR ist das Unternehmen aus meiner Sicht recht günstig bewertet, wenn man sich klar macht, welche Zeit- und Kosteneinsparungen die marktreife Technologie den großen Pharma-Unternehmen ermöglicht. Näheres dazu auch in der Unternehmenspräsentation:

http://www.sqidiagnostics.com/about/files/sqi-ir-deck.pdf

Ich habe heute meine Position um 5.000 St. ausgebaut. Der Wert wird extrem dünn gehandelt, sodass bei Interesse in jedem Fall limitiert geordert werden sollte.

M@trix

Edison Investment Research has published an report on SQI Diagnostics (SQD.V). Edison is one of Europe’s largest independent equity research firms with worldwide distribution.

Edison puts a valuation on the stock. According to the report:

“We [Edison] value SQI at C$70m, or $1.55 per share, based on a five-year (2014-18), risk adjusted, sum-of-the-parts DCF valuation model.” The author later goes on to explain that “The C$1.55 per share value is not a price target but a fair value for the stock today. Upside would come from a more rapid uptake of assays and machines from pharma customers and centralized laboratories than we [Edison] currently model. This would also increase the probabilities of success for securing new business in later years, resulting in a higher valuation.”

http://my.alphastox.com/wp-content/uploads/2014/01/Edison-Re…

Weniger erfreulich:

"but a ~C$4m funding requirement is an overhang"

Dennoch sollte 2014 für SQI den Durchbruch und für die Aktie eine Neubewertung bringen.

Edison puts a valuation on the stock. According to the report:

“We [Edison] value SQI at C$70m, or $1.55 per share, based on a five-year (2014-18), risk adjusted, sum-of-the-parts DCF valuation model.” The author later goes on to explain that “The C$1.55 per share value is not a price target but a fair value for the stock today. Upside would come from a more rapid uptake of assays and machines from pharma customers and centralized laboratories than we [Edison] currently model. This would also increase the probabilities of success for securing new business in later years, resulting in a higher valuation.”

http://my.alphastox.com/wp-content/uploads/2014/01/Edison-Re…

Weniger erfreulich:

"but a ~C$4m funding requirement is an overhang"

Dennoch sollte 2014 für SQI den Durchbruch und für die Aktie eine Neubewertung bringen.

Aus dem MD&A von SQI:

"We anticipate that the successful evaluation projects completed in fiscal 2013 and early 2014 will proceed to the next expected commercial phase, where SQI will produce and sell test kits for either its fully automated sqidlite or semi-automated sqid-X platform. One case could result in the purchase of the custom product for use on an SQI platform in a portion of the customer’s human clinical trials and, in the other case, we believe that this customer has initiated the internal processes to acquire a sqidlite platform and will likely purchase the custom developed kits to process samples generated by their clinical testing studies."

Mit anderen Worten: wir stehen nun unmittelbar vor den ersten "echten Umsätzen". Leider ist der Wert selbst in Kanada so gut wie unbekannt und zudem sehr markteng. Umso fulminanter könnte jedoch die Entwicklung in 2014 werden...

Weniger schön aber auch nicht anders zu erwarten:

"As a result of the financing and additional cost reductions the Company now has funds sufficient to meet our anticipated cash requirements for approximately the next four months."

Mal sehen - ich bleibe zuversichtlich.

"We anticipate that the successful evaluation projects completed in fiscal 2013 and early 2014 will proceed to the next expected commercial phase, where SQI will produce and sell test kits for either its fully automated sqidlite or semi-automated sqid-X platform. One case could result in the purchase of the custom product for use on an SQI platform in a portion of the customer’s human clinical trials and, in the other case, we believe that this customer has initiated the internal processes to acquire a sqidlite platform and will likely purchase the custom developed kits to process samples generated by their clinical testing studies."

Mit anderen Worten: wir stehen nun unmittelbar vor den ersten "echten Umsätzen". Leider ist der Wert selbst in Kanada so gut wie unbekannt und zudem sehr markteng. Umso fulminanter könnte jedoch die Entwicklung in 2014 werden...

Weniger schön aber auch nicht anders zu erwarten:

"As a result of the financing and additional cost reductions the Company now has funds sufficient to meet our anticipated cash requirements for approximately the next four months."

Mal sehen - ich bleibe zuversichtlich.

Ich war so frei und hab mal wieder was für meinen Blog geschrieben, das ich hier gerne (mit)teile:

SQI Diagnostics vor Neubewertung

Wenn ein Unternehmen mit seinen Produkten unmittelbar vor der erfolgreichen Kommerzialisierung steht, ist das oft ein guter Moment, zu investieren. Ist die Aktie dazu noch nahezu unbekannt, ist die Chance auf einen günstigen Einstieg besonders hoch. Diesen seltenen Fall haben wir derzeit bei SQI Diagnostics, einem kanadischen Medizintechnik-Unternehmen. Kernkompetenz sind vollautomatische Analysen aus einer einzigen biologischen Probe (z.B. Blut), sogenannte Multiplex-Tests.

SQI hat über fünf Jahre an seiner Technologie gearbeitet und über 45 Millionen USD darin investiert. Mögliche Einsatzbereiche sind Diagnostische Labore sowie die Produktentwicklung von Pharma-Unternehmen, die durch den Einsatz der SQI-Produkte bis zu 40% ihrer Labor-Kosten reduzieren und schnellere sowie bessere Daten generieren können. SQI schätzt das Marktvolumen für Multiplex-Tests allein in Europa und den USA auf 2 Mrd. USD.

Im vergangenen Jahr wurden vier “Master Service Agreements” mit großen Pharma-Unternehmen geschlossen, um diese von den Produkten zu überzeugen. Prototypen wurden entwickelt und binnen weniger Wochen sollten nun daraus konkrete Abschlüsse hervorgehen. Allein diese vier Pharma-Unternehmen, darunter ISIS Pharmaceuticals und Allergan, haben 112 Medikamente in der Entwicklung. Für jedes dieser Medikamente liegt das Umsatzpotenzial von SQI zwischen einigen hunderttausend bis zu über einer Millionen US-Dollar. Und man kann mit einer gewissen Wahrscheinlichkeit davon ausgehen, dass nach Abschluss der ersten Deals weitere wesentlich leichter zu erreichen sein werden.

Die großen Pharma-Unternehmen müssen Kosten sparen. Und sie müssen auch alles tun, um die Entwicklung neuer Medikamente zu beschleunigen. Wenn ein Gigant wie Bristol-Myers Squibb öffentlich bekannt macht, dass die SQI-Technologie überlegen ist, dann hat das schon etwas von einem “Ritter-Schlag”.

Mit einem Börsenwert von gerade mal 25 Mio. CAD erscheint mir das Unternehmen recht günstig bewertet. Zwar wird SQI in 2014 noch Verluste ausweisen, doch es dürften erstmals seit Gründung relevante Umsätze verzeichnet werden. 2015 sollte dann der “große Sprung” einsetzen, den die Börse jedoch schon in 2014 antizipieren dürfte. Ich kann der (bezahlten) Bewertung von Edison Research einiges abgewinnen, die den fairen Unternehmenswert bei 70 Mio. CAD sehen. Das würde einem Kurs von 1,45 CAD entsprechen.

Ich habe entsprechend in den vergangenen Wochen eine mittelfristig ausgerichtete Position in Aktien von SQI Diagnostics aufgebaut und übe mich nun in Geduld. Die Aktie ist extrem markteng, sodass relevante Neuigkeiten sehr schnell zu einer Neubewertung führen können.

Daten:

SQI Diagnostics

Kurs: 0,52 CAD

Kürzel/ISIN: SQD.V / CA78466B1085

Bitte beachten Sie: Dies ist keine Anlageberatung. Sie sind für Ihre Wertpapiertransaktionen selbst verantwortlich.

---

Feedback immer willkommen!

M@trix

SQI Diagnostics vor Neubewertung

Wenn ein Unternehmen mit seinen Produkten unmittelbar vor der erfolgreichen Kommerzialisierung steht, ist das oft ein guter Moment, zu investieren. Ist die Aktie dazu noch nahezu unbekannt, ist die Chance auf einen günstigen Einstieg besonders hoch. Diesen seltenen Fall haben wir derzeit bei SQI Diagnostics, einem kanadischen Medizintechnik-Unternehmen. Kernkompetenz sind vollautomatische Analysen aus einer einzigen biologischen Probe (z.B. Blut), sogenannte Multiplex-Tests.

SQI hat über fünf Jahre an seiner Technologie gearbeitet und über 45 Millionen USD darin investiert. Mögliche Einsatzbereiche sind Diagnostische Labore sowie die Produktentwicklung von Pharma-Unternehmen, die durch den Einsatz der SQI-Produkte bis zu 40% ihrer Labor-Kosten reduzieren und schnellere sowie bessere Daten generieren können. SQI schätzt das Marktvolumen für Multiplex-Tests allein in Europa und den USA auf 2 Mrd. USD.

Im vergangenen Jahr wurden vier “Master Service Agreements” mit großen Pharma-Unternehmen geschlossen, um diese von den Produkten zu überzeugen. Prototypen wurden entwickelt und binnen weniger Wochen sollten nun daraus konkrete Abschlüsse hervorgehen. Allein diese vier Pharma-Unternehmen, darunter ISIS Pharmaceuticals und Allergan, haben 112 Medikamente in der Entwicklung. Für jedes dieser Medikamente liegt das Umsatzpotenzial von SQI zwischen einigen hunderttausend bis zu über einer Millionen US-Dollar. Und man kann mit einer gewissen Wahrscheinlichkeit davon ausgehen, dass nach Abschluss der ersten Deals weitere wesentlich leichter zu erreichen sein werden.

Die großen Pharma-Unternehmen müssen Kosten sparen. Und sie müssen auch alles tun, um die Entwicklung neuer Medikamente zu beschleunigen. Wenn ein Gigant wie Bristol-Myers Squibb öffentlich bekannt macht, dass die SQI-Technologie überlegen ist, dann hat das schon etwas von einem “Ritter-Schlag”.

Mit einem Börsenwert von gerade mal 25 Mio. CAD erscheint mir das Unternehmen recht günstig bewertet. Zwar wird SQI in 2014 noch Verluste ausweisen, doch es dürften erstmals seit Gründung relevante Umsätze verzeichnet werden. 2015 sollte dann der “große Sprung” einsetzen, den die Börse jedoch schon in 2014 antizipieren dürfte. Ich kann der (bezahlten) Bewertung von Edison Research einiges abgewinnen, die den fairen Unternehmenswert bei 70 Mio. CAD sehen. Das würde einem Kurs von 1,45 CAD entsprechen.

Ich habe entsprechend in den vergangenen Wochen eine mittelfristig ausgerichtete Position in Aktien von SQI Diagnostics aufgebaut und übe mich nun in Geduld. Die Aktie ist extrem markteng, sodass relevante Neuigkeiten sehr schnell zu einer Neubewertung führen können.

Daten:

SQI Diagnostics

Kurs: 0,52 CAD

Kürzel/ISIN: SQD.V / CA78466B1085

Bitte beachten Sie: Dies ist keine Anlageberatung. Sie sind für Ihre Wertpapiertransaktionen selbst verantwortlich.

---

Feedback immer willkommen!

M@trix

Antwort auf Beitrag Nr.: 46.542.443 von M@trix am 28.02.14 15:16:28

Der Blog ist ma abgespeichert.

Ich kann zu den meisten nichts konkret sagen(RGX eine Ausnahme), aber mach weiter so.

Gruß

P.

Der Blog ist ma abgespeichert.

Ich kann zu den meisten nichts konkret sagen(RGX eine Ausnahme), aber mach weiter so.

Gruß

P.

Antwort auf Beitrag Nr.: 46.496.037 von M@trix am 20.02.14 14:40:33

MD &A - Feb 14, 2014

http://sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=0002…

MD &A - Feb 14, 2014

http://sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=0002…

Antwort auf Beitrag Nr.: 46.239.061 von M@trix am 16.01.14 11:06:23

Das Edison Teil ist interessant.

Gruß

P.

Das Edison Teil ist interessant.

Gruß

P.

Antwort auf Beitrag Nr.: 46.239.061 von M@trix am 16.01.14 11:06:23

da kommt es.

SQI Diagnostics Announces Filing of Preliminary Prospectus - Mar 12, 2014

http://finance.yahoo.com/news/sqi-diagnostics-announces-fili…

" TORONTO , March 12, 2014 /CNW/ - SQI Diagnostics Inc. ("SQI" or the "Company") (SQD.V), a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced it has filed and received a receipt for a preliminary short form prospectus in connection with a proposed offering of units of the Company. Each unit will be comprised of one common share and a fraction of up to one common share purchase warrant. The offering will be pursued on a best efforts basis pursuant to an agency agreement to be entered into between the Company and Euro Pacific Canada Inc. (the "Agent") in each of the provinces of Ontario , British Columbia and Alberta . The number of units to be distributed under the offering, the price and composition of each unit and the exercise price of each common share purchase warrant will be determined in the context of the market by the Company and the Agent prior to filing the final short form prospectus.

SQI intends to use the net proceeds to fund the Company's product development and commercialization programs, sales and marketing and for general working capital purposes.

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and accordingly may not be offered or sold within the United States or to "U.S. persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act ("U.S. Persons"), except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This news release does not constitute an offer to sell or a solicitation of an offer to buy and of the Company's securities to, or for the account of benefit of, persons in the United States or U.S. Persons.

About SQI Diagnostics

SQI Diagnostics is a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. The Company's proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. For more information, please visit www.sqidiagnostics.com. "

da kommt es.

SQI Diagnostics Announces Filing of Preliminary Prospectus - Mar 12, 2014

http://finance.yahoo.com/news/sqi-diagnostics-announces-fili…

" TORONTO , March 12, 2014 /CNW/ - SQI Diagnostics Inc. ("SQI" or the "Company") (SQD.V), a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced it has filed and received a receipt for a preliminary short form prospectus in connection with a proposed offering of units of the Company. Each unit will be comprised of one common share and a fraction of up to one common share purchase warrant. The offering will be pursued on a best efforts basis pursuant to an agency agreement to be entered into between the Company and Euro Pacific Canada Inc. (the "Agent") in each of the provinces of Ontario , British Columbia and Alberta . The number of units to be distributed under the offering, the price and composition of each unit and the exercise price of each common share purchase warrant will be determined in the context of the market by the Company and the Agent prior to filing the final short form prospectus.

SQI intends to use the net proceeds to fund the Company's product development and commercialization programs, sales and marketing and for general working capital purposes.

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and accordingly may not be offered or sold within the United States or to "U.S. persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act ("U.S. Persons"), except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This news release does not constitute an offer to sell or a solicitation of an offer to buy and of the Company's securities to, or for the account of benefit of, persons in the United States or U.S. Persons.

About SQI Diagnostics

SQI Diagnostics is a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. The Company's proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. For more information, please visit www.sqidiagnostics.com. "

SQI Diagnostics Signs Commercial Agreement, with "Global Pharma Customer", SQI to Develop Custom 21-Plex Protein Microarray for Drug Epitope Mapping - Mar 19, 2014

http://sqidiagnostics.com/media/2014/sqi-diagnostics-signs-c…

"SQI Diagnostics Inc. (TSX-V: SQD), a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced that it has expanded its previously announced product development relationship with a global pharmaceutical company (“Global Pharma 1”) to develop a custom multiplex test to support the pharmaceutical company’s clinical drug development activities, through the entering into of a revenue-generating agreement with Global Pharma 1 to develop a 21-plex protein microarray.

Pharmaceutical companies expend substantial resources to better understand potential immune responses to the novel therapeutics they are developing. Under this new commercial agreement, SQI will develop a 21-plex protein microarray, based on the already completed prototype, for use in identifying specific immunogenic regions within a specific drug (also known as “epitope mapping”) during Global Pharma 1’s human clinical trials. The agreement for the second phase of the project includes both payment for services and for the consumables used during development and sample testing.

SQI recently successfully completed development of a series of multiplex anti-drug antibody (“ADA”) assays for Global Pharma 1 to detect and measure immunogenic responses to the drug during its pre-clinical development as part of the first phase of the project.

About SQI Diagnostics

SQI Diagnostics is a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. The Company’s proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. For more information, please visit www.sqidiagnostics.com.

SQI’s custom Ig_plex® tests and sqidlite™ automated testing equipment provide significant benefits to drug developers. SQI’s Ig_plex® products have been shown to significantly improve the sensitivity and other important performance metrics of ADA testing, ultimately resulting higher quality data. By decreasing the total number of tests performed through multiplexing, the total time required to process tests is reduced, resulting in reduced labour and testing timelines. In addition, considerably less blood volume is required from patient samples. These benefits can potentially have a significant impact on a customer’s total cost of testing in the clinical phases of the customer’s drug development programs.

Sales and Marketing Contact

Russ Peloquin

Vice President, Global Commercial Operations

913.484.9022

rpeloquin@sqidiagnostics.com

Investor Relations Contact

Andrew Morris

Chief Executive Officer

416.674.9500 ext. 229

amorris@sqidiagnostics.com

James Smith

VP Corporate Development

416.674.9500 ext. 241

jsmith@sqidiagnostics.com "

http://sqidiagnostics.com/media/2014/sqi-diagnostics-signs-c…

"SQI Diagnostics Inc. (TSX-V: SQD), a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced that it has expanded its previously announced product development relationship with a global pharmaceutical company (“Global Pharma 1”) to develop a custom multiplex test to support the pharmaceutical company’s clinical drug development activities, through the entering into of a revenue-generating agreement with Global Pharma 1 to develop a 21-plex protein microarray.

Pharmaceutical companies expend substantial resources to better understand potential immune responses to the novel therapeutics they are developing. Under this new commercial agreement, SQI will develop a 21-plex protein microarray, based on the already completed prototype, for use in identifying specific immunogenic regions within a specific drug (also known as “epitope mapping”) during Global Pharma 1’s human clinical trials. The agreement for the second phase of the project includes both payment for services and for the consumables used during development and sample testing.

SQI recently successfully completed development of a series of multiplex anti-drug antibody (“ADA”) assays for Global Pharma 1 to detect and measure immunogenic responses to the drug during its pre-clinical development as part of the first phase of the project.

About SQI Diagnostics

SQI Diagnostics is a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. The Company’s proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. For more information, please visit www.sqidiagnostics.com.

SQI’s custom Ig_plex® tests and sqidlite™ automated testing equipment provide significant benefits to drug developers. SQI’s Ig_plex® products have been shown to significantly improve the sensitivity and other important performance metrics of ADA testing, ultimately resulting higher quality data. By decreasing the total number of tests performed through multiplexing, the total time required to process tests is reduced, resulting in reduced labour and testing timelines. In addition, considerably less blood volume is required from patient samples. These benefits can potentially have a significant impact on a customer’s total cost of testing in the clinical phases of the customer’s drug development programs.

Sales and Marketing Contact

Russ Peloquin

Vice President, Global Commercial Operations

913.484.9022

rpeloquin@sqidiagnostics.com

Investor Relations Contact

Andrew Morris

Chief Executive Officer

416.674.9500 ext. 229

amorris@sqidiagnostics.com

James Smith

VP Corporate Development

416.674.9500 ext. 241

jsmith@sqidiagnostics.com "

Ja, es geht voran - nur nicht beim Kurs. Indes ist die Aktie sehr illiquide. Ich nehme an, es wird irgendwann ein Tag kommen, an dem eine sehr publikumswirksame Empfehlung die Aktie binnen weniger Tage auf deutlich über 1,00 CAD steigen lassen wird.

Generell wäre m.E. für SQI ein Listing an der Nasdaq sehr vorteilhaft. Ich frage mal nach, ob so etwas geplant ist.

Auf sedar wurden übrigens "Marketing-Unterlagen" veröffentlicht. SQI sucht offensichtlich einen Investor...

Generell wäre m.E. für SQI ein Listing an der Nasdaq sehr vorteilhaft. Ich frage mal nach, ob so etwas geplant ist.

Auf sedar wurden übrigens "Marketing-Unterlagen" veröffentlicht. SQI sucht offensichtlich einen Investor...

Antwort auf Beitrag Nr.: 46.674.345 von M@trix am 21.03.14 14:17:56

Ich hab mir Edison mal reingehauen und die sind ja, kurszieltechnisch, von einigen ANnahmen ausgegangen/von abhängig.

Bis dahin wäre es noch ein gutes STück Weg. Da muss man schon bisschen rechnen, mit den 3 verschiedenen Geräten.

Für mich, bis jetzt, nichts.

"Publikumswirksame" EMpfehlungen sind mir Sch....nurzegal, bin eigentlich sogar eher dagegen.

Entweder ne Firma schafft es, oder das ist eh nur stupid money.

Gruß

P.

Ich hab mir Edison mal reingehauen und die sind ja, kurszieltechnisch, von einigen ANnahmen ausgegangen/von abhängig.

Bis dahin wäre es noch ein gutes STück Weg. Da muss man schon bisschen rechnen, mit den 3 verschiedenen Geräten.

Für mich, bis jetzt, nichts.

"Publikumswirksame" EMpfehlungen sind mir Sch....nurzegal, bin eigentlich sogar eher dagegen.

Entweder ne Firma schafft es, oder das ist eh nur stupid money.

Gruß

P.

Hallo Popeye82,

die Empfehlungen sind nicht unwichtig, denn sie schaffen Liquidität und Bekanntheit. Beides ist auch für Institutionelle wichtig. Zudem vereinfacht es die Aufnahme von Kapital, ohne extrem verwässern zu müssen.

Wir werden sehen - ich bleibe dabei. Das Unternehmen hat Top Leute an Board und dass sie auch Abschlüsse erreichen können, hat sich nun auch gezeigt. Ich denke, in 12-18 Monaten wird SQI völlig anders bewertet als jetzt.

Beste Grüße,

M@trix

die Empfehlungen sind nicht unwichtig, denn sie schaffen Liquidität und Bekanntheit. Beides ist auch für Institutionelle wichtig. Zudem vereinfacht es die Aufnahme von Kapital, ohne extrem verwässern zu müssen.

Wir werden sehen - ich bleibe dabei. Das Unternehmen hat Top Leute an Board und dass sie auch Abschlüsse erreichen können, hat sich nun auch gezeigt. Ich denke, in 12-18 Monaten wird SQI völlig anders bewertet als jetzt.

Beste Grüße,

M@trix

Antwort auf Beitrag Nr.: 46.623.675 von Popeye82 am 13.03.14 16:49:14

SQI Diagnostics Completes $4.200.000 Equity Financing - Apr 10, 2014

http://finance.yahoo.com/news/sqi-diagnostics-completes-4-2-…

"TORONTO, April 10, 2014 /PRNewswire/ - SQI Diagnostics Inc. ("SQI" or the "Company") (SQD.V), a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced that it has closed its previously announced public offering (the "Offering"). Pursuant to the Offering, SQI issued 8,400,000 units of the Company ("Units") at a price of C$0.50 per Unit for gross proceeds of C$4.2 million. Each Unit is comprised of one common share of the Company (a "Common Share") and one Common Share purchase warrant (a "Warrant"). Each Warrant is exercisable at a price of C$0.65 and entitles the holder thereof to acquire one Common Share until April 10, 2016.

The Units were issued pursuant to an agency agreement the Company entered into with Euro Pacific Canada Inc. (the "Agent"). H.C. Wainwright & Co., LLC and Kingsdale Capital Markets Inc. formed part of the selling group, and H.C. Wainwright & Co., LLC acted as lead U.S. placement agent. The Company paid the Agent a fee equal to 7% of the gross proceeds raised ($0.035 per unit) and issued compensation options to acquire up to that number of Common Shares as is equal to 7% of the number of Units issued pursuant to the Offering at the offering price until April 10, 2016.

SQI intends to use the net proceeds to fund the Company's product development and commercialization programs, sales and marketing and for general working capital purposes.

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and accordingly may not be offered or sold within the United States or to "U.S. persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act ("U.S. Persons"), except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the Company's securities to, or for the account of benefit of, persons in the United States or U.S. Persons.

About SQI Diagnostics

SQI Diagnostics is a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. The Company's proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. For more information, please visit www.sqidiagnostics.com. "

SQI Diagnostics Completes $4.200.000 Equity Financing - Apr 10, 2014

http://finance.yahoo.com/news/sqi-diagnostics-completes-4-2-…

"TORONTO, April 10, 2014 /PRNewswire/ - SQI Diagnostics Inc. ("SQI" or the "Company") (SQD.V), a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced that it has closed its previously announced public offering (the "Offering"). Pursuant to the Offering, SQI issued 8,400,000 units of the Company ("Units") at a price of C$0.50 per Unit for gross proceeds of C$4.2 million. Each Unit is comprised of one common share of the Company (a "Common Share") and one Common Share purchase warrant (a "Warrant"). Each Warrant is exercisable at a price of C$0.65 and entitles the holder thereof to acquire one Common Share until April 10, 2016.

The Units were issued pursuant to an agency agreement the Company entered into with Euro Pacific Canada Inc. (the "Agent"). H.C. Wainwright & Co., LLC and Kingsdale Capital Markets Inc. formed part of the selling group, and H.C. Wainwright & Co., LLC acted as lead U.S. placement agent. The Company paid the Agent a fee equal to 7% of the gross proceeds raised ($0.035 per unit) and issued compensation options to acquire up to that number of Common Shares as is equal to 7% of the number of Units issued pursuant to the Offering at the offering price until April 10, 2016.

SQI intends to use the net proceeds to fund the Company's product development and commercialization programs, sales and marketing and for general working capital purposes.

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and accordingly may not be offered or sold within the United States or to "U.S. persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act ("U.S. Persons"), except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the Company's securities to, or for the account of benefit of, persons in the United States or U.S. Persons.

About SQI Diagnostics

SQI Diagnostics is a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. The Company's proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. For more information, please visit www.sqidiagnostics.com. "

.....hi.....

vom Hoch bei ca.2.- E runter auf 0,20.- der Markt zeigt was er bisher von dem Wert hält......Nichts.......Dabei ist das was SQI hat durchaus vorzeigbar......jetzt sollte mal definitif eine den Markt überzeugende Kooperation mit einem der Marktgrossen der Branche kommen,die sich auch in klingender Münze ausdrückt....das wäre doch ein Aufhorchsignal...

M.

vom Hoch bei ca.2.- E runter auf 0,20.- der Markt zeigt was er bisher von dem Wert hält......Nichts.......Dabei ist das was SQI hat durchaus vorzeigbar......jetzt sollte mal definitif eine den Markt überzeugende Kooperation mit einem der Marktgrossen der Branche kommen,die sich auch in klingender Münze ausdrückt....das wäre doch ein Aufhorchsignal...

M.

SQI Diagnostics Hired by 'Global Pharmaceutical Company', "one of the ten largest pharmaceutical companies in the world", to Develop Two Prototype Multiplex Immunoassays for Evaluation - May 20, 2014

http://sqidiagnostics.com/media/2014/sqi-diagnostics-hired-g…

"TORONTO, May 20, 2014 /CNW/ - SQI Diagnostics Inc. (TSX-V: SQD), a life sciences company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced it is being paid by one of the ten largest pharmaceutical companies in the world to develop and validate two custom multiplex anti-drug-antibody ("ADA") assays. This new customer will evaluate these two products using an established drug from its portfolio in order to assess the capabilities and performance of SQI's technologies.

"This is an important opportunity to establish SQI's capabilities with one of the largest customers in our industry, and highlights the growing interest for our technology and its ability to make drug development faster and more efficient," said Andrew Morris, CEO of SQI Diagnostics. "To date, our customer base includes four of the fifty largest pharmaceutical and biotech companies which have contracted SQI to develop custom assays for evaluation to facilitate their immunogenicity testing."

About SQI Diagnostics

SQI Diagnostics is a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. The Company's proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. For more information, please visit www.sqidiagnostics.com. "

http://sqidiagnostics.com/media/2014/sqi-diagnostics-hired-g…

"TORONTO, May 20, 2014 /CNW/ - SQI Diagnostics Inc. (TSX-V: SQD), a life sciences company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced it is being paid by one of the ten largest pharmaceutical companies in the world to develop and validate two custom multiplex anti-drug-antibody ("ADA") assays. This new customer will evaluate these two products using an established drug from its portfolio in order to assess the capabilities and performance of SQI's technologies.

"This is an important opportunity to establish SQI's capabilities with one of the largest customers in our industry, and highlights the growing interest for our technology and its ability to make drug development faster and more efficient," said Andrew Morris, CEO of SQI Diagnostics. "To date, our customer base includes four of the fifty largest pharmaceutical and biotech companies which have contracted SQI to develop custom assays for evaluation to facilitate their immunogenicity testing."

About SQI Diagnostics

SQI Diagnostics is a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. The Company's proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. For more information, please visit www.sqidiagnostics.com. "

Ich habe meine Position in SQI gestern erneut aufgestockt. Das Unternehmen ist auf dem richtigen Weg und die Aktie noch völlig unentdeckt. Insofern steigt der Wert des Unternehmens und es ist nur eine Frage der Zeit, bis der Kurs dies reflektiert.

Hier die m.E. sehr gelungene Investorenpräsentation:

http://sqidiagnostics.com/sites/default/files/SQI%20Website%…

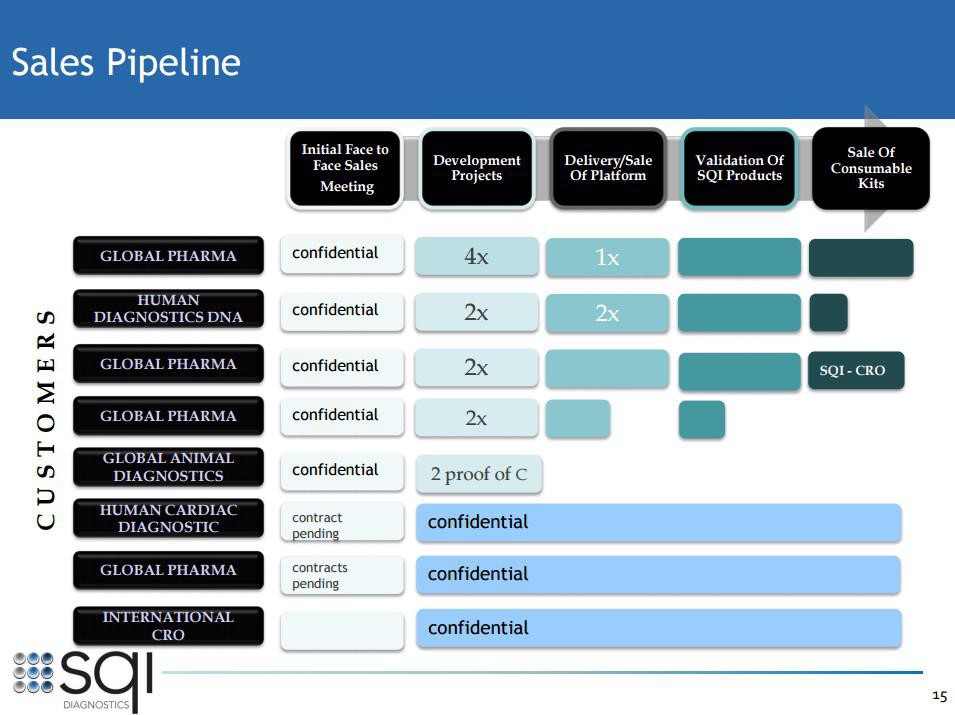

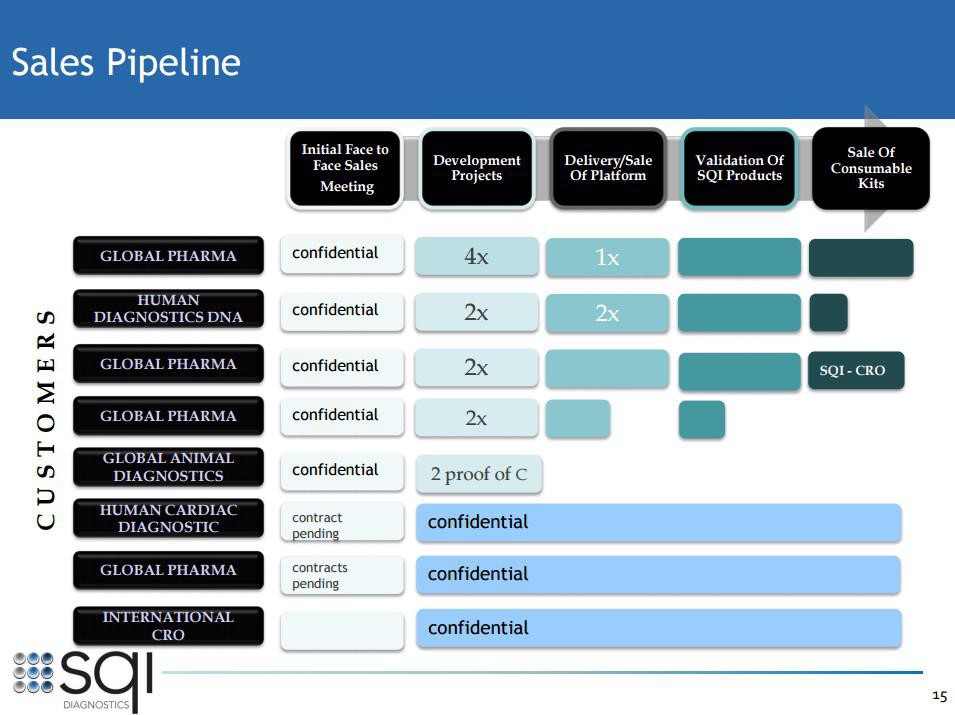

Man achte vor allem auf Folie 13. Da steckt noch immenses Potenzial bei den bereits bestehenden Kunden und natürlich sollte SQI auch weitere Neukunden gewinnen können.

Für die kommenden 12 Monate ist keine Kapitalerhöhung mehr zu erwarten. Demnach sollte von nun an jede positive Nachricht den Unternehmenswert weiter steigen lassen.

Ich halte auf Sicht eines Jahres durchaus Kursregionen um 1,00 CAD für möglich. Aktuell 0,40 CAD...

M@trix

Hier die m.E. sehr gelungene Investorenpräsentation:

http://sqidiagnostics.com/sites/default/files/SQI%20Website%…

Man achte vor allem auf Folie 13. Da steckt noch immenses Potenzial bei den bereits bestehenden Kunden und natürlich sollte SQI auch weitere Neukunden gewinnen können.

Für die kommenden 12 Monate ist keine Kapitalerhöhung mehr zu erwarten. Demnach sollte von nun an jede positive Nachricht den Unternehmenswert weiter steigen lassen.

Ich halte auf Sicht eines Jahres durchaus Kursregionen um 1,00 CAD für möglich. Aktuell 0,40 CAD...

M@trix

SQI building value - now best time to invest

Imho now is the best time to invest - I just bought again last Friday. Reasons:

1. $45 million invested in the superior technology - current market value of the whole company $22.5 million.

2. First revenues and gaining momentum – good indicator is hiring (current opportunities from website):

Life Sciences Business Manager, Northeast US

Development Associate

Assay Development Scientist

Manufacturing Technologist

3. Full pipeline with already existing customers (see investor presentation slide 13):

http://sqidiagnostics.com/sites/default/files/SQI%20Website%…

4. Market for multiplexed testing by North American and European pharmaceutical companies $2.0 billion => lots of space to grow.

5. Break even next year.

6. No need for capital for the next 12 months (= no further dilution).

7. SQI seeks a listing on the Nasdaq. I don't think this will happen this year, but 2015 seems possible.

8. Stock unknown and undiscovered - yet.

So at $0,40 it's an absolute bargain! You will remember my words...

http://www.stockhouse.com/companies/bullboard/v.sqd/sqi-diag…

Imho now is the best time to invest - I just bought again last Friday. Reasons:

1. $45 million invested in the superior technology - current market value of the whole company $22.5 million.

2. First revenues and gaining momentum – good indicator is hiring (current opportunities from website):

Life Sciences Business Manager, Northeast US

Development Associate

Assay Development Scientist

Manufacturing Technologist

3. Full pipeline with already existing customers (see investor presentation slide 13):

http://sqidiagnostics.com/sites/default/files/SQI%20Website%…

4. Market for multiplexed testing by North American and European pharmaceutical companies $2.0 billion => lots of space to grow.

5. Break even next year.

6. No need for capital for the next 12 months (= no further dilution).

7. SQI seeks a listing on the Nasdaq. I don't think this will happen this year, but 2015 seems possible.

8. Stock unknown and undiscovered - yet.

So at $0,40 it's an absolute bargain! You will remember my words...

http://www.stockhouse.com/companies/bullboard/v.sqd/sqi-diag…

Antwort auf Beitrag Nr.: 47.085.114 von M@trix am 02.06.14 11:51:38

Dieser Einschätzung schliesse ich mich, so, nicht an.

Gruß

P.

Dieser Einschätzung schliesse ich mich, so, nicht an.

Gruß

P.

Hallo Popeye82,

kannst du vielleicht kurz begründen, warum nicht?

Bin immer offen für Argumente, die meine Bewertung hinterfragen.

Grüße,

M@trix

kannst du vielleicht kurz begründen, warum nicht?

Bin immer offen für Argumente, die meine Bewertung hinterfragen.

Grüße,

M@trix

Antwort auf Beitrag Nr.: 47.090.802 von M@trix am 03.06.14 08:48:44

Weil Du an SQI Diagnostics interessiert bist, die Butze kannst Du Dir auch mal anschauen.

Von SeeThruEquity weiss ich auf jeden Fall dass sie über einige interessante bis hochinteressante (meist "development stage")Buden Recherche machen, bin da eingetragen.

"COTI is a leading-edge bioinformatics company specializing in accelerating the discovery and development of small molecules - dramatically reducing the time and cost to bring new drugs to market. COTI's proprietary artificial intelligence system, CHEMSAS(R), utilizes a series of predictive computer models to identify compounds with a high probability of being successfully developed from disease specific drug discovery through chemical optimization and preclinical testing. These compounds are targeted for a variety of diseases, particularly those for which current treatments are either lacking or ineffective. "

Critical Outcome Technologies - SeeThruEquity Initiates Research Coverage - Jun 13, 2014

http://media.wix.com/ugd/a15970_a457b590c6ed465a8ebeccfc812c…

Gruß

P.

Weil Du an SQI Diagnostics interessiert bist, die Butze kannst Du Dir auch mal anschauen.

Von SeeThruEquity weiss ich auf jeden Fall dass sie über einige interessante bis hochinteressante (meist "development stage")Buden Recherche machen, bin da eingetragen.

"COTI is a leading-edge bioinformatics company specializing in accelerating the discovery and development of small molecules - dramatically reducing the time and cost to bring new drugs to market. COTI's proprietary artificial intelligence system, CHEMSAS(R), utilizes a series of predictive computer models to identify compounds with a high probability of being successfully developed from disease specific drug discovery through chemical optimization and preclinical testing. These compounds are targeted for a variety of diseases, particularly those for which current treatments are either lacking or ineffective. "

Critical Outcome Technologies - SeeThruEquity Initiates Research Coverage - Jun 13, 2014

http://media.wix.com/ugd/a15970_a457b590c6ed465a8ebeccfc812c…

Gruß

P.

Hallo Matrix, Hallo Popeye82 schliessen sich die beiden Technologien SQI/COTI aus ?

Popeye / Matrix auf der ersten Seite sprecht ihr von Matrixs Blog...ähem wo kann ich denn den finden ? leider war da auf der ersten Seite kein Link.....

Popeye / Matrix auf der ersten Seite sprecht ihr von Matrixs Blog...ähem wo kann ich denn den finden ? leider war da auf der ersten Seite kein Link.....

Antwort auf Beitrag Nr.: 47.196.144 von boersehp am 23.06.14 20:22:27

Hallo boersehp,

Also ob sich die beiden 'ausschliessen' kann ich Dir aus dem Stand nicht sagen.

Matrix Blog müsste der hier sein, kann man auch in seinem Profil nachlesen.

http://boerseninfo.wordpress.com

Gruß´

P.

Hallo boersehp,

Also ob sich die beiden 'ausschliessen' kann ich Dir aus dem Stand nicht sagen.

Matrix Blog müsste der hier sein, kann man auch in seinem Profil nachlesen.

http://boerseninfo.wordpress.com

Gruß´

P.

Ich habe meinen Bestand in den letzten Tagen weiter ausgebaut. Sehr aufmerksam verfolge ich seit einigen Wochen die für das Unternehmen auffällig hohe Zahl an Stellenanzeigen (aktuell 4, folgende 2 kürzlich noch offene Stellen scheinen schon besetzt worden zu sein "Assay Development Scientist" und "Manufacturing Technologist"):

http://sqidiagnostics.com/about/careers

Mein Eindruck ist, dass hier bereits Aufträge "sicher" sind, aber noch nicht kommuniziert werden können/sollen. Man lese dazu auch den jüngsten Brief an die Investoren:

http://sqidiagnostics.com/sites/default/files/SQI%20Sharehol…

Auszüge:

"This new customer will evaluate these two products using one of its already established drugs in order to assess the capabilities and performance of SQI’s technologies. As such, this is an initial entry point into a much larger opportunity to provide ADA testing for one or more of the numerous early stage drug candidates in their development pipeline. It’s also an opportunity, should we prove ourselves, to sell other types of product and services to them."

"For another Pharma customer, SQI has progressed from their evaluation of ADA tests to a request from them to build a higher value “epitope mapping” test prototype. We recently delivered our initial data resulting from the prototype test development to the customer and we now await the results of their assessment. For a third Pharma customer, our relationship recently expanded in that they asked us to provide data reporting services to them in addition to the assay development work we are doing, providing additional revenue from them as we move forward with them to commercialize the prototype."

"With many programs ongoing with a range of customers, we have a substantial volume of work ahead of us to deliver on – it will not be a quiet summer at SQI!"

Nach meiner Einschätzung könnte es hier bald "Schlag auf Schlag" gehen - und das bei einer Aktie, die extrem markteng ist... Die Bewertung kann sich dann sehr schnell verdoppeln, zumal für die nächsten 11 Monate auch keine weitere Verwässerung droht.

Ergo: SQI ist nun meine größte Position überhaupt. Ich bin davon überzeugt, dass hier eine unentdeckte Perle liegt deren Entdeckung nur noch eine Frage von Monaten ist.

M@trix

http://sqidiagnostics.com/about/careers

Mein Eindruck ist, dass hier bereits Aufträge "sicher" sind, aber noch nicht kommuniziert werden können/sollen. Man lese dazu auch den jüngsten Brief an die Investoren:

http://sqidiagnostics.com/sites/default/files/SQI%20Sharehol…

Auszüge:

"This new customer will evaluate these two products using one of its already established drugs in order to assess the capabilities and performance of SQI’s technologies. As such, this is an initial entry point into a much larger opportunity to provide ADA testing for one or more of the numerous early stage drug candidates in their development pipeline. It’s also an opportunity, should we prove ourselves, to sell other types of product and services to them."

"For another Pharma customer, SQI has progressed from their evaluation of ADA tests to a request from them to build a higher value “epitope mapping” test prototype. We recently delivered our initial data resulting from the prototype test development to the customer and we now await the results of their assessment. For a third Pharma customer, our relationship recently expanded in that they asked us to provide data reporting services to them in addition to the assay development work we are doing, providing additional revenue from them as we move forward with them to commercialize the prototype."

"With many programs ongoing with a range of customers, we have a substantial volume of work ahead of us to deliver on – it will not be a quiet summer at SQI!"

Nach meiner Einschätzung könnte es hier bald "Schlag auf Schlag" gehen - und das bei einer Aktie, die extrem markteng ist... Die Bewertung kann sich dann sehr schnell verdoppeln, zumal für die nächsten 11 Monate auch keine weitere Verwässerung droht.

Ergo: SQI ist nun meine größte Position überhaupt. Ich bin davon überzeugt, dass hier eine unentdeckte Perle liegt deren Entdeckung nur noch eine Frage von Monaten ist.

M@trix

Antwort auf Beitrag Nr.: 47.262.478 von M@trix am 04.07.14 16:27:27

Ich wäre mit Deinen Now best time to invest Kommentaren ein bisschen vorsichtig.

Ich denke die sich einstellende Erfahrung wird mir Recht geben.

Gruß

P.

Ich wäre mit Deinen Now best time to invest Kommentaren ein bisschen vorsichtig.

Ich denke die sich einstellende Erfahrung wird mir Recht geben.

Gruß

P.

Antwort auf Beitrag Nr.: 47.196.144 von boersehp am 23.06.14 20:22:27

Also hab jetzt mal beide Recherchen durch.

Die verfolgen, technisch, ganz andere Ansätze und -bin ich mir nicht gaaanz sicher- dürften sich daher eher keine Zielgruppen wegnehmen.

Und selbst wenn, der Markt -der (Pharma)R&D Auslagerung, Abnahme/Erleichterung von Arbeiten- ist riesengroß, dass wäre denke ich praktisch eher so wenn man 2 Lachse in der Ostsee hat, und befürchtet dass die sich gegenseitig dass Futter wegnehmen.

Zwischen ich finde was, eine Anwendung, interessant und ist ein (klarer)Kauf liegen bei mir aber oft gewaaaltige Unterschiede.

Ich denke, wenn, führt kein Weg dran vorbei sich die Sachen an Denen sie arbeiten, wie CHEMSAS(R), genauer angucken.

Gruß

P.

Also hab jetzt mal beide Recherchen durch.

Die verfolgen, technisch, ganz andere Ansätze und -bin ich mir nicht gaaanz sicher- dürften sich daher eher keine Zielgruppen wegnehmen.

Und selbst wenn, der Markt -der (Pharma)R&D Auslagerung, Abnahme/Erleichterung von Arbeiten- ist riesengroß, dass wäre denke ich praktisch eher so wenn man 2 Lachse in der Ostsee hat, und befürchtet dass die sich gegenseitig dass Futter wegnehmen.

Zwischen ich finde was, eine Anwendung, interessant und ist ein (klarer)Kauf liegen bei mir aber oft gewaaaltige Unterschiede.

Ich denke, wenn, führt kein Weg dran vorbei sich die Sachen an Denen sie arbeiten, wie CHEMSAS(R), genauer angucken.

Gruß

P.

Danke und noch ein schönes Wochenende!

Antwort auf Beitrag Nr.: 47.196.144 von boersehp am 23.06.14 20:22:27@boersehyp

Critical Outcome Technologies ist ein Bioinformatik-Unternehmen, SQI eher ein hochspezialisierter Maschinenbauer. Aus meiner Sicht sind die beiden Unternehmen überhaupt nicht vergleichbar. COTI KÖNNTE längerfristig ein größerer Hit werden, ich sehe aber keine kurzfristigen Trigger und COTI hat nach meiner Einschätzung noch einen langen Weg vor sich. Bei SQI ist die Entwicklungsphase weitestgehend abgeschlossen und die Kommerzialisierungsphase hat begonnen. Der Nutzen des SQI-Produkte ist evident und durch große Pharma-Unternehmen verifiziert: geringere Kosten und schnelleres Vorankommen. Jetzt geht es eben drum, wirkliche Abschlüsse zu erzielen. Was mir bei SQI sehr gut gefällt ist, dass wenn sie einen Kunden gewinnen, man recht sicher davon ausgehen kann, dass das Geschäft sich nach und nach deutlich ausweiten lassen wird. Offen ist noch, wie profitabel das Geschäftsmodell ist. Ich erwarte den break-even auf Quartalsbasis in der zweiten Hälfte des kommenden Jahres. Sollte ich mit der Annahme richtig liegen, dürfte der Börsenwert 2-3 mal höher liegen als jetzt.

@Popeye82

Mal sehen. Ich habe rund 20 Jahre Börsenerfahrung, davon etwa 15 mit Small Caps. Insofern bin ich mir der Risiken/Unwägbarkeiten durchaus bewusst.

M@trix

Critical Outcome Technologies ist ein Bioinformatik-Unternehmen, SQI eher ein hochspezialisierter Maschinenbauer. Aus meiner Sicht sind die beiden Unternehmen überhaupt nicht vergleichbar. COTI KÖNNTE längerfristig ein größerer Hit werden, ich sehe aber keine kurzfristigen Trigger und COTI hat nach meiner Einschätzung noch einen langen Weg vor sich. Bei SQI ist die Entwicklungsphase weitestgehend abgeschlossen und die Kommerzialisierungsphase hat begonnen. Der Nutzen des SQI-Produkte ist evident und durch große Pharma-Unternehmen verifiziert: geringere Kosten und schnelleres Vorankommen. Jetzt geht es eben drum, wirkliche Abschlüsse zu erzielen. Was mir bei SQI sehr gut gefällt ist, dass wenn sie einen Kunden gewinnen, man recht sicher davon ausgehen kann, dass das Geschäft sich nach und nach deutlich ausweiten lassen wird. Offen ist noch, wie profitabel das Geschäftsmodell ist. Ich erwarte den break-even auf Quartalsbasis in der zweiten Hälfte des kommenden Jahres. Sollte ich mit der Annahme richtig liegen, dürfte der Börsenwert 2-3 mal höher liegen als jetzt.

@Popeye82

Mal sehen. Ich habe rund 20 Jahre Börsenerfahrung, davon etwa 15 mit Small Caps. Insofern bin ich mir der Risiken/Unwägbarkeiten durchaus bewusst.

M@trix

SQI Diagnostics Appoints Industry Veteran to its Board of Directors

TORONTO, July 15, 2014 /PRNewswire/ - SQI Diagnostics Inc. (SQD.V), a life sciences company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced it has appointed Dr. Allan Pronovost to its Board of Directors. SQI will also retain the services of Dr. Pronovost, as strategic advisor, where he will assist the Company in its efforts to secure strategic partnerships and/or additional capital to further advance the Company's IVD and Pharma business units. Dr. Pronovost has more than thirty years of experience in the field of innovative diagnostic testing.

"The extensive experience Allan brings to SQI is well-aligned with our strategic objectives. He has led the invention, development and commercialization of numerous innovative medical diagnostic tests, and also has a track record of success in providing diagnostic development services to Pharma and biotech companies," said Andrew Morris, CEO of SQI Diagnostics. "Dr. Pronovost will be an important advisor to SQI as we commercialize our products and services in the US and work to expand our current base of Pharma customers."

Dr. Pronovost is currently the President and CSO of Red Lion Chem Tech, a consortium of health related companies he founded over the past ten years, based in San Diego, California. He is also currently the Founder, Chairman and CEO of Stone Investments, LLC, an investment holding company. From 2003-2006, he was the President of the NID Division of Quest Diagnostics, the largest clinical diagnostic reference laboratory network in the world. Prior to this, from 1995-2006, he was Chairman and CEO of BioAlliances Group, LLC, a contract R&D and manufacturing company serving the Pharma and biotech industry, primarily in the development of novel diagnostic tests. From 1986-1995 he was the Vice President R&D at Quidel Corporation, San Diego and has also contributed in various roles at Ortho Clinical Diagnostics-Johnson & Johnson, DuPont, Eastman Kodak, Ansys Diagnostics and Trinity Biotech Holding PLC.

Dr. Pronovost has advanced 123 products from concept to market with commercial sales, including 74 FDA 510(K) Approved Medical Device products. He is credited with 63 issued patents or applications, and is an author of more than 80 publications including two books. Dr. Pronovost obtained his Ph.D. in Pathology at the University of Rhode Island and completed a Post-Doctoral Fellowship in Clinical Virology & Immunology at the Yale University School of Medicine and is certified in Clinical Laboratory Medicine.

Dr. Pronovost replaces Dr. Peter Lea who has resigned from the Board, effective immediately. Dr. Lea will continue as an active, non-voting senior advisor to the Board. Dr. Lea founded SQI Diagnostics in 1999 and invented and patented the core technology underpinning SQI's multiplexing microarray technology and is actively involved day to day in the role of Founder.

Dr. Pronovost will be granted options (the "Options") to purchase an aggregate of 300,000 common shares of the Corporation (the "Shares") at a price which is the greater of $0.40 per Share or the closing price per Share on the date hereof, pursuant to the Corporation's incentive stock option plan.

In addition, SQI has retained the services of Renmark Financial Communications Inc. ("Renmark") to provide the Company with investor relations services such as roadshow management, the organization of investor events and the distribution of corporate information. Renmark does not have any interest, directly or indirectly, in SQI Diagnostics or its securities, or any right or intent to acquire such an interest. The Company will pay to Renmark a monthly retainer of $5,000. The term of the agreement with Renmark is on a month-to-month basis, and the agreement can be terminated by either party by giving 30 days' written notice to the other party.

http://finance.yahoo.com/news/sqi-diagnostics-appoints-indus…

Wie mir scheint eine hochkarätige Ergänzung mit gutem Netzwerk und großem Erfahrungsschatz.

TORONTO, July 15, 2014 /PRNewswire/ - SQI Diagnostics Inc. (SQD.V), a life sciences company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced it has appointed Dr. Allan Pronovost to its Board of Directors. SQI will also retain the services of Dr. Pronovost, as strategic advisor, where he will assist the Company in its efforts to secure strategic partnerships and/or additional capital to further advance the Company's IVD and Pharma business units. Dr. Pronovost has more than thirty years of experience in the field of innovative diagnostic testing.

"The extensive experience Allan brings to SQI is well-aligned with our strategic objectives. He has led the invention, development and commercialization of numerous innovative medical diagnostic tests, and also has a track record of success in providing diagnostic development services to Pharma and biotech companies," said Andrew Morris, CEO of SQI Diagnostics. "Dr. Pronovost will be an important advisor to SQI as we commercialize our products and services in the US and work to expand our current base of Pharma customers."

Dr. Pronovost is currently the President and CSO of Red Lion Chem Tech, a consortium of health related companies he founded over the past ten years, based in San Diego, California. He is also currently the Founder, Chairman and CEO of Stone Investments, LLC, an investment holding company. From 2003-2006, he was the President of the NID Division of Quest Diagnostics, the largest clinical diagnostic reference laboratory network in the world. Prior to this, from 1995-2006, he was Chairman and CEO of BioAlliances Group, LLC, a contract R&D and manufacturing company serving the Pharma and biotech industry, primarily in the development of novel diagnostic tests. From 1986-1995 he was the Vice President R&D at Quidel Corporation, San Diego and has also contributed in various roles at Ortho Clinical Diagnostics-Johnson & Johnson, DuPont, Eastman Kodak, Ansys Diagnostics and Trinity Biotech Holding PLC.

Dr. Pronovost has advanced 123 products from concept to market with commercial sales, including 74 FDA 510(K) Approved Medical Device products. He is credited with 63 issued patents or applications, and is an author of more than 80 publications including two books. Dr. Pronovost obtained his Ph.D. in Pathology at the University of Rhode Island and completed a Post-Doctoral Fellowship in Clinical Virology & Immunology at the Yale University School of Medicine and is certified in Clinical Laboratory Medicine.

Dr. Pronovost replaces Dr. Peter Lea who has resigned from the Board, effective immediately. Dr. Lea will continue as an active, non-voting senior advisor to the Board. Dr. Lea founded SQI Diagnostics in 1999 and invented and patented the core technology underpinning SQI's multiplexing microarray technology and is actively involved day to day in the role of Founder.

Dr. Pronovost will be granted options (the "Options") to purchase an aggregate of 300,000 common shares of the Corporation (the "Shares") at a price which is the greater of $0.40 per Share or the closing price per Share on the date hereof, pursuant to the Corporation's incentive stock option plan.

In addition, SQI has retained the services of Renmark Financial Communications Inc. ("Renmark") to provide the Company with investor relations services such as roadshow management, the organization of investor events and the distribution of corporate information. Renmark does not have any interest, directly or indirectly, in SQI Diagnostics or its securities, or any right or intent to acquire such an interest. The Company will pay to Renmark a monthly retainer of $5,000. The term of the agreement with Renmark is on a month-to-month basis, and the agreement can be terminated by either party by giving 30 days' written notice to the other party.

http://finance.yahoo.com/news/sqi-diagnostics-appoints-indus…

Wie mir scheint eine hochkarätige Ergänzung mit gutem Netzwerk und großem Erfahrungsschatz.

Antwort auf Beitrag Nr.: 47.324.344 von M@trix am 17.07.14 09:45:59

Lebensläufe ist immer so eine Sache.

Ich habe keine Ahnung von diesem Mann, aber schätze 123 concept to sales, und davon 74 bis zur FDA Genehmigung, duuuuurch, ist schon hammerhart, gut.

Gruß

P.

Lebensläufe ist immer so eine Sache.

Ich habe keine Ahnung von diesem Mann, aber schätze 123 concept to sales, und davon 74 bis zur FDA Genehmigung, duuuuurch, ist schon hammerhart, gut.

Gruß

P.

.....wieso der Absturz heute????

M.

M.

Leider ist dies ALLEIN der Marktenge geschuldet:

Transaction Volume: 80,130

Das ist ein Witz. Ich habe heute noch mal das Management angeschrieben, wann ein Nasdaq-Listing ansteht. Ohne Liquidität packt diese Aktie kein institutioneller Investor an.

Aus meiner Sicht jedenfalls eher eine Kaufchance. Mal sehen, was ich als Antwort bekomme. Je nach dem kaufe ich nach. Übrigens erneut neue Stellenausschreibung ("Quality Control Associate").

M@trix

Transaction Volume: 80,130

Das ist ein Witz. Ich habe heute noch mal das Management angeschrieben, wann ein Nasdaq-Listing ansteht. Ohne Liquidität packt diese Aktie kein institutioneller Investor an.

Aus meiner Sicht jedenfalls eher eine Kaufchance. Mal sehen, was ich als Antwort bekomme. Je nach dem kaufe ich nach. Übrigens erneut neue Stellenausschreibung ("Quality Control Associate").

M@trix

Antwort auf Beitrag Nr.: 47.196.144 von boersehp am 23.06.14 20:22:27

an Denen reizt es mich auch schon, geraume Zeit, mal dran zu knabbern. Aber eher eine 'medical device' Firma.

Aber einige Dinge abzuschätzen ist nicht so ganz einfach.

http://media.wix.com/ugd/a15970_7ed8b1f6bb0441628123c9e6fc35…

www.marketwired.com/press-release/oxysure-oxys-announces-cor…

www.oxysure.com/OxySure_Earnings_Presentation_1Q2014%20v2.pd…

Gruß

P.

an Denen reizt es mich auch schon, geraume Zeit, mal dran zu knabbern. Aber eher eine 'medical device' Firma.

Aber einige Dinge abzuschätzen ist nicht so ganz einfach.

http://media.wix.com/ugd/a15970_7ed8b1f6bb0441628123c9e6fc35…

www.marketwired.com/press-release/oxysure-oxys-announces-cor…

www.oxysure.com/OxySure_Earnings_Presentation_1Q2014%20v2.pd…

Gruß

P.

Aus dem aktuellen MD&A:

"The Company is currently in the process of finalizing a commercial contract with Isis’s CRO to implement the SQI-developed test in clinical testing, which could result in material revenues to the Company in fiscal 2014 with the CRO’s validation work expected to start in August, 2014"

"We anticipate that many of the successful evaluation projects completed over the last nine months will proceed to the next expected commercial phases, where SQI will produce and sell test kits to these customers for either its fully automated sqidlite or semi-automated sqid-X platforms. Within each Pharma customer, we are also seeking opportunities to expand the scope of ongoing programs and to develop new product opportunities."

"Management expects to reduce losses later in fiscal 2014 as it generates revenues and margin from a variety of Diagnostic Tools and Services’ customers. Successful US FDA clearance of its IVD Celiac test could result in initial revenue from that product in late fiscal 2014, further reducing overall losses."

http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issu…

"The Company is currently in the process of finalizing a commercial contract with Isis’s CRO to implement the SQI-developed test in clinical testing, which could result in material revenues to the Company in fiscal 2014 with the CRO’s validation work expected to start in August, 2014"

"We anticipate that many of the successful evaluation projects completed over the last nine months will proceed to the next expected commercial phases, where SQI will produce and sell test kits to these customers for either its fully automated sqidlite or semi-automated sqid-X platforms. Within each Pharma customer, we are also seeking opportunities to expand the scope of ongoing programs and to develop new product opportunities."

"Management expects to reduce losses later in fiscal 2014 as it generates revenues and margin from a variety of Diagnostic Tools and Services’ customers. Successful US FDA clearance of its IVD Celiac test could result in initial revenue from that product in late fiscal 2014, further reducing overall losses."

http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issu…

SQI Diagnostics Contracted to Automate Pathogen Detection Assays

TORONTO, Aug. 22, 2014 /PRNewswire/ - SQI Diagnostics Inc. (SQD.V), a life sciences company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced that it has entered into a Master Service Agreement to contract with a UK-based company to automate their DNA-based pathogen detection assays. During the initial phase of this agreement, SQI will be paid to deliver an automated working prototype of one of the customer's assays, operational on SQI's sqidlite™ system. The initial phase is scheduled for completion by mid-September 2014. It is anticipated that other molecular diagnostic tests will be commissioned in a separate agreement following successful implementation of the initial phase.

The first assay being automated is used to identify pathogens in raw milk from dairy cows. Currently, dairy cows are routinely tested for health through a global network of laboratories and when symptoms of bacterial infections appear, pathogens are commonly detected using traditional plate cultures. The new application can be used for much faster and more accurate identification of multiple pathogens simultaneously. The UK-based company is developing additional assays for agriculture, food safety and human pathogen testing, intended to screen high volumes of samples on a regular basis.

"As we've explored this opportunity, we've been impressed by the compatibility and synergy of our new customer's high-performance molecular diagnostic technology with our automated multiplexing assay technologies," said Andrew Morris, CEO of SQI Diagnostics. "Although our automated systems have been developed to run our own protein-based IVD and pharma assays, our technology solution is highly adaptable to other types of tests and this presents a valuable additional market opportunity where our technologies can be applied with the potential for significant test volumes and revenue."

About SQI Diagnostics

SQI Diagnostics is a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. The Company's proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. For more information, please visit www.sqidiagnostics.com.

---

Heute findet zudem ein Investor Call statt, zudem ich einige Fragen eingereicht habe. Mal gespannt, wie die Antworten ausfallen. Der Call wird auch auf der Homepage von SQI veröffentlicht werden.

Generell bin ich weiterhin der Ansicht, dass die Aktie vollkommen unterbewertet ist. Die Zeit wird zeigen, ob ich da im Irrtum bin.

M@trix

TORONTO, Aug. 22, 2014 /PRNewswire/ - SQI Diagnostics Inc. (SQD.V), a life sciences company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics, today announced that it has entered into a Master Service Agreement to contract with a UK-based company to automate their DNA-based pathogen detection assays. During the initial phase of this agreement, SQI will be paid to deliver an automated working prototype of one of the customer's assays, operational on SQI's sqidlite™ system. The initial phase is scheduled for completion by mid-September 2014. It is anticipated that other molecular diagnostic tests will be commissioned in a separate agreement following successful implementation of the initial phase.

The first assay being automated is used to identify pathogens in raw milk from dairy cows. Currently, dairy cows are routinely tested for health through a global network of laboratories and when symptoms of bacterial infections appear, pathogens are commonly detected using traditional plate cultures. The new application can be used for much faster and more accurate identification of multiple pathogens simultaneously. The UK-based company is developing additional assays for agriculture, food safety and human pathogen testing, intended to screen high volumes of samples on a regular basis.

"As we've explored this opportunity, we've been impressed by the compatibility and synergy of our new customer's high-performance molecular diagnostic technology with our automated multiplexing assay technologies," said Andrew Morris, CEO of SQI Diagnostics. "Although our automated systems have been developed to run our own protein-based IVD and pharma assays, our technology solution is highly adaptable to other types of tests and this presents a valuable additional market opportunity where our technologies can be applied with the potential for significant test volumes and revenue."

About SQI Diagnostics

SQI Diagnostics is a life sciences and diagnostics company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. The Company's proprietary microarray tests and fully-automated systems are designed to simplify protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. For more information, please visit www.sqidiagnostics.com.

---

Heute findet zudem ein Investor Call statt, zudem ich einige Fragen eingereicht habe. Mal gespannt, wie die Antworten ausfallen. Der Call wird auch auf der Homepage von SQI veröffentlicht werden.

Generell bin ich weiterhin der Ansicht, dass die Aktie vollkommen unterbewertet ist. Die Zeit wird zeigen, ob ich da im Irrtum bin.

M@trix

Aber was die Frankfurter Börse da wieder für einen spread hat ist ja schon brutal......

"[...] The company's multiplexing technology, IgPlex, enables users to assay proteins on planar arrays printed on 96-well plates. With regards to competitors in the space, he said that SQI's assays "appear to be more impervious to the confounding effects of free drug remaining in the blood sample that interacts with the antibodies you are trying to detect."

Working to serve pharma clients' needs also develops SQI's skill set. Morris said that SQI's partners have asked it to tackle new problems, resulting in new assays.