Oaktree Capital Group, LLC Announces Pricing of Public Offering of Class A Units - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 13.03.14 17:25:58 von

neuester Beitrag 08.09.19 11:09:15 von

neuester Beitrag 08.09.19 11:09:15 von

Beiträge: 29

ID: 1.192.417

ID: 1.192.417

Aufrufe heute: 0

Gesamt: 958

Gesamt: 958

Aktive User: 0

ISIN: US6740012017 · WKN: A1JWW7

47,72

EUR

-1,12 %

-0,54 EUR

Letzter Kurs 13.09.19 Lang & Schwarz

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 12,300 | +14,37 | |

| 1,7000 | +12,77 | |

| 24,800 | +9,73 | |

| 6,3850 | +7,98 | |

| 8,9400 | +6,43 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,1264 | -7,55 | |

| 4,0800 | -8,93 | |

| 92,50 | -9,31 | |

| 1,5000 | -23,08 | |

| 0,7500 | -25,00 |

Oaktree Capital Group, LLC (NYSE: OAK) (“Oaktree”) today announced the pricing of its previously announced public offering of 5,000,000 Class A units for expected approximate gross proceeds of $300 million before …

Lesen sie den ganzen Artikel: Oaktree Capital Group, LLC Announces Pricing of Public Offering of Class A Units

Lesen sie den ganzen Artikel: Oaktree Capital Group, LLC Announces Pricing of Public Offering of Class A Units

Oaktree wird geführt von Howard Marks, von dem Warren Buffett sagt, dass er sofort alles lesen würde was der schreibt...

habe mir mal ein paar Ansichtsstücke geholt

habe mir mal ein paar Ansichtsstücke geholt

in den letzten 12 Monaten haben sie $4,66 pro unit ausgeschüttet: http://ir.oaktreecapital.com/phoenix.zhtml?c=212597&p=irol-d…

habe zu $57,23 gekauft, also 8,1%

habe zu $57,23 gekauft, also 8,1%

ist ein Pro-Link, weiß nicht wie lange der offenbleibt: http://seekingalpha.com/article/2634415-oaktree-sum-of-the-p…

nachgelegt

Antwort auf Beitrag Nr.: 48.400.901 von R-BgO am 24.11.14 18:12:31Ist bei Euch die Dividende schon vollständig da? Ich habe von meiner Bank bisher pro Quartal immer drei Teilzahlungen erhalten, diesmal bloß zwei. Im Vergleich zum Vorquartal fehlt rund die Hälfte der Summe.

Und: Danke an R-BgO für den Link!

Und: Danke an R-BgO für den Link!

Antwort auf Beitrag Nr.: 48.411.200 von Schubu am 25.11.14 18:21:00bei mir kam eine Zahlung etwas später, es ist aber alles da

bin bei comdirect

bin bei comdirect

Antwort auf Beitrag Nr.: 48.414.356 von R-BgO am 25.11.14 23:59:36Danke, warte ich mal weiter

Oaktree poised to rebound in next credit cycle: Barron's

http://www.reuters.com/article/2014/11/30/us-oaktree-cap-grp…

http://www.reuters.com/article/2014/11/30/us-oaktree-cap-grp…

Antwort auf Beitrag Nr.: 48.233.713 von R-BgO am 05.11.14 19:01:28' nu isser zu...

Jahreszahlen kamen gestern, muss zugeben dass ich deren Rechnungslegung nicht verstehe;

Q1 Distribution von 56c nach $1 im VJ

Jahreszahlen kamen gestern, muss zugeben dass ich deren Rechnungslegung nicht verstehe;

Q1 Distribution von 56c nach $1 im VJ

Howard Marks’ Oaktree Outfoxes Apollo In Molycorp Inc Bankruptcy

Posted By: Clayton BrownePosted date: July 06, 2015 06:47:17 AMHoward Marks, the co-founder of (NYSE:OAK) Capital Group, has experienced hundreds of bankruptcies in his several decades on Wall Street, so it's not a complete surprise to learn he has outfoxed Leon Black of Apollo Management and other creditors by providing a rescue financing deal in the ongoing Molycorp bankruptcy.

According to the Wall Street Journal, mining firm Molycorp’s bankruptcy will leave credit-investing fund Oaktree Capital Group undamaged while Apollo Global Management LLC (NYSE:APO) and other junior creditors suffer significant losses.

The WSJ sources say Oaktree managed to beat Apollo and other firms to the punch last year in making a deal to provide $400 million in rescue financing to Molycorp. This rescue financing deal allowed Oaktree to negotiate for a safer senior creditor position in a restructuring of the miner’s debt.

More on Molycorp bankruptcy

Molycorp made it official on Thursday when it filed for chapter 11 bankruptcy. However, the firm is continuing to pay the high-interest loan from Oaktree as it slashes other parts of its $1.7 billion debt load, based on legal filings. This seniormost debtor treatment comes after aggressive negotiating by Oaktree last summer for terms to give it leverage in Molycorp’s eventual negotiations, according to knowledgeable sources.

Apollo has not publicly released the size of their stake in Molycorp bonds, but according to sources, the investment is relatively small. Of note, Molycorp owes Oaktree about $260 million on the loan, according to court documents.

Apollo is led by junk bond vet Leon Black, and together with Oaktree are the most highly regarded investors in the private debt sector. Analysts point out that investment in this area are high-risk, complex wagers that can land fat profits or lead to painful losses.

These firms have been chasing high-yield distressed investments for years, but in an era of historically low return from "regular" investments, they are now facing stiff competition for deals from other investors. Keep in mind that very low interest rates and relatively calm economic conditions (as well as the big washout of bankruptcies in 2007 and 2008) have minimized the number of distressed firms.

Oaktree and Apollo offered competing financing proposals to Colorado-based Molycorp back in the summer of 2014, and the company decided to go with Marks and Oaktree, leaving Leon Black and Apollo holding the bag.

That said, you can bet your bottom dollar that Apollo's lawyers are already working on legal action to contest this apparent collusion, and that the matter will ultimately be settled in court.

Antwort auf Beitrag Nr.: 50.190.432 von R-BgO am 15.07.15 10:53:38

http://www.welt.de/newsticker/bloomberg/article144584403/Bed…

"Bedrohung durch China, Öl, Griechenland erst am Anfang - Oaktree"

Aus der "WELT": "Die letzten Jahre waren frustrierend für den weltgrößten Investor in notleidende Kredite und Anleihen. Die boomenden Märkte schützten die Unternehmen. Aber jetzt könnten bessere Zeiten für Oaktree..."http://www.welt.de/newsticker/bloomberg/article144584403/Bed…

Oaktree ist 62% Eigner von Torm,

sie haben die Bude restrukturiert;Thread: Torm A/S - dänischer Tankerbetreiber

Howard Marks' London Value Investor Conference Presentation

Markets have been pretty boring for the last six years. We have to keep our focus in times of boredom. We are living through a period of complacency with zero interest rates leading some to believe in TINA (there is no alternative). There are no areas of acute over-valuation in Marks’s main markets which are corporate bonds, distressed debt, and real estate. In the stock market he thinks social media stocks are overvalued.

Everyone thinks that interest rates will remain low in the future, there is low demand for capital and the demographics are quite poor. His intellectual side says that low growth is here to stay. His alter ego tells him that when everyone is thinking the same thing he should be more optimistic. However, he did say that he does not listen to his alter ego very often.

Value investing is a big tent. He also referred to it as the value pantheon. It ranges on a continuum from cigar butts to investing in franchise businesses with large moats and good management at a reasonable price. He referred to this as Buffett’s journey. What is outside the value tent? Only dreams – companies with no earnings and only growth prospects.

Marks said that he had never carried out a liquidation and that he was not drawn to the cigar butt end of the spectrum. Because he wants high returns, he is very price sensitive so he does not buy safe, quality, unleveraged companies. He is somewhere in the middle of the value pantheon.

When Marks and his partners set up Oaktree they adopted the motto, “If you avoid the losers the winners will take care of themselves.” In high yield bonds Oaktree have only suffered a 1.4% default rate. While avoiding the losers worked in bonds as they moved into other markets like distressed debt and mezzanine it became less appropriate. If you want more than high single digit returns in these markets you have to do more than avoid losers. ‘Risk control’ and ‘loss avoidance’ are important but not ‘risk avoidance’. He warned that risk avoidance often leads to return avoidance.

If you hear that an asset is so dangerous that there is no price at which it can be bought your antennae should prick up. It probably means it is a good time to buy. Throughout his career he has bought assets that other people would not invest in. When an asset class gains a reputation for being unseemly and becomes stigmatised like high yield bonds in the 1980s, emerging markets in the late 1990s, bank securities in 2008 and more recently the oil sector it is usually time to buy.

Investing is harder today than earlier in his career because there is more competition from other investors. The search for bargains has become more intense. Like the growth investor, the value investor needs to think about disruption. He highlighted the big changes a foot in the media, television cable area as an example.

Oaktree put some money to work in the oil sector earlier this year. They have been doing more commercial real estate investing than anything else over the last five years. The real estate market is heterogeneous. Prime office buildings are expensive in the US today. They have been busiest in out-of-the-way places in non-prime properties. He mentioned that they have been buying zombie properties that require renovation and new tenants which they have been buying from banks at a discount.

Markets have been pretty boring for the last six years. We have to keep our focus in times of boredom. We are living through a period of complacency with zero interest rates leading some to believe in TINA (there is no alternative). There are no areas of acute over-valuation in Marks’s main markets which are corporate bonds, distressed debt, and real estate. In the stock market he thinks social media stocks are overvalued.

Everyone thinks that interest rates will remain low in the future, there is low demand for capital and the demographics are quite poor. His intellectual side says that low growth is here to stay. His alter ego tells him that when everyone is thinking the same thing he should be more optimistic. However, he did say that he does not listen to his alter ego very often.

Value investing is a big tent. He also referred to it as the value pantheon. It ranges on a continuum from cigar butts to investing in franchise businesses with large moats and good management at a reasonable price. He referred to this as Buffett’s journey. What is outside the value tent? Only dreams – companies with no earnings and only growth prospects.

Marks said that he had never carried out a liquidation and that he was not drawn to the cigar butt end of the spectrum. Because he wants high returns, he is very price sensitive so he does not buy safe, quality, unleveraged companies. He is somewhere in the middle of the value pantheon.

When Marks and his partners set up Oaktree they adopted the motto, “If you avoid the losers the winners will take care of themselves.” In high yield bonds Oaktree have only suffered a 1.4% default rate. While avoiding the losers worked in bonds as they moved into other markets like distressed debt and mezzanine it became less appropriate. If you want more than high single digit returns in these markets you have to do more than avoid losers. ‘Risk control’ and ‘loss avoidance’ are important but not ‘risk avoidance’. He warned that risk avoidance often leads to return avoidance.

If you hear that an asset is so dangerous that there is no price at which it can be bought your antennae should prick up. It probably means it is a good time to buy. Throughout his career he has bought assets that other people would not invest in. When an asset class gains a reputation for being unseemly and becomes stigmatised like high yield bonds in the 1980s, emerging markets in the late 1990s, bank securities in 2008 and more recently the oil sector it is usually time to buy.

Investing is harder today than earlier in his career because there is more competition from other investors. The search for bargains has become more intense. Like the growth investor, the value investor needs to think about disruption. He highlighted the big changes a foot in the media, television cable area as an example.

Oaktree put some money to work in the oil sector earlier this year. They have been doing more commercial real estate investing than anything else over the last five years. The real estate market is heterogeneous. Prime office buildings are expensive in the US today. They have been busiest in out-of-the-way places in non-prime properties. He mentioned that they have been buying zombie properties that require renovation and new tenants which they have been buying from banks at a discount.

Oaktree investiert in Tracker-Hersteller:

http://www.pv-tech.org/news/array-technologies-surpasses-5.6…

...kreativ sind sie ja:

Oaktree Introduces Oaktree Specialty Lending Corporation and Oaktree Strategic Income Corporation

Completes Transaction to Assume Management of Two Business Development Companies

LOS ANGELES--(BUSINESS WIRE)--Oct. 17, 2017--

Oaktree Capital Group, LLC (NYSE: OAK) (“OCG”) today announced that Oaktree Capital Management, L.P. (“Oaktree”) has closed its asset purchase agreement pursuant to which Oaktree has become the new investment adviser to two business development companies (“BDCs”): Oaktree Specialty Lending Corporation (formerly Fifth Street Finance Corp., NASDAQ: FSC) and Oaktree Strategic Income Corporation (formerly Fifth Street Senior Floating Rate Corp., NASDAQ: FSFR). The common stocks now trade on NASDAQ under the new ticker symbols OCSL and OCSI, respectively.

“We are excited to introduce our new BDCs, Oaktree Specialty Lending and Oaktree Strategic Income. These companies provide us with a BDC platform with scale that benefits from Oaktree’s deep credit and direct lending expertise, origination capabilities and underwriting skills,” said Jay Wintrob, Chief Executive Officer. “We look forward to leveraging our 22-year history of successful credit investing to maximize the value of our BDC platform for the shareholders of both the BDCs and Oaktree over time.”

Oaktree Specialty Lending will operate as a specialty finance company dedicated to providing customized, one-stop credit solutions to companies with limited access to public or syndicated capital markets, offering flexible and innovative financing solutions through first and second lien loans, unsecured and mezzanine loans, and preferred equity. Oaktree Strategic Income will focus on providing customized capital solutions to middle-market companies, offering a range of first-lien financing solutions to companies across a wide variety of industries.

Oaktree portfolio manager Edgar Lee has been named Chief Executive Officer of both Oaktree Specialty Lending and Oaktree Strategic Income, which together have approximately $2.5 billion of assets under management across first lien, second lien, unsecured and mezzanine loans. Other members of the executive leadership team for the BDCs are Matt Pendo, Chief Operating Officer, Mel Carlisle, Chief Financial Officer and Kim Larin, Chief Compliance Officer.

“Direct lending has always been an important part of Oaktree’s credit investment strategy. Since 2005, we have invested $10 billion in over 200 directly originated loans,” said Edgar Lee. “Consistent with Oaktree’s investment philosophy, we plan to manage the existing portfolios and originate new loans with an emphasis on fundamental credit analysis and downside protection. We believe this approach makes us an excellent long-term partner for financial sponsors and management teams, and also positions us to deliver attractive, risk-adjusted returns to our BDC shareholders.”

John Frank, Vice Chairman of OCG, has been appointed Chairman of the Boards of Directors of both Oaktree Specialty Lending Corporation and Oaktree Strategic Income Corporation, and Marc Gamsin, Craig Jacobson, Richard Ruben and Bruce Zimmerman have been appointed as new independent directors. The Boards of Directors of both BDCs are comprised of a majority of independent directors.

Oaktree Introduces Oaktree Specialty Lending Corporation and Oaktree Strategic Income Corporation

Completes Transaction to Assume Management of Two Business Development Companies

LOS ANGELES--(BUSINESS WIRE)--Oct. 17, 2017--

Oaktree Capital Group, LLC (NYSE: OAK) (“OCG”) today announced that Oaktree Capital Management, L.P. (“Oaktree”) has closed its asset purchase agreement pursuant to which Oaktree has become the new investment adviser to two business development companies (“BDCs”): Oaktree Specialty Lending Corporation (formerly Fifth Street Finance Corp., NASDAQ: FSC) and Oaktree Strategic Income Corporation (formerly Fifth Street Senior Floating Rate Corp., NASDAQ: FSFR). The common stocks now trade on NASDAQ under the new ticker symbols OCSL and OCSI, respectively.

“We are excited to introduce our new BDCs, Oaktree Specialty Lending and Oaktree Strategic Income. These companies provide us with a BDC platform with scale that benefits from Oaktree’s deep credit and direct lending expertise, origination capabilities and underwriting skills,” said Jay Wintrob, Chief Executive Officer. “We look forward to leveraging our 22-year history of successful credit investing to maximize the value of our BDC platform for the shareholders of both the BDCs and Oaktree over time.”

Oaktree Specialty Lending will operate as a specialty finance company dedicated to providing customized, one-stop credit solutions to companies with limited access to public or syndicated capital markets, offering flexible and innovative financing solutions through first and second lien loans, unsecured and mezzanine loans, and preferred equity. Oaktree Strategic Income will focus on providing customized capital solutions to middle-market companies, offering a range of first-lien financing solutions to companies across a wide variety of industries.

Oaktree portfolio manager Edgar Lee has been named Chief Executive Officer of both Oaktree Specialty Lending and Oaktree Strategic Income, which together have approximately $2.5 billion of assets under management across first lien, second lien, unsecured and mezzanine loans. Other members of the executive leadership team for the BDCs are Matt Pendo, Chief Operating Officer, Mel Carlisle, Chief Financial Officer and Kim Larin, Chief Compliance Officer.

“Direct lending has always been an important part of Oaktree’s credit investment strategy. Since 2005, we have invested $10 billion in over 200 directly originated loans,” said Edgar Lee. “Consistent with Oaktree’s investment philosophy, we plan to manage the existing portfolios and originate new loans with an emphasis on fundamental credit analysis and downside protection. We believe this approach makes us an excellent long-term partner for financial sponsors and management teams, and also positions us to deliver attractive, risk-adjusted returns to our BDC shareholders.”

John Frank, Vice Chairman of OCG, has been appointed Chairman of the Boards of Directors of both Oaktree Specialty Lending Corporation and Oaktree Strategic Income Corporation, and Marc Gamsin, Craig Jacobson, Richard Ruben and Bruce Zimmerman have been appointed as new independent directors. The Boards of Directors of both BDCs are comprised of a majority of independent directors.

Antwort auf Beitrag Nr.: 56.951.723 von R-BgO am 06.02.18 17:16:57

Jahreszahlen kamen heute auch,

sind ordentlich solide

aufgestockt zu $40,95

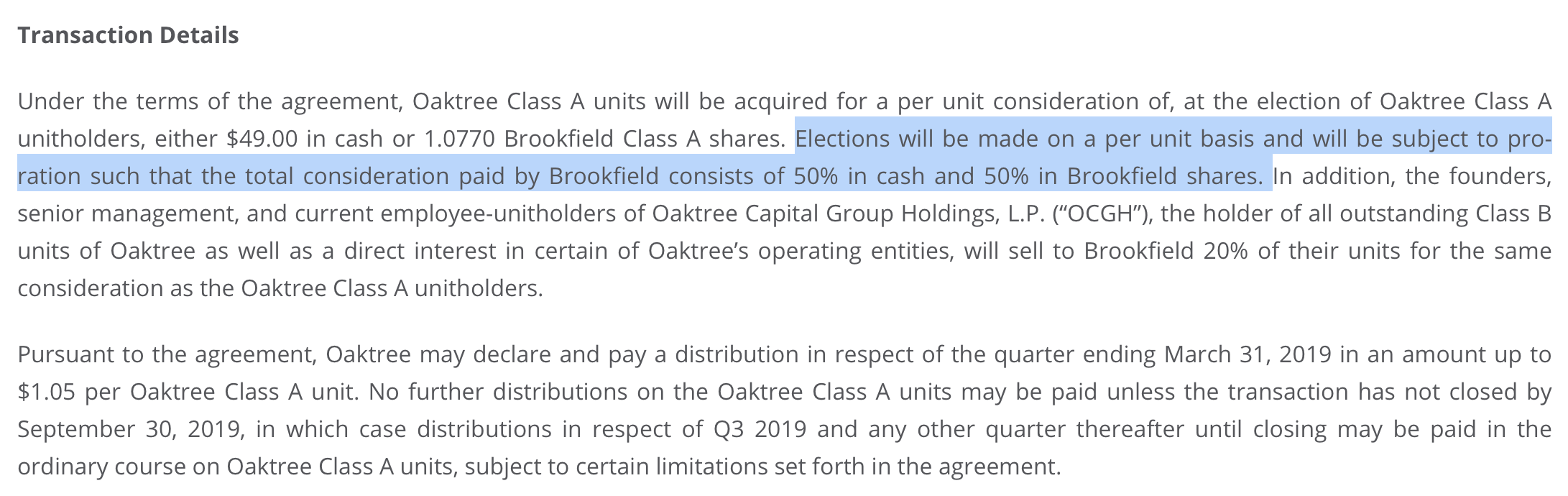

Knaller:

Antwort auf Beitrag Nr.: 60.117.433 von R-BgO am 16.03.19 09:23:24

Antwort auf Beitrag Nr.: 61.432.712 von R-BgO am 07.09.19 09:23:40

BAM $53,48 x 1,077 = $57,60

=> der Markt scheint also von einer 50:50 Zuteilung auszugehen

aktuelle Kurse:

Oaktree $53,41BAM $53,48 x 1,077 = $57,60

=> der Markt scheint also von einer 50:50 Zuteilung auszugehen

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -6,25 | |

| -0,89 | |

| -1,11 | |

| -1,97 | |

| -0,25 | |

| -0,31 | |

| -0,91 | |

| -1,63 | |

| +0,44 | |

| 0,00 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 220 | ||

| 112 | ||

| 108 | ||

| 76 | ||

| 44 | ||

| 43 | ||

| 39 | ||

| 35 | ||

| 33 | ||

| 32 |