Regis Resources - Goldproduzent in Australien (Seite 10)

eröffnet am 27.05.14 18:48:58 von

neuester Beitrag 03.02.24 00:49:24 von

neuester Beitrag 03.02.24 00:49:24 von

Beiträge: 106

ID: 1.194.806

ID: 1.194.806

Aufrufe heute: 0

Gesamt: 17.549

Gesamt: 17.549

Aktive User: 0

ISIN: AU000000RRL8 · WKN: A0B8RA · Symbol: RKQ

1,3850

EUR

-0,11 %

-0,0015 EUR

Letzter Kurs 19.04.24 Tradegate

Neuigkeiten

10.04.24 · wO Chartvergleich |

09.11.23 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,8000 | +17,65 | |

| 0,5500 | +14,61 | |

| 0,8200 | +12,33 | |

| 11,420 | +11,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,1600 | -8,67 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 0,7997 | -12,16 | |

| 4,2300 | -17,86 |

Beitrag zu dieser Diskussion schreiben

Schon einen guten Monat alt, aber trotzdem aussagekräftig:

http://www.fool.com.au/2015/09/04/t...play-should-consider-r…

Those looking for a gold play should consider Regis Resources Limited

By Brett Bearham - September 4, 2015 | More on: RRL

Mining stocks have experienced a turbulent ride over the past 18 months, with those in the gold sector no exception. Despite several gold stocks enjoying a significant bounce from their yearly lows, such as Northern Star Resources Ltd (ASX: NST) and Evolution Mining Limited (ASX: EVN), there are still opportunities. One of those opportunities is Regis Resources Limited (ASX: RRL).

Regis is an Australian-based gold production and exploration company. Its core operation is at the Duketon Gold Project in the North Eastern Goldfields of Western Australia, which consists of three main deposits in Moolart Well, Garden Well and Rosemont. Both Garden Well and Rosemont support robust mining schedules, and have long mine lives exceeding seven years and six years respectively.

The company has sought to extend the operational mine life at Moolart Well also, with the recent acquisition of the Gloster Gold Deposit. This deposit is strategically located 26 kilometres from Regis’ Moolart Well processing plant, and has an historic resource estimate of 365,000 ounces.

In its most recent quarterly report, Regis announced it had $51.7 million in cash and $21.4 million in gold bullion. Cash holdings more than doubled in value over the quarter, and the cash position increased an incredible $100 million for the 12 months to June 2015. The company has also reduced its debt level to just $20 million, which is covered easily by available cash.

Regis has reduced operational costs over the past 12 months whilst increasing operating cash flow. It expects to generate operating cash flow of around $140 million in FY 2016, with expansion capital expenditure expected to be in the order of $15 million to $20 million for the same period.

At the mid-point of FY 2016 estimates, the company expects to produce 290,000 ounces at an AISC (all in sustaining cost) of $1,020 per ounce. This makes Regis one of the most competitive gold producers in the Australian market.

The company has also been prudent in managing its gold sales and hedging. Regis has hedged a total of 281,000 ounces at an average price of $1,437 per ounce. These hedges are not subject to a specific delivery schedule, meaning the company can choose to sell its gold at either the spot price, or the hedge price, depending on which is more profitable.

Regis has indicated it will resume dividends later this year, targeting a payout ratio of 60% of net profit after tax. A dividend target of between 5 cents and 7 cents a share indicates a dividend yield of between 3.4% and 4.7%, which is much higher than that presently offered by Northern Star and Evolution Mining.

The company also has an opportunity to improve the value provided by its Garden Well project. The project accounts for around 35% of production, but has a low recovery rate of just 83.9%. An increased recovery rate would lead to a decreased AISC and a further boost to profits.

Foolish takeaway

Regis Resources is a well-managed gold producer with low debt, long mine life and cash in the bank. It has a good hedging policy, expects to resume paying dividends later this year, and has the opportunity to boost profits further. If you are looking to add a gold stock to your portfolio, Regis Resources should be at the top of your list.

http://www.fool.com.au/2015/09/04/t...play-should-consider-r…

Those looking for a gold play should consider Regis Resources Limited

By Brett Bearham - September 4, 2015 | More on: RRL

Mining stocks have experienced a turbulent ride over the past 18 months, with those in the gold sector no exception. Despite several gold stocks enjoying a significant bounce from their yearly lows, such as Northern Star Resources Ltd (ASX: NST) and Evolution Mining Limited (ASX: EVN), there are still opportunities. One of those opportunities is Regis Resources Limited (ASX: RRL).

Regis is an Australian-based gold production and exploration company. Its core operation is at the Duketon Gold Project in the North Eastern Goldfields of Western Australia, which consists of three main deposits in Moolart Well, Garden Well and Rosemont. Both Garden Well and Rosemont support robust mining schedules, and have long mine lives exceeding seven years and six years respectively.

The company has sought to extend the operational mine life at Moolart Well also, with the recent acquisition of the Gloster Gold Deposit. This deposit is strategically located 26 kilometres from Regis’ Moolart Well processing plant, and has an historic resource estimate of 365,000 ounces.

In its most recent quarterly report, Regis announced it had $51.7 million in cash and $21.4 million in gold bullion. Cash holdings more than doubled in value over the quarter, and the cash position increased an incredible $100 million for the 12 months to June 2015. The company has also reduced its debt level to just $20 million, which is covered easily by available cash.

Regis has reduced operational costs over the past 12 months whilst increasing operating cash flow. It expects to generate operating cash flow of around $140 million in FY 2016, with expansion capital expenditure expected to be in the order of $15 million to $20 million for the same period.

At the mid-point of FY 2016 estimates, the company expects to produce 290,000 ounces at an AISC (all in sustaining cost) of $1,020 per ounce. This makes Regis one of the most competitive gold producers in the Australian market.

The company has also been prudent in managing its gold sales and hedging. Regis has hedged a total of 281,000 ounces at an average price of $1,437 per ounce. These hedges are not subject to a specific delivery schedule, meaning the company can choose to sell its gold at either the spot price, or the hedge price, depending on which is more profitable.

Regis has indicated it will resume dividends later this year, targeting a payout ratio of 60% of net profit after tax. A dividend target of between 5 cents and 7 cents a share indicates a dividend yield of between 3.4% and 4.7%, which is much higher than that presently offered by Northern Star and Evolution Mining.

The company also has an opportunity to improve the value provided by its Garden Well project. The project accounts for around 35% of production, but has a low recovery rate of just 83.9%. An increased recovery rate would lead to a decreased AISC and a further boost to profits.

Foolish takeaway

Regis Resources is a well-managed gold producer with low debt, long mine life and cash in the bank. It has a good hedging policy, expects to resume paying dividends later this year, and has the opportunity to boost profits further. If you are looking to add a gold stock to your portfolio, Regis Resources should be at the top of your list.

Hallo ihr alle,

vielen Dank für eure Beiträge in diesem Forum. Die Recherche ist mir dadurch deutlich erleichtert worden!

bin seit heute auch mit einer ersten Position an Board.

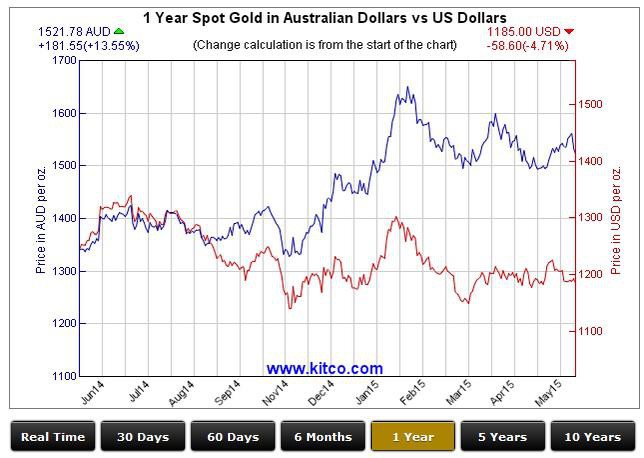

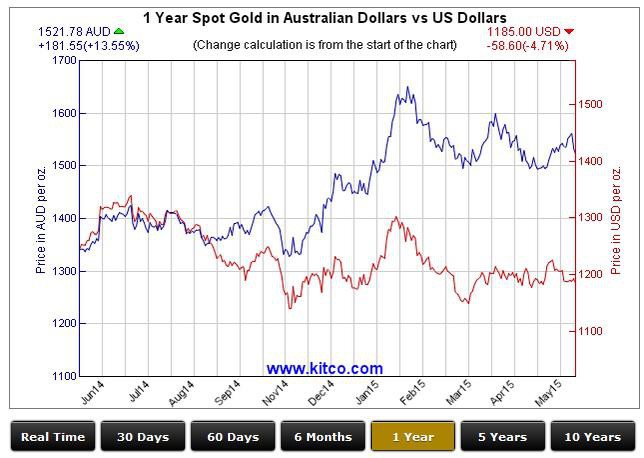

Ich vermute für die nächsten Wochen eine allgemeine Abwärtsbewegung an den Börsen und parallel einen moderaten Anstieg des Goldpreises.

Australische Werte sollten sich aufgrund der Währungsentwicklungen besser schlagen als amerikanische.

Passend zur Marktsituation habe ich mir einen Produzenten ausgesucht, der nach meinem Wissen auf soliden finanziellen Füßen mit geringen Cash-Kosten steht und damit auch eine tubulente und unruhige Phase ohne Not überstehen kann.

Die relativ umfangreichen Explorationsaktivitäten bieten eine zusätzliche Chance auf unerwartete positve Nachrichtungen, die sich auf die Kursentwicklung auswirken könnten.

Sicherlich wäre es besser gewesen, vor 2-3 Monaten einzusteigen, denn so sind die ersten 50% schon weg. Mit Blick auf mein Depot ist mir Sicherheit bei dieser Anlage aber wichtiger.

Habe ein Stopploss bei etwa 20% unter dem heutigen Kurs.

Euch allen (und auch mir) viel Erfolg mit dieser Anlage!

vielen Dank für eure Beiträge in diesem Forum. Die Recherche ist mir dadurch deutlich erleichtert worden!

bin seit heute auch mit einer ersten Position an Board.

Ich vermute für die nächsten Wochen eine allgemeine Abwärtsbewegung an den Börsen und parallel einen moderaten Anstieg des Goldpreises.

Australische Werte sollten sich aufgrund der Währungsentwicklungen besser schlagen als amerikanische.

Passend zur Marktsituation habe ich mir einen Produzenten ausgesucht, der nach meinem Wissen auf soliden finanziellen Füßen mit geringen Cash-Kosten steht und damit auch eine tubulente und unruhige Phase ohne Not überstehen kann.

Die relativ umfangreichen Explorationsaktivitäten bieten eine zusätzliche Chance auf unerwartete positve Nachrichtungen, die sich auf die Kursentwicklung auswirken könnten.

Sicherlich wäre es besser gewesen, vor 2-3 Monaten einzusteigen, denn so sind die ersten 50% schon weg. Mit Blick auf mein Depot ist mir Sicherheit bei dieser Anlage aber wichtiger.

Habe ein Stopploss bei etwa 20% unter dem heutigen Kurs.

Euch allen (und auch mir) viel Erfolg mit dieser Anlage!

Buy Gloster Gold Deposit

http://www.asx.com.au/asxpdf/20150722/pdf/42zz3ybs4jrcv6.pdf

Optimistisch für FY16:

http://seekingalpha.com/article/3336855-regis-resources-is-e…

RRL.AX 1,35 AUD

http://www.asx.com.au/asxpdf/20150722/pdf/42zz3ybs4jrcv6.pdf

Optimistisch für FY16:

http://seekingalpha.com/article/3336855-regis-resources-is-e…

RRL.AX 1,35 AUD

Wielange wird dieser Trend noch anhalten?

RRL.AX 1,1650 A$

RRL.AX 1,1650 A$

Ganz schön eingeschlafen der Regis-Thread.

http://www.asx.com.au/asxpdf/20150313/pdf/42x7xk49pb5vv5.pdf

RRL.AX 1,29 A$

http://www.asx.com.au/asxpdf/20150313/pdf/42x7xk49pb5vv5.pdf

RRL.AX 1,29 A$

Alles nicht so schlimm...von hier aus kann es aufwärts gehen!

updated production guidance for FY 2015Posted on: June 16, 2014

Regis Resources (ASX:RRL) which has been plagued by the severe rainfall in Australia earlier this year, has announced an updated production guidance for its financial year 2015 (which starts in calendar Q3 2014). The total expected production for the year is 305-355,000 ounces of gold at a cash cost of $835-915. The mid-point of the guidance would be a production of 330,000 ounces of gold at a cost of $875/oz.

Assuming a sustaining capex and exploration cost of $50M per year, an USD/AUD exchange rate of 1.07 and including the royalty payments, we think Regis should be able to produce at an all-in sustaining cash cost of approximately $1000/oz going forward, and this AISC should be trending downward towards FY 2016 when all the issues of the heavy rainfall will have been digested.

As Regis Resources is a dividend payer, investors will be keen to see what the dividend for FY 2014 (which ends at the end of this quarter) will be. There’s no doubt last year’s dividend of A$0.15/share will not be repeated, and it will be interesting to see which decision the Regis management will take.

Quelle: CAESARSREPORT.COM

updated production guidance for FY 2015Posted on: June 16, 2014

Regis Resources (ASX:RRL) which has been plagued by the severe rainfall in Australia earlier this year, has announced an updated production guidance for its financial year 2015 (which starts in calendar Q3 2014). The total expected production for the year is 305-355,000 ounces of gold at a cash cost of $835-915. The mid-point of the guidance would be a production of 330,000 ounces of gold at a cost of $875/oz.

Assuming a sustaining capex and exploration cost of $50M per year, an USD/AUD exchange rate of 1.07 and including the royalty payments, we think Regis should be able to produce at an all-in sustaining cash cost of approximately $1000/oz going forward, and this AISC should be trending downward towards FY 2016 when all the issues of the heavy rainfall will have been digested.

As Regis Resources is a dividend payer, investors will be keen to see what the dividend for FY 2014 (which ends at the end of this quarter) will be. There’s no doubt last year’s dividend of A$0.15/share will not be repeated, and it will be interesting to see which decision the Regis management will take.

Quelle: CAESARSREPORT.COM

Regis wird gekickt, kann noch billiger werden

S&P/ASX 100 Index

–

June 20, 2014 After Market Close

S&P/ASX 100 Index

–

June 20, 2014 After Market Close

starke director buy atm von Nick Giorgatta

1mio shares für nen 1.50er schnitt

er hält jetzt über 20 mio shares persönlich und hat vorher auch schon ein gutes näschen beim kaufen bewiesen. mit verkaufen hat ers allerdings nicht so...

at 94c - 2m of them in July 2010.

8m at 42c approx, and 2.5m @ 33c approx in Dec 2009.

The last dividend alone was worth 21.5c including franking credits

1mio shares für nen 1.50er schnitt

er hält jetzt über 20 mio shares persönlich und hat vorher auch schon ein gutes näschen beim kaufen bewiesen. mit verkaufen hat ers allerdings nicht so...

at 94c - 2m of them in July 2010.

8m at 42c approx, and 2.5m @ 33c approx in Dec 2009.

The last dividend alone was worth 21.5c including franking credits

du gute kommt aber trotz kleinem gold-spot-hüpfer noch nicht so richtig in die puschen. die australier sind skeptisch

Mein Reden...

Regis Resources Has Dropped Much Too Far

Jun. 3, 2014 6:30 AM ET |

Summary

Gold miner Regis Resources has been challenged by flooding of two pits and grade reconciliation issues.

Updated production and cost guidance for the next 12 months has caused panic selling and the share price has overshot to the downside.

We see 50% near-term upside just to reach fair value as implicated by the updated guidance.

Further upside is a real possibility when taking into account the potential for operations improving to previous efficiency levels.

Mr. Nick Giorgetta is a legend in the Australian gold mining space. This man was one of the founding members of Equigold which fetched A$1.1B when it was sold in 2008. The Equigold team stayed together and built another gold miner by the name of Regis Resources (OTC:RGRNF), the second largest by market capitalization and arguably the most profitable in Australia until as recently as January this year.

Mr Giorgetta has just increased his personal holdings in Regis Resources on market to the tune of $1.35M (A$1.5M). This transaction is a strong statement of support for Regis Resources which has been battling the fallout of a force majeure declared in February following a severe weather event.

Regis Resources has just released an "Operational Update and 2015 Guidance." The impact of the events in February had been known before and the numbers presented in the guidance were certainly no surprise to your humble scribe. Other investors seemed to think differently, however, and the stock was sold off violently by 35% in what we view as a panic reaction. Shares are trading around $1.35 (A$1.50) in the aftermath.

The resulting share price has overshot to the downside by some margin and we believe that investors should be looking at the current share price weakness as a rare buying opportunity; and take Mr Giorgetta's cue who seems to recognize a bargain when it is staring in his face.

Regis Resources - A Brief Summary

This bellwether Australian gold miner has received a fair amount of coverage here on Seeking Alpha, not just by your humble scribe but also by another author. We recommend a browse through these articles to gain a basic understanding of the company.

Here is a brief summary with a few useful links for more detailed information nevertheless:

Regis Resources controls the Duketon gold project in Western Australia, with currently three operating mines: The Moolart Well mine, the Garden Well mine and the Rosemont mine. Two CIL plants process ore from these mines with ore slurry from the Rosemont mine pumped to the Garden Wells facilities. The company has been able to achieve very low cash costs at these operations and has remained highly profitable throughout the past three years of gold price correction. This profitability has allowed the company to declare a maiden dividend last year.

Regis Resources is also developing the McPhillamys gold project in New South Wales, also in Australia. The project is close to infrastructure including roads, rail and power; however, sourcing water for McPhillamy could be problematic. There are several other large gold mines nearby including Barrick Gold's (ABX) Cowal Gold Mine, Newcrest's (OTCPK:NCMGF) Cadia Mine and the Northparke's Gold Mine owned by Rio Tinto (RIO). A PFS for this project is overdue; Regis is targeting possible first production as early as 2017 with an annual target of 140,000 to 160,000 ounces in a bulk mining CIL scenario, although this schedule might prove ambitious considering permitting procedures in NSW.

Force Majeure

A one in 150 year rainfall event on February 13 was too much for the protection bunds and after 14 hours of abnormal downpour significant amounts of water entered the Garden Well and Rosemont pits. Thankfully no one was injured, but the pit infrastructure certainly suffered. Moolart Well operations, and also the Garden Well processing plants were not affected by this event.

The attached photograph was published by miningaustralia.com and shows water cascading into the Garden Well pit.

Regis Resources declared a force majeure, and set to work pumping out the water and repairing the damage while processing stockpiled ore and limited amounts of ore mined from un-affected portions of the pits. The company also extended its credit facility but has not drawn down on this extension so far.

To date most of the damage at the Rosemont mine has been repaired, plus a pit wall slip that has occurred since then. Water has been pumped out of the Garden Well pit and sludge removal from the bottom is ongoing. Mining at Garden Well is scheduled to resume towards the end of June.

In the context of this force majeure it is noteworthy that so far the company has funded all repair work from cash on hand. It has not had to draw down on the credit facility extension, and no additional equity has been issued. A remarkable show of strength, indeed.

Grade Reconciliation Issues

Operations at Garden Well have been plagued by grade reconciliation issues since mining started in 2012 and the most recent operational update reported similar issues at Rosemont. These issues manifest themselves in lower than anticipated head grades and seem to be associated with flat lying oxides.

This flat lying oxide ore will be mined for another half year in the main Rosemont pit before more predictable fresh rock ore can be accessed throughout the Rosemont operations. Similarly, we expect head grades at Garden Well to reconcile with reserve grades in due time as mining advances from the oxide layers to fresh ore.

Again, most of these issues have been known to the market for some time, and had been priced in prior to the release of the update and sell-off of last week.

2015 Guidance

In the light of ongoing remedial work and the described grade reconciliation issues the company has published its production and cash cost guidance for the upcoming 2015 financial year mentioned in the introduction to this article. The table below summarizes this guidance and we have added our estimate for all-in-sustaining costs, or AISC, in the rightmost column assuming A$60/oz royalties plus allowances for sustaining capital and G&A. We are listing our AISC estimates in Australian Dollars, or A$, as well as US Dollars, or $.

While hardly surprising in our view, these numbers seem to have caught some investors off-guard prompting the sustained selling following the release of the guidance. Projections of more than 400,000 ounces of annual production in the coming financial year as indicated in last year's AGM were revised considerably and 2015 guidance is now for 305,000 to 355,000 ounces; while cash cost guidance has been increased for Garden Well and Rosemont.

It takes some pretty high expectations if guidance for 300,000+ ounces of gold production at AISC of under $1,000/oz is considered 'bad news' causing a 35% sell-off. Many gold miners would consider themselves lucky, if only they could break such news to their shareholders.

Price Pressure to Continue For a Short While

There are two reasons why we believe that price pressure is here to stay until mid-year:

1.Fiscal years in Australia last from July 1 to June 30 and tax loss selling typically occurs in June. Regis Resources has not traded below $3 for several years and this company is therefore a prime candidate for tax-related selling pressure in coming weeks.

2.Regis Resources is a constituent of the ASX S&P 100 index. We expect the company to be dropped from this list when the index is re-balanced at the end of June. Typically this leads to additional selling pressure as large funds and institutions reduce their holdings in consequence.

Looking Ahead

It is worth noting that the guidance which has just been released is for the coming financial year and the company's focus will be squarely set on increasing production and lowering costs at Rosemont and Garden Well in order to match the profile of Moolart Well, and the original forecasts.

Improvements in productivity and cost efficiency at Rosemont should be seen within months as oxide ore will be depleted and mining of fresh ore will bring grade consistency and lower costs. A similar effect can be expected at Garden Well in due time after this mine returns to normal operating conditions after the clean-up in July.

Regis management has a long standing reputation of bringing out optimized performance in the gold mines it operates and we see no reason why this time should be any different. We therefore see the upcoming year as a year to regroup, with a firm view to regain the unparalleled profitability of previous years.

So, What's it Worth?

Using guidance, and assuming minimal developing expenditure for development activities at the McPhillamys project and a gold price around $1,250/oz we conservatively estimate an EBITDA of $100M for the upcoming financial year. Using the current enterprise value this leads to an EV/EBITDA ratio of 6.9.

Consider the attached table which lists other precious metal miners with market capitalization in the same order of magnitude and multiple assets located in relatively safe jurisdictions. Regis Resources is trading at roughly half the EV/EBITDA ratio of this peer group. Other metrics also confirm the view that the recent sell-off has left Regis Resources undervalued.

For a more comprehensive view we used a discounted cash flow model, or DCM, considering the three individual mines and assuming a gold price of $1,250/oz. We explicitly assumed no improvements in production from the described 2015 guidance and used AISC as listed earlier in this piece. We assumed a discount rate of 5% in acknowledgement of low operational and political risks, and we assumed an effective tax rate of 25% in line with previous years. We also assumed mine lives of 16 years for all three mines, which implies a continuation of reserve conversion, and utilization of known high-grade satellite deposits for blending with lower grade resources for Moolart Well.

The resulting NPVs for the three mines are documented in the table below. Moolart Well represents the greatest value in this model, with Garden Well and Rosemont impaired by the described challenges. We repeat, that we assumed no remediation of these challenges in this model, a highly pessimistic assumption in our view. Still, the sum of these parts is $788M.

Repeating the exercise, and including some degree of improvement from the current status at Garden Well and Rosemont quickly pushes the total present value above $1B. And these considerations only include the three producing mines, and ignore the McPhillamys project which our fellow author Investment Doctor has valued at $304M.

However, considering the current enterprise value of $688M all these calculations only reveal different shades of severe under-valuation; a result of the recent sell-off and a special situation that will rectify itself to the upside before long.

Our current base case assumes full valuation of the assets under guidance production rates and values McPhillamys at a modest 0.2xNAV. These assumptions lead to a short-term target price of $2.23 ($A2.47) or 50% upside, to be achieved before the end of the year. In the longer term we expect a return to the operational efficiencies already displayed in previous years which should prompt the share price to return to A$3+ levels as was the norm before the declaration of the force majeure.

Our short-term price target correlates very well with the only in-depth buy-side research report since the operational update by Argonaut which states a price target of $2.12 (A$2.35) and notes that "operational expectations have now been largely reset and the Company remains one of the few 'go to' names in the Australian gold sector given its scalable production profile and low sovereign risks" while maintaining a BUY rating.

The chart at the top of this article shows that shares of Regis Resources were in fact trading around the quoted short-term price targets before the recent update by the company. As we have stated before, we believe that most information contained in this update had already been known, and had been priced in. The sell-off after the update was unfounded in our view and not in sync with the company's value. We strongly believe that this imbalance will be resolved by a correction to the upside before long.

Additional Upside and Catalysts

In the very short term, the end of the financial year on June 30 will mean an end of selling pressure from tax loss selling and re-balancing of ASX indices. A return to more reasonable valuations closer to the intrinsic value of Regis Resources should start early in July. In this context it should be noted that July is winter time in Australia, and no lull in trading is to be expected as is the case for the Northern hemisphere "summer months."

The publication of a PFS for the McPhillamy project is imminent and should provide confirmation of the value implied above. Our base case valuation only accounts for 20% of this project's NAV and a strong PFS should prompt investors to use a higher percentage.

The company paid a maiden dividend last year. Due to the force majeure situation and the associated challenges it is widely believed that this dividend will be suspended. However, in reviewing the balance sheet and considering the imminent re-start of operations at Garden Well we would not be surprised to see a continuation of dividend payments at a reduced level. A dividend reduction of 50% would still mean a 5% dividend yield at the current share price and would provide a pleasant surprise and buying incentive for many. An announcement to this regard is due around the end of August.

More than anything else, we expect news about a return to normal operations, improved grade reconciliation as the company will increasingly mine fresh ore, and a return to previous low-cost high-profit operations to drive the share price back up again.

Takeaway

Regis Resources is a bellwether all-Australian gold mining stock. The recent sell-off has been overdone and the share price has overshot to the downside.

With repair work progressing as planned, funding well and truly under control, and operations resuming we expect the share price to correct closer to fair value in due time. In this context we see 50% upside.

Should the PFS for McPhillamy hold up to expectations, and should operational parameters improve as anticipated we would not be surprised to see the upside extended well beyond this short-term target in due time.

Editor's Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks.

Quelle: Seeking Alpha

Regis Resources Has Dropped Much Too Far

Jun. 3, 2014 6:30 AM ET |

Summary

Gold miner Regis Resources has been challenged by flooding of two pits and grade reconciliation issues.

Updated production and cost guidance for the next 12 months has caused panic selling and the share price has overshot to the downside.

We see 50% near-term upside just to reach fair value as implicated by the updated guidance.

Further upside is a real possibility when taking into account the potential for operations improving to previous efficiency levels.

Mr. Nick Giorgetta is a legend in the Australian gold mining space. This man was one of the founding members of Equigold which fetched A$1.1B when it was sold in 2008. The Equigold team stayed together and built another gold miner by the name of Regis Resources (OTC:RGRNF), the second largest by market capitalization and arguably the most profitable in Australia until as recently as January this year.

Mr Giorgetta has just increased his personal holdings in Regis Resources on market to the tune of $1.35M (A$1.5M). This transaction is a strong statement of support for Regis Resources which has been battling the fallout of a force majeure declared in February following a severe weather event.

Regis Resources has just released an "Operational Update and 2015 Guidance." The impact of the events in February had been known before and the numbers presented in the guidance were certainly no surprise to your humble scribe. Other investors seemed to think differently, however, and the stock was sold off violently by 35% in what we view as a panic reaction. Shares are trading around $1.35 (A$1.50) in the aftermath.

The resulting share price has overshot to the downside by some margin and we believe that investors should be looking at the current share price weakness as a rare buying opportunity; and take Mr Giorgetta's cue who seems to recognize a bargain when it is staring in his face.

Regis Resources - A Brief Summary

This bellwether Australian gold miner has received a fair amount of coverage here on Seeking Alpha, not just by your humble scribe but also by another author. We recommend a browse through these articles to gain a basic understanding of the company.

Here is a brief summary with a few useful links for more detailed information nevertheless:

Regis Resources controls the Duketon gold project in Western Australia, with currently three operating mines: The Moolart Well mine, the Garden Well mine and the Rosemont mine. Two CIL plants process ore from these mines with ore slurry from the Rosemont mine pumped to the Garden Wells facilities. The company has been able to achieve very low cash costs at these operations and has remained highly profitable throughout the past three years of gold price correction. This profitability has allowed the company to declare a maiden dividend last year.

Regis Resources is also developing the McPhillamys gold project in New South Wales, also in Australia. The project is close to infrastructure including roads, rail and power; however, sourcing water for McPhillamy could be problematic. There are several other large gold mines nearby including Barrick Gold's (ABX) Cowal Gold Mine, Newcrest's (OTCPK:NCMGF) Cadia Mine and the Northparke's Gold Mine owned by Rio Tinto (RIO). A PFS for this project is overdue; Regis is targeting possible first production as early as 2017 with an annual target of 140,000 to 160,000 ounces in a bulk mining CIL scenario, although this schedule might prove ambitious considering permitting procedures in NSW.

Force Majeure

A one in 150 year rainfall event on February 13 was too much for the protection bunds and after 14 hours of abnormal downpour significant amounts of water entered the Garden Well and Rosemont pits. Thankfully no one was injured, but the pit infrastructure certainly suffered. Moolart Well operations, and also the Garden Well processing plants were not affected by this event.

The attached photograph was published by miningaustralia.com and shows water cascading into the Garden Well pit.

Regis Resources declared a force majeure, and set to work pumping out the water and repairing the damage while processing stockpiled ore and limited amounts of ore mined from un-affected portions of the pits. The company also extended its credit facility but has not drawn down on this extension so far.

To date most of the damage at the Rosemont mine has been repaired, plus a pit wall slip that has occurred since then. Water has been pumped out of the Garden Well pit and sludge removal from the bottom is ongoing. Mining at Garden Well is scheduled to resume towards the end of June.

In the context of this force majeure it is noteworthy that so far the company has funded all repair work from cash on hand. It has not had to draw down on the credit facility extension, and no additional equity has been issued. A remarkable show of strength, indeed.

Grade Reconciliation Issues

Operations at Garden Well have been plagued by grade reconciliation issues since mining started in 2012 and the most recent operational update reported similar issues at Rosemont. These issues manifest themselves in lower than anticipated head grades and seem to be associated with flat lying oxides.

This flat lying oxide ore will be mined for another half year in the main Rosemont pit before more predictable fresh rock ore can be accessed throughout the Rosemont operations. Similarly, we expect head grades at Garden Well to reconcile with reserve grades in due time as mining advances from the oxide layers to fresh ore.

Again, most of these issues have been known to the market for some time, and had been priced in prior to the release of the update and sell-off of last week.

2015 Guidance

In the light of ongoing remedial work and the described grade reconciliation issues the company has published its production and cash cost guidance for the upcoming 2015 financial year mentioned in the introduction to this article. The table below summarizes this guidance and we have added our estimate for all-in-sustaining costs, or AISC, in the rightmost column assuming A$60/oz royalties plus allowances for sustaining capital and G&A. We are listing our AISC estimates in Australian Dollars, or A$, as well as US Dollars, or $.

While hardly surprising in our view, these numbers seem to have caught some investors off-guard prompting the sustained selling following the release of the guidance. Projections of more than 400,000 ounces of annual production in the coming financial year as indicated in last year's AGM were revised considerably and 2015 guidance is now for 305,000 to 355,000 ounces; while cash cost guidance has been increased for Garden Well and Rosemont.

It takes some pretty high expectations if guidance for 300,000+ ounces of gold production at AISC of under $1,000/oz is considered 'bad news' causing a 35% sell-off. Many gold miners would consider themselves lucky, if only they could break such news to their shareholders.

Price Pressure to Continue For a Short While

There are two reasons why we believe that price pressure is here to stay until mid-year:

1.Fiscal years in Australia last from July 1 to June 30 and tax loss selling typically occurs in June. Regis Resources has not traded below $3 for several years and this company is therefore a prime candidate for tax-related selling pressure in coming weeks.

2.Regis Resources is a constituent of the ASX S&P 100 index. We expect the company to be dropped from this list when the index is re-balanced at the end of June. Typically this leads to additional selling pressure as large funds and institutions reduce their holdings in consequence.

Looking Ahead

It is worth noting that the guidance which has just been released is for the coming financial year and the company's focus will be squarely set on increasing production and lowering costs at Rosemont and Garden Well in order to match the profile of Moolart Well, and the original forecasts.

Improvements in productivity and cost efficiency at Rosemont should be seen within months as oxide ore will be depleted and mining of fresh ore will bring grade consistency and lower costs. A similar effect can be expected at Garden Well in due time after this mine returns to normal operating conditions after the clean-up in July.

Regis management has a long standing reputation of bringing out optimized performance in the gold mines it operates and we see no reason why this time should be any different. We therefore see the upcoming year as a year to regroup, with a firm view to regain the unparalleled profitability of previous years.

So, What's it Worth?

Using guidance, and assuming minimal developing expenditure for development activities at the McPhillamys project and a gold price around $1,250/oz we conservatively estimate an EBITDA of $100M for the upcoming financial year. Using the current enterprise value this leads to an EV/EBITDA ratio of 6.9.

Consider the attached table which lists other precious metal miners with market capitalization in the same order of magnitude and multiple assets located in relatively safe jurisdictions. Regis Resources is trading at roughly half the EV/EBITDA ratio of this peer group. Other metrics also confirm the view that the recent sell-off has left Regis Resources undervalued.

For a more comprehensive view we used a discounted cash flow model, or DCM, considering the three individual mines and assuming a gold price of $1,250/oz. We explicitly assumed no improvements in production from the described 2015 guidance and used AISC as listed earlier in this piece. We assumed a discount rate of 5% in acknowledgement of low operational and political risks, and we assumed an effective tax rate of 25% in line with previous years. We also assumed mine lives of 16 years for all three mines, which implies a continuation of reserve conversion, and utilization of known high-grade satellite deposits for blending with lower grade resources for Moolart Well.

The resulting NPVs for the three mines are documented in the table below. Moolart Well represents the greatest value in this model, with Garden Well and Rosemont impaired by the described challenges. We repeat, that we assumed no remediation of these challenges in this model, a highly pessimistic assumption in our view. Still, the sum of these parts is $788M.

Repeating the exercise, and including some degree of improvement from the current status at Garden Well and Rosemont quickly pushes the total present value above $1B. And these considerations only include the three producing mines, and ignore the McPhillamys project which our fellow author Investment Doctor has valued at $304M.

However, considering the current enterprise value of $688M all these calculations only reveal different shades of severe under-valuation; a result of the recent sell-off and a special situation that will rectify itself to the upside before long.

Our current base case assumes full valuation of the assets under guidance production rates and values McPhillamys at a modest 0.2xNAV. These assumptions lead to a short-term target price of $2.23 ($A2.47) or 50% upside, to be achieved before the end of the year. In the longer term we expect a return to the operational efficiencies already displayed in previous years which should prompt the share price to return to A$3+ levels as was the norm before the declaration of the force majeure.

Our short-term price target correlates very well with the only in-depth buy-side research report since the operational update by Argonaut which states a price target of $2.12 (A$2.35) and notes that "operational expectations have now been largely reset and the Company remains one of the few 'go to' names in the Australian gold sector given its scalable production profile and low sovereign risks" while maintaining a BUY rating.

The chart at the top of this article shows that shares of Regis Resources were in fact trading around the quoted short-term price targets before the recent update by the company. As we have stated before, we believe that most information contained in this update had already been known, and had been priced in. The sell-off after the update was unfounded in our view and not in sync with the company's value. We strongly believe that this imbalance will be resolved by a correction to the upside before long.

Additional Upside and Catalysts

In the very short term, the end of the financial year on June 30 will mean an end of selling pressure from tax loss selling and re-balancing of ASX indices. A return to more reasonable valuations closer to the intrinsic value of Regis Resources should start early in July. In this context it should be noted that July is winter time in Australia, and no lull in trading is to be expected as is the case for the Northern hemisphere "summer months."

The publication of a PFS for the McPhillamy project is imminent and should provide confirmation of the value implied above. Our base case valuation only accounts for 20% of this project's NAV and a strong PFS should prompt investors to use a higher percentage.

The company paid a maiden dividend last year. Due to the force majeure situation and the associated challenges it is widely believed that this dividend will be suspended. However, in reviewing the balance sheet and considering the imminent re-start of operations at Garden Well we would not be surprised to see a continuation of dividend payments at a reduced level. A dividend reduction of 50% would still mean a 5% dividend yield at the current share price and would provide a pleasant surprise and buying incentive for many. An announcement to this regard is due around the end of August.

More than anything else, we expect news about a return to normal operations, improved grade reconciliation as the company will increasingly mine fresh ore, and a return to previous low-cost high-profit operations to drive the share price back up again.

Takeaway

Regis Resources is a bellwether all-Australian gold mining stock. The recent sell-off has been overdone and the share price has overshot to the downside.

With repair work progressing as planned, funding well and truly under control, and operations resuming we expect the share price to correct closer to fair value in due time. In this context we see 50% upside.

Should the PFS for McPhillamy hold up to expectations, and should operational parameters improve as anticipated we would not be surprised to see the upside extended well beyond this short-term target in due time.

Editor's Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks.

Quelle: Seeking Alpha

10.04.24 · wO Chartvergleich · Baader Bank |

09.11.23 · wallstreetONLINE Redaktion · Compania de Minas Buenaventura SAA |