Wann und wie kommt der nächste Crash? (Seite 11)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 1

Gesamt: 179.917

Gesamt: 179.917

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 137 | |

| gestern 23:09 | 121 | |

| vor 1 Stunde | 102 | |

| gestern 23:31 | 79 | |

| vor 1 Stunde | 78 | |

| gestern 22:15 | 77 | |

| gestern 21:35 | 75 | |

| gestern 22:52 | 75 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.075,00 | +0,33 | 241 | |||

| 2. | 2. | 1,3800 | -1,43 | 102 | |||

| 3. | 3. | 0,1890 | -2,58 | 81 | |||

| 4. | 4. | 172,53 | +6,41 | 79 | |||

| 5. | 5. | 9,3325 | -3,69 | 75 | |||

| 6. | 6. | 7,0010 | +4,17 | 53 | |||

| 7. | 7. | 22,240 | -3,22 | 41 | |||

| 8. | 8. | 0,0160 | -24,17 | 38 |

Beitrag zu dieser Diskussion schreiben

20.4.

Fed Emergency Loans to Banks Post First Rise in Five Weeks

https://finance.yahoo.com/news/fed-emergency-loans-banks-pos…

...

The US central bank had $143.9 billion of loans outstanding to financial institutions through two backstop lending facilities in the week through April 19, compared with $139.5 billion the previous week, according to data published Thursday.

The weekly Fed balance sheet data showed $69.9 billion of outstanding borrowing from the central bank’s traditional backstop lending program, known as the discount window, compared with $67.6 billion the previous week and the record $152.9 billion reached last month.

Demand in the new Bank Term Funding Program also climbed, rising to $74 billion, compared with $71.8 billion the previous week.

The discount window is the Fed’s oldest liquidity backstop for banks. The BTFP, meanwhile, was launched March 12 after the Fed declared emergency conditions following the collapse of California’s Silicon Valley Bank and New York’s Signature Bank.

...

Fed Emergency Loans to Banks Post First Rise in Five Weeks

https://finance.yahoo.com/news/fed-emergency-loans-banks-pos…

...

The US central bank had $143.9 billion of loans outstanding to financial institutions through two backstop lending facilities in the week through April 19, compared with $139.5 billion the previous week, according to data published Thursday.

The weekly Fed balance sheet data showed $69.9 billion of outstanding borrowing from the central bank’s traditional backstop lending program, known as the discount window, compared with $67.6 billion the previous week and the record $152.9 billion reached last month.

Demand in the new Bank Term Funding Program also climbed, rising to $74 billion, compared with $71.8 billion the previous week.

The discount window is the Fed’s oldest liquidity backstop for banks. The BTFP, meanwhile, was launched March 12 after the Fed declared emergency conditions following the collapse of California’s Silicon Valley Bank and New York’s Signature Bank.

...

Uuuups

20.4.

JPMorgan sees "non-trivial risk" of a technical default on U.S. Treasuries as debt ceiling looms

https://www.msn.com/en-ca/money/topstories/jpmorgan-sees-non…

...

JPMorgan expects the U.S. debt ceiling to become an issue as early as next month with the Wall Street bank ascribing a "non-trivial risk" of a technical default on U.S. Treasuries.

In a note published to clients late on Wednesday, JPMorgan said it expected both the debate over the debt ceiling as well as the one on the federal funding bill to run "dangerously close" to their final deadlines.

The bank said its U.S. rates strategy team expects the Treasury could run out of available resources by the middle of August.

The debt ceiling is the maximum amount the U.S. government can borrow to meet its financial obligations. When the ceiling is reached, the Treasury cannot issue any more bills, bonds or notes. It can only pay Treasury bills (T-bills) through tax revenues.

"Signs of stress typically start in the T-bill market 2-3 months before the X-date given money market funds (MMF), which are large holders of T-bills, will begin to more actively advertise that they don't hold any bills that mature over those dates," JPMorgan said.

Treasury Secretary Janet Yellen is expected in the next few days to revise the X-date - or the date by which the federal government can no longer meet all its obligations in full and on time absent actions by Congress - which is currently early June.

U.S. credit default swaps, market-based gauges of the risk of a default, this month hit their highest level since 2012. Those contracts are denominated in euros, as investors lower exposure to dollar-denominated assets.

20.4.

JPMorgan sees "non-trivial risk" of a technical default on U.S. Treasuries as debt ceiling looms

https://www.msn.com/en-ca/money/topstories/jpmorgan-sees-non…

...

JPMorgan expects the U.S. debt ceiling to become an issue as early as next month with the Wall Street bank ascribing a "non-trivial risk" of a technical default on U.S. Treasuries.

In a note published to clients late on Wednesday, JPMorgan said it expected both the debate over the debt ceiling as well as the one on the federal funding bill to run "dangerously close" to their final deadlines.

The bank said its U.S. rates strategy team expects the Treasury could run out of available resources by the middle of August.

The debt ceiling is the maximum amount the U.S. government can borrow to meet its financial obligations. When the ceiling is reached, the Treasury cannot issue any more bills, bonds or notes. It can only pay Treasury bills (T-bills) through tax revenues.

"Signs of stress typically start in the T-bill market 2-3 months before the X-date given money market funds (MMF), which are large holders of T-bills, will begin to more actively advertise that they don't hold any bills that mature over those dates," JPMorgan said.

Treasury Secretary Janet Yellen is expected in the next few days to revise the X-date - or the date by which the federal government can no longer meet all its obligations in full and on time absent actions by Congress - which is currently early June.

U.S. credit default swaps, market-based gauges of the risk of a default, this month hit their highest level since 2012. Those contracts are denominated in euros, as investors lower exposure to dollar-denominated assets.

<

ich hab nun meine 2. und letzte $TECK-Tranche verkauft. Ich denke nicht mehr, daß die Angebote vor Kohle-Spinoff oder erst danach noch viel höher ausfallen werden: https://uk.finance.yahoo.com/news/sumitomo-metal-mining-conf…

>

ich hab nun meine 2. und letzte $TECK-Tranche verkauft. Ich denke nicht mehr, daß die Angebote vor Kohle-Spinoff oder erst danach noch viel höher ausfallen werden: https://uk.finance.yahoo.com/news/sumitomo-metal-mining-conf…

>

...

Investors including pension funds, family offices and insurers currently allocate 24% of their portfolios, on average, to private markets, according to a newly released BlackRock survey of senior executives and allocators at more than 200 firms managing a total of $15 trillion.

Of those surveyed, 72% said they plan to increase allocations to private equity funds, while 52% aim to boost private-credit holdings.

The survey ran from October 2022 through January 2023, before the collapse of three regional banks spurred the biggest industry crisis since 2008.

...

18.4.

BlackRock Sees Big Investors Boosting Private Equity, PE Stakes

https://finance.yahoo.com/news/blackrock-sees-big-investors-…

Investors including pension funds, family offices and insurers currently allocate 24% of their portfolios, on average, to private markets, according to a newly released BlackRock survey of senior executives and allocators at more than 200 firms managing a total of $15 trillion.

Of those surveyed, 72% said they plan to increase allocations to private equity funds, while 52% aim to boost private-credit holdings.

The survey ran from October 2022 through January 2023, before the collapse of three regional banks spurred the biggest industry crisis since 2008.

...

18.4.

BlackRock Sees Big Investors Boosting Private Equity, PE Stakes

https://finance.yahoo.com/news/blackrock-sees-big-investors-…

Antwort auf Beitrag Nr.: 73.670.960 von faultcode am 14.04.23 13:06:21

*Lol*

Wieviel Euroland gibt es eigentlich?

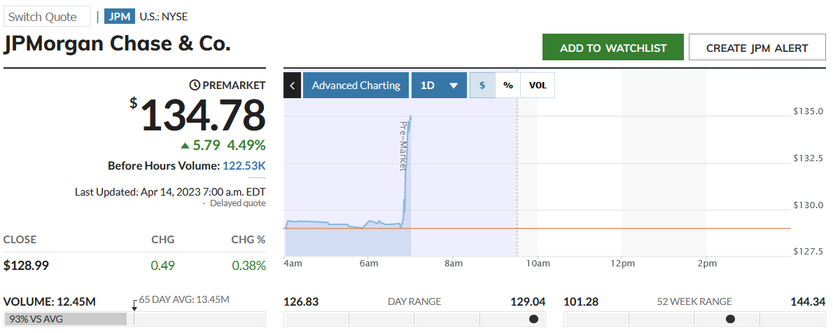

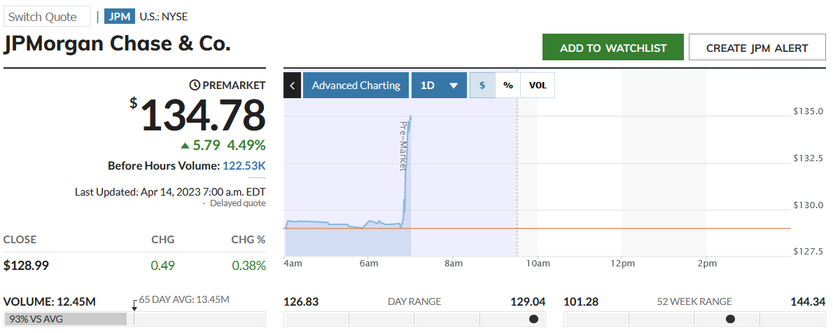

$JPM: beat!

14.4.

JPMorgan profit surges 52% on robust consumer business

https://www.investing.com/news/stock-market-news/jpmorgan-pr…

...

JPMorgan Chase & Co (NYSE:JPM)'s profit climbed in the first quarter as higher interest rates boosted its consumer business in a period that saw two of the biggest banking failures in U.S. history.

The bank's profit increased 52% to $12.62 billion, or $4.10 per share, in the three months ended Mar. 31.

JPMorgan's solid performance follows the high-profile shutdowns of three U.S. lenders last month in the worst banking turmoil since the global financial crisis of 2008.

...

JPMorgan set aside provisions of $2.3 billion, up 56% from last year.

Revenue at the lender's consumer and community banking unit rose 80% to $5.2 billion. Its Wall Street investment banking business was weighed down by tepid markets for mergers, acquisitions and stock sales.

14.4.

JPMorgan profit surges 52% on robust consumer business

https://www.investing.com/news/stock-market-news/jpmorgan-pr…

...

JPMorgan Chase & Co (NYSE:JPM)'s profit climbed in the first quarter as higher interest rates boosted its consumer business in a period that saw two of the biggest banking failures in U.S. history.

The bank's profit increased 52% to $12.62 billion, or $4.10 per share, in the three months ended Mar. 31.

JPMorgan's solid performance follows the high-profile shutdowns of three U.S. lenders last month in the worst banking turmoil since the global financial crisis of 2008.

...

JPMorgan set aside provisions of $2.3 billion, up 56% from last year.

Revenue at the lender's consumer and community banking unit rose 80% to $5.2 billion. Its Wall Street investment banking business was weighed down by tepid markets for mergers, acquisitions and stock sales.

7.4.

U.S. unemployment rate falls to 3.5% as 236,000 jobs are created in March

https://www.marketwatch.com/story/jobs-report-shows-236-000-…

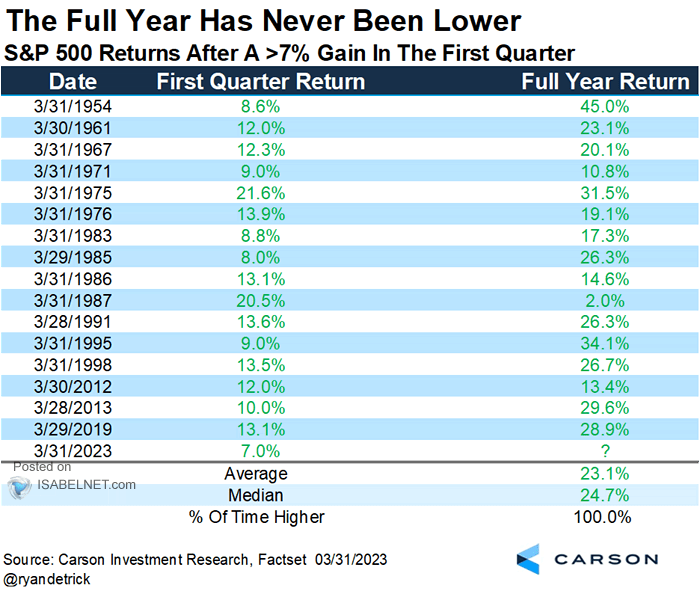

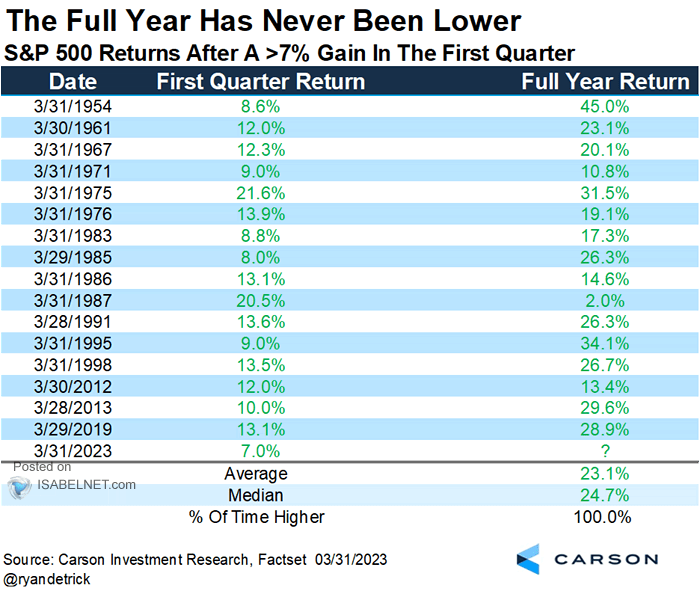

Antwort auf Beitrag Nr.: 73.584.342 von faultcode am 30.03.23 16:06:56auf der anderen Seite gibt es dieses statistische Phänomen -- auch mit 1987 noch in grün am Ende:

https://twitter.com/ISABELNET_SA/status/1642112195386302466

https://twitter.com/ISABELNET_SA/status/1642112195386302466

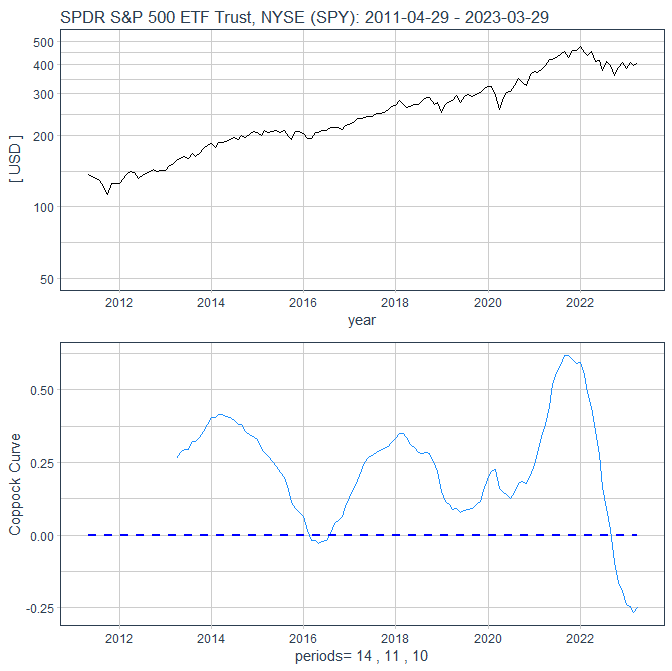

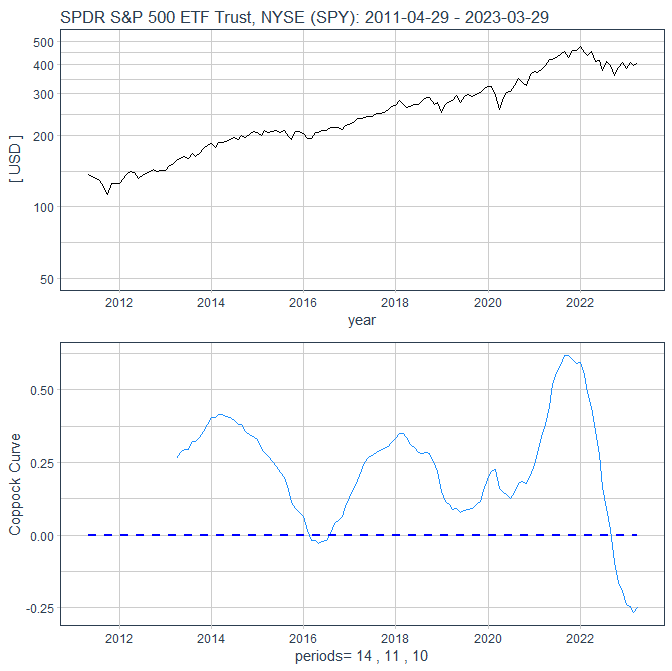

Antwort auf Beitrag Nr.: 72.412.263 von faultcode am 16.09.22 18:20:35Update Coppock Curve:

=> nach diesem System braucht man nicht auf die Idee kommen groß Aktien zu kaufen, solange dieser Indikator nicht wieder über Null ist

=> nach diesem System braucht man nicht auf die Idee kommen groß Aktien zu kaufen, solange dieser Indikator nicht wieder über Null ist

Antwort auf Beitrag Nr.: 73.554.980 von faultcode am 26.03.23 12:50:30

https://www.marketwatch.com/story/3-charts-show-u-s-bank-fai…

https://www.marketwatch.com/story/3-charts-show-u-s-bank-fai…