Wann und wie kommt der nächste Crash? (Seite 32)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 5

Gesamt: 179.915

Gesamt: 179.915

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 49 Minuten | 10090 | |

| vor 36 Minuten | 6703 | |

| vor 1 Stunde | 3414 | |

| vor 30 Minuten | 3339 | |

| vor 1 Stunde | 3254 | |

| vor 1 Stunde | 3051 | |

| vor 53 Minuten | 2504 | |

| vor 1 Stunde | 2462 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.940,94 | -0,81 | 239 | |||

| 2. | 3. | 166,06 | +2,42 | 83 | |||

| 3. | 2. | 9,2900 | -3,68 | 82 | |||

| 4. | 4. | 0,1910 | -1,55 | 77 | |||

| 5. | 34. | 0,6800 | -51,43 | 68 | |||

| 6. | 14. | 7,0480 | +4,60 | 55 | |||

| 7. | 6. | 0,0262 | +24,17 | 49 | |||

| 8. | 13. | 440,05 | -10,83 | 47 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 71.299.287 von faultcode am 06.04.22 20:21:20so was kann auf Dauer nicht ohne Folgen auf die (US-)Aktienmärkte bleiben:

https://www.marketwatch.com/investing/bond/tmubmusd01y?count…

https://www.marketwatch.com/investing/bond/tmubmusd01y?count…

Antwort auf Beitrag Nr.: 71.107.095 von faultcode am 15.03.22 12:50:33

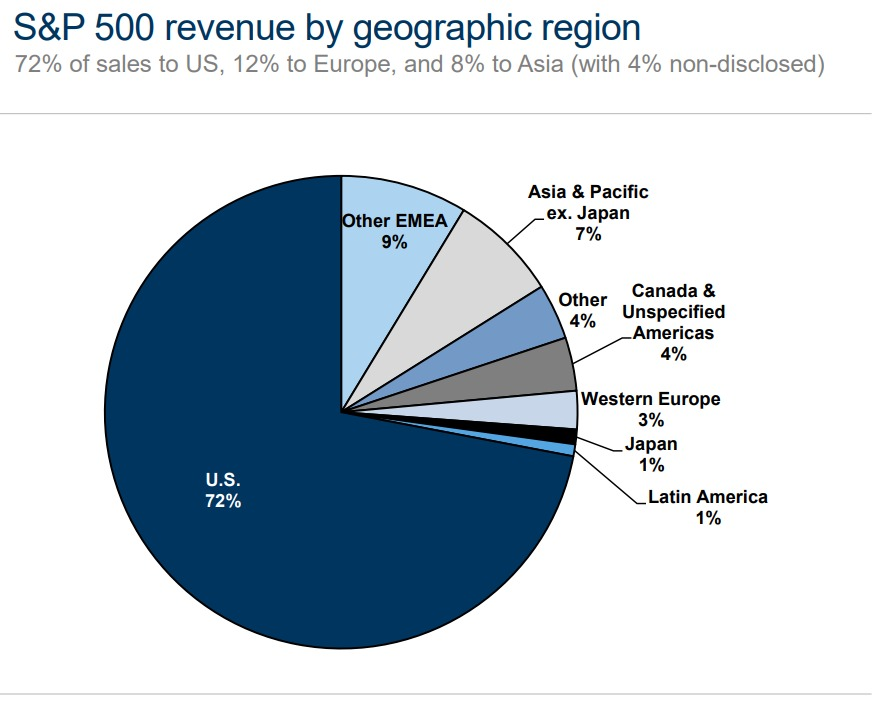

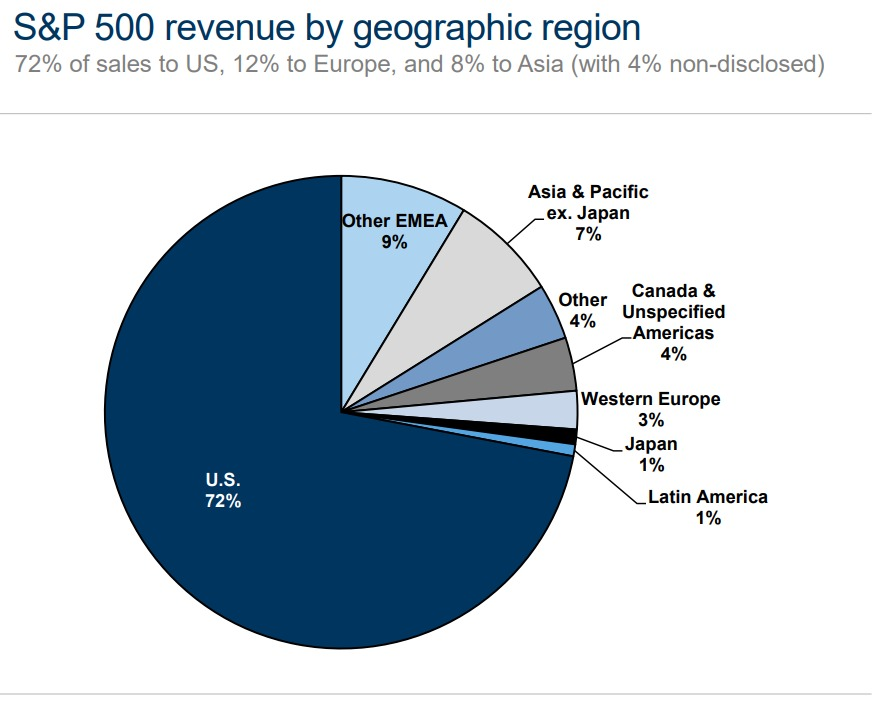

https://twitter.com/TheMarketDog/status/1512117642122907651

Tag: SP500, S&P 500

https://twitter.com/TheMarketDog/status/1512117642122907651

Tag: SP500, S&P 500

Antwort auf Beitrag Nr.: 66.520.700 von faultcode am 20.01.21 12:00:16 20.01.2021

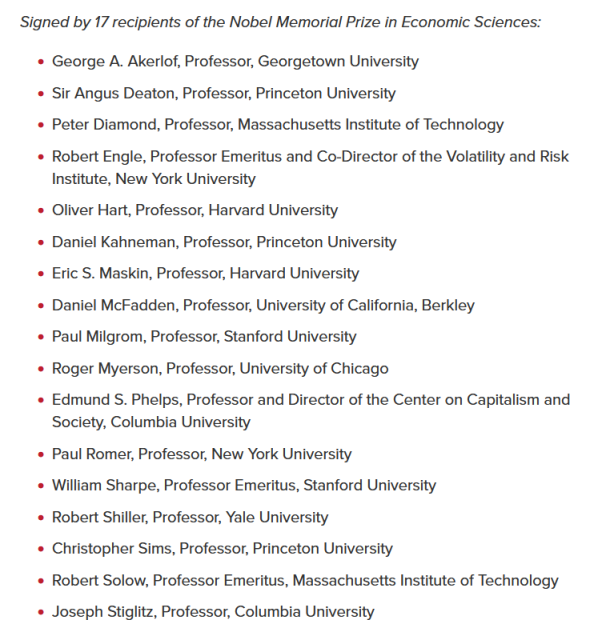

Jeremy Siegel -- Russell E. Palmer Professor of Finance at the Wharton School of the University of Pennsylvania -- und kein recipient of the Nobel Memorial Prize in Economic Sciences hatte Recht. Nochmal zum langsam mitlesen:

Historic increase in monetary supply to fight Covid crisis will lead to higher consumer prices

Die hier sahen das aus unerfindlichen Gründen anders:

September 20, 2021

Open letter from Nobel Laureates in support of economic recovery agenda

https://www.epi.org/press/nobel-laureate-economist-joseph-st…

https://www.epi.org/open-letter-from-nobel-laureates-in-supp…

...

Because this agenda invests in long-term economic capacity and will enhance the ability of more Americans to participate productively in the economy, it will ease longer-term inflationary pressures.

...

5.4.

Nobel economists were dead wrong on inflation: Don’t expect an apology

...

https://thehill.com/opinion/finance/3259197-nobel-economists…

...

Don’t expect a mea culpa from Stiglitz or his coauthors any time soon.

Being an economist confers a magical identity that few other occupations enjoy. Economists know this and work to maintain it.

They can be wrong, really wrong, and never pay a price. Indeed, while their pronouncements can lead to horrible policies that cause real people to lose real money betting on the wrong future, hardly anyone ever calls them out.

They have a kind of intellectual immunity conferred by others who seem to think of economists as brainiacs of a different order. After all, no other academic discipline has an equivalent of the Council of Economic Advisors advising the president.

Shortly after the council was first formed, Harry Truman joked that he’d give anything for a one-armed economist — one who would give him definitive advice on monetary and fiscal policy. Maybe, in the old days, economists understood that a goodly amount of humility was needed to offset swagger.

Ich sag dazu nur: Kahneman und Shiller auch?!?

Gut, William Sharpe scheint in seinem Alter mittlerweile alles zu unterschreiben

Tag: no skin in the game

Zitat von faultcode: Jeremy Siegel in der FT:

19.1.

Higher inflation is coming and it will hit bondholders

Historic increase in monetary supply to fight Covid crisis will lead to higher consumer prices

https://www.ft.com/content/6536113f-f509-41e2-bee0-597ed9084…

...

Jeremy Siegel -- Russell E. Palmer Professor of Finance at the Wharton School of the University of Pennsylvania -- und kein recipient of the Nobel Memorial Prize in Economic Sciences hatte Recht. Nochmal zum langsam mitlesen:

Historic increase in monetary supply to fight Covid crisis will lead to higher consumer prices

Die hier sahen das aus unerfindlichen Gründen anders:

September 20, 2021

Open letter from Nobel Laureates in support of economic recovery agenda

https://www.epi.org/press/nobel-laureate-economist-joseph-st…

https://www.epi.org/open-letter-from-nobel-laureates-in-supp…

...

Because this agenda invests in long-term economic capacity and will enhance the ability of more Americans to participate productively in the economy, it will ease longer-term inflationary pressures.

...

5.4.

Nobel economists were dead wrong on inflation: Don’t expect an apology

...

https://thehill.com/opinion/finance/3259197-nobel-economists…

...

Don’t expect a mea culpa from Stiglitz or his coauthors any time soon.

Being an economist confers a magical identity that few other occupations enjoy. Economists know this and work to maintain it.

They can be wrong, really wrong, and never pay a price. Indeed, while their pronouncements can lead to horrible policies that cause real people to lose real money betting on the wrong future, hardly anyone ever calls them out.

They have a kind of intellectual immunity conferred by others who seem to think of economists as brainiacs of a different order. After all, no other academic discipline has an equivalent of the Council of Economic Advisors advising the president.

Shortly after the council was first formed, Harry Truman joked that he’d give anything for a one-armed economist — one who would give him definitive advice on monetary and fiscal policy. Maybe, in the old days, economists understood that a goodly amount of humility was needed to offset swagger.

Ich sag dazu nur: Kahneman und Shiller auch?!?

Gut, William Sharpe scheint in seinem Alter mittlerweile alles zu unterschreiben

Tag: no skin in the game

Based on data going back to 1928, the S&P 500 has seen a median gain of 11.5% a year after exiting correction, and average gain of nearly 14% — rising nearly 77% of the time. Median and average returns for shorter term time frames were also positive.

...

29.3.

S&P 500 exits correction: Here’s what history says happens next to U.S. stock-market benchmark

https://www.marketwatch.com/story/s-p-500-set-to-exit-correc…

Antwort auf Beitrag Nr.: 71.174.587 von faultcode am 23.03.22 13:59:46

sieht man mMn auch an dieser schönen Divergenz (S&P500-ETF vs. Fixed income):

https://twitter.com/AlessioUrban/status/1507119392806604811

Zitat von faultcode: 22.3.

Recession Is Unavoidable Without Russian Oil, Dallas Fed Study Says

https://finance.yahoo.com/news/recession-unavoidable-without…

...

sieht man mMn auch an dieser schönen Divergenz (S&P500-ETF vs. Fixed income):

https://twitter.com/AlessioUrban/status/1507119392806604811

22.3.

Recession Is Unavoidable Without Russian Oil, Dallas Fed Study Says

https://finance.yahoo.com/news/recession-unavoidable-without…

...

“If the bulk of Russian energy exports is off the market for the remainder of 2022, a global economic downturn seems unavoidable,” economists Lutz Kilian and Michael Plante wrote in an article posted by the Dallas Fed Tuesday. “This slowdown could be more protracted than that in 1991.”

The authors drew a parallel to the 1991 global recession, set off by Iraq’s invasion of Kuwait in the year prior that caused an oil-supply shock. Back then, Saudi Arabia partly reduced the impact by pledging to ramp up production, helping ensure what the researchers called “only a brief U.S. recession,” which lasted less than a year.

The refusal of financial institutions to support Russian energy exports has been the main development putting those shipments at risk, the Dallas Fed economists wrote. “This outcome was largely unanticipated, as U.S. and European Union sanctions originally deliberately excluded Russian energy exports.”

...

Recession Is Unavoidable Without Russian Oil, Dallas Fed Study Says

https://finance.yahoo.com/news/recession-unavoidable-without…

...

“If the bulk of Russian energy exports is off the market for the remainder of 2022, a global economic downturn seems unavoidable,” economists Lutz Kilian and Michael Plante wrote in an article posted by the Dallas Fed Tuesday. “This slowdown could be more protracted than that in 1991.”

The authors drew a parallel to the 1991 global recession, set off by Iraq’s invasion of Kuwait in the year prior that caused an oil-supply shock. Back then, Saudi Arabia partly reduced the impact by pledging to ramp up production, helping ensure what the researchers called “only a brief U.S. recession,” which lasted less than a year.

The refusal of financial institutions to support Russian energy exports has been the main development putting those shipments at risk, the Dallas Fed economists wrote. “This outcome was largely unanticipated, as U.S. and European Union sanctions originally deliberately excluded Russian energy exports.”

...

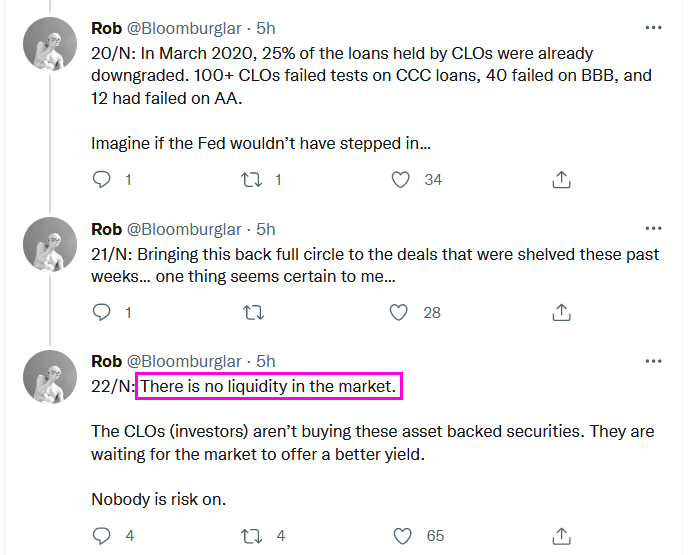

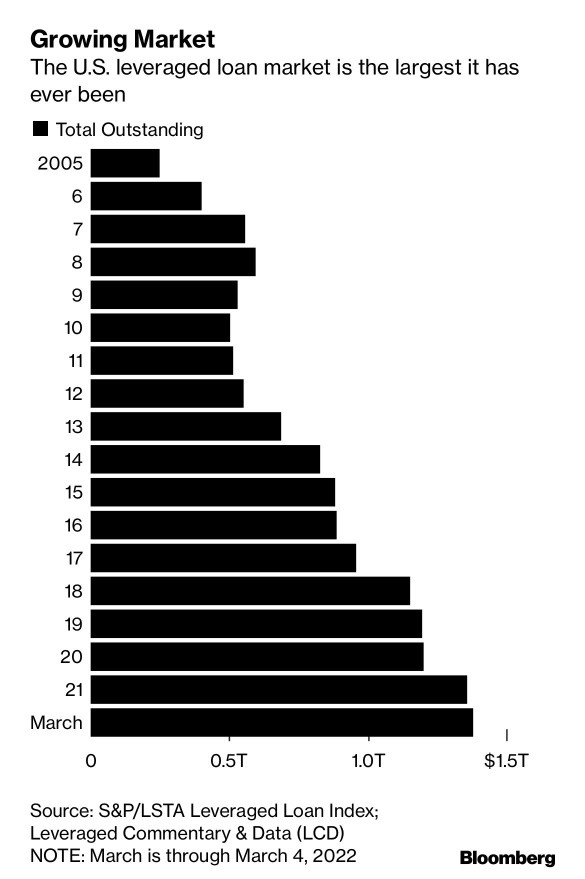

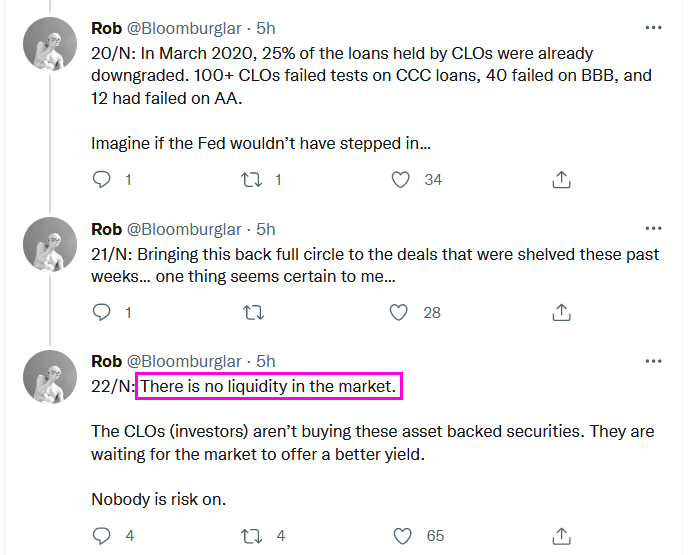

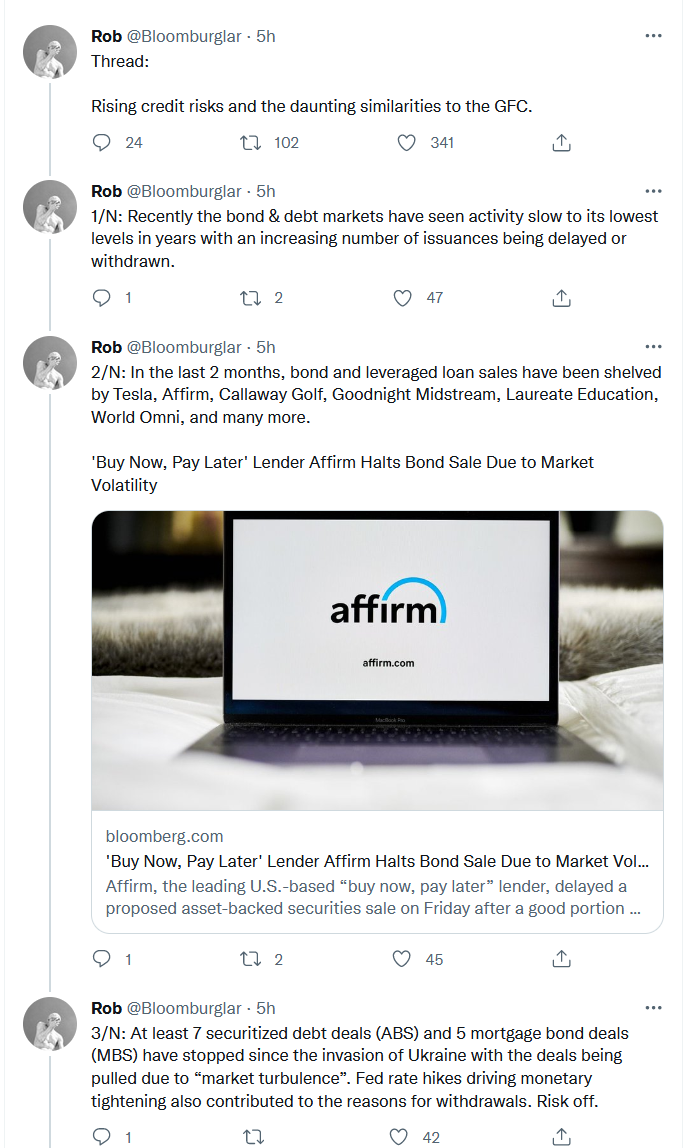

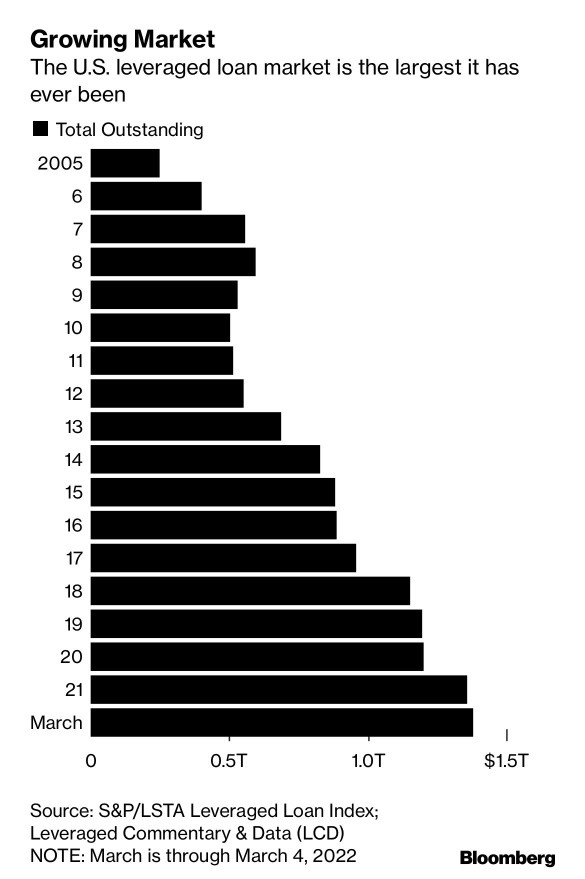

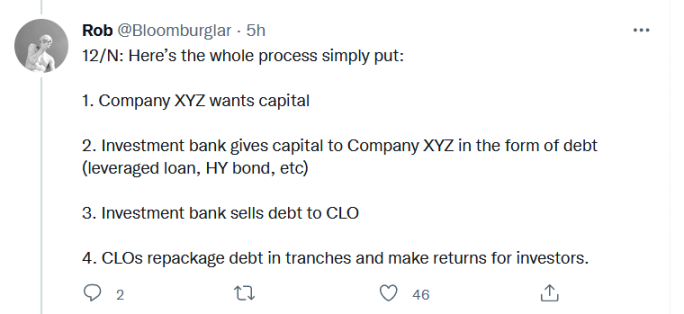

Antwort auf Beitrag Nr.: 71.144.286 von faultcode am 18.03.22 23:54:54das ist auch noch passend dazu: Collateralized loan obligations (CLO)

Rising credit risks and the daunting similarities to the GFC

...

https://twitter.com/Bloomburglar/status/1504869389019058213

...

...

...

https://twitter.com/Bloomburglar/status/1504869389019058213

...

...