Wann und wie kommt der nächste Crash? (Seite 54)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 4

Gesamt: 179.889

Gesamt: 179.889

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| heute 21:20 | 6599 | |

| vor 38 Minuten | 4839 | |

| vor 58 Minuten | 4626 | |

| heute 18:00 | 3197 | |

| vor 1 Stunde | 2933 | |

| vor 46 Minuten | 2814 | |

| vor 44 Minuten | 2067 | |

| vor 44 Minuten | 1709 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.716,00 | -0,19 | 198 | |||

| 2. | 2. | 146,97 | -1,97 | 95 | |||

| 3. | 7. | 6,6460 | -1,23 | 70 | |||

| 4. | 5. | 0,1810 | -1,90 | 51 | |||

| 5. | Neu! | 716,49 | -22,83 | 46 | |||

| 6. | 8. | 3,7675 | +0,74 | 45 | |||

| 7. | 17. | 7,2825 | -0,24 | 43 | |||

| 8. | 4. | 2.390,60 | +0,50 | 41 |

Beitrag zu dieser Diskussion schreiben

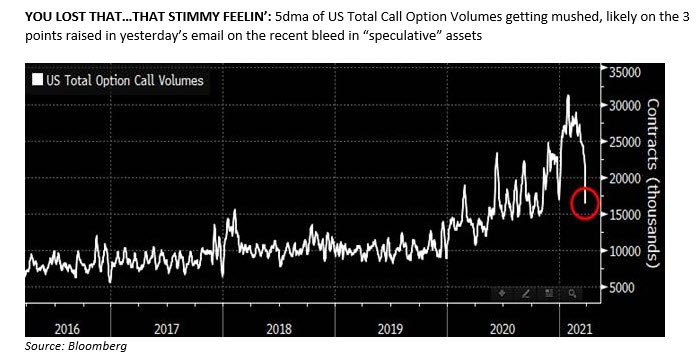

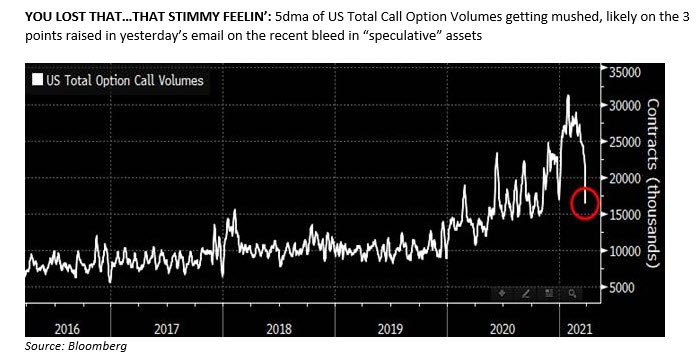

Antwort auf Beitrag Nr.: 67.674.268 von faultcode am 31.03.21 23:38:45 +

+

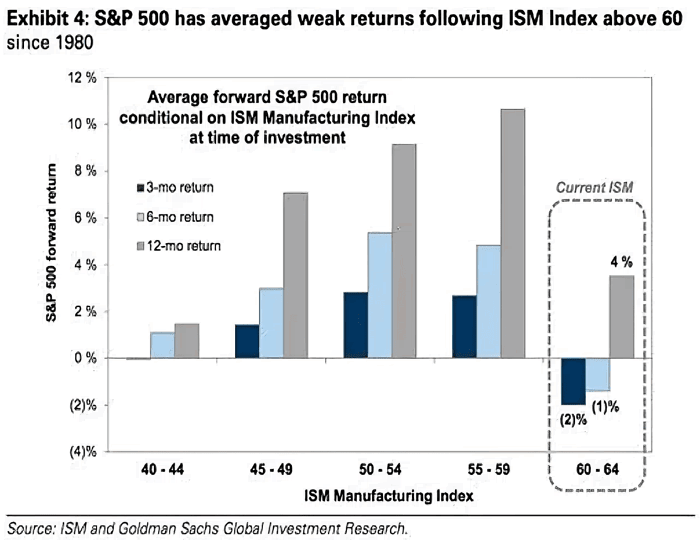

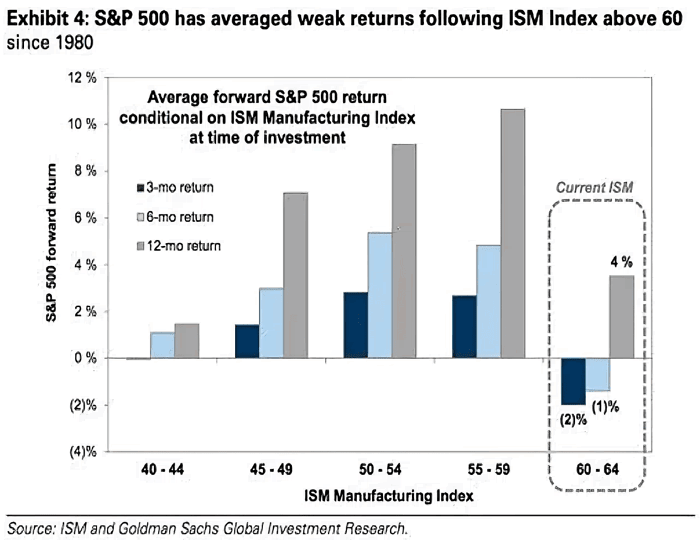

https://twitter.com/ISABELNET_SA/status/1377220433443962882

+

+https://twitter.com/ISABELNET_SA/status/1377220433443962882

Antwort auf Beitrag Nr.: 63.017.599 von faultcode am 16.03.20 00:24:42

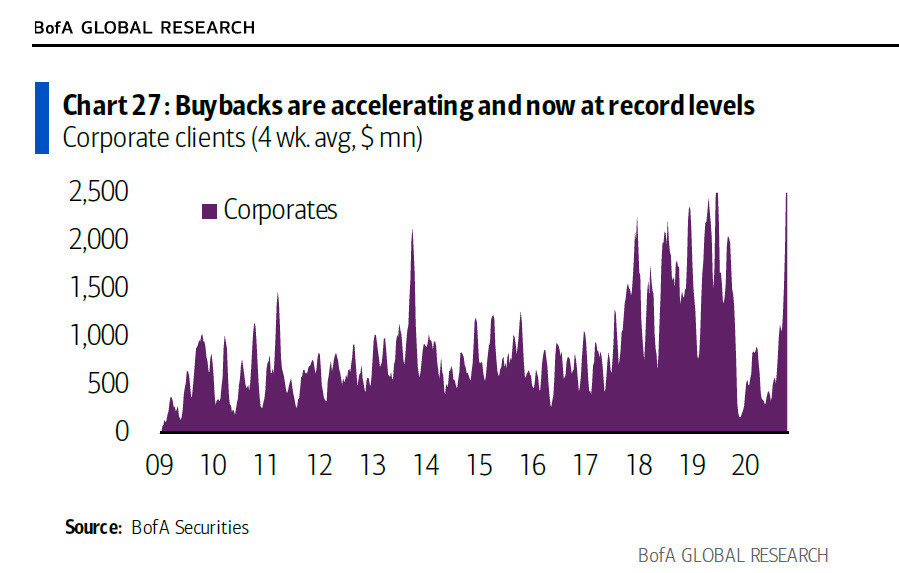

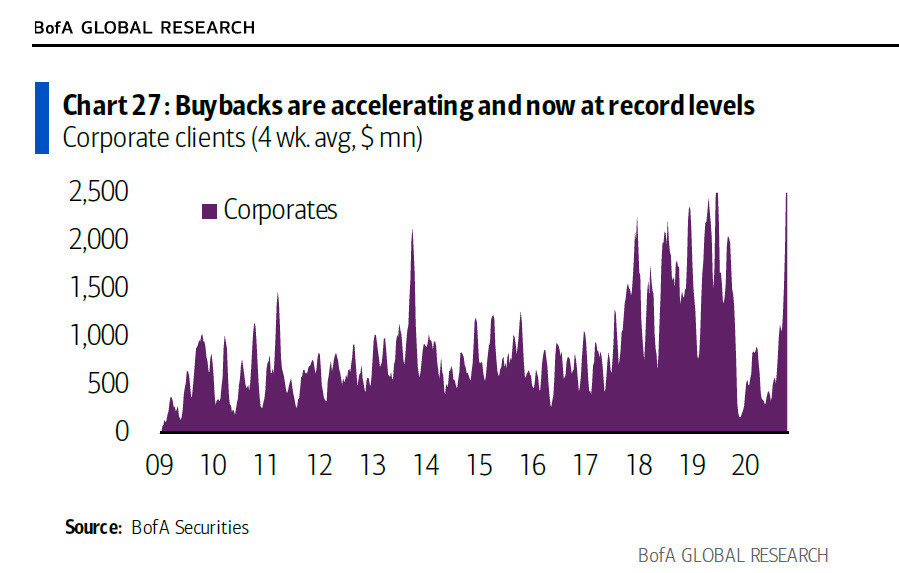

währte nicht lange. Share buybacks sind zurück!

Zitat von faultcode: ...

15.3.

JPMorgan, Bank of America, Citigroup and other major banks suspend stock buybacks due to pandemic

https://www.cnbc.com/2020/03/15/jpmorgan-bank-of-america-cit…

...

währte nicht lange. Share buybacks sind zurück!

Antwort auf Beitrag Nr.: 67.639.033 von faultcode am 29.03.21 14:32:48

Antwort auf Beitrag Nr.: 67.543.420 von faultcode am 21.03.21 11:20:0427.3.

The Ultra-Rich Who Crushed It In 2020 Are Now Bracing For The "Backlash"

https://www.zerohedge.com/markets/ultra-rich-who-crushed-it-…

...

Now, the rich are starting to brace "for the backlash" of both widening inequality and markets eventually turning against their favor, Reuters reports.

Morris Pearl, a former managing director at BlackRock, told Reuters: “The stock market crashed a year ago, by July or so my portfolio was back where it was before, at the beginning of the year, and now it’s far higher. The fundamental problem is this gross inequality that’s getting worse.”

Rob Weeber, CEO at Swiss wealth manager Tiedemann Constantia, suggested the rich want to start selling before taxes inevitably rise: “It’s quite evident that the bill is coming for everybody.”

...

Obviously, the U.S. is expected to hike taxes as a result of Joe Biden's election. Alvina Lo, chief wealth strategist at Wilmington Trust, commented: “We saw a surge of trusts created and funded in Q4 of last year. The vast majority of our clients adopted a wait-and-see approach until the election in November, and then it just kicked up into high gear.”

Jason Cain, who works for Boston Private, also said that families moved items into trust funds: “75-80% of the families that we talk to were convinced that that was an opportunistic time and they needed to do something.”

Many of the rich cashed in on investment opportunities that the average investor couldn't participate in, like "capitalising on market volatility with short-term derivative trades," the report notes. Maximilian Kunkel, UBS’s chief investment officer for wealthy family offices, said: “Some of our clients were extraordinarily agile in taking advantage of the biggest market dislocations.”

...

The Ultra-Rich Who Crushed It In 2020 Are Now Bracing For The "Backlash"

https://www.zerohedge.com/markets/ultra-rich-who-crushed-it-…

...

Now, the rich are starting to brace "for the backlash" of both widening inequality and markets eventually turning against their favor, Reuters reports.

Morris Pearl, a former managing director at BlackRock, told Reuters: “The stock market crashed a year ago, by July or so my portfolio was back where it was before, at the beginning of the year, and now it’s far higher. The fundamental problem is this gross inequality that’s getting worse.”

Rob Weeber, CEO at Swiss wealth manager Tiedemann Constantia, suggested the rich want to start selling before taxes inevitably rise: “It’s quite evident that the bill is coming for everybody.”

...

Obviously, the U.S. is expected to hike taxes as a result of Joe Biden's election. Alvina Lo, chief wealth strategist at Wilmington Trust, commented: “We saw a surge of trusts created and funded in Q4 of last year. The vast majority of our clients adopted a wait-and-see approach until the election in November, and then it just kicked up into high gear.”

Jason Cain, who works for Boston Private, also said that families moved items into trust funds: “75-80% of the families that we talk to were convinced that that was an opportunistic time and they needed to do something.”

Many of the rich cashed in on investment opportunities that the average investor couldn't participate in, like "capitalising on market volatility with short-term derivative trades," the report notes. Maximilian Kunkel, UBS’s chief investment officer for wealthy family offices, said: “Some of our clients were extraordinarily agile in taking advantage of the biggest market dislocations.”

...

Antwort auf Beitrag Nr.: 67.543.420 von faultcode am 21.03.21 11:20:04Zusatzinfo: Den gleichen Stand von 1,5% hatten wir aber auch schon am 29.1..

If markets are indeed about to roll over, there are no natural buyers left

https://twitter.com/zerohedge/status/1373465056713842692

So ist es.

Antwort auf Beitrag Nr.: 67.462.241 von faultcode am 15.03.21 14:28:39U.S. 10-YEAR TREASURY INFLATION-PROTECTED SECURITIES BREAKEVEN INFLATION RATE HITS 2.303%, HIGHEST SINCE JULY 2014

https://twitter.com/DeItaone/status/1371847567118569473

https://twitter.com/DeItaone/status/1371847567118569473