Wann und wie kommt der nächste Crash? (Seite 9)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 4

Gesamt: 179.889

Gesamt: 179.889

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 6412 | |

| vor 46 Minuten | 4699 | |

| vor 21 Minuten | 4509 | |

| heute 18:00 | 3177 | |

| vor 34 Minuten | 2746 | |

| vor 56 Minuten | 2692 | |

| heute 20:23 | 2036 | |

| vor 1 Stunde | 1670 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.716,00 | -0,19 | 203 | |||

| 2. | 2. | 137,96 | -2,24 | 92 | |||

| 3. | 7. | 6,6640 | -0,97 | 70 | |||

| 4. | 5. | 0,1835 | -2,65 | 56 | |||

| 5. | 8. | 3,7675 | +0,74 | 55 | |||

| 6. | Neu! | 674,40 | -22,32 | 45 | |||

| 7. | 17. | 7,2825 | -0,24 | 45 | |||

| 8. | 4. | 2.391,16 | +0,50 | 40 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 73.891.619 von faultcode am 23.05.23 12:42:48...

Greg Peters, the firm’s co-chief investment officer, has bought long-dated credit default swaps — insurance against a future default — on the basis that the US will find itself in a similar impasse all over again.

These are tough situations for investors to navigate: politicians are largely seen reaching a deal soon to lift the debt ceiling, yet the X-date — the point at which the government loses the ability to pay its obligations — is dangerously close.

Some investors are betting on short-dated Treasury bills, given dislocations in the market around the potential X-date. But Peters says those wagers simply aren’t worth it for his funds at PGIM Fixed Income, which oversees $793 billion of assets. Instead, he’s focusing on the US CDS curve.

“The US CDS curve is highly inverted, which means people are paying up for default protection in the near term,” he said in a phone interview. “We went out the curve somewhat, as our sneaking suspicion is that it will continue year after year. The congressional disruption in DC is not going away anytime soon.”

...

23.5.

$793 Billion Fund Is Betting on Rerun of US Debt Drama

https://finance.yahoo.com/news/793-billion-fund-betting-reru…

Greg Peters, the firm’s co-chief investment officer, has bought long-dated credit default swaps — insurance against a future default — on the basis that the US will find itself in a similar impasse all over again.

These are tough situations for investors to navigate: politicians are largely seen reaching a deal soon to lift the debt ceiling, yet the X-date — the point at which the government loses the ability to pay its obligations — is dangerously close.

Some investors are betting on short-dated Treasury bills, given dislocations in the market around the potential X-date. But Peters says those wagers simply aren’t worth it for his funds at PGIM Fixed Income, which oversees $793 billion of assets. Instead, he’s focusing on the US CDS curve.

“The US CDS curve is highly inverted, which means people are paying up for default protection in the near term,” he said in a phone interview. “We went out the curve somewhat, as our sneaking suspicion is that it will continue year after year. The congressional disruption in DC is not going away anytime soon.”

...

23.5.

$793 Billion Fund Is Betting on Rerun of US Debt Drama

https://finance.yahoo.com/news/793-billion-fund-betting-reru…

24.5.

AI-Powered ETF Getting Left Behind by an AI-Powered Stock Rally

https://finance.yahoo.com/news/ai-powered-etf-getting-left-1…

Antwort auf Beitrag Nr.: 73.886.005 von faultcode am 22.05.23 13:35:25...

Game theory offers some insight, according to analysts at Citigroup. Simply put, investors could unload risk assets now and force negotiators into a deal — and then immediately regret that they sold. Holding tight, though, could lead to an impasse that eventually craters the economy and markets.

“Investors shouldn’t be seeking to game the politicians into a solution — that is a risky and uncertain proposition at best,” wrote analysts led by Nathan Sheets. “Rather, with or without an immediate market response, the debt ceiling brings heightened economic and financial uncertainty and other pressures. And investors are well-advised to respond to that reality, as dictated by their investment horizons and appetite for risk.”

...

“The reason that the market has held up is because most people on Wall Street don’t believe Congress is that stupid, and that simply this is another example of Congress teaching Hollywood a thing or two about drama,” said Sam Stovall, chief investment strategist at CFRA. “In the end, they will come to an agreement and I believe that is why the market is remaining fairly resilient — only the most bearish of bears, the most cynical of cynics believe that the extremists in DC want us to go into default.” Stocks could rally after a resolution has been reached, he added.

Since 2011, a meaningful stock-market decline has typically been required to force policymakers to come to an agreement, according to Lori Calvasina, head of US equity strategy at RBC Capital Markets. Those drawdowns have varied anywhere between 5-6% to 10-19% during what she calls “higher-drama years.” Still, angst around the debt ceiling has given investors a reason to rotate out of growth and into value, helping backstop the S&P 500, she said. “If Washington does manage to get a deal done, this will likely remove a key downside risk for the stock market and is likely to cause the bears to quiet down,” Calvasina wrote in a note.

Others point out that market gains are capped right now thanks to worries around the debt ceiling. The overhang is putting a lid on the market right now, according to Elyse Ausenbaugh, a global investment strategist at JPMorgan Wealth Management. “So long as we get a resolution to the debt ceiling — which is our base case — we do think that it’s possible in the near-term you actually see the S&P 500 break above our year-end target of 4,300,” she told Bloomberg TV.

...

23.5.

Game Theory Offers Clue to Market Calm Amid Debt Impasse

https://finance.yahoo.com/news/game-theory-offers-clue-marke…

Impasse = Sackgasse

Game theory offers some insight, according to analysts at Citigroup. Simply put, investors could unload risk assets now and force negotiators into a deal — and then immediately regret that they sold. Holding tight, though, could lead to an impasse that eventually craters the economy and markets.

“Investors shouldn’t be seeking to game the politicians into a solution — that is a risky and uncertain proposition at best,” wrote analysts led by Nathan Sheets. “Rather, with or without an immediate market response, the debt ceiling brings heightened economic and financial uncertainty and other pressures. And investors are well-advised to respond to that reality, as dictated by their investment horizons and appetite for risk.”

...

“The reason that the market has held up is because most people on Wall Street don’t believe Congress is that stupid, and that simply this is another example of Congress teaching Hollywood a thing or two about drama,” said Sam Stovall, chief investment strategist at CFRA. “In the end, they will come to an agreement and I believe that is why the market is remaining fairly resilient — only the most bearish of bears, the most cynical of cynics believe that the extremists in DC want us to go into default.” Stocks could rally after a resolution has been reached, he added.

Since 2011, a meaningful stock-market decline has typically been required to force policymakers to come to an agreement, according to Lori Calvasina, head of US equity strategy at RBC Capital Markets. Those drawdowns have varied anywhere between 5-6% to 10-19% during what she calls “higher-drama years.” Still, angst around the debt ceiling has given investors a reason to rotate out of growth and into value, helping backstop the S&P 500, she said. “If Washington does manage to get a deal done, this will likely remove a key downside risk for the stock market and is likely to cause the bears to quiet down,” Calvasina wrote in a note.

Others point out that market gains are capped right now thanks to worries around the debt ceiling. The overhang is putting a lid on the market right now, according to Elyse Ausenbaugh, a global investment strategist at JPMorgan Wealth Management. “So long as we get a resolution to the debt ceiling — which is our base case — we do think that it’s possible in the near-term you actually see the S&P 500 break above our year-end target of 4,300,” she told Bloomberg TV.

...

23.5.

Game Theory Offers Clue to Market Calm Amid Debt Impasse

https://finance.yahoo.com/news/game-theory-offers-clue-marke…

Impasse = Sackgasse

Antwort auf Beitrag Nr.: 73.881.046 von faultcode am 20.05.23 17:00:32

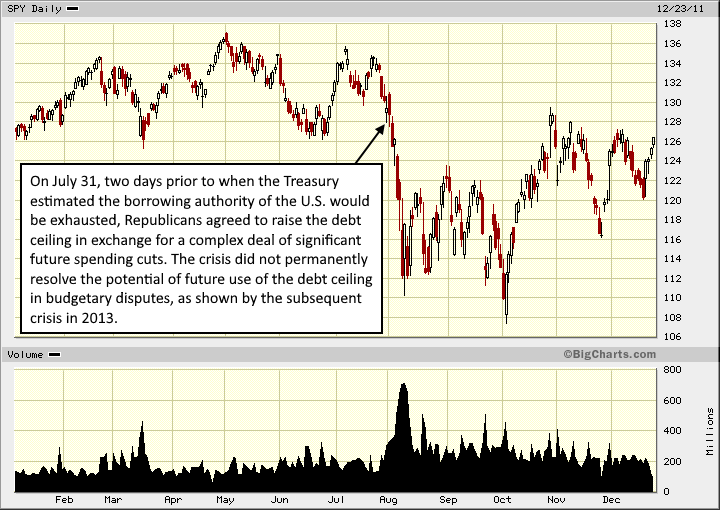

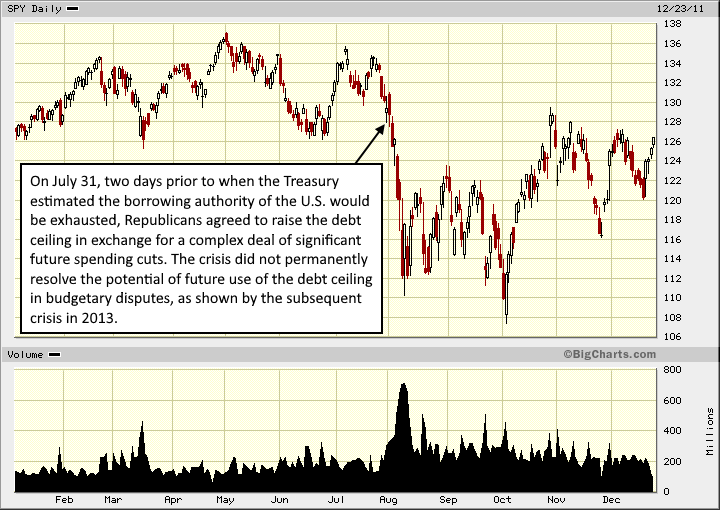

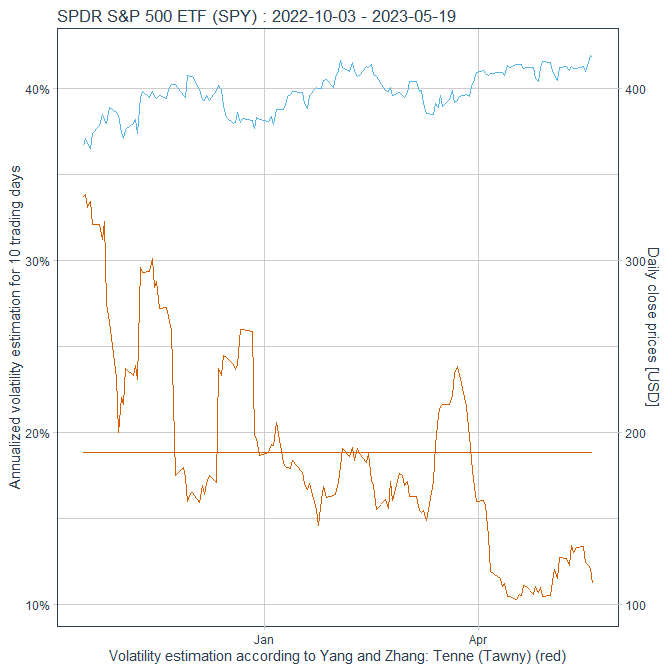

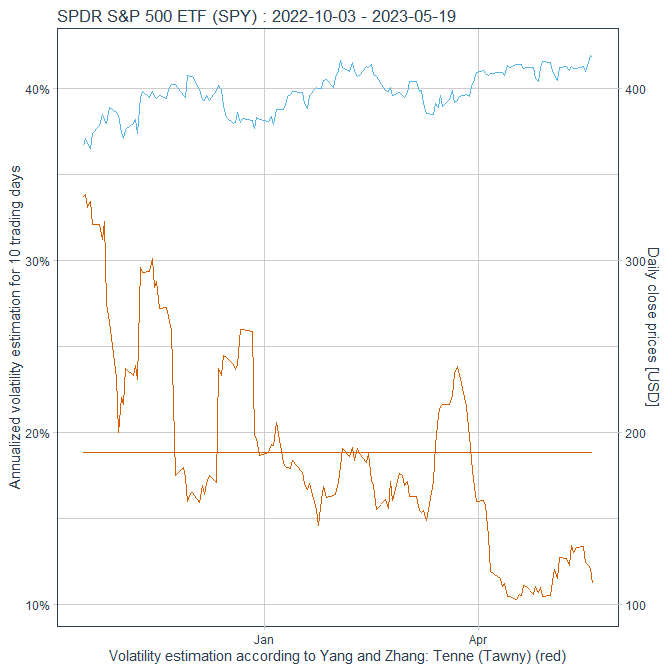

<$SPY S&P500 ETF>

https://en.wikipedia.org/wiki/2011_United_States_debt-ceilin…

<$SPY S&P500 ETF>

https://en.wikipedia.org/wiki/2011_United_States_debt-ceilin…

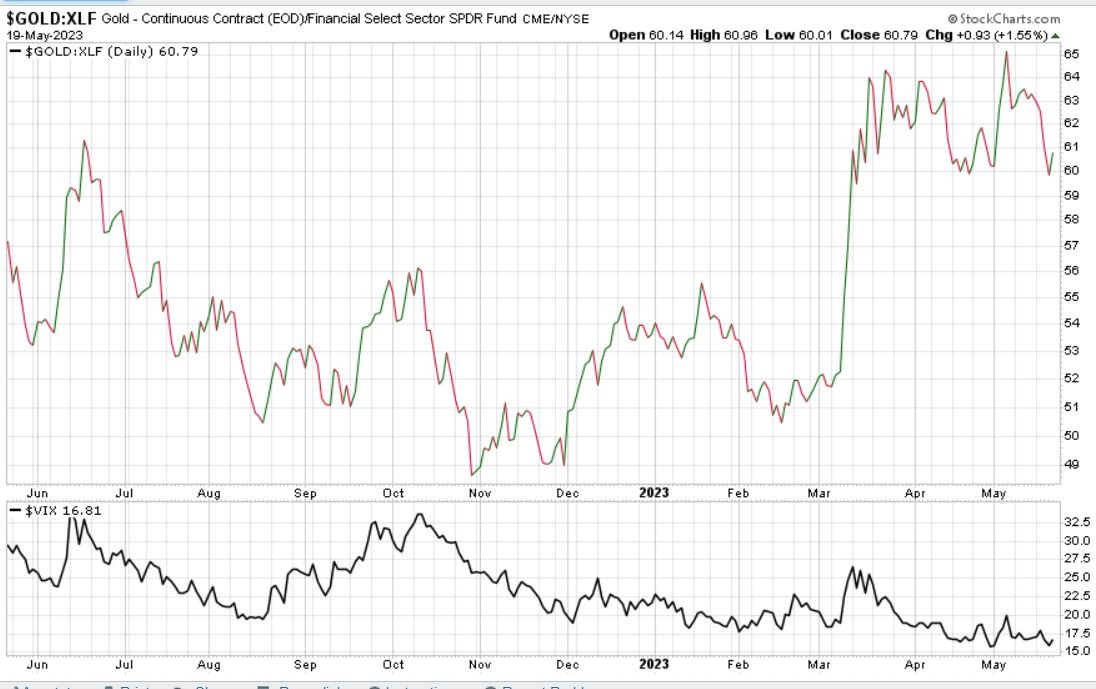

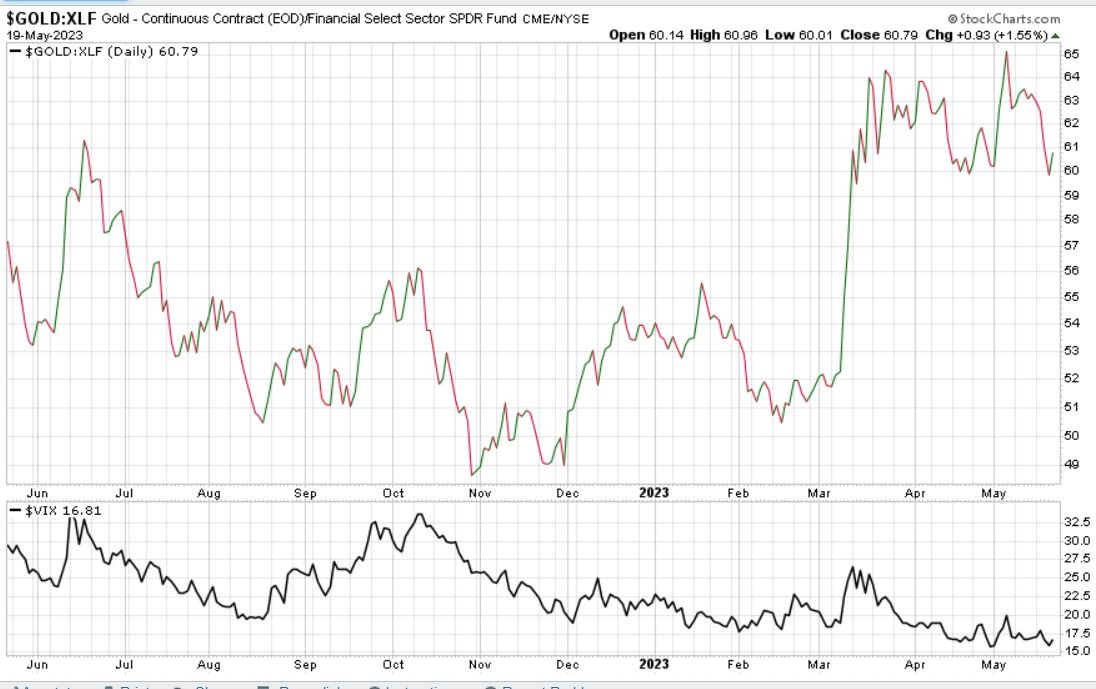

Auf den XLF (US-Banken) achten. Wenn die Vola steigt: Gold long, Banken short

Antwort auf Beitrag Nr.: 73.881.046 von faultcode am 20.05.23 17:00:32

20.5.

Here’s how investors can profit and protect their portfolios if a debt-ceiling fight unleashes market chaos

https://www.marketwatch.com/story/heres-how-investors-can-pr…

...

A team of equity derivative strategists at Bank of America has told clients that S&P 500 index put options expiring in the weeks ahead look “cheap” when considering the high risk for a selloff.

In a research note, the team said clients could reap returns of up to 30 times the upfront premium paid by buying certain types of options that would pay off if the S&P 500 fell by 10% or more, such as puts on the S&P 500, calls on the Cboe Volatility Index, otherwise known as the Vix, or calls tied to an exchange-traded fund that tracks the price of gold.

Right now, these options are only pricing in a “4% to 6%” chance of this happening but the Bank of America team believes the odds of such an outcome are much higher.

Between July 22 and Oct. 3, 2011 for example the S&P 500 fell 22%, according to FactSet. Stocks continued to fall even after a debt-ceiling deal passed Congress that year as Standard & Poor’s stripped the U.S. of its AAA credit rating shortly after.

“Despite managing to raise the debt ceiling in time, the 2011 episode caused a large spike in volatility and triggered sharp moves across asset classes,” the Bank of America analysts said in the note.

“One can argue that market stress contributed to that resolution, and that the same may be needed this time around. Yet various asset classes remain seemingly calm about the current (arguably riskier) situation.”

Some on Wall Street fear that Congress might only be motivated to strike a deal if markets turn chaotic.

“Nobody thinks the U.S. is going to default, but nobody thinks this is going to be resolved quickly, so everyone thinks it could take a big selloff in stocks to motivate them,” said Amy Wu Silverman, equity derivative strategist at RBC Capital Markets, during a phone interview with MarketWatch.

Silverman pointed to several derivatives-market indicators showing that demand for so-called tail risk hedges, or put options on the S&P 500 that would pay off if stocks fell by roughly 10% or more, has increased somewhat in recent weeks.

The Bank of America team also noted that there have been differences between how markets have reacted to the debt ceiling impasse. Treasury yields have been much more sensitive than stocks as yields on Treasury bills have shot above 5% recently.

The Nations TailDex, a gauge of demand for options that would pay off if the S&P 500 fell 10% or more, stood at 15.12 on Thursday. It traded as high as 22 back in March.

Silverman also noted that demand for call options linked to gold-tracking ETFs has risen since March.

...

Here’s how investors can profit and protect their portfolios if a debt-ceiling fight unleashes market chaos

https://www.marketwatch.com/story/heres-how-investors-can-pr…

...

A team of equity derivative strategists at Bank of America has told clients that S&P 500 index put options expiring in the weeks ahead look “cheap” when considering the high risk for a selloff.

In a research note, the team said clients could reap returns of up to 30 times the upfront premium paid by buying certain types of options that would pay off if the S&P 500 fell by 10% or more, such as puts on the S&P 500, calls on the Cboe Volatility Index, otherwise known as the Vix, or calls tied to an exchange-traded fund that tracks the price of gold.

Right now, these options are only pricing in a “4% to 6%” chance of this happening but the Bank of America team believes the odds of such an outcome are much higher.

Between July 22 and Oct. 3, 2011 for example the S&P 500 fell 22%, according to FactSet. Stocks continued to fall even after a debt-ceiling deal passed Congress that year as Standard & Poor’s stripped the U.S. of its AAA credit rating shortly after.

“Despite managing to raise the debt ceiling in time, the 2011 episode caused a large spike in volatility and triggered sharp moves across asset classes,” the Bank of America analysts said in the note.

“One can argue that market stress contributed to that resolution, and that the same may be needed this time around. Yet various asset classes remain seemingly calm about the current (arguably riskier) situation.”

Some on Wall Street fear that Congress might only be motivated to strike a deal if markets turn chaotic.

“Nobody thinks the U.S. is going to default, but nobody thinks this is going to be resolved quickly, so everyone thinks it could take a big selloff in stocks to motivate them,” said Amy Wu Silverman, equity derivative strategist at RBC Capital Markets, during a phone interview with MarketWatch.

Silverman pointed to several derivatives-market indicators showing that demand for so-called tail risk hedges, or put options on the S&P 500 that would pay off if stocks fell by roughly 10% or more, has increased somewhat in recent weeks.

The Bank of America team also noted that there have been differences between how markets have reacted to the debt ceiling impasse. Treasury yields have been much more sensitive than stocks as yields on Treasury bills have shot above 5% recently.

The Nations TailDex, a gauge of demand for options that would pay off if the S&P 500 fell 10% or more, stood at 15.12 on Thursday. It traded as high as 22 back in March.

Silverman also noted that demand for call options linked to gold-tracking ETFs has risen since March.

...

26.4.

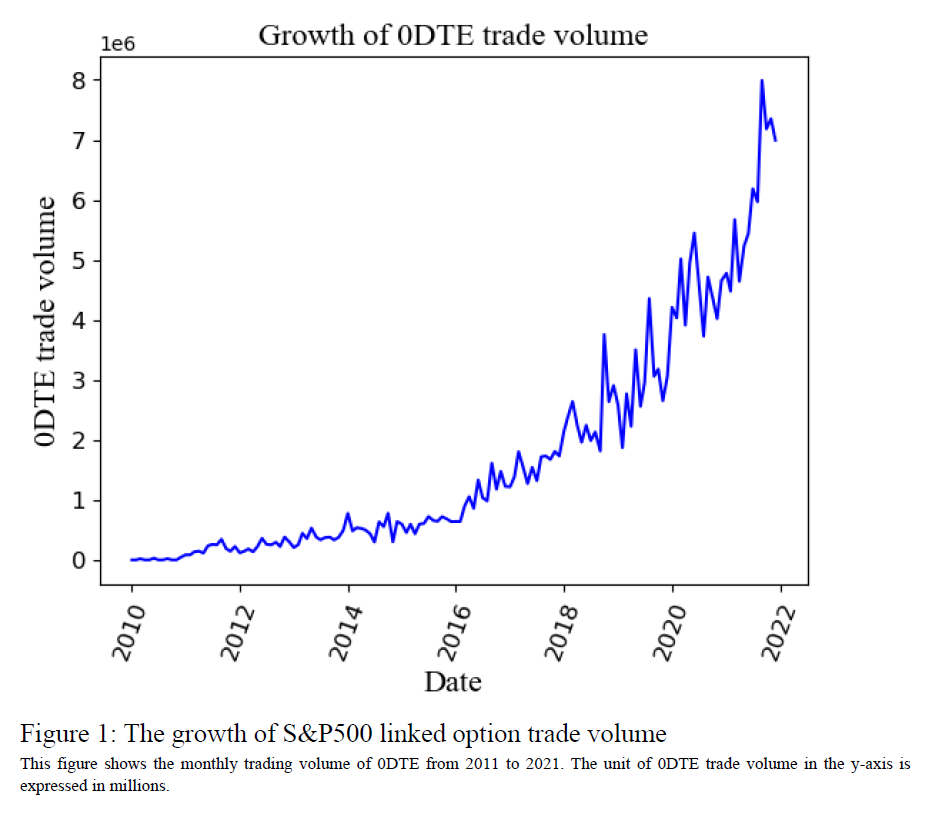

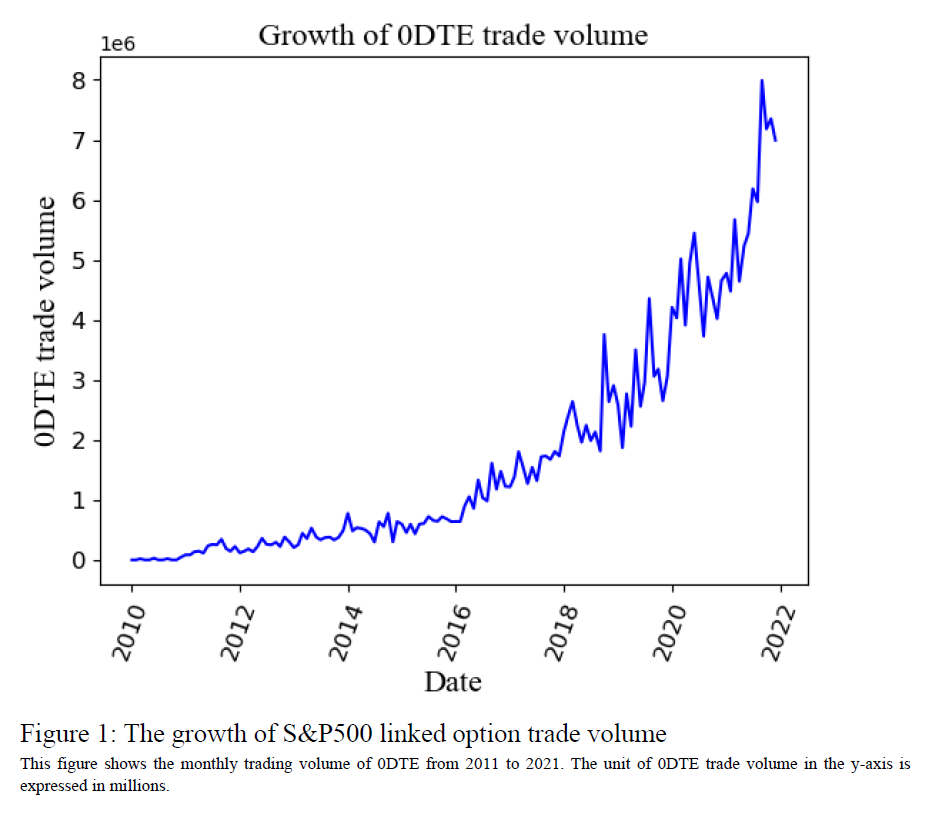

How Does Zero-Day-To-Expiry Options Trading Affect the Volatility of Underlying Assets?

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4426358

...

ABSTRACT

The monthly trading volume and proportion of Zero-Day-to-Expiry (0DTE) options have increased from zero to 7 million contracts between 2011 and 2021. We study how 0DTE option trading affects the volatility of the underlying asset. We find that more 0DTE options trading increases the volatility of the underlying asset. An increase of one standard deviation in the instrumented trading volume of 0DTE options relative to the total volume of other options results in an approximately 6.2% increase in the 5-minute volatility of the underlying asset.

...

...

7. Conclusion

...

Using the VR ratio, we find that 0DTE option trading deteriorates market efficiency.

...

VR = variance ratio

How Does Zero-Day-To-Expiry Options Trading Affect the Volatility of Underlying Assets?

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4426358

...

ABSTRACT

The monthly trading volume and proportion of Zero-Day-to-Expiry (0DTE) options have increased from zero to 7 million contracts between 2011 and 2021. We study how 0DTE option trading affects the volatility of the underlying asset. We find that more 0DTE options trading increases the volatility of the underlying asset. An increase of one standard deviation in the instrumented trading volume of 0DTE options relative to the total volume of other options results in an approximately 6.2% increase in the 5-minute volatility of the underlying asset.

...

...

7. Conclusion

...

Using the VR ratio, we find that 0DTE option trading deteriorates market efficiency.

...

VR = variance ratio

18.5.

Now's The Time To Get Ahead Of Inflation Resurgence

https://www.zerohedge.com/markets/nows-time-get-ahead-inflat…

...

That’s unlikely, as I’ll show. But the market has already been trading off this theme for several months, with many inflation trades now underwater. This opens up an ideal opportunity to hedge portfolios ahead of the re-acceleration of prices we’re likely to see as early as the end of this year.

Specifically, the current window is the time to rotate back toward low-duration stocks and sectors such as energy, and away from tech; reduce positioning in fixed-income securities such as Treasuries and corporate bonds; and increase exposure to inflation-linked debt, commodities and other real assets.

...

The economist J. Bradford De Long, in his brilliant essay America’s Peacetime Inflation: The 1970s, offered a convincing explanation why:

“Before the supply shocks hit, wage inflation was slowly trending upward. After the supply shocks had passed, price inflation quickly returned to levels consistent with wage and productivity growth, and wage inflation was slowly trending upward”

Today productivity growth is falling, and while wage growth may have slowed slightly in recent months, it is still considerably higher than it was three years ago.

The stage is thus set for a renewal in inflation’s upward trend. This will shake confidence that inflation is a “one-shot” problem and instead is likely to be with us for some time. This is likely to prompt a root-and-branch rethink about how to invest in an environment of persistent and entrenched inflation Inflation hedges that look cheap today thus won’t be cheap for very long

Now's The Time To Get Ahead Of Inflation Resurgence

https://www.zerohedge.com/markets/nows-time-get-ahead-inflat…

...

That’s unlikely, as I’ll show. But the market has already been trading off this theme for several months, with many inflation trades now underwater. This opens up an ideal opportunity to hedge portfolios ahead of the re-acceleration of prices we’re likely to see as early as the end of this year.

Specifically, the current window is the time to rotate back toward low-duration stocks and sectors such as energy, and away from tech; reduce positioning in fixed-income securities such as Treasuries and corporate bonds; and increase exposure to inflation-linked debt, commodities and other real assets.

...

The economist J. Bradford De Long, in his brilliant essay America’s Peacetime Inflation: The 1970s, offered a convincing explanation why:

“Before the supply shocks hit, wage inflation was slowly trending upward. After the supply shocks had passed, price inflation quickly returned to levels consistent with wage and productivity growth, and wage inflation was slowly trending upward”

Today productivity growth is falling, and while wage growth may have slowed slightly in recent months, it is still considerably higher than it was three years ago.

The stage is thus set for a renewal in inflation’s upward trend. This will shake confidence that inflation is a “one-shot” problem and instead is likely to be with us for some time. This is likely to prompt a root-and-branch rethink about how to invest in an environment of persistent and entrenched inflation Inflation hedges that look cheap today thus won’t be cheap for very long