Wann und wie kommt der nächste Crash? (Seite 10)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 0

Gesamt: 179.910

Gesamt: 179.910

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 23:15 | 132 | |

| 20.04.24, 12:11 | 120 | |

| vor 1 Stunde | 107 | |

| gestern 23:07 | 76 | |

| 13.04.14, 13:04 | 68 | |

| vor 1 Stunde | 67 | |

| 06.03.17, 11:10 | 62 | |

| gestern 22:28 | 61 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.015,00 | -0,90 | 204 | |||

| 2. | 2. | 9,6900 | -33,06 | 190 | |||

| 3. | 3. | 162,13 | +12,06 | 146 | |||

| 4. | 4. | 0,1940 | +1,57 | 69 | |||

| 5. | 5. | 6,7090 | -2,94 | 32 | |||

| 6. | 6. | 0,0211 | -32,59 | 29 | |||

| 7. | 7. | 1,3500 | -0,74 | 29 | |||

| 8. | 8. | 56,40 | +1,26 | 26 |

Beitrag zu dieser Diskussion schreiben

15.5.

A potential U.S. debt-ceiling suspension may present an upside risk for dollar, says BNP Paribas

https://www.marketwatch.com/story/a-potential-u-s-debt-ceili…

...

A team of strategists at BNP Paribas, led by foreign exchange strategist Alexander Jekov, said they expect the U.S. debt ceiling to become “an increasingly important theme” for markets, and a potential suspension may give room for the U.S. dollar DXY, -0.05% to jump.

“The U.S. debt ceiling presents an asymmetric upside risk for the U.S. dollar, in our view,” the strategists wrote in a Sunday note. “While there is no clear pattern as to how the USD trades into the U.S. Treasury’s X-date historically, once the debt ceiling is suspended or raised, the USD tends to either rally or trade flat.”

...

When a debt ceiling is hit, or the Treasury Department spends the maximum amount authorized under the ceiling, the government can only fund its day-to-day spending with its existing cash balance deposited in the Treasury General Account, or TGA, managed by the New York Fed.

The TGA is a liability on the Federal Reserve’s balance sheet, similar to bank reserves and notes. In order to balance the central bank’s assets and liabilities, a drop in the TGA will cause bank reserves to go up, administering an injection of liquidity into the financial system. In other words, the dollar liquidity is boosted, said Jekov and his team.

Advertisement

However, once the ceiling is no longer a “binding constraint” due to a raise or a suspension, T-bill issuance tends to rise, rebuilding the TGA cash balance, which could lead to a liquidity tightening, the strategists said.

“Tighter liquidity, in turn, spills over to the risk environment in a negative way, leading to a rally in the USD which is more pronounced versus high-beta currencies than versus low yielders,” said the strategists at BNP Paribas.

However, if there is no debt-ceiling rise or suspension in the next few months, strategists expect a risk-off across asset classes as markets begin to discount a higher risk of technical default.

Extended short-USD positioning according to a BNP Paribas’s model “could exacerbate any move higher in USD,” said strategists.

<

Rolls-Royce Holdings: Verkauf der halben Position

>

Rolls-Royce Holdings: Verkauf der halben Position

>

Antwort auf Beitrag Nr.: 73.830.946 von faultcode am 11.05.23 12:03:03Das würde ich her umgekehrt deuten - ist doch eher eine schöne Voraussetzung für einen Crash?

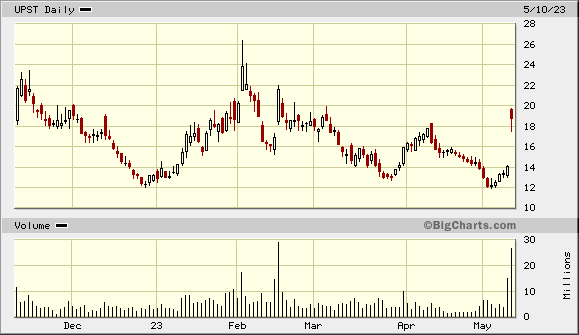

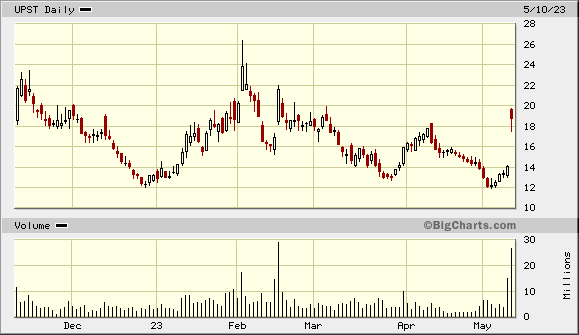

solange Meme-Aktien wie $UPST ("AI lending platform") nach einem mMn fundamental schlechten Q1-Bericht (*) mit so einem Up-Gap reagieren...

...wird der US-Markt mMn nicht crashen

(*) https://www.it-times.de/news/upstart-holdings-verlust-des-us…

...wird der US-Markt mMn nicht crashen

(*) https://www.it-times.de/news/upstart-holdings-verlust-des-us…

10.5.

US Default Insurance Cost Eclipses Brazil, Mexico as X-Day Nears

https://finance.yahoo.com/news/us-default-insurance-cost-ecl…

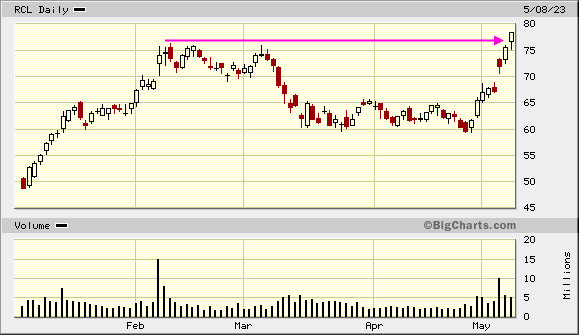

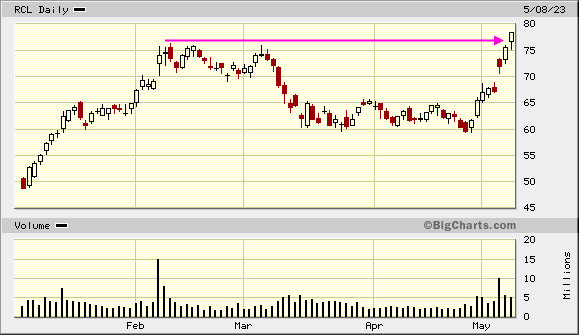

was man halt so kauft vor einer mutmaßlichen US-Rezession: Aktien eines hochverschuldeteten Kreuzfahrtschiff-Unternehmens:

Schon beeindruckend

...dass die übrigen 495 Aktien gerade einmal 3% in 4 Monaten - also dem ersten Drittel des Jahres - gemacht haben.Wer immer von den überhöhten Kursen spricht, kann sich mithin nur auf die extrem erfolgreichen Top 5 beziehen, bei denen die Gewinnentwicklung jedoch als Rechtfertigung Bestand hat.

1.5.

Equity Bulls Count on Fed-Cycle Math That Worked For Decades

• BofA says ‘sell the last rate hike’ on rising recession risk

• Still, monetary history offers some comfort for stock bulls

https://www.bloomberg.com/news/articles/2023-04-30/equity-bu…

...

History has shown that buying stocks at the end of a hiking cycle has proven to be a winning strategy in relatively low-inflationary environments like in the 1990s. But in the wake of inflationary pressures in the 1970s and beyond, stocks fell in the three months after every last hike, according to Bank of America Corp.

...

28.4.

Forget the Soft Landing Says Research Affiliates Equities Chief

“When the Fed raises rates and it breaks something, it rarely happens that it’s a very small break,” Que Nguyen says.

https://www.bloomberg.com/news/articles/2023-04-28/podcast-f…

...

While the drama surrounding regional US banks has largely subsided following the failure of three lenders in March, that doesn’t mean the ripple effects of Federal Reserve interest-rate hikes are over. This is according to Que Nguyen, chief investment officer of equities at Research Affiliates, who joined the What Goes Up podcast to give her outlook on markets and talk about why she doesn’t foresee a soft landing for the economy.

“When the Fed raises rates and it breaks something, it rarely happens that it’s a very small break,” she says. “Usually it’s a very big break. And so while I’d never thought that we would get to a great-financial-crisis level of breakdown, I do believe—and I did believe, and I still believe—that there would be more things that break. Whether that continued to be in the small regional banks or whether that bled over to something else such as real estate lending, private credit—definitely those dangers still remain out there.”

...

Forget the Soft Landing Says Research Affiliates Equities Chief

“When the Fed raises rates and it breaks something, it rarely happens that it’s a very small break,” Que Nguyen says.

https://www.bloomberg.com/news/articles/2023-04-28/podcast-f…

...

While the drama surrounding regional US banks has largely subsided following the failure of three lenders in March, that doesn’t mean the ripple effects of Federal Reserve interest-rate hikes are over. This is according to Que Nguyen, chief investment officer of equities at Research Affiliates, who joined the What Goes Up podcast to give her outlook on markets and talk about why she doesn’t foresee a soft landing for the economy.

“When the Fed raises rates and it breaks something, it rarely happens that it’s a very small break,” she says. “Usually it’s a very big break. And so while I’d never thought that we would get to a great-financial-crisis level of breakdown, I do believe—and I did believe, and I still believe—that there would be more things that break. Whether that continued to be in the small regional banks or whether that bled over to something else such as real estate lending, private credit—definitely those dangers still remain out there.”

...