Wann und wie kommt der nächste Crash? - Die letzten 30 Beiträge

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 3

Gesamt: 179.888

Gesamt: 179.888

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 37 Minuten | 4381 | |

| vor 22 Minuten | 3258 | |

| vor 1 Stunde | 2384 | |

| vor 19 Minuten | 2359 | |

| vor 1 Stunde | 1792 | |

| vor 28 Minuten | 1566 | |

| heute 13:33 | 1201 | |

| heute 13:38 | 1145 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.736,88 | -0,09 | 202 | |||

| 2. | 2. | 149,09 | -0,56 | 98 | |||

| 3. | 7. | 6,6940 | -0,51 | 89 | |||

| 4. | 5. | 0,1785 | -3,25 | 71 | |||

| 5. | 8. | 3,7950 | +1,47 | 64 | |||

| 6. | 4. | 2.388,49 | +0,38 | 57 | |||

| 7. | 17. | 7,3750 | +0,96 | 38 | |||

| 8. | 9. | 12,300 | -0,24 | 37 |

Beitrag zu dieser Diskussion schreiben

23.1.

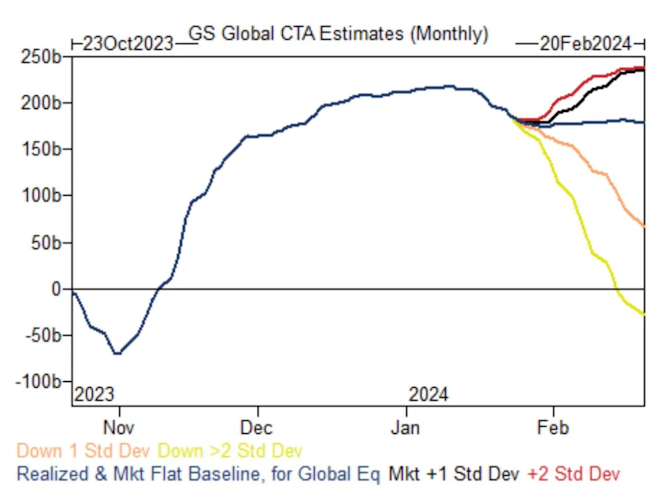

Goldman Says Momentum Traders to Sell Stocks in ‘Every Scenario’

https://finance.yahoo.com/news/goldman-says-momentum-traders…

...

No matter which way markets go, Goldman Sachs Group Inc. says some traders are modeled to sell stocks over the next week.

Cullen Morgan, an equity derivatives and flows specialist at the bank, expects that commodity trading advisers, or CTAs that surf the momentum of asset prices through long and short bets in the futures market, could be forced to sell after building $129 billion in long positions.

The trend-following cohort are modeled to sell $10 billion in a rising market, and up to $42 billion if stocks decline, over the next week. On a longer time frame of one month, CTAs are likely to buy $42 billion in a rising market versus $226 billion to sell should markets start to trend lower again.

...

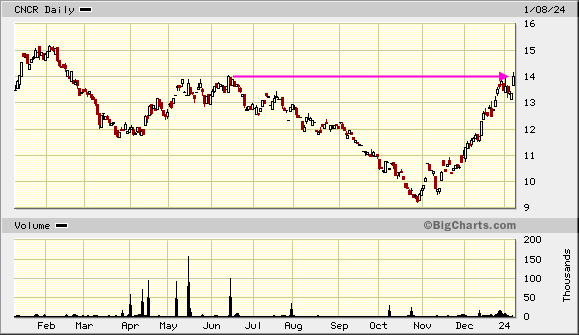

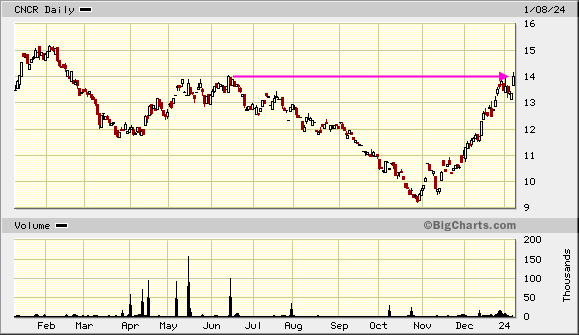

Antwort auf Beitrag Nr.: 74.785.685 von faultcode am 10.11.23 21:28:45Pharma- und Biotech rocken wieder:

<Range Cancer Therapeutics ETF, $CNCR>

<Range Cancer Therapeutics ETF, $CNCR>

4.1.

What history says about stocks and the bond market ahead of a first Fed rate cut

https://www.marketwatch.com/story/what-history-says-about-st…

...

Stocks, meanwhile, have tended to see a relatively flat performance in the three-month run-up to an initial cut, Kalish observed in a separate note this week, and has never rallied more than 11% over that stretch.

After that first rate cut, however, stocks have tended to rally over the next six to seven months, with the S&P 500 seeing a mean gain of 12%, Kalish said. Over the entire easing cycle, stocks have seen a mean rise of around 21% and a median rise of 15.4%.

The S&P 500 has rallied over every easing cycle since 1970, with the exception of a 27.6% drop between Jan. 3, 2001, and June 25, 2003, following the collapse of the tech bubble.

...

=> also bei US-Aktien: erst flach, dann nach der ersten Zinssenkung ein Anstieg seit 1970 -- außer nach dem Platzen der Dotcom-Blase 2001 - 2003

What history says about stocks and the bond market ahead of a first Fed rate cut

https://www.marketwatch.com/story/what-history-says-about-st…

...

Stocks, meanwhile, have tended to see a relatively flat performance in the three-month run-up to an initial cut, Kalish observed in a separate note this week, and has never rallied more than 11% over that stretch.

After that first rate cut, however, stocks have tended to rally over the next six to seven months, with the S&P 500 seeing a mean gain of 12%, Kalish said. Over the entire easing cycle, stocks have seen a mean rise of around 21% and a median rise of 15.4%.

The S&P 500 has rallied over every easing cycle since 1970, with the exception of a 27.6% drop between Jan. 3, 2001, and June 25, 2003, following the collapse of the tech bubble.

...

=> also bei US-Aktien: erst flach, dann nach der ersten Zinssenkung ein Anstieg seit 1970 -- außer nach dem Platzen der Dotcom-Blase 2001 - 2003

3.1.

Stock Skeptics Say $6 Trillion Cash Waiting on Sidelines Is a Mirage

https://finance.yahoo.com/news/stock-skeptics-6-trillion-cas…

...

One often-made argument in favor of stocks says investors should dive in before roughly $6 trillion of money-market cash gets redeployed into equity assets globally.

But buying the theory requires a big leap of faith — there’s significantly less out there to actually fund riskier gambles.

So say a pack of stock skeptics who, while not counseling selling out of the market, warn that some of the bull cases going around suffer from some optimistic framings.

Among them is Deborah Cunningham of Federated Hermes, who estimates that at least 80% of the nearly $1 trillion that’s poured into money-market funds since March’s financial system woes represents depositors leaving banks, rather than people waiting for entry points in equities and credit.

“It’s come through the deposit market, through the retail trade, with the likelihood of that being very sticky,” Cunningham said in a late-December interview on Bloomberg Television.

...

Antwort auf Beitrag Nr.: 75.026.228 von faultcode am 29.12.23 00:51:3429.12.2023

es sieht so aus:

Zitat von faultcode: ... => gesund ist das mMn nicht und daher könnte der Januar bei den Large caps in den USA mMn enttäuschen, weil die Trader ihre Capital gains, oder einen Teil davon, ins neue Jahr schleppten, um in 2023 kurz vor Schluss noch Steuern zu vermeiden

es sieht so aus:

Antwort auf Beitrag Nr.: 71.520.621 von faultcode am 08.05.22 16:40:0630.11.

Roundhill MEME ETF to Shut Down Despite Strong Performance in 2023

The Roundhill MEME ETF will close in December due to a lack of investor interest. Here's what investors need to know.

https://www.thestreet.com/memestocks/other-memes/roundhill-m…

...

=>

https://www.t-online.de/finanzen/boerse/etf/roundhill-meme-e…

Roundhill MEME ETF to Shut Down Despite Strong Performance in 2023

The Roundhill MEME ETF will close in December due to a lack of investor interest. Here's what investors need to know.

https://www.thestreet.com/memestocks/other-memes/roundhill-m…

...

=>

https://www.t-online.de/finanzen/boerse/etf/roundhill-meme-e…

Antwort auf Beitrag Nr.: 74.966.596 von matjung am 14.12.23 16:53:30

Hat sich eigentlich schon mal ein schlauer Kopf, oder sonst jemand, Gedanken drüber gemacht was passiert an den Aktienmärkten wenn die Ukraine den Krieg verliert ?

Will keiner hören, ist aber nicht ausgeschlossen.

Ok, Rheinmetall dürfte safe sein, aber der Rest ?

Zitat von matjung: Der nächste Crash könnte kommen wenn die Zentralbanken anfangen den Zins zu senken.

Solange die Wirtschaft läuft, senken sie nicht..

Hat sich eigentlich schon mal ein schlauer Kopf, oder sonst jemand, Gedanken drüber gemacht was passiert an den Aktienmärkten wenn die Ukraine den Krieg verliert ?

Will keiner hören, ist aber nicht ausgeschlossen.

Ok, Rheinmetall dürfte safe sein, aber der Rest ?

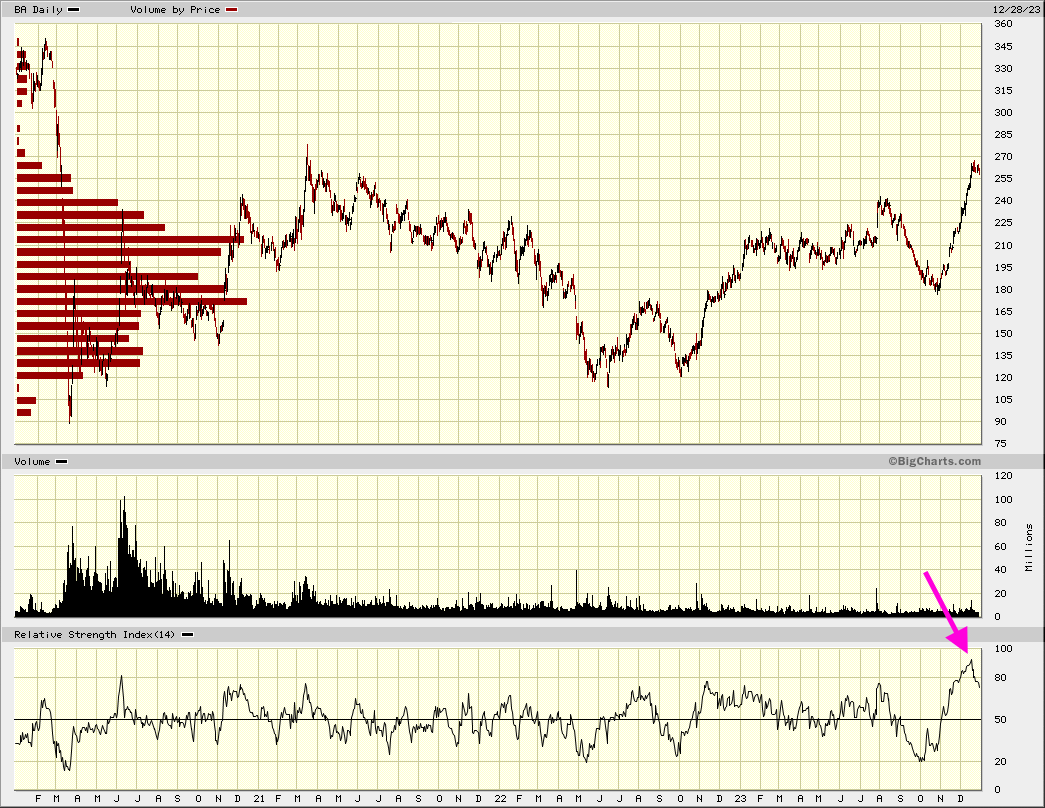

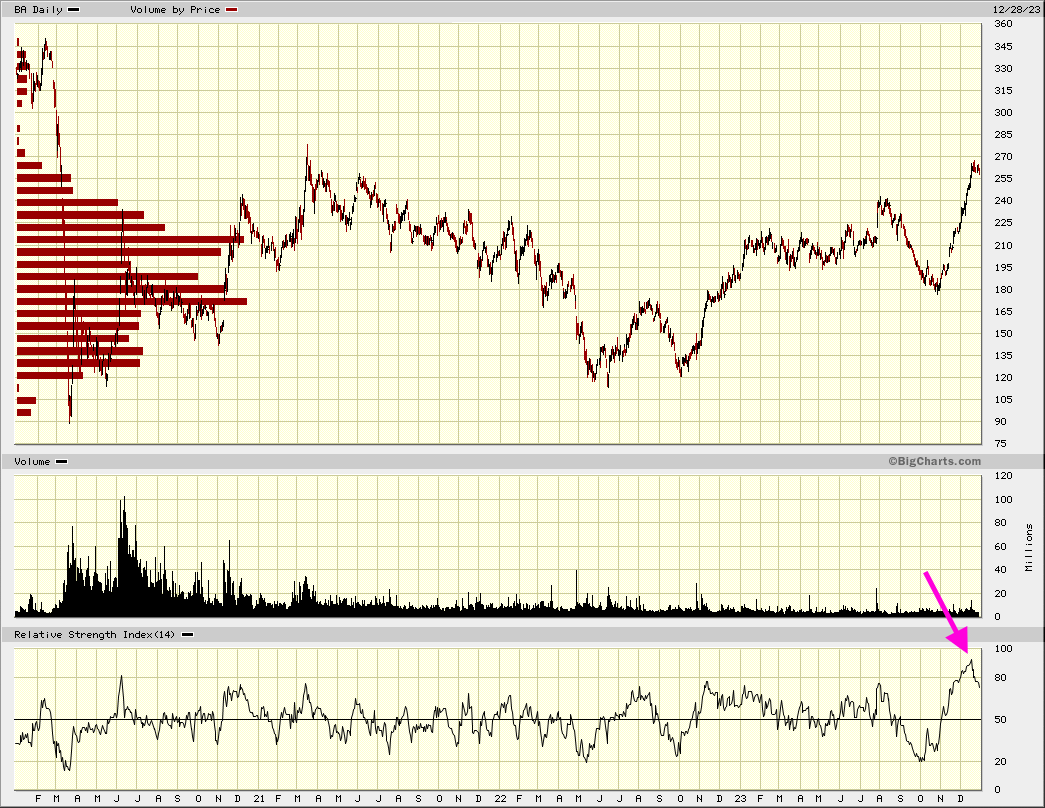

Boeing's Monster moves: RSI|14 von <= 20 auf > 80 in 2 1/2 Monaten:

=> gesund ist das mMn nicht und daher könnte der Januar bei den Large caps in den USA mMn enttäuschen, weil die Trader ihre Capital gains, oder einen Teil davon, ins neue Jahr schleppten, um in 2023 kurz vor Schluss noch Steuern zu vermeiden

=> gesund ist das mMn nicht und daher könnte der Januar bei den Large caps in den USA mMn enttäuschen, weil die Trader ihre Capital gains, oder einen Teil davon, ins neue Jahr schleppten, um in 2023 kurz vor Schluss noch Steuern zu vermeiden

27.12.

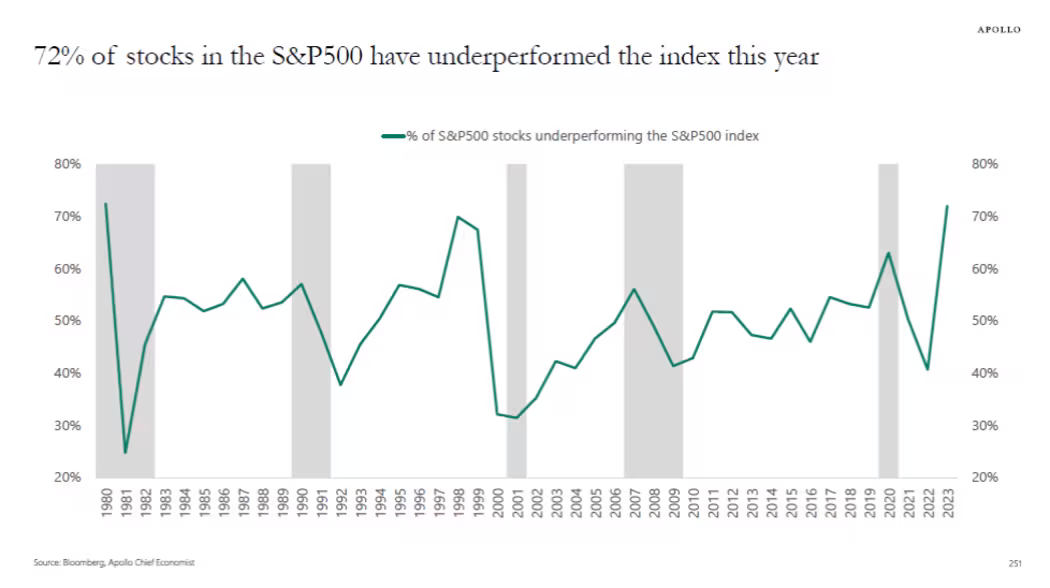

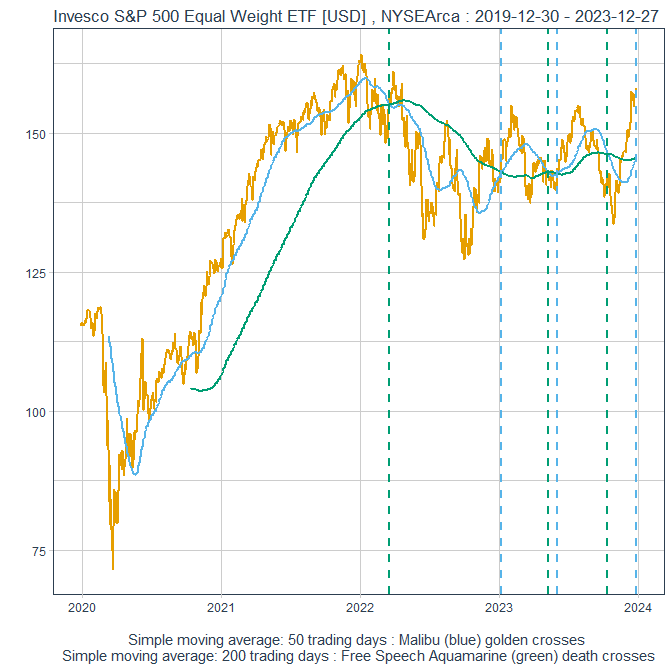

A record share of S&P 500 stocks have underperformed the index in 2023 as ‘weirdest bull market in decades’ marches on

https://www.marketwatch.com/story/a-record-share-of-s-p-500-…

...

For what its worth, RSP (Invesco S&P 500 Equal Weight ETF/FC) is on the verge of a “golden cross” as its 50-day moving average nears its 200-day moving average, as many of the market’s laggards have narrowed the performance gap with traders pricing in multiple Federal Reserve interest-rate cuts in 2024.

...

=>

<$OUST: tax loss selling: ich war hier zu impulsiv: https://www.wallstreet-online.de/diskussion/1336912-1-10/ous… => merke: "sector powerhouse" != "powerhouse"; eine nachhaltige Kurserholung wird - auch nach den letzten Rückschlägen bei auton.Fahrzeugen in den USA (*) - mMn länger dauern>

(*) https://consent.yahoo.com/v2/collectConsent?sessionId=3_cc-s…

(*) https://consent.yahoo.com/v2/collectConsent?sessionId=3_cc-s…

Antwort auf Beitrag Nr.: 74.895.357 von faultcode am 01.12.23 14:00:34

so ist es:

22.12.

Record Cash Inflows Show Investors Missed Out on Stock Rally

https://finance.yahoo.com/news/record-cash-inflows-show-inve…

...

The figures illustrate how this year’s equity rally took most investors by surprise after a dismal 2022. And it could mean there’s still a lot of money on the sidelines that’s waiting to be pushed into stocks and bonds in the new year, should expectations of central bank policy easing prove correct.

“There is significant dry power available for investors to come back to equities, should the rate cuts/soft landing scenario pan out,” Emmanuel Cau, a Barclays Plc strategist, wrote in a separate note.

Unexpectedly resilient economies provided a platform for this year’s equity rally, which gained extra impetus in the fourth quarter as optimism about central bank easing took hold.

...

Zitat von faultcode: ... nicht nur die, sondern auch viele Altherren in den prallhans- und Reibkuchen-Foren

...

so ist es:

22.12.

Record Cash Inflows Show Investors Missed Out on Stock Rally

https://finance.yahoo.com/news/record-cash-inflows-show-inve…

...

The figures illustrate how this year’s equity rally took most investors by surprise after a dismal 2022. And it could mean there’s still a lot of money on the sidelines that’s waiting to be pushed into stocks and bonds in the new year, should expectations of central bank policy easing prove correct.

“There is significant dry power available for investors to come back to equities, should the rate cuts/soft landing scenario pan out,” Emmanuel Cau, a Barclays Plc strategist, wrote in a separate note.

Unexpectedly resilient economies provided a platform for this year’s equity rally, which gained extra impetus in the fourth quarter as optimism about central bank easing took hold.

...

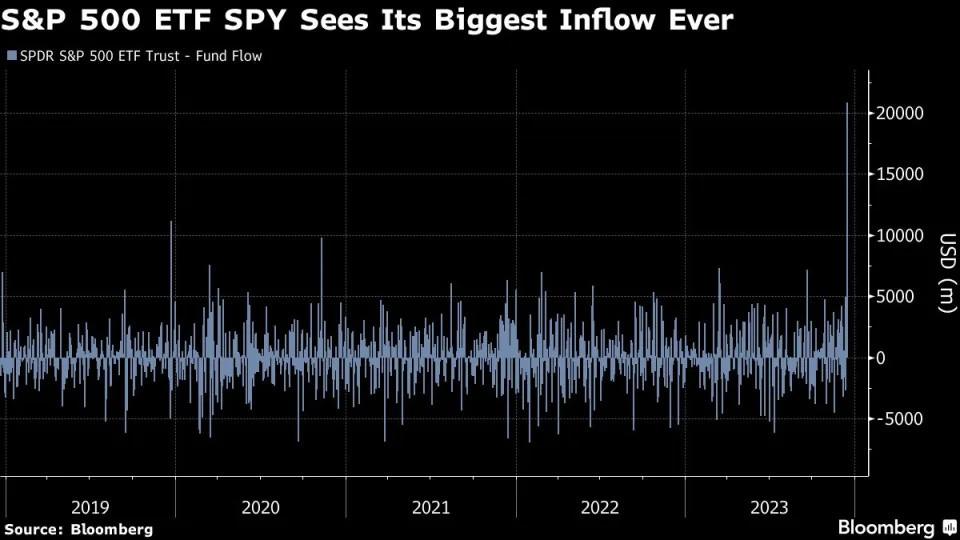

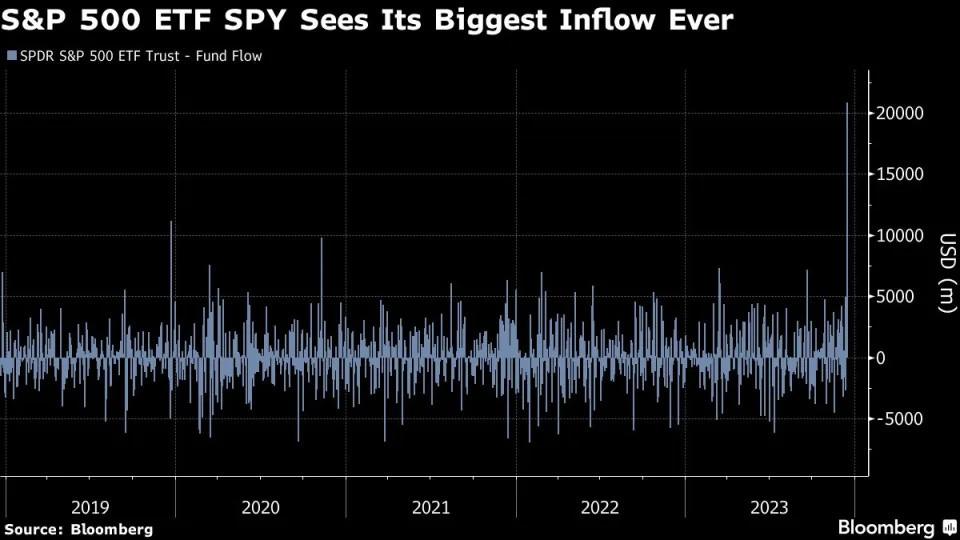

$SPY

19.12.

World’s Biggest ETF Sees Record $21 Billion Flow on Stock Rally

https://finance.yahoo.com/news/world-biggest-etf-sees-record…

...

State Street’s $478 billion SPDR S&P 500 ETF (ticker SPY) raked in $20.8 billion on Friday, the biggest inflow since the fund’s inception in 1993.

According to Bloomberg Intelligence, it was the largest one-day flow for any ETF. For the week, the ETF garnered more than $24 billion, also a record, data compiled by Bloomberg showed.

SPY’s inflows coincided with several events known to increase trading activity, said Matt Bartolini, head of SPDR Americas Research at State Street Global Advisors. Friday was the final trading day before the S&P 500 and Nasdaq 100’s rebalancings went into effect, which can prompt funds managing trillions of dollars to readjust to align with new index compositions. Roughly $5 trillion of options also expired on the same day, which generally sees Wall Street managers roll over existing positions or start new ones.

“The flow that we saw on Friday was 100% organic from clients and investors and traders,” Bartolini said by phone. “It also reflects the massive Santa Claus rally that we have seen in the past few days — so momentum-trading going into SPY as well.”

...

19.12.

World’s Biggest ETF Sees Record $21 Billion Flow on Stock Rally

https://finance.yahoo.com/news/world-biggest-etf-sees-record…

...

State Street’s $478 billion SPDR S&P 500 ETF (ticker SPY) raked in $20.8 billion on Friday, the biggest inflow since the fund’s inception in 1993.

According to Bloomberg Intelligence, it was the largest one-day flow for any ETF. For the week, the ETF garnered more than $24 billion, also a record, data compiled by Bloomberg showed.

SPY’s inflows coincided with several events known to increase trading activity, said Matt Bartolini, head of SPDR Americas Research at State Street Global Advisors. Friday was the final trading day before the S&P 500 and Nasdaq 100’s rebalancings went into effect, which can prompt funds managing trillions of dollars to readjust to align with new index compositions. Roughly $5 trillion of options also expired on the same day, which generally sees Wall Street managers roll over existing positions or start new ones.

“The flow that we saw on Friday was 100% organic from clients and investors and traders,” Bartolini said by phone. “It also reflects the massive Santa Claus rally that we have seen in the past few days — so momentum-trading going into SPY as well.”

...

Antwort auf Beitrag Nr.: 74.964.745 von faultcode am 14.12.23 11:55:20Last Updated: Dec. 18, 2023 at 4:02 p.m. ET

Fed’s dovish pivot is big gamble that’s likely to fail, says former top New York Fed official

https://www.marketwatch.com/story/feds-dovish-pivot-is-big-g…

...

In a Bloomberg column on Monday, Dudley wrote that Fed Chair Jerome Powell and other policy makers are taking a pretty big gamble by expecting that they’ll be able to vanquish inflation without causing a U.S. recession.

At the moment, the Fed’s thinking amounts to the idea that further drops in inflation should make earlier and more rapid rate cuts possible, and officials have penciled in three quarter-point cuts for next year.

But a pivot like the one being contemplated by the Fed would also reduce the risk of either an economic downturn or even harder landing, through its spillover effects into financial markets, according to Dudley. The more weight that Powell puts on cutting rates to avoid a recession, “the greater the risk of failing to control inflation — and of markets getting a big, unpleasant surprise,” Dudley wrote.

The problem is that the central bank’s dovishness “increases the possibility of no landing at all — that is, overheating and persistent inflation that could undermine the Fed’s credibility, while requiring renewed tightening and a deeper recession to get things back under control,” according to the ex-New York Fed president.

And “there’s plenty that can go wrong,” Dudley said. One is that the slowdown in economy seen late this year might reverse in 2024. Another is that prices could accelerate again, with services inflation excluding housing possibly proving to be more unexpectedly stubborn. And a third is that the job market could remain too tight if 2023’s large increase in labor supply fails to extend into the new year.

...

Fed’s dovish pivot is big gamble that’s likely to fail, says former top New York Fed official

https://www.marketwatch.com/story/feds-dovish-pivot-is-big-g…

...

In a Bloomberg column on Monday, Dudley wrote that Fed Chair Jerome Powell and other policy makers are taking a pretty big gamble by expecting that they’ll be able to vanquish inflation without causing a U.S. recession.

At the moment, the Fed’s thinking amounts to the idea that further drops in inflation should make earlier and more rapid rate cuts possible, and officials have penciled in three quarter-point cuts for next year.

But a pivot like the one being contemplated by the Fed would also reduce the risk of either an economic downturn or even harder landing, through its spillover effects into financial markets, according to Dudley. The more weight that Powell puts on cutting rates to avoid a recession, “the greater the risk of failing to control inflation — and of markets getting a big, unpleasant surprise,” Dudley wrote.

The problem is that the central bank’s dovishness “increases the possibility of no landing at all — that is, overheating and persistent inflation that could undermine the Fed’s credibility, while requiring renewed tightening and a deeper recession to get things back under control,” according to the ex-New York Fed president.

And “there’s plenty that can go wrong,” Dudley said. One is that the slowdown in economy seen late this year might reverse in 2024. Another is that prices could accelerate again, with services inflation excluding housing possibly proving to be more unexpectedly stubborn. And a third is that the job market could remain too tight if 2023’s large increase in labor supply fails to extend into the new year.

...

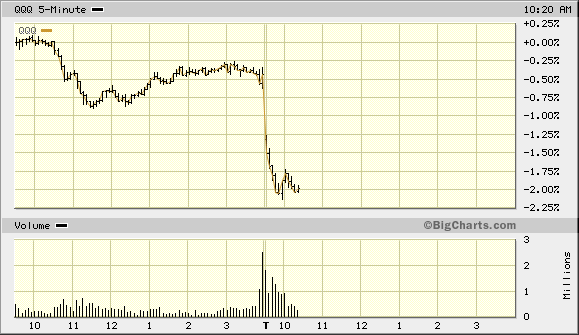

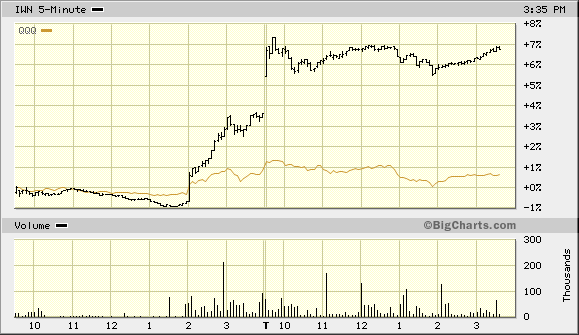

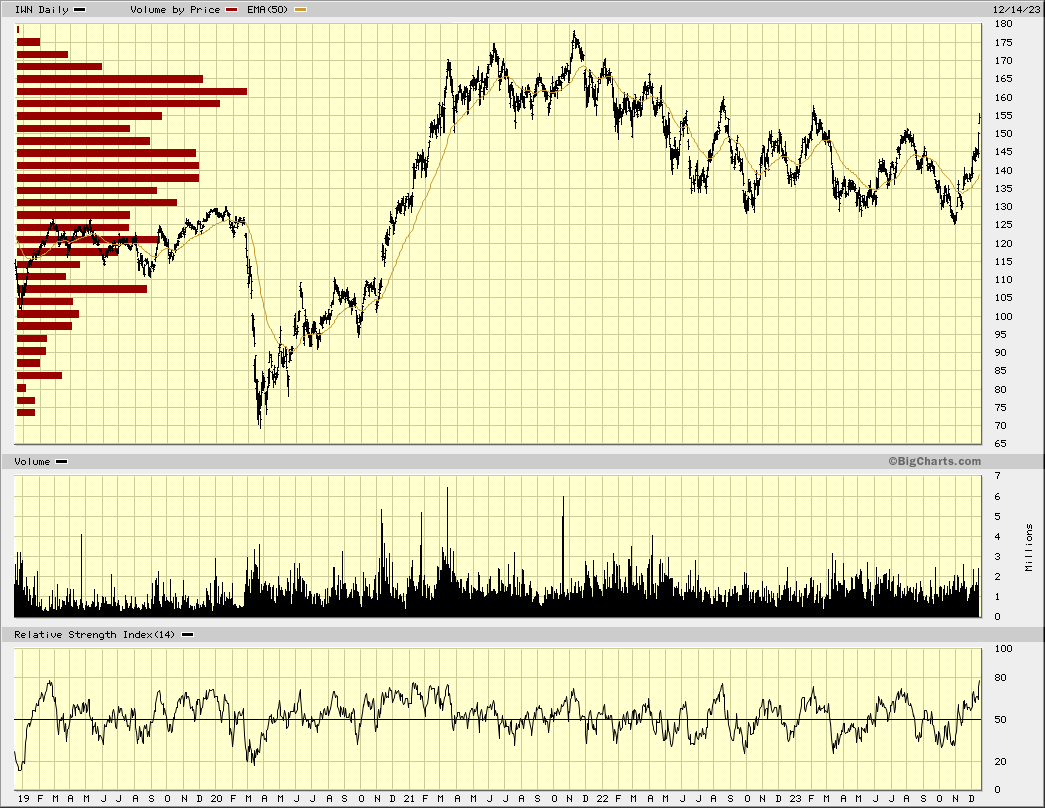

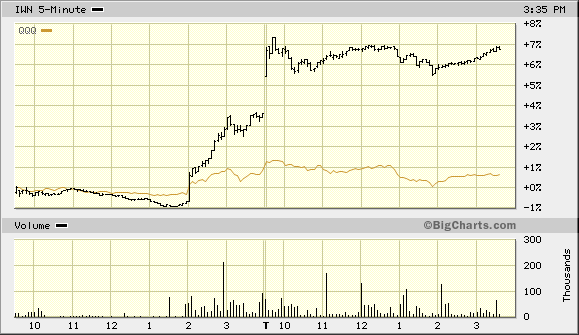

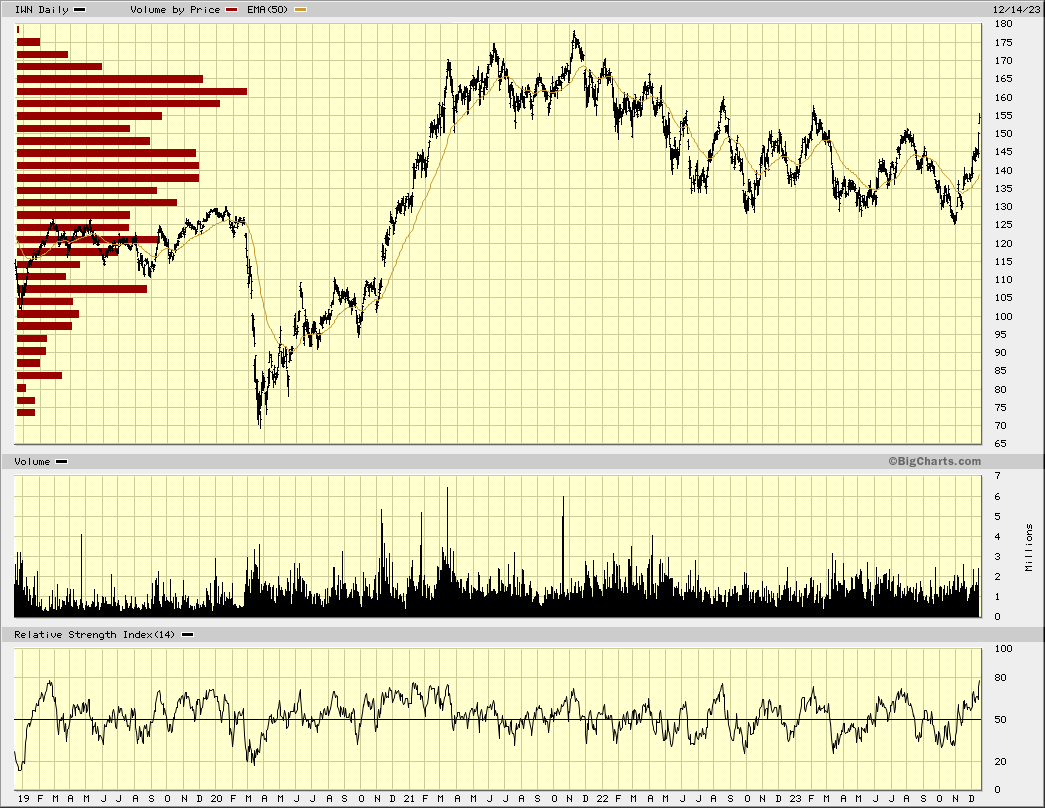

heute war "Rage buying" in der zweiten Reihe angesagt, hier der $IWN (US-Nebenwerte, iShares Russell 2000 Value ETF) vs $QQQ (NASDAQ100-Proxy):

mit Gap-up

bigger picture:

<kein Total return; Number of Holdings as of Dec 13, 2023: 1,437 --> https://www.ishares.com/us/products/239712/ishares-russell-2…>

mit Gap-up

bigger picture:

<kein Total return; Number of Holdings as of Dec 13, 2023: 1,437 --> https://www.ishares.com/us/products/239712/ishares-russell-2…>

Der nächste Crash könnte kommen wenn die Zentralbanken anfangen den Zins zu senken.

Solange die Wirtschaft läuft, senken sie nicht.

Wenn die Gewerkschaften mit hohen Lohnforderungen aufhören, wird der Zins fallen, und der Crash kommen.

Auch Krankenversicherungen, Telcos und Eisenbahnen sollten sich zurückhalten.

Gibt natürlich auch andere Meinungen.

Bevor der nächste Crash kommt, warte ich das nächste DAX ATH ab.

Solange die Wirtschaft läuft, senken sie nicht.

Wenn die Gewerkschaften mit hohen Lohnforderungen aufhören, wird der Zins fallen, und der Crash kommen.

Auch Krankenversicherungen, Telcos und Eisenbahnen sollten sich zurückhalten.

Gibt natürlich auch andere Meinungen.

Bevor der nächste Crash kommt, warte ich das nächste DAX ATH ab.

14.12.

Swedish Real Estate, Mining Stocks Lead Post-Fed Rally in Europe

https://finance.yahoo.com/news/swedish-real-estate-mining-st…

...

The news sent battered real estate stocks soaring, with the likes of Fastighets AB, Sagax AB and Vonovia SE leading the charge higher.

Anglo American Plc — Europe’s worst-performing mining stock of 2023 — jumped.

Orsted and Vestas Wind Systems A/S also soared after dismal performance this year.

“Anything small and value is currently gaining, as a reflection of how much loser financial conditions matter to these stocks,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management. “This is a Fed recovery trend, and as long as the Fed does not shift direction, this trend is likely to be with us.”

Banks — which outperformed the market this year — lagged amid the prospects of rate cuts, with Italian and Spanish lenders particularly lagging.

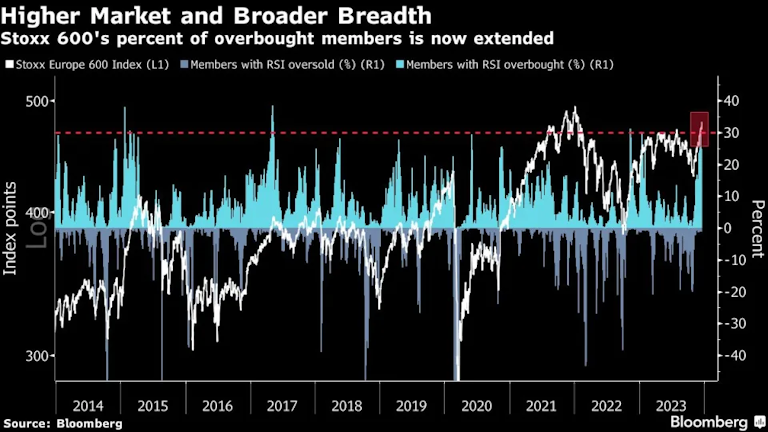

European stocks are rallying for a second month amid optimism about central bank easing next year. The Stoxx 600 has surged nearly 12% since a low in late October, and technical indicators show the index at the most overbought level in two years.

Gains in The Euro Stoxx 50 index have run so hot this week that technical indicators showed it’s at the most overbought level since 1999. Benchmark indexes in the region including France’s CAC 40 and Germany’s DAX hit fresh record highs.

...

14.12.

Wall Street Traders Go All-In on Great Monetary Pivot of 2024

https://finance.yahoo.com/news/wall-street-traders-great-mon…

...

“This is a massive paradigm shift on Wall Street, with the most aggressive rate-hiking cycle in decades coming to an end,” said Adam Sarhan, founder of 50 Park Investments. “The Fed is no longer dealing with inflation as public enemy No. 1.”

Investors are now pricing in six quarter-point rate reductions in 2024 by the Fed, twice the three penciled in by the central bankers. Economists at Goldman Sachs Group Inc. revised their forecast to show cuts starting in March.

...

Wall Street Traders Go All-In on Great Monetary Pivot of 2024

https://finance.yahoo.com/news/wall-street-traders-great-mon…

...

“This is a massive paradigm shift on Wall Street, with the most aggressive rate-hiking cycle in decades coming to an end,” said Adam Sarhan, founder of 50 Park Investments. “The Fed is no longer dealing with inflation as public enemy No. 1.”

Investors are now pricing in six quarter-point rate reductions in 2024 by the Fed, twice the three penciled in by the central bankers. Economists at Goldman Sachs Group Inc. revised their forecast to show cuts starting in March.

...

https://www.marketwatch.com/livecoverage/cpi-report-for-nove…

12.12.

Hot shelter inflation catches traders' attention. It could help keep Fed on hold, Goldman Sachs says

...

It seems traders are focusing on signs that the long-expected disinflation in the cost of shelter still hadn't arrived in November, according to commentary from a top strategist at Goldman Sachs Group.

As MarketWatch highlighted earlier, owners' equivalent rent, a key component of shelter costs, rose 0.5% in November, helping to drive overall shelter-related costs up 0.4%. The Fed has said they're paying particularly close attention to the cost of housing, and Goldman concluded that the data would likely support the Fed keeping interest rates on hold.

"Today's Core CPI print was below expectations. The number was expected to be higher due in part to residual seasonality and new source data that was incorporated in the health insurance calculation. However, the important indicator on inflation in focus was OER. Big reversion from upside miss on shelter last month to a meaningful deceleration in shelter. This should solidify the Fed on hold in December," said Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management.

Shelter wasn't the only surprisingly hot component of the report. Used-car prices climbed 1.6% in November, eschewing expectations for a slower increase, or even a decline.

To be sure, the data weren't all that bad: core prices rose 4% year-over-year, while the six-month annualized pace slowed to 2.9%, drawing closer to the Fed's 2% target.

...

12.12.

Hot shelter inflation catches traders' attention. It could help keep Fed on hold, Goldman Sachs says

...

It seems traders are focusing on signs that the long-expected disinflation in the cost of shelter still hadn't arrived in November, according to commentary from a top strategist at Goldman Sachs Group.

As MarketWatch highlighted earlier, owners' equivalent rent, a key component of shelter costs, rose 0.5% in November, helping to drive overall shelter-related costs up 0.4%. The Fed has said they're paying particularly close attention to the cost of housing, and Goldman concluded that the data would likely support the Fed keeping interest rates on hold.

"Today's Core CPI print was below expectations. The number was expected to be higher due in part to residual seasonality and new source data that was incorporated in the health insurance calculation. However, the important indicator on inflation in focus was OER. Big reversion from upside miss on shelter last month to a meaningful deceleration in shelter. This should solidify the Fed on hold in December," said Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management.

Shelter wasn't the only surprisingly hot component of the report. Used-car prices climbed 1.6% in November, eschewing expectations for a slower increase, or even a decline.

To be sure, the data weren't all that bad: core prices rose 4% year-over-year, while the six-month annualized pace slowed to 2.9%, drawing closer to the Fed's 2% target.

...

Antwort auf Beitrag Nr.: 74.915.191 von faultcode am 05.12.23 17:37:23Wer gibt ihm denn viele Mrd. an US$, um die Alt-Währung zu ersetzen, die hoch inflationiert ist, um die dicken Sozialprogramme zu finanzieren?

--> gute Frage:

10.12.

In inaugural speech, Argentina's Javier Milei prepares nation for painful shock adjustment

https://www.msn.com/en-us/news/world/in-inaugural-speech-arg…

...

--> gute Frage:

10.12.

In inaugural speech, Argentina's Javier Milei prepares nation for painful shock adjustment

https://www.msn.com/en-us/news/world/in-inaugural-speech-arg…

...

<Teil-Verkauf meiner $AGI-Position, <50% nach Stückzahl, mit bislang relativ hohem Portfoliogewicht bei mir; günstig eingesammelt ab 2017+2018:

https://www.wallstreet-online.de/diskussion/1215750-321-330/…

https://www.wallstreet-online.de/diskussion/1215750-271-280/…

nein, das zyklische Tief Ende 2018 habe ich nicht getroffen; der Rest bleibt vorerst im Portfolio nach Plan; dieser Goldminer ist mMn nicht mehr günstig --> "priced for perfection" mMn>

https://www.wallstreet-online.de/diskussion/1215750-321-330/…

https://www.wallstreet-online.de/diskussion/1215750-271-280/…

nein, das zyklische Tief Ende 2018 habe ich nicht getroffen; der Rest bleibt vorerst im Portfolio nach Plan; dieser Goldminer ist mMn nicht mehr günstig --> "priced for perfection" mMn>

<das argentinische $BMA-Experiment habe ich hiermit auch +/- 0 beendet. MMn kann der "Anarchokapitalist" Javier Milei das System auch nur langsam, wenn überhaupt, ändern. Wer gibt ihm denn viele Mrd. an US$, um die Alt-Währung zu ersetzen, die hoch inflationiert ist, um die dicken Sozialprogramme zu finanzieren? Und wenn, finden diese US$ mMn schnell wieder den Weg aus Argentinien heraus. Argentinien ist z.B. nicht Europa.>

30.11.

S&P 500’s Historic 8.9% Rally Blindsides Skeptics on Wall Street

https://finance.yahoo.com/news/traders-eager-even-more-gains…

nicht nur die, sondern auch viele Altherren in den prallhans- und Reibkuchen-Foren

...

The S&P 500 Index advanced 8.9% this month, for its second-best November since 1980, behind only the pandemic-fueled rebound in 2020, data compiled by Bloomberg show.

The gauge is up around 19% in 2023 and snapped a three-month losing streak as investors looked past the possibility of a recession, geopolitical turmoil and soaring borrowing costs.

“Almost everyone was offsides coming into November,” said Ryan Detrick, chief market strategist at Carson Group. “So there’s still a big opportunity for traders to chase gains in December, too.”

...

S&P 500’s Historic 8.9% Rally Blindsides Skeptics on Wall Street

https://finance.yahoo.com/news/traders-eager-even-more-gains…

nicht nur die, sondern auch viele Altherren in den prallhans- und Reibkuchen-Foren

...

The S&P 500 Index advanced 8.9% this month, for its second-best November since 1980, behind only the pandemic-fueled rebound in 2020, data compiled by Bloomberg show.

The gauge is up around 19% in 2023 and snapped a three-month losing streak as investors looked past the possibility of a recession, geopolitical turmoil and soaring borrowing costs.

“Almost everyone was offsides coming into November,” said Ryan Detrick, chief market strategist at Carson Group. “So there’s still a big opportunity for traders to chase gains in December, too.”

...

Antwort auf Beitrag Nr.: 74.888.562 von faultcode am 30.11.23 14:12:11

https://www.t-online.de/finanzen/aktuelles/wirtschaft/id_100…

Crash

Wenn man das überall so hört kann man nur probieren Schulden auf 0 zu bringen das man da schonmal Save ist oder so reduzieren das man die innerhalb von 6 Monaten los wird https://www.t-online.de/finanzen/aktuelles/wirtschaft/id_100…

30.11.

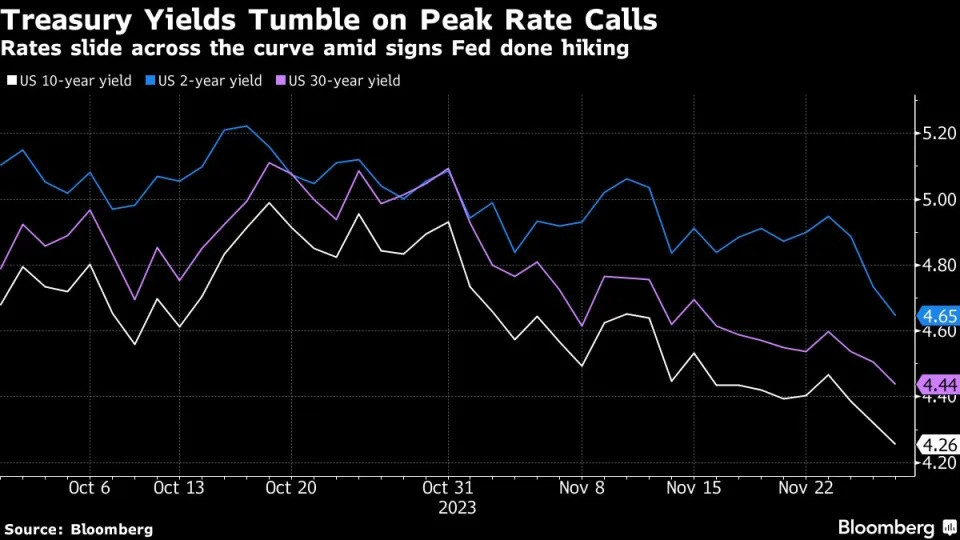

Biggest Blowout in Bonds Since the 1980s Sparks Everything Rally

https://finance.yahoo.com/news/biggest-blowout-bonds-since-1…

...

Investors frantically bid up the price of Treasuries, agency and mortgage debt, sparking the best month since the 1980s and igniting a powerful pan-markets rally in everything from stocks to credit to emerging markets. Even obscure cryptocurrencies, the sort of speculative, uber-risky assets that struggled when yields were soaring, posted big gains.

For those bond investors bracing for a possible third straight year of losses — an unprecedented streak in the Treasuries market — the rally was desperately needed. The Bloomberg US Aggregate Index has returned 4.9% this month through Wednesday as the yield on the 10-year bond, the benchmark for everything from home loans to corporate debt, sank close to 0.65 percentage points to 4.29%.

...

<Verkauf Vertex Pharmaceuticals -- keine Kern-Komponente, die auch bislang gut lief; ansonsten bin ich skeptisch bei Pharma geworden; siehe auch oben Beitrag Nr. 1.311>

Antwort auf Beitrag Nr.: 74.209.317 von faultcode am 26.07.23 12:39:3026.07.2023

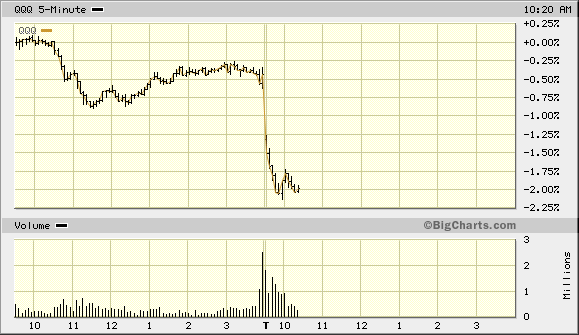

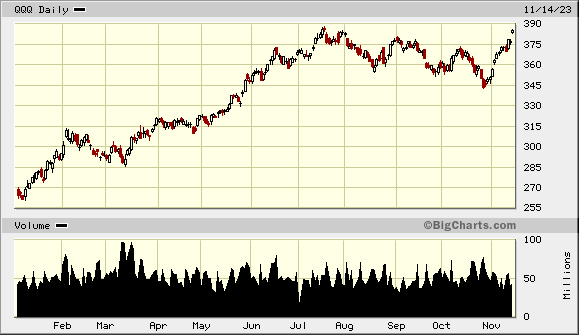

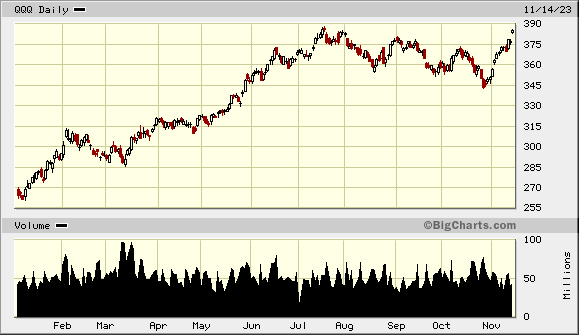

$QQQ: "Tech-Korrektur" beendet:

wegen "subdued inflation report": https://www.marketwatch.com/livecoverage/october-cpi-report-…

Zitat von faultcode: Coppock Curve (mit S&P 500-ETF-Proxy) kurz vor dem (Wieder-)Einstiegssignal:

...

$QQQ: "Tech-Korrektur" beendet:

wegen "subdued inflation report": https://www.marketwatch.com/livecoverage/october-cpi-report-…

Last Updated: Nov. 10, 2023 at 6:31 p.m. ET

Moody’s cuts outlook on U.S. credit rating to negative from stable

https://www.marketwatch.com/story/moodys-cuts-outlook-on-u-s…

...

Moody’s Investors Service late Friday cut its outlook on the U.S. sovereign credit rating to negative from stable, citing higher interest rates and doubts about the government’s ability implement effective fiscal policies.

A negative outlook means that a rating may be cut in the future, but doesn’t mean that it will be. Moody’s continues to rate U.S. sovereign debt Aaa — the only one of the three major credit-rating companies to maintain a triple-A rating on the world’s largest economy.

“The sharp rise in U.S. Treasury bond yields this year has increased pre-existing pressure on U.S. debt affordability. In the absence of policy action, Moody’s expects the U.S.’s debt affordability to decline further, steadily and significantly, to very weak levels compared to other highly-rated sovereigns, which may offset the sovereign’s credit strengths explained below,” the company said, in a statement.

In response to the announcement, a Treasury Department official said the agency disagrees with the warning sounded by Moody’s.

“While the statement by Moody’s maintains the United States’ Aaa rating, we disagree with the shift to a negative outlook. The American economy remains strong, and Treasury securities are the world’s preeminent safe and liquid asset,” said Deputy Secretary of the Treasury Wally Adeyemo, in a statement.

He went on to say that the Biden administration’s more than $1 trillion in deficit reduction included in the June debt limit deal and budget proposals that would reduce the deficit by nearly $2.5 trillion over the next decade put the country on sounder footing than the Moody’s outlook would suggest.

Moody’s said the rating could be cut if the company concludes that policy makers were unlikely to respond to the country’s growing fiscal challenges over the medium term, through measures to increase government revenue or structurally reduce spending to slow the deterioration in debt affordability.

...

Moody’s cuts outlook on U.S. credit rating to negative from stable

https://www.marketwatch.com/story/moodys-cuts-outlook-on-u-s…

...

Moody’s Investors Service late Friday cut its outlook on the U.S. sovereign credit rating to negative from stable, citing higher interest rates and doubts about the government’s ability implement effective fiscal policies.

A negative outlook means that a rating may be cut in the future, but doesn’t mean that it will be. Moody’s continues to rate U.S. sovereign debt Aaa — the only one of the three major credit-rating companies to maintain a triple-A rating on the world’s largest economy.

“The sharp rise in U.S. Treasury bond yields this year has increased pre-existing pressure on U.S. debt affordability. In the absence of policy action, Moody’s expects the U.S.’s debt affordability to decline further, steadily and significantly, to very weak levels compared to other highly-rated sovereigns, which may offset the sovereign’s credit strengths explained below,” the company said, in a statement.

In response to the announcement, a Treasury Department official said the agency disagrees with the warning sounded by Moody’s.

“While the statement by Moody’s maintains the United States’ Aaa rating, we disagree with the shift to a negative outlook. The American economy remains strong, and Treasury securities are the world’s preeminent safe and liquid asset,” said Deputy Secretary of the Treasury Wally Adeyemo, in a statement.

He went on to say that the Biden administration’s more than $1 trillion in deficit reduction included in the June debt limit deal and budget proposals that would reduce the deficit by nearly $2.5 trillion over the next decade put the country on sounder footing than the Moody’s outlook would suggest.

Moody’s said the rating could be cut if the company concludes that policy makers were unlikely to respond to the country’s growing fiscal challenges over the medium term, through measures to increase government revenue or structurally reduce spending to slow the deterioration in debt affordability.

...

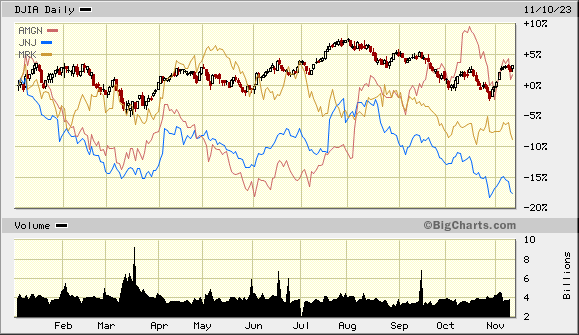

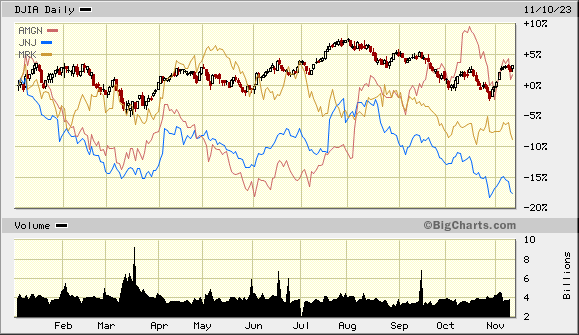

Antwort auf Beitrag Nr.: 74.785.535 von faultcode am 10.11.23 21:01:01im Dow Jones Industrial Average-Index gibt's noch 3 Pharma-Aktien im engeren Sinne ($MRK, $JNJ, $AMGN) und die einzige davon, die sich halbwegs halten konnte, war Amgen (obwohl auch dort der Gewinn in Q3, YoY, nachließ bei leicht steigenden Umsätzen --> Schulden + satte Zinsen auch wegen der mMn superteuren Horizon Therapeutics-Übernahme für schlappe US$27.8Mrd):

..während Merck & Co. in 2023 so dahin KEYTRUDELTE und das Witwen- und Waisen-Papier Johnson & Johnson mit -17% Bottom 4 bislang darstellt.

Die Top-4-Werte bislang in 2023 im Dow Jones Industrial Average waren alles Tech-Werte mit mindestens +40% Performance. Und dann kommt eine richtige Lücke mit Visa mit +17% auf Platz #5.

..während Merck & Co. in 2023 so dahin KEYTRUDELTE und das Witwen- und Waisen-Papier Johnson & Johnson mit -17% Bottom 4 bislang darstellt.

Die Top-4-Werte bislang in 2023 im Dow Jones Industrial Average waren alles Tech-Werte mit mindestens +40% Performance. Und dann kommt eine richtige Lücke mit Visa mit +17% auf Platz #5.

Antwort auf Beitrag Nr.: 74.783.438 von faultcode am 10.11.23 16:05:36<die Pharma-Experimente $BFRI, $EBS und $OGN habe ich auch beendet. Pharma hat es sehr schwer z.Z.; bei $OGN ist die Schuldenlast mMn viel zu hoch, wenn auch erst alles in 2028 fällig, und da will ich nicht erst auf eine Dividenden-Kürzung warten; der Wettbewerbsdruck im Pharmabereich, neben dem Kostendruck zuletzt, scheint allgemein spürbar zugenommen zu haben>