Wer ist dabei? - 500 Beiträge pro Seite

eröffnet am 30.07.14 13:27:46 von

neuester Beitrag 22.09.19 17:44:27 von

neuester Beitrag 22.09.19 17:44:27 von

Beiträge: 31

ID: 1.196.872

ID: 1.196.872

Aufrufe heute: 0

Gesamt: 5.147

Gesamt: 5.147

Aktive User: 0

ISIN: AU000000LNG0 · WKN: A0DPU5

0,0280

EUR

-6,67 %

-0,0020 EUR

Letzter Kurs 30.04.20 Tradegate

Neuigkeiten

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,6500 | +35,38 | |

| 0,6300 | +22,09 | |

| 5,0700 | +13,68 | |

| 1,1975 | +12,44 | |

| 4,2200 | +9,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,5750 | -13,26 | |

| 1.050,01 | -14,28 | |

| 1,9300 | -16,45 | |

| 12,445 | -16,76 | |

| 1,6100 | -20,69 |

Die Aktie steigt rasant und keiner ist dabei?

Die Aktie steigt rasant und keiner ist dabei?

Klar sinma dabei-und zwar schon seit Mai-mehr sog i ned ausser gib kein Stück aus de Händ

Mal schaun, was die Amis heute machen....

Mal schaun, was die Amis heute machen....

Geht wieder schön und langsam hoch ^^

Baupost increases stake in LNG Limited

Liquefied Natural Gas Limited issued a notice showing that The Baupost Group increased its shareholding in the company to 11.41%.Baupost, that had previously owned 10.08%, purchased 6,251,580 shares from October 14, 2014 to January 8, 2015.

Share prices ranged from $1.96 to $3.00.

LNG Limited has been making progress recently on its Magnolia LNG project and as the company’s Managing Director and CEO, Maurice Brand, said, the project is close to finalizing all the FERC filing processes and issuing a notice of schedule in early 2015.

habe mir auch mal eine Schnupperposi gegönnt

LNG Limited signs deal with KMLP for Magnolia project

Liquefied Natural Gas Limited informed that its unit, Magnolia LNG, has executed a gas pipeline interconnect agreement with Kinder Morgan Louisiana Pipeline.This PIA sets out the technical scope and specifications for gas supply to the Magnolia LNG Plant, stands in the LNG Limited’s statement.

The PIA defines each parties’ obligations in relation to the design, procurement, construction, installation, operations, maintenance and ownership of the facilities.

LNGL Managing Director and Chief Executive Officer, Maurice Brand, said that “the Kinder Morgan Louisiana Pipeline is an existing interstate gas pipeline system that traverses the Magnolia LNG Plant site. Magnolia has already entered into a legally binding agreement with KMLP to access 1.4 bcf/day of capacity over a 20-year term.”

This capacity is sufficient for Magnolia LNG to produce its full 8 mtpa design capacity, concludes Brand.

Magnolia LNG receives FEIS

LNG Limited of Australia informed that the U.S. Federal Energy Regulatory Commission issued the final environmental impact statement for the Magnolia LNG project in Lake Charles, Louisiana.FERC also issued a final EIS for the associated Kinder Morgan Louisiana Pipeline (KMLP) Lake Charles expansion project on November 13, the company confirmed in its statement on Monday.

In the FEIS, FERC concludes that construction and operation of the proposed projects would result in “limited adverse environmental impacts, but these impacts would be reduced to less-than-significant levels” with the implementation of MLNG’s and KMLP’s proposed mitigations and the additional measures recommended in the FEIS.

The next step in the FERC process is for the commissioners to act on MLNG’s and KMLP’s respective applications, LNG Limited added.

LNG Limited completes Magnolia EPC contract with KSJV

Liquefied Natural Gas Limited’s Magnolia LNG has agreed a US$4.35 billion contract with the KBR-SKE&C joint venture.The EPC contract covers the engineering, procurement and construction of four LNG production trains with a design capacity of 2 mtpa or greater each.

It also includes wo 160,000 cbm full containment storage tanks, LNG marine and ship loading facilities, supporting infrastructure and all required post-FID approvals and licenses.

Earlier in August MLNG selected Siemens Energy process compression and driver equipment which could potentially enable higher final plant design capacity which, following completion of remaining engineering and analysis, will be confirmed prior to the final investment decision, LNG Limited said on Monday.

As a result, MLNG’s per tonne EPC cost may reduce within the range of US$495/tonne – US$544/tonne based on the final installed capacity design.

The EPC guaranteed production totalling 7.6 mtpa for the four-train MLNG project will not change, the company said.

The KSJV also provided pricing on a reduced (three train) project scope. The take-out cost for one train, estimated by KSJV at US$630 million, is subject to final confirmation by 31 December 2015.

LNGL Managing Director and Chief Executive Officer, Maurice Brand said, “With the execution of the EPC contract in hand, we shall continue with final engineering activities but will not commit to out-sized, non-cancellable commitments in advance of execution of offtake agreements for at least 4 mtpa of additional sales.”

For a period of up to 15 years following the declaration of the commercial start date for each train, the KSJV may be eligible for annual revenue sharing payments ranging from $0 to $30 million across the four-train plant (maximum of about $0.07/mmBtu per annum).

Magnolia, Meridian extend tolling deal deadline

Magnolia LNG, a project company owned by Australia’s LNG Limited, said it has agreed to extend the financial close date for a tolling deal signed with Meridian LNG.The deal has been extended from June 30 to December 31, 2016, Magnolia LNG informed in a statement on Monday.

Magnolia LNG signed in July last year a binding agreement with Meridian LNG for firm capacity rights for up to 2 million tonnes per annum (mtpa) at Magnolia LNG, located on the Calcasieu shipping channel in the Lake Charles District, State of Louisiana, USA.

Under the liquefaction tolling agreement, Magnolia will provide liquefaction services to Meridian LNG over an initial term of 20 years, with option to extend by a further 5 years in return for monthly capacity payments.

Meridian LNG plans to deliver the LNG to Port Meridian, its Höegh LNG operated floating re‐gasification terminal in the UK with the gas delivered to E.ON Global Commodities under the 20‐year gas sales agreement executed in April 2015.

LNG Limited’s CEO and President of Magnolia LNG, Maurice Brand, said that “financial close date for the Magnolia LNG project is dependent on the execution of further binding offtake agreements the timing of which is uncertain due to current market conditions. The extension of time with Meridian LNG provides additional time for Magnolia LNG to finalise additional offtake agreements and allows for a typical timeline to conclude both project equity and debt following the execution of offtake agreements.”

Der Wert ist ja mächtig ausgebrannt die letzten Monate. Sollte sich der Ölpreis weiter stabilisieren könnten hier wieder die 1$ in Reichweite kommen.

Antwort auf Beitrag Nr.: 52.223.131 von synergy1 am 19.04.16 13:03:30

MAGNOLIA LNG RECEIVES FERC ORDER

Liquefied Natural Gas Limited (ASX: LNG; OTC ADR: LNGLY) (LNGL or the Company) is pleased to advise that its wholly owned subsidiary, Magnolia LNG, LLC (Magnolia LNG), received the Federal Energy Regulatory Commission (FERC) authorization (FERC Order) to site, construct, and operate facilities to liquefy and export domestically produced natural gas from its liquefied natural gas (LNG) terminal in the Lake Charles District, State of Louisiana, USA.

In addition, the Louisiana Department of Environmental Quality (LDEQ) approved the air permit for the Magnolia LNG.

In a related matter, FERC also authorized the Kinder Morgan Louisiana Pipeline LLC (KMLP Pipeline) to install compression and other related facilities on the KMLP Pipeline, facilitating the transportation of full feed gas volumes to the Magnolia LNG project.

LNGL Managing Director and Chief Executive Officer, Greg Vesey said, “We are pleased to receive the FERC Order and the air permit from LDEQ. Both of these items are important milestones as we progress the Magnolia LNG project towards a final investment decision. We look forward to the US Department of Energy (DOE) processing Magnolia LNG’s pending application to export LNG to countries that do not have a free trade agreement (FTA) with the United States.”

Magnolia LNG proposes to construct and operate up to four liquefaction production trains, each with a capacity of 2 mtpa or greater using the Company’s OSMR® patented LNG process technology.

Construction and operation shall include two 160,000m3 full containment storage tanks, ship, barge and truck loading facilities, and supporting infrastructure.

As previously announced, construction of the facility will be by the KBR‐SKE&C joint venture (KSJV) under a lump sum turnkey EPC contract.

“Our primary focus remains to complete marketing of Magnolia LNG’s offtake capacity, finalize financing arrangements, and progress towards construction”, stated Mr Vesey.

das erklärt den heutigen Kurssprung:

18 APRIL 2016MAGNOLIA LNG RECEIVES FERC ORDER

Liquefied Natural Gas Limited (ASX: LNG; OTC ADR: LNGLY) (LNGL or the Company) is pleased to advise that its wholly owned subsidiary, Magnolia LNG, LLC (Magnolia LNG), received the Federal Energy Regulatory Commission (FERC) authorization (FERC Order) to site, construct, and operate facilities to liquefy and export domestically produced natural gas from its liquefied natural gas (LNG) terminal in the Lake Charles District, State of Louisiana, USA.

In addition, the Louisiana Department of Environmental Quality (LDEQ) approved the air permit for the Magnolia LNG.

In a related matter, FERC also authorized the Kinder Morgan Louisiana Pipeline LLC (KMLP Pipeline) to install compression and other related facilities on the KMLP Pipeline, facilitating the transportation of full feed gas volumes to the Magnolia LNG project.

LNGL Managing Director and Chief Executive Officer, Greg Vesey said, “We are pleased to receive the FERC Order and the air permit from LDEQ. Both of these items are important milestones as we progress the Magnolia LNG project towards a final investment decision. We look forward to the US Department of Energy (DOE) processing Magnolia LNG’s pending application to export LNG to countries that do not have a free trade agreement (FTA) with the United States.”

Magnolia LNG proposes to construct and operate up to four liquefaction production trains, each with a capacity of 2 mtpa or greater using the Company’s OSMR® patented LNG process technology.

Construction and operation shall include two 160,000m3 full containment storage tanks, ship, barge and truck loading facilities, and supporting infrastructure.

As previously announced, construction of the facility will be by the KBR‐SKE&C joint venture (KSJV) under a lump sum turnkey EPC contract.

“Our primary focus remains to complete marketing of Magnolia LNG’s offtake capacity, finalize financing arrangements, and progress towards construction”, stated Mr Vesey.

Fällt trotzdem an der ASX weiter leicht.

Kommt noch nicht so richtig in die Gänge trotz momentan gutem Umweld.

Kommt noch nicht so richtig in die Gänge trotz momentan gutem Umweld.

LNG Limited’s shares keep climbing

Shares in the LNG terminal developer, LNG Limited are continuing to rise hitting a five-month high on Tuesday.Shares in the Australian-listed company rose almost 50 percent since last Thursday to A$0.82.

LNG Limited said in a statement to the Australian stock exchange on Monday that it “does not have an explanation for the price change in the securities of the company“.

“The company is not aware of any information concerning it that has not been announced to the market which, if known, could explain the recent trading in its securities,” LNG Limited said.

The company is currently developing LNG export terminal projects in the United States, Canada, and Australia having combined aggregate design production capacity of nearly 20 mtpa, with a further expansion option of up to 4 mtpa in Canada, according to its website.

LNG Limited’s portfolio includes the Magnolia LNG export terminal in Louisiana, U.S., Bear Head LNG in Nova Scotia, Canada, and Fisherman’s Landing project in Gladstone, Australia.

Antwort auf Beitrag Nr.: 52.566.518 von R-BgO am 08.06.16 10:49:04

The company noted in its short filing to the stock exchange that it is “not aware of or is in discussions in relation to a takeover.”

The rumours came following more than a 50 percent rise in company’s shares since last week that are now trading at A$1.075.

The company previously responded that it has no explanation for the price change, and had no information that could explain the trading in its securities.

Perth-based LNG player has three LNG export terminal projects under development in the United States, Canada, and Australia with a combined aggregate design production capacity of nearly 20 mtpa, with a further expansion option of up to 4 mtpa in Canada, according to its website.

LNG Limited’s portfolio includes the Magnolia LNG export terminal in Louisiana, U.S., Bear Head LNG in Nova Scotia, Canada, and Fisherman’s Landing project in Gladstone, Australia.

LNG Limited squashes takeover rumors

Australian LNG terminal developer LNG Limited on Thursday issued a comment declining media reports of a possible takeover, that was reported as a reason for the recent surge in the company’s shares price.The company noted in its short filing to the stock exchange that it is “not aware of or is in discussions in relation to a takeover.”

The rumours came following more than a 50 percent rise in company’s shares since last week that are now trading at A$1.075.

The company previously responded that it has no explanation for the price change, and had no information that could explain the trading in its securities.

Perth-based LNG player has three LNG export terminal projects under development in the United States, Canada, and Australia with a combined aggregate design production capacity of nearly 20 mtpa, with a further expansion option of up to 4 mtpa in Canada, according to its website.

LNG Limited’s portfolio includes the Magnolia LNG export terminal in Louisiana, U.S., Bear Head LNG in Nova Scotia, Canada, and Fisherman’s Landing project in Gladstone, Australia.

Hier mal was aktuelles

http://media.abnnewswire.net/media/en/presentations/rpt/ASX-…

Der LNG und LPG Markt werden in den nächsten Jahren mächtig zulegen und dann wird man die Kapazitäten von Liquefied Natural Gas sehr gut gebrauchen können...

Fakt ist der LPG und LNG verbrauch steigen immer mehr...

Die Kapitalkosten scheinen sehr günstig zu sein im Gegensatz zu dennen von anderen LNG Hafen Betreibern das geht ja in den nächsten Jahren erst richtig los..

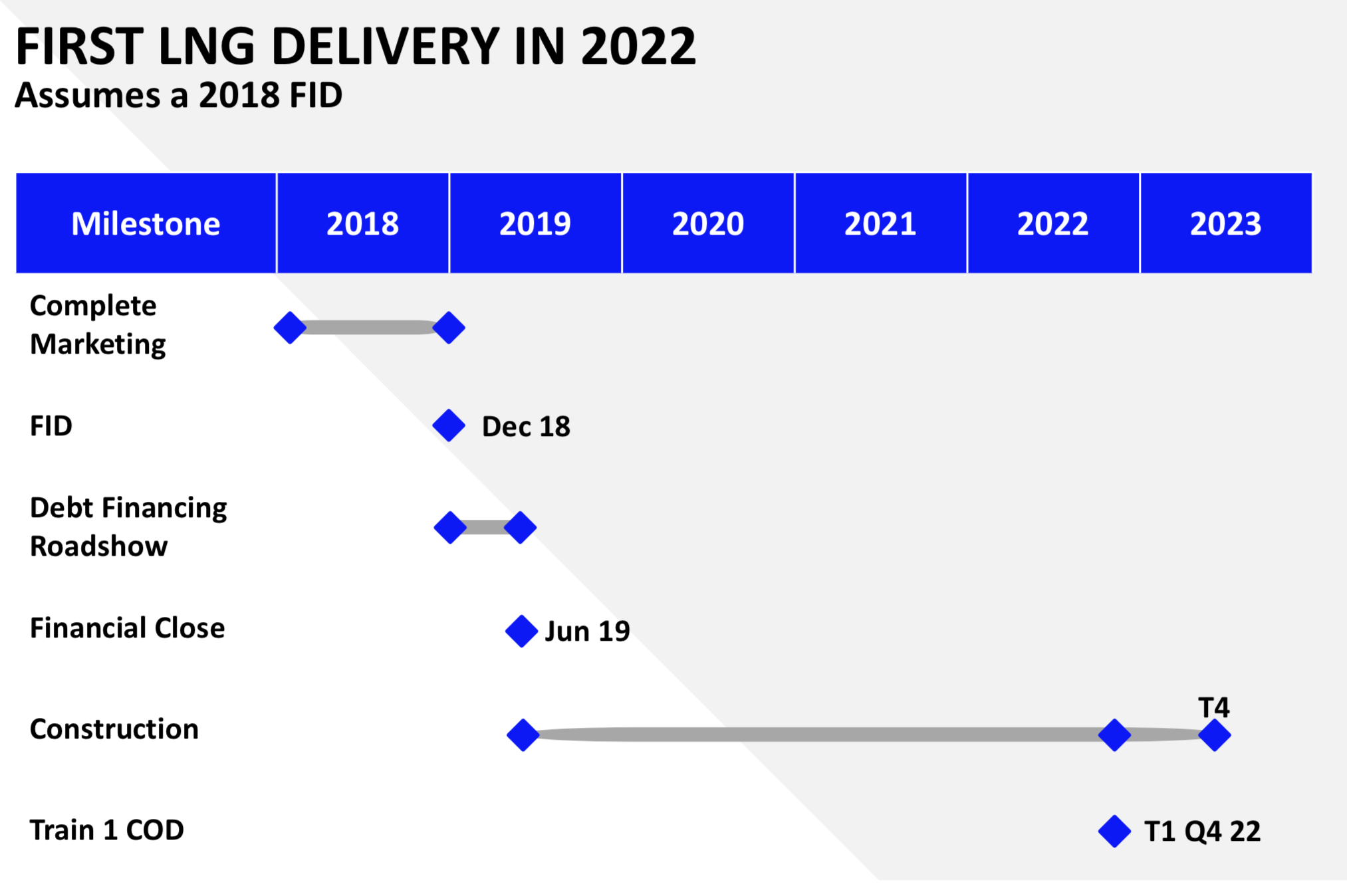

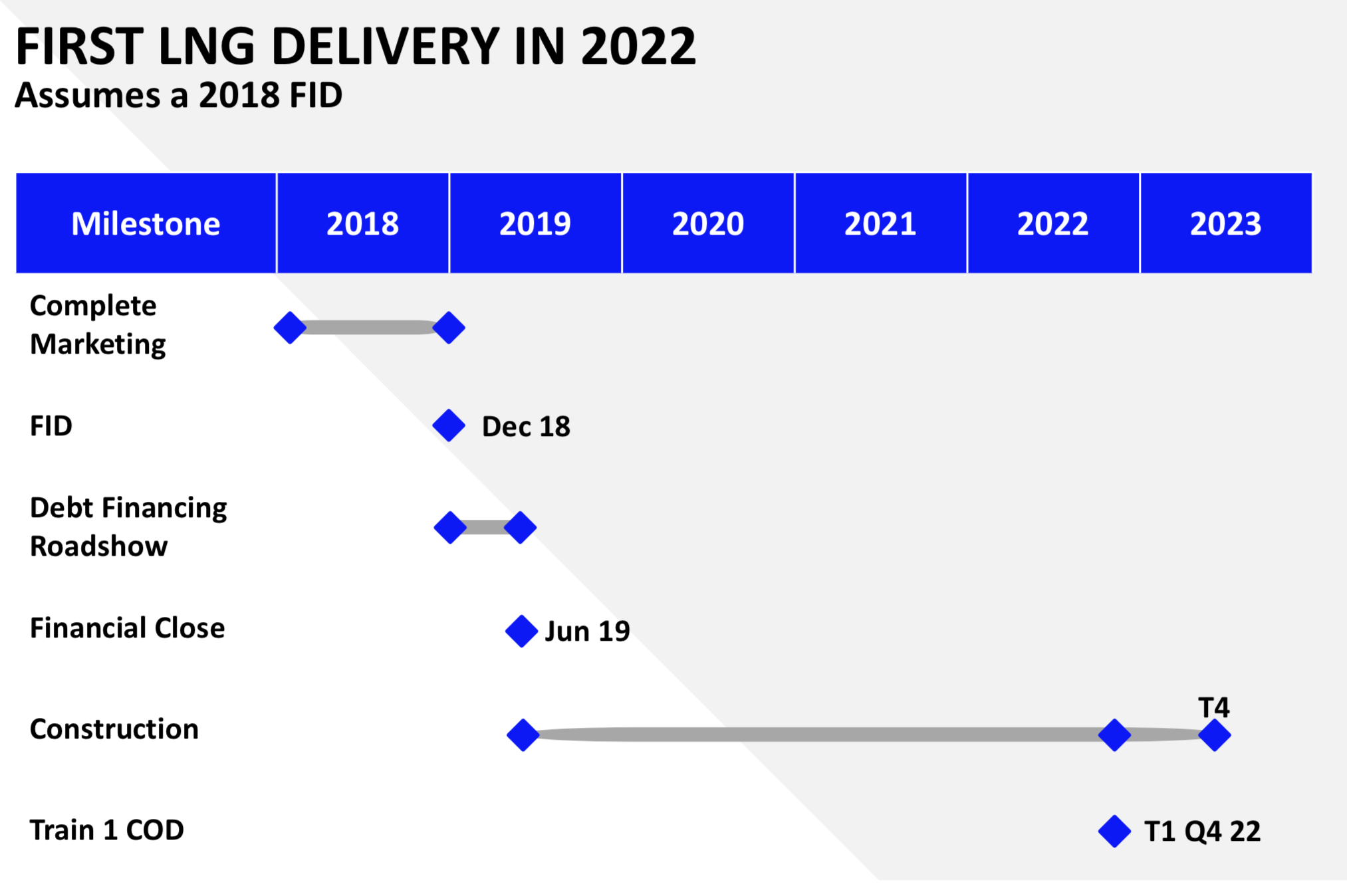

Wann rechnet ihr mit einem "Produktionsstart"? es wird ja immer von 2020 gesprochen.

http://media.abnnewswire.net/media/en/presentations/rpt/ASX-…

Der LNG und LPG Markt werden in den nächsten Jahren mächtig zulegen und dann wird man die Kapazitäten von Liquefied Natural Gas sehr gut gebrauchen können...

Fakt ist der LPG und LNG verbrauch steigen immer mehr...

Die Kapitalkosten scheinen sehr günstig zu sein im Gegensatz zu dennen von anderen LNG Hafen Betreibern das geht ja in den nächsten Jahren erst richtig los..

Wann rechnet ihr mit einem "Produktionsstart"? es wird ja immer von 2020 gesprochen.

fast 30% spread in Dtld,

Antwort auf Beitrag Nr.: 53.417.478 von R-BgO am 06.10.16 00:00:59LNG Limited says it can’t explain rise in its share price

LNG export terminal developer, LNG Limited on Monday issued a comment after it had been asked by the Australian Stock Exchange on the reasons behind a 23 percent rise in the company’s share price.

LNG Limited securities rose from a closing price of A$0.70 on January 10 to a high of $0.86 on January 13.

There was also a significant increase in the volume of the company’s securities traded in the past few trading days, the ASX noted in a letter dated January 13 asking LNG Limited whether the company is aware of any information that had not been announced to the market.

“The company is not aware of any information concerning it that has not been announced to the market which, if known, could explain the recent trading in its securities,” LNG Limited said in its response.

This is not the first time that the ASX is asking LNG Limited to explain reasons behind the rise in the company’s shares price.

Back in June 2016, LNG Limited declined media reports of a possible takeover of the company, that was reported as a reason for a surge in the company’s shares price. The rumors came following more than a 50 percent rise in company’s shares.

LNG Limited’s shares dropped 5 percent from Friday, closing at $o.81 on Monday.

Perth-based LNG export player has three LNG terminal projects under development in the United States, Canada, and Australia with a combined production capacity of nearly 20 mtpa, according to its website.

LNG Limited’s portfolio includes the Magnolia LNG export terminal in Louisiana, U.S., Bear Head LNG in Nova Scotia, Canada, and Fisherman’s Landing project in Gladstone, Australia.

LNG export terminal developer, LNG Limited on Monday issued a comment after it had been asked by the Australian Stock Exchange on the reasons behind a 23 percent rise in the company’s share price.

LNG Limited securities rose from a closing price of A$0.70 on January 10 to a high of $0.86 on January 13.

There was also a significant increase in the volume of the company’s securities traded in the past few trading days, the ASX noted in a letter dated January 13 asking LNG Limited whether the company is aware of any information that had not been announced to the market.

“The company is not aware of any information concerning it that has not been announced to the market which, if known, could explain the recent trading in its securities,” LNG Limited said in its response.

This is not the first time that the ASX is asking LNG Limited to explain reasons behind the rise in the company’s shares price.

Back in June 2016, LNG Limited declined media reports of a possible takeover of the company, that was reported as a reason for a surge in the company’s shares price. The rumors came following more than a 50 percent rise in company’s shares.

LNG Limited’s shares dropped 5 percent from Friday, closing at $o.81 on Monday.

Perth-based LNG export player has three LNG terminal projects under development in the United States, Canada, and Australia with a combined production capacity of nearly 20 mtpa, according to its website.

LNG Limited’s portfolio includes the Magnolia LNG export terminal in Louisiana, U.S., Bear Head LNG in Nova Scotia, Canada, and Fisherman’s Landing project in Gladstone, Australia.

Antwort auf Beitrag Nr.: 54.098.909 von R-BgO am 17.01.17 09:18:07LNG Limited’s Magnolia LNG to supply India’s first East coast terminal

Magnolia LNG, Perth-based LNG Limited’s U.S. unit, signed a heads of agreement with Vessel Gasification Solutions for a 20-year supply of 4 mtpa of liquefied natural gas from its project in Lake Charles, Louisiana.

According to the company’s statement, the non-binding HoA provides for free-on-board deliveries to the proposed Krishna Godavari LNG import terminal.

The firm SPA is conditional upon the financial close of the KG LNG terminal and satisfaction by VGS of defined credit requirements underpinning their LNG purchases within agreed timeframes.

Gaurav Tiwari, president of VGS added that the deal with Magnolia LNG would bring a “significant tranche of U.S.-produced LNG” to a new market on India’s East coast.

The terminal being developed by VGS is located offshore at Kakinada Deepwater port in Andhra Pradesh, India. The facility aims to supply regasified natural gas to power plants with the capacity of 7000 MW as well as industrial users.

The proposed Magnolia LNG facility would have up to four trains each with a liquefaction capacity of 2 mtpa or more, two 160,000-cbm storage tanks, ship, barge and truck loading facilities and supporting infrastructure.

Magnolia LNG, Perth-based LNG Limited’s U.S. unit, signed a heads of agreement with Vessel Gasification Solutions for a 20-year supply of 4 mtpa of liquefied natural gas from its project in Lake Charles, Louisiana.

According to the company’s statement, the non-binding HoA provides for free-on-board deliveries to the proposed Krishna Godavari LNG import terminal.

The firm SPA is conditional upon the financial close of the KG LNG terminal and satisfaction by VGS of defined credit requirements underpinning their LNG purchases within agreed timeframes.

Gaurav Tiwari, president of VGS added that the deal with Magnolia LNG would bring a “significant tranche of U.S.-produced LNG” to a new market on India’s East coast.

The terminal being developed by VGS is located offshore at Kakinada Deepwater port in Andhra Pradesh, India. The facility aims to supply regasified natural gas to power plants with the capacity of 7000 MW as well as industrial users.

The proposed Magnolia LNG facility would have up to four trains each with a liquefaction capacity of 2 mtpa or more, two 160,000-cbm storage tanks, ship, barge and truck loading facilities and supporting infrastructure.

Hallo leider sehr ruhig hier im Forum

Hier mal eine neuen Presentation

http://www.abnnewswire.net/press/en/87696

http://media.abnnewswire.net/media/en/presentations/rpt/ASX-…

Hier mal eine neuen Presentation

http://www.abnnewswire.net/press/en/87696

http://media.abnnewswire.net/media/en/presentations/rpt/ASX-…

LNG Limited secures $1.5 billion for Magnolia LNG project

Liquefied Natural Gas Limited said it has agreed on an amended and restated Magnolia LNG equity agreement with Stonepeak Partners securing a $1.5 billion commitment.

Additionally, the two companies have updated the associated Magnolia LLC agreement, replacing the existing Stonepeak agreements signed in October 2013 in their entirety.

The commitment is expected to fund the full Magnolia LNG project equity requirement, LNG Limited said in a statement.

Stonepeak Co-founder and senior managing director, Trent Vichie, said the company believes Magnolia LNG is among the “best positioned projects for the next wave of US LNG exports.”

The ECA governs the relationship, cooperation, rights, and obligations between Stonepeak and LNGL through financial close of Magnolia. The LLC agreement sets out the respective rights and obligations of Stonepeak and LNGL relating to Magnolia from financial close, including the governance, construction, operation, allocation of profits, distribution of postdebt service cash flows, and other related matters.

The amended and restated agreement represents the definitive documentation under which investment funds managed by Stonepeak will acquire preferred interest in the Magnolia LNG project.

LNG Limited said the proceeds will be used to fund the full expected US dollar equivalent equity requirement to construct and place into service the 8 mtpa Magnolia LNG project located in Lake Charles, Louisiana, USA.

Stonepeak’s investment is scheduled to close following a positive FID on Magnolia by LNGL.

Liquefied Natural Gas Limited said it has agreed on an amended and restated Magnolia LNG equity agreement with Stonepeak Partners securing a $1.5 billion commitment.

Additionally, the two companies have updated the associated Magnolia LLC agreement, replacing the existing Stonepeak agreements signed in October 2013 in their entirety.

The commitment is expected to fund the full Magnolia LNG project equity requirement, LNG Limited said in a statement.

Stonepeak Co-founder and senior managing director, Trent Vichie, said the company believes Magnolia LNG is among the “best positioned projects for the next wave of US LNG exports.”

The ECA governs the relationship, cooperation, rights, and obligations between Stonepeak and LNGL through financial close of Magnolia. The LLC agreement sets out the respective rights and obligations of Stonepeak and LNGL relating to Magnolia from financial close, including the governance, construction, operation, allocation of profits, distribution of postdebt service cash flows, and other related matters.

The amended and restated agreement represents the definitive documentation under which investment funds managed by Stonepeak will acquire preferred interest in the Magnolia LNG project.

LNG Limited said the proceeds will be used to fund the full expected US dollar equivalent equity requirement to construct and place into service the 8 mtpa Magnolia LNG project located in Lake Charles, Louisiana, USA.

Stonepeak’s investment is scheduled to close following a positive FID on Magnolia by LNGL.

4E ist da, Verlust ist stark zurückgegangen

LNG Limited halts efforts to redomicile to USA

Liquefied Natural Gas Limited has put a halt on all activity related to the redomicile of the company to the United States in order to focus on current business.

LNGL’s managing director and CEO, Greg Vesey said,“the board’s decision allows management to maintain its focus on marketing the offtake at Magnolia LNG and Bear Head LNG.”

He said that the company is continuing to monitor market conditions to potentially re-engage on the redomiciling efforts at an optimal time. LNG Limited looks to focus on opportunities to create additional long-term value for LNGL shareholders, and to strengthen liquidity.

Chairman of LNG Limited Paul Cavicchi, added the company will be brought to the U.S. market at an appropriate time best suited to maximize investor value.

“A U.S. listing is the right step for LNGL, but we must ensure we proceed deliberately and remain attentive to all shareholder expectations,” he said.

LNG Limited is developing two liquefied natural gas export projects, the 8 mtpa Magnolia LNG project in the Port of Lake Charles, Louisiana and the 12 mtpa Bear head LNG project in Richmond County, Nova Scotia, Canada.

Liquefied Natural Gas Limited has put a halt on all activity related to the redomicile of the company to the United States in order to focus on current business.

LNGL’s managing director and CEO, Greg Vesey said,“the board’s decision allows management to maintain its focus on marketing the offtake at Magnolia LNG and Bear Head LNG.”

He said that the company is continuing to monitor market conditions to potentially re-engage on the redomiciling efforts at an optimal time. LNG Limited looks to focus on opportunities to create additional long-term value for LNGL shareholders, and to strengthen liquidity.

Chairman of LNG Limited Paul Cavicchi, added the company will be brought to the U.S. market at an appropriate time best suited to maximize investor value.

“A U.S. listing is the right step for LNGL, but we must ensure we proceed deliberately and remain attentive to all shareholder expectations,” he said.

LNG Limited is developing two liquefied natural gas export projects, the 8 mtpa Magnolia LNG project in the Port of Lake Charles, Louisiana and the 12 mtpa Bear head LNG project in Richmond County, Nova Scotia, Canada.

LNG Limited welcomes new investor, raises $21.4m through share placement

LNG Limited, the Australian company developing two LNG export projects in North America, has raised A$28.2 million ($21.4m) through a share placement agreement with the Hong Kong-listed investment holding company IDG Energy Investment Group.

The share placement will raise the proceeds through the issuance of 56,444,500 ordinary shares at A$0.50 per ordinary share, representing a 14.1 percent premium to the volume weighted average price of LNG Limited shares on the ASX over the 30-trading day period ending June 1, the company said in a statement on Monday.

Following close of the placement, IDG Energy Investment, which is an affiliate of IDG Capital, will hold a 9.9 percent interest in LNG Limited.

LNG Limited said that the proceedings would be used in support of ongoing LNG offtake marketing efforts, focused on the Magnolia LNG export project, and for general corporate purposes.

“It is a great pleasure to welcome IDG Energy Investment to LNGL’s investor group,” said Greg Vesey, LNG Limited’s Managing Director and CEO.

Vesey went on to say that proceeds from this placement provide additional liquidity to LNG Limited, and the investment from IDG Energy Investment demonstrates a “high level of confidence in the company, and particularly a strong confidence in the fully permitted, shovel-ready Magnolia LNG project.”

“We are confident that our strategic relationship with IDG Energy Investment will provide LNGL with additional opportunities to market LNG volumes given IDG Energy Investment’s portfolio of infrastructure investments, including regasification interests,” Vesey said.

IDG Energy Investment’s President, Liu Zhihai said that the company sees the Magnolia LNG project as one of the best positioned U.S. liquefaction projects to deliver needed LNG exports to Asia.

“IDG Energy Investment is particularly bullish on the long-term outlook for U.S.-sourced LNG into China, and we will immediately begin working with LNGL to assist them in unlocking this market,” Zhihai said.

LNG Limited, the Australian company developing two LNG export projects in North America, has raised A$28.2 million ($21.4m) through a share placement agreement with the Hong Kong-listed investment holding company IDG Energy Investment Group.

The share placement will raise the proceeds through the issuance of 56,444,500 ordinary shares at A$0.50 per ordinary share, representing a 14.1 percent premium to the volume weighted average price of LNG Limited shares on the ASX over the 30-trading day period ending June 1, the company said in a statement on Monday.

Following close of the placement, IDG Energy Investment, which is an affiliate of IDG Capital, will hold a 9.9 percent interest in LNG Limited.

LNG Limited said that the proceedings would be used in support of ongoing LNG offtake marketing efforts, focused on the Magnolia LNG export project, and for general corporate purposes.

“It is a great pleasure to welcome IDG Energy Investment to LNGL’s investor group,” said Greg Vesey, LNG Limited’s Managing Director and CEO.

Vesey went on to say that proceeds from this placement provide additional liquidity to LNG Limited, and the investment from IDG Energy Investment demonstrates a “high level of confidence in the company, and particularly a strong confidence in the fully permitted, shovel-ready Magnolia LNG project.”

“We are confident that our strategic relationship with IDG Energy Investment will provide LNGL with additional opportunities to market LNG volumes given IDG Energy Investment’s portfolio of infrastructure investments, including regasification interests,” Vesey said.

IDG Energy Investment’s President, Liu Zhihai said that the company sees the Magnolia LNG project as one of the best positioned U.S. liquefaction projects to deliver needed LNG exports to Asia.

“IDG Energy Investment is particularly bullish on the long-term outlook for U.S.-sourced LNG into China, and we will immediately begin working with LNGL to assist them in unlocking this market,” Zhihai said.

Antwort auf Beitrag Nr.: 57.908.931 von R-BgO am 05.06.18 09:08:24Schön das mal jemand im Forum schreibt Langfristig könnte das eine Goldgrube werden....

https://www.bnnbloomberg.ca/commodities/video/bear-head-lng-…

https://www.bnnbloomberg.ca/commodities/video/bear-head-lng-…

Antwort auf Beitrag Nr.: 58.221.210 von freddy1989 am 16.07.18 09:36:09

Langfristig

ist das richtige Wort; es wird noch Jahre dauern, bis -if at all- jemals etwas Zählbares rauskommt:

raus bis aufs Erinnerungsstück

Antwort auf Beitrag Nr.: 59.349.095 von R-BgO am 03.12.18 11:24:52Hallo was meint ihr ob das noch was wird

https://www.lnglimited.com.au/site/content/

Neue Webseite und Animation mal sehen wann sie das umsetzten.

https://www.lnglimited.com.au/site/content/

Neue Webseite und Animation mal sehen wann sie das umsetzten.

Antwort auf Beitrag Nr.: 58.663.680 von R-BgO am 10.09.18 19:46:37

noch immer keine FID;

dafür will man jetzt nach USA re-domizilieren...

Antwort auf Beitrag Nr.: 61.541.487 von R-BgO am 22.09.19 17:43:02

sehe gerade #24:

würde sagen, Glaubwürdigkeit ist N U L L Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -5,02 | |

| -2,07 | |

| +0,17 | |

| +1,17 | |

| -1,62 | |

| 0,00 | |

| +0,07 | |

| -1,28 | |

| -3,56 | |

| +0,66 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 220 | ||

| 118 | ||

| 85 | ||

| 76 | ||

| 58 | ||

| 52 | ||

| 45 | ||

| 39 | ||

| 38 | ||

| 35 |