Union Pacific zahlt 50 Cents Dividende - Die letzten 30 Beiträge

eröffnet am 01.12.14 18:12:16 von

neuester Beitrag 27.07.23 09:29:19 von

neuester Beitrag 27.07.23 09:29:19 von

Beiträge: 85

ID: 1.203.536

ID: 1.203.536

Aufrufe heute: 0

Gesamt: 10.638

Gesamt: 10.638

Aktive User: 0

ISIN: US9078181081 · WKN: 858144 · Symbol: UNP

233,94

USD

-0,20 %

-0,46 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

10.04.24 · Business Wire (engl.) |

28.03.24 · Business Wire (engl.) |

02.02.24 · Aktienwelt360 |

14.07.23 · LYNX Analysen Anzeige |

Werte aus der Branche Verkehr

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +99.999,00 | |

| 19,360 | +22,92 | |

| 5,4200 | +15,07 | |

| 45,00 | +12,50 | |

| 27,59 | +10,36 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4400 | -22,79 | |

| 7,5000 | -33,63 | |

| 30,17 | -49,46 | |

| 9,3250 | -54,51 | |

| 1,0000 | -88,90 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 73.839.652 von foret am 12.05.23 13:58:04

die dann manchmal doch kommen !

Zitat von foret: Die 200 $ scheinen schwer zu überwinden ohne real good news ...

die dann manchmal doch kommen !

Union Pacific shares spike following CEO succession announcement

https://www.cnbc.com/video/2023/07/26/union-pacific-shares-s…

https://www.cnbc.com/video/2023/07/26/union-pacific-shares-s…

Die 200 $ scheinen schwer zu überwinden ohne real good news ...

Guten Morgen Unioner

Ich stelle heute 6 weitere MACD Signal Kandidaten vor, die mir ins Auge gestochen sind.

Wie sich die Titel nach dem Signal entwickeln, weiss ich leider auch nicht.

Ich hoffe natürlich auf steigende Kurse.

Ich habe jeweils einen KO Schein ausgesucht, der ungefähr einen 5er Hebel liefert.

Im Endeffekt stelle ich hier einfach meine Analysen und Erkenntnisse zur Verfügung.

!!! Das ist keine Handelsempfehlung und auch keine Kaufaufforderung !!!

Ich teile einfach meine Gedanken und Ideen mit.

Sollte trotzdem jemand auf Grund meiner Bildchen handeln, so wird dies

zu 100% auf eigenes Risiko gemacht.

Bei KO Produkten sind Totalverluste an der Tagesordnung!!!

Ich wünsche viel Spass beim Studieren meiner Charts.

Good Luck

Chartier

Ich stelle heute 6 weitere MACD Signal Kandidaten vor, die mir ins Auge gestochen sind.

Wie sich die Titel nach dem Signal entwickeln, weiss ich leider auch nicht.

Ich hoffe natürlich auf steigende Kurse.

Ich habe jeweils einen KO Schein ausgesucht, der ungefähr einen 5er Hebel liefert.

Im Endeffekt stelle ich hier einfach meine Analysen und Erkenntnisse zur Verfügung.

!!! Das ist keine Handelsempfehlung und auch keine Kaufaufforderung !!!

Ich teile einfach meine Gedanken und Ideen mit.

Sollte trotzdem jemand auf Grund meiner Bildchen handeln, so wird dies

zu 100% auf eigenes Risiko gemacht.

Bei KO Produkten sind Totalverluste an der Tagesordnung!!!

Ich wünsche viel Spass beim Studieren meiner Charts.

Good Luck

Chartier

CEO tritt ab, deswegen. https://www.reuters.com/business/union-pacific-says-it-expec…

warum heute einfach mal 12 Euro hoch ?

Cp mit neuem ath in c$

,

,

Antwort auf Beitrag Nr.: 70.586.480 von biviol1 am 21.01.22 08:39:13Ich denke es geht um die Konkurrenz, für UP stieg die Dividende zuletzt auf mehr als 1 Dollar

Bin neu hier?

Habe mich entschlossen an dieser doch sehr ausgiebigen Wachstumsstory teilhaben zu wollen. Bin seit heute dabei.Mein Ziel ist 100% in 5 - 10 Jahren

Die Rally auf Schienen: Das sind die Gewinner-Aktien

Die Konsumwut der Verbraucher lässt auch die Logistikbranche boomen. Profiteure sind die Bahngesellschaften, die gleichzeitig mit Klimaschutz punkten, und ihre Zulieferer.

https://www.finanzen.net/nachricht/aktien/volle-fahrt-die-ra…

Antwort auf Beitrag Nr.: 67.544.687 von biviol1 am 21.03.21 14:40:07für den baranteil von 90$ pro ksu aktie erstmal cp gekauft.

FreightWaves

Wed, March 24, 2021, 4:29 PM

Canadian Pacific (NYSE: CP) announced plans to acquire Kansas City Southern (NYSE: KSU) for $29 billion on Sunday morning. Here are five initial impressions from Wall Street transportation analysts about this proposed transaction.

Wall Street likes the deal

The merger of CP and Kansas City Southern (KCS) would be combining two of the smallest Class I railroads. It would also be integrating two railroads that are striving to reach an operating ratio (OR) in the mid-50s. OR, represented in a percentage such as 55%, is a tool investors use to gauge the financial health of a company, with a lower OR implying improved financial health.

"We believe the fit of the two rail systems and strategic logic is good. Both railroads have track records of delivering volume growth and the significant extension of CP's reach should allow meaningful revenue synergies," said a Monday note from UBS (NYSE: UBS) transportation analyst Tom Wadewitz.

However, like other observers, Wall Street will also be watching how the Surface Transportation Board, the regulatory body that would approve the merger, considers CP's proposed acquisition, noting that the board has been mindful of shippers' concerns in recent and ongoing proceedings.

Could the third time be a charm?

CP has considered merging with two other Class I railroads — CSX (NYSE: CSX) and Norfolk Southern (NYSE: NSC) — in the past seven years. But this merger would be different because it would be with a much smaller railroad revenuewise.

"The regulatory consideration is an important one because in 2016, during CP's attempted takeover of Norfolk Southern (NSC), the attempt ended after heightened scrutiny from the Obama administration on antitrust issues," said Deutsche Bank (NYSE: DB) analyst Amit Mehrotra. "But we note at that time NSC rejected CP's offer, whereas [this] announcement is a friendly deal, and KSU is only about one-fourth the size of NSC from a revenue standpoint — i.e., pro forma for the deal CPKC will still be the smallest Class I rail." CPKC stands for the name for the new company.

Could this result in more mergers and acquisitions?

Although analysts are uncertain whether the CP-KCS transaction will result in a wave of mergers and acquisitions with the freight railroad industry, the proposed acquisition points to an industry that seeks to pivot to growth after implementing precision scheduled railroading (PSR), an operational tool that seeks to streamline operations and cut costs.

"This transaction could get other railroads thinking about the urge to merge. Aside from other mergers, CPKC is targeting nearly $800 [million] in revenue synergies by 2025. These are likely to be spread fairly evenly over the time frame and come from three main buckets: intermodal/automotive, bulk and carload," said Cowen (NASDAQ: COWN) analyst Jason Seidl in a Monday note. "Some of these wins will undoubtedly be taken off the highway as a complete interline service should make for a more reliable rail product. On its deal call, management mentioned that it plans to offer new services as well due to the increased reach and specifically mentioned some routes east of Chicago. Some of these could be taken from other rail operators in our view."

Bascome Majors, analyst for Susquehanna Financial Group (OTC: SQCF), said, "To be clear, we wouldn't expect other Class I deals to be announced near term, with executives, boards and advisers of other rails closely watching the CP-KSU litmus test for the STB's current merger appetite before diving in. But if CP-KSU were to show signs of regulatory traction, a full-fledged final round of Class I consolidation could follow in 2022-2025."

Which railroads would be affected by this?

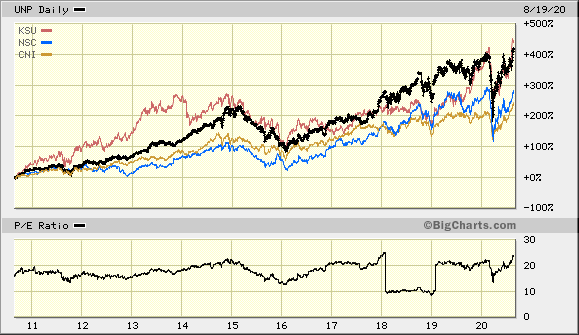

Competing Canadian railway CN (NYSE: CNI) is likely to be affected by the merger since it has a T-shaped network consisting of the two Canadian coasts and the U.S. Gulf Coast. The CP-KCS combination would also have a T-shaped network.

But Union Pacific (NYSE: UNP) could face a potential share shift, particularly for automotive and intermodal traffic, because of its cross-border network with Mexico. BNSF (NYSE: BRK) could also be exposed as well to potential competition for grain transport in the Upper Midwest.

"The potential combination of CP and KSU would create a stronger north-south railroad competitor to UNP and CNI," Wadewitz said. "UNP has an efficient route structure from Chicago to Texas and the border at Laredo and CP/KSU would also become a stronger competitor on traffic running north-south in the U.S. We would expect CP and KSU to move a portion of their interchange traffic with other railroads onto the new combined system if the deal is approved."

But there is still a lot of regulatory uncertainty

Despite initial expectations that STB would likely approve the deal, industry consolidation in the 1980s and 1990s has led to a field consisting of seven Class I railroads. Regulators — and shippers especially — are wary of additional consolidation.

"To be clear, we do believe the STB will ultimately approve the CP-KSU merger. But we're also prepared for the process to drag on beyond the mid-2022 approval timeline management laid out today, with an approval potentially including conditions offering modest concessions to customers and competitors," Majors said.

https://www.bnnbloomberg.ca/video/very-encouraged-by-respons…

FreightWaves

Wed, March 24, 2021, 4:29 PM

Canadian Pacific (NYSE: CP) announced plans to acquire Kansas City Southern (NYSE: KSU) for $29 billion on Sunday morning. Here are five initial impressions from Wall Street transportation analysts about this proposed transaction.

Wall Street likes the deal

The merger of CP and Kansas City Southern (KCS) would be combining two of the smallest Class I railroads. It would also be integrating two railroads that are striving to reach an operating ratio (OR) in the mid-50s. OR, represented in a percentage such as 55%, is a tool investors use to gauge the financial health of a company, with a lower OR implying improved financial health.

"We believe the fit of the two rail systems and strategic logic is good. Both railroads have track records of delivering volume growth and the significant extension of CP's reach should allow meaningful revenue synergies," said a Monday note from UBS (NYSE: UBS) transportation analyst Tom Wadewitz.

However, like other observers, Wall Street will also be watching how the Surface Transportation Board, the regulatory body that would approve the merger, considers CP's proposed acquisition, noting that the board has been mindful of shippers' concerns in recent and ongoing proceedings.

Could the third time be a charm?

CP has considered merging with two other Class I railroads — CSX (NYSE: CSX) and Norfolk Southern (NYSE: NSC) — in the past seven years. But this merger would be different because it would be with a much smaller railroad revenuewise.

"The regulatory consideration is an important one because in 2016, during CP's attempted takeover of Norfolk Southern (NSC), the attempt ended after heightened scrutiny from the Obama administration on antitrust issues," said Deutsche Bank (NYSE: DB) analyst Amit Mehrotra. "But we note at that time NSC rejected CP's offer, whereas [this] announcement is a friendly deal, and KSU is only about one-fourth the size of NSC from a revenue standpoint — i.e., pro forma for the deal CPKC will still be the smallest Class I rail." CPKC stands for the name for the new company.

Could this result in more mergers and acquisitions?

Although analysts are uncertain whether the CP-KCS transaction will result in a wave of mergers and acquisitions with the freight railroad industry, the proposed acquisition points to an industry that seeks to pivot to growth after implementing precision scheduled railroading (PSR), an operational tool that seeks to streamline operations and cut costs.

"This transaction could get other railroads thinking about the urge to merge. Aside from other mergers, CPKC is targeting nearly $800 [million] in revenue synergies by 2025. These are likely to be spread fairly evenly over the time frame and come from three main buckets: intermodal/automotive, bulk and carload," said Cowen (NASDAQ: COWN) analyst Jason Seidl in a Monday note. "Some of these wins will undoubtedly be taken off the highway as a complete interline service should make for a more reliable rail product. On its deal call, management mentioned that it plans to offer new services as well due to the increased reach and specifically mentioned some routes east of Chicago. Some of these could be taken from other rail operators in our view."

Bascome Majors, analyst for Susquehanna Financial Group (OTC: SQCF), said, "To be clear, we wouldn't expect other Class I deals to be announced near term, with executives, boards and advisers of other rails closely watching the CP-KSU litmus test for the STB's current merger appetite before diving in. But if CP-KSU were to show signs of regulatory traction, a full-fledged final round of Class I consolidation could follow in 2022-2025."

Which railroads would be affected by this?

Competing Canadian railway CN (NYSE: CNI) is likely to be affected by the merger since it has a T-shaped network consisting of the two Canadian coasts and the U.S. Gulf Coast. The CP-KCS combination would also have a T-shaped network.

But Union Pacific (NYSE: UNP) could face a potential share shift, particularly for automotive and intermodal traffic, because of its cross-border network with Mexico. BNSF (NYSE: BRK) could also be exposed as well to potential competition for grain transport in the Upper Midwest.

"The potential combination of CP and KSU would create a stronger north-south railroad competitor to UNP and CNI," Wadewitz said. "UNP has an efficient route structure from Chicago to Texas and the border at Laredo and CP/KSU would also become a stronger competitor on traffic running north-south in the U.S. We would expect CP and KSU to move a portion of their interchange traffic with other railroads onto the new combined system if the deal is approved."

But there is still a lot of regulatory uncertainty

Despite initial expectations that STB would likely approve the deal, industry consolidation in the 1980s and 1990s has led to a field consisting of seven Class I railroads. Regulators — and shippers especially — are wary of additional consolidation.

"To be clear, we do believe the STB will ultimately approve the CP-KSU merger. But we're also prepared for the process to drag on beyond the mid-2022 approval timeline management laid out today, with an approval potentially including conditions offering modest concessions to customers and competitors," Majors said.

https://www.bnnbloomberg.ca/video/very-encouraged-by-respons…

https://futureforfreight.com/investors/press-release/

😡 mich ein wenig an. war zwar klar das da was kommt, aber

zumindest fette beute für 3 jahre.

😡 mich ein wenig an. war zwar klar das da was kommt, aber

zumindest fette beute für 3 jahre.

Habe um 170 Euro zugeschlagen, zwei Tage später hätte ich sie um 161 gekriegt :-) Ist aber nicht dramatisch, die vererbe ich meinem Junior

Ich denke am 29 04 21

Antwort auf Beitrag Nr.: 66.515.219 von Srtmtim am 20.01.21 04:55:03wann kommen hier die Zahlen ?

Hat jemand Ideen zu einem vertretbaren Einstiegspreis? Ich möchte hier langfristig investieren, will allerdings nicht zum ATH einsteigen. Wäre dankbar für Anregungen.

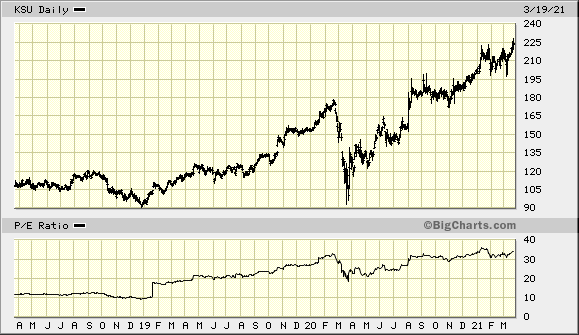

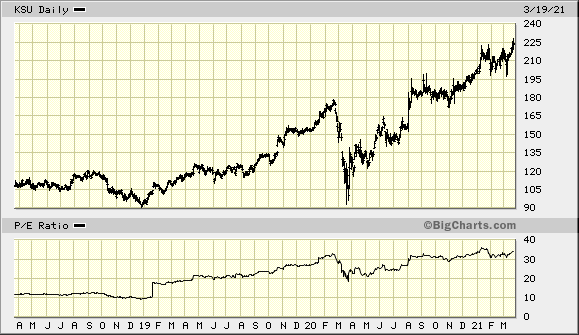

teuer

aber dankt psr sollten die gewinnen weiter stark wachsen

Die US-Regierung hat eine positive Zwischenbilanz des Handelsabkommens mit China gezogen. Er sei zufrieden damit, wie China seinen Verpflichtungen zum Kauf von US-Importen zunehmend nachkomme, sagte Larry Kudlow, der Wirtschaftsberater von Präsident Trump, am Donnerstag.

https://www.finanznachrichten.de/nachrichten-2020-08/5046906…" target="_blank" rel="nofollow ugc noopener">

https://www.finanznachrichten.de/nachrichten-2020-08/5046906…

Portfoliocheck: Ken Fisher setzt mit Union Pacific auf die US-Konjunktur und ein Ende des Handelskriegs

Doch Fisher hat im dritten Quartal noch weitere Konjunktur sensible Werte eingekauft, wie Caterpillar, Home Depot und den UNP-Konkurrenten CSX Corp.

https://www.wallstreet-online.de/nachricht/11992908-portfoli…

Doch Fisher hat im dritten Quartal noch weitere Konjunktur sensible Werte eingekauft, wie Caterpillar, Home Depot und den UNP-Konkurrenten CSX Corp.

https://www.wallstreet-online.de/nachricht/11992908-portfoli…

Hierfür bietet sich die Eisenbahn an. In den USA werden bereits über 30 Prozent aller Güter zwischen den Städten und dem Ex- und Import mit der Eisenbahn transportiert. Sie gilt dabei als besonders umweltfreundlich, da sie 2017 im Schnitt mit einer Gallone Diesel eine Tonne Fracht 479 Meilen weit transportiert hat. Rechnet man das auf einen LKW (40-Tonner mit 25 t Nutzlast) um, dürfte der gerade einmal etwas mehr als 12 Liter (und nicht zwischen 30 und 40 Litern) auf 100 km verbrauchen. So ist es nicht verwunderlich, dass Donald Trump im April eine Verordnung erließ, den Transport von LNG in Eisenbahntankwagen zu ermöglichen. Hintergrund ist die Steigerung der Kapazität zur Verflüssigung von Erdgas um 939 Prozent im Zeitraum zwischen 2010 und 2018 durch die Inbetriebnahme neuer Terminals für den Export – Tendenz weiter stark steigend. Mit anderen Worten, es steht genug verflüssigtes Erdgas in den USA zur Verfügung, es muss nur noch zu den potenziellen Verbrauchern im Inland gelangen.

https://www.achgut.com/artikel/fluessiges_erdgas_die_usa_sta…

https://www.achgut.com/artikel/fluessiges_erdgas_die_usa_sta…

Mongeau, 57, is former president and chief executive officer of Canadian National Railway Company, holding those positions from 2010 to 2016. He has been appointed to the Compensation Committee and the Finance and Risk Management Committee of the Norfolk Southern board and will serve as an independent director.

https://finance.yahoo.com/news/claude-mongeau-elected-norfol…

https://finance.yahoo.com/news/claude-mongeau-elected-norfol…

Eisenbahn im depot tut gut

Imo

Imo

nur mal so

J.B. Hunt Stock Is a Bargain Play in Intermodal Shipping

Even if you have discarded the possessions that don’t spark joy, lots of people around you are buying more stuff.

The business of moving that stuff has fallen in part to J.B. Hunt Transport Services (ticker: JBHT), the king of what’s known as intermodal shipping, or transporting goods on containers over low-cost rail and then switching to higher-cost, shorter-distance trucks. Hunt now has about a quarter of the $18 billion intermodal industry.

“There’s rail, there’s intermodal, and then there’s Hunt,” says Ted Prince, chief operating officer of Tiger Cool Express, a third-party logistics company. “They’re the biggest. They’re the best.”

Wall Street has been significantly less laudatory of late. Trends in the railroad industry and in e-commerce are seen as negatives for J.B. Hunt’s business. Its shares are down nearly 30% from their high of $132 last spring. A big miss on first-quarter operating revenue last month didn’t help.

Yet, at a recent $95, J.B. Hunt’s stock looks cheap. Even after analysts reduced their earnings estimates for 2019 to $5.71 a share, J.B. Hunt trades at 16.6 times forward earnings forecasts. Historically, the shares have commanded 22 times. That compares with 19 times for the S&P 500 and 18 times for rival XPO Logistics (XPO).

If multiples revert to their 10-year average, the stock could climb 50%-plus over the next couple of years. “By my math, they can have $7 a share in earnings in three years,” says David Powell, co-manager of the Brown Advisory Sustainable Growth fund, which owns shares in the company. “If you can get a 20 multiple, you can get to $140.”

Founded in 1961 by Johnnie Bryan Hunt, who died in 2006, J.B. Hunt is 17% owned by his widow, Johnelle. It has 28,000 employees, including about 19,000 drivers.

Analysts, on average, expect J.B. Hunt to earn $5.71 a share this year on revenue of $9.3 billion, versus $5.39 on $8.62 billion in 2018. For 2020, Wall Street sees the company making $6.47 on $10 billion.

Intermodal accounts for half of J.B. Hunt’s revenue; dedicated contract services, in which Hunt’s trucks are used exclusively by one shipper, is about a third. The remainder is generated by the company’s logistics business, as well as a tractor-trucking operation that picks up freight at a dock and transports the load directly to the consignee.

J.B. Hunt’s recent problems have been with the railroads. Late last year, arbitrators awarded Berkshire Hathaway ’s (BRK.B) Burlington Northern, Hunt’s major partner in the western U.S., an unspecified greater percentage of the revenue that the two companies share for intermodal services. Investors fear that Hunt won’t be able to recoup the difference through higher prices.

More broadly, railroads are adopting what’s called precision-scheduled railroading, which means they are closing unprofitable routes like those to Syracuse, N.Y., and Cincinnati, and causing slowdowns in transport, leading frustrated clients to avoid intermodal and switch to trucking.

Developments in e-commerce delivery also threaten J.B. Hunt. Deutsche Bank analysts recently downgraded the stock to a Sell, arguing that as online retailers build more fulfillment centers in densely populated regions like the East Coast, they will turn to trucking, instead of intermodal.

Then, there’s Amazon.com (AMZN), which is pushing into one-day shipping and has opened an online freight-brokerage business that competes with other logistics firms.

But the decline in J.B. Hunt’s stock is an overreaction to these developments, bulls say.

For one thing, the estimated times of arrival for railroads seem to be improving. Norfolk Southern (NSC) says that it decreased the time spent at a scheduled stop by 23% in the first quarter and increased train speeds.

“ “The cost of moving on highways is going up, and the cost of going on rail is going down.” ”

—David Vernon

During the first-quarter earnings conference call, J.B. Hunt executives said they expect volume growth to return in the third and fourth quarters. “We believe the service levels should go up,” Chief Executive John Roberts told analysts. That “should attract more freight to intermodal, and that would be a positive part of scheduled railroading.” (J.B. Hunt declined to make senior executives available for comment to Barron’s.)

Railroads have invested heavily in infrastructure over the past several years and need intermodal to grow.

The intermodal industry will bounce back from the first-quarter decline “to a normalized growth rate of 3% to 3.5% a year,” predicts Matthew Young, a Morningstar analyst. “Shippers want intermodal because they can save money on their supply chain. You’ll see this work out over the next 12 to 15 months.”

What about competition from trucking? That can go only so far: Truckers say they have a hard time hiring drivers, with the U.S. enjoying what many economists view as full employment.

Trucking is suffering because it’s unable to attract younger employees. The average commercial truck driver in the U.S. is aged 55, and many will retire in the coming years. “The biggest problem for traditional truckers is finding new drivers,” says Bill Bell of Atlanta Capital, which manages Eaton Vance Atlanta Capital SMID-Cap Fund, which owns Hunt shares. “It makes intermodal more competitive.”

To help Hunt expand the pool of potential drivers,Trillium Asset Management, a sustainable investor, filed a proposal in 2016 urging Hunt to adopt a policy explicitly prohibiting discrimination based on sexual orientation, gender identity, or gender expression. Hunt has declined to comment.

Elizabeth Levy, portfolio manager at Trillium, says today: “We consider Hunt to be a core holding. Truck driving is not really an occupation younger people want to get into. Carbon emissions from trucking are much higher than rail. Hunt, as the leader in Intermodal, is a main beneficiary for many years to come.” Levy says a 20% return for the stock over the next 12 months “seems reasonable.”

“The cost of moving on highways is going up, and the cost of going on rail is going down,” says David Vernon, an analyst with Bernstein Research. “Even if you have autonomous trucks, you will still have congestion.”

Vernon isn’t worried about Amazon, which buys intermodal service, he points out. He and other analysts are heartened by Hunt’s logistics business and its Marketplace 360, a digital brokerage firm that helps shippers reduce transportation costs. It is growing nicely. “We’re at a cyclical moment,” Vernon says. “This is a temporary lull.”

J.B. Hunt Stock Is a Bargain Play in Intermodal Shipping

Even if you have discarded the possessions that don’t spark joy, lots of people around you are buying more stuff.

The business of moving that stuff has fallen in part to J.B. Hunt Transport Services (ticker: JBHT), the king of what’s known as intermodal shipping, or transporting goods on containers over low-cost rail and then switching to higher-cost, shorter-distance trucks. Hunt now has about a quarter of the $18 billion intermodal industry.

“There’s rail, there’s intermodal, and then there’s Hunt,” says Ted Prince, chief operating officer of Tiger Cool Express, a third-party logistics company. “They’re the biggest. They’re the best.”

Wall Street has been significantly less laudatory of late. Trends in the railroad industry and in e-commerce are seen as negatives for J.B. Hunt’s business. Its shares are down nearly 30% from their high of $132 last spring. A big miss on first-quarter operating revenue last month didn’t help.

Yet, at a recent $95, J.B. Hunt’s stock looks cheap. Even after analysts reduced their earnings estimates for 2019 to $5.71 a share, J.B. Hunt trades at 16.6 times forward earnings forecasts. Historically, the shares have commanded 22 times. That compares with 19 times for the S&P 500 and 18 times for rival XPO Logistics (XPO).

If multiples revert to their 10-year average, the stock could climb 50%-plus over the next couple of years. “By my math, they can have $7 a share in earnings in three years,” says David Powell, co-manager of the Brown Advisory Sustainable Growth fund, which owns shares in the company. “If you can get a 20 multiple, you can get to $140.”

Founded in 1961 by Johnnie Bryan Hunt, who died in 2006, J.B. Hunt is 17% owned by his widow, Johnelle. It has 28,000 employees, including about 19,000 drivers.

Analysts, on average, expect J.B. Hunt to earn $5.71 a share this year on revenue of $9.3 billion, versus $5.39 on $8.62 billion in 2018. For 2020, Wall Street sees the company making $6.47 on $10 billion.

Intermodal accounts for half of J.B. Hunt’s revenue; dedicated contract services, in which Hunt’s trucks are used exclusively by one shipper, is about a third. The remainder is generated by the company’s logistics business, as well as a tractor-trucking operation that picks up freight at a dock and transports the load directly to the consignee.

J.B. Hunt’s recent problems have been with the railroads. Late last year, arbitrators awarded Berkshire Hathaway ’s (BRK.B) Burlington Northern, Hunt’s major partner in the western U.S., an unspecified greater percentage of the revenue that the two companies share for intermodal services. Investors fear that Hunt won’t be able to recoup the difference through higher prices.

More broadly, railroads are adopting what’s called precision-scheduled railroading, which means they are closing unprofitable routes like those to Syracuse, N.Y., and Cincinnati, and causing slowdowns in transport, leading frustrated clients to avoid intermodal and switch to trucking.

Developments in e-commerce delivery also threaten J.B. Hunt. Deutsche Bank analysts recently downgraded the stock to a Sell, arguing that as online retailers build more fulfillment centers in densely populated regions like the East Coast, they will turn to trucking, instead of intermodal.

Then, there’s Amazon.com (AMZN), which is pushing into one-day shipping and has opened an online freight-brokerage business that competes with other logistics firms.

But the decline in J.B. Hunt’s stock is an overreaction to these developments, bulls say.

For one thing, the estimated times of arrival for railroads seem to be improving. Norfolk Southern (NSC) says that it decreased the time spent at a scheduled stop by 23% in the first quarter and increased train speeds.

“ “The cost of moving on highways is going up, and the cost of going on rail is going down.” ”

—David Vernon

During the first-quarter earnings conference call, J.B. Hunt executives said they expect volume growth to return in the third and fourth quarters. “We believe the service levels should go up,” Chief Executive John Roberts told analysts. That “should attract more freight to intermodal, and that would be a positive part of scheduled railroading.” (J.B. Hunt declined to make senior executives available for comment to Barron’s.)

Railroads have invested heavily in infrastructure over the past several years and need intermodal to grow.

The intermodal industry will bounce back from the first-quarter decline “to a normalized growth rate of 3% to 3.5% a year,” predicts Matthew Young, a Morningstar analyst. “Shippers want intermodal because they can save money on their supply chain. You’ll see this work out over the next 12 to 15 months.”

What about competition from trucking? That can go only so far: Truckers say they have a hard time hiring drivers, with the U.S. enjoying what many economists view as full employment.

Trucking is suffering because it’s unable to attract younger employees. The average commercial truck driver in the U.S. is aged 55, and many will retire in the coming years. “The biggest problem for traditional truckers is finding new drivers,” says Bill Bell of Atlanta Capital, which manages Eaton Vance Atlanta Capital SMID-Cap Fund, which owns Hunt shares. “It makes intermodal more competitive.”

To help Hunt expand the pool of potential drivers,Trillium Asset Management, a sustainable investor, filed a proposal in 2016 urging Hunt to adopt a policy explicitly prohibiting discrimination based on sexual orientation, gender identity, or gender expression. Hunt has declined to comment.

Elizabeth Levy, portfolio manager at Trillium, says today: “We consider Hunt to be a core holding. Truck driving is not really an occupation younger people want to get into. Carbon emissions from trucking are much higher than rail. Hunt, as the leader in Intermodal, is a main beneficiary for many years to come.” Levy says a 20% return for the stock over the next 12 months “seems reasonable.”

“The cost of moving on highways is going up, and the cost of going on rail is going down,” says David Vernon, an analyst with Bernstein Research. “Even if you have autonomous trucks, you will still have congestion.”

Vernon isn’t worried about Amazon, which buys intermodal service, he points out. He and other analysts are heartened by Hunt’s logistics business and its Marketplace 360, a digital brokerage firm that helps shippers reduce transportation costs. It is growing nicely. “We’re at a cyclical moment,” Vernon says. “This is a temporary lull.”

Trump told a campaign rally in Green Bay, Wisconsin, on Saturday that Abe said Japan would invest $40 billion in U.S. car factories, though Trump did not give details on the time line for the planned investments.

https://www.japantimes.co.jp/news/2019/04/28/national/politi…

https://www.japantimes.co.jp/news/2019/04/28/national/politi…

oder so

Union Pacific zahlt 50 Cents Dividende