Voltalia - neue WKN nach reverse split - 500 Beiträge pro Seite

eröffnet am 15.01.15 10:45:26 von

neuester Beitrag 26.06.19 09:23:08 von

neuester Beitrag 26.06.19 09:23:08 von

Beiträge: 18

ID: 1.205.939

ID: 1.205.939

Aufrufe heute: 0

Gesamt: 5.193

Gesamt: 5.193

Aktive User: 0

ISIN: FR0011995588 · WKN: A1161Y

8,0450

EUR

+3,27 %

+0,2550 EUR

Letzter Kurs 19:04:55 Lang & Schwarz

Neuigkeiten

24.04.24 · globenewswire |

15.04.24 · globenewswire |

15.04.24 · globenewswire |

09.04.24 · globenewswire |

08.04.24 · globenewswire |

Werte aus der Branche Versorger

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +17,65 | |

| 9.341,90 | +13,74 | |

| 1,7000 | +13,33 | |

| 95,25 | +13,15 | |

| 1,7500 | +12,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,444 | -11,15 | |

| 2,3850 | -12,32 | |

| 11,720 | -12,41 | |

| 21,000 | -13,22 | |

| 490,00 | -18,33 |

vielleicht wird es ja diesmal was...

auf jeden Fall gibt es mal wieder eine KE: http://www.voltalia.com/upload/voltalia/Communique_Presse/20…

auf jeden Fall gibt es mal wieder eine KE: http://www.voltalia.com/upload/voltalia/Communique_Presse/20…

erstmals seit langem ein positives Nettoergebnis: 4,5 Mio

frage mich immer wieder, warum die Aktie so teuer ist;

nach meiner Schätzung EV/EBITDA > 20

nach meiner Schätzung EV/EBITDA > 20

Antwort auf Beitrag Nr.: 50.644.851 von R-BgO am 17.09.15 13:12:58

Mit ihren eigenen Angaben zu

EBITDA = 30 MEUR

debt = 340 MEUR

und einer aktuellen market cap von 26,2 Mio. Aktien x 8,8 = 232 MEUR

komme ich auf ein

EV/EBITDA multiple von (340+232)/30 = 19x

finde ich affenteuer

Bin jetzt erst dazu gekommen, mir die 2015er-Zahlen anzuschauen:

Nettogewinn kleiner als VJ, trotz Fast-Verdoppelung des Geschäftsvolumens;Mit ihren eigenen Angaben zu

EBITDA = 30 MEUR

debt = 340 MEUR

und einer aktuellen market cap von 26,2 Mio. Aktien x 8,8 = 232 MEUR

komme ich auf ein

EV/EBITDA multiple von (340+232)/30 = 19x

finde ich affenteuer

Developer Voltalia in advanced talks to acquire Martifer Solar

By Liam Stoker Jun 22, 2016 9:45 AM BST 0

French renewables developer Voltalia has confirmed it is in exclusive, advanced-stage negotiations to acquire Martifer Solar.

The purchase, valued at around €9 million (US$10.1 million), would see Voltalia take on Martifer’s development, construction and O&M business with Voltalia particularly attracted to its solar division.

The deal is to be paid for entirely through Voltalia’s existing cash assets but is subject to Martifer disposing of its US-focused assets.

Voltalia expects to close the deal in Q3 2016.

In a statement issued yesterday, Voltalia said that Martifer’s move into O&M made its business model “complementary” to Voltalia’s core business and would speed up its “diversification of both its international footprint and its energy mix”.

Voltalia said the resulting group of companies would “immediately benefit from economies of scale”, adding that the company had already pinpointed several areas in which the two parties would be able to combine. One noted area is O&M services for onshore wind power plants as well as solar, of which the UK has a significant pipeline.

“Once merged, our two companies form an international group integrated throughout the renewable energy value chain with a double positioning as renewable power producer and as service provider for third-party clients,” Sébastien Clerc, chief executive at Voltalia, said.

By Liam Stoker Jun 22, 2016 9:45 AM BST 0

French renewables developer Voltalia has confirmed it is in exclusive, advanced-stage negotiations to acquire Martifer Solar.

The purchase, valued at around €9 million (US$10.1 million), would see Voltalia take on Martifer’s development, construction and O&M business with Voltalia particularly attracted to its solar division.

The deal is to be paid for entirely through Voltalia’s existing cash assets but is subject to Martifer disposing of its US-focused assets.

Voltalia expects to close the deal in Q3 2016.

In a statement issued yesterday, Voltalia said that Martifer’s move into O&M made its business model “complementary” to Voltalia’s core business and would speed up its “diversification of both its international footprint and its energy mix”.

Voltalia said the resulting group of companies would “immediately benefit from economies of scale”, adding that the company had already pinpointed several areas in which the two parties would be able to combine. One noted area is O&M services for onshore wind power plants as well as solar, of which the UK has a significant pipeline.

“Once merged, our two companies form an international group integrated throughout the renewable energy value chain with a double positioning as renewable power producer and as service provider for third-party clients,” Sébastien Clerc, chief executive at Voltalia, said.

Antwort auf Beitrag Nr.: 52.671.515 von R-BgO am 22.06.16 16:40:56Voltalia completes Martifer acquisition to become ‘global renewables champion’

By Liam Stoker Aug 22, 2016 11:19 AM BST 0

French renewables firm Voltalia has completed its acquisition of Martifer Solar in a move which the two companies said had resulted in the “birth of a global renewables champion”.

Voltalia revealed it was in advanced discussions with Martifer in June, but completed the transaction on Friday and the two firms have now begun the process of merging their interests.

In merging the two businesses, Voltalia’s portfolio of assets through development, construction, operation and maintenance services would more than treble from 418MW to over 1GW. It would directly own assets totalling 376MW and offer O&M services to third-party clients owning 627MW.

Consolidated turnover would also more than triple, from €68 million (US$76.8 million) to around €198 million, and its workforce would rise from 157 staff to 423.

Voltalia said the strategic acquisition would see the firm focus more intently on solar – the technology would now make up half of its project portfolio instead of 13% - and its focus on O&M add a “less capital-intensive business” to the group.

Sebastian Clerc, chief executive at Voltalia, said he welcomed Martifer’s 266-strong team and added that the purchase would strengthen the firm’s position in solar.

Henrique Rodrigues, chief executive at Martifer, added: "We are very excited about this transaction: in addition to ensuring a continued service to Martifer Solar clients, this merger with Voltalia is an opportunity for us to join a fast-growing group with strong prospects and high ambitions.”

Martifer confirmed that it has completed the sale of its US assets – a condition in Voltalia’s original offer – and other synergies arising from the merger are currently being pursued.

More detail surrounding those synergies and Voltalia’s plans for the merger process are to be revealed at the group’s next results disclosure, taking place on 19 September 2016.

By Liam Stoker Aug 22, 2016 11:19 AM BST 0

French renewables firm Voltalia has completed its acquisition of Martifer Solar in a move which the two companies said had resulted in the “birth of a global renewables champion”.

Voltalia revealed it was in advanced discussions with Martifer in June, but completed the transaction on Friday and the two firms have now begun the process of merging their interests.

In merging the two businesses, Voltalia’s portfolio of assets through development, construction, operation and maintenance services would more than treble from 418MW to over 1GW. It would directly own assets totalling 376MW and offer O&M services to third-party clients owning 627MW.

Consolidated turnover would also more than triple, from €68 million (US$76.8 million) to around €198 million, and its workforce would rise from 157 staff to 423.

Voltalia said the strategic acquisition would see the firm focus more intently on solar – the technology would now make up half of its project portfolio instead of 13% - and its focus on O&M add a “less capital-intensive business” to the group.

Sebastian Clerc, chief executive at Voltalia, said he welcomed Martifer’s 266-strong team and added that the purchase would strengthen the firm’s position in solar.

Henrique Rodrigues, chief executive at Martifer, added: "We are very excited about this transaction: in addition to ensuring a continued service to Martifer Solar clients, this merger with Voltalia is an opportunity for us to join a fast-growing group with strong prospects and high ambitions.”

Martifer confirmed that it has completed the sale of its US assets – a condition in Voltalia’s original offer – and other synergies arising from the merger are currently being pursued.

More detail surrounding those synergies and Voltalia’s plans for the merger process are to be revealed at the group’s next results disclosure, taking place on 19 September 2016.

Antwort auf Beitrag Nr.: 53.155.899 von R-BgO am 28.08.16 23:48:23

dicke KE - 170 MEUR:

https://www.euronext.com/sites/www.euronext.com/files/cpr03_…

Voltalia commissions its first project in Brazil

By Danielle Ola Jan 24, 2017

French renewable energy company Voltalia has commissioned its first solar PV plant in Brazil.

Construction has just begun on the 4MW Oiapoque plant, located in the state of Amapa.

Voltalia won the Oiapoque tender in 2014 and aims to commission its new plant in Q3 2017. The company worked closely with Martifer Solar on the deal, utilising the latter’s experience in solar plant design.

The plant’s transmission line is owned by Voltalia and power will be sold to a nearby substation owned by a local utility under a 15-year contract.

This solar plant s part of a greater hdyro/thermal project; once completed it will consist of 4MW of solar, 12MW of thermal and 7.5MW of hydro.

By Danielle Ola Jan 24, 2017

French renewable energy company Voltalia has commissioned its first solar PV plant in Brazil.

Construction has just begun on the 4MW Oiapoque plant, located in the state of Amapa.

Voltalia won the Oiapoque tender in 2014 and aims to commission its new plant in Q3 2017. The company worked closely with Martifer Solar on the deal, utilising the latter’s experience in solar plant design.

The plant’s transmission line is owned by Voltalia and power will be sold to a nearby substation owned by a local utility under a 15-year contract.

This solar plant s part of a greater hdyro/thermal project; once completed it will consist of 4MW of solar, 12MW of thermal and 7.5MW of hydro.

für 2016 ist es eine schwarze Null geworden...

Voltalia to install solar and batteries at Myanmar telecom towers

By Tom Kenning Feb 22, 2018

French renewable energy company Voltalia is to install renewable energy systems at 171 telecom towers in the Bago and Ayeyarwaddy regions of Myanmar for MNTI, the local owner of a network of such towers.

The telecom towers are used by MyTel, a telecom operator jointly controlled by Myanmar National Telecom Holdings and Viettel, which is Vietnam’s national telecom operator.

The 10-year contract with Voltalia will see it supply 2kW of power at each of the 171 sites with potential for future collaboration on more towers. Of those 171 telecom towers 80% are not connected to the national grid.

Voltalia will install batteries and a thermal genset initially to start generating power as soon as possible. Later, solar panels will be added and connected to an energy management system that is also hooked up with the telecom tower.

Sébastien Clerc, CEO of Voltalia, said: “Over the past years, Voltalia has developed internal know-how for isolated sites, primarily in Latin America. This expertise is now used for telecom towers, a fast-growing niche within the decentralized generation market. The signing of our first contract with a telecom tower company opens many opportunities. Energy supply in isolated sites is a key expertise of Voltalia, which is particularly relevant in many countries we already cover, especially in Africa.”

By Tom Kenning Feb 22, 2018

French renewable energy company Voltalia is to install renewable energy systems at 171 telecom towers in the Bago and Ayeyarwaddy regions of Myanmar for MNTI, the local owner of a network of such towers.

The telecom towers are used by MyTel, a telecom operator jointly controlled by Myanmar National Telecom Holdings and Viettel, which is Vietnam’s national telecom operator.

The 10-year contract with Voltalia will see it supply 2kW of power at each of the 171 sites with potential for future collaboration on more towers. Of those 171 telecom towers 80% are not connected to the national grid.

Voltalia will install batteries and a thermal genset initially to start generating power as soon as possible. Later, solar panels will be added and connected to an energy management system that is also hooked up with the telecom tower.

Sébastien Clerc, CEO of Voltalia, said: “Over the past years, Voltalia has developed internal know-how for isolated sites, primarily in Latin America. This expertise is now used for telecom towers, a fast-growing niche within the decentralized generation market. The signing of our first contract with a telecom tower company opens many opportunities. Energy supply in isolated sites is a key expertise of Voltalia, which is particularly relevant in many countries we already cover, especially in Africa.”

2017 war break-even

Antwort auf Beitrag Nr.: 57.664.059 von R-BgO am 30.04.18 17:24:39

50MW in Kenya:

https://www.pv-tech.org/news/voltalia-inks-ppa-for-50mw-sola… 32 MW in Ägypten:

https://www.pv-tech.org/news/voltalia-starts-building-32mw-s… 2,5 MW in Albanien:

https://www.pv-tech.org/news/voltalia-signs-construction-om-…

Nettoergebnis 2018 ver-15x-facht;

KGV trotzdem noch 55

KGV trotzdem noch 55

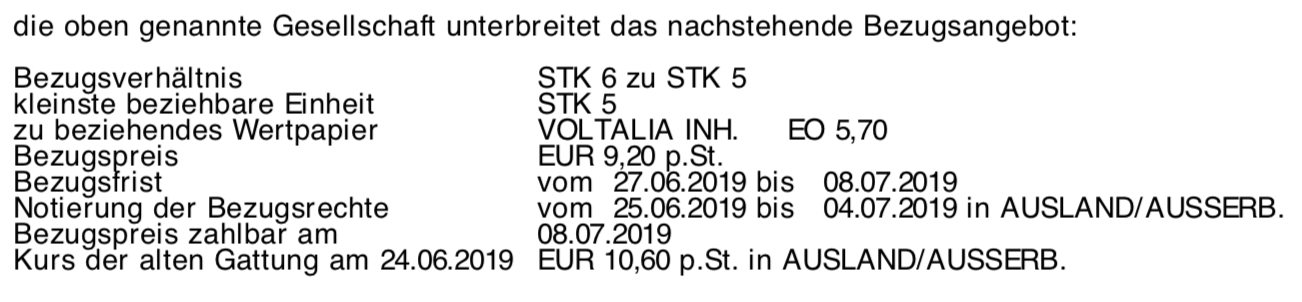

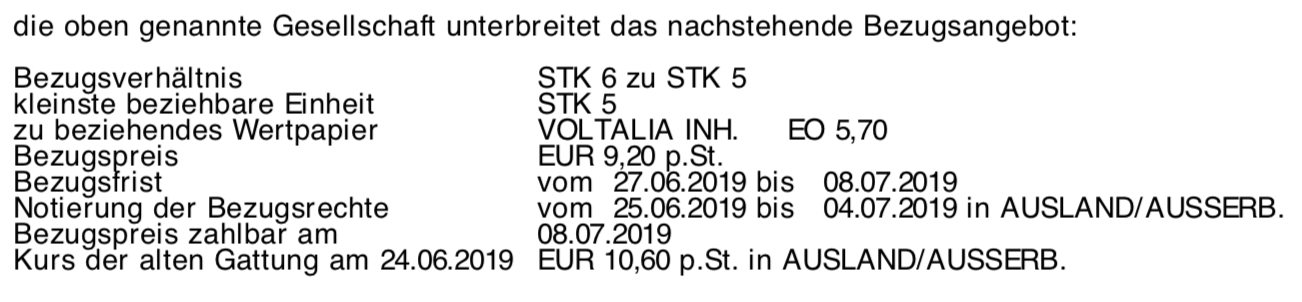

Antwort auf Beitrag Nr.: 60.889.293 von R-BgO am 25.06.19 19:33:22

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| 0,00 | |

| -2,06 | |

| -0,90 | |

| -0,83 | |

| -8,39 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 237 | ||

| 87 | ||

| 85 | ||

| 83 | ||

| 62 | ||

| 59 | ||

| 56 | ||

| 47 | ||

| 34 | ||

| 34 |