US Steel (X) +50% sind hier locker drin (Seite 2)

eröffnet am 10.02.15 22:32:47 von

neuester Beitrag 19.12.23 16:32:52 von

neuester Beitrag 19.12.23 16:32:52 von

Beiträge: 155

ID: 1.207.439

ID: 1.207.439

Aufrufe heute: 0

Gesamt: 9.518

Gesamt: 9.518

Aktive User: 0

ISIN: US9129091081 · WKN: 529498 · Symbol: X

36,60

USD

-3,53 %

-1,34 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

18.04.24 · dpa-AFX |

16.04.24 · Business Wire (engl.) |

12.04.24 · Business Wire (engl.) |

03.04.24 · Business Wire (engl.) |

29.03.24 · Business Wire (engl.) |

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 14,000 | +26,13 | |

| 198,20 | +19,98 | |

| 246,10 | +16,25 | |

| 0,8001 | +14,14 | |

| 118,97 | +9,99 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6135 | -7,07 | |

| 19.800,00 | -7,91 | |

| 3,1200 | -10,60 | |

| 8,9100 | -10,90 | |

| 0,5200 | -47,47 |

Beitrag zu dieser Diskussion schreiben

Anmerkung vor den Zahlen:

Stahlaktien sind und waren immer zyklisch. Ja, ich weiß.

Aber:

Diese scheinbar albern niedrigen Bewertungen der großen US-Stahlaktien

ist schon bemerkenswert.

Wobei besonders US Stell noch einmal um Längen günstiger erscheint als die anderen,

denn hier notiert man inzwischen bei einem KGV von 1 bis 2 UND wir sind auch noch weit unter Buchwert.

Würde US Stell ähnlich bewertet wie Nucor, müsste sich US Steel aus dem Stand heraus

mehr als verdreifachen.

Stahlaktien sind und waren immer zyklisch. Ja, ich weiß.

Aber:

Diese scheinbar albern niedrigen Bewertungen der großen US-Stahlaktien

ist schon bemerkenswert.

Wobei besonders US Stell noch einmal um Längen günstiger erscheint als die anderen,

denn hier notiert man inzwischen bei einem KGV von 1 bis 2 UND wir sind auch noch weit unter Buchwert.

Würde US Stell ähnlich bewertet wie Nucor, müsste sich US Steel aus dem Stand heraus

mehr als verdreifachen.

17.12.

U.S. Steel Warns of Slowdown in Orders as Industry’s Rally Ebbs

https://finance.yahoo.com/news/u-steel-slumps-profit-warning…

...

U.S. Steel Warns of Slowdown in Orders as Industry’s Rally Ebbs

https://finance.yahoo.com/news/u-steel-slumps-profit-warning…

...

28.10.

United States Steel Corporation Announces a $300 Million Stock Repurchase Program and Increases Its Quarterly Dividend to $0.05 Per Share

https://www.wallstreet-online.de/nachricht/14597704-united-s…

...

United States Steel Corporation (NYSE: X) (“U. S. Steel”) today announced that its Board of Directors approved significant enhancements to its capital allocation priorities aligned with the continued execution of its Best for All℠ strategy. The enhancements include:

• A stock repurchase program under which up to $300 million of the Company’s outstanding common stock may be repurchased at the discretion of management.

• A quarterly dividend of $0.05 per share, a 400%, or $0.04 per share, increase over the previous quarter’s dividend. The dividend is payable Thursday, December 9, 2021 to stockholders of record at the close of business on Monday, November 8, 2021.

“Today’s announcement demonstrates the significant progress we have made in the execution of our Best for All strategy,” said U. S. Steel President and Chief Executive Officer David B. Burritt.

“We have made substantial progress on our announced deleveraging plans and expect to complete our incremental $1.0 billion target by the end of the year and ahead of schedule. Our expected $3.1 billion of total 2021 deleveraging combined with our robust cash and liquidity position has also allowed us to confidently begin executing organic growth investments aligned with long-term value creation. Today’s capital allocation enhancements further affirm our bullish outlook for the long-term future of U. S. Steel, are attractive uses of capital and demonstrate that our strategy is truly best for all by ensuring our stockholders directly benefit from the company’s continued success.”

...

United States Steel Corporation Announces a $300 Million Stock Repurchase Program and Increases Its Quarterly Dividend to $0.05 Per Share

https://www.wallstreet-online.de/nachricht/14597704-united-s…

...

United States Steel Corporation (NYSE: X) (“U. S. Steel”) today announced that its Board of Directors approved significant enhancements to its capital allocation priorities aligned with the continued execution of its Best for All℠ strategy. The enhancements include:

• A stock repurchase program under which up to $300 million of the Company’s outstanding common stock may be repurchased at the discretion of management.

• A quarterly dividend of $0.05 per share, a 400%, or $0.04 per share, increase over the previous quarter’s dividend. The dividend is payable Thursday, December 9, 2021 to stockholders of record at the close of business on Monday, November 8, 2021.

“Today’s announcement demonstrates the significant progress we have made in the execution of our Best for All strategy,” said U. S. Steel President and Chief Executive Officer David B. Burritt.

“We have made substantial progress on our announced deleveraging plans and expect to complete our incremental $1.0 billion target by the end of the year and ahead of schedule. Our expected $3.1 billion of total 2021 deleveraging combined with our robust cash and liquidity position has also allowed us to confidently begin executing organic growth investments aligned with long-term value creation. Today’s capital allocation enhancements further affirm our bullish outlook for the long-term future of U. S. Steel, are attractive uses of capital and demonstrate that our strategy is truly best for all by ensuring our stockholders directly benefit from the company’s continued success.”

...

17.9.

U.S. Steel to Build $3 Billion Mill With Record Rally Enduring

https://www.bloomberg.com/news/articles/2021-09-16/u-s-steel…

...

U.S. Steel Corp. will spend about $3 billion to build a new mill, the latest sign that steelmakers are growing more comfortable that higher prices will last.

The so-called mini-mill will combine two electric arc furnaces, which primarily use steel scrap and are far more energy-efficient than traditional integrated plants that are fed by coal. The company expects to begin construction in the first half of 2022 and start producing in 2024.

...

U.S. Steel characterized the planned mill, expected to produce 3 million tons of flat-rolled steel products, as part of the efforts to achieve its 2030 goal of reducing greenhouse gas emissions intensity by 20%, according to a statement.

The board has authorized an exploratory site selection process for the location of the mini-mill, according to the statement. Potential locations include Indiana and Illinois where U.S. Steel has existing EAF operations as well as greenfield sites.

EAF = electric arc furnace

U.S. Steel to Build $3 Billion Mill With Record Rally Enduring

https://www.bloomberg.com/news/articles/2021-09-16/u-s-steel…

...

U.S. Steel Corp. will spend about $3 billion to build a new mill, the latest sign that steelmakers are growing more comfortable that higher prices will last.

The so-called mini-mill will combine two electric arc furnaces, which primarily use steel scrap and are far more energy-efficient than traditional integrated plants that are fed by coal. The company expects to begin construction in the first half of 2022 and start producing in 2024.

...

U.S. Steel characterized the planned mill, expected to produce 3 million tons of flat-rolled steel products, as part of the efforts to achieve its 2030 goal of reducing greenhouse gas emissions intensity by 20%, according to a statement.

The board has authorized an exploratory site selection process for the location of the mini-mill, according to the statement. Potential locations include Indiana and Illinois where U.S. Steel has existing EAF operations as well as greenfield sites.

EAF = electric arc furnace

10.8.

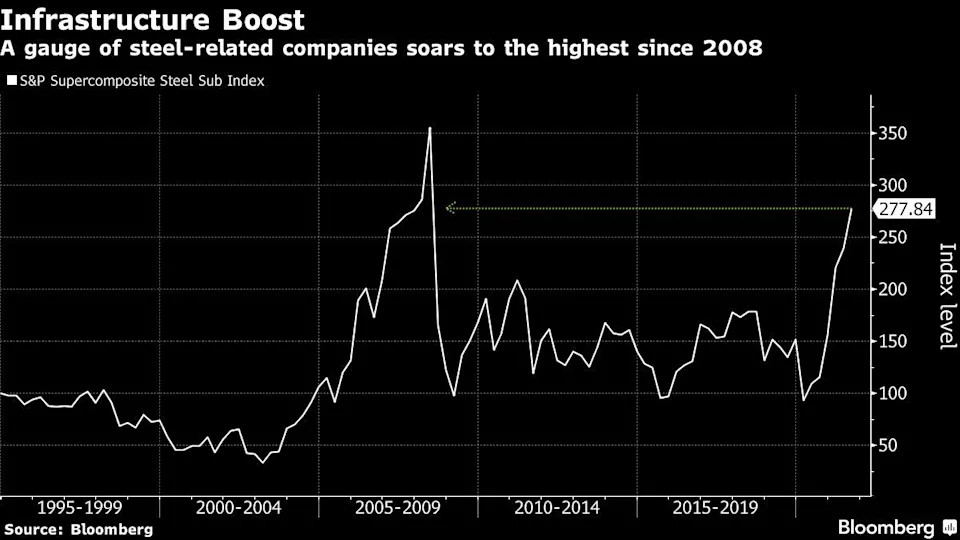

Steelmakers Surge as U.S. Infrastructure Plan Buoys Demand View

https://finance.yahoo.com/news/steelmakers-surge-u-infrastru…

...

Steelmakers Surge as U.S. Infrastructure Plan Buoys Demand View

https://finance.yahoo.com/news/steelmakers-surge-u-infrastru…

...

22.4.

Steel Futures Soar in China as Output Cuts Meet Robust Demand

https://finance.yahoo.com/news/steel-futures-soar-china-outp…

...

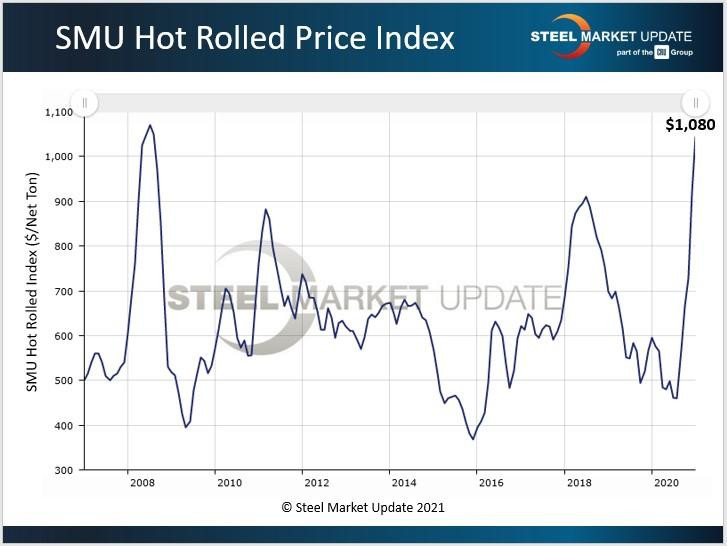

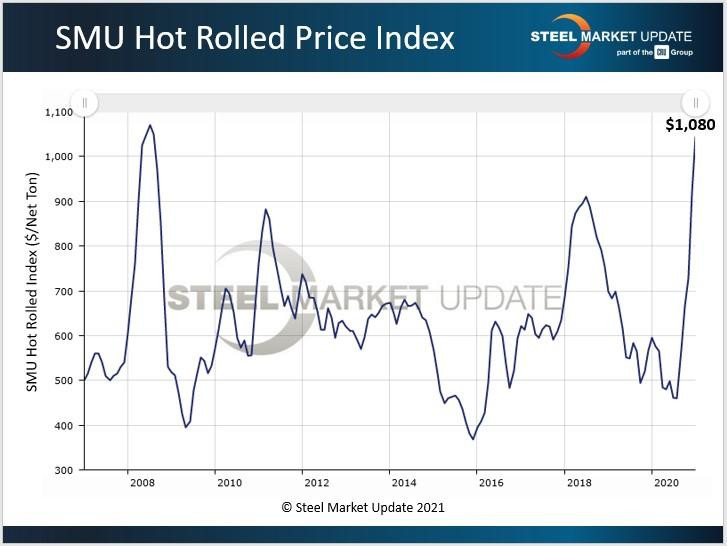

Steel futures in China extended their surge as the country pushes to rein in production amid a seasonal pick up in demand.

Rebar in Shanghai is at the highest since futures began trading in 2009, while hot-rolled coil is near the highest since 2014. Prices are surging after Chinese authorities and the steel sector pledged measures to reduce output, including in the hub of Tangshan, and curb carbon emissions.

“We expect the central government will likely launch a nationwide production control plan soon,” which could be followed by more cuts in other provinces in the second half, Citigroup Inc. wrote in a note. “Despite the market concerns of potential inflation risks, we believe the government is determined to curb steel production in order to reduce its carbon footprint.”

The surge in steel has boosted profit margins at China’s mills, encouraging producers to increase output and lifting benchmark spot iron ore prices to the highest in a decade. Crude steel production neared a record in March despite the pollution crackdown.

“Steel producers appear to be making the most of the high margins, boosting output ahead of possible further restrictions,” Australia & New Zealand Banking Group Ltd. analysts including Daniel Hynes wrote in a note. “This is creating strong demand for steel-making raw materials. Combined with ongoing supply side issues, iron ore prices look well supported in the short term.”

Still, if Chinese stimulus measures end later this year, steel output will eventually weaken, the bank said, and increasing environmental curbs on the sector could have a sizable impact on iron ore prices.

...

Steel Futures Soar in China as Output Cuts Meet Robust Demand

https://finance.yahoo.com/news/steel-futures-soar-china-outp…

...

Steel futures in China extended their surge as the country pushes to rein in production amid a seasonal pick up in demand.

Rebar in Shanghai is at the highest since futures began trading in 2009, while hot-rolled coil is near the highest since 2014. Prices are surging after Chinese authorities and the steel sector pledged measures to reduce output, including in the hub of Tangshan, and curb carbon emissions.

“We expect the central government will likely launch a nationwide production control plan soon,” which could be followed by more cuts in other provinces in the second half, Citigroup Inc. wrote in a note. “Despite the market concerns of potential inflation risks, we believe the government is determined to curb steel production in order to reduce its carbon footprint.”

The surge in steel has boosted profit margins at China’s mills, encouraging producers to increase output and lifting benchmark spot iron ore prices to the highest in a decade. Crude steel production neared a record in March despite the pollution crackdown.

“Steel producers appear to be making the most of the high margins, boosting output ahead of possible further restrictions,” Australia & New Zealand Banking Group Ltd. analysts including Daniel Hynes wrote in a note. “This is creating strong demand for steel-making raw materials. Combined with ongoing supply side issues, iron ore prices look well supported in the short term.”

Still, if Chinese stimulus measures end later this year, steel output will eventually weaken, the bank said, and increasing environmental curbs on the sector could have a sizable impact on iron ore prices.

...

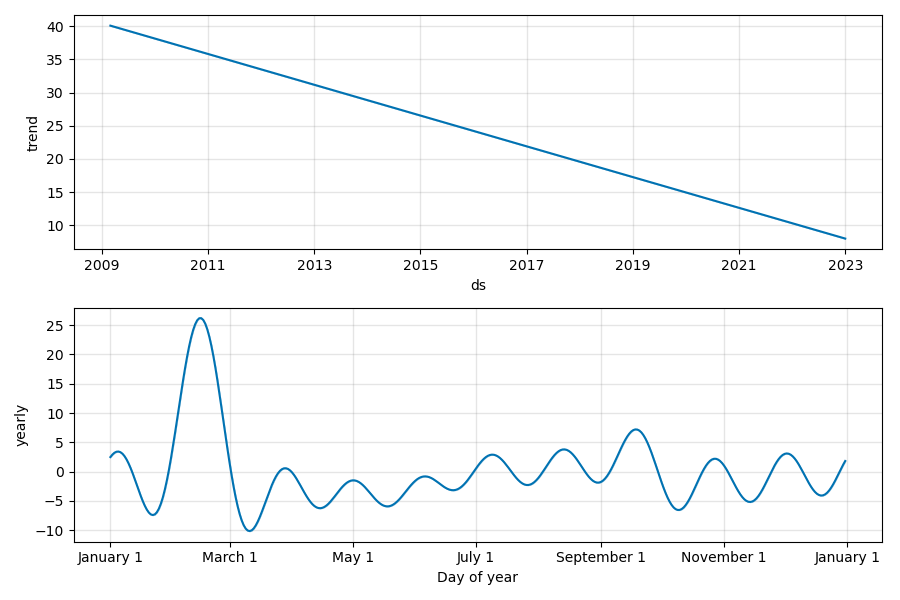

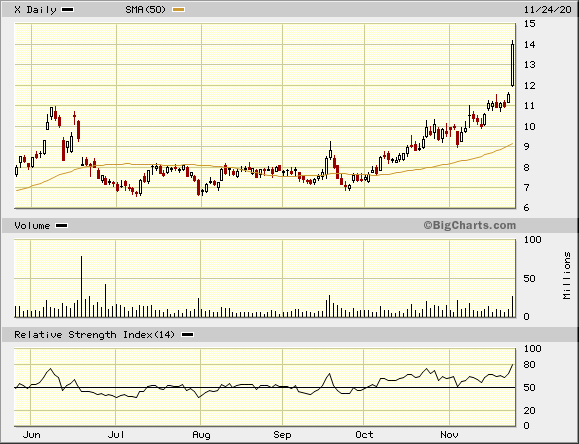

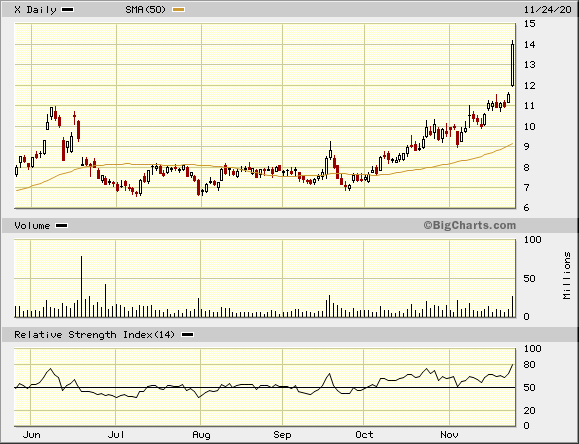

Antwort auf Beitrag Nr.: 65.829.918 von faultcode am 24.11.20 20:41:33Saisonalität bei $X:

• Close-Preise am Monatsende in USD: März 2009|Ende der GFC bis Januar 2021

• gemacht mit fbprophet: https://pypi.org/project/fbprophet/

• Close-Preise am Monatsende in USD: März 2009|Ende der GFC bis Januar 2021

• gemacht mit fbprophet: https://pypi.org/project/fbprophet/

Antwort auf Beitrag Nr.: 65.829.918 von faultcode am 24.11.20 20:41:33

Antwort auf Beitrag Nr.: 65.320.742 von faultcode am 08.10.20 12:09:28Jetzt auch schon Stahl mit irgendein Analyst hat was gesagt und viele kaufen

Antwort auf Beitrag Nr.: 65.320.742 von faultcode am 08.10.20 12:09:28Nippon Steel möchte wohl gerüchterweise auch in den USA verkaufen - nach ArcelorMittal: https://steelguru.com/steel/nippon-steel-may-sell-plants-in-…

=> die Konzentration setzt sich fort

=> die Konzentration setzt sich fort

US Steel (X) +50% sind hier locker drin