US Steel (X) +50% sind hier locker drin - Die letzten 30 Beiträge

eröffnet am 10.02.15 22:32:47 von

neuester Beitrag 19.12.23 16:32:52 von

neuester Beitrag 19.12.23 16:32:52 von

Beiträge: 155

ID: 1.207.439

ID: 1.207.439

Aufrufe heute: 0

Gesamt: 9.518

Gesamt: 9.518

Aktive User: 0

ISIN: US9129091081 · WKN: 529498 · Symbol: X

38,94

USD

-0,49 %

-0,19 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

18.04.24 · dpa-AFX |

16.04.24 · Business Wire (engl.) |

12.04.24 · Business Wire (engl.) |

03.04.24 · Business Wire (engl.) |

29.03.24 · Business Wire (engl.) |

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +30,77 | |

| 0,5998 | +22,41 | |

| 0,6200 | +21,57 | |

| 4,8450 | +11,64 | |

| 27,85 | +10,38 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5700 | -11,63 | |

| 500,00 | -13,04 | |

| 15.280,00 | -16,14 | |

| 3,5700 | -16,78 | |

| 5.153,50 | -27,60 |

Beitrag zu dieser Diskussion schreiben

es wachsen die Zweifel am Deal:

19.12.

Bipartisan opposition to Nippon takeover of U.S. Steel grows

https://www.marketwatch.com/story/nippon-steel-said-its-reac…

...

Both Democrats and Republicans blasted the move Monday, arguing that it could threaten both U.S. national security and good-paying union jobs in the United States.

“Today a critical piece of America’s defense-industrial base was auctioned off to foreigners for cash,” said Sen. J. D. Vance, an Ohio Republican, in a statement to MarketWatch in which he criticized U.S. Steel’s focus on the value of the deal for shareholders while ignoring its impact on “our nation’s security, industry and workers.”

The Democratic senators from the Pittsburgh-based company’s home state both came out against the deal as well.

Sen. John Fetterman of Pennsylvania posted a video to X Monday afternoon stating that the deal “is wrong for workers and wrong for Pennsylvania” and pledging that he’d do “everything” he can to block it.

Advertisement

Fellow Democratic Sen. Bob Casey of Pennsylvania told MarketWatch in an email that the “United States’ marquee steel company should remain under American ownership” because the “deal appears to be a bad deal for Pennsylvania and for Pennsylvania workers.”

...

19.12.

Bipartisan opposition to Nippon takeover of U.S. Steel grows

https://www.marketwatch.com/story/nippon-steel-said-its-reac…

...

Both Democrats and Republicans blasted the move Monday, arguing that it could threaten both U.S. national security and good-paying union jobs in the United States.

“Today a critical piece of America’s defense-industrial base was auctioned off to foreigners for cash,” said Sen. J. D. Vance, an Ohio Republican, in a statement to MarketWatch in which he criticized U.S. Steel’s focus on the value of the deal for shareholders while ignoring its impact on “our nation’s security, industry and workers.”

The Democratic senators from the Pittsburgh-based company’s home state both came out against the deal as well.

Sen. John Fetterman of Pennsylvania posted a video to X Monday afternoon stating that the deal “is wrong for workers and wrong for Pennsylvania” and pledging that he’d do “everything” he can to block it.

Advertisement

Fellow Democratic Sen. Bob Casey of Pennsylvania told MarketWatch in an email that the “United States’ marquee steel company should remain under American ownership” because the “deal appears to be a bad deal for Pennsylvania and for Pennsylvania workers.”

...

Nippon Steel ist es geworden:

18.12.2023, 16:42 |

142 Prozent Aufschlag! Sensationelle Übernahme: Nippon Steel kauft U.S. Steel für 14,9 Mrd. US-Dollar!

https://www.wallstreet-online.de/nachricht/17643563-142-proz…

Die zuletzt eher träge Stahlbranche wurde am Montag von einer Mega-Übernahme aufgerüttelt. Durch die Übernahme der Stahlikone U.S. Steel durch Nippon Steel entsteht der zweitgrößte Stahlkonzern der Welt.

Das japanische Unternehmen Nippon Steel hat am Montag den Kauf von U.S. Steel für 14,9 Milliarden US-Dollar in bar angekündigt und sich damit in einer Auktion um die 122 Jahre alte Stahlikone gegen Konkurrenten wie Cleveland-Cliffs und ArcellorMittal durchgesetzt.

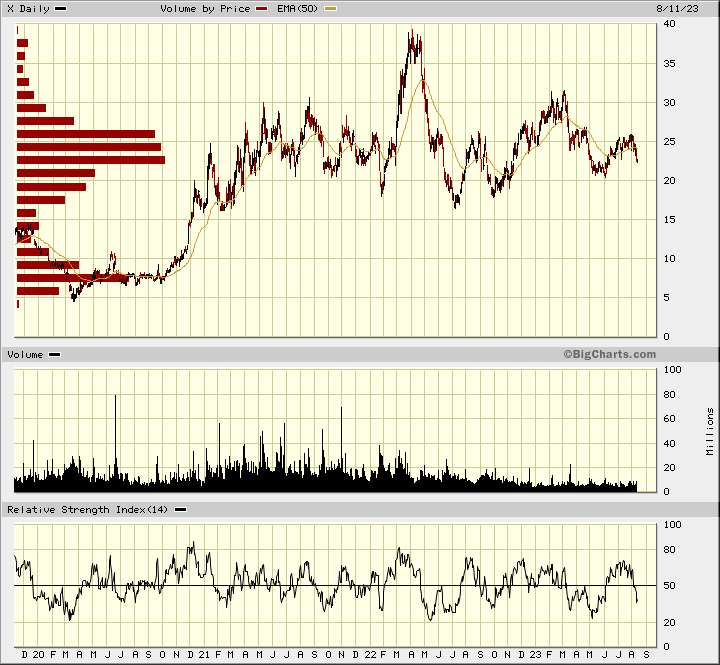

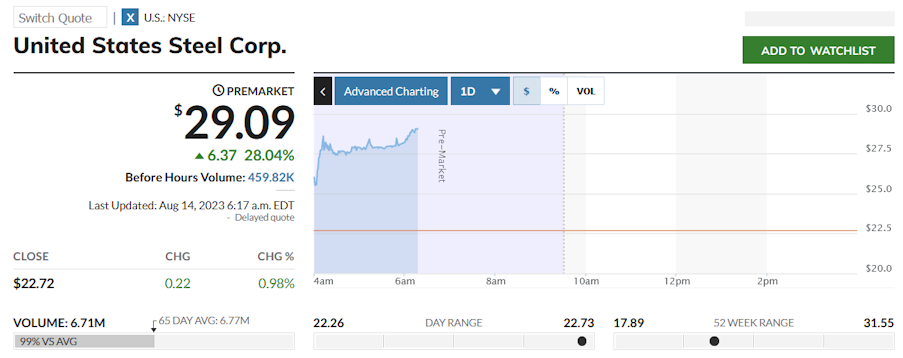

Der Preis von 55 US-Dollar pro Aktie entspricht einem Aufschlag von 142 Prozent gegenüber dem Kurs am 11. August, dem letzten Handelstag, bevor Cleveland-Cliffs ein Bar- und Aktienangebot von 35 US-Dollar pro Aktie für U.S. Steel unterbreitete.

...

=>

18.12.2023, 16:42 |

142 Prozent Aufschlag! Sensationelle Übernahme: Nippon Steel kauft U.S. Steel für 14,9 Mrd. US-Dollar!

https://www.wallstreet-online.de/nachricht/17643563-142-proz…

Die zuletzt eher träge Stahlbranche wurde am Montag von einer Mega-Übernahme aufgerüttelt. Durch die Übernahme der Stahlikone U.S. Steel durch Nippon Steel entsteht der zweitgrößte Stahlkonzern der Welt.

Das japanische Unternehmen Nippon Steel hat am Montag den Kauf von U.S. Steel für 14,9 Milliarden US-Dollar in bar angekündigt und sich damit in einer Auktion um die 122 Jahre alte Stahlikone gegen Konkurrenten wie Cleveland-Cliffs und ArcellorMittal durchgesetzt.

Der Preis von 55 US-Dollar pro Aktie entspricht einem Aufschlag von 142 Prozent gegenüber dem Kurs am 11. August, dem letzten Handelstag, bevor Cleveland-Cliffs ein Bar- und Aktienangebot von 35 US-Dollar pro Aktie für U.S. Steel unterbreitete.

...

=>

23.8.

Unlikely Bidder Behind $7.8 Billion US Steel Deal Backs Away

https://www.bnnbloomberg.ca/unlikely-bidder-behind-7-8-billi…

...

One day later, Esmark Inc., a steel distributor controlled by Bouchard, announced it was making a higher, all-cash proposal valuing its target at $7.8 billion.

Cut to Wednesday this week and a fresh plot twist: Esmark said it’s no longer pursuing a takeover, citing the United Steelworkers union’s support for Cliffs.

By that point, skepticism was already swirling around the Esmark proposal. While Bouchard, 62, is well known within the US steel world and has a track record of dealmaking, closely held Esmark was an unlikely suitor. A distributor of the metal rather than a producer, the company is also a conglomerate involved in diverse sectors ranging from aviation and real estate, and has about $500 million in annual revenue. An acquisition of US Steel, which had $21 billion in sales last year, would have been its biggest transaction by far.

...

Unlikely Bidder Behind $7.8 Billion US Steel Deal Backs Away

https://www.bnnbloomberg.ca/unlikely-bidder-behind-7-8-billi…

...

One day later, Esmark Inc., a steel distributor controlled by Bouchard, announced it was making a higher, all-cash proposal valuing its target at $7.8 billion.

Cut to Wednesday this week and a fresh plot twist: Esmark said it’s no longer pursuing a takeover, citing the United Steelworkers union’s support for Cliffs.

By that point, skepticism was already swirling around the Esmark proposal. While Bouchard, 62, is well known within the US steel world and has a track record of dealmaking, closely held Esmark was an unlikely suitor. A distributor of the metal rather than a producer, the company is also a conglomerate involved in diverse sectors ranging from aviation and real estate, and has about $500 million in annual revenue. An acquisition of US Steel, which had $21 billion in sales last year, would have been its biggest transaction by far.

...

16.8.

Exclusive - ArcelorMittal Weighs Possible Bid for US Steel -Sources

https://money.usnews.com/investing/news/articles/2023-08-16/…

...

ArcelorMittal SA, the world's second-largest steelmaker, is considering a potential offer for U.S. Steel Corp, three people familiar with the matter said on Wednesday.

The combination would reverse ArcelorMittal's retreat from the United States as a production base after it sold most of its operations to Cleveland-Cliffs Inc in 2020 for $1.4 billion to focus on growing markets such as India and Brazil.

...

Exclusive - ArcelorMittal Weighs Possible Bid for US Steel -Sources

https://money.usnews.com/investing/news/articles/2023-08-16/…

...

ArcelorMittal SA, the world's second-largest steelmaker, is considering a potential offer for U.S. Steel Corp, three people familiar with the matter said on Wednesday.

The combination would reverse ArcelorMittal's retreat from the United States as a production base after it sold most of its operations to Cleveland-Cliffs Inc in 2020 for $1.4 billion to focus on growing markets such as India and Brazil.

...

15.8.

Esmark Offers to Buy US Steel for Cash, Trumping Cliffs

https://finance.yahoo.com/news/esmark-offers-buy-us-steel-19…

...

Esmark Inc. offered to buy United States Steel Corp. for $7.8 billion in cash, trumping an earlier bid from Cleveland-Cliffs Inc. and raising the stakes in a battle for the future of the US industrial icon.

The announcement by privately held Esmark has surprised many market watchers — the industrial company’s steel business is focused on processing and distributing rather than the raw metal that US Steel produces, making it an unlikely buyer. Esmark chief executive officer and owner James Bouchard, a one-time US Steel executive, said in a phone interview that the company has available cash on hand to fund the offer.

...

Esmark Offers to Buy US Steel for Cash, Trumping Cliffs

https://finance.yahoo.com/news/esmark-offers-buy-us-steel-19…

...

Esmark Inc. offered to buy United States Steel Corp. for $7.8 billion in cash, trumping an earlier bid from Cleveland-Cliffs Inc. and raising the stakes in a battle for the future of the US industrial icon.

The announcement by privately held Esmark has surprised many market watchers — the industrial company’s steel business is focused on processing and distributing rather than the raw metal that US Steel produces, making it an unlikely buyer. Esmark chief executive officer and owner James Bouchard, a one-time US Steel executive, said in a phone interview that the company has available cash on hand to fund the offer.

...

14.8.

U. S. Steel Confirms Receipt of Unsolicited Proposals from Cleveland-Cliffs and Multiple Other Parties; Reaffirms Competitive Strategic Review Process to Maximize Stockholder Value

https://www.wallstreet-online.de/nachricht/17237293-u-s-stee…

...

United States Steel Corporation (NYSE: X) (“U. S. Steel” or “the Company”) today confirmed that it has invited Cleveland-Cliffs Inc. (“Cleveland-Cliffs”) to participate in its previously announced strategic review process. The Company previously disclosed it has commenced a formal review process, with the assistance of outside financial and legal advisors, to evaluate strategic alternatives for the Company after receiving multiple unsolicited proposals that ranged from the acquisition of certain production assets to consideration for the whole Company.

The Company had received an unsolicited cash and stock proposal from Cleveland-Cliffs to acquire all of U. S. Steel’s outstanding shares. As detailed in the letter below, U. S. Steel was unable to properly evaluate the proposal because Cleveland-Cliffs refused to engage in the necessary and customary process to assess valuation and certainty unless U. S. Steel agreed to the economic terms of the proposal in advance.

...

=>

U. S. Steel Confirms Receipt of Unsolicited Proposals from Cleveland-Cliffs and Multiple Other Parties; Reaffirms Competitive Strategic Review Process to Maximize Stockholder Value

https://www.wallstreet-online.de/nachricht/17237293-u-s-stee…

...

United States Steel Corporation (NYSE: X) (“U. S. Steel” or “the Company”) today confirmed that it has invited Cleveland-Cliffs Inc. (“Cleveland-Cliffs”) to participate in its previously announced strategic review process. The Company previously disclosed it has commenced a formal review process, with the assistance of outside financial and legal advisors, to evaluate strategic alternatives for the Company after receiving multiple unsolicited proposals that ranged from the acquisition of certain production assets to consideration for the whole Company.

The Company had received an unsolicited cash and stock proposal from Cleveland-Cliffs to acquire all of U. S. Steel’s outstanding shares. As detailed in the letter below, U. S. Steel was unable to properly evaluate the proposal because Cleveland-Cliffs refused to engage in the necessary and customary process to assess valuation and certainty unless U. S. Steel agreed to the economic terms of the proposal in advance.

...

=>

23.8.

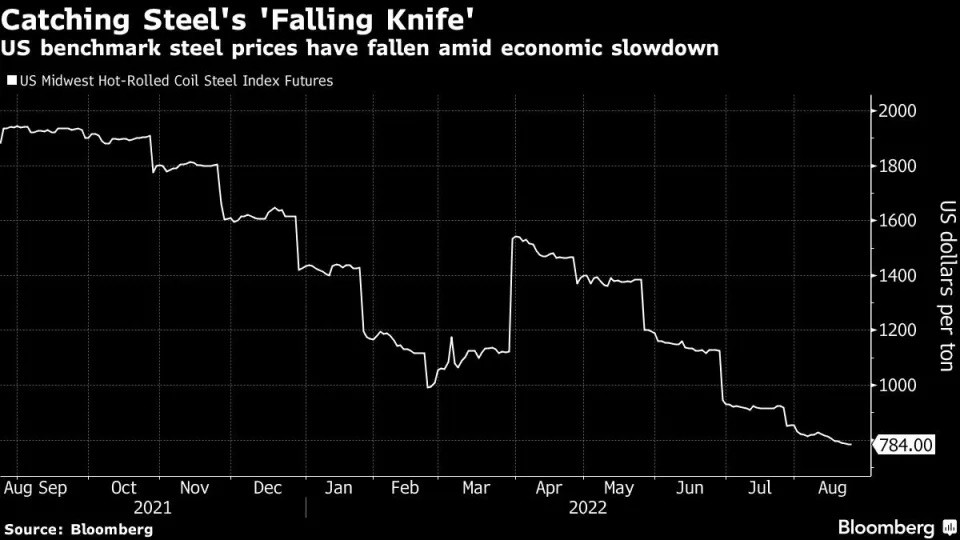

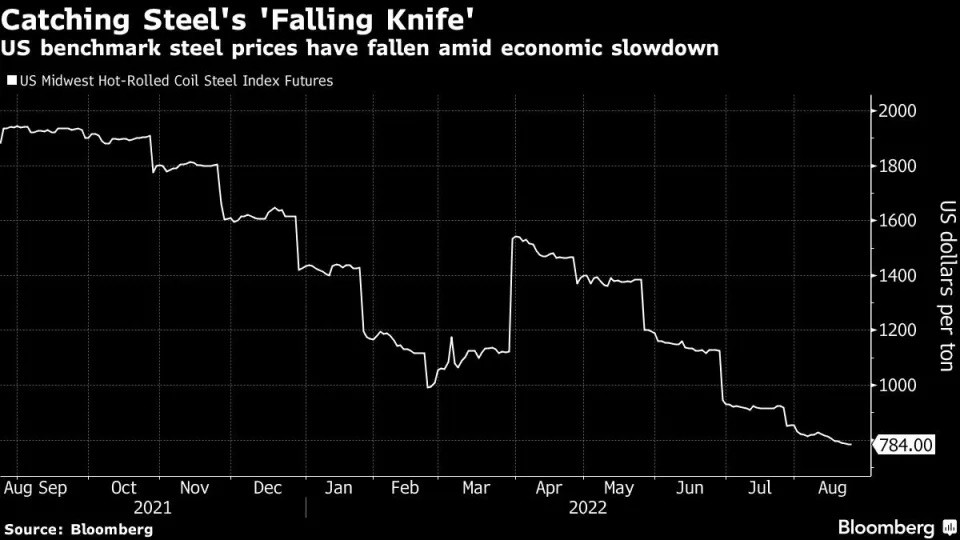

CEO Who Dubbed Steel Market a Falling Knife Is Calling a Bottom

https://finance.yahoo.com/news/ceo-dubbed-steel-market-falli…

...

While Stelco’s CEO doesn’t see a further decline in prices, Kestenbaum said he also doesn’t anticipate an unexpected surge.

CEO Who Dubbed Steel Market a Falling Knife Is Calling a Bottom

https://finance.yahoo.com/news/ceo-dubbed-steel-market-falli…

...

While Stelco’s CEO doesn’t see a further decline in prices, Kestenbaum said he also doesn’t anticipate an unexpected surge.

31.3.

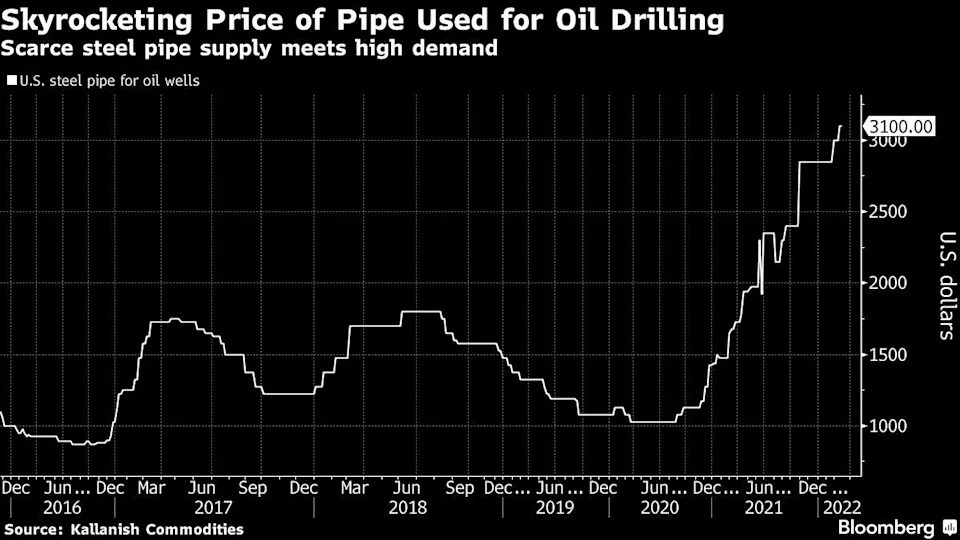

Oil Drillers Say Scarce Steel a Reason for Flat U.S. Output

https://finance.yahoo.com/news/oil-drillers-scarce-steel-one…

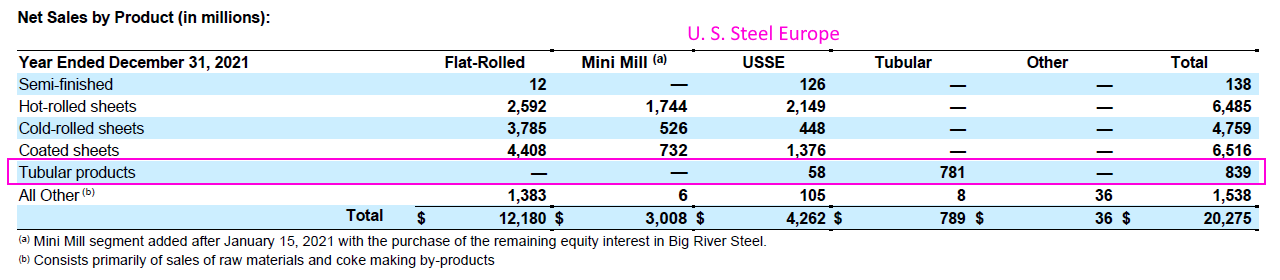

=> U.S. Steel war früher mal traditionell stark im O&G-Röhrenbau -- inkl. Höhen und Tiefen (ausgesprochen zyklisches Geschäft):

siehe aber z.B. im AR2021:

=> in 2021 machten Tubular products nur noch gut 4% der Net sales aus; in 2019 waren es z.B. noch über 9%

Die Ergebnisse von US Steel waren zwar leicht unter den Erwartungen,

aber der Ausblick für das laufende Jahr sehr optimistisch.

Wir befinden uns ja schon seit vielen Jahren an der Börse nicht mehr

im Bereich von logisch nachvollziehbaren Bewertungen im Hinblick auf Wert und

Geldströme von Unternehmen.

Da werden Unternehmen wie Tesla in schwindelerregende Höhen hochgejubelt

(Tesla müsste, wenn ich es richtig sehe, aktuell mehr wert sein als alle anderen Automobilunternehmen auf der Welt zusammen genommen!? - und vermutlich reicht das auch noch nicht - man müsste vermutlich noch das ein oder andere Unternehmen aus anderen Branchen hinzu nehmen, um an die Bewertung von Tesla heran zu reichen - also vielleicht noch Bayer, BASF, Lanxess und Covestro hinzu addiert...und vermutlich reicht auch das noch nicht).

Nun denn, jedenfalls soll US Steel alleine in diesem Jahr rund die Hälfte der aktuellen Bewertung an Gewinn einfahren. Noch mal so ein Jahr wie in 2022 in Aussicht gestellt, und der gesamte Wert von US Steel wäre komplett an den Investor zurück geflossen, der heute kauft.

Alles nur meine Meinung.

aber der Ausblick für das laufende Jahr sehr optimistisch.

Wir befinden uns ja schon seit vielen Jahren an der Börse nicht mehr

im Bereich von logisch nachvollziehbaren Bewertungen im Hinblick auf Wert und

Geldströme von Unternehmen.

Da werden Unternehmen wie Tesla in schwindelerregende Höhen hochgejubelt

(Tesla müsste, wenn ich es richtig sehe, aktuell mehr wert sein als alle anderen Automobilunternehmen auf der Welt zusammen genommen!? - und vermutlich reicht das auch noch nicht - man müsste vermutlich noch das ein oder andere Unternehmen aus anderen Branchen hinzu nehmen, um an die Bewertung von Tesla heran zu reichen - also vielleicht noch Bayer, BASF, Lanxess und Covestro hinzu addiert...und vermutlich reicht auch das noch nicht).

Nun denn, jedenfalls soll US Steel alleine in diesem Jahr rund die Hälfte der aktuellen Bewertung an Gewinn einfahren. Noch mal so ein Jahr wie in 2022 in Aussicht gestellt, und der gesamte Wert von US Steel wäre komplett an den Investor zurück geflossen, der heute kauft.

Alles nur meine Meinung.

Anmerkung vor den Zahlen:

Stahlaktien sind und waren immer zyklisch. Ja, ich weiß.

Aber:

Diese scheinbar albern niedrigen Bewertungen der großen US-Stahlaktien

ist schon bemerkenswert.

Wobei besonders US Stell noch einmal um Längen günstiger erscheint als die anderen,

denn hier notiert man inzwischen bei einem KGV von 1 bis 2 UND wir sind auch noch weit unter Buchwert.

Würde US Stell ähnlich bewertet wie Nucor, müsste sich US Steel aus dem Stand heraus

mehr als verdreifachen.

Stahlaktien sind und waren immer zyklisch. Ja, ich weiß.

Aber:

Diese scheinbar albern niedrigen Bewertungen der großen US-Stahlaktien

ist schon bemerkenswert.

Wobei besonders US Stell noch einmal um Längen günstiger erscheint als die anderen,

denn hier notiert man inzwischen bei einem KGV von 1 bis 2 UND wir sind auch noch weit unter Buchwert.

Würde US Stell ähnlich bewertet wie Nucor, müsste sich US Steel aus dem Stand heraus

mehr als verdreifachen.

17.12.

U.S. Steel Warns of Slowdown in Orders as Industry’s Rally Ebbs

https://finance.yahoo.com/news/u-steel-slumps-profit-warning…

...

U.S. Steel Warns of Slowdown in Orders as Industry’s Rally Ebbs

https://finance.yahoo.com/news/u-steel-slumps-profit-warning…

...

28.10.

United States Steel Corporation Announces a $300 Million Stock Repurchase Program and Increases Its Quarterly Dividend to $0.05 Per Share

https://www.wallstreet-online.de/nachricht/14597704-united-s…

...

United States Steel Corporation (NYSE: X) (“U. S. Steel”) today announced that its Board of Directors approved significant enhancements to its capital allocation priorities aligned with the continued execution of its Best for All℠ strategy. The enhancements include:

• A stock repurchase program under which up to $300 million of the Company’s outstanding common stock may be repurchased at the discretion of management.

• A quarterly dividend of $0.05 per share, a 400%, or $0.04 per share, increase over the previous quarter’s dividend. The dividend is payable Thursday, December 9, 2021 to stockholders of record at the close of business on Monday, November 8, 2021.

“Today’s announcement demonstrates the significant progress we have made in the execution of our Best for All strategy,” said U. S. Steel President and Chief Executive Officer David B. Burritt.

“We have made substantial progress on our announced deleveraging plans and expect to complete our incremental $1.0 billion target by the end of the year and ahead of schedule. Our expected $3.1 billion of total 2021 deleveraging combined with our robust cash and liquidity position has also allowed us to confidently begin executing organic growth investments aligned with long-term value creation. Today’s capital allocation enhancements further affirm our bullish outlook for the long-term future of U. S. Steel, are attractive uses of capital and demonstrate that our strategy is truly best for all by ensuring our stockholders directly benefit from the company’s continued success.”

...

United States Steel Corporation Announces a $300 Million Stock Repurchase Program and Increases Its Quarterly Dividend to $0.05 Per Share

https://www.wallstreet-online.de/nachricht/14597704-united-s…

...

United States Steel Corporation (NYSE: X) (“U. S. Steel”) today announced that its Board of Directors approved significant enhancements to its capital allocation priorities aligned with the continued execution of its Best for All℠ strategy. The enhancements include:

• A stock repurchase program under which up to $300 million of the Company’s outstanding common stock may be repurchased at the discretion of management.

• A quarterly dividend of $0.05 per share, a 400%, or $0.04 per share, increase over the previous quarter’s dividend. The dividend is payable Thursday, December 9, 2021 to stockholders of record at the close of business on Monday, November 8, 2021.

“Today’s announcement demonstrates the significant progress we have made in the execution of our Best for All strategy,” said U. S. Steel President and Chief Executive Officer David B. Burritt.

“We have made substantial progress on our announced deleveraging plans and expect to complete our incremental $1.0 billion target by the end of the year and ahead of schedule. Our expected $3.1 billion of total 2021 deleveraging combined with our robust cash and liquidity position has also allowed us to confidently begin executing organic growth investments aligned with long-term value creation. Today’s capital allocation enhancements further affirm our bullish outlook for the long-term future of U. S. Steel, are attractive uses of capital and demonstrate that our strategy is truly best for all by ensuring our stockholders directly benefit from the company’s continued success.”

...

17.9.

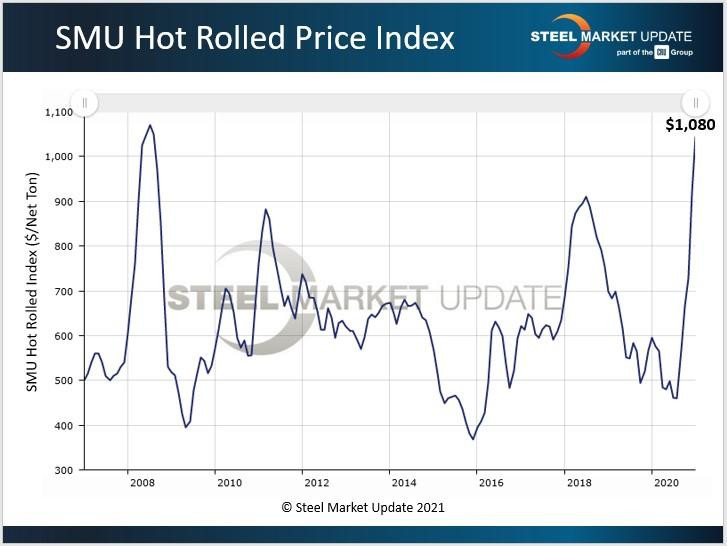

U.S. Steel to Build $3 Billion Mill With Record Rally Enduring

https://www.bloomberg.com/news/articles/2021-09-16/u-s-steel…

...

U.S. Steel Corp. will spend about $3 billion to build a new mill, the latest sign that steelmakers are growing more comfortable that higher prices will last.

The so-called mini-mill will combine two electric arc furnaces, which primarily use steel scrap and are far more energy-efficient than traditional integrated plants that are fed by coal. The company expects to begin construction in the first half of 2022 and start producing in 2024.

...

U.S. Steel characterized the planned mill, expected to produce 3 million tons of flat-rolled steel products, as part of the efforts to achieve its 2030 goal of reducing greenhouse gas emissions intensity by 20%, according to a statement.

The board has authorized an exploratory site selection process for the location of the mini-mill, according to the statement. Potential locations include Indiana and Illinois where U.S. Steel has existing EAF operations as well as greenfield sites.

EAF = electric arc furnace

U.S. Steel to Build $3 Billion Mill With Record Rally Enduring

https://www.bloomberg.com/news/articles/2021-09-16/u-s-steel…

...

U.S. Steel Corp. will spend about $3 billion to build a new mill, the latest sign that steelmakers are growing more comfortable that higher prices will last.

The so-called mini-mill will combine two electric arc furnaces, which primarily use steel scrap and are far more energy-efficient than traditional integrated plants that are fed by coal. The company expects to begin construction in the first half of 2022 and start producing in 2024.

...

U.S. Steel characterized the planned mill, expected to produce 3 million tons of flat-rolled steel products, as part of the efforts to achieve its 2030 goal of reducing greenhouse gas emissions intensity by 20%, according to a statement.

The board has authorized an exploratory site selection process for the location of the mini-mill, according to the statement. Potential locations include Indiana and Illinois where U.S. Steel has existing EAF operations as well as greenfield sites.

EAF = electric arc furnace

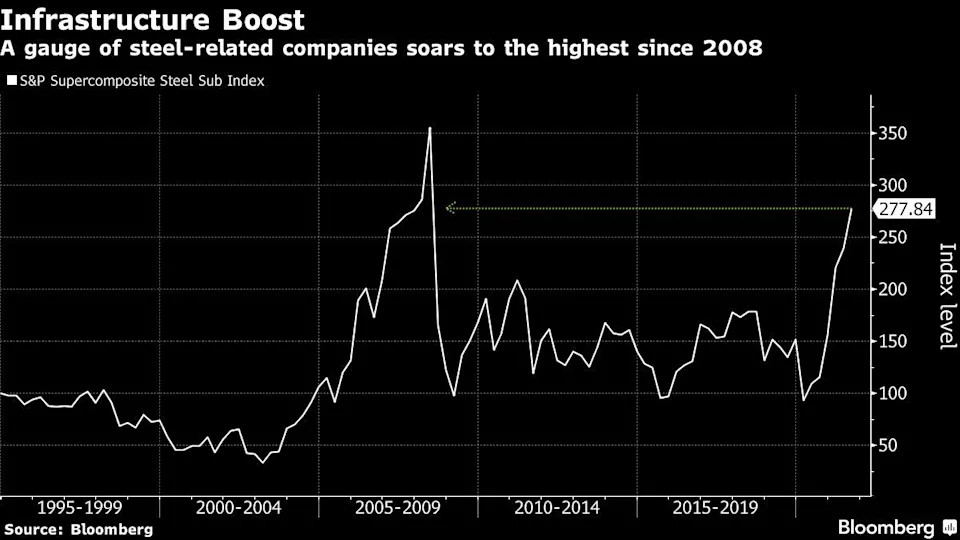

10.8.

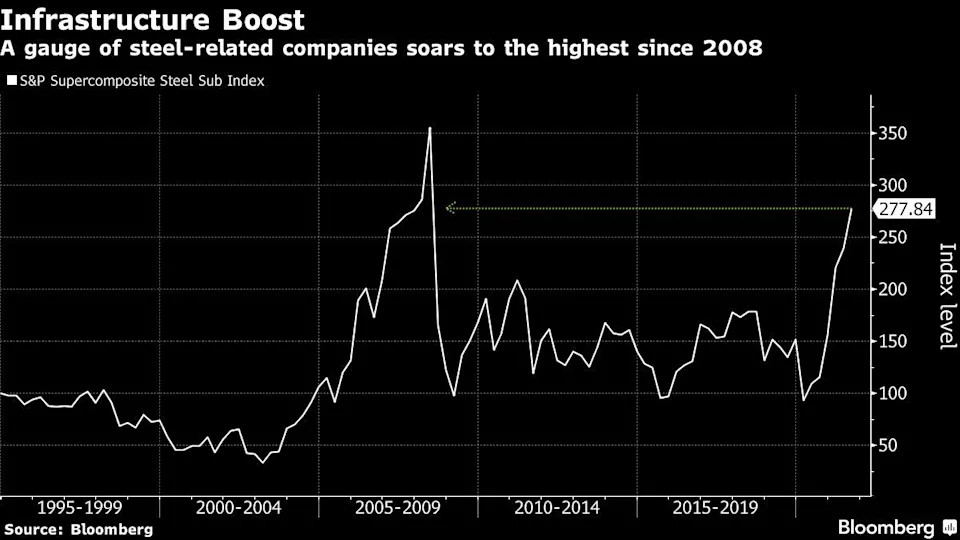

Steelmakers Surge as U.S. Infrastructure Plan Buoys Demand View

https://finance.yahoo.com/news/steelmakers-surge-u-infrastru…

...

Steelmakers Surge as U.S. Infrastructure Plan Buoys Demand View

https://finance.yahoo.com/news/steelmakers-surge-u-infrastru…

...

22.4.

Steel Futures Soar in China as Output Cuts Meet Robust Demand

https://finance.yahoo.com/news/steel-futures-soar-china-outp…

...

Steel futures in China extended their surge as the country pushes to rein in production amid a seasonal pick up in demand.

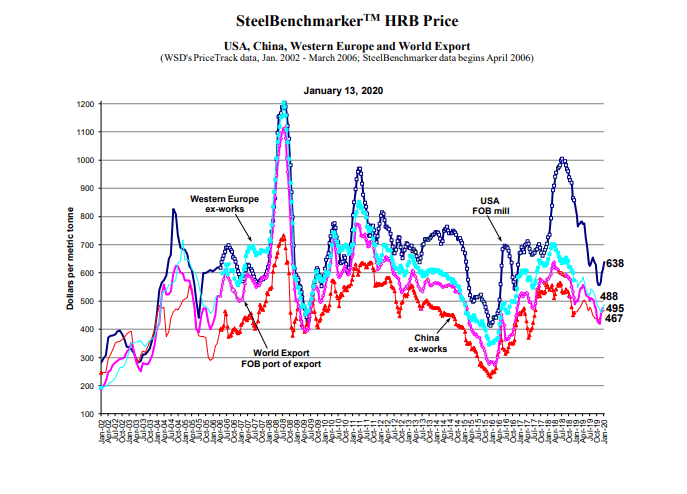

Rebar in Shanghai is at the highest since futures began trading in 2009, while hot-rolled coil is near the highest since 2014. Prices are surging after Chinese authorities and the steel sector pledged measures to reduce output, including in the hub of Tangshan, and curb carbon emissions.

“We expect the central government will likely launch a nationwide production control plan soon,” which could be followed by more cuts in other provinces in the second half, Citigroup Inc. wrote in a note. “Despite the market concerns of potential inflation risks, we believe the government is determined to curb steel production in order to reduce its carbon footprint.”

The surge in steel has boosted profit margins at China’s mills, encouraging producers to increase output and lifting benchmark spot iron ore prices to the highest in a decade. Crude steel production neared a record in March despite the pollution crackdown.

“Steel producers appear to be making the most of the high margins, boosting output ahead of possible further restrictions,” Australia & New Zealand Banking Group Ltd. analysts including Daniel Hynes wrote in a note. “This is creating strong demand for steel-making raw materials. Combined with ongoing supply side issues, iron ore prices look well supported in the short term.”

Still, if Chinese stimulus measures end later this year, steel output will eventually weaken, the bank said, and increasing environmental curbs on the sector could have a sizable impact on iron ore prices.

...

Steel Futures Soar in China as Output Cuts Meet Robust Demand

https://finance.yahoo.com/news/steel-futures-soar-china-outp…

...

Steel futures in China extended their surge as the country pushes to rein in production amid a seasonal pick up in demand.

Rebar in Shanghai is at the highest since futures began trading in 2009, while hot-rolled coil is near the highest since 2014. Prices are surging after Chinese authorities and the steel sector pledged measures to reduce output, including in the hub of Tangshan, and curb carbon emissions.

“We expect the central government will likely launch a nationwide production control plan soon,” which could be followed by more cuts in other provinces in the second half, Citigroup Inc. wrote in a note. “Despite the market concerns of potential inflation risks, we believe the government is determined to curb steel production in order to reduce its carbon footprint.”

The surge in steel has boosted profit margins at China’s mills, encouraging producers to increase output and lifting benchmark spot iron ore prices to the highest in a decade. Crude steel production neared a record in March despite the pollution crackdown.

“Steel producers appear to be making the most of the high margins, boosting output ahead of possible further restrictions,” Australia & New Zealand Banking Group Ltd. analysts including Daniel Hynes wrote in a note. “This is creating strong demand for steel-making raw materials. Combined with ongoing supply side issues, iron ore prices look well supported in the short term.”

Still, if Chinese stimulus measures end later this year, steel output will eventually weaken, the bank said, and increasing environmental curbs on the sector could have a sizable impact on iron ore prices.

...

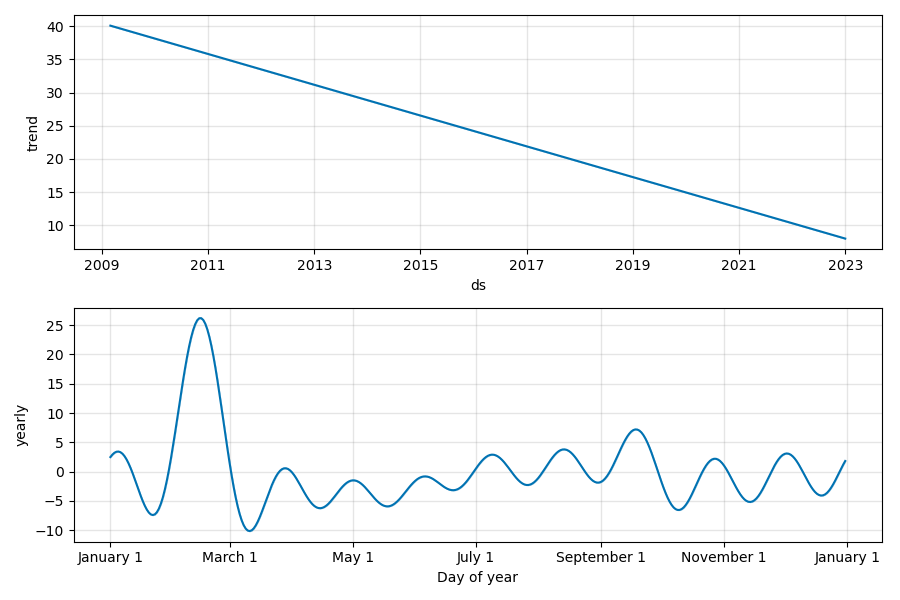

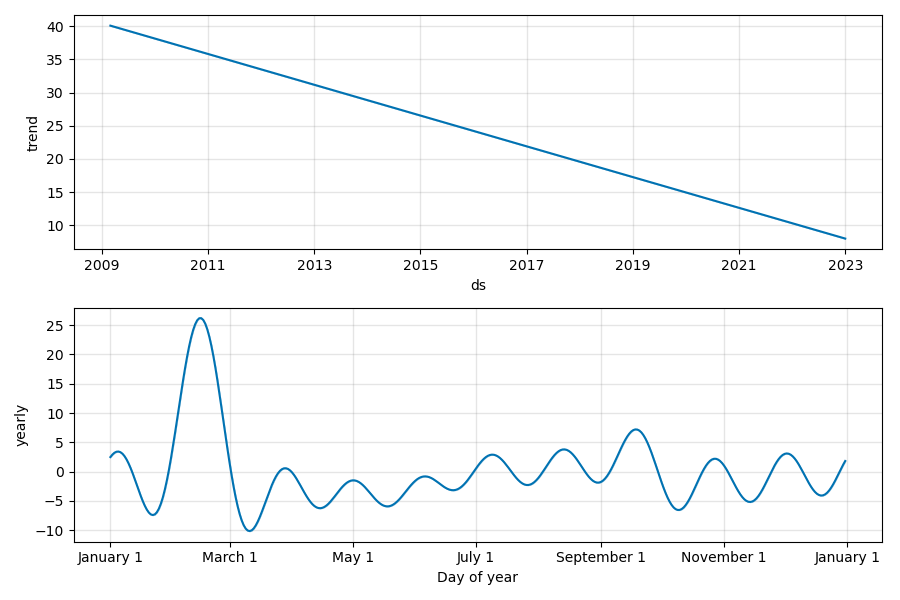

Antwort auf Beitrag Nr.: 65.829.918 von faultcode am 24.11.20 20:41:33Saisonalität bei $X:

• Close-Preise am Monatsende in USD: März 2009|Ende der GFC bis Januar 2021

• gemacht mit fbprophet: https://pypi.org/project/fbprophet/

• Close-Preise am Monatsende in USD: März 2009|Ende der GFC bis Januar 2021

• gemacht mit fbprophet: https://pypi.org/project/fbprophet/

Antwort auf Beitrag Nr.: 65.829.918 von faultcode am 24.11.20 20:41:33

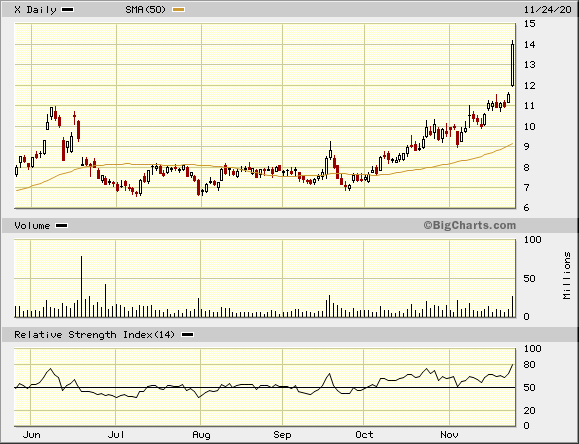

Antwort auf Beitrag Nr.: 65.320.742 von faultcode am 08.10.20 12:09:28Jetzt auch schon Stahl mit irgendein Analyst hat was gesagt und viele kaufen

Antwort auf Beitrag Nr.: 65.320.742 von faultcode am 08.10.20 12:09:28Nippon Steel möchte wohl gerüchterweise auch in den USA verkaufen - nach ArcelorMittal: https://steelguru.com/steel/nippon-steel-may-sell-plants-in-…

=> die Konzentration setzt sich fort

=> die Konzentration setzt sich fort

2017 - 2020

U.S. raw steel production continues to leap on a weekly basis on an improvement in capacity utilization — a key metric in the steel industry. According to the latest American Iron and Steel Institute ("AISI") weekly report, domestic raw steel production was 1,484,000 net tons for the week ending Oct 3, a 0.3% increase from production of 1,480,000 net tons for the week ending Sep 26. This follows a 2.4% rise on a weekly comparison basis for the week ending Sep 26.

However, the weekly production still trails that of a year ago. Production for the reported week was down 17.7% from 1,803,000 net tons registered for the same period a year ago.

...

Notably, United States Steel Corporation last month said that is encouraged by the pace at which the market is improving. The company has responded to an improving order booking by restarting three blast furnaces, which it temporarily idled in response to the coronavirus pandemic.

...

7.10.

US Steel Output on an Upswing: Demand Revival Buoys Prospects

https://www.zacks.com/stock/news/1072049/us-steel-output-on-…

Miese Zahlen, trotzdem weit über Erwartung.

US Steel EPS beats by $0.48, beats on revenue

https://seekingalpha.com/news/3536640-us-steel-eps-beats-0_4…

US Steel EPS beats by $0.48, beats on revenue

https://seekingalpha.com/news/3536640-us-steel-eps-beats-0_4…

U.S. Steel's Significant Rebound Potential Still Intact

-U.S. Steel shares are close to their 2016 lows.

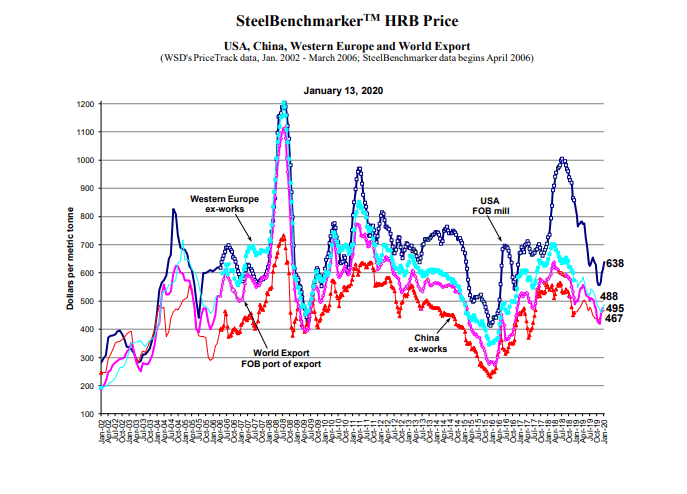

-Steel prices are materially higher than their 2016 lows.

-The balance sheet of U.S. Steel is in much better shape than late 2015/early 2016, implying that a rebound this time could be more vigorous.

https://seekingalpha.com/article/4318748-u-s-steels-signific…

Ich kaufe aktuell wieder zu, mit Perspektive 1-2 Jahre.

-U.S. Steel shares are close to their 2016 lows.

-Steel prices are materially higher than their 2016 lows.

-The balance sheet of U.S. Steel is in much better shape than late 2015/early 2016, implying that a rebound this time could be more vigorous.

https://seekingalpha.com/article/4318748-u-s-steels-signific…

Ich kaufe aktuell wieder zu, mit Perspektive 1-2 Jahre.

Antwort auf Beitrag Nr.: 62.208.309 von startvestor am 20.12.19 17:26:39Vergiß das mit der Pleite. Denen ist es schon viel schlechtergegangen.

Aber es war unbestreitbar beschissen, was da an Ausblick gegeben wurde. Hab einen Teil verkauft, den ich ganz unten aufgesammelt hab. 2021 Hauptposition läuft weiter.

Aber es war unbestreitbar beschissen, was da an Ausblick gegeben wurde. Hab einen Teil verkauft, den ich ganz unten aufgesammelt hab. 2021 Hauptposition läuft weiter.

Antwort auf Beitrag Nr.: 62.202.840 von charliebraun am 20.12.19 02:07:30Unfassbarer Ausblick für Q4. Habe nur das negative EBITDA gelesen und bin sofort vorbörslich mit meiner Restposi rausgerannt. Unklar, ob sie die Pleite abwenden. Die würde ich auch unter 10 nicht mehr kaufen.

Antwort auf Beitrag Nr.: 62.202.816 von faultcode am 20.12.19 01:40:56Mühsam. Wenn immer ich knapp davor bin, gedeckte Calls gegen meine Position zu schreiben, kommt irgenwas daher.

Published: Dec 19, 2019 7:26 p.m. ET

U.S. Steel to lay off workers, cut dividend and terminate stock buybacks

https://www.marketwatch.com/story/us-steel-to-lay-off-worker…

U.S. Steel Corp. announced Thursday afternoon that its financial performance will be worse than expected in the fourth quarter, and the company plans to slash its dividend, suspend stock repurchases, lay off workers and suspend some operations.

In two news releases, the steel giant said that it now expects to report an adjusted loss of $1.15 a share in the fourth quarter; analysts had expected U.S. Steel to report an adjusted loss of 62 cents a share, according to FactSet.

The company said it would reduce its quarterly dividend to a penny a share from 5 cents and halt all share buybacks, and is planning to suspend much of its operations at a plant near Detroit. Those operations will begin being suspended on April 1, 2020, and will involve issuing notices of potential layoffs to 1,545 workers, but the company said it anticipates "the final number of employees who will be impacted by the idling will be lower."

U.S. Steel also adjusted its capital spending forecast for 2020, lowering it by $75 million to $875 million. Shares dropped as much as 3% in after-hours trading following the announcement.

U.S. Steel to lay off workers, cut dividend and terminate stock buybacks

https://www.marketwatch.com/story/us-steel-to-lay-off-worker…

U.S. Steel Corp. announced Thursday afternoon that its financial performance will be worse than expected in the fourth quarter, and the company plans to slash its dividend, suspend stock repurchases, lay off workers and suspend some operations.

In two news releases, the steel giant said that it now expects to report an adjusted loss of $1.15 a share in the fourth quarter; analysts had expected U.S. Steel to report an adjusted loss of 62 cents a share, according to FactSet.

The company said it would reduce its quarterly dividend to a penny a share from 5 cents and halt all share buybacks, and is planning to suspend much of its operations at a plant near Detroit. Those operations will begin being suspended on April 1, 2020, and will involve issuing notices of potential layoffs to 1,545 workers, but the company said it anticipates "the final number of employees who will be impacted by the idling will be lower."

U.S. Steel also adjusted its capital spending forecast for 2020, lowering it by $75 million to $875 million. Shares dropped as much as 3% in after-hours trading following the announcement.

14 14 14 14... $

Der Kampf geht seit 4 Wochen.

Der Kampf geht seit 4 Wochen.

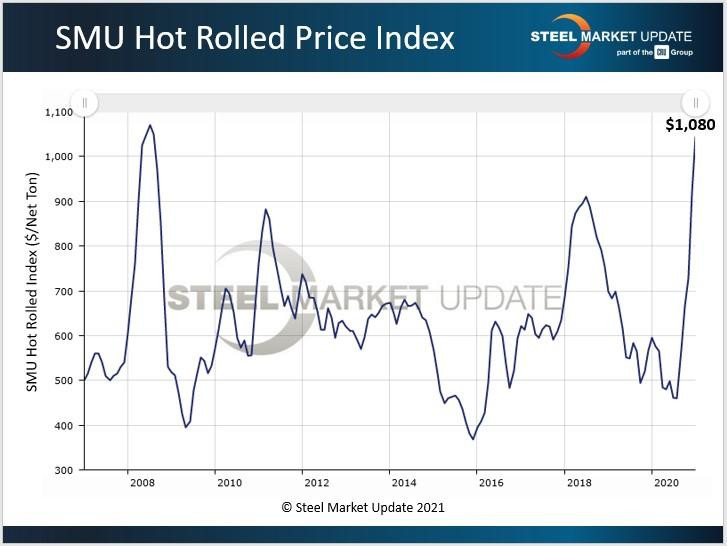

Antwort auf Beitrag Nr.: 62.072.336 von charliebraun am 03.12.19 23:02:46Ich kenne Goncalves schon länger, ich hatte mal Aktien von Cliffs. Übernahmeziel X? Das wird das Management nicht wollen, auch deshalb haben sie die Geldschwemme losgetreten und zuletzt den Deal mit Big River gemacht.

Kann X pleite gehen? Der Markt hält das wohl nicht so recht für möglich, trotz der vielen Shorties. Investieren mussten sie mal in ihre Uraltanlagen, aber gleich so viel?

Ich schwanke zwischen Ausstieg und Nachkauf bei 13. Der Sektor stützt, der HRC steigt, aber Q4 wird trotzdem grausam.

Kann X pleite gehen? Der Markt hält das wohl nicht so recht für möglich, trotz der vielen Shorties. Investieren mussten sie mal in ihre Uraltanlagen, aber gleich so viel?

Ich schwanke zwischen Ausstieg und Nachkauf bei 13. Der Sektor stützt, der HRC steigt, aber Q4 wird trotzdem grausam.

Antwort auf Beitrag Nr.: 62.072.165 von startvestor am 03.12.19 22:34:14Ich hab von Goncalves nur mehr den Schluß auf CNBC mitgekriegt.

Ich seh X schon lange als Übernahmekandidaten, was nicht unbedingt was heißen will. ☺

Ist auch nicht unbedingt mein Wunsch oder Ziel. Ich glaube, sie steigt auch von allein auf 25 oder 30$.

Ich seh X schon lange als Übernahmekandidaten, was nicht unbedingt was heißen will. ☺

Ist auch nicht unbedingt mein Wunsch oder Ziel. Ich glaube, sie steigt auch von allein auf 25 oder 30$.

US Steel (X) +50% sind hier locker drin