Samsung Display - 500 Beiträge pro Seite

eröffnet am 13.02.15 11:25:44 von

neuester Beitrag 06.12.18 11:08:35 von

neuester Beitrag 06.12.18 11:08:35 von

Beiträge: 23

ID: 1.207.598

ID: 1.207.598

Aufrufe heute: 0

Gesamt: 3.896

Gesamt: 3.896

Aktive User: 0

ISIN: US7960542030 · WKN: 923086

67,80

EUR

-0,59 %

-0,40 EUR

Letzter Kurs 11:31:30 Lang & Schwarz

Neuigkeiten

07.03.24 · Markus Weingran |

30.01.24 · Markus Weingran |

Großes Aufwärtspotenzial: Goldmänner sehen starke Marktdurchdringung: Vier Batterie-Aktien to "buy"! 24.01.24 · wallstreetONLINE Redaktion |

15.01.24 · Jörg Schulte Anzeige |

Werte aus der Branche Elektrogeräte

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,0000 | +2.300,00 | |

| 4,0000 | +100,00 | |

| 0,7000 | +32,08 | |

| 0,5550 | +24,72 | |

| 0,5090 | +23,81 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,0000 | -9,91 | |

| 0,5406 | -12,67 | |

| 240,03 | -16,22 | |

| 1,5000 | -24,24 | |

| 6,8500 | -37,21 |

Samsung Pumps $3.6bn into OLED Panel Productions

Paul Buckley, EE Times Europe

2/12/2015 07:32 PM EST

South Korea's Samsung Display has unveiled plans to invest $3.6 billion into making organic light-emitting diode (OLED) panels to support the company's parent Samsung Electronics Co Ltd aims to boost components sales to offset weaker smartphone earnings.

The new production line is expected to make medium and small-sized OLED displays for consumer electronics devices like smartphones and tablets. The investment will be made from 2015 to 2017.

The new production line will begin by producing curved panels like those on the Galaxy Note Edge but will aim to help win Samsung Electronics external customers to drive future earnings growth as sales of the smartphone business decline.

The investment is a reaction to the fourth quarter data in 2014 showing that rival Apple Inc is becoming increasingly competitive with Samsung and is now challenging to be recognised as the world's top smartphone maker.

Samsung Electronics invested $21bn in capital expenditures for the company's components business in 2014. Approximately $12.9bn was for the semiconductor business while another $3.6bn was directed to displays.

In addition to the planned OLED investment, Samsung is expected to start building a $14bn chip plant in South Korea sometime in the first half of 2015. The company said in October 2014 that construction for this plant will be completed in the second half of 2017.

LG Display Co Ltd has also declared plans to invest $0.9bn between $1bn in 2015 to add capacity in an existing large-panel OLED production line.

Paul Buckley, EE Times Europe

2/12/2015 07:32 PM EST

South Korea's Samsung Display has unveiled plans to invest $3.6 billion into making organic light-emitting diode (OLED) panels to support the company's parent Samsung Electronics Co Ltd aims to boost components sales to offset weaker smartphone earnings.

The new production line is expected to make medium and small-sized OLED displays for consumer electronics devices like smartphones and tablets. The investment will be made from 2015 to 2017.

The new production line will begin by producing curved panels like those on the Galaxy Note Edge but will aim to help win Samsung Electronics external customers to drive future earnings growth as sales of the smartphone business decline.

The investment is a reaction to the fourth quarter data in 2014 showing that rival Apple Inc is becoming increasingly competitive with Samsung and is now challenging to be recognised as the world's top smartphone maker.

Samsung Electronics invested $21bn in capital expenditures for the company's components business in 2014. Approximately $12.9bn was for the semiconductor business while another $3.6bn was directed to displays.

In addition to the planned OLED investment, Samsung is expected to start building a $14bn chip plant in South Korea sometime in the first half of 2015. The company said in October 2014 that construction for this plant will be completed in the second half of 2017.

LG Display Co Ltd has also declared plans to invest $0.9bn between $1bn in 2015 to add capacity in an existing large-panel OLED production line.

Ich möchte einen 24-Zoll-OLED-Monitor mit 4k-Auflösung für <500 Euro.

Hiernach sind Samsung Display und Samsung SDI zwei verschiedene Paar Stiefel:

http://www.samsung.com/de/aboutsamsung/samsung/affiliatedcom…und insoweit ist mein Posting #1 damit an der falschen Stelle gelandet.

Da der Titel aber passt, lasse ich es einfach dabei, man muss nur aufpassen dass man den Kurs von SDI nicht für den von Display hält.

Bin nicht mal mehr sicher, ob es eine eigene Display-Aktie überhaupt gibt...

nicht gut für Margen:

China to dominate flat panel display manufacturing by 2018, says IHS

Press release, November 6; Alex Wolfgram, DIGITIMES [Friday 6 November 2015]

While conventional thin film TFT LCD displays are rapidly trending towards commoditization and currently suffering from declining prices and margins, China is quickly adding capacity in all flat panel display (FPD) manufacturing segments. Supported by financial incentives from local governments, China TFT capacity is projected to grow 40% per year between 2010-2018. In 2010 China accounted for just 4% of total TFT capacity. However by 2018, China is forecast to become the largest FPD-producing region in the world, accounting for 35% of the global market, according to IHS.

While China capacity expands, Japan, South Korea and Taiwan have restricted investments to focus mainly on advanced technologies. TFT capacity for FPD production in these countries is forecast to grow on average at less than 2% per year between 2010-2018.

BOE stands out as the leading producer of FPDs in China. With a capacity growth rate of 44% per year between 2010-2018, BOE will become the main driver for China share gains. By 2018, the company will have ramped up more FPD capacity than any other producers, except for LG Display and Samsung Display.

"Despite growing concerns of oversupply for the next several years in most parts of the display industry, there is still little evidence that China makers are reconsidering or scaling back their ambitious expansion plans," said Charles Annis, senior director at IHS. "On the contrary, there continues to be a steady stream of announcements of new factory plans by various regional governments and panel makers."

In China the central government has generally encouraged investment in FPDs, in order to shift the economy to higher technology manufacturing, to increase domestic supply and to support gross domestic product (GDP) growth. Provincial governments have become the main enabler of capacity expansion through product and technology subsidies, joint ventures and other direct investments, by providing land and facilities and through tax incentives. In return, new FPD fabs increase tax revenue, support land value appreciation, increase employment and spur the local economy. The economic benefits generated from the feedback loop between local governments, panel makers and new FPD factories are still considered sufficiently positive in China to warrant application of significant public resources.

"China currently produces only about a third of the FPD panels it consumes. However, by rapidly expanding capacity, panel makers and government officials are expecting to double domestic production rates in the next few years and are also looking to export markets," Annis said. "How excessive global supply, falling prices and lower profitability will affect these plans over time is not yet exactly clear. Even so, there is now so much new capacity in the pipeline that China will almost certainly become the top producer of FPDs by 2018."

China to dominate flat panel display manufacturing by 2018, says IHS

Press release, November 6; Alex Wolfgram, DIGITIMES [Friday 6 November 2015]

While conventional thin film TFT LCD displays are rapidly trending towards commoditization and currently suffering from declining prices and margins, China is quickly adding capacity in all flat panel display (FPD) manufacturing segments. Supported by financial incentives from local governments, China TFT capacity is projected to grow 40% per year between 2010-2018. In 2010 China accounted for just 4% of total TFT capacity. However by 2018, China is forecast to become the largest FPD-producing region in the world, accounting for 35% of the global market, according to IHS.

While China capacity expands, Japan, South Korea and Taiwan have restricted investments to focus mainly on advanced technologies. TFT capacity for FPD production in these countries is forecast to grow on average at less than 2% per year between 2010-2018.

BOE stands out as the leading producer of FPDs in China. With a capacity growth rate of 44% per year between 2010-2018, BOE will become the main driver for China share gains. By 2018, the company will have ramped up more FPD capacity than any other producers, except for LG Display and Samsung Display.

"Despite growing concerns of oversupply for the next several years in most parts of the display industry, there is still little evidence that China makers are reconsidering or scaling back their ambitious expansion plans," said Charles Annis, senior director at IHS. "On the contrary, there continues to be a steady stream of announcements of new factory plans by various regional governments and panel makers."

In China the central government has generally encouraged investment in FPDs, in order to shift the economy to higher technology manufacturing, to increase domestic supply and to support gross domestic product (GDP) growth. Provincial governments have become the main enabler of capacity expansion through product and technology subsidies, joint ventures and other direct investments, by providing land and facilities and through tax incentives. In return, new FPD fabs increase tax revenue, support land value appreciation, increase employment and spur the local economy. The economic benefits generated from the feedback loop between local governments, panel makers and new FPD factories are still considered sufficiently positive in China to warrant application of significant public resources.

"China currently produces only about a third of the FPD panels it consumes. However, by rapidly expanding capacity, panel makers and government officials are expecting to double domestic production rates in the next few years and are also looking to export markets," Annis said. "How excessive global supply, falling prices and lower profitability will affect these plans over time is not yet exactly clear. Even so, there is now so much new capacity in the pipeline that China will almost certainly become the top producer of FPDs by 2018."

Antwort auf Beitrag Nr.: 51.023.268 von R-BgO am 06.11.15 14:02:37LG Display retains top spot in large-panel sector for 6th year

2015/11/17 08:34

SEOUL, Nov. 17 (Yonhap) -- South Korea's LG Display Co. maintained its top position in the large-sized panel market for the sixth consecutive year, data showed Tuesday, coming in far above other South Korean and Taiwanese rivals.

LG shipped 39.4 million units of display panels 9 inches or higher in the July-September period with a share of 22.5 percent, the data compiled by industry tracker IHS showed. It marked the 24th consecutive quarter for LG to sit on the throne in the segment.

Its local rival, Samsung Display Co., followed with a 17.6 percent share, trailed by Taiwan-based Innolux Corp. and AU Optronics with 17.3 percent and 15.1 percent, respectively.

"While South Korean firms are still leading the display market, the rise of Chinese and Taiwanese players will intensify down the road," an industry source said.

"Thus, local companies must make active investments for the future, such as in the organic light-emitting diode (OLED) segment, to further expand their technology prowess over rivals," it added.

By sectors, Samsung Display outpaced LG Display in the TV market at 20.5 percent. As for the Ultra HD TV panel sector, their shares stood at 31.9 percent and 31.4 percent, respectively.

LG Display, however, defeated Samsung Display in the laptop panel market 27.2 percent to 17.2 percent.

2015/11/17 08:34

SEOUL, Nov. 17 (Yonhap) -- South Korea's LG Display Co. maintained its top position in the large-sized panel market for the sixth consecutive year, data showed Tuesday, coming in far above other South Korean and Taiwanese rivals.

LG shipped 39.4 million units of display panels 9 inches or higher in the July-September period with a share of 22.5 percent, the data compiled by industry tracker IHS showed. It marked the 24th consecutive quarter for LG to sit on the throne in the segment.

Its local rival, Samsung Display Co., followed with a 17.6 percent share, trailed by Taiwan-based Innolux Corp. and AU Optronics with 17.3 percent and 15.1 percent, respectively.

"While South Korean firms are still leading the display market, the rise of Chinese and Taiwanese players will intensify down the road," an industry source said.

"Thus, local companies must make active investments for the future, such as in the organic light-emitting diode (OLED) segment, to further expand their technology prowess over rivals," it added.

By sectors, Samsung Display outpaced LG Display in the TV market at 20.5 percent. As for the Ultra HD TV panel sector, their shares stood at 31.9 percent and 31.4 percent, respectively.

LG Display, however, defeated Samsung Display in the laptop panel market 27.2 percent to 17.2 percent.

Apple close to sign an OLED supply deal with SDC and LGD?

Since Apple adopted a flexible AMOLED display for the Watch, people have been speculating that the company is also looking into using OLEDs for their smartphones and tablets. Reports that Apple is talking with both Samsung Display and LG Display regarding a future OLED display supply deal surfaced in past weeks.A few days ago Reuters cited the Electronics Times saying that SDC and LGD are close to signing an agreement with Apple. The two display makers will invest $12.8 billion together to increase OLED capacity for Apple. Reuters says that Apple will likely provide some funding to LG and Samsung, and Samsung will get the larger share of the OLED volume.

It seems that these reports are getting more credible. As OLEDs are becoming better and better than LCDs, and as flexible OLEDs are entering the market and changing the design options for mobile phones, it's highly likely that Apple will have no choice but to switch to OLED eventually. Apple requires a huge production capacity - so it makes sense for Apple to talk to suppliers several years in advance.

According to Bloomberg, Apple recently opened a new laboratory in Taiwan where 50 engineers are developing new display technologies. Apple aims to develop new iPhone and iPad screens that are thinner, lighter, brighter and more energy efficient. Bloomberg says that Apple is focused on better LCDs - but is also "keen" to move to OLED displays.

Samsung to invest US$7.4 billion in OLED displays for iPhone, says paper

Yansi Han, Taipei; Alex Wolfgram, DIGITIMES [Thursday 14 January 2016]Samsung Display has solidified plans to invest US$7.4 billion in OLED equipment for production of curved OLED displays for Apple, according to Korea-based ET News.

Apple will use the curved OLED panel supply for future iPhones as the company intends to shift away from LTPS TFT LCD to OLED, ET News said.

Samsung Display will expand production by 30,000-45,000 substrates in 2016 followed by 45,000 substrates in 2017, with total investment split between the two years.

Production and testing equipment will come mainly from AP Systems in addition to HB Technology, the report said.

Samsung Display is also expected to invest KRW1 trillion (US$823 million) in additional OLED manufacturing equipment to meet demand from China vendors in addition to Galaxy smartphones from Samsung Electronics.

Samsung Display to Supply OLED Display Panels for Apple’s iPhone from Next Year

April 16, 2016 07:12 l April 16, 2016 07:12트위터로 보내기 페이스북으로 보내기

Samsung Display will supply OLED display panels for use in Apple’s iPhone, starting from next year. According to industry sources on April 14, Samsung Display recently signed a deal with Apple to supply 100 million units of 5-inch-plus OLED panels for use in iPhone 7s.

The value of this deal is estimated at around 3 trillion won. Apple plans to use OLED panels for its 5.8-inch premium iPhone 7 models which are slated to be released in the latter half of 2017.

To supply OLED panels to Apple, Samsung Display plans to set up additional production lines at its Asan A3 plant in South Chungcheong Province.

Starting from February, Samsung Display has invested several trillion won to expand the monthly production capacity of its A3 line from 15,000 units to 30,000 units. This contract would increase Samsung Display’s investment in A3 plant up to 10 trillion won. Samsung Display has commercialized OLED technology first in the world in 2007 and dominates the global smartphone OLED panel market with a share of 99 percent.

April 16, 2016 07:12 l April 16, 2016 07:12트위터로 보내기 페이스북으로 보내기

Samsung Display will supply OLED display panels for use in Apple’s iPhone, starting from next year. According to industry sources on April 14, Samsung Display recently signed a deal with Apple to supply 100 million units of 5-inch-plus OLED panels for use in iPhone 7s.

The value of this deal is estimated at around 3 trillion won. Apple plans to use OLED panels for its 5.8-inch premium iPhone 7 models which are slated to be released in the latter half of 2017.

To supply OLED panels to Apple, Samsung Display plans to set up additional production lines at its Asan A3 plant in South Chungcheong Province.

Starting from February, Samsung Display has invested several trillion won to expand the monthly production capacity of its A3 line from 15,000 units to 30,000 units. This contract would increase Samsung Display’s investment in A3 plant up to 10 trillion won. Samsung Display has commercialized OLED technology first in the world in 2007 and dominates the global smartphone OLED panel market with a share of 99 percent.

Samsung Display leads in 1Q16 smartphone panel shipment, says Sigmaintell

Rebecca Kuo, Tainan; Adam Hwang, DIGITIMES [Monday 25 April 2016]

Samsung Display was largest maker of smartphone panels, shipping more than 80 million panels, in the first quarter of 2016, according to China-based Sigmaintell Consulting.

About 440 million smartphone-use panels shipped globally in the first quarter, increasing 7% on year, and nearly one-third were of AMOLED models, Sigmaintell said.

LG Display shipped 34 million smartphone-use panels in the quarter, BOE Technology and Tianma Micro-electronics shipped 76 million units and 38 million units, Japan Display and Sharp shipped 41 million units and 23 million units, and AU Optronics and Innolux shipped 27 million units and 21 million units.

=> Rangliste (in Mio.)

80 Samsung Display

76 BOE

41 Japan Display

38 Tianma Microelectronics

34 LG Display

27 AUO

23 Sharp

21 Innolux

340 von 440 insgesamt = 77%

Rebecca Kuo, Tainan; Adam Hwang, DIGITIMES [Monday 25 April 2016]

Samsung Display was largest maker of smartphone panels, shipping more than 80 million panels, in the first quarter of 2016, according to China-based Sigmaintell Consulting.

About 440 million smartphone-use panels shipped globally in the first quarter, increasing 7% on year, and nearly one-third were of AMOLED models, Sigmaintell said.

LG Display shipped 34 million smartphone-use panels in the quarter, BOE Technology and Tianma Micro-electronics shipped 76 million units and 38 million units, Japan Display and Sharp shipped 41 million units and 23 million units, and AU Optronics and Innolux shipped 27 million units and 21 million units.

=> Rangliste (in Mio.)

80 Samsung Display

76 BOE

41 Japan Display

38 Tianma Microelectronics

34 LG Display

27 AUO

23 Sharp

21 Innolux

340 von 440 insgesamt = 77%

Samsung Display to expand OLED capacity by 50%, says paper

Chen Duan-wu, Taipei; Steve Shen, DIGITIMES [Tuesday 21 June 2016]

Samsung Display, viewing that Apple is likely to adopt OLED panels for new iPhone to be launched in 2017 and other smartphone vendors will follow suit, will invest KRW8.0 trillion (US$6.82 billion) in 2016 to expand its OLED panel production capacity by 50%, according to Japan-based Nikkei Asian Review.

The added OLED panel production capacity will be sufficient for production of 200 million units of smartphones, compared to Samsung's current capacity of 300 million OLED panels for smartphones, said the paper.

Given Samsung shipped only 320 million smartphones in 2015, the expansion project may affect Samsung's future profitability if oversupply of panels occurs, the paper added.

Apple has informed its suppliers that all iPhone devices will switch to OLED displays in 2018, with a portion of products to use OLED panels in advance, the paper noted.

Meanwhile, LG Display also plans to invest over KWR10 trillion in the next few years to ramp up production of its OLED panels for TVs and smartphones, while JDI will also spend JPY50billion (US$479 million) in 2017 to set up new OLED production lines, the paper indicated.

Chen Duan-wu, Taipei; Steve Shen, DIGITIMES [Tuesday 21 June 2016]

Samsung Display, viewing that Apple is likely to adopt OLED panels for new iPhone to be launched in 2017 and other smartphone vendors will follow suit, will invest KRW8.0 trillion (US$6.82 billion) in 2016 to expand its OLED panel production capacity by 50%, according to Japan-based Nikkei Asian Review.

The added OLED panel production capacity will be sufficient for production of 200 million units of smartphones, compared to Samsung's current capacity of 300 million OLED panels for smartphones, said the paper.

Given Samsung shipped only 320 million smartphones in 2015, the expansion project may affect Samsung's future profitability if oversupply of panels occurs, the paper added.

Apple has informed its suppliers that all iPhone devices will switch to OLED displays in 2018, with a portion of products to use OLED panels in advance, the paper noted.

Meanwhile, LG Display also plans to invest over KWR10 trillion in the next few years to ramp up production of its OLED panels for TVs and smartphones, while JDI will also spend JPY50billion (US$479 million) in 2017 to set up new OLED production lines, the paper indicated.

die beiden wollen's wissen...:

Digitimes Research: Samsung Display, LG Display to keep expanding AMOLED capacities

Tony Huang, DIGITIMES Research, Taipei [Friday 24 June 2016]

Samsung Display and LG Display, in order to put pressure on competitors, has focused on AMOLED panels and will continue expansion of AMOLED production capacities, with combined AMOLED capacity to increase at a CAGR of 33.1% during 2015-2019, according to Digitimes Research.

The two companies' combined annual capacity for AMOLED panels will increase from 6.093 million square meters in 2015 to 19.1 million square meters in 2019, Digitimes Research indicated. If broken down by generation, combined annual AMOLED capacity at 8G and above factories will increase from 1.815 million square meters in 2015 to 7.079 million square meters in 2019, and at 4.5-6G factories from 4.278 million square meters to 12.021 million square meters.

Demand for smartphone-use AMOLED panels from Samsung Electronics and Apple alone in 2019 will exceed 420 million units. In addition to smartphones, AMOLED panels will be used in tablets, automotive displays and TVs.

Digitimes Research: Samsung Display, LG Display to keep expanding AMOLED capacities

Tony Huang, DIGITIMES Research, Taipei [Friday 24 June 2016]

Samsung Display and LG Display, in order to put pressure on competitors, has focused on AMOLED panels and will continue expansion of AMOLED production capacities, with combined AMOLED capacity to increase at a CAGR of 33.1% during 2015-2019, according to Digitimes Research.

The two companies' combined annual capacity for AMOLED panels will increase from 6.093 million square meters in 2015 to 19.1 million square meters in 2019, Digitimes Research indicated. If broken down by generation, combined annual AMOLED capacity at 8G and above factories will increase from 1.815 million square meters in 2015 to 7.079 million square meters in 2019, and at 4.5-6G factories from 4.278 million square meters to 12.021 million square meters.

Demand for smartphone-use AMOLED panels from Samsung Electronics and Apple alone in 2019 will exceed 420 million units. In addition to smartphones, AMOLED panels will be used in tablets, automotive displays and TVs.

Digitimes Research: Samsung Display AMOLED shipments to increase to 560 million units in 2019

Tony Huang, DIGITIMES Research, Taipei [Tuesday 28 June 2016]

Samsung Display has dominated global production and supply of smartphone-use AMOLED panels and will maintain the leading status over the next few years, with its shipments to increase to 560 million units in 2019, hiking 114% from 2015, according to Digitimes Research.

Samsung Electronics is Samsung Display's largest client for smartphone-use AMOLED panels and will remain so over the next few years, with demand to grow from 239 million units in 2016 to 290 million units in 2019, Digitimes Research indicated.

Apple is expected to initially adopt AMOLED panels for iPhones to be launched in 2017, with Samsung Display's supply estimated at 40 million units in 2017, 80 million units in 2018 and 120 million units in 2019.

Several China-based smartphone vendors, including Vivo, Oppo, GiONEE, Huawei Technologies and Lenovo, have adopted or decided to adopt AMOLED panels, and Samsung Display's combined shipments to them will increase from 99 million units in 2016 to 150 million units in 2019.

As Japan Display, Sharp, China- and Taiwan-based panel makers plan to step into AMOLED panels, Samsung Display may begin to face competition in 2019 or 2020.

Tony Huang, DIGITIMES Research, Taipei [Tuesday 28 June 2016]

Samsung Display has dominated global production and supply of smartphone-use AMOLED panels and will maintain the leading status over the next few years, with its shipments to increase to 560 million units in 2019, hiking 114% from 2015, according to Digitimes Research.

Samsung Electronics is Samsung Display's largest client for smartphone-use AMOLED panels and will remain so over the next few years, with demand to grow from 239 million units in 2016 to 290 million units in 2019, Digitimes Research indicated.

Apple is expected to initially adopt AMOLED panels for iPhones to be launched in 2017, with Samsung Display's supply estimated at 40 million units in 2017, 80 million units in 2018 and 120 million units in 2019.

Several China-based smartphone vendors, including Vivo, Oppo, GiONEE, Huawei Technologies and Lenovo, have adopted or decided to adopt AMOLED panels, and Samsung Display's combined shipments to them will increase from 99 million units in 2016 to 150 million units in 2019.

As Japan Display, Sharp, China- and Taiwan-based panel makers plan to step into AMOLED panels, Samsung Display may begin to face competition in 2019 or 2020.

Oppo smartphone shipments marred by tight AMOLED supply

Sammi Huang, Taipei; Steve Shen, DIGITIMES [Thursday 4 August 2016]

Shipments of smartphones by China-based Oppo may fall short of its revised goal of shipping 90-100 million units in 2016 due to insufficient supply of AMOLED panels from Samsung Display, according to industry sources.

Oppo shipped 50 million smartphones 2015 and originally set a goal to ship 60 million in 2016. However, the vendor raised its shipment goal for the year to 80 million units in June and revise the goal again to 90-100 million recently, the sources indicated.

Oppo has been increasing its orders for smartphone panels recently, looking to achieve its shipment goal. However, Samsung Display is having trouble supplying sufficient AMOLED panels to Oppo due to tight production capacity, said the sources.

Samsung Display is expected to ship a total of 100 million smartphone-use panels to China-based smartphone makers, including Oppo and other vendors, in 2016 in addition to 240 million units to be used by its own smartphone production, according to Digitimes Research.

Obviously, Samsung Display is unable to ship all of its smartphone panels designated for the China market to Oppo alone in 2016, said the sources.

Samsung Display is expected to ramp up its AMOLED panel shipments to China to over 150 million units in 2019 and ship another 290 million units for internal consumption during the same year, Digitimes Research estimated.

Sammi Huang, Taipei; Steve Shen, DIGITIMES [Thursday 4 August 2016]

Shipments of smartphones by China-based Oppo may fall short of its revised goal of shipping 90-100 million units in 2016 due to insufficient supply of AMOLED panels from Samsung Display, according to industry sources.

Oppo shipped 50 million smartphones 2015 and originally set a goal to ship 60 million in 2016. However, the vendor raised its shipment goal for the year to 80 million units in June and revise the goal again to 90-100 million recently, the sources indicated.

Oppo has been increasing its orders for smartphone panels recently, looking to achieve its shipment goal. However, Samsung Display is having trouble supplying sufficient AMOLED panels to Oppo due to tight production capacity, said the sources.

Samsung Display is expected to ship a total of 100 million smartphone-use panels to China-based smartphone makers, including Oppo and other vendors, in 2016 in addition to 240 million units to be used by its own smartphone production, according to Digitimes Research.

Obviously, Samsung Display is unable to ship all of its smartphone panels designated for the China market to Oppo alone in 2016, said the sources.

Samsung Display is expected to ramp up its AMOLED panel shipments to China to over 150 million units in 2019 and ship another 290 million units for internal consumption during the same year, Digitimes Research estimated.

Samsung Display to obtain 9.77% stake in joint venture 11G LCD factory in China

Chen Duan-wu, Taipei; Adam Hwang, DIGITIMES [Wednesday 14 September 2016]

China-based vendor TCL on September 13 announced that Samsung Display will invest CNY2.1 billion (US$314 million) for a 9.77% stake in an 11G TFT-LCD factory to be established in Shenzhen, southern China, on a joint venture basis with TCL's subsidiary China Star Optoelectronics Technology (CSOT) and the city government of Shenzhen.

The factory will have an initial paid-in capital of CNY21.5 billion, with CSOT to invest CNY11.4 billion for a 53.02% stake and the city government of Shenzhen CNY8.0 billion for 37.21%.

Construction will begin in December 2016 and the factory will have a monthly production capacity of 90,000 3,370mm by 2,940mm glass substrates. Production will start in July 2019 and focus on 43-, 65-, 70- and 75-inch LCD TV panels as well as large-size PID (public information display) panels.

Chen Duan-wu, Taipei; Adam Hwang, DIGITIMES [Wednesday 14 September 2016]

China-based vendor TCL on September 13 announced that Samsung Display will invest CNY2.1 billion (US$314 million) for a 9.77% stake in an 11G TFT-LCD factory to be established in Shenzhen, southern China, on a joint venture basis with TCL's subsidiary China Star Optoelectronics Technology (CSOT) and the city government of Shenzhen.

The factory will have an initial paid-in capital of CNY21.5 billion, with CSOT to invest CNY11.4 billion for a 53.02% stake and the city government of Shenzhen CNY8.0 billion for 37.21%.

Construction will begin in December 2016 and the factory will have a monthly production capacity of 90,000 3,370mm by 2,940mm glass substrates. Production will start in July 2019 and focus on 43-, 65-, 70- and 75-inch LCD TV panels as well as large-size PID (public information display) panels.

Samsung Display to supply AMOLED panels for new iPhone in 2017, say Taiwan makers

Siu Han, Taipei; Adam Hwang, DIGITIMES [Thursday 29 December 2016]

Samsung Display will become the exclusive supplier of AMOLED panels for use in Apple's new iPhone devices to be launched in 2017 and can supply 20 million units in maximum a month, according to Taiwan-based supply chain makers.

Apple will launch 4.7-, 5.5- and 5.8-inch new iPhone models in second-half 2017, with TFT-LCD panels to be used in the former two models and AMOLED for the 5.8-inch one, the sources said. Global shipments of the AMOLED iPhone in 2017 are estimated at 60-70 million units, the sources noted.

Japan-based Nissha Printing will supply touch sensors for use in AMOLED panels and bonding of touch sensors and AMOLED display panels will be undertaken by either Samsung Display or Taiwan-based TPK Holding and General Interface Solution.

Supply chain makers of the new iPhone will begin production in small volumes in March 2017 and increase output in May-June.

Siu Han, Taipei; Adam Hwang, DIGITIMES [Thursday 29 December 2016]

Samsung Display will become the exclusive supplier of AMOLED panels for use in Apple's new iPhone devices to be launched in 2017 and can supply 20 million units in maximum a month, according to Taiwan-based supply chain makers.

Apple will launch 4.7-, 5.5- and 5.8-inch new iPhone models in second-half 2017, with TFT-LCD panels to be used in the former two models and AMOLED for the 5.8-inch one, the sources said. Global shipments of the AMOLED iPhone in 2017 are estimated at 60-70 million units, the sources noted.

Japan-based Nissha Printing will supply touch sensors for use in AMOLED panels and bonding of touch sensors and AMOLED display panels will be undertaken by either Samsung Display or Taiwan-based TPK Holding and General Interface Solution.

Supply chain makers of the new iPhone will begin production in small volumes in March 2017 and increase output in May-June.

Antwort auf Beitrag Nr.: 53.971.124 von R-BgO am 29.12.16 11:29:16Samsung reportedly earns AMOLED panel orders from Apple

Michael McManus, DIGITIMES, Taipei [Wednesday 15 February 2017]

Samsung Display has received AMOLED panel orders from Apple for its upcoming iPhone, according to reports coming out of Korea, reinforcing a recent report from Digitimes that indicated that Apple has ordered sufficient OLED panels from Samsung Display, and that the supply chain will start working on OLED panel bonding for the next-generation iPhone around the end of the first quarter.

The Korea Herald indicated that Samsung Display recently won the order for 60 million AMOLED panels from Apple.

With the use of AMOLED panels set to rise dramatically in 2017, Samsung Display is said to be talking with the government of Bac Ninh Province, northern Vietnam, about an additional investment of US$2.5 billion to expand a factory of AMOLED modules there.

An estimated 150 million flexible AMOLED panels for use in smartphones will be shipped globally in 2017, triple the shipments in 2016. Up until now, Samsung Display has dominated global supply for smartphone-use AMOLED panels, though China-based EverDisplay Optronics (Shanghai) and Visionox can supply small volumes. But as global demand for flexible AMOLED panels will exceed global supply in 2017, it is possible only Apple and Samsung Electronics will be able to secure sufficient supply to meet their demand.

While China is now making heavy investments in AMOLED panel capacity, Korean makers are focusing on flexible AMOLED panels. Samsung Display and LG Display had a combined annual production capacity of 4.945 million square meters for AMOLED panels in 2016 and the capacity will increase to 15.130 million square meters by 2020. However, the proportion of flexible panel production will increase from 46.1%to 72.6% in that time, according to Digitimes Research.

Michael McManus, DIGITIMES, Taipei [Wednesday 15 February 2017]

Samsung Display has received AMOLED panel orders from Apple for its upcoming iPhone, according to reports coming out of Korea, reinforcing a recent report from Digitimes that indicated that Apple has ordered sufficient OLED panels from Samsung Display, and that the supply chain will start working on OLED panel bonding for the next-generation iPhone around the end of the first quarter.

The Korea Herald indicated that Samsung Display recently won the order for 60 million AMOLED panels from Apple.

With the use of AMOLED panels set to rise dramatically in 2017, Samsung Display is said to be talking with the government of Bac Ninh Province, northern Vietnam, about an additional investment of US$2.5 billion to expand a factory of AMOLED modules there.

An estimated 150 million flexible AMOLED panels for use in smartphones will be shipped globally in 2017, triple the shipments in 2016. Up until now, Samsung Display has dominated global supply for smartphone-use AMOLED panels, though China-based EverDisplay Optronics (Shanghai) and Visionox can supply small volumes. But as global demand for flexible AMOLED panels will exceed global supply in 2017, it is possible only Apple and Samsung Electronics will be able to secure sufficient supply to meet their demand.

While China is now making heavy investments in AMOLED panel capacity, Korean makers are focusing on flexible AMOLED panels. Samsung Display and LG Display had a combined annual production capacity of 4.945 million square meters for AMOLED panels in 2016 and the capacity will increase to 15.130 million square meters by 2020. However, the proportion of flexible panel production will increase from 46.1%to 72.6% in that time, according to Digitimes Research.

Samsung Display leading in OLED, says PIDA

Rebecca Kuo, Tainan; Adam Hwang, DIGITIMES [Friday 3 March 2017]

While several panel makers are investing in the production of OLED panels, Samsung Display has taken a far lead due to its advantages in patents on key materials, manufacturing equipment and product formulae, according to the Photonics Industry & Technology Development Association (PIDA).

Samsung Display shipped nearly 100 million small- to medium-size OLED panels in the third quarter of 2016, accounting for over 90% of global output. China-based Tianma Micro-electronics, EverDisplay Optronics (Shanghai) and Kunshan Govisionox Optoelectronics together accounted for the remainder, PIDA cited IHS as indicating.

Viewing that Apple is very likely to launch iPhones with OLED panels in the second half of 2017, and many of first-tier China-based smartphone vendors will follow suit, Samsung Display is expanding production capacity at its 6G OLED factory, A3, and will refit its 7G TFT-LCD factory, L7-1, to produce OLED panels.

For OLED panel competitors, a smooth transition into production hinges on the availability of equipment and materials for vacuum deposition, PIDA indicated.

Rebecca Kuo, Tainan; Adam Hwang, DIGITIMES [Friday 3 March 2017]

While several panel makers are investing in the production of OLED panels, Samsung Display has taken a far lead due to its advantages in patents on key materials, manufacturing equipment and product formulae, according to the Photonics Industry & Technology Development Association (PIDA).

Samsung Display shipped nearly 100 million small- to medium-size OLED panels in the third quarter of 2016, accounting for over 90% of global output. China-based Tianma Micro-electronics, EverDisplay Optronics (Shanghai) and Kunshan Govisionox Optoelectronics together accounted for the remainder, PIDA cited IHS as indicating.

Viewing that Apple is very likely to launch iPhones with OLED panels in the second half of 2017, and many of first-tier China-based smartphone vendors will follow suit, Samsung Display is expanding production capacity at its 6G OLED factory, A3, and will refit its 7G TFT-LCD factory, L7-1, to produce OLED panels.

For OLED panel competitors, a smooth transition into production hinges on the availability of equipment and materials for vacuum deposition, PIDA indicated.

Apple signs 2-year OLED panel supply contract with Samsung Display, say reports

Yiling Lin, Taipei; Steve Shen, DIGITIMES [Thursday 6 April 2017]

Apple reportedly has signed a two-year contract with Samsung Display for the supply of KRW10 trillion (US$9 billion) worth of small-size curved OLED panels, according to Korea-based ET News, Chosun Biz and other media.

Based on the contract, Samsung Display will ship 70-92 million small-size OLED panels to Apple in 2017, said the reports. This means that about 30% of iPhone devices shipped in 2017 will come with curved OLED panels, given that Apple currently ships about 200 million iPhone devices a year.

Japan-based Nikkei also reported that Apple has ordered 70 million OLED panels from Samsung Display. But to meet increasing demand from Apple, Samsung Display has been exerting efforts to ramp up its capacity to 95 million units.

Meanwhile, Taiwan-based Yuanta Securities Investment Consulting has estimated that shipments of new iPhone devices are likely to reach 100 million units in 2017, of which at least 55 million will feature OLED panels.

Samsung Display reportedly is converting an LCD factory in Asa into an OLED panel plant, and its total investments for OLED production lines could reach KRW10 trillion in 2017, said the reports.

Yiling Lin, Taipei; Steve Shen, DIGITIMES [Thursday 6 April 2017]

Apple reportedly has signed a two-year contract with Samsung Display for the supply of KRW10 trillion (US$9 billion) worth of small-size curved OLED panels, according to Korea-based ET News, Chosun Biz and other media.

Based on the contract, Samsung Display will ship 70-92 million small-size OLED panels to Apple in 2017, said the reports. This means that about 30% of iPhone devices shipped in 2017 will come with curved OLED panels, given that Apple currently ships about 200 million iPhone devices a year.

Japan-based Nikkei also reported that Apple has ordered 70 million OLED panels from Samsung Display. But to meet increasing demand from Apple, Samsung Display has been exerting efforts to ramp up its capacity to 95 million units.

Meanwhile, Taiwan-based Yuanta Securities Investment Consulting has estimated that shipments of new iPhone devices are likely to reach 100 million units in 2017, of which at least 55 million will feature OLED panels.

Samsung Display reportedly is converting an LCD factory in Asa into an OLED panel plant, and its total investments for OLED production lines could reach KRW10 trillion in 2017, said the reports.

Samsung Display to ship rigid OLED panels to Xiaomi, says report

Amy Fan, Taipei; Steve Shen, DIGITIMES [Thursday 20 July 2017]

Samsung Display will start supplying Xiaomi Technology with 6-inch QHD OLED (rigid type) panels in December 2017 for the production of Xiaomi's next-generation flagship smartphones, according to a Korea-based The Bell report.

Samsung Display will ship one million rigid OLED panels to Xiaomi in December and further increase shipments to 2.2 million units in January 2018, said the report.

Xiaomi had originally planned to use a 5.49-inch flexible OLED panel from LG Display, but the deal fell apart as operations of LGD's new plant were delayed.

Due to issues related to the supply of OLED panels, Xiaomi's new flagship model planned for the second half of 2017 is likely to be delayed to early 2018, according to industry sources in Taiwan.

Samsung Display signed panel supply contracts with Huawei, Oppo and Vivo in 2016, and the inclusion of Xiaomi into its client list means the panel maker has managed to grab orders from nearly all major smartphone vendors in China.

Given the rising market share held by China-based smartphone vendors globally, it is becoming important for Samsung Display to continue to lock in orders from those clients, said the sources.

Huawei, Oppo, Vivo and Xiaomi together accounted for a 27.4% share of the global smartphone market in the first quarter of 2017, with Huawei leading the group with a 9% share, followed by Oppo 8.1%, Vivo 6.8% and Xiaomi 3.5%, the sources indicated.

Amy Fan, Taipei; Steve Shen, DIGITIMES [Thursday 20 July 2017]

Samsung Display will start supplying Xiaomi Technology with 6-inch QHD OLED (rigid type) panels in December 2017 for the production of Xiaomi's next-generation flagship smartphones, according to a Korea-based The Bell report.

Samsung Display will ship one million rigid OLED panels to Xiaomi in December and further increase shipments to 2.2 million units in January 2018, said the report.

Xiaomi had originally planned to use a 5.49-inch flexible OLED panel from LG Display, but the deal fell apart as operations of LGD's new plant were delayed.

Due to issues related to the supply of OLED panels, Xiaomi's new flagship model planned for the second half of 2017 is likely to be delayed to early 2018, according to industry sources in Taiwan.

Samsung Display signed panel supply contracts with Huawei, Oppo and Vivo in 2016, and the inclusion of Xiaomi into its client list means the panel maker has managed to grab orders from nearly all major smartphone vendors in China.

Given the rising market share held by China-based smartphone vendors globally, it is becoming important for Samsung Display to continue to lock in orders from those clients, said the sources.

Huawei, Oppo, Vivo and Xiaomi together accounted for a 27.4% share of the global smartphone market in the first quarter of 2017, with Huawei leading the group with a 9% share, followed by Oppo 8.1%, Vivo 6.8% and Xiaomi 3.5%, the sources indicated.

China AMOLED panel capacity expansion forecast, 2016-2020

Jason Yang, DIGITIMES Research, Taipei [Thursday 8 June 2017]

This Digitimes Research Special Report examines the China AMOLED industry, focusing on the expansion capacity of the makers, the current implementation plans of major smartphone vendors in the market and the technological hurdles faced by China's makers.

ABSTRACT

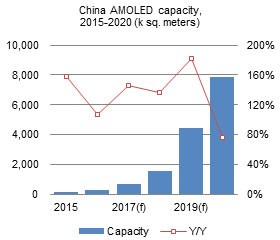

China AMOLED capacity, 2015-2020 (k sq. meters)

One of the hottest areas of investment in the display panel industry in 2017 is coming from the AMOLED sector, with China being ground zero for capacity expansion. According to Digitimes Research, seven China-based panel makers have been expanding existing or setting up new AMOLED production capacities, with the total annual capacity estimated to increase from 272,000 square meters in 2016 to 1.584 million square meters in 2018, 4.464 million square meters in 2019, and 7.864 million square meters in 2020, representing an overall CAGR of 131.9% from 2016-2020.

In 2020, BOE Technology will be the largest China-based AMOLED panel maker, accounting for 35% of the country’s annual production capacity, while Tianma Micro-electronics will have a 17.6% share and Visionox will account for 14% of the capacity.

However, this dramatic growth for China makers is coming from a trailing position from its peers in South Korea. For example, Samsung Display and LG Display had a combined annual production capacity of 4.945 million square meters for AMOLED panels in 2016 and the total capacity will increase to 15.130 million square meters in 2020 at a 2016-2020 CAGR of 32.3%.

It should be noted that these two makers are relatively focusing their expansion on flexible AMOLED panels, with the proportion for flexible models to increase from 46.1% in 2016 to 72.6% in 2020. It may be difficult for China-based AMOLED panel makers to obtain orders from Apple and other international smartphone vendors at least in the next five years, as they are technologically inferior to Samsung Display, but their products are likely to be adopted by local smartphone vendors whose global market share is rising, according to Digitimes Research.

China AMOLED makers face two major barriers in the development of their products: increasing resolution and harnessing plastic substrate technology. Samsung Display is significantly superior to China-based makers in these two areas.

For the two key technologies, China-based EverDisplay Optronics (Shanghai) in 2017 is expected to attain the level that Samsung Display reached in 2014. EverDisplay is lagging three years behind, while other China-based makers are behind even further by 1-2 more years.

In manufacturing AMOLED panels, yield rates for evaporating light-emitting materials are a bottleneck and the yield rates decrease as resolution increases. Among China-based makers, only EverDisplay and Truly Opto-Electronics are capable of producing Full HD AMOLED panels currently, and Kunshan Go-Visionox Optoelectronics, BOE Technology and Tianma may be able to do that by the end of 2017 and/or mid-2018.

Moreover, Samsung Display began production of flexible AMOLED panels using PI (polyimide) materials in the second half of 2014. China-based makers have unveiled such panels but cannot start volume production until 2018.

Jason Yang, DIGITIMES Research, Taipei [Thursday 8 June 2017]

This Digitimes Research Special Report examines the China AMOLED industry, focusing on the expansion capacity of the makers, the current implementation plans of major smartphone vendors in the market and the technological hurdles faced by China's makers.

ABSTRACT

China AMOLED capacity, 2015-2020 (k sq. meters)

One of the hottest areas of investment in the display panel industry in 2017 is coming from the AMOLED sector, with China being ground zero for capacity expansion. According to Digitimes Research, seven China-based panel makers have been expanding existing or setting up new AMOLED production capacities, with the total annual capacity estimated to increase from 272,000 square meters in 2016 to 1.584 million square meters in 2018, 4.464 million square meters in 2019, and 7.864 million square meters in 2020, representing an overall CAGR of 131.9% from 2016-2020.

In 2020, BOE Technology will be the largest China-based AMOLED panel maker, accounting for 35% of the country’s annual production capacity, while Tianma Micro-electronics will have a 17.6% share and Visionox will account for 14% of the capacity.

However, this dramatic growth for China makers is coming from a trailing position from its peers in South Korea. For example, Samsung Display and LG Display had a combined annual production capacity of 4.945 million square meters for AMOLED panels in 2016 and the total capacity will increase to 15.130 million square meters in 2020 at a 2016-2020 CAGR of 32.3%.

It should be noted that these two makers are relatively focusing their expansion on flexible AMOLED panels, with the proportion for flexible models to increase from 46.1% in 2016 to 72.6% in 2020. It may be difficult for China-based AMOLED panel makers to obtain orders from Apple and other international smartphone vendors at least in the next five years, as they are technologically inferior to Samsung Display, but their products are likely to be adopted by local smartphone vendors whose global market share is rising, according to Digitimes Research.

China AMOLED makers face two major barriers in the development of their products: increasing resolution and harnessing plastic substrate technology. Samsung Display is significantly superior to China-based makers in these two areas.

For the two key technologies, China-based EverDisplay Optronics (Shanghai) in 2017 is expected to attain the level that Samsung Display reached in 2014. EverDisplay is lagging three years behind, while other China-based makers are behind even further by 1-2 more years.

In manufacturing AMOLED panels, yield rates for evaporating light-emitting materials are a bottleneck and the yield rates decrease as resolution increases. Among China-based makers, only EverDisplay and Truly Opto-Electronics are capable of producing Full HD AMOLED panels currently, and Kunshan Go-Visionox Optoelectronics, BOE Technology and Tianma may be able to do that by the end of 2017 and/or mid-2018.

Moreover, Samsung Display began production of flexible AMOLED panels using PI (polyimide) materials in the second half of 2014. China-based makers have unveiled such panels but cannot start volume production until 2018.

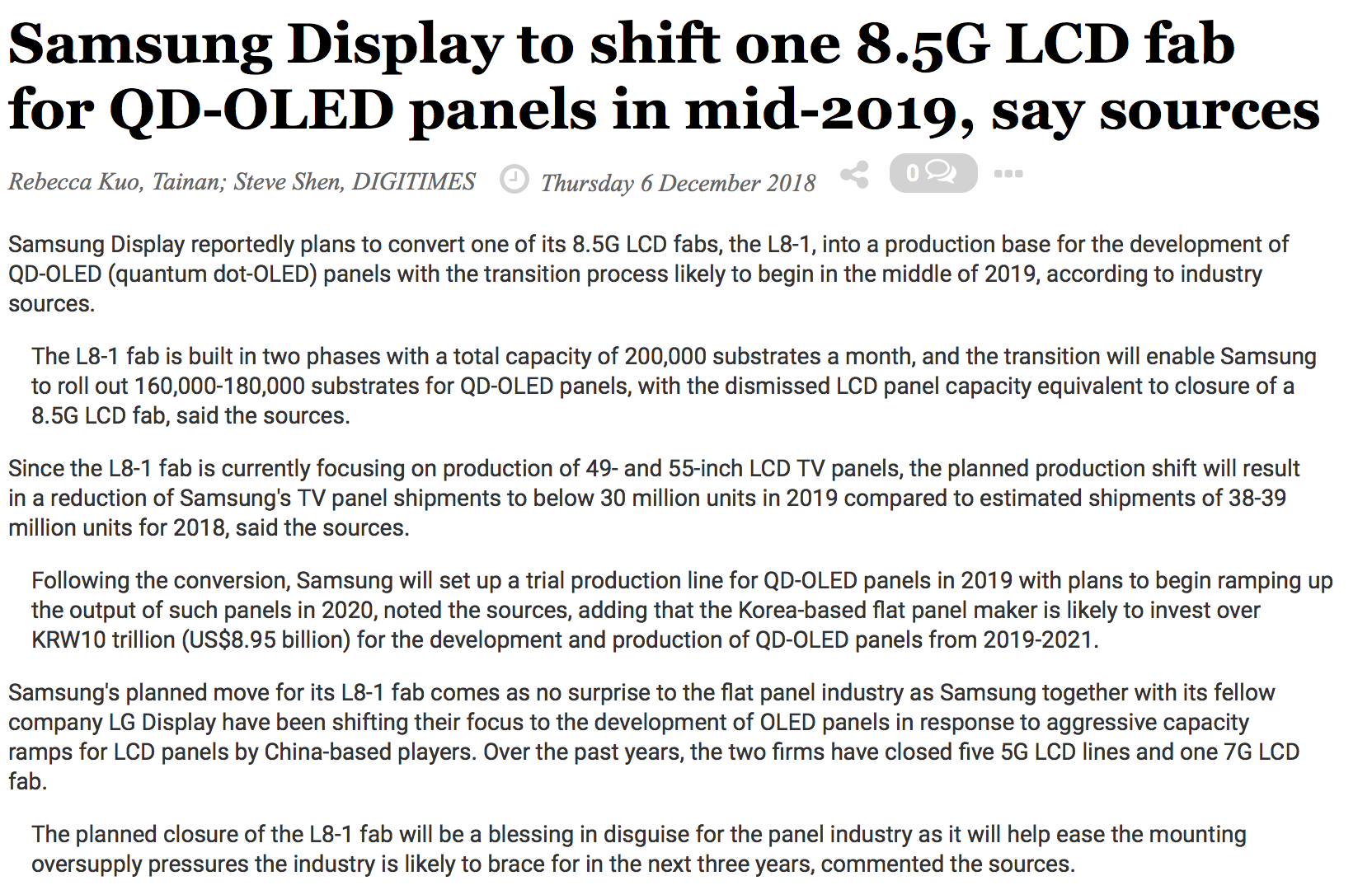

Apple reportedly requires price cuts for OLED panels

Rebecca Kuo, Tainan; Steve Shen, DIGITIMES Tuesday 24 April 2018

Apple is reportedly negotiating with Samsung Display for a reduction of the price of OLED panels as the iPhone X vendor is seeking to lower the production cost in order to ramp up sales of OLED-based models, according to industry sources.

The request for price reductions comes as no surprise to the industry as the OLED panel accounts for about one-third of the total production cost of an iPhone X and has been pinpointed as a key factor contributing to the lackluster sales of Apple's first OLED model, said the sources.

Apple is requiring the Korea display vendor to lower the unit price of its OLED panels to US$100, down from the US$110 in 2017, the sources indicated.

Apple is likely to purchase up to 100 million OLED panels from Samsung Display in 2018, with 25 million to be used by the current iPhone X and the remaining 75 million for the next-generation OLED models to be launched in 2018 - one being a 5.8-inch model and another a 6.5-inch one, indicated the sources.

Apple bought about 50 million OLED panels from Samsung Display in 2017, the sources added. .

Apple appears to uphold its strategy to continue promoting OLED models. The use of the OLED panels should not be considered the culprit for the slower-than-expected sales of the iPhone X, as other vendors have also launched OLED models that have been selling well, commented the sources.

Meanwhile, other sources indicated that prices of smartphone-used OLED panels are likely to go down soon as OLED panel makers in China are likely to cut their prices in order to keep their production lines running.

Rebecca Kuo, Tainan; Steve Shen, DIGITIMES Tuesday 24 April 2018

Apple is reportedly negotiating with Samsung Display for a reduction of the price of OLED panels as the iPhone X vendor is seeking to lower the production cost in order to ramp up sales of OLED-based models, according to industry sources.

The request for price reductions comes as no surprise to the industry as the OLED panel accounts for about one-third of the total production cost of an iPhone X and has been pinpointed as a key factor contributing to the lackluster sales of Apple's first OLED model, said the sources.

Apple is requiring the Korea display vendor to lower the unit price of its OLED panels to US$100, down from the US$110 in 2017, the sources indicated.

Apple is likely to purchase up to 100 million OLED panels from Samsung Display in 2018, with 25 million to be used by the current iPhone X and the remaining 75 million for the next-generation OLED models to be launched in 2018 - one being a 5.8-inch model and another a 6.5-inch one, indicated the sources.

Apple bought about 50 million OLED panels from Samsung Display in 2017, the sources added. .

Apple appears to uphold its strategy to continue promoting OLED models. The use of the OLED panels should not be considered the culprit for the slower-than-expected sales of the iPhone X, as other vendors have also launched OLED models that have been selling well, commented the sources.

Meanwhile, other sources indicated that prices of smartphone-used OLED panels are likely to go down soon as OLED panel makers in China are likely to cut their prices in order to keep their production lines running.

Gorilla-

Vorteil:Samsung Display heaping pressure on LG Display in OLED automotive panel sector

Ricky Tu, DIGITIMES Research, Taipei Monday 17 September 2018

In spite of its status as one of the top-five suppliers of OLED automotive panels globally, LG Display is facing increasing challenge from Samsung Display, which is making headway in the field utilizing its superior production capacity, according to Digitimes Research.

The latest competition has seen Samsung Display unveil 12.4- and 14-inch CID (central information display) products as well as a steering wheel-use 6.22-inch flexible OLED panel. LG Display has rolled out OLED-based 12.3-inch dashboard and 15.4-inch CIDs.

The new offerings from the two firms are likely to push the development of automotive panels with their average sizes to move toward over 12 inches.

Since 2016, LG Display has signed contracts to supply OLED automotive panels with a number of automakers including Mercedes-Benz and Volkswagen, with shipments to Mercedes-Benz for its E- and S-class sedans to kick off in 2020.

However, Samsung Display has gained ground in the domestic Korea market by shipping OLED CIDs to Hyundai since May 2018, and its 5.7-inch Full HD OLED panels have also found their way to the touch panels of rear seat entertainment systems of Audi's fourth-generation A8 luxury sedan.

By the end of 2018, Samsung Display's production capacity of OLED panels under its sub-6G lines will be 7-fold higher than that of LG Display's, based on the substrate capacity of 6G fab.

Additionally, Samsung Display is to kick off new production lines at its A5 fab in Tangjeong in 2020, maintaining its advantage in terms of production capacity and putting more pressure on LG Display as it continues to enhance its deployment in the automotive panel sector.

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -0,88 | |

| -0,40 | |

| -0,76 | |

| -1,18 | |

| -2,86 | |

| -1,96 | |

| -1,08 | |

| -1,38 | |

| -1,03 | |

| -0,86 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 188 | ||

| 116 | ||

| 80 | ||

| 71 | ||

| 68 | ||

| 63 | ||

| 57 | ||

| 47 | ||

| 43 | ||

| 41 |

Großes Aufwärtspotenzial: Goldmänner sehen starke Marktdurchdringung: Vier Batterie-Aktien to "buy"! 24.01.24 · wallstreetONLINE Redaktion · Samsung SDI JH |

15.11.23 · wallstreetONLINE NewsUpdate · BMW |

Zukunftsmarkt E-Mobilität: E-Autos werden zum Massenmarkt: HSBC nennt die Gewinner im Batteriesektor 15.11.23 · wallstreetONLINE Redaktion · BMW |

01.11.23 · wallstreetONLINE Redaktion · Apple |

27.10.23 · wallstreetONLINE Redaktion · Samsung SDI JH |

21.06.23 · wallstreetONLINE Redaktion · iShares MSCI South Korea ETF |

| Zeit | Titel |

|---|---|

| 18.04.24 |