LNG, LPG etc. - Übersichtsthread - 500 Beiträge pro Seite

eröffnet am 25.02.15 13:30:51 von

neuester Beitrag 31.08.19 18:10:21 von

neuester Beitrag 31.08.19 18:10:21 von

Beiträge: 178

ID: 1.208.297

ID: 1.208.297

Aufrufe heute: 0

Gesamt: 8.971

Gesamt: 8.971

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 44 Minuten | 941 | |

| vor 41 Minuten | 884 | |

| gestern 21:55 | 493 | |

| vor 39 Minuten | 411 | |

| 15.05.11, 11:34 | 409 | |

| gestern 13:40 | 390 | |

| heute 00:17 | 310 | |

| gestern 21:33 | 297 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.217,07 | +0,30 | 222 | |||

| 2. | 2. | 152,12 | +12,43 | 167 | |||

| 3. | 3. | 0,1910 | 0,00 | 75 | |||

| 4. | 4. | 2.328,60 | +0,28 | 57 | |||

| 5. | 5. | 0,0313 | +95,63 | 49 | |||

| 6. | 7. | 4,7580 | +0,17 | 46 | |||

| 7. | 8. | 13,350 | -7,99 | 46 | |||

| 8. | 6. | 44,10 | +0,46 | 45 |

Habe mich in den letzten Monaten -parallel zum Ölpreisrückgang- ziemlich in das Thema reingewühlt und möchte jetzt, nachdem ich bisher den BG Group-company-Thread als Postingplatz "missbraucht" habe, einen eigenen Faden zu unternehmensübergreifenden Punkten aufmachen.

Kalkül wie früher: es verbessert die Chancen gute Investentscheidungen zu treffen und gemeinsam ist man stärker.

Grundsatzüberlegung und Scope:

Die verschiedenen Gase sind ein interessantes Thema, weil

* die Produktion stark ansteigt w-Fracking & zunehmender Öl/Gas-Mischproduktion

* über die Verflüssigung werden die Gase transportfähig, womit man Pipelines umgehen kann

* Gas ist der beste Komplementärbrennstoff zu Renewables

* Europa sollte sich von Russland unabhängiger machen

* Die Erzeugung von Gas aus Renewable-Strom könnte sich eines Tages als eine gute oder sogar die beste Speicherungsmöglichkeit erweisen

Beobachten würde ich gerne die ganze Wertschöpfungskette, von-bis:

Produktion

Verflüssigung

Transport

Regasification / Speicherung

bis zum Endverbraucher.

Würde mich freuen, wenn sich auch andere fürs Thema interessieren.

Kalkül wie früher: es verbessert die Chancen gute Investentscheidungen zu treffen und gemeinsam ist man stärker.

Grundsatzüberlegung und Scope:

Die verschiedenen Gase sind ein interessantes Thema, weil

* die Produktion stark ansteigt w-Fracking & zunehmender Öl/Gas-Mischproduktion

* über die Verflüssigung werden die Gase transportfähig, womit man Pipelines umgehen kann

* Gas ist der beste Komplementärbrennstoff zu Renewables

* Europa sollte sich von Russland unabhängiger machen

* Die Erzeugung von Gas aus Renewable-Strom könnte sich eines Tages als eine gute oder sogar die beste Speicherungsmöglichkeit erweisen

Beobachten würde ich gerne die ganze Wertschöpfungskette, von-bis:

Produktion

Verflüssigung

Transport

Regasification / Speicherung

bis zum Endverbraucher.

Würde mich freuen, wenn sich auch andere fürs Thema interessieren.

Einzelwerte

die ich interessant finde und/oder in unterschiedlichen Mengen im Portfolio habe:Gastechnologie/Shipyards

Thread: GTT - (fast) Monopolist für LNG-Technik

Thread: Höegh - LNG-Spezialist

Thread: Technip to release Fourth Quarter and Full Year 2014 results on February 18, 2015

Thread: Notification in accordance with the Finnish Securities Market Act Chapter 9 § 5: The restructuring o (Wärtsilä)

Thread: Golar neue Chancen durch verstärkte Umwandlung von Gas in LNG

Thread: Keppel Corporation aus Singapur

Thread: Sembcorp Marine - Werft aus Singapur

Terminalprojekte

Thread: Öl, Erdgas: US-Erdgas bald gratis? Chancen für Value-Investoren! (Cheniere Energy)

Thread: Cheniere Energy Partners - betreibt Sabine Pass Terminal als MLP

Thread: Wer ist dabei? (LNG Ltd)

Pipeline-/Speicherbetreiber

Thread: Enagas - spanischer LNG-Player

Thread: Fluxys - belgischer Gasnetzbetreiber

Thread: Snam - italienischer Gasnetzbetreiber

Thread: Vopak - Neue Erholungswelle?

Thread: Spanisches Gas Natural vor milliardenschwerer Übernahme in Chile

Thread: Buckeye Partner - Tanklager- und Pipelinbetreiber

Thread: Kinder Morgan Inc. - jetzt auch an der Börse

Thread: Boardwalk Pipeline Partners - US-MLP

Gastankerbetreiber LNG (große)

Thread: Teekay LNG Partners - Flüssiggas MLP

Thread: Golar LNG Partners LP - LNG-MLP

Thread: Dynagas LNG Partners L.P. Increases Quarterly Cash Distribution for the Quarter Ended September 30,

Thread: GasLog Ltd. Reports Financial Results for the Quarter Ended June 30, 2014

Thread: GasLog Partners LP Reports Financial Results for the Three and Six Month Periods Ended June 30, 2014

Thread: Höegh LNG Partners

Thread: Nippon Yusen - Zeit für Schnäppchenjäger

andere Gas-Schiffe (LPG, kleine LBG, FSRU, etc.)

Thread: Gastanker

Thread: BW LPG - aus Norwegen

Thread: Dorian LPG - ein börsennotiertes Neubauprogramm

Thread: Navigator Holdings Ltd. Announces Date for the Release of Third Quarter 2014 Results, Conference Cal

Thread: StealthGas - griechischer LPG-shipper

Thread: Avance Gas- Gastanker

Gashandel/-vertrieb & Market Intelligence

Thread: BG Group verdient wegen geringerer Flüssiggas-Lieferungen weniger

Thread: Clarkson - Infodienstleister Schiffbranche

Thread: Brady PLC - Commodity-Software

Thread: Amerigas - US-MLP steueroptimiert

Thread: UGI Corp. - Gasflaschenlieferant

Die Kategorisierungen erheben keinen Anspruch auf Eindeutigkeit, mann kann sicher auch andere wählen.

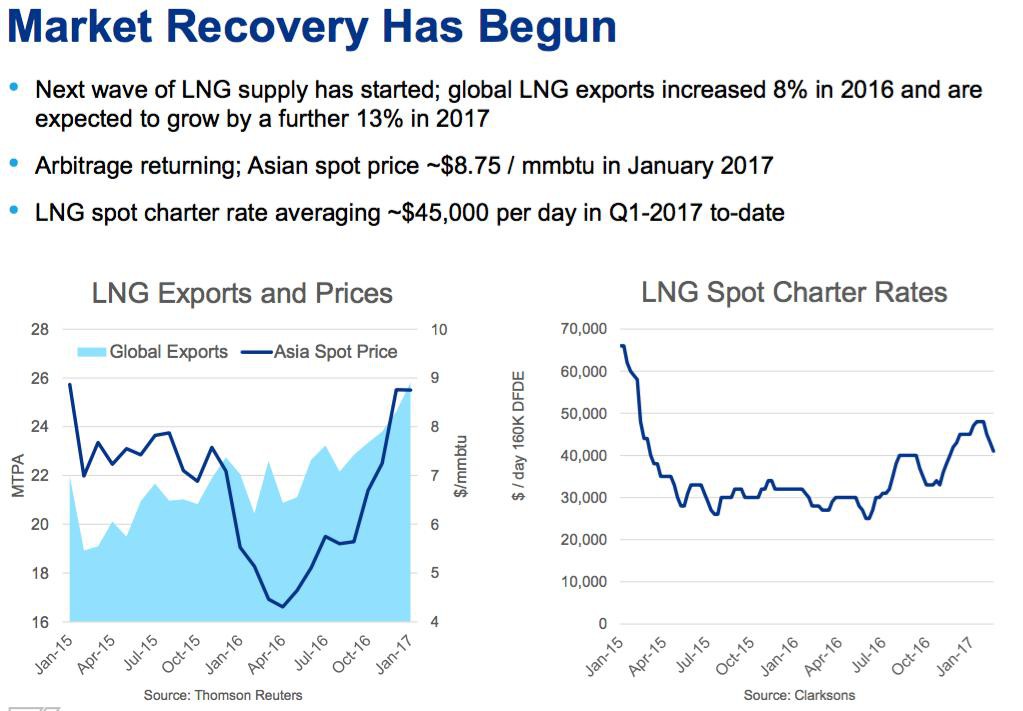

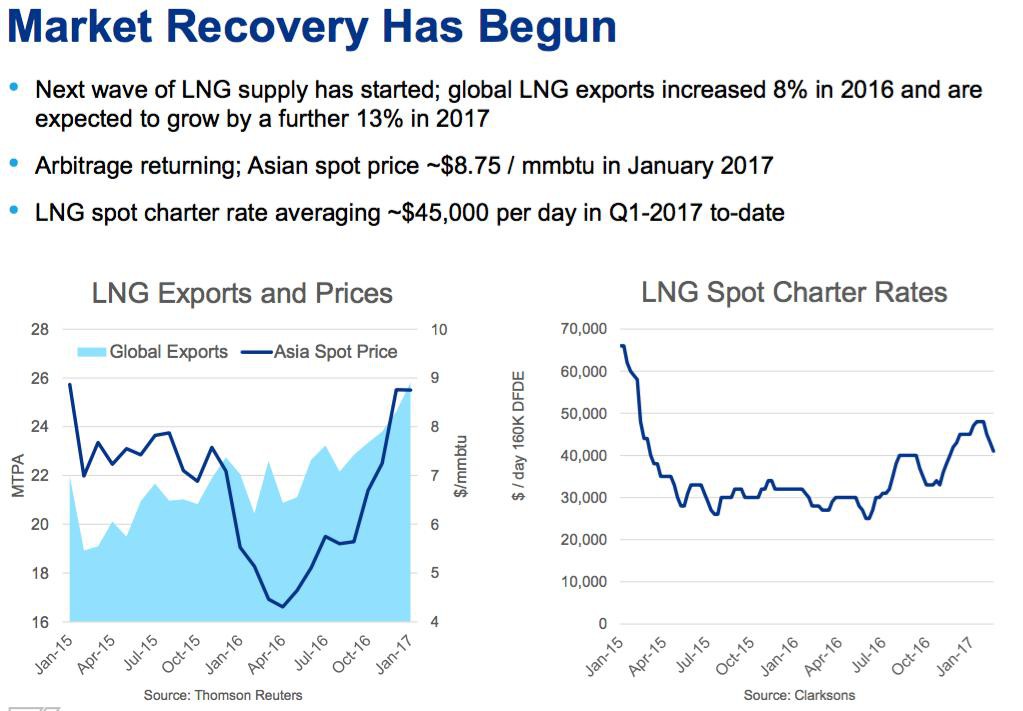

aus dem Golar-LNG Q4-Bericht:

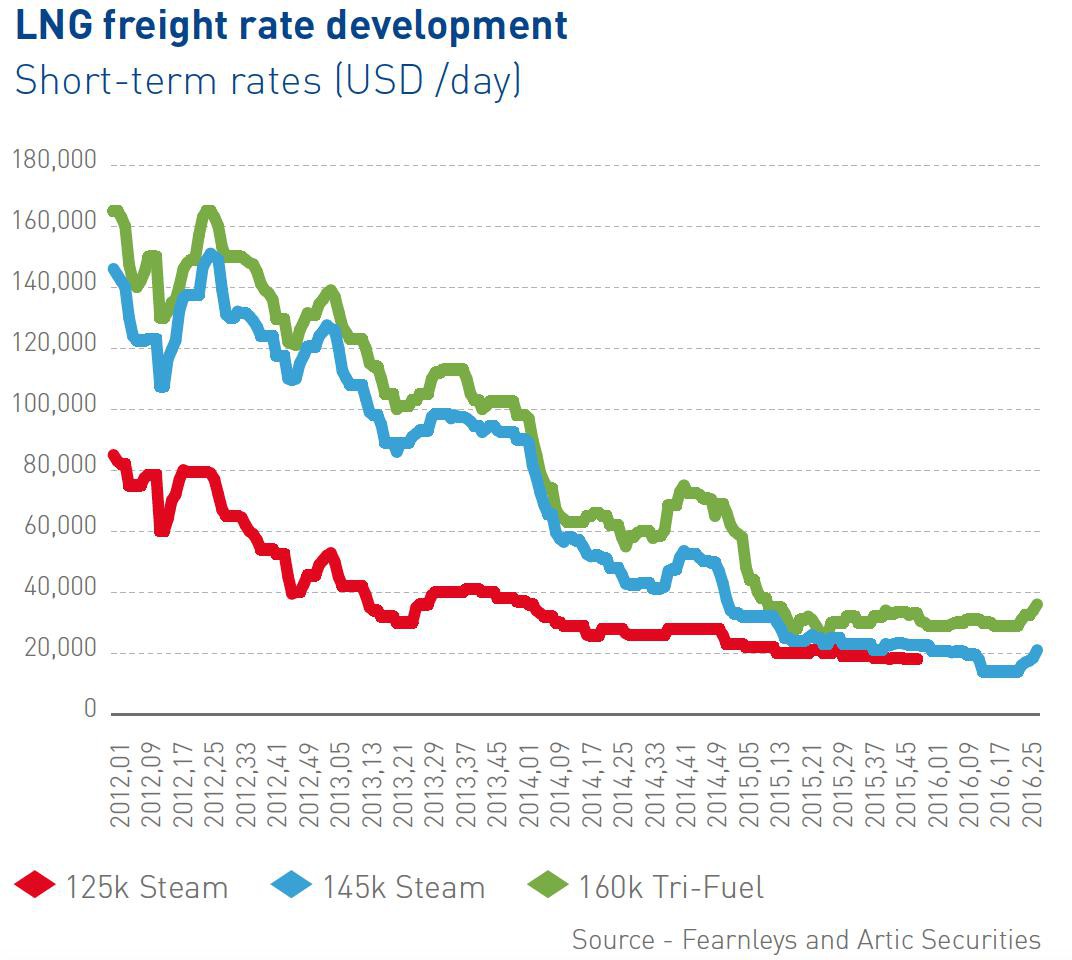

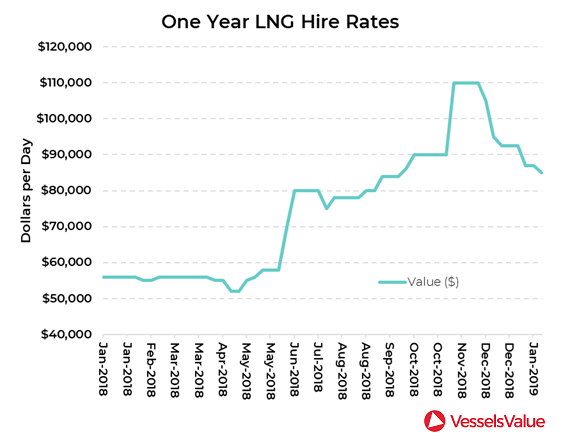

The average 4Q rate for steam LNG Carriers in the short-term market is estimated to have been around $50,000-$55,000 per day

and $65,000-$70,000 per day for TFDE vessels.

Not all short-term deals were concluded on a full round trip basis, but rather included fuel only on ballast legs. Although chartering activity was consistent with that in 3Q, the 4Q market became acutely sensitive to timing and location. In many cases ships lay idle for significant periods with steam vessels managing only to achieve rates in the $30,000 range with limited re-positioning fees. In other cases, charterers experienced a lack of prompt availability of cold and compatible vessels, where some TFDE vessels rates reached $80-90,000 per day range on round trip voyages.

Es scheint bei den Schiffstypen unterschieden zu werden zwischen

Steam,

TFDE und neu

MEGI (habe ich bisher nur bei Teekay LNG gesehen)

schöner thread, freue mich auf konstuktive konversationen hier.

ich bin der meinung man sollte zum gas auch die brennstoffzellen branche miteinbeziehen.

ich bin der meinung man sollte zum gas auch die brennstoffzellen branche miteinbeziehen.

Drewry: lower oil prices boost LPG shipping earnings

(von LNG world News)LPG shipping earnings are forecast to remain buoyant on the back of low oil prices and the absence of fuel substitution, shipping consultancy Drewry said in its LPG Forecaster.

Low oil prices have not triggered the substitution of LPG as the fuel of industrial use, as feared by some analysts. As a result, LPG shipping demand has remained intact and low bunker prices have supported vessel earnings.

Drewry expects this trend to continue, as 60% of global consumption is residential whose demand is largely inelastic to oil price change. The remainder is largely consumed by petrochemical production and Drewry estimates that only 20% of the sector’s capacity is capable of switching away from LPG fuel. Historically, LPG consumption has proven remarkably stable in spite of oil price volatility.

Meanwhile, the fall in oil prices has lowered shipping’s fuel costs which have fed through into time charter equivalent earnings despite weakening freight rates. For example, Drewry estimates that lower fourth quarter bunker costs contributed an 11% boost to LPG TCE earnings for very large gas carriers on the Arabian Gulf-Japan route compared to the previous quarter. Over this period, average freight rates fell 26% to $85 per tonne.

A similar trend has been witnessed on coastal trades, with North West Europe-East Europe TCE earnings rising 22% over the same period despite lower freight rates.

“The implication is that LPG shipping has everything to gain from lower oil prices, despite unfounded fears that this may reduce cargo demand and so damage sector earnings,” said Shresth Sharma, senior analyst, gas shipping at Drewry. “While we do not anticipate VLGC freight rates reaching the highs of last year given the large number of vessels lined up for delivery, we expect bunker costs to remain low through 2015 which will help support LPG shipping earnings.”

Finde ich insoweit interessant, als dass die LPG-shipper derzeit wirklich niedrig bewertet werden. Gestern kam z.B. der Jahresbericht von Avance: KGV2014 ist 7,2...

Der LPG-Markt scheint bisher unbeeindruckt vom Ölpreis zu sein:

aus dem Q4-Bericht von BW LPG"For this time of the year, Q1 2015 has so far been the historic strongest in terms of growth in the chartering

market. Supply, demand and infrastructure build-out suggest continued growth in 2015. 2016 sees fleet

expansion and the rate of export growth will dictate the overall impact on the chartering market, with longerterm

continuing growth expected. Beyond 2016, the supply"

BG: LNG market entering a period of supply growth

For the LNG market, 2015 will be marked by increasing volatility as new ‘waves’ of supply start adding volume together with new markets opening up, according to BG Group’s annual Global LNG Market Outlook.Andrew Walker, BG Group Vice President of Global LNG, commented: “After four years of flat supply we are entering a period of supply growth. 2014 marked the start-up of a new wave of supply from Australia. This will be joined by the first volumes from the US Gulf of Mexico around the end of 2015. This new supply will be absorbed by continued growth in Asian demand, together with the creation of up to six new markets in 2015, further diversifying the LNG trade and opening up new sales opportunities.”

Walker said that while good growth in LNG imports into Asia in 2015 is visible, key influences that will affect demand include the rate of return of Japanese nuclear power plants, economic growth rates for China and South Korea, as well as when the new markets begin importing. Over the longer-term BG Group continues to expect LNG trade worldwide to exceed 400 million tonnes per year by 2025, representing an annual growth rate of around 5%, almost twice the rate of expected growth in global gas consumption.

Although the industry expects five new liquefaction trains and one FLNG production facility to start-up in 2015, Walker noted that “these will be towards the end of the year limiting incremental supply in 2015 to around 7 million tonnes. How the market responds to the growing volumes in 2016 and 2017 will be a key factor to watch. We expect the LNG market to become more volatile over the next few years as it responds to ‘lumpy’ supply and market side additions plus exogenous supply and demand factors.”

Walker explained that fewer final investment decisions will be taken in 2015 than previously expected, which will mean less LNG is available to the market at the end of the decade. This uncertainty brings into sharper focus the attractiveness of flexible supply portfolios which can respond to changing market dynamics.

Japan: spot LNG price drops to USD 7.6 per mmbtu in February

The average price of spot-LNG imported into Japan that was contracted in February 2015 was at $7.6 per mmbtu on DES basis, Japan’s Ministry of Economy, Trade and Industry (METI) said in a statement.The average price of spot-LNG imported into Japan that arrived in February 2015 fell to $10.7 compared to the January price that averaged $13.9 per mmbtu.

Only spot LNG cargoes are taken into account in this assessment, excluding short, medium and long-term contract cargoes, as well as those linked to a particular price index.

Japan imported 87.73 million tonnes of LNG in the fiscal year ended in March, up 1 percent compared to the same period a year ago.

60% Preisrückgang sind schon ein Pfund...:

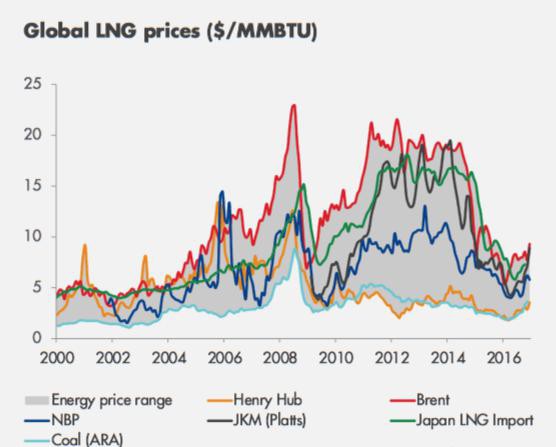

Platts: April spot LNG prices to Asia keep droppingPrices of spot liquefied natural gas for April delivery to northeast Asia continued their downward slide, falling 59.8% year over year to average $7.279 per million British thermal units, according to the latest Platts Japan/Korea Marker data for month-ahead delivery.

The figure reflects the daily JKM assessed between February 16 and March 13 expressed as a monthly average.

The year-over-year drop was largely attributed to weaker-than-expected demand from buyers in northeast Asia, where both electricity generation and utility gas usage are down on fairly mild temperatures over the winter season, and slowing economic growth. The fall followed the record year-over-year plunge of 61.7% seen the previous trading month.

Month over month, the April JKM dipped a more marginal 2.1%, suggesting that the downward spiral in prices was beginning to lose momentum.

The JKM had opened the trading month at $6.725/MMBtu on assessment date February 16 before beginning a steady uptick that saw the marker gain 97.5 cents over the period to close at $7.70/MMBtu on assessment date March 13.

This was the first sustained period of increases for the JKM since the beginning of 2015, although the market remained in backwardation, as demand is expected to slow further with the advent of northern hemisphere spring and warmer temperatures.

The U.K. National Balancing Point onshore gas market was seen to be providing some support to Asian spot prices, as NBP had been trading at a premium to JKM for the first half of the trading month.

“This afforded suppliers and traders the opportunity to deliver Atlantic-loading cargoes into the premium European onshore gas markets, while backfilling requirements in the Asian Pacific basin with cheaper spot cargoes,” said Stephanie Wilson, managing editor of Asia LNG at Platts. “This effectively tightened availability of cargoes in the Asian spot market as traders and sellers bought spot cargoes from various liquefaction projects, driving prices higher.”

At the beginning of the trading month, the NBP had been trading 40 cents above the JKM, but the spread narrowed as NBP prices slipped on warmer temperatures, while JKM trended higher as supply in the Asia Pacific basin tightened. The April JKM ended the trading month 80 cents higher than the NBP.

The effects of the higher NBP price were also felt in India, where importers looking to secure deliveries into the west of the country were forced to bid above other Asian buyers in order to attract cargoes from the Atlantic and Middle East.

Meanwhile, the price of possible competing fuel thermal coal decreased 11.5% year over year, while fuel oil was down 42.4% year over year.

PIRA: Asian demand outlook remains weak

PIRA Energy Group said it believes that the Asian demand outlook remains essentially weak and will not begin to turn around, even in the face of some of the lowest LNG prices in over a year.PIRA has pared down its demand growth outlook for the year. More LNG will be coming to Europe in the months ahead, which will backstop production losses in the Netherlands and feed renewed demand for gas in the power sector, now that spot and oil-indexed prices are lower.

According to PIRA, it is becoming clearer that the demand side of the gas fundamentals equation is becoming stronger, which does not surprise it given that PIRA has been forecasting 7% growth for Europe in 2015 since late last year.

The next major event to emerge in the gas market will be the beginning of peak maintenance season in Norway. The first major cuts will emerge in the second week of April, which helps to explain the 2-3p/th (€1-1.5/MWh) backwardation with the May contract.

The maintenance pattern has been set for some time, so no surprises appear to face the market in the weeks ahead, PIRA added.

Moody’s expects more LNG projects to get canceled

Liquefied natural gas suppliers are curtailing their capital budgets, amid low oil prices and a coming glut of new LNG supply from Australia and the US, Moody’s Investors Service says in its new report.Moody’s says low LNG prices will result in the cancellation of the vast majority of the nearly 30 liquefaction projects currently proposed in the US, 18 in western Canada, and four in eastern Canada.

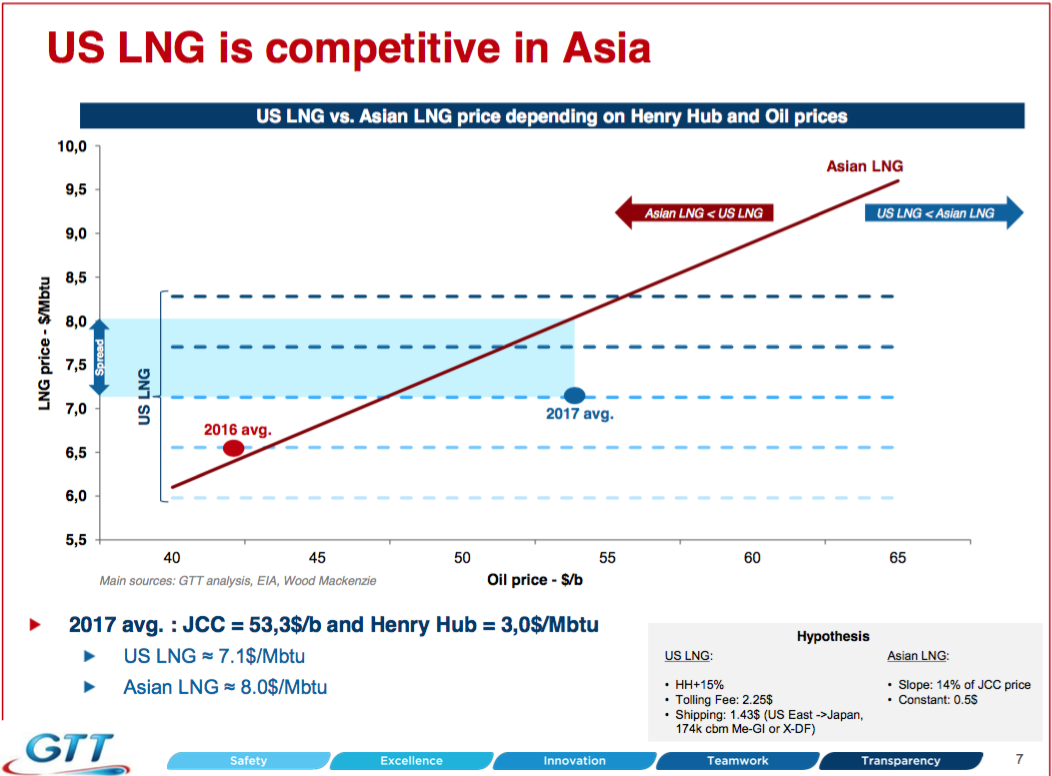

“The drop in international oil prices relative to US natural gas prices has wiped out the price advantage US LNG projects, reversing the wide differentials of the past four years that led Asian buyers to demand more Henry Hub-linked contracts for their LNG portfolios,” says Moody’s Senior Vice President Mihoko Manabe.

However, projects already under construction will continue as planned, which will lead to excess liquefaction capacity over the rest of this decade, Moddy’s said in the report. Notably, through 2017, Australia will see new capacity come online from roughly $180 billion in investments, which will result in a 25% increase in global liquefaction capacity. Likewise, the US is poised to become a net LNG exporter after the Sabine Pass liquefaction project goes into service in the fourth quarter of 2015.

Moody’s expects Cheniere Energy’s Corpus Christi project will be the likeliest project to move forward this year, since it is among the very few projects in advanced development that have secured sufficient commercial or financial backing to begin construction.

Lower oil prices will result in the deferral or cancellation of most other projects, especially this year. While some companies like Exxon Mobil can afford to be patient and wait several years until markets are more favorable, most other LNG sponsors have far less financial wherewithal, and some may be more eager to capitalize on the billions of dollars of upfront investments they have made already, sooner rather than later.

Greenfield projects on undeveloped property are much more expensive, involve more construction risk, and take longer to build than brownfield projects, which re-purpose existing LNG regasification sites. Greenfield projects are also frequently challenged by local opposition and occasionally by untested laws and regulations. Based on the public estimates of companies building new LNG liquefaction capacity, the median cost to build a US brownfield project is roughly $800 per ton of capacity, compared with the more advanced Australian greenfield projects, now estimated at around $3,400 per ton.

Through the end of the decade, Moody’s expects LNG demand will grow more slowly versus supply. China will be the biggest variable and most important driver of global LNG in that timeframe. India will see rapid growth, but not be as big of a player as China. Other more mature LNG markets in Japan, South Korea and Europe, which represent the bulk of demand, will have flat growth.

PIRA: optimization of LNG assets highly important

NYC-based PIRA Energy Group reports that Asian spot prices in the second quarter are once again buckling under pressure from weak global LNG fundamentals.As a result, the need to optimize every aspect of a company’s LNG assets has never been more important. At the essence of the purchase of the BG Group by Royal Dutch/Shell is the desire to achieve such a goal, with the latter rounding out its portfolio with the assets of the former. BG was heading into difficult territory on several fronts due to the collapse of crude prices, and the lack of an end-user market for the massive amount of LNG equity production and contracted supply on its books. On all these fronts, Shell is well positioned to help itself, PIRA writes in its report.

In the United States, EIA reported a bearish injection of 15 BCF relative to 9-11 BCF general refill expectations. Given the surprise, NYMEX price action was decisively geared to the downside as the contract fell to a new low of ~$2.52 after the release before closing the day at ~$2.53, down ~8¢. The current week’s HH price erosion ahead of last week’s EIA report signaled the market’s earliest physical reality phase. Seasonal heating load losses have begun to underscore the market’s difficult transition to at least partially offset those losses with rising gas-fired EG.

PIRA believes that Europe’s increasingly decisive role in LNG markets this summer will offer a preview of years to come. The unique aspect that Europe plays in the LNG market is that it is just as important for what it does not buy as for what it does due to the surge in re-exporting LNG. At the moment, European send-out from its wide variety of terminals is well down in April versus March for reasons that are not entirely clear. With Norwegian field and processor maintenance starting to shut down and last over the next two weeks, PIRA expects a strong turnaround in LNG flows that will take volumes back near March levels of around 150-mmcm/d.

EIA: FSRU’s prefered choice of smaller LNG markets

Floating regasification is a flexible, cost-effective way to receive and process shipments of liquefied natural gas.

Floating regasification is increasingly being used to meet natural gas demand in smaller markets, or as a temporary solution until onshore regasification facilities are built. Of four countries planning to begin importing LNG in 2015, three of them—Pakistan, Jordan, and Egypt—have chosen to do so using floating regasification rather than building full-scale onshore regasification facilities, U.S. Energy Information Administration said in a report.

Floating regasification involves the use of a specialized vessel called a floating storage and regasification unit, which is capable of transporting, storing, and regasifying LNG onboard. Floating regasification also requires either an offshore terminal, which typically includes a buoy and connecting undersea pipelines to transport regasified LNG to shore, or an onshore dockside receiving terminal. An FSRU can be purpose-built or be converted from a conventional LNG vessel.

Floating regasification offers a flexible, cost-effective solution for smaller or seasonal markets, and can be developed in less time than an onshore facility of comparable size. It can also serve as a temporary solution while permanent onshore facilities are constructed, and an FSRU can be redeployed elsewhere once construction is completed. There are currently 16 FSRUs functioning as both transportation and regasification vessels and 5 permanently moored regasification units that have been converted into FSRUs from conventional LNG vessels.

The use of floating regasification has grown rapidly in recent years, particularly in emerging markets facing short-term supply shortages. Floating regasification was first deployed in the U.S. Gulf of Mexico in 2005 and, since its deployment, it has been used in nine other countries: Argentina, Brazil, China, Indonesia, Israel, Italy, Kuwait, Lithuania, and the United Arab Emirates. Floating regasification capacity totaled 7.8 billion cubic feet per day at the end of 2014, representing 8% of the global installed regasification capacity, according to data from the International Gas Union. The three floating terminals that are scheduled to come online in 2015 will add 1.4 Bcf/d of new capacity.

Pakistan received its first LNG import cargo on March 27, 2015 after completing the development of receiving infrastructure for an offshore regasification terminal (0.3 Bcf/d capacity) located near Port Qasim, Karachi, which will be served by an FSRU.

Egypt, a traditional natural gas exporter, has formerly supplied natural gas to international buyers by both pipeline and through two LNG export terminals. Faced with domestic supply shortages because of rapid growth in natural gas consumption for power generation, Egypt suspended exports and scheduled all natural gas production for domestic consumption. Egypt began building infrastructure for an offshore regasification terminal in 2012, and recently contracted an FSRU. The terminal (0.5 Bcf/d capacity) received its first LNG cargo in early April.

Jordan lacks domestic energy reserves and has struggled to meet rapidly growing domestic natural gas demand after Egypt suspended pipeline exports to the country. Floating regasification became the only short-term option for natural gas supply, and Jordan has made significant progress in building regasification infrastructure since 2013. Jordan has secured an FSRU vessel that will be located offshore Aqaba, in the Red Sea, and the regasification terminal (0.5 Bcf/d capacity) is scheduled to come online in May 2015.

Uruguay is building infrastructure for an offshore regasification terminal (0.4 Bcf/d capacity) located near Montevideo to supply its domestic market and to potentially provide natural gas for export by pipeline to Argentina. Originally planned to come online in mid-2015, the regasification terminal has been delayed until 2016.

Four more floating regasification terminals totaling 1.3 Bcf/d are currently being developed in India, the Dominican Republic, Colombia, and the Philippines, with expected online dates in 2016-17. Floating regasification is likely to remain a preferred technology option for emerging markets because of its flexible deployment capabilities, smaller capacities, quick start-up, and relatively low costs compared with those of onshore terminals.

NBP ist der britische Benchmark-Preis

Bits aus dem Golar LNG Quartalsbericht:

.Bermuda-based Golar LNG said the market for chartering of LNG shipping has remained weak for the first half of 2015.

With close to 40 LNG carriers currently idle it will take some time to see a full recovery, Golar LNG said in its first quarter report on Wednesday.

...

According to Golar LNG, the first signs of an improved chartering environment, albeit from a very low base, are starting to become evident as new LNG production capacity is prepared for start-up and new markets for receiving LNG in Pakistan, Jordan and Egypt have started to receive their first cargoes.

...

In contrast to the market for LNG carriers, the level of enquiry and interest for FSRU’s is the strongest it has been for some time. The company is therefore very optimistic that the FSRU Tundra will be contracted on terms that make it a suitable near-mid-term dropdown candidate to Golar Partners, it said in the report.

IEA: gas demand growth to fall short of forecasts

Lower prices will feed a pick-up in global natural gas demand over the next five years following a marked slowdown in 2013 and 2014, the International Energy Agency said in its 2015 Medium-Term Gas Market report.Nevertheless, the growth in demand will fall short of previous forecasts, IEA said.

The report sees global demand rising by 2% per year by the end of the forecast period, compared with 2.3% projected in last year’s outlook. A significant reason for the downward revision is weaker gas demand in Asia, where persistently high gas prices until very recently caused consumers to switch to other options.

“One of the key – and largely unexpected – developments of 2014 was weak Asian demand,” said IEA Executive Director Maria van der Hoeven. “Indeed, the belief that Asia will take whatever quantity of gas at whatever price is no longer a given. The experience of the past two years has opened the gas industry’s eyes to a harsh reality: in a world of very cheap coal and falling costs for renewables, it was difficult for gas to compete.”

Asian gas prices are indexed, or linked, to those for oil. For several years, as oil prices hovered over USD 100/barrel, that meant Asian consumers were paying a hefty premium for their gas compared with buyers in other parts of the world. The rout in oil prices that began in mid-2014 has spilled over to natural gas markets in Asia and allowed the Asian premium to narrow substantially. But demand for gas in Asia may not recover as quickly as the drop in prices.

In the short term, gas demand will benefit from plunging prices, but the report adds that the long-term outlook for gas has become more uncertain – especially in Asia. A few Asian countries have decided to move ahead with plans to expand coal-fired power generation instead of gas-fired generation. “For the fuel to make sustained inroads in the energy mix, confidence in its long-term competitiveness must increase,” the report says.

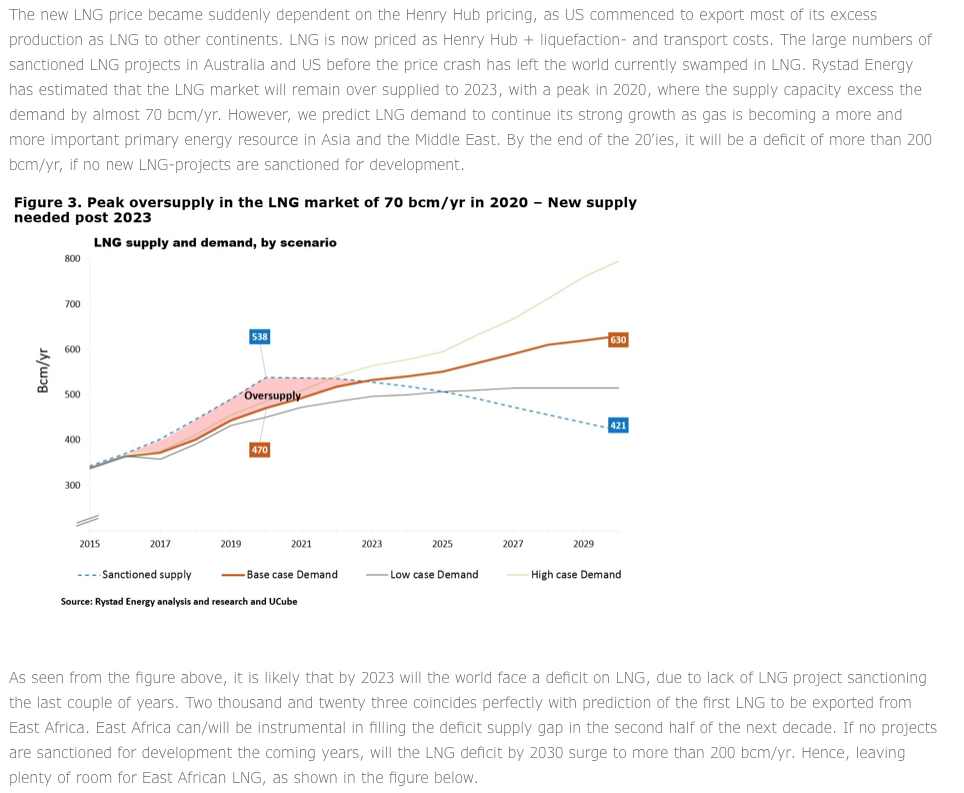

On the supply side, the report notes that lower oil prices will have a major impact on gas upstream and infrastructure investment. Companies are cutting capital expenditures and refocusing on core assets with fast returns, which will unavoidably lead to slower production growth over the medium term. Due to their capital-intensive nature and long lead times, liquefied natural gas projects are soft targets for investment reductions and several of them are likely to be delayed or even cancelled. If current low prices persist, LNG markets could start tightening substantially by 2020, with demand gradually absorbing the large supply upswing expected over the next three years.

In the short term, gas markets will need to cope with a flood of new LNG supplies. The report projects global LNG export capacity to increase by more than 40% by 2020, with 90% of the additions coming from Australia and the United States. Lower oil prices pose little risk to the timing of projects already under construction. The Australian projects are at an advanced stage of development, while project’s operators in the United States have limited price exposure once deals have been signed. New projects, however, will struggle to get off the ground at current prices.

As LNG supplies surge over the next five years, Europe is set to offer an important outlet. The report projects that the region’s LNG imports will roughly double between 2014 and 2020. Despite the foreseen increase in LNG intakes, the report does not anticipate a meaningful reduction in European imports from Russia, which will remain locked in a 150-160 bcm range. In OECD-Europe, domestic gas production is projected to continue to fall and to stand 25% below its 2010 level by 2020. Compounding the declining trend in production is a moderate recovery in demand. As a result, European gas import requirements are set to increase by almost one-third between 2014 and 2020.

Platts: July spot LNG prices to Asia plummet

Prices of spot liquefied natural gas for July delivery to Asia averaged $7.600 per million British thermal units, according to the latest Platts Japan/Korea Marker data for month-ahead delivery.The figure reflects the daily Platts JKM assessed between May 18 and June 15 expressed as a monthly average.

The marker, which gained 6.7% month over month, started the assessment period at $7.750/MMBtu, but weakened over the course of the month to be assessed at $7.300/MMBtu on June 15, even as Asian power utilities entered the traditionally high-demand summer season, when electricity generators have to cope with increased air conditioning use in the northern hemisphere. However, this was 41.3% lower than the same period last year.

“The July market started off very strongly due to production issues at Australia’s Northwest Shelf project that resulted in some sellers raising offers quite aggressively,” said Max Gostelow, Platts pricing analyst for Asia LNG. “However, the expected demand spike never did materialize, and it quickly became apparent that supply in the region still far outstripped demand, with projects in Malaysia, Indonesia, Papua New Guinea, Russia, and even Australia’s Darwin project, having surplus cargoes.”

While buyers in Taiwan and Japan entered the spot market to buy several cargoes, most of the demand for July delivery was focused on India, which was the premium market in the Asia Pacific basin. However, by the end of the month, Indian prices had fallen to $7.300/MMBtu, the same price as the JKM, on slower demand due to India’s monsoon season, and declining prices in competing markets –such as the UK onshore National Balancing Point gas market. This marked the end of a recent trend that saw Indian prices consistently above the JKM since April 13.

Meanwhile, the price of possible competing fuel thermal coal was up 0.8% on a month-over-month basis, while fuel oil was down 0.6% month over month during the May 18 to June 15 assessment period.

Teekay: 2015 short-term LNG charter rates weak

Short-term charter rates for LNG vessels are likely to remain weak for much of this year, but this is forecasted to be the bottom of the market.Talking about LNG trade, Teekay’s Research Projects Manager, Nicholas Schneider said that global LNG import growth has been moderate.

Global LNG imports increased 1% in 2014 to 239 million tonnes. During Q1-2015, global LNG imports were 2.4% higher than during the same quarter last year. Europe, Japan and Taiwan saw the largest increase in year-over-year LNG imports in Q1-2015, mostly due to lower LNG prices and new LNG supply in the Pacific region. However, increases in Europe and parts of Asia were largely offset by declines in South Korea and China. Mild winter weather across Asia resulted in high LNG inventories, reducing import demand, Schneider said in the first quarter LNG market update.

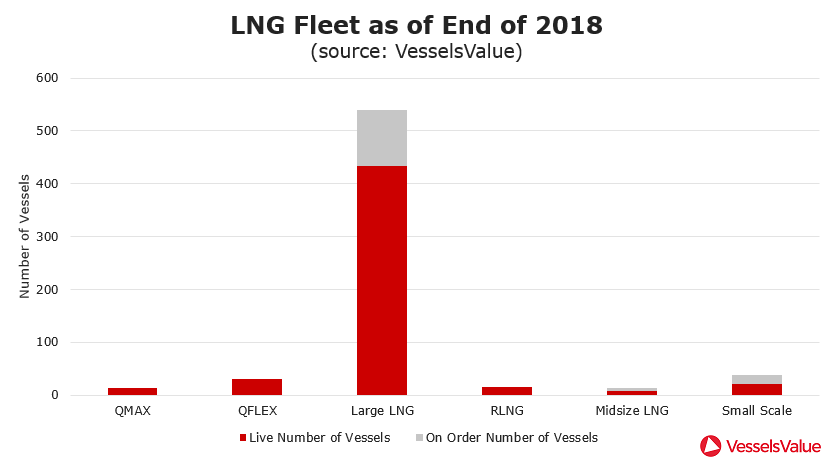

Teekay 2015 LNG short-term charter rates week, chart World LNG Fleet

The LNG carrier fleet now consists of 384 vessels and 137 newbuildings on order, not including regas vessels and small LNG carriers. Contracting for newbuild LNG vessels has slowed in 2015. After an all-time high of 63 orders in 2014, there have been only 10 orders to date in 2015. The LNG fleet increased by 9% in 2014 in terms of total cubic meter capacity, and another 2% in Q1-2015. There has been a significant increase in the number of vessels available on the spot / short-term market in Q1-2015. According to Fearnley, roughly 50 vessels were available as of May 2015, significantly more than the 10 – 20 vessels typically available throughout 2014. The increase in the number of vessels available on the spot market was due to new LNG vessel deliveries, project outages, and less long-haul arbitrage trade to Asia, Teekay said in the report.

LNG Charter Rates

Short-term charter rates declined in 2014, and have decreased further in Q1-2015 due to the increase in vessels available on the spot market. As of May 2015, short-term rates for modern vessels were roughly $30,000 per day, according to Clarksons.

Charter rates graph

Outlook

Schneider said the company expects short-term charter rates to remain weak throughout most of 2015. However, vessel utilization should improve towards year-end. The ongoing ramp-up of volumes from QC LNG in Australia, which shipped its first cargo in December 2014, along with the startup of four new exporting projects in the second half of 2015 will increase LNG trade.

Teekay’s long-term forecast to 2020 is largely unchanged from last quarter. Over 120 MTPA of new export capacity has reached a final investment decision (FID) and is in various stages of construction. In addition, despite lower LNG prices, new US projects continue to advance. Overall, Teekay expect vessel utilization to improve from 2016 onwards, Schneider said.

Study reveals surplus of future LNG projects

A new global gas study published by the London-based Carbon Tracker Initiative, identifies $283 billion of possible liquefied natural gas projects to 2025 that are likely to be surplus to requirements in a low demand scenario.A transition to a low carbon economy indicates there is some room for gas demand growth to 2040, unlike coal and oil use that must peak and decline. But if the world is to stay within a carbon budget that limits global warming to the 2⁰C U.N. target, energy companies will need to be selective over which gas projects they develop. This is also the case in a low demand scenario.

The study finds that over the next ten years $82 billion of potential capex in LNG plants will not be needed in Canada, $71 billion in the United States and $68 billion in Australia in the lower demand scenario. The value of unneeded LNG projects rises to $379 billion by 2035, according to the study.

“Investors should scrutinise the true potential for growth of LNG businesses over the next decade. The current oversupply of LNG means there is already a pipeline of projects waiting to come on stream. It is not clear whether these will be needed and generate value for shareholders,” said James Leaton, Carbon Tracker’s head of research.

The analysis, which completes the think-tank’s series of Carbon Supply Cost Curves, follows a similar approach to the oil and coal studies published in 2014 that identify high-carbon, high-cost projects for investors. It finds that new projects that rely on an LNG price of more than $10/mmBtu may not be needed over the next decade.

Shell’s agreed $70 billion takeover of BG will combine two companies with significant LNG projects over the next decade, making it by far the biggest player in the market. Shell has disclosed that it assumed oil prices will recover to $90 per barrel in making the offer, which translates to an oil-linked LNG price of $14-15/mmBtu based on typical contract pricing formulae. The analysis suggests that $85 billion of Shell’s and BG’s potential future LNG project options may not be needed under a low demand scenario to 2035.

The study finds that 16 of the world’s 20 biggest LNG companies are considering future major projects that are unlikely to be needed to meet demand to 2025. Only three, Eni, Cheniere and Noble, have additional projects that are needed to meet demand to 2025. The remaining company, Total, is not modelled as developing any new LNG projects over the course of the next decade beyond those already operational or under construction.

“The size of the gas industry in North America could fall short of industry projections – especially those expecting new LNG industries in the U.S. and Canada. Avoiding the combination of U.S. shale gas being exported as LNG will be important if we are to use the carbon budget most efficiently,” said Andrew Grant, lead analyst at Carbon Tracker and co-author of the report.

Gas has been perceived as the cleanest fossil fuel and huge investment has poured into developing new gas supplies. But there is a limit to the amount of gas that will be needed in a world committed to a 2⁰C limit, especially as there is currently a glut of LNG, and the cheapest sources are likely to be used first. The study analyses projects that companies are considering but have not yet made final investment decisions on.

“Natural gas is complex when seen in the context of a climate-constrained world. It can deliver better outcomes than coal, but gas must continue to work on reducing its fugitive emissions and there is a possibility that if it reaches too large a share of the energy mix then in the longer run this could still be incompatible with a 2⁰C outcome,” said Mark Fulton advisor to Carbon Tracker and a co-author of the report.

The study indicates that there is a perfect storm of factors in play to cause a rapid transition to a low-carbon energy system. Cheaper renewables, stronger energy efficiency measures, new storage technologies, higher carbon prices and fluctuating energy prices will all influence global gas demand. As renewables costs come down, some regions are likely to leapfrog over gas straight to renewables.

Recent calls from the European oil and gas industry for a global carbon price show the industry is under pressure to demonstrate its role in a low carbon future. Natural gas production results in the leak of methane, a highly potent greenhouse gas. These “fugitive emissions” must be kept below 3% for gas to maintain its climate benefit over coal, so minimising them should be a high priority for the industry.

“Fugitive emissions are on the run in the U.S. – regulators, investors and industry leaders are all out to ensure gas can demonstrate it has a climate advantage over coal,” said Anthony Hobley, CEO of Carbon Tracker.

The paper shows that the highest greenhouse gas emissions are caused by unconventional gas supplied via LNG infrastructure. Fortunately, however, it finds that only around 17% of LNG fed by North American Shale gas or Australian coal-bed methane is needed in a low demand scenario.

Over half of the unneeded LNG capex analysed relates to unconventional gas projects — like shale, tight gas and coal bed methane — in the United States and Canada. Foregoing this supply will limit future greenhouse gas emissions according to the study.

Carbon Tracker’s analysis breaks down demand growth into three main markets: North America, Europe and global LNG, which combined represent half of the global gas market; the remainder is largely produced and consumed domestically and therefore does not interact with the globally traded gas markets referenced. There is little evidence from the project economics that Europe could repeat the US shale boom.

“The economics shows UK unconventional supply will struggle to compete in the gas market over the next decade, and shale gas could only contribute a tiny volume if projects do go ahead,” concluded Andrew Grant.

PIRA: US LNG exports to mark new era

NYC-based PIRA Energy Group believes that the U.S. as LNG supplier on a large scale is the new era in the global gas industry.An initial Asian spot deal for $7.20/MMBtu sourced from Australia is actually a harbinger of a new era in global gas: that of the U.S. as LNG supplier on a large scale. It also strongly suggests that some good deals are available in Australia on FOB cargos to keep the trains operating at a higher capacity, PIRA said in its weekly report.

In the United States, the release of the EIA’s April Monthly came with a wealth of new supply data as the agency expanded coverage to include monthly production statistics from 10 additional states. The data were retroactive through the first quarter of 2015.

The third quarter is, by far and away, the lowest period for gas demand during the calendar year in Europe, says PIRA.

While the year-on-year growth in gas demand seen in the first half of the year will continue in the third quarter, the volume of growth in absolute terms will be so small as to be hardly noticeable in the gas balances. The third quarter is often useful for understanding the outlook for underlying gas demand growth, as the role of weather is severely diminished in most cases.

The recent heat wave will offer some support to gas demand, as it has already been seen in France, but the focus is on 3Q as a period when more about underlying gas demand in sectors such as industry is revealed.

The conclusion is that some recovery is occurring in places like Spain and the U.K., but efficiency gains in gas consumption and renewables substitution in emerging lower carbon markets continue to stymie growth in most other places.

Platts: August LNG spot prices to Asia slide

Prices of spot liquefied natural gas for August delivery to Asia averaged $7.395 per million British thermal units, according to latest Platts Japan/Korea Marker data for month-ahead delivery.The marker slid 2.7% month over month, with demand from end-users in northeast Asia extremely slow, despite the fact that August is traditionally the peak month of the summer buying season due to increased power generation.

“A slew of supply tenders from liquefaction projects in Asia largely capped the potential gains on the JKM early in the month,” said Platts’ Stephanie Wilson. “But traders and suppliers with short positions absorbed the bulk of these volumes.”

The August JKM opened the trading month at $7.20/MMBtu, the lowest level seen for August since 2010, before making the bulk of its 50 cent gain in the second half of the assessment period. This was largely driven by interest to either optimize or backfill short positions from traders and suppliers. This pushed the marker to close at $7.70.

This is the sixth consecutive month that JKM prices have been range bound between $7-8/MMBtu since declining from the $9-10/MMBtu level seen over January and February delivery.

Year over year, the JKM was down 34.9%, the slowest decline of 2015 so far, with August 2014 average prices at $11.365/MMBtu.

“New and existing buyers with emerging demand requirements in the Atlantic basin once again created opportunities for portfolio sellers and traders looking to optimize their deliveries by the end of the month, which pushed bids for the last few remaining cargoes higher,” said Wilson

Prices struggled to move beyond the $7.70/MMBtu mark in northeast Asia, however, as recent declines in the crude oil markets also provided a natural ceiling to prices.

Meanwhile, the price of possible competing fuel thermal coal also decreased 21.2% year over year, while fuel oil was also down 44.7% from the same month in 2014 as crude oil rebounded.

interessante Entwicklung:

3 "kleinere" legen zusammen und treten damit z.B. gegen Teekay LNG an;frage mich allerdings, wie das zu den jeweiligen Tochter-MLPs passt?

oder sind die genannten Schiffe schon die der MLPs?

Published: 13:01 CEST 18-08-2015 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009

Dynagas Ltd., GasLog Ltd. and Golar LNG Ltd. have entered into an agreement to establish and operate an LNG Carrier Pool

Monaco - August 18, 2015 - Dynagas Ltd. ("Dynagas"), GasLog Ltd. ("GasLog", NYSE: GLOG) and Golar LNG Ltd ("Golar", NASDAQ: GLNG) today jointly announce that they have entered into an LNG carrier pooling agreement (the "LNG Carrier Pool") to market their vessels, which are currently operating in the LNG shipping spot market.

The LNG Carrier Pool allows the participating owners to optimise the operation of the pool vessels through improved scheduling ability, cost efficiencies and common marketing. The objective of the LNG Carrier Pool is to serve the transportation requirements of a rapidly growing LNG shipping market by providing customers with reliable, more flexible, and innovative solutions to meet their increasingly complex shipping requirements.

The LNG Carrier Pool - to be named "The Cool Pool" - will initially consist of 14 modern, high quality and essentially equivalent vessels powered by fuel efficient Tri Fuel Diesel Electric ("TFDE") propulsion technology. The three owners' initial vessels eligible for contribution to The Cool Pool will be as follows: Dynagas: 3 vessels; Gaslog: 3 vessels; and Golar: 8 vessels. Each vessel owner will continue to be fully responsible for the manning and technical management of their respective vessels.

Tony Lauritzen has agreed to take overall responsibility for the running of The Cool Pool and Morten Nielsen has been appointed as Pool Manager, with the mandate to schedule employment for each pool vessel. The Cool Pool will focus exclusively on charters of 12 months duration or less. The scheduling of employment opportunities in excess of 12 months will remain the mandate of the respective vessel owner. If a pool vessel is scheduled by an owner for a charter that exceeds 12 months in duration such vessel will cease to form part of the LNG Carrier Pool's fleet.

All three owners have expressed enthusiasm for the benefits the pool is anticipated to deliver to charterers and participants alike. The LNG Carrier Pool provides the opportunity to deliver benefits, including COAs and other contract forms not previously executed in LNG shipping. Importantly all three vessel owners are experienced LNG Carrier operators with substantial track records offering potential charterers the best available level of safe and reliable ship management.

It is anticipated that The Cool Pool will commence operation in September 2015.

Clarksons: more newbuilds needed to cover LNG demand

Shipping services group Clarksons said that the current order book for LNG tankers will need to be added to significantly to keep pace with demand.The London-based company revealed in its half-year results report on Monday that it expects LNG trade to grow at around 5% CAGR through to 2025. This will add an additional 160 million tonnes of new demand.

“We must await the new waves of supply coming between 2017-2019 as a catalyst for a more bullish sentiment from the owning community,” Clarksons said.

The increase in volume over the next ten years means that the current order book for LNG vessels will need to be added to significantly.

According to Clarksons, the first six months of this year saw rates for the most modern LNG vessels slip from US$72,000 per day in 2014 to a disappointing US$41,000 per day average so far this year.

The older steam turbine vessels suffered equal pain sliding from US$49,000 per day down to US$29,000 per day, the company added.

zum ersten Mal seit Langem ein Anstieg:

Japan’s spot LNG price climbs in AugustJapan’s price of spot liquefied natural gas contracted in August averaged US$8.1 per mmBtu on DES basis, up from US$7.9 per mmBtu in July, according to the Ministry of Economy, Trade and Industry (METI).

The average price of spot LNG imported into Japan that arrived in August 2015 was at US$7.7 per mmBtu, the data shows.

Only spot LNG cargoes are taken into account in this assessments, excluding short, medium and long-term contract cargoes, as well as those linked to a particular price index.

EIA:

The monthly natural gas share of total U.S. electricity generation surpassed the coal share in July for the second time ever, with natural gas fueling 35% of total generation to coal’s 34.9% share, the U.S. EIA said in a report.Compared to the previous July, coal-fired generation fell in every region of the country, while natural gas-fired generation rose in every region.

Earlier this year, natural gas-fired generation surpassed generation from coal for the first time. This switch occurred in April, generally the month with the lowest demand for electricity. In times of low electricity demand, many generators schedule routine maintenance, and utilization rates for generating plants are low. As demand increases during the summer, output from both coal- and natural gas-fired generators increases.

Total electricity demand, excluding demand met by distributed (largely renewable) sources, increased from 384 billion kilowatthours (kWh) in July 2014 to 398 billion kWh in July 2015. Coal-fired generation fell from 150 billion kWh to 139 billion kWh, while natural gas-fired generation rose from 114 billion kWh to 140 billion kWh. This decrease in coal and increase in natural gas occurred in every region of the country: the Mid-Atlantic region had the largest decline in coal-fired generation, followed by Texas, while the Southeast and Central regions had the largest increases in natural gas-fired generation.

Natural gas prices continue to be relatively low. The monthly average price at Henry Hub, a natural gas benchmark, declined from $4.14 per million Btu (MMBtu) in July 2014 to $2.91/MMBtu in July 2015, and it has since fallen to $2.72/MMBtu in September. The average price of wholesale natural gas in New York City during July ($2.06/MMBtu) was below the average wholesale price of Central Appalachian coal ($2.31/MMBtu), even before accounting for differences in fuel conversion efficiencies between coal- and natural gas-fired generators. Prior to this year, the last time electricity generation from natural gas came close to surpassing coal-fired generation was April 2012, when monthly average spot prices for natural gas were near $2.00/MMBtu. Power generation shares for coal and natural gas diverged as natural gas spot prices rose to about $3.50/MMBtu by the end of 2012.

Electricity generation dispatch decisions, especially between coal and natural gas, are complex. The ultimate level of generation reflects delivered costs, emission costs (where applicable), heat rates, supply availability, and other factors in fuel markets.

DW: global LNG Capex to rise in 2016-2020, focus on liquefaction projects

Douglas-Westwood forecasts capital expenditure on global LNG facilities will total $241 billion between 2016 and 2020, rising 34 percent compared to the preceding five-year period.DW’s Hannah Lewendon, said, “Capex on LNG facilities has risen substantially in recent years, due mainly to the growth in the global economy which has been driving demand for natural gas. By far the largest proportion of the total expenditure will be attributed to liquefaction projects. Global expenditure in this segment is forecast to total $160 billion over the next five years.”

The consultancy puts the focus shift down to a weakened demand growth in Asia and the oil price slump as well as the pause in commitments to new LNG projects. Spending on LNG carriers is expected to account for 12 percent of the total expenditure, mostly attributed to Asia.

“The Australasian LNG construction boom looks to be coming to an end as the country prepares to enter a new production phase. Massive investments in large LNG projects will result in seven new LNG plants becoming operational over the next few years. With commodity prices depressed, future LNG projects are uncertain, as those which are currently in Front End Engineering Design (FEED) are struggling to make economic sense in the low price environment,” added Mark Adeosun of Douglas-Westwood.

Adeosun also noted that the slow approval process for onshore projects in the United States limits the growth rate of LNG expenditure in the region over 2016-2020.

DW predicts that only six LNG export terminals will be built during this period out of 11 planned. In total, there are 20 us LNG export projects proposed for the future.

Still, DW expects that North America will play a significant role in the market by the end of the forecast period.

Singapore plans to establish domestic gas trading market

Singapore is aiming to establish a domestic gas trading market as it looks to become the centre of LNG trading in Asia.“To enhance the trading environment, we plan to establish a Secondary Gas Trading Market (SGTM) in Singapore, where gas buyers and sellers can trade gas on a short-term basis domestically,” S. Iswaran, Minister for Trade and Industry, said on Monday at the opening of Singapore’s International Energy Week (SIEW).

“An SGTM can yield several potential benefits. First, it will allow domestic gas price discovery that reflects Singapore’s demand and supply conditions. Second, gas users will be able to complement their portfolio of long and medium-term gas supplies with short-term supplies, so that they can optimise their gas supply portfolios and mitigate price volatility,” Iswaran said.

According to Iswaran, such a market will enhance Singapore’s position as a hub for LNG and gas trading activities and pave the way for the potential establishment of a gas futures market.

The Energy Market Authority will take steps to systematically develop the market, following reviews of gas trading in other jurisdictions such as Belgium, the Netherlands and the UK, he said.

“EMA will issue a consultation paper today to seek industry feedback on a proposed market design and implementation roadmap, as well as on the establishment of an industry working group to deliberate on the details for implementing an SGTM in Singapore,” he added.

WoodMac: new supply to test spot LNG price floor

With 130 mtpa of additional LNG supply set to reach the market over the next five years new local floors for spot prices will be tested, unlocking new demand and curtailing supply, with global pricing implications, according to Wood Mackenzie.Noel Tomnay of Wood Mackenzie says, “The last LNG oversupply between 2008-10 came about when Qatar ramped up its LNG output and the market had to absorb 50 mmtpa of new LNG, at a time when demand growth had slowed. As a result, gas spot prices in Europe traded under US$4 per million British Thermal Unit through the summer of 2009 and with no market in Asia, those prices were still enough to attract LNG cargoes to Europe, including from Australia.”

The LNG market is facing another oversupply which is likely to be deeper and will persist for some years. Prices in Asia will be lower than in Europe, and at their worst, between 2017-19, while prices in Europe will not reach a low point until 2020.

“The key question the industry is wrestling with is: how low will prices go?” Tomnay asks.

Wood Mackenzie asserts in a report that China’s market policies will be key. While more new LNG markets will emerge with lower gas prices, particularly if oil prices climb, more liberalised market conditions in China could enable it to absorb a lot more LNG, mitigating the impact of the LNG oversupply on price. This includes improved regasification infrastructure access, reductions in regulated gas prices and allowing the curtailment of high-cost indigenous gas.

Tomnay elaborates, “It is likely that output from some high-cost gas will be curtailed but protectionist measures will restrict China’s willingness to fully replace indigenous gas with lower-priced LNG, dampening the potential supply response.”

New demand for gas and LNG could be created through the displacement of coal in power generation, WoodMac says. The gas price at which coal will be displaced, a soft floor for gas prices, will be determined, in part, by the price of coal.

“Assuming higher ARA coal prices in Europe of US$70/tonne and Japanese coal prices of US$80/t (CFR), a floor price for gas in Europe and Asia should be maintained at prices above US$5.00/mmbtu. This should be sufficiently high to avoid US LNG being shut-in,” Tomnay explains.

However, lower coal prices, possibly a consequence of reduced demand through displacement by gas, risks pulling both gas and coal prices down further Wood Mackenzie says.

“At prevailing ARA coal prices of US$50/t and Japanese coal prices of US$60/t CFR, a floor price for gas in Europe and Asia could go down to prices at which many US LNG exports fail to cover cash costs, around US$4/mmbtu. This would force US LNG exporters to consider shutting-in for periods, a move which would depress US gas prices,” Tomnay adds.

Tomnay also explains why the behaviour of major suppliers, most notably Russia, will be key.

“We could see major suppliers withdraw gas from the market, thereby supporting LNG spot prices. It was Gazprom’s withdrawal of 20 bcm per annum of pipe gas from Europe between 2008-10, equivalent to 15 mmtpa of LNG, that prevented spot prices from remaining low,” Tomnay says.

He concludes that at periods of severe oversupply, Russian gas supply behaviour will again be key to gas price formation in Europe – and this time in Asia and even the US too.

Drewry: European LNG demand growth will not raise freight rates

LNG shipping freight rates continue to be under pressure from weak Asian demand and a growing fleet, shipping consultancy Drewry said in a report.Shipowners are now pinning hopes on a revival in European demand. However, European LNG demand growth will not be sufficient to raise freight rates, according to Drewry.

Until the recent fall in oil prices, Asian LNG prices were at a premium compared to piped gas prices in Europe. European traders therefore preferred to re-export cargoes to more profitable Asian markets.

Drewry’s report says this helped to create substantial shipping demand as vessels found employment on both legs of the trade, first in import and then in re-export.

However, as Asian demand has weakened the price differential between Asian LNG and European piped gas has eroded, which has hit re-exports from Europe. Spain, the biggest re-exporter from Europe, shipped 1.3 million tonnes of LNG during the first eight months of the current year, down 40% over the same period last year-

But can Europe be the game changer? The recent fall in oil prices has made LNG competitive compared with piped gas, which has the potential to create more demand for LNG in European countries as they seek to diversify their supply base.

However, a growing preference for renewable sources of energy and weakening domestic gas consumption will cap any major surge in LNG demand in Europe. Asia will continue to be the main hub for LNG demand and trade, the report added.

Antwort auf Beitrag Nr.: 50.982.723 von R-BgO am 02.11.15 09:32:54

finde ich vom Volumen her jetzt nicht so dramatisch

finde ich vom Volumen her jetzt nicht so dramatisch

LPG-Markt

nachdem ich einige Werte jetzt ungefähr 1 Jahr im Depot habe, fange ich an die Strukturen besser zu verstehen:Wichtig scheint mir, dass es mindestens drei ziemlich unterschiedliche Teilmärkte gibt, die sich nach den Größenklassen der Schiffe unterscheiden (VLGC, Handysize und small).

VLGC-Charterraten sind die letzten Jahre durch die Decke gegangen, weswegen die Unternehmen dort sich so dumm & dusselig verdienen (Avance, BW). Diese beiden schützen auch irre viel aus, so in der Art wie die ganzen Frederiksen-companies. So hat man Kohle hinter der Brandmauer, wenn es mal in die andere Richtung geht. Es wird nämlich investiert wie blöde. Bisher scheint es mir aber, dass der Markt skeptischer war als die tatsächliche Entwicklung.

Dorian ist ein Sonderfall, sie befinden sich in einem gigantischen VLGC-Neubauprogramm und die Erträge sprießen gerade erst noch. Ist der einzige Wert, der heute nicht deutlich unter meinem ursprünglichen Einstieg notiert.

In den beiden anderen Märkten sind die Raten nur wenig gestiegen, oder sogar nahe am historischen Tief (Small). Hier sind Navigator (Handysize) und Stealth (small) unterwegs. Erstere verdienen ordentlich, letztere schreiben eher 'ne schwarze Null und zahlen keine Divi.

http://www.lngworldnews.com/tekay-global-lng-trade-up-in-fir…

LNG Charter Rates

As of early November 2015, short-term charter rates for modern diesel-electric vessels were $28,000 – $35,000 per day, according to Affinity LNG.

Outlook

LNG fleet utilization should gradually increase through 2016. Nine separate LNG projects are scheduled to start or further ramp-up in 2016, including four large projects scheduled to start over the next six months, the report says.

While LNG vessel demand will increase next year, so will fleet supply; 46 newbuild LNG vessels are scheduled to deliver by the end of 2016. Any further export project delays or startup problems could cause vessels to deliver in advance of cargos, which could keep short-term rates near current levels through 2016.

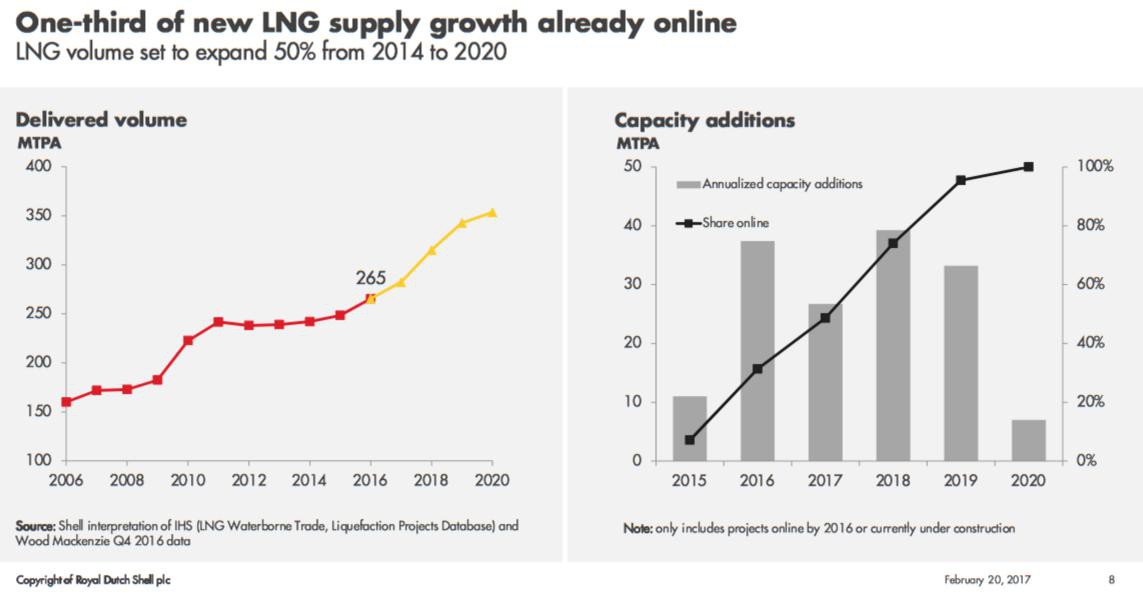

In the longer-term, there is approximately 140 million tonnes per annum (MTPA) of export capacity currently under construction. According to the International Energy Agency, this will increase LNG trade to approximately 350 MTPA in 2020, roughly a 45% increase over 2014 volumes.

While LNG trade will grow strongly to 2020, low energy prices are having an impact on LNG export projects currently in planning; several export projects that were scheduled to take a final investment decision (FID) in 2015 now appear likely to delay their decision to 2016 or later.

LNG Charter Rates

As of early November 2015, short-term charter rates for modern diesel-electric vessels were $28,000 – $35,000 per day, according to Affinity LNG.

Outlook

LNG fleet utilization should gradually increase through 2016. Nine separate LNG projects are scheduled to start or further ramp-up in 2016, including four large projects scheduled to start over the next six months, the report says.

While LNG vessel demand will increase next year, so will fleet supply; 46 newbuild LNG vessels are scheduled to deliver by the end of 2016. Any further export project delays or startup problems could cause vessels to deliver in advance of cargos, which could keep short-term rates near current levels through 2016.

In the longer-term, there is approximately 140 million tonnes per annum (MTPA) of export capacity currently under construction. According to the International Energy Agency, this will increase LNG trade to approximately 350 MTPA in 2020, roughly a 45% increase over 2014 volumes.

While LNG trade will grow strongly to 2020, low energy prices are having an impact on LNG export projects currently in planning; several export projects that were scheduled to take a final investment decision (FID) in 2015 now appear likely to delay their decision to 2016 or later.

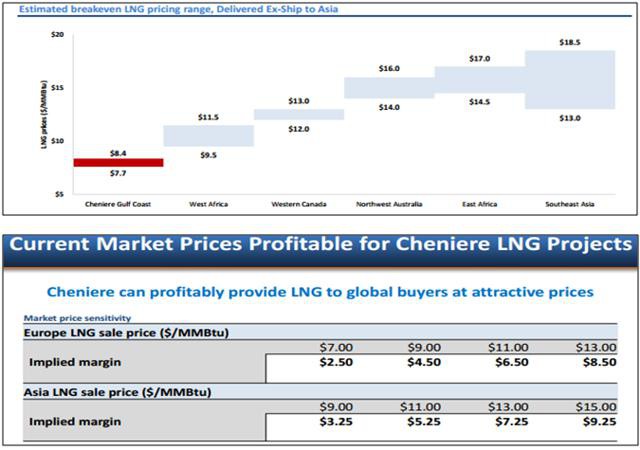

Cheniere Energy - Don't Miss This Opportunity

http://seekingalpha.com/article/3696846-cheniere-energy-dont…

Oberkassler

Antwort auf Beitrag Nr.: 51.157.188 von Oberkassel am 23.11.15 19:37:33

2) das Posting würde m.E. besser in den Cheniere-Thread (Thread: Öl, Erdgas: US-Erdgas bald gratis? Chancen für Value-Investoren!) passen, da es nur von einer Firma und weniger vom Markt an sich handelt

3) finde ich den referenzierten Artikel doch eher dünn, u.a. daran zu sehen, dass die prognostizierten Preisbänder derzeit weit verlassen sind (stelle fest, dass bei SA eine -gefühlt- zunehmende Anzahl von Artikeln eher als Selbstzweck geschrieben zu werden scheinen, denn als "genuine invest research")

1) Freue mich sehr, dass sich auch mal jemand anderes hierher "verirrt" und mitmacht

aber2) das Posting würde m.E. besser in den Cheniere-Thread (Thread: Öl, Erdgas: US-Erdgas bald gratis? Chancen für Value-Investoren!) passen, da es nur von einer Firma und weniger vom Markt an sich handelt

3) finde ich den referenzierten Artikel doch eher dünn, u.a. daran zu sehen, dass die prognostizierten Preisbänder derzeit weit verlassen sind (stelle fest, dass bei SA eine -gefühlt- zunehmende Anzahl von Artikeln eher als Selbstzweck geschrieben zu werden scheinen, denn als "genuine invest research")

hat-tip to Big Charly:

http://www.lngworldshipping.com/news/view,lng-carrier-market…LNG carrier market ‘will reach US$7.7 billion in 2016’

Mon 14 Dec 2015 by Karen Thomas

Oversupply will slow new spending on LNG carriers from 2021, Visiongain predicts. (Matthew Fuentes)

Capital expenditure on new LNG carriers will drop in 2016-2026, despite global fleet growth and new production capacity coming to market in Australia and North America as oversupply slows new spending on fleet from 2021, according to a new market study from Visiongain.

The world market for LNG carriers will reach nearly US$7.7 billion next year but “an oversupplied market by 2020 will lead to less spending”, according to Visiongain’s LNG Carrier Market Report 2016-2026.

Charter rates have hit their lowest level this decade, thanks to a large number of deliveries in 2013 and 2014, to delays to LNG-export projects and to slowing demand in Asia.

The report highlights the slump in average day rates from a high of US$150,000 a day after the 2012 Fukushima nuclear incident in 2012 to US$80,000 a day in 2014 and to US$40,000 for long-term charters and US$25,000 for spot deals by September this year.

“The LNG carrier market is driven by the arbitrage opportunity that exists between the supply side – North America, Africa, Qatar, Australia and Russia – and demand side, east Asia, Europe and emerging importers of the LNG market,” Visiongain says.

“Very strong dynamics on both sides have created an opportunity for profits to be made. However, this opportunity can be constrained by lack of liquefaction capacity or LNG carriers.”

The report predicts that capital expenditure on LNG carriers will reflect the need for a more flexible but also a more specialised fleet, by growth in long-haul shipments and by growth in spot-traded cargoes.

New trades will emerge, including icebound passages, such as the northern sea route linking Russia to Japan, longer-haul routes from North America to east Asia and shorter routes between the US and Europe.

Visiongain also flags growth prospects for small-scale LNG carriers and new hub-and-spoke trading from larger import hubs to new, regional markets. It concludes: “A growing LNG spot market serves to underpin and underwrite capex on LNG carriers.

“Declining charter rates could restrain orders. However, extra capacity coming online in 2016-2020 will push utilisation rates back and create demand for additional carrying capacity.”

LNG-Export Projekte 2013-2021 Kosten pro Tonne

LNG World Shipping hat die Kosten pro Tonne jährlichen Produktionskapazität für 37 LNG-Projekte im Spiel über den Zeitraum 2013 bis 2021 geprüft. Die Ergebnisse unterstreichen einige offensichtliche Schlussfolgerungen - wie beispielsweise die Tatsache, dass Australien hat eine High-Cost-Ort, um sieben herausfordernde, World-Projekte in Betrieb gleichzeitig zu bringen - und viele mehr subtilen Schlußfolgerungen.Das Projekt-Kostenprüfung umfasste Regelungen seit 2013 abgeschlossen, der im Bau, denen in einem fortgeschrittenen Planungsphase und für eine pre-2021 Start-up und mehrere, die in den letzten drei Jahren aufgehoben worden sind, ausgerichtet..............................................

http://www.lngworldshipping.com/news/view,lng-project-costs-…

Douglas-Westwood: LNG Capex growth to continue

Energy industry consultancy, Douglas-Westwood (DW), predicts that the trend of growing capital expenditure (Capex) on LNG facilities will continue, reaching US$241 billion between 2016 and 2020.The Capex rise has mainly been spurred on by the growth in the global economy that has driven demand for natural gas, the DW report issued on Tuesday revealed.

DW’s Hannah Lewendon, stated, “Emissions from the burning of fossil fuels has become an increasingly important consideration in recent decades. In light of environmental damage from energy consumption, there has been movement towards the use of cleaner fuels.”

Natural gas is seen as a mechanism for reducing emissions as it only emits half of the greenhouse gases of coal.

Lewendon added the low-carbon roadmap agreed at the recently concluded COP21 will expedite the shift towards gas that is regarded as the “bridging fuel” to renewables in the future. Tighter environmental legislation will also animate the transport and power generation industries in using LNG as an alternative fuel, in addition to the price arbitrage effect.

Mark Adeosun of DW concluded, “In the decades ahead, natural gas will play an increasingly significant role in meeting the world’s energy demand. The long-term potential of the LNG industry is evident as vast reserves of natural gas found in remote regions such as East Africa and the Arctic present considerable LNG opportunities for the future.”

He noted that in the short-term, LNG spot price declined rapidly due to a combination of low oil prices and a fall in Asian economic growth forecast, adding that low hydrocarbon prices remain a concern as most LNG contracts are linked to oil price.

“Therefore, the global LNG Capex outlook to 2020 will be characterised by a change in regional spend. The weaker projected expenditure in 2016 will be a result of a pause in commitments to new LNG projects,” according to Adeosun.

He revealed that, out of the total expenditure over the forecast period 66 percent will go to the liquefaction projects, import facilities will take up 21 percent while LNG carrier newbuilds will take 13 percent of total expenditure between 2016 and 2020.

Preispunkt LNG:

..

Petronet, RasGas agree new LNG price, penalty waived

India’s largest LNG importer, Petronet said it has come to an agreement with RasGas of Qatar to revise the 7.5 mtpa LNG import deal terms significantly cutting the price.

Under the initial deal signed in 1999, Petronet agreed to pay about US$13 per million British thermal units, while the revised price is reduced to around US$6 to US$7, according to India’s minister for petroleum and natural gas, Dharmendra Pradhan.

The two companies said in a joint statement last week that the revised price will be linked to the oil index that closely reflects the prevailing oil prices.

Additionally, Petronet has avoided paying the US$1.5 billion penalty for taking less LNG than it contracted for 2015, but under the new agreement, it will have to take and pay for all of the volumes it has not taken in 2015 during the remaining term of the 25-year SPA.

Petronet also agreed to buy additional 1 mtpa of LNG from RasGas for further sale to Indian Oil, Bharat Petroleum, GAIL and Gujarat State Petroleum, with the delivery starting in 2016.

US-Gasmarkt aus Traderperspektive:

http://econintersect.com/pages/investing/investing.php?post=…Auszug:

What I do know is one way or another natural gas somehow finds its way back to the $5 MMBtu level even during the shale revolution. I expect that sometime over the next three years natural gas finds its way back to this 'natural gravitational' market price. It may even make several trips up to $5 MMBtu over the course of the next three years. It was just over $7 MMBtu two winters ago after the last crushing of the market back in 2012 to below $2 MMBtu. It took just two short years to really move well above the $5 level.

Hallo ich brauch mal Hilfe bitte.

Wo finde ich die LPG Charterraten für den letzten Monat?

Firmen wie Avance Gas und Co verdienen sich dumm und dähmlich und schreiben gute Gewinne zuzeit.

Ist es richtig das die USA in großen Stil in das Erdgas und LNG Geschäft einsteigen wollen?Dann müssten Theoretisch Schiffe fehlen.

Wo finde ich die LPG Charterraten für den letzten Monat?

Firmen wie Avance Gas und Co verdienen sich dumm und dähmlich und schreiben gute Gewinne zuzeit.

Ist es richtig das die USA in großen Stil in das Erdgas und LNG Geschäft einsteigen wollen?Dann müssten Theoretisch Schiffe fehlen.

Nicht einfach an die Daten zu kommen

http://www.koenig-cie.de/de/node/3170http://www.harperpetersen.com/harpex/harpexVP.do

der Öl und Gasmarkt Transportation sehr interessant !

BW LPG Aktie [WKN: A1W81N / ISIN: BMG173841013]

Dividende von circa 17%, KGV 5 !

Interessanter Markt

Peer Group Vergleich Dorian LPG WKN A11356

Torm WKN: A14ZY9

Exmar WKN: 812680

Hoegh LNG Partners L.P

Tekay Copoeration

Muss mich da weiter reinarbeiten.

Oberkassler

Antwort auf Beitrag Nr.: 51.457.878 von Oberkassel am 10.01.16 20:28:00

Dorian ist ein LPG-Großtanker-Player (wie BW, Avance,..)

Torm habe ich mir lange nicht angesehen, war früher aber ein einfacher Öltankerbetreiber

Höegh LNG Partners, ist ein MLP, der nur die "sicheren" LNG-FSRU-Projekte der Mutter betreibt

Teekay Corp ist wie ein kleiner Fonds, als Holding der MLP: TK LNG, TK Offshore, TK Tankers.

Sind also in mehr oder weniger unterschiedlichen Märkten unterwegs.

Zu allen Werten gibt es Threads...

hatte am Anfang des Threads, in Post #2 mal versucht, einen Überblick zu geben...

Zitat von Oberkassel: http://www.koenig-cie.de/de/node/3170

http://www.harperpetersen.com/harpex/harpexVP.do

der Öl und Gasmarkt Transportation sehr interessant !

BW LPG Aktie [WKN: A1W81N / ISIN: BMG173841013]

Dividende von circa 17%, KGV 5 !

Interessanter Markt

Peer Group Vergleich Dorian LPG WKN A11356

Torm WKN: A14ZY9

Exmar WKN: 812680

Hoegh LNG Partners L.P

Tekay Copoeration

Muss mich da weiter reinarbeiten.

Oberkassler

Dorian ist ein LPG-Großtanker-Player (wie BW, Avance,..)

Torm habe ich mir lange nicht angesehen, war früher aber ein einfacher Öltankerbetreiber

Höegh LNG Partners, ist ein MLP, der nur die "sicheren" LNG-FSRU-Projekte der Mutter betreibt

Teekay Corp ist wie ein kleiner Fonds, als Holding der MLP: TK LNG, TK Offshore, TK Tankers.

Sind also in mehr oder weniger unterschiedlichen Märkten unterwegs.

Zu allen Werten gibt es Threads...

WoodMac: LNG growth wave to come post 2016

WoodMac’s review of the LNG industry reveals that the 2015 market was characterised by weaker Asian demand which dropped 2 percent forcing LNG players to shift focus to developing markets and employing new regasification capacity.Despite weakened demand and the impact of the oil price crash, LNG production remained high throughout the year reaching 250 million tonnes in 2015, up 4 million tons on 2014, primarily due to a number of key project start-ups, the review shows.

...

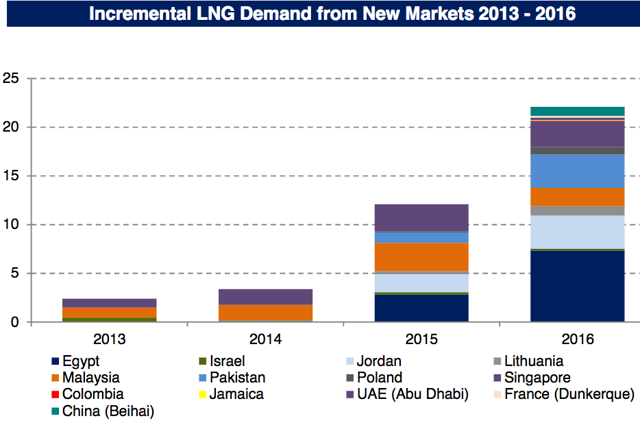

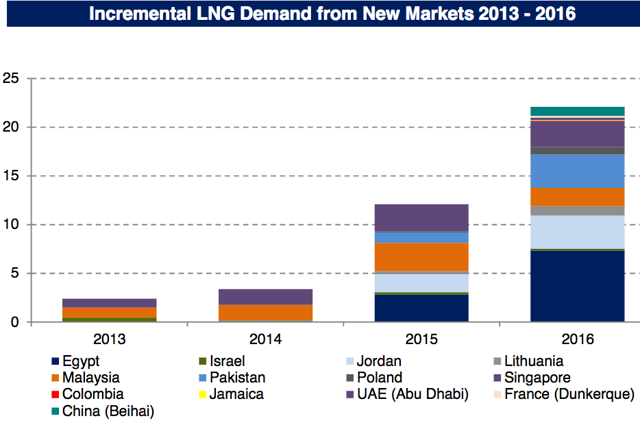

Chong adds that new buyers played a crucial role in balancing the market during 2015 making up for the decline in Asian LNG demand. Jordan, Egypt and Pakistan, newcomers to the LNG market together imported 5.8 million tons of liquefied natural gas in 2015. According to Chong, this trend is expected to continue in 2016 as new customers and regasification capacity remains key.

...

Giles Farrer of Wood Mackenzie adds that the increase is primarily due to the start-up of key coal seam gas projects in Australia, BG’s QC LNG in January and Santos’ GLNG in August 2015.

Adding to that, ConocoPhillips-operated APLNG plant recently shipped its first cargo, which according to Farrer, moves Australia closer to becoming the world’s largest supplier of LNG by 2019, as the three Curtis Island facilities bring a total of 26.5 mtpa to the market.

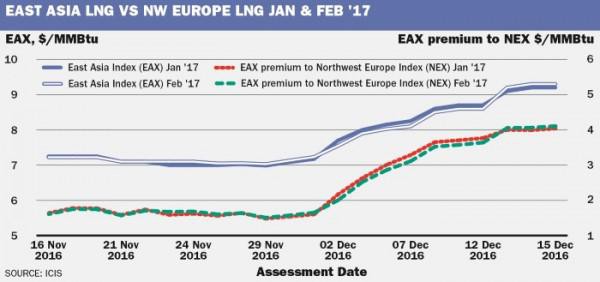

“The fall in Asian demand and the rise in Australian supply, meant some Atlantic LNG volumes were squeezed out of the market and Atlantic to Pacific trade flows fell by 16% – from 96 mtpa to 82 mtpa. With the lower oil price driving down Asian LNG prices, the spread between European gas prices and Asian LNG prices narrowed. Consequently, companies with Atlantic supply were drawn to European markets offering more attractive returns,” Farrer adds.

...

He said the growth wave is set to come after 2016 noting that several key dynamics will affect LNG prices and flows, namely, the coal to gas competition in both Europe and Asia, Chinese energy policy as well as access to regas capacity in Europe and contract flexibility.

Cedigaz: European LNG net imports up in 2015

In 2015, LNG net imports grew by 16.6 percent in Europe as demand for natural gas grew in the region, according to the international association for natural gas, Cedigaz.