ALAMOS GOLD INC. (NEW) - Die Neue --- Hält dieses Unternehmen . . . . . (Seite 23)

eröffnet am 14.07.15 23:59:19 von

neuester Beitrag 12.04.24 14:33:41 von

neuester Beitrag 12.04.24 14:33:41 von

Beiträge: 438

ID: 1.215.750

ID: 1.215.750

Aufrufe heute: 0

Gesamt: 32.699

Gesamt: 32.699

Aktive User: 0

ISIN: CA0115321089 · WKN: A14WBB · Symbol: AGI

20,560

CAD

-0,10 %

-0,020 CAD

Letzter Kurs 17.04.24 Toronto

Neuigkeiten

15.04.24 · wallstreetONLINE Redaktion |

11.04.24 · LYNX Analysen Anzeige |

06.04.24 · wallstreetONLINE Redaktion |

30.03.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3900 | +13,01 | |

| 0,7000 | +11,11 | |

| 1,4000 | +10,24 | |

| 37,18 | +10,00 | |

| 17,930 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5900 | -8,09 | |

| 2,1800 | -9,17 | |

| 69,05 | -9,48 | |

| 154,95 | -9,76 | |

| 0,7997 | -12,16 |

Beitrag zu dieser Diskussion schreiben

Und schon wieder eine neue Präsentation von ALAMOS GOLD

Corporate PresentationJune 2019https://s1.q4cdn.com/556167425/files/doc_presentations/2019/…

Da haben wir ja doch noch einiges von ALAMOS GOLD in diesem Jahr zu erwarten.

Alamos Gold Receives Phase II Expansion Permit for Island Gold05/28/2019

Download this Press Release (PDF 185 KB)

TORONTO, May 28, 2019 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported it has been granted amendments to its existing operational permits from the Ministry of the Environment, Conservation and Parks, Ontario, allowing for the Phase II expansion of the Island Gold Mine to 1,200 tonnes per day (“tpd”).

These amendments were received ahead of schedule and will allow underground mining and mill throughput rates to increase from the previously permitted rate of 1,100 tpd. Underground mining rates are expected to increase to 1,200 tpd in 2020. The Company will look for opportunities to ramp up mining rates to 1,200 tpd before the end of 2019; however, 2019 guidance for production and costs is unchanged. With a mine and mill that can both support throughput rates of 1,200 tpd, no additional capital will be required for the Phase II expansion.

In parallel, the Company is continuing with a large ongoing exploration program at Island Gold which has been successful in driving significant growth in Mineral Reserves and Resources the last several years. This growth and ongoing exploration success is being incorporated into a Phase III expansion study beyond 1,200 tpd. The study is expected to be completed over the next year.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Chris Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101.

Upcoming Catalysts and News Flow

Q2 2019 – Young-Davidson and Island Gold Site Tours

Mid-2019 – Lynn Lake Optimization Study

H2 2019 – La Yaqui Grande EIA Approval

H2 2019 – Cerro Pelon Construction Update

H2 2019 – Kirazlı Construction Update

About Alamos

Hier sind die nächsten Vorstellungstermine von ALAMOS GOLD in den nächsten Wochen

RBC Global Mining & Materials ConferenceJune 6, 2019

New York, USA

Young-Davidson and Island Gold Site Tours

June 11, 2019

John Tumazos Very Independent Research Metals Conference

June 19, 2019

New Jersey, USA

ALAMOS GOLD hat sich für die Zukunft vielleicht hiermit bei einem neuen "Goldesel" eingenistet.

Ob das allerdings richtig ist wird die nahe Zukunft zeigen. Wir wollen nur hoffen, das sie mit dieser Beteiligung richtig liegen. Hier ist der Link zu dem neuen "Goldesel": https://orfordmining.com/projects/qiqavik/

Alamos Gold becomes a strategic investor in Orford Mining

Mining News - Published on Tue, 21 May 2019

alamos-gold-becomes-a-strategic-investor-in-orford-mining_35326.jpg Image Source: Twitter

Orford Mining Corporation announced that, further to its news release dated May 9, 2019, it has closed a non-brokered private placement of (i) 11,764,706 flow-through common shares at an issue price of CAD 0.17 per share, and (ii) 3,000,000 hard dollar common shares at an issue price of CAD 0.10 per share. Orford understands that Alamos Gold Inc now owns a total of 14,764,706 common shares of Orford, or 19.3% of its issued and outstanding common shares.

Following completion of this private placement, and the issuance described below, there will be 76,333,460 issued and outstanding common shares of Orford. Two Alamos nominees will serve on a newly-created Orford exploration advisory committee, which will help guide future programs along the high-grade Qiqavik gold trend and elsewhere.

Mr David Christie, President and CEO of Orford commented, "I look forward to working with Alamos as a partner and key Orford shareholder. We will benefit greatly from the expertise and experience of the Alamos representatives on our new exploration advisory committee as we advance the exploration program at Qiqavik – a greenfield gold discovery where high grade gold surface showings have been discovered in multiple locations across 45 kilometres."

https://steelguru.com/mining/alamos-gold-becomes-a-strategic…

Antwort auf Beitrag Nr.: 60.561.306 von Megastuhls am 14.05.19 09:10:50Nein Nein ich bin auch drin aber vielleicht brauchen wir nur Zeit. Normal wenn ich richtig informiert bin müsste das ding schon lange steigen,aber vielleicht wird der Goldpreis künstlich gedrückt,aus Gründen wo wir nicht wissen.

Antwort auf Beitrag Nr.: 60.558.810 von boersentrader02 am 13.05.19 21:32:53Grüße

Wir beide scheinen die Einzigen zu sein , die den Wert im Portfolio haben. Mal zu :

Mal zu :

Die Aktie wird uns noch viel Freude bereiten

Du das dachte ich auch mal. Aber glauben kann ich das schon lange nicht mehr. Trotz guter Resultate und Q Berichte kommt das Teil nicht vom Fleck.

Wir beide scheinen die Einzigen zu sein , die den Wert im Portfolio haben.

Mal zu :

Mal zu :Die Aktie wird uns noch viel Freude bereiten

Du das dachte ich auch mal. Aber glauben kann ich das schon lange nicht mehr. Trotz guter Resultate und Q Berichte kommt das Teil nicht vom Fleck.

Die Aktie wird uns noch viel Freude bereiten.

Alamos Gold: Better Than Many This Reporting SeasonMay 8, 2019 1:42 AM ET

Vladimir Zernov

Alamos Gold reports Q1 results, mostly in line with analyst estimates.

The company continues to execute on its plan, proceeding with the development of Kirazli and buying back its shares.

All major catalysts are planned for 2020, so the stock needs near-term support from gold prices to have more upside after the recent pullback.

Unlike many gold miners’ reports this earnings season, Alamos Gold's (AGI) first-quarter report was a decent one. The company reported production of 125,300 ounces of gold at all-in sustaining costs (AISC) of $957 per ounce. With these results, Alamos Gold remains fully on track to reach its full-year production guidance of 480,000–520,000 ounces of gold at AISC of $920-960 per ounce.

From a financial point of view, the company remains in good shape. The cash position decreased from $206 million to $181 million as the company spent about $11 million on the share repurchase program, and its capex spending outpaced operating cash flow. However, Alamos Gold remains favorably positioned to continue current capital spending programs, including construction activities at Kirazli mine which is set to deliver initial production in late 2020.

Another potential positive catalyst for 2020 is the expansion of the lower mine at Young-Davidson, which is expected to drive strong free cash flow growth in the second half of 2020. Currently, Young-Davidson’s cost performance is sub-optimal (note the El Chanate ceased mining operations in October 2018):

Source: Alamos Gold Q1 report

The problem for Alamos Gold as a stock right now is that developments at Kirazli and Young-Davidson will happen in the second half of 2020, which is more than one year away from now. While the stock market is forward-looking, it also needs nearer-term catalysts to support the share price. Alamos Gold's shares are up almost 25% year to date despite the recent pullback, but the reason for this performance is the low base – the stock had a horrible fourth quarter of 2018. With roughly flat production planned for 2019, Alamos Gold's shares will likely need some help from gold prices to continue the upside trend which started back in January 2019. The slide from the recent presentation highlights the fact that there are no big catalysts expected this year:

Source: Alamos Gold presentation

I believe that the company is favorably positioned in the longer term. The absence of debt and the possession of sufficient capital for the ongoing projects are major strengths of Alamos Gold. With some help from the gold prices, the stock should be able to return to the $5.00-5.50 level seen earlier this year. Some investors may consider Turkish projects (Kirazli, as well as Agi Dagi and Camyurt) risky, but I’d argue that miners did not have material problems in the country in recent years despite currency fluctuations and somewhat heated political climate.

Right now, the stock is trying to gain ground above $4.50 which is good for near-term upside momentum. Longer-term, investors will have to wait until real big catalysts start coming in 2020, which means that gold price fluctuations will have a big impact on Alamos Gold's share prices. Having read a number of gold miners’ earnings reports this earnings season, I’m a bit surprised that the company's shares did not receive increased support as Alamos Gold looks materially better in comparison with many. Perhaps, a general investor fatigue with poor results of the gold mining sector is playing a role here. Anyway, the future looks promising for Alamos Gold, so stay tuned!

If you like my work, don't forget to click on the big orange "Follow" button at the top of the screen and hit the "Like" button at the bottom of this article.

https://seekingalpha.com/article/4261318-alamos-gold-better-…

Am Freitag wurden die neuen Bohrergebnisse von dem Island Goldfeld gemeldet . Und meines Erachtens

können die sich wohl recht gut sehen lassen. Aber schaut selber einmal nach und äussert eure Meinungen dazu. Alamos Gold Inc.

Brookfield Place, 181 Bay Street, Suite 3910, P.O. Box #823

Toronto, Ontario M5J 2T3

All amounts are in United States dollars, unless otherwise stated.

Alamos Gold Intersects High-Grade Mineralization in New Area of Focus Between Eastern and Main Extensions at Island Gold

Toronto, Ontario (May 9, 2019) - Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported new results from surface and underground exploration and delineation drilling at the Island Gold Mine. Drilling in 2019 continues to extend high-grade gold mineralization across each of the Main, Western, and Eastern Extensions. All reported drill widths are true width of the mineralized zones, unless otherwise stated.

•

Eastern Extension: high-grade mineralization intersected in a previously untested area between the Eastern and Main Extensions, within a 500 metre (“m”) gap between Inferred Mineral Resource blocks. This area is only 1,000 m from surface and relatively close to existing infrastructure. New highlights include:

•

46.11 g/t Au (25.81 g/t cut) over 4.67m (MH18-03);

•

Main Extension: high-grade mineralization extended 65 m up-plunge (MH13-5) and 65 m down-plunge (MH17-04) from the nearest previously reported intersections. High-grade mineralization has been extended over 1,000 m east of current mine workings and remains open along strike to the east and both up and down-plunge. New highlights include:

71.17 g/t Au (24.53 g/t cut) over 5.10 m (MH13-5);

40.75 g/t Au (34.01 g/t cut) over 5.15 m (MH17-04); and

30.01 g/t Au (15.13 g/t cut) over 4.96 m (MH12-5).

Note: Drillhole composite intervals reported as “cut” may include higher grade samples which have been cut to 225 g/t Au for Main and Extension 1 areas, and 160 g/t Au for Extension 2 Area.

“Drill results continue to demonstrate the tremendous growth potential of the Island Gold deposit across multiple areas of focus. The Main Extension continues to grow and we see excellent potential for this to continue with more than 90% of our exploration drill holes intersecting gold mineralization along the Island Gold Main Zone.

We are also particulary excited about the potential between the Main and Eastern Extensions having intersected high-grade mineralization in an area that has seen very little drilling to date. We have started to close the gap between high grade resources in both areas and see excellent potential for this to continue,” said John A. McCluskey, President and Chief Executive Officer.

https://www.sec.gov/Archives/edgar/data/1178819/000117881919…

Hier ist das Ergebnis von ALAMOS GOLD aus dem 1. Quartal 2019

Alamos Reports First Quarter 2019 ResultsAll amounts are in United States dollars, unless otherwise stated.

TORONTO, May 01, 2019 - Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported its financial results for the quarter ended March 31, 2019.

“Alamos had a solid start to 2019, with strong performances at each operation. This included another record quarter of production from Island Gold, achieving budgeted mining rates at Young-Davidson, producing our two millionth ounce of gold at Mulatos and reducing consolidated cash costs by seven percent compared to a year ago. With the strong first quarter performance, we remain on track to achieve full year production and cost guidance,” said John A. McCluskey, President and Chief Executive Officer.

“Our various growth initiatives remain on schedule with the lower mine expansion at Young-Davidson and development of the Cerro Pelon project progressing well in the quarter. In addition, construction activities at Kirazlı will be ramping up through the year having received the Operating Permit during the quarter. These projects will be drivers of strong free cash flow growth starting in the second half of 2020 which will in turn support growing returns to our shareholders,” Mr. McCluskey added.

First Quarter 2019

Reported 125,300 ounces of gold production, reflecting strong performances from each site, including record quarterly gold production of 35,600 ounces and record quarterly free cash flow1 of $16.6 million from Island Gold

Produced the two millionth ounce of gold at Mulatos in March 2019, marking the end of the 5% royalty that has been paid since the start of production in 2005

Achieved underground mining rates of 6,500 tonnes per day at Young-Davidson, and produced 45,000 ounces of gold, both consistent with annual guidance

Sold 119,705 ounces of gold at an average realized price of $1,304 per ounce, in-line with the average London PM Fix for the quarter, for revenues of $156.1 million. Gold production exceeded gold sales with a portion of first quarter production sold subsequent to quarter end

Total cash costs1 of $732 per ounce, all-in sustaining costs ("AISC")1 of $957 per ounce, and cost of sales of $1,061 per ounce were in line with annual guidance. Total cash costs were 5% lower than the fourth quarter of 2018 and 7% lower than the first quarter of 2018 driven by low cost production growth at Island Gold

Reported adjusted net earnings1 of $10.3 million, or $0.03 per share1, reflecting adjustments for unrealized foreign exchange gains recorded within both deferred taxes and foreign exchange of $4.3 million, and other gains totaling $2.2 million

Realized net earnings of $16.8 million, or $0.04 per share

Generated cash flow from operating activities of $42.4 million ($61.7 million, or $0.16 per share, before changes in working capital1)

Ended the quarter with no debt and cash and cash equivalents of $180.6 million

Repurchased and canceled 2,565,752 common shares at a cost of $10.6 million, or $4.14 per share under its Normal Course Issuer Bid ("NCIB") announced in December 2018

Announced a doubling of the annual dividend, with a $0.01 per share dividend to be paid quarterly in 2019 (up from $0.01 per share semi-annually previously). The first quarterly dividend, paid on March 29, 2019, totaled $3.9 million

Received the Operating Permit for the Kirazlı project in Turkey, and has been granted all the major permits required for the start of construction

Subsequent to quarter-end, sold non-core royalties to Metalla Royalty & Streaming Ltd. ("Metalla") for proceeds of $8.0 million

(1) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

Den Test findet ihr hier. bt02

https://www.minenportal.de/unternehmen_nachrichten.php?mid=3…

Ich glaube das auch, dass das Gold und die weiteren Edelmetalle, u. a. Silber in 2019

den Weg nach oben suchen werden. Mir soll das nur recht sein.

Commerzbank Analysen

Warum Gold 2019 steigen wird

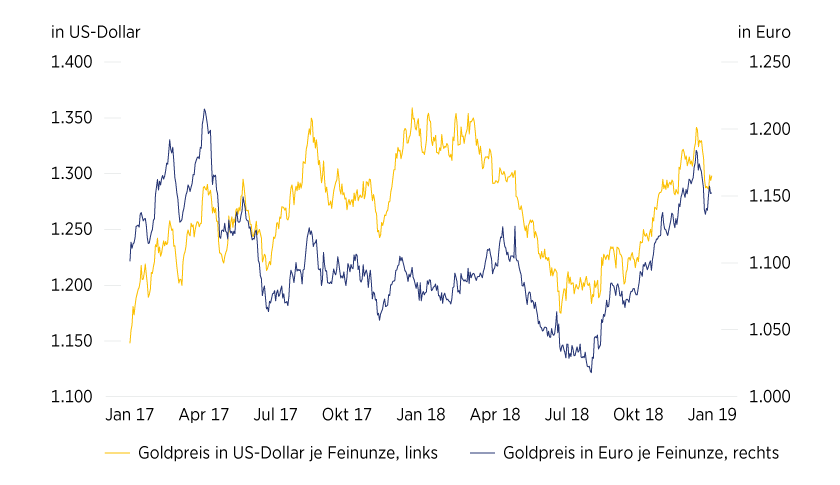

Der Goldpreis rutschte Anfang März wieder unter die Marke von 1.300 US-Dollar je Feinunze. Gold hat damit fast alle Gewinne seit Jahresbeginn wieder abgegeben. Wenige Wochen zuvor verzeichnete es bei knapp 1.350 US-Dollar je Feinunze noch ein 10-Monats-Hoch. Gold in Euro stieg im Februar sogar auf den höchsten Stand seit fast zwei Jahren bei fast 1.190 Euro je Feinunze, verlor dann aber ebenfalls deutlich.

Der Preisanstieg und auch der anschließende Rückgang vollzogen sich in beiden Währungen nahezu parallel (siehe Grafik 1). Gold hatte sich von der Währungsentwicklung in den ersten beiden Monaten 2019 also weitgehend abgekoppelt. Eine wichtigere Rolle bei der Goldpreisentwicklung spielte dagegen der Aktienmarkt. Dieser geriet Ende 2018 stark unter Druck, was Gold die Initialzündung für den Preisanstieg zu Jahresbeginn gab. Die deutliche Erholung der Aktienkurse änderte daran im Januar zwar noch nichts.

Die Gold-ETFs verzeichneten sogar den stärksten Monatszufluss seit fast zwei Jahren. Seit Anfang Februar kommt es aber wieder zu Umschichtungen von Gold zurück in Aktien, was sich in entsprechenden ETF-Abflüssen äußerte und Gold letztlich unter Druck setzte.

Somit scheint sich bei Gold ein mittlerweile bekanntes Muster zu wiederholen, nämlich stark in das Jahr zu starten, um danach wieder den Rückzug anzutreten. 2014, 2015 und 2018 verzeichnete Gold sein Jahreshoch jeweils in den ersten drei Monaten des Jahres. Das jüngste Hoch liegt zudem nicht weit von den Hochs der Jahre 2016, 2017 und 2018 entfernt.

Hat Gold sein Hoch damit schon gesehen? Wir denken nicht. Gold dürfte unseres Erachtens im Laufe des Jahres noch deutlich höhere Preise markieren als im Februar. Dafür sprechen mehrere Gründe:

Die US-Notenbank Fed hat Ende Januar angekündigt, die Leitzinsen nicht weiter anheben zu wollen. Zudem soll der Abbau der Fed-Bilanz voraussichtlich zum Jahresende auslaufen. Es gibt somit keinen Gegenwind für Gold durch weiter steigende Zinsen oder den fortgesetzten Entzug von Liquidität. In der Vergangenheit geriet der US-Dollar nach dem Ende eines Zinserhöhungszyklus zumeist unter Druck. Dass er es diesmal noch nicht tat, hängt vermutlich mit überlagernden Einflussfaktoren wie dem weiterhin schwelenden Handelskonflikt, dem Richtungswechsel auch anderer Zentralbanken weg von geplanten (weiteren) Zinserhöhungen und der schwächelnden Konjunktur in der Eurozone zusammen.

Die EZB hat der stärker ausgeprägten Konjunkturabschwächung in der Eurozone Rechnung getragen und den Zeitpunkt für die erste Zinserhöhung ins nächste Jahr geschoben. Zudem hat sie neue zielgerichtete Langfristtender (TLTROs) angekündigt, um eine unerwünschte monetäre Straffung zu verhindern. Diese würde bei einer Rückzahlung der in einem Jahr auslaufenden TLTROs entstehen. Durch diese Maßnahmen wird zwar eine stärkere Abwertung des US-Dollar gegenüber dem Euro verhindert. Eine längere Beibehaltung der ultralockeren EZB-Geldpolitik – wir rechnen auch 2020 nicht mit einer Zinserhöhung – sollte Gold aber ebenfalls zugutekommen. So liegen die Renditen deutscher Bundesanleihen bis einschließlich neun Jahren Laufzeit unter 0 Prozent.

Die deutsche Zehnjahresrendite kratzt an der Nulllinie. Abzüglich der Inflationsrate sind die Realzinsen somit deutlich negativ. Negative Realzinsen sind ein starkes Kaufargument für Gold.

https://www.ideas-magazin.de/2019/ausgabe-204/maerkte/warum-…" target="_blank" rel="nofollow ugc noopener">https://www.ideas-magazin.de/2019/ausgabe-204/maerkte/warum-…

15.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

06.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

30.03.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

24.03.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

19.03.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

18.03.24 · Gold-Silber-Rohstofftrends · Barrick Gold Corporation |

12.03.24 · Gold-Silber-Rohstofftrends · Barrick Gold Corporation |

12.03.24 · Gold-Silber-Rohstofftrends · Barrick Gold Corporation |