Dow Chemical - ein Value Investment? - 500 Beiträge pro Seite

eröffnet am 14.08.15 19:41:35 von

neuester Beitrag 21.06.17 09:47:56 von

neuester Beitrag 21.06.17 09:47:56 von

Beiträge: 5

ID: 1.217.169

ID: 1.217.169

Aufrufe heute: 0

Gesamt: 1.583

Gesamt: 1.583

Aktive User: 0

ISIN: US2605431038 · WKN: 850917

66,05

USD

+1,77 %

+1,15 USD

Letzter Kurs 01.09.17 NYSE

Werte aus der Branche Chemie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 87.000,00 | +27,94 | |

| 168,55 | +14,74 | |

| 717,50 | +14,06 | |

| 386,40 | +13,81 | |

| 212,90 | +12,73 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 15,480 | -10,00 | |

| 411,85 | -11,50 | |

| 21,498 | -13,00 | |

| 1,0100 | -22,31 | |

| 5,6900 | -26,68 |

Artikel auf Motley Fool vom 03.08.2015

Dow Chemical Company Becoming a Deep Value for Investors

Earnings growth, a low P/E ratio, and a solid dividend make Dow Chemical Company a great buy for value investors.

At a time when investors are looking for almost any reason to turn negative on a stock, the big industrial companies don't seem to have a lot to offer Wall Street. Dow Chemical Company's (NYSE OW) recent earnings report was the latest sign of that.

OW) recent earnings report was the latest sign of that.

On the surface, the report looked fine, with adjusted net income up 19% to $1.06 billion, or $0.91 per share. But a decline in sales and less-than-bullish comments about China have sent most investors running for the hills, which may create a great buying opportunity for investors willing to focus on the long term.

How sales can fall and profits can jump

One of the strange things happening to Dow Chemical today is the decline in sales while net income is rising. But there are some reasonable explanations for that trend.

On the top line, a strong dollar can make sales overseas look lower than with a weak dollar, even if profits in the local currency were the same. Low oil prices can also have a negative effect on sales for products based on oil. Often these products have dynamic pricing, and in a down oil market, that's a negative for Dow Chemical's sales.

Low oil prices may have a negative impact on the top line, but it also helps lower input costs for chemical products that use it as a raw material. That pushes margins and profits higher, at least in the short term.

While the gyration of revenue may seem like a concern for investors, it's not something to be worried about, because it's just natural in the course of business.

What does the future look like for Dow Chemical?

The bigger question is where Dow Chemical stands in today's competitive market. With a renewed focus on high-value chemicals and engineered agricultural products, the company should be well positioned for high margins in the future.

Rising oil prices and a weakening economy could eat into some of the profits and margin expansion I pointed out above, but for now Dow Chemical looks to be well positioned to slowly grow both revenue and earnings.

Deep value in Dow Chemical

Where Dow Chemical really looks attractive for investors is on the value front. The stock trades at just 13.5 times trailing earnings and, as you can see above, earnings are still growing.

With a strong competitive advantage in both chemicals and agriculture, and a long history of delivering profits for investors, this is the perfect stock for investors looking for value and income on today's market. It's a part of the market that's overlooked, and if the economy goes through a downturn, it could be a great place to have exposure.

Dow Chemical Company Becoming a Deep Value for Investors

Earnings growth, a low P/E ratio, and a solid dividend make Dow Chemical Company a great buy for value investors.

At a time when investors are looking for almost any reason to turn negative on a stock, the big industrial companies don't seem to have a lot to offer Wall Street. Dow Chemical Company's (NYSE

OW) recent earnings report was the latest sign of that.

OW) recent earnings report was the latest sign of that.On the surface, the report looked fine, with adjusted net income up 19% to $1.06 billion, or $0.91 per share. But a decline in sales and less-than-bullish comments about China have sent most investors running for the hills, which may create a great buying opportunity for investors willing to focus on the long term.

How sales can fall and profits can jump

One of the strange things happening to Dow Chemical today is the decline in sales while net income is rising. But there are some reasonable explanations for that trend.

On the top line, a strong dollar can make sales overseas look lower than with a weak dollar, even if profits in the local currency were the same. Low oil prices can also have a negative effect on sales for products based on oil. Often these products have dynamic pricing, and in a down oil market, that's a negative for Dow Chemical's sales.

Low oil prices may have a negative impact on the top line, but it also helps lower input costs for chemical products that use it as a raw material. That pushes margins and profits higher, at least in the short term.

While the gyration of revenue may seem like a concern for investors, it's not something to be worried about, because it's just natural in the course of business.

What does the future look like for Dow Chemical?

The bigger question is where Dow Chemical stands in today's competitive market. With a renewed focus on high-value chemicals and engineered agricultural products, the company should be well positioned for high margins in the future.

Rising oil prices and a weakening economy could eat into some of the profits and margin expansion I pointed out above, but for now Dow Chemical looks to be well positioned to slowly grow both revenue and earnings.

Deep value in Dow Chemical

Where Dow Chemical really looks attractive for investors is on the value front. The stock trades at just 13.5 times trailing earnings and, as you can see above, earnings are still growing.

With a strong competitive advantage in both chemicals and agriculture, and a long history of delivering profits for investors, this is the perfect stock for investors looking for value and income on today's market. It's a part of the market that's overlooked, and if the economy goes through a downturn, it could be a great place to have exposure.

Why Dow Chemical's Stock Is An Excellent Long-Term Investment Opportunity

Summary

- Dow Chemical delivered outstanding second quarter 2015 results, with the highest second quarter operating EBITDA margin since 2005.

- Dow will continue to benefit from cheap energy prices that have gone down way faster than the price of its products. Energy prices have continued to fall sharply this quarter.

- According to TipRanks, the average target price of the top analysts is at $60, 32% up from its August 07 closing price.

However, in my view, although shares could go much higher, one-year target price of $55 sounds more reasonable.

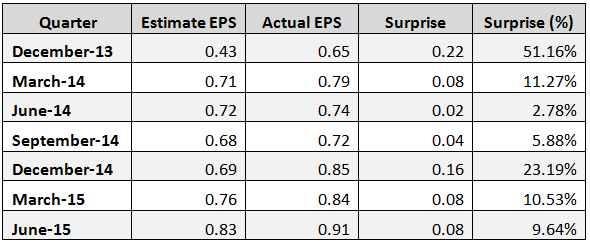

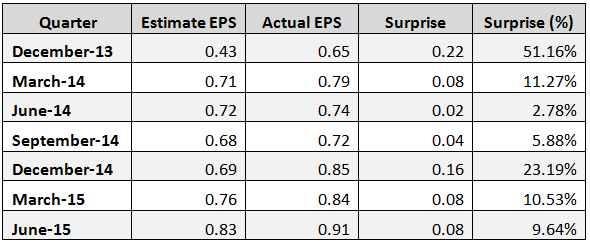

On July 23, Dow Chemical reported outstanding second quarter 2015 results, with the highest second quarter operating EBITDA margin since 2005. Gains were due to strong margins in Performance Plastics and Performance Materials & Chemicals. The company beat EPS expectations by $0.08 (9.6%). Last quarter was the 11th quarter in a row in which Dow achieved operating earnings and margin growth. DOW showed significant earnings per share surprise in its last seven quarters, as shown in the table below.

ganzen Artikel lesen...

Summary

- Dow Chemical delivered outstanding second quarter 2015 results, with the highest second quarter operating EBITDA margin since 2005.

- Dow will continue to benefit from cheap energy prices that have gone down way faster than the price of its products. Energy prices have continued to fall sharply this quarter.

- According to TipRanks, the average target price of the top analysts is at $60, 32% up from its August 07 closing price.

However, in my view, although shares could go much higher, one-year target price of $55 sounds more reasonable.

On July 23, Dow Chemical reported outstanding second quarter 2015 results, with the highest second quarter operating EBITDA margin since 2005. Gains were due to strong margins in Performance Plastics and Performance Materials & Chemicals. The company beat EPS expectations by $0.08 (9.6%). Last quarter was the 11th quarter in a row in which Dow achieved operating earnings and margin growth. DOW showed significant earnings per share surprise in its last seven quarters, as shown in the table below.

ganzen Artikel lesen...

Dow Chemical Upgraded to “Buy” at Zacks

Dow Chemical Co logoZacks upgraded shares of Dow Chemical (NYSE OW) from a hold rating to a buy rating in a research report sent to investors on Friday morning, MarketBeat reports. Zacks currently has $50.00 target price on the stock.

OW) from a hold rating to a buy rating in a research report sent to investors on Friday morning, MarketBeat reports. Zacks currently has $50.00 target price on the stock.

According to Zacks, “Dow Chemical’s profit for the second quarter of 2015 surged year over year on strong margins in its performance plastics business. Adjusted earnings topped the Zacks Consensus Estimate. But revenues fell by double-digits on unfavorable currency impact and lower oil prices, and missed expectations. Dow’s strategic actions, including productivity improvement and aggressive portfolio management, are expected to enhance shareholder value this year. A string of innovative products in its pipeline also adds to its strength.” (...)

Ganzen Artikel lesen...

Dow Chemical Co logoZacks upgraded shares of Dow Chemical (NYSE

OW) from a hold rating to a buy rating in a research report sent to investors on Friday morning, MarketBeat reports. Zacks currently has $50.00 target price on the stock.

OW) from a hold rating to a buy rating in a research report sent to investors on Friday morning, MarketBeat reports. Zacks currently has $50.00 target price on the stock.According to Zacks, “Dow Chemical’s profit for the second quarter of 2015 surged year over year on strong margins in its performance plastics business. Adjusted earnings topped the Zacks Consensus Estimate. But revenues fell by double-digits on unfavorable currency impact and lower oil prices, and missed expectations. Dow’s strategic actions, including productivity improvement and aggressive portfolio management, are expected to enhance shareholder value this year. A string of innovative products in its pipeline also adds to its strength.” (...)

Ganzen Artikel lesen...

Artikel auf iNTELLiGENT iNVESTiEREN

Elefantenhochzeit: Dow Chemical macht(e) Dupont den Hof

+++ Börsenticker +++ Jetzt ist es amtlich: die beiden amerikanischen Chemie-Riesen Dow Chemical und Dupont schicken sich an, durch ihre 130-Milliarden-Dollar Fusion den deutschen Chemie-Giganten BASF vom Thron zu stoßen und zur weltweiten Nummer 1 aufzusteigen.Zumindest vorübergehend. Denn nach der Fusion will man sich in die drei einzelnen und jeweils börsennotierten Unternehmen für Agrarchemikalien, Spezialchemikalien und Kunststoffe aufspalten. Aufgrund des gewählten Aktienumtauschverhältnisses werden die Altaktionäre von Dow Chemical und Dupont nach der Fusion in etwa die gleichen Anteile am fusionierten Unternehmen halten.

Der Zusammenschluss soll bereits innerhalb der ersten 24 Monate zu Kosteneinsparungen von rund 3 Mrd. USD führen und darüber hinaus erwartet man rund 1 Mrd. USD an Wachstums-Effekten. Nach dem erfolgreichen Abschluss der Fusion rechnen die Unternehmen für das zweite Halbjahr 2016 gerechnet und innerhalb von weiteren 18 bis 24 Monaten soll dann die Aufspaltung in die drei börsennotierten Spezialisten erfolgen.

Elefantenhochzeit: Dow Chemical macht(e) Dupont den Hof

+++ Börsenticker +++ Jetzt ist es amtlich: die beiden amerikanischen Chemie-Riesen Dow Chemical und Dupont schicken sich an, durch ihre 130-Milliarden-Dollar Fusion den deutschen Chemie-Giganten BASF vom Thron zu stoßen und zur weltweiten Nummer 1 aufzusteigen.Zumindest vorübergehend. Denn nach der Fusion will man sich in die drei einzelnen und jeweils börsennotierten Unternehmen für Agrarchemikalien, Spezialchemikalien und Kunststoffe aufspalten. Aufgrund des gewählten Aktienumtauschverhältnisses werden die Altaktionäre von Dow Chemical und Dupont nach der Fusion in etwa die gleichen Anteile am fusionierten Unternehmen halten.

Der Zusammenschluss soll bereits innerhalb der ersten 24 Monate zu Kosteneinsparungen von rund 3 Mrd. USD führen und darüber hinaus erwartet man rund 1 Mrd. USD an Wachstums-Effekten. Nach dem erfolgreichen Abschluss der Fusion rechnen die Unternehmen für das zweite Halbjahr 2016 gerechnet und innerhalb von weiteren 18 bis 24 Monaten soll dann die Aufspaltung in die drei börsennotierten Spezialisten erfolgen.

Was wird die Großfusion für deutsche Anleger bringen ?

Wie wird das Urteil der deutschen Steuerbehörden ausfallen ?

Wieder einmal Sachausschüttung und damit Steuer ?

Die sichere Seite ist : Verkaufen, selbst auf Steuerfreiheit verzichten !

Wie wird das Urteil der deutschen Steuerbehörden ausfallen ?

Wieder einmal Sachausschüttung und damit Steuer ?

Die sichere Seite ist : Verkaufen, selbst auf Steuerfreiheit verzichten !

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +0,60 | |

| +1,30 | |

| -1,28 | |

| -0,26 | |

| +0,15 | |

| +0,37 | |

| +0,30 | |

| +0,23 | |

| +1,54 | |

| -0,11 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 218 | ||

| 156 | ||

| 77 | ||

| 59 | ||

| 49 | ||

| 45 | ||

| 43 | ||

| 41 | ||

| 36 | ||

| 29 |