Phillips 66 Reports Second-Quarter Earnings of $1.0 Billion or $1.84 Per Share (Seite 6) | Diskussion im Forum

eröffnet am 17.09.15 13:06:55 von

neuester Beitrag 18.12.23 18:35:21 von

neuester Beitrag 18.12.23 18:35:21 von

Beiträge: 117

ID: 1.218.621

ID: 1.218.621

Aufrufe heute: 0

Gesamt: 6.811

Gesamt: 6.811

Aktive User: 0

ISIN: US7185461040 · WKN: A1JWQU · Symbol: PSX

156,67

USD

-1,37 %

-2,17 USD

Letzter Kurs 18:42:02 NYSE

Neuigkeiten

03.04.24 · Business Wire (engl.) |

02.04.24 · wO Newsflash |

01.04.24 · Business Wire (engl.) |

14.03.24 · Business Wire (engl.) |

29.02.24 · Business Wire (engl.) |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +53,15 | |

| 6,0800 | +43,06 | |

| 12,990 | +38,93 | |

| 0,5070 | +31,52 | |

| 1,0200 | +24,39 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 20,030 | -7,61 | |

| 4,9800 | -8,62 | |

| 6,7200 | -8,82 | |

| 0,6500 | -12,16 | |

| 20,000 | -33,33 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 55.328.386 von faultcode am 14.07.17 21:55:51

=> HFC: nicht mehr (30.9.):

• Price-to-Free-Cash-Flow = 10.38

• Forward PE Ratio = 7.94 (7.74: Thomson Reuters)

• Piotroski F-Score = 7

• Debt-to-EBITDA = 1.07

• Quick Ratio = 1.30

• Equity-to-Asset 0.52

Quelle: GF

• HFC’s ISS Governance QualityScore as of November 1, 2018 is 6.

• 2018-11: Acquisition of Sonneborn/NL for USD655m: http://www.sonneborn.com/

HFC

14.7.17Zitat von faultcode: ...

Allerdings sind manche US Oil Refiner immer noch unprofitabel, so wie DK und HFC...

=> HFC: nicht mehr (30.9.):

• Price-to-Free-Cash-Flow = 10.38

• Forward PE Ratio = 7.94 (7.74: Thomson Reuters)

• Piotroski F-Score = 7

• Debt-to-EBITDA = 1.07

• Quick Ratio = 1.30

• Equity-to-Asset 0.52

Quelle: GF

• HFC’s ISS Governance QualityScore as of November 1, 2018 is 6.

• 2018-11: Acquisition of Sonneborn/NL for USD655m: http://www.sonneborn.com/

Antwort auf Beitrag Nr.: 58.744.045 von faultcode am 19.09.18 23:11:03

aus: https://marketrealist.com/2018/11/did-mpc-vlo-hfc-and-psx-se…

U.S. refiner -- Q3

aus: https://marketrealist.com/2018/11/did-mpc-vlo-hfc-and-psx-se…

Antwort auf Beitrag Nr.: 58.612.050 von faultcode am 04.09.18 16:17:22-- alle großen US-Refiner dick im Minus.

-- WTI +2% heute

-- $CRACK321 hat heute witzigerweise sogar leicht zugenommen

=> das nennt man dann Gewinnmitnahmen

-- WTI +2% heute

-- $CRACK321 hat heute witzigerweise sogar leicht zugenommen

=> das nennt man dann Gewinnmitnahmen

Antwort auf Beitrag Nr.: 58.528.764 von faultcode am 24.08.18 16:59:54• U.S. oil refiner fast alle dick im Plus gerade; gut, PSX weniger, aber auch noch Plus

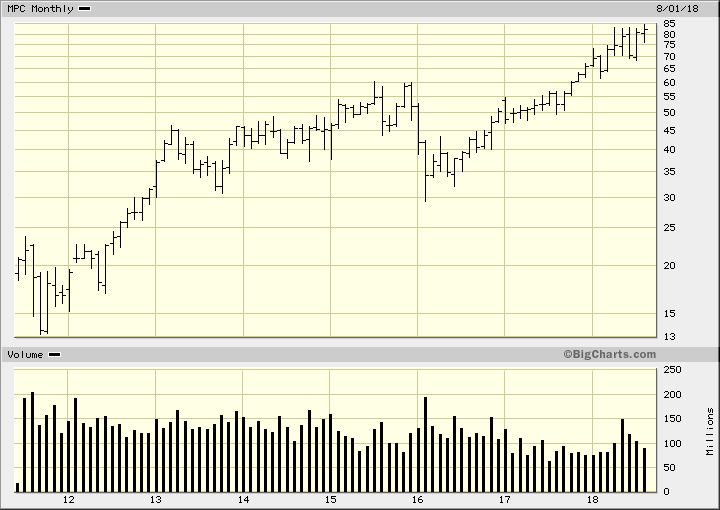

• MARATHON PETROLEUM CORP auf All time high soeben:

• MARATHON PETROLEUM CORP auf All time high soeben:

Antwort auf Beitrag Nr.: 57.665.166 von faultcode am 30.04.18 19:31:38=> ANDV nun angemeldet zum Tausch in MPC (nur stocks, kein Cash für mich)

=> merke:

• der Wettbewerb nimmt noch weiter ab, wenn man überhaupt noch davon sprechen kann

=> wie lange das noch gut geht?

=> merke:

• der Wettbewerb nimmt noch weiter ab, wenn man überhaupt noch davon sprechen kann

=> wie lange das noch gut geht?

Antwort auf Beitrag Nr.: 57.827.189 von faultcode am 24.05.18 20:54:05

=>

...Phillips 66 is running all the heavy Canadian crude oil the independent refiner can handle at its U.S. refineries and will not seek additional supply from a new pipeline, Chief Executive Greg Garland said on Friday.

"We're bringing over 500,000 barrels a day of Canadian crude in today," Garland said during a conference call with Wall Street analysts. "So we're the largest importer of Canadian crude. We're probably running at about 80 percent of it or so, I would guess. So we're kind of maxed out on Canadian heavy today."

During a call to discuss second-quarter results, the company said its nine refineries would operate in the mid-90 percent range of their combined crude oil processing capacity of 1.65 million barrels per day in the third quarter of 2018.

Garland also said there were no major turnaround overhauls planned for its refineries in the third quarter of 2018...

__

2018Q2:

https://www.businesswire.com/news/home/20180727005090/en/

=>

Highlights

• Achieved 100 percent utilization in Refining

• CPChem's new ethane cracker exceeding design rates

• Generated $2.4 billion in cash from operations

• Returned $602 million to shareholders through dividends and share repurchases

• Increased quarterly dividend by 14 percent

• Began construction of the 300,000 BPD Sweeny Hub NGL expansion project

• Phillips 66 Partners recently completed Gray Oak Pipeline open season

(FC: Sweeny Hub is an integrated natural gas liquids (NGL) fractionation, storage and export complex)

...

Financial Position, Liquidity and Return of Capital

Phillips 66 generated $2.4 billion in cash from operations during the second quarter, including $610 million of cash distributions from equity affiliates. Excluding working capital impacts, operating cash flow was $1.7 billion.

During the quarter, Phillips 66 funded $230 million in share repurchases, $372 million in dividends and $538 million of capital expenditures and investments. Additionally, the company repaid $250 million of debt in the quarter. The company ended the quarter with 464 million shares outstanding.

As of June 30, 2018, cash and cash equivalents were $1.9 billion, and consolidated debt was $11.4 billion, including $2.9 billion at Phillips 66 Partners (PSXP). The company's consolidated debt-to-capital ratio and net-debt-to-capital ratio were 31 percent and 28 percent, respectively. Excluding PSXP, the debt-to-capital ratio was 27 percent and the net-debt-to-capital ratio was 23 percent.

'maxed out' on Canadian heavy crude oil: CEO -- Q2

https://ca.finance.yahoo.com/news/phillips-66-maxed-canadian…=>

...Phillips 66 is running all the heavy Canadian crude oil the independent refiner can handle at its U.S. refineries and will not seek additional supply from a new pipeline, Chief Executive Greg Garland said on Friday.

"We're bringing over 500,000 barrels a day of Canadian crude in today," Garland said during a conference call with Wall Street analysts. "So we're the largest importer of Canadian crude. We're probably running at about 80 percent of it or so, I would guess. So we're kind of maxed out on Canadian heavy today."

During a call to discuss second-quarter results, the company said its nine refineries would operate in the mid-90 percent range of their combined crude oil processing capacity of 1.65 million barrels per day in the third quarter of 2018.

Garland also said there were no major turnaround overhauls planned for its refineries in the third quarter of 2018...

__

2018Q2:

https://www.businesswire.com/news/home/20180727005090/en/

=>

Highlights

• Achieved 100 percent utilization in Refining

• CPChem's new ethane cracker exceeding design rates

• Generated $2.4 billion in cash from operations

• Returned $602 million to shareholders through dividends and share repurchases

• Increased quarterly dividend by 14 percent

• Began construction of the 300,000 BPD Sweeny Hub NGL expansion project

• Phillips 66 Partners recently completed Gray Oak Pipeline open season

(FC: Sweeny Hub is an integrated natural gas liquids (NGL) fractionation, storage and export complex)

...

Financial Position, Liquidity and Return of Capital

Phillips 66 generated $2.4 billion in cash from operations during the second quarter, including $610 million of cash distributions from equity affiliates. Excluding working capital impacts, operating cash flow was $1.7 billion.

During the quarter, Phillips 66 funded $230 million in share repurchases, $372 million in dividends and $538 million of capital expenditures and investments. Additionally, the company repaid $250 million of debt in the quarter. The company ended the quarter with 464 million shares outstanding.

As of June 30, 2018, cash and cash equivalents were $1.9 billion, and consolidated debt was $11.4 billion, including $2.9 billion at Phillips 66 Partners (PSXP). The company's consolidated debt-to-capital ratio and net-debt-to-capital ratio were 31 percent and 28 percent, respectively. Excluding PSXP, the debt-to-capital ratio was 27 percent and the net-debt-to-capital ratio was 23 percent.

Antwort auf Beitrag Nr.: 57.782.305 von faultcode am 17.05.18 16:08:32

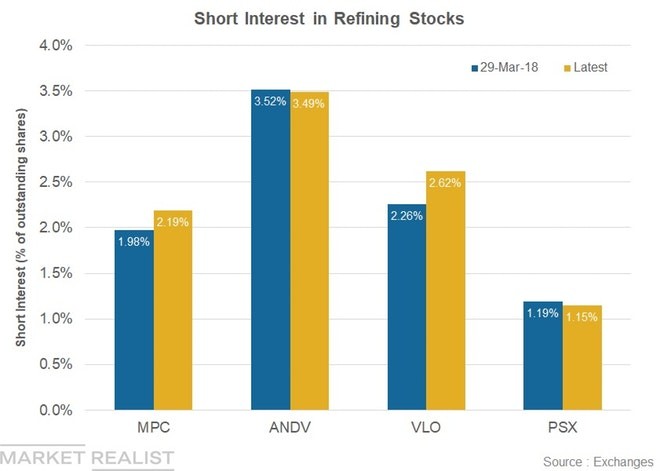

=> Short Interests sind durchgehend niedrig:

..und Institutional ownership hoch:

How Are Short Interests in Refining Stocks Trending?

https://marketrealist.com/2018/05/how-are-short-interests-in…=> Short Interests sind durchgehend niedrig:

..und Institutional ownership hoch:

neues ATH -- alle Gross-Refiner satt im Plus --> "golden age" of refining through 2020

z.Z.PSX +2.9%

VLO +4.1%

MPC +3.6%

ANDV +31.%

Grund: satte Gewinndynamik:

aus: https://marketrealist.com/2018/05/mpc-vlo-andv-psx-refining-…

__

Morgan Stanley upgrades Valero ahead of expected 'golden age' of refining

https://thefly.com/landingPageNews.php?id=2732926

=>

As previously reported, Morgan Stanley analyst Benny Wong upgraded Valero (VLO) to Overweight from Equal Weight, stating that recent underinvestment in refining, slippages in capacity additions and overdone concerns on long-term demand have set the stage for refining to enter a "golden age" through 2020.

While the world is falling short by about one refinery annually until 2020, jet fuel, mining, chemicals and heavy transport demand are "here to stay," argues Wong and his team at the firm.

The shift in global oil supply towards light oil and regulations to control pollution should drive outsized returns for complex refiners, added the analyst, who called Valero and Marathon Petroleum (MPC) his top U.S. picks in the space.

Wong raised his price target on Valero to $140 from $110 and increased his target on Marathon to $100 from $90.

__

=> eine Warnung: hier sind mittlerweile - aller Wahrscheinlichkeit nach - dick die (positiven) "Momos" (Momentum player) drin --> d.h. die können auch so schnell wieder raus, wie sie rein gegangen sind

Antwort auf Beitrag Nr.: 55.328.386 von faultcode am 14.07.17 21:55:51

--> so, so, das war also einer der Treiber bei den US-Refinern zuletzt -- man kennst sich ja

Marathon Petroleum Corp. and Andeavor Combination to Create Leading U.S. Refining, Marketing, and Midstream Company

https://www.nasdaq.com/press-release/marathon-petroleum-corp…

...Marathon Petroleum Corp. (NYSE: MPC) and Andeavor (NYSE:ANDV) today announced that they have entered into a definitive merger agreement under which MPC will acquire all of ANDV's outstanding shares, representing a total equity value of $23.3 billion and total enterprise value of $35.6 billion, based on MPC's April 27, 2018, closing price of $81.43.

ANDV shareholders will have the option to choose 1.87 shares of MPC stock, or $152.27 in cash subject to a proration mechanism that will result in 15 percent of ANDV's fully diluted shares receiving cash consideration.

This represents a premium of 24.4 percent to ANDV's closing price on April 27, 2018.

MPC and ANDV shareholders will own approximately 66 percent and 34 percent of the combined company, respectively. The transaction was unanimously approved by the board of directors of both companies and is expected to close in the second half of 2018, subject to regulatory and other customary closing conditions, including approvals from both MPC and ANDV shareholders. The headquarters will be located in Findlay, Ohio, and the combined business will maintain an office in San Antonio, Texas.

--> trotz allem nehme ich die MPC shares, wenn möglich. Sollte auch steuerschonender sein.

=> MPC würde bei Erfolg PSX als #1 der unabhängigen US-Refiner ablösen.

--> den US Refiner geht's gut:

- PSX grün

- VLO grün

- PBF satt grün

--> die zweite Garnitur mit DK und HFC auch grün

--> eine ganze Branche grünt! (ausser MPC )

)

(man beachte: WTI Rohöl ist auch sichtbar teurer heute mit z.Z. +1.5% )

)

--> wer ist als nächstes dran?

MPC übernimmt Andeavor

+13% zur Zeit: https://www.wallstreet-online.de/aktien/andeavor-aktie--> so, so, das war also einer der Treiber bei den US-Refinern zuletzt -- man kennst sich ja

Marathon Petroleum Corp. and Andeavor Combination to Create Leading U.S. Refining, Marketing, and Midstream Company

https://www.nasdaq.com/press-release/marathon-petroleum-corp…

...Marathon Petroleum Corp. (NYSE: MPC) and Andeavor (NYSE:ANDV) today announced that they have entered into a definitive merger agreement under which MPC will acquire all of ANDV's outstanding shares, representing a total equity value of $23.3 billion and total enterprise value of $35.6 billion, based on MPC's April 27, 2018, closing price of $81.43.

ANDV shareholders will have the option to choose 1.87 shares of MPC stock, or $152.27 in cash subject to a proration mechanism that will result in 15 percent of ANDV's fully diluted shares receiving cash consideration.

This represents a premium of 24.4 percent to ANDV's closing price on April 27, 2018.

MPC and ANDV shareholders will own approximately 66 percent and 34 percent of the combined company, respectively. The transaction was unanimously approved by the board of directors of both companies and is expected to close in the second half of 2018, subject to regulatory and other customary closing conditions, including approvals from both MPC and ANDV shareholders. The headquarters will be located in Findlay, Ohio, and the combined business will maintain an office in San Antonio, Texas.

--> trotz allem nehme ich die MPC shares, wenn möglich. Sollte auch steuerschonender sein.

=> MPC würde bei Erfolg PSX als #1 der unabhängigen US-Refiner ablösen.

--> den US Refiner geht's gut:

- PSX grün

- VLO grün

- PBF satt grün

--> die zweite Garnitur mit DK und HFC auch grün

--> eine ganze Branche grünt! (ausser MPC

)

)(man beachte: WTI Rohöl ist auch sichtbar teurer heute mit z.Z. +1.5%

)

)--> wer ist als nächstes dran?

Phillips 66 Reports Second-Quarter Earnings of $1.0 Billion or $1.84 Per Share