Phillips 66 Reports Second-Quarter Earnings of $1.0 Billion or $1.84 Per Share - Die letzten 30 Beiträge | Diskussion im Forum

eröffnet am 17.09.15 13:06:55 von

neuester Beitrag 18.12.23 18:35:21 von

neuester Beitrag 18.12.23 18:35:21 von

Beiträge: 117

ID: 1.218.621

ID: 1.218.621

Aufrufe heute: 0

Gesamt: 6.811

Gesamt: 6.811

Aktive User: 0

ISIN: US7185461040 · WKN: A1JWQU

146,44

EUR

-0,71 %

-1,04 EUR

Letzter Kurs 22:42:05 Lang & Schwarz

Neuigkeiten

03.04.24 · Business Wire (engl.) |

02.04.24 · wO Newsflash |

01.04.24 · Business Wire (engl.) |

14.03.24 · Business Wire (engl.) |

29.02.24 · Business Wire (engl.) |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 75,38 | +19,99 | |

| 11,48 | +10,28 | |

| 16,530 | +9,98 | |

| 45,00 | +9,76 | |

| 5,2000 | +9,47 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 12,080 | -12,27 | |

| 13,140 | -23,60 | |

| 86,49 | -25,39 | |

| 9,3500 | -28,02 | |

| 20,000 | -33,33 |

Beitrag zu dieser Diskussion schreiben

Paul Singer mal wieder:

29.11.

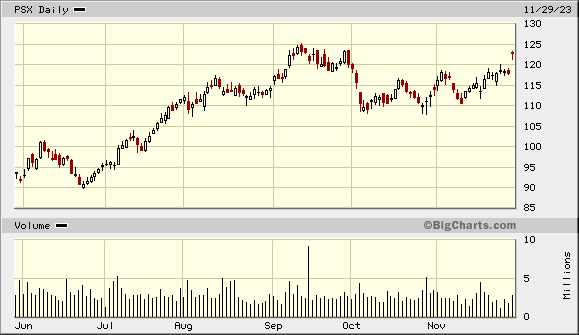

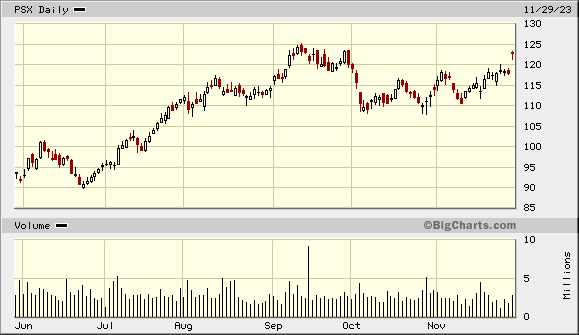

Phillips 66 Stock Is Rising. Activist Elliott Takes $1 Billion Stake, Wants Changes.

https://www.marketwatch.com/articles/phillips-66-stock-activ…

...

Elliott Investment Management has taken a $1 billion stake in Phillips 66, the activist investor disclosed in a letter to the refiner’s board on Wednesday.

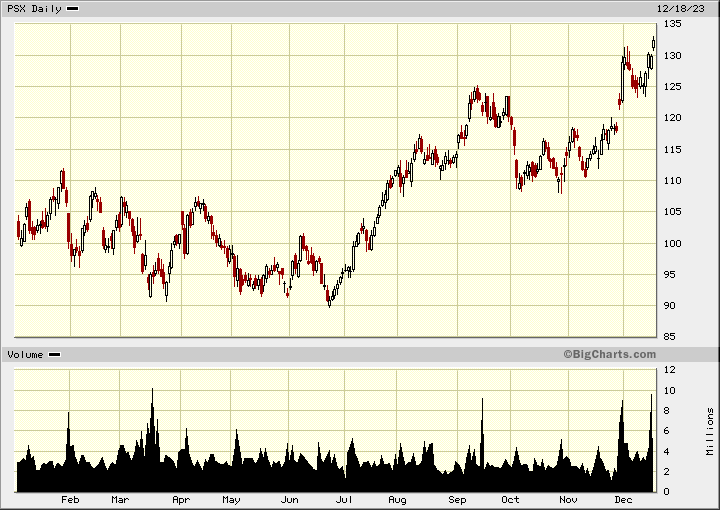

Phillips 66 stock rose 4.2% to $122.98 Wednesday morning. This year, the stock is up 18%.

In the letter, Elliott highlighted drivers of the stock’s underperformance, and said that after some improvements, the stock could reach more than $200, about 75% higher than today’s current price.

“We have engaged in discussions with Elliott Management, and we welcome their perspectives and the perspectives of other shareholders on our strategy and the actions we are taking to drive long-term sustainable growth and value creation,” said President and CEO Mark Lashier in an emailed statement to Barron’s.

“Phillips 66 continues to invest in returns-focused growth opportunities, and with a portfolio of diversified, integrated assets, we are well positioned to continue driving long-term shareholder value,” he continued. “We remain committed to acting in the best interests of our shareholders.”

...

=>

29.11.

Phillips 66 Stock Is Rising. Activist Elliott Takes $1 Billion Stake, Wants Changes.

https://www.marketwatch.com/articles/phillips-66-stock-activ…

...

Elliott Investment Management has taken a $1 billion stake in Phillips 66, the activist investor disclosed in a letter to the refiner’s board on Wednesday.

Phillips 66 stock rose 4.2% to $122.98 Wednesday morning. This year, the stock is up 18%.

In the letter, Elliott highlighted drivers of the stock’s underperformance, and said that after some improvements, the stock could reach more than $200, about 75% higher than today’s current price.

“We have engaged in discussions with Elliott Management, and we welcome their perspectives and the perspectives of other shareholders on our strategy and the actions we are taking to drive long-term sustainable growth and value creation,” said President and CEO Mark Lashier in an emailed statement to Barron’s.

“Phillips 66 continues to invest in returns-focused growth opportunities, and with a portfolio of diversified, integrated assets, we are well positioned to continue driving long-term shareholder value,” he continued. “We remain committed to acting in the best interests of our shareholders.”

...

=>

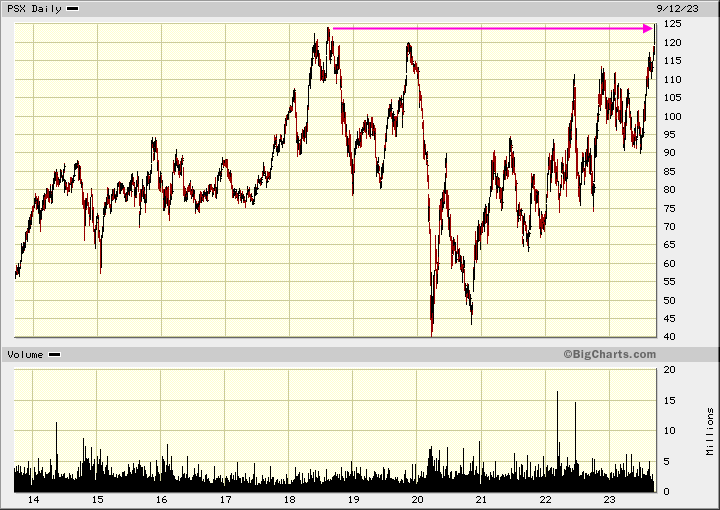

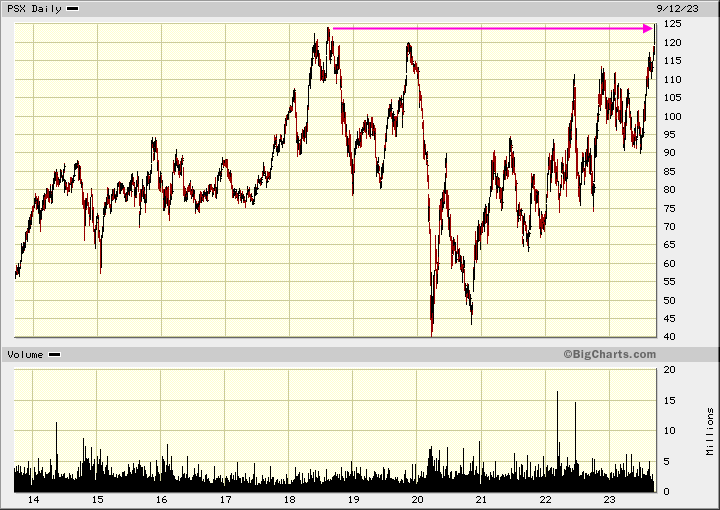

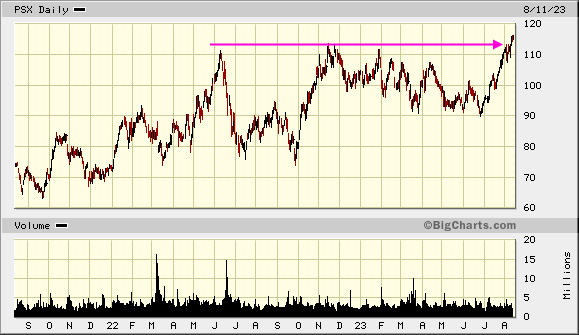

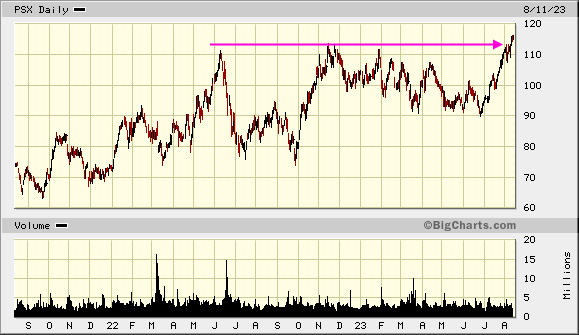

Antwort auf Beitrag Nr.: 74.303.619 von faultcode am 11.08.23 16:32:04auch hier nun ein neues Allzeithoch:

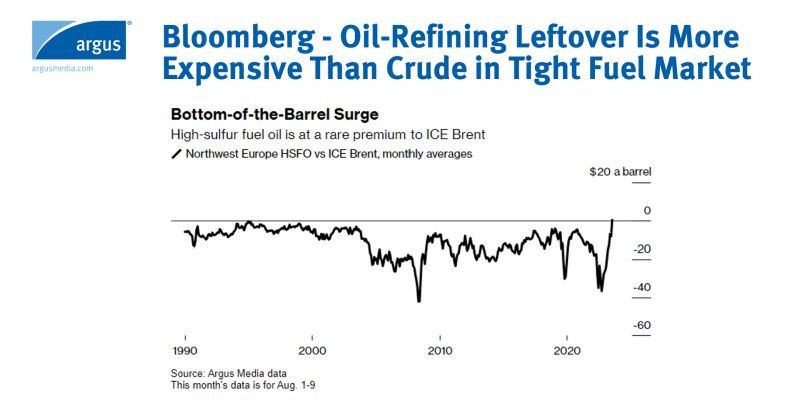

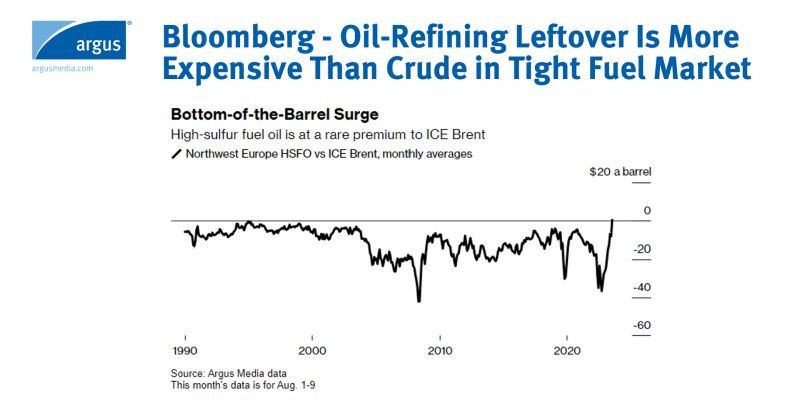

Antwort auf Beitrag Nr.: 74.303.619 von faultcode am 11.08.23 16:32:04high sulfur fuel:

https://twitter.com/ArgusMedia/status/1689829512635203584

https://twitter.com/ArgusMedia/status/1689829512635203584

fast nichts ist momentan so wertvoll wie Kapazitäten zur Öl-Raffinerie, nicht nur in den USA, sondern auch in Europa:

Ein anderer Kurs-Treiber hier könnte auch der zuletzt stattgefundene Sentiment-Wechsel beim Reiz-Thema "ESG" mMn sein: in den letzten Jahren gab's genügend große Asset Manager, die in "Schmutzaktien" wie Phillips 66 und Co. einfach nicht investieren duften

Das könnte sich momentan allmählich wieder ändern.

Ein anderer Kurs-Treiber hier könnte auch der zuletzt stattgefundene Sentiment-Wechsel beim Reiz-Thema "ESG" mMn sein: in den letzten Jahren gab's genügend große Asset Manager, die in "Schmutzaktien" wie Phillips 66 und Co. einfach nicht investieren duften

Das könnte sich momentan allmählich wieder ändern.

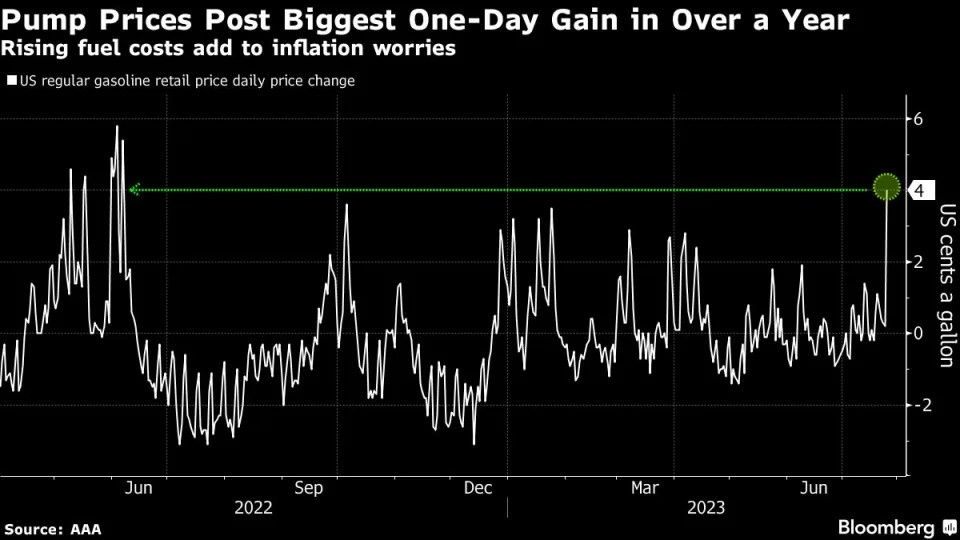

25.7.

Gasoline Prices in US Rises Most in a Year, Hurting Inflation Fight

https://finance.yahoo.com/news/gasoline-prices-us-rises-most…

...

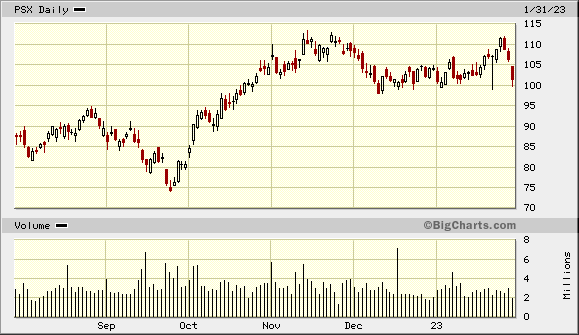

bei Öl läuft nun vielfach "sell the news":

31.1.

Phillips 66 Reports Fourth-Quarter 2022 Financial Results

https://www.wallstreet-online.de/nachricht/16497628-phillips…

...

Phillips 66 (NYSE: PSX), a diversified energy company, announces fourth-quarter 2022 earnings of $1.9 billion, compared with earnings of $5.4 billion in the third quarter of 2022.

Excluding special items of $15 million, the company had adjusted earnings of $1.9 billion in the fourth quarter, compared with third-quarter adjusted earnings of $3.1 billion.

“Our integrated portfolio positioned us to generate robust earnings and cash flow in 2022, supported by a favorable market environment, solid operations and strong safety performance,” said Mark Lashier, President and CEO of Phillips 66. “During 2022 we increased shareholder distributions and strengthened our balance sheet by repaying debt. Since July 2022, we have returned $2.4 billion to shareholders through share repurchases and dividends as we progress toward our commitment to return $10 billion to $12 billion by year-end 2024.

...

We are on track to deliver $1 billion of annualized savings by year-end 2023. In addition, we continue to grow our NGL business with the integration of DCP Midstream and recently reached an agreement to acquire all public common units. We remain committed to operating excellence and disciplined capital allocation as we execute our strategic priorities.”

...

=>

31.1.

Phillips 66 Reports Fourth-Quarter 2022 Financial Results

https://www.wallstreet-online.de/nachricht/16497628-phillips…

...

Phillips 66 (NYSE: PSX), a diversified energy company, announces fourth-quarter 2022 earnings of $1.9 billion, compared with earnings of $5.4 billion in the third quarter of 2022.

Excluding special items of $15 million, the company had adjusted earnings of $1.9 billion in the fourth quarter, compared with third-quarter adjusted earnings of $3.1 billion.

“Our integrated portfolio positioned us to generate robust earnings and cash flow in 2022, supported by a favorable market environment, solid operations and strong safety performance,” said Mark Lashier, President and CEO of Phillips 66. “During 2022 we increased shareholder distributions and strengthened our balance sheet by repaying debt. Since July 2022, we have returned $2.4 billion to shareholders through share repurchases and dividends as we progress toward our commitment to return $10 billion to $12 billion by year-end 2024.

...

We are on track to deliver $1 billion of annualized savings by year-end 2023. In addition, we continue to grow our NGL business with the integration of DCP Midstream and recently reached an agreement to acquire all public common units. We remain committed to operating excellence and disciplined capital allocation as we execute our strategic priorities.”

...

=>

15.1.

Chevron expands Venezuelan crude sales to other oil refiners

https://www.ajot.com/news/chevron-expands-venezuelan-crude-s…

...

Chevron Corp. sold a cargo of Venezuelan oil to another US refiner in the first such transaction since sanctions against the Latin American nation were eased less than two months ago.

Phillips 66 bought half-a-million barrels of a type of sludgy oil known as Hamaca from Chevron, according to a person with knowledge of the situation who asked not to be identified. The crude will be processed at the refiner’s Sweeny, Texas, complex about 65 miles (105 kilometers) south of Houston, the person said.

Chevron is expanding Venezuelan crude sales beyond its own refining network just weeks after US sanctions relief allowed the oil giant to return key managers to the country and resume drilling. The transactions appear to advance President Joe Biden’s dual objectives of re-engagement with the Nicolas Maduro regime and increasing crude supplies available to American fuel makers.

The cargo of Hamaca will be loaded onto the tanker Carina Voyager in Venezuela this month, according to another person who requested anonymity while discussing non-public information. Phillips 66 was one of the largest buyers of Venezuelan oil prior to the imposition of sanctions about four years ago.

...

Chevron expands Venezuelan crude sales to other oil refiners

https://www.ajot.com/news/chevron-expands-venezuelan-crude-s…

...

Chevron Corp. sold a cargo of Venezuelan oil to another US refiner in the first such transaction since sanctions against the Latin American nation were eased less than two months ago.

Phillips 66 bought half-a-million barrels of a type of sludgy oil known as Hamaca from Chevron, according to a person with knowledge of the situation who asked not to be identified. The crude will be processed at the refiner’s Sweeny, Texas, complex about 65 miles (105 kilometers) south of Houston, the person said.

Chevron is expanding Venezuelan crude sales beyond its own refining network just weeks after US sanctions relief allowed the oil giant to return key managers to the country and resume drilling. The transactions appear to advance President Joe Biden’s dual objectives of re-engagement with the Nicolas Maduro regime and increasing crude supplies available to American fuel makers.

The cargo of Hamaca will be loaded onto the tanker Carina Voyager in Venezuela this month, according to another person who requested anonymity while discussing non-public information. Phillips 66 was one of the largest buyers of Venezuelan oil prior to the imposition of sanctions about four years ago.

...

Antwort auf Beitrag Nr.: 72.222.093 von faultcode am 18.08.22 14:16:446.1.

Phillips 66 Reaches Agreement to Acquire Publicly Held Common Units of DCP Midstream, LP

https://www.wallstreet-online.de/nachricht/16403252-phillips…

...

Phillips 66 (NYSE: PSX) and DCP Midstream, LP (“DCP Midstream”) (NYSE: DCP) announced today that they have entered into a definitive agreement pursuant to which Phillips 66 will acquire all of the publicly held common units representing limited partner interests in DCP Midstream for cash consideration of $41.75 per common unit, increasing its economic interest in DCP Midstream to 86.8%.

“We are delivering on our commitment to grow our NGL business,” said Mark Lashier, President and CEO of Phillips 66. “Our wellhead-to-market platform captures the full NGL value chain. As we continue integrating DCP Midstream, we are unlocking significant synergies and growth opportunities.”

In combination with the previously announced realignment of Phillips 66’s economic and governance interests in DCP Midstream, the transaction is expected to generate an incremental $1 billion of adjusted EBITDA for Phillips 66. In addition, Phillips 66 expects to capture operational and commercial synergies of at least $300 million by integrating DCP Midstream into its existing midstream business.

Phillips 66 plans to fund the approximately $3.8 billion cash consideration through a combination of cash and debt while maintaining its current investment grade credit ratings. The transaction is expected to close in the second quarter of 2023, subject to customary closing conditions.

The transaction was unanimously approved by the board of directors of DCP Midstream GP, LLC, the general partner of DCP Midstream GP, LP, the general partner of DCP Midstream, based on the unanimous approval and recommendation of a special committee comprised entirely of independent directors after evaluation of the transaction by the special committee in consultation with independent financial and legal advisors.

Affiliates of Phillips 66, as the holders of a majority of the outstanding DCP Midstream common units, have delivered their consent to approve the transaction. As a result, DCP Midstream has not solicited and is not soliciting approval of the transaction by any other holders of DCP Midstream common units.

...

Phillips 66 Reaches Agreement to Acquire Publicly Held Common Units of DCP Midstream, LP

https://www.wallstreet-online.de/nachricht/16403252-phillips…

...

Phillips 66 (NYSE: PSX) and DCP Midstream, LP (“DCP Midstream”) (NYSE: DCP) announced today that they have entered into a definitive agreement pursuant to which Phillips 66 will acquire all of the publicly held common units representing limited partner interests in DCP Midstream for cash consideration of $41.75 per common unit, increasing its economic interest in DCP Midstream to 86.8%.

“We are delivering on our commitment to grow our NGL business,” said Mark Lashier, President and CEO of Phillips 66. “Our wellhead-to-market platform captures the full NGL value chain. As we continue integrating DCP Midstream, we are unlocking significant synergies and growth opportunities.”

In combination with the previously announced realignment of Phillips 66’s economic and governance interests in DCP Midstream, the transaction is expected to generate an incremental $1 billion of adjusted EBITDA for Phillips 66. In addition, Phillips 66 expects to capture operational and commercial synergies of at least $300 million by integrating DCP Midstream into its existing midstream business.

Phillips 66 plans to fund the approximately $3.8 billion cash consideration through a combination of cash and debt while maintaining its current investment grade credit ratings. The transaction is expected to close in the second quarter of 2023, subject to customary closing conditions.

The transaction was unanimously approved by the board of directors of DCP Midstream GP, LLC, the general partner of DCP Midstream GP, LP, the general partner of DCP Midstream, based on the unanimous approval and recommendation of a special committee comprised entirely of independent directors after evaluation of the transaction by the special committee in consultation with independent financial and legal advisors.

Affiliates of Phillips 66, as the holders of a majority of the outstanding DCP Midstream common units, have delivered their consent to approve the transaction. As a result, DCP Midstream has not solicited and is not soliciting approval of the transaction by any other holders of DCP Midstream common units.

...

9.11.

...

The company’s Board of Directors approved a $5 billion increase to its authorization to repurchase its common stock, which brings the total amount of share repurchases authorized by the Board since 2012 to an aggregate of $20 billion.

...

Phillips 66 Outlines Plans to Increase Shareholder Distributions

https://www.wallstreet-online.de/nachricht/16177334-phillips…

...

The company’s Board of Directors approved a $5 billion increase to its authorization to repurchase its common stock, which brings the total amount of share repurchases authorized by the Board since 2012 to an aggregate of $20 billion.

...

Phillips 66 Outlines Plans to Increase Shareholder Distributions

https://www.wallstreet-online.de/nachricht/16177334-phillips…

18.8.

Phillips 66, Enbridge Swap Stakes in US Pipes Through JV Merger

https://finance.yahoo.com/news/phillips-66-enbridge-swap-sta…

...

Phillips 66 increased its ownership of DCP Midstream LP to 43.3% from 28.3% while slashing its stake in Gray Oak Pipeline LLC to 6.5% from 42.3%, the crude refiner said in a statement. The company will pay Enbridge $400 million in cash as part of the transaction.

Enbridge’s share of Gray Oak will increase to 58.5% from 22.8% while its stake in DCP will fall to 13.2% from 28.3%, the Calgary-based company said. Enbridge has also agreed to operate the pipeline, currently managed by Phillips 66, starting in the second quarter of 2023.

In a separate announcement, Phillips 66 said it has made a non-binding offer to buy all publicly held common units of DCP Midstream for $34.75 each. The shares fell 3.5% Wednesday to $34.75, paring this year’s gain to 26%.

With the reshuffle, Phillips 66 aims to further expand into natural gas liquids, a key feedstock used by refineries and petrochemical plants. Meanwhile, the deal allows Enbridge to focus on moving crude oil from the Permian basin to the Gulf Coast.

Currently, Phillips 66 and Enbridge share ownership in DCP and Gray Oak through two separate joint ventures, which will now be merged into a single entity. The transaction was entered into and closed on Wednesday.

...

Phillips 66, Enbridge Swap Stakes in US Pipes Through JV Merger

https://finance.yahoo.com/news/phillips-66-enbridge-swap-sta…

...

Phillips 66 increased its ownership of DCP Midstream LP to 43.3% from 28.3% while slashing its stake in Gray Oak Pipeline LLC to 6.5% from 42.3%, the crude refiner said in a statement. The company will pay Enbridge $400 million in cash as part of the transaction.

Enbridge’s share of Gray Oak will increase to 58.5% from 22.8% while its stake in DCP will fall to 13.2% from 28.3%, the Calgary-based company said. Enbridge has also agreed to operate the pipeline, currently managed by Phillips 66, starting in the second quarter of 2023.

In a separate announcement, Phillips 66 said it has made a non-binding offer to buy all publicly held common units of DCP Midstream for $34.75 each. The shares fell 3.5% Wednesday to $34.75, paring this year’s gain to 26%.

With the reshuffle, Phillips 66 aims to further expand into natural gas liquids, a key feedstock used by refineries and petrochemical plants. Meanwhile, the deal allows Enbridge to focus on moving crude oil from the Permian basin to the Gulf Coast.

Currently, Phillips 66 and Enbridge share ownership in DCP and Gray Oak through two separate joint ventures, which will now be merged into a single entity. The transaction was entered into and closed on Wednesday.

...

29.7.

Phillips 66 Reports Second-Quarter 2022 Financial Results

https://www.wallstreet-online.de/nachricht/15756284-phillips…

...

Phillips 66 (NYSE: PSX), a diversified energy company, announces second-quarter 2022 earnings of $3.2 billion, compared with earnings of $582 million in the first quarter of 2022. Excluding special items of $118 million, the company had adjusted earnings of $3.3 billion in the second quarter, compared with first-quarter adjusted earnings of $595 million.

“Our earnings reflect the strong market environment during the second quarter driven by a tight global product supply and demand balance,” said Mark Lashier, President and CEO of Phillips 66. “We are focused on reliably providing critical energy products, including transportation fuels, to meet peak summer demand. We also advanced strategic capital projects to help meet the growing demand for renewable fuels and NGLs.

“During the second quarter, we paid down $1.5 billion of debt, increased our dividend and resumed share repurchases. Additionally, we are transforming our business to achieve sustained annual cost savings of at least $700 million to ensure we remain competitive in any market environment. We will continue to prioritize operating excellence and disciplined capital allocation.”

...

Strategic Update

Phillips 66 is continuing its business transformation that will enable sustainable cost reductions of at least $700 million annually across the enterprise. Phillips 66 will provide a business transformation and strategy update at its investor day in New York City on November 9.

...

At the Sweeny Hub, Frac 4 startup is expected late in the third quarter of 2022, adding 150,000 BPD of capacity. The total project cost is expected to be approximately $525 million. Upon completion, total Sweeny Hub fractionation capacity will be 550,000 BPD. The fractionators are supported by long-term commitments.

....

Phillips 66 Reports Second-Quarter 2022 Financial Results

https://www.wallstreet-online.de/nachricht/15756284-phillips…

...

Phillips 66 (NYSE: PSX), a diversified energy company, announces second-quarter 2022 earnings of $3.2 billion, compared with earnings of $582 million in the first quarter of 2022. Excluding special items of $118 million, the company had adjusted earnings of $3.3 billion in the second quarter, compared with first-quarter adjusted earnings of $595 million.

“Our earnings reflect the strong market environment during the second quarter driven by a tight global product supply and demand balance,” said Mark Lashier, President and CEO of Phillips 66. “We are focused on reliably providing critical energy products, including transportation fuels, to meet peak summer demand. We also advanced strategic capital projects to help meet the growing demand for renewable fuels and NGLs.

“During the second quarter, we paid down $1.5 billion of debt, increased our dividend and resumed share repurchases. Additionally, we are transforming our business to achieve sustained annual cost savings of at least $700 million to ensure we remain competitive in any market environment. We will continue to prioritize operating excellence and disciplined capital allocation.”

...

Strategic Update

Phillips 66 is continuing its business transformation that will enable sustainable cost reductions of at least $700 million annually across the enterprise. Phillips 66 will provide a business transformation and strategy update at its investor day in New York City on November 9.

...

At the Sweeny Hub, Frac 4 startup is expected late in the third quarter of 2022, adding 150,000 BPD of capacity. The total project cost is expected to be approximately $525 million. Upon completion, total Sweeny Hub fractionation capacity will be 550,000 BPD. The fractionators are supported by long-term commitments.

....

Echt eine Aktie welche derzeit gegen den Trend gut läuft...

Das Unternehmen stand schon vor der Krise Fundamental gut da und ixh denke, ohne hier Insider zu sein, das es von der neuen geopolitischen Lage sogar noch profitieren dürfte.

Erdgas fördern die ja auch wie ich gelesen habe. Aber was ich besonders Zukunftsträchtig finde, sind die Investitionen in green Energy wie eben die in sustainable Fuel oder auch der Einstieg bei Novonix.

Was denkt ihr?

Das Unternehmen stand schon vor der Krise Fundamental gut da und ixh denke, ohne hier Insider zu sein, das es von der neuen geopolitischen Lage sogar noch profitieren dürfte.

Erdgas fördern die ja auch wie ich gelesen habe. Aber was ich besonders Zukunftsträchtig finde, sind die Investitionen in green Energy wie eben die in sustainable Fuel oder auch der Einstieg bei Novonix.

Was denkt ihr?

Antwort auf Beitrag Nr.: 70.145.765 von faultcode am 07.12.21 13:52:1611.5.

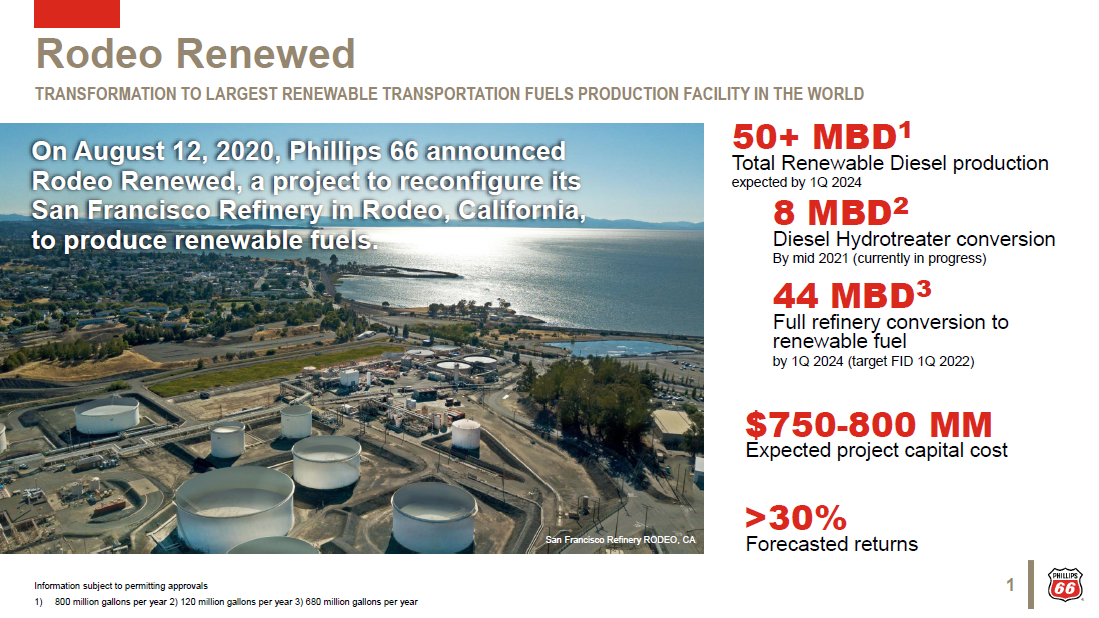

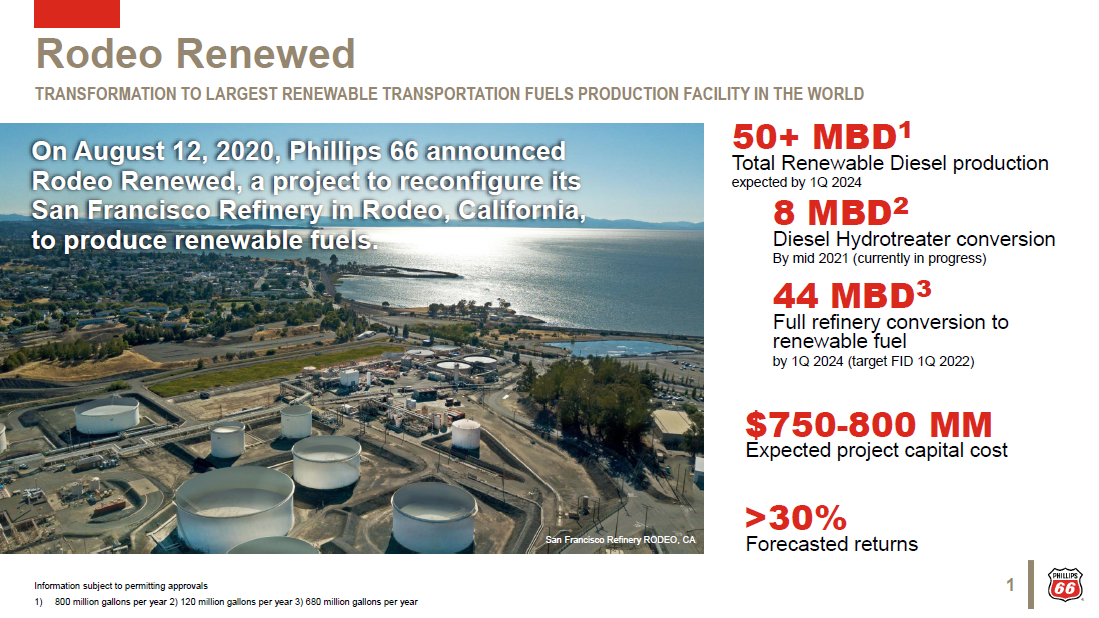

Phillips 66 makes final investment decision to convert San Francisco Refinery to a renewable fuels facility

https://www.phillips66.com/newsroom/220511-rodeo_final_inves…

...

Phillips 66 made a final investment decision Wednesday to move forward with Rodeo Renewed, the project to convert its San Francisco Refinery in Rodeo, California, into one of the world’s largest renewable fuels facilities. The project, which recently received approval from Contra Costa County, is expected to cost approximately $850 million and begin commercial operations in the first quarter of 2024.

...

Upon completion of Rodeo Renewed, the converted facility will no longer process crude oil and instead use waste oils, fats, greases and vegetable oils to produce an initial 800 million gallons per year (over 50,000 barrels per day) of renewable transportation fuels, including renewable diesel, renewable gasoline and sustainable aviation fuel. Production of these fuels is projected to reduce lifecycle carbon emissions by approximately 65% — the equivalent of taking 1.4 million cars off California roads each year. Rodeo Renewed is also expected to cut criteria pollutant emissions at the site by 55% and water use by 160 million gallons per year.

The scope of the project includes the construction of pre-treatment units and the repurposing of existing hydrocracking units to enable production of renewable fuels. The converted facility will leverage its flexible logistics infrastructure to secure renewable feedstocks from local, domestic and international sources and supply renewable fuels to California and other markets.

...

Phillips 66 makes final investment decision to convert San Francisco Refinery to a renewable fuels facility

https://www.phillips66.com/newsroom/220511-rodeo_final_inves…

...

Phillips 66 made a final investment decision Wednesday to move forward with Rodeo Renewed, the project to convert its San Francisco Refinery in Rodeo, California, into one of the world’s largest renewable fuels facilities. The project, which recently received approval from Contra Costa County, is expected to cost approximately $850 million and begin commercial operations in the first quarter of 2024.

...

Upon completion of Rodeo Renewed, the converted facility will no longer process crude oil and instead use waste oils, fats, greases and vegetable oils to produce an initial 800 million gallons per year (over 50,000 barrels per day) of renewable transportation fuels, including renewable diesel, renewable gasoline and sustainable aviation fuel. Production of these fuels is projected to reduce lifecycle carbon emissions by approximately 65% — the equivalent of taking 1.4 million cars off California roads each year. Rodeo Renewed is also expected to cut criteria pollutant emissions at the site by 55% and water use by 160 million gallons per year.

The scope of the project includes the construction of pre-treatment units and the repurposing of existing hydrocracking units to enable production of renewable fuels. The converted facility will leverage its flexible logistics infrastructure to secure renewable feedstocks from local, domestic and international sources and supply renewable fuels to California and other markets.

...

29.3.

U.S. Exports More Diesel as Global Shortage Fuels Competition

https://finance.yahoo.com/news/u-exports-more-diesel-global-…

Antwort auf Beitrag Nr.: 70.814.642 von Briefmarke am 11.02.22 21:15:00

Phillips66 produziert kein Rohöl daher bringt der hohe Ölpreis auch nicht wirklich was. Ganz im Gegenteil werden Endverbraucher bei hohen Preisen eher weniger Benzin kaufen.... daher absolut logisch das die Aktie nicht steigt wenn der Ölpreis steigt. Wenn du davon profitieren willst musst du einen Förderer kaufen. Z.B. ConocoPhillips

VG G

Zitat von Briefmarke: DZ Bank erhöht fairen Wert für Salzgitter von €39 auf €42. Buy. / Quelle: Guidants News https://news.guidants.com

Die DZ Bank hat Recht. Aber wieso empfehlt niemand Phillips 66 ?

Ölpreis derzeit 94 US Dollar. Unsere Aktie zahlt bald Dividende!

Also gut, dann probiere ich es mal:

Briefmarke erhöht fairen Wert für Phillips 66 von 92 Dollar auf 125 Dollar

Phillips66 produziert kein Rohöl daher bringt der hohe Ölpreis auch nicht wirklich was. Ganz im Gegenteil werden Endverbraucher bei hohen Preisen eher weniger Benzin kaufen.... daher absolut logisch das die Aktie nicht steigt wenn der Ölpreis steigt. Wenn du davon profitieren willst musst du einen Förderer kaufen. Z.B. ConocoPhillips

VG G

Ich habe hier auch mal eine Order gesetzt. Phillips66 ist bei Marketscreener bestens bewertet, zahlt Dividende, der Ölpreis ist hoch und sie investieren reihenweise in Zukunftstechnologien: Novonix ( Batteriemateriealien und Testequipment) und ein Wasserstofftankstellennetz in Deutschland.

DZ Bank erhöht fairen Wert für Salzgitter von €39 auf €42. Buy. / Quelle: Guidants News https://news.guidants.com

Die DZ Bank hat Recht. Aber wieso empfehlt niemand Phillips 66 ?

Ölpreis derzeit 94 US Dollar. Unsere Aktie zahlt bald Dividende!

Also gut, dann probiere ich es mal:

Briefmarke erhöht fairen Wert für Phillips 66 von 92 Dollar auf 125 Dollar

Die DZ Bank hat Recht. Aber wieso empfehlt niemand Phillips 66 ?

Ölpreis derzeit 94 US Dollar. Unsere Aktie zahlt bald Dividende!

Also gut, dann probiere ich es mal:

Briefmarke erhöht fairen Wert für Phillips 66 von 92 Dollar auf 125 Dollar

Hallo zusammen,

hier liest ohnehin keiner mit!

Wie doof muss, kann man eigentlich sein? Öl steht bei 92 Dollar.

Die Dividende im Quartal bei 92 US-Cent. Die verdienen sich dumm und dusselig!

Was macht der Kurs? Genau das selbige wie die Resonanz hier:

Schlafen.

hier liest ohnehin keiner mit!

Wie doof muss, kann man eigentlich sein? Öl steht bei 92 Dollar.

Die Dividende im Quartal bei 92 US-Cent. Die verdienen sich dumm und dusselig!

Was macht der Kurs? Genau das selbige wie die Resonanz hier:

Schlafen.

San Francisco Refinery:

<Worley, Investor Day 1 December 2021>

<Worley, Investor Day 1 December 2021>

27.10.

Phillips 66 Announces Agreement to Acquire Phillips 66 Partners

https://www.wallstreet-online.de/nachricht/14587189-phillips…

...

Phillips 66 (NYSE: PSX) and Phillips 66 Partners (“PSXP” or the “Partnership”) (NYSE: PSXP) announced today that they have entered into a definitive agreement for Phillips 66 to acquire all of the publicly held common units representing limited partner interests in the Partnership not already owned by Phillips 66 and its affiliates.

The agreement, expected to close in the first quarter of 2022, provides for an all-stock transaction in which each outstanding PSXP common unitholder would receive 0.50 shares of PSX common stock for each PSXP common unit. The Partnership’s preferred units would be converted into common units at a premium to the original issuance price prior to exchange for Phillips 66 common stock.

“We are announcing an agreement to acquire all outstanding units of Phillips 66 Partners,” said Greg Garland, Chairman and CEO of Phillips 66. “We believe this acquisition will allow both PSX shareholders and PSXP unitholders to participate in the value creation of the combined entities, supported by the strong financial position of Phillips 66.”

...

siehe z.B.:

08.05.2019

Phillips 66 Announces Agreement to Acquire Phillips 66 Partners

https://www.wallstreet-online.de/nachricht/14587189-phillips…

...

Phillips 66 (NYSE: PSX) and Phillips 66 Partners (“PSXP” or the “Partnership”) (NYSE: PSXP) announced today that they have entered into a definitive agreement for Phillips 66 to acquire all of the publicly held common units representing limited partner interests in the Partnership not already owned by Phillips 66 and its affiliates.

The agreement, expected to close in the first quarter of 2022, provides for an all-stock transaction in which each outstanding PSXP common unitholder would receive 0.50 shares of PSX common stock for each PSXP common unit. The Partnership’s preferred units would be converted into common units at a premium to the original issuance price prior to exchange for Phillips 66 common stock.

“We are announcing an agreement to acquire all outstanding units of Phillips 66 Partners,” said Greg Garland, Chairman and CEO of Phillips 66. “We believe this acquisition will allow both PSX shareholders and PSXP unitholders to participate in the value creation of the combined entities, supported by the strong financial position of Phillips 66.”

...

siehe z.B.:

08.05.2019

Zitat von faultcode: 8.5.

Marathon Petroleum combines midstream units, surprise loss drags down shares

https://finance.yahoo.com/news/marathon-petroleum-merge-mids…

...

--> diese Reintegration von MLP's (US master limited partnerships) ist ja seit den US-Steuergesetzt-Änderungen, bzw. Reinterpretationen der IRS, zur Zeit sehr in Mode

Der amerikanische Energiekonzern Phillips 66 (ISIN: US7185461040, NYSE: PSX) gibt eine Quartalsdividende in Höhe von 92 US-Cents je Aktie bekannt und erhöht die Dividende damit um 2 Prozent gegenüber dem Vorquartal (90 US-Cents). Die Auszahlung der Dividende erfolgt am 1. Dezember 2021 (Record date: 17. November 2021).

Auf das Jahr hochgerechnet werden damit 3,68 US-Dollar ausgeschüttet. Das entspricht beim aktuellen Börsenkurs von 82,13 US-Dollar (Stand: 8. Oktober 2021) einer Dividendenrendite von 4,48 Prozent. Nach Firmenangaben wurde die Dividende seit 2012 insgesamt 10-Mal erhöht.

Für das zweite Quartal (30. Juni) des Fiskaljahres 2021 meldete das Unternehmen einen Gewinn von 296 Mio. US-Dollar nach einem Verlust von 141 Mio. US-Dollar im Vorjahr, wie am 3. August berichtet wurde. Phillips 66 beschäftigt rund 14.000 Mitarbeiter und ist im Raffineriegeschäft (Downstream-Sektor) und der Vermarktung von Mineralölprodukten tätig. Zum 30. April 2012 erfolgte die Abspaltung von ConocoPhillips. Unter Markennamen, wie Phillips 66 oder Conoco, werden zahlreiche Tankstellen betrieben. In Deutschland gehören die Jet-Tankstellen zum Portfolio. Der Firmensitz liegt in Houston, im US-Bundesstaat Texas.

Die Aktie liegt an der Wall Street seit Jahresanfang 2021 auf der aktuellen Kursbasis mit 17,43 Prozent im Plus und weist eine Marktkapitalisierung in Höhe von 35,97 Mrd. US-Dollar (Stand: 8. Oktober 2021) auf.

Redaktion MyDividends.de

Auf das Jahr hochgerechnet werden damit 3,68 US-Dollar ausgeschüttet. Das entspricht beim aktuellen Börsenkurs von 82,13 US-Dollar (Stand: 8. Oktober 2021) einer Dividendenrendite von 4,48 Prozent. Nach Firmenangaben wurde die Dividende seit 2012 insgesamt 10-Mal erhöht.

Für das zweite Quartal (30. Juni) des Fiskaljahres 2021 meldete das Unternehmen einen Gewinn von 296 Mio. US-Dollar nach einem Verlust von 141 Mio. US-Dollar im Vorjahr, wie am 3. August berichtet wurde. Phillips 66 beschäftigt rund 14.000 Mitarbeiter und ist im Raffineriegeschäft (Downstream-Sektor) und der Vermarktung von Mineralölprodukten tätig. Zum 30. April 2012 erfolgte die Abspaltung von ConocoPhillips. Unter Markennamen, wie Phillips 66 oder Conoco, werden zahlreiche Tankstellen betrieben. In Deutschland gehören die Jet-Tankstellen zum Portfolio. Der Firmensitz liegt in Houston, im US-Bundesstaat Texas.

Die Aktie liegt an der Wall Street seit Jahresanfang 2021 auf der aktuellen Kursbasis mit 17,43 Prozent im Plus und weist eine Marktkapitalisierung in Höhe von 35,97 Mrd. US-Dollar (Stand: 8. Oktober 2021) auf.

Redaktion MyDividends.de

WTI ÖL nun wieder über 70 Dollar.

An für sich ein Wunder, dass die Aktie immer noch unter 100 US-Dollar notiert!

Prognose für Öl und Ölaktien sind zuversichtlich. Ausstieg jedoch nicht vergessen, vielleicht bei 110 $?

An für sich ein Wunder, dass die Aktie immer noch unter 100 US-Dollar notiert!

Prognose für Öl und Ölaktien sind zuversichtlich. Ausstieg jedoch nicht vergessen, vielleicht bei 110 $?

Antwort auf Beitrag Nr.: 65.928.351 von faultcode am 02.12.20 22:24:129.4.

Americans Desperate to Get Out Set Stage for Gasoline Comeback

https://financialpost.com/pmn/business-pmn/americans-despera…

...

Americans are getting ready to rekindle their love affair with the open road, unleashing a full-fledged recovery for gasoline that could send demand to a record.

Traffic is already roaring back in cities like Houston as offices reopen. Things will really start taking off this summer as pent-up travel demand finally busts out thanks to the increase in vaccinations. After almost half of Americans ended up canceling trips in 2020, many are planning to take an extra week of vacation this year to make up for lost time. Theme parks are gearing up for an influx of visitors, and attendance at national parks is expected to swell.

Demand is predicted to be so hot that Phillips 66 is set to reverse the flow of one of its pipelines starting May 1 so it can carry gasoline from Texas into Denver as more tourists head west.

...

The surge in consumption means gasoline is likely going to be even more expensive than the U.S. government is forecasting. The Energy Information Administration this week said average pump prices this summer will be more than 30% higher than last year at $2.78 a gallon. But many analysts are estimating prices will hit $3 a gallon for the first time since 2014.

...

Americans Desperate to Get Out Set Stage for Gasoline Comeback

https://financialpost.com/pmn/business-pmn/americans-despera…

...

Americans are getting ready to rekindle their love affair with the open road, unleashing a full-fledged recovery for gasoline that could send demand to a record.

Traffic is already roaring back in cities like Houston as offices reopen. Things will really start taking off this summer as pent-up travel demand finally busts out thanks to the increase in vaccinations. After almost half of Americans ended up canceling trips in 2020, many are planning to take an extra week of vacation this year to make up for lost time. Theme parks are gearing up for an influx of visitors, and attendance at national parks is expected to swell.

Demand is predicted to be so hot that Phillips 66 is set to reverse the flow of one of its pipelines starting May 1 so it can carry gasoline from Texas into Denver as more tourists head west.

...

The surge in consumption means gasoline is likely going to be even more expensive than the U.S. government is forecasting. The Energy Information Administration this week said average pump prices this summer will be more than 30% higher than last year at $2.78 a gallon. But many analysts are estimating prices will hit $3 a gallon for the first time since 2014.

...

Antwort auf Beitrag Nr.: 65.527.762 von Briefmarke am 28.10.20 19:52:13Kurs gerade um die 62,50 Euro.

Obwohl von 38 Euro bereits deutlich gestiegen, ist ein Verkauf nicht notwendig.

Solange der Ölpreis steigt und die E-Autos weiterhin eine Nische sind, wird der Kurs noch deutlich zulegen.

Zahlen pro Q 90 US-Cent Dividende und haben zudem in den letzten Jahren eigene Aktien vom Markt genommen.

Pro Aktie (Kurs 76 Dollar) ein mehrfaches an Umsatz laut Geschäftsbericht.

Steigt der Ölpreis weiterhin, explodieren hier geradezu die Gewinne pro Aktie und lassen ein Kursziel von 100 bis 120 Dollar erahnen.

Egal ob in 20 Jahren weniger Öl gebraucht wird, jetzt und heute kann man hier noch einsteigen.

Ab 100 Dollar pro Aktie wieder den Markt beobachten und sich dann neu orientieren ob ein halten oder sogar ein verkaufen besser ist.

Obwohl von 38 Euro bereits deutlich gestiegen, ist ein Verkauf nicht notwendig.

Solange der Ölpreis steigt und die E-Autos weiterhin eine Nische sind, wird der Kurs noch deutlich zulegen.

Zahlen pro Q 90 US-Cent Dividende und haben zudem in den letzten Jahren eigene Aktien vom Markt genommen.

Pro Aktie (Kurs 76 Dollar) ein mehrfaches an Umsatz laut Geschäftsbericht.

Steigt der Ölpreis weiterhin, explodieren hier geradezu die Gewinne pro Aktie und lassen ein Kursziel von 100 bis 120 Dollar erahnen.

Egal ob in 20 Jahren weniger Öl gebraucht wird, jetzt und heute kann man hier noch einsteigen.

Ab 100 Dollar pro Aktie wieder den Markt beobachten und sich dann neu orientieren ob ein halten oder sogar ein verkaufen besser ist.

Antwort auf Beitrag Nr.: 65.611.790 von faultcode am 05.11.20 21:43:49San Francisco Refinery in Rodeo, California:

Apart from HollyFrontier, management at Houston, TX-based Phillips 66 stated that it intends to convert a refinery in California into a biofuel facility. The Rodeo Renewed project of Phillips 66 is expected to become one of the world’s largest biodiesel facilities that will utilize used cooking oil, fats, soybean oils and greases as inputs.

https://www.zacks.com/stock/news/1123251/hollyfrontier-hfc-t…

--> https://investor.phillips66.com/events-and-presentations/eve…

Apart from HollyFrontier, management at Houston, TX-based Phillips 66 stated that it intends to convert a refinery in California into a biofuel facility. The Rodeo Renewed project of Phillips 66 is expected to become one of the world’s largest biodiesel facilities that will utilize used cooking oil, fats, soybean oils and greases as inputs.

https://www.zacks.com/stock/news/1123251/hollyfrontier-hfc-t…

--> https://investor.phillips66.com/events-and-presentations/eve…

Phillips 66 Reports Second-Quarter Earnings of $1.0 Billion or $1.84 Per Share