wann zündet die nächste stufe bei kanad. MON ???? - 500 Beiträge pro Seite

eröffnet am 30.10.15 16:26:25 von

neuester Beitrag 12.03.18 19:51:20 von

neuester Beitrag 12.03.18 19:51:20 von

Beiträge: 9

ID: 1.220.838

ID: 1.220.838

Aufrufe heute: 0

Gesamt: 2.497

Gesamt: 2.497

Aktive User: 0

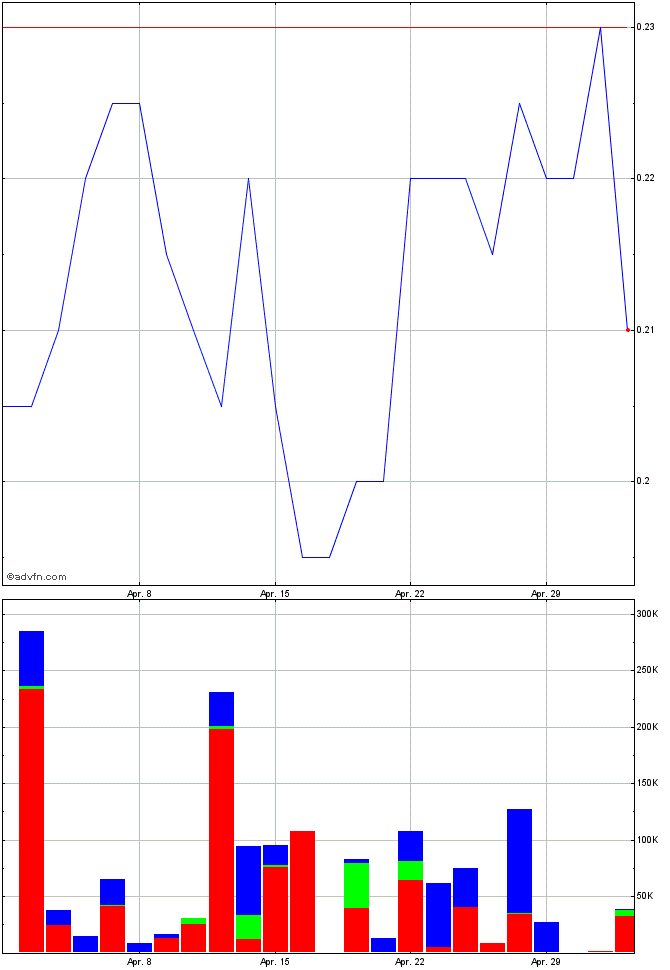

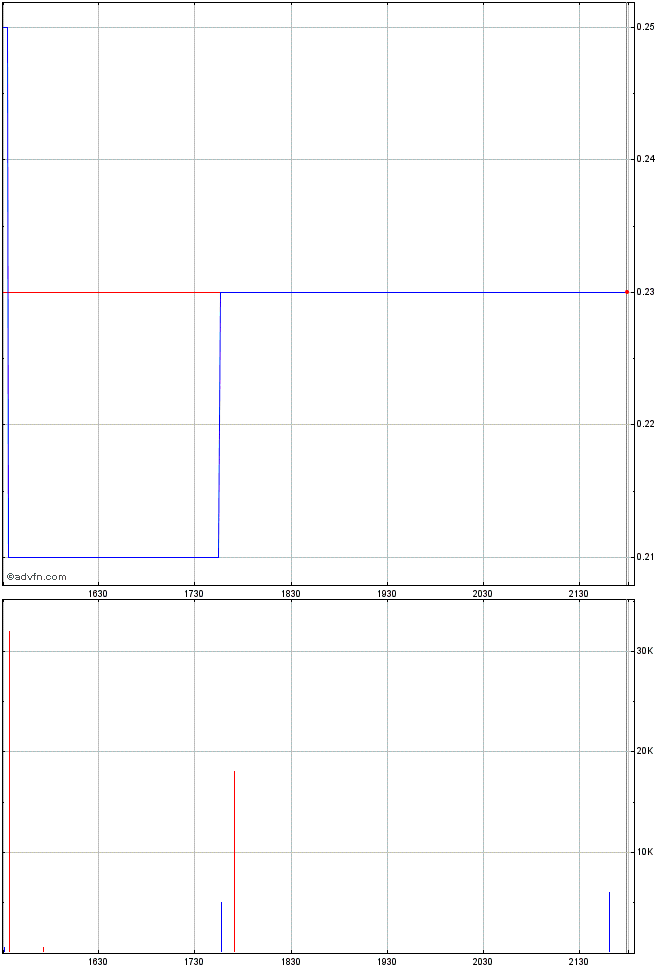

ISIN: CA6126483032 · WKN: A2DUSZ · Symbol: MON

0,2000

CAD

0,00 %

0,0000 CAD

Letzter Kurs 18.04.24 TSX Venture

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +30,77 | |

| 0,5998 | +22,41 | |

| 0,6200 | +21,57 | |

| 27,85 | +10,38 | |

| 10,000 | +10,01 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,95 | -10,00 | |

| 500,00 | -13,04 | |

| 15.280,00 | -16,14 | |

| 8,5962 | -18,13 | |

| 5.153,50 | -27,60 |

moin explorer- fans,

bin jüngst über eine wahre perle gestolpert, die nebst dem REE- haupt- proj. in

tansania auch noch über ein ausgesprochen aussichtsreiches phosh.- proj. in südafrika verfügt.

SO aussichtsreich, daß ein investor für ein 10%iges paket bereit war 2,7mios

zu investieren - d.h. mit anderen worten: das GESAMT- proj. wird mit ca 27mios

bewertet !!!

wie unschwer auf obigem chart zu erkennen ist, sahen wir nach dieser TOP- meldung

bei rekord- vol. einen ersten ausbruch bis auf jahreshoch von 6ct.

nachfolg. entspr. PR...........

Montero partner to acquire 10% of Duyker for $2.7M

2015-10-14 10:28 ET - News Release

Dr. Tony Harwood reports

MONTERO SECURES CDN $2.7 MILLION INVESTMENT TO COMPLETE A PRE-FEASIBILITY STUDY ON DUYKER EILAND PHOSPHATE PROJECT

Montero Mining and Exploration Ltd.'s financing partner, Ovation Capital, has committed to expenditures of approximately $2.7-million (before VAT) to acquire a 10-per-cent interest in Montero's Duyker Eiland project. On March 2, 2015, Montero entered into an agreement whereby Ovation may earn a 10-per-cent interest in the Duyker Eiland phosphate project at asset level by completing a prefeasibility study and a further 20-per-cent interest by completing a bankable feasibility study.

Dr. Tony Harwood, president and chief executive officer of Montero, commented: "Ovation is providing approximately $2.7-million in funding to advance Montero's Duyker Eiland phosphate project. DRA, Outotec and the Sebata Group have been retained to complete prefeasibility, opportunity and environment studies with a view to establishing the costs of developing a rock phosphate mine and fertilizer operation. Ovation is also committed to funding other phosphate opportunities identified by Montero in the region."

Montero completed a technical report (National Instrument 43-101 compliant) prepared by AMEC (news release dated Dec. 14, 2011) and an independent preliminary economic assessment (PEA) report of the Duyker Eiland project prepared by Turgis Consultants (news release dated Feb. 28, 2012, filed on SEDAR April 13, 2012). The bulk of Ovation's project level financing is being used to complete engineering and environmental studies by DRA Global, Outotec (in conjunction with Sofreco) and the Sebata Group............

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aMON-23170…

weitere infos auf nachfolg. HP.......

http://www.monteromining.com/projects/index.html

inzwischen haben leichte gewinnmitnahmen kurs etwas gedrückt und aus meiner sicht

schöne zustiegschancen für jene an der seitenlinie geebnet

der clou ist, daß wert bei akt. kurs von 3,5ct bei knapp 72mio shares grad mal

mit cad- mios 2,5 gewertet ist - nicht mal einem zehntel von NUR dem taxierten

wert dieses EINEN proj. !!!!

denke mal, hier steht eine unmittelbare KORREKTUR bevor - leider NUR für jene, die

direkt an der kanad. börse handeln können

Antwort auf Beitrag Nr.: 50.971.143 von hbg55 am 30.10.15 16:26:25

....schlossen vergangene woche bei lebhaftem handel und knapp 1mio- vol. bzw.

TH von 4ct. mit nachfolg. last trades.......

Recent Trades - Last 10 of 48

Time ET Ex Price Change Volume Buyer Seller Markers

15:50:50 V 0.035 0.005 10,000 7 TD Sec 7 TD Sec K

15:46:16 V 0.035 0.005 5,000 7 TD Sec 7 TD Sec K

15:32:22 V 0.035 0.005 11,000 143 Pershing 7 TD Sec K

15:32:22 V 0.035 0.005 1,000 7 TD Sec 7 TD Sec K

15:24:32 V 0.035 0.005 10,000 143 Pershing 19 Desjardins K

15:24:32 V 0.035 0.005 20,000 143 Pershing 9 BMO Nesbitt K

15:24:32 V 0.035 0.005 59,000 143 Pershing 7 TD Sec K

14:47:35 V 0.035 0.005 1,000 143 Pershing 7 TD Sec K

14:47:17 V 0.035 0.005 99,000 143 Pershing 7 TD Sec K

14:38:34 V 0.035 0.005 1,000 9 BMO Nesbitt 7 TD Sec K

....nicht übel für nen freitag und läßt vermuten, daß wir in komm. woche, bei störungsfreiem umfeld, weitere int.- zunahme erwarten dürfen....IMO

....schlossen vergangene woche bei lebhaftem handel und knapp 1mio- vol. bzw.

TH von 4ct. mit nachfolg. last trades.......

Recent Trades - Last 10 of 48

Time ET Ex Price Change Volume Buyer Seller Markers

15:50:50 V 0.035 0.005 10,000 7 TD Sec 7 TD Sec K

15:46:16 V 0.035 0.005 5,000 7 TD Sec 7 TD Sec K

15:32:22 V 0.035 0.005 11,000 143 Pershing 7 TD Sec K

15:32:22 V 0.035 0.005 1,000 7 TD Sec 7 TD Sec K

15:24:32 V 0.035 0.005 10,000 143 Pershing 19 Desjardins K

15:24:32 V 0.035 0.005 20,000 143 Pershing 9 BMO Nesbitt K

15:24:32 V 0.035 0.005 59,000 143 Pershing 7 TD Sec K

14:47:35 V 0.035 0.005 1,000 143 Pershing 7 TD Sec K

14:47:17 V 0.035 0.005 99,000 143 Pershing 7 TD Sec K

14:38:34 V 0.035 0.005 1,000 9 BMO Nesbitt 7 TD Sec K

....nicht übel für nen freitag und läßt vermuten, daß wir in komm. woche, bei störungsfreiem umfeld, weitere int.- zunahme erwarten dürfen....IMO

Antwort auf Beitrag Nr.: 50.978.529 von hbg55 am 01.11.15 09:57:27wem bis dahin noch an weiteren infos gelegen ist, dem seien ua auch nachfolg.

fact sheets aus q1 2015 mit ner reihe dates, graphiken etc. als gute grundlage

für den näher rückenden wochenstart empfohlen.........

http://www.monteromining.com/downloads/MONfactsheetQ1-2015-P…

http://www.monteromining.com/downloads/MONfactsheetQ1-2015-W…

fact sheets aus q1 2015 mit ner reihe dates, graphiken etc. als gute grundlage

für den näher rückenden wochenstart empfohlen.........

http://www.monteromining.com/downloads/MONfactsheetQ1-2015-P…

http://www.monteromining.com/downloads/MONfactsheetQ1-2015-W…

Antwort auf Beitrag Nr.: 50.978.529 von hbg55 am 01.11.15 09:57:27...trotz negativ- vorgaben ausm asiat. raum setzt sich bei MON aufwärtstrend zum wochenstart

fort und hat den anschein, daß übers WE ne reihe investoren zu der erkenntnis kamen, daß es hier billiger NICHT mehr wird..........

RT.........cad 0,045

fort und hat den anschein, daß übers WE ne reihe investoren zu der erkenntnis kamen, daß es hier billiger NICHT mehr wird..........

RT.........cad 0,045

Bin mit einer 1. Posistion dabei. Wirkt spannend.

71 Millionen Aktien, MK keine 3 Millionen, Projekte weit fortgeschritten und Investoren an Bord.

In letzter Zeit (seit Juni) etwas ruhig...meist ein Zeichen dafür, dass irgendwas köchelt.

71 Millionen Aktien, MK keine 3 Millionen, Projekte weit fortgeschritten und Investoren an Bord.

In letzter Zeit (seit Juni) etwas ruhig...meist ein Zeichen dafür, dass irgendwas köchelt.

Antwort auf Beitrag Nr.: 53.052.802 von Stockplan am 13.08.16 09:10:07

WELCOME on board, SP

.....und für MICH war jüngste PR grund auch noch einmal abissl nachzulegen.....

Montero Announces Proposed Debt Settlement

TORONTO, ONTARIO--(Marketwired - June 1, 2016) -

NOT FOR DISSEMINATION IN THE UNITED STATES OR OVER UNITED STATES NEWSWIRE SERVICES

Montero Mining and Exploration Ltd. (TSX VENTURE:MON) ("Montero" or the "Corporation") announces that it intends to complete a debt settlement transaction (the "Debt Settlement") with certain creditors ("Creditors"), including Creditors who are related parties of the Corporation, providing for the settlement of approximately $1,018,980 of its outstanding debts, of which $679,487 in debt will be settled through the issuance of an aggregate of 13,589,740 common shares of the Corporation ("Common Shares") at a deemed issue price of $0.05 per Common Share, and $339,493 in debt will be forgiven. The Debt Settlement is subject to regulatory and shareholder approval. The Corporation expects to complete the Debt Settlement shortly after such approvals are obtained.

Dr. Antony Harwood, President and Chief Executive Officer of Montero, commented, "Montero's goal is to create value for our shareholders. We propose to complete this debt settlement to preserve working capital and improve Montero's prospects for future financing." Dr. Harwood added, "Montero's strategy remains to attract strategic partners to fund projects at the asset level, avoiding dilution at the corporate level. We remain focused on funding for our Wigu Hill rare earth project to take it through feasibility study and development. The exploration work at Wigu Hill has been put on a care and maintenance program while we seek a funding partner and for rare earth prices to recover.

I remain confident in our projects and our strategy to creat…

http://web.tmxmoney.com/article.php?newsid=5536418587126976&…

hoffe mal, daß wir alsbald nächste steps vermittelt bekommen

WELCOME on board, SP

.....und für MICH war jüngste PR grund auch noch einmal abissl nachzulegen.....

Montero Announces Proposed Debt Settlement

TORONTO, ONTARIO--(Marketwired - June 1, 2016) -

NOT FOR DISSEMINATION IN THE UNITED STATES OR OVER UNITED STATES NEWSWIRE SERVICES

Montero Mining and Exploration Ltd. (TSX VENTURE:MON) ("Montero" or the "Corporation") announces that it intends to complete a debt settlement transaction (the "Debt Settlement") with certain creditors ("Creditors"), including Creditors who are related parties of the Corporation, providing for the settlement of approximately $1,018,980 of its outstanding debts, of which $679,487 in debt will be settled through the issuance of an aggregate of 13,589,740 common shares of the Corporation ("Common Shares") at a deemed issue price of $0.05 per Common Share, and $339,493 in debt will be forgiven. The Debt Settlement is subject to regulatory and shareholder approval. The Corporation expects to complete the Debt Settlement shortly after such approvals are obtained.

Dr. Antony Harwood, President and Chief Executive Officer of Montero, commented, "Montero's goal is to create value for our shareholders. We propose to complete this debt settlement to preserve working capital and improve Montero's prospects for future financing." Dr. Harwood added, "Montero's strategy remains to attract strategic partners to fund projects at the asset level, avoiding dilution at the corporate level. We remain focused on funding for our Wigu Hill rare earth project to take it through feasibility study and development. The exploration work at Wigu Hill has been put on a care and maintenance program while we seek a funding partner and for rare earth prices to recover.

I remain confident in our projects and our strategy to creat…

http://web.tmxmoney.com/article.php?newsid=5536418587126976&…

hoffe mal, daß wir alsbald nächste steps vermittelt bekommen

Zwei Tage in Folge Kurs und Volumenanstieg. Dazu wird das Orderbuch nach oben hin dünner. Vielleicht lässt man im September die Katze aus dem Sack. MK nach wie vor ein Witz.

TORONTO, ONTARIO--(Marketwired - Oct. 24, 2016) -

NOT FOR DISSEMINATION IN THE UNITED STATES OR OVER UNITED STATES NEWSWIRE SERVICES

Montero Mining and Exploration Ltd. (TSX VENTURE:MON) ("Montero" or the "Corporation") announces that it has completed its previously-announced debt settlement transaction (the "Debt Settlement"). Pursuant to the Debt Settlement, the Corporation settled debts of approximately $1,007,475. The Corporation issued 13,720,495 common shares ("Common Shares") to certain creditors at a deemed issue price of $0.05 per Common Share in settlement of approximately $686,025 in debt, and obtained the release from a further $321,450 in debt. The Common Shares issued by the Corporation pursuant to the Debt Settlement are subject to a four month hold period expiring on February 25, 2017.

Dr. Antony Harwood, President and Chief Executive Officer of Montero, commented, "I am pleased to announce the debt settlement, which will provide a platform on which the company can now move forward. I am grateful to interested parties for their continued support of the company."

Certain related parties of the Corporation participated in the Debt Settlement. Global Mining Services Ltd., a corporation in which Dr. Harwood has beneficial interests, settled approximately $237,546 in debt in exchange for 4,750,920 Common Shares, and released a further $228,389 in debt; Criss Cross Inc., a corporation of which Antonia J. Chapman, the CFO, Corporate Secretary, and a director of the Corporation, is a director and 100% beneficial owner, settled approximately $92,250 in debt in exchange for 1,845,000 Common Shares, and released a further $69,750 in debt; Golden Phoenix International Pty Ltd., a corporation controlled by Gregory C. Hall, a director of the Corporation, settled approximately $12,943 in debt in exchange for 258,680 Common Shares; and Andrew Thomson, a director of the Corporation, settled $15,000 in debt in exchange for 300,000 Common Shares, and released a further $11,000 in debt (Global Mining Services Ltd., Criss Cross Inc., Golden Phoenix International Pty Ltd., and Mr. Thomson, the "Related Creditors").

The participation in the Debt Settlement by the Related Creditors constitutes a "related party transaction" as such terms are defined by Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"), requiring the Corporation, in the absence of exemptions, to obtain a formal valuation for, and minority shareholder approval of, the "related party transaction". The Corporation is relying on an exemption from the formal valuation requirements of MI 61-101 available because no securities of the Corporation are listed on specified markets, including the TSX, the New York Stock Exchange, the American Stock Exchange, the NASDAQ or any stock exchange outside of Canada and the United States other than the Alternative Investment Market of the London Stock Exchange or the PLUS markets operated by PLUS Markets Group plc. The Debt Settlement was approved by a majority of disinterested shareholders at the annual and special meeting of shareholders of the Corporation held on June 29, 2016. The participation by each of the Related Creditors in the Debt Settlement was approved by directors of the Corporation who are independent of such Related Creditors.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended, (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to or for the account or benefit of a U.S. person (as defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About Montero Mining and Exploration Ltd.

Montero is a mineral exploration and development company engaged in the identification, acquisition, evaluation and exploration of mineral properties. These include phosphates in South Africa and rare earth elements (REE) in Tanzania. Montero has entered into agreement to develop its portfolio of phosphate properties with Ovation Capital in South Africa. Montero remains focused on attracting a strategic investor for the further development of the Wigu Hill Rare Earth Element Project in Tanzania. Montero trades on the TSX Venture Exchange under the symbol MON.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking information" within the meaning of applicable Canadian securities laws. Forward looking information includes, but is not limited to, statements, projections and estimates with respect to the Debt Settlement. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Such information is based on information currently available to Montero and Montero provides no assurance that actual results will meet management's expectations. Forward-looking information by its very nature involves inherent risks and uncertainties that may cause the actual results, level of activity, performance, or achievements of Montero to be materially different from those expressed or implied by such forward-looking information. Actual results relating to, among other things, approval and completion of the Debt Settlement, results of exploration, project development, reclamation and capital costs of Montero's mineral properties, and Montero's financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with Montero's activities; and other matters discussed in this news release and in filings made with securities regulators. This list is not exhaustive of the factors that may affect any of Montero's forward-looking statements. These and other factors should be considered carefully and accordingly, readers should not place undue reliance on forward-looking information. Montero does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Montero Mining and Exploration Ltd.

Dr. Tony Harwood

President and Chief Executive Officer

+1 866 688 4671

+1 416 840 9197

ir@monteromining.com

www.monteromining.com

Read more at http://www.stockhouse.com/news/press-releases/2016/10/24/mon…

NOT FOR DISSEMINATION IN THE UNITED STATES OR OVER UNITED STATES NEWSWIRE SERVICES

Montero Mining and Exploration Ltd. (TSX VENTURE:MON) ("Montero" or the "Corporation") announces that it has completed its previously-announced debt settlement transaction (the "Debt Settlement"). Pursuant to the Debt Settlement, the Corporation settled debts of approximately $1,007,475. The Corporation issued 13,720,495 common shares ("Common Shares") to certain creditors at a deemed issue price of $0.05 per Common Share in settlement of approximately $686,025 in debt, and obtained the release from a further $321,450 in debt. The Common Shares issued by the Corporation pursuant to the Debt Settlement are subject to a four month hold period expiring on February 25, 2017.

Dr. Antony Harwood, President and Chief Executive Officer of Montero, commented, "I am pleased to announce the debt settlement, which will provide a platform on which the company can now move forward. I am grateful to interested parties for their continued support of the company."

Certain related parties of the Corporation participated in the Debt Settlement. Global Mining Services Ltd., a corporation in which Dr. Harwood has beneficial interests, settled approximately $237,546 in debt in exchange for 4,750,920 Common Shares, and released a further $228,389 in debt; Criss Cross Inc., a corporation of which Antonia J. Chapman, the CFO, Corporate Secretary, and a director of the Corporation, is a director and 100% beneficial owner, settled approximately $92,250 in debt in exchange for 1,845,000 Common Shares, and released a further $69,750 in debt; Golden Phoenix International Pty Ltd., a corporation controlled by Gregory C. Hall, a director of the Corporation, settled approximately $12,943 in debt in exchange for 258,680 Common Shares; and Andrew Thomson, a director of the Corporation, settled $15,000 in debt in exchange for 300,000 Common Shares, and released a further $11,000 in debt (Global Mining Services Ltd., Criss Cross Inc., Golden Phoenix International Pty Ltd., and Mr. Thomson, the "Related Creditors").

The participation in the Debt Settlement by the Related Creditors constitutes a "related party transaction" as such terms are defined by Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"), requiring the Corporation, in the absence of exemptions, to obtain a formal valuation for, and minority shareholder approval of, the "related party transaction". The Corporation is relying on an exemption from the formal valuation requirements of MI 61-101 available because no securities of the Corporation are listed on specified markets, including the TSX, the New York Stock Exchange, the American Stock Exchange, the NASDAQ or any stock exchange outside of Canada and the United States other than the Alternative Investment Market of the London Stock Exchange or the PLUS markets operated by PLUS Markets Group plc. The Debt Settlement was approved by a majority of disinterested shareholders at the annual and special meeting of shareholders of the Corporation held on June 29, 2016. The participation by each of the Related Creditors in the Debt Settlement was approved by directors of the Corporation who are independent of such Related Creditors.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended, (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to or for the account or benefit of a U.S. person (as defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About Montero Mining and Exploration Ltd.

Montero is a mineral exploration and development company engaged in the identification, acquisition, evaluation and exploration of mineral properties. These include phosphates in South Africa and rare earth elements (REE) in Tanzania. Montero has entered into agreement to develop its portfolio of phosphate properties with Ovation Capital in South Africa. Montero remains focused on attracting a strategic investor for the further development of the Wigu Hill Rare Earth Element Project in Tanzania. Montero trades on the TSX Venture Exchange under the symbol MON.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking information" within the meaning of applicable Canadian securities laws. Forward looking information includes, but is not limited to, statements, projections and estimates with respect to the Debt Settlement. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Such information is based on information currently available to Montero and Montero provides no assurance that actual results will meet management's expectations. Forward-looking information by its very nature involves inherent risks and uncertainties that may cause the actual results, level of activity, performance, or achievements of Montero to be materially different from those expressed or implied by such forward-looking information. Actual results relating to, among other things, approval and completion of the Debt Settlement, results of exploration, project development, reclamation and capital costs of Montero's mineral properties, and Montero's financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with Montero's activities; and other matters discussed in this news release and in filings made with securities regulators. This list is not exhaustive of the factors that may affect any of Montero's forward-looking statements. These and other factors should be considered carefully and accordingly, readers should not place undue reliance on forward-looking information. Montero does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Montero Mining and Exploration Ltd.

Dr. Tony Harwood

President and Chief Executive Officer

+1 866 688 4671

+1 416 840 9197

ir@monteromining.com

www.monteromining.com

Read more at http://www.stockhouse.com/news/press-releases/2016/10/24/mon…

Antwort auf Beitrag Nr.: 53.551.749 von Stockplan am 25.10.16 20:57:16

Montero to acquire 95% of Uis Li-Sn project

2018-03-06 15:37 ET - News Release

Dr. Tony Harwood reports

Montero Mining and Exploration Ltd. has entered into a binding heads of agreement with Namib Base Minerals CC and Namibia Silica CC to acquire a 95-per-cent interest in the Uis lithium-tin tailings project in Namibia. The agreement provides Montero two months to complete legal and technical due diligence to its satisfaction and is also subject to regulatory approval.

Under the terms of the HOA, Montero would earn a 95-per-cent interest in the project by committing to milestone payments totalling $1.425-million (U.S.) to the owners. A payment of $10,000 (U.S.) has been paid on execution of the HOA and $40,000 (U.S.) shall be paid on successful completion of due diligence, a further payment of $275,000 (U.S.) shall be paid within six months and the remainder as staged milestone payments through to production. Montero will also issue $125,000 of cash or shares in Montero to Lithium Africa 1 for drilling and other data pertaining to the project four months from successful completion of the due diligence. In 2016 LA1 completed 1,531 metres of aircore drilling in a 63-drill-hole program. The drill samples have been assayed for tin, lithium, tantalum and niobium, and confirmed the continuous lithium and tin mineralization within parts of the project.

Preliminary analysis of the 2016 drill hole assay data shows that the samples range in lithium content from 0.07 per cent to 0.73 per cent Li2O, the tin content from 12 parts per million to 1,752 ppm SnO2, and tantalum content from 1.5 ppm to 114 ppm Ta2O5. The drill hole assay data show average values of 0.42 per cent lithium (Li2O), 523 ppm tin (SnO2) and 55 ppm tantalum (Ta2O5). The average, range and median values for the 1,531 drill sample assays obtained are provided in the attached table.

The Uis mine operated from 1924 to 1990 with confirmed ore tonnage production mined between 1966 and 1981 of 10,657,075 tonnes (ISCOR 1982, U.S. Bureau of Mines, 1992) and previous mining adding a total potential tonnage of tailings of up to 20 million tonnes derived from approximate surface measurements and density estimates from the 2016 drill program. A review of available surface and drill data is under way. Further work including tonnage and resource estimation, mineralogical investigations, and preliminary metallurgical testwork is planned and updates will be provided............

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aMON-2578…

......DAS liest sich SO schlecht nicht - grad auch unter berücksichtigung der akt. MK von

grad mal cad- mios 3,0 ( a 0,29 )

MONTERO ACQUIRES UIS LITHIUM-TIN TAILINGS PROJECT, NAMIBIA

Montero to acquire 95% of Uis Li-Sn project

2018-03-06 15:37 ET - News Release

Dr. Tony Harwood reports

Montero Mining and Exploration Ltd. has entered into a binding heads of agreement with Namib Base Minerals CC and Namibia Silica CC to acquire a 95-per-cent interest in the Uis lithium-tin tailings project in Namibia. The agreement provides Montero two months to complete legal and technical due diligence to its satisfaction and is also subject to regulatory approval.

Under the terms of the HOA, Montero would earn a 95-per-cent interest in the project by committing to milestone payments totalling $1.425-million (U.S.) to the owners. A payment of $10,000 (U.S.) has been paid on execution of the HOA and $40,000 (U.S.) shall be paid on successful completion of due diligence, a further payment of $275,000 (U.S.) shall be paid within six months and the remainder as staged milestone payments through to production. Montero will also issue $125,000 of cash or shares in Montero to Lithium Africa 1 for drilling and other data pertaining to the project four months from successful completion of the due diligence. In 2016 LA1 completed 1,531 metres of aircore drilling in a 63-drill-hole program. The drill samples have been assayed for tin, lithium, tantalum and niobium, and confirmed the continuous lithium and tin mineralization within parts of the project.

Preliminary analysis of the 2016 drill hole assay data shows that the samples range in lithium content from 0.07 per cent to 0.73 per cent Li2O, the tin content from 12 parts per million to 1,752 ppm SnO2, and tantalum content from 1.5 ppm to 114 ppm Ta2O5. The drill hole assay data show average values of 0.42 per cent lithium (Li2O), 523 ppm tin (SnO2) and 55 ppm tantalum (Ta2O5). The average, range and median values for the 1,531 drill sample assays obtained are provided in the attached table.

The Uis mine operated from 1924 to 1990 with confirmed ore tonnage production mined between 1966 and 1981 of 10,657,075 tonnes (ISCOR 1982, U.S. Bureau of Mines, 1992) and previous mining adding a total potential tonnage of tailings of up to 20 million tonnes derived from approximate surface measurements and density estimates from the 2016 drill program. A review of available surface and drill data is under way. Further work including tonnage and resource estimation, mineralogical investigations, and preliminary metallurgical testwork is planned and updates will be provided............

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aMON-2578…

......DAS liest sich SO schlecht nicht - grad auch unter berücksichtigung der akt. MK von

grad mal cad- mios 3,0 ( a 0,29 )

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -0,43 | |

| 0,00 | |

| -2,80 | |

| -0,63 | |

| +0,22 | |

| +1,85 | |

| -1,51 | |

| -0,74 | |

| -20,00 | |

| -2,36 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 193 | ||

| 101 | ||

| 95 | ||

| 72 | ||

| 64 | ||

| 60 | ||

| 44 | ||

| 36 | ||

| 36 | ||

| 32 |

wann zündet die nächste stufe bei kanad. MON ????