Chesapeake Energy - 500 Beiträge pro Seite

eröffnet am 02.01.16 11:14:31 von

neuester Beitrag 02.07.20 12:21:11 von

neuester Beitrag 02.07.20 12:21:11 von

Beiträge: 232

ID: 1.223.835

ID: 1.223.835

Aufrufe heute: 0

Gesamt: 24.123

Gesamt: 24.123

Aktive User: 0

ISIN: US1651677437 · WKN: A2P232

3,0500

USD

+1,33 %

+0,0400 USD

Letzter Kurs 10.02.21 Nasdaq OTC

...another distressed Fracker;

Ansichtsstücke geholt.

Ansichtsstücke geholt.

hauptsächlich Gas, Liquids-Anteil etwa 28%

Antwort auf Beitrag Nr.: 51.396.927 von R-BgO am 02.01.16 11:14:31

Hussa!

heute minus 36% weil sie den Insolvenzspezialiisten Kirkland & Ellis schon seit 2010 als advisor haben...

Eine Pleite koennte den US Gaspreis befluegeln ... ?

Antwort auf Beitrag Nr.: 51.690.970 von bmann025 am 08.02.16 21:27:56

glaube ich nicht,

wie soll das gehen? Zitat von R-BgO: wie soll das gehen?

Natural Gas und Oel sind nur teilweise korreliert.

Es wird zwar teilweise substituiert, aber bei den niedrigen Preisen lohnt es sich kaum, LNG ueber die Weltmeere zu schippern. Das heisst die Gas Maerkte sind im Gegensatz zu den Oelmaerkten lokaler mit erheblichen Presiunterschieden in den verschiedenen Weltrgionen.

Fuer den US Gasmarkt ist also die heimische Produktion (und die Kanadas) entscheidend. Wenn dort nun die Oelproduktion wegen des nierigen Oelpreises sinkt, wird auch weniger Gas als Nebenprodukt gefoerdert, was den Gaspreis dort heben koennte.

Timing:

Wenn ein grosser der Branche in Schwierigkeiten geraet, koennte man nahe am Tiefpunkt sein..

Natural Gas testet heute erneut das Mehrjahrestief.

-> Bin heute bei HNU.TO eingestiegen, aber Vorsicht: fallendes Messer !

http://www.stockhouse.com/companies/quote/t.hnu/horizons-bet…

Die Oelminister von Saudi Arabien, Russland, Katar und Venezuela werdne sich diese Woche treffen und ich wuerde darauf setzen, dass hier bereits eine Produktionskuerzung vereinbart wird. Versuche daher, heute ein Oelzertifikat mit niedrigem Hebel (1 oder 2) zu kaufen.

Begruendung:

Das Weltgeschehen koennte man etwa so zusammen:

Deutschland hat aufgehoert, seine eigenen Interessen zu vertreten und ist damit kein rationaler Akteur mehr. Dieses irrationale Handeln ist nicht nur fuer Deutschland, sondern auch fuer dessen Verbuendete gefaehrlich und so werden nun Entscheidungen, mithin sogar Entscheidungen zugunsten Deutschlands, ohne Deutschland getroffen.

Die Tuerkei ist der Stoerenfried. Einerseits durch Spielen der Migrationswaffe gegen Europa, andererseits durch Wiederbelebung osmanischer Machtphantasien von Europa bis Zentralasien, mit riesigem Konfliktpotential.

Saudi Arabiens Rolle wird durch eine von Wikileaks veroeffentlichte Korrespondenz des saudischen Aussenministerums auf den Punkt gebracht. “Syrian regime must be overthrown to avoid revenge for what we've done to them”. SA ist sich klar bewusst, welche Katastrophen man von Libyen bis Afghanistan angezettelt hat, einschliesslich dem Beitrag zum Entstehen von ISIS. SA wird sich zufrieden geben, wenn sie moeglichst unbeschadet wieder herauskommen.

Russland ist nun mit amerikanischem und israelischem Beistand die Aufgabe uebertragen worden, diese Konflikte zu loesen.

In Syrien heisst dies zunaechst, eine Beendigung des Konflikts und die Ausschaltung von ISIS und radikalen Islamisten. Zum zweiten eine Friedensloesung, die alle uebrigen Kraefte einschliesst. Die Golfstaaten werden am Ende mit ins Boot geholt, die Tuerkei bleibt als einzige Kriegspartei aussen vor.

Begruendung:

Das Weltgeschehen koennte man etwa so zusammen:

Deutschland hat aufgehoert, seine eigenen Interessen zu vertreten und ist damit kein rationaler Akteur mehr. Dieses irrationale Handeln ist nicht nur fuer Deutschland, sondern auch fuer dessen Verbuendete gefaehrlich und so werden nun Entscheidungen, mithin sogar Entscheidungen zugunsten Deutschlands, ohne Deutschland getroffen.

Die Tuerkei ist der Stoerenfried. Einerseits durch Spielen der Migrationswaffe gegen Europa, andererseits durch Wiederbelebung osmanischer Machtphantasien von Europa bis Zentralasien, mit riesigem Konfliktpotential.

Saudi Arabiens Rolle wird durch eine von Wikileaks veroeffentlichte Korrespondenz des saudischen Aussenministerums auf den Punkt gebracht. “Syrian regime must be overthrown to avoid revenge for what we've done to them”. SA ist sich klar bewusst, welche Katastrophen man von Libyen bis Afghanistan angezettelt hat, einschliesslich dem Beitrag zum Entstehen von ISIS. SA wird sich zufrieden geben, wenn sie moeglichst unbeschadet wieder herauskommen.

Russland ist nun mit amerikanischem und israelischem Beistand die Aufgabe uebertragen worden, diese Konflikte zu loesen.

In Syrien heisst dies zunaechst, eine Beendigung des Konflikts und die Ausschaltung von ISIS und radikalen Islamisten. Zum zweiten eine Friedensloesung, die alle uebrigen Kraefte einschliesst. Die Golfstaaten werden am Ende mit ins Boot geholt, die Tuerkei bleibt als einzige Kriegspartei aussen vor.

Chesapeake soll der zweitgrößte amerikanische Erdgas-Produzent sein.

Tod eines Fracking-Superstars

http://www.handelsblatt.com/unternehmen/management/aubrey-mc…

Aubrey McClendon baute in zwei Jahrzehnten aus dem Nichts den zweitgrößten Gasproduzenten Amerikas auf. Dabei ging es wohl nicht immer mit rechten Dingen zu. Sein Unfalltod lässt nun viele Fragen offen.....

http://www.handelsblatt.com/unternehmen/management/aubrey-mc…

Aubrey McClendon baute in zwei Jahrzehnten aus dem Nichts den zweitgrößten Gasproduzenten Amerikas auf. Dabei ging es wohl nicht immer mit rechten Dingen zu. Sein Unfalltod lässt nun viele Fragen offen.....

Antwort auf Beitrag Nr.: 51.900.549 von Mittachmahl am 04.03.16 11:06:53Häufig raten teure Unternehmensberatungen den Unternehmen, sich hoch zu verschulden. Damit wird dann GROWTH gekauft und der Aktienkurs steigt. Am Schluß wissen die Firmen dann nicht, wie sie die Schulden bedienen sollen und gehen nicht selten Pleite. Es fehlte das VALUE.

Bin heute eingestiegen

Habe momentan fast ausschließlich gut laufende deutsche Dividendentitel und nun auch noch eine solide Risikoaktie mit Potential  .

.Mal sehen ob man damit in so einem Jahr um die 75 % Gewinn machen kann. Was so stark zurück gekommen ist, geht entweder Pleite oder kommt zurück.

Etwas Nervenkitzel muss sein!

Heutiger Anstieg an der NASDAQ ca. 8,5 % --- der Turnaround sollte langsam beginnen

Chesapeake Investors Should Bet On A Turnaroundhttp://seekingalpha.com/article/3987160-chesapeake-investors…

Noch kann ein Einstieg interessant sein ---

auch wenn die Aktie generell nicht zu den mündelsicheren gehört. Aber das Potential ist bei einer Erholung der Energiepreise recht hoch.http://seekingalpha.com/article/3991432-chesapeake-energy-bu…

Antwort auf Beitrag Nr.: 52.918.186 von Pebbles am 26.07.16 14:58:00bin seit eben auch dabei.

Spekuliere aber auf kürzere Sicht

Spekuliere aber auf kürzere Sicht

Antwort auf Beitrag Nr.: 52.919.161 von checkpointuk am 26.07.16 16:40:47naja, ich hoffe auf ein langfristigen Anstieg

die letzten Tage waren ja sehr erfreulich.

so bin nun nach dem starken Rücksetzer auch wieder dabei.

LG PRINTI

LG PRINTI

Antwort auf Beitrag Nr.: 51.396.927 von R-BgO am 02.01.16 11:14:31auf Erinnerungsstück reduziert

Antwort auf Beitrag Nr.: 53.664.693 von R-BgO am 10.11.16 14:33:33war kein Fehler

um 3 € hat sich der Boden gefunden ....nicht nur bei der Aktie ...auch die Bonds haben sich massiv erholt und im Bereich 2018-22 brennt da nicht mehr viel an ..mag man meinen ...wenn man die (Bond)Kurse sieht ...wäre der Aktienkurs mitgezogen ....würde / sollte er schon weit über 5 € mE liegen ....das ist die Chance 2018 .....sollte Öl sein Niveau halten ....sollte Öl weiter steigen ...könnte Chesapeak wie in Phönix aus dem Ölsumpf wieder auferstehen ....

So ein/das mögliches Drehbuch 2018 ohne Anspruch auf Ausführung ...aber es gibt Wahrscheinlichkeiten und Kausalitäten die nicht unbedingt dagegen sprechen ...im Gegenteil ..

Cure

So ein/das mögliches Drehbuch 2018 ohne Anspruch auf Ausführung ...aber es gibt Wahrscheinlichkeiten und Kausalitäten die nicht unbedingt dagegen sprechen ...im Gegenteil ..

Cure

Antwort auf Beitrag Nr.: 56.546.968 von cure am 27.12.17 08:42:21Hallo Cure,

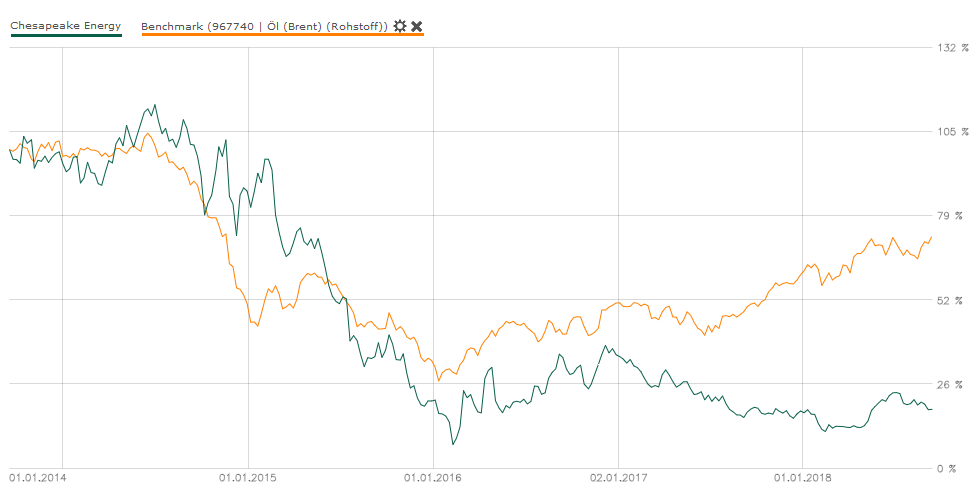

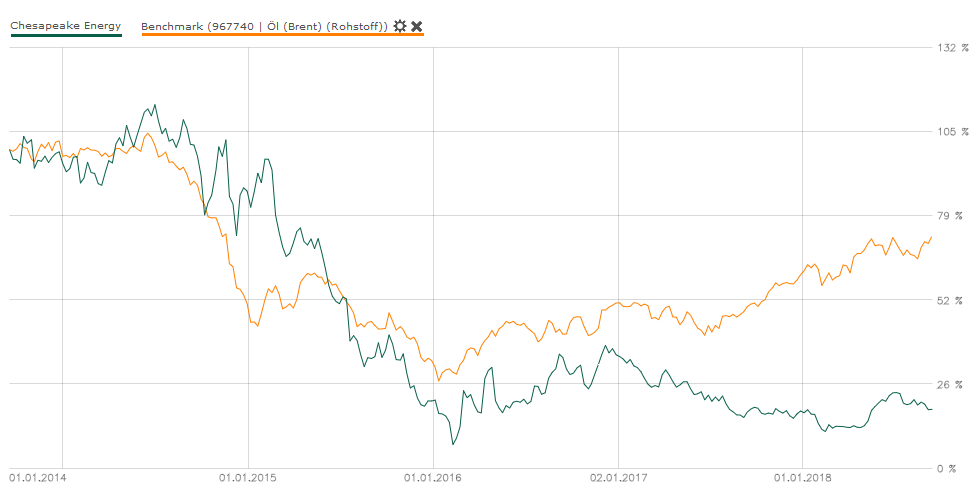

wenn ich den Vergleich zwischen Öl und Chesapeake der letzten drei Jahre sehe, steckt hier ein beträchtliches Erholungspotential. Ich bin dabei und warte auf den Zwischenstand von 5€.

Gruß Substanzsucher

wenn ich den Vergleich zwischen Öl und Chesapeake der letzten drei Jahre sehe, steckt hier ein beträchtliches Erholungspotential. Ich bin dabei und warte auf den Zwischenstand von 5€.

Gruß Substanzsucher

Antwort auf Beitrag Nr.: 56.665.958 von Substanzsucher am 09.01.18 19:56:55eben ....genau darum ist die Aktie hoch explosiv ...noch in keinster Weise die Ölpreiserholung nachgebildet ....

Schaut man sich den historischen Chart von Ches. an , lauert hier eine tickende Zeitkursbombe .....

Die Bonds haben sich schon erholt ...der Aktienkurs dümpelt noch auf unter 50 USD Dollar Brent-Niveau ...

Das ist die Spekulation ...eigentlich sollte die Aktie schon längst mE zw. 5-10 Euro kosten .....zumal Ches. ja auch keine Frittenbude ist sondern einer DER Player im US -Frakinggeschäft ...

Abwarten...Tick-Tack

Cure

Schaut man sich den historischen Chart von Ches. an , lauert hier eine tickende Zeitkursbombe .....

Die Bonds haben sich schon erholt ...der Aktienkurs dümpelt noch auf unter 50 USD Dollar Brent-Niveau ...

Das ist die Spekulation ...eigentlich sollte die Aktie schon längst mE zw. 5-10 Euro kosten .....zumal Ches. ja auch keine Frittenbude ist sondern einer DER Player im US -Frakinggeschäft ...

Abwarten...Tick-Tack

Cure

Brent 70 USD .....

Tick Tack

Tick Tack

schwimmt/frackt sich langsam frei ....

erster größerer Wiederstand ist die 4,40-4,50 € ..... 12 Monatshoch bei / um 7 Euro ..

Im großen Bild sieht man wo es wieder hingehen könnte ....dafür brauchen wir aber Kurse Brent im Bereich 100 USD ...+- 10 USD ...

Aber wenn Brent/WTI das Tempo beibehalten ...kann das sogar schnell gehen ...zumal immer noch keiner so richtig dran glaubt ...was eigentlich schon erstaunlich ist , wenn man sieht wie die Weltwirtschaft brummt...und wie der Energiehunger zunimmt ...

Spannend !!

Cure

erster größerer Wiederstand ist die 4,40-4,50 € ..... 12 Monatshoch bei / um 7 Euro ..

Im großen Bild sieht man wo es wieder hingehen könnte ....dafür brauchen wir aber Kurse Brent im Bereich 100 USD ...+- 10 USD ...

Aber wenn Brent/WTI das Tempo beibehalten ...kann das sogar schnell gehen ...zumal immer noch keiner so richtig dran glaubt ...was eigentlich schon erstaunlich ist , wenn man sieht wie die Weltwirtschaft brummt...und wie der Energiehunger zunimmt ...

Spannend !!

Cure

Hallo zusammen,

mit jedem Cent-Anstieg beim Öl, wird die Kursfeder bei der Chesapeak weiter angespannt. Über Kurz oder Lang wird der Druck zu groß und die Feder entspannt sich.

Je länger die Blockierung anhält umso heftiger ist der spätere Ausbruch. Soviel zur Theorie.

Uns wird immer verkauft, dass es an der Börse um Millisekunden geht und ein kurzer Informationsvorsprung unbezahlbar sei.

Meine Erfahrung sagt jedoch etwas ganz anderes. Die richtig guten Storys bauen sich langsam auf und als Anleger hat man oft Monate Zeit um einzusteigen.

Die Chesapeak könnte für diese Theorie/Erfahrung ein Lehrbeispiel werden.

Gruß Substanzsucher

mit jedem Cent-Anstieg beim Öl, wird die Kursfeder bei der Chesapeak weiter angespannt. Über Kurz oder Lang wird der Druck zu groß und die Feder entspannt sich.

Je länger die Blockierung anhält umso heftiger ist der spätere Ausbruch. Soviel zur Theorie.

Uns wird immer verkauft, dass es an der Börse um Millisekunden geht und ein kurzer Informationsvorsprung unbezahlbar sei.

Meine Erfahrung sagt jedoch etwas ganz anderes. Die richtig guten Storys bauen sich langsam auf und als Anleger hat man oft Monate Zeit um einzusteigen.

Die Chesapeak könnte für diese Theorie/Erfahrung ein Lehrbeispiel werden.

Gruß Substanzsucher

Fräcking ist mittl. um 40 USD profitabel ....

Wenn man hier 1 zu 1 zusammenzählt sollte man das Potentail riechen ....

Geklingelt wird nicht ..und ja ....über 10 USD kann man dann auch noch kaufen ...

High Risk ...High Chance ..sollte Brent / WTI wieder die 80-100USD in Angriff nehmen ( sooo weit ist das gar nicht mehr ), werden wir mE mit diesem Wert richtig Späßchen haben .....

Das ist dann momentan alles nur Vorgeplänkel .....

Cure

Wenn man hier 1 zu 1 zusammenzählt sollte man das Potentail riechen ....

Geklingelt wird nicht ..und ja ....über 10 USD kann man dann auch noch kaufen ...

High Risk ...High Chance ..sollte Brent / WTI wieder die 80-100USD in Angriff nehmen ( sooo weit ist das gar nicht mehr ), werden wir mE mit diesem Wert richtig Späßchen haben .....

Das ist dann momentan alles nur Vorgeplänkel .....

Cure

Kurznachricht –11:11

IEA erwartet aufgrund anziehender Ölpreise "explosionsartigen" Anstieg der US-Ölförderung.

"Tick Tack Bumm"

IEA erwartet aufgrund anziehender Ölpreise "explosionsartigen" Anstieg der US-Ölförderung.

"Tick Tack Bumm"

https://ledgergazette.com/2018/01/23/chesapeake-energy-co-ch…

Chesapeake Energy Co. (NYSE:CHK) – Analysts at SunTrust Banks increased their FY2017 earnings per share estimates for Chesapeake Energy in a research note issued on Wednesday, Zacks Investment Research reports. SunTrust Banks analyst N. Dingmann now forecasts that the oil and gas exploration company will post earnings of $0.67 per share for the year, up from their prior estimate of $0.65.

SunTrust Banks has a “Buy” rating and a $6.00 price “ objective on the stock.

SunTrust Banks also issued estimates for Chesapeake Energy’s Q4 2017 earnings at $0.19 EPS, FY2019 earnings at $0.86 EPS and FY2020 earnings at $0.96 EPS.

Chesapeake Energy Co. (NYSE:CHK) – Analysts at SunTrust Banks increased their FY2017 earnings per share estimates for Chesapeake Energy in a research note issued on Wednesday, Zacks Investment Research reports. SunTrust Banks analyst N. Dingmann now forecasts that the oil and gas exploration company will post earnings of $0.67 per share for the year, up from their prior estimate of $0.65.

SunTrust Banks has a “Buy” rating and a $6.00 price “ objective on the stock.

SunTrust Banks also issued estimates for Chesapeake Energy’s Q4 2017 earnings at $0.19 EPS, FY2019 earnings at $0.86 EPS and FY2020 earnings at $0.96 EPS.

so bin gerade wieder rein zu 3,12$

LG Printi

LG Printi

Hammer was da wieder abgeht ..Brent/WTI korrigieren nach dem heftigen Anstieg um 10 % ...und die ganze Ölpeer / Driller fallen um 30-40 % von ihren kürzlichen Verlaufhoch zurück ...

Gibt/ bekommt man wirklich eine zweite Chance .....werden die alten Tiefs nochmal angetestet ...was haben die Algos vor ??

Spannend ..

Cure

Gibt/ bekommt man wirklich eine zweite Chance .....werden die alten Tiefs nochmal angetestet ...was haben die Algos vor ??

Spannend ..

Cure

Antwort auf Beitrag Nr.: 56.943.506 von cure am 06.02.18 08:11:50Ja krass

habe mich gefreut so günstig an CHK Aktien zu kommen einen Teil werde ich versuchen zu 3,5$ wieder zu verkaufen und den Rest lasse ich langfristig liegen

LG Printi

habe mich gefreut so günstig an CHK Aktien zu kommen einen Teil werde ich versuchen zu 3,5$ wieder zu verkaufen und den Rest lasse ich langfristig liegen

LG Printi

Hallo zusammen,

habe die Gelegenheit genutzt und meine Position ausgebaut.

Man kann sich über Kursschwächen ärgern oder es auch als Chance sehen.

Gruß

Substanzsucher

habe die Gelegenheit genutzt und meine Position ausgebaut.

Man kann sich über Kursschwächen ärgern oder es auch als Chance sehen.

Gruß

Substanzsucher

... meinte natürlich up...

Antwort auf Beitrag Nr.: 56.943.506 von cure am 06.02.18 08:11:50

hier jetzt weiter zugekauft (gegen RIG etwas getauscht ) und weiter damit runtergezogen ...Chesapeak ist der einzige Wert bei mir der (noch) rot steht ...der Rest der Driller läuft wunderbar dunkelgrün ...

Mal sehn ob Sie nicht auch bald aufwacht und der Peer hinterherhechelt ...

Zitat von cure: Hammer was da wieder abgeht ..Brent/WTI korrigieren nach dem heftigen Anstieg um 10 % ...und die ganze Ölpeer / Driller fallen um 30-40 % von ihren kürzlichen Verlaufhoch zurück ...

Gibt/ bekommt man wirklich eine zweite Chance .....werden die alten Tiefs nochmal angetestet ...was haben die Algos vor ??

Spannend ..

Cure

hier jetzt weiter zugekauft (gegen RIG etwas getauscht ) und weiter damit runtergezogen ...Chesapeak ist der einzige Wert bei mir der (noch) rot steht ...der Rest der Driller läuft wunderbar dunkelgrün ...

Mal sehn ob Sie nicht auch bald aufwacht und der Peer hinterherhechelt ...

Bin hier aus dem gleichen Grund auch dabei.

Die Flut sollte alles heben, auch die bisherigen Underperformer.

Im Goldsektor deshalb New Gold gekauft.

Die Flut sollte alles heben, auch die bisherigen Underperformer.

Im Goldsektor deshalb New Gold gekauft.

..auch Anglogold Ashanti sind noch kaum gelaufen ....

Netter Chart - meide aber Südafrika.

Impala lässt grüßen ;-)

Bin ich zum Glück nicht drin.

Impala lässt grüßen ;-)

Bin ich zum Glück nicht drin.

Chesapeake Energy Corp. übertrifft im ersten Quartal mit einem Gewinn je Aktie von $0,34 die Analystenschätzungen von $0,27.

Kurznachricht

Kurznachricht

einstelliges KGV nach dem 1.Q-..und die Aktie kommt einfach nicht ins laufen ...

Wenn da nicht die Schulden wären ....aber das kann doch nicht der Grund sein ...die gab"s früher auch ....

Der Ölpreis kennt auch nur eine Richtung ...die 100 ist keine Utopie mehr !

Ich habe zugekauft ...knapp hinten noch ...mit Whitcap / Nat.Oil.Varco/ Whiting P. / Carbo Car. / Marathon /Carrizo liege ich teils fett vorne ...

Nur die olle Chesapeake zickt noch rum ...sollte eigentlich schon längst zw. 3-5 Euro stehen ...

(Weiter)Abwarten ..

Cure

Wenn da nicht die Schulden wären ....aber das kann doch nicht der Grund sein ...die gab"s früher auch ....

Der Ölpreis kennt auch nur eine Richtung ...die 100 ist keine Utopie mehr !

Ich habe zugekauft ...knapp hinten noch ...mit Whitcap / Nat.Oil.Varco/ Whiting P. / Carbo Car. / Marathon /Carrizo liege ich teils fett vorne ...

Nur die olle Chesapeake zickt noch rum ...sollte eigentlich schon längst zw. 3-5 Euro stehen ...

(Weiter)Abwarten ..

Cure

die Rahmenbedingungen waren schon lange nicht mehr so gut wie aktuell.

Mit Überschreiten der 3,50$ Linie wird es sehr schnell nach oben gehen.

Gruß Substanzsucher

Mit Überschreiten der 3,50$ Linie wird es sehr schnell nach oben gehen.

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Gruß Substanzsucher

Antwort auf Beitrag Nr.: 57.723.550 von cure am 09.05.18 08:31:40

irgendwas muss da eigentlich faul sein...

schon mal überlegt,

warum die preferreds noch alle bei ungefähr dem halben Nennwert dümpeln?irgendwas muss da eigentlich faul sein...

Hallo zusammen,

die 3,50$ sind gefallen.

Mit jedem verkauften Barrel werden heute 30$ mehr verdient als noch vor einem Jahr.

Falls das Öl auf diesem Niveau bleibt oder sogar noch weiter steigt, werden die Gewinne wieder sprudeln. Die Börse wird die Bewertung dementsprechend anpassen.

Gruß

Substanzsucher

die 3,50$ sind gefallen.

Mit jedem verkauften Barrel werden heute 30$ mehr verdient als noch vor einem Jahr.

Falls das Öl auf diesem Niveau bleibt oder sogar noch weiter steigt, werden die Gewinne wieder sprudeln. Die Börse wird die Bewertung dementsprechend anpassen.

Gruß

Substanzsucher

Antwort auf Beitrag Nr.: 57.723.550 von cure am 09.05.18 08:31:40

...langsam wird dann doch das Hirn eingeschaltet ...

Zitat von cure: einstelliges KGV nach dem 1.Q-..und die Aktie kommt einfach nicht ins laufen ...

Wenn da nicht die Schulden wären ....aber das kann doch nicht der Grund sein ...die gab"s früher auch ....

Der Ölpreis kennt auch nur eine Richtung ...die 100 ist keine Utopie mehr !

Ich habe zugekauft ...knapp hinten noch ...mit Whitcap / Nat.Oil.Varco/ Whiting P. / Carbo Car. / Marathon /Carrizo liege ich teils fett vorne ...

Nur die olle Chesapeake zickt noch rum ...sollte eigentlich schon längst zw. 3-5 Euro stehen ...

(Weiter)Abwarten ..

Cure

...langsam wird dann doch das Hirn eingeschaltet ...

Antwort auf Beitrag Nr.: 57.756.982 von Substanzsucher am 14.05.18 19:13:52

Wie Butter durch die USD 3,50 ......nachste Hürde 6-8 USD ........man darf schon ein bissl träumen .....August 2014 lag Brent um 100 USD ....weit ist es bis dahin nicht mehr..........und da lage Ches. bei 27-29 USD .....

Sollte also Brent dieses Jahr die 100 anpeilen ....sollte man sich anschnallen ....so die Theorie ...

Schau dir auch mal die Carbo Ceramics an .....die Cisco der Frackingzulieferer ......kommt von 160 USD (2014) ...noch schlappe etwas über 10 USD ...Tendenz aber auch langsam auf Entdeckungsmodus ...

Grüße

Cure

Zitat von Substanzsucher: Hallo zusammen,

die 3,50$ sind gefallen.

Mit jedem verkauften Barrel werden heute 30$ mehr verdient als noch vor einem Jahr.

Falls das Öl auf diesem Niveau bleibt oder sogar noch weiter steigt, werden die Gewinne wieder sprudeln. Die Börse wird die Bewertung dementsprechend anpassen.

Gruß

Substanzsucher

Wie Butter durch die USD 3,50 ......nachste Hürde 6-8 USD ........man darf schon ein bissl träumen .....August 2014 lag Brent um 100 USD ....weit ist es bis dahin nicht mehr..........und da lage Ches. bei 27-29 USD .....

Sollte also Brent dieses Jahr die 100 anpeilen ....sollte man sich anschnallen ....so die Theorie ...

Schau dir auch mal die Carbo Ceramics an .....die Cisco der Frackingzulieferer ......kommt von 160 USD (2014) ...noch schlappe etwas über 10 USD ...Tendenz aber auch langsam auf Entdeckungsmodus ...

Grüße

Cure

Antwort auf Beitrag Nr.: 57.764.845 von cure am 15.05.18 16:50:24die 3,50$ sind Vergangenheit!

In den letzten zwei Jahren wurde die Branche, bedingt durch die schwachen Ölpreise massiv nach unten geprügelt und wer gekauft hat lag kurze Zeit später im Verlust. Als das Öl wieder anzog trauten sich nur Wenig wieder einzusteigen. Da die Kurse dem steigendem Ölpreis nicht folgten, wurde die Kursfeder immer weiter gespannt und aktuell scheint es so, als ob jemend den Abzug gedrückt hat.

Hier kann es ganz schnell sehr hoch gehen und wenn erst einmal der breite Markt wieder Vertrauen gefunden hat sind Kursziele schwer abzuschätzen.

Bei der Carbo Ceramics gilt natürlich das Gleiche. Ich habe mir eine erste Position ins Depot gelegt.

Viele Grüße

Substanzsucher

In den letzten zwei Jahren wurde die Branche, bedingt durch die schwachen Ölpreise massiv nach unten geprügelt und wer gekauft hat lag kurze Zeit später im Verlust. Als das Öl wieder anzog trauten sich nur Wenig wieder einzusteigen. Da die Kurse dem steigendem Ölpreis nicht folgten, wurde die Kursfeder immer weiter gespannt und aktuell scheint es so, als ob jemend den Abzug gedrückt hat.

Hier kann es ganz schnell sehr hoch gehen und wenn erst einmal der breite Markt wieder Vertrauen gefunden hat sind Kursziele schwer abzuschätzen.

Bei der Carbo Ceramics gilt natürlich das Gleiche. Ich habe mir eine erste Position ins Depot gelegt.

Viele Grüße

Substanzsucher

Antwort auf Beitrag Nr.: 57.778.972 von Substanzsucher am 17.05.18 10:06:43nicht auszudenken wohin der Kurs geht wenn wir dieses Jahr beim Öl die 100 anpeilen ..langsam schießen sich ja auch die Medien auf diese Zahl ein ...und seriös kann man durch die immer weiter steigende Ölnachfrage dies auch herleiten ..so blöde das auch für den Autoliebhaber ist ....

Wo wir bei Chesapeake chartt. herkommen ...kann man sich anschauen und es wird einem schwindelig ...

Öl ist die Zündschnur ......Chesapeake ist das Pulverfass ...

Cure

Wo wir bei Chesapeake chartt. herkommen ...kann man sich anschauen und es wird einem schwindelig ...

Öl ist die Zündschnur ......Chesapeake ist das Pulverfass ...

Cure

Kennt jemand den Artikel im Turnaround-Trader vom 15. Mai 2018 über Chesapeake Energy?

Wie ist die Einschätzung vom Turnaround-Trader zu Chesapeake Energy?

Wie ist die Einschätzung vom Turnaround-Trader zu Chesapeake Energy?

So habe gerade eine größere Position zu 4,02-4,05$ aufgebaut

Nach dem steilen Anstieg von 3$-4,5$ ohne Zwischenstopp musste es ja mal kurzfristig rückwärts gehen.

Nach dem steilen Anstieg von 3$-4,5$ ohne Zwischenstopp musste es ja mal kurzfristig rückwärts gehen.

bis Ende des Jahres hoffe ich auf mindestens 8$ pro Aktie langfristig 20-30$ möglich

LG Printi

LG Printi

sieht sehr sehr gut aus...

LG Printi

LG Printi

moin

Moin. Klassischer shortsqueeze. Amerika ist auf dem besten weg, gas zu exportieren. Der ölpreis geht gen 100 USD. Carl Icahn hatte das wohl erkannt ist aber zu früh eingestiegen. Lg

Antwort auf Beitrag Nr.: 57.779.545 von cure am 17.05.18 11:08:28

13 % gestern wieder .....wenn das so weitergeht ...sind wir Ende des Monats über 10 USD

Zitat von cure: nicht auszudenken wohin der Kurs geht wenn wir dieses Jahr beim Öl die 100 anpeilen ..langsam schießen sich ja auch die Medien auf diese Zahl ein ...und seriös kann man durch die immer weiter steigende Ölnachfrage dies auch herleiten ..so blöde das auch für den Autoliebhaber ist ....

Wo wir bei Chesapeake chartt. herkommen ...kann man sich anschauen und es wird einem schwindelig ...

Öl ist die Zündschnur ......Chesapeake ist das Pulverfass ...

Cure

13 % gestern wieder .....wenn das so weitergeht ...sind wir Ende des Monats über 10 USD

Antwort auf Beitrag Nr.: 57.803.321 von einverstanden am 21.05.18 19:31:44

52 Week Range 2.86 - 5.00

hälfte raus

52 Week Range 2.86 - 5.00

hälfte raus

kleine Posi zu 4,21$ wieder rein....

große Posi kommt zu 4,01$ ins Depot

LG Printi

große Posi kommt zu 4,01$ ins Depot

LG Printi

Hallo zusammen,

vor gut vier Wochen hat der Kurs um die Marke 3,50$ gekämpft und heute stehen wir an der Schwelle zu 5,00$. Wir sind immer noch am Ende der Bodenbildung und trotz des Anstieges sind wir noch weit weg von dem möglichen Potential.

Die Ölwerte werden langsam wieder hoffähig und wenn erst die Meinungsmacher diese Werte entdecken, können bei einer Chesapeaks schnell zweistellige Kurse entstehen.

Ich gebe kein Stück aus der Hand.

Gruß

Substanzsucher

vor gut vier Wochen hat der Kurs um die Marke 3,50$ gekämpft und heute stehen wir an der Schwelle zu 5,00$. Wir sind immer noch am Ende der Bodenbildung und trotz des Anstieges sind wir noch weit weg von dem möglichen Potential.

Die Ölwerte werden langsam wieder hoffähig und wenn erst die Meinungsmacher diese Werte entdecken, können bei einer Chesapeaks schnell zweistellige Kurse entstehen.

Ich gebe kein Stück aus der Hand.

Gruß

Substanzsucher

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Antwort auf Beitrag Nr.: 57.968.622 von Substanzsucher am 12.06.18 17:39:23Hallo zusammen,

Schlußkurs im Amiland: 5,05$

Die Hürde ist noch nicht nachhaltig gefallen aber so langsam können wir auf die 7$ schauen.

Gruß

Substanzsucher

Schlußkurs im Amiland: 5,05$

Die Hürde ist noch nicht nachhaltig gefallen aber so langsam können wir auf die 7$ schauen.

Gruß

Substanzsucher

5,16 $

Der Wert macht weiter sehr viel Spaß ...und das um so mehr wenn man sich die doch schwierigen Börsen anschaut ....schwierig hier Werte zu erwischen denen das sowas von am ....vorbei geht ..

Fein !!

Der Wert macht weiter sehr viel Spaß ...und das um so mehr wenn man sich die doch schwierigen Börsen anschaut ....schwierig hier Werte zu erwischen denen das sowas von am ....vorbei geht ..

Fein !!

Ich habe heute noch einmal etwas aufgestockt.

CHK ist megastark rechne hier mit Kursen um die 10-12,5$ bis Jahresende

LG Printi

CHK ist megastark rechne hier mit Kursen um die 10-12,5$ bis Jahresende

LG Printi

Antwort auf Beitrag Nr.: 58.092.553 von printguru am 28.06.18 21:20:11kursprognosen finde ich prinzipiell schwierig aber sofern es nicht

crash und der markt boomt sollte es zumindest nicht nach unten laufen

ich bleibe und warte ab...

crash und der markt boomt sollte es zumindest nicht nach unten laufen

ich bleibe und warte ab...

Moin,

ist noch jemand bei der Aktie dabei?

Gruß

ist noch jemand bei der Aktie dabei?

Gruß

Antwort auf Beitrag Nr.: 58.250.406 von NormanBates1 am 19.07.18 09:29:21Hälfte habe ich noch ...SL um 3,50 ....aber schon in der ganzen Peer / Sektor ( Werte kennema ) Gewinne eingetütet ...wäre zu schade ..

Frage ...ist die Schwäche vorrübergehend oder war"s das mit der Ölspeku .

Keine Ahnung ...besten die Frau im Zelt auf dem Jahrmarkt fragen ...kommt bald wieder auf Pützchen ...

Wenn es das war ...kann man sich wieder an den Spieltisch setzen ...und das Spiel beginnt von vorne ...mit neuen alten Karten ..

Wäre auch nicht schlecht ...auch wenn der Rest im Depot dann wieder auf +- 0 gehen würde ..ganz raus gehe ich nicht ..mache ich nie ...Fehler ..teils ja ..teils nein...brauch ich auch nicht ..

Aber ..wie gesagt....wer die Glaskugel hat ....hat den Vorteil ...und ..die haben hier ja fast alle ..

Schönes Wochenende ...

Cure

Frage ...ist die Schwäche vorrübergehend oder war"s das mit der Ölspeku .

Keine Ahnung ...besten die Frau im Zelt auf dem Jahrmarkt fragen ...kommt bald wieder auf Pützchen ...

Wenn es das war ...kann man sich wieder an den Spieltisch setzen ...und das Spiel beginnt von vorne ...mit neuen alten Karten ..

Wäre auch nicht schlecht ...auch wenn der Rest im Depot dann wieder auf +- 0 gehen würde ..ganz raus gehe ich nicht ..mache ich nie ...Fehler ..teils ja ..teils nein...brauch ich auch nicht ..

Aber ..wie gesagt....wer die Glaskugel hat ....hat den Vorteil ...und ..die haben hier ja fast alle ..

Schönes Wochenende ...

Cure

Antwort auf Beitrag Nr.: 58.258.415 von cure am 20.07.18 08:46:02Hallo Cure,

Danke für Deine Einschätzung .

.

LG und ein schönes WE

Danke für Deine Einschätzung

.

.LG und ein schönes WE

Antwort auf Beitrag Nr.: 58.083.865 von cure am 28.06.18 07:41:36turnaround kandidat.

https://www.bloomberg.com/news/articles/2018-07-26/chesapeak…

premarket +16%

lg

vario2000

https://www.bloomberg.com/news/articles/2018-07-26/chesapeak…

premarket +16%

lg

vario2000

Schade dass CHK wieder so stark zurückgekommen ist...….aber ich denke langfristig wird das was Kurse von 15-20$ könnten/sollten drinnen sein.

LG Printi

LG Printi

mich juckt es auch schon wieder Positionen zurück zu holen .....

Meinungen ?

Meinungen ?

Antwort auf Beitrag Nr.: 58.657.902 von cure am 10.09.18 08:27:32Hallo cure,

um den Kurs der Chesapeak richtig einschätzen zu können, braucht man nur den Kursverlauf der Chesapeak mit dem Verlauf des Ölpreises vergleichen. Bis Anfang 2017 hat die Korrelation noch gepasst und seither ging die Entwicklung immer weiter außeinander. Bei Chesapeak hat sich ein sehr hohes Potential aufgebaut.

Ich bin zwischenzeitlich wieder voll investiert.

um den Kurs der Chesapeak richtig einschätzen zu können, braucht man nur den Kursverlauf der Chesapeak mit dem Verlauf des Ölpreises vergleichen. Bis Anfang 2017 hat die Korrelation noch gepasst und seither ging die Entwicklung immer weiter außeinander. Bei Chesapeak hat sich ein sehr hohes Potential aufgebaut.

Ich bin zwischenzeitlich wieder voll investiert.

Antwort auf Beitrag Nr.: 58.681.992 von Substanzsucher am 12.09.18 15:49:36Moin ,

Dito...habe auch Teile zurückgekauft ....Chesapeake hat Sprengstoffpotential .....Brent um 80 ..... wann hatten wir das zuletzt ...Ende 2014 .....und da stand Chesapeake E. um 24 und nicht wie jetzt um 3,5 ....

MM hat die Aktie bis Ende Ultimo Verdopplungs bis Ver3fachpotential .....zumal ich den Ölpreis eher weiter steigen sehe ....

Auch Carbo Ceramic läuft in der selben Spur .....kaum was passiert ...liegt in der Peer massig zurück...

Von den ganze großen ist Schlumberger massig hinten dran ...

Meine Drillergewinne gehen hier rein ...

Spannend ..

Cure

Dito...habe auch Teile zurückgekauft ....Chesapeake hat Sprengstoffpotential .....Brent um 80 ..... wann hatten wir das zuletzt ...Ende 2014 .....und da stand Chesapeake E. um 24 und nicht wie jetzt um 3,5 ....

MM hat die Aktie bis Ende Ultimo Verdopplungs bis Ver3fachpotential .....zumal ich den Ölpreis eher weiter steigen sehe ....

Auch Carbo Ceramic läuft in der selben Spur .....kaum was passiert ...liegt in der Peer massig zurück...

Von den ganze großen ist Schlumberger massig hinten dran ...

Meine Drillergewinne gehen hier rein ...

Spannend ..

Cure

Antwort auf Beitrag Nr.: 58.687.269 von cure am 13.09.18 07:46:26wenn die 80 fallen geht es hier ab

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Antwort auf Beitrag Nr.: 58.726.408 von Substanzsucher am 18.09.18 12:01:51die 80 sind gefallen

verrückt tief der Kurs bei diesem Ölpreisansteig ...aber langsam wird ja wieder Fahrt aufgenommen ....

vor genau einem Jahr stand das Brent bei 55$ und heute sind wir gut 30$ höher. Dieser Anstieg geht eins zu eins in den Reingewinn da sich die Fixkosten bei gleichem Fördervolumen nicht erhöhen.

Beim Öl wird viel auf Termin verkauft und deshalb wird es hier einen gewissen Nachlauf geben. Das heißt aber auch, dass die nächsten zwei/drei Quartale schon in trockenen Tüchern sind.

Beim Öl wird viel auf Termin verkauft und deshalb wird es hier einen gewissen Nachlauf geben. Das heißt aber auch, dass die nächsten zwei/drei Quartale schon in trockenen Tüchern sind.

Chesapeake will release its 2018 third quarter operational and financial results before market open on Wednesday, October 31, 2018. A conference call to discuss the results has been scheduled for the same day at 9:00 am EDT.

Antwort auf Beitrag Nr.: 59.005.365 von einverstanden am 19.10.18 16:23:07

Chesapeake Energy Corporation Declares Quarterly Preferred Stock Dividends And Provides 2018 Third Quarter Earnings Conference Call Information

PR Newswire•October 19, 2018

https://finance.yahoo.com/news/chesapeake-energy-corporation…

Chesapeake Energy Corporation Declares Quarterly Preferred Stock Dividends And Provides 2018 Third Quarter Earnings Conference Call Information

PR Newswire•October 19, 2018

https://finance.yahoo.com/news/chesapeake-energy-corporation…

(Reuters) - Chesapeake Energy Corp (CHK.N) on Tuesday agreed to buy Texas oil producer WildHorse Resource Development Corp (WRD.N) in a nearly $4 billion cash-and-stock deal that knocked down the natural gas producer's shares by more than 12 percent.

Investors have punished shares of oil and gas producers that have struck deals this year for higher production instead of focusing on improved returns. Denbury Resources (DNR.N), Concho Resources (CXO.N) and Diamondback Energy (FANG.O) each fell after disclosing acquisitions this year.

WildHorse shareholders will get either 5.989 shares of Chesapeake common stock, or a combination of 5.336 shares of Chesapeake stock and $3 in cash, for each share held, under terms of the agreement.

The offer implies a 21 percent premium to WildHorse's closing price on Monday, while the stock-and-cash option represents a 24 percent premium.

The deal, which includes assumption of WildHorse's debt of $930 million, will increase Chesapeake's shares outstanding by up to 90 percent, diluting existing holders' stakes.

WildHorse's shares were up 4.7 percent at $19.26 while Chesapeake's fell 46 cents to $3.26 in midday trading amid a volatile market.

"Investors first response any time they see a company focus on growth is to sell off the stock, believing it pushes the free cash flow horizon further out," said Andrew Dittmar, a mergers and acquisition analyst at DrillingInfo.

The acquisition is expected to give Chesapeake about 420,000 net acres in the Eagle Ford shale and Austin Chalk formations in Texas, and help save between $200 million and $280 million in annual costs over the first five years, the companies said.

The Austin Chalk, which lies atop the Eagle Ford, is undergoing a renaissance as oil producers deploy technology developed in the shale boom to boost output.

"The complementary WildHorse assets build upon our existing Eagle Ford position and with our Powder River Basin position gives us two powerful oil growth engines in our portfolio," Chesapeake Chief Executive Doug Lawler said on a call with analysts.

Chesapeake has been directing its capital toward oil production against a backdrop of rising crude prices and declining natural gas prices. The combination would reduce the company's gas-to-oil split to 68 percent gas, from 72 percent, said analysts at Sanford C. Bernstein.

Lawler said the acquisition would allow Chesapeake to generate free cash flow "much sooner" than without the deal. The company aims to generate free cash flow equal to costs in 2020, he said Tuesday.

The Oklahoma City-based company said its shareholders will own about 55 percent of the combined company, while WildHorse shareholders, including private-equity firm NGP, will own the rest.

Chesapeake said it plans to finance the cash portion of the deal, expected to be between $275 million and $400 million, through its revolving credit facility.

Oklahoma-based Chesapeake posted a net profit of $60 million for the third quarter, following a loss of $41 million a year earlier.

Excluding one-time items, the company earned 19 cents a share, topping estimates for 15 cents, according to Refinitiv data.

Revenue rose to $2.42 billion from $1.94 billion.

erst austoben lassen

danach ist

aufstocken angesagt

Investors have punished shares of oil and gas producers that have struck deals this year for higher production instead of focusing on improved returns. Denbury Resources (DNR.N), Concho Resources (CXO.N) and Diamondback Energy (FANG.O) each fell after disclosing acquisitions this year.

WildHorse shareholders will get either 5.989 shares of Chesapeake common stock, or a combination of 5.336 shares of Chesapeake stock and $3 in cash, for each share held, under terms of the agreement.

The offer implies a 21 percent premium to WildHorse's closing price on Monday, while the stock-and-cash option represents a 24 percent premium.

The deal, which includes assumption of WildHorse's debt of $930 million, will increase Chesapeake's shares outstanding by up to 90 percent, diluting existing holders' stakes.

WildHorse's shares were up 4.7 percent at $19.26 while Chesapeake's fell 46 cents to $3.26 in midday trading amid a volatile market.

"Investors first response any time they see a company focus on growth is to sell off the stock, believing it pushes the free cash flow horizon further out," said Andrew Dittmar, a mergers and acquisition analyst at DrillingInfo.

The acquisition is expected to give Chesapeake about 420,000 net acres in the Eagle Ford shale and Austin Chalk formations in Texas, and help save between $200 million and $280 million in annual costs over the first five years, the companies said.

The Austin Chalk, which lies atop the Eagle Ford, is undergoing a renaissance as oil producers deploy technology developed in the shale boom to boost output.

"The complementary WildHorse assets build upon our existing Eagle Ford position and with our Powder River Basin position gives us two powerful oil growth engines in our portfolio," Chesapeake Chief Executive Doug Lawler said on a call with analysts.

Chesapeake has been directing its capital toward oil production against a backdrop of rising crude prices and declining natural gas prices. The combination would reduce the company's gas-to-oil split to 68 percent gas, from 72 percent, said analysts at Sanford C. Bernstein.

Lawler said the acquisition would allow Chesapeake to generate free cash flow "much sooner" than without the deal. The company aims to generate free cash flow equal to costs in 2020, he said Tuesday.

The Oklahoma City-based company said its shareholders will own about 55 percent of the combined company, while WildHorse shareholders, including private-equity firm NGP, will own the rest.

Chesapeake said it plans to finance the cash portion of the deal, expected to be between $275 million and $400 million, through its revolving credit facility.

Oklahoma-based Chesapeake posted a net profit of $60 million for the third quarter, following a loss of $41 million a year earlier.

Excluding one-time items, the company earned 19 cents a share, topping estimates for 15 cents, according to Refinitiv data.

Revenue rose to $2.42 billion from $1.94 billion.

erst austoben lassen

danach ist

aufstocken angesagt

Verstehe diesen Abschlag heute nicht......klingt doch alles sehr gut wie ich finde.

Was meint Ihr dazu?

Was meint Ihr dazu?

Also ich habe um 2,72 wieder gekauft ...die Zahlen waren über den Erwartungen ..klar geschlagen die Flüsterschätzungen ...der Abschlag ist wegen dem Megamerger gekommen ...die Börse fragt sich ..spinnen die ...zeigt ..Cheas . wird mutig und geht in den Angriffsmodus wieder ..die wollen wieder ganz nach oben ........Glas halb leer/voll ....

Hier mal die meiner M. sehr guten Q-Zahlen durch den Übersetzer gejagt ...das die Whildhorse jetzt übernehmen ist natürlich ein Knaller ...nehmen damit natürlich viel Geld und Risiko in die Hand ...können aber damit in neue Dimensionen wachsen ...scheint so die wollen wieder dorthin wo Ches. mal stand ....könnte ne Neubewertung anstehen ..die Börse hat es wohl gestern erstmal kritisch gesehen ...aber abwarten ...

OKLAHOMA CITY, 30. Oktober 2018 (ots / PRNewswire) - Die Chesapeake Energy Corporation (CHK) meldete heute ihre finanziellen und operativen Ergebnisse für das dritte Quartal 2018. Höhepunkte umfassen:

Nettogewinn aus dem dritten Quartal 2018 für Stammaktionäre in Höhe von 60 Millionen US-Dollar oder 0,07 US-Dollar pro verwässerter Aktie; Bereinigt um das im dritten Quartal bereinigte Nettoergebnis von Chesapeake von 174 Millionen US-Dollar oder 0,19 US-Dollar pro Aktie

Der Cashflow aus laufender Geschäftstätigkeit belief sich im dritten Quartal auf 504 Millionen US-Dollar und lag damit um 52 Prozent höher als im dritten Quartal 2017

Durchschnittliche Produktion im dritten Quartal von rund 537.000 Barrel Öläquivalent (BOE) im Jahr 2018, plus 5 Prozent im Vergleich zum dritten Quartal 2017, bereinigt um den Verkauf von Vermögenswerten

Durchschnittliche Ölproduktion im dritten Quartal von rund 89.000 Barrel (bbls) Öl pro Tag, plus 13 Prozent im Vergleich zum dritten Quartal 2017, bereinigt um den Verkauf von Vermögenswerten, vor allem aufgrund des höheren Mengenwachstums aus dem Powder River Basin (PRB)

https://mma.prnewswire.com/media/683641/Chesapeake_Energy_Co…

Doug Lawler, President und Chief Executive Officer von Chesapeake, kommentierte: "Chesapeake macht weiterhin bedeutende Fortschritte bei unseren strategischen Prioritäten, wie unser verbesserter Cashflow aus dem operativen Geschäft zeigt, der aufgrund des höheren Durchschnitts mehr als 50 Prozent über dem dritten Quartal 2017 lag Realisierte Rohstoffpreise und ein 13-prozentiges Wachstum unserer bereinigten Ölproduktion.Wir planen, den Großteil unserer für 2019 geplanten Aktivitäten auf unsere margenstarken Ölgelegenheiten mit höherer Rendite im PRB und Eagle Ford Shale zu konzentrieren, während das Kapital und die Aktivitäten gesenkt werden in Richtung unseres Erdgasportfolios, das zusätzlichen freien Cashflow generieren wird.Unser Investitionsaufwand für 2018 bleibt auf Kurs, da wir unsere Prioritäten bezüglich Hebelabbau, Margensteigerung und nachhaltigem positiven Cash-Flow erfüllen und für das Jahr 2019 weitere Fortschritte erwarten. "

Ergebnisse des dritten Quartals 2018

Für das dritte Quartal 2018 verzeichnete Chesapeake einen Nettogewinn von 85 Millionen US-Dollar und einen Nettogewinn von 60 Millionen US-Dollar oder 0,07 US-Dollar pro Aktie. Der EBITDA des Unternehmens für das dritte Quartal 2018 betrug 504 Millionen US-Dollar. Bereinigt um Posten, die typischerweise von Wertpapieranalysten ausgeschlossen werden, belief sich das bereinigte Nettoergebnis von Chesapeake für das dritte Quartal 2018 auf 174 Millionen US-Dollar oder 0,19 US-Dollar pro verwässerter Aktie, während das bereinigte EBITDA des Unternehmens bei 594 Millionen US-Dollar lag. Überleitungen von Finanzkennzahlen nach GAAP zu Non-GAAP-Kennzahlen finden Sie auf den Seiten 13 - 18 dieser Pressemitteilung.

Die Produktionskosten im dritten Quartal 2018 beliefen sich auf 2,68 USD pro boe, verglichen mit 3,03 USD pro boe im dritten Quartal 2017. Der Rückgang resultierte in erster Linie aus bestimmten Veräußerungen in den Jahren 2018 und 2017 sowie aus geringeren Überarbeitungsaktivitäten im Eagle Ford Shale. Die allgemeinen Verwaltungskosten (einschließlich aktienbasierter Vergütungen) beliefen sich im dritten Quartal 2018 auf 1,34 USD pro boe, verglichen mit 1,08 USD pro boe im dritten Quartal 2017. Der Anstieg resultiert im Wesentlichen aus einem geringeren Aufwand für Produktionskosten, Marketingaufwendungen und aktivierten allgemeinen Verwaltungskosten sowie einem geringeren Aufwand für die Eigentümer von Betriebsinteressen aufgrund bestimmter Veräußerungen in den Jahren 2017 und 2018. Die Kosten für Beschaffung, Verarbeitung und Transport des Unternehmens sank im dritten Quartal 2017 auf 7,36 USD pro boe von 7,40 USD pro boe, was in erster Linie auf bestimmte Veräußerungen in den Jahren 2018 und 2017, niedrigere Gebühren aufgrund restrukturierter Midstream-Verträge und geringere Volumenverpflichtungen zurückzuführen ist.

Kapitalausgaben Überblick

Chesapeake verzeichnete im dritten Quartal 2018 Gesamtinvestitionen einschließlich kapitalisierter Zinsen in Höhe von 42 Millionen US-Dollar in Höhe von rund 619 Millionen US-Dollar, verglichen mit rund 692 Millionen US-Dollar im dritten Quartal 2017. Eine Zusammenfassung finden Sie in der folgenden Tabelle.

OKLAHOMA CITY, 30. Oktober 2018 (ots / PRNewswire) - Die Chesapeake Energy Corporation (CHK) meldete heute ihre finanziellen und operativen Ergebnisse für das dritte Quartal 2018. Höhepunkte umfassen:

Nettogewinn aus dem dritten Quartal 2018 für Stammaktionäre in Höhe von 60 Millionen US-Dollar oder 0,07 US-Dollar pro verwässerter Aktie; Bereinigt um das im dritten Quartal bereinigte Nettoergebnis von Chesapeake von 174 Millionen US-Dollar oder 0,19 US-Dollar pro Aktie

Der Cashflow aus laufender Geschäftstätigkeit belief sich im dritten Quartal auf 504 Millionen US-Dollar und lag damit um 52 Prozent höher als im dritten Quartal 2017

Durchschnittliche Produktion im dritten Quartal von rund 537.000 Barrel Öläquivalent (BOE) im Jahr 2018, plus 5 Prozent im Vergleich zum dritten Quartal 2017, bereinigt um den Verkauf von Vermögenswerten

Durchschnittliche Ölproduktion im dritten Quartal von rund 89.000 Barrel (bbls) Öl pro Tag, plus 13 Prozent im Vergleich zum dritten Quartal 2017, bereinigt um den Verkauf von Vermögenswerten, vor allem aufgrund des höheren Mengenwachstums aus dem Powder River Basin (PRB)

https://mma.prnewswire.com/media/683641/Chesapeake_Energy_Co…

Doug Lawler, President und Chief Executive Officer von Chesapeake, kommentierte: "Chesapeake macht weiterhin bedeutende Fortschritte bei unseren strategischen Prioritäten, wie unser verbesserter Cashflow aus dem operativen Geschäft zeigt, der aufgrund des höheren Durchschnitts mehr als 50 Prozent über dem dritten Quartal 2017 lag Realisierte Rohstoffpreise und ein 13-prozentiges Wachstum unserer bereinigten Ölproduktion.Wir planen, den Großteil unserer für 2019 geplanten Aktivitäten auf unsere margenstarken Ölgelegenheiten mit höherer Rendite im PRB und Eagle Ford Shale zu konzentrieren, während das Kapital und die Aktivitäten gesenkt werden in Richtung unseres Erdgasportfolios, das zusätzlichen freien Cashflow generieren wird.Unser Investitionsaufwand für 2018 bleibt auf Kurs, da wir unsere Prioritäten bezüglich Hebelabbau, Margensteigerung und nachhaltigem positiven Cash-Flow erfüllen und für das Jahr 2019 weitere Fortschritte erwarten. "

Ergebnisse des dritten Quartals 2018

Für das dritte Quartal 2018 verzeichnete Chesapeake einen Nettogewinn von 85 Millionen US-Dollar und einen Nettogewinn von 60 Millionen US-Dollar oder 0,07 US-Dollar pro Aktie. Der EBITDA des Unternehmens für das dritte Quartal 2018 betrug 504 Millionen US-Dollar. Bereinigt um Posten, die typischerweise von Wertpapieranalysten ausgeschlossen werden, belief sich das bereinigte Nettoergebnis von Chesapeake für das dritte Quartal 2018 auf 174 Millionen US-Dollar oder 0,19 US-Dollar pro verwässerter Aktie, während das bereinigte EBITDA des Unternehmens bei 594 Millionen US-Dollar lag. Überleitungen von Finanzkennzahlen nach GAAP zu Non-GAAP-Kennzahlen finden Sie auf den Seiten 13 - 18 dieser Pressemitteilung.

Die Produktionskosten im dritten Quartal 2018 beliefen sich auf 2,68 USD pro boe, verglichen mit 3,03 USD pro boe im dritten Quartal 2017. Der Rückgang resultierte in erster Linie aus bestimmten Veräußerungen in den Jahren 2018 und 2017 sowie aus geringeren Überarbeitungsaktivitäten im Eagle Ford Shale. Die allgemeinen Verwaltungskosten (einschließlich aktienbasierter Vergütungen) beliefen sich im dritten Quartal 2018 auf 1,34 USD pro boe, verglichen mit 1,08 USD pro boe im dritten Quartal 2017. Der Anstieg resultiert im Wesentlichen aus einem geringeren Aufwand für Produktionskosten, Marketingaufwendungen und aktivierten allgemeinen Verwaltungskosten sowie einem geringeren Aufwand für die Eigentümer von Betriebsinteressen aufgrund bestimmter Veräußerungen in den Jahren 2017 und 2018. Die Kosten für Beschaffung, Verarbeitung und Transport des Unternehmens sank im dritten Quartal 2017 auf 7,36 USD pro boe von 7,40 USD pro boe, was in erster Linie auf bestimmte Veräußerungen in den Jahren 2018 und 2017, niedrigere Gebühren aufgrund restrukturierter Midstream-Verträge und geringere Volumenverpflichtungen zurückzuführen ist.

Kapitalausgaben Überblick

Chesapeake verzeichnete im dritten Quartal 2018 Gesamtinvestitionen einschließlich kapitalisierter Zinsen in Höhe von 42 Millionen US-Dollar in Höhe von rund 619 Millionen US-Dollar, verglichen mit rund 692 Millionen US-Dollar im dritten Quartal 2017. Eine Zusammenfassung finden Sie in der folgenden Tabelle.

Nachrichtenquelle: The Motley Fool

Chesapeake Energy sagte kürzlich, dass sich die Region „schnell als Wachstumsmotor des Unternehmens etablieren“ würde. Die Produktion von Chesapeake hat sich bereits im vergangenen Jahr verdoppelt und wird sich 2019 wieder verdoppeln.

Diese unauffällige Energieaktie könnte ein großer Gewinner sein | wallstreet-online.de - Vollständiger Artikel unter:

https://www.wallstreet-online.de/nachricht/10975961-unauffae…

Chesapeake Energy sagte kürzlich, dass sich die Region „schnell als Wachstumsmotor des Unternehmens etablieren“ würde. Die Produktion von Chesapeake hat sich bereits im vergangenen Jahr verdoppelt und wird sich 2019 wieder verdoppeln.

Diese unauffällige Energieaktie könnte ein großer Gewinner sein | wallstreet-online.de - Vollständiger Artikel unter:

https://www.wallstreet-online.de/nachricht/10975961-unauffae…

Hier mal lesen ....guter Artikel der den Merger ganz gut zusammenfasst ..( Chancen/Risiken ) ...Ches. wächst in ganz neue Dimensionen ...die nächsten Wochen/Monate/Jahre könnten also sehr spannend werden und eine Neueinstufung ist m.E.obligatorisch .....

Wo das kurstechnisch hinführen könnte überlasse ich anderen .....

Schönen Feiertag ..

https://seekingalpha.com/article/4216453-forgotten-equity-ch…

Wo das kurstechnisch hinführen könnte überlasse ich anderen .....

Schönen Feiertag ..

https://seekingalpha.com/article/4216453-forgotten-equity-ch…

Antwort auf Beitrag Nr.: 59.110.214 von cure am 01.11.18 07:44:39

Weil es so schön ist

https://seekingalpha.com/article/4217353-chesapeake-energy-s… Zeit zu sammeln, wie mir ein erfahrener User beibrachte. Schönes Wochenende.

Spannend !!!

Ich bin gestern Abend rein zu 2,68€.

Das wird ein Fest in 2-4 Jahren verkaufe ich die Aktien zu 15-20$

Das wird ein Fest in 2-4 Jahren verkaufe ich die Aktien zu 15-20$

Sprichbeidl

ist der weg in richtung 1,60$ jetzt frei ?!

nochmals -30%

nochmals -30%

Das ist doch ein schlechter Witz CHK bei 2,12$

jetzt unter 1,9$ was für ein Gemetzel

ist noch viel luft nach unten

Chairman Emeritus Archie Dunham bought 2.1 million shares of stock, good for more than $4 million.

Bret Kenwell

TheStreet.comDecember 28, 2018

Bret Kenwell

TheStreet.comDecember 28, 2018

Chesapeake Energy Jumps on Strong Production Outlook

M. Corey Goldman

TheStreet.comJanuary 09, 2019

jumped 10% to $2.70 on Wednesday after the oil and gas company said its fourth-quarter production numbers would come in above analysts' expectations. The Oklahoma City-based company said in a statement that it sees production for the most recent quarter of 462,000 to 464,000 barrels of oil equivalent (BOE) per day, compared with the FactSet consensus of 448,000 BOE per day. Oil production is estimated to range from 86,000 to 87,000 barrels of oil per day, above the FactSet consensus of 85,200.

M. Corey Goldman

TheStreet.comJanuary 09, 2019

jumped 10% to $2.70 on Wednesday after the oil and gas company said its fourth-quarter production numbers would come in above analysts' expectations. The Oklahoma City-based company said in a statement that it sees production for the most recent quarter of 462,000 to 464,000 barrels of oil equivalent (BOE) per day, compared with the FactSet consensus of 448,000 BOE per day. Oil production is estimated to range from 86,000 to 87,000 barrels of oil per day, above the FactSet consensus of 85,200.

Hallo zusammen,

im Sommer / Herbst 2018 konnte man mit der Chesapeaks schön von dem steigenden Ölpreis profitieren.

Als das Öl gegen Ende 2018 von gut 80$ auf gut 50$ absackte, gings mit der Chesapeaks Aktie ebenfalls Richtung Süden. Von dem Anstieg auf aktuell 67$/Barrel hat die Aktie etwas profitiert, es steckt jedoch noch ein gewaltiges Potential drin.

Das Produkt Öl oder Gas kann man nicht mit einem normalen Industrieprodukt vergleichen. Bei der Förderung wird viel Geld investiert und das ganze Geschäfte rechnet sich erst ab einem bestimmten Barrelpreis. Sind die Fiskosten gedeckt, wird mit jedem weiteren Ölpreisanstieg sofort richtig viel Geld verdient, da die variablen Kosten sehr klein sind.

Eine Chesakpeaks kann man somit als Hebelprodukt auf den Öl-/Gaspreis bezeichnen. Die Aktie liegt heute nicht viel höher als im Frühjahr 2016 und damals lag das Barrel bei ca. 30$ (!). Da die ÖL-/Gaspreise z. T. länger abgesicher sind gibt es hier einen gewissen Nachlauf.

Bis die höheren Preise in den Quartalszahlen erscheinen kann auch noch eine gewisse Zeit vergehen.

Ich bin wieder drin und warte bis man die nächste Welle abreiten kann.

Gruß Substanzsucher

im Sommer / Herbst 2018 konnte man mit der Chesapeaks schön von dem steigenden Ölpreis profitieren.

Als das Öl gegen Ende 2018 von gut 80$ auf gut 50$ absackte, gings mit der Chesapeaks Aktie ebenfalls Richtung Süden. Von dem Anstieg auf aktuell 67$/Barrel hat die Aktie etwas profitiert, es steckt jedoch noch ein gewaltiges Potential drin.

Das Produkt Öl oder Gas kann man nicht mit einem normalen Industrieprodukt vergleichen. Bei der Förderung wird viel Geld investiert und das ganze Geschäfte rechnet sich erst ab einem bestimmten Barrelpreis. Sind die Fiskosten gedeckt, wird mit jedem weiteren Ölpreisanstieg sofort richtig viel Geld verdient, da die variablen Kosten sehr klein sind.

Eine Chesakpeaks kann man somit als Hebelprodukt auf den Öl-/Gaspreis bezeichnen. Die Aktie liegt heute nicht viel höher als im Frühjahr 2016 und damals lag das Barrel bei ca. 30$ (!). Da die ÖL-/Gaspreise z. T. länger abgesicher sind gibt es hier einen gewissen Nachlauf.

Bis die höheren Preise in den Quartalszahlen erscheinen kann auch noch eine gewisse Zeit vergehen.

Ich bin wieder drin und warte bis man die nächste Welle abreiten kann.

Gruß Substanzsucher

2018 Results:

• Portfolio evolution drives improved returns and leverage reduction: Divested lower-margin Utica and Mid-Continent assets and expanded higher-margin oil growth platform through strategic focus on the Powder River Basin (PRB) and announcement of the acquisition of WildHorse Resource Development Corporation (WildHorse); overall total debt reduction of $1.8 billion as of December 31, 2018, including the elimination of $2.6 billion in secured debt;

• Oil production growth: 2018 average daily oil production of approximately 90,000 barrels (bbls), up 10 percent compared to 2017 levels, adjusted for asset sales; December 2018 oil production equaled 21 percent of total production mix;

• Highest margins since 2014: 2018 net income available to common stockholders of $775 million, or $0.85 per diluted share; 2018 adjusted net income attributable to Chesapeake of $816 million, or $0.90 per diluted share; 2018 fourth quarter net income available to common stockholders of $486 million, or $0.49 per diluted share; 2018 fourth quarter adjusted net income attributable to Chesapeake of $238 million, or $0.21 per diluted share; highest adjusted EBITDA generated per barrel of oil equivalent (boe) of $12.81 since 2014.

2019 Outlook:

• Transformational oil growth: Projected 2019 average daily oil production of approximately 116,000 to 122,000 bbls, an absolute increase of approximately 32 percent (or 50 percent adjusted for asset sales), driven by the acquisition of the WildHorse asset and organic growth from the PRB; oil mix projected to be approximately 26 percent by 2019 fourth quarter;

• Capital expenditure program discipline: Projected 2019 capital expenditures range from $2.3 to $2.5 billion, effectively flat compared to $2.366 billion in 2018;

• Lower costs lead to improved capital efficiency and enhanced competitiveness: Cash costs projected to decrease by approximately $200 million, driven by lower gathering, processing and transportation (GP&T) expenses partially offset by slightly higher production and general and administrative expenses as a result of production and working interest mix; EBITDA generated per boe projected to increase by approximately 12 to 15 percent, based on recent strip prices.

Doug Lawler, Chesapeake's President and Chief Executive Officer, commented, "I am very pleased with Chesapeake's operational and financial performance in 2018. Two transformational business transactions not only serve as a significant inflection point for the company, but also provide foundational support in our strategic goals of further reducing our net debt, achieving sustainable positive free cash flow, and enhancing margins. The recent acquisition of WildHorse, which we refer to as our Brazos Valley business unit, provides significant profitability, flexibility and optionality to our diverse, deep asset portfolio and facilitates our achieving these strategic goals.

"Over the past five years, we have clearly established our operational and capital efficiency leadership. We have also materially improved our financial leverage and significantly reduced our obligations, commitments and complexity. Our 2018 accomplishments of 10 percent adjusted oil growth, improved realizations and lower absolute cash costs compared to 2017 resulted in the highest EBITDA generated per boe for Chesapeake since 2014, when oil averaged more than $90 per barrel and gas averaged more than $4 per thousand cubic feet. Our strategic focus on increasing our oil production is working, as we increased annual net oil volumes from the PRB by 78 percent in 2018, resulting in oil production representing 21 percent of our overall production mix in December. Our oil focus will be fully evident in 2019, as annual net oil volumes from the PRB are expected to more than double compared to 2018 and as we begin a robust drilling program on our Brazos Valley asset, while also attacking the base production in all our operating areas with full-field optimization and downtime reduction programs. As a result, we project our average oil mix to be approximately 24 percent of total volumes in 2019 compared to 17 percent in 2018, with our year-end 2019 oil mix approaching 26 percent.

"We are off to a fast start in 2019. With the integration of the Brazos Valley asset into Chesapeake fully underway, we are already seeing a significant amount of cost savings to be captured and strong performance from the asset. The Brazos Valley asset had very strong 2018 fourth quarter performance, with production, capital expenditures and cash flow better than we had originally projected at the time of the acquisition announcement.

"At today's strip pricing, we expect our cash flow to be meaningfully stronger in 2019, as we continue to leverage our strength in capital efficiency and cash cost leadership. Chesapeake's progress, portfolio and strategic plan provides a compelling investment opportunity and we look forward to driving differential value for our shareholders in the year ahead."

2018 Full Year Results

For the 2018 full year, Chesapeake reported net income of $877 million and net income available to common stockholders of $775 million, or $0.85 per diluted share, compared to $953 million, $813 million, and $0.90 in 2017, respectively. The company's EBITDA for the 2018 full year was $2.499 billion, compared to $2.376 billion in 2017. Adjusting for items that are typically excluded by securities analysts, the 2018 full year adjusted net income attributable to Chesapeake was $816 million, or $0.90 per diluted share, compared to $742 million, or $0.82 per diluted share in 2017, while the company's adjusted EBITDA was $2.436 billion, compared to $2.160 billion in 2017. Reconciliations of financial measures calculated in accordance with GAAP to non-GAAP measures are provided on pages 14 - 17 of this release.

Average daily production for 2018 of approximately 521,000 boe increased by 4 percent compared to 2017 levels, adjusted for asset sales, and consisted of approximately 90,000 bbls of oil, 2.278 billion cubic feet (bcf) of natural gas and 52,000 bbls of NGL.

Production expenses in 2018 were $2.84 per boe, compared to $2.81 per boe in 2017. The per unit increase was the result of increased ad valorem tax primarily due to higher prices received for the company's oil, natural gas and NGL production. General and administrative expenses (including stock-based compensation) in 2018 were $1.47 per boe, compared to $1.31 per boe in 2017. The increase was primarily due to less overhead allocated to production expenses, marketing expenses and capitalized general and administrative costs, as well as less overhead billed to working interest owners, due to certain divestitures in 2018 and 2017.

2018 Fourth Quarter Results

For the 2018 fourth quarter, Chesapeake reported net income of $514 million and net income available to common stockholders of $486 million, or $0.49 per diluted share, compared to $334 million, $309 million, and $0.33 in the 2017 fourth quarter, respectively. The company's EBITDA for the 2018 fourth quarter was $910 million, compared to $764 million in the 2017 fourth quarter. Adjusting for items that are typically excluded by securities analysts, the 2018 fourth quarter adjusted net income attributable to Chesapeake was $238 million, or $0.21 per diluted share, compared to $314 million, or $0.30 per diluted share in the 2017 fourth quarter. The company's adjusted EBITDA was $574 million in the fourth quarter of 2018, compared to $706 million in the fourth quarter of 2017. Reconciliations of financial measures calculated in accordance with GAAP to non-GAAP measures are provided on pages 14 - 17 of this release.

Average daily production for the 2018 fourth quarter was approximately 464,000 boe, a 7 percent decrease compared to 2017 levels, adjusted for asset sales, and consisted of approximately 87,000 bbls of oil, 2.009 bcf of natural gas and 42,000 bbls of NGL.

Production expenses during the 2018 fourth quarter were $2.87 per boe, compared to $2.50 per boe in the 2017 fourth quarter. The increase was primarily a result of certain 2018 and 2017 divestitures and increased ad valorem tax due to higher prices received for the company's oil, natural gas and NGL production. General and administrative expenses (including stock-based compensation) during the 2018 fourth quarter were $1.19 per boe, compared to $1.34 per boe in the 2017 fourth quarter. The decrease was primarily due to lower compensation expenses, partially offset by less overhead allocated to production expenses, marketing expenses and capitalized general and administrative costs. The company's GP&T expenses increased to $7.92 per boe from $7.15 per boe during the 2017 fourth quarter, primarily due to a shortfall payment for Eagle Ford oil transportation volumes.

Capital Spending Overview

Chesapeake's total capital investments were approximately $541 million during the 2018 fourth quarter and $2.366 billion during the 2018 full year, compared to approximately $523 million and $2.458 billion in the 2017 fourth quarter and 2017 full year, respectively. A summary of the company's 2018 and 2017 capital expenditures, as well as the current 2019 capital expenditure guidance, is provided in the table below.

• Portfolio evolution drives improved returns and leverage reduction: Divested lower-margin Utica and Mid-Continent assets and expanded higher-margin oil growth platform through strategic focus on the Powder River Basin (PRB) and announcement of the acquisition of WildHorse Resource Development Corporation (WildHorse); overall total debt reduction of $1.8 billion as of December 31, 2018, including the elimination of $2.6 billion in secured debt;

• Oil production growth: 2018 average daily oil production of approximately 90,000 barrels (bbls), up 10 percent compared to 2017 levels, adjusted for asset sales; December 2018 oil production equaled 21 percent of total production mix;

• Highest margins since 2014: 2018 net income available to common stockholders of $775 million, or $0.85 per diluted share; 2018 adjusted net income attributable to Chesapeake of $816 million, or $0.90 per diluted share; 2018 fourth quarter net income available to common stockholders of $486 million, or $0.49 per diluted share; 2018 fourth quarter adjusted net income attributable to Chesapeake of $238 million, or $0.21 per diluted share; highest adjusted EBITDA generated per barrel of oil equivalent (boe) of $12.81 since 2014.

2019 Outlook:

• Transformational oil growth: Projected 2019 average daily oil production of approximately 116,000 to 122,000 bbls, an absolute increase of approximately 32 percent (or 50 percent adjusted for asset sales), driven by the acquisition of the WildHorse asset and organic growth from the PRB; oil mix projected to be approximately 26 percent by 2019 fourth quarter;

• Capital expenditure program discipline: Projected 2019 capital expenditures range from $2.3 to $2.5 billion, effectively flat compared to $2.366 billion in 2018;

• Lower costs lead to improved capital efficiency and enhanced competitiveness: Cash costs projected to decrease by approximately $200 million, driven by lower gathering, processing and transportation (GP&T) expenses partially offset by slightly higher production and general and administrative expenses as a result of production and working interest mix; EBITDA generated per boe projected to increase by approximately 12 to 15 percent, based on recent strip prices.

Doug Lawler, Chesapeake's President and Chief Executive Officer, commented, "I am very pleased with Chesapeake's operational and financial performance in 2018. Two transformational business transactions not only serve as a significant inflection point for the company, but also provide foundational support in our strategic goals of further reducing our net debt, achieving sustainable positive free cash flow, and enhancing margins. The recent acquisition of WildHorse, which we refer to as our Brazos Valley business unit, provides significant profitability, flexibility and optionality to our diverse, deep asset portfolio and facilitates our achieving these strategic goals.

"Over the past five years, we have clearly established our operational and capital efficiency leadership. We have also materially improved our financial leverage and significantly reduced our obligations, commitments and complexity. Our 2018 accomplishments of 10 percent adjusted oil growth, improved realizations and lower absolute cash costs compared to 2017 resulted in the highest EBITDA generated per boe for Chesapeake since 2014, when oil averaged more than $90 per barrel and gas averaged more than $4 per thousand cubic feet. Our strategic focus on increasing our oil production is working, as we increased annual net oil volumes from the PRB by 78 percent in 2018, resulting in oil production representing 21 percent of our overall production mix in December. Our oil focus will be fully evident in 2019, as annual net oil volumes from the PRB are expected to more than double compared to 2018 and as we begin a robust drilling program on our Brazos Valley asset, while also attacking the base production in all our operating areas with full-field optimization and downtime reduction programs. As a result, we project our average oil mix to be approximately 24 percent of total volumes in 2019 compared to 17 percent in 2018, with our year-end 2019 oil mix approaching 26 percent.

"We are off to a fast start in 2019. With the integration of the Brazos Valley asset into Chesapeake fully underway, we are already seeing a significant amount of cost savings to be captured and strong performance from the asset. The Brazos Valley asset had very strong 2018 fourth quarter performance, with production, capital expenditures and cash flow better than we had originally projected at the time of the acquisition announcement.

"At today's strip pricing, we expect our cash flow to be meaningfully stronger in 2019, as we continue to leverage our strength in capital efficiency and cash cost leadership. Chesapeake's progress, portfolio and strategic plan provides a compelling investment opportunity and we look forward to driving differential value for our shareholders in the year ahead."

2018 Full Year Results

For the 2018 full year, Chesapeake reported net income of $877 million and net income available to common stockholders of $775 million, or $0.85 per diluted share, compared to $953 million, $813 million, and $0.90 in 2017, respectively. The company's EBITDA for the 2018 full year was $2.499 billion, compared to $2.376 billion in 2017. Adjusting for items that are typically excluded by securities analysts, the 2018 full year adjusted net income attributable to Chesapeake was $816 million, or $0.90 per diluted share, compared to $742 million, or $0.82 per diluted share in 2017, while the company's adjusted EBITDA was $2.436 billion, compared to $2.160 billion in 2017. Reconciliations of financial measures calculated in accordance with GAAP to non-GAAP measures are provided on pages 14 - 17 of this release.

Average daily production for 2018 of approximately 521,000 boe increased by 4 percent compared to 2017 levels, adjusted for asset sales, and consisted of approximately 90,000 bbls of oil, 2.278 billion cubic feet (bcf) of natural gas and 52,000 bbls of NGL.

Production expenses in 2018 were $2.84 per boe, compared to $2.81 per boe in 2017. The per unit increase was the result of increased ad valorem tax primarily due to higher prices received for the company's oil, natural gas and NGL production. General and administrative expenses (including stock-based compensation) in 2018 were $1.47 per boe, compared to $1.31 per boe in 2017. The increase was primarily due to less overhead allocated to production expenses, marketing expenses and capitalized general and administrative costs, as well as less overhead billed to working interest owners, due to certain divestitures in 2018 and 2017.

2018 Fourth Quarter Results

For the 2018 fourth quarter, Chesapeake reported net income of $514 million and net income available to common stockholders of $486 million, or $0.49 per diluted share, compared to $334 million, $309 million, and $0.33 in the 2017 fourth quarter, respectively. The company's EBITDA for the 2018 fourth quarter was $910 million, compared to $764 million in the 2017 fourth quarter. Adjusting for items that are typically excluded by securities analysts, the 2018 fourth quarter adjusted net income attributable to Chesapeake was $238 million, or $0.21 per diluted share, compared to $314 million, or $0.30 per diluted share in the 2017 fourth quarter. The company's adjusted EBITDA was $574 million in the fourth quarter of 2018, compared to $706 million in the fourth quarter of 2017. Reconciliations of financial measures calculated in accordance with GAAP to non-GAAP measures are provided on pages 14 - 17 of this release.

Average daily production for the 2018 fourth quarter was approximately 464,000 boe, a 7 percent decrease compared to 2017 levels, adjusted for asset sales, and consisted of approximately 87,000 bbls of oil, 2.009 bcf of natural gas and 42,000 bbls of NGL.

Production expenses during the 2018 fourth quarter were $2.87 per boe, compared to $2.50 per boe in the 2017 fourth quarter. The increase was primarily a result of certain 2018 and 2017 divestitures and increased ad valorem tax due to higher prices received for the company's oil, natural gas and NGL production. General and administrative expenses (including stock-based compensation) during the 2018 fourth quarter were $1.19 per boe, compared to $1.34 per boe in the 2017 fourth quarter. The decrease was primarily due to lower compensation expenses, partially offset by less overhead allocated to production expenses, marketing expenses and capitalized general and administrative costs. The company's GP&T expenses increased to $7.92 per boe from $7.15 per boe during the 2017 fourth quarter, primarily due to a shortfall payment for Eagle Ford oil transportation volumes.

Capital Spending Overview

Chesapeake's total capital investments were approximately $541 million during the 2018 fourth quarter and $2.366 billion during the 2018 full year, compared to approximately $523 million and $2.458 billion in the 2017 fourth quarter and 2017 full year, respectively. A summary of the company's 2018 and 2017 capital expenditures, as well as the current 2019 capital expenditure guidance, is provided in the table below.

läuft

Hallo zusammen,

die Aktie kämpft noch mit der 3$ Marke und beim nachhaltigen Überwinden dieser Linie, sollte es schnell Richtung 4$ gehen.

die Aktie kämpft noch mit der 3$ Marke und beim nachhaltigen Überwinden dieser Linie, sollte es schnell Richtung 4$ gehen.

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

der Kampf um die 3$ ist noch nicht gewonnen.

Das Öl geht zumindest aus Sicht von Chesapeake in die richtige Richtung.

Das Öl geht zumindest aus Sicht von Chesapeake in die richtige Richtung.

Meldung ven Heute! Falls die Planungen/Erwartungen von Wintershall eintreffen, steht unsere Chesapeake bei 6-7$

Wintershall plant 2019 mit Ölpreis von 70 Dollar

21.03.2019 - 10:48

FRANKFURT (Dow Jones)Für Wintershall steht 2019 die Umsetzung des Zusammenschlusses mit DEA im Mittelpunkt. Der Mutterkonzern BASF will das Unternehmen bis zur Jahresmitte mit dem Wettbewerber fusionieren. Bei entsprechenden Marktbedingungen soll das Gemeinschaftsunternehmen Wintershall DEA ab der zweiten Jahreshälfte 2020 an die Börse gebracht werden.

Bei seinen Planungen für 2019 geht Wintershall von einem durchschnittlichen Ölpreis der Sorte Brent von 70 US-Dollar je Barrel und einem Wechselkurs von 1,15 Dollar je Euro aus.

Wintershall plant 2019 mit Ölpreis von 70 Dollar

21.03.2019 - 10:48

FRANKFURT (Dow Jones)Für Wintershall steht 2019 die Umsetzung des Zusammenschlusses mit DEA im Mittelpunkt. Der Mutterkonzern BASF will das Unternehmen bis zur Jahresmitte mit dem Wettbewerber fusionieren. Bei entsprechenden Marktbedingungen soll das Gemeinschaftsunternehmen Wintershall DEA ab der zweiten Jahreshälfte 2020 an die Börse gebracht werden.

Bei seinen Planungen für 2019 geht Wintershall von einem durchschnittlichen Ölpreis der Sorte Brent von 70 US-Dollar je Barrel und einem Wechselkurs von 1,15 Dollar je Euro aus.

der Kampf um die 3$ sollte mit dem heutigen Anstieg gewonnen sein.

Schönes WE

Schönes WE

die 3$ Marke war jetzt doch schwerer zu nehmen als von mir angenomen.

Mit dem heutigen Anstieg beim Ölpreis sollte es erledigt sein.

Mit dem heutigen Anstieg beim Ölpreis sollte es erledigt sein.

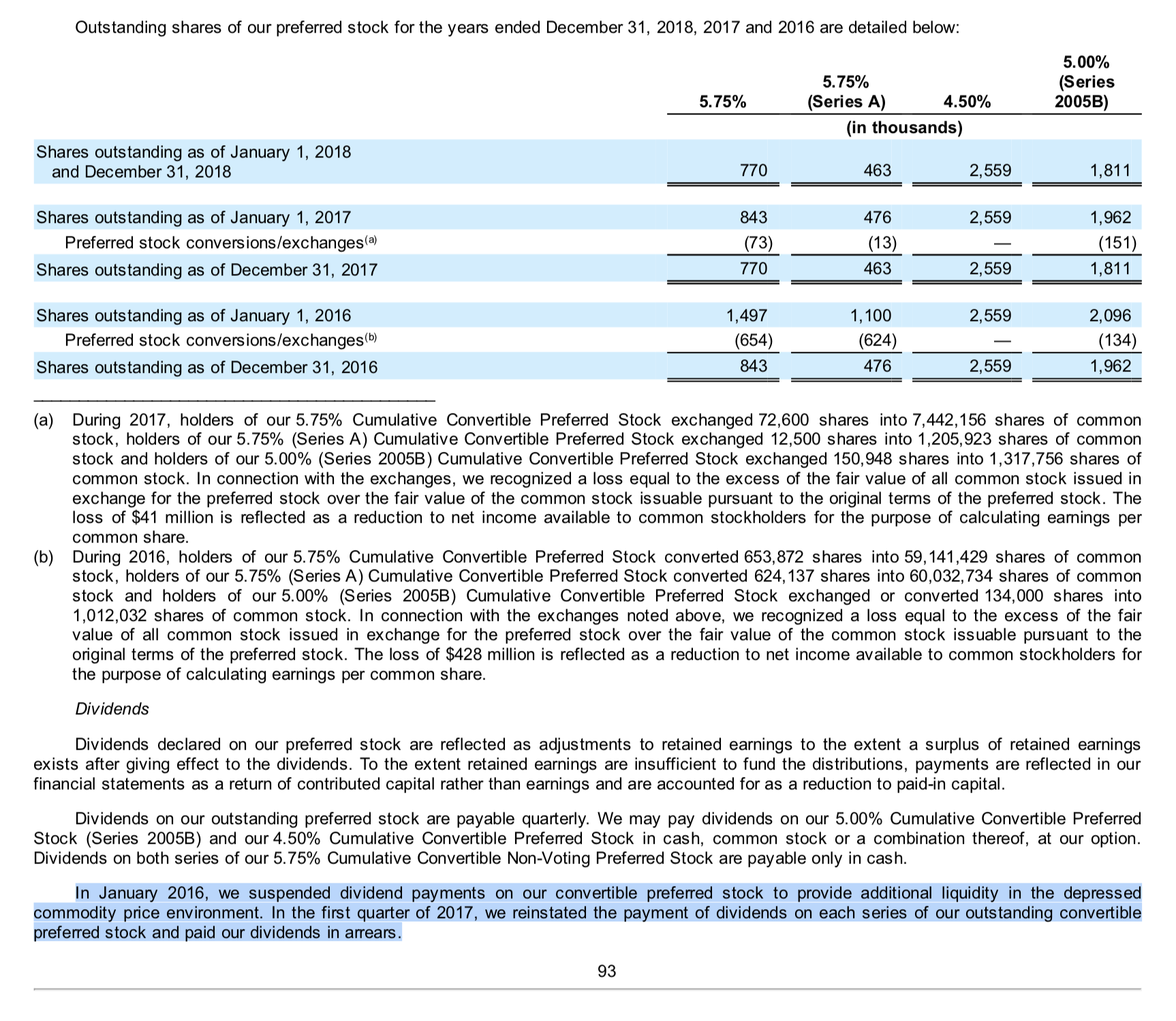

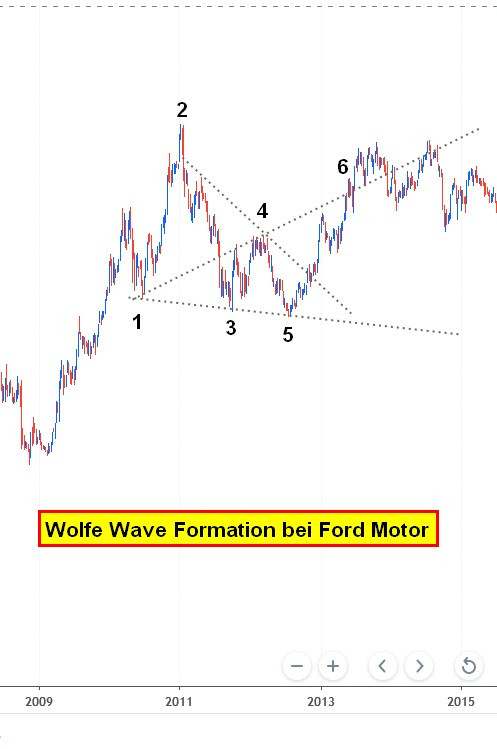

Antwort auf Beitrag Nr.: 57.749.224 von R-BgO am 13.05.18 14:53:24

Dividenden werden anscheinend gezahlt - aus dem 10k:

Ist noch jemand dabei?

Ich bin diese Woche zu 1,7$ wieder eingestiegen.

Ich bin diese Woche zu 1,7$ wieder eingestiegen.

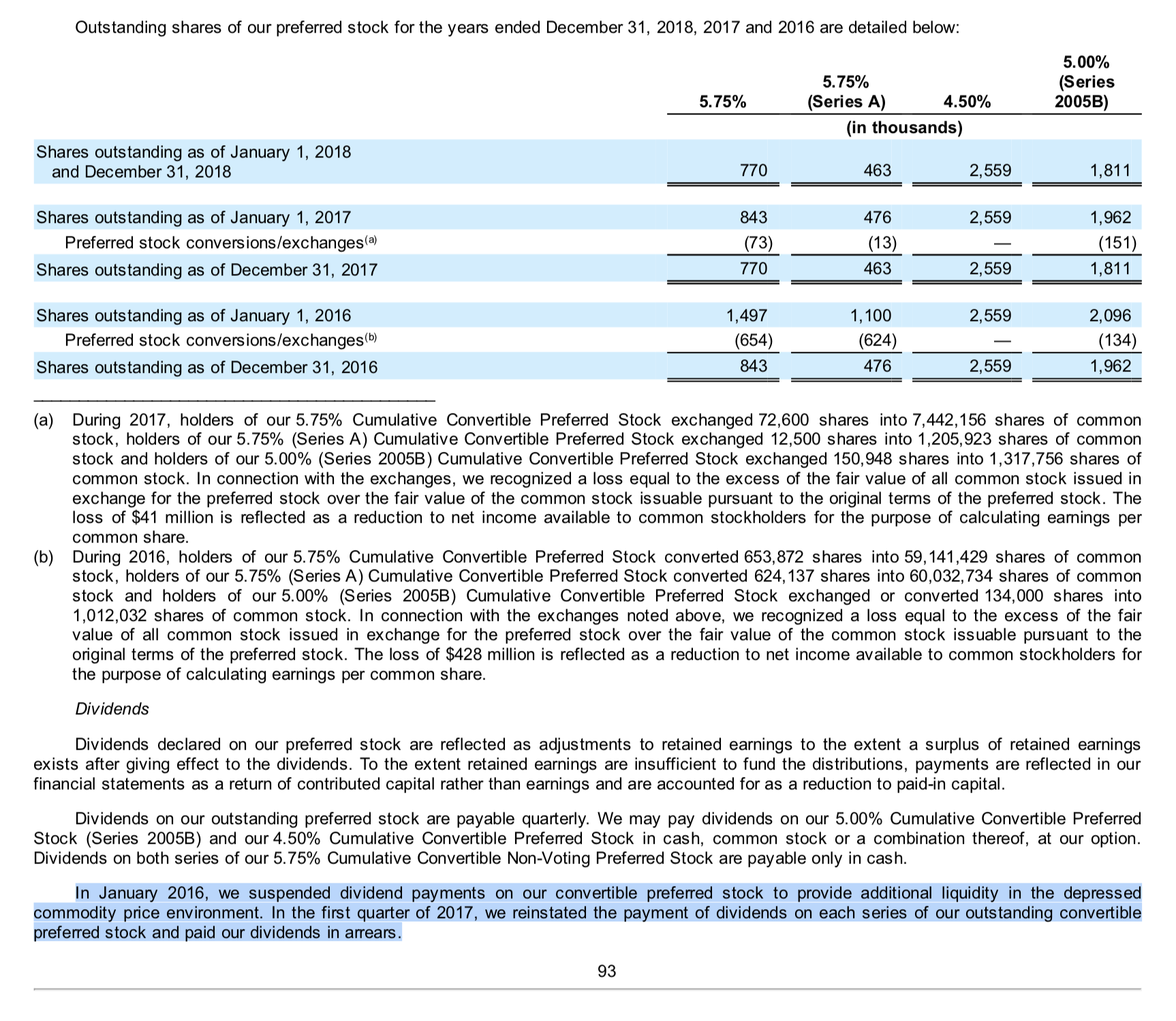

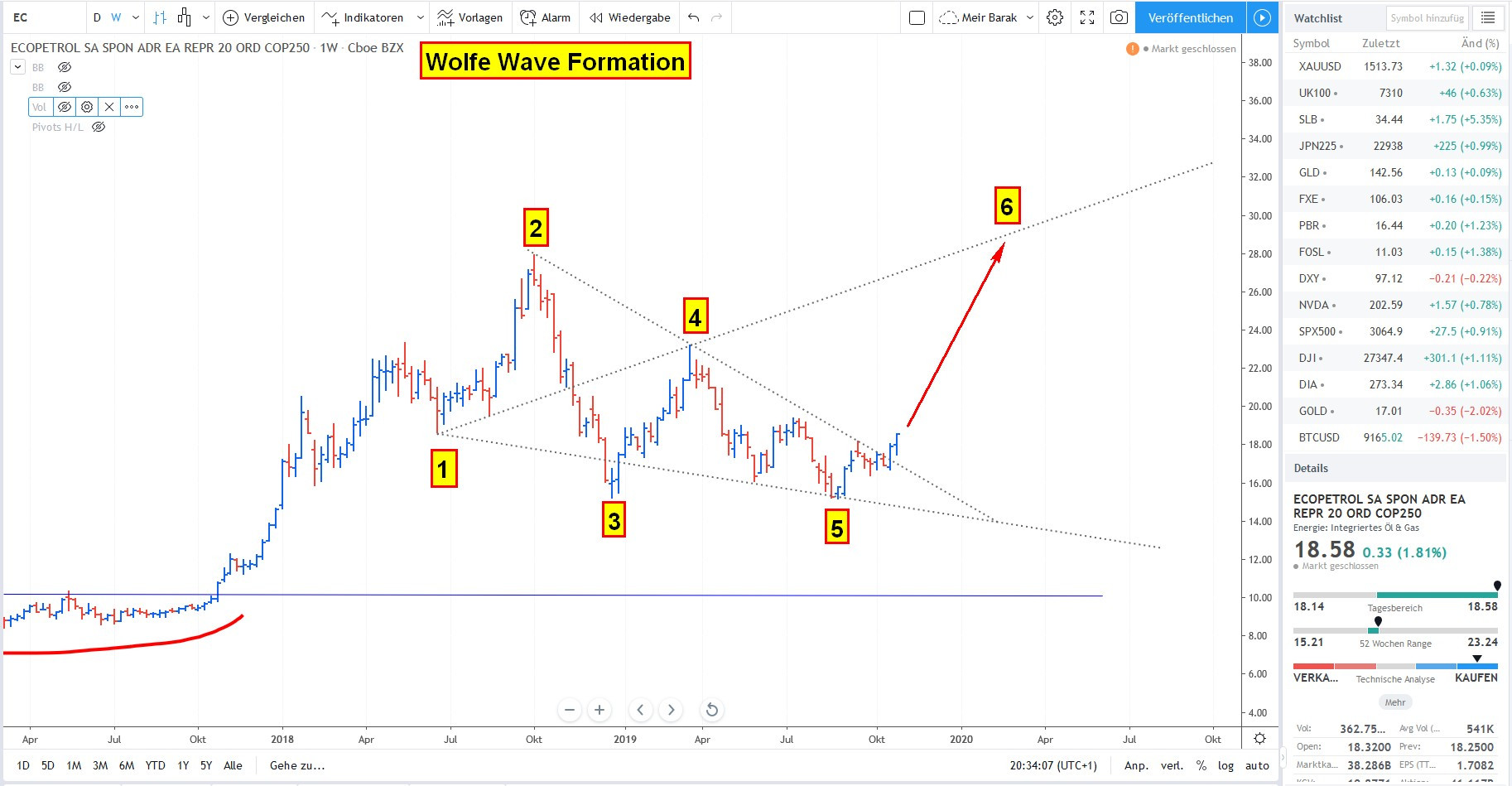

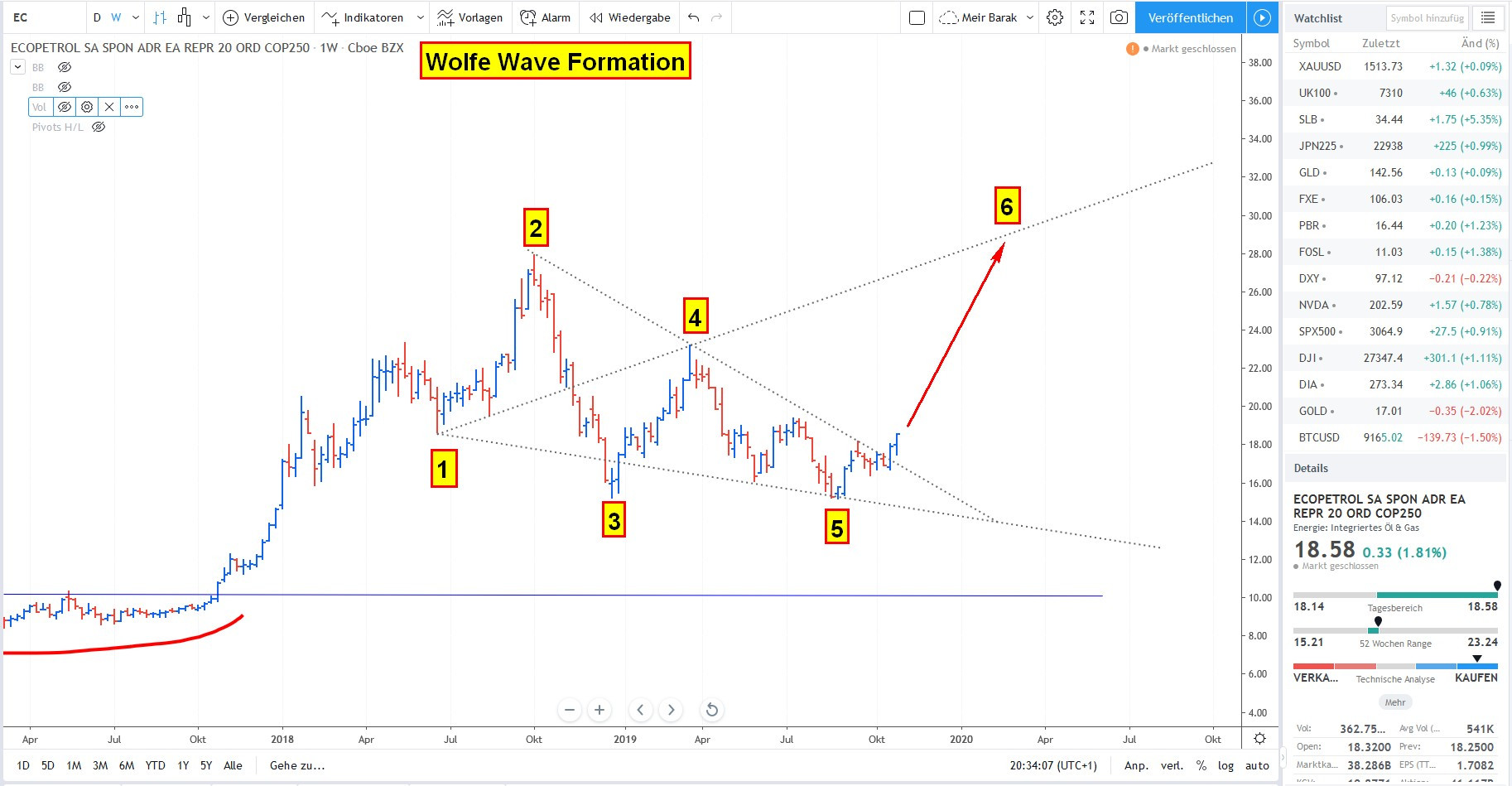

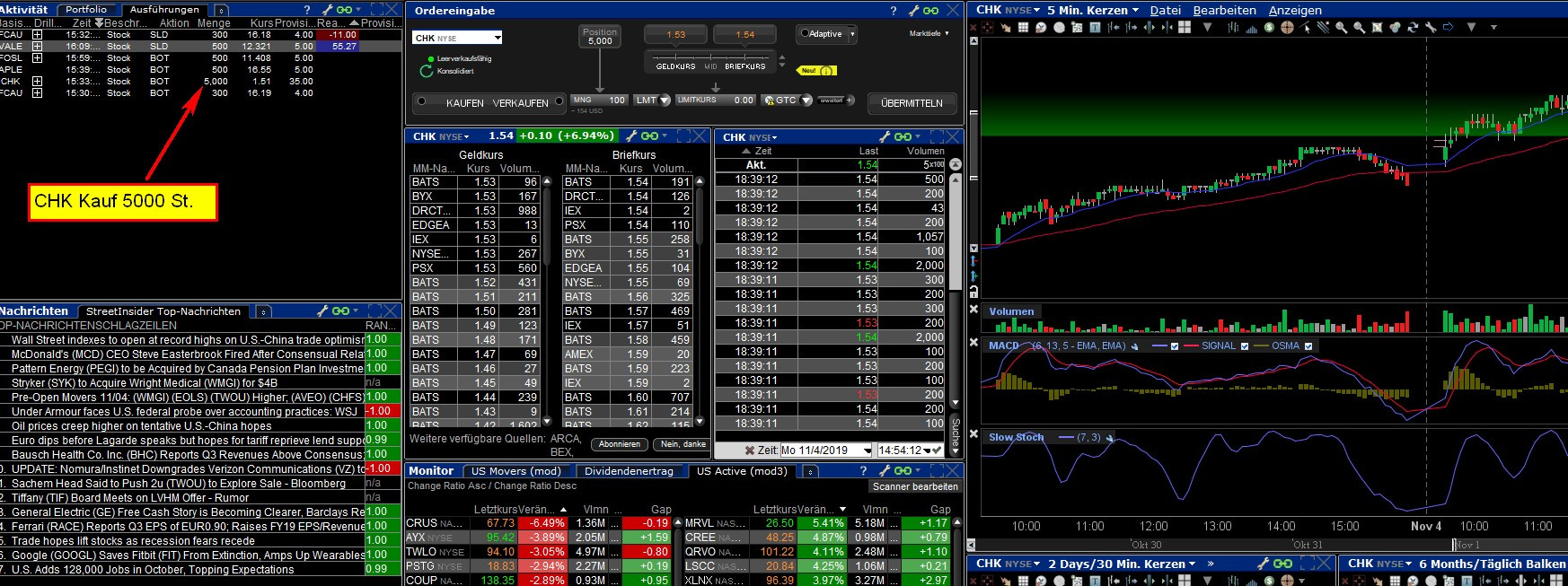

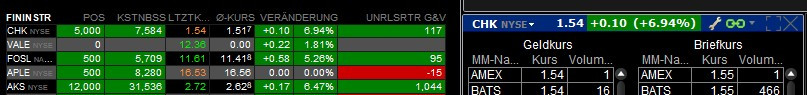

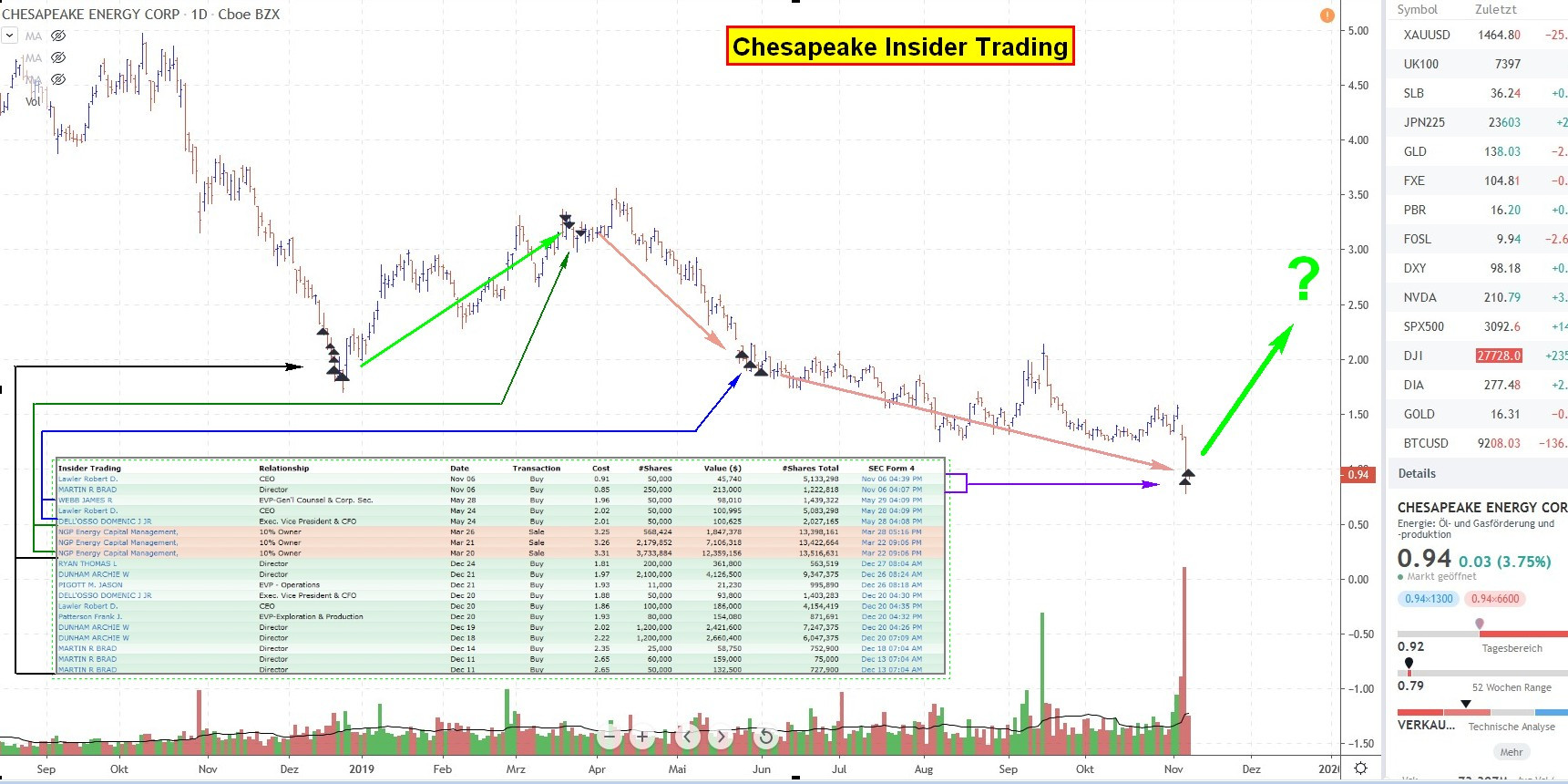

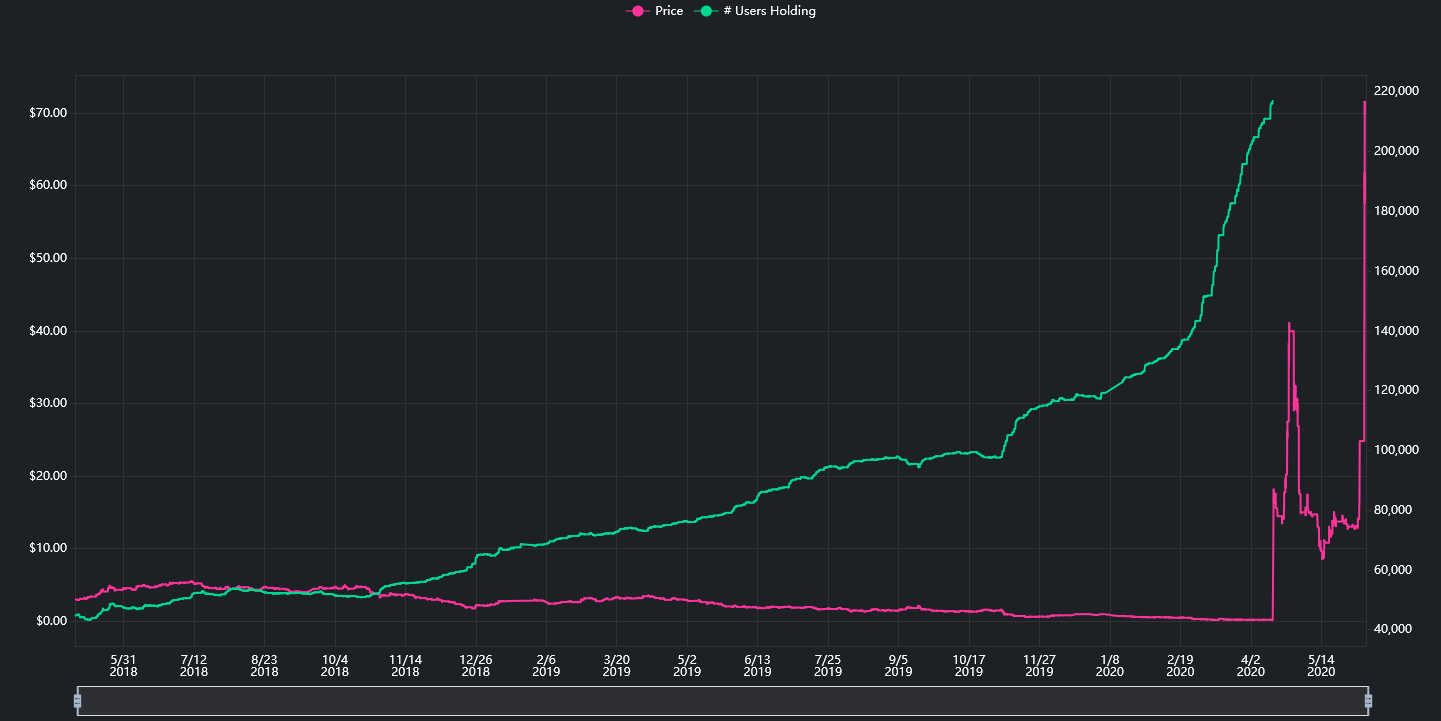

Ich möchte Euch auf eine schöne Trading-Gelegenheit bei Chesapeake Energy aufmerksam machen, die meiner Meinung nach, bis zu 250% Kursanstieg verspricht!

Schaut Euch den Monatschart von Chesapeake Energy unten an: