Jaguar Mining - Goldminer in Minas Gerais (Brazil) - Die letzten 30 Beiträge

eröffnet am 05.03.16 20:20:39 von

neuester Beitrag 14.04.24 23:52:18 von

neuester Beitrag 14.04.24 23:52:18 von

Beiträge: 110

ID: 1.227.912

ID: 1.227.912

Aufrufe heute: 1

Gesamt: 12.750

Gesamt: 12.750

Aktive User: 0

ISIN: CA47009M8896 · WKN: A2QA7P · Symbol: 32JP

1,9360

EUR

-7,37 %

-0,1540 EUR

Letzter Kurs 22.04.24 Tradegate

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 13,170 | +15,32 | |

| 46,82 | +12,12 | |

| 41,11 | +9,98 | |

| 1,4000 | +8,95 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6700 | -9,46 | |

| 103,80 | -9,50 | |

| 0,6800 | -15,00 | |

| 4,2300 | -17,86 | |

| 0,9000 | -25,00 |

Beitrag zu dieser Diskussion schreiben

Na mal sehen wie es hier weiter geht

https://www.accesswire.com/846730/jaguar-mining-reports-fina…

https://www.focus.de/finanzen/boerse/gold/3000-dollar-pro-un…

https://www.accesswire.com/846730/jaguar-mining-reports-fina…

https://www.focus.de/finanzen/boerse/gold/3000-dollar-pro-un…

Antwort auf Beitrag Nr.: 75.057.639 von Brainiac108 am 05.01.24 17:37:56Kosten sind ziehmlich Krass gestiegen

AISC liegt seit Jahresbeginn bei 1.682 USD/Unze

da muss man ehrlich sein sollten schnellstmöglich die Produktion steigern das man auf 1300 Dollar ALL In zurück kommt.

AISC liegt seit Jahresbeginn bei 1.682 USD/Unze

da muss man ehrlich sein sollten schnellstmöglich die Produktion steigern das man auf 1300 Dollar ALL In zurück kommt.

Jaguar Mining: Ein weiteres Jahr mit massiver Underperformance im Vergleich zu den Prognosen

27. Dezember 2023, 16:37 Uhr ETJaguar Mining Inc. (JAG:CA) Aktie, JAGGF- Die Produktion von Jaguar Mining ging im dritten Quartal um 18 % zurück, so dass die Produktion seit Jahresbeginn nur noch etwa 61 % der vorherigen (inzwischen zurückgezogenen) Jahresprognose beträgt.

- Unterdessen war es einer der wenigen Produzenten, der im Jahresvergleich einen deutlichen Rückgang der AISC-Margen meldete, obwohl es von günstigen Wettbewerbsvorteilen und einem viel höheren Goldpreis profitierte.... Wie wir weiter unten näher erläutern werden, war die Leistung im Verhältnis zu den Kostenvorgaben nicht besser, und Jaguar hat sich mittlerweile zu einem der kostenintensivsten Hersteller in der gesamten Branche entwickelt.......Leider führten die geringeren Produktions-/Verkaufsraten zu einem erheblichen Anstieg der Gesamtkosten (AISC), obwohl die Abhängigkeit vom teureren Vertragsabbau geringer war, wobei die Kosten im Jahresvergleich um etwa 38 % auf 1.701 US-Dollar pro Unze stiegen......Jaguar war einer der Namen, der seine Prognosen im Zeitraum 2021–2023 am wenigsten einhielt. Daher halte ich es für einen Namen mit hohem Risiko und hoher Rendite, und ich betrachte Investitionen in Namen mit diesen Eigenschaften (schlechte Lieferung, hauchdünne Margen, marginale Projekte/Minen) als Glücksspiel und nicht als Investition.

Zusammenfassend lässt sich sagen, dass ich andernorts weiterhin weitaus attraktivere Wetten sehe und mich erst bei einem Rückgang unter 1,05 US-Dollar für Jaguar Mining interessieren würde....

https://seekingalpha.com/article/4660004-jaguar-mining-anoth…

Antwort auf Beitrag Nr.: 71.359.096 von LugInvest am 14.04.22 13:15:20Hier mal die neusten Produktionszahlen

"We continue to have a strong financial position, with only $3-million in debt and a cash balance at quarter-end of $19.9-million. Was gut ist das sie wenig Schulden haben. Mal sehen wie das ganze weiter geht

https://www.stockwatch.com/News/Item/Z-C!JAG-3465440/C/JAG

"We continue to have a strong financial position, with only $3-million in debt and a cash balance at quarter-end of $19.9-million. Was gut ist das sie wenig Schulden haben. Mal sehen wie das ganze weiter geht

https://www.stockwatch.com/News/Item/Z-C!JAG-3465440/C/JAG

Jaguar Mining meldet für Q1 2022 einen Produktionsrückgang von 8 % auf 16.663 Unzen Gold.

https://www.jaguarmining.com/en/investors/news-releases/2022…

https://www.jaguarmining.com/en/investors/news-releases/2022…

Bei Jaguar Mining Inc hat der MACD im Daily die Signallinie nach oben gekreuzt.

💡

Antwort auf Beitrag Nr.: 65.864.418 von faultcode am 27.11.20 13:10:01Charttechnisch interessant (Ausbruch)! …very good news ahead??

…very good news ahead??

Gruß

reini81

…very good news ahead??

…very good news ahead??Gruß

reini81

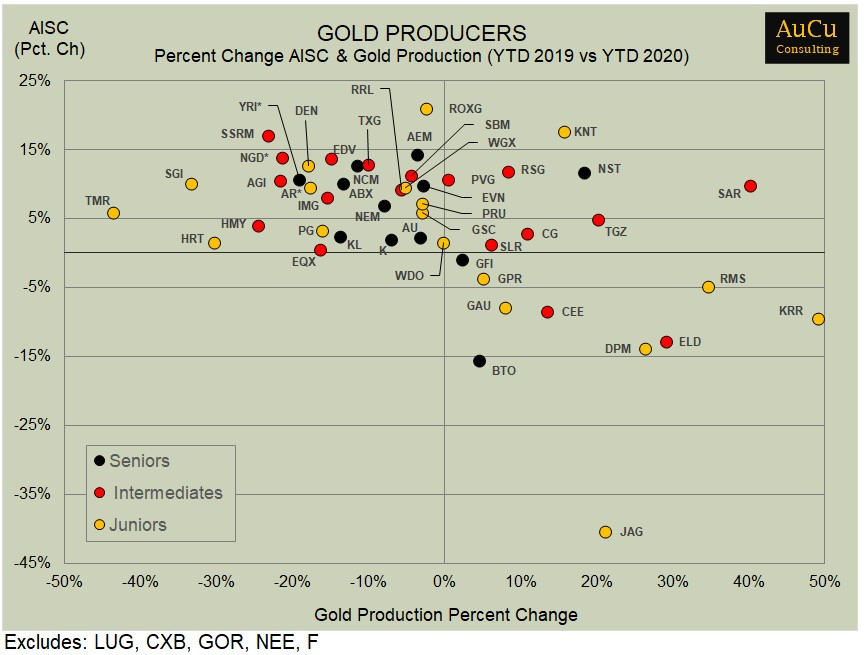

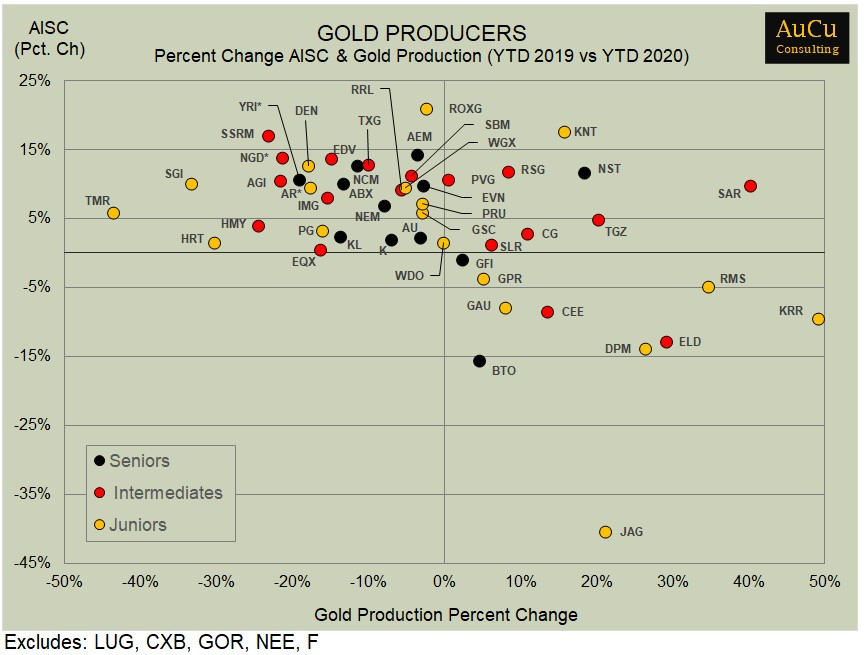

Jaguar Mining / JAG ist der fundamentale Gewinner in 2020 bislang.

Im Quadrant unten rechts möchte man sein:

https://twitter.com/RonaldS_AuCu/status/1330909418154811393

Im Quadrant unten rechts möchte man sein:

https://twitter.com/RonaldS_AuCu/status/1330909418154811393

Die haben einen aktiensplit vorgenommen, bedeutet aus den 700.mio aktien wurden jetzt 70mio. Deswegen ist eine Aktie jetzt halt das 10fache wert aber weniger aktien stehen aus

Antwort auf Beitrag Nr.: 64.899.905 von RoccoStellios am 27.08.20 12:19:13

Verständnisfrage

Kurze Frage in die Runde, wie hoch liegt die Aktie aktuell? bei 0,54 oder 5,30? irgendwie stehe ich gerade auf dem Schlauch

Kann man den Thread in die neue konsolidierte Aktie verschieben?

Antwort auf Beitrag Nr.: 64.689.526 von The_sledge am 07.08.20 22:17:52Danke fürs einstellen des Artikels

Die zahlen sind besser als meine Erwartungen fantastisch.

Vor allem die niedrigen AISC unter 900 sind stark und ein Nettogewinn von über 19 mio schon in Q2 sehr gut, habe eher mit irgendwas um die 15 gerechnet.

Wenn wir jetzt für das dritte und vierte Quartal einen GP von 1900/oz annehmen bei gleicher Produktion und etwa gleichen AISC, dann sind wir hier mit 0,12 USD EPS dabei was auf den aktuellem Preis von ~0,51$ ein klasse Ergebnis wäre.

Meiner Meinung nach ist Jaguar noch deutlich unterbewertet, nach diesen Ergebnissen und dem vorsichtigen Blick in die Zukunft wäre jetzt aktuell ein Preis um 0,70€ angemessen bzw fair.

Außerdem freue ich mich auf die ausstehenden explorationsergebnisse.

Keine Handlungsempfehlung oder Aufforderung zum Kauf.

Die zahlen sind besser als meine Erwartungen fantastisch.

Vor allem die niedrigen AISC unter 900 sind stark und ein Nettogewinn von über 19 mio schon in Q2 sehr gut, habe eher mit irgendwas um die 15 gerechnet.

Wenn wir jetzt für das dritte und vierte Quartal einen GP von 1900/oz annehmen bei gleicher Produktion und etwa gleichen AISC, dann sind wir hier mit 0,12 USD EPS dabei was auf den aktuellem Preis von ~0,51$ ein klasse Ergebnis wäre.

Meiner Meinung nach ist Jaguar noch deutlich unterbewertet, nach diesen Ergebnissen und dem vorsichtigen Blick in die Zukunft wäre jetzt aktuell ein Preis um 0,70€ angemessen bzw fair.

Außerdem freue ich mich auf die ausstehenden explorationsergebnisse.

Keine Handlungsempfehlung oder Aufforderung zum Kauf.

August 6, 2020

Consolidated Gold Production Increased 28%

Gross Profit increased 312%

Strong Treasury Position of $30.2M

COC Decreased by 25% to $586/oz Au and AISC Decreased 35% to $882/oz Au

Toronto, August 6, 2020 – Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX: JAG) today announced financial and operating results for the three months ("Q2 2020") and six months ended June 30, 2020. All figures are in US Dollars, unless otherwise expressed.

Q2 2020 Operating Summary

Consolidated gold production increased 43% with 23,483 ounces produced (208,000 tonnes milled, average grade of 4.00 g/t) in Q2 2020 compared to 16,365 ounces produced in Q1 2019 and 28% compared to 18,366 ounces produced in Q2 2019.

Pilar mine gold production increased 17% with 13,452 ounces produced compared to 11,521 ounces produced in Q1 2020 and increased 28% compared to 10,543 ounces produced in Q2 2019.

Turmalina mine gold production of increased 6% with 10,031 ounces produced compared to 9,487 ounces produced in Q1 2020 and increased 28% compared to 7,823 ounces produced in Q2 2019.

Primary development increased 30% to 1,707 meters compared to 1,310 meters completed in Q2 2019.

Sustaining capital expenditures of $6.1 million invested in mining equipment and development.

Q2 2020 Financial Results Summary

Gross profit increased 312% to $23.9 million compared to $5.8 million in Q2 2019.

Increased profitability in Q2 2020 reflects higher operating production quarter-over-quarter, and also an increase in the average realized gold price of $1,703/oz in Q2 2020 compared to $1,286/oz for Q2 2019.

Consolidated Cash operating costs ("COC") decreased 25% to $586 per ounce of gold sold for Q2 2020, compared to $786 during Q2 2019.

Consolidated all-in sustaining costs ("AISC") decreased 35% to $882 per ounce of gold sold in Q2 2020, compared to $1,366 during Q2 2019.

Decrease in costs is mainly due to increase in production, higher head-grade and devaluation of the BRL currency.

Operating cash flow of $27.5 million; adjusted EBITDA of $27.2 million.

Net income of $19.2 million, or net income per share of $0.03.

Free cash flow was $21.4 million for Q2 2020 based on operating cash flow, less sustaining capital, compared to negative $0.9 million in Q2 2019. The free cash flow for the quarter includes approximately $3.2M of sales proceeds from Q1 2020 which was received in Q2 2020.

Free cash flow was $858 per ounce sold in Q2 2020 compared to negative $47 per ounce sold in Q2 2019.

Strong treasury as of June 30, 2020, with cash of $30.2 million compared to cash of $12.1 million on March 31, 2020, demonstrating significant generation of pre-tax free cash flow.

Vern Baker, President and CEO of Jaguar Mining stated: "These strong second quarter results reflect our steady progression to reach our sustainable goal of 25,000 ounces per quarter. The financials reflect both improving production performance and strong tailwinds in the form of a weaker Brazilian Real and improving prices for gold. We are pleased to report that this is now our fifth quarter in a row with increasing ounce production. All the members of our Brazilian team of miners have demonstrated a commitment to moving our company through this current COVID-19 crisis and building a sustainable organization.

COVID-19 remains our key risk in terms of maintaining momentum. Cases in Brazil have been on the increase and our team has now reported its first few cases with our people. However, the team has remained calm and focused, and people who have confirmed positive with the virus, have now returned to work after appropriate quarantining. All our people are working to manage our way through the COVID-19 issue, and we have developed plans to deal with various potential scenarios as the situation continues to unfold.

Vern added, "We are pleased to report that Pilar Gold Mine reached a new production record for the quarter with 13,452 ounces produced. Turmalina Gold Mine production continues to improve, and this quarter reported a 6% increase from the prior quarter with 10,031 ounces produced, and development rates at Turmalina are sufficient to augment production in the second half of the year.

Jaguar enters the second half of the year with a very strong balance sheet, a sustainable production platform, excellent exploration opportunities, an impressive position in the Iron Quadrangle; both in hectares and in available infrastructure, and an outstanding cash flow position. With this strong performance, our supportive board have approved additional expenditures in 2020 for exploration and project evaluation."

Q2 2020 Financial Results

Cash Position and Use of Funds

Strong treasury as of June 30, 2020, with cash of $30.2 million compared to cash of $12.1 million on March 31, 2020. Brazilian Bank debt of $1 million was also paid down and $0.7 million of common shares were bought back through the Normal Course Issuer Bid program.

As at June 30, 2020, working capital was $25.8 million, compared to $9.4 million as at December 31, 2019, which includes $3.5 million in loans from Brazilian banks, which mature every six months and are expected to be rolled forward.

Qualified Persons

Scientific and technical information contained in this press release has been reviewed and approved by Jonathan Victor Hill, BSc (Hons) (Economic Geology - UCT), Senior Expert Advisor Geology and Exploration to the Jaguar Mining Management Committee, who is also an employee of Jaguar Mining Inc., and is a "qualified person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699–1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar holds the second largest gold land position in the Iron Quadrangle with just over 25,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims covering an area of approximately 64,000 hectares. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex and Caeté Mining Complex (Pilar and Roça Grande Mines, and Caeté Plant). The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. The Roça Grande Mine has been on temporary care and maintenance since April 2019. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

Vernon Baker

Chief Executive Officer

Jaguar Mining Inc.

vernon.baker@jaguarmining.com

416-847-1854

Hashim Ahmed

Chief Financial Officer

Jaguar Mining Inc.

hashim.ahmed@jaguarmining.com

416-847-1854

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, expected sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the estimated timeline for the development of its mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR at www.sedar.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

Non-IFRS Measures

This news release provides certain financial measures that do not have a standardized meaning prescribed by IFRS. Readers are cautioned to review the below stated footnotes where the Company expands on its use of non-IFRS measures.

Cash operating costs and cash operating cost per ounce are non-IFRS measures. In the gold mining industry, cash operating costs and cash operating costs per ounce are common performance measures but do not have any standardized meaning. Cash operating costs are derived from amounts included in the Consolidated Statements of Comprehensive Income (Loss) and include mine-site operating costs such as mining, processing and administration, as well as royalty expenses, but exclude depreciation, depletion, share-based payment expenses, and reclamation costs. Cash operating costs per ounce are based on ounces produced and are calculated by dividing cash operating costs by commercial gold ounces produced; US$ cash operating costs per ounce produced are derived from the cash operating costs per ounce produced translated using the average Brazilian Central Bank R$/US$ exchange rate. The Company discloses cash operating costs and cash operating costs per ounce, as it believes those measures provide valuable assistance to investors and analysts in evaluating the Company's operational performance and ability to generate cash flow. The most directly comparable measure prepared in accordance with IFRS is total production costs. A reconciliation of cash operating costs per ounce to total production costs for the most recent reporting period, the quarter ended June 30, 2020, is set out in the Company's second quarter 2020 Management Discussion and Analysis (MD&A) filed on SEDAR at www.sedar.com.

All-in sustaining cost is a non-IFRS measure. This measure is intended to assist readers in evaluating the total costs of producing gold from current operations. While there is no standardized meaning across the industry for this measure, except for non-cash items the Company's definition conforms to the all-in sustaining cost definition as set out by the World Gold Council in its guidance note dated June 27, 2013. The Company defines all-in sustaining cost as the sum of production costs, sustaining capital (capital required to maintain current operations at existing levels), corporate general and administrative expenses, and in-mine exploration expenses. All-in sustaining cost excludes growth capital, reclamation cost accretion related to current operations, interest and other financing costs, and taxes. A reconciliation of all-in sustaining cost to total production costs for the most recent reporting period, the quarter ended June 30, 2020, is set out in the Company's second quarter 2020 MD&A filed on SEDAR at www.sedar.com.

View in PDF Format

View online | Unsubscribe

Jaguar Mining Inc.

First Canadian Place

100 King Street West, 56th Floor

Toronto, Ontario M5X 1C9

Telephone +1 (416) 847-1854

Habe den Bericht kurz überflogen und sehe eigentlich nur positive Kennzahlen, top top top

Consolidated Gold Production Increased 28%

Gross Profit increased 312%

Strong Treasury Position of $30.2M

COC Decreased by 25% to $586/oz Au and AISC Decreased 35% to $882/oz Au

Toronto, August 6, 2020 – Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX: JAG) today announced financial and operating results for the three months ("Q2 2020") and six months ended June 30, 2020. All figures are in US Dollars, unless otherwise expressed.

Q2 2020 Operating Summary

Consolidated gold production increased 43% with 23,483 ounces produced (208,000 tonnes milled, average grade of 4.00 g/t) in Q2 2020 compared to 16,365 ounces produced in Q1 2019 and 28% compared to 18,366 ounces produced in Q2 2019.

Pilar mine gold production increased 17% with 13,452 ounces produced compared to 11,521 ounces produced in Q1 2020 and increased 28% compared to 10,543 ounces produced in Q2 2019.

Turmalina mine gold production of increased 6% with 10,031 ounces produced compared to 9,487 ounces produced in Q1 2020 and increased 28% compared to 7,823 ounces produced in Q2 2019.

Primary development increased 30% to 1,707 meters compared to 1,310 meters completed in Q2 2019.

Sustaining capital expenditures of $6.1 million invested in mining equipment and development.

Q2 2020 Financial Results Summary

Gross profit increased 312% to $23.9 million compared to $5.8 million in Q2 2019.

Increased profitability in Q2 2020 reflects higher operating production quarter-over-quarter, and also an increase in the average realized gold price of $1,703/oz in Q2 2020 compared to $1,286/oz for Q2 2019.

Consolidated Cash operating costs ("COC") decreased 25% to $586 per ounce of gold sold for Q2 2020, compared to $786 during Q2 2019.

Consolidated all-in sustaining costs ("AISC") decreased 35% to $882 per ounce of gold sold in Q2 2020, compared to $1,366 during Q2 2019.

Decrease in costs is mainly due to increase in production, higher head-grade and devaluation of the BRL currency.

Operating cash flow of $27.5 million; adjusted EBITDA of $27.2 million.

Net income of $19.2 million, or net income per share of $0.03.

Free cash flow was $21.4 million for Q2 2020 based on operating cash flow, less sustaining capital, compared to negative $0.9 million in Q2 2019. The free cash flow for the quarter includes approximately $3.2M of sales proceeds from Q1 2020 which was received in Q2 2020.

Free cash flow was $858 per ounce sold in Q2 2020 compared to negative $47 per ounce sold in Q2 2019.

Strong treasury as of June 30, 2020, with cash of $30.2 million compared to cash of $12.1 million on March 31, 2020, demonstrating significant generation of pre-tax free cash flow.

Vern Baker, President and CEO of Jaguar Mining stated: "These strong second quarter results reflect our steady progression to reach our sustainable goal of 25,000 ounces per quarter. The financials reflect both improving production performance and strong tailwinds in the form of a weaker Brazilian Real and improving prices for gold. We are pleased to report that this is now our fifth quarter in a row with increasing ounce production. All the members of our Brazilian team of miners have demonstrated a commitment to moving our company through this current COVID-19 crisis and building a sustainable organization.

COVID-19 remains our key risk in terms of maintaining momentum. Cases in Brazil have been on the increase and our team has now reported its first few cases with our people. However, the team has remained calm and focused, and people who have confirmed positive with the virus, have now returned to work after appropriate quarantining. All our people are working to manage our way through the COVID-19 issue, and we have developed plans to deal with various potential scenarios as the situation continues to unfold.

Vern added, "We are pleased to report that Pilar Gold Mine reached a new production record for the quarter with 13,452 ounces produced. Turmalina Gold Mine production continues to improve, and this quarter reported a 6% increase from the prior quarter with 10,031 ounces produced, and development rates at Turmalina are sufficient to augment production in the second half of the year.

Jaguar enters the second half of the year with a very strong balance sheet, a sustainable production platform, excellent exploration opportunities, an impressive position in the Iron Quadrangle; both in hectares and in available infrastructure, and an outstanding cash flow position. With this strong performance, our supportive board have approved additional expenditures in 2020 for exploration and project evaluation."

Q2 2020 Financial Results

Cash Position and Use of Funds

Strong treasury as of June 30, 2020, with cash of $30.2 million compared to cash of $12.1 million on March 31, 2020. Brazilian Bank debt of $1 million was also paid down and $0.7 million of common shares were bought back through the Normal Course Issuer Bid program.

As at June 30, 2020, working capital was $25.8 million, compared to $9.4 million as at December 31, 2019, which includes $3.5 million in loans from Brazilian banks, which mature every six months and are expected to be rolled forward.

Qualified Persons

Scientific and technical information contained in this press release has been reviewed and approved by Jonathan Victor Hill, BSc (Hons) (Economic Geology - UCT), Senior Expert Advisor Geology and Exploration to the Jaguar Mining Management Committee, who is also an employee of Jaguar Mining Inc., and is a "qualified person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699–1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar holds the second largest gold land position in the Iron Quadrangle with just over 25,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims covering an area of approximately 64,000 hectares. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex and Caeté Mining Complex (Pilar and Roça Grande Mines, and Caeté Plant). The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. The Roça Grande Mine has been on temporary care and maintenance since April 2019. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

Vernon Baker

Chief Executive Officer

Jaguar Mining Inc.

vernon.baker@jaguarmining.com

416-847-1854

Hashim Ahmed

Chief Financial Officer

Jaguar Mining Inc.

hashim.ahmed@jaguarmining.com

416-847-1854

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, expected sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the estimated timeline for the development of its mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR at www.sedar.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

Non-IFRS Measures

This news release provides certain financial measures that do not have a standardized meaning prescribed by IFRS. Readers are cautioned to review the below stated footnotes where the Company expands on its use of non-IFRS measures.

Cash operating costs and cash operating cost per ounce are non-IFRS measures. In the gold mining industry, cash operating costs and cash operating costs per ounce are common performance measures but do not have any standardized meaning. Cash operating costs are derived from amounts included in the Consolidated Statements of Comprehensive Income (Loss) and include mine-site operating costs such as mining, processing and administration, as well as royalty expenses, but exclude depreciation, depletion, share-based payment expenses, and reclamation costs. Cash operating costs per ounce are based on ounces produced and are calculated by dividing cash operating costs by commercial gold ounces produced; US$ cash operating costs per ounce produced are derived from the cash operating costs per ounce produced translated using the average Brazilian Central Bank R$/US$ exchange rate. The Company discloses cash operating costs and cash operating costs per ounce, as it believes those measures provide valuable assistance to investors and analysts in evaluating the Company's operational performance and ability to generate cash flow. The most directly comparable measure prepared in accordance with IFRS is total production costs. A reconciliation of cash operating costs per ounce to total production costs for the most recent reporting period, the quarter ended June 30, 2020, is set out in the Company's second quarter 2020 Management Discussion and Analysis (MD&A) filed on SEDAR at www.sedar.com.

All-in sustaining cost is a non-IFRS measure. This measure is intended to assist readers in evaluating the total costs of producing gold from current operations. While there is no standardized meaning across the industry for this measure, except for non-cash items the Company's definition conforms to the all-in sustaining cost definition as set out by the World Gold Council in its guidance note dated June 27, 2013. The Company defines all-in sustaining cost as the sum of production costs, sustaining capital (capital required to maintain current operations at existing levels), corporate general and administrative expenses, and in-mine exploration expenses. All-in sustaining cost excludes growth capital, reclamation cost accretion related to current operations, interest and other financing costs, and taxes. A reconciliation of all-in sustaining cost to total production costs for the most recent reporting period, the quarter ended June 30, 2020, is set out in the Company's second quarter 2020 MD&A filed on SEDAR at www.sedar.com.

View in PDF Format

View online | Unsubscribe

Jaguar Mining Inc.

First Canadian Place

100 King Street West, 56th Floor

Toronto, Ontario M5X 1C9

Telephone +1 (416) 847-1854

Habe den Bericht kurz überflogen und sehe eigentlich nur positive Kennzahlen, top top top

!

Dieser Beitrag wurde von CommunityAssistance moderiert. Grund: Bleiben Sie bitte sachlich. Bitte kehren Sie zum Threadthema zurück.

Hallo Leute

Hab mich mal bisschen in die Zahlen, Daten, Fakten und Präsentationen eingelesen.

Ich muss sagen bin beeindruckt.

Kurz zusammengefasst was hier für ein invest spricht.

- Produktion steigt seit 5 Quartalen an

- bilanz sieht wunderbar aus mit 30mio cash und mittlerweile fast keinen Schulden mehr

- aktien werden zurückgekauft

- Firma ist seit 2020 komplette unhedged, rückblickend sehr geil, weil gold stark im Preis gestiegen ist.

- grade sind hoch und werden zusammen mit diesen produktionszahlen von >90k oz die förderkosten senken

- somit wird AISC auf ca 900-1000 USD geschätzt.

- reserven und resourcen sind da um noch weitere Jahre Produktion zu sichern

- VIEL Potential in der Resourcenerweiterung, was das explorationsprogramm zeigt (Q2 14000meter gebohrt)

Fazit: wenn man den Gewinn fürs erste und zweite Quartal nimmt und das nun auch für das 3,4 als Bezug nimmt, was eher konservativ ist in Anbetracht des steigenden goldpreises, kommen wir hier auf ca 0,08$ pro share was bei einem aktuell Preis von ca 0.40$ ein tolles KGV von 5 ergibt.

Selbstverständlich nur dann wenn die Rahmenbedingungen Goldpreis, Produktion, grade etc... ausfallen wie erwartet.

Das ist so meine Einschätzung zu der aktien

Gerne ergänzen und verbessern falls jmd was findet, was kritisiert werden kann.

Nur meine Meinung keine Beratung zu Kauf/Verkauf.

Hab mich mal bisschen in die Zahlen, Daten, Fakten und Präsentationen eingelesen.

Ich muss sagen bin beeindruckt.

Kurz zusammengefasst was hier für ein invest spricht.

- Produktion steigt seit 5 Quartalen an

- bilanz sieht wunderbar aus mit 30mio cash und mittlerweile fast keinen Schulden mehr

- aktien werden zurückgekauft

- Firma ist seit 2020 komplette unhedged, rückblickend sehr geil, weil gold stark im Preis gestiegen ist.

- grade sind hoch und werden zusammen mit diesen produktionszahlen von >90k oz die förderkosten senken

- somit wird AISC auf ca 900-1000 USD geschätzt.

- reserven und resourcen sind da um noch weitere Jahre Produktion zu sichern

- VIEL Potential in der Resourcenerweiterung, was das explorationsprogramm zeigt (Q2 14000meter gebohrt)

Fazit: wenn man den Gewinn fürs erste und zweite Quartal nimmt und das nun auch für das 3,4 als Bezug nimmt, was eher konservativ ist in Anbetracht des steigenden goldpreises, kommen wir hier auf ca 0,08$ pro share was bei einem aktuell Preis von ca 0.40$ ein tolles KGV von 5 ergibt.

Selbstverständlich nur dann wenn die Rahmenbedingungen Goldpreis, Produktion, grade etc... ausfallen wie erwartet.

Das ist so meine Einschätzung zu der aktien

Gerne ergänzen und verbessern falls jmd was findet, was kritisiert werden kann.

Nur meine Meinung keine Beratung zu Kauf/Verkauf.

Antwort auf Beitrag Nr.: 64.320.740 von RoccoStark am 07.07.20 14:40:35Über 300% plus seit 9/19.

Gold ist kurz vor ATH.

Volumen ist auch gestiegen die letzten Wochen.

Grade sind niedrig angegeben in der News ,aber bei den Goldpreisen immer noch im Rahmen.

Gold ist kurz vor ATH.

Volumen ist auch gestiegen die letzten Wochen.

Grade sind niedrig angegeben in der News ,aber bei den Goldpreisen immer noch im Rahmen.

https://www.jaguarmining.com/en/investors/news-releases/2020…

Frische news.

Ich bin weiterhin positiv. Produktion läuft. Wenn die Kosten sich im Rahmen halten (ich kann nichts dazu in der News finden) gibts nichts zu meckern.

Frische news.

Ich bin weiterhin positiv. Produktion läuft. Wenn die Kosten sich im Rahmen halten (ich kann nichts dazu in der News finden) gibts nichts zu meckern.

Antwort auf Beitrag Nr.: 63.665.602 von RoccoStark am 13.05.20 17:30:51Kann mich meinem Namensvetter nur anschließen.

Bin mit unter 0,1 mit einer höheren 4K€ Posi drin.

Würde auch gerne andere Meinungen hören wohin die Reise gehen könnte.

Vielen Dank vorab und viel Glück bei euren Invests.

Bin mit unter 0,1 mit einer höheren 4K€ Posi drin.

Würde auch gerne andere Meinungen hören wohin die Reise gehen könnte.

Vielen Dank vorab und viel Glück bei euren Invests.

https://www.accesswire.com/589521/Jaguar-Mining-Reports-Firs…

Die Zahlen sind TOP.

Ich kann mir nicht vorstellen, dass die Randbedingungen sich verschlechtern werden (Währung, Kosten, Goldpreis) und daher kann es nur in eine RIchtung gehen. IMO

MonsieurCB - sehe wir sind in den gleichen Minen investiert wie es aussieht (siehe mein fälschlicher Beitrag bei FOS) :-)

Die Zahlen sind TOP.

Ich kann mir nicht vorstellen, dass die Randbedingungen sich verschlechtern werden (Währung, Kosten, Goldpreis) und daher kann es nur in eine RIchtung gehen. IMO

MonsieurCB - sehe wir sind in den gleichen Minen investiert wie es aussieht (siehe mein fälschlicher Beitrag bei FOS) :-)

Bei DIESEN neuen Werten wird einem Sprott's Invest immer verständlicher ... ;-)))

https://finance.yahoo.com/news/jaguar-announces-turmalina-mi…

https://finance.yahoo.com/news/jaguar-announces-turmalina-mi…

Kein Wunder, dass der Kurs in CA seit einiger Zeit merklich anzieht ...

https://finance.yahoo.com/news/jaguar-mining-reports-20-029-…

https://finance.yahoo.com/news/jaguar-mining-reports-20-029-…

Ok....aber was ist mit dem Tocqueville Asset Management, L.P., die dürften eine tiefen Einblick ins Unternehmen haben und die schmeissen zur Zeit ihre Aktien panisch aus den Depot raus....

https://www.canadianinsider.com/node/7?menu_tickersearch=JAG…

https://www.canadianinsider.com/node/7?menu_tickersearch=JAG…

Sprott steckt NOCH MEHR Geld rein ...

und prompt schießt der Kurs in Kanada um 25 % hoch ...

https://finance.yahoo.com/news/eric-sprott-announces-investm…

und prompt schießt der Kurs in Kanada um 25 % hoch ...

https://finance.yahoo.com/news/eric-sprott-announces-investm…

Habe mal jetzt einen Link reingesetzt für den Kurs 01/2008-01/2009 .Börsenplatz Toronto.

https://de.finance.yahoo.com/quote/JAG.TO/history?period1=11…

https://de.finance.yahoo.com/quote/JAG.TO/history?period1=11…

Als die USA im August /September 2019 die Sanktionen gegen den Iran verschärft haben und Saudische Ölfelder angegriffen wurden stiegt der Kurs auf über 0,17€.

Gold ist in Krisenzeiten schon immer ein sicherer Hafen gewesen.

Ich meine mich erinnern zu können das ein User hier im Forum mur mitteilte das der Kurs während der Lehman-Krise über 100€ war.

Ich bin bei 0,092 mit einer kleinen Posi wieder drin.

Gold ist in Krisenzeiten schon immer ein sicherer Hafen gewesen.

Ich meine mich erinnern zu können das ein User hier im Forum mur mitteilte das der Kurs während der Lehman-Krise über 100€ war.

Ich bin bei 0,092 mit einer kleinen Posi wieder drin.

Antwort auf Beitrag Nr.: 62.223.128 von MONSIEURCB am 23.12.19 18:55:06 Es liegt am derzeitigen Konflikt im nahen Osten.

Der USA-Iran Konflikt,Türkei -Zypern Konflikt.Es geht da um Erdgasbohrungen.

Netanyahu hat in Israel die Wahlen gewonnen und es droht ein Krieg gegen den Iran geführt von den USA.

Kriege und Konflikte führten bis jetzt immer zu hohen Goldpreisen an den Börsen.

Der USA-Iran Konflikt,Türkei -Zypern Konflikt.Es geht da um Erdgasbohrungen.

Netanyahu hat in Israel die Wahlen gewonnen und es droht ein Krieg gegen den Iran geführt von den USA.

Kriege und Konflikte führten bis jetzt immer zu hohen Goldpreisen an den Börsen.

Mittlerweile +38 % .. hat keiner eine Idee, was da los ist???

Heute +25% in Kanada ??????!!!!!!!!!!!!!!!!

Antwort auf Beitrag Nr.: 62.183.619 von MONSIEURCB am 17.12.19 22:31:00Am 11.12. gab es eine Meldung bzgl. eines neuen Board-Mitglieds. Aber ob das die Erklärung ist, weiss ich nicht. Vielleicht ein Börsenbrief, der was dazu geschrieben hat.

December 11, 2019

Toronto, December 11, 2019 – Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX: JAG) is pleased to announce Mr. Rodney Lamond, current Director on the Board, has been named Chairman of the Board effective December 9, 2019. Mr. Thomas Weng, current Chairman of the Board, has chosen to step down, but will continue to serve on the Board of Jaguar Mining.

With more than 30 years of global mining experience across North America, South America and Australia, Mr. Lamond brings deep expertise in operations, projects and business development in the precious metals sector to support the future growth and performance of Jaguar Mining. Mr. Lamond currently serves as President and CEO of Jerritt Canyon Gold.

“I am delighted to take on the post of Chairman to support the continued evolution of Jaguar Mining. During my tenure with Jaguar, the Company has focused on building its sustainable production profile delivering steady improvements in operational execution as well as significant exploration success. With a stable cash position, I look forward to working with the Board, Vern Baker, CEO, and the management team to ensure we continue making the right investments to unlock the true value of our quality Brazilian assets. On behalf of the Board, we thank Tom for his contributions as Chairman over the past year and look forward to his continued support.”

December 11, 2019

Toronto, December 11, 2019 – Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX: JAG) is pleased to announce Mr. Rodney Lamond, current Director on the Board, has been named Chairman of the Board effective December 9, 2019. Mr. Thomas Weng, current Chairman of the Board, has chosen to step down, but will continue to serve on the Board of Jaguar Mining.

With more than 30 years of global mining experience across North America, South America and Australia, Mr. Lamond brings deep expertise in operations, projects and business development in the precious metals sector to support the future growth and performance of Jaguar Mining. Mr. Lamond currently serves as President and CEO of Jerritt Canyon Gold.

“I am delighted to take on the post of Chairman to support the continued evolution of Jaguar Mining. During my tenure with Jaguar, the Company has focused on building its sustainable production profile delivering steady improvements in operational execution as well as significant exploration success. With a stable cash position, I look forward to working with the Board, Vern Baker, CEO, and the management team to ensure we continue making the right investments to unlock the true value of our quality Brazilian assets. On behalf of the Board, we thank Tom for his contributions as Chairman over the past year and look forward to his continued support.”