Europa's Banken: Schicksalsjahr 2016 - Die letzten 30 Beiträge

eröffnet am 31.07.16 19:44:34 von

neuester Beitrag 05.12.23 15:03:17 von

neuester Beitrag 05.12.23 15:03:17 von

Beiträge: 158

ID: 1.236.043

ID: 1.236.043

Aufrufe heute: 0

Gesamt: 10.244

Gesamt: 10.244

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 23:15 | 911 | |

| gestern 12:15 | 836 | |

| 20.04.24, 12:11 | 509 | |

| gestern 19:30 | 413 | |

| vor 1 Stunde | 404 | |

| heute 03:00 | 362 | |

| heute 05:38 | 343 | |

| vor 58 Minuten | 322 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.046,40 | -0,23 | 200 | |||

| 2. | 2. | 9,7650 | +1,24 | 184 | |||

| 3. | 3. | 149,42 | -1,41 | 132 | |||

| 4. | 4. | 0,1900 | -2,06 | 70 | |||

| 5. | 6. | 0,0211 | -32,59 | 29 | |||

| 6. | 5. | 6,7320 | -0,18 | 29 | |||

| 7. | 7. | 1,3400 | -0,74 | 29 | |||

| 8. | 15. | 2,2720 | -3,57 | 26 |

Beitrag zu dieser Diskussion schreiben

5.12.

Schnabel ECB Rate U-Turn Prompts Market Bets on Earlier Cut

https://finance.yahoo.com/news/schnabel-ecb-rate-u-turn-1009…

...

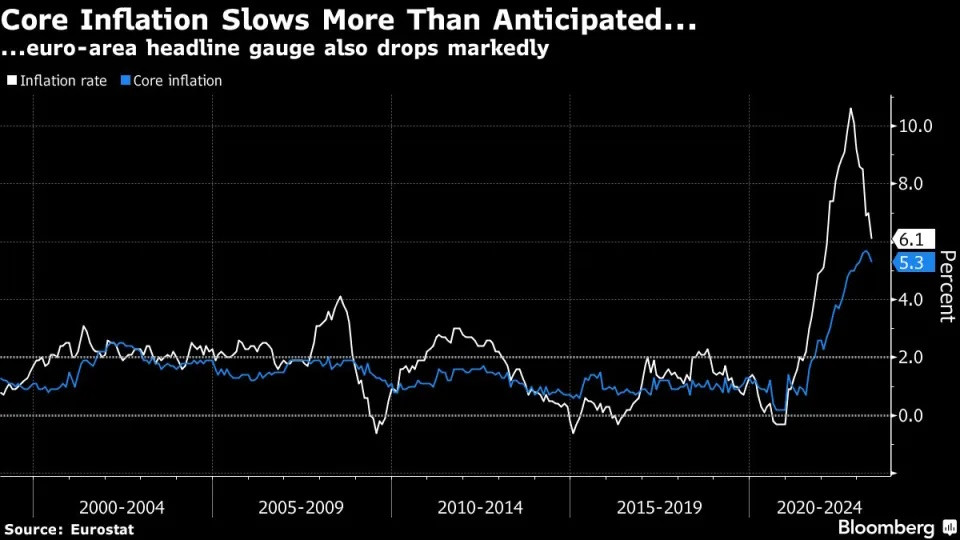

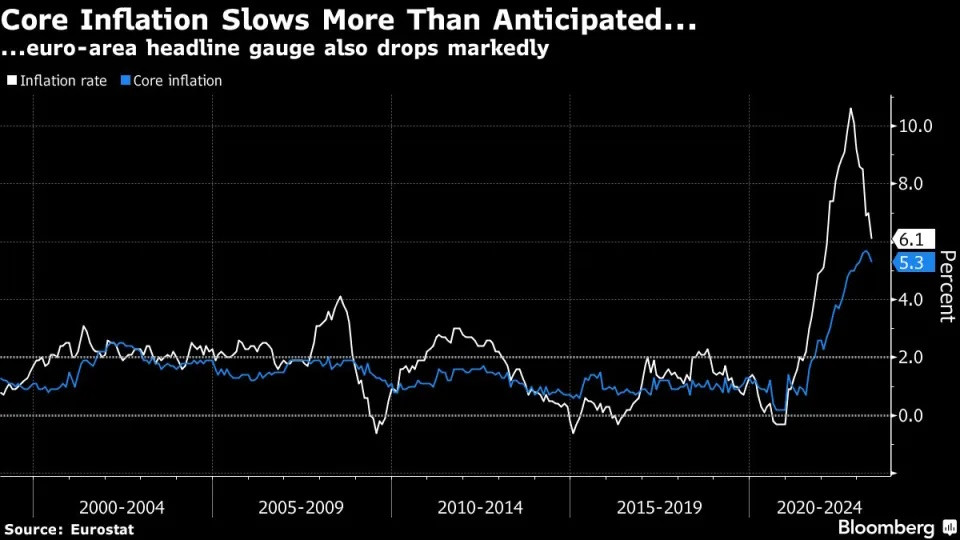

One of the European Central Bank’s most hawkish officials said inflation is showing a “remarkable” slowdown, a U-turn prompting markets to ramp up bets on an interest-rate cut as early as March.

Executive Board member Isabel Schnabel, speaking in a Reuters interview, said that the consumer-price data released last week now make another hike in borrowing costs “rather unlikely,” and refused to be drawn on the prospect that a reduction could even transpire within six months.

Money markets ramped up bets on faster and deeper rate cuts after the comments, almost fully pricing a quarter-point drop by March and 150-basis-points of decreases by the end of next year. The odds of a move in the first quarter were almost zero three weeks ago, while late last month only three quarter-point cuts were priced for next year.

Schnabel spoke days after a report showed euro-area inflation slowed to 2.4%, far lower than economists had anticipated and approaching the ECB’s 2% target. So-called core price growth — which strips out volatile elements such as energy — has also retreated.

“The November flash release was a very pleasant surprise,” she said according to a transcript of the Dec. 1 interview published Tuesday on the ECB’s website. “Most importantly, underlying inflation, which has proven more stubborn, is now also falling more quickly than we had expected. This is quite remarkable. All in all, inflation developments have been encouraging.”

...

Schnabel ECB Rate U-Turn Prompts Market Bets on Earlier Cut

https://finance.yahoo.com/news/schnabel-ecb-rate-u-turn-1009…

...

One of the European Central Bank’s most hawkish officials said inflation is showing a “remarkable” slowdown, a U-turn prompting markets to ramp up bets on an interest-rate cut as early as March.

Executive Board member Isabel Schnabel, speaking in a Reuters interview, said that the consumer-price data released last week now make another hike in borrowing costs “rather unlikely,” and refused to be drawn on the prospect that a reduction could even transpire within six months.

Money markets ramped up bets on faster and deeper rate cuts after the comments, almost fully pricing a quarter-point drop by March and 150-basis-points of decreases by the end of next year. The odds of a move in the first quarter were almost zero three weeks ago, while late last month only three quarter-point cuts were priced for next year.

Schnabel spoke days after a report showed euro-area inflation slowed to 2.4%, far lower than economists had anticipated and approaching the ECB’s 2% target. So-called core price growth — which strips out volatile elements such as energy — has also retreated.

“The November flash release was a very pleasant surprise,” she said according to a transcript of the Dec. 1 interview published Tuesday on the ECB’s website. “Most importantly, underlying inflation, which has proven more stubborn, is now also falling more quickly than we had expected. This is quite remarkable. All in all, inflation developments have been encouraging.”

...

30.10.

It’s Time to Short European Banks After Rally, JPMorgan Says

https://finance.yahoo.com/news/time-short-european-banks-ral…

...

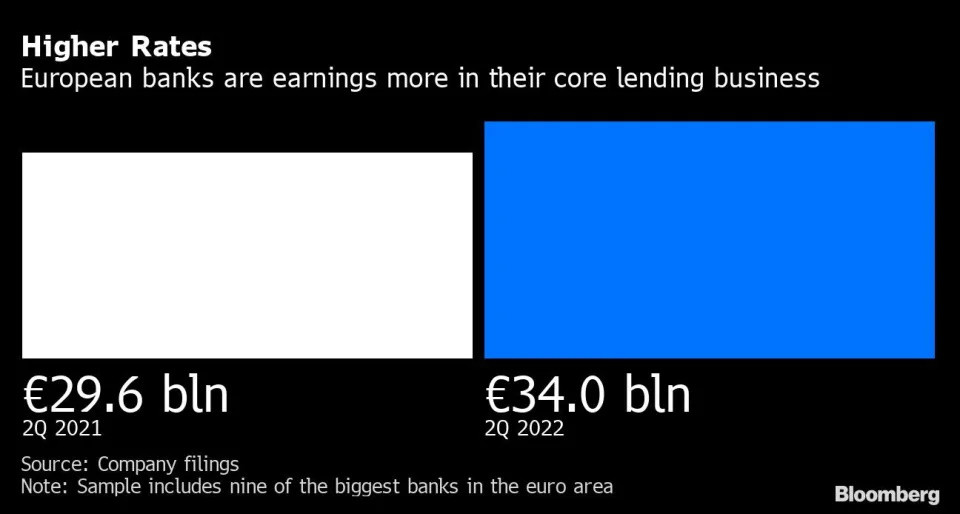

Following a strong performance by European banking stocks this year, investors should now bet on declines in the sector as lenders are at risk from a looming peak in bond yields, according to JPMorgan Chase & Co. strategists.

Any drop in yields, or interest-rate cuts by the European Central Bank next year, will reduce banks’ profitability, strategists led by Mislav Matejka wrote in a note Monday. They are also vulnerable to any signs of a recession in the region, the team said, advising opening a short on the sector and downgrading it to underweight from neutral.

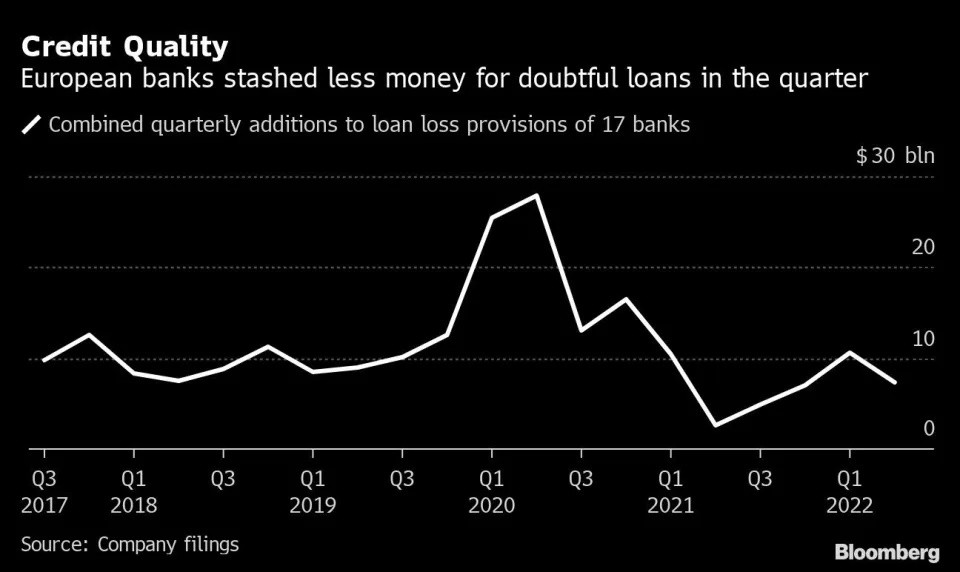

“Banks could suffer if economies enter contraction, and if some of the very benign credit backdrop changes next year, with spreads widening and delinquencies rising,” they wrote in a note. Credit risks look likely to rise, particularly for lenders exposed to high-yield corporates, small-and-medium enterprises and commercial real estate, as refinancing needs are set to increase from next year.

...

28.10.

Lagardes Kurs übers Hochzinsplateau braucht ihre volle Ausdauer

https://de.finance.yahoo.com/nachrichten/lagardes-kurs-%C3%B…

26.10.

Leitzins: EZB legt Zinspause ein - Guidance für APP und PEPP bestätigt

https://www.finanzen.net/nachricht/zinsen/zinsentscheid-leit…

...

Zum weiteren geldpolitischen Kurs heißt es: "Auf der Grundlage seiner derzeitigen Einschätzung ist der EZB-Rat der Ansicht, dass die Leitzinsen ein Niveau erreicht haben, das, wenn es für einen ausreichend langen Zeitraum beibehalten wird, einen wesentlichen Beitrag zur rechtzeitigen Rückkehr der Inflation zum Zielwert leisten wird."

Die künftigen Beschlüsse des EZB-Rats würden dafür sorgen, dass die Leitzinsen so lange wie nötig auf einem hinreichend restriktiven Niveau gehalten würden.

...

Leitzins: EZB legt Zinspause ein - Guidance für APP und PEPP bestätigt

https://www.finanzen.net/nachricht/zinsen/zinsentscheid-leit…

...

Zum weiteren geldpolitischen Kurs heißt es: "Auf der Grundlage seiner derzeitigen Einschätzung ist der EZB-Rat der Ansicht, dass die Leitzinsen ein Niveau erreicht haben, das, wenn es für einen ausreichend langen Zeitraum beibehalten wird, einen wesentlichen Beitrag zur rechtzeitigen Rückkehr der Inflation zum Zielwert leisten wird."

Die künftigen Beschlüsse des EZB-Rats würden dafür sorgen, dass die Leitzinsen so lange wie nötig auf einem hinreichend restriktiven Niveau gehalten würden.

...

29.9.

Euro-Zone Core Inflation Hits 1-Year Low, Backing ECB Pause

https://finance.yahoo.com/news/euro-zone-core-inflation-hits…

...

Euro-area core inflation eased to its slowest pace in a year, supporting expectations that the European Central Bank will keep interest rates on hold to gauge the impact of its unprecedented campaign of hikes.

...

Friday’s data offer the most definitive sign yet that the growth in core prices, a key metric as monetary policy was tightened, is firmly on the way down following a summer during which statistical distortions propped it up.

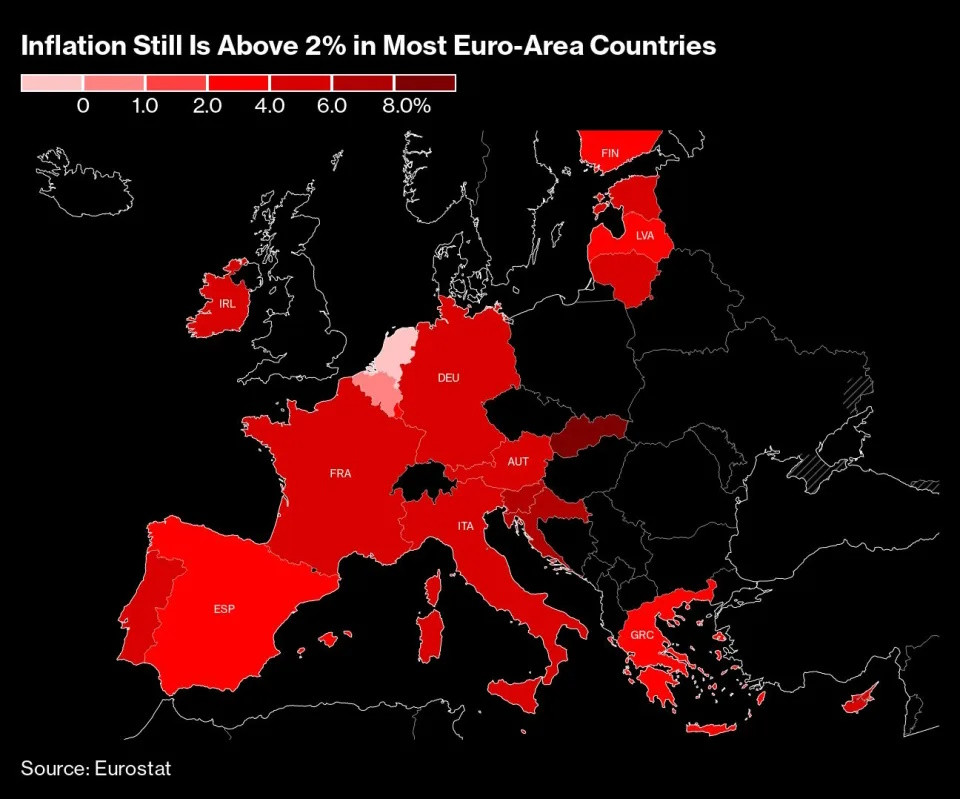

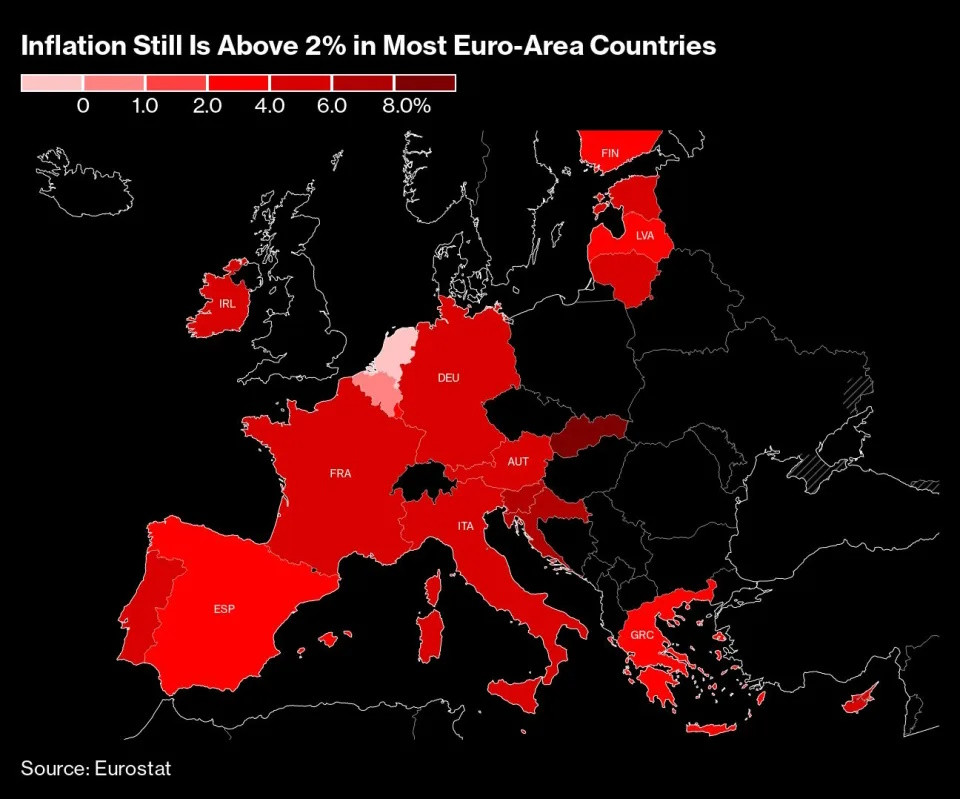

But with both measures still more than double the ECB’s 2% goal, markets are bracing for what officials say will be an extended period of elevated borrowing costs. Highlighting the divergent trends in the 20-member euro zone, German inflation plunged to a two-year low this month, while Spain’s reading jumped back above 3%.

...

Euro-Zone Core Inflation Hits 1-Year Low, Backing ECB Pause

https://finance.yahoo.com/news/euro-zone-core-inflation-hits…

...

Euro-area core inflation eased to its slowest pace in a year, supporting expectations that the European Central Bank will keep interest rates on hold to gauge the impact of its unprecedented campaign of hikes.

...

Friday’s data offer the most definitive sign yet that the growth in core prices, a key metric as monetary policy was tightened, is firmly on the way down following a summer during which statistical distortions propped it up.

But with both measures still more than double the ECB’s 2% goal, markets are bracing for what officials say will be an extended period of elevated borrowing costs. Highlighting the divergent trends in the 20-member euro zone, German inflation plunged to a two-year low this month, while Spain’s reading jumped back above 3%.

...

25.7.

Options Traders Wager on Fastest Ever U-Turn From the ECB

https://www.bnnbloomberg.ca/options-traders-wager-on-fastest…

...

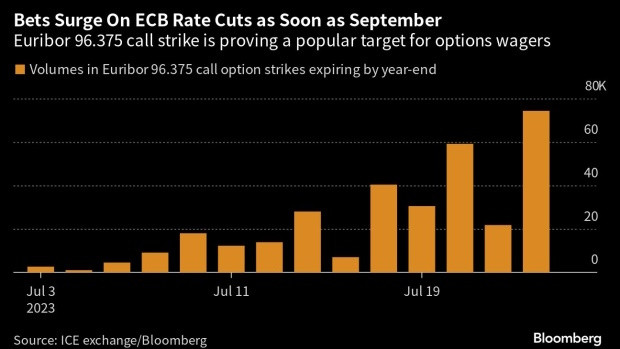

Money-market pricing points to two more rate rises — a 25 basis point hike this week, while odds favor a further increase to a record-high 4%. But options markets — which give investors a cheap way to wager on alternative outcomes — suggest there won’t be a second hike, and cuts could come as soon as September to avoid too harsh a blow to growth.

That would be a quicker about-face than in 2008, when European policy makers sought to rapidly undo the damage of the previous run of hikes, heralding a phase of aggressive monetary-policy easing as the global financial crisis unfolded.

...

9.7.

ECB Rate Hikes to End Soon at ‘High Plateau,’ Villeroy Says

https://www.bloomberg.com/news/articles/2023-07-09/ecb-will-…

• Borrowing costs must stay elevated to impact economy, he says

• Centeno sees inflation coming down ‘faster than the way up’

...

ECB Rate Hikes to End Soon at ‘High Plateau,’ Villeroy Says

https://www.bloomberg.com/news/articles/2023-07-09/ecb-will-…

• Borrowing costs must stay elevated to impact economy, he says

• Centeno sees inflation coming down ‘faster than the way up’

...

6.6.

Lagarde Says Inflation Is Strong, ECB to Hike Further

https://finance.yahoo.com/news/ecb-lagarde-says-price-pressu…

...

“Price pressures remain strong,” Lagarde told European Union lawmakers in Brussels.

“Our future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to our 2% medium-term target and will be kept at those levels for as long as necessary, she said.

...

Lagarde Says Inflation Is Strong, ECB to Hike Further

https://finance.yahoo.com/news/ecb-lagarde-says-price-pressu…

...

“Price pressures remain strong,” Lagarde told European Union lawmakers in Brussels.

“Our future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to our 2% medium-term target and will be kept at those levels for as long as necessary, she said.

...

26.3.

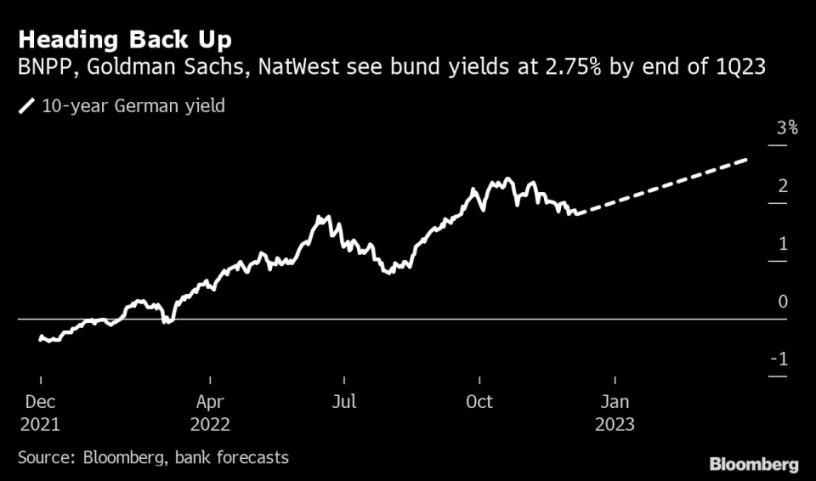

Euro Rally Puts $1.10 in Sight With ECB Now Last Hawk Standing

https://finance.yahoo.com/news/euro-rally-puts-1-10-07000090…

...

Christine Lagarde is cementing her credentials as the biggest hawk among major central bankers despite the mounting banking stress, handing financial markets a reason to buy the euro and sell German bonds.

The president of the European Central Bank last week declared getting euro-area inflation back on target is “non-negotiable” and won’t involve “trade-offs,” days after she boosted interest rates by 50 basis points.

By contrast, Federal Reserve Chair Jerome Powell executed a smaller increase and said US rate setters had considered a pause, while Governor Andrew Bailey’s Bank of England delivered a 25 basis point hike and said inflation was likely to slow “sharply.”

The widening divergence in monetary policy sits at the heart of two trades favored by currency and bond investors.

...

Euro Rally Puts $1.10 in Sight With ECB Now Last Hawk Standing

https://finance.yahoo.com/news/euro-rally-puts-1-10-07000090…

...

Christine Lagarde is cementing her credentials as the biggest hawk among major central bankers despite the mounting banking stress, handing financial markets a reason to buy the euro and sell German bonds.

The president of the European Central Bank last week declared getting euro-area inflation back on target is “non-negotiable” and won’t involve “trade-offs,” days after she boosted interest rates by 50 basis points.

By contrast, Federal Reserve Chair Jerome Powell executed a smaller increase and said US rate setters had considered a pause, while Governor Andrew Bailey’s Bank of England delivered a 25 basis point hike and said inflation was likely to slow “sharply.”

The widening divergence in monetary policy sits at the heart of two trades favored by currency and bond investors.

...

15. März 2023 um 17:04 MEZ

ECB to Only Hike by Quarter Point Amid Banking Turmoil, Bloomberg Economics Says

https://www.bloomberg.com/news/articles/2023-03-15/ecb-to-on…

...

The European Central Bank will forgo earlier guidance for a half-point interest-rate increase at this week’s meeting and only hike by half that amount amid concerns over the health of the financial sector, according to Bloomberg Economics.

Economists David Powell, Maeva Cousin and Jamie Rush changed their call for the upcoming decision, and now predict only a quarter-point step.

...

upcoming decision --> nächste EZB-Sitzung morgen am Donnerstag, 16.3.

ECB to Only Hike by Quarter Point Amid Banking Turmoil, Bloomberg Economics Says

https://www.bloomberg.com/news/articles/2023-03-15/ecb-to-on…

...

The European Central Bank will forgo earlier guidance for a half-point interest-rate increase at this week’s meeting and only hike by half that amount amid concerns over the health of the financial sector, according to Bloomberg Economics.

Economists David Powell, Maeva Cousin and Jamie Rush changed their call for the upcoming decision, and now predict only a quarter-point step.

...

upcoming decision --> nächste EZB-Sitzung morgen am Donnerstag, 16.3.

7.3.

Europe’s Bond Sales Top $130 Billion in Record Time

https://www.bnnbloomberg.ca/europe-s-bond-sales-top-130-bill…

...

A deluge of debt sales in Europe has pushed issuance for the year beyond $150 billion in the quickest time ever.

More than 80 predominantly high-grade borrowers have piled in to the market in January to lock in funding that’s around the cheapest since the summer, according to data compiled by Bloomberg. It’s the fastest start to a year for Europe’s publicly-syndicated debt sales on record, Bloomberg data going back to 2014 show.

“Issuers are taking this opportunity to get some funding done given there are still a lot of uncertainties out there,” said Marco Baldini, global co-head of investment grade syndicate at Barclays Bank Plc. “Right now, investors have cash and are positively disposed towards primary market investing.”

...

Europe’s Bond Sales Top $130 Billion in Record Time

https://www.bnnbloomberg.ca/europe-s-bond-sales-top-130-bill…

...

A deluge of debt sales in Europe has pushed issuance for the year beyond $150 billion in the quickest time ever.

More than 80 predominantly high-grade borrowers have piled in to the market in January to lock in funding that’s around the cheapest since the summer, according to data compiled by Bloomberg. It’s the fastest start to a year for Europe’s publicly-syndicated debt sales on record, Bloomberg data going back to 2014 show.

“Issuers are taking this opportunity to get some funding done given there are still a lot of uncertainties out there,” said Marco Baldini, global co-head of investment grade syndicate at Barclays Bank Plc. “Right now, investors have cash and are positively disposed towards primary market investing.”

...

Christine Lagarde lässt offenbar nachlegen...

https://www.spiegel.de/wirtschaft/soziales/ezb-plant-leitzin…

...und betreibt nun PR in eigener Sache:

https://www.manager-magazin.de/print/mm/index-2023-2.html

=> EURO STOXX Banks (EU0009658426):

https://www.spiegel.de/wirtschaft/soziales/ezb-plant-leitzin…

...und betreibt nun PR in eigener Sache:

https://www.manager-magazin.de/print/mm/index-2023-2.html

=> EURO STOXX Banks (EU0009658426):

9.1.

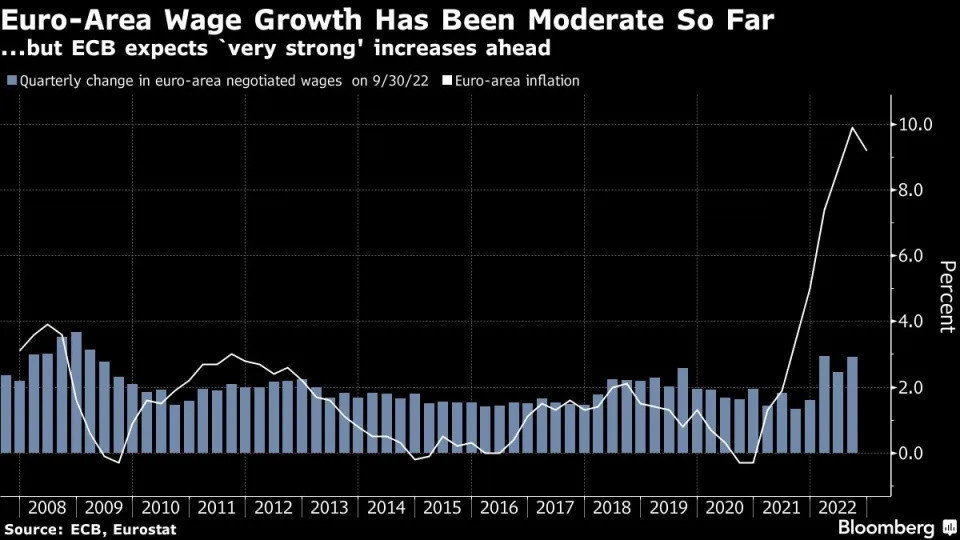

ECB Sees ‘Very Strong’ Wage Growth Ahead as More Hikes Planned

https://finance.yahoo.com/news/ecb-sees-very-strong-wage-094…

...

A study of salary developments since the start of the pandemic shows underlying pay growth has been “relatively moderate” and is currently close to its long-term trend, the institution said Monday in an article to be published in its Economic Bulletin.

Even so, “looking ahead, wage growth over the next few quarters is expected to be very strong compared with historical patterns,” it said. “This reflects robust labor markets that so far haven’t been substantially affected by the slowing of the economy, increases in national minimum wages and some catch-up between wages and high rates of inflation.”

Price gains have exceeded the ECB’s 2% goal for the past 1 1/2 years and surged above 10% in late 2022. While inflation has since come off its peak, an underlying gauge that excludes volatile items like food and energy hit a record high in December.

With forecasts showing 2% inflation will be elusive until end-2025 and trade unions pushing for generous compensation packages, the ECB has delivered an unprecedented series of rate increases that took the deposit rate to 2% last month.

President Christine Lagarde has flagged another half-point hike at February’s meeting — “and possibly at the one after that” — to avoid a wage-price spiral.

...

Antwort auf Beitrag Nr.: 72.881.010 von faultcode am 08.12.22 12:43:0816.12.

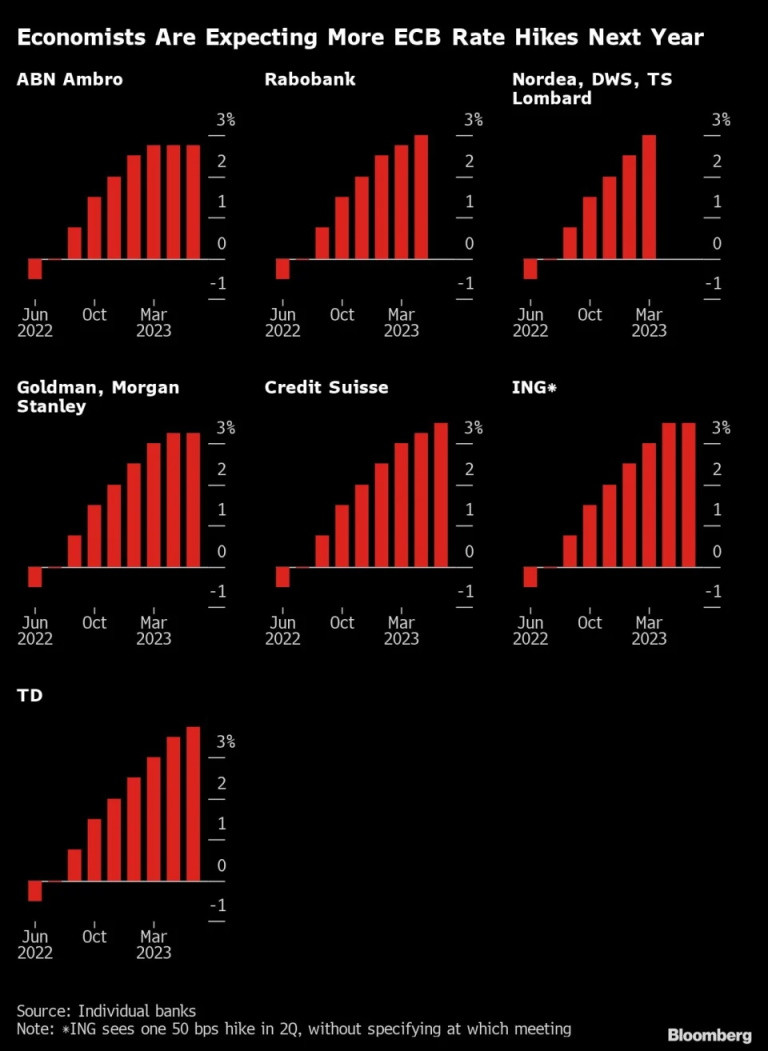

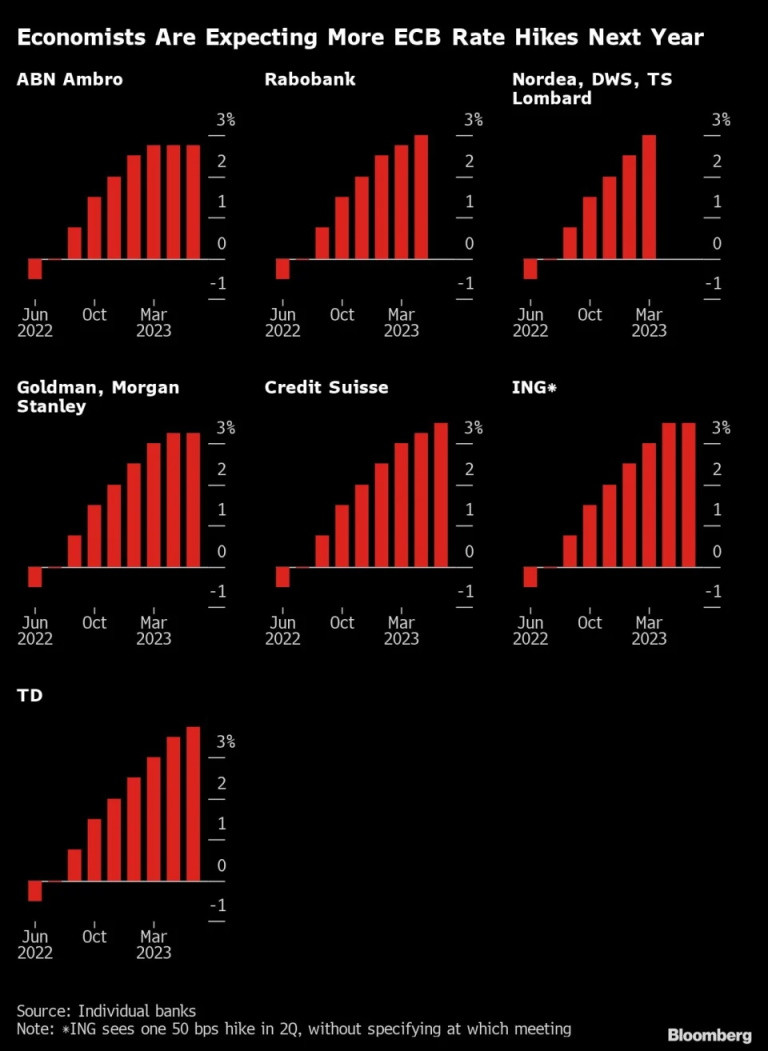

Most Banks See More ECB Rate Hikes With Potentially Higher Peak

https://finance.yahoo.com/news/most-banks-see-more-ecb-09275…

...

...

Most Banks See More ECB Rate Hikes With Potentially Higher Peak

https://finance.yahoo.com/news/most-banks-see-more-ecb-09275…

...

...

14.12.

Interne Notenbank-Prognose -- So geht es mit der Inflation bis 2025 weiter

https://www.bild.de/geld/wirtschaft/wirtschaft/inflation-so-…

...

Insidern zufolge erwartet die Euro-Notenbank auch für die nächsten drei Jahre eine Inflationsrate ÜBER ihrem Zielwert von zwei Prozent. Das berichtet „Reuters“. Demnach wird die Teuerung im Jahr 2024 deutlich über zwei Prozent liegen und auch 2025 das von der EZB angestrebte Zwei-Prozent-Ziel nicht erreichen.

...

Am kommenden Donnerstag steht die nächste Zinsentscheidung der Notenbank an. Experten rechnen damit, dass sie den Leitzins von 2 auf 2,5 Prozent anheben wird – um die Inflation endlich zu drücken.

...

Interne Notenbank-Prognose -- So geht es mit der Inflation bis 2025 weiter

https://www.bild.de/geld/wirtschaft/wirtschaft/inflation-so-…

...

Insidern zufolge erwartet die Euro-Notenbank auch für die nächsten drei Jahre eine Inflationsrate ÜBER ihrem Zielwert von zwei Prozent. Das berichtet „Reuters“. Demnach wird die Teuerung im Jahr 2024 deutlich über zwei Prozent liegen und auch 2025 das von der EZB angestrebte Zwei-Prozent-Ziel nicht erreichen.

...

Am kommenden Donnerstag steht die nächste Zinsentscheidung der Notenbank an. Experten rechnen damit, dass sie den Leitzins von 2 auf 2,5 Prozent anheben wird – um die Inflation endlich zu drücken.

...

8.12.

Europe Needs €500 Billion in Cash After Losing Top Bond Buyer

https://finance.yahoo.com/news/europe-needs-500-billion-cash…

...

The problem with it all is that unlike the past eight years, when the European Central Bank was happy to print money and buy as many bonds as needed, governments will have to find new financiers.

So rapid, in fact, will the ECB’s policy pivot be that analysts estimate it will force the region’s governments to sell more new debt in the bond market next year — upwards of €500 billion on a net basis — than anytime this century. And bond investors, scarred by the same inflation surge that the ECB is trying to squelch, aren’t in the mood to tolerate fiscal largesse right now. As Liz Truss found out, they will exact a price.

...

Christine Lagarde hechelt jetzt nur noch ihren Nicht- bzw. Fehlentscheidungen der Vergangenheit hinterher:

18.11.

Lagarde -- EZB kämpft weiter entschlossen gegen Inflation

https://www.wallstreet-online.de/nachricht/16224002-lagarde-…

...

EZB-Präsidentin Christine Lagarde hat die Entschlossenheit der Notenbank im Kampf gegen die rekordhohe Inflation bekräftigt. "Wir gehen davon aus, dass wir die Zinssätze weiter anheben werden", sagte Lagarde am Freitag beim "Frankfurt European Banking Congress". "Letztendlich werden wir die Zinsen auf ein Niveau anheben, das die Inflation rechtzeitig auf unser mittelfristiges Ziel zurückführt."

Die Europäische Zentralbank strebt für den Euroraum mittelfristig Preisstabilität bei einer Teuerungsrate von zwei Prozent an. Im Euroraum lagen die Verbraucherpreise im Oktober um 10,6 Prozent über dem Niveau des Vorjahresmonats. In Europas größter Volkswirtschaft Deutschland stieg die Inflationsrate im Oktober auf 10,4 Prozent.

...

18.11.

Lagarde -- EZB kämpft weiter entschlossen gegen Inflation

https://www.wallstreet-online.de/nachricht/16224002-lagarde-…

...

EZB-Präsidentin Christine Lagarde hat die Entschlossenheit der Notenbank im Kampf gegen die rekordhohe Inflation bekräftigt. "Wir gehen davon aus, dass wir die Zinssätze weiter anheben werden", sagte Lagarde am Freitag beim "Frankfurt European Banking Congress". "Letztendlich werden wir die Zinsen auf ein Niveau anheben, das die Inflation rechtzeitig auf unser mittelfristiges Ziel zurückführt."

Die Europäische Zentralbank strebt für den Euroraum mittelfristig Preisstabilität bei einer Teuerungsrate von zwei Prozent an. Im Euroraum lagen die Verbraucherpreise im Oktober um 10,6 Prozent über dem Niveau des Vorjahresmonats. In Europas größter Volkswirtschaft Deutschland stieg die Inflationsrate im Oktober auf 10,4 Prozent.

...

Antwort auf Beitrag Nr.: 72.176.091 von faultcode am 11.08.22 16:16:11es gibt geld-politische Entscheidungen und es gibt politische Entscheidungen.

Christine Lagarde wird sich im Zweifelsfall immer für Letzteres entscheiden:

https://twitter.com/jsblokland/status/1567862329630490627

Christine Lagarde wird sich im Zweifelsfall immer für Letzteres entscheiden:

https://twitter.com/jsblokland/status/1567862329630490627

Antwort auf Beitrag Nr.: 71.755.007 von faultcode am 10.06.22 17:14:57

https://www.bloomberg.com/news/articles/2022-08-10/ecb-infla…

"firmly grounded" haben diese EZB-Banker gestern verzapft:

...

To sum up, the new ECB strategy has contributed to a more solid anchoring of inflation expectations at 2%. Monetary policy decisions taken by the ECB’s Governing Council since July 2021 have been firmly grounded in the strategy. In the light of rising inflationary pressures, in December 2021 the Governing Council decided to embark on a path of monetary policy normalisation. Since then the Governing Council has repeatedly emphasised that it will ensure inflation returns to the 2% target over the medium term, in line with its commitment to symmetry.

...

https://www.ecb.europa.eu/press/blog/date/2022/html/ecb.blog…

=> was bitteschön soll an dieser -- irgendwann im Nachhinein erfundenen -- Symmetrie gut sein?

=> intellektuelles Geschwurbel:

Economic Bulletin Issue 7, 2021:

...

In general, there was a strong correlation between the ranking of the various elements/statements in terms of their perceived importance in the new strategy and their perceived improvement on the previous strategy.

Taking the percentage balance between positive and negative assessments as a summary statistic, respondents ranked the explicit reference to symmetry and the move away from “‘close to, but below, 2%’” to ‘2%’” as the two most important or relevant elements.

Other elements with relatively high net percentage balances include the reference to especially forceful or persistent monetary policy action when the economy is close to the effective lower bound, the permanently expanded toolkit and climate-related action.

It should also be noted that there was a positive net percentage balance for all of the elements/statements surveyed, indicating that respondents viewed them as important. In terms of their improvement on the previous strategy, the first four items (i.e. symmetry, 2%, forceful action at the effective lower bound and the toolkit) received the same ranking as for their importance.

https://www.ecb.europa.eu/pub/economic-bulletin/focus/2021/h…

https://www.bloomberg.com/news/articles/2022-08-10/ecb-infla…

"firmly grounded" haben diese EZB-Banker gestern verzapft:

...

To sum up, the new ECB strategy has contributed to a more solid anchoring of inflation expectations at 2%. Monetary policy decisions taken by the ECB’s Governing Council since July 2021 have been firmly grounded in the strategy. In the light of rising inflationary pressures, in December 2021 the Governing Council decided to embark on a path of monetary policy normalisation. Since then the Governing Council has repeatedly emphasised that it will ensure inflation returns to the 2% target over the medium term, in line with its commitment to symmetry.

...

https://www.ecb.europa.eu/press/blog/date/2022/html/ecb.blog…

=> was bitteschön soll an dieser -- irgendwann im Nachhinein erfundenen -- Symmetrie gut sein?

=> intellektuelles Geschwurbel:

Economic Bulletin Issue 7, 2021:

...

In general, there was a strong correlation between the ranking of the various elements/statements in terms of their perceived importance in the new strategy and their perceived improvement on the previous strategy.

Taking the percentage balance between positive and negative assessments as a summary statistic, respondents ranked the explicit reference to symmetry and the move away from “‘close to, but below, 2%’” to ‘2%’” as the two most important or relevant elements.

Other elements with relatively high net percentage balances include the reference to especially forceful or persistent monetary policy action when the economy is close to the effective lower bound, the permanently expanded toolkit and climate-related action.

It should also be noted that there was a positive net percentage balance for all of the elements/statements surveyed, indicating that respondents viewed them as important. In terms of their improvement on the previous strategy, the first four items (i.e. symmetry, 2%, forceful action at the effective lower bound and the toolkit) received the same ranking as for their importance.

https://www.ecb.europa.eu/pub/economic-bulletin/focus/2021/h…

4.8.

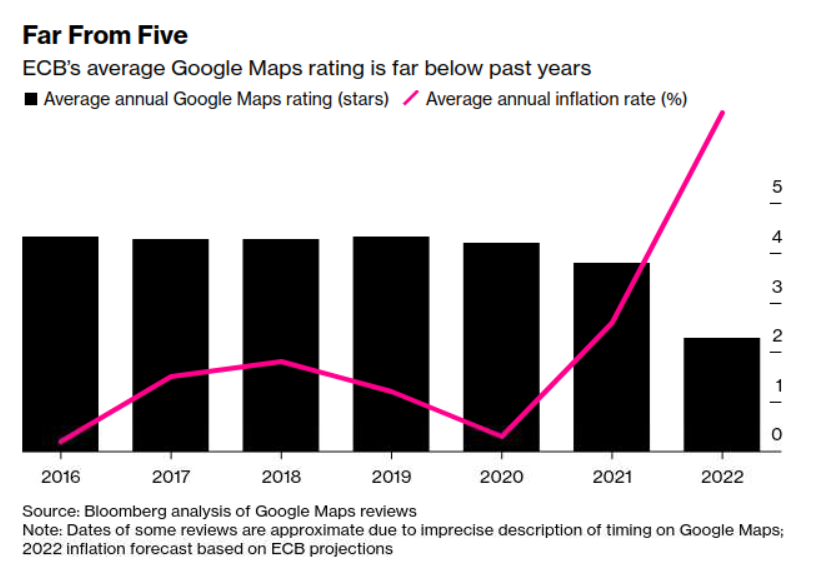

Angry Europeans Lower ECB’s Google Rating Amid Soaring Inflation

https://www.bloomberg.com/news/articles/2022-08-04/ecb-s-goo…

...

Critics of the European Central Bank have found a new way to vent their frustration, with a stream of poor ratings thrown at the Google Maps listing of its Frankfurt headquarters.

While such reviews on the search engine often focus on a building’s architecture or facilities, about half of the hundred or so left in the 10th anniversary year of its completion are complaints on the policies of President Christine Lagarde and her colleagues.

As a result, average ratings on Google Maps for the 45-story green-glass ECB tower have fallen significantly. Its entry has also attracted more reviews in the first seven months of 2022 alone than in any previous year.

Such frustration follows a surge in inflation that reached a euro-era record of 8.9% in July, the same month the ECB lifted borrowing costs for the first time in over a decade. The hesitation of officials to raise rates while global peers tightened has prompted criticism particularly in its home country of Germany.

One reviewer, Christoph H., posted a week ago that the ECB “is only focused on government financing through the back door.” A post by someone called Ludwig Berg a few days beforehand criticized politicians’ appointment of Lagarde, in view of “galloping inflation.” Reviews were posted in numerous languages, though many of the more critical ones were written in German.

...

...

Antwort auf Beitrag Nr.: 72.017.557 von faultcode am 20.07.22 12:03:55...

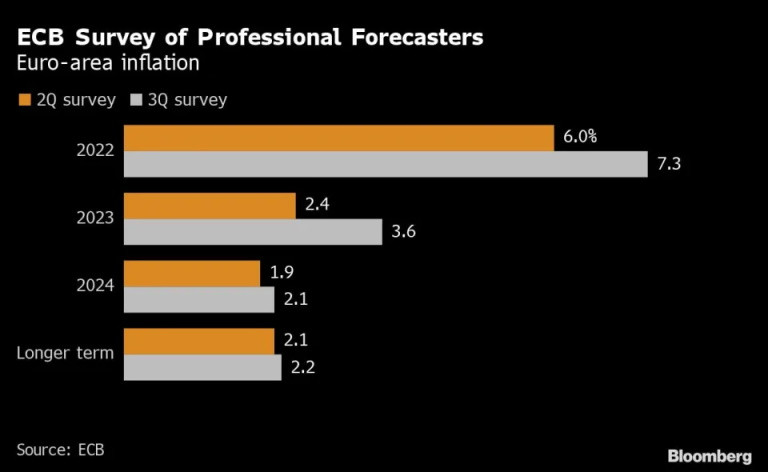

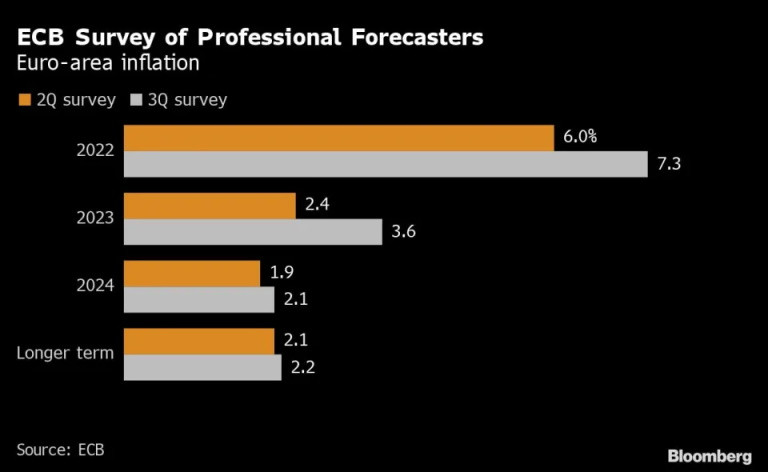

Professional forecasters surveyed by the European Central Bank raised their longer-term inflation outlook to 2.2% from 2.1% three months ago.

...

https://uk.finance.yahoo.com/news/ecb-survey-shows-inflation…

Professional forecasters surveyed by the European Central Bank raised their longer-term inflation outlook to 2.2% from 2.1% three months ago.

...

https://uk.finance.yahoo.com/news/ecb-survey-shows-inflation…

20.7.

ECB Aims for Bulletproof Crisis Tool Anticipating Legal Showdown

https://www.bnnbloomberg.ca/ecb-aims-for-bulletproof-crisis-…

...

...

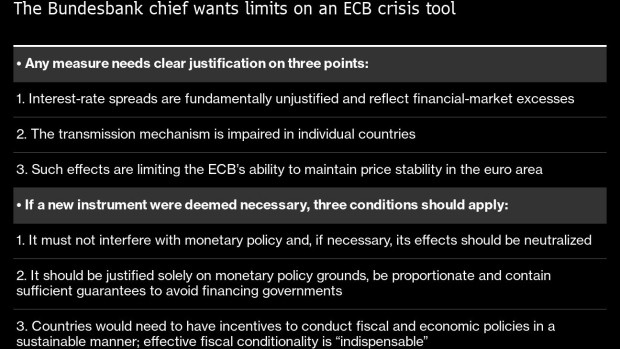

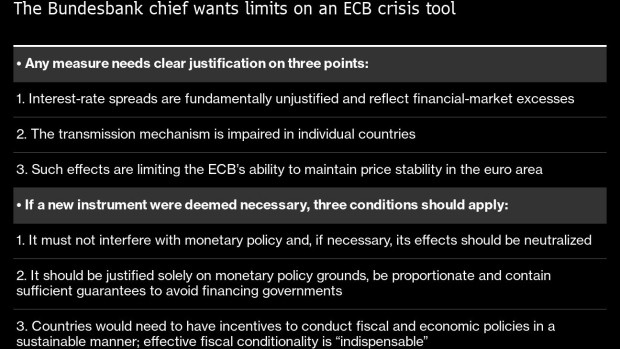

For European Central Bank officials devising a crisis tool that will be credible enough to keep the euro together, the biggest challenge may be to get it past the lawyers.

President Christine Lagarde and her colleagues know any measure they reveal on Thursday is likely to be scrutinized by Germany’s constitutional court. Every one of the ECB’s past bond-buying programs has provoked lawsuits, with each getting progressively more complicated to resolve.

Given that history, the Governing Council’s creation of a tool that can facilitate interest-rate increases while stemming subsequent market speculation on Italy’s public finances may involve more legal considerations than any monetary policy decision since the euro was founded.

The challenge is to ensure any plan conforms to the ECB’s mandate of delivering price stability and doesn’t directly finance governments. That means a decision, on when and under what circumstances it can buy bonds, needs to be matched by safeguards and conditions countries must fulfill in exchange.

“Managing spreads of individual member states is a minefield,” said Christoph Ohler, a law professor at the University of Jena in Germany.

...

ECB Aims for Bulletproof Crisis Tool Anticipating Legal Showdown

https://www.bnnbloomberg.ca/ecb-aims-for-bulletproof-crisis-…

...

...

For European Central Bank officials devising a crisis tool that will be credible enough to keep the euro together, the biggest challenge may be to get it past the lawyers.

President Christine Lagarde and her colleagues know any measure they reveal on Thursday is likely to be scrutinized by Germany’s constitutional court. Every one of the ECB’s past bond-buying programs has provoked lawsuits, with each getting progressively more complicated to resolve.

Given that history, the Governing Council’s creation of a tool that can facilitate interest-rate increases while stemming subsequent market speculation on Italy’s public finances may involve more legal considerations than any monetary policy decision since the euro was founded.

The challenge is to ensure any plan conforms to the ECB’s mandate of delivering price stability and doesn’t directly finance governments. That means a decision, on when and under what circumstances it can buy bonds, needs to be matched by safeguards and conditions countries must fulfill in exchange.

“Managing spreads of individual member states is a minefield,” said Christoph Ohler, a law professor at the University of Jena in Germany.

...

Milton Friedman Speaks: Money and Inflation, 1978:

https://twitter.com/FinanceLancelot/status/15428506777890406…

https://twitter.com/FinanceLancelot/status/15428506777890406…

30.6.

ECB to Ask Banks to Weigh Russian Gas Embargo in Dividend Plans

https://www.bnnbloomberg.ca/ecb-to-ask-banks-to-weigh-russia…

...

The European Central Bank plans to ask the region’s lenders to factor in the economic hit of a potential cut off of Russian gas when considering payouts to shareholders.

“We will propose to ask banks to recalculate their capital trajectories under a more adverse scenario including also potentially a gas embargo or a recession,” said Andrea Enria, who leads the ECB’s supervisory board. The watchdog would “use this also for the purpose of vetting their distribution plans going ahead.”

European banks have seen their prospects clouded as Russia’s invasion of Ukraine raises the possibility of a wave of soured loans given a spike in inflation and companies’ difficulty in sourcing commodities. That’s a stark difference to the beginning of the year when European banks were luring back investors with pledges to return billions of euros in capital via dividends and share buybacks.

...

ECB to Ask Banks to Weigh Russian Gas Embargo in Dividend Plans

https://www.bnnbloomberg.ca/ecb-to-ask-banks-to-weigh-russia…

...

The European Central Bank plans to ask the region’s lenders to factor in the economic hit of a potential cut off of Russian gas when considering payouts to shareholders.

“We will propose to ask banks to recalculate their capital trajectories under a more adverse scenario including also potentially a gas embargo or a recession,” said Andrea Enria, who leads the ECB’s supervisory board. The watchdog would “use this also for the purpose of vetting their distribution plans going ahead.”

European banks have seen their prospects clouded as Russia’s invasion of Ukraine raises the possibility of a wave of soured loans given a spike in inflation and companies’ difficulty in sourcing commodities. That’s a stark difference to the beginning of the year when European banks were luring back investors with pledges to return billions of euros in capital via dividends and share buybacks.

...

"Narrow Path"

Television interview on the sidelines of a conference to celebrate the 350th anniversary of the Riksbank in Stockholm, Sweden, on Friday, May 25, 2018. The central bank has embarked on an historic monetary easing program over the past years to bring back inflation, using a weaker krona to help achieve its goal. Photographer: Mikael Sjoberg/Bloomberg , Bloomberg

27.6.

Central Banks Have Narrow Path to Soft Landing, BIS Chief Says

https://www.bnnbloomberg.ca/central-banks-have-narrow-path-t…

Television interview on the sidelines of a conference to celebrate the 350th anniversary of the Riksbank in Stockholm, Sweden, on Friday, May 25, 2018. The central bank has embarked on an historic monetary easing program over the past years to bring back inflation, using a weaker krona to help achieve its goal. Photographer: Mikael Sjoberg/Bloomberg , Bloomberg

27.6.

Central Banks Have Narrow Path to Soft Landing, BIS Chief Says

https://www.bnnbloomberg.ca/central-banks-have-narrow-path-t…

so kann man das offensichtlich kompetenzbefreite Wirken von Frau Anungslos auch vornehmer umschreiben:

https://www.bloomberg.com/news/articles/2022-06-09/lagarde-s…

https://www.bloomberg.com/news/articles/2022-06-09/lagarde-s…

Antwort auf Beitrag Nr.: 71.635.473 von faultcode am 23.05.22 14:25:4711.9.2021

09.06.2022 - 13:54 Uhr

Leitzins soll im Juli steigen -- EZB leitet Zins-Wende ein

https://www.bild.de/geld/wirtschaft/wirtschaft/wirtschaft-in…

Die Europäische Zentralbank (EZB) beendet ihre milliardenschweren Netto-Anleihenkäufe zum 1. Juli und macht damit den Weg frei für die erste Zinserhöhung im Euroraum seit elf Jahren.

Das beschloss der EZB-Rat am Donnerstag bei seiner auswärtigen Sitzung in Amsterdam, wie die Notenbank in Frankfurt mitteilte.

Im Juli soll der Leitzins demnach um 0,25 Prozent steigen.

...

Zitat von faultcode: FRAU AHNUNGSLOS IN HOCHFORM:

11.9.2021

ECB’s Lagarde says a rate hike unlikely for 2022...

https://www.cnbc.com/2021/11/19/ecbs-lagarde-says-a-rate-hik…

...

09.06.2022 - 13:54 Uhr

Leitzins soll im Juli steigen -- EZB leitet Zins-Wende ein

https://www.bild.de/geld/wirtschaft/wirtschaft/wirtschaft-in…

Die Europäische Zentralbank (EZB) beendet ihre milliardenschweren Netto-Anleihenkäufe zum 1. Juli und macht damit den Weg frei für die erste Zinserhöhung im Euroraum seit elf Jahren.

Das beschloss der EZB-Rat am Donnerstag bei seiner auswärtigen Sitzung in Amsterdam, wie die Notenbank in Frankfurt mitteilte.

Im Juli soll der Leitzins demnach um 0,25 Prozent steigen.

...

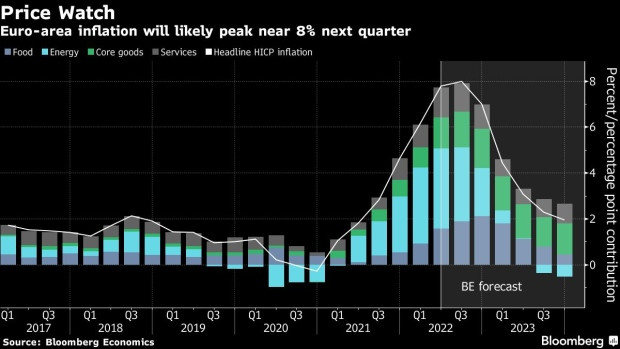

8.6.

Euro-Area Inflation Is Set to Peak in Third Quarter

https://www.bnnbloomberg.ca/euro-area-inflation-is-set-to-pe…

BE = Bloomberg Economics