The stock of Auryn Resources Inc (CVE:AUG) gapped up by $0.01 today and has $9.88 target - 500 Beiträge pro Seite

eröffnet am 06.08.16 15:00:57 von

neuester Beitrag 21.01.21 09:28:44 von

neuester Beitrag 21.01.21 09:28:44 von

Beiträge: 265

ID: 1.236.409

ID: 1.236.409

Aufrufe heute: 2

Gesamt: 26.711

Gesamt: 26.711

Aktive User: 0

ISIN: CA05208W1086 · WKN: A1404Y

1,9340

EUR

0,00 %

0,0000 EUR

Letzter Kurs 13.10.20 Berlin

Neuigkeiten

30.04.23 · Jörg Schulte Anzeige |

23.04.23 · Jörg Schulte Anzeige |

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +30,77 | |

| 0,5998 | +22,41 | |

| 0,6200 | +21,57 | |

| 4,8450 | +11,64 | |

| 27,85 | +10,38 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5700 | -11,63 | |

| 500,00 | -13,04 | |

| 15.280,00 | -16,14 | |

| 3,5700 | -16,78 | |

| 5.153,50 | -27,60 |

http://www.consumereagle.com/some-traders-are-very-bullish-o… The stock of Auryn Resources Inc (CVE:AUG) gapped up by $0.01 today and has $9.88 target or 147.00% above today’s $4.00 share price. The 6 months technical chart setup indicates low risk for the $242.52 million company. The gap was reported on Aug, 2 by Barchart.com. If the $9.88 price target is reached, the company will be worth $356.50M more. Gaps up are useful for using as a support level and to some extent as a tradeable event. If investors already hold the stock and experience a price gap up, then its usually a good idea to hold the stock for a stronger up move. Back-tests of these patterns indicate that two-thirds of the times the stock performance improves after the gap. The area gaps close 89% of the time, the breakaway gaps, 2%, the continuation gaps 4% and the exhaustion gaps 61%. About 282,408 shares traded hands or 109.09% up from the average. Auryn Resources Inc (CVE:AUG) has risen 6.00% since July 3, 2016 and is uptrending. It has outperformed by 0.67% the S&P500.

Auryn Resources Inc., formerly Georgetown Capital Corp., is a junior exploration company. The company has a market cap of $242.52 million. The Firm is focused on the acquisition, exploration and development of mineral resource properties. It currently has negative earnings. The Firm holds interest in the Committee Bay Project in Nunavut, Canada.

Auryn Resources Inc., formerly Georgetown Capital Corp., is a junior exploration company. The company has a market cap of $242.52 million. The Firm is focused on the acquisition, exploration and development of mineral resource properties. It currently has negative earnings. The Firm holds interest in the Committee Bay Project in Nunavut, Canada.

Auryn Resources to Acquire Homestake Resource Corporation

http://www.marketwired.com/press-release/auryn-resources-to-… June 14, 2016 08:00 ET

Auryn Resources to Acquire Homestake Resource Corporation

VANCOUVER, BRITISH COLUMBIA--(Marketwired - June 14, 2016) -

THIS PRESS RELEASE IS NOT FOR DISTRIBUTION TO THE UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

Auryn Resources Inc. (TSX VENTURE:AUG) (OTCQX:GGTCF) ("Auryn") and Homestake Resource Corporation (TSX VENTURE:HSR)(FRANKFURT:B6IH) ("Homestake") are pleased to announce that they have entered into a binding letter agreement pursuant to which Auryn will acquire Homestake under a plan of arrangement (the "Arrangement"). The consideration for 100% of the Homestake shares will be the issuance of approximately 3.3 million Auryn shares valued at approximately $8.9 million based on the closing price of Auryn shares of $2.68 per share as at June 13, 2016. Under the proposed Arrangement, Homestake shareholders will receive one Auryn share for each seventeen (17) Homestake common shares held at the time of completion of the Arrangement. The acquisition price represents a premium of 13% to the closing price of Auryn shares as at June 13, 2016, a 31% premium to the volume weighted average price of Homestake shares on the TSX Venture Exchange for the 20-day period prior to June 14, 2016 and a 55% premium based on a 60-day volume weighted average price.

The outstanding Homestake warrants and options will be amended to entitle the holder thereof to receive upon exercise 0.0588 of an Auryn common share in lieu of a Homestake share at an exercise price increased by multiplying such price by 17, with such other terms of the options and warrants remaining the same. In addition, certain eligible creditors may convert all or part of debt of Homestake into common shares in the capital of Auryn at the conversion price of $2.30 per share on the Closing Date.

The letter agreement requires that directors and officers of Homestake will enter into support agreements concurrently with execution of a definitive arrangement agreement to be entered into between Auryn and Homestake within approximately 30 days. The support agreements will provide that these key shareholders will, amongst other things, support the transaction and vote their Homestake shares in favour of the Arrangement.

The approximately 3.3 million Auryn shares to be issued will constitute approximately 5.72% of Auryn's outstanding shares after completion of the Arrangement. The acquisition is not expected to be subject to Auryn shareholder approval.

Homestake owns 100% in the Homestake Ridge Project which covers approximately 3,600 hectares within the Iskut-Stewart-Kitsault belt, NW British Columbia. The Homestake Ridge project hosts numerous precious metal epithermal occurrences and a significant resource as listed in the table below (refer to 43-101 report dated June 7, 2013 as filed under Homestake Resource's sedar profile at www.sedar.com).

Table 1: Combined Main Homestake, Homestake Silver and South Reef Resources at incremental $NSR/T cut-offs

Tonnes Grade

Au

(g/t)

Contained Au

(oz) Grade

Ag

(g/t)

Contained Ag

(oz) Grade

Cu

(%) Contained

Cu

(Mlb)

$85/t Cut-off

Indicated 604,000 6.4 124,000 48.3 939,000 0.18 2.4

Inferred 6,766,000 4.2 911,000 93.6 20,366,000 0.11 16.3

$100/t Cut-off

Indicated 549,000 6.8 120,000 52.0 918,000 0.20 2.4

Inferred 5,600,000 4.7 846,000 105 19,000,000 0.11 14.0

$120/t Cut-off

Indicated 482,000 7.4 115,000 57.0 883,000 0.21 2.2

Inferred 4,470,000 5.4 779,000 117.5 16,885,000 0.12 11.6

Notes:

CIM definitions were followed for Mineral Resources.

Mineral Resources utilize three separate block models constrained by 3D wireframes of the mineralized zones. The block models are comprised of an array of blocks measuring 5 m x 5 m x 5 m, with grades for Au, Ag, Cu, and NSR values interpolated using ID3 weighting.

Mineral Resources are estimated using an average long‐term gold price of US$1,500 per ounce Au, US$27 per ounce Ag, and

US$3.50 per pound Cu, with an exchange rate of C$1.00=US$1.00.

The NSR calculation included provisions for treatment charges, refining costs, transportation, and a 2% NSR royalty; and was calculated using Au, Ag and Cu metallurgical recoveries of 92% Au, 88% Ag and 87.5% Cu in blocks where Cu%>0.1%; and was calculated using just Au and Ag recoveries in blocks with <0.1% Cu.

The current estimate was prepared by Roscoe Postle Associates Inc. (RPA). David Rennie (P. Eng.) is the Principal Geologist for Roscoe Postle Associates Inc. and is the Independent Qualified Person responsible for preparation and review of the Mineral Resource Estimate. (Effective date: Dec 31, 2012).

Shawn Wallace President and CEO of Auryn stated: "The acquisition of Homestake is the next step in our stated goal of acquiring high grade gold projects in stable jurisdictions. We look forward to leveraging the 35 million dollars of exploration work completed by Homestake to date and fully unlocking the mineral potential of this highly prospective project."

Lawrence Page, Q. C., Chairman of Homestake stated: "The proposed arrangement with Auryn provides our Company with a depth of financial and professional expertise contained within Auryn to bring the Homestake Project to its full potential within a realistic time frame and allows Homestake shareholders the ability to profit from the development of other mineral properties owned by Auryn which are currently under exploration and development."

Completion of the Arrangement is principally subject to negotiation of a definitive arrangement agreement, special majority approval by Homestake security holders, as well as TSX Venture Exchange approval, British Columbia Court approval and other customary closing conditions. Full details of the Arrangement will be set out in Homestake's information circular which will be prepared in respect of the meeting of security holders to consider the Arrangement. Homestake intends to mail the information circular within the next 45 days. The transaction is expected to close before the end of September 2016. Auryn has agreed to pay a finder's fee of approximately 5% of the transaction value payable to Bocking Financial Corp. This finder's fee is subject to approval from the TSXV.

Pursuant to the letter agreement, Homestake is subject to customary non-solicitation covenants and has agreed to pay a termination fee of $0.2 million to Auryn in the event it terminates the Agreement in favour of a superior offer or completes any alternative transaction within six months of termination for any reason.

During the Arrangement process, Auryn has agreed to provide to Homestake a demand loan of up to $150,000 on an interest free, unsecured basis.

Bruce McKnight Minerals Advisor Services has provided a draft opinion to the board of directors of Homestake that, as of the date thereof and subject to the assumptions, limitations and qualifications set out therein, the Arrangement is fair, from a financial point of view, to the shareholders of Homestake other than Auryn.

Homestake's board of directors has unanimously determined that the Arrangement is in the best interests of Homestake and its security holders. It is expected that, upon execution of a definitive Arrangement agreement, Homestake's board of directors will unanimously recommend that Homestake security holders vote in favour of the Arrangement.

Copies of the letter agreement, Arrangement agreement, support agreements, management information circular and certain related documents will be filed with securities regulators and will be available on SEDAR at www.sedar.com in due course. The status of the transaction and projected completion date will be updated by news releases from time to time.

The securities to be issued pursuant to the transaction have not been registered under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"), and may not be offered or sold in the United States absent registration or applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Auryn Resources

Auryn Resources is a junior mining exploration company focused on delivering shareholder value through project acquisition and development. The Company's management team is highly experienced with an impressive track record of success in the discovery, development, financing and monetizing of mining assets for shareholders.

About Homestake Resource Corporation

Homestake owns a 100 percent interest in the Homestake Ridge project, located in the Kitsault Mineral district in northwestern British Columbia, subject to various royalty interests held by vendors. The project is being advanced as a potential high-grade underground mining operation. To date, 268 holes, totalling 77,845 metres, have been completed on the property by Homestake and multiple exploration targets remain to be tested on the 3,617-hectare property. For more information on the Homestake Ridge project please refer to the Homestake's website at www.homestakeresourecorporation.com.

ON BEHALF OF THE BOARD OF DIRECTORS OFAURYN RESOURCES INC. ON BEHALF OF THE BOARD OF DIRECTORS OF HOMESTAKE RESOURCE CORPORATION

"Shawn Wallace" "Lawrence Page, Q.C.."

Shawn Wallace Lawrence Page, Q.C.

President & Director Chairman & Director

Jetzt hat sich Auryn, eines der tollsten Explorationsunternehmen, nämlich . . . .

. . . die alte BRAVO GOLD und die bisherige HOMESTAKE RESOURCES geschnappt und keiner der alten BRAVO-hörigen Jünger ist in diesem Thread bereits angekommen. Wo sind die alten "Goldgräber" die bei BRAVO schon eigentlich das Gold in der Tasche hatten ?

Keiner ist mehr hier im Netz mehr tätig, sie lecken alle ihre Wunden, die sie mit diesem Wert erlitten haben.

Aber jetzt geht es wieder aufwärts. AURYN RESOURCES sei Dank.

In den vergangenen 10 Jahren haben die "BRAVO-JÜNGER" ihr Geld verloren, aber ich kann sie alle beruhigen, das Geld ist JA nicht weg, es hat einfach nur ein anderer.

OB DIESER ALLERDINGS GLÜCKLICHER IST; WEISS KEINER ?

Und wer das dann so sieht wird auch in AURYN wieder investieren, was will man denn sonst mit dem vielen "gewonnenen" Geld an der Börse machen ?

Bin echt gespannt wann die ersten "Goldgräber" hier wieder auftauchen werden ?

Auryn Resources Completes Acquisition of Homestake Resource Corp.

08.09.2016, 13:00 | 119 | 0 | 0 VANCOUVER, BRITISH COLUMBIA--

(Marketwired - Sept. 8, 2016) -

Auryn Resources Inc. (TSX VENTURE:AUG)(OTCQX:GGTCF) ("Auryn") is pleased to announce, effective September 7, 2016, the completion of the previously announced plan of arrangement (the "Arrangement") pursuant to which Auryn has acquired all of the issued and outstanding common shares of Homestake Resource Corporation ("Homestake"). Homestake is now a wholly-owned subsidiary of Auryn. Shawn Wallace, President and Chief Executive Officer of Auryn, stated, "We are very pleased to have completed another key acquisition further achieving Auryn's objective of acquiring high-grade, quality, expandable gold assets in a premier mining jurisdictions."

Auryn Resources Completes Acquisition of Homestake Resource Corp. | wallstreet-online.de - Vollständiger Artikel unter:

http://www.wallstreet-online.de/nachricht/8904357-auryn-reso…

Die neuen AURYN RESOURCES - Aktien sind mir heute ins Depot gebucht worden.

Leider sind bei mir die "halben Aktien-Teile" nicht berücksichtigt worden. Abe was soll's.

Habe hier sovoel Geld in den Sand gesetzt da kommt es auf diese paar Peanuts auch nicht mehr an.

Man muss schon sagen, die Jungs von Auryn sind sehr aktiv und vielleicht kaufen sie schon das

nächste allerdings noch unberührte Goldfeld in Peru. Mut haben sie auch, das muss man ebenfalls sagen. Sollte das so weiter gehen werden die alten "BRAVO-Fans" vielleicht doch noch einiges von dem verlorenen Geld zurückholen.

Wenn es halt nicht klappt ist es auch nicht schlimm, das Geld wurde doch schon abgeschrieben.

Und das sagt uns, es kann nur besser werden und mit dem Depotwert auch wieder nach oben gehen.

26.09.2016 | 13:04

(4 Leser)

Marketwired · Mehr Nachrichten von Marketwired

Auryn Options Banos Del Indio Gold Property in Southern Peru

VANCOUVER, BRITISH COLUMBIA -- (Marketwired) -- 09/26/16 -- Auryn Resources Inc. (TSX VENTURE: AUG)(OTCQX: GGTCF) ("Auryn") is pleased to announce that it has acquired the option to earn a 100% interest in the Banos del Indio gold project located 10 km to the north of Auryn's Huilacollo project with known gold mineralization (see figure 1 and figure 2). The project is located in the Tacna province of Southern Peru. The Banos Del Indio gold project hosts one of the largest untested alteration systems in the Andes and is located within a prominent epithermal belt.

Shawn Wallace, President and CEO commented, "Our pursuit of acquisitions in Peru has been largely predicated on our technical teams vast knowledge and experience in the country. Banos Del Indio represents an exceptional exploration opportunity that our technical team has been aware of and desired for several years."

Mr. Wallace further stated, "With these acquisitions in Peru and the others that we have recently completed, our goal of building a diverse portfolio with high grade exploration targets in Canada and some of the largest scalable oxide exploration targets is being achieved. We look forward to aggressively executing capital efficient exploration programs including substantive drill programs over the next few years."

Banos Del Indio Property

The Banos del Indio epithermal property is comprised of 7,534 hectares of well-developed high-level steam heated epithermal style alteration and is considered by Auryn to be one of the largest untested epithermal alteration centers in Peru (see Figure 3). Banos del Indio shares many similarities with the La Coipa mine complex in northern Chile where economic mineralization is principally located beneath similar high-level steam heated epithermal alteration. Initial exploration to define drill targets will focus on structural mapping, multi-spectral analysis to identify high temperature clays, volumetric sampling and induced polarization geophysical surveys.

Antonio Arribas, Director of Auryn, stated, "Banos del Indio is one of the largest and least explored alteration anomalies that I am familiar with in the region which I have been aware of for several years. The property is situated in the perfect location for significant epithermal discoveries in Southern Peru."

The Company acquired the rights to the Banos del Indio property through an option agreement with a local Peruvian company, Exploandes S.A.C (the "Banos Option"). Under the Banos Option, the Company may acquire a 100% interest, subject to a net smelter return royalty (NSR), through a combination of work expenditures and cash payments (all dollar amounts are in USD) as detailed in the table below:

----------------------------------------------------------------------------

Property Work

Due dates Payments Expenditures

----------------------------------------------------------------------------

On signing $ 100,000 -

----------------------------------------------------------------------------

Within 12 months of the commence of work $ 100,000 $ 200,000

(additional)

----------------------------------------------------------------------------

Within 24 months of the commence of $ 100,000 $ 250,000

work(additional)

----------------------------------------------------------------------------

Within 36 months of the commence of work $ 200,000 $ 1,000,000

(additional)

----------------------------------------------------------------------------

Within 48 months of the commence of work $ 150,000 $ 2,000,000

(additional)

----------------------------------------------------------------------------

Within 60 months of the commence of work $ 2,500,000 -

(additional)

----------------------------------------------------------------------------

Total $ 3,150,000 $ 3,450,000

----------------------------------------------------------------------------

The Banos del Indio NSR is 3.0% with 50% (being 1.5%) buyable for $6,000,000. In the event the Company does not complete a feasibility study within 3 years of exercising the option, an escalating advanced royalty starting at $200,000 per annum shall become payable. The total amount of the advanced royalty is capped at $1.5 million.

The Company is also obligated to pay a production bonus of $2,500,000 upon initial commercial production.

To view Figures 1-3, visit the following link: http://media3.marketwire.com/docs/1070514_F1-3.pdf

The Banos del Indio licenses are located within a special economic zone situated within 50km of the Peruvian boarder. As a non-resident company, Auryn's right to ultimately exploit these licenses or register its interests require approval from the Peruvian government in the form of a Supreme Decree. Auryn is in the process of submitting its applications with respect the approval and anticipates receiving the approval prior to exercising its option.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The securities to be issued pursuant to the transaction have not been registered under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"), and may not be offered or sold in the United States absent registration or applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address events or developments that the company expects are forward-looking statements. Although the company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. The principal factors that could cause actual results to differ materially from those in forward-looking statements in connection with this news release include the uncertainty of Homestake shareholders approvals, and the outcome of regulatory and judicial approvals. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com

Contacts:

Auryn Resources Inc.

Investor Relations

778-729-0600

info@aurynresources.com

www.aurynresources.com

http://www.finanznachrichten.de/nachrichten-2016-09/38682970…" target="_blank" rel="nofollow ugc noopener">http://www.finanznachrichten.de/nachrichten-2016-09/38682970…

Was eine Listing an der Toronto Stock Exchange ("TSX"). schon ausmachen kann.

Der Kurs springt heute um ca. 15 %.AURYN RESOURCES INC

1,76 Euro---------0,188-------------+11,96 %

Realtime----18:52

Geld------- 1,748

Brief-------1,826

05.10.2016 | 13:04

Auryn Resources Receives Conditional Acceptance to List on the Toronto Stock Exchange

VANCOUVER, BRITISH COLUMBIA -- (Marketwired) -- 10/05/16 -- Auryn Resources Inc. (TSX VENTURE: AUG)(OTCQX: GGTCF) ("Auryn" or the "Company") is pleased to announce that it has received conditional approval to list the Company's common shares on the Toronto Stock Exchange ("TSX").

Shawn Wallace, President and CEO, commented, "Graduation to the TSX mainboard will give the Company access to additional investors at home and abroad and should provide better liquidity for all of our shareholders."

ON BEHALF OF THE BOARD OF DIRECTORS OF AURYN RESOURCES INC.

Shawn Wallace, President & Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contacts:

Auryn Resources Inc.

Shawn Wallace

President & Director

+1 (778) 729-0600

info@aurymnresources.com

www.aurynresources.com

Homestake ist wohl doch nicht so schlecht wie gedacht...

http://www.aurynresources.com/news/auryn-resources-announces…

http://www.aurynresources.com/news/auryn-resources-announces…

Unter den unten angegebenen Link gibt es eine ganze Menge von Filme über die Auryn Res.

Die Filmchen stehen alle links am Rand. Jeder kann sie dort ansehen. Ivan Bebek, Executive Chairman and Director of Auryn Resources

https://www.youtube.com/watch?v=COYusNEpIaY" target="_blank" rel="nofollow ugc noopener">https://www.youtube.com/watch?v=COYusNEpIaY

Und wieder wurde ein neuer Direktor eingestellt. Hoffentlich bessert sich jetzt das Umfeld.

Auryn Resources appoints Kosowan to board2016-11-30 09:11 ET - News Release

Mr. Ivan Bebek reports

AURYN APPOINTS PREMIER MINING FINANCIER, MICHAEL KOSOWAN TO ITS BOARD OF DIRECTORS

Auryn Resources Inc. has appointed Michael Kosowan to its board of directors. Mr. Kosowan holds a master's of applied science degree, is a mining engineer (PEng) and a former investment adviser of Sprott Private Wealth (Canada) and Sprott Global Resources Inc. (United States).

Mr. Kosowan is also an industry expert with over 20 years of experience in the junior mining sector. For the past 17 years, he has been leading mining investment and financings in the U.S. and Canada through his work with Sprott and other premier brokerage houses. Previously, Mr. Kosowan worked for a number of top tier Canadian mining companies such as Placer Dome, Falconbridge and Inco, as a project engineer, and for Atapa Minerals in Indonesia and Peru, as an exploration manager.

Auryn executive chairman, Ivan Bebek, commented: "We are very fortunate to have someone of Michael's calibre join our team. He brings a depth of experience on the financial and technical side of the business. Furthermore, his global network and long-term relationship with Auryn's founders provides a seamless integration with the Auryn board and will be a tremendous asset to the company as we plan to advance our entire exploration portfolio in 2017."

© 2016 Canjex Publishing Ltd. All rights reserved.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:AUG-2427415

Insiderkäufe

Ich finde es bemerkenswert, dass das Management den Aktienkurs unterstützt. Bebek hat über 100.00 St. dazugekauft, im November.

siehe:

https://www.canadianinsider.com/company?menu_tickersearch=Au…

Strategic Investment by Goldcorp Inc.

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan. 9, 2017) - Auryn Resources Inc. (TSX:AUG)(OTCQX:GGTCF) ("Auryn" or the "Company") is pleased to announce that it has entered into an Investment Agreement with Goldcorp Inc. ("Goldcorp") (TSX:G)(NYSE:GG) for a strategic equity placement whereby Goldcorp will purchase directly and indirectly in two tranches 9,542,402 common shares of Auryn for C$3.67 per share (the "Placement"). After giving effect to the Placement, Goldcorp will own 12.5% of Auryn's outstanding common shares.Auryn Announces Strategic Investment by Goldcorp Inc. | wallstreet-online.de - Vollständiger Artikel unter:

http://www.wallstreet-online.de/nachricht/9217675-auryn-anno…

Wenn Goldcorp dort sein Geld anlegt dann sollten wir das wohl auch, oder ?

Ist denn auch der Handel in D mit dieser Aktie eingestellt ? Auryn Resources to receive investment from Goldcorp

2017-01-09 09:10 ET - News Release

Mr. Shawn Wallace reports

AURYN ANNOUNCES STRATEGIC INVESTMENT BY GOLDCORP INC.

Auryn Resources Inc. has entered into an investment agreement with Goldcorp Inc. for a strategic equity placement whereby Goldcorp will purchase directly and indirectly in two tranches 9,542,402 common shares of Auryn for $3.67 per share. After giving effect to the placement, Goldcorp will own 12.5 per cent of Auryn's outstanding common shares.

In addition, Auryn and Goldcorp have entered into an investor rights and obligations agreement whereby, as long as Goldcorp maintains a 5-per-cent or greater equity ownership interest in Auryn:

Goldcorp will have the right to participate in future Auryn equity issues in the amount necessary to maintain up to a 12.5-per-cent interest.

Goldcorp will have a right to match certain non-equity financings.

If Goldcorp chooses to sell more than 2 per cent of Auryn's shares, Auryn will have the right to designate buyers, and Goldcorp will vote its shares to elect the Auryn recommended director nominees.

An aggregate of 4,590,818 common shares will be issued to third party investors through a brokered private placement offering conducted by a syndicate of agents led by Beacon Securities Ltd. as flow-through shares at a price $5.01 per flow-through share, the terms of which provide that Auryn will renounce the income tax benefits of the Canadian exploration expense related to the expenditure of the proceeds of those shares to those third party investors.

Accordingly, gross proceeds to be received by Auryn will be $41,158,911.46, consisting of $18,172,313.28 in direct share subscriptions and $22,999,998.19 in flow-through dollars through third parties. Goldcorp's cost of the 9,542,402 common shares will be $35,020,615.34.

Shawn Wallace, president and chief executive officer, commented that: "We are very pleased to have secured an important investment with an industry leader such as Goldcorp on favourable terms that minimizes dilution to our shareholders. Auryn is now fully funded to complete one of the most extensive, globally significant exploration programs in 2017. The program will include a planned 55,000 metres of exploration drilling across six projects in Canada and Peru, and expect to make a number of advances that could potentially contribute to the realization of multiple major gold discoveries."

The net proceeds of the placement will be used to finance exploration at Auryn's properties and for general corporate purposes.

The closing of the placement is expected to occur during January, 2017, and is subject to the completion of formal documentation and receipt of Toronto Stock Exchange acceptance. All securities issued in connection with the placement will be subject to a four-month hold period.

Auryn's financial adviser with respect to the strategic investment was Minvisory Corp.

Upon completion of the investment, Goldcorp will have acquired ownership of 9,542,402 common shares of Auryn at a subscription price of $3.67 per common share for a total purchase price of $35,020,615.34. The common shares acquired by Goldcorp represent 12.5 per cent of the issued and outstanding common shares of Auryn.

Prior to this acquisition Goldcorp did not own any securities of Auryn. Goldcorp acquired the common shares for investment purposes. Goldcorp will evaluate its investment in Auryn from time to time and may, based on such evaluation, market conditions and other circumstances, increase or decrease shareholdings as circumstances require.

The exemption relied on for the acquisition of the common shares is Section 2.10 of National Instrument 45-106, prospectus and registration exemptions. A copy of the early warning report filed by Goldcorp in connection with the acquisition will be available on Auryn's SEDAR profile. Goldcorp's head office is located at suite 3400, 666 Burrard St. Vancouver, B.C., V6C 2X8.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:AUG-2435068" target="_blank" rel="nofollow ugc noopener">http://www.stockwatch.com/News/Item.aspx?bid=Z-C:AUG-2435068

Antwort auf Beitrag Nr.: 54.042.652 von boersentrader02 am 09.01.17 17:39:27In Deutschland kannste doch handeln.

Ich werde aber kein einziges Stück hergeben, jetzt, wo das Bohrprogramm für 2017 finanziert ist.

Ich werde aber kein einziges Stück hergeben, jetzt, wo das Bohrprogramm für 2017 finanziert ist.

Ivan Bebeck kauft weiter zu

zum Thema:Wenn Goldcorp dort sein Geld anlegt dann sollten wir das wohl auch, oder ?

Er hat zumindest gestern nochmal nachgelegt.

https://www.canadianinsider.com/company?ticker=AUG

AUG mal charttechnisch betrachtet

man kann schön sehen, wie die Aktie den seit Juli bestehenden Abwärtstrend gebrochen hat.Nun entsteht ein neuer Aufwärtstrend, der allerdings noch nicht ganz scharf ist (3 grüne Trendlinien).

Die 3,20 cad wurden mit einen Kurslücke (blau) übersprungen, seitdem ist der Kurs im oberen Bereich.

Vielleicht kann man in den nächsten 1 - 3 Wochen nochmal Aktien für ca. 3,00 cad bekommen, wenn es einen Gapclose gibt, falls nicht steigt sie halt weiter. Ist ja auch nicht so schlimm,

.

.

Vielleicht doch lieber früher kaufen?

Hier sind alle Ampeln auf grün gestellt.

https://www.barchart.com/stocks/quotes/GGTCF/opinion

Bebek und Kosowan kauften gestern weiter zu

die halten den Kurs echt oben,... ich warte mal weiter auf Gapclose, ca. 3,00 cad.

https://www.canadianinsider.com/company?ticker=AUG

Aufwärtstrend von AUG festigt sich

Zu gerne hätte ich bei 3,00 cad (Gapclose untere blaue Linie) nachgekauft, ...

aber nach dem gestrigen Tag wird es damit wohl nichts mehr werden.

Im Hoch gestern bei 3,85 cad lief sie an die obere Trendlinie heran.

Aber wieder ein neues kleines Gap bei 3,50 cad aufgerissen, dieses sollte aber im laufe der nächsten Woche geschlossen werden.

Da werde ich mich positionieren.

Besten Dank an die heutigen Verkäufer, die den Kurs zurückgebracht haben.

Jetzt hab ich meine gewünschte Stückzahl zum gewünschten Kurs.

p.s. ich handele die Aktie nur an der TSX

Jetzt hab ich meine gewünschte Stückzahl zum gewünschten Kurs.

p.s. ich handele die Aktie nur an der TSX

Insiderkäufe und Stückzahlen

... da hat der Herr Bebek gestern aber günstig gekauft.Mal ne kleine Auflistung der Insider und deren Stückzahlen:

Goldcorp 9,542,402 St.

Bebek, Ivan 4,400,000 St.

Wallace, Shawn 3,328,333 St.

Kosowan, Michael 2,855,100 St.

https://www.canadianinsider.com/company?ticker=AUG

Ein sehr ausführlicher Bericht über den Explorer AURYN RESOURCES von Fabio Herrero.

Fabio schreibt hier sehr ausführlich über die 3 interessantesten Projekte die bei AURYN RESOURCES noch für Furore sorgen können. Im 3. Quaeral 2017 wird auch wieder auf dem Homestake Ridge-Gelände in Britsh Columbia, dem alte BRAVO GOLD Gelände, wieder gebohrt. AURYN wird auch aus diesem Gebiet noch eine Goldgrube machen, oder aber auch nicht ? Wer weiß das schon ?

Die Zeit wird es an den Tag holen, warten wir ab ?

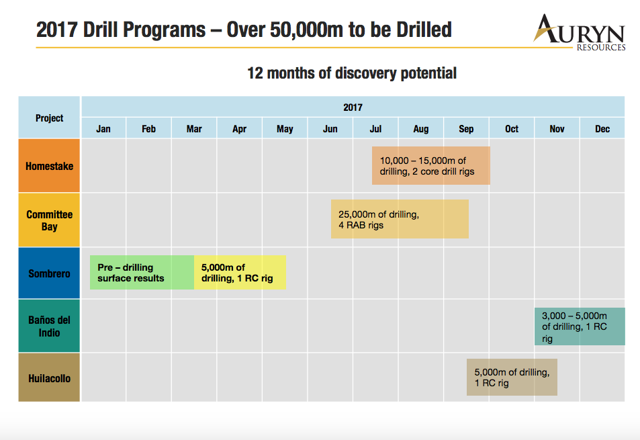

Hier sind die gesamten Aktivitäten, von AURYN RESOURCES für das Jahr 2017 im Bilde, wie es heuer weiter gehen soll.

Allein Gold Corp, als großer Ankeraktionär, ist hier mit fast 9 Mill Aktien investiert. Und diese Experten wissen wohl schon wo es lang geht, oder ?

Looking For A Solid Gold Play? Auryn Resources Checks Many Boxes

Jan. 30, 2017 2:23 AM ET|

About: Auryn Resources Inc. (GGTCF), Includes: GG

Fabio Herrero

Auryn Resources is a well-managed company with interesting gold properties in Canada and Peru. Company management is mainly composed of ex-directors of Keegan (now Asanko Gold) and Cayden Resources.

The company had exploration success and is poised to deliver in the long term. Goldcorp just became a major shareholder, acquiring 12.5% in a bought deal.

Auryn has two advanced exploration projects in Nunavut and British Columbia, and a portfolio of four oxide exploration properties in south Peru.

Although Auryn is mainly known for the high-grade Committee Bay project in Nunavut, the other five assets represent real value, and the company is actively exploring them.

Auryn Resources Inc (OTCQX:GGTCF) is a Canadian junior gold explorer with operations in Nunavut and British Columbia in Canada and in the Tacna province of Southern Peru.

http://seekingalpha.com/article/4040526-looking-solid-gold-p…

Wird es eine S-K-S ??

... es sollte in CAN heute oder morgen deutlich übers letzte Hoch (3,85 $) gehen,sonst entsteht vielleicht eine S-K-S Umkehrformation mit Gap-Close und Trendbruch.

Die letzte Tageskerze sieht sehr gut aus, + 3,4 % in CAN

S-K-S scheint nicht einzutreten, langer Kerzenkörper mit Tagesschluss zum Höchstkurs.

Idealerweise gibt es einen 3 white soldiers und der Kurs steigt über 3,85 $.

Dann ist sogar bald das ATH vom Juli 16 bei 4,17 $ erreichbar.

Ich freu mich schon auf nächste Woche.

Sollte man mal lesen,....

http://www.juniorstockreview.com/2017/02/10/insiders-industr… Wohin geht die Reise??

Im Moment scheint die Richtung neutral und seitwärts zu sein.

Das große Dreieck sollte aber mittlerweile jeder gesehen haben.

Ich werde mich hier erst wieder bei Ausbruch aus dem Dreieck nach oben einkaufen.

So long

Fahrzeugpapiere und Ausweis, BITTE

Antwort auf Beitrag Nr.: 54.767.638 von Popeye82 am 20.04.17 16:24:11Kannst dich u.a. ja mal hier einlesen:

http://kingworldnews.com/auryn-resources-inc/

http://kingworldnews.com/auryn-resources-inc/

Oha, schon 3,50 CAD , das ging aber schnell mit dem einlesen und kaufen

Antwort auf Beitrag Nr.: 54.960.659 von rudelnuss am 17.05.17 09:50:46

sind Sie die Schwarze WITWE??

man kann seinen Lebensunterhalt auch SERIÖS verdienen!!!

sind Sie die Schwarze WITWE??

man kann seinen Lebensunterhalt auch SERIÖS verdienen!!!

An alle alten BRAVO-Anleger, es geht wieder los. Auf dem Gebiet von

Homestake Ridge wird wieder gebohrt. Hoffentlich haben sie mehr Glück und erweitern das bisher vorliegende Edelmetall-Ergebnis.

Auryn Resources starts drilling at Homestake Ridge

2017-07-17 07:06 ET - News Release

Mr. Shawn Wallace reports

AURYN COMMENCES DRILLING AT THE HOMESTAKE RIDGE GOLD PROJECT

Auryn Resources Inc. has initiated a 15,000-metre exploration drill program on the Homestake Ridge gold project located within the Golden Triangle in northwestern British Columbia.

Shawn Wallace, Auryn's chief executive officer, commented: "With the commencement of this drill program, Auryn now has two discovery drill programs running simultaneously. These programs further increase the potential for major discoveries in some of the most prolific high-grade gold regions within Canada."

Mr. Wallace further stated, "Surface exploration programs are ongoing in Peru and drilling is anticipated to commence in the fourth quarter, once the Canadian drilling is complete."

The 12-week summer exploration program at Homestake is primarily focused on making new discoveries to considerably add to the high-grade resource that is currently defined on the project as listed in the associated table (refer to the technical report dated June 7, 2013, filed on SEDAR).

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aAUG-2487…

Unter diesem Link findet ihr noch einmal die bisher vorhandenen Edelmetall-Ergebnisse.

Solche Veröffentlichungen müßte AURYN RESOURCES jetzt nur noch öfter bringen.

AURYN RESOURCES INC2,175 Euro +0,021

+0,97 %

WKN: A1404Y ISIN: CA05208W1086 Ticker-Symbol: AUN Stuttgart | 24.08.17 | 16:11 Uhr

24.08.2017 | 13:04

(7 Leser)

Marketwired·Mehr Nachrichten von Marketwired

Auryn drills 9.15 meters of 3.48 g/t gold at Committee Bay and provides exploration update

VANCOUVER, BRITISH COLUMBIA -- (Marketwired) -- 08/24/17 -- Editor's Note: There are three images associated with this news release.

Auryn Resources Inc. (TSX: AUG)(NYSE AMERICAN: AUG)(NYSE MKT: AUG) ("Auryn" or the "Company") is pleased to announce initial results from its summer exploration drill program at the Committee Bay Gold Project located in Nunavut, Canada. The results represent 15% or 21 holes out of 148 holes currently drilled across 18 targets in the belt this summer (see Figure 1). Highlights include 9.15 meters of 3.48 g/t Au and 1.53 meters of 7.48 g/t Au which ended in mineralization where the hole was lost at West Plains. West Plains remains open at depth (See Figure 2).

Committee Bay program highlights:

-- Drilling 5 additional targets (total drilled targets increased from 13

to 18)

-- Increased drill meters from 25,000 to 29,000

-- Extended high-grade mineralization to a vertical depth of 150 meters

-- Purchased $1.8 million of fuel for a 2018 drill program

President and CEO, Shawn Wallace stated, "We are pleased with the results we have seen to date and the level of efficiency of the work completed this season. The Committee Bay summer program is a considerable undertaking both technically and logistically. We are looking very forward to receiving the results of the remaining 25,000 meters as we have tested the most robust targets on the belt that we have found to date."

Mr. Wallace further stated, "This is an exciting time for Auryn shareholders as we enter a busy season of results from the Committee Bay and Homestake drill programs. Surface exploration is also currently underway in Peru ahead of drilling later this year."

Rotary Air Blast (RAB) Drilling Results:

http://www.finanznachrichten.de/nachrichten-2017-08/41548218…

Wir hören und können es jetzt sogar lesen, es gibt ein neues Lebzeichen von der unserer alten BRAVO

Nur es ist ein riesen Paket, es entspricht sovie wie es doe gestern veröffentlichten Paradise Leaks . Und dafür haben diese Leute 1 Jahr gebraucht.Bin echt gespannt ob es sich lohnt diesen neuen Technical Report zu lesen. Ich hane es bisher noch nicht geschafft.

Wer Lust und Laune hat kann sich diesen Bericht ja schon einmal vor die Brust nehmen.

Technical Report on the HOMESTAKE RIDGE Project, SKEENA MINING DIVISION, NORTHWESTERN BRITISH COLUMBIA

PREPARED FOR AURYN RESOURCES Inc.

Report for NI 43-101

Qualified Persons:

David Ross, P.Geo. +

Paul Chamois, P.Geo.

September 29, 2017

https://www.sec.gov/Archives/edgar/data/1514597/000117184317…

Ivan ist von seinem Unternehmen total überzeugt denn sonst würde er keine 100k Ca $

in ca 8 Wochen in dies Unternehmen investieren. https://ledgergazette.com/2017/11/13/auryn-resources-inc-aug…" target="_blank" rel="nofollow ugc noopener">https://ledgergazette.com/2017/11/13/auryn-resources-inc-aug…

Auryn Resources Inc (TSE:AUG) Director Ivan Bebek bought 5,000 shares of the stock in a transaction on Friday, November 10th. The shares were bought at an average cost of C$2.30 per share, with a total value of C$11,500.00.

Ivan Bebek also recently made the following trade(s):

On Thursday, October 26th, Ivan Bebek bought 10,000 shares of Auryn Resources stock. The shares were bought at an average cost of C$2.08 per share, with a total value of C$20,800.00.

On Monday, October 23rd, Ivan Bebek bought 20,000 shares of Auryn Resources stock. The shares were bought at an average cost of C$2.05 per share, with a total value of C$41,000.00.

On Thursday, October 19th, Ivan Bebek bought 10,000 shares of Auryn Resources stock. The shares were bought at an average cost of C$2.53 per share, with a total value of C$25,300.00.

On Tuesday, September 19th, Ivan Bebek bought 4,000 shares of Auryn Resources stock. The shares were bought at an average cost of C$3.06 per share, with a total value of C$12,240.00.

On Friday, September 15th, Ivan Bebek acquired 41,000 shares of Auryn Resources stock. The stock was acquired at an average cost of C$3.03 per share, with a total value of C$124,230.00.

Auryn Resources Inc (TSE AUG) opened at C$2.09 on Monday. Auryn Resources Inc has a 12 month low of C$2.00 and a 12 month high of C$3.85.

Bin hier auch mal auf den Zug aufgesprungen...

Antwort auf Beitrag Nr.: 56.646.734 von newzealaender am 08.01.18 09:28:34https://youtu.be/P_dEg4Pf_mI

Auryn Resources Inc. fehlt nur etwas Glück um den großen Wurf hervorzubringen.

Auryn Resources Inc. – Fokussiert auf Goldentdeckungen in Kanada und Peru22.01.2018 - 04:40 | Quelle: Jörg Schulte

Auryn Resources Inc. (WKN: A1404Y / ISIN: CA05208W1086 / TSX: AUG) ist eine kanadische Explorationsgesellschaft, die sich auf die Erkundung skalierbarer hochgradiger Goldvorkommen in etablierten Bergbauregionen fokussiert. Aktuell betreibt das Unternehmen aus Vancouver bereits 3 Projekte im Norden bzw. Westen Kanadas sowie 4 weitere im Süden Perus.

Trotzdem hält das erfahrene Management-Team um die beiden Firmengründer Ivan Bebek und Shawn Wallace weiterhin Ausschau nach zusätzlichen attraktiven Akquisitionszielen.

http://www.finanztreff.de/sc/news2-feed-img/2018-01-22/219_1…

Die kanadischen Explorationsprojekte:

Quelle: Auryn Resources Inc.

Committee Bay:

Im Zuge der Übernahme der North Country Gold Corp. erwarb Auryn im Herbst 2015 das rund 390.000 Hektar große ‚Committee Bay‘-Projekt im Herzen des nordkanadischen ‚Nunavut‘-Territoriums. Die Liegenschaft ist Teil eines gleichnamigen Grünsteingürtels, der sich rund 180 km nordöstlich von Agnico-Eagles ‚Meadowbank‘-Mine über eine Länge von mehr als 300 km bis an das Ufer der ‚Committee‘-Bucht erstreckt. In den vergangenen 20 Jahren wurden hier rund 27 Mio. CAD in Infrastrukturmaßnahmen investiert. Dabei entstanden u.a. ein Explorationscamp für 100 Personen mit einer für Versorgungsflüge mit einer Boeing 737 geeigneten Landebahn sowie 2 weitere Satelliten-Camps. Außerdem stehen dort inzwischen 5 hocheffiziente Bohrgeräte, ein großer Baumaschinen-Fuhrpark, eine Bohrwasserheizanlage sowie mehrere Treibstofflager zur Verfügung.

Allein im Bereich der sog. ‚Three Bluffs‘-Entdeckung konnten bislang 534.000 Unzen an angezeigten (‚indicated‘) Goldressourcen ermittelt werden, wobei der Goldgehalt des Gesteins bei durchschnittlich 7,85 Gramm pro Tonne lag. Hinzu kamen weitere 720.000 Unzen an geschlussfolgerten (‚inferred‘) Goldressourcen. Das Vorkommen gilt zudem noch immer sowohl in Streichrichtung als auch in der Tiefe als offen, so dass hier in Zukunft mit weiteren signifikanten Ressourcensteigerungen zu rechnen ist.

http://www.finanztreff.de/news/auryn-resources-inc--fokussie…

Antwort auf Beitrag Nr.: 56.787.442 von boersentrader02 am 22.01.18 11:46:17

Homestake Ridge:

Im Spätsommer 2016 übernahm Auryn den Konkurrenten Homestake Resource Corp. und damit die Rechte an dessen ‚Homestake Ridge‘-Projekt im Nordwesten British Columbias. Das rund 7.500 Hektar große Gelände im sog. ‚Goldenen Dreieck‘ der Provinz, in dem auch zahlreiche andere Edelmetallgesellschaften wie Barrick Gold oder Pretivm Resources aktiv sind, befindet sich rund 32 km südöstlich der Ortschaft Stewart und ist Teil des sog. ‚Iskut-Stewart-Kitsault‘-Gürtels, der zahlreiche hochgradige Edel- und Basismetallvorkommen beherbergt.

Vor der Übernahme durch Auryn wurden auf dem Gelände schon mehrere aussichtsreiche Explorationsziele wie die ‚Homestake‘-Haupt- und Silberzone oder die ‚South Reef‘-Zone erkundet und dafür mehr als 275 Bohrungen mit über 80 km Gesamtlänge niedergebracht. Laut einer daraus resultierenden Ressourcenschätzung konnten so bislang bei einem Grenzgehalt (‚Cut-off Grade‘) von 2,0 Gramm Goldäquivalent pro Tonne Gestein rund 125.000 Unzen Gold, 1 Mio. Unzen Silber sowie 2,4 Mio. Pfund Kupfer an angezeigten Ressourcen nachgewiesen werden. Überdies wurden dabei weitere 932.000 Unzen Gold, 21,2 Mio. Unzen Silber und 16,9 Mio. Pfund Kupfer an geschlussfolgerten Ressourcen ermittelt.

http://www.finanztreff.de/sc/news2-feed-img/2018-01-22/219_1…

Quelle: Auryn Resources Inc.

Im Sommer 2017 ließ Auryn im Rahmen eines 12-wöchigen Explorationsprogramms 37 Bohrungen mit einer Gesamtlänge von 14.850 m niederbringen. Im Bereich der ‚South Reef‘-Zone wurden dabei Goldgehalte von bis zu 18,2 Gramm pro Tonne festgestellt.

Für das ‚Homestake Ridge‘-Projekt besteht eine 2 % ‚NSR-Royalty‘-Verpflichtung, die jedoch für Teile der Liegenschaft jederzeit zu einem Preis von 1 Mio. CAD abgelöst werden kann.

Aus der vorgenannten News stammt auch dieses Update von dem Homestake Gelände aus dem

Besitztum der alten BRAVO Homstake oder BRAVO GOLD. Es wird also immer noch dort gearbeitet, hoffentlich mit den Erfolg, das es einmal wieder in die alten Höhen gehen wird. Der Link ist der gleiche wie vor, es muss nur etwas weiter nach unten gescrollt werde.Homestake Ridge:

Im Spätsommer 2016 übernahm Auryn den Konkurrenten Homestake Resource Corp. und damit die Rechte an dessen ‚Homestake Ridge‘-Projekt im Nordwesten British Columbias. Das rund 7.500 Hektar große Gelände im sog. ‚Goldenen Dreieck‘ der Provinz, in dem auch zahlreiche andere Edelmetallgesellschaften wie Barrick Gold oder Pretivm Resources aktiv sind, befindet sich rund 32 km südöstlich der Ortschaft Stewart und ist Teil des sog. ‚Iskut-Stewart-Kitsault‘-Gürtels, der zahlreiche hochgradige Edel- und Basismetallvorkommen beherbergt.

Vor der Übernahme durch Auryn wurden auf dem Gelände schon mehrere aussichtsreiche Explorationsziele wie die ‚Homestake‘-Haupt- und Silberzone oder die ‚South Reef‘-Zone erkundet und dafür mehr als 275 Bohrungen mit über 80 km Gesamtlänge niedergebracht. Laut einer daraus resultierenden Ressourcenschätzung konnten so bislang bei einem Grenzgehalt (‚Cut-off Grade‘) von 2,0 Gramm Goldäquivalent pro Tonne Gestein rund 125.000 Unzen Gold, 1 Mio. Unzen Silber sowie 2,4 Mio. Pfund Kupfer an angezeigten Ressourcen nachgewiesen werden. Überdies wurden dabei weitere 932.000 Unzen Gold, 21,2 Mio. Unzen Silber und 16,9 Mio. Pfund Kupfer an geschlussfolgerten Ressourcen ermittelt.

http://www.finanztreff.de/sc/news2-feed-img/2018-01-22/219_1…

Quelle: Auryn Resources Inc.

Im Sommer 2017 ließ Auryn im Rahmen eines 12-wöchigen Explorationsprogramms 37 Bohrungen mit einer Gesamtlänge von 14.850 m niederbringen. Im Bereich der ‚South Reef‘-Zone wurden dabei Goldgehalte von bis zu 18,2 Gramm pro Tonne festgestellt.

Für das ‚Homestake Ridge‘-Projekt besteht eine 2 % ‚NSR-Royalty‘-Verpflichtung, die jedoch für Teile der Liegenschaft jederzeit zu einem Preis von 1 Mio. CAD abgelöst werden kann.

Unter den angegebenen Link findet ihr ein neues Video von Auryn

Auryn Resources: Fokus auf Wertsteigerung der einzelnen Projektehttp://www.finanznachrichten.de/nachrichten-2018-02/43138125…

ab Minute 3,40

wird diese Aktie als ein Top 3 Pick von Byron King empfohlen

http://www.kitco.com/news/video/show/PDAC-2018/1883/2018-03-…

wird diese Aktie als ein Top 3 Pick von Byron King empfohlen

http://www.kitco.com/news/video/show/PDAC-2018/1883/2018-03-…

könnte sein das der Anstieg gestern damit zu tun hatte

Antwort auf Beitrag Nr.: 57.152.166 von boersentrader02 am 28.02.18 22:55:44

oder so

Zitat von boersentrader02: Auryn Resources: Fokus auf Wertsteigerung der einzelnen Projekte

http://www.finanznachrichten.de/nachrichten-2018-02/43138125…

oder so

Antwort auf Beitrag Nr.: 57.212.299 von senna7 am 07.03.18 15:24:37Das letzte Jahr mit den schwachen Bohrergebnissen konnten die relativ hohe Bewertung nicht bestätigen. Mittlerweile mit ca 150 mio cad schon einiges billiger. Irgendwie gefällt mir aber K92 Mining mit kora und einer Bewertung von aktuell 100 mio cad trotzdem besser. Jeder Drill war hier ein guter Treffer. Außerdem gibt es ja auch schon eine Mine.

Und sie haben schon wieder das Kapital verwässert. Ich frage mich warum ?

Haben sie denn schon den bisherigen Kasseninhalt verbohrt ? Haben zumindest für diese über 5 Mil. Aktien-Ausgabe, einen Preis von 1,30 US $ erhalten. Die Käufer haben dazu das Recht innerhalb von 30 Tagen - über 780k weitere Aktien zu einem Gesamt-Preis von ca. 1,02 Mill. US$ zu erwerden. Dies soll jawohl zu dem gleichen Preis wie bei dem Großteil der angebotenen Aktien von über 5 Mill Stück geschehen.

Dies ist aber nur der erste (1.) Teil der jetzigen KapitalErhöhung.

Eine 2. Kapital-Erhöhung ist ebenfalls, allerdings als Privat-Platzierung in der Stückzahl von ca. 950k Stück zu 1,70 US$, geplant. Hierbei gilt es aber auch, das eventuell Goldcorp nach ca. 4 Monaten Haltefrist von den Käufern, den Zugriff auf diese Aktien bekommen kann. Auch hier ist noch eine weitere 10-%ige Herausgabe von Aktien, zu gleichen Bedingungen vorgesehen.

Das bedeuted für heute, es ist eine Gesamtausgabe von ca. 7 Mill Aktien zu einem Bruttopreis von ca. 8,5 Mill. US$ im Spiel. Dies sind fast 10 % des bisherigen vorhandenen Kapitals.

Wir werden die 100 Mill Aktien bald bei Auryn Resources sehen. Wenn es ja dann zum Verkauf an Goldcorp kommt zu einem 3-fachen Preis wäre es für alle Aktionäre schön, oder ?

Es sieht so aus, das alles auf die nächsten Bohrergebnisse wartet.

Sollte die entsprechend ausfallen kann der Kurs auch wieder steigen. Hoffen wir das beste, sowohl für das Unternehmen als auch für uns.

Auryn Resources Announces US$8.5 Million Financing

March 13, 2018

Vancouver, British Columbia - March 13, 2018 - Auryn Resources Inc. (TSX: AUG, NYSE American: AUG, “Auryn” or the “Company”) announces that it has entered into an agreement dated March 13, 2018 with Cantor Fitzgerald Canada Corporation (“CFCC”), as bookrunner and lead underwriter, on behalf of itself and a syndicate of underwriters (collectively, the “Underwriters”) to purchase, on a bought deal basis, 5,230,770 common shares of the Company (the “Offered Shares”) at the price of US$1.30 per Offered Share (the “Issue Price”) for aggregate gross proceeds of approximately US$6.8 million (the “Offering”).

In addition, the Company plans to complete a concurrent private placement of flow-through common shares for proceeds of up to US$1.7 million, as described below.

In addition, the Company has agreed to grant to the Underwriters an over-allotment option (the “Over-Allotment Option”) exercisable, in whole or in part, in the sole discretion of the Underwriters to purchase up to an additional 784,615 Offered Shares at the Issue Price for a period of up to 30 days after the closing of the Offering for potential additional gross proceeds to the Company of up to approximately US$1.02 million.

The Company has agreed to pay the Underwriters a cash commission equal to 6% of the gross proceeds of the Offering, including proceeds received from the exercise of the Over-Allotment Option.

CFCC is acting as the sole book-running manager for the Offering. The Offering will be made in the United States through CFCC’s U.S. affiliate, Cantor Fitzgerald & Co.

The Company plans to concurrently conduct a private placement financing involving the sale of up to 955,384 flow-through common shares of the Company (the “Flow-Through Shares”) at a 40% premium to the Issue Price (the “FT Share Issue Price”) for anticipated proceeds of up to US$1.7 million. In the event the Over-Allotment Option is exercised, up to an additional 98,077 Flow-Through Shares may be issued under the concurrent private placement.

It is anticipated that the Flow-Through Shares will be initially purchased by certain private investors who will commit to resell the Flow-Through Shares to Goldcorp Inc. Under the terms of the January 2017 Investor Rights and Obligations Agreement between Goldcorp and Auryn, Goldcorp is entitled to, among other things, participate in any subsequent offering in order to maintain up to a 12.5% interest in the Company.

The Flow-Through Shares will be offered in Canada pursuant to available prospectus exemptions and will be subject to a four month hold period in Canada. The Flow-Through Shares have not been and will not be registered under the United States Securities Act of 1933, as amended, and will not be offered or sold in the United States. The bought deal Offering is not conditional on the sale of the Flow-Through Shares. Except for certain non-material Canadian tax benefits available for investors in the Flow Through Shares, these shares are identical in all respects to common shares.

The Offering is expected to close on or about March 23, 2018 and is subject to certain conditions including, but not limited to, the receipt of all necessary approvals including the approval of the Toronto Stock Exchange and the NYSE American stock exchange. Proceeds of the Offering are anticipated to be used for (i) drilling and exploration at the Company’s principal mineral projects, Committee Bay and Homestake Ridge; (ii) continuation of exploration programs at Huilacollo and Sombrero in Peru, (iii) general corporate purposes, and (iv) working capital requirements.

The Offered Shares will be offered by way of a short form prospectus in the provinces of British Columbia, Alberta and Ontario, and will be offered in the United States pursuant to a prospectus filed as part of a registration statement under the Canada/U.S. multi-jurisdictional disclosure system. A registration statement on Form F-10 relating to these securities has been filed with the United States Securities and Exchange Commission (the “SEC”) but has not yet become effective. The securities may not be sold nor may offers to buy be accepted in the United States prior to the time the registration statement becomes effective.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the Offered Shares in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction. The Offered Shares have not been approved or disapproved by any regulatory authority, nor has any such authority passed upon by the accuracy or adequacy of the prospectus or the registration statement.

The preliminary short form prospectus is available on SEDAR at www.sedar.com. The registration statement on Form F-10, including the U.S. form of the preliminary short form prospectus, is available on the SEC’s website at www.sec.gov. Alternatively, a written prospectus relating to the Offering may be obtained upon request by contacting the Company or Cantor Fitzgerald Canada Corporation in Canada, attention: Equity Capital Markets, 181 University Avenue, Suite 1500, Toronto, ON, M5H 3M7, email: ecmcanada@cantor.com; or Cantor Fitzgerald & Co. in the United States, Attention: Equity Capital Markets, 110 East 59th Street, New York, New York, 10022, telephone: (212) 829-7122.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURYN RESOURCES INC.

Shawn Wallace

President and CEO of Auryn Resources Inc.

For further information on Auryn Resources Inc., please contact Ivan Bebek, Executive Chairman at (778) 729-0600 or info@aurynresources.com

https://www.aurynresources.com/news/2018/test/

Antwort auf Beitrag Nr.: 57.264.472 von boersentrader02 am 13.03.18 15:42:28und auf Deutsch :

Auryn Resources gibt für bis zu 9,7 Mio. USD neue Aktien aus

http://www.finanztreff.de/news/auryn-resources-gibt-fuer-bis…" target="_blank" rel="nofollow ugc noopener">

http://www.finanztreff.de/news/auryn-resources-gibt-fuer-bis…

Auryn Resources gibt für bis zu 9,7 Mio. USD neue Aktien aus

http://www.finanztreff.de/news/auryn-resources-gibt-fuer-bis…" target="_blank" rel="nofollow ugc noopener">

http://www.finanztreff.de/news/auryn-resources-gibt-fuer-bis…

der Markt sieht es positiv

Auryn Resources schließt 9,8 Mio. USD-Kapitalerhöhung ab

http://www.finanztreff.de/news/auryn-resources-schliesst-98-…" target="_blank" rel="nofollow ugc noopener">

http://www.finanztreff.de/news/auryn-resources-schliesst-98-…

http://www.finanztreff.de/news/auryn-resources-schliesst-98-…" target="_blank" rel="nofollow ugc noopener">

http://www.finanztreff.de/news/auryn-resources-schliesst-98-…

Auryn Resources expands oxide gold mineralization at the Huilacollo project, Peru

VANCOUVER, British Columbia, April 13, 2018 (GLOBE NEWSWIRE) -- Auryn Resources Inc. (TSX:AUG) (NYSE American:AUG) (“Auryn” or the “Company”) is pleased to announce drill results from its initial five drill holes at the Huilacollo oxide gold project in southern Peru. Only two conceptual targets adjacent to the existing mineralization were drilled in a short 1,500 meter program completed prior to the rainy season. Numerous targets across the property remain untested.

In addition to drilling at Huilacollo, reconnaissance rock sampling at the Tacora target yielded broad zones of oxide mineralization within a 750 meter structural zone. The Tacora and Huilacollo structural corridors present an opportunity to define multiple zones of oxide mineralization.

Ivan Bebek, Executive Chairman of Auryn, stated, “The Huilacollo project represents a potential low cost oxide mining scenario with accessible infrastructure. These initial holes give us strong indications of the direction of the mineralization as well as the potential for significant expansion. We look forward to resuming drilling once the new pad placements are permitted.

Drilling successfully expanded mineralization to the northwest by 100 meters with drill hole 17-HUI-002 intersecting 62 meters of 0.45 g/t Au (including 22 meters of 0.71g/t Au) oxide mineralization from surface and drill hole 17-HUI-004 intersecting 22 meters of 0.2 g/t Au 100 meters to the southwest from hole 17-HUI-002. Although hole 17-HUI-002 encountered lower grades of mineralization, it demonstrates the system is open to the northwest (Figure 1 & 2). These results have identified the potential for expanding surface mineralization to the northwest within the 1.5 kilometer long silica-alunite alteration zone that defines the core of the epithermal alteration system within the northern region of the project. Importantly, the encountered mineralization within these drill holes validates Auryn’s exploration model of targeting breccia bodies within the silica-alunite alteration system. There are several untested targets in the zone as shown in Figure 1.

Significant drill results from the initial five holes are presented below in Table 1.

Table 1:

Significant Intercepts – 2017/2018

Hole ID From (m) To (m) Interval (m) Au (g/t) Ag (g/t)

17HUI-001 34 42 8 0.12 1.0

58 60 2 0.16 0.8

80 82 2 0.12 0.4

104 110 6 0.09 0.5

17HUI-002 0 62 62 0.45 2.7

including 24 46 22 0.71 4.2

120 122 2 0.11 2.9

18HUI-003 1 2 1 0.27 2.0

14 24 10 0.17 1.2

50 64 14 0.12 4.0

102 108 6 0.11 0.9

148 150 2 0.1 1.5

350 352 2 0.26 0.4

18HUI-004 0 22 22 0.20 0.5

18HUI-005 24 26 2 0.11 1.8

44 54 10 0.11 1.7

86 92 6 0.28 3.3

126 128 2 0.10 2.1

206 214 8 0.16 1.5

The known mineralized zone is sub-horizontal in orientation. The estimated true width of these results is between 60 and 75%.

Auryn completed reconnaissance sampling of the Tacora and Huilacollo South targets through an initial rock-sampling program. At the Tacora prospect, Auryn defined a 750-meter long corridor of oxide gold mineralization within a northeast trending graben structure (Figure 3). Samples ranged up to 4.98 g/t Au within a 70 meter zone of mineralized samples from current and historical sampling. The samples across this 70 meter wide mineralized zone averaged 0.91g/t Au and demonstrate the continuity and potential to delineate significant oxide mineralization within the 750 meter strike length of the graben (Figure 3). Rock samples are presented below in Table 2.

In the Huilacollo South target, significant silver mineralization was sampled in the two areas within the silver in talus fine anomalies that were identified in 2017. These samples were situated within two separate structural zones that measure 1.3 kilometers and 750 meters respectively (Figure 4). Silver values ranged from below detection to 1310 g/t Ag. The 1.3 kilometer long corridor of anomalous silver in talus fines is characterized by higher-grade samples that range from 40 – 463 g/t Ag. The 750 meter corridor has higher-grade samples that ranged from 40 – 1310 g/t Ag. Together these zones are interpreted to represent a higher level in the epithermal system with potential to encounter gold mineralization at shallow depths. Significant rock samples from the Tacora and Huilacollo South targets are summarized below in Table 2.

Table 2:

Auryn Program: Significant rock samples from the Tacora and Huilacollo South

Gold Silver

1.91 g/t 1310 g/t 173 g/t

1.44 g/t 1080 g/t 172 g/t

1.43 g/t 827 g/t 155 g/t

1.40 g/t 463 g/t 146 g/t

1.35 g/t 246 g/t 108 g/t

1.31 g/t 235 g/t 97 g/t

1.27 g/t 224 g/t 92.2 g/t

0.95 g/t 194 g/t

0.86 g/t 184 g/t

Michael Henrichsen, COO and Chief Geologist, stated, “Our exploration thesis of targeting breccia bodies within the well-defined silica-alunite alteration zone has been validated. Several mapped breccia bodies remain to be drill tested that have the potential to significantly expand upon the known mineralization. In addition, the reconnaissance rock sampling at the Tacora and Huilacollo South target zones demonstrate the potential for the property to yield significant new zones of oxide mineralization.”

Michael Henrichsen, P.Geo, COO of Auryn, is the Qualified Person who assumes responsibility for the technical disclosures in this press release.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURYN RESOURCES INC.

Ivan Bebek,

Executive Chairman

quelle :

http://crweworld.com/article/news-provided-by-globenewswire/…

VANCOUVER, British Columbia, April 13, 2018 (GLOBE NEWSWIRE) -- Auryn Resources Inc. (TSX:AUG) (NYSE American:AUG) (“Auryn” or the “Company”) is pleased to announce drill results from its initial five drill holes at the Huilacollo oxide gold project in southern Peru. Only two conceptual targets adjacent to the existing mineralization were drilled in a short 1,500 meter program completed prior to the rainy season. Numerous targets across the property remain untested.

In addition to drilling at Huilacollo, reconnaissance rock sampling at the Tacora target yielded broad zones of oxide mineralization within a 750 meter structural zone. The Tacora and Huilacollo structural corridors present an opportunity to define multiple zones of oxide mineralization.

Ivan Bebek, Executive Chairman of Auryn, stated, “The Huilacollo project represents a potential low cost oxide mining scenario with accessible infrastructure. These initial holes give us strong indications of the direction of the mineralization as well as the potential for significant expansion. We look forward to resuming drilling once the new pad placements are permitted.

Drilling successfully expanded mineralization to the northwest by 100 meters with drill hole 17-HUI-002 intersecting 62 meters of 0.45 g/t Au (including 22 meters of 0.71g/t Au) oxide mineralization from surface and drill hole 17-HUI-004 intersecting 22 meters of 0.2 g/t Au 100 meters to the southwest from hole 17-HUI-002. Although hole 17-HUI-002 encountered lower grades of mineralization, it demonstrates the system is open to the northwest (Figure 1 & 2). These results have identified the potential for expanding surface mineralization to the northwest within the 1.5 kilometer long silica-alunite alteration zone that defines the core of the epithermal alteration system within the northern region of the project. Importantly, the encountered mineralization within these drill holes validates Auryn’s exploration model of targeting breccia bodies within the silica-alunite alteration system. There are several untested targets in the zone as shown in Figure 1.

Significant drill results from the initial five holes are presented below in Table 1.

Table 1:

Significant Intercepts – 2017/2018

Hole ID From (m) To (m) Interval (m) Au (g/t) Ag (g/t)

17HUI-001 34 42 8 0.12 1.0

58 60 2 0.16 0.8

80 82 2 0.12 0.4

104 110 6 0.09 0.5

17HUI-002 0 62 62 0.45 2.7

including 24 46 22 0.71 4.2

120 122 2 0.11 2.9

18HUI-003 1 2 1 0.27 2.0

14 24 10 0.17 1.2

50 64 14 0.12 4.0

102 108 6 0.11 0.9

148 150 2 0.1 1.5

350 352 2 0.26 0.4

18HUI-004 0 22 22 0.20 0.5

18HUI-005 24 26 2 0.11 1.8

44 54 10 0.11 1.7

86 92 6 0.28 3.3

126 128 2 0.10 2.1

206 214 8 0.16 1.5

The known mineralized zone is sub-horizontal in orientation. The estimated true width of these results is between 60 and 75%.

Auryn completed reconnaissance sampling of the Tacora and Huilacollo South targets through an initial rock-sampling program. At the Tacora prospect, Auryn defined a 750-meter long corridor of oxide gold mineralization within a northeast trending graben structure (Figure 3). Samples ranged up to 4.98 g/t Au within a 70 meter zone of mineralized samples from current and historical sampling. The samples across this 70 meter wide mineralized zone averaged 0.91g/t Au and demonstrate the continuity and potential to delineate significant oxide mineralization within the 750 meter strike length of the graben (Figure 3). Rock samples are presented below in Table 2.

In the Huilacollo South target, significant silver mineralization was sampled in the two areas within the silver in talus fine anomalies that were identified in 2017. These samples were situated within two separate structural zones that measure 1.3 kilometers and 750 meters respectively (Figure 4). Silver values ranged from below detection to 1310 g/t Ag. The 1.3 kilometer long corridor of anomalous silver in talus fines is characterized by higher-grade samples that range from 40 – 463 g/t Ag. The 750 meter corridor has higher-grade samples that ranged from 40 – 1310 g/t Ag. Together these zones are interpreted to represent a higher level in the epithermal system with potential to encounter gold mineralization at shallow depths. Significant rock samples from the Tacora and Huilacollo South targets are summarized below in Table 2.

Table 2:

Auryn Program: Significant rock samples from the Tacora and Huilacollo South

Gold Silver

1.91 g/t 1310 g/t 173 g/t

1.44 g/t 1080 g/t 172 g/t

1.43 g/t 827 g/t 155 g/t

1.40 g/t 463 g/t 146 g/t

1.35 g/t 246 g/t 108 g/t

1.31 g/t 235 g/t 97 g/t

1.27 g/t 224 g/t 92.2 g/t

0.95 g/t 194 g/t

0.86 g/t 184 g/t

Michael Henrichsen, COO and Chief Geologist, stated, “Our exploration thesis of targeting breccia bodies within the well-defined silica-alunite alteration zone has been validated. Several mapped breccia bodies remain to be drill tested that have the potential to significantly expand upon the known mineralization. In addition, the reconnaissance rock sampling at the Tacora and Huilacollo South target zones demonstrate the potential for the property to yield significant new zones of oxide mineralization.”

Michael Henrichsen, P.Geo, COO of Auryn, is the Qualified Person who assumes responsibility for the technical disclosures in this press release.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURYN RESOURCES INC.

Ivan Bebek,

Executive Chairman

quelle :

http://crweworld.com/article/news-provided-by-globenewswire/…

Hier gibt es den ganzen Artikel auch mit den angesprochenen Bildern in deutscher Sprache.

Auryn Resources Inc. 13.04.2018Auryn Resources erweitert Goldoxidmineralisierung im Projekt Huilacollo in Peru

Vancouver, British Columbia – 13. April 2018 –

Auryn Resources Inc. (TSX: AUG, NYSE American: AUG) („Auryn“ oder das „Unternehmenׅ“ - http://www.commodity-tv.net/c/search_adv/?v=298204) freut sich, die Bohrergebnisse aus den ersten fünf Bohrlöchern im Goldoxidprojekt Huilacollo in Südperu bekannt zu geben. Im Rahmen eines kurzen Bohrprogramms über 1.500 Bohrmeter, das noch vor der Regenperiode abgeschlossen wurde, wurden nur zwei konzeptionelle Bohrziele unmittelbar neben der bestehenden Mineralisierung untersucht. Zahlreiche Ziele quer über das Konzessionsgebiet blieben unerkundet.

Ergänzend zu den Bohrungen bei Huilacollo stieß man im Rahmen von Probenahmen aus dem Gestein im Ziel Tacora auf breite Zonen einer Oxiderzmineralisierung, die in eine 750 Meter mächtige Strukturzone eingebettet sind. In den Strukturkorridoren Tacora und Huilacollo bietet sich die Gelegenheit, zahlreiche Zonen mit Oxiderzmineralisierung zu definieren.

Ivan Bebek, Executive Chairman von Auryn, meint dazu: „Das Projekt Huilacollo birgt Potenzial für ein Bergbauszenario, das einen kostengünstigen Abbau von Oxiderz samt verfügbarer Infrastruktur beinhaltet. Diese ersten Löcher liefern uns konkrete Hinweise auf die Ausrichtung der Mineralisierung und auf ein umfassendes Erweiterungspotenzial. Wir freuen uns darauf, die Bohrungen wieder aufzunehmen, sobald die neuen Bohrplattformen genehmigt wurden.

Im Zuge der Bohrungen wurde die Mineralisierung in nordwestlicher Richtung erfolgreich um 100 Meter erweitert. Hier wurden in Bohrloch 17-HUI-002 ein 62 Meter breiter Abschnitt mit Oxiderzmineralisierung und einem Goldgehalt von 0,45 g/t (einschließlich 22 Meter mit 0,71 g/t Au) ab Oberflächenniveau und in Bohrloch 17-HUI-004 ein 22 Meter breiter Abschnitt mit 0,2 g/t Au (100 Meter südwestlich von Loch 17-HUI-002) durchteuft. In Loch 17-HUI-002 wurde zwar eine geringergradige Mineralisierung ermittelt, es zeigt sich aber, dass das System in nordwestlicher Richtung offen ist (Abbildung 1 & 2).

Diese Ergebnisse haben das Potenzial für die Erweiterung der oberflächennahen Mineralisierung in nordwestlicher Richtung innerhalb der 1,5 Kilometer langen Quarz-Alunit-Alterierungszone aufgezeigt, die den Kern des epithermalen Alterierungssystems innerhalb der Nordzone des Projekts definiert. Von Bedeutung ist, dass die in diesen Bohrlöchern entdeckte Mineralisierung das Explorationsmodell von Auryn untermauert, das sich auf die Brekzienkörper innerhalb des Quarz-Alunit-Alterierungssystems konzentriert. In der in Abbildung 1 dargestellten Zone befinden sich mehrere noch unerkundete Ziele.

Wichtige Ergebnisse aus den ersten fünf Löchern sind in der nachstehenden Tabelle zusammengefasst:

Tabelle 1: ( findet ihr auch in diesem Bericht)

Abbildung 1

http://www.irw-press.at/prcom/images/messages/2018/43065/130…

Abbildung 2

http://www.irw-press.at/prcom/images/messages/2018/43065/130…

Abbildung 3

http://www.irw-press.at/prcom/images/messages/2018/43065/130… Abbildung 3 zeigt die Goldergebnisse aus der ersten Gesteinsprobenahme in den Zielzonen Tacora und Huilacollo South. Das Zielgebiet Tacora wird durch einen 750 Meter langen Graben definiert. Entlang des Grabens wurden Stichproben mit einem Goldgehalt von über 1 g/t gewonnen. Proben aus einer 70 Meter mächtigen Zone, in der im Rahmen von aktuellen und historischen Gesteinsprobenahmen ein durchschnittlicher Goldgehalt von 0,91 g/t ermittelt wurde, wiesen Goldwerte von bis zu 4,88 g/t auf und deuten auf die Kontinuität und das Potenzial für die Abgrenzung einer bedeutenden Oxiderzmineralisierung innerhalb der 750 Meter umfassenden Streichlänge des Grabens hin.

Abbildung 4

http://www.irw-press.at/prcom/images/messages/2018/43065/130…

Abbildung 4 zeigt die Silberergebnisse aus der ersten Gesteinsprobenahme in den Zielzonen Tacora und Huilacollo South. Das Zielgebiet Huilacollo South wird von mehreren Proben definiert, zu denen auch Proben mit einem Silbergehalt von über 100 g/t zählen. Sie wurden entlang von zwei unterschiedlichen Clustern mit Silberanomalien im Felsschutt gewonnen, wobei der Spitzenwert bei 1.310 g/t Ag liegt. Auryn geht davon aus, dass dieses Zielgebiet ein höheres Niveau innerhalb des epithermalen Systems darstellt und großes Potenzial für die Auffindung einer Goldmineralisierung in geringer Tiefe birgt.

Die Ausgangssprache (in der Regel Englisch), in der der Originaltext veröffentlicht wird, ist die offizielle, autorisierte und rechtsgültige Version. Diese Übersetzung wird zur besseren Verständigung mitgeliefert. Die deutschsprachige Fassung kann gekürzt oder zusammengefasst sein. Es wird keine Verantwortung oder Haftung: für den Inhalt, für die Richtigkeit, der Angemessenheit oder der Genauigkeit dieser Übersetzung übernommen. Aus Sicht des Übersetzers stellt die Meldung keine Kauf- oder Verkaufsempfehlung dar! Bitte beachten Sie die englische Originalmeldung auf www.sedar.com, www.sec.gov, www.asx.com.au/ oder auf der Firmenwebsite!

http://www.irw-press.at/press_html.aspx?messageID=43065&tr=1

Auryn Resources Inc. beginnt in Kürze bestimmt mit den Bohrarbeiten auf dem erweiterten Landpaket in Peru.

http://www.finanznachrichten.de/nachrichten-2018-04/43550067…dpa-AFX·Mehr Nachrichten von dpa-AFX

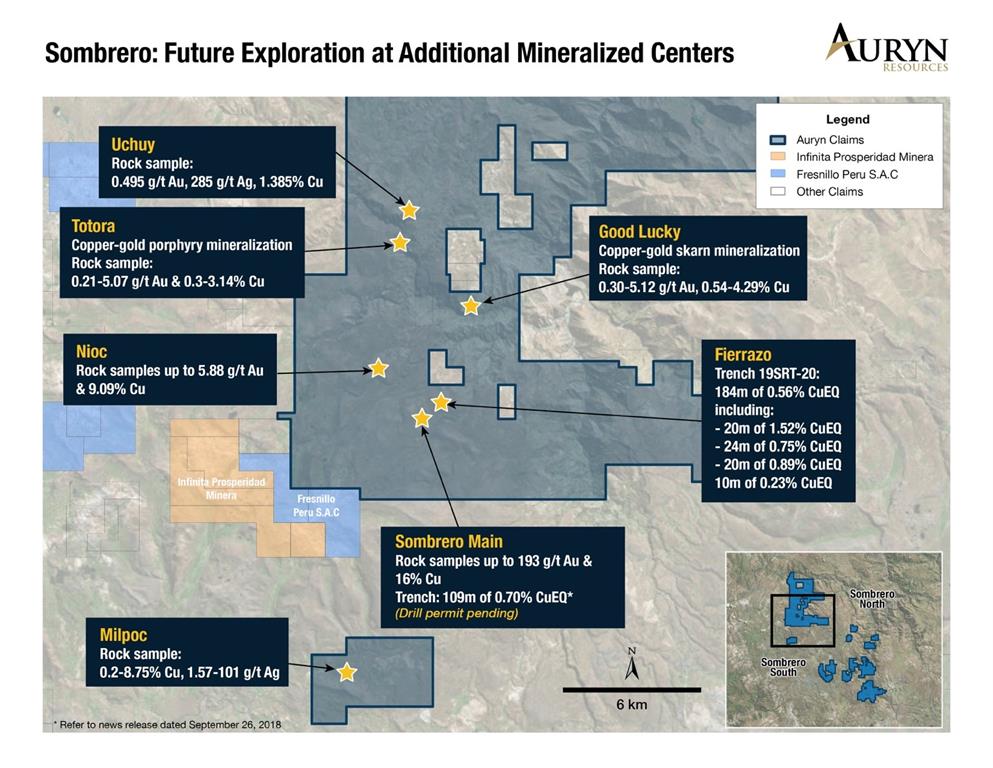

IRW-PRESS: Auryn Resources Inc.: Auryn beginnt mit Arbeiten und erweitert Landpaket bei Gold- und Kupferprojekt Sombrero

Auryn beginnt mit Arbeiten und erweitert Landpaket bei Gold- und Kupferprojekt Sombrero

Vancouver (British Columbia), 17. April 2018.

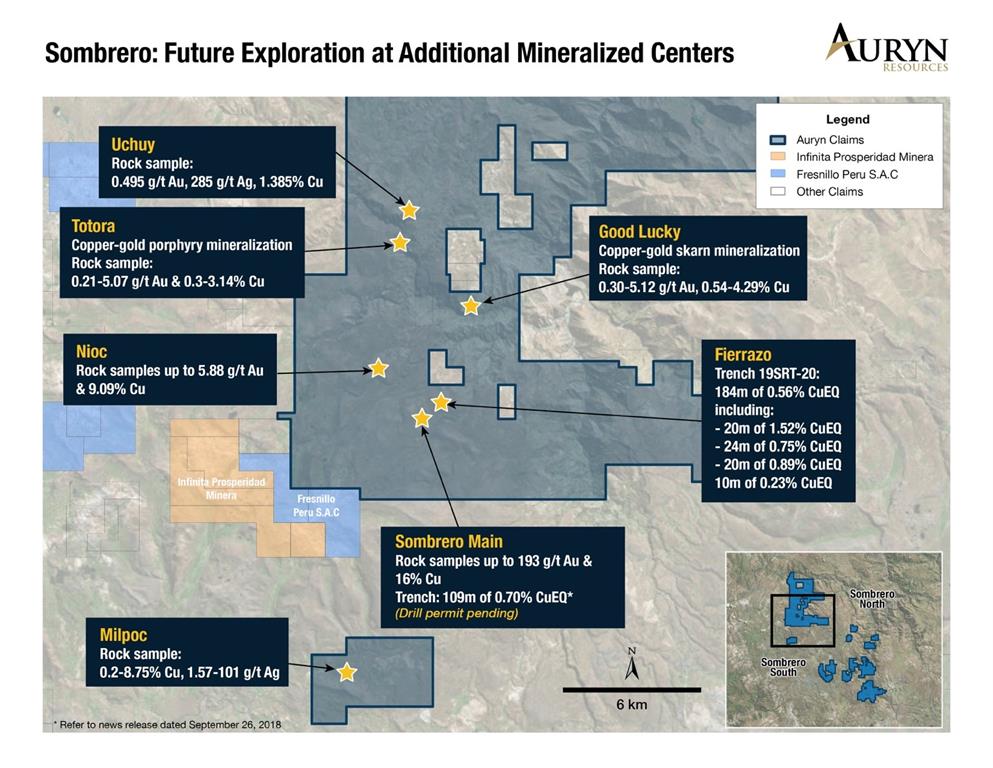

Auryn Resources Inc. (TSX: AUG, NYSE American: AUG - https://www.youtube.com/watch?v=89IOKIaiPvc&list=PLBpDlKjdv3… EU2dq8ikvb5EJ4l&index=3&t=30s) (Auryn oder das Unternehmen) freut sich bekannt zu geben, dass es ein langfristiges Zugangsabkommen mit der Gemeinde Huancasancos unterzeichnet hat, die etwa die Hälfte der Sombrero-Schürfrechte aus dem Jahr 2016 im Süden von Peru umfasst. Durch das Abkommen hat Auryn einen Oberflächenzugang zu den Explorationsprogrammen, die als Vorbereitung auf ein erstes Bohrprogramm im Gange sind. Das Unternehmen hat mittels des Absteckens von Land unmittelbar neben dem Projektgebiet auch sein Landpaket um insgesamt 34.180 Hektar erweitert, womit es in diesem Gebiet nun 47.320 Hektar Land kontrolliert.

Executive Chairman Ivan Bebek sagte: Das Projekt Sombrero ist aufgrund seiner Größe, seiner hohen Gehalte, die an der Oberfläche beobachtet wurden, und der produktiven Region in Peru, in der es sich befindet, eine bedeutsame Entdeckungsmöglichkeit für die Aktionäre von Auryn. Obwohl Auryn beeindruckende Oberflächenprobennahmen durchgeführt hat, wurden die Konzessionen niemals bebohrt, weshalb wir uns auf den Beginn unserer bevorstehenden Explorationsprogramme freuen.

Sombrero im Überblick

Das Konzessionsgebiet Sombrero befindet sich im Andahuaylas-Yauri-Gürtel und wird als der nordwestliche Rand der porphyrischen Kupfer- und Skarngürtel aus dem Eozän/Oligozän interpretiert, der die Lagerstätten Las Bambas, Haquira, Los Chancas, Cotabambas, Constancia, Antapaccay und Tintaya beherbergt (Abbildung 1). Die wichtigsten Ziele bei Sombrero sind Kupfer-Gold-Skarn- und porphyrische Systeme sowie epithermale Edelmetall-Lagerstätten.

Oberflächenarbeiten und geplante Bohrungen

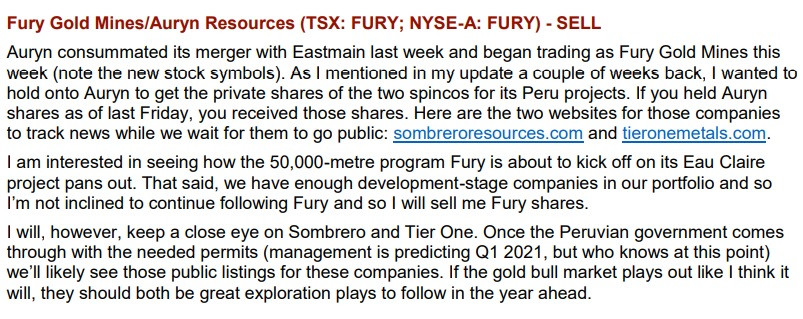

Die Oberflächenarbeiten bei Sombrero werden Kartierungen, Boden- und Gesteinsprobennahmen, Grabungen sowie Magnet-Bodenuntersuchungen umfassen, die voraussichtlich vor einem ersten Bohrprogramm durchgeführt werden.