Diskussion zu Plateau Uranium -- ISIN CA7276381083 - 500 Beiträge pro Seite (Seite 2)

eröffnet am 01.10.16 12:03:38 von

neuester Beitrag 20.05.21 21:15:13 von

neuester Beitrag 20.05.21 21:15:13 von

Beiträge: 675

ID: 1.239.138

ID: 1.239.138

Aufrufe heute: 1

Gesamt: 42.228

Gesamt: 42.228

Aktive User: 0

ISIN: CA72764B1004 · WKN: A2JGKQ

0,4300

EUR

0,00 %

0,0000 EUR

Letzter Kurs 12.05.21 Gettex

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9900 | +90,38 | |

| 14,000 | +26,13 | |

| 108,16 | +19,99 | |

| 211,70 | +13,54 | |

| 378,55 | +9,44 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,1200 | -10,60 | |

| 1,7900 | -10,95 | |

| 30,10 | -14,25 | |

| 1,6400 | -14,36 | |

| 0,7010 | -30,59 |

Antwort auf Beitrag Nr.: 56.837.137 von Popeye82 am 26.01.18 11:30:41Ja stimmt. Hab nicht lang genug zurück geschaut. Aber Richtung letztem Hoch.

Also ich denke mal die 1 CAD sind wie immer ein nicht zu unterschätzender Widerstand, sollte es dynamisch drüber gehn kommt wie schon so oft Momentum in die Sache.....allein schon wegen der "unter 1 $/CAD sollten Fondmanager nicht ínvestieren Geschichte" ....

Ansonsten bin ich entgegen meiner Crypto Investitionen hier absolut HODL eingestellt

Antwort auf Beitrag Nr.: 56.833.942 von jogii am 26.01.18 07:04:43Du hast Dir Das verdient, mit DEM Durchhaltevermögen.

Freut mich wirklich.

Aber wenn PLU Dein "Bestes" Pferd ist, muss Das glaube ich schon Nachkäufe mit beinhalten?

Momentan sind Sie denke ich-aufgrund 2,3er Umstände- sehr momentumgetrieben.

Pass auf die ENTSCHEIDENDEN Fragen nicht aus den Augen zu verlieren.

Freut mich wirklich.

Aber wenn PLU Dein "Bestes" Pferd ist, muss Das glaube ich schon Nachkäufe mit beinhalten?

Momentan sind Sie denke ich-aufgrund 2,3er Umstände- sehr momentumgetrieben.

Pass auf die ENTSCHEIDENDEN Fragen nicht aus den Augen zu verlieren.

Antwort auf Beitrag Nr.: 56.849.185 von Popeye82 am 27.01.18 16:06:49möchte mal wissen wo der kurs ohne Li-beiprodukt stehen würde...

und das wird überschätzt.

also halbierung z.b. durchaus denkbar

und das wird überschätzt.

also halbierung z.b. durchaus denkbar

Ich mache nicht umsonst Den Verweis auf Die ENTSCHEIDENEN Fragen.

Haltet Euch DAran, und lasst Euch nicht den Kopf verdrehen.

Ist ja so Eine "Experten"krankheit.

Wenn Die "Richtigen" Sachen passieren kann Es m.E. noch viel, viel höher gehen.

Dann halte ich Hier (Irgendwann)mal eine Bewertung-NACH Capex- im Milliarden-stelligen Bereich für problemLOS erzielbar.

Das hängt aber ganz erheblich von Der EIGENEN EInschätzung Einiger Dinge ab,

und Das MÜSST Ihr Euch klar machen.

Haltet Euch DAran, und lasst Euch nicht den Kopf verdrehen.

Ist ja so Eine "Experten"krankheit.

Wenn Die "Richtigen" Sachen passieren kann Es m.E. noch viel, viel höher gehen.

Dann halte ich Hier (Irgendwann)mal eine Bewertung-NACH Capex- im Milliarden-stelligen Bereich für problemLOS erzielbar.

Das hängt aber ganz erheblich von Der EIGENEN EInschätzung Einiger Dinge ab,

und Das MÜSST Ihr Euch klar machen.

Antwort auf Beitrag Nr.: 56.849.311 von Popeye82 am 27.01.18 16:29:58machs nicht komplizierter als es ist...

uran-permit in peru schaumer mal

uransektor als solcher

lithium als beidpordukt, recovery usw.

solche werte brauchen lange bis sie am ziel sind und eben auch eine sektorhausse.

da reichen nicht nur gute bohrergebisse

aber zumindest ist hier mal EIN deposit vorhanden das ich als ziemlich klasse bezeichnen würde.

uran-permit in peru schaumer mal

uransektor als solcher

lithium als beidpordukt, recovery usw.

solche werte brauchen lange bis sie am ziel sind und eben auch eine sektorhausse.

da reichen nicht nur gute bohrergebisse

aber zumindest ist hier mal EIN deposit vorhanden das ich als ziemlich klasse bezeichnen würde.

Ich mache Es nicht komplizierter als Es ist,

ich will dass IHR Es nehmt WIE Es ist.

Da liegen ja mehr Die (perma)Probleme.

ich will dass IHR Es nehmt WIE Es ist.

Da liegen ja mehr Die (perma)Probleme.

Antwort auf Beitrag Nr.: 56.849.566 von Popeye82 am 27.01.18 17:33:06eine glaskugel war im gemischtwarenladen heute leider NICHT vorrätig

und meine kontakte zur peruanischen regierung sind auch noch verbesserungswürdig

und meine kontakte zur peruanischen regierung sind auch noch verbesserungswürdig

diese Kindergartenboards werden immer lächerlicher.

im Prinzip werden Die von Selbstständigen Menschen nicht gebraucht.

im Prinzip werden Die von Selbstständigen Menschen nicht gebraucht.

Antwort auf Beitrag Nr.: 56.849.833 von Popeye82 am 27.01.18 18:25:10Dann melde Dich doch einfach ab. Besser als Dich ständig über andere User lustig zu machen.

nööö, find ich Das Andere besser.

Ist echt krass Was in Diesen portals abgeht.

Ich denke auf eine TIEFENanalyse werden Sie sicher verzichten.

VerSTÄNDLICHERweise.

Ist echt krass Was in Diesen portals abgeht.

Ich denke auf eine TIEFENanalyse werden Sie sicher verzichten.

VerSTÄNDLICHERweise.

Antwort auf Beitrag Nr.: 56.855.120 von Popeye82 am 28.01.18 19:10:26Also entweder ist es was persönliches oder meine Antwort auf die Falcanithematik war Ihnen nicht tiefgründig genug um diese für beachtenswert zu halten.

Nein, Nichts von Beidem.

Ich bin mir auch nicht sicher ob Ihre örtlichen Gegebenheiten für ein "central processing"/gemeinsame Verarbeitungsanlagen günstig genug sind;

aber wenn ich Ihre Letzten Aussagen richtig verstanden habe wollen Sie genau Das versuchen.

Ich bin mir auch nicht sicher ob Ihre örtlichen Gegebenheiten für ein "central processing"/gemeinsame Verarbeitungsanlagen günstig genug sind;

aber wenn ich Ihre Letzten Aussagen richtig verstanden habe wollen Sie genau Das versuchen.

https://investingnews.com/daily/resource-investing/energy-in…

"IEA Sees China Overtaking US as Biggest Nuclear Energy Nation

The International Energy Agency sees China surpassing the US to become the world's largest producer of nuclear energy by 2030.

« Blue Sky Uranium CEO: Ama…

Nicole Rashotte • February 22, 2018

Add Comment

0 0 0

pexels-photo-157039

According to the International Energy Agency (IEA), China will more than triple its nuclear energy capacity over the next 20 years, making it the world’s largest nuclear power producer.

The IEA believes that China is charging ahead due to the fact that the US and Europe are not investing enough in nuclear power.

IEA Executive Director Fatih Birol explained, “China is coming back strong. Today there are about 60 nuclear power plants under construction and more than one third of them are in China.”

uranium free industry report

Looking for Uranium Stocks?

Find a list in our new uranium outlook report!

Get My Free Report

Birol added, “China is growing and as a result of that we’ll soon see China overtaking the United States as the number 1 nuclear power in the world.”

While the US has been the global leader in nuclear power since the 1960s, there are two trends currently threatening to knock the country out of the top spot.

The first is that very few additions to nuclear capacity have been made, and the second is that there are no lifetime extensions for the existing power plants.

It is worth noting that the US has recently requested that the lives of some nuclear power reactors be extended, keeping them in operation for as long as 80 years. This request is part of President Donald Trump’s initiative to revitalize the nation’s nuclear industry.

While this is a good step, there are still many concerns. As Birol explained, if this trend with the US and China continues, “[t]he U.S. nuclear capacity will go from 20% [of overall power supply] to 7%.”

The IEA notes what is currently taking place with energy is the same as what happened in the solar sector years prior.

“[China] is learning by doing, bringing costs down and therefore [they] are now ready to export [their] technology and are much more cost effective than others. And [they] challenge the established exporters such as the U.S., Japan, Korea and European countries,” said Birol.

Birol expects China to overtake the US as the biggest nuclear nation by 2030.

Additionally, the IEA expects nuclear power capacity in China to make up 4 percent of the country’s total power supply in 2040, up from 2 percent in 2016. It also expects China’s overall power supply across all energy sources to double from 1,625 gigawatts in 2016 to 3,188 gigawatts in 2040.

China is also pushing an initiative to “make the skies blue again” to repair its current smoggy skies.

Birol sees this initiative as a major upheaval that is bound to shake up the energy markets, and noted that when “[C]hina changes, everything changes.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Nicole Rashotte, hold no direct investment interest in any company mentioned in this article."

"IEA Sees China Overtaking US as Biggest Nuclear Energy Nation

The International Energy Agency sees China surpassing the US to become the world's largest producer of nuclear energy by 2030.

« Blue Sky Uranium CEO: Ama…

Nicole Rashotte • February 22, 2018

Add Comment

0 0 0

pexels-photo-157039

According to the International Energy Agency (IEA), China will more than triple its nuclear energy capacity over the next 20 years, making it the world’s largest nuclear power producer.

The IEA believes that China is charging ahead due to the fact that the US and Europe are not investing enough in nuclear power.

IEA Executive Director Fatih Birol explained, “China is coming back strong. Today there are about 60 nuclear power plants under construction and more than one third of them are in China.”

uranium free industry report

Looking for Uranium Stocks?

Find a list in our new uranium outlook report!

Get My Free Report

Birol added, “China is growing and as a result of that we’ll soon see China overtaking the United States as the number 1 nuclear power in the world.”

While the US has been the global leader in nuclear power since the 1960s, there are two trends currently threatening to knock the country out of the top spot.

The first is that very few additions to nuclear capacity have been made, and the second is that there are no lifetime extensions for the existing power plants.

It is worth noting that the US has recently requested that the lives of some nuclear power reactors be extended, keeping them in operation for as long as 80 years. This request is part of President Donald Trump’s initiative to revitalize the nation’s nuclear industry.

While this is a good step, there are still many concerns. As Birol explained, if this trend with the US and China continues, “[t]he U.S. nuclear capacity will go from 20% [of overall power supply] to 7%.”

The IEA notes what is currently taking place with energy is the same as what happened in the solar sector years prior.

“[China] is learning by doing, bringing costs down and therefore [they] are now ready to export [their] technology and are much more cost effective than others. And [they] challenge the established exporters such as the U.S., Japan, Korea and European countries,” said Birol.

Birol expects China to overtake the US as the biggest nuclear nation by 2030.

Additionally, the IEA expects nuclear power capacity in China to make up 4 percent of the country’s total power supply in 2040, up from 2 percent in 2016. It also expects China’s overall power supply across all energy sources to double from 1,625 gigawatts in 2016 to 3,188 gigawatts in 2040.

China is also pushing an initiative to “make the skies blue again” to repair its current smoggy skies.

Birol sees this initiative as a major upheaval that is bound to shake up the energy markets, and noted that when “[C]hina changes, everything changes.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Nicole Rashotte, hold no direct investment interest in any company mentioned in this article."

Wenn da permits kommen ... Denn kann es mal derbe nach oben knallen .

Weiß jemand, weshalb die Aktie jetzt unter einer neuen WKN A2JGKQ mit neuem Namen Plateau Energy Met. geführt wird? In meinem Depot bei Consors wird die Aktie noch unter dem alten Namen mit der alten WKN aufgeführt und dadurch ist es mir nicht möglich, die Aktie bei Bedarf zu verkaufen.

Antwort auf Beitrag Nr.: 57.333.293 von Streberleiche am 20.03.18 17:31:19Sie wollen a bisserl weg vom Uran, und damit sagen, dass es noch weitere Rohstoffe gilt abzubauen.... Eigentlich Positiv, da Uran ja einen leichten negativen Touch hat.... ;-)

Antwort auf Beitrag Nr.: 57.333.293 von Streberleiche am 20.03.18 17:31:19bei mir ist auch noch die "alte" drin... das dauert immer einige tage bis zur umbuchung.

kenn ich schon zur genüge...

namensänderung halt wegen nennenswertem lithiumfund.

kenn ich schon zur genüge...

namensänderung halt wegen nennenswertem lithiumfund.

Vielen Dank für eure Antworten.

Im Grunde ist die Aktie ja sowieso in meinem Langfristdepot und soll somit erstmal nicht verkauft werden. Aber irgendwie immer n komisches Gefühl, ne Aktie zu besitzen, die im Fall der Fälle über Tage nicht verkauft werden kann...

Im Grunde ist die Aktie ja sowieso in meinem Langfristdepot und soll somit erstmal nicht verkauft werden. Aber irgendwie immer n komisches Gefühl, ne Aktie zu besitzen, die im Fall der Fälle über Tage nicht verkauft werden kann...

Antwort auf Beitrag Nr.: 57.337.022 von Streberleiche am 21.03.18 03:44:10Wenn Ihr glaubt dass Der Abbau nicht verweigert wird würde ich Plateau Aktien sehr, sehr gut festhalten.

Nach dem scharfen Rückgang unter 0,60 CAD diesen Monat schon 50% Plus. Hier braucht man echt gute Nerven oder das Glück, oben aus- und unter wieder einzusteigen.

Plateau geht steil und da ist ja nicht mal das Uran mit berücksichtigt .

Versteht das jemand? Ich beklage mich nicht ;-)

Finde aber keine News.

Ressourcenschätung soll wohl im Q2 kommen, soweit mir bekannt.

Finde aber keine News.

Ressourcenschätung soll wohl im Q2 kommen, soweit mir bekannt.

weiterer Teiverkauf umgeschichtet in Orca Gold.... 😁

Antwort auf Beitrag Nr.: 57.858.246 von Mineral-deposits666 am 29.05.18 17:12:11die beiden vertragen sich auch gut nebeneinander in meinem depot.

plateau lass ich wie es ist.... ich denke von permits abgesehen kann die suppe keiner mehr versalzen

plateau lass ich wie es ist.... ich denke von permits abgesehen kann die suppe keiner mehr versalzen

Antwort auf Beitrag Nr.: 57.859.143 von Boersiback am 29.05.18 18:36:17Gehts hier wieder 20-30 Prozent runter greif ich wieder zu.... nächster Kauf wäre nächste Woche Wesdome Gold.... 😁immer sammeln sammeln sammeln.... 😉

Antwort auf Beitrag Nr.: 57.859.380 von Mineral-deposits666 am 29.05.18 19:03:07

Schön schauts aus

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Schön schauts aus

Antwort auf Beitrag Nr.: 57.904.455 von jogii am 04.06.18 17:20:01Herr Bundestrainer

Wie LANGE wollen Sie Das RanzTeil denn halten??

Wie LANGE wollen Sie Das RanzTeil denn halten??

Antwort auf Beitrag Nr.: 57.947.940 von Popeye82 am 09.06.18 10:56:49

Das RanzTeil!???

Dachte so lange bis ich reich bin

Zitat von Popeye82: Herr Bundestrainer

Wie LANGE wollen Sie Das RanzTeil denn halten??

Das RanzTeil!???

Dachte so lange bis ich reich bin

Chartbild kritisch...

denke um da durchzugehen brauchts wieder nen anlauf (von einiges weiter unten vermutlich)

Antwort auf Beitrag Nr.: 57.949.353 von jogii am 09.06.18 17:24:37Ja, toller Plan.

Das "käme" u.A. Darauf an ob Sie aktuell 1/2 reich sind, 1/4, 1/10, 1/100...................................

Ich meinte aber von Der ZEITdauer, oder gegebenenfalls "Meilen"steinen.

"Ranz"teil hat Etwas mit Innerer Stärke zu tun.

Das muss man nicht verstehen.

Das "käme" u.A. Darauf an ob Sie aktuell 1/2 reich sind, 1/4, 1/10, 1/100...................................

Ich meinte aber von Der ZEITdauer, oder gegebenenfalls "Meilen"steinen.

"Ranz"teil hat Etwas mit Innerer Stärke zu tun.

Das muss man nicht verstehen.

Antwort auf Beitrag Nr.: 57.949.410 von Boersiback am 09.06.18 17:38:09Im Tagesverlauf diese Woche bereits bei 1,30 CAD.

Gute Unterstützung im Bereich von 0,90 CAD. Das könnte das Sprungbrett sein, tiefer glaube ich nicht.

Wir wollen doch alle nur das eine.

Gute Unterstützung im Bereich von 0,90 CAD. Das könnte das Sprungbrett sein, tiefer glaube ich nicht.

Wir wollen doch alle nur das eine.

Antwort auf Beitrag Nr.: 57.949.800 von branigan am 09.06.18 19:39:36vergiss die vola nicht.

0,6 cad kanns auch locker werden

0,6 cad kanns auch locker werden

Moin zusammen

Ich hab meinen Einsatz schon rausgenommen, den Gewinn lass ich mal ein paar Jahre laufen. Ich denke demnächst gibt's nen heftigen Rohstoff Bullrun und insb. Uranium und Lithium scheinen derzeit noch stark unterbewertet. Auf das Rein-Raus Spiel hab ich momentan kein Bock mehr, bei Aktien Investments

Bin eigentlich nicht so der Long Hodler (Trade auch mit Cryptos) ....hab aber iwie das Gefühl, dass aus PLU was großes werden könnte.

Ich hab meinen Einsatz schon rausgenommen, den Gewinn lass ich mal ein paar Jahre laufen. Ich denke demnächst gibt's nen heftigen Rohstoff Bullrun und insb. Uranium und Lithium scheinen derzeit noch stark unterbewertet. Auf das Rein-Raus Spiel hab ich momentan kein Bock mehr, bei Aktien Investments

Bin eigentlich nicht so der Long Hodler (Trade auch mit Cryptos) ....hab aber iwie das Gefühl, dass aus PLU was großes werden könnte.

"We remain confident Falchani can eventually grow into one of the largest open-pittable near surface lithium deposits in the world.” Ian Stalker

Aus dem unten verlinkten Interview:

INN: Are there any recent exploration highlights from the Falchani discovery that you would like to share?

IS: We found high grade uranium and some exciting lithium intersections at Falchani. With additional exploration, we’ve potentially identified a two by three kilometer anomaly and have drilled approximately 20 percent of that anomaly. Our drilling results will be included in our NI 43-101 resource which should be released by the end of the month

INN: What is next for the Macusani project and how does that fit into the company’s long-term plans?

IS: Along with completing our NI 43-101 and our test work with ANTSO, we’re looking to run financial modeling and complete a PEA with pre-feasibility considerations highlighted within the document. We’re hoping to have this completed by the end of the year to show the size of the project as well as the economic benefits it can offer.

Interview mit Ian Stalker: https://investingnews.com/daily/resource-investing/energy-in…

Neue Insider-Käufe am Freitag: https://www.canadianinsider.com/node/7?menu_tickersearch=PLU…

Aus dem unten verlinkten Interview:

INN: Are there any recent exploration highlights from the Falchani discovery that you would like to share?

IS: We found high grade uranium and some exciting lithium intersections at Falchani. With additional exploration, we’ve potentially identified a two by three kilometer anomaly and have drilled approximately 20 percent of that anomaly. Our drilling results will be included in our NI 43-101 resource which should be released by the end of the month

INN: What is next for the Macusani project and how does that fit into the company’s long-term plans?

IS: Along with completing our NI 43-101 and our test work with ANTSO, we’re looking to run financial modeling and complete a PEA with pre-feasibility considerations highlighted within the document. We’re hoping to have this completed by the end of the year to show the size of the project as well as the economic benefits it can offer.

Interview mit Ian Stalker: https://investingnews.com/daily/resource-investing/energy-in…

Neue Insider-Käufe am Freitag: https://www.canadianinsider.com/node/7?menu_tickersearch=PLU…

Heute schon mal an 1,5 CAD geschnuppert. MK jetzt über 100 Mio CAD.

Der Wert hat ein starkes Momentum. Der NI-Report für Falchani wird spannend. Bisher sind nur 20% gebohrt.

Der Wert hat ein starkes Momentum. Der NI-Report für Falchani wird spannend. Bisher sind nur 20% gebohrt.

Tolle Entwicklung .

Leider den nun 6 Bagger zu früh weg geworfen .

Leider den nun 6 Bagger zu früh weg geworfen .

meine teilverkäuft bei 0,60 cad und 1,30 cad waren auch nicht so gut

Buy and Hold bzw. Augen zu und durch hat sich gelohnt.

Bei 0,60 CAD nachzukaufen wäre noch besser gewesen ...

Bei 0,60 CAD nachzukaufen wäre noch besser gewesen ...

Antwort auf Beitrag Nr.: 58.238.097 von Boersiback am 17.07.18 22:57:34

-------------------------------------------------

Glueckwunsch ! Was gibts da zu meckern , beste Handelsstrategie nach all meinen Erfahrungswerten sind Teilverkäufe in steigende Kurse ... die Bye ans Hold Strategie geht viel zu oft in die Hose .

Ihr alle habts hier mit Plateau jedenfalls besser gemacht als ich . Hab blöderweise an das Ding nicht geglaubt, als sie plötzlich mit dem Li-Projekt kamen und der Kurs anzog . Bin 20017 raus , ärger mich jedesmal, wenn ich das seh . Also freut Euch , wenn Ihr dabei wart oder noch seid und wenn Ihr SICHERHEITSHALBER schonmal Gewinne beiseite geschafft habt ... der Rueckschlag kommt , das ist Börsengesetz , spätestens wenns ans "Eingemachte" geht.

Zitat von Boersiback: meine teilverkäuft bei 0,60 cad und 1,30 cad waren auch nicht so gut

-------------------------------------------------

Glueckwunsch ! Was gibts da zu meckern , beste Handelsstrategie nach all meinen Erfahrungswerten sind Teilverkäufe in steigende Kurse ... die Bye ans Hold Strategie geht viel zu oft in die Hose .

Ihr alle habts hier mit Plateau jedenfalls besser gemacht als ich . Hab blöderweise an das Ding nicht geglaubt, als sie plötzlich mit dem Li-Projekt kamen und der Kurs anzog . Bin 20017 raus , ärger mich jedesmal, wenn ich das seh . Also freut Euch , wenn Ihr dabei wart oder noch seid und wenn Ihr SICHERHEITSHALBER schonmal Gewinne beiseite geschafft habt ... der Rueckschlag kommt , das ist Börsengesetz , spätestens wenns ans "Eingemachte" geht.

Antwort auf Beitrag Nr.: 58.238.349 von winni2 am 17.07.18 23:51:14klar, man darf auch nicht zurückschauen.

lange halten kann man in dem sektor im allgemeinen sowieso wenig... vor allem dann nicht wenn es im marktfokus ist.

von daher erstaunlich wie stark PLU immer noch ist (obwohl sie schon wirklich klasse sind, aber der sektor wird ja derzeit ziemlich verachtet)

lange halten kann man in dem sektor im allgemeinen sowieso wenig... vor allem dann nicht wenn es im marktfokus ist.

von daher erstaunlich wie stark PLU immer noch ist (obwohl sie schon wirklich klasse sind, aber der sektor wird ja derzeit ziemlich verachtet)

Antwort auf Beitrag Nr.: 58.238.406 von Boersiback am 18.07.18 00:12:38Du hast doch wie ich sehr viele Werte im Depot. Ich tu mich auch schwer, Aktien rauszuschmeissen, weil ich nachher im Minenforum, das ich täglich durchlese, alte Werte immer wieder sehe ohne es zu wollen. Manchmal würde ich mir eine Funktion auf w-o wünschen, mit der man unerwünschte Threads ausblenden kann.

Der Chart von Pleateau ist super. Ich lass die weiterlaufen.

Der Chart von Pleateau ist super. Ich lass die weiterlaufen.

TORONTO, ONTARIO -- (GlobeNewswire – July 18, 2018)

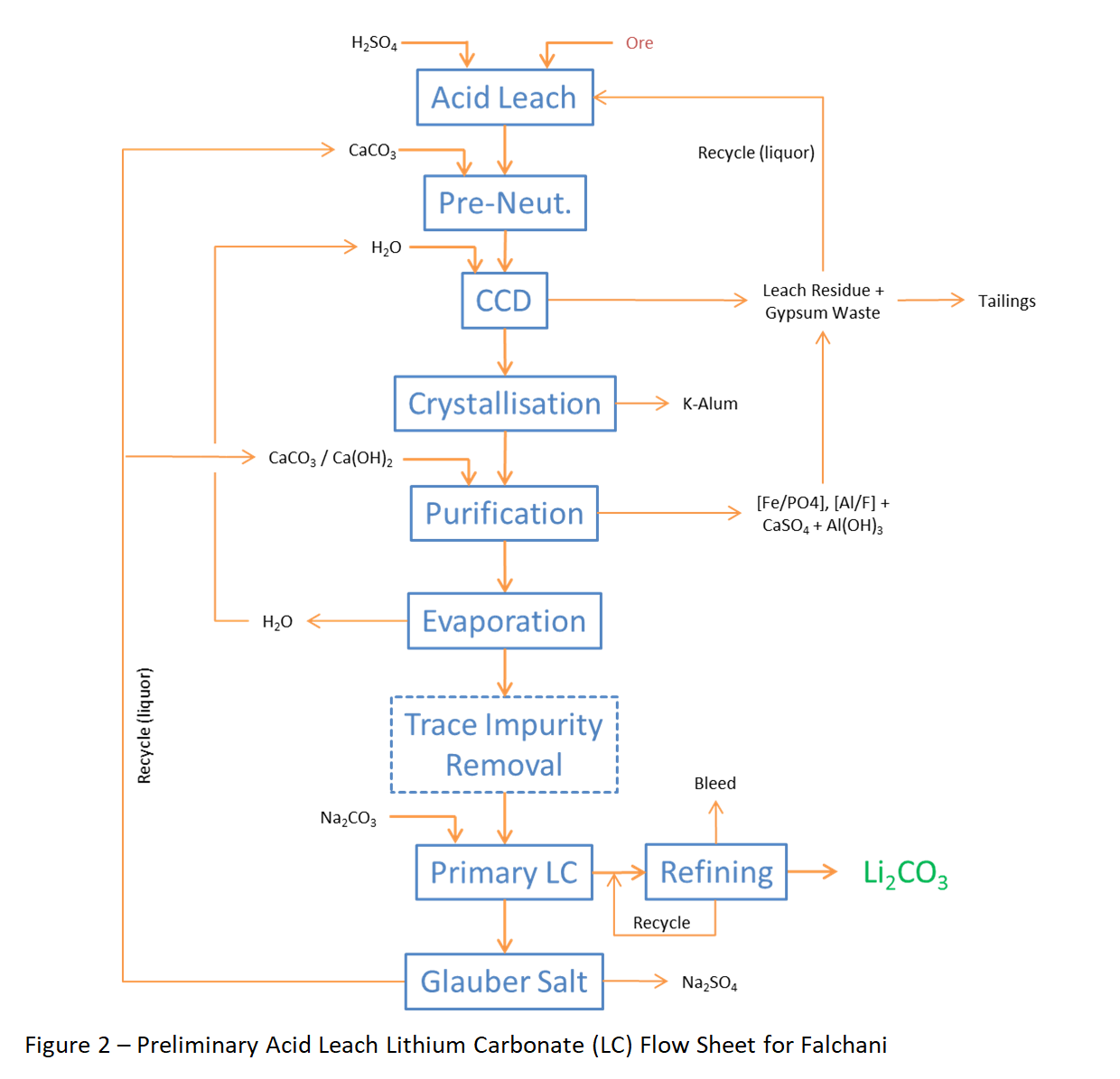

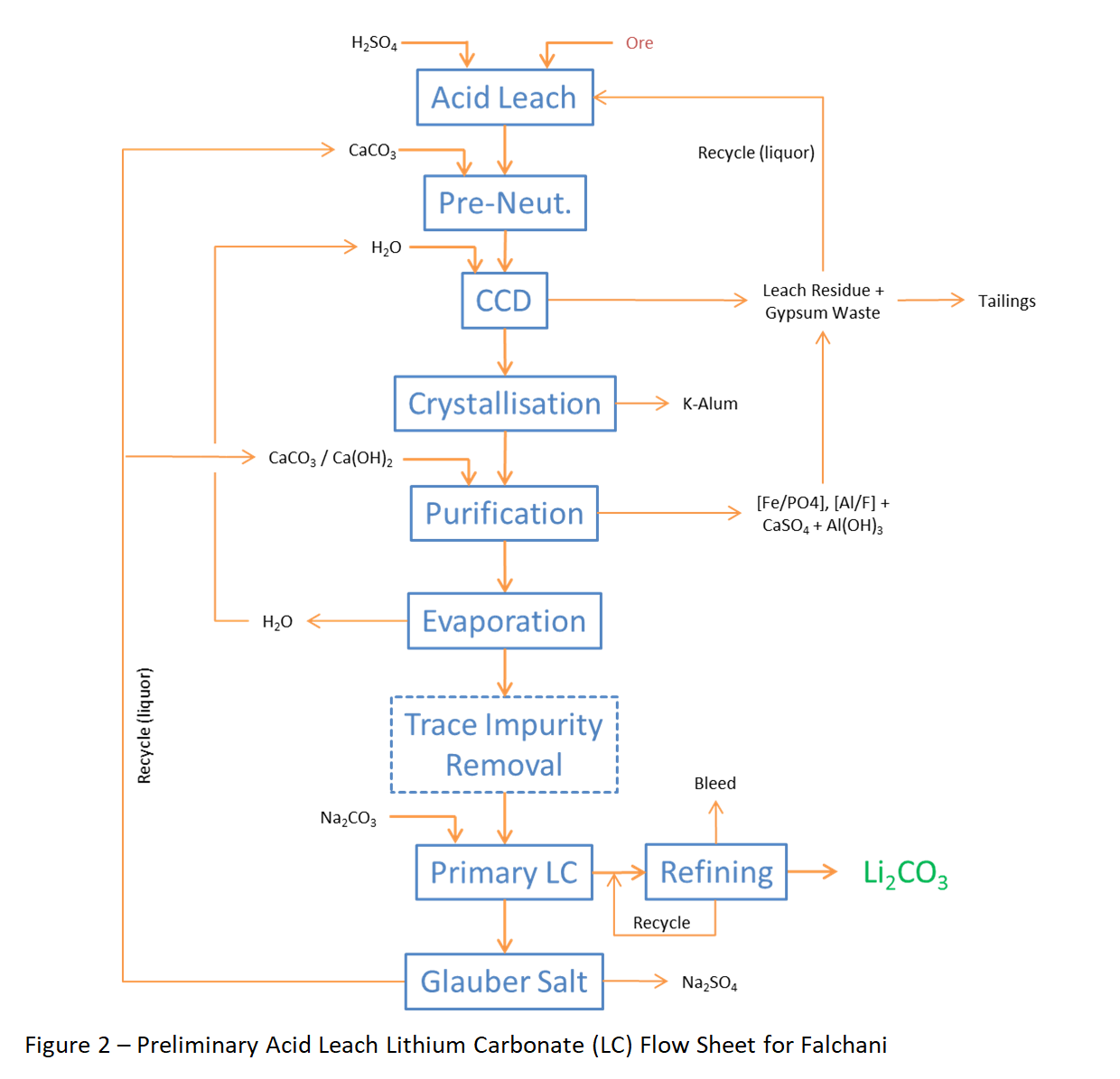

Plateau Energy Metals Inc. a lithium and uranium exploration and development company, is pleased to provide final results from the initial metallurgical test work program undertaken by ANSTO Minerals (a division of the Australian Nuclear Science and Technology Organisation) processing laboratories in Sydney, Australia. The test work was completed on representative lithium-rich tuff samples collected from outcrop trenches at the Falchani discovery on the Company’s Macusani Plateau lithium/uranium project in southeastern Peru.

The test work forms part of the Company's continuing efforts to unlock value from the Falchani high-grade lithium discovery and demonstrates successful ‘proof of concept’ precipitation of battery grade lithium carbonate product employing an approach which involves simple atmospheric acid leaching of the lithium-rich tuff feed material followed by conventional lithium processing steps.

ANSTO Minerals Test Work Results

• ANSTO Minerals has successfully completed a scoping study taking a sample of lithium-rich tuff, provided by PLU from the Falchani deposit in Peru, through to a battery grade lithium carbonate product. (Link to Figure 1 – Image of PLU Li2CO3 Product)

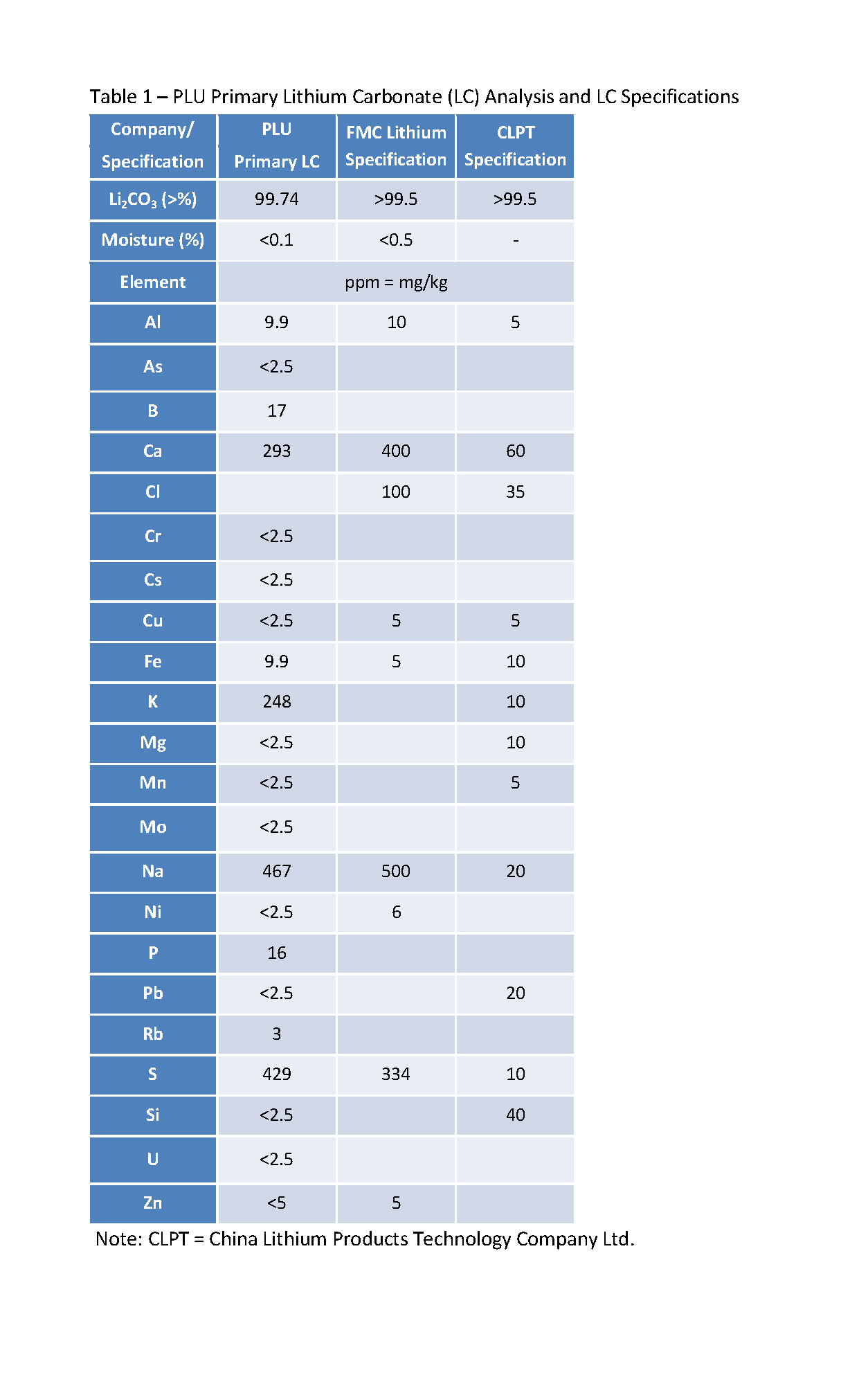

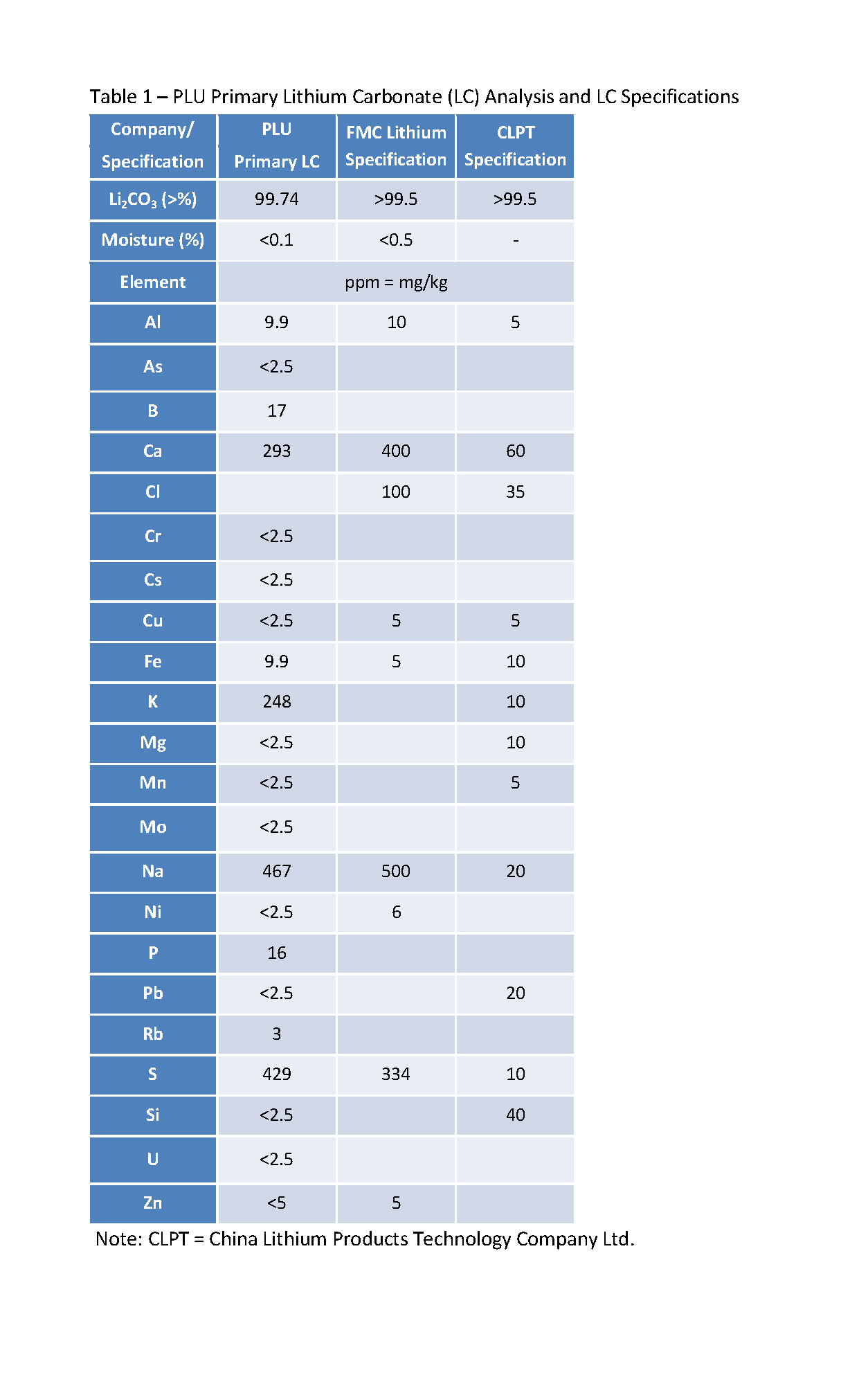

• Lithium Carbonate purity was reported at 99.73% from Primary LC precipitation before final refining

• Primary Lithium Carbonate product compares favourably with Industry Specifications (Link to Table 1 – PLU Primary Lithium Carbonate (LC) Analysis and LC Specifications). Final Refining expected to remove any elements that are ‘near-spec’ limits (ex. Ca, K, Na, S)

• Starting with an atmospheric sulfuric acid leach, then after 12 hours in the bulk leach, downstream processing and purification was completed as per the flowsheet previously recommended by ANSTO Minerals.

• The approach successfully employed conventional lithium processing steps to produce battery grade product at the primary lithium carbonate precipitation step without any additional refining steps. (Link to Figure 2– Preliminary Acid Leach Lithium Carbonate (LC) Flow Sheet for Falchani)

• This demonstrates the “proof of concept” required for the production of lithium carbonate from the Falchani deposit.

• The next step is to further develop the flowsheet and associated economic parameters for Li production to the requirements of a PEA level study.

Ian Stalker, the Interim CEO of Plateau Energy Metals, commented: “These are excellent results for Plateau Energy Metals. This preliminary metallurgical investigation work, completed at the well-known and highly respected laboratories at ANSTO Minerals, confirms that battery grade quality Lithium Carbonate can be produced from our Falchani ‘high-grade’ lithium feed material. It is important to note that these first pass test results did not highlight any major concerns in the delivery of a quality, final product. The process flow sheet ANSTO followed used the simple sulfuric acid leach approach and employed conventional lithium processing steps.

The next step for PLU is commencing a Preliminary Economic Assessment Study (PEA) to better understand the economic background behind this preliminary result. We intend to commence this ‘Study’ this quarter.

PLU is also busy completing our NI 43-101 Mineral Resource Estimate for our Falchani discovery and expect to release this shortly. The Resource Estimate will include a Maiden Resource for our high-grade Falchani Lithium discovery and also a separate resource estimate for the uranium mineralization discovered during this recent drill program.

Plateau Energy Metals Inc. a lithium and uranium exploration and development company, is pleased to provide final results from the initial metallurgical test work program undertaken by ANSTO Minerals (a division of the Australian Nuclear Science and Technology Organisation) processing laboratories in Sydney, Australia. The test work was completed on representative lithium-rich tuff samples collected from outcrop trenches at the Falchani discovery on the Company’s Macusani Plateau lithium/uranium project in southeastern Peru.

The test work forms part of the Company's continuing efforts to unlock value from the Falchani high-grade lithium discovery and demonstrates successful ‘proof of concept’ precipitation of battery grade lithium carbonate product employing an approach which involves simple atmospheric acid leaching of the lithium-rich tuff feed material followed by conventional lithium processing steps.

ANSTO Minerals Test Work Results

• ANSTO Minerals has successfully completed a scoping study taking a sample of lithium-rich tuff, provided by PLU from the Falchani deposit in Peru, through to a battery grade lithium carbonate product. (Link to Figure 1 – Image of PLU Li2CO3 Product)

• Lithium Carbonate purity was reported at 99.73% from Primary LC precipitation before final refining

• Primary Lithium Carbonate product compares favourably with Industry Specifications (Link to Table 1 – PLU Primary Lithium Carbonate (LC) Analysis and LC Specifications). Final Refining expected to remove any elements that are ‘near-spec’ limits (ex. Ca, K, Na, S)

• Starting with an atmospheric sulfuric acid leach, then after 12 hours in the bulk leach, downstream processing and purification was completed as per the flowsheet previously recommended by ANSTO Minerals.

• The approach successfully employed conventional lithium processing steps to produce battery grade product at the primary lithium carbonate precipitation step without any additional refining steps. (Link to Figure 2– Preliminary Acid Leach Lithium Carbonate (LC) Flow Sheet for Falchani)

• This demonstrates the “proof of concept” required for the production of lithium carbonate from the Falchani deposit.

• The next step is to further develop the flowsheet and associated economic parameters for Li production to the requirements of a PEA level study.

Ian Stalker, the Interim CEO of Plateau Energy Metals, commented: “These are excellent results for Plateau Energy Metals. This preliminary metallurgical investigation work, completed at the well-known and highly respected laboratories at ANSTO Minerals, confirms that battery grade quality Lithium Carbonate can be produced from our Falchani ‘high-grade’ lithium feed material. It is important to note that these first pass test results did not highlight any major concerns in the delivery of a quality, final product. The process flow sheet ANSTO followed used the simple sulfuric acid leach approach and employed conventional lithium processing steps.

The next step for PLU is commencing a Preliminary Economic Assessment Study (PEA) to better understand the economic background behind this preliminary result. We intend to commence this ‘Study’ this quarter.

PLU is also busy completing our NI 43-101 Mineral Resource Estimate for our Falchani discovery and expect to release this shortly. The Resource Estimate will include a Maiden Resource for our high-grade Falchani Lithium discovery and also a separate resource estimate for the uranium mineralization discovered during this recent drill program.

Beitrag aus Stockhouse (dem ich mich anschließen kann):

I'd be very interested to see what they come up with for the U308 resources. The Li resource as someone mentioned already will be about 2.5 mt LiCO3 for 25% of the area drilled.

If they can find a decent amount of 500-600ppm U at/near surface, that will really make a difference to the economics of the already robust U308 project, which is what I'm really interested in. As far as I can gather, after the first platform, thye've focussed on drilling the Li resource and kind of neglected the U. And that first platform has some really exciting U grades and widths!

But this Li processing news is awesome though, better than I expected really. To be able to achieve that level of purity after just a first pass assay without refining is very impressive. To put this in context, true battery grade LiCO3 does not sell for 12K/tonne. It is more like 18k/tonne. 12k/tonne is the LiCO3 the brine producers produce, which is not all that pure and requires further refining. The hard rock producers in oz don't produce Li, they export spodumene, which the chinese then refine. Next step is to prove they can do this from multiple samples throughout the resource to demonstrate consistent purity throughout the mine life, which is what the battery producers are really interested in.

I'd be very interested to see what they come up with for the U308 resources. The Li resource as someone mentioned already will be about 2.5 mt LiCO3 for 25% of the area drilled.

If they can find a decent amount of 500-600ppm U at/near surface, that will really make a difference to the economics of the already robust U308 project, which is what I'm really interested in. As far as I can gather, after the first platform, thye've focussed on drilling the Li resource and kind of neglected the U. And that first platform has some really exciting U grades and widths!

But this Li processing news is awesome though, better than I expected really. To be able to achieve that level of purity after just a first pass assay without refining is very impressive. To put this in context, true battery grade LiCO3 does not sell for 12K/tonne. It is more like 18k/tonne. 12k/tonne is the LiCO3 the brine producers produce, which is not all that pure and requires further refining. The hard rock producers in oz don't produce Li, they export spodumene, which the chinese then refine. Next step is to prove they can do this from multiple samples throughout the resource to demonstrate consistent purity throughout the mine life, which is what the battery producers are really interested in.

Dieser Artikel im spanischen Blatt "El Pais" könnte der Auslöser des heutigen Kursrutsches sein

(irgendwelche Felsenmalerei innerhalb des Konzessionsgebietes):

Macusani Yellowcake, Peruvian subsidiary to the Canadian mining company Plateau Energy Metals, announced on Monday the discovery of 2.5m tonnes of lithium at high grade and 124m lbs of uranium at its Falchani concession, in the Puno region in South Peru. Howver, in 2008 local authorities and the World Monuments Fund stopped the mining projects of radioactive material because the concession lies over more than 100 sites of rock paintings and petroglyphs that are over 5,000 years old."

"In 2005, the National Institute of Culture (Peru INC), today a ministry, declared the rock paintings of Corani and Macusani in the Carabaya province of Puno 'Cultural Patrimony of the Nation' after the initiative of Rainer Hostnig, an independent investigator who studied the art work between 2001 and 2008. Hostnig did so because the Peruvian State had awarded the Canadian mining company "Pacific" a concession of 30,000 heactares for the exploitation of uranium.

"The area under concession totally coincides with a zone that hosts the largest concentration of rock art in South-Eastern Peru, with the majority beloning to the era of hunter-gatherers", said Hostnig, quoting the regulation that was emitted by the rector of the institute. In 2011 the Ministry of Culture recognized the prehispanic archeological monument as Cultural Patrimony in the category "Archeological Cultural Land". The area covers more than 36,000 hectares at 4,500mabove sea level."

Originalquelle: https://elpais.com/economia/2018/07/17/actualidad/1531864592…

(irgendwelche Felsenmalerei innerhalb des Konzessionsgebietes):

Macusani Yellowcake, Peruvian subsidiary to the Canadian mining company Plateau Energy Metals, announced on Monday the discovery of 2.5m tonnes of lithium at high grade and 124m lbs of uranium at its Falchani concession, in the Puno region in South Peru. Howver, in 2008 local authorities and the World Monuments Fund stopped the mining projects of radioactive material because the concession lies over more than 100 sites of rock paintings and petroglyphs that are over 5,000 years old."

"In 2005, the National Institute of Culture (Peru INC), today a ministry, declared the rock paintings of Corani and Macusani in the Carabaya province of Puno 'Cultural Patrimony of the Nation' after the initiative of Rainer Hostnig, an independent investigator who studied the art work between 2001 and 2008. Hostnig did so because the Peruvian State had awarded the Canadian mining company "Pacific" a concession of 30,000 heactares for the exploitation of uranium.

"The area under concession totally coincides with a zone that hosts the largest concentration of rock art in South-Eastern Peru, with the majority beloning to the era of hunter-gatherers", said Hostnig, quoting the regulation that was emitted by the rector of the institute. In 2011 the Ministry of Culture recognized the prehispanic archeological monument as Cultural Patrimony in the category "Archeological Cultural Land". The area covers more than 36,000 hectares at 4,500mabove sea level."

Originalquelle: https://elpais.com/economia/2018/07/17/actualidad/1531864592…

naja dosto hatte auch mal nebenbei erwähnt er hätte PLU im Auge. aber nicht für steigende kurse!

sicherlich muss man nicht alles glauben und schon gar nicht gut finden was er so schreibt, aber ich bin hier auch immer noch skeptisch, ob die regierung verbindliche uranbergbauvorschriften zeitnah erlässt!

bei ceo.ca gehen die holzfäller voll auf die lithiumgeschichte ab. uran wird da von denen gar nicht so kritisch betrachtet.

sicherlich muss man nicht alles glauben und schon gar nicht gut finden was er so schreibt, aber ich bin hier auch immer noch skeptisch, ob die regierung verbindliche uranbergbauvorschriften zeitnah erlässt!

bei ceo.ca gehen die holzfäller voll auf die lithiumgeschichte ab. uran wird da von denen gar nicht so kritisch betrachtet.

naja der rückschlag ist normal... man weiss halt nie von wo nach wo.

ich hab nicht umsonst eingie bei 1,30 CAD verkauft... war aber zu früh. wir stehen immer noch drüber.

grundsätzlich wird jeder starke anstieg abverkauft, da trading. sehr selten dass etwas steil geht und danach seitwärts weiterläuft

ich hab nicht umsonst eingie bei 1,30 CAD verkauft... war aber zu früh. wir stehen immer noch drüber.

grundsätzlich wird jeder starke anstieg abverkauft, da trading. sehr selten dass etwas steil geht und danach seitwärts weiterläuft

Plateau Energy Metals Announces Maiden Mineral Resource Estimate for Falchani Lithium Deposit

TORONTO, ONTARIO --(GlobeNewswire–July24, 2018) –Plateau Energy Metals Inc., a lithium and uranium exploration and development company,is pleased to announce a maiden Lithium Mineral Resource estimate for the Falchani Projectlocated on the Macusani Plateau in the Puno District of southeastern Peru. The estimate was prepared by The Mineral Corporationof South Africa and the NI 43-101 Technical Report in support of the estimate will be filed on SEDAR within 45 days. Also, the Company is pleased to provide clarity on Areas of Cultural and Archeological Significance in the vicinity of the project.

Highlights of Lithium Mineral Resource Estimates by Category

The consolidated Mineral Resource estimates, based on a 0.1% Li2O cut-off grade are as follows:

A. Within the Li-rich tuff sequence, only:

Indicated Mineral Resources:34.82Mt at 0.73% Li2Ocontaining 0.63Mt Li2CO3(equivalent)

Inferred Mineral Resources:77.80Mtat 0.73% Li2Ocontaining 1.41Mt Li2CO3(equivalent)

B. Within the wider Li-rich package including the upper and lower breccia units:

Indicated Mineral Resources:40.58Mt at 0.67% Li2Ocontaining 0.67Mt Li2CO3(equivalent)

Inferred Mineral Resources:121.70Mt at 0.59% Li2O containing 1.76Mt Li2CO3(equivalent)

The footprint of the drilled, mapped and surface sampled Li-rich tuff unit extends up to 1,700 m (N-S) and 2,200 m (E-W)

The maiden resource estimate is based on drilling that covers an area of 1,250 m (N-S) and 350 to 500 m (E-W) representing approximately 20% of the potential deposit area.

The consistency of the Li grades over the wide intersections washighlighted by the Mineral Resource Consultant

Drilling continues at site to define additionalMineral Resources

Clarification on Areas of Archeological Significance

The Company, and its predecessor companies,have been exploring continuously in the Macusani area since their initial land acquisition in 2005.All exploration activities are completed under fully approved social and exploration/mining permits,which remain in effect today. The local Corani-Macusani Area of Cultural and Archeological Significance is very clearly defined and well-known to people working in the region. (See:Figure 2-PLU Project Location Map with Archeological Area of Interest). More significant for the Company is that the new Falchani discovery area and lithium depositlies outside of the Area of Cultural and Archeological Significance. Archeological studies completed as part of our exploration program permitting and recent Environmental Impact Assessment study work has shown that to date, there are no sites of cultural or archeological significance affecting Falchani. The local landscape, landforms, higher elevation and rock weathering style at Falchani was not conducive for hosting, or preservation of, sites of archeological significance. The Company’s existing uranium depositsare located within the Area of Cultural and Archeological Significance, but are not directly affected by any such sites. The Company is working with highly respected and experienced environmental and archeological consultants, local communities and Peruvian

authorities to develop a plan toprotectany sites located inproximity toproposed future project infrastructure.

TORONTO, ONTARIO --(GlobeNewswire–July24, 2018) –Plateau Energy Metals Inc., a lithium and uranium exploration and development company,is pleased to announce a maiden Lithium Mineral Resource estimate for the Falchani Projectlocated on the Macusani Plateau in the Puno District of southeastern Peru. The estimate was prepared by The Mineral Corporationof South Africa and the NI 43-101 Technical Report in support of the estimate will be filed on SEDAR within 45 days. Also, the Company is pleased to provide clarity on Areas of Cultural and Archeological Significance in the vicinity of the project.

Highlights of Lithium Mineral Resource Estimates by Category

The consolidated Mineral Resource estimates, based on a 0.1% Li2O cut-off grade are as follows:

A. Within the Li-rich tuff sequence, only:

Indicated Mineral Resources:34.82Mt at 0.73% Li2Ocontaining 0.63Mt Li2CO3(equivalent)

Inferred Mineral Resources:77.80Mtat 0.73% Li2Ocontaining 1.41Mt Li2CO3(equivalent)

B. Within the wider Li-rich package including the upper and lower breccia units:

Indicated Mineral Resources:40.58Mt at 0.67% Li2Ocontaining 0.67Mt Li2CO3(equivalent)

Inferred Mineral Resources:121.70Mt at 0.59% Li2O containing 1.76Mt Li2CO3(equivalent)

The footprint of the drilled, mapped and surface sampled Li-rich tuff unit extends up to 1,700 m (N-S) and 2,200 m (E-W)

The maiden resource estimate is based on drilling that covers an area of 1,250 m (N-S) and 350 to 500 m (E-W) representing approximately 20% of the potential deposit area.

The consistency of the Li grades over the wide intersections washighlighted by the Mineral Resource Consultant

Drilling continues at site to define additionalMineral Resources

Clarification on Areas of Archeological Significance

The Company, and its predecessor companies,have been exploring continuously in the Macusani area since their initial land acquisition in 2005.All exploration activities are completed under fully approved social and exploration/mining permits,which remain in effect today. The local Corani-Macusani Area of Cultural and Archeological Significance is very clearly defined and well-known to people working in the region. (See:Figure 2-PLU Project Location Map with Archeological Area of Interest). More significant for the Company is that the new Falchani discovery area and lithium depositlies outside of the Area of Cultural and Archeological Significance. Archeological studies completed as part of our exploration program permitting and recent Environmental Impact Assessment study work has shown that to date, there are no sites of cultural or archeological significance affecting Falchani. The local landscape, landforms, higher elevation and rock weathering style at Falchani was not conducive for hosting, or preservation of, sites of archeological significance. The Company’s existing uranium depositsare located within the Area of Cultural and Archeological Significance, but are not directly affected by any such sites. The Company is working with highly respected and experienced environmental and archeological consultants, local communities and Peruvian

authorities to develop a plan toprotectany sites located inproximity toproposed future project infrastructure.

Plateau Reaches New Heights on Lithium Windfall at Falchani

7/25/2018 By: Malcolm Shaw

It's been a while since I've said much about Plateau Energy Metals (previously Plateau Uranium, PLU.V, last at $1.35), but the name change says a lot about what's transpired here. While a lot of junior companies constantly re-invent themselves to chase the next "hot" commodity in a new area, Plateau had the good fortune of having a new "energy metal" (lithium) fall into its lap right in its own backyard. The Falchani deposit consists of a lithium-rich tuff (extrusive volcanic rock) that accumulated over a large area in which the lithium was trapped over millennia of hydrologic activity. In a practical sense, it appears to be laterally continuous, good grade (0.6-0.7% lithium oxide), and seems to be amenable to open pit mining methods and standard recovery processes.

And it looks like Falchani is big. With widely spaced drilling to date covering only about 20% of the prospective area, Falchani's inferred resource is already well over 100 million tonnes at a grade of 0.6-0.7% Li2O. That translates into about 2-2.5 million tonnes of lithium carbonate which is already enough to keep a good-sized open-pit operation of 50,000 t of Li2CO3 going for 40-50 years. I was looking around for a decent market comparable in terms of the potential economic value of the asset and I came across Lithium America's Thacker Pass project in Nevada. While the Thacker Pass is claystone hosted, Falchani is in a tuff (extrusive volcanic), and as a result I suspect that the Falchani rock will make for a more simple overall operation, even if the terrain is more complex in the greater Falchani area. The deposits are both flat lying though, close to surface, and of comparable scale and grade. There certainly are deposits with higher grades (e.g., Nemaska Lithium, NMX.TO, Critical Elements (CRE.V), but Falchani's tonnage potential makes it stand out as one of the biggest hard-rock lithium deposits out there. That big tonnage potential might make all the difference in a major mining company's interest level in the project, so I'll we watching closely to see what the next move is from a corporate standpoint. If things are handled properly, there may be a multi-bagger on the table here.

For Peru, the asset would put the country on the lithium stage globally and deposits like this are hard to come by in regions that also have highways, labour, water, and power all easily accessible. On that basis, I see a lithium project as an easy sell from a permitting and financing perspective and Peru is a great place to export from. Despite some recent reports regarding the potential for archeological sites in the region that briefly took the shares down about 20%, I would point out that Plateau has been operating in the area for more than a decade and is quite familiar with areas of potential cultural significance. I have to think that any archeological review could be conducted and concluded relatively quickly, but this will be a topic that management will address as part of the permitting process. It comes with the territory, so to speak.

There are some very sharp tacks behind this story now and I suspect some CA's will be signed here soon, if not already, by majors wanting to have a closer look at what Plateau has found at Falchani. Of course there's an extra "side project" of around 100 million pounds of low-cost uranium on the table as well, but that's for another day. Plateau has certainly earned its "Energy Metals" moniker with the Falchani resource estimate that was released yesterday. Now it's just a matter of seeing who's paying attention and how management carries the ball. Next stop: China? Korea? India? Time will tell.

Quelle: http://hydracapital.ca/hydra-blog.html

7/25/2018 By: Malcolm Shaw

It's been a while since I've said much about Plateau Energy Metals (previously Plateau Uranium, PLU.V, last at $1.35), but the name change says a lot about what's transpired here. While a lot of junior companies constantly re-invent themselves to chase the next "hot" commodity in a new area, Plateau had the good fortune of having a new "energy metal" (lithium) fall into its lap right in its own backyard. The Falchani deposit consists of a lithium-rich tuff (extrusive volcanic rock) that accumulated over a large area in which the lithium was trapped over millennia of hydrologic activity. In a practical sense, it appears to be laterally continuous, good grade (0.6-0.7% lithium oxide), and seems to be amenable to open pit mining methods and standard recovery processes.

And it looks like Falchani is big. With widely spaced drilling to date covering only about 20% of the prospective area, Falchani's inferred resource is already well over 100 million tonnes at a grade of 0.6-0.7% Li2O. That translates into about 2-2.5 million tonnes of lithium carbonate which is already enough to keep a good-sized open-pit operation of 50,000 t of Li2CO3 going for 40-50 years. I was looking around for a decent market comparable in terms of the potential economic value of the asset and I came across Lithium America's Thacker Pass project in Nevada. While the Thacker Pass is claystone hosted, Falchani is in a tuff (extrusive volcanic), and as a result I suspect that the Falchani rock will make for a more simple overall operation, even if the terrain is more complex in the greater Falchani area. The deposits are both flat lying though, close to surface, and of comparable scale and grade. There certainly are deposits with higher grades (e.g., Nemaska Lithium, NMX.TO, Critical Elements (CRE.V), but Falchani's tonnage potential makes it stand out as one of the biggest hard-rock lithium deposits out there. That big tonnage potential might make all the difference in a major mining company's interest level in the project, so I'll we watching closely to see what the next move is from a corporate standpoint. If things are handled properly, there may be a multi-bagger on the table here.

For Peru, the asset would put the country on the lithium stage globally and deposits like this are hard to come by in regions that also have highways, labour, water, and power all easily accessible. On that basis, I see a lithium project as an easy sell from a permitting and financing perspective and Peru is a great place to export from. Despite some recent reports regarding the potential for archeological sites in the region that briefly took the shares down about 20%, I would point out that Plateau has been operating in the area for more than a decade and is quite familiar with areas of potential cultural significance. I have to think that any archeological review could be conducted and concluded relatively quickly, but this will be a topic that management will address as part of the permitting process. It comes with the territory, so to speak.

There are some very sharp tacks behind this story now and I suspect some CA's will be signed here soon, if not already, by majors wanting to have a closer look at what Plateau has found at Falchani. Of course there's an extra "side project" of around 100 million pounds of low-cost uranium on the table as well, but that's for another day. Plateau has certainly earned its "Energy Metals" moniker with the Falchani resource estimate that was released yesterday. Now it's just a matter of seeing who's paying attention and how management carries the ball. Next stop: China? Korea? India? Time will tell.

Quelle: http://hydracapital.ca/hydra-blog.html

Jede Korrektur scheint hier eine Kaufgelegenheit zu sein. Das zeigt sich heute wieder. Nachdem der Kurs nur ein paar Tageheftig korrigierte, knallt der heute zum Schluss auf Tageshoch bei 1,55 CAD.

Ich habe bei PLU alles richtig gemacht lol ..

EK 0,25 CAD nach Höhenflug auf 0,65 CAD zu 0,27 CAD verkauft wegen Uranmisere und Placement.

Dafür dann Cordoba Minerals gekauft ... Anstatt +600% einfach mal Minus 80% .

Mal als abschreckendes Beispiel.. Bissl Gewinn mitnehmen schadet nie .

Wenn die jetzt noch Uran genehmigt bekommen sollten oder irgendwann mal Gerüchte aufkommen sollten das Peru Uran erlaubt .. Dann gehts hier wohl weiter richtigt steil gen Norden.

EK 0,25 CAD nach Höhenflug auf 0,65 CAD zu 0,27 CAD verkauft wegen Uranmisere und Placement.

Dafür dann Cordoba Minerals gekauft ... Anstatt +600% einfach mal Minus 80% .

Mal als abschreckendes Beispiel.. Bissl Gewinn mitnehmen schadet nie .

Wenn die jetzt noch Uran genehmigt bekommen sollten oder irgendwann mal Gerüchte aufkommen sollten das Peru Uran erlaubt .. Dann gehts hier wohl weiter richtigt steil gen Norden.

Antwort auf Beitrag Nr.: 58.345.707 von Szween am 31.07.18 22:31:22Cordoba ist schon ein trauerspiel geworden. bin da längst weg mit verlusten.

so ganz kapier ich hier und da den kursverlauf nicht.

kupfer/basismetallexplorer sind schon in summe sehr stark eingebrochen.

aber deswegen find ich die kategorie jetzt am interessantesten

heut mal paar fireweeds nachgekauft.

so ganz kapier ich hier und da den kursverlauf nicht.

kupfer/basismetallexplorer sind schon in summe sehr stark eingebrochen.

aber deswegen find ich die kategorie jetzt am interessantesten

heut mal paar fireweeds nachgekauft.

Otto IKN hat da so ne Theorie , wie es halt öfter läuft bei Friedland.

Er hat sich nun eingedeckt schon mal recht günstig . Nun müssen seine Freunde wie Rick Rule und Konsorten noch günstig weitere shares bekommen beim nächsten Placement im Pennybereich und dann fährt er das Ding wieder hoch .

Er hat sich nun eingedeckt schon mal recht günstig . Nun müssen seine Freunde wie Rick Rule und Konsorten noch günstig weitere shares bekommen beim nächsten Placement im Pennybereich und dann fährt er das Ding wieder hoch .

Btw waren sogar 0,28 CAD die ich am 10.10.17 für PLU bekommen hatte .

Shame on me

Shame on me

Antwort auf Beitrag Nr.: 58.345.902 von Szween am 31.07.18 23:04:27könnte man vermuten...

wobei der laden ganz schön verwässert hat und bei 16,5 CAD-cents immer noch >30 Mios CAD wert ist... was haben die eigentlich angestellt mit der kohle ??

von großen treffern hab ich nix mitbekommen... der markt wohl auch nicht.

da ist aston bay noch billiger... und da dürften im september erste bohrergebnisse anstehen in etwa. bei historie und "visible copper" müsste sich ihr star-geologe schon recht dumm anstellen wenn da nix rumkommt.

wobei der laden ganz schön verwässert hat und bei 16,5 CAD-cents immer noch >30 Mios CAD wert ist... was haben die eigentlich angestellt mit der kohle ??

von großen treffern hab ich nix mitbekommen... der markt wohl auch nicht.

da ist aston bay noch billiger... und da dürften im september erste bohrergebnisse anstehen in etwa. bei historie und "visible copper" müsste sich ihr star-geologe schon recht dumm anstellen wenn da nix rumkommt.

Jo kommt nen Resplit... Das Ding gehört ja eh zu 73% Friedland mitlerweile .

Der CEO ist halt ne Marionette .. Bissl visible Gold und schwups drehen alle durch wie bei Novo auch .

Der CEO ist halt ne Marionette .. Bissl visible Gold und schwups drehen alle durch wie bei Novo auch .

Starker Wochenausklang. Korrektur schon wieder beendet. Nächste Woche neue Hochs.

so rest verkauft zu 1,04 CAD

chart sagt 0,9

zu viel lithium.....

grad ein dutzend werte geschmissen

chart sagt 0,9

zu viel lithium.....

grad ein dutzend werte geschmissen

Antwort auf Beitrag Nr.: 58.454.494 von Boersiback am 15.08.18 16:09:41und schwups antwortet chart mit 0,91

wer bock auf harakiri hat darf jetzt wieder kaufen

ich schone mein herz aber erstmal

wer bock auf harakiri hat darf jetzt wieder kaufen

ich schone mein herz aber erstmal

energy fuels auch vertickt... auch da schöne gewinne.

ich glaube nach branchen betrachtet war ich bisher im uransektor am besten.

i love it... nächste chance abwarten.

momentan ist der allgemeine rohstoffsog zu steil nach unten und die miner kriegens jetzt voll ab

ich glaube nach branchen betrachtet war ich bisher im uransektor am besten.

i love it... nächste chance abwarten.

momentan ist der allgemeine rohstoffsog zu steil nach unten und die miner kriegens jetzt voll ab

gedreht von knapp unter 0,90 CAD

auch das perfekte charttechnik, die hier sehr ausschlaggebend sein wird aufs längere

alles andere ist sekundär.

allerdings reichen meine charttechnischen kenntnisse nicht aus um von hier eine weitere prognose abzugeben

gibts keine techniker im thread ?

auch das perfekte charttechnik, die hier sehr ausschlaggebend sein wird aufs längere

alles andere ist sekundär.

allerdings reichen meine charttechnischen kenntnisse nicht aus um von hier eine weitere prognose abzugeben

gibts keine techniker im thread ?

na schön wär´s....

marktkap 76 Mios CAD im grunde ein witz beim vorhandenen

(Denison z.B. 450 Mios CAD bewertet. halte ich grob für vergleichbar)

marktkap 76 Mios CAD im grunde ein witz beim vorhandenen

(Denison z.B. 450 Mios CAD bewertet. halte ich grob für vergleichbar)

Antwort auf Beitrag Nr.: 58.798.835 von Popeye82 am 26.09.18 00:18:13Und Eines Was ich Allen empfehle.

Wenn Das in (4,5 Monaten?) kommt: Setzt DAVOR Einen STOP.

Die Hoffnungen sind nat Andere, Aber sollte Die Negativ ausfallen, kanns denke ich auch richtig heftig ins "Unter"geschoss gehen.

Mir Wurscht Was Andere machen, aber EInmal der KLARE Hinweis.

Ich habe.

Über EK, Kohle abgeben tue ich Hier nicht mehr.

Wenn Das in (4,5 Monaten?) kommt: Setzt DAVOR Einen STOP.

Die Hoffnungen sind nat Andere, Aber sollte Die Negativ ausfallen, kanns denke ich auch richtig heftig ins "Unter"geschoss gehen.

Mir Wurscht Was Andere machen, aber EInmal der KLARE Hinweis.

Ich habe.

Über EK, Kohle abgeben tue ich Hier nicht mehr.

https://globenewswire.com/news-release/2018/10/10/1619327/0/…

kann dies der grund sein, weshalb der kurs nochmal um 15% nachgibt, nachdem er eh schon ziemlich zurückgekommen war.

kann dies der grund sein, weshalb der kurs nochmal um 15% nachgibt, nachdem er eh schon ziemlich zurückgekommen war.

Antwort auf Beitrag Nr.: 58.919.628 von jomic am 10.10.18 18:01:13klar, KE zu 0,95 CAD

ich auch eben grad zu 0,95 CAD aufgestockt

immer auf KE´s oder verzöherungen und schlechte marktstimmung warten beim zukaufen

ich auch eben grad zu 0,95 CAD aufgestockt

immer auf KE´s oder verzöherungen und schlechte marktstimmung warten beim zukaufen

Antwort auf Beitrag Nr.: 58.919.628 von jomic am 10.10.18 18:01:13KE ist voll OK in Meinen Augen.

ENTSCHEIDENDE Faktoren sind ganz, ganz Andere Sachen.

Nicht nur aber in Erster Linie Abbauerlaubnis.

Lasst Schreiben 583 nicht aus den Augen.

ENTSCHEIDENDE Faktoren sind ganz, ganz Andere Sachen.

Nicht nur aber in Erster Linie Abbauerlaubnis.

Lasst Schreiben 583 nicht aus den Augen.

Antwort auf Beitrag Nr.: 58.851.018 von Popeye82 am 02.10.18 12:18:08da vorher rauszukommen ist unmöglich.... da würde jede sekunde zählen.

auch wenn man dann nach tehoretischen 60% tagesverlust immer noch verkaufen sollte beim negativen entscheid, auch klar

auch wenn man dann nach tehoretischen 60% tagesverlust immer noch verkaufen sollte beim negativen entscheid, auch klar

Antwort auf Beitrag Nr.: 58.923.882 von Boersiback am 10.10.18 23:56:52Ist klar.

Wenn Die Entscheidung Jetzt, sagen Wir mal, ENDGÜLTIG negativ wäre, wirst Du nicht den "Erstbesten" Kurs kriegen.

Trotzdem, unter Meinen Kaufkurs sollte ich Hier nicht mehr rausgehen.

Die Hoffnung liegt natürlich, weiter, auf dem Upside.

Und da ist in Meinen Augen auch Eine >Mrd Bewertung absolut nicht undenkbar.

Und bei "Mrd" müsste nicht zwingend eine 1 Vorne heissen.

Aber, Was man sich klarmachen sollte, m.M.: Das "smart" Money Moneygiert oft ZIEMLICH, ZIEMLICH Anders. Als der "Normal"anleger.

Heisst: Die bwerten, Meiner Erfahrung, oft Viele Dinge, Ereignisse, ganz, ganz Anders.

Hat natürlich auch Viel mit Meilensteinen/Derisking zu tun.

Und in Dem Zusammenhang denk ich dass man Das bei Der Entscheidung wahrscheinlich deutlich sehen wird.

Wenn Die Entscheidung Jetzt, sagen Wir mal, ENDGÜLTIG negativ wäre, wirst Du nicht den "Erstbesten" Kurs kriegen.

Trotzdem, unter Meinen Kaufkurs sollte ich Hier nicht mehr rausgehen.

Die Hoffnung liegt natürlich, weiter, auf dem Upside.

Und da ist in Meinen Augen auch Eine >Mrd Bewertung absolut nicht undenkbar.

Und bei "Mrd" müsste nicht zwingend eine 1 Vorne heissen.

Aber, Was man sich klarmachen sollte, m.M.: Das "smart" Money Moneygiert oft ZIEMLICH, ZIEMLICH Anders. Als der "Normal"anleger.

Heisst: Die bwerten, Meiner Erfahrung, oft Viele Dinge, Ereignisse, ganz, ganz Anders.

Hat natürlich auch Viel mit Meilensteinen/Derisking zu tun.

Und in Dem Zusammenhang denk ich dass man Das bei Der Entscheidung wahrscheinlich deutlich sehen wird.

Antwort auf Beitrag Nr.: 58.923.957 von Popeye82 am 11.10.18 00:28:19ja, das schon...

stört mich aber alles nicht. KE auch ok... gibt am ende nur "kopf" oder "zahl".

ich denke sektorseitig her gesehen wenn ich mal "nur" uran nehme

droht uns nix allzu schlimmes wie eine allgemeine umbewertung nach unten.

dafür ist PLU ohnehin zu billig. am ende aber auch evtl. völlig wertlos.

ich hatte ja mal alle verkauft mit etwa 200% gewinn.

die posi ist nicht ganz so groß wie sie war nach dem gewinn.

evtl. riskier ich´s einfach mal ohne stop.

das problem beim stop ist halt immer abgefischt zu werden.

würd ich in der minute wo die entscheidung fällt vorm rechner sitzen,

dann würd ich im negativen fall ohne limit sofort verkaufen.

die chancenseite ist halt schon sehr sehr heftig...

20-bagger würd ich mal tippen inkl verwässerung.

abgsehen von ner kleinen wletwirtschaftskrise die uns alle noch gehörig ärgern

könnte... aber wenigstens ist die sektorbewertung eigentlich so tief insgesamt

gesehen wie 2008... nach dem crash. also von daher ->

(nee schon klar wenns richtig knallt sehen wir noch viel tiefere kurse allgemein)

stört mich aber alles nicht. KE auch ok... gibt am ende nur "kopf" oder "zahl".

ich denke sektorseitig her gesehen wenn ich mal "nur" uran nehme

droht uns nix allzu schlimmes wie eine allgemeine umbewertung nach unten.

dafür ist PLU ohnehin zu billig. am ende aber auch evtl. völlig wertlos.

ich hatte ja mal alle verkauft mit etwa 200% gewinn.

die posi ist nicht ganz so groß wie sie war nach dem gewinn.

evtl. riskier ich´s einfach mal ohne stop.

das problem beim stop ist halt immer abgefischt zu werden.

würd ich in der minute wo die entscheidung fällt vorm rechner sitzen,

dann würd ich im negativen fall ohne limit sofort verkaufen.

die chancenseite ist halt schon sehr sehr heftig...

20-bagger würd ich mal tippen inkl verwässerung.

abgsehen von ner kleinen wletwirtschaftskrise die uns alle noch gehörig ärgern

könnte... aber wenigstens ist die sektorbewertung eigentlich so tief insgesamt

gesehen wie 2008... nach dem crash. also von daher ->

(nee schon klar wenns richtig knallt sehen wir noch viel tiefere kurse allgemein)

Antwort auf Beitrag Nr.: 59.093.834 von Popeye82 am 30.10.18 13:44:13when you worry in Trouble: it get's DOUBLE.

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Seit Wochen keine Diskussion hier ? Story tot ? oder was ist hier los das die Aktie so abgestürzt ist ....?

Antwort auf Beitrag Nr.: 59.479.038 von Popeye82 am 20.12.18 13:33:15Tja nicht mal Popeye welche hier 2018 immer aktiv war, hat noch eine Meinung zu den Unternehmen ….schade, scheint wohl wirklich tot zu sein das Forum hier, oder ?

Antwort auf Beitrag Nr.: 59.949.067 von goldfinger69 am 24.02.19 12:25:12Das ist nicht wahr.

Aber für mit Dem Wind-Heuler mache ich Keinen Grossen Aufriss mehr.

Das sind Die nicht wert.

Aber für mit Dem Wind-Heuler mache ich Keinen Grossen Aufriss mehr.

Das sind Die nicht wert.

Antwort auf Beitrag Nr.: 60.060.590 von Popeye82 am 09.03.19 21:08:34"....He added that they are waiting for regulations on uranium, an element also present in Falchani.

......."

ich auch... bis das unklar ist, gibt´s für mich eigentlich auch nicht viel zu sagen hier.

bei einem "YES" dürfte man wieder rechnen.

man wird sehen.... oft wird erst abgelehnt wenn es wirklich drauf ankommt und vorher lässt man sie machen (oft gesehen so... Berkeley, Strateco wären beispiele)

......."

ich auch... bis das unklar ist, gibt´s für mich eigentlich auch nicht viel zu sagen hier.

bei einem "YES" dürfte man wieder rechnen.

man wird sehen.... oft wird erst abgelehnt wenn es wirklich drauf ankommt und vorher lässt man sie machen (oft gesehen so... Berkeley, Strateco wären beispiele)

Antwort auf Beitrag Nr.: 60.060.656 von Boersiback am 09.03.19 21:32:22 man wird sehen.... oft wird erst abgelehnt wenn es wirklich drauf ankommt und vorher lässt man sie machen (oft gesehen so... Berkeley, Strateco wären beispiele)

________________________________________________________________________________

Ja, kommt mit Meinen Erfahrungen, Gesehenem, roundabout auch so hin.

Also sicher, in Dem Bezug und generell, ist immer erst wenn Es im SACK ist.

Wenn Sie Es schaffen, Produzent zu werden, kann PLU m.E. Eine "Billion Dollar Company" werden.

"Ex" CAPEX, natürlich.

Und Das müsste, Vorne, nicht, zwingend, Eine "1stellige" Zahl sein.

Aber Die Abbaugenehmigung ist natürlich Einer der GANZ Zentralen Teile dabei.

________________________________________________________________________________

Ja, kommt mit Meinen Erfahrungen, Gesehenem, roundabout auch so hin.

Also sicher, in Dem Bezug und generell, ist immer erst wenn Es im SACK ist.

Wenn Sie Es schaffen, Produzent zu werden, kann PLU m.E. Eine "Billion Dollar Company" werden.

"Ex" CAPEX, natürlich.

Und Das müsste, Vorne, nicht, zwingend, Eine "1stellige" Zahl sein.

Aber Die Abbaugenehmigung ist natürlich Einer der GANZ Zentralen Teile dabei.

Dosto wird schon seine Finger im Spiel haben. Mich würde es insgesamt nicht wundern wenn's bei der Uranthematik böse ausgeht. Ich kann mir letztlich keinen Eindruck von der Stimmung machen weil ich niemanden im Lande(vor Ort) kenne.

Antwort auf Beitrag Nr.: 60.060.749 von sir_krisowaritschko am 09.03.19 21:48:23Also ich bin auch nicht sonderlich positiv zu Uran.

Lääängerfristig vielleicht iiiiirgendwann mal wieder.

Aber, vom Meiner Seite, ist das Kein setzen auf "Uran", sondern auf Ein BESTIMMTES Projekt.

Wie Die Entscheidung ausgeht: Keine Ahnung.

Wird man bald wohl mehr wissen.

Was ich "nur"; ziemlich sicher, weiss: Ist dass Die DECIDING ist.

Mit einer Erlaubnis ist man -noch- Kein "Producer",

aber Ohne wird man Es nie werden.

Lääängerfristig vielleicht iiiiirgendwann mal wieder.

Aber, vom Meiner Seite, ist das Kein setzen auf "Uran", sondern auf Ein BESTIMMTES Projekt.

Wie Die Entscheidung ausgeht: Keine Ahnung.

Wird man bald wohl mehr wissen.

Was ich "nur"; ziemlich sicher, weiss: Ist dass Die DECIDING ist.

Mit einer Erlaubnis ist man -noch- Kein "Producer",

aber Ohne wird man Es nie werden.

Antwort auf Beitrag Nr.: 60.060.656 von Boersiback am 09.03.19 21:32:22Wer zu "Peru" Bestimmte Punkte, Fragen hat,

Der kann Den Hier auch mal ansprechen:

http://stockhouse.com/members/juanperu

Hab Den gefragt, Der kommt von Da.

Ich will Den auch nochmal zu Ein "paar domestic" Sachen fragen.

Der kann Den Hier auch mal ansprechen:

http://stockhouse.com/members/juanperu

Hab Den gefragt, Der kommt von Da.

Ich will Den auch nochmal zu Ein "paar domestic" Sachen fragen.

Mar 8/19 Mar 6/19 Holmes, Alexander Direct Ownership Common Shares 10 - Acquisition in the public market 7,300 $0.670

Mar 6/19 Mar 5/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 25,250 $0.688

Mar 6/19 Mar 5/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 14,250 $0.700

Mar 5/19 Mar 4/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 35,750 $0.667

Mar 5/19 Mar 4/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 35,750 $0.667

Mar 4/19 Mar 1/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 39,000 $0.636

Mar 1/19 Feb 28/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 19,500 $0.650

Mar 1/19 Feb 27/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 20,000 $0.670

Feb 27/19 Feb 25/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 10,000 $0.670

Feb 27/19 Feb 25/19 Disbrow, Robert Control or Direction Common Shares 10 - Acquisition in the public market 10,000 $0.670

Mar 6/19 Mar 5/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 25,250 $0.688

Mar 6/19 Mar 5/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 14,250 $0.700

Mar 5/19 Mar 4/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 35,750 $0.667

Mar 5/19 Mar 4/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 35,750 $0.667

Mar 4/19 Mar 1/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 39,000 $0.636

Mar 1/19 Feb 28/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 19,500 $0.650

Mar 1/19 Feb 27/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 20,000 $0.670

Feb 27/19 Feb 25/19 Relling, Thomas Peter Max Control or Direction Common Shares 10 - Acquisition in the public market 10,000 $0.670

Feb 27/19 Feb 25/19 Disbrow, Robert Control or Direction Common Shares 10 - Acquisition in the public market 10,000 $0.670

Weiß jemand, ob da was dran ist?

Warum sollten sie so dumm sein, für 2 Jahre die Konzessionsgebühren nicht zu zahlen für ihr Projekt ...

On February 20th 2019, Peru's geological regulatory body INGEMMET, via its Presidential Resolution 0464, decreed that due to non-payment of concession fees in both 2017 and 2018 the wholly owned subsidiary of Plateau Energy Metals (PLU.v) would be stripped of 32 concessions from its flagship project in the Macusani region of Puno, Peru. What's more, one of the 32 concessions now stripped from the company is Ocacasa 4 which is 1000 hectares of the total 1,700 hectare zone of the property that contains its lithium resource.

This snafu rates highly in IKN's "Annals of Material Event Disclosure Failure." Frankly amazing that the company has tried to keep this under wraps.

Quelle: https://incakolanews.blogspot.com/2019/03/plateau-energy-met…

Warum sollten sie so dumm sein, für 2 Jahre die Konzessionsgebühren nicht zu zahlen für ihr Projekt ...

On February 20th 2019, Peru's geological regulatory body INGEMMET, via its Presidential Resolution 0464, decreed that due to non-payment of concession fees in both 2017 and 2018 the wholly owned subsidiary of Plateau Energy Metals (PLU.v) would be stripped of 32 concessions from its flagship project in the Macusani region of Puno, Peru. What's more, one of the 32 concessions now stripped from the company is Ocacasa 4 which is 1000 hectares of the total 1,700 hectare zone of the property that contains its lithium resource.

This snafu rates highly in IKN's "Annals of Material Event Disclosure Failure." Frankly amazing that the company has tried to keep this under wraps.

Quelle: https://incakolanews.blogspot.com/2019/03/plateau-energy-met…

Trading halt

Antwort auf Beitrag Nr.: 60.110.737 von mge am 15.03.19 13:53:14da ist nichts dran, deshalb wahrscheinlich auch der trading halt jetzt erstmal...

wieso soll das so sein... insider kaufen unsummen von aktien

wieso soll das so sein... insider kaufen unsummen von aktien

Klarstellung von PLU

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aPLU-2731…

Otto legt nach (is ja fast wie bei Wirecard)

What it fails to explain or refer to are the rulings emitted by Peru's INGEMMET this year, namely ruling 405 dated February 14th 2019 and ruling 464 dated February 20th. Your author has a copy of these documents (just in case PLU are looking in today, as they are apparently thinking of taking legal action against this blog and may like to think again about how much shareholder money they'd waste by doing so) and will be happy to use them in evidence, come the day. These documents state that the payments due to the government of Peru on 32 concession blocks held by the wholly owned subsidiary of Plateau Energy have not been made on two consecutive years and that according to the rules, those concessions are now lapsed. What PLU may be hiding behind today is the fact they have the right to appeal to March 31st, but that does not invalidate the INGEMMET ruling. Or to use the PLU CEOs own words, it's disappointing to see this irresponsible spread of misinformation. That these people insist on hiding behind sophistry and carefully selected phrasing to make half-truths sound like something else is all too typical in the shady world of the junior mining company.

Bin mal gespannt wie das weitergeht. Irgendwas wird schon dran sein, oder es sin Gebiete an denen sie kein Interesse mehr haben.

What it fails to explain or refer to are the rulings emitted by Peru's INGEMMET this year, namely ruling 405 dated February 14th 2019 and ruling 464 dated February 20th. Your author has a copy of these documents (just in case PLU are looking in today, as they are apparently thinking of taking legal action against this blog and may like to think again about how much shareholder money they'd waste by doing so) and will be happy to use them in evidence, come the day. These documents state that the payments due to the government of Peru on 32 concession blocks held by the wholly owned subsidiary of Plateau Energy have not been made on two consecutive years and that according to the rules, those concessions are now lapsed. What PLU may be hiding behind today is the fact they have the right to appeal to March 31st, but that does not invalidate the INGEMMET ruling. Or to use the PLU CEOs own words, it's disappointing to see this irresponsible spread of misinformation. That these people insist on hiding behind sophistry and carefully selected phrasing to make half-truths sound like something else is all too typical in the shady world of the junior mining company.

Bin mal gespannt wie das weitergeht. Irgendwas wird schon dran sein, oder es sin Gebiete an denen sie kein Interesse mehr haben.

Antwort auf Beitrag Nr.: 60.118.741 von mge am 16.03.19 13:20:14die große frage wird sein, was passiert heute mittag?

wird es aufgrund der geschürrten unsicherheit zu einem großen abschlag kommen?

oder wird aufgrund der aussage das es "quatsch" ist, bei einem staielen kurs bleiben?

wird es aufgrund der geschürrten unsicherheit zu einem großen abschlag kommen?

oder wird aufgrund der aussage das es "quatsch" ist, bei einem staielen kurs bleiben?

insider hat wieder gekauft, war die beste antwort auf den blogeintrag.

habe heute vormittag auch nochmal nachgelegt

habe heute vormittag auch nochmal nachgelegt

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

daraus machen wir nun Hühnerfrikassee

Antwort auf Beitrag Nr.: 60.541.023 von dosto am 10.05.19 20:49:170,25-0,30 CAD in Bälde....

will den gleichen mive nochmal wie damals auf 1,50 CAD

nach chart fressvorlage jetzt natürlich...

so kommen wir anderen zu einstiegen.

will den gleichen mive nochmal wie damals auf 1,50 CAD

nach chart fressvorlage jetzt natürlich...

so kommen wir anderen zu einstiegen.

Hauptding bleibt permits in Peru ja, nein, vielleicht...

entweder sind die 2 CAD wert oder 0 CAD. dazwischen gibts dann nix mehr.

entweder sind die 2 CAD wert oder 0 CAD. dazwischen gibts dann nix mehr.

Antwort auf Beitrag Nr.: 60.541.068 von Boersiback am 10.05.19 20:54:32wenn Sies s,agen wirds so sein.

Mich interessiert nur deren verschwinden.

Mich interessiert nur deren verschwinden.

Antwort auf Beitrag Nr.: 60.541.095 von dosto am 10.05.19 20:57:56schon klar....

ich schätze die Chancen auch unter 50%, daß am Ende des Tages tatsächlich gefördert wird...

aber wenn´s so weit laufen sollte wie bei Berkeley vor dem Abschuß kann´s dem Kurs nach Boden wieder ne Weile recht sein.

ich schätze die Chancen auch unter 50%, daß am Ende des Tages tatsächlich gefördert wird...

aber wenn´s so weit laufen sollte wie bei Berkeley vor dem Abschuß kann´s dem Kurs nach Boden wieder ne Weile recht sein.

irgendwas muß immer gefördert werden, Herr dosto.

Die Erneuerbaren und E-Autos brauchen dann halt wieder mehr Metalle.

Den Bergbau werden sie nicht abschaffen können