Wird der Rohstoff steigen oder fallen? (Seite 5)

eröffnet am 10.12.16 23:57:36 von

neuester Beitrag 11.09.23 12:55:10 von

neuester Beitrag 11.09.23 12:55:10 von

Beiträge: 109

ID: 1.242.856

ID: 1.242.856

Aufrufe heute: 9

Gesamt: 11.552

Gesamt: 11.552

Aktive User: 0

ISIN: XD0002058432 · Symbol: HG

4,349

USD

+1,61 %

+0,069 USD

Letzter Kurs 17.04.24 COMEX

Neuigkeiten

17.04.24 · wallstreetONLINE Redaktion |

08:56 Uhr · dpa-AFX |

07:21 Uhr · Jörg Schulte Anzeige |

00:30 Uhr · Swiss Resource Capital AG Anzeige |

17.04.24 · axinocapital.de Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5750 | +15,38 | |

| 45,20 | +14,14 | |

| 1,4000 | +10,24 | |

| 37,18 | +10,00 | |

| 22,460 | +9,99 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5900 | -8,09 | |

| 2,1800 | -9,17 | |

| 69,05 | -9,48 | |

| 154,95 | -9,76 | |

| 0,7997 | -12,16 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 58.951.566 von Popeye82 am 13.10.18 18:11:48

Chile’s state miner Codelco, the world’s No.1 copper producer, has revealed its smelter at Chuquicamata, its second largest operation by size, will be running at reduced rates until at least the end of the year, as it hurries to complete a planned overhaul ahead of stricter emissions standards coming in effect.

[urlhttp://www.mining.com/worlds-top-copper-producer-faces-lengthy-smelter-halt-major-mine/] [/url]

Top Copper Miner Almost Sold Out on Strong China Demand

https://www.hellenicshippingnews.com/top-copper-miner-almost…

Zwei Meldungen von Codelco, (weltweit producer nr. 1) in den letzten 2 Tagen... bei der grössten Mine wird erstmal weniger produiziert.. zudem ist für nächstes Jahr schon alles verkauft und fast nichts mehr da..

Das müsste doch nun einen Einfluss auf den Kupferpreis haben..

ja genau alles in die Tüte.. -)

Hier mal news vom Freitag...Chile’s state miner Codelco, the world’s No.1 copper producer, has revealed its smelter at Chuquicamata, its second largest operation by size, will be running at reduced rates until at least the end of the year, as it hurries to complete a planned overhaul ahead of stricter emissions standards coming in effect.

[urlhttp://www.mining.com/worlds-top-copper-producer-faces-lengthy-smelter-halt-major-mine/] [/url]

Top Copper Miner Almost Sold Out on Strong China Demand

https://www.hellenicshippingnews.com/top-copper-miner-almost…

Zwei Meldungen von Codelco, (weltweit producer nr. 1) in den letzten 2 Tagen... bei der grössten Mine wird erstmal weniger produiziert.. zudem ist für nächstes Jahr schon alles verkauft und fast nichts mehr da..

Das müsste doch nun einen Einfluss auf den Kupferpreis haben..

Antwort auf Beitrag Nr.: 58.950.342 von freddy1989 am 13.10.18 12:46:34In die Zukunft sehen kann ich nicht,

aber bin mittelfristig(2-5 Jahre(++??)) für Cu auch sehr optimistisch.

Also wenn man da vielleicht schöne Sachen, pot leveraged Plays, oder Was immer Instrumente, haben will, sollte man Das RECHTzeitig machen. Drum kümmern.

Aber wenns deutlicher hochgehen wird, wirds vmtl Wie Meistens laufen:

Dann stürzen sich "Alle" auf "Alles" wo Kupfer "drauf"steht.

Hauptsache passt in Die Tüte, Was drin ist total egal.

aber bin mittelfristig(2-5 Jahre(++??)) für Cu auch sehr optimistisch.

Also wenn man da vielleicht schöne Sachen, pot leveraged Plays, oder Was immer Instrumente, haben will, sollte man Das RECHTzeitig machen. Drum kümmern.

Aber wenns deutlicher hochgehen wird, wirds vmtl Wie Meistens laufen:

Dann stürzen sich "Alle" auf "Alles" wo Kupfer "drauf"steht.

Hauptsache passt in Die Tüte, Was drin ist total egal.

Antwort auf Beitrag Nr.: 58.950.087 von Popeye82 am 13.10.18 11:47:02Ich glaube bei Kupfer muss man einfach Geduld haben

Die ganzen Elktroauto Sache und Grüne Energie usw fängt ja alles gerade erst an zu laufen

http://www.aktiencheck.de/kolumnen/Artikel-Steuern_oben_Kupf…

Die ganzen Elktroauto Sache und Grüne Energie usw fängt ja alles gerade erst an zu laufen

http://www.aktiencheck.de/kolumnen/Artikel-Steuern_oben_Kupf…

Antwort auf Beitrag Nr.: 58.948.557 von wallstone am 13.10.18 00:19:37ich bin Kupfer mittelfristig+(+?) interessiert.

aktuell aber Nix Konkretes.

aktuell aber Nix Konkretes.

Antwort auf Beitrag Nr.: 58.537.499 von Popeye82 am 26.08.18 16:08:51

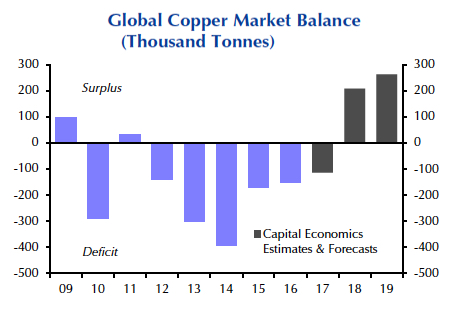

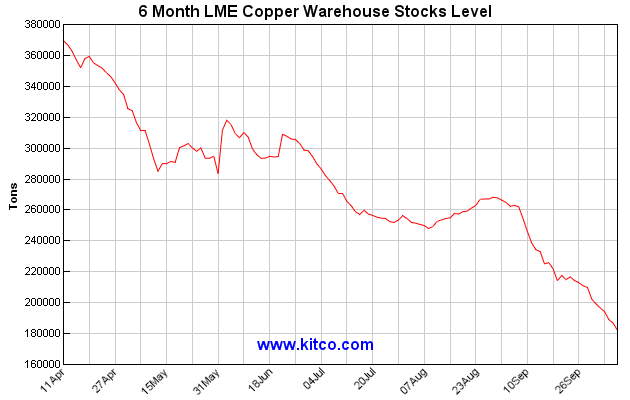

Der Warehousebestand ist in den letzten Monaten schon drastisch gefallen

Kupfer

Die Nachfrage wird aber deutlich grösser als Angebot es wird mit eine Defizit von bis zu 5 Mio Tonnen Kupfer gerechnet .Der Warehousebestand ist in den letzten Monaten schon drastisch gefallen

wird WOHL auf 0 gehen.

http://www.first-quantum.com/Media-Centre/Press-Releases/Pre…

"First Quantum Minerals Announces Capacity Expansion to the Cobre Panama Project, Updated Capital Estimate and Ramp-up Expectations

02/12/2018

(In United States dollars, except where noted otherwise)

TORONTO, Feb. 12, 2018 /CNW/ - First Quantum Minerals Ltd. ("First Quantum" or the "Company", TSX Symbol "FM") today announced that its Board of Directors has approved the expansion of Cobre Panama's throughput capacity, by 15%, to 85 million tonnes per annum ("mtpa") and upgrades to certain areas to accommodate a further increase to 100 mtpa after year 2022. The Board has also approved additional initiatives aimed at achieving a smooth and efficient commissioning and ramp-up phase.

Altogether, Cobre Panama's total development capital is now estimated at $6.3 billion with an improved capital intensity of $18,000 per tonne of annual copper produced, assuming an annual production rate of 350,000 tonnes of copper in concentrate.

DETAILS:

Expansions of throughput capacity:

Installation of an eighth mill, which is already owned by the Company, and associated infrastructure is planned to begin in the second half of 2018 for completion in the second half of 2019

Includes an expansion of the mining fleet and process equipment, additional pre-production stripping and supporting infrastructure to accommodate the future expansion

Expansion to 100 mpta is expected to be undertaken after 2022

Additional initiatives to enable a smooth and efficient commissioning and ramp-up:

Following on the successful commissioning and ramp-up of our Kansanshi smelter, we plan to embed various highly-skilled technical personnel from our equipment manufacturers and suppliers and a supplemental experienced operational ramp-up team during the pre-commissioning stage

Other initiatives include the procurement and increased market cost for higher quality and capacity equipment, additional spares, upgrade and rectification of certain power station equipment and an increase in the contingency cost to completion

RAMP-UP EXPECTATIONS:

The project is expected to start phased commissioning during 2018, continue to ramp-up over 2019 and reach the 85 mtpa throughput rate by 2020. Over this period, contained copper production is estimated at a minimum of 150,000 tonnes in 2019, between 270,000 tonnes and 300,000 tonnes in 2020 and up to 350,000 tonnes in 2021. At steady-state, the unit cost of production is estimated at $1.20 per pound C1 and $1.50 per pound all-in sustaining, net of a by-product credit of $0.25 per pound.

CEO'S COMMENTS:

"The outlook for copper has improved meaningfully and is widely expected to remain strong for some significant time. As such, we believe this is an opportune time to undertake these initiatives which have compelling estimated benefits. The addition of the eighth mill is expected to optimize the current milling circuit which would facilitate the plant to ramp up to 85 mtpa from the outset. Looking further out, the upgrades to some areas of the mine and process plant are intended to allow the future expansion to 100 mtpa to be achieved without interruption to operations," commented Philip Pascall, CEO and Chairman.

"Additionally, all steps conceivable are being taken to enable a smooth and efficient commissioning and ramp-up process. We are replicating the principles we had implemented at our Kansanshi smelter where we achieved commercial operations well ahead of all prior projections. It is important to us that we deliver a successful project that will benefit all stakeholders."

On Behalf of the Board of Directors of First Quantum Minerals Ltd.

G. Clive Newall

President"

"First Quantum Minerals Announces Capacity Expansion to the Cobre Panama Project, Updated Capital Estimate and Ramp-up Expectations

02/12/2018

(In United States dollars, except where noted otherwise)

TORONTO, Feb. 12, 2018 /CNW/ - First Quantum Minerals Ltd. ("First Quantum" or the "Company", TSX Symbol "FM") today announced that its Board of Directors has approved the expansion of Cobre Panama's throughput capacity, by 15%, to 85 million tonnes per annum ("mtpa") and upgrades to certain areas to accommodate a further increase to 100 mtpa after year 2022. The Board has also approved additional initiatives aimed at achieving a smooth and efficient commissioning and ramp-up phase.

Altogether, Cobre Panama's total development capital is now estimated at $6.3 billion with an improved capital intensity of $18,000 per tonne of annual copper produced, assuming an annual production rate of 350,000 tonnes of copper in concentrate.

DETAILS:

Expansions of throughput capacity:

Installation of an eighth mill, which is already owned by the Company, and associated infrastructure is planned to begin in the second half of 2018 for completion in the second half of 2019

Includes an expansion of the mining fleet and process equipment, additional pre-production stripping and supporting infrastructure to accommodate the future expansion

Expansion to 100 mpta is expected to be undertaken after 2022

Additional initiatives to enable a smooth and efficient commissioning and ramp-up:

Following on the successful commissioning and ramp-up of our Kansanshi smelter, we plan to embed various highly-skilled technical personnel from our equipment manufacturers and suppliers and a supplemental experienced operational ramp-up team during the pre-commissioning stage

Other initiatives include the procurement and increased market cost for higher quality and capacity equipment, additional spares, upgrade and rectification of certain power station equipment and an increase in the contingency cost to completion

RAMP-UP EXPECTATIONS:

The project is expected to start phased commissioning during 2018, continue to ramp-up over 2019 and reach the 85 mtpa throughput rate by 2020. Over this period, contained copper production is estimated at a minimum of 150,000 tonnes in 2019, between 270,000 tonnes and 300,000 tonnes in 2020 and up to 350,000 tonnes in 2021. At steady-state, the unit cost of production is estimated at $1.20 per pound C1 and $1.50 per pound all-in sustaining, net of a by-product credit of $0.25 per pound.

CEO'S COMMENTS:

"The outlook for copper has improved meaningfully and is widely expected to remain strong for some significant time. As such, we believe this is an opportune time to undertake these initiatives which have compelling estimated benefits. The addition of the eighth mill is expected to optimize the current milling circuit which would facilitate the plant to ramp up to 85 mtpa from the outset. Looking further out, the upgrades to some areas of the mine and process plant are intended to allow the future expansion to 100 mtpa to be achieved without interruption to operations," commented Philip Pascall, CEO and Chairman.

"Additionally, all steps conceivable are being taken to enable a smooth and efficient commissioning and ramp-up process. We are replicating the principles we had implemented at our Kansanshi smelter where we achieved commercial operations well ahead of all prior projections. It is important to us that we deliver a successful project that will benefit all stakeholders."

On Behalf of the Board of Directors of First Quantum Minerals Ltd.

G. Clive Newall

President"

Mich würde interessieren, wie einige von euch bei Kupfer investiert sind.

Mein Invest liegt bei Tiger resources Limitit = Produzent von Kathodenkupfer.

Mein Invest liegt bei Tiger resources Limitit = Produzent von Kathodenkupfer.

08:56 Uhr · dpa-AFX · Kupfer |

07:21 Uhr · Jörg Schulte · Hecla MiningAnzeige |

00:30 Uhr · Swiss Resource Capital AG · Endeavour SilverAnzeige |

17.04.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |

16.04.24 · wallstreetONLINE Redaktion · EUR/USD |