Yatra Online - 500 Beiträge pro Seite

eröffnet am 21.12.16 16:57:18 von

neuester Beitrag 30.08.19 11:24:11 von

neuester Beitrag 30.08.19 11:24:11 von

Beiträge: 24

ID: 1.243.307

ID: 1.243.307

Aufrufe heute: 0

Gesamt: 2.226

Gesamt: 2.226

Aktive User: 0

ISIN: KYG983381099 · WKN: A2DJKF

1,1650

EUR

0,00 %

0,0000 EUR

Letzter Kurs 22:58:10 Lang & Schwarz

Neuigkeiten

14.02.24 · Business Wire (engl.) |

16.10.23 · wallstreetONLINE Redaktion |

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 179,44 | +11,38 | |

| 0,7230 | +11,06 | |

| 31,58 | +9,83 | |

| 1,9300 | +8,43 | |

| 3,2720 | +8,34 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 446,52 | -9,52 | |

| 1,7900 | -9,60 | |

| 9,4600 | -10,25 | |

| 16,900 | -11,05 | |

| 5,8500 | -11,36 |

...hat's gestern an die Börse geschafft:

Yatra makes its Nasdaq debut

Dec 21.2016

Indian OTA Yatra.com had a quiet start to life on the Nasdaq yesterday, although Dhruv Shringi, co-founder and CEO, did get to ring the closing bell.

Shares debuted on Tuesday at $10 and closed at $9.70, having hit a high of $10.15 and a low of $8.40 during the day.

However, less than 10,000 shares were traded during the day.

At $10 a share its market capitalization is $355 million.

The move came about as part of a reverse merger with an acquisition vehicle, Terrapin 3. As part of the process, Yatra has raised $92.5 million of capital which has reportedly been earmarked to ramp up its presence in India’s tier two and tier three cities.

At a presentation last month, which drilled down into operational and financial details for potential investors, Yatra said that it will be in the black – on an adjusted EBITDA basis – for the year to end-March 2019 and that it can meet this target without additional funding.

Despite being the number two player in India after MakeMyTrip, Yatra does have some areas where it has the edge, such as being the only Indian OTA with channels serving with consumers, corporates and travel agents.

More than 14,000 agents across India are signed up to Yatra and, as the presentation points out, many Indians still pay for their travel using cash. But having an offline presence also puts it in a position to capture offline-to-online business.

It is worth noting that the presentation took place before the Indian government’s demonitization policy was announced. Yatra itself noted a “drastic dip” in offline bookings as a result.

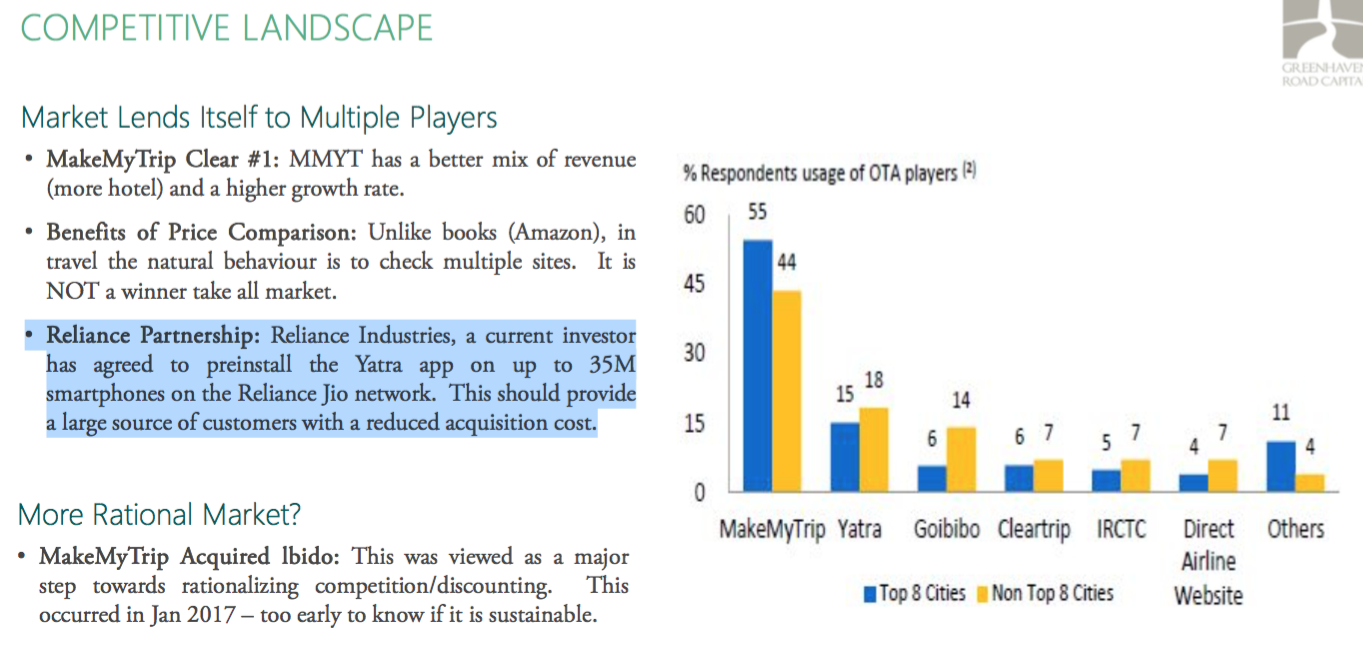

Another area where it sees an advantage over MakeMyTrip is via its strategic partnership with Indian conglomerate Reliance Industries. The deal, which also includes an equity stake in the business for Reliance, means the Yatra app is preinstalled on its partner’s smartphones, which “will substantially lower…customer acquisition costs and…increase our mobile app install base by up to 6x.”

Currently its apps have been downloaded 7 million times and 59% of its traffic already comes from mobile. It also said that more than 80% of the visits to the site comes from free traffic and that 74% of its business comes from repeat customers.

Yatra makes its Nasdaq debut

Dec 21.2016

Indian OTA Yatra.com had a quiet start to life on the Nasdaq yesterday, although Dhruv Shringi, co-founder and CEO, did get to ring the closing bell.

Shares debuted on Tuesday at $10 and closed at $9.70, having hit a high of $10.15 and a low of $8.40 during the day.

However, less than 10,000 shares were traded during the day.

At $10 a share its market capitalization is $355 million.

The move came about as part of a reverse merger with an acquisition vehicle, Terrapin 3. As part of the process, Yatra has raised $92.5 million of capital which has reportedly been earmarked to ramp up its presence in India’s tier two and tier three cities.

At a presentation last month, which drilled down into operational and financial details for potential investors, Yatra said that it will be in the black – on an adjusted EBITDA basis – for the year to end-March 2019 and that it can meet this target without additional funding.

Despite being the number two player in India after MakeMyTrip, Yatra does have some areas where it has the edge, such as being the only Indian OTA with channels serving with consumers, corporates and travel agents.

More than 14,000 agents across India are signed up to Yatra and, as the presentation points out, many Indians still pay for their travel using cash. But having an offline presence also puts it in a position to capture offline-to-online business.

It is worth noting that the presentation took place before the Indian government’s demonitization policy was announced. Yatra itself noted a “drastic dip” in offline bookings as a result.

Another area where it sees an advantage over MakeMyTrip is via its strategic partnership with Indian conglomerate Reliance Industries. The deal, which also includes an equity stake in the business for Reliance, means the Yatra app is preinstalled on its partner’s smartphones, which “will substantially lower…customer acquisition costs and…increase our mobile app install base by up to 6x.”

Currently its apps have been downloaded 7 million times and 59% of its traffic already comes from mobile. It also said that more than 80% of the visits to the site comes from free traffic and that 74% of its business comes from repeat customers.

Antwort auf Beitrag Nr.: 53.933.525 von R-BgO am 21.12.16 16:57:18

IR-Seite:

https://www.yatra.com/investor/investor-relations

Indian Nasdaq-listed OTA Yatra.com has stepped up its drive to acquire new mobile users and is allowing anyone with a Truecaller account to register for the Yatra Android app in a single click using its TrueSDK product which offers verified phone number based sign up and login features. OYO Rooms, RedBus and Ixigo also use TrueSDK.

Yatra numbers show scale of marketing spend gap with MakeMyTrip

Feb 3.2017

Yatra.com‘s first quarterly earnings release since joining Nasdaq in December shows a 20%+ increase in booking volumes from its air and hotels business.

In the Oct-Dec period, Yatra handled 1.8 million air passengers, up by 23.7% compared with the same period in 2015. Revenue from air was up by 27.2% to INR 943.8 million ($14 million) “due to better volume based deals negotiated with the airlines and higher fixed fee on comparatively lower air ticket prices”.

For hotels, room night volumes for the quarter came in at 365,000, up 21.3%. Its packages business was flat at 36,000. Revenues for hotel and packages are reported together and were down in the quarter by 4.9% to INR 1,340.3 million ($19.9 million).

Yatra’s listing on Nasdaq allows direct comparisons to be made with MakeMyTrip, India’s biggest OTA which published its results for the same period earlier this week.

On MakeMyTrip’s earnings call, its CEO Deep Kalra said of Yatra:

“I think they are fairly active on both air and packages but our understanding of their hotel business, from what we’ve learned from our suppliers, is still modest and small, and they are not a significant player there. They are more active on air and holiday packages.”

The significance here is that MakeMyTrip has constantly referenced hotels as having massive growth potential in India, with online (including mobile) only accounting for some 15% of India’s hotel market.

And the filings highlight the gap – MakeMyTrip’s hotels and packages transaction volumes came in at 849,000, more than double Yatra’s.

On air, where MakeMyTrip sees Yatra as “active”, the numbers are identical when rounded up, with MakeMyTrip also recording 1.8 million transactions.

(updated 3Feb 1630GMT. The numbers in the paragraph above are incorrect and have been replaced with the correct figure below. The original headline has also been amended. Apologies for the mistake.)

On air, Yatra’s 1.8 million transactions in the quarter compares with MakeMyTrip’s 2.3 million.

Yatra’s net revenue margin on air of 6.8% is lower than MakeMyTrip’s 10.1%. And it also falls behind when it comes to hotels and packages margins – Yatra’s 10.8% significantly underperforming MakeMyTrip’s 19.4%.

Overall, Yatra and MakeMyTrip’s combined net revenue margins are 8% and 13.1% respectively.

Another important comparison to make is their respective marketing and sales expenses. MakeMyTrip has been saying for a number of quarters that its priority is growing market share and that it is willing to invest in acquiring new customers.

In the Oct-Dec period, its sales and expenses rose by 53.8% to $44.5 million, “primarily as a result of significant customer inducement/acquisition programs [given to customers for accelerating growth in our standalone hotel booking business] along with an increase in brand advertisement expenses and mobile application download and referral cost.”

Yatra meanwhile lifted its sales and marketing spend by 46.8% to INR 612 million ($9 million) “primarily on account of increases in consumer promotion and loyalty incentive programs.”

MakeMyTrip is already the biggest online player in India and that dominance will strengthen via its merger with Ibibo Group. Spending five times as much on marketing as Yatra also reinforces its number one slot.

But with a number of external tailwinds in play for online travel in India – a strong economy, a digitally aware government, a young population and an improving mobile infrastructure – there is enough room for more than one player.

Yatra can take heart from a strong air ticketing business performance but needs to be prepared for a long (and expensive) battle for hotels.

Feb 3.2017

Yatra.com‘s first quarterly earnings release since joining Nasdaq in December shows a 20%+ increase in booking volumes from its air and hotels business.

In the Oct-Dec period, Yatra handled 1.8 million air passengers, up by 23.7% compared with the same period in 2015. Revenue from air was up by 27.2% to INR 943.8 million ($14 million) “due to better volume based deals negotiated with the airlines and higher fixed fee on comparatively lower air ticket prices”.

For hotels, room night volumes for the quarter came in at 365,000, up 21.3%. Its packages business was flat at 36,000. Revenues for hotel and packages are reported together and were down in the quarter by 4.9% to INR 1,340.3 million ($19.9 million).

Yatra’s listing on Nasdaq allows direct comparisons to be made with MakeMyTrip, India’s biggest OTA which published its results for the same period earlier this week.

On MakeMyTrip’s earnings call, its CEO Deep Kalra said of Yatra:

“I think they are fairly active on both air and packages but our understanding of their hotel business, from what we’ve learned from our suppliers, is still modest and small, and they are not a significant player there. They are more active on air and holiday packages.”

The significance here is that MakeMyTrip has constantly referenced hotels as having massive growth potential in India, with online (including mobile) only accounting for some 15% of India’s hotel market.

And the filings highlight the gap – MakeMyTrip’s hotels and packages transaction volumes came in at 849,000, more than double Yatra’s.

On air, where MakeMyTrip sees Yatra as “active”, the numbers are identical when rounded up, with MakeMyTrip also recording 1.8 million transactions.

(updated 3Feb 1630GMT. The numbers in the paragraph above are incorrect and have been replaced with the correct figure below. The original headline has also been amended. Apologies for the mistake.)

On air, Yatra’s 1.8 million transactions in the quarter compares with MakeMyTrip’s 2.3 million.

Yatra’s net revenue margin on air of 6.8% is lower than MakeMyTrip’s 10.1%. And it also falls behind when it comes to hotels and packages margins – Yatra’s 10.8% significantly underperforming MakeMyTrip’s 19.4%.

Overall, Yatra and MakeMyTrip’s combined net revenue margins are 8% and 13.1% respectively.

Another important comparison to make is their respective marketing and sales expenses. MakeMyTrip has been saying for a number of quarters that its priority is growing market share and that it is willing to invest in acquiring new customers.

In the Oct-Dec period, its sales and expenses rose by 53.8% to $44.5 million, “primarily as a result of significant customer inducement/acquisition programs [given to customers for accelerating growth in our standalone hotel booking business] along with an increase in brand advertisement expenses and mobile application download and referral cost.”

Yatra meanwhile lifted its sales and marketing spend by 46.8% to INR 612 million ($9 million) “primarily on account of increases in consumer promotion and loyalty incentive programs.”

MakeMyTrip is already the biggest online player in India and that dominance will strengthen via its merger with Ibibo Group. Spending five times as much on marketing as Yatra also reinforces its number one slot.

But with a number of external tailwinds in play for online travel in India – a strong economy, a digitally aware government, a young population and an improving mobile infrastructure – there is enough room for more than one player.

Yatra can take heart from a strong air ticketing business performance but needs to be prepared for a long (and expensive) battle for hotels.

lebendiger Markt, mit viel Wettbewerb: https://skift.com/2017/02/06/5-new-travel-startups-from-indi…

Yatra lifts marketing spend by 46% in a year

May 17.2017

Yatra.com has reported its full-year results to end-March, confirming that it is growing strongly in volume terms while finding it difficult to rein in costs and losses.

Its financial year runs April-March, slightly out of synch with other B2C travel brands, although India’s other Nasdaq-listed OTA MakeMyTrip has the same year. Its results for the same period are out later this week.

During the year, the growth in volume terms for Yatra is strong. Air booking are up 20.6% at 6.9 million; room nights are up 21.4% at 1.4 million and package travellers up 9.8% at 143,000.

Revenue less service cost from air increased by 27.1% to INR 3.7 billion ($57 million). Net revenue margin is up from 5.8% to 6.4%, “due to better volume based deals negotiated with the airlines and higher fixed fee on comparatively lower air ticket prices.”

The financial performance from hotels and packages was weak in comparison. Revenue less service cost for this segment increased by 7.4% to INR 1.1 billion ($17.4 million) although the net revenue margin dropped from 10.9% to 10.8%.

Revenue less service cost is the metric of choice, in terms of the guidance it gives the markets. For the year to end-March this came in at INR 5.2 billion ($80.4 million), up 23.6% and “exceeding the high end” of what it said it would deliver.

Having said that, losses have increased – up to INR 6 billion ($94 million) “as per IFRS” or INR 1 billion ($15.4 million) “as per non-IFRS”.

Revenue less service cost is expected to grow by between 30-35% in the year to end-March 18.

One of the most relevant metrics is the sales and marketing expense, particularly important in India where Yatra is up again the combined MakeMyTrip-Ibibo in the battle to gain market share.

Yatra has increased this expense during the year by 46% to INR 2.5 billion ($38.6 million) “on account of increases in consumer promotion programs, loyalty incentive programs and brand spends on TV and print media”.

Also of importance in India is the growth of mobile. In the Jan-March quarter, 72% of Yatra’s traffic came from mobile, up from 67% in the previous quarter.

May 17.2017

Yatra.com has reported its full-year results to end-March, confirming that it is growing strongly in volume terms while finding it difficult to rein in costs and losses.

Its financial year runs April-March, slightly out of synch with other B2C travel brands, although India’s other Nasdaq-listed OTA MakeMyTrip has the same year. Its results for the same period are out later this week.

During the year, the growth in volume terms for Yatra is strong. Air booking are up 20.6% at 6.9 million; room nights are up 21.4% at 1.4 million and package travellers up 9.8% at 143,000.

Revenue less service cost from air increased by 27.1% to INR 3.7 billion ($57 million). Net revenue margin is up from 5.8% to 6.4%, “due to better volume based deals negotiated with the airlines and higher fixed fee on comparatively lower air ticket prices.”

The financial performance from hotels and packages was weak in comparison. Revenue less service cost for this segment increased by 7.4% to INR 1.1 billion ($17.4 million) although the net revenue margin dropped from 10.9% to 10.8%.

Revenue less service cost is the metric of choice, in terms of the guidance it gives the markets. For the year to end-March this came in at INR 5.2 billion ($80.4 million), up 23.6% and “exceeding the high end” of what it said it would deliver.

Having said that, losses have increased – up to INR 6 billion ($94 million) “as per IFRS” or INR 1 billion ($15.4 million) “as per non-IFRS”.

Revenue less service cost is expected to grow by between 30-35% in the year to end-March 18.

One of the most relevant metrics is the sales and marketing expense, particularly important in India where Yatra is up again the combined MakeMyTrip-Ibibo in the battle to gain market share.

Yatra has increased this expense during the year by 46% to INR 2.5 billion ($38.6 million) “on account of increases in consumer promotion programs, loyalty incentive programs and brand spends on TV and print media”.

Also of importance in India is the growth of mobile. In the Jan-March quarter, 72% of Yatra’s traffic came from mobile, up from 67% in the previous quarter.

Antwort auf Beitrag Nr.: 54.250.031 von R-BgO am 06.02.17 15:50:53ambitioniert:

Goomo raises $50 million to challenge online travel giants of India

Jun 5.2017

India-based online travel agency Goomo is just a few months old but has managed to raise a massive $50 million in private equity funding.

A Mauritius-based group known as Emerging India is backing the company in a series of tranches, with $25 million already put into the company.

Goomo launched in March this year but came from an existing offline business, Goomo Holdings, which began operations in 2006 in Mumbai.

The ramping up of activity follows Emerging India’s acquisition of Orbit Corporate and Leisure Tours in November last year as part of a $180 million investment in online travel.

The strategy is to build a brand in the India market to rival that of MakeMyTrip and Cleartrip over the next two to three years.

The company intends to target both leisure and business travel but currently has just products covering flights, packages and trade fairs.

Hotel, bus and rail content is to be added shortly.

CEO Varun Gupta says:

“Goomo is being built ground up to be an omnichannel platform that will facilitate corporate and consumer travel bookings across online and offline channels.”

Goomo says it has more than 300 employees based in 15 cities mostly in India, with an office also in Germany.

Goomo raises $50 million to challenge online travel giants of India

Jun 5.2017

India-based online travel agency Goomo is just a few months old but has managed to raise a massive $50 million in private equity funding.

A Mauritius-based group known as Emerging India is backing the company in a series of tranches, with $25 million already put into the company.

Goomo launched in March this year but came from an existing offline business, Goomo Holdings, which began operations in 2006 in Mumbai.

The ramping up of activity follows Emerging India’s acquisition of Orbit Corporate and Leisure Tours in November last year as part of a $180 million investment in online travel.

The strategy is to build a brand in the India market to rival that of MakeMyTrip and Cleartrip over the next two to three years.

The company intends to target both leisure and business travel but currently has just products covering flights, packages and trade fairs.

Hotel, bus and rail content is to be added shortly.

CEO Varun Gupta says:

“Goomo is being built ground up to be an omnichannel platform that will facilitate corporate and consumer travel bookings across online and offline channels.”

Goomo says it has more than 300 employees based in 15 cities mostly in India, with an office also in Germany.

Yatra Attains Leadership Position in Corporate Travel with the Acquisition of Air Travel Bureau Ltd

Gurgaon, India and New York, July 23, 2017

Yatra Online, Inc. ("Yatra" or the "Company") (Nasdaq: YTRA and OTCQX: YTROF) today announced that it has entered into a definitive agreement, through its subsidiary, Yatra Online Private Limited, under which it will acquire Air Travel Bureau Ltd. ("ATB"), which is India's largest independent corporate travel services provider with Gross Bookings of INR 15 Billion generated through a diverse client base of over 400 large and medium sized businesses across India.

"This acquisition significantly strengthens our position in the large and growing corporate travel market in India. We believe that as a combined entity, we are now the largest corporate travel services platform in India by Gross Bookings. This acquisition will allow us to deliver best-in-class experiences to an even wider set of travelers, through our web and mobile app platforms and enhance our reach to cross-sell our entire product suite, including hotels, to this customer base " said Dhruv Shringi, Co-Founder and Chief Executive Officer, Yatra Online, Inc. "We look forward to welcoming the ATB team to the Yatra family."

"ATB has built a very strong presence over the last 30 years in the corporate travel space," said Sunil Narain, Chairman and Chief Executive Officer, ATB. "We're excited for ATB to join the Yatra family and for our teams to work together to further enhance the offerings we provide to our customers and partners by leveraging Yatra's technology platform and large hotel network."

The Boards of Directors of both companies have approved the transaction. The first Closing to acquire majority of the outstanding shares is expected to occur by mid-August, 2017 and the second Closing is expected to occur in Q2 of the 2018 calendar year, subject to other customary closing conditions.

Pursuant to the terms of the definitive agreement, Yatra has agreed to acquire all of the outstanding shares of ATB and assume its debt.

Gurgaon, India and New York, July 23, 2017

Yatra Online, Inc. ("Yatra" or the "Company") (Nasdaq: YTRA and OTCQX: YTROF) today announced that it has entered into a definitive agreement, through its subsidiary, Yatra Online Private Limited, under which it will acquire Air Travel Bureau Ltd. ("ATB"), which is India's largest independent corporate travel services provider with Gross Bookings of INR 15 Billion generated through a diverse client base of over 400 large and medium sized businesses across India.

"This acquisition significantly strengthens our position in the large and growing corporate travel market in India. We believe that as a combined entity, we are now the largest corporate travel services platform in India by Gross Bookings. This acquisition will allow us to deliver best-in-class experiences to an even wider set of travelers, through our web and mobile app platforms and enhance our reach to cross-sell our entire product suite, including hotels, to this customer base " said Dhruv Shringi, Co-Founder and Chief Executive Officer, Yatra Online, Inc. "We look forward to welcoming the ATB team to the Yatra family."

"ATB has built a very strong presence over the last 30 years in the corporate travel space," said Sunil Narain, Chairman and Chief Executive Officer, ATB. "We're excited for ATB to join the Yatra family and for our teams to work together to further enhance the offerings we provide to our customers and partners by leveraging Yatra's technology platform and large hotel network."

The Boards of Directors of both companies have approved the transaction. The first Closing to acquire majority of the outstanding shares is expected to occur by mid-August, 2017 and the second Closing is expected to occur in Q2 of the 2018 calendar year, subject to other customary closing conditions.

Pursuant to the terms of the definitive agreement, Yatra has agreed to acquire all of the outstanding shares of ATB and assume its debt.

Das mit Reliance finde ich interessant...

Antwort auf Beitrag Nr.: 55.761.171 von R-BgO am 17.09.17 10:46:32...ob das auch hierfür gilt (Venture debt ist richtig TEUER)?:

Yatra Raises $15.4 million on Venture Debt from InnoVen Capital

CHINMAY BIDKAR

21 September 2017, India:

http://techstory.in/yatra-venture-debt-innoven-capital-2017/

Online travel portal Yatra has raised $15.4 million in venture debt from InnoVen Capital India Pvt. Ltd. The fresh funds will be utilized to meet the working capital required by Yatra to grow further and expand its offerings across geographies.

Gurgaon-headquartered Yatra was founded in August 2006 by Sabina Chopra, Manish Amin and Dhruv Shringi. It provides a full range of travel-related services such as domestic and international air ticketing, hotel booking, homestays, holiday packages, bus ticketing, rail ticketing, activities, attractions and ancillary services.

“After having raised $92 million through our Nasdaq listing in December 2016, this debt funding provides us additional capital for our growth needs,” Yatra group CFO Alok Vaish said.

“Through InnoVen’s cross-border funding capability and our confidence in Yatra’s management team, we were able to meet its financing needs across different geographies,” said Chin Chao, interim CEO, InnoVen Capital India, and CEO, InnoVen Capital South East Asia. In 2013, InnoVen Capital had invested $4 million in Yatra.

“Venture debt is not just for early-stage companies anymore. In 2016, we saw a lot of pullbacks in terms of funding. This year, we have seen a slow uptick in funding. We have a lot of deals with Indian companies in the pipeline since a lot are planning to expand overseas,” said Chao, who is based in Singapore.

Yatra claims to have tie-ups with over 65,000 hotels in India and nearly 500K hotels across the globe. The 11-year-old company is backed by IDG Ventures, Vertex Venture Management, Norwest Venture Partners, and other investors.

Meanwhile, Yatra’s fierce competitor online travel firm MakeMyTrip recently raised $330 million in the round of funding led by its existing investors Naspers and Ctrip. MakeMyTrip was founded in 2000 as an online travel company by Deep Kalra and Keyur Joshi. The company “holds close to 25% market share of the OTA hotel booking segment” as per the report by NewsBytes. (Image- Yatra.com)

Yatra Raises $15.4 million on Venture Debt from InnoVen Capital

CHINMAY BIDKAR

21 September 2017, India:

http://techstory.in/yatra-venture-debt-innoven-capital-2017/

Online travel portal Yatra has raised $15.4 million in venture debt from InnoVen Capital India Pvt. Ltd. The fresh funds will be utilized to meet the working capital required by Yatra to grow further and expand its offerings across geographies.

Gurgaon-headquartered Yatra was founded in August 2006 by Sabina Chopra, Manish Amin and Dhruv Shringi. It provides a full range of travel-related services such as domestic and international air ticketing, hotel booking, homestays, holiday packages, bus ticketing, rail ticketing, activities, attractions and ancillary services.

“After having raised $92 million through our Nasdaq listing in December 2016, this debt funding provides us additional capital for our growth needs,” Yatra group CFO Alok Vaish said.

“Through InnoVen’s cross-border funding capability and our confidence in Yatra’s management team, we were able to meet its financing needs across different geographies,” said Chin Chao, interim CEO, InnoVen Capital India, and CEO, InnoVen Capital South East Asia. In 2013, InnoVen Capital had invested $4 million in Yatra.

“Venture debt is not just for early-stage companies anymore. In 2016, we saw a lot of pullbacks in terms of funding. This year, we have seen a slow uptick in funding. We have a lot of deals with Indian companies in the pipeline since a lot are planning to expand overseas,” said Chao, who is based in Singapore.

Yatra claims to have tie-ups with over 65,000 hotels in India and nearly 500K hotels across the globe. The 11-year-old company is backed by IDG Ventures, Vertex Venture Management, Norwest Venture Partners, and other investors.

Meanwhile, Yatra’s fierce competitor online travel firm MakeMyTrip recently raised $330 million in the round of funding led by its existing investors Naspers and Ctrip. MakeMyTrip was founded in 2000 as an online travel company by Deep Kalra and Keyur Joshi. The company “holds close to 25% market share of the OTA hotel booking segment” as per the report by NewsBytes. (Image- Yatra.com)

Antwort auf Beitrag Nr.: 55.805.622 von R-BgO am 22.09.17 21:57:08Kann teuer sein muss aber nicht unbedingt.

Die Story ist ja das Yatra weiterhin mit hohem Tempo wächst. Dazu benötigt es ne ganze Menge Working Capital. Lieber teuer als kein Wachstum?

Denke man kann die Company aktuell nur am Umsatzwachstum messen. Schreiben ja noch Verlust.

Wie seht ihr das oder wie bewertet ihr das Potenzial?

Die Story ist ja das Yatra weiterhin mit hohem Tempo wächst. Dazu benötigt es ne ganze Menge Working Capital. Lieber teuer als kein Wachstum?

Denke man kann die Company aktuell nur am Umsatzwachstum messen. Schreiben ja noch Verlust.

Wie seht ihr das oder wie bewertet ihr das Potenzial?

Hi

wundert mich ein bisschen, dass Yatra hier so wenig Aufmerksamkeit erfährt. Würde mich gern mehr dazu austauschen.

Ist an der US Börse gelistet.

Reiseportal, zweitgrößter Player in Indien.

GRUNDSTORY Indien wächst ebenso der Flugverkehr, Yatra wächst kräftig zweistellige.

Soll in 1 bis 2 Jahre. Profitabel werden. Niedrig bewertet.

Gegenstimmen?

wundert mich ein bisschen, dass Yatra hier so wenig Aufmerksamkeit erfährt. Würde mich gern mehr dazu austauschen.

Ist an der US Börse gelistet.

Reiseportal, zweitgrößter Player in Indien.

GRUNDSTORY Indien wächst ebenso der Flugverkehr, Yatra wächst kräftig zweistellige.

Soll in 1 bis 2 Jahre. Profitabel werden. Niedrig bewertet.

Gegenstimmen?

Antwort auf Beitrag Nr.: 57.995.910 von Waschtl123 am 15.06.18 17:04:41Aktuell 9 % im Plus heute. Mal sehen ob das hält. Hab noch keinen konkreten Grund für den Anstieg gefunden. Pressemitteilung oder dergleichen.

Aber der Verlust sollte laut Oppenheimer Analysten die nächsten Quartale etwas sinken. Für 2019/20 ist ja Break-Even angestrebt.

Aber der Verlust sollte laut Oppenheimer Analysten die nächsten Quartale etwas sinken. Für 2019/20 ist ja Break-Even angestrebt.

in Q2 war nix mehr mit Umsatzwachstum...

tuck-in acquisition:

https://skift.com/2019/01/10/yatra-buys-pl-worldways-in-indi…"Yatra Acquires PL Worldways to Further Bolster its Corporate Business

Jan 8, 2019

Acquisition strengthens Yatra's foothold in the southern India region

GURUGRAM, India and NEW YORK, January 8, 2019 /PRNewswire/ --

Yatra Online, Inc. (NASDAQ: YTRA) (OTCQX: YTROF), India's largest corporate travel services provider and one of India's leading online travel companies, today announced the acquisition of the corporate travel business of PL Worldways Limited (PLW), a Chennai-based corporate travel services provider. This acquisition will help strengthen Yatra's foothold in the southern India region along with adding over 100 corporate clients to its existing client base of over 700.

Commenting on the acquisition Dhruv Shringi, Co-Founder and CEO, Yatra Online, Inc., said, "PL Worldways has an unparalleled reputation in corporate travel in the southern part of the country due to its strong customer focus and unmatched service. With this acquisition, we not only strengthen our position in the growing corporate travel market in India but also in Southern India, which has been in our cross-hairs for some time. Our endeavour will be to deliver best-in-class service to PLW's existing customer base, through our self-booking platform and expense management solution software. We look forward to welcoming PL Worldways team to the Yatra family."

Anil Pathak, Chairman, PL Worldways, said, "We are excited for PL Worldways to join Yatra family. PL Worldways' local connect & customer service expertise will complement Yatra's technology platform and leverage the largest hotel network in the country; helping clients optimize their travel spend and improve their travel processes."

Watch Watch

Antwort auf Beitrag Nr.: 60.119.497 von R-BgO am 16.03.19 16:07:56

sind allerdings ein paar Haken und Ösen drin:

https://www.globenewswire.com/news-release/2019/03/11/175126…

immer noch keine Zahlen, spät dieses Jahr

Antwort auf Beitrag Nr.: 60.975.412 von R-BgO am 08.07.19 12:17:41

Ebix Signs Agreement to Acquire Yatra Online Creating India's Leading Travel Services Platform

-Strategic Combination Broadens Capabilities to Capture Growing Multi-Billion Dollar Opportunity in India

-Expected to Generate 40 to 75 cents of Accretion to Ebix’s non-GAAP EPS within 9 to 12 Months Following Closing

Companies to Hold a Joint Conference Call over the Next Few Days

GURUGRAM & NOIDA, India, ATLANTA and NEW YORK– July 17, 2019 –

Ebix, Inc. (NASDAQ: EBIX) and Yatra Online, Inc. (NASDAQ: YTRA) today announced that they have entered into a definitive agreement under which Ebix will acquire Yatra via merger. In connection with the merger, each ordinary share of Yatra (“Yatra Ordinary Share”) will be entitled to receive 0.005 shares of a new class of preferred stock of Ebix (“Ebix Convertible Preferred Stock”). Each share of Ebix Convertible Preferred Stock received for each Yatra Ordinary Share will, in turn, be convertible into 20 shares of common stock of Ebix (“Ebix Common Stock”).

Based on the trailing 15-day volume weighted average price (“VWAP”) of Ebix Common Stock of $49.05 per share, each Yatra Ordinary Share convertible into Ebix Common Stock would be valued, on an as-converted basis, at $4.90 per share, representing an approximately 32% premium to Yatra’s closing share price on March 8, 2019, the last trading day prior to the public announcement of Ebix’s offer to acquire Yatra. Assuming a value of $4.90 per Yatra Ordinary Share, the transaction implies an enterprise value of $337.8mil at the Ebix collar price of $59 per share and post adjustment for Indebtedness, Working capital, Warrants to be converted and minimum cash requirement, a net equity value of $239 million.

Ebix will be issuing 243,747 convertible preferred stock, which in turn will be convertible into 4,874,931 shares of Ebix common stock.

Ebix is a leading international supplier of On-Demand software and E-commerce services to the insurance, financial, healthcare and e-learning industries. Yatra Online is the parent company of Yatra Online Pvt. Ltd., India's leading Corporate Travel services provider and one of India's leading online travel companies. Following the completion of the transaction, Yatra will become part of Ebix’s EbixCash travel portfolio alongside Via and Mercury and will continue to serve customers under the Yatra brand. The transaction will create India’s largest and most profitable travel services company, and a leading online travel platform poised to capture significant international growth opportunities.

Ebix Chairman, President and CEO Robin Raina, commented, "The acquisition of Yatra would lend itself to significant synergies and the emergence of EbixCash as India’s largest and most profitable travel services company, besides being the largest enterprise financial exchange in the country. Over the last few months, we have evolved a detailed synergistic plan, that once fully executed can provide between 40 to 75 cents of accretion to the Ebix non-GAAP EPS. We are excited by the cross-selling opportunities that this combination provides us, while further strengthening our future EbixCash IPO offering.”

“We are pleased to announce this agreement with Ebix, which provides our shareholders with the opportunity to participate in the significant upside potential of one of the fastest growing multinational On-Demand software and E-commerce services companies in the world,” said Dhruv Shringi, Co-founder and CEO of Yatra Online. “Over the last several years, we have built Yatra into one of India’s most well-recognized e-commerce brands, growing into the leading corporate travel services provider and one of the largest consumer travel companies. Becoming a part of Ebix’s EbixCash travel portfolio will enable us to continue on that path. As part of a larger diversified organization with the necessary scale and resources to be a leader in today’s dynamic travel marketplace, we will provide more options and an enhanced experience for our joint customers and will be an even stronger partner to the airline, hotel, car rental and other businesses we work with. We are confident that combining Yatra’s loyal customer base, comprehensive service offering and multi-channel platform with Ebix’s complementary Via and Mercury businesses, will create a leading online travel platform and India’s largest corporate travel platform that will capture growth opportunities and deliver enhanced value to shareholders.”

Strategic and Financial Benefits of the Transaction:

Accelerates Growth Potential as a Premier International Travel Services Provider. Under Ebix’s leading travel platform, the combined company will leverage Yatra’s large and loyal existing customer base, comprehensive service offering and multi-channel platform to take advantage of the dynamic and growing multibillion-dollar opportunity in India. The combined company will have an international footprint with more than 11,000 employees and a travel expanse spanning GCC, ASEAN and Asia Pacific countries. The transaction also provides the necessary scale to extend its travel business to North America, Latin America and Europe. Together, Ebix and Yatra will be a comprehensive global platform with “on-the-ground” presence in major markets worldwide.

Creates World’s Leading End-to-End Enterprise Financial and Insurance Services Provider. Given the highly complementary nature of each company’s travel platform, the combined entity will create India’s largest end-to-end travel industry provider, offering distribution, travel insurance, forex, MICE, Visa, and travel technology services. Combining Yatra’s loyal customer base, comprehensive service offering and multi-channel platform with Ebix’s complementary Via and Mercury businesses, creates a leading online travel platform that will capture cross selling growth opportunities across the EbixCash portfolio of products an customers, while delivering enhanced value to shareholders.

Delivers Short and Long-Term Financial Benefits. The transaction is expected to be 40 to 75 cents accretive to Ebix’s non-GAAP earnings per share within a period of 6 to 12 months from closing, once all the mutual synergies have been executed. Ebix has a proven track record of successfully integrating acquired products, services and companies in a highly disciplined and efficient manner, with resulting cash flow and earnings per share being key endpoint metrics and generating significant shareholder value.

Creation of India’s Largest Financial and Travel EbixCash Exchange. Ebix intends to make Yatra an integral part of the EbixCash financial and travel exchange portfolio, while targeting an EbixCash IPO in the second quarter of 2020. The synergies and the cross-selling opportunities can create tremendous economic value for the shareholders, once the IPO is done.

Pre-Closing Tender for Yatra Warrants

As a condition to the closing of the transaction, Yatra will offer newly issued Yatra Ordinary Shares in exchange for 50% of the outstanding warrants to purchase Yatra Ordinary Shares (“Yatra Warrants”). It is currently anticipated that approximately 1.3 million newly issued Yatra Ordinary Shares will be exchanged for 50% of the outstanding Yatra Warrants, representing an exchange ratio of 0.075 newly issued Yatra Shares per Yatra Warrant. Assuming the value of the underlying Ebix Common Stock to be received for each Yatra share is $4.90, the value offered per Yatra Warrant would be $0.37.

Redemption Option

The Ebix Convertible Preferred Stock will offer all Yatra shareholders the right to have redeemed, for a cash price of $5.31, the shares of Ebix Convertible Preferred Stock received per Yatra Ordinary Share. The redemption option will be available to Yatra shareholders during the 25th month after closing. The redemption option is accordingly only available to Yatra shareholders who have not opted to convert the Ebix convertible preferred stock into common stock of Ebix before the 25th month after closing.

Timing and Approvals

The transaction has been approved unanimously by each of Ebix's and Yatra’s Boards of Directors, and it is expected to close by the fourth quarter of 2019. The obligations of each party to consummate the transaction are subject to approval by Yatra shareholders, clearances by the U.S. Securities and Exchange Commission (the “SEC”) and Nasdaq of the registration and listing of the Ebix Convertible Preferred Stock, respectively, and other customary closing conditions. The obligations of Ebix to consummate the transaction are further conditioned upon (i) Yatra obtaining the cancellation or other extinguishment of Yatra Warrants such that no more than 8,768,979 Yatra Ordinary Shares remain subject to Yatra Warrants and (ii) Ebix’s receipt of written acknowledgment from Yatra’s financial advisor that its fees and expenses due for such services have been paid in full.

der Merger könnte ein Grund gewesen sein,

Ergebnis ist auf jeden Fall übel für Yatra-Investoren:Ebix Signs Agreement to Acquire Yatra Online Creating India's Leading Travel Services Platform

-Strategic Combination Broadens Capabilities to Capture Growing Multi-Billion Dollar Opportunity in India

-Expected to Generate 40 to 75 cents of Accretion to Ebix’s non-GAAP EPS within 9 to 12 Months Following Closing

Companies to Hold a Joint Conference Call over the Next Few Days

GURUGRAM & NOIDA, India, ATLANTA and NEW YORK– July 17, 2019 –

Ebix, Inc. (NASDAQ: EBIX) and Yatra Online, Inc. (NASDAQ: YTRA) today announced that they have entered into a definitive agreement under which Ebix will acquire Yatra via merger. In connection with the merger, each ordinary share of Yatra (“Yatra Ordinary Share”) will be entitled to receive 0.005 shares of a new class of preferred stock of Ebix (“Ebix Convertible Preferred Stock”). Each share of Ebix Convertible Preferred Stock received for each Yatra Ordinary Share will, in turn, be convertible into 20 shares of common stock of Ebix (“Ebix Common Stock”).

Based on the trailing 15-day volume weighted average price (“VWAP”) of Ebix Common Stock of $49.05 per share, each Yatra Ordinary Share convertible into Ebix Common Stock would be valued, on an as-converted basis, at $4.90 per share, representing an approximately 32% premium to Yatra’s closing share price on March 8, 2019, the last trading day prior to the public announcement of Ebix’s offer to acquire Yatra. Assuming a value of $4.90 per Yatra Ordinary Share, the transaction implies an enterprise value of $337.8mil at the Ebix collar price of $59 per share and post adjustment for Indebtedness, Working capital, Warrants to be converted and minimum cash requirement, a net equity value of $239 million.

Ebix will be issuing 243,747 convertible preferred stock, which in turn will be convertible into 4,874,931 shares of Ebix common stock.

Ebix is a leading international supplier of On-Demand software and E-commerce services to the insurance, financial, healthcare and e-learning industries. Yatra Online is the parent company of Yatra Online Pvt. Ltd., India's leading Corporate Travel services provider and one of India's leading online travel companies. Following the completion of the transaction, Yatra will become part of Ebix’s EbixCash travel portfolio alongside Via and Mercury and will continue to serve customers under the Yatra brand. The transaction will create India’s largest and most profitable travel services company, and a leading online travel platform poised to capture significant international growth opportunities.

Ebix Chairman, President and CEO Robin Raina, commented, "The acquisition of Yatra would lend itself to significant synergies and the emergence of EbixCash as India’s largest and most profitable travel services company, besides being the largest enterprise financial exchange in the country. Over the last few months, we have evolved a detailed synergistic plan, that once fully executed can provide between 40 to 75 cents of accretion to the Ebix non-GAAP EPS. We are excited by the cross-selling opportunities that this combination provides us, while further strengthening our future EbixCash IPO offering.”

“We are pleased to announce this agreement with Ebix, which provides our shareholders with the opportunity to participate in the significant upside potential of one of the fastest growing multinational On-Demand software and E-commerce services companies in the world,” said Dhruv Shringi, Co-founder and CEO of Yatra Online. “Over the last several years, we have built Yatra into one of India’s most well-recognized e-commerce brands, growing into the leading corporate travel services provider and one of the largest consumer travel companies. Becoming a part of Ebix’s EbixCash travel portfolio will enable us to continue on that path. As part of a larger diversified organization with the necessary scale and resources to be a leader in today’s dynamic travel marketplace, we will provide more options and an enhanced experience for our joint customers and will be an even stronger partner to the airline, hotel, car rental and other businesses we work with. We are confident that combining Yatra’s loyal customer base, comprehensive service offering and multi-channel platform with Ebix’s complementary Via and Mercury businesses, will create a leading online travel platform and India’s largest corporate travel platform that will capture growth opportunities and deliver enhanced value to shareholders.”

Strategic and Financial Benefits of the Transaction:

Accelerates Growth Potential as a Premier International Travel Services Provider. Under Ebix’s leading travel platform, the combined company will leverage Yatra’s large and loyal existing customer base, comprehensive service offering and multi-channel platform to take advantage of the dynamic and growing multibillion-dollar opportunity in India. The combined company will have an international footprint with more than 11,000 employees and a travel expanse spanning GCC, ASEAN and Asia Pacific countries. The transaction also provides the necessary scale to extend its travel business to North America, Latin America and Europe. Together, Ebix and Yatra will be a comprehensive global platform with “on-the-ground” presence in major markets worldwide.

Creates World’s Leading End-to-End Enterprise Financial and Insurance Services Provider. Given the highly complementary nature of each company’s travel platform, the combined entity will create India’s largest end-to-end travel industry provider, offering distribution, travel insurance, forex, MICE, Visa, and travel technology services. Combining Yatra’s loyal customer base, comprehensive service offering and multi-channel platform with Ebix’s complementary Via and Mercury businesses, creates a leading online travel platform that will capture cross selling growth opportunities across the EbixCash portfolio of products an customers, while delivering enhanced value to shareholders.

Delivers Short and Long-Term Financial Benefits. The transaction is expected to be 40 to 75 cents accretive to Ebix’s non-GAAP earnings per share within a period of 6 to 12 months from closing, once all the mutual synergies have been executed. Ebix has a proven track record of successfully integrating acquired products, services and companies in a highly disciplined and efficient manner, with resulting cash flow and earnings per share being key endpoint metrics and generating significant shareholder value.

Creation of India’s Largest Financial and Travel EbixCash Exchange. Ebix intends to make Yatra an integral part of the EbixCash financial and travel exchange portfolio, while targeting an EbixCash IPO in the second quarter of 2020. The synergies and the cross-selling opportunities can create tremendous economic value for the shareholders, once the IPO is done.

Pre-Closing Tender for Yatra Warrants

As a condition to the closing of the transaction, Yatra will offer newly issued Yatra Ordinary Shares in exchange for 50% of the outstanding warrants to purchase Yatra Ordinary Shares (“Yatra Warrants”). It is currently anticipated that approximately 1.3 million newly issued Yatra Ordinary Shares will be exchanged for 50% of the outstanding Yatra Warrants, representing an exchange ratio of 0.075 newly issued Yatra Shares per Yatra Warrant. Assuming the value of the underlying Ebix Common Stock to be received for each Yatra share is $4.90, the value offered per Yatra Warrant would be $0.37.

Redemption Option

The Ebix Convertible Preferred Stock will offer all Yatra shareholders the right to have redeemed, for a cash price of $5.31, the shares of Ebix Convertible Preferred Stock received per Yatra Ordinary Share. The redemption option will be available to Yatra shareholders during the 25th month after closing. The redemption option is accordingly only available to Yatra shareholders who have not opted to convert the Ebix convertible preferred stock into common stock of Ebix before the 25th month after closing.

Timing and Approvals

The transaction has been approved unanimously by each of Ebix's and Yatra’s Boards of Directors, and it is expected to close by the fourth quarter of 2019. The obligations of each party to consummate the transaction are subject to approval by Yatra shareholders, clearances by the U.S. Securities and Exchange Commission (the “SEC”) and Nasdaq of the registration and listing of the Ebix Convertible Preferred Stock, respectively, and other customary closing conditions. The obligations of Ebix to consummate the transaction are further conditioned upon (i) Yatra obtaining the cancellation or other extinguishment of Yatra Warrants such that no more than 8,768,979 Yatra Ordinary Shares remain subject to Yatra Warrants and (ii) Ebix’s receipt of written acknowledgment from Yatra’s financial advisor that its fees and expenses due for such services have been paid in full.

Antwort auf Beitrag Nr.: 60.975.412 von R-BgO am 08.07.19 12:17:41

kamen am 31.7.;

Verlust deutlich eingedämmt Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +0,26 | |

| -0,42 | |

| +0,60 | |

| -8,51 | |

| +0,19 | |

| +0,66 | |

| -1,84 | |

| +0,63 | |

| +0,01 | |

| +0,24 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 239 | ||

| 102 | ||

| 81 | ||

| 78 | ||

| 77 | ||

| 53 | ||

| 40 | ||

| 38 | ||

| 36 | ||

| 34 |

Yatra Online