Hummingbird Resources - baut gerade eine Goldmine in Mali 107k zu 695 AISC (Seite 7)

eröffnet am 03.01.17 18:52:18 von

neuester Beitrag 19.10.23 17:10:17 von

neuester Beitrag 19.10.23 17:10:17 von

Beiträge: 69

ID: 1.243.883

ID: 1.243.883

Aufrufe heute: 0

Gesamt: 5.361

Gesamt: 5.361

Aktive User: 0

ISIN: GB00B60BWY28 · WKN: A1H57G · Symbol: HUM

0,0725

GBP

-3,33 %

-0,0025 GBP

Letzter Kurs 18:52:00 London

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 55,80 | +15,41 | |

| 1,7500 | +15,13 | |

| 0,7999 | +14,27 | |

| 11,250 | +12,73 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5100 | -8,93 | |

| 2,1800 | -9,17 | |

| 186,20 | -10,48 | |

| 4,2300 | -17,86 | |

| 46,74 | -98,00 |

Beitrag zu dieser Diskussion schreiben

30 January 2017

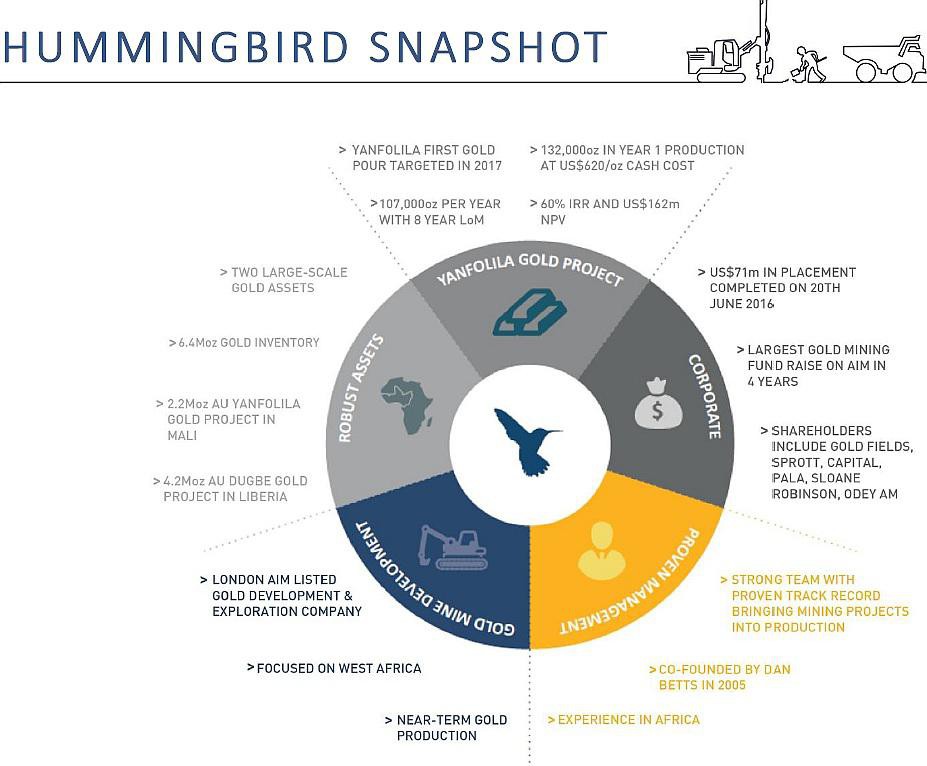

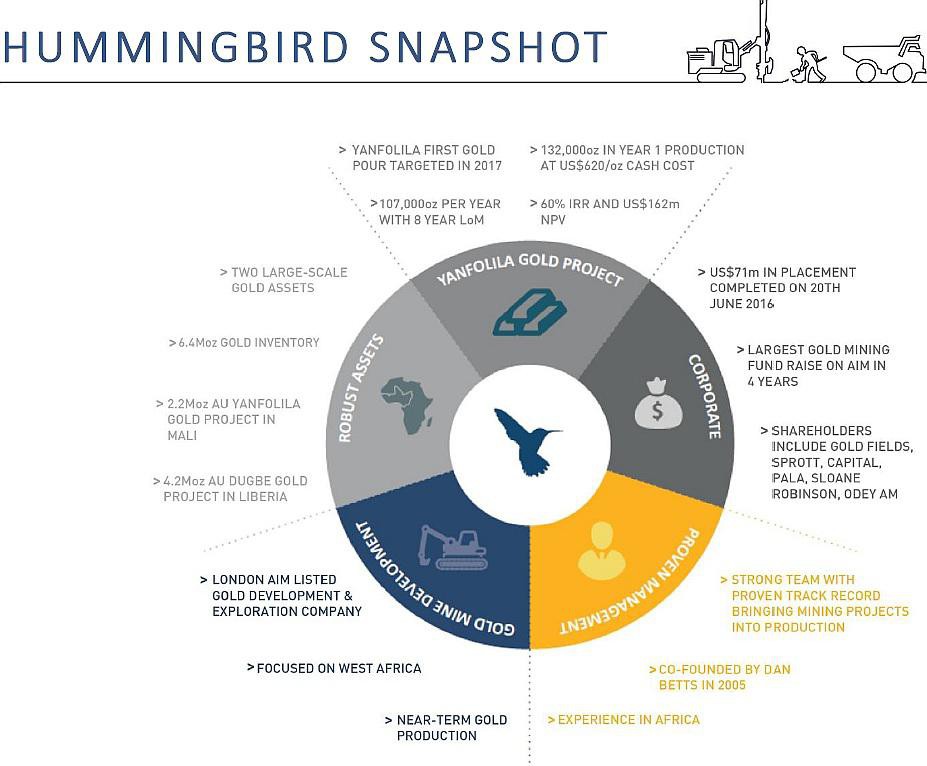

Hummingbird Resources – Building one of West Africa’s next best goldmines

https://www.miningreview.com/magazine_articles/hummingbird-r…

AIM-listed gold junior Hummingbird Resources’ Yanfolila project is well on its way to becoming one of the next new gold mines to commence production in Mali, West Africa this year – the continent’s most active and attractive gold mining hot spot – host to a significant number of new gold mines and over a handful more due to come on stream before 2020. Chantelle Kotze writes.

What sets this junior apart from its peers is that unlike most junior mining companies whose approach to project delivery has been to bring their primary assets into production as quickly as possible, Hummingbird’s strategy has always been to create a gold company – one that has a portfolio of assets encompassing exploration, development and production, explains Robert Monro, Hummingbird head of business development.

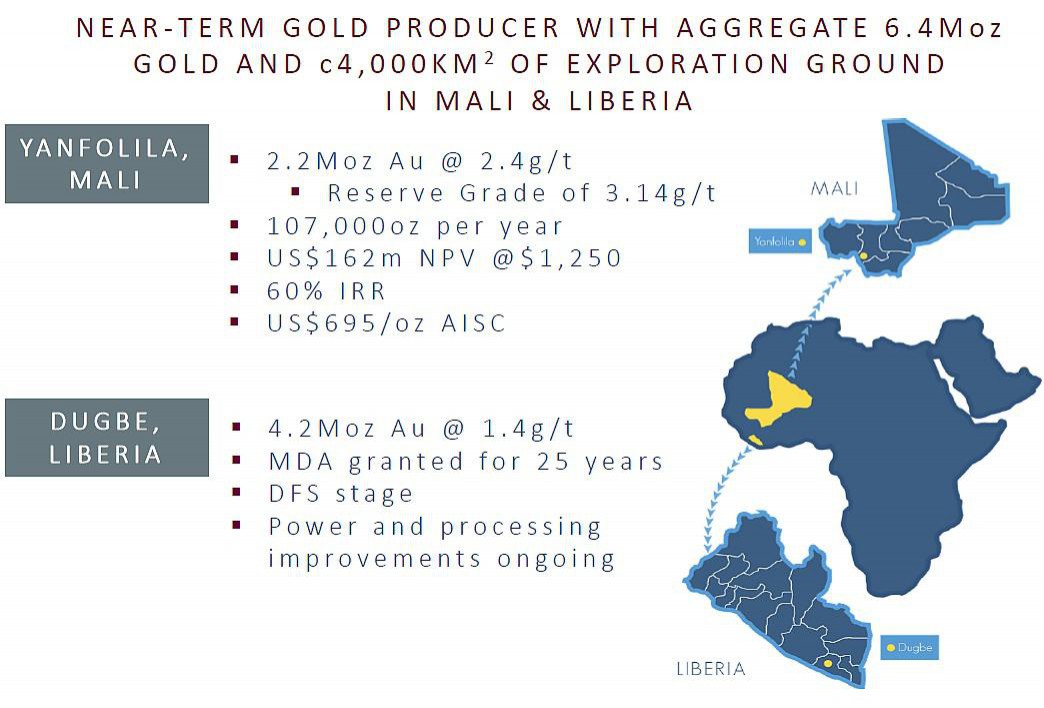

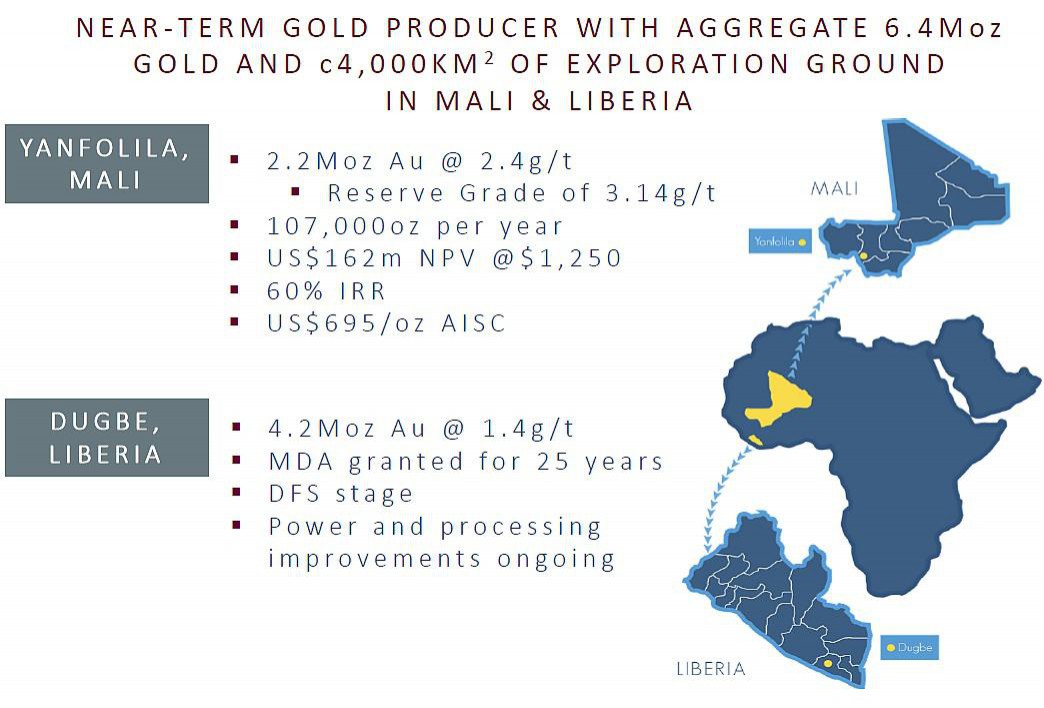

Hummingbird’s purchase of the Yanfolila gold project from Gold Fields in 2014 marked a significant step towards fulfilling this ambition as the company is now a multi-project, near-term producer with a combined 6.4 Moz gold resource and about 4 000 km2 of exploration ground with significant upside potential within its portfolio.

Monro believes that Hummingbird’s flagship and immediate priority project – the 2.2 Moz Yanfolila gold project – provides the company with a fast, simple and low cost route to production.

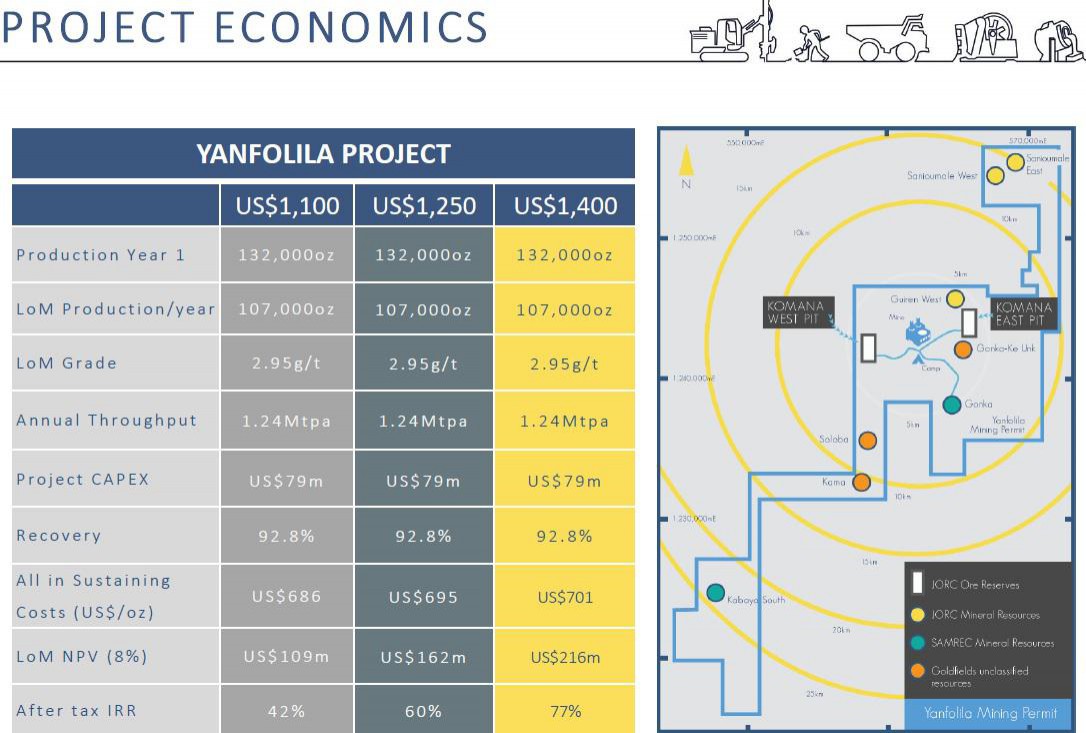

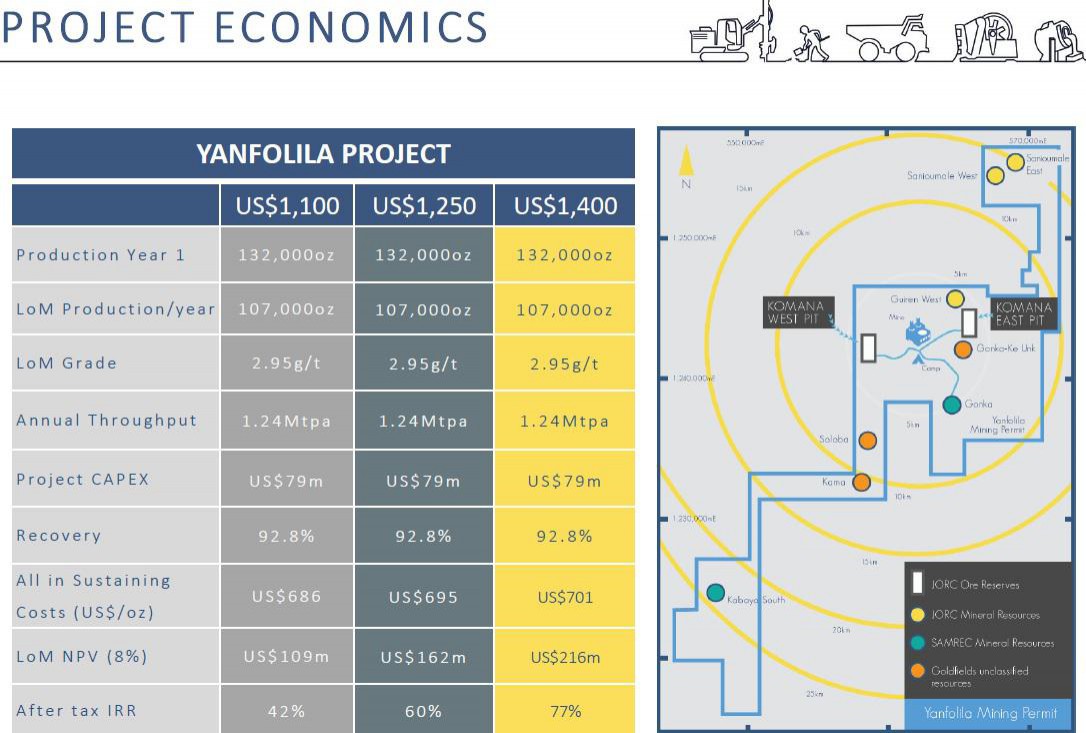

The development plan of Yanfolila, based on the definitive feasibility plan released in February 2016, will see Yanfolila produce 107 000 ozpa from a 1.24 Mtpa carbon-in leach (CIL) plant for seven and a half years. This will be undertaken at a total capital expenditure (capex) of US$88 million of which the company is fully funded to production, having secured $71 million in equity in July 2016 and a further $55 million in debt in December 2016, with commitments to date representing nearly 30% of the project capex.

“This achievement proves that despite market conditions, good projects do get funded and good projects are built,” Monro enthuses.

To achieve this goal, Hummingbird awarded the full engineering, procurement and construction contractor management (EPCM) contract in July 2016 to African engineering expert SENET, who is spearheading the development for both the Yanfolila plant and its associated infrastructure including mine dewatering, access roads, airstrip, an accommodation village, offices and a tailings storage facility.

SENET, who has completed numerous projects in West Africa in Mali, Ghana, Burkina Faso, Guinea and Ivory Coast, is already well advanced with the engineering design and procurement. The major long lead items have already been procured; namely the ball mill, crushing circuit equipment, interstage screens, the carbon regeneration kiln, the CIL tower crane and the leach tanks to name a few.

With full scale-construction already well underway at Yanfolila, having kicked off in October 2016 for a build period of 12 months, the civil contractor local Malian company , who has been tasked with the completion of plant civil which makes the project viable even at low gold prices.

Construction of the plant, starting with the erection of the steelwork, began in January 2017 and Monro notes that Yanfolila is on track for plant commissioning during the fourth quarter of 2017, with first gold pour expected directly thereafter around December.

In its first full year of production Yanfolila will produce 132 000 oz of gold after which it will settle at 107 000 ozpa over its lifespan at a low all-in-sustaining-cost of $695/oz – which will be in the lowest quartile for African gold producers.

Moreover, the project is expected to deliver an IRR of 60% and an NPV of $162 million at a $1 250/oz gold price –which makes the project viable even at low gold prices.

Monro explains that the plant will comprise a gravity circuit in combination with CIL, unlike the typical heap leach extraction method, because the grade and ore body at Yanfolila is amenable to this process as it will drive the best grade extractions and returns. Yanfolila has a 3.14 g/t reserve grade which is relatively high when considering the global average head grade of around 1 g/t in West Africa, he notes.

Over its lifespan the plant, which is capable of treating 1.24 Mtpa of ore and producing up to 120 000 ozpa of gold, will process on average between 35% and 40% oxide material and between 65% and 70% fresh material, although it will be majority oxide ore in the early years, notes Monro.

In terms of the mine, this will comprise a series of open cast pits but initially only two, namely Komana East and Komana West, which are situated on either side of the process plant. These two pits will drive all of production ounces for the fi rst fi ve years of mine life after which an additional three pits will contribute towards maintaining the production profile. To bring this into fruition, Hummingbird Resources appointed African Mining Services (AMS), the Ghanaian contract mining subsidiary of ASX-listed mining services company Ausdrill, as its mining contractor at Yanfolila.

As the single largest contract that the company has awarded at $112 million, AMS will for an initial period of three years, commencing in the third quarter of 2017, undertake mining operations at Yanfolila using conventional drill and blast, and load and haul mining methods from the Komana East and Komana West deposits initially.

Upside potential

Monro highlights that an eight year lifespan is just the beginning for Yanfolila. The project may have just over 700 000 oz in reserve, but has a total 2.2 Moz of gold in the ground and Hummingbird plans to convert these inferred and indicated ounces into reserves with time, which will extend the mine life.

Moreover, the project has significant upside thanks to a +1 Moz gold inventory outside of the current mine plan and project economics but within the mining permit, which Hummingbird will look to bring into account.

One such exploration target that provides potential resource extension is Gonka.

Located 5 km south of Yanfolila, Gonka has an inferred resource of 385 198 oz in open pit, grading at 2.33 g/t of gold as well as 166 086 oz in underground, grading at 4.47 g/t of gold – open at depth and along strike.

“Currently at scoping study level, by bringing Gonka into the current mine plan the deposit could potentially add 30 000 ozpa to the operation over six years, increasing the NVP of the project by an additional $24 million at a $1 250/oz gold price,” Monro points out.

“This is exciting for us and something we just have to unlock and spend money on to complete all the drilling and studies,” he adds.

Once Hummingbird is confi dent that it will deliver Yanfolila on time and on budget it will have the ability to bring further ounces into the mine plan.

Dugbe and its role in building a ‘gold company’

In line with Hummingbird’s strategy of creating a significant gold company in West Africa, the gold developer describes its Liberia-based, 4.2 Moz Dugbe gold project as its “company making” project.

“While our immediate priority may be Yanfolila we are slowing working on Dugbe as well,” Monro ensures. As testimony to this, the company signed a mineral development agreement (MDA) with the government of Liberia in 2015 which in essence is a 25 year mining permit which covers all three discoveries at Dugbe, namely Dugbe F, Tuzon and Sackor.

Following the completion of a pre-economic assessment study in 2013, which was then followed by a pre-feasibility study, the company is currently progressing its detailed feasibility study (DFS).

At a gold price of about $1 300/oz, Monro says Dugbe looks particularly attractive. “We want to remind the market that this large, long-life project remains a priority in our portfolio and we will tap into its potential and deliver it to market and return its value to all stakeholders.”

Hummingbird Resources – Building one of West Africa’s next best goldmines

https://www.miningreview.com/magazine_articles/hummingbird-r…

AIM-listed gold junior Hummingbird Resources’ Yanfolila project is well on its way to becoming one of the next new gold mines to commence production in Mali, West Africa this year – the continent’s most active and attractive gold mining hot spot – host to a significant number of new gold mines and over a handful more due to come on stream before 2020. Chantelle Kotze writes.

What sets this junior apart from its peers is that unlike most junior mining companies whose approach to project delivery has been to bring their primary assets into production as quickly as possible, Hummingbird’s strategy has always been to create a gold company – one that has a portfolio of assets encompassing exploration, development and production, explains Robert Monro, Hummingbird head of business development.

Hummingbird’s purchase of the Yanfolila gold project from Gold Fields in 2014 marked a significant step towards fulfilling this ambition as the company is now a multi-project, near-term producer with a combined 6.4 Moz gold resource and about 4 000 km2 of exploration ground with significant upside potential within its portfolio.

Monro believes that Hummingbird’s flagship and immediate priority project – the 2.2 Moz Yanfolila gold project – provides the company with a fast, simple and low cost route to production.

The development plan of Yanfolila, based on the definitive feasibility plan released in February 2016, will see Yanfolila produce 107 000 ozpa from a 1.24 Mtpa carbon-in leach (CIL) plant for seven and a half years. This will be undertaken at a total capital expenditure (capex) of US$88 million of which the company is fully funded to production, having secured $71 million in equity in July 2016 and a further $55 million in debt in December 2016, with commitments to date representing nearly 30% of the project capex.

“This achievement proves that despite market conditions, good projects do get funded and good projects are built,” Monro enthuses.

To achieve this goal, Hummingbird awarded the full engineering, procurement and construction contractor management (EPCM) contract in July 2016 to African engineering expert SENET, who is spearheading the development for both the Yanfolila plant and its associated infrastructure including mine dewatering, access roads, airstrip, an accommodation village, offices and a tailings storage facility.

SENET, who has completed numerous projects in West Africa in Mali, Ghana, Burkina Faso, Guinea and Ivory Coast, is already well advanced with the engineering design and procurement. The major long lead items have already been procured; namely the ball mill, crushing circuit equipment, interstage screens, the carbon regeneration kiln, the CIL tower crane and the leach tanks to name a few.

With full scale-construction already well underway at Yanfolila, having kicked off in October 2016 for a build period of 12 months, the civil contractor local Malian company , who has been tasked with the completion of plant civil which makes the project viable even at low gold prices.

Construction of the plant, starting with the erection of the steelwork, began in January 2017 and Monro notes that Yanfolila is on track for plant commissioning during the fourth quarter of 2017, with first gold pour expected directly thereafter around December.

In its first full year of production Yanfolila will produce 132 000 oz of gold after which it will settle at 107 000 ozpa over its lifespan at a low all-in-sustaining-cost of $695/oz – which will be in the lowest quartile for African gold producers.

Moreover, the project is expected to deliver an IRR of 60% and an NPV of $162 million at a $1 250/oz gold price –which makes the project viable even at low gold prices.

Monro explains that the plant will comprise a gravity circuit in combination with CIL, unlike the typical heap leach extraction method, because the grade and ore body at Yanfolila is amenable to this process as it will drive the best grade extractions and returns. Yanfolila has a 3.14 g/t reserve grade which is relatively high when considering the global average head grade of around 1 g/t in West Africa, he notes.

Over its lifespan the plant, which is capable of treating 1.24 Mtpa of ore and producing up to 120 000 ozpa of gold, will process on average between 35% and 40% oxide material and between 65% and 70% fresh material, although it will be majority oxide ore in the early years, notes Monro.

In terms of the mine, this will comprise a series of open cast pits but initially only two, namely Komana East and Komana West, which are situated on either side of the process plant. These two pits will drive all of production ounces for the fi rst fi ve years of mine life after which an additional three pits will contribute towards maintaining the production profile. To bring this into fruition, Hummingbird Resources appointed African Mining Services (AMS), the Ghanaian contract mining subsidiary of ASX-listed mining services company Ausdrill, as its mining contractor at Yanfolila.

As the single largest contract that the company has awarded at $112 million, AMS will for an initial period of three years, commencing in the third quarter of 2017, undertake mining operations at Yanfolila using conventional drill and blast, and load and haul mining methods from the Komana East and Komana West deposits initially.

Upside potential

Monro highlights that an eight year lifespan is just the beginning for Yanfolila. The project may have just over 700 000 oz in reserve, but has a total 2.2 Moz of gold in the ground and Hummingbird plans to convert these inferred and indicated ounces into reserves with time, which will extend the mine life.

Moreover, the project has significant upside thanks to a +1 Moz gold inventory outside of the current mine plan and project economics but within the mining permit, which Hummingbird will look to bring into account.

One such exploration target that provides potential resource extension is Gonka.

Located 5 km south of Yanfolila, Gonka has an inferred resource of 385 198 oz in open pit, grading at 2.33 g/t of gold as well as 166 086 oz in underground, grading at 4.47 g/t of gold – open at depth and along strike.

“Currently at scoping study level, by bringing Gonka into the current mine plan the deposit could potentially add 30 000 ozpa to the operation over six years, increasing the NVP of the project by an additional $24 million at a $1 250/oz gold price,” Monro points out.

“This is exciting for us and something we just have to unlock and spend money on to complete all the drilling and studies,” he adds.

Once Hummingbird is confi dent that it will deliver Yanfolila on time and on budget it will have the ability to bring further ounces into the mine plan.

Dugbe and its role in building a ‘gold company’

In line with Hummingbird’s strategy of creating a significant gold company in West Africa, the gold developer describes its Liberia-based, 4.2 Moz Dugbe gold project as its “company making” project.

“While our immediate priority may be Yanfolila we are slowing working on Dugbe as well,” Monro ensures. As testimony to this, the company signed a mineral development agreement (MDA) with the government of Liberia in 2015 which in essence is a 25 year mining permit which covers all three discoveries at Dugbe, namely Dugbe F, Tuzon and Sackor.

Following the completion of a pre-economic assessment study in 2013, which was then followed by a pre-feasibility study, the company is currently progressing its detailed feasibility study (DFS).

At a gold price of about $1 300/oz, Monro says Dugbe looks particularly attractive. “We want to remind the market that this large, long-life project remains a priority in our portfolio and we will tap into its potential and deliver it to market and return its value to all stakeholders.”

Today's Market View - Condor Gold PLC, Hummingbird Resources Ltd

11:24 27 Jan 2017

http://www.proactiveinvestors.co.uk/columns/sp-angel/26979/t…

Hummingbird Resources (LON:HUM) 22p, Mkt Cap £77m – Yanfolila development ramping up with project delivery on target

The Hummingbird Resources team hosted a site visit at the Yanfolila project that was acquired from Gold Fields in 2014 and is currently in the development stage for the first gold pour targeted for the end of this year.

On the geological setting and exploration potential, the project is found in the Yanfolila Greenstone Belt stretching North/South along the eastern margin on the Siguiri Basin and bound to the east by the Sanakarani Shear Zone.

Mineralised zones are controlled by numerous sub vertical NS and NE faults with host rocks ranging from sedimentary siltstones and sandstones to igneous basalt, dolerite and porphyry.

Mineralisation is found in steeply dipping quartz-feldspar-pyrite veins with true widths ranging between deposits with an average of below 10m.

The Company benefits from more than $100m worth of exploration data completed by previous owners of the Project (mostly, Gold Fields) with the current mining plan including only two deposits (Komana East and Komana West) of six contained in the JORC compliant resource.

Applying historic resource conversion rates (50-55%) to available resource there is a potential to expand the reserve base by c.225koz; while, taking into account of historic Gold Fields estimates for ounces included in the old DFS (non-JORC) a potential of additional 507koz may be added to the mine life.

Additionally, existing deposits are expected to benefit from step out drilling along the strike as well as down dip with a potential for underground mining at certain targets.

Regarding mining operations, African Mining Services, a signed mining contractor, has a long history of operating in the West African province including works performed at Anglo-Gold Ashanti, Resolute Mining and Endeavour Mining projects.

AMS has access to the required fleet including excavators, trucks (18 100t CATs at peak of operations) and dual purpose drill rigs (for drill/blasting as well as grade control).

Fleet to start arriving onsite in Mar/Apr ahead of the start of mining operations in Aug.

Preparations for dewatering of pits to lower the level of the ground water table in progress.

As with all steeply dipping veins orebodies waste stripping ratio comes in high at 12-13 times.

Grade control will be crucial to minimise mining dilution (planned at 10-11% at the moment) and keep operating costs in check; although, the orebody seems well-structured and allows for an easy visual control of the ore/waste.

Processing plant completion remains on target for 28 Nov/17 with first gold pour scheduled for 19 Dec/17.

Ramp up to full capacity budgeted through Mar/18.

Crushers are in transit with the ball mill expecting shipment from South Africa (app. 8 weeks delivery time).

The variability in the ore type (weathered/transitionary/primary) is addressed with a single/two stage crushing.

The weathering profile varies across deposits from 60-90m at KW, 40-50m at KE to shallow 15-20m at Gonka, although all seem to be well defined with a relatively thin layer of transitional material (5-10m).

Potentially, as mining progresses deeper in the sulphide zone, a third crusher to be added (c. year 3 of operations) to account for a harder rock feed to the ball mill.

Accurate ores blending from the ROM pad will be critical to running the plant at a budgeted throughput and meet planned recoveries.

Also ROM pad to allow for a smooth feed to the mill with mining operations running at below/above the plant capacity during the wet (May-Oct)/dry season.

The site to run on a set of diesel generators (7MW total capacity) with a significant cost benefit drawn from fuel tax free agreement with authorities under the current permit.

Artisanal miners are established in the area which provide local communities with an income compensating for poor farming yields during the dry season (Feb-Apr).

The Company is planning to follow the “peaceful coexistence” approach allowing artisanal mining in areas not required for immediate development works.

Komana East and Komana West deposits, the two starting pits, will see miners moved this quarter with the remainder of sites remaining open for orpaillage (Company estimates c.2-3koz per annum depletion rate from those activities).

A share of affected miners are planned to be engaged in the construction/operations stage as well as in socio-economic projects launched by the Company (e.g. development of market gardens) compensating people for a lost source of income.

The project is likely to employ significantly more than the 80% minimum local labour requirement (currently running at 95%) maintaining good relations with local communities and making sure those participate in economic benefits of the project.

Conclusion: The project seems well set up to go into an active development stage with mining contractors arriving in the next few weeks and material processing equipment on its way to the site.

The management has done well to assemble a team with an extensive experience of taking the project through development and commissioning stage with development works progressing on time and schedule. The project benefits from an extensive historic drilling completed on the site which should help the mine plan and processing run rates to come in line with budgeted levels.

While the project clearly offers an upside to the current mine plan, the team is focused on delivering the project on time and on budget with any excessive funds to be carefully directed to further de-risking of the available resources.

Preparatory works are addressing issues that may influence the timing of the commissioning and ramp up of the mine including dewatering of pits, planning mining sequence adjusting accounting for the rainy season, engaging with local communities (including numerous artisanal miners) as well the timely delivery and installation of processing equipment.

The Company is currently trading on $118/oz on the EV/PP Reserves and $665/oz on the EV/Production multiples compared to same size producers averages of $182/oz and $1,625/oz, respectively, reflecting development and commissioning risks of the Company. We would expect the gap to close as the Company continues to deliver on its plans with commissioning and ramp up going as planned.

11:24 27 Jan 2017

http://www.proactiveinvestors.co.uk/columns/sp-angel/26979/t…

Hummingbird Resources (LON:HUM) 22p, Mkt Cap £77m – Yanfolila development ramping up with project delivery on target

The Hummingbird Resources team hosted a site visit at the Yanfolila project that was acquired from Gold Fields in 2014 and is currently in the development stage for the first gold pour targeted for the end of this year.

On the geological setting and exploration potential, the project is found in the Yanfolila Greenstone Belt stretching North/South along the eastern margin on the Siguiri Basin and bound to the east by the Sanakarani Shear Zone.

Mineralised zones are controlled by numerous sub vertical NS and NE faults with host rocks ranging from sedimentary siltstones and sandstones to igneous basalt, dolerite and porphyry.

Mineralisation is found in steeply dipping quartz-feldspar-pyrite veins with true widths ranging between deposits with an average of below 10m.

The Company benefits from more than $100m worth of exploration data completed by previous owners of the Project (mostly, Gold Fields) with the current mining plan including only two deposits (Komana East and Komana West) of six contained in the JORC compliant resource.

Applying historic resource conversion rates (50-55%) to available resource there is a potential to expand the reserve base by c.225koz; while, taking into account of historic Gold Fields estimates for ounces included in the old DFS (non-JORC) a potential of additional 507koz may be added to the mine life.

Additionally, existing deposits are expected to benefit from step out drilling along the strike as well as down dip with a potential for underground mining at certain targets.

Regarding mining operations, African Mining Services, a signed mining contractor, has a long history of operating in the West African province including works performed at Anglo-Gold Ashanti, Resolute Mining and Endeavour Mining projects.

AMS has access to the required fleet including excavators, trucks (18 100t CATs at peak of operations) and dual purpose drill rigs (for drill/blasting as well as grade control).

Fleet to start arriving onsite in Mar/Apr ahead of the start of mining operations in Aug.

Preparations for dewatering of pits to lower the level of the ground water table in progress.

As with all steeply dipping veins orebodies waste stripping ratio comes in high at 12-13 times.

Grade control will be crucial to minimise mining dilution (planned at 10-11% at the moment) and keep operating costs in check; although, the orebody seems well-structured and allows for an easy visual control of the ore/waste.

Processing plant completion remains on target for 28 Nov/17 with first gold pour scheduled for 19 Dec/17.

Ramp up to full capacity budgeted through Mar/18.

Crushers are in transit with the ball mill expecting shipment from South Africa (app. 8 weeks delivery time).

The variability in the ore type (weathered/transitionary/primary) is addressed with a single/two stage crushing.

The weathering profile varies across deposits from 60-90m at KW, 40-50m at KE to shallow 15-20m at Gonka, although all seem to be well defined with a relatively thin layer of transitional material (5-10m).

Potentially, as mining progresses deeper in the sulphide zone, a third crusher to be added (c. year 3 of operations) to account for a harder rock feed to the ball mill.

Accurate ores blending from the ROM pad will be critical to running the plant at a budgeted throughput and meet planned recoveries.

Also ROM pad to allow for a smooth feed to the mill with mining operations running at below/above the plant capacity during the wet (May-Oct)/dry season.

The site to run on a set of diesel generators (7MW total capacity) with a significant cost benefit drawn from fuel tax free agreement with authorities under the current permit.

Artisanal miners are established in the area which provide local communities with an income compensating for poor farming yields during the dry season (Feb-Apr).

The Company is planning to follow the “peaceful coexistence” approach allowing artisanal mining in areas not required for immediate development works.

Komana East and Komana West deposits, the two starting pits, will see miners moved this quarter with the remainder of sites remaining open for orpaillage (Company estimates c.2-3koz per annum depletion rate from those activities).

A share of affected miners are planned to be engaged in the construction/operations stage as well as in socio-economic projects launched by the Company (e.g. development of market gardens) compensating people for a lost source of income.

The project is likely to employ significantly more than the 80% minimum local labour requirement (currently running at 95%) maintaining good relations with local communities and making sure those participate in economic benefits of the project.

Conclusion: The project seems well set up to go into an active development stage with mining contractors arriving in the next few weeks and material processing equipment on its way to the site.

The management has done well to assemble a team with an extensive experience of taking the project through development and commissioning stage with development works progressing on time and schedule. The project benefits from an extensive historic drilling completed on the site which should help the mine plan and processing run rates to come in line with budgeted levels.

While the project clearly offers an upside to the current mine plan, the team is focused on delivering the project on time and on budget with any excessive funds to be carefully directed to further de-risking of the available resources.

Preparatory works are addressing issues that may influence the timing of the commissioning and ramp up of the mine including dewatering of pits, planning mining sequence adjusting accounting for the rainy season, engaging with local communities (including numerous artisanal miners) as well the timely delivery and installation of processing equipment.

The Company is currently trading on $118/oz on the EV/PP Reserves and $665/oz on the EV/Production multiples compared to same size producers averages of $182/oz and $1,625/oz, respectively, reflecting development and commissioning risks of the Company. We would expect the gap to close as the Company continues to deliver on its plans with commissioning and ramp up going as planned.

Hummingbird Resources plc (“Hummingbird” or “the Company”)

SMPP Contract Signed and Steel Work Arriving at Yanfolila

Hummingbird Resources (AIM: HUM), ahead of the site visit next week is pleased to announce an update from its Yanfolila Gold Project in Mali (“Yanfolila”) where mine construction is currently underway with its first gold pour expected by end of 2017.

Highlights:

Award of Structural, Mechanical, Plate work and Piping (“SMPP”) contract at Yanfolila to IMAGRI-SARL

Tower crane and pre-rolled CIL tanks delivered to site

Dewatering bore hole drilling commenced ahead of pre-mining pit dewatering

Plant construction on track with planned completion in Q4 2017, ahead of first gold pour by YE 2017

Analyst site visit scheduled for week commencing 23 January 2017

Please click on the following link to see recent pictures and videos of construction http://hummingbirdresources.co.uk/gallery/ . This page will continue to be updated regularly.

Dan Betts, CEO of Hummingbird Resources, said: “We are making great progress on the ground and as a result we remain on schedule to deliver our first gold by the end of the year. We are delighted to have appointed IMAGARI-SARL for the important SMPP contract having already seen their excellent results from the civil works on site. Steel work has started to arrive at Yanfolila and we are looking forward to seeing the CIL tanks being assembled in the near future. In the mean time we look forward to welcoming a number of mining analysts and investors on site at Yanfolila next week at this exciting time for Hummingbird.”

SMPP Contract Signed and Steel Work Arriving at Yanfolila

Hummingbird Resources (AIM: HUM), ahead of the site visit next week is pleased to announce an update from its Yanfolila Gold Project in Mali (“Yanfolila”) where mine construction is currently underway with its first gold pour expected by end of 2017.

Highlights:

Award of Structural, Mechanical, Plate work and Piping (“SMPP”) contract at Yanfolila to IMAGRI-SARL

Tower crane and pre-rolled CIL tanks delivered to site

Dewatering bore hole drilling commenced ahead of pre-mining pit dewatering

Plant construction on track with planned completion in Q4 2017, ahead of first gold pour by YE 2017

Analyst site visit scheduled for week commencing 23 January 2017

Please click on the following link to see recent pictures and videos of construction http://hummingbirdresources.co.uk/gallery/ . This page will continue to be updated regularly.

Dan Betts, CEO of Hummingbird Resources, said: “We are making great progress on the ground and as a result we remain on schedule to deliver our first gold by the end of the year. We are delighted to have appointed IMAGARI-SARL for the important SMPP contract having already seen their excellent results from the civil works on site. Steel work has started to arrive at Yanfolila and we are looking forward to seeing the CIL tanks being assembled in the near future. In the mean time we look forward to welcoming a number of mining analysts and investors on site at Yanfolila next week at this exciting time for Hummingbird.”

Hummingbird Resources PLC 11 January 2017

Ticker: HUM / Index: AIM / Sector: Mining

Quarterly Review

Hummingbird Resources (AIM: HUM), is pleased to announce a review of activities during Q4 2016 which saw construction commencing at its Yanfolila Gold Project in Mali ("Yanfolila") ahead of expected first gold production at the end of 2017.

Highlights

· Commencement of construction at Yanfolila in October 2016:

o IMAGRI-SARL, a leading specialist of building, mining and industrial infrastructure in Mali, commenced civil works

o First concrete poured on 20 October 2016

· Long lead items ordered in October 2016, including the crushing circuit equipment from Metso, agitators from Afromix, screens and carbon regeneration kiln from Kemix

· Mill shell, pinions and gears all ordered and construction on schedule

· US$45 million Senior Secured Term Facility and US$10 million Cost Overrun Facility signed with Taurus Funds Management Pty Limited ("Taurus" or "Taurus Funds Management") ensuring Yanfolila is fully funded through to positive cash flow

· African Mining Services, a subsidiary of ASX listed Ausdrill Limited, appointed as mining contractor at Yanfolila

Please click on the following link to see recent pictures and videos of construction. This will continue to be updated regularly. http://hummingbirdresources.co.uk/gallery/

Review

The on-going transformation of Hummingbird into a production company started in Q4 2016 and a huge amount of activity has taken place.

The defining moment of Q4 2016 was the commencement of full scale construction at Yanfolila, our 2.2 million ounces ("Moz") gold project in Mali, in October 2016. Yanfolila boasts impressive economics demonstrated by the US$162 million NPV8 and 60% IRR at a US$1,250/oz gold price. The plant will have capacity to process 1.24 million tonnes / year ("Mt/year"), producing 132,000oz of gold in its first full year of production and a life of mine average of 107,000oz/year with 3.1 grams/tonne ("g/t") reserves. Yanfolila provides rapid payback on initial capital invested with over US$70 million free cash flow expected to be generated in its first full year of production. Our all in sustaining cash cost ("AISC") is in the bottom quartile of producers at circa US$700/oz and importantly, at a US$1,100/oz gold price the project, with a 42% IRR, is extremely robust. There is also considerable upside at Yanfolila, with over 1Moz of gold outside of the mine plan but within the permit as well as the Gonka deposit (5km south of the Yanfolila plant), which based on the desktop study undertaken by DRA Projects (as announced on 2 February 2016) can add a further US$24 million to the NPV alone.

Having secured the necessary equity to build Yanfolila in the summer of 2016, Hummingbird finalised the arrangements for a US$45 million debt facility with an additional $10m cost-over run facility with Taurus Funds Management in Q4. Taurus confirmed completion of technical due-diligence on the project and provided the additional flexibility for Hummingbird to further extend its Bridge Facility by a further US$10 million to US$25 million whilst facility documentation is completed; underlying its commitment to Yanfolila. The Taurus debt facility was the final funding stage necessary to ensure full funding for Yanfolila into positive cash-flows.

Yanfolila is now a hive of activity with good progress being made on the ground. A few short months ago, only earthworks had been completed and now, with civil works underway we are on track for steel work to begin in the coming weeks. The Company is hosting a site visit of mining analysts later this month and the Company is confident that strong progress made over recent weeks and months will be recognised by that group.

In December, the executive team visited the factories in Europe which are presently constructing the ball mill and gearing, and we are pleased to report that excellent progress is being made across all areas of this critical aspect of the plant development. The professionalism and quality of the work at the facilities was impressive to see.

The Company looks forward to providing further regular updates over the coming months as activity ramps up and Yanfolila evolves in to what is expected to be a high margin gold mining operation in the near term.

Ticker: HUM / Index: AIM / Sector: Mining

Quarterly Review

Hummingbird Resources (AIM: HUM), is pleased to announce a review of activities during Q4 2016 which saw construction commencing at its Yanfolila Gold Project in Mali ("Yanfolila") ahead of expected first gold production at the end of 2017.

Highlights

· Commencement of construction at Yanfolila in October 2016:

o IMAGRI-SARL, a leading specialist of building, mining and industrial infrastructure in Mali, commenced civil works

o First concrete poured on 20 October 2016

· Long lead items ordered in October 2016, including the crushing circuit equipment from Metso, agitators from Afromix, screens and carbon regeneration kiln from Kemix

· Mill shell, pinions and gears all ordered and construction on schedule

· US$45 million Senior Secured Term Facility and US$10 million Cost Overrun Facility signed with Taurus Funds Management Pty Limited ("Taurus" or "Taurus Funds Management") ensuring Yanfolila is fully funded through to positive cash flow

· African Mining Services, a subsidiary of ASX listed Ausdrill Limited, appointed as mining contractor at Yanfolila

Please click on the following link to see recent pictures and videos of construction. This will continue to be updated regularly. http://hummingbirdresources.co.uk/gallery/

Review

The on-going transformation of Hummingbird into a production company started in Q4 2016 and a huge amount of activity has taken place.

The defining moment of Q4 2016 was the commencement of full scale construction at Yanfolila, our 2.2 million ounces ("Moz") gold project in Mali, in October 2016. Yanfolila boasts impressive economics demonstrated by the US$162 million NPV8 and 60% IRR at a US$1,250/oz gold price. The plant will have capacity to process 1.24 million tonnes / year ("Mt/year"), producing 132,000oz of gold in its first full year of production and a life of mine average of 107,000oz/year with 3.1 grams/tonne ("g/t") reserves. Yanfolila provides rapid payback on initial capital invested with over US$70 million free cash flow expected to be generated in its first full year of production. Our all in sustaining cash cost ("AISC") is in the bottom quartile of producers at circa US$700/oz and importantly, at a US$1,100/oz gold price the project, with a 42% IRR, is extremely robust. There is also considerable upside at Yanfolila, with over 1Moz of gold outside of the mine plan but within the permit as well as the Gonka deposit (5km south of the Yanfolila plant), which based on the desktop study undertaken by DRA Projects (as announced on 2 February 2016) can add a further US$24 million to the NPV alone.

Having secured the necessary equity to build Yanfolila in the summer of 2016, Hummingbird finalised the arrangements for a US$45 million debt facility with an additional $10m cost-over run facility with Taurus Funds Management in Q4. Taurus confirmed completion of technical due-diligence on the project and provided the additional flexibility for Hummingbird to further extend its Bridge Facility by a further US$10 million to US$25 million whilst facility documentation is completed; underlying its commitment to Yanfolila. The Taurus debt facility was the final funding stage necessary to ensure full funding for Yanfolila into positive cash-flows.

Yanfolila is now a hive of activity with good progress being made on the ground. A few short months ago, only earthworks had been completed and now, with civil works underway we are on track for steel work to begin in the coming weeks. The Company is hosting a site visit of mining analysts later this month and the Company is confident that strong progress made over recent weeks and months will be recognised by that group.

In December, the executive team visited the factories in Europe which are presently constructing the ball mill and gearing, and we are pleased to report that excellent progress is being made across all areas of this critical aspect of the plant development. The professionalism and quality of the work at the facilities was impressive to see.

The Company looks forward to providing further regular updates over the coming months as activity ramps up and Yanfolila evolves in to what is expected to be a high margin gold mining operation in the near term.

https://youtu.be/BvBHTe4CSlY?t=2m10s

Shareviews Ep 24: Amanda van Dyke talks on Gold, Uranium stocks and safe investment in commodities

Veröffentlicht am 06.01.2017

Fund Manager Amanda van Dyke talks on Gold and Uranium trends, market and companies to follow. Both precious metals are expected to have a bright future in the year 2017: Gold will be extremely hot during the Chinese New Year, Uranium might hit $30/40 price mark. Her stock picks includes Hummingbird Resources (LON:HUM), Centamin (LON:CEY) and Berkeley Energy (LON-ASX:BKY). Amanda is also Non Exec Director of Paternoster Resources (AIM:PRS), AIM listed investing company, aiming at helping undervalued AIM shells in the resources sector to turn around.

Super günstiges Uran durch Berkeley Energia | wallstreet-online.de - Vollständige Diskussion unter:

http://www.wallstreet-online.de/diskussion/1225023-351-360/s…

Shareviews Ep 24: Amanda van Dyke talks on Gold, Uranium stocks and safe investment in commodities

Veröffentlicht am 06.01.2017

Fund Manager Amanda van Dyke talks on Gold and Uranium trends, market and companies to follow. Both precious metals are expected to have a bright future in the year 2017: Gold will be extremely hot during the Chinese New Year, Uranium might hit $30/40 price mark. Her stock picks includes Hummingbird Resources (LON:HUM), Centamin (LON:CEY) and Berkeley Energy (LON-ASX:BKY). Amanda is also Non Exec Director of Paternoster Resources (AIM:PRS), AIM listed investing company, aiming at helping undervalued AIM shells in the resources sector to turn around.

Super günstiges Uran durch Berkeley Energia | wallstreet-online.de - Vollständige Diskussion unter:

http://www.wallstreet-online.de/diskussion/1225023-351-360/s…

ich bin hier schon länger dabei... dem Wert fehlt es an Aufmerkasmakeit... die mine ist durchfinanziert und mit dem Cashflow kann man das 2. (grössere) Projekt vorantreiben ... interessante Aktie!

Forum LSE

http://www.lse.co.uk/SharePrice.asp?SharePrice=hum&goButton=…

HUM CEO updates on the Yanfolila Gold Project now fully funded

https://www.youtube.com/watch?v=bBs_GAo36W4

http://www.telegraph.co.uk/business/2016/12/31/shares-bring-…

on Yeomans: Hummingbird Resources

A bet on a gold miner is in a large part a bet on the price of gold, which has not performed well of late. The election of Donald Trump initially boosted the precious metal, in the expectation of heightened uncertainty, but the market has since decided that the president-elect poses less of a risk to stability.

For anyone less sanguine, a gold miner that is advancing its project to production in 2018 may be an attractive opportunity – especially since gold stocks are not being replenished at a fast enough rate. Amid a plethora of junior miners clustered on Aim, Hummingbird Resources stands out: its $88m (£72m) Yanofila mine in Mali is now fully funded, after it raised $55m in debt last month, and $71m in equity last year.

gold miner

A gold miner that is advancing its project to production in 2018 may be an attractive opportunity

Construction begins in April, with the first gold expected next December. In Mali, Hummingbird has a relatively stable jurisdiction and an experienced mining workforce. Founder Daniel Betts has a gold pedigree: his family business owns the oldest privately held bullion smelter in the UK. Hummingbird also has a tantalising option to develop a gold field in Liberia.

http://www.lse.co.uk/SharePrice.asp?SharePrice=hum&goButton=…

HUM CEO updates on the Yanfolila Gold Project now fully funded

https://www.youtube.com/watch?v=bBs_GAo36W4

http://www.telegraph.co.uk/business/2016/12/31/shares-bring-…

on Yeomans: Hummingbird Resources

A bet on a gold miner is in a large part a bet on the price of gold, which has not performed well of late. The election of Donald Trump initially boosted the precious metal, in the expectation of heightened uncertainty, but the market has since decided that the president-elect poses less of a risk to stability.

For anyone less sanguine, a gold miner that is advancing its project to production in 2018 may be an attractive opportunity – especially since gold stocks are not being replenished at a fast enough rate. Amid a plethora of junior miners clustered on Aim, Hummingbird Resources stands out: its $88m (£72m) Yanofila mine in Mali is now fully funded, after it raised $55m in debt last month, and $71m in equity last year.

gold miner

A gold miner that is advancing its project to production in 2018 may be an attractive opportunity

Construction begins in April, with the first gold expected next December. In Mali, Hummingbird has a relatively stable jurisdiction and an experienced mining workforce. Founder Daniel Betts has a gold pedigree: his family business owns the oldest privately held bullion smelter in the UK. Hummingbird also has a tantalising option to develop a gold field in Liberia.

29.12.2016 Appointment of Mining Contractor for Yanfolila Gold Project

Hummingbird Resources (AIM: HUM), is pleased to announce that it has appointed African Mining Services ("AMS"), a subsidiary of ASX listed Ausdrill Limited, as its mining contractor at the Company's Yanfolila Gold Project in Mali, where mine construction is currently underway ahead of its first gold pour, expected to occur in 2017.

http://www.londonstockexchange.com/exchange/news/market-news…

6.12.2016 US$55 Million Debt Facility Fully Funds Yanfolila Gold Project

http://www.londonstockexchange.com/exchange/news/market-news…

Gallerie

http://hummingbirdresources.co.uk/gallery/

Hummingbird Resources (AIM: HUM), is pleased to announce that it has appointed African Mining Services ("AMS"), a subsidiary of ASX listed Ausdrill Limited, as its mining contractor at the Company's Yanfolila Gold Project in Mali, where mine construction is currently underway ahead of its first gold pour, expected to occur in 2017.

http://www.londonstockexchange.com/exchange/news/market-news…

6.12.2016 US$55 Million Debt Facility Fully Funds Yanfolila Gold Project

http://www.londonstockexchange.com/exchange/news/market-news…

Gallerie

http://hummingbirdresources.co.uk/gallery/

Nachdem es zu Hummingbird noch kein Thema gibt eröffne ich hiermit einen.

Hummingbird baut gerade eine Mine in Mali (eher in der sichereren Südwestecke) und haben noch ein Projekt in Liberia - Liberia’s largest gold deposit –total mineral resource of 4.2Moz Au

Mittlerweile auch voll finanziert un und soll Ende 2017 produzieren- Mining is due to commence in Q3 2017 with first gold pour due by the end of Q4 2017.

Meiner Meinung nach ein ideales Übernahmeziel (ähnlich True Gold 2016)

Einige große Aktionäre wie Goldfields, Sprott und Pala sowie einige bekannte Firmen in der Nähe wie z.b. Endeavour Mining, Randgold etc.

sinnvoller Handel findet nur in London statt

Kurs am 3.1.2017 0,20 GBP

http://hummingbirdresources.co.uk/

Präsentation: http://hummingbirdresources.co.uk/_downloads/Hummingbird_Q4…

Hummingbird baut gerade eine Mine in Mali (eher in der sichereren Südwestecke) und haben noch ein Projekt in Liberia - Liberia’s largest gold deposit –total mineral resource of 4.2Moz Au

Mittlerweile auch voll finanziert un und soll Ende 2017 produzieren- Mining is due to commence in Q3 2017 with first gold pour due by the end of Q4 2017.

Meiner Meinung nach ein ideales Übernahmeziel (ähnlich True Gold 2016)

Einige große Aktionäre wie Goldfields, Sprott und Pala sowie einige bekannte Firmen in der Nähe wie z.b. Endeavour Mining, Randgold etc.

sinnvoller Handel findet nur in London statt

Kurs am 3.1.2017 0,20 GBP

http://hummingbirdresources.co.uk/

Präsentation: http://hummingbirdresources.co.uk/_downloads/Hummingbird_Q4…