Resource Capital Gold - Ein Multi-Bagger - 500 Beiträge pro Seite

eröffnet am 21.02.17 23:48:40 von

neuester Beitrag 06.02.19 09:55:13 von

neuester Beitrag 06.02.19 09:55:13 von

Beiträge: 21

ID: 1.247.311

ID: 1.247.311

Aufrufe heute: 0

Gesamt: 1.264

Gesamt: 1.264

Aktive User: 0

ISIN: CA76124L1040 · WKN: A2AF09 · Symbol: GDPEF

0,0001

USD

+9.900,00 %

+0,0001 USD

Letzter Kurs 19.01.24 Nasdaq OTC

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,8000 | +17,65 | |

| 0,5500 | +14,61 | |

| 0,8200 | +12,33 | |

| 11,420 | +11,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2100 | -7,63 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 4,2300 | -17,86 | |

| 47,85 | -97,99 |

http://www.rcgcorp.ca/

Infos aus Palisade Research December 5, 2016

http://palisade-research.com/resource-capital-gold-corp-tsxv…

Current Price: C$0.225

Shares Outstanding: ~113.9 million

Market Capitalization: C$25.6 million

52-Week Range: C$0.02 – C$0.35

Cash: ~C$2.5 million

Projekte:

Finance – Enter Eric Sprott, The Validator

RCG currently has ~C$2.5 million in cash. Its share count is surprisingly low for a company nearing production with only 113.9 million shares outstanding. Incredibly, RCG has kept an airtight share structure; it was not until recently the company issued its first warrants. The company recently closed a C$5.0 million private placement, with Eric Sprott personally taking C$3.0 million of it. Post-financing, there are now 26.5 million warrants outstanding, for a total of 140.4 million fully diluted shares outstanding. We were fortunate to be involved throughout Eric’s investment process, and his team’s due diligence verified what we found. His involvement is a huge validation of RCG’s asset and team.

...

Talking to management, there is enough cash to get to production and to all-important cash flow. Afterwards, we expect RCG will tap into the debt markets to fund expansion and to continue rolling up the area.

We do not doubt Resource Capital Gold will be a premier mid-tier gold producer. This is one of the best teams we have come across with top-tier assets to boot, and due to the company’s lack of marketing, it is greatly undervalued.

While its total NPV is around C$240 million, the company’s total market capitalization is just a little over C$25 million. This stock is a multi-bagger.

Heute mit großem Volumen

Ich bin hier mal eingesteigen.

Wieder ein Tag mit auffälligem Volumen. Irgendwas tut sich doch hier?

Meinungen erwünscht.

Meinungen erwünscht.

RCG Produces First Gold at Dufferin

VANCOUVER, BC --(Marketwired - March 02, 2017) -Resource Capital Gold Corp. (TSX VENTURE: RCG) ("RCG" or the "Company") is pleased to announce that it has produced its first gold from mill operations at its Dufferin Gold Mine ("Dufferin Project") located in Nova Scotia, Canada. Gold was recovered from a 15-tonne run of test milling of materials stockpiled near the mill. The Company is continuing additional testing in preparation to commence milling on mineralized material from full milling operations commencing in late March(1) .

Initial test milling work successfully completed; first gold recovered

The Company's successful completion of the initial test milling at the Dufferin mill included testing of all milling circuits, each of which performed in line with expected operating conditions. Gold was recovered from gravity concentrates produced from the one-hour test milling of a 15-tonne bulk sample of previously mined material, which was taken as a representative sample from a much larger stockpile containing approximately 3,500 tonnes. This material in the stockpile is believed to have similar overall mineralogy to the materials to be mined at Dufferin.

Additional gold was also recovered during testing of individual pieces of equipment and general mill cleanup during the initial test. A total of 10.1 ounces of gold was recovered from the portion of the concentrates analyzed to date. The Company is continuing to improve the grade of the concentrates through equipment adjustments to improve cleanup of the concentrates, and will run a second test milling sequence today in order to calculate recoveries from the material processed.

The bulk sample for the test milling was processed through the jaw crusher, cone crusher, a 5 X 16 double deck vibrating screen sized at 3/8 inch and conveyed to the fine ore bin. From the fine ore bin the material was conveyed to the ball mill for further size reduction and passed over a sizing screen where minus 2 mm material was screened off and sent to the centrifugal concentrator. Concentrates recovered in the concentrator were pumped to a secure holding tank until drained from the tank and processed over the shaker table to further assist in separating the gold from the waste material. Further testing is being done to improve separation of gold and waste material on the table.

The mineralized material in the 15-tonne batch previously tested and in the test to be performed today is believed to be similar in overall mineralogy to the first 15,000-tonne block of material to be mined commencing later in March. The work was completed while simultaneously preparing for resumption of mining operations at the Dufferin Mine. The Company expects to generate cash flow from processing these materials preparatory to the commencement of mining.

"We are very pleased in the recent events just announced, for two significant reasons," said George S. Young, CEO of RCG. "First, though only a relatively nominal amount of cash is being generated from the test work, we have demonstrated that the mill is in working condition, and the revenues represent the first ever revenues generated of any kind in the entire history of the Company, and point in the direction we are heading. Second, the methodical work being conducted in the test milling operations shows that we are proceeding with all of our activities in a professional manner with care and exactness to establish an efficient, high margin mining and milling operation at Dufferin. We will conduct all of our business and operations with a focus on generating cash flow and high return on the capital we deploy. Less than 6 months in to our "roll up" strategy sees us now generating our first revenues and preparing for full operations in the coming weeks, while we prepare Preliminary Economic Assessments on two other projects to also be developed in the near future."

About Resource Capital Gold

Resource Capital Gold Corp. is developing the high-grade Dufferin Gold Mine and mill in Nova Scotia, with initial gold production scheduled for February 2017. The Dufferin project covers 1,684 hectares in 104 mineral claims which contain more than 14 east-west trending "saddle reef" quartz vein gold-bearing structures, each with free-milling gold. The stacked gold reefs are open at depth and extend along trend for over 4.7 kilometers.

The Company is also advancing the Tangier and Forest Hill gold projects and is preparing preliminary economic assessments ("PEA's") on both. These historic mines add considerable high-grade gold to Resource Capital Gold's resource inventory and they provide the momentum for RCG to fast-track the development of low-cost gold production from a network of high-grade deposits in Nova Scotia. RCG is also earning-in to the high-grade Corcoran silver-gold project in Nevada, USA.

Qualified Persons

The scientific and technical data contained in this news release was reviewed and approved by Michael P. Gross, M.Sc., P.Geo., who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Gross reviewed the technical reports referenced above on behalf of the Company.

On behalf of the Board of Directors of Resource Capital Gold Corp.

George S. Young

CEO

Quelle:

http://www.stockhouse.com/news/press-releases/2017/03/02/rcg…

In der Tristen Minenwelt schön zu sehen das es auch noch Werte gibt die mal ein wenig steigen .

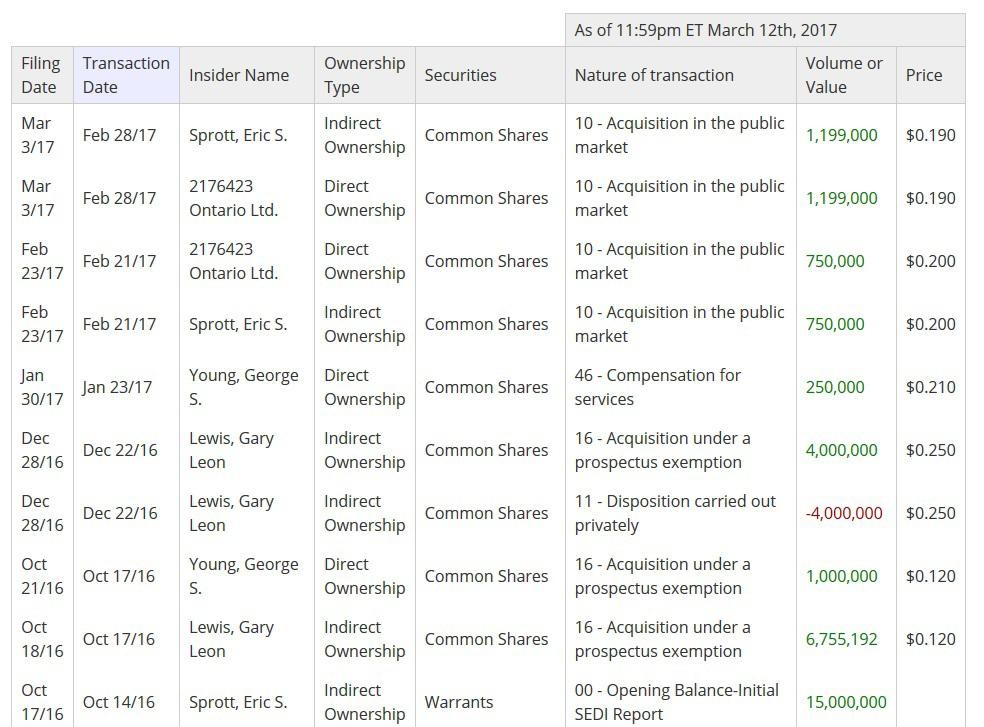

Insiderkauf

Der Grund für das hohe Volumen ist jetzt klar.Sprott hat wieder eingekauft

Trading Halt

VANCOUVER, March 21, 2017VANCOUVER, March 21, 2017 /CNW/ - The following issues have been halted by IIROC:

Company: Resource Capital Gold Corp.

TSX-Venture Symbol: RCG

Reason: At the Request of the Company Pending News

Halt Time (ET): 9:15 AM

RCG Enters Agreement to Sell Corcoran Silver Project, Raising Funds for Expansion of Gold Projects in Nova S.

VANCOUVER, BC --(Marketwired - March 21, 2017) -NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

Deal to include C$2.7 million cash payment to RCG

Dividend of acquiring company shares intended to be distributed to RCG shareholders, subject to regulatory compliance

Gold production on schedule at Dufferin mine and mill

Resource Capital Gold Corp., (TSX VENTURE: RCG) ("RCG" or the "Company") is pleased to announce that it has entered into an agreement with a private Australian company to sell its interests in the Corcoran silver-gold project in Nevada, generating cash for further expansion of its gold projects in Nova Scotia, Canada. The Company also announces that the commencement of full milling operations at its Dufferin Gold Mine and Mill ("Dufferin Project") continues on track. Additional milling on mineralized material was conducted during March, with gold being recovered from milling of materials stockpiled near the mill, and full milling operations commencing in the next few weeks1.

Corcoran spinoff to generate cash for Company development, shares for shareholders

The Company has executed an agreement with AUSAG Resources Pty Ltd ("AUSAG"), a private arm's length Australian company to sell its interests in the Corcoran silver property in Nevada, and which contains, as one of the conditions precedent, that AUSAG seek to go public (IPO) and list on the Australian Stock Exchange (ASX) within 3 months of transaction close. The terms of the transaction include C$2.7 million in cash to be paid by AUSAG to RCG at closing, plus 43.9 million shares of AUSAG, representing 46% of the expected outstanding shares after AUSAG's IPO and listing. The Company's Board of Directors intends to dividend a portion of the 43.9 million shares of AUSAG to its shareholders of record as of a future date on the basis of up to 1 share of AUSAG for every 4 RCG shares held, subject to regulatory compliance. With the expected share price of AUSAG's financing in connection with its listing estimated to be AUD$0.20, the value of a 1 for 4 dividend would be approximately 25% of the value of the Company's shares at the current share price of C$0.20 per share.

The transaction represents an opportunity to post a gain on the Company's balance sheet, since the carrying cost of the Corcoran property on the Company's books as of December 31, 2016 is only $513,000, and to generate working capital as the Company commences production at the Dufferin Project and continues its other developments in Nova Scotia. At the same time, the Company (or directly by its shareholders, post-dividend) will be able to maintain a significant ownership percentage in the Corcoran property, as well as other properties to be acquired by AUSAG as it moves ahead with its silver business model, through ownership of shares in AUSAG.

Dufferin Project in final stages of preparation for full milling and mining operations

The Company is completing final adjustments to the mill at the Dufferin Project, Nova Scotia in advance of full milling operations. The test milling operations were successful, with all circuits performing in line with expectations under full operating conditions. Gold was recovered from two sets of bulk sample runs, with gravity concentrates produced from the milling of bulk samples of previously mined material taken as a representative sample from a much larger stockpile containing approximately 3,500 tonnes. The material in the stockpile is believed to have similar overall mineralogy to the materials to be mined at Dufferin. Based on the test milling, the Company is expecting to achieve high recoveries of gold from the materials to be mined, in line with its previous expectations.

The Company has made adjustments to the gravity table and added a Knelson concentrator to treat the gravity concentrates produced over the table and provide for improved dore quality for sale or offtake. The Company has also commenced negotiations for the sale of dore, and has received term sheets for consideration in marketing its gold production. The Company has also received a proposal for purchase of the flotation concentrates left on site from previous operators.

The weather at the site has improved and the winter snowfall has melted. Conditions at the tailings facility have dried and improved to allow for minor repairs and adjustments to be made in anticipation of the utilization of the facility during a full start up in the next few weeks. The Company will commence milling stockpiles of materials bearing gold that have been mined previously. All of the work described above has been completed while simultaneously preparing for resumption of mining operations at the Dufferin Mine. The Company expects to generate cash flow from processing the materials already on surface while it develops new mining faces in preparation for the commencement of mining of new materials.

"We are very pleased to generate income from the proposed sale of the Corcoran project in the form of cash for working capital, and at the same time retain a significant interest for our shareholders in that project," said George S. Young, CEO of RCG. "With the rapid advance of our production and development strategy in Nova Scotia, the silver project encompassed by the Corcoran property in Nevada provides an ideal opportunity for a spin out. Its value can now be more readily recognized in another vehicle. In the process, we believe we have generated not only the first income in the long history of the Company, but also intend to provide direct income for our shareholders in the form of a share dividend, subject to regulatory compliance. At the same time, the cash we will receive will reduce our working capital needs and thereby save on dilution to shareholders by reducing the amount of any further capital raise. We can now more fully focus on our business and operations in Nova Scotia with their imminent generation of cash flow and high return on the capital we deploy. Less than 6 months into our regional "roll up" strategy, we will add operating revenue to the income generated by the Corcoran transaction, and will continue adding value through the development of the Forest Hill and Tangier projects."

About Resource Capital Gold

Resource Capital Gold Corp. is developing the high-grade Dufferin Gold Mine and mill in Nova Scotia, with initial gold production scheduled for March 2017. The Dufferin project covers 1,684 hectares in 104 mineral claims which contain more than 14 east-west trending "saddle reef" quartz vein gold-bearing structures, each with free-milling gold. The stacked gold reefs are open at depth and extend along trend for over 4.7 kilometers.

The Company is also advancing the Tangier and Forest Hill gold projects and is preparing preliminary economic assessments ("PEA's") on both. These historic mines should add considerable high-grade gold to Resource Capital Gold's resource inventory and they provide the momentum for RCG to fast-track the development of low-cost gold production from a network of high-grade deposits in Nova Scotia.

Qualified Persons

The scientific and technical data contained in this news release was reviewed and approved by Michael P. Gross, M.Sc., P.Geo., who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

On behalf of the Board of Directors of Resource Capital Gold Corp.

George S. Young

CEO

Eine neue Präsentation wurde veröffentlicht:

http://www.rcgcorp.ca/assets/docs/RCG_Corporate_Presentation…

und eine neue News:

RCG Files Amendments to PEA on Dufferin Gold Project

http://web.tmxmoney.com/article.php?newsid=8601116125845047&…

daraus:

Economic results remained unchanged from the PEA as originally filed, which show the production of 216,050 ounces of gold during a 10-year mine life, with a pre-tax IRR of 158% and a capital payback period of 1.3 years.

Die IRR von 158% ist klasse!

http://www.rcgcorp.ca/assets/docs/RCG_Corporate_Presentation…

und eine neue News:

RCG Files Amendments to PEA on Dufferin Gold Project

http://web.tmxmoney.com/article.php?newsid=8601116125845047&…

daraus:

Economic results remained unchanged from the PEA as originally filed, which show the production of 216,050 ounces of gold during a 10-year mine life, with a pre-tax IRR of 158% and a capital payback period of 1.3 years.

Die IRR von 158% ist klasse!

RCG Announces Updated Resource Estimates at the Forest Hill and Tangier Properties

VANCOUVER, BC --(Marketwired - April 26, 2017) -NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

Resource Capital Gold Corp., (TSX VENTURE: RCG) ("RCG" or the "Company") is pleased to report the results of updated resource estimates on its Forest Hill and Tangier properties in Nova Scotia, Canada.

The updated resource estimate for the Forest Hill property is shown in the table below at a cutoff grade of 2 g/t Au.

Forest Hill Updated Resource

Capped at 110 g/t Au Uncapped

Tonnes Au g/t Oz Au Tonnes Au g/t Oz Au

Indicated 322,000 7.1 73,000 322,000 11.0 114,000

Inferred 905,000 7.1 208,000 905,000 10.6 308,000

The updated resource estimate on the Tangier property was done on a portion of the property known as the Blueberry Hill zone, and is shown in the table below at a cutoff grade of 2 g/t Au.

Tangier - Blueberry Hill Updated Resource

Capped at 40 g/t Au Uncapped

Tonnes Au g/t Oz Au Tonnes Au g/t Oz Au

Inferred 493,000 5.9 93,000 511,000 9.9 163,000

"We are excited about the new resource results from these properties, which both show considerable upside for expanding the current resources," said CEO George Young. "In particular, the new resource estimate at Tangier was done on only 500 meters of the 3,400-meter-long system of identified gold-bearing quartz veins on the property, leaving tremendous upside for the project. At Forest Hill the mineralization has been drilled only to a depth of 300 meters and is open below this depth along the entire 2,300-m drilled strike length of mineralization. We believe that with further work we can substantially increase the overall resource estimates on both projects."

The resource estimates were prepared by Global Mineral Resource Services of Vancouver, B.C. and the technical reports have been filed on SEDAR.

New Tangier estimate compares favorably with previous estimate

At the Tangier property, the new resource estimate uncapped compares favorably with the previous estimate within the Blueberry Hill zone of the property, as shown in the table below.(1)

Tangier - Blueberry Hill Resource Comparison

RCG, 2017 (Current) Mercator, 20041 (Historic)

Tonnes Au g/t Oz Au Tonnes Au g/t Oz Au

Blueberry Hill Indicated - - - 206,000 7.23 47,885

Blueberry Hill Inferred 511,000 9.9 163,000 345,400 7.02 77,956

Note: at 2 g/t Au cutoff, uncapped

The Blueberry Hill zone is one of two drilled zones of mineralization on the Tangier project, the other being Strawberry Hill-Mooseland East (collectively referred to here as Strawberry Hill). The Strawberry Hill zone hosts approximately 34 drill holes and is currently classified as an exploration target with potential size between 100,000 and 700,000 tonnes and potential average grade between 2 and 10 g/t Au.

Excellent expansion potential at both properties

The projects both show excellent potential for expansion of the current resources. At Tangier, 2.9 kilometers of mineralized strike length not included in the current resource estimate show outcropping gold-bearing quartz veins, but remain largely unexplored. In particular, the Strawberry Hill zone, located approximately 1.5 kilometers east of Blueberry Hill, hosts approximately 34 drill holes over 900 meters of strike length. Additional expansion potential is evident in the 1 km between Blueberry Hill and Strawberry Hill, and in the 1 km of outcropping quartz veins to the west of Blueberry Hill. Mineralization is also open at depth below the 300-m extent of current drilling.

At Forest Hill, mineralization has been drilled to a depth of 300 meters but remains open below this depth along the entire 2.3-kilometer drilled strike length of the known mineralized system.

PEAs planned as next steps

The Company plans to proceed with Preliminary Economic Assessments on the current resources at both properties. At Tangier, it also intends to evaluate drilling at Blueberry Hill to upgrade the resource categories, evaluate additional potential in the Strawberry Hill zone, and confirm the depth extent of gold-bearing veins exposed on surface along the 1 km between Strawberry Hill and Blueberry Hill.

About the Forest Hill property

Forest Hill is an advanced gold project with a drilled gold resource. Gold was discovered in 1893, followed by production, which up to 1916 produced 26,792 ounces at an overall recovered grade of 16.6 g/t Au. In the 1980s, a 230-m shaft was sunk and approximately 94,000 tonnes of ore mined. A total of 10 km of underground workings exist on the project, along with 249 surface drill holes totaling 34,413 m and 127 underground drill holes totaling 7,267 m. The project comprises 1,840 hectares in 115 exploration claims.

Steeply dipping stratabound quartz veins on the south limb of the east-west trending Forest Hill anticline contain free-milling gold accompanied by arsenopyrite, pyrite, pyrrhotite and minor galena and chalcopyrite. Numerous veins have been encountered on the property, and they have been tracked for over 600 m along strike and 250 m down dip with excellent continuity demonstrated by drilling and mine workings.

The project shows very good grades and bulk sampling during the 1980s returned grades between 9.2 g/t Au and 13.8 g/t Au for diluted ore, with 94.9% overall recovery, of which 74.2% recovery was attained by gravity methods alone. The expansion potential at Forest Hill is very good, with mineralization open at depth along the entire mineralized system.

About the Tangier property

Tangier was the site of the first gold discovery in Nova Scotia in 1860. Total historic gold production up to 1919 is estimated at 29,000 ounces at a recovered grade of 17.5 g/t Au. The property saw several phases of bulk sampling during the 1980s and 1990s, the best of which was 2,578 tonnes with a recovered grade of approximately 16 g/t Au.

A total of 211 surface and underground drill holes have been completed on the property. Past mining activities have developed 3,300 m of underground workings. The mine sits on a project area of 1,904 hectares in 119 exploration claims.

The Tangier gold deposit is situated along the east-west trending Tangier anticline, a structure that has been traced for 7.3 km. Within this anticline, two sections totaling 1.4 km have been explored with drilling and past mining, which demonstrate good continuity of gold-bearing quartz veins to depths of 300 m. Gold-bearing quartz veins have been identified over a total strike length of 3.4 km on the property. This work has identified 70 or more gold-bearing quartz veins, demonstrating an extensive mineralized system.

Mineralization at Tangier consists of coarse flake gold and nuggets in generally stratabound quartz veins up to 1.5 meters thick containing calcite and up to 5% sulfide minerals, including pyrite, pyrrhotite, arsenopyrite, sphalerite, and galena. The characteristics of the mineralization indicate that the deposit is an orogenic gold deposit, similar to the Dufferin Mine and others in Nova Scotia's Meguma Terrane.

Qualified Persons

The scientific and technical information contained in this news release was reviewed and approved by David S. Smith, MS, MBA, CPG, who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Smith reviewed the technical report referenced above on behalf of the Company.

The Forest Hill and Tangier technical reports were prepared by independent Qualified Person Mr. Greg Mosher of Global Mineral Resource Services. Mr. Mosher has reviewed and approved the contents of this news release.

About Resource Capital Gold

Resource Capital Gold Corp. is developing the high-grade Dufferin Gold Mine and mill in Nova Scotia, with initial gold production in progress. The Dufferin project covers 1,684 hectares in 104 mineral claims which contain more than 14 east-west trending "saddle reef" quartz vein gold-bearing structures, each with free-milling gold. The stacked gold reefs are open at depth and extend along trend for over 4.7 kilometers.

The Company is also advancing the Tangier and Forest Hill gold projects and is preparing preliminary economic assessments ("PEA's") on both. These historic mines should add considerable high-grade gold to Resource Capital Gold's resource inventory and they provide the momentum for RCG to fast-track the development of low-cost gold production from a network of high-grade deposits in Nova Scotia.

On behalf of the Board of Directors of Resource Capital Gold Corp.

George S. Young, CEO

Quelle:

http://www.stockhouse.com/news/press-releases/2017/04/26/rcg…

Untätigkeit kann man den Herrschaften ja nicht vorwerfen . Leider ist der Kurs nicht so toll trotz solider Basis. Ich habe das Gefühl das in der Miningwelt nur noch Multimillionen Unzen Deposits zählen. Dabei erwirtschaften kleine Unternehmen doch auch gutes Geld . Gerade weil die nicht mir ihren Ausgaben so umher werfen können wie andere .....

http://www.marketwired.com/press-release/rcg-sets-record-dat…

Doof das es AUD sind , wenn man keinen Aussibroker hat.

Doof das es AUD sind , wenn man keinen Aussibroker hat.

hab mich mal eingekauft, interessante story...

high-grade gold, near-term cash-flow, kleinere projektgröße und Sprott mit dabei.

hab mal was im Rohstoffthread gepostet:

https://www.wallstreet-online.de/diskussion/1170870-38771-38…

high-grade gold, near-term cash-flow, kleinere projektgröße und Sprott mit dabei.

hab mal was im Rohstoffthread gepostet:

https://www.wallstreet-online.de/diskussion/1170870-38771-38…

Resource Capital Gold Announces Closing of Non-BROKERED Financing for Gross Proceeds of $4 Million

VANCOUVER, BC--(Marketwired - July 20, 2017) - RESOURCE CAPITAL GOLD CORP. (TSX VENTURE: RCG) ("RCG" or the "Company") announces it has closed the previously announced non-brokered private placement for gross proceeds of $4,000,010 (the "Offering"), comprised of 2,857,200 common shares of the Company (the "Common Shares") at an issue price of $0.175 per Common Share and 17,500,000 flow-through shares at a price of $0.20 per flow-through share (the "FT Shares").

The gross proceeds from the sale of the FT Shares will be used to fund work on the Company's properties as qualifying Canadian Exploration Expenses as defined in subsection 127(9) of the Income Tax Act (Canada) which will be renounced to the subscribers with an effective date of December 31, 2017.

The net proceeds from the sale of the Common Shares will be used for advancing the Company's projects, working capital and general corporate purposes.

Finder's fees payable on the Offering to Sprott Capital Partners and Mackie Research Capital, consisting of (i) a fee equal to 6% of the gross proceeds of the Offering placed by the finders (satisfied through the issuance of 1,371,374 compensation shares), and (ii) the issuance of 1,221,132 non-transferable share purchase warrants (the "Finders' Warrants") equal to 6.0% of the Common Shares and FT Shares placed by the finders were also issued by the Company. Each Finders' Warrant entitles the holder to subscribe for one common share for 24 months from the closing date of the Offering at $0.175.

All of the securities sold pursuant to the Offering, including the shares issuable on exercise of the Finders' Warrants, are subject to a four month hold period expiring on November 20, 2017. Such securities will not participate in the receipt of the third-party share dividend to be received by the other RCG shareholders in connection with the transaction involving the transfer of the Corcoran project previously announced by the Company.

Eric Sprott and 2176423 Ontario Ltd., a corporation which is beneficially owned by him, acquired 7,200,000 FT Shares and 1,997,200 Common Shares pursuant to the Offering (representing approximately 6.4% of the outstanding Common Shares) for total consideration of $1,789,510. RCG understands that, prior to the Offering, Mr. Sprott indirectly owned 16,949,000 Common Shares and 15,000,000 share purchase warrants representing approximately 13.7% on a non-diluted basis and 23.1% on a partially diluted basis assuming exercise of such warrants. RCG further understands that Mr. Sprott now owns directly and indirectly 26,146,200 Common Shares and 15,000,000 share purchase warrants representing approximately 18.2% on a non-diluted basis and 25.9% on a partially diluted basis assuming exercise of such warrants.

RCG has been advised that FT Shares and Common Shares were acquired by Mr. Sprott and 2176423 Ontario Ltd. for investment purposes and that Mr. Sprott has a long-term view of the investment and may acquire additional securities of the Company either on the open market or through private acquisitions or sell securities of the Company either on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors. A copy of Mr. Sprott's early warning report will appear on the Company's profile on SEDAR and may also be obtained by calling (416) 362-7172 (200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J2).

VANCOUVER, BC--(Marketwired - July 20, 2017) - RESOURCE CAPITAL GOLD CORP. (TSX VENTURE: RCG) ("RCG" or the "Company") announces it has closed the previously announced non-brokered private placement for gross proceeds of $4,000,010 (the "Offering"), comprised of 2,857,200 common shares of the Company (the "Common Shares") at an issue price of $0.175 per Common Share and 17,500,000 flow-through shares at a price of $0.20 per flow-through share (the "FT Shares").

The gross proceeds from the sale of the FT Shares will be used to fund work on the Company's properties as qualifying Canadian Exploration Expenses as defined in subsection 127(9) of the Income Tax Act (Canada) which will be renounced to the subscribers with an effective date of December 31, 2017.

The net proceeds from the sale of the Common Shares will be used for advancing the Company's projects, working capital and general corporate purposes.

Finder's fees payable on the Offering to Sprott Capital Partners and Mackie Research Capital, consisting of (i) a fee equal to 6% of the gross proceeds of the Offering placed by the finders (satisfied through the issuance of 1,371,374 compensation shares), and (ii) the issuance of 1,221,132 non-transferable share purchase warrants (the "Finders' Warrants") equal to 6.0% of the Common Shares and FT Shares placed by the finders were also issued by the Company. Each Finders' Warrant entitles the holder to subscribe for one common share for 24 months from the closing date of the Offering at $0.175.

All of the securities sold pursuant to the Offering, including the shares issuable on exercise of the Finders' Warrants, are subject to a four month hold period expiring on November 20, 2017. Such securities will not participate in the receipt of the third-party share dividend to be received by the other RCG shareholders in connection with the transaction involving the transfer of the Corcoran project previously announced by the Company.

Eric Sprott and 2176423 Ontario Ltd., a corporation which is beneficially owned by him, acquired 7,200,000 FT Shares and 1,997,200 Common Shares pursuant to the Offering (representing approximately 6.4% of the outstanding Common Shares) for total consideration of $1,789,510. RCG understands that, prior to the Offering, Mr. Sprott indirectly owned 16,949,000 Common Shares and 15,000,000 share purchase warrants representing approximately 13.7% on a non-diluted basis and 23.1% on a partially diluted basis assuming exercise of such warrants. RCG further understands that Mr. Sprott now owns directly and indirectly 26,146,200 Common Shares and 15,000,000 share purchase warrants representing approximately 18.2% on a non-diluted basis and 25.9% on a partially diluted basis assuming exercise of such warrants.

RCG has been advised that FT Shares and Common Shares were acquired by Mr. Sprott and 2176423 Ontario Ltd. for investment purposes and that Mr. Sprott has a long-term view of the investment and may acquire additional securities of the Company either on the open market or through private acquisitions or sell securities of the Company either on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors. A copy of Mr. Sprott's early warning report will appear on the Company's profile on SEDAR and may also be obtained by calling (416) 362-7172 (200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J2).

Solange Mrs. Sprott die 16 Mio. Optionen zu 12,5 kanad. Cent ziehen kann, wird der Kurs nicht exorbitant steigen.

Hier die News von der RCG-Seite vom 11.01.18 ...

"...Resource Capital Gold gibt die Zahlung von USD 8 Millionen an Verschuldung, Kreditfinanzierung für USD 5,5 Millionen und Änderungen der NSR-Lizenzgebühr in Höhe von 1,0% für das Dufferin-Projekt bekannt

Vancouver, BC - 11. Dezember 2017 - Resource Capital Gold Corp., TSXV: RCG ("RCG" oder die "Gesellschaft"), freut sich bekannt zu geben, dass es eine erstrangig besicherte Darlehensfazilität über USD 5.500.000 (die "Kreditfazilität") abgeschlossen hat. ), die von Sprott Private Resource Lending (Sammler) LP ("Sprott") im Rahmen eines zwischen den Tochtergesellschaften von RCG, Sprott und RCG, Maritime Gold Corp., Maritime Dufferin Gold Corp. und Flex Mining & Exploration Limited geschlossenen Kreditvertrags bereitgestellt wurde, als Bürgen.

Die Kreditfazilität unterliegt einem zusätzlichen, im Voraus bezahlten Zins von 2%, der am oder vor dem 31. Januar 2018 fällig wird, und dem Abschluss einer Eigenkapitalfinanzierung durch RCG und wird mit einem Zinssatz von 9,00% plus einem höheren Zinssatz verzinst von (i) US-Dollar 12-Monats-LIBOR und (ii) 1,00% pro Jahr, zahlbar monatlich, und wird am 8. Dezember 2020 fällig. Hauptrückzahlungen beginnen im Dezember 2018, mit gleichen monatlichen Raten danach. RCG schlägt vor, die Kreditfazilität durch Einnahmen aus der Produktion der Goldmine Dufferin (das "Projekt") zu bedienen und zurückzuzahlen.

RCG hat den Erlös der Kreditfazilität zur vollständigen und endgültigen Begleichung ihres Schuldscheindarlehens an LRC-RA LP (Nennwert USD 8.000.000) in Höhe von USD 5.625.000 verwendet, die RCG bei der Übernahme des Projekts im Oktober 2016 angefallen ist.

Im Zusammenhang mit der Kreditfazilität hat RCG im Wesentlichen ihr gesamtes Vermögen zu Gunsten von Sprott abgesichert und 16.000.000 Optionsscheine auf Stammaktien ausgegeben, die ganz oder teilweise für eine Laufzeit von drei Jahren zu einem Ausübungspreis von 7% ausgeübt werden können CAD 0,125 pro Stammaktie des Unternehmens .

Darüber hinaus hat RCG mit LRC eine geänderte und geänderte Net Smelter Return-Lizenzvereinbarung abgeschlossen, nach der die NSR-Zinsen, die LRC gewährt wurden, jetzt gesichert sind und für jedes ab dem 1. Januar 2018 abgebaute und versandte Gold zahlbar sind. ob in der kommerziellen Produktion oder in irgendeiner anderen Bergbautätigkeit.

Im Auftrag des Board of Directors von Resource Capital Gold Corp.

George S. Young / CEO ..."

Hier die News von der RCG-Seite vom 11.01.18 ...

"...Resource Capital Gold gibt die Zahlung von USD 8 Millionen an Verschuldung, Kreditfinanzierung für USD 5,5 Millionen und Änderungen der NSR-Lizenzgebühr in Höhe von 1,0% für das Dufferin-Projekt bekannt

Vancouver, BC - 11. Dezember 2017 - Resource Capital Gold Corp., TSXV: RCG ("RCG" oder die "Gesellschaft"), freut sich bekannt zu geben, dass es eine erstrangig besicherte Darlehensfazilität über USD 5.500.000 (die "Kreditfazilität") abgeschlossen hat. ), die von Sprott Private Resource Lending (Sammler) LP ("Sprott") im Rahmen eines zwischen den Tochtergesellschaften von RCG, Sprott und RCG, Maritime Gold Corp., Maritime Dufferin Gold Corp. und Flex Mining & Exploration Limited geschlossenen Kreditvertrags bereitgestellt wurde, als Bürgen.

Die Kreditfazilität unterliegt einem zusätzlichen, im Voraus bezahlten Zins von 2%, der am oder vor dem 31. Januar 2018 fällig wird, und dem Abschluss einer Eigenkapitalfinanzierung durch RCG und wird mit einem Zinssatz von 9,00% plus einem höheren Zinssatz verzinst von (i) US-Dollar 12-Monats-LIBOR und (ii) 1,00% pro Jahr, zahlbar monatlich, und wird am 8. Dezember 2020 fällig. Hauptrückzahlungen beginnen im Dezember 2018, mit gleichen monatlichen Raten danach. RCG schlägt vor, die Kreditfazilität durch Einnahmen aus der Produktion der Goldmine Dufferin (das "Projekt") zu bedienen und zurückzuzahlen.

RCG hat den Erlös der Kreditfazilität zur vollständigen und endgültigen Begleichung ihres Schuldscheindarlehens an LRC-RA LP (Nennwert USD 8.000.000) in Höhe von USD 5.625.000 verwendet, die RCG bei der Übernahme des Projekts im Oktober 2016 angefallen ist.

Im Zusammenhang mit der Kreditfazilität hat RCG im Wesentlichen ihr gesamtes Vermögen zu Gunsten von Sprott abgesichert und 16.000.000 Optionsscheine auf Stammaktien ausgegeben, die ganz oder teilweise für eine Laufzeit von drei Jahren zu einem Ausübungspreis von 7% ausgeübt werden können CAD 0,125 pro Stammaktie des Unternehmens .

Darüber hinaus hat RCG mit LRC eine geänderte und geänderte Net Smelter Return-Lizenzvereinbarung abgeschlossen, nach der die NSR-Zinsen, die LRC gewährt wurden, jetzt gesichert sind und für jedes ab dem 1. Januar 2018 abgebaute und versandte Gold zahlbar sind. ob in der kommerziellen Produktion oder in irgendeiner anderen Bergbautätigkeit.

Im Auftrag des Board of Directors von Resource Capital Gold Corp.

George S. Young / CEO ..."

sorry, die News sind vom 11.12.17 - habe ich nicht richtig hingeschaut.

Weiß jemand, wann denn die Produktion endlich in der Dufferin Mine aufgenommen wird??

Weiß jemand, wann denn die Produktion endlich in der Dufferin Mine aufgenommen wird??

Eric Sprott Announces Holdings in Resource Capital Gold

Toronto, Ontario--(Newsfile Corp. - October 16, 2018) - Eric Sprott announces that the expiry of certain common share purchase warrants ("Warrants") of Resource Capital Gold Corp. (the "Corporation") has resulted in his partially diluted beneficial ownership of common shares of the Corporation to decrease by greater than 2%.

On October 12, 2018, a total of 15,000,000 Warrants expired unexercised representing approximately 6.1% of the outstanding common shares on a partially diluted basis. Prior to the expiry of these Warrants, Mr. Sprott beneficially owned and controlled 34,035,089 common shares and 18,944,444 Warrants representing approximately 19.5% of the outstanding common shares on a non-diluted basis and approximately 27.3% on a partially diluted basis assuming the exercise of all Warrants.

As a result of the Warrant expiry, Mr. Sprott now beneficially owns and controls 34,035,089 common shares and 3,944,444 Warrants representing approximately 19.5% of the outstanding common shares on a non-diluted basis and approximately 21.2% on a partially diluted basis assuming the exercise of all Warrants.

The securities noted above are held for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities either on the open market or through private acquisitions or sell the securities either on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

The Corporation is located at 500-666 Burrard Street, Vancouver, BC V6C 3P6. A copy of the early warning report with respect to the foregoing will appear on the Corporation's profile on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com and may also be obtained by calling Mr. Sprott at (416) 362-7172.

Eric Sprott

200 Bay Street, Suite 2600

Royal Bank Plaza, South Tower

Toronto, Ontario M5J 2J1

Toronto, Ontario--(Newsfile Corp. - October 16, 2018) - Eric Sprott announces that the expiry of certain common share purchase warrants ("Warrants") of Resource Capital Gold Corp. (the "Corporation") has resulted in his partially diluted beneficial ownership of common shares of the Corporation to decrease by greater than 2%.

On October 12, 2018, a total of 15,000,000 Warrants expired unexercised representing approximately 6.1% of the outstanding common shares on a partially diluted basis. Prior to the expiry of these Warrants, Mr. Sprott beneficially owned and controlled 34,035,089 common shares and 18,944,444 Warrants representing approximately 19.5% of the outstanding common shares on a non-diluted basis and approximately 27.3% on a partially diluted basis assuming the exercise of all Warrants.

As a result of the Warrant expiry, Mr. Sprott now beneficially owns and controls 34,035,089 common shares and 3,944,444 Warrants representing approximately 19.5% of the outstanding common shares on a non-diluted basis and approximately 21.2% on a partially diluted basis assuming the exercise of all Warrants.

The securities noted above are held for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities either on the open market or through private acquisitions or sell the securities either on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

The Corporation is located at 500-666 Burrard Street, Vancouver, BC V6C 3P6. A copy of the early warning report with respect to the foregoing will appear on the Corporation's profile on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com and may also be obtained by calling Mr. Sprott at (416) 362-7172.

Eric Sprott

200 Bay Street, Suite 2600

Royal Bank Plaza, South Tower

Toronto, Ontario M5J 2J1

Back

,

RCG Provides Update on Completion of the Sale in Its Option Interest in the Corcoran Project

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

VANCOUVER, British Columbia, Nov. 12, 2018 (GLOBE NEWSWIRE) -- Resource Capital Gold Corp., TSXV:RCG (“RCG” or the “Company”) is pleased to announce that the previously announced sale of its option agreement in the Corcoran project in Nye County, Nevada, see press release of February 2, 2018, is complete.

The Company sold its option interest in the Corcoran project to AUSAG Resources Ltd. (“AUSAG”), subsequently renamed Metals 479 Ltd, for a previously received cash payment of US$2 million.

The Company also announces that it has canceled the previously arranged share purchase agreement between ACT2 Pty Limited and Maritime Gold Corp. Both parties mutually determined to cancel the transaction due to regulatory complications. The share purchase agreement was arranged to acquire the 10% holding of ACT2 Pty Ltd. (“ACT2”) in Maritime Gold Corp., the sole shareholder of Maritime Dufferin Gold Corp., the owner of the Dufferin project.

About Resource Capital Gold and the Dufferin Project

Resource Capital Gold Corp. is developing the high-grade Dufferin Gold Mine and mill in Nova Scotia, with initial gold production from test milling achieved in March 2017. The Dufferin project covers 1,684 hectares in 104 mineral claims which contain more than 14 east-west trending “saddle reef" quartz vein gold-bearing structures, each with free-milling gold. The stacked gold reefs are open at depth and extend along trend for over 3.2 kilometers within the Dufferin and West Dufferin projects, with additional strike length being held in claims by the Company up to a total of 11 km of strike length.

The Company is also advancing the Tangier and Forest Hill gold projects and is preparing preliminary economic assessments on both.

Additional information with respect to the Dufferin gold project is available in the revised technical report of the Company filed on SEDAR entitled “Revised Preliminary Economic Assessment of the Dufferin Gold Deposit”, dated as of April 3, 2017.

Qualified Persons

The scientific and technical data contained in this news release was reviewed and approved by David Smith, CPG, who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

On behalf of the Board of Directors of Resource Capital Gold Corp.

Jack R. Cartmel

Interim President & CEO

For further Information please contact:

Jack R. Cartmel at (604) 642 6114

Resource Capital Gold Corp.

Vancouver Park Place

666 Burrard Street, Suite 500

Vancouver V6C 3P6

BC Canada

P +1 604 642 6114

E info@rcgcorp.ca

rcgcorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

,

RCG Provides Update on Completion of the Sale in Its Option Interest in the Corcoran Project

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

VANCOUVER, British Columbia, Nov. 12, 2018 (GLOBE NEWSWIRE) -- Resource Capital Gold Corp., TSXV:RCG (“RCG” or the “Company”) is pleased to announce that the previously announced sale of its option agreement in the Corcoran project in Nye County, Nevada, see press release of February 2, 2018, is complete.

The Company sold its option interest in the Corcoran project to AUSAG Resources Ltd. (“AUSAG”), subsequently renamed Metals 479 Ltd, for a previously received cash payment of US$2 million.

The Company also announces that it has canceled the previously arranged share purchase agreement between ACT2 Pty Limited and Maritime Gold Corp. Both parties mutually determined to cancel the transaction due to regulatory complications. The share purchase agreement was arranged to acquire the 10% holding of ACT2 Pty Ltd. (“ACT2”) in Maritime Gold Corp., the sole shareholder of Maritime Dufferin Gold Corp., the owner of the Dufferin project.

About Resource Capital Gold and the Dufferin Project

Resource Capital Gold Corp. is developing the high-grade Dufferin Gold Mine and mill in Nova Scotia, with initial gold production from test milling achieved in March 2017. The Dufferin project covers 1,684 hectares in 104 mineral claims which contain more than 14 east-west trending “saddle reef" quartz vein gold-bearing structures, each with free-milling gold. The stacked gold reefs are open at depth and extend along trend for over 3.2 kilometers within the Dufferin and West Dufferin projects, with additional strike length being held in claims by the Company up to a total of 11 km of strike length.

The Company is also advancing the Tangier and Forest Hill gold projects and is preparing preliminary economic assessments on both.

Additional information with respect to the Dufferin gold project is available in the revised technical report of the Company filed on SEDAR entitled “Revised Preliminary Economic Assessment of the Dufferin Gold Deposit”, dated as of April 3, 2017.

Qualified Persons

The scientific and technical data contained in this news release was reviewed and approved by David Smith, CPG, who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

On behalf of the Board of Directors of Resource Capital Gold Corp.

Jack R. Cartmel

Interim President & CEO

For further Information please contact:

Jack R. Cartmel at (604) 642 6114

Resource Capital Gold Corp.

Vancouver Park Place

666 Burrard Street, Suite 500

Vancouver V6C 3P6

BC Canada

P +1 604 642 6114

E info@rcgcorp.ca

rcgcorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Eric Sprott Announces Holdings in Resource Capital Gold

Toronto, Ontario--(Newsfile Corp. - December 27, 2018) - Eric Sprott announces that he holds 26,835,089 common shares (shares) and 3,944,444 share purchase warrants of Resource Capital Gold Corp. ("Resource Capital") representing approximately 15.4% of the outstanding shares on a non-diluted basis and 17.2% on a partially diluted basis. This press release is being issued pursuant to Canadian early warning requirements because the sale of shares, as described below, has resulted in a decrease in Mr. Sprott's beneficial holdings of shares of more than 2% of the outstanding shares of Resource Capital.

On December 24, 2018, Eric Sprott sold 7.2 million shares at a price of $0.015 per share ($108,000), representing approximately 4.1% of the outstanding shares, in two private transactions. Prior to this disposition, Mr. Sprott beneficially held 34,035,089 shares and 3,944,444 share purchase warrants, representing approximately 19.4% of the outstanding shares on a non-diluted basis and 21.2% on a partially diluted basis.

The shares are held for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities either on the open market or through private acquisitions or sell the securities either on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

Resource Capital Gold is located at 500-666 Burrard Street, Vancouver, BC V6C 3P6. A copy of the early warning report with respect to the foregoing will appear on the Corporation's profile on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com and may also be obtained by calling Mr. Sprott at (416) 362-7172.

Mr. Eric Sprott

200 Bay Street, Suite 2600

Royal Bank Plaza, South Tower

Toronto, Ontario M5J 2J1

copyright (c) newsfile corp. 2018

Toronto, Ontario--(Newsfile Corp. - December 27, 2018) - Eric Sprott announces that he holds 26,835,089 common shares (shares) and 3,944,444 share purchase warrants of Resource Capital Gold Corp. ("Resource Capital") representing approximately 15.4% of the outstanding shares on a non-diluted basis and 17.2% on a partially diluted basis. This press release is being issued pursuant to Canadian early warning requirements because the sale of shares, as described below, has resulted in a decrease in Mr. Sprott's beneficial holdings of shares of more than 2% of the outstanding shares of Resource Capital.

On December 24, 2018, Eric Sprott sold 7.2 million shares at a price of $0.015 per share ($108,000), representing approximately 4.1% of the outstanding shares, in two private transactions. Prior to this disposition, Mr. Sprott beneficially held 34,035,089 shares and 3,944,444 share purchase warrants, representing approximately 19.4% of the outstanding shares on a non-diluted basis and 21.2% on a partially diluted basis.

The shares are held for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities either on the open market or through private acquisitions or sell the securities either on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

Resource Capital Gold is located at 500-666 Burrard Street, Vancouver, BC V6C 3P6. A copy of the early warning report with respect to the foregoing will appear on the Corporation's profile on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com and may also be obtained by calling Mr. Sprott at (416) 362-7172.

Mr. Eric Sprott

200 Bay Street, Suite 2600

Royal Bank Plaza, South Tower

Toronto, Ontario M5J 2J1

copyright (c) newsfile corp. 2018

https://sedar.com/GetFile.do?lang=EN&docClass=8&issuerNo=000…

Konkursverfahren steht kurz bevor - Hier werden bald die Tore für immer geschlossen

Konkursverfahren steht kurz bevor - Hier werden bald die Tore für immer geschlossen

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +3,16 | |

| +0,13 | |

| -1,10 | |

| +0,85 | |

| +9,52 | |

| +33,33 | |

| +0,57 | |

| +0,51 | |

| +3,13 | |

| 0,00 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 196 | ||

| 93 | ||

| 66 | ||

| 50 | ||

| 46 | ||

| 43 | ||

| 42 | ||

| 37 | ||

| 33 | ||

| 27 |