Santos Ltd.

eröffnet am 25.02.17 09:30:04 von

neuester Beitrag 07.12.23 12:52:08 von

neuester Beitrag 07.12.23 12:52:08 von

Beiträge: 16

ID: 1.247.560

ID: 1.247.560

Aufrufe heute: 0

Gesamt: 2.008

Gesamt: 2.008

Aktive User: 0

ISIN: AU000000STO6 · WKN: 863403

4,6830

EUR

+0,20 %

+0,0095 EUR

Letzter Kurs 22:59:56 Lang & Schwarz

Neuigkeiten

31.05.23 · wallstreetONLINE Redaktion |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +53,15 | |

| 6,0800 | +43,06 | |

| 12,990 | +38,93 | |

| 0,5070 | +31,52 | |

| 1,4750 | +21,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,9800 | -8,62 | |

| 6,7200 | -8,82 | |

| 4,7400 | -15,36 | |

| 13,420 | -21,98 | |

| 20,000 | -33,33 |

Beitrag zu dieser Diskussion schreiben

7.12.

Woodside Energy, Santos in Merger Talks to Create Global Energy Giant

https://www.msn.com/en-us/money/markets/woodside-energy-sant…

...

Woodside Energy and Santos said they are discussing a merger that could result in a new global giant worth around $52 billion, illustrating how rising demand for natural gas in the wake of the Ukraine war is reshaping the energy sector.

Woodside and Santos said talks are at an early stage and there is no agreement over a deal that would rank as one of the largest in the energy sector this year. Santos, whose stock has declined about 5% over the past 12 months, said it was weighing the merger alongside other options to boost value for shareholders.

A combination of Woodside, which has a market value of $37.3 billion, and Santos, worth some $14.6 billion, would bring together Australia’s two largest energy companies as the country vies with Qatar to be the world’s top exporter of liquefied natural gas.

Joining with Santos would represent the second major transaction completed by Woodside in recent years after it acquired the petroleum business of BHP Group in 2022. Woodside operates LNG export terminals in Australia, and it acquired assets in the Gulf of Mexico and Caribbean through the BHP deal.

...

Woodside Energy, Santos in Merger Talks to Create Global Energy Giant

https://www.msn.com/en-us/money/markets/woodside-energy-sant…

...

Woodside Energy and Santos said they are discussing a merger that could result in a new global giant worth around $52 billion, illustrating how rising demand for natural gas in the wake of the Ukraine war is reshaping the energy sector.

Woodside and Santos said talks are at an early stage and there is no agreement over a deal that would rank as one of the largest in the energy sector this year. Santos, whose stock has declined about 5% over the past 12 months, said it was weighing the merger alongside other options to boost value for shareholders.

A combination of Woodside, which has a market value of $37.3 billion, and Santos, worth some $14.6 billion, would bring together Australia’s two largest energy companies as the country vies with Qatar to be the world’s top exporter of liquefied natural gas.

Joining with Santos would represent the second major transaction completed by Woodside in recent years after it acquired the petroleum business of BHP Group in 2022. Woodside operates LNG export terminals in Australia, and it acquired assets in the Gulf of Mexico and Caribbean through the BHP deal.

...

Santos ups Buyback Scheme with US$350 Million Increase

Auszug"The simplified capital management framework

Santos explained that its key strategy is maintaining a ‘disciplined, low-cost operating model to deliver strong cash flows through the commodity price cycle’.

The changes to its capital framework include the increased share buyback today, which is said to target a suitable capital structure and allows the company to strike a balance in capital allocation between various business investments.

Such investments include its backfill projects, decarbonisation projects, developments in growth and clean fuel projects, and, as already stated today, allowing sustainable returns to shareholders based on its free cash flow.

STO’s simplified capital management framework includes the policy of at least a 40% payout to shareholders based on its annual generated cash flow, which could soon be upped to 50%.

It also includes cash dividends or buybacks to shareholders based on market conditions and Board discretion and its existing target gearing range of 15–25%.

Mr Spence believes Santos is currently creating healthy cash flow with present commodity prices, and the Santos Board is reinforcing his confidence by agreeing to raise shareholder returns."

mehr

https://www.moneymorning.com.au/20221207/santos-ups-buyback-…

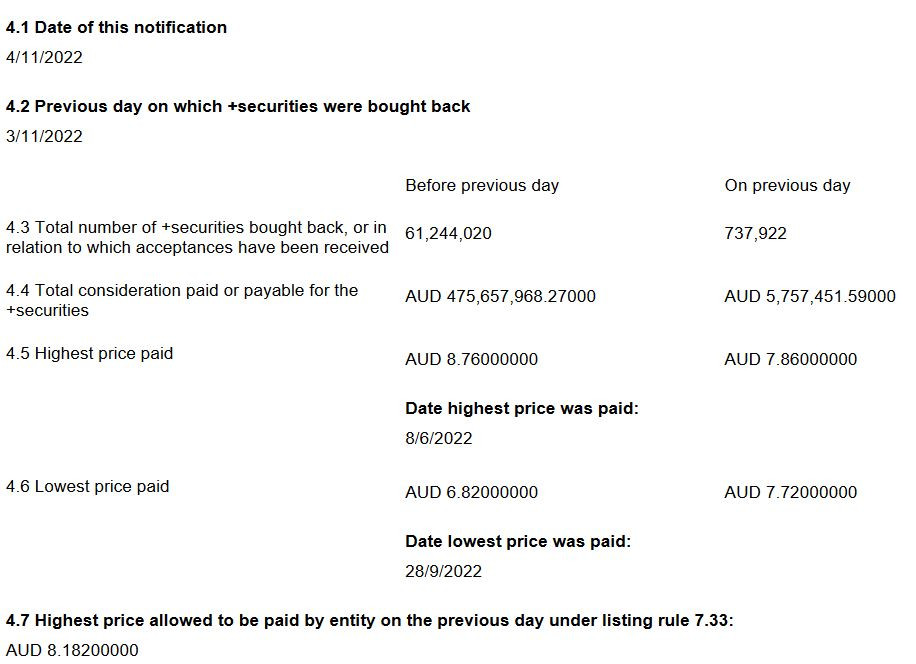

JP Morgan / Buy Back

Auszug25.10.

According to a note out of Morgans, its analysts have retained their add rating on the company’s shares and lifted their price target to $9.40.

Based on the current Santos share price, this implies potential upside of 23% for investors over the next 12 months.

In addition, the broker is expecting a dividend of approximately 27 cents per share in FY 2023, which equates to an attractive 3.5% yield.

Why is Santos an ASX 200 energy share to buy?

Morgans was pleased with Santos’ recent quarterly update and highlights that it “continues to unlock healthy synergies from its merger with OSH, so far achieving savings of US$112m during the 9 months since the merger completed.”

The broker believes that the “post-merger STO is starting to really stretch its legs in terms of quality of earnings and cash flow” and expects its gearing to continue to lower, which “will increase STO’s investment appeal.”

*****

Buy Back

https://hotcopper.com.au/threads/ann-update-notification-of-…

*****

Erster Kauf für das Value Depot

SL 7,5

17.8.

Santos to Boost Oil Output With $2.6 Billion Alaskan Project

https://uk.news.yahoo.com/santos-boost-oil-output-2-01054602…

...

Santos Ltd. has given the go-ahead for a $2.6 billion oil field project in Alaska to expand its production beyond the Asia-Pacific region.

The producer and joint venture partner Repsol SA took a final investment decision on phase 1 of the Pikka development on Wednesday, Adelaide, South Australia-based Santos said in an earnings statement. The project is expected to produce 80,000 barrels a day of oil from 2026.

Santos, which became one of the world’s top 20 producers following its merger with domestic rival Oil Search Ltd. last year, has been seen as overly dependent on the Asia-Pacific region, with all its major developments in Australia and Papua New Guinea. The company on Wednesday said net profit in the first half more than tripled from a year earlier to $1.2 billion on the back of higher prices for oil and natural gas.

“The project will add further diversification to our portfolio and reduces geographic concentration risk,” Santos Chief Executive Officer Kevin Galllagher said in a statement. “Santos has emission reduction plans to achieve scope 1 and 2 net-zero emissions by 2040 and in-line with that commitment, Pikka will be a net-zero project.”

Santos has entered into memorandums of understanding with Alaska Native Corporations to deliver carbon offset projects, it said. The company is the operator of Pikka and has a 51% stake while Repsol holds the rest.

Santos to Boost Oil Output With $2.6 Billion Alaskan Project

https://uk.news.yahoo.com/santos-boost-oil-output-2-01054602…

...

Santos Ltd. has given the go-ahead for a $2.6 billion oil field project in Alaska to expand its production beyond the Asia-Pacific region.

The producer and joint venture partner Repsol SA took a final investment decision on phase 1 of the Pikka development on Wednesday, Adelaide, South Australia-based Santos said in an earnings statement. The project is expected to produce 80,000 barrels a day of oil from 2026.

Santos, which became one of the world’s top 20 producers following its merger with domestic rival Oil Search Ltd. last year, has been seen as overly dependent on the Asia-Pacific region, with all its major developments in Australia and Papua New Guinea. The company on Wednesday said net profit in the first half more than tripled from a year earlier to $1.2 billion on the back of higher prices for oil and natural gas.

“The project will add further diversification to our portfolio and reduces geographic concentration risk,” Santos Chief Executive Officer Kevin Galllagher said in a statement. “Santos has emission reduction plans to achieve scope 1 and 2 net-zero emissions by 2040 and in-line with that commitment, Pikka will be a net-zero project.”

Santos has entered into memorandums of understanding with Alaska Native Corporations to deliver carbon offset projects, it said. The company is the operator of Pikka and has a 51% stake while Repsol holds the rest.

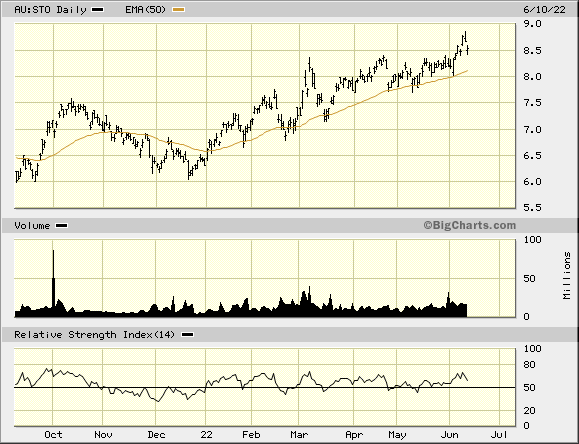

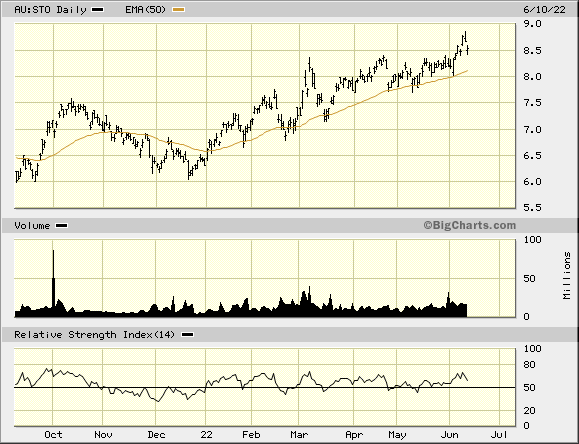

Aktienrückkauf und Dividendenpolitik

https://www.santos.com/news/santos-announces-new-capital-man…

+40% seitdem (in AUD):

die Aktie ist nicht besonders volatil (mMn); selbst Woodside ist etwas volatiler mit 43%|250d (FactSet) zu 35%|250d.

Das liegt auf dem Niveau einer ConocoPhillips z.B., die 7x so groß ist (Enterprise Value) und auch noch weniger Dividende bezahlt!

Vielleicht der allerletzte Geheimtipp bei den größeren Ölfirmen im derzeitigen Zyklus.

die Aktie ist nicht besonders volatil (mMn); selbst Woodside ist etwas volatiler mit 43%|250d (FactSet) zu 35%|250d.

Das liegt auf dem Niveau einer ConocoPhillips z.B., die 7x so groß ist (Enterprise Value) und auch noch weniger Dividende bezahlt!

Vielleicht der allerletzte Geheimtipp bei den größeren Ölfirmen im derzeitigen Zyklus.

Antwort auf Beitrag Nr.: 63.090.802 von texas2 am 22.03.20 09:43:48Santos und Oilsearch könnten als Firmen tatsächlich gut zusammenpassen und sich ergänzen

https://www.santos.com/wp-content/uploads/2021/09/210907-CEO…

https://www.santos.com/wp-content/uploads/2021/09/210907-CEO…

Antwort auf Beitrag Nr.: 57.476.006 von R-BgO am 06.04.18 00:50:26Wieder auf dem 2015, 2016 niveau

Antwort auf Beitrag Nr.: 58.810.757 von R-BgO am 27.09.18 09:35:53https://www.santos.com/media/4655/2018-shareholder-review.pd…

Santos Ltd.