Kleines Subportfolio "Lithium" - Produzenten oder nahe Produktion - Die letzten 30 Beiträge

eröffnet am 30.05.17 17:40:26 von

neuester Beitrag 06.10.23 15:31:41 von

neuester Beitrag 06.10.23 15:31:41 von

Beiträge: 98

ID: 1.254.052

ID: 1.254.052

Aufrufe heute: 1

Gesamt: 11.113

Gesamt: 11.113

Aktive User: 0

ISIN: US37954Y8553 · WKN: A143H3

39,15

EUR

-1,09 %

-0,43 EUR

Letzter Kurs 24.04.24 Lang & Schwarz

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 325,00 | +13,24 | |

| 0,7900 | +11,27 | |

| 6,3850 | +7,98 | |

| 0,6625 | +6,85 | |

| 29,36 | +6,57 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 20,740 | -9,83 | |

| 6,8200 | -10,26 | |

| 4,5200 | -12,23 | |

| 1,5000 | -23,08 | |

| 0,7500 | -25,00 |

Beitrag zu dieser Diskussion schreiben

6.10.

Chinese Lithium Plunge Has Created Huge Discount to US Prices

https://www.bnnbloomberg.ca/chinese-lithium-plunge-has-creat…

...

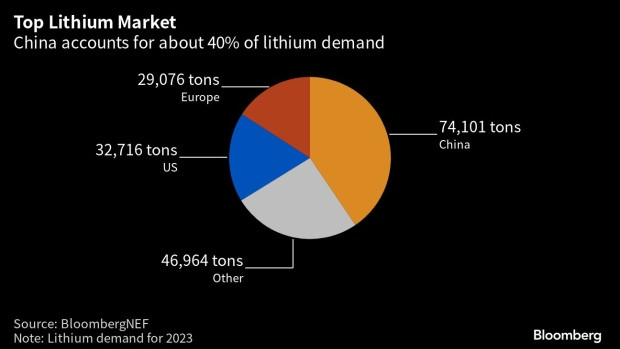

Lithium prices are plunging around the world, but the slump is particularly glaring in China, where the key battery metal is trading at a big discount versus the US.

After a buying frenzy sent global prices soaring though last year, they’ve since plunged as electric vehicle demand disappoints and supplies are expected to remain ample. Yet despite the broad rout, futures in the crucial Chinese market are about a third cheaper.

The spread offers traders an opportunity to make money, but also highlights just how bearish the outlook is in the top EV producer. The weakness has been especially pronounced there as battery makers tap stockpiles built up during the boom, while demand concerns are being exacerbated by wider fears about the country’s economy.

“Everybody has a lot of inventory,” said Leon Hoffmann, a broker at SCB Environmental Markets in Switzerland. Chinese traders have been “very bearish and they just kept on selling.”

...

29.8.

A worldwide lithium shortage could come as soon as 2025

• A worldwide shortage for lithium could be on its way as demand for the metal ramps up.

• “Global lithium supply is expected to enter a deficit relative to demand by 2025,” said BMI, a Fitch Solutions research unit.

https://www.cnbc.com/2023/08/29/a-worldwide-lithium-shortage…

...

“We expect an average of 20.4% year-on-year annual growth for China’s lithium demand for EVs alone over 2023-2032,” the report stated.

In contrast, China’s lithium supply will only grow 6% over the same period, BMI said, adding that rate cannot satiate even one third of forecasted demand.

...

Other analysts don’t see a deficit coming so soon, but still predicted a shortfall by the end of the decade.

While more lithium mines and mining exploration projects coming online could support burgeoning demand, that would only extend the runway for a few more years, according to Rystad Energy’s estimates.

According to the energy research firm, hundreds of lithium projects are currently under exploration, but the complexity in geology and time-consuming permitting process still pose challenges.

There are currently only 101 lithium mines in the world, according to Refinitiv data.

Rystad Energy Vice President Susan Zou estimates that total lithium mine supply will increase by 30% and 40% year on year in 2023 and 2024, and that miners would continue to develop both existing and greenfield projects amid a “global push to electrify transportations.”

While that could point to a global lithium surplus next year, shortages could start to plague supply chains in 2028.

...

A worldwide lithium shortage could come as soon as 2025

• A worldwide shortage for lithium could be on its way as demand for the metal ramps up.

• “Global lithium supply is expected to enter a deficit relative to demand by 2025,” said BMI, a Fitch Solutions research unit.

https://www.cnbc.com/2023/08/29/a-worldwide-lithium-shortage…

...

“We expect an average of 20.4% year-on-year annual growth for China’s lithium demand for EVs alone over 2023-2032,” the report stated.

In contrast, China’s lithium supply will only grow 6% over the same period, BMI said, adding that rate cannot satiate even one third of forecasted demand.

...

Other analysts don’t see a deficit coming so soon, but still predicted a shortfall by the end of the decade.

While more lithium mines and mining exploration projects coming online could support burgeoning demand, that would only extend the runway for a few more years, according to Rystad Energy’s estimates.

According to the energy research firm, hundreds of lithium projects are currently under exploration, but the complexity in geology and time-consuming permitting process still pose challenges.

There are currently only 101 lithium mines in the world, according to Refinitiv data.

Rystad Energy Vice President Susan Zou estimates that total lithium mine supply will increase by 30% and 40% year on year in 2023 and 2024, and that miners would continue to develop both existing and greenfield projects amid a “global push to electrify transportations.”

While that could point to a global lithium surplus next year, shortages could start to plague supply chains in 2028.

...

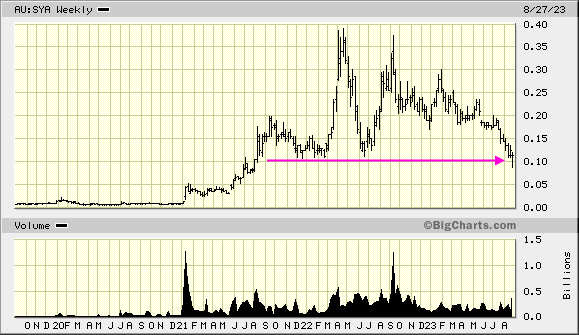

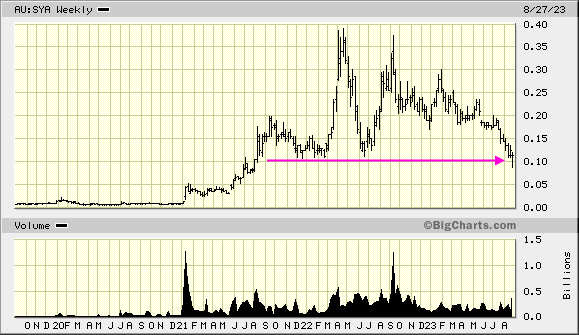

auch hier kehrt mittlerweile die Realität ein: Sayona Mining

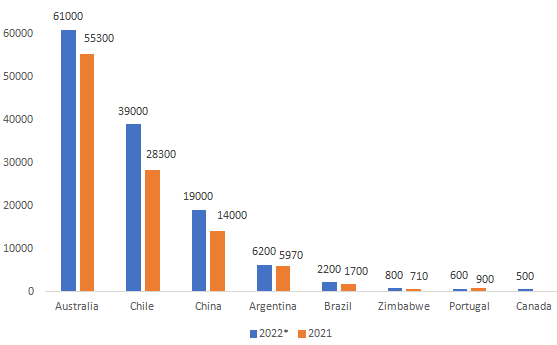

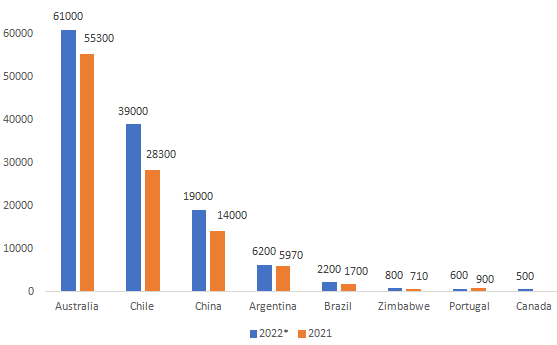

Lithium producing countries, tonnes of contained lithium. 2022* - preliminary data. Source: USGS:

https://www.kitco.com/news/2023-02-01/The-world-s-largest-li…

https://www.kitco.com/news/2023-02-01/The-world-s-largest-li…

4.6.

Global lithium production to keep up with demand until 2026 - report

https://www.kitco.com/news/2021-06-04/Global-lithium-product…

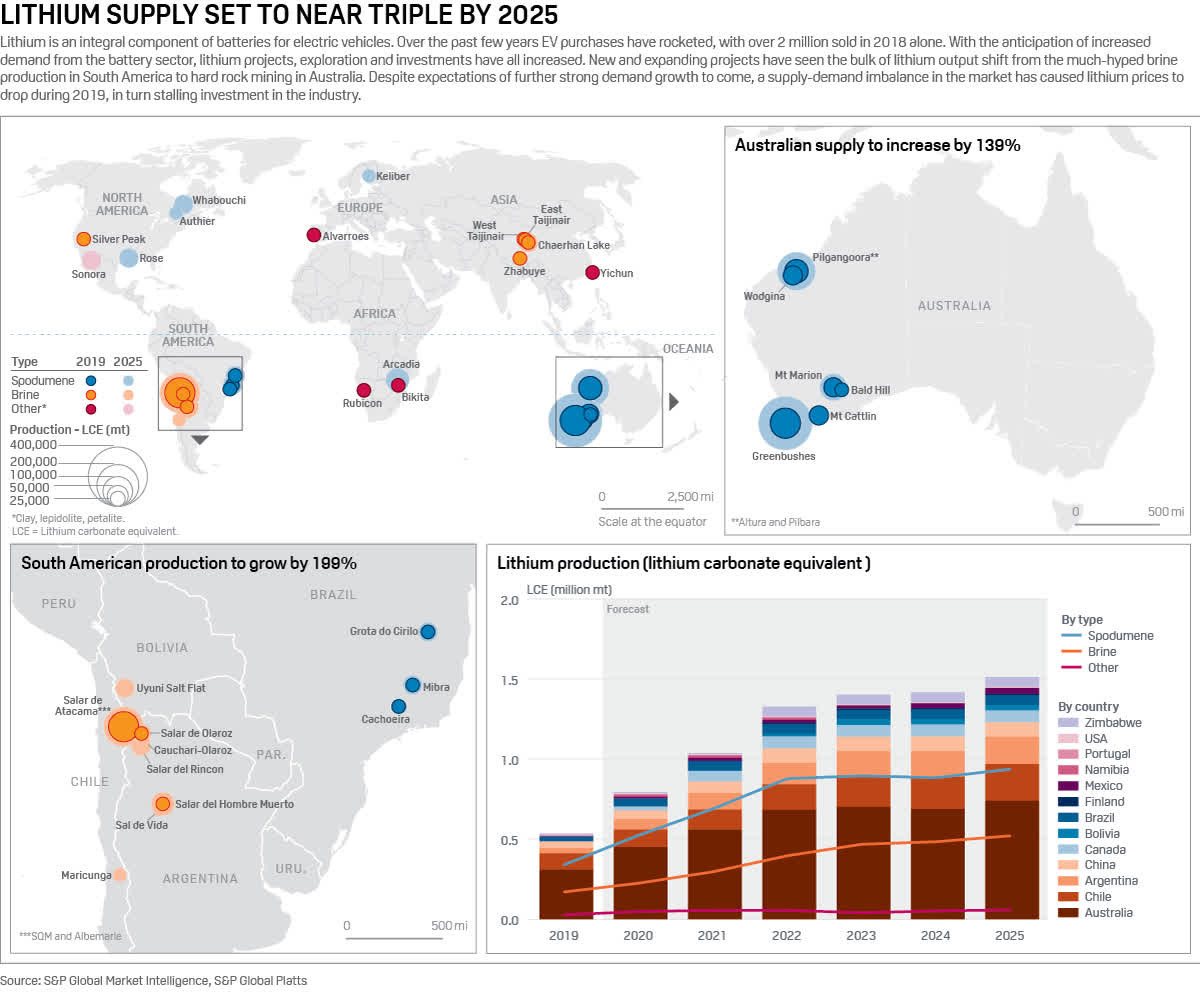

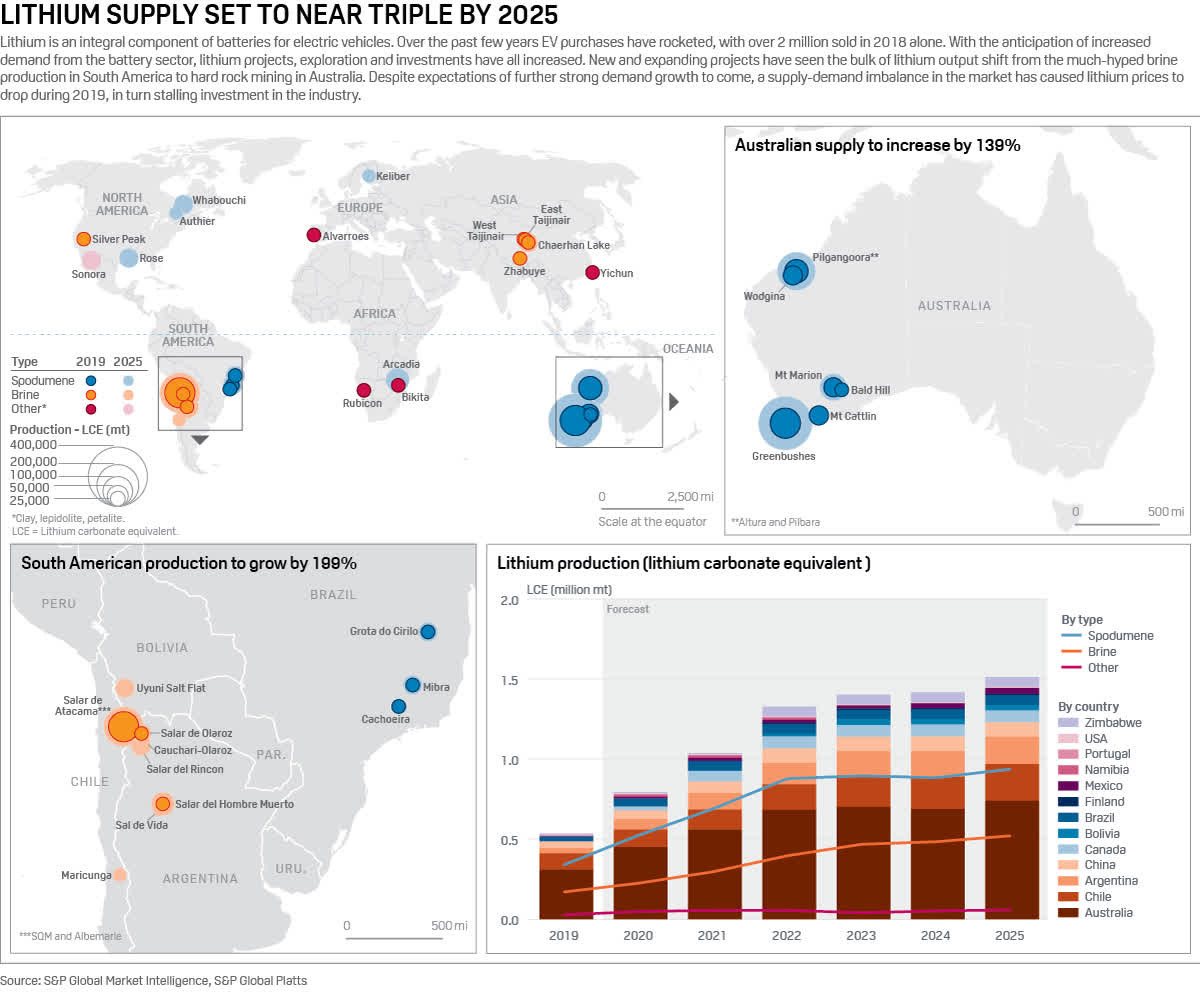

According to the Australian Government's Department of Industry, Science, Energy and Resources (DISER), global lithium production was stronger than anticipated in 2020, driven in response to increasing EV demand.

DISER said that global lithium output in 2020 is estimated at 439,000 tonnes of lithium carbonate equivalent (LCE). Production is forecast at 516,000 tonnes LCE in 2021, and projected to be 1,084,000 tonnes by 2026. At this stage, supply may fall short of demand unless significant recycling is undertaken, or mine and brine operations are expanded beyond initial projections, the report indicated.

World demand for lithium is estimated to increase from 305,000 tonnes LCE in 2020 to 426,000 tonnes in 2021. Demand is then forecast to exceed half a million tonnes in 2022, and more than 1.0 million tonnes by 2026 as global electric vehicle uptake rises further.

DISER noted that "Green" stimulus packages and tightening emissions standards in Europe, are changing the nature of a previously oversupplied market. As a result, the gap between supply and demand is narrowing. Stockpiles still exist, but their size is difficult to determine — with some suggestions of 4-8 weeks for spodumene. Additionally, offtake and equity investments continue, suggesting security of supply may be an issue going forward, the report explained.

Meanwhile, according to the report’s findings, Australian production is expected to rise over the outlook period, from 244,000 tonnes LCE in 2020–21 to 571,000 tonnes LCE in 2025–26, maintaining around 50% of world output.

Global lithium production to keep up with demand until 2026 - report

https://www.kitco.com/news/2021-06-04/Global-lithium-product…

According to the Australian Government's Department of Industry, Science, Energy and Resources (DISER), global lithium production was stronger than anticipated in 2020, driven in response to increasing EV demand.

DISER said that global lithium output in 2020 is estimated at 439,000 tonnes of lithium carbonate equivalent (LCE). Production is forecast at 516,000 tonnes LCE in 2021, and projected to be 1,084,000 tonnes by 2026. At this stage, supply may fall short of demand unless significant recycling is undertaken, or mine and brine operations are expanded beyond initial projections, the report indicated.

World demand for lithium is estimated to increase from 305,000 tonnes LCE in 2020 to 426,000 tonnes in 2021. Demand is then forecast to exceed half a million tonnes in 2022, and more than 1.0 million tonnes by 2026 as global electric vehicle uptake rises further.

DISER noted that "Green" stimulus packages and tightening emissions standards in Europe, are changing the nature of a previously oversupplied market. As a result, the gap between supply and demand is narrowing. Stockpiles still exist, but their size is difficult to determine — with some suggestions of 4-8 weeks for spodumene. Additionally, offtake and equity investments continue, suggesting security of supply may be an issue going forward, the report explained.

Meanwhile, according to the report’s findings, Australian production is expected to rise over the outlook period, from 244,000 tonnes LCE in 2020–21 to 571,000 tonnes LCE in 2025–26, maintaining around 50% of world output.

Jetzt kommen die Big Boys bei Lithium rein:

...

Oilfield services firm Schlumberger's New Energy division said on Thursday it would launch a lithium extraction plant in Nevada to cash in on the surging demand for the battery metal from electric vehicle makers and technology companies.

The division said it has invested more than $15 million in the direct lithium extraction process and expects the development and operation of the Nevada plant to require similar funding. Schlumberger New Energy said it would extract lithium from brine, which occurs naturally around its proposed project site at Clayton Valley in Nevada, in a way that's more efficient than the industry standard of using evaporation ponds.

This method is also used by privately held Lilac Solutions and Standard Lithium Ltd , which count as competitors for Schlumberger's unit in the direct lithium extraction space.

...

18.3.

Schlumberger unit to launch Nevada lithium plant as EV demand rises

https://www.kitco.com/news/2021-03-18/UPDATE-2-Schlumberger-…

...

Oilfield services firm Schlumberger's New Energy division said on Thursday it would launch a lithium extraction plant in Nevada to cash in on the surging demand for the battery metal from electric vehicle makers and technology companies.

The division said it has invested more than $15 million in the direct lithium extraction process and expects the development and operation of the Nevada plant to require similar funding. Schlumberger New Energy said it would extract lithium from brine, which occurs naturally around its proposed project site at Clayton Valley in Nevada, in a way that's more efficient than the industry standard of using evaporation ponds.

This method is also used by privately held Lilac Solutions and Standard Lithium Ltd , which count as competitors for Schlumberger's unit in the direct lithium extraction space.

...

18.3.

Schlumberger unit to launch Nevada lithium plant as EV demand rises

https://www.kitco.com/news/2021-03-18/UPDATE-2-Schlumberger-…

Antwort auf Beitrag Nr.: 65.696.706 von faultcode am 13.11.20 11:29:59

so ist es:

4.3.

Exclusive: Lithium giant Albemarle slams Chile over 'unjust' withholding of Atacama study

https://in.news.yahoo.com/exclusive-lithium-giant-albemarle-…

...

Albemarle Corp, the world's top lithium producer, has accused a Chilean regulator of "unjust" discrimination for refusing to make public a key report on the impact of mining on the Atacama salt flat, according to court filings.

U.S.-based Albemarle in July last year asked to see the publicly funded report but regulator Corfo rejected the request after Chilean miner SQM, a top competitor, objected on grounds it contained confidential information. A government watchdog upheld the decision.

Both Albemarle and SQM - the only two lithium miners on the salt flat - contributed data to the report. But while SQM's contract with the government allows it to review and comment on the study, Albemarle's agreement does not.

Albemarle blasted that discrepancy in previously unreported arguments made before a Santiago appeals court in February, saying it resulted in "arbitrary, unjust, illegal, and above all, unconstitutional discrimination." The company is appealing the watchdog's decision and demanding the report be made public immediately.

The spat underscores rising tensions between Albemarle and regulators in the Andean nation over operations in the high-altitude Atacama flat, home to one-quarter of the world's current supply of lithium.

Albemarle has for months also feuded with Corfo over royalty payments, and with another Chilean regulator over data used to determine its production quota.

...

Zitat von faultcode: immer wieder Ärger in Chile bei den Li-Minern. War "früher" nicht so:

...

so ist es:

4.3.

Exclusive: Lithium giant Albemarle slams Chile over 'unjust' withholding of Atacama study

https://in.news.yahoo.com/exclusive-lithium-giant-albemarle-…

...

Albemarle Corp, the world's top lithium producer, has accused a Chilean regulator of "unjust" discrimination for refusing to make public a key report on the impact of mining on the Atacama salt flat, according to court filings.

U.S.-based Albemarle in July last year asked to see the publicly funded report but regulator Corfo rejected the request after Chilean miner SQM, a top competitor, objected on grounds it contained confidential information. A government watchdog upheld the decision.

Both Albemarle and SQM - the only two lithium miners on the salt flat - contributed data to the report. But while SQM's contract with the government allows it to review and comment on the study, Albemarle's agreement does not.

Albemarle blasted that discrepancy in previously unreported arguments made before a Santiago appeals court in February, saying it resulted in "arbitrary, unjust, illegal, and above all, unconstitutional discrimination." The company is appealing the watchdog's decision and demanding the report be made public immediately.

The spat underscores rising tensions between Albemarle and regulators in the Andean nation over operations in the high-altitude Atacama flat, home to one-quarter of the world's current supply of lithium.

Albemarle has for months also feuded with Corfo over royalty payments, and with another Chilean regulator over data used to determine its production quota.

...

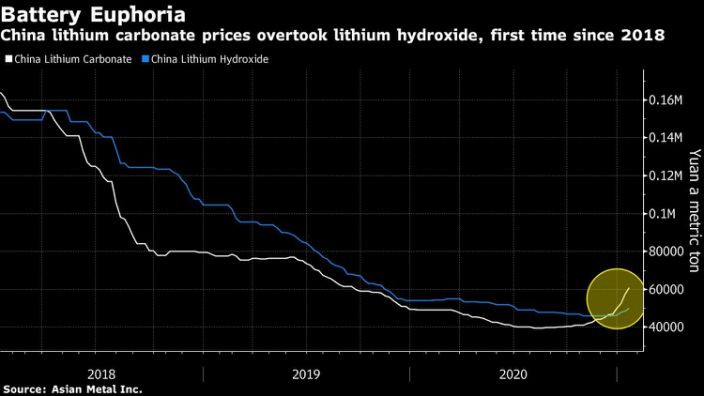

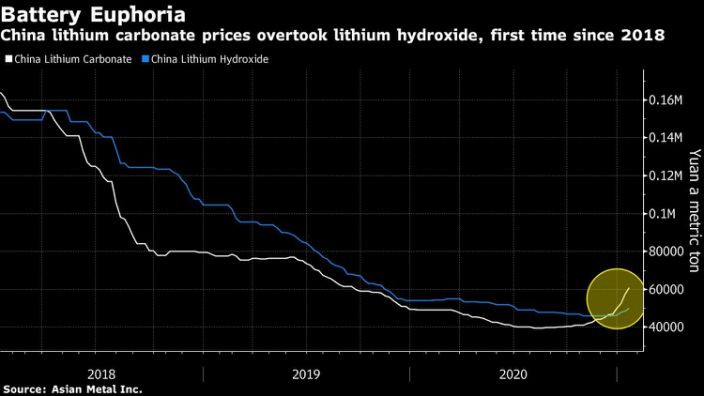

Antwort auf Beitrag Nr.: 66.188.320 von faultcode am 24.12.20 12:41:22lithium carbonate

https://news.yahoo.com/demand-cheaper-batteries-china-sends-…

...

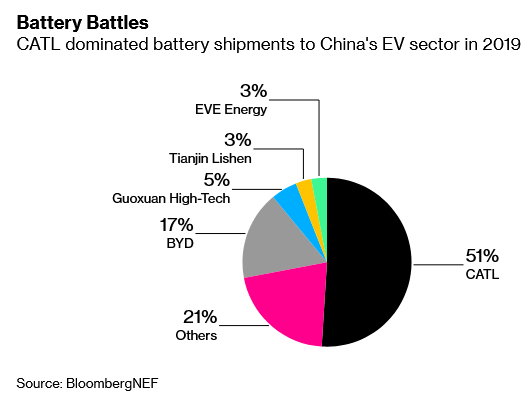

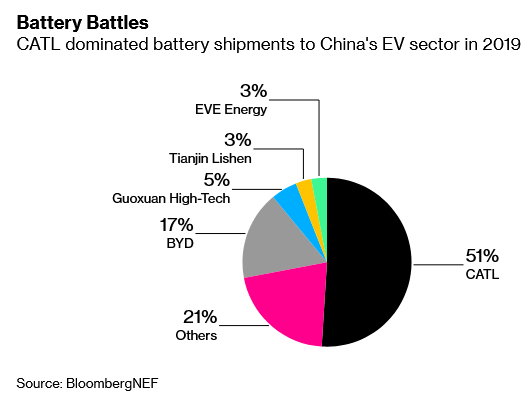

These lithium-iron-phosphate (LFP) batteries are stealing the limelight in China after reductions to EV subsidies, just as competition intensifies in the automotive sector. Top EV makers including Tesla Inc and BYD Co. are already betting on them.

“Automakers in China have turned back to the more cost-effective LFP cathodes amid a low-subsidy environment,” said Alice Yu, research analyst at S&P Global Market Intelligence.

Lithium carbonate is also thriving because it can be used in a wider range of EV batteries compared to lithium hydroxide, said Sharon Mustri, an analyst at BloombergNEF. Carbonate prices in China jumped 37% in January.

The LFP packs are simpler to manufacture and also use lower-cost materials -- making them about 20% cheaper to build than battery cells that use nickel, cobalt and manganese, according to BloombergNEF. Lithium hydroxide is mainly used in batteries with higher nickel content that power longer-range EV models.

...

https://news.yahoo.com/demand-cheaper-batteries-china-sends-…

...

These lithium-iron-phosphate (LFP) batteries are stealing the limelight in China after reductions to EV subsidies, just as competition intensifies in the automotive sector. Top EV makers including Tesla Inc and BYD Co. are already betting on them.

“Automakers in China have turned back to the more cost-effective LFP cathodes amid a low-subsidy environment,” said Alice Yu, research analyst at S&P Global Market Intelligence.

Lithium carbonate is also thriving because it can be used in a wider range of EV batteries compared to lithium hydroxide, said Sharon Mustri, an analyst at BloombergNEF. Carbonate prices in China jumped 37% in January.

The LFP packs are simpler to manufacture and also use lower-cost materials -- making them about 20% cheaper to build than battery cells that use nickel, cobalt and manganese, according to BloombergNEF. Lithium hydroxide is mainly used in batteries with higher nickel content that power longer-range EV models.

...

Uuuups!

Antwort auf Beitrag Nr.: 56.759.379 von faultcode am 18.01.18 18:43:43immer wieder Ärger in Chile bei den Li-Minern. War "früher" nicht so:

12.11.

Chile vows to take lithium giant Albemarle to arbitration over royalty spat

https://uk.reuters.com/article/chile-lithium-albemarle/chile…

...

Chilean regulators have accused Albemarle, the world’s largest lithium producer, of underpaying royalties by $11 million and vowed to take the U.S.-based miner to international arbitration over what they called a breach of its contract with the government.

Corfo, which oversees Albemarle’s contract for lithium mining in Chile’s Salar de Atacama, told lawmakers the miner had misinterpreted the part of their agreement that outlines the basis for royalty payments, favoring a too-low commission on its sales.

“For (Corfo) it is unacceptable that Albemarle pretends to alter what was negotiated and agreed upon by the two parties,” said Corfo vice-president Pablo Terrazas in an Oct. 14 letter to lawmakers viewed by Reuters. He said the disagreement represented a “breach” of the 2016 contract that increased Albemarle’s quota to extract lithium.

Albemarle rejected those claims in a statement to Reuters on Wednesday, saying Corfo’s call for arbitration was unnecessary. Albemarle said it has met its royalty obligations and the contract makes clear such disputes can be settled without arbitration.

“We do not understand Corfo’s insistence on international arbitration, which is a process that will take years and will mean an enormous expense...for the State,” Albemarle said.

The latest spat comes two months after Albemarle locked horns with Chilean nuclear agency CCHEN over reserves data. CCHEN has demanded additional information on reserves held by Albemarle at Atacama, details regulators say they need to assure the miner can sustain increased output. The two are still discussing the matter, Albemarle told Reuters.

Albemarle has been pushing to expand its production in Chile. Marketwatchers expect demand for the white metal to triple by 2025 as automakers produce more electric vehicles (EVs).

The coronavirus pandemic and falling prices, however, have set many producers back, forcing them to shelve projects, cut costs and temporarily tamp down output.

...

___

Die Chilenen sind auch nicht doof. Die bekommen auch mit, was für ein klima-aktivistischer Affentanz in Europa wegen der BEV's etc. aufgeführt wird

12.11.

Chile vows to take lithium giant Albemarle to arbitration over royalty spat

https://uk.reuters.com/article/chile-lithium-albemarle/chile…

...

Chilean regulators have accused Albemarle, the world’s largest lithium producer, of underpaying royalties by $11 million and vowed to take the U.S.-based miner to international arbitration over what they called a breach of its contract with the government.

Corfo, which oversees Albemarle’s contract for lithium mining in Chile’s Salar de Atacama, told lawmakers the miner had misinterpreted the part of their agreement that outlines the basis for royalty payments, favoring a too-low commission on its sales.

“For (Corfo) it is unacceptable that Albemarle pretends to alter what was negotiated and agreed upon by the two parties,” said Corfo vice-president Pablo Terrazas in an Oct. 14 letter to lawmakers viewed by Reuters. He said the disagreement represented a “breach” of the 2016 contract that increased Albemarle’s quota to extract lithium.

Albemarle rejected those claims in a statement to Reuters on Wednesday, saying Corfo’s call for arbitration was unnecessary. Albemarle said it has met its royalty obligations and the contract makes clear such disputes can be settled without arbitration.

“We do not understand Corfo’s insistence on international arbitration, which is a process that will take years and will mean an enormous expense...for the State,” Albemarle said.

The latest spat comes two months after Albemarle locked horns with Chilean nuclear agency CCHEN over reserves data. CCHEN has demanded additional information on reserves held by Albemarle at Atacama, details regulators say they need to assure the miner can sustain increased output. The two are still discussing the matter, Albemarle told Reuters.

Albemarle has been pushing to expand its production in Chile. Marketwatchers expect demand for the white metal to triple by 2025 as automakers produce more electric vehicles (EVs).

The coronavirus pandemic and falling prices, however, have set many producers back, forcing them to shelve projects, cut costs and temporarily tamp down output.

...

___

Die Chilenen sind auch nicht doof. Die bekommen auch mit, was für ein klima-aktivistischer Affentanz in Europa wegen der BEV's etc. aufgeführt wird

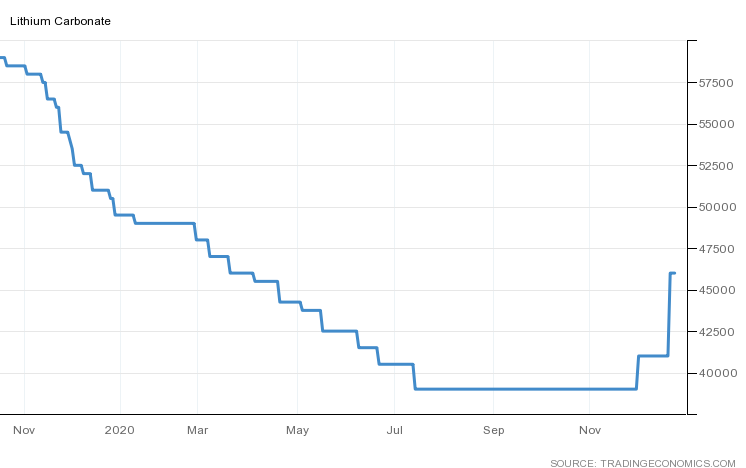

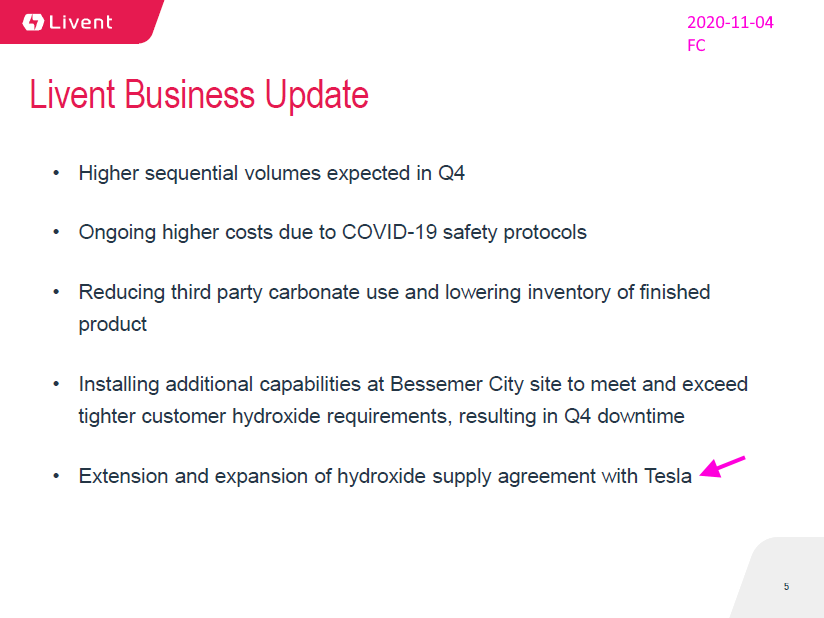

Antwort auf Beitrag Nr.: 65.639.130 von faultcode am 09.11.20 12:44:58Trotzdem: Sub-Portfolio mit beiden Rest-Komponenten heute aufgelöst:

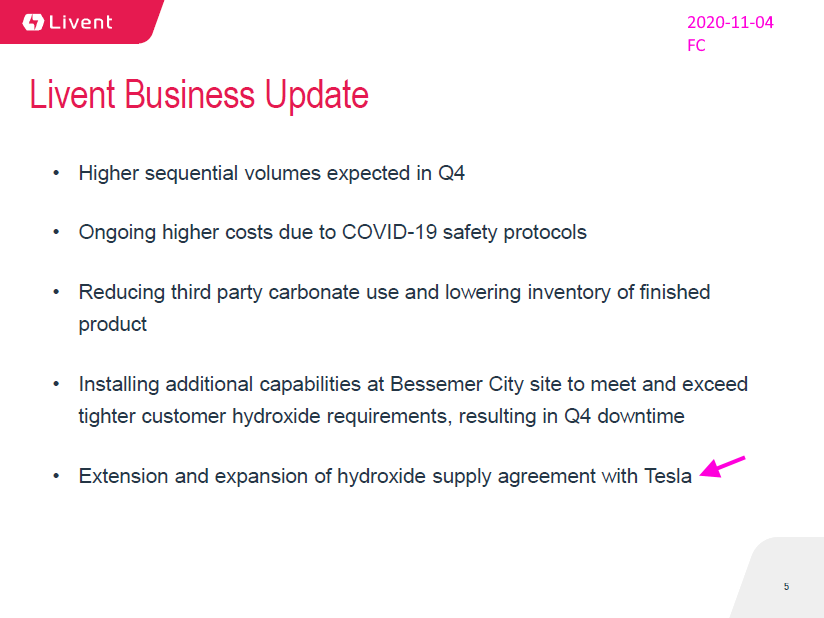

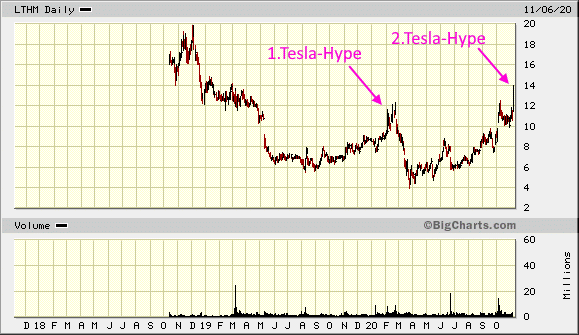

• Livent im Tesla-Hype #2

• Neometals auch, weil sehr klein mit ~20 MA's und einer Unternehmens-Politik, die ich bis heute für recht riskant halte.

Die beiden JV's (SMS + SSAB) kosten viel Geld und das ist in wenigen Jahren weg, wenn die damit verbundenen Anlagen nicht gleich zu einem positiven, oper. Cash flow beitragen (Positiv-Szenario).

Und diese Wahrscheinlichkeit halte ich für hoch, weil immer mehr große Player den Li battery recycling-Markt für sich entdecken werden (oft auch nur, weil sie es irgendwie müssen, so wie z.B. VW).

11.06.18

• Livent im Tesla-Hype #2

• Neometals auch, weil sehr klein mit ~20 MA's und einer Unternehmens-Politik, die ich bis heute für recht riskant halte.

Die beiden JV's (SMS + SSAB) kosten viel Geld und das ist in wenigen Jahren weg, wenn die damit verbundenen Anlagen nicht gleich zu einem positiven, oper. Cash flow beitragen (Positiv-Szenario).

Und diese Wahrscheinlichkeit halte ich für hoch, weil immer mehr große Player den Li battery recycling-Markt für sich entdecken werden (oft auch nur, weil sie es irgendwie müssen, so wie z.B. VW).

11.06.18

Zitat von faultcode: ...=> Neometals zahlte Dividende von AUD0.01 per Share (Extag : 31.05.2018)

=> man fragt sich: von was denn?

Schliesslich sind sie mitten drin, die Kalgoorlie lithium hydroxide facility zu entwickeln...

Antwort auf Beitrag Nr.: 65.624.489 von faultcode am 07.11.20 01:00:19Livent ist demnach noch immer erhöht geshortet:

https://twitter.com/IotraderScans/status/1325543707249139712

https://twitter.com/IotraderScans/status/1325543707249139712

Antwort auf Beitrag Nr.: 64.719.616 von faultcode am 11.08.20 13:29:42Livent wieder im Tesla-Hype (*):

-->

6.11.

Tesla verlängert Lithium-Liefervertrag mit Livent

https://www.electrive.net/2020/11/06/tesla-verlaengert-lithi…

...

(*)

-->

6.11.

Tesla verlängert Lithium-Liefervertrag mit Livent

https://www.electrive.net/2020/11/06/tesla-verlaengert-lithi…

...

(*)

29.10.

'Lithium prices appear to have bottomed' - Orocobre

https://www.kitco.com/news/2020-10-29/-Lithium-prices-appear…

...

Sales volume for the quarter was up 112% quarter on quarter to 3,393 tonnes, while sales revenue was up 68% QoQ to $10.5 million following the sale of excess inventory. The realized average price achieved was $3,102/tonne on a free on board basis.

Cash cost of sales was successfully maintained near recent lows at US$3,974/tonne.

The EV material sector started the year downbeat. In January, Orocobre was laboring under lithium prices that dropped 24%.

"Lithium prices appear to have bottomed and realized Q2 FY21 prices are expected to be higher than Q1," wrote the company.

During the quarter Orocobre highlighted a non-binding MOU with Prime Planet Energy and Solutions (PPES), a joint venture between Toyota (51%) and Panasonic (49%) specializing in the production of automotive battery cells, for the long-term supply of product culminating in 30kt of lithium carbonate equivalent (LCE) in CY25. Orocobre said discussions are now underway to finalize the detailed terms of the agreement.

'Lithium prices appear to have bottomed' - Orocobre

https://www.kitco.com/news/2020-10-29/-Lithium-prices-appear…

...

Sales volume for the quarter was up 112% quarter on quarter to 3,393 tonnes, while sales revenue was up 68% QoQ to $10.5 million following the sale of excess inventory. The realized average price achieved was $3,102/tonne on a free on board basis.

Cash cost of sales was successfully maintained near recent lows at US$3,974/tonne.

The EV material sector started the year downbeat. In January, Orocobre was laboring under lithium prices that dropped 24%.

"Lithium prices appear to have bottomed and realized Q2 FY21 prices are expected to be higher than Q1," wrote the company.

During the quarter Orocobre highlighted a non-binding MOU with Prime Planet Energy and Solutions (PPES), a joint venture between Toyota (51%) and Panasonic (49%) specializing in the production of automotive battery cells, for the long-term supply of product culminating in 30kt of lithium carbonate equivalent (LCE) in CY25. Orocobre said discussions are now underway to finalize the detailed terms of the agreement.

Antwort auf Beitrag Nr.: 65.521.636 von faultcode am 28.10.20 13:40:4628.10.

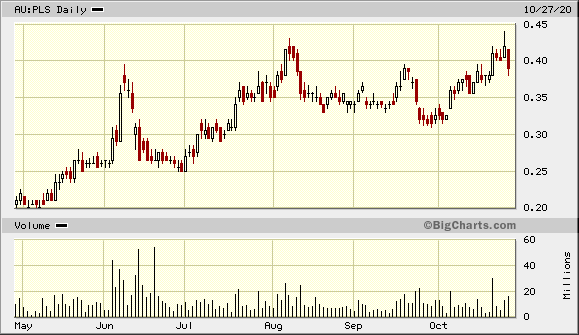

Pilbara Minerals lines up potential $175 million Altura lithium deal

https://www.reuters.com/article/altura-mining-m-a-pilbara-in…

...

Lithium miner Pilbara Minerals Ltd PLS.AX said on Wednesday it had entered into a conditional agreement to acquire Altura Mining Ltd's AJM.AX lithium project for about $175 million.

Pilbara was vying with Galaxy Resources GXY.AX to acquire the embattled hard rock lithium producer and was considered the frontrunner given the proximity of its lithium project to Altura's in Pilgangoora, Western Australia, according to a report by the Australian Financial Review. Altura entered administration on Tuesday after the impact of the pandemic exacerbated a prolonged period of low prices for battery materials.

Pilbara said the agreement with the senior secured loan noteholders of Altura provides it with a path to potentially acquire the project through the purchase of shares in Altura Lithium Operations Pty Ltd.

Loan Noteholders have agreed to vote in favour of the Pilbara should the acquisition proceed, the company said.

West Perth-based Pilbara has agreed to pay an upfront cash payment of $155 million and about $20 million for the shares in Altura Lithium Operations upon successful completion of the deal.

The cash portion will be mostly funded through future equity capital raising of about A$240 million ($171.10 million), Pilbara said.

Pilbara Minerals earlier in the day halted trading following media reports of it looking to buy Altura.

Pilbara Minerals lines up potential $175 million Altura lithium deal

https://www.reuters.com/article/altura-mining-m-a-pilbara-in…

...

Lithium miner Pilbara Minerals Ltd PLS.AX said on Wednesday it had entered into a conditional agreement to acquire Altura Mining Ltd's AJM.AX lithium project for about $175 million.

Pilbara was vying with Galaxy Resources GXY.AX to acquire the embattled hard rock lithium producer and was considered the frontrunner given the proximity of its lithium project to Altura's in Pilgangoora, Western Australia, according to a report by the Australian Financial Review. Altura entered administration on Tuesday after the impact of the pandemic exacerbated a prolonged period of low prices for battery materials.

Pilbara said the agreement with the senior secured loan noteholders of Altura provides it with a path to potentially acquire the project through the purchase of shares in Altura Lithium Operations Pty Ltd.

Loan Noteholders have agreed to vote in favour of the Pilbara should the acquisition proceed, the company said.

West Perth-based Pilbara has agreed to pay an upfront cash payment of $155 million and about $20 million for the shares in Altura Lithium Operations upon successful completion of the deal.

The cash portion will be mostly funded through future equity capital raising of about A$240 million ($171.10 million), Pilbara said.

Pilbara Minerals earlier in the day halted trading following media reports of it looking to buy Altura.

Another one bites the dust:

26.10.

ASX-listed Altura Mining in receivership; $150m recap sinks

https://www.afr.com/street-talk/asx-listed-lithium-play-altu…

...

26.10.

ASX-listed Altura Mining in receivership; $150m recap sinks

https://www.afr.com/street-talk/asx-listed-lithium-play-altu…

...

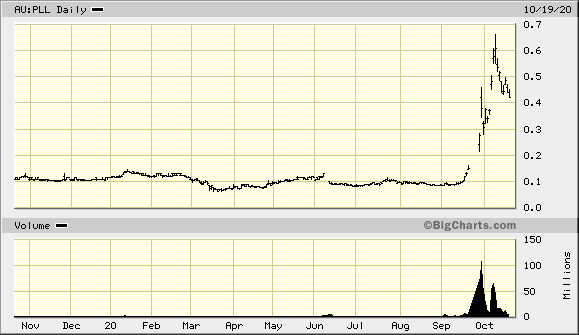

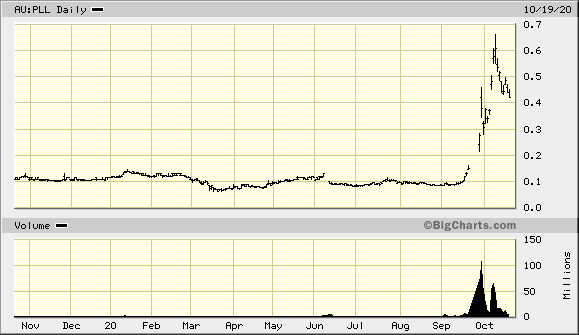

20.10.

This Miner Stock Is Rising Because Tesla Needs More Lithium

https://www.barrons.com/articles/tesla-demand-is-driving-thi…

Stock in exploration-stage lithium miner Piedmont Lithium has soared—by about 166%—since electric-vehicle behemoth Tesla hosted its battery technology day on Sept. 22.

At the event, Tesla painted a picture of future EV demand that implied the world needs a lot more EV-related materials, including lithium. Now Piedmont (PLL) is using its recent share strength to raise money to fund growth.

On Monday, Piedmont announced plans to raise money by selling stock. The company wants to sell up to 1.5 million American depositary receipts, or ADRs.

...

The sale has the potential to bring in roughly $45 million to company coffers, depending on the price discount offered on the sale. Piedmont has about $19 million in cash on its balance sheet, based on recent filings.

The company might use the cash toward the hard rock mine it is developing in North Carolina. (Most of the world’s lithium today comes from evaporating salt from brine ponds.) Early phases of Piedmont’s mine should cost about $170 million, according to CEO Keith Phillips.

Piedmont is also getting some money from Tesla. Piedmont stock soared more than 200% on Sept 28, days after Telsa’s battery event, when Tesla signed a deal for five years of lithium-ore supply, with a possible extension for another five years. Deliveries from Piedmont to Telsa are expected to start around 2022.

The lithium sector is heating up, and Barron’s recently wrote positively about lithium miners. We prefer Livent (LTHM), believing higher demand from EVs will drive higher commodity volumes for all miners, as well as higher lithium-linked commodity prices.

When we wrote about the miners, we focused on the established players, including SQM (SQM), Albemarle (ALB), and Livent. Those three have an aggregate market capitalization of more than $19 billion.

But there are riskier plays. Piedmont, with a market value of about $340 million, is one. Lithium Americas (LAC), valued at $1.2 billion, is another. Those two don’t have sales yet. Orocobre (ORE.Australia) is another small-capitalization lithium firm, though with some sales. It produces lithium from brines in Argentina, and has a market cap of about $640 million.

Orocobre stock is down 5% since Tesla’s battery event. Lithium Americas stock has climbed 42%.

Year to date, Piedmont shares are up about 250%. Excluding Piedmont, the other five lithium mining stocks are up about 77% year to date, on average, far better than comparable returns of the S&P 500 and Dow Jones Industrial Average.

To buy mining startups or exploration-stage companies, investors have to be confident in their ability to understand proven and probable mining reserves, along with how much the companies plan to spend before generating free cash flow.

This Miner Stock Is Rising Because Tesla Needs More Lithium

https://www.barrons.com/articles/tesla-demand-is-driving-thi…

Stock in exploration-stage lithium miner Piedmont Lithium has soared—by about 166%—since electric-vehicle behemoth Tesla hosted its battery technology day on Sept. 22.

At the event, Tesla painted a picture of future EV demand that implied the world needs a lot more EV-related materials, including lithium. Now Piedmont (PLL) is using its recent share strength to raise money to fund growth.

On Monday, Piedmont announced plans to raise money by selling stock. The company wants to sell up to 1.5 million American depositary receipts, or ADRs.

...

The sale has the potential to bring in roughly $45 million to company coffers, depending on the price discount offered on the sale. Piedmont has about $19 million in cash on its balance sheet, based on recent filings.

The company might use the cash toward the hard rock mine it is developing in North Carolina. (Most of the world’s lithium today comes from evaporating salt from brine ponds.) Early phases of Piedmont’s mine should cost about $170 million, according to CEO Keith Phillips.

Piedmont is also getting some money from Tesla. Piedmont stock soared more than 200% on Sept 28, days after Telsa’s battery event, when Tesla signed a deal for five years of lithium-ore supply, with a possible extension for another five years. Deliveries from Piedmont to Telsa are expected to start around 2022.

The lithium sector is heating up, and Barron’s recently wrote positively about lithium miners. We prefer Livent (LTHM), believing higher demand from EVs will drive higher commodity volumes for all miners, as well as higher lithium-linked commodity prices.

When we wrote about the miners, we focused on the established players, including SQM (SQM), Albemarle (ALB), and Livent. Those three have an aggregate market capitalization of more than $19 billion.

But there are riskier plays. Piedmont, with a market value of about $340 million, is one. Lithium Americas (LAC), valued at $1.2 billion, is another. Those two don’t have sales yet. Orocobre (ORE.Australia) is another small-capitalization lithium firm, though with some sales. It produces lithium from brines in Argentina, and has a market cap of about $640 million.

Orocobre stock is down 5% since Tesla’s battery event. Lithium Americas stock has climbed 42%.

Year to date, Piedmont shares are up about 250%. Excluding Piedmont, the other five lithium mining stocks are up about 77% year to date, on average, far better than comparable returns of the S&P 500 and Dow Jones Industrial Average.

To buy mining startups or exploration-stage companies, investors have to be confident in their ability to understand proven and probable mining reserves, along with how much the companies plan to spend before generating free cash flow.

Antwort auf Beitrag Nr.: 65.359.422 von faultcode am 12.10.20 15:45:26

...

Huizhou, Guangdong-based EVE, which has pacts with automakers including Daimler AG, has seen tentative signals of a recovery in lithium and cobalt prices in China, meaning there’d be an advantage to lock in additional supplies now, Chairman Liu Jincheng said in a phone interview.

...

https://www.bloomberg.com/news/articles/2020-10-12/eve-energ…

Huizhou, Guangdong-based EVE, which has pacts with automakers including Daimler AG, has seen tentative signals of a recovery in lithium and cobalt prices in China, meaning there’d be an advantage to lock in additional supplies now, Chairman Liu Jincheng said in a phone interview.

...

https://www.bloomberg.com/news/articles/2020-10-12/eve-energ…

Antwort auf Beitrag Nr.: 64.719.616 von faultcode am 11.08.20 13:29:42so wird das nichts mit einer Preiserholung -- ich erwarte, daß sich der Li-Markt dem Dünger-Welt-Markt allmählich angleichen wird

=> die kleinen und mittleren Produzenten werden früher oder später unter die Räder kommen bei einer Commodity

...

One of the world’s largest lithium suppliers is producing at record levels because of optimism about long-term demand for the material used in electric vehicle batteries.

“Given the demand growth expectations in coming years, we feel comfortable with the higher level of inventories that are being built,” Soc. Quimica y Minera de Chile SA said after reporting second-quarter income beat the highest analyst estimates.

...

20.8.

Top Lithium Miner Boosts Output on Optimism About Long-Term Demand

https://www.bloomberg.com/news/articles/2020-08-20/top-lithi…

=> die kleinen und mittleren Produzenten werden früher oder später unter die Räder kommen bei einer Commodity

...

One of the world’s largest lithium suppliers is producing at record levels because of optimism about long-term demand for the material used in electric vehicle batteries.

“Given the demand growth expectations in coming years, we feel comfortable with the higher level of inventories that are being built,” Soc. Quimica y Minera de Chile SA said after reporting second-quarter income beat the highest analyst estimates.

...

20.8.

Top Lithium Miner Boosts Output on Optimism About Long-Term Demand

https://www.bloomberg.com/news/articles/2020-08-20/top-lithi…

Antwort auf Beitrag Nr.: 62.582.359 von faultcode am 04.02.20 19:47:26...

The electric vehicle industry must pay more for lithium in order to spur investment and prevent future supply crunches of the battery metal, the chief executive of lithium producer Livent Corp <LTHM.N> said on Friday.

Demand for EVs is expected to surge in coming years, spurred in part by government mandates, rising concern about climate change and other factors.

But the coronavirus pandemic has paused that trend, causing a short-term oversupply of lithium, pushing down prices more than 10% this year and forcing producers of the white metal to halt expansion projects.

Sensing an opportunity to pay less, the EV industry has pushed to renegotiate supply agreements while at the same time demanding higher production later this decade, a dissonance that Livent CEO Paul Graves labeled "voodoo economics."

"If you don't have a rational conversation with me about what the (lithium) price needs to be for me to invest, then I don't invest," Graves told Reuters.

Livent has, for example, halted a multiyear expansion project in Argentina. Restarting construction there would take at least six months due to regulations and other factors, and it would be several years before any new production came online, Graves said.

Livent and rival Albemarle Corp <ALB.N>, which has also delayed expansions, reported sharp drops in sales earlier this week.

"If every EV company took their 2023 plans and went to the lithium market today, they'd probably only get about 15% of their needed supply of lithium," he said.

Historically, battery makers like Panasonic Corp <6752.T> have contracted with lithium producers, though automakers are mulling deals.

While lithium prices are low today, longer-term contracts should be signed at higher prices in order to incentivize the industry to build new mines, Graves said.

"Otherwise, when this does turn, and it will, this will flip the other way and lithium producers will demand higher prices," he said.

7.8.

Livent CEO to EV industry: sign better deals or risk lithium supply

https://finance.yahoo.com/news/livent-ceo-ev-industry-sign-1…

The electric vehicle industry must pay more for lithium in order to spur investment and prevent future supply crunches of the battery metal, the chief executive of lithium producer Livent Corp <LTHM.N> said on Friday.

Demand for EVs is expected to surge in coming years, spurred in part by government mandates, rising concern about climate change and other factors.

But the coronavirus pandemic has paused that trend, causing a short-term oversupply of lithium, pushing down prices more than 10% this year and forcing producers of the white metal to halt expansion projects.

Sensing an opportunity to pay less, the EV industry has pushed to renegotiate supply agreements while at the same time demanding higher production later this decade, a dissonance that Livent CEO Paul Graves labeled "voodoo economics."

"If you don't have a rational conversation with me about what the (lithium) price needs to be for me to invest, then I don't invest," Graves told Reuters.

Livent has, for example, halted a multiyear expansion project in Argentina. Restarting construction there would take at least six months due to regulations and other factors, and it would be several years before any new production came online, Graves said.

Livent and rival Albemarle Corp <ALB.N>, which has also delayed expansions, reported sharp drops in sales earlier this week.

"If every EV company took their 2023 plans and went to the lithium market today, they'd probably only get about 15% of their needed supply of lithium," he said.

Historically, battery makers like Panasonic Corp <6752.T> have contracted with lithium producers, though automakers are mulling deals.

While lithium prices are low today, longer-term contracts should be signed at higher prices in order to incentivize the industry to build new mines, Graves said.

"Otherwise, when this does turn, and it will, this will flip the other way and lithium producers will demand higher prices," he said.

7.8.

Livent CEO to EV industry: sign better deals or risk lithium supply

https://finance.yahoo.com/news/livent-ceo-ev-industry-sign-1…

Antwort auf Beitrag Nr.: 58.171.652 von faultcode am 09.07.18 19:04:56

--> nach Erholung raus mit dem Müll im fortgesetzten Li-Bärenmarkt:

=> wo bleibt die Schlumberger Technologies-"Pilotanlage"

Schlumberger hat ganz andere Probleme z.Z....

Zitat von faultcode: ...=> demnach:

• Pure Energy Minerals als der erste "echte" Loserwert in diesem Subportfolio bleibt vorerst genauso wie (zu teuer) gekauft

--> nach Erholung raus mit dem Müll im fortgesetzten Li-Bärenmarkt:

=> wo bleibt die Schlumberger Technologies-"Pilotanlage"

Schlumberger hat ganz andere Probleme z.Z....

Antwort auf Beitrag Nr.: 63.845.987 von faultcode am 29.05.20 17:42:06die weiteren Preisaussichten bei Li: düster

=> zu wenig Nachfrage, zu hohes Angebot

=> zu wenig Nachfrage, zu hohes Angebot

KV = Kannste vergessen in Deutschland

13.6.

Kampf um Lithium

Die deutsche Autobranche will stärker auf Elektroantriebe setzen. Die wichtigste Zutat für die Akkus will eine Firma bald auch am Oberrhein fördern. Doch vor Ort wächst der Widerstand.

https://www.spiegel.de/wirtschaft/unternehmen/treibstoff-fue…

...

Für die beiden in der Ortenau geplanten Kraftwerke wird Vulcan nach Einschätzung von Analysten bis in drei Jahren mehr als 300 Millionen Euro Kapital sammeln müssen, hinzu kommt zusätzlich eine ähnlich hohe Summe für die Lithiumgewinnung an sich. Ingenieur Kreuter sucht noch nach Investoren.

...

Da ist auch BGR-Geologe Schmidt vorsichtiger. "Theoretisch ist so etwas möglich. Aber eine fundierte Beantwortung dieser Frage erfordert weitergehende wissenschaftliche Untersuchungen." Und auch Schmidt weiß: "Wir haben in Deutschland keinen Bergbau mehr wie noch vor 40 Jahren, somit könnte die Akzeptanz eine andere sein als etwa in Ländern, in denen Bergbau einen maßgeblichen Wirtschaftszweig darstellt."

a/ niemand wird dem Herrn ein Ini-CAPEX von EUR300M geben. Nicht für ein Projekt in Deutschland

b/ richtig! Erst noch ein paar "wissenschaftliche Untersuchungen". Das schafft schließlich auch Arbeitsplätze auf Steuerzahlerkosten

c/ und ansonsten gilt in Deutschland allgemein:

• wie nehmen nur die angenehmen Seiten von "Umweltschutz" an, die unangenehmen sollen bitteschön die anderen übernehmen.

Zum Beispiel die Leute in Südamerika.

Wäre ja noch schöner

13.6.

Kampf um Lithium

Die deutsche Autobranche will stärker auf Elektroantriebe setzen. Die wichtigste Zutat für die Akkus will eine Firma bald auch am Oberrhein fördern. Doch vor Ort wächst der Widerstand.

https://www.spiegel.de/wirtschaft/unternehmen/treibstoff-fue…

...

Für die beiden in der Ortenau geplanten Kraftwerke wird Vulcan nach Einschätzung von Analysten bis in drei Jahren mehr als 300 Millionen Euro Kapital sammeln müssen, hinzu kommt zusätzlich eine ähnlich hohe Summe für die Lithiumgewinnung an sich. Ingenieur Kreuter sucht noch nach Investoren.

...

Da ist auch BGR-Geologe Schmidt vorsichtiger. "Theoretisch ist so etwas möglich. Aber eine fundierte Beantwortung dieser Frage erfordert weitergehende wissenschaftliche Untersuchungen." Und auch Schmidt weiß: "Wir haben in Deutschland keinen Bergbau mehr wie noch vor 40 Jahren, somit könnte die Akzeptanz eine andere sein als etwa in Ländern, in denen Bergbau einen maßgeblichen Wirtschaftszweig darstellt."

a/ niemand wird dem Herrn ein Ini-CAPEX von EUR300M geben. Nicht für ein Projekt in Deutschland

b/ richtig! Erst noch ein paar "wissenschaftliche Untersuchungen". Das schafft schließlich auch Arbeitsplätze auf Steuerzahlerkosten

c/ und ansonsten gilt in Deutschland allgemein:

• wie nehmen nur die angenehmen Seiten von "Umweltschutz" an, die unangenehmen sollen bitteschön die anderen übernehmen.

Zum Beispiel die Leute in Südamerika.

Wäre ja noch schöner

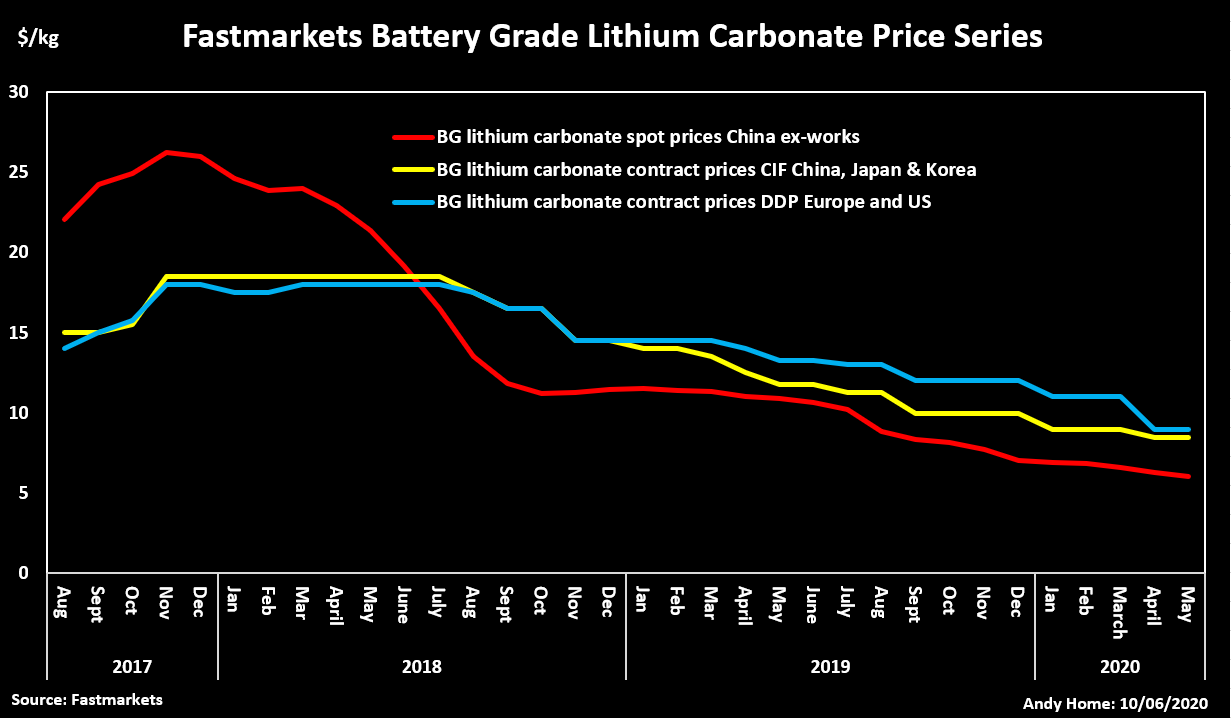

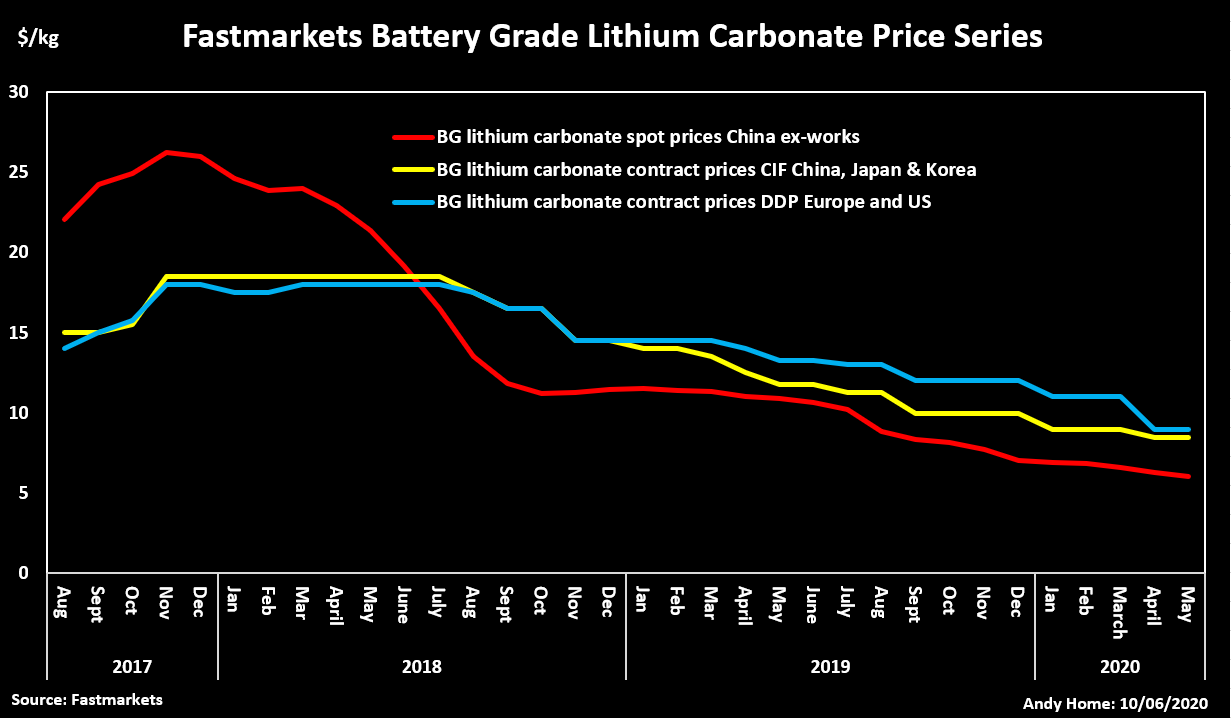

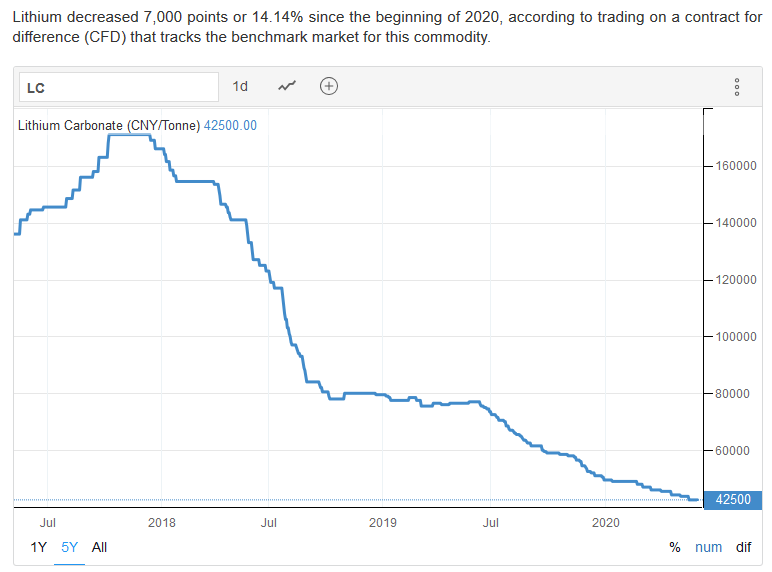

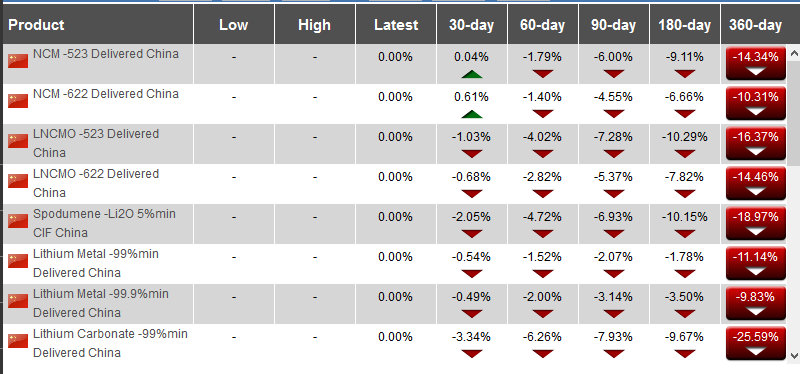

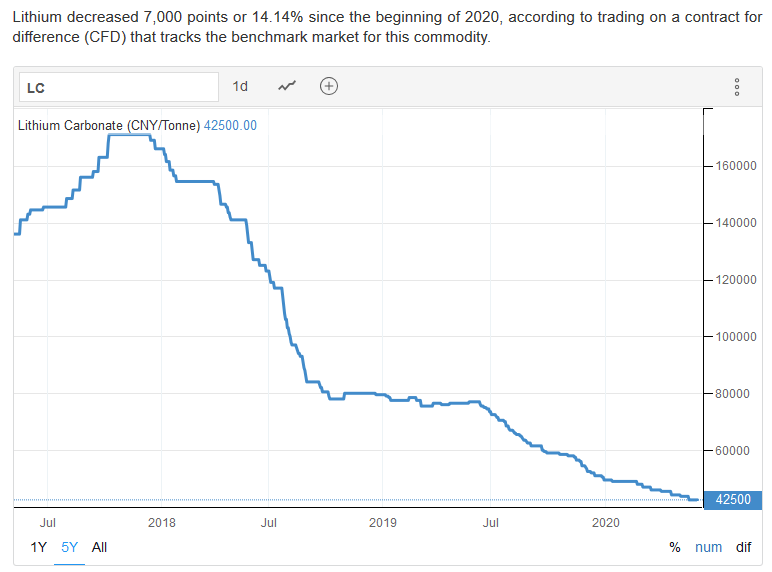

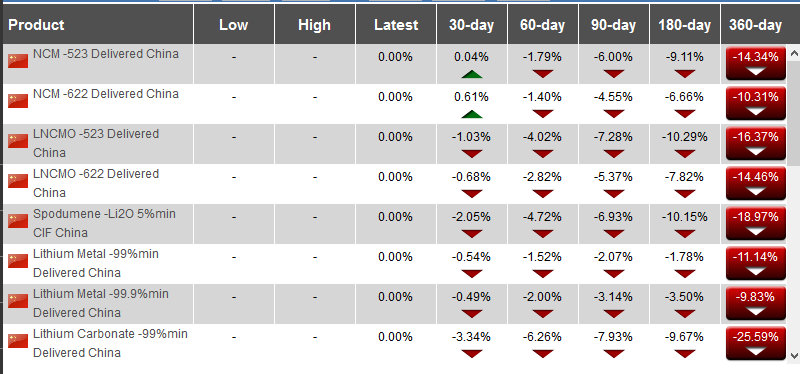

Antwort auf Beitrag Nr.: 62.502.092 von faultcode am 27.01.20 20:29:49trübe Aussichten bei Lithium:

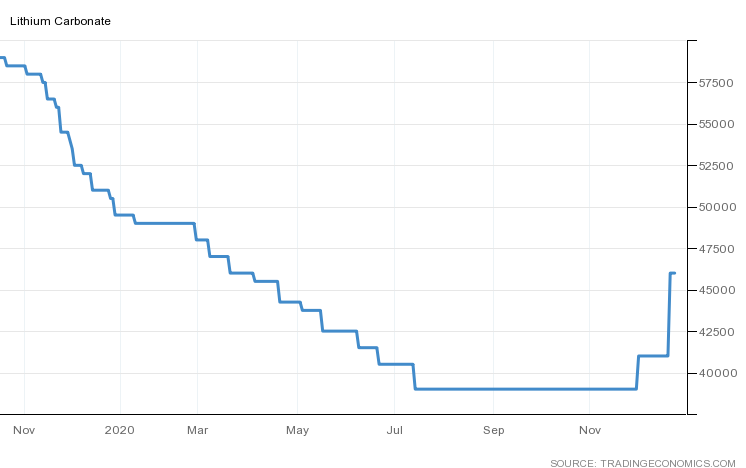

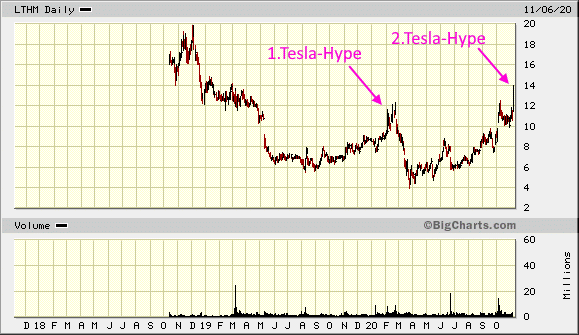

Lithium Carbonate scheint besonders unter Druck zu sein:

http://www.asianmetal.com/LithiumPrice/Lithium.html

Lithium Carbonate scheint besonders unter Druck zu sein:

http://www.asianmetal.com/LithiumPrice/Lithium.html

Antwort auf Beitrag Nr.: 59.886.799 von faultcode am 15.02.19 19:24:4518.2.

Orocobre Agrees to Acquire Advantage Lithium Corp.

https://www.wallstreet-online.de/nachricht/12179935-orocobre…

...

Orocobre Limited (ASX: ORE, TSX: ORL) (Orocobre or the Company) is pleased to announce that it has entered into a definitive agreement (the Agreement) pursuant to which Orocobre will acquire 100% of the issued and outstanding shares of Advantage Lithium Corp. (Advantage) (TSX Venture: AAL) (OTCQX: AVLIF) that it does not already own.

This transaction (the Transaction) will allow Orocobre to continue to develop the Olaroz/Cauchari basin in a cost-effective manner that will optimise extraction of the resource to the benefit of shareholders, local communities, the Provincial and National governments of Argentina, and other stakeholders.

Orocobre shareholders will gain exposure to the 4.8 million tonnes (Mt) of Measured and Indicated Resources and 1.5 Mt of Inferred Resources (expressed as lithium carbonate equivalent) at Cauchari developed by the Advantage and Orocobre joint venture as detailed in the Orocobre ASX Release dated 7 March 2019.

The Transaction further consolidates Orocobre’s leading position within the region as a low-cost producer of lithium chemicals. Orocobre will also acquire Advantage’s exploration properties including those at Antofalla and Incahuasi. Integration of Cauchari with Olaroz enables Orocobre to deliver optimal basin management and maximises the long term productive capacity of the Olaroz/Cauchari basin. The development of Cauchari will be considered within future plans for the Olaroz Lithium Facility. The Transaction does not trigger any need for additional financing for the ongoing development of the Olaroz and Cauchari basins currently being undertaken by Orocobre and its joint venture partners.

...

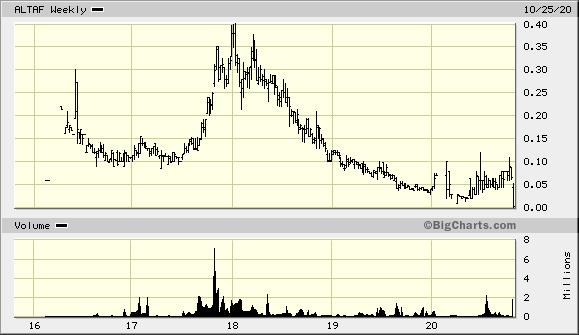

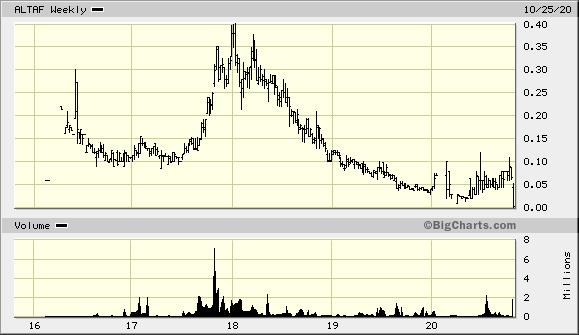

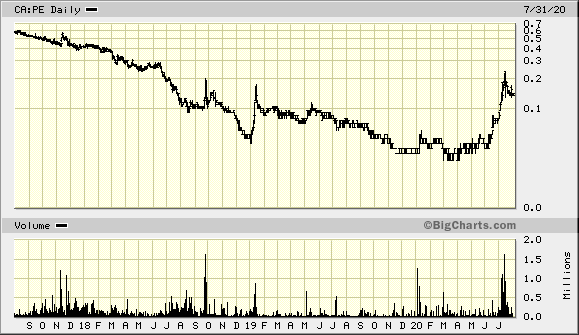

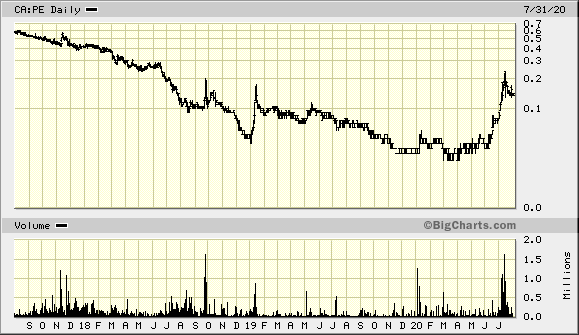

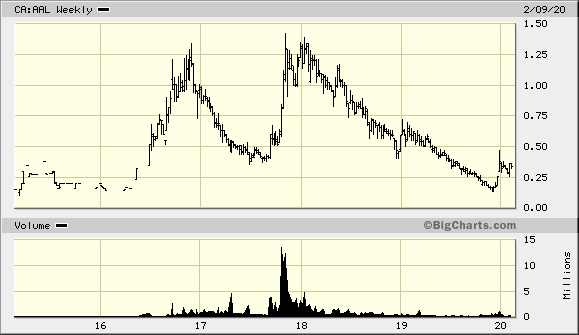

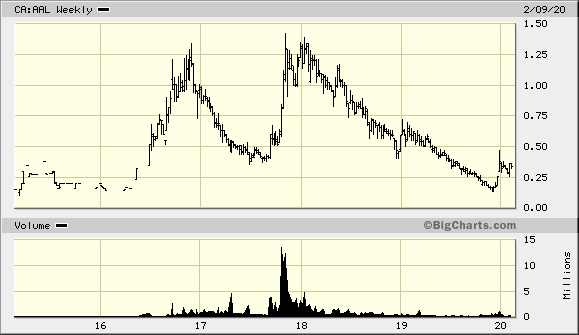

Advantage Lithium zuletzt:

--> was noch da ist an Qualität, aber zu klein und damit idR zu wenig Kapital, wird nun übernommen; der Rest muss schauen, wo er bei Lithium bleibt

Orocobre Agrees to Acquire Advantage Lithium Corp.

https://www.wallstreet-online.de/nachricht/12179935-orocobre…

...

Orocobre Limited (ASX: ORE, TSX: ORL) (Orocobre or the Company) is pleased to announce that it has entered into a definitive agreement (the Agreement) pursuant to which Orocobre will acquire 100% of the issued and outstanding shares of Advantage Lithium Corp. (Advantage) (TSX Venture: AAL) (OTCQX: AVLIF) that it does not already own.

This transaction (the Transaction) will allow Orocobre to continue to develop the Olaroz/Cauchari basin in a cost-effective manner that will optimise extraction of the resource to the benefit of shareholders, local communities, the Provincial and National governments of Argentina, and other stakeholders.

Orocobre shareholders will gain exposure to the 4.8 million tonnes (Mt) of Measured and Indicated Resources and 1.5 Mt of Inferred Resources (expressed as lithium carbonate equivalent) at Cauchari developed by the Advantage and Orocobre joint venture as detailed in the Orocobre ASX Release dated 7 March 2019.

The Transaction further consolidates Orocobre’s leading position within the region as a low-cost producer of lithium chemicals. Orocobre will also acquire Advantage’s exploration properties including those at Antofalla and Incahuasi. Integration of Cauchari with Olaroz enables Orocobre to deliver optimal basin management and maximises the long term productive capacity of the Olaroz/Cauchari basin. The development of Cauchari will be considered within future plans for the Olaroz Lithium Facility. The Transaction does not trigger any need for additional financing for the ongoing development of the Olaroz and Cauchari basins currently being undertaken by Orocobre and its joint venture partners.

...

Advantage Lithium zuletzt:

--> was noch da ist an Qualität, aber zu klein und damit idR zu wenig Kapital, wird nun übernommen; der Rest muss schauen, wo er bei Lithium bleibt

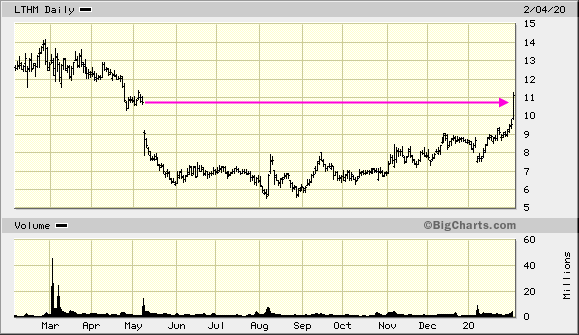

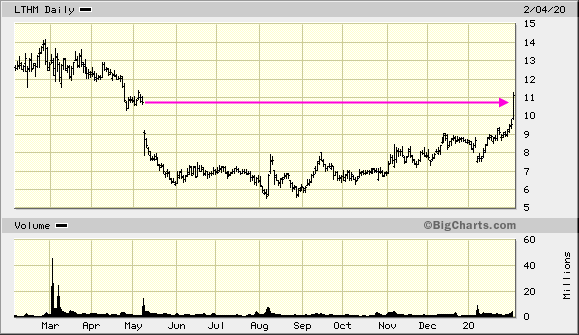

Antwort auf Beitrag Nr.: 62.340.410 von faultcode am 10.01.20 18:06:554.2.

Lithium stocks soar alongside Tesla on EV optimism

...

Livent lifts to its highest levels since May on heavy volume, as lithium industry stocks rise in tandem with the recent surge in electric vehicle maker Tesla and a strong move today from Chinese EV-maker Nio.

Livent spoke at length during its Q3 earnings call in November about the relationship between the development of the global EV market and demand for lithium hydroxide, and noted that it intended to prioritize the buildup of hydroxide inventory in Q4 to meet customer demand.

...

https://seekingalpha.com/news/3538012-lithium-stocks-soar-al…

Lithium stocks soar alongside Tesla on EV optimism

...

Livent lifts to its highest levels since May on heavy volume, as lithium industry stocks rise in tandem with the recent surge in electric vehicle maker Tesla and a strong move today from Chinese EV-maker Nio.

Livent spoke at length during its Q3 earnings call in November about the relationship between the development of the global EV market and demand for lithium hydroxide, and noted that it intended to prioritize the buildup of hydroxide inventory in Q4 to meet customer demand.

...

https://seekingalpha.com/news/3538012-lithium-stocks-soar-al…

Antwort auf Beitrag Nr.: 62.502.020 von faultcode am 27.01.20 20:21:46Schweinezyklus

--> aber wie das halt so ist; genau wenn die Kapazitätsbeschränkungen eintrudeln, steigen auch schon wieder die Preise

https://tradingeconomics.com/commodity/lithium

--> aber wie das halt so ist; genau wenn die Kapazitätsbeschränkungen eintrudeln, steigen auch schon wieder die Preise

https://tradingeconomics.com/commodity/lithium

24.1.

Wesfarmer stalls A$600 million lithium project

https://www.kitco.com/news/2020-01-24/Wesfarmer-stalls-A-600…

Bending to the poor lithium market fundamentals, Wesfamer said Thursday it is suspending development of its Mt Holland lithium project until next year.

The lithium market has been upset by low prices. This week the other Australian lithium producer, Galaxy Resources, cut production 60%.

Wesfarmers has a definitive feasibility study for Mt Holland. The company said it will now take its time to optimize the project: reducing capital costs, upgrading road and utility infrastructure and ensuring lithium it eventually produces has right chemistry for its customers.

Wesfarmers said it will make a final investment decision in 2021.

In a corporate presentation from 2019, Wesfarmers pegged the price to develop the project at A$600 million (US$409 million). The Mt Holland lithium project is a 50:50 joint venture with SQM.

Last year, Wesfarmers acquired the Mt. Holland stake from Kidman Resources for A$776 million (US$529 million).

Wesfarmer stalls A$600 million lithium project

https://www.kitco.com/news/2020-01-24/Wesfarmer-stalls-A-600…

Bending to the poor lithium market fundamentals, Wesfamer said Thursday it is suspending development of its Mt Holland lithium project until next year.

The lithium market has been upset by low prices. This week the other Australian lithium producer, Galaxy Resources, cut production 60%.

Wesfarmers has a definitive feasibility study for Mt Holland. The company said it will now take its time to optimize the project: reducing capital costs, upgrading road and utility infrastructure and ensuring lithium it eventually produces has right chemistry for its customers.

Wesfarmers said it will make a final investment decision in 2021.

In a corporate presentation from 2019, Wesfarmers pegged the price to develop the project at A$600 million (US$409 million). The Mt Holland lithium project is a 50:50 joint venture with SQM.

Last year, Wesfarmers acquired the Mt. Holland stake from Kidman Resources for A$776 million (US$529 million).