MACA Ltd. - mal anders am australischen Gold verdienen - Die letzten 30 Beiträge

eröffnet am 08.06.17 19:38:32 von

neuester Beitrag 23.08.22 08:11:22 von

neuester Beitrag 23.08.22 08:11:22 von

Beiträge: 45

ID: 1.254.727

ID: 1.254.727

Aufrufe heute: 0

Gesamt: 2.445

Gesamt: 2.445

Aktive User: 0

ISIN: AU000000MLD9 · WKN: A1C58N

0,6255

EUR

+1,05 %

+0,0065 EUR

Letzter Kurs 25.01.19 Lang & Schwarz

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 55,80 | +15,41 | |

| 0,7999 | +14,27 | |

| 11,250 | +12,73 | |

| 0,5500 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5100 | -8,93 | |

| 2,1800 | -9,17 | |

| 17,310 | -9,98 | |

| 186,20 | -10,48 | |

| 4,2300 | -17,86 |

Beitrag zu dieser Diskussion schreiben

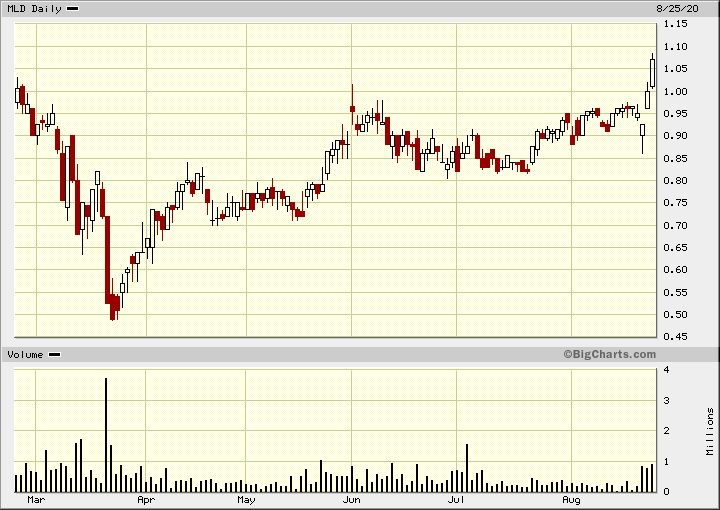

1,07 bekommen. Schöner Trade, aber leider nur mit Zockerposi von 1k

das kommt ja ganz gelegen, um den margenschwachen krempel schön im Plus zu verscheppern

Antwort auf Beitrag Nr.: 72.059.003 von faultcode am 26.07.22 15:26:48dann halt so: https://www.thiess.com/en/news/2022/thiess-announces-recomme…

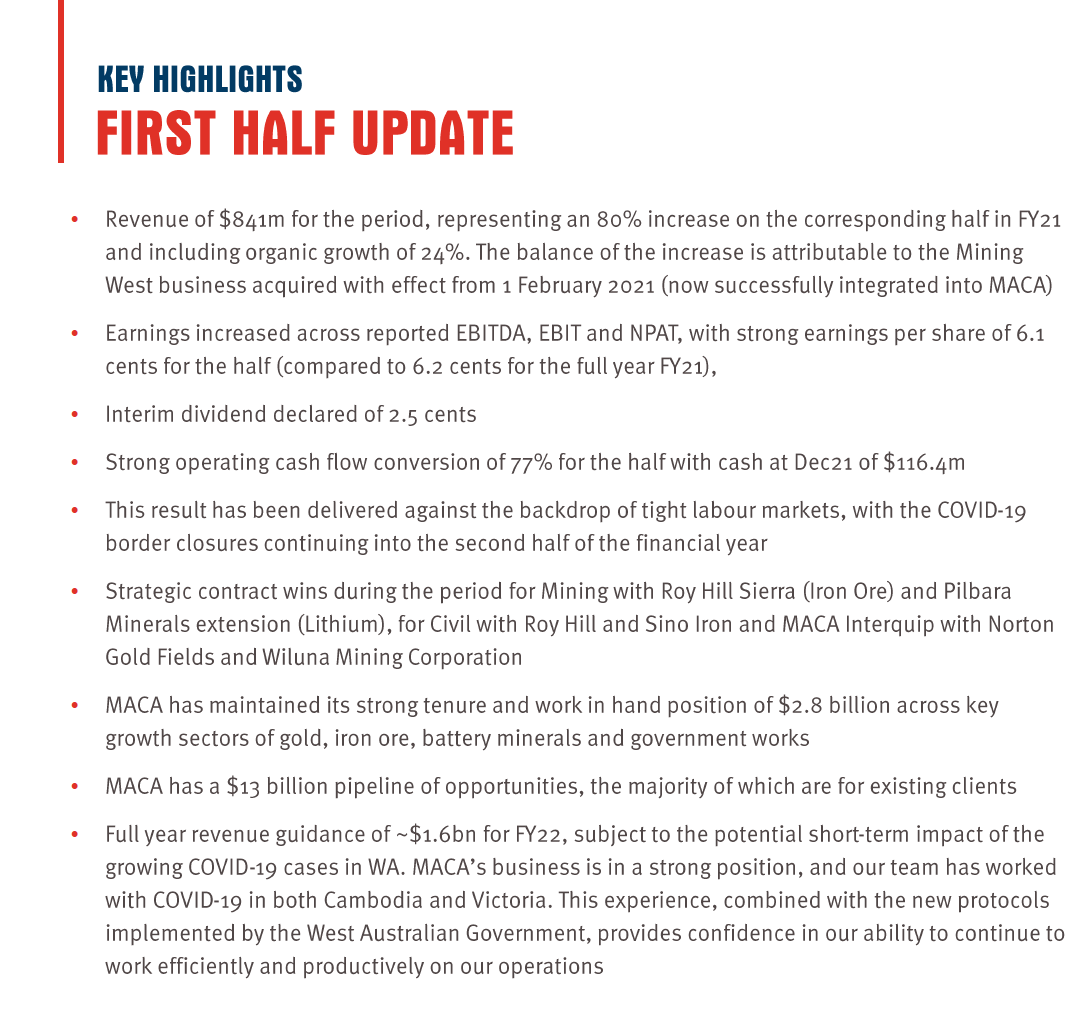

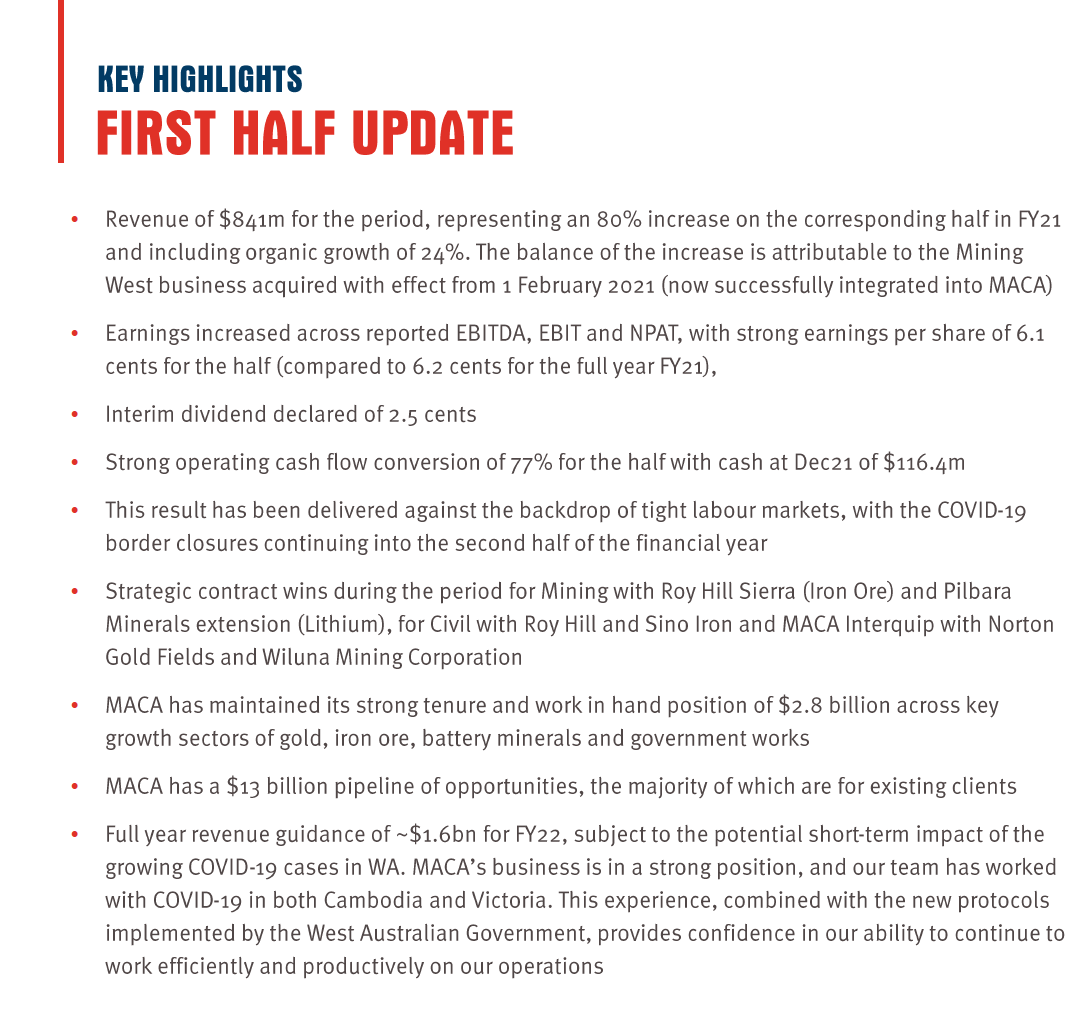

FY2022H1:

...

=>

...

=>

Bin heute auch rein zu 0,72 AUD. Bleibt aber eher ein kleiner Zock.

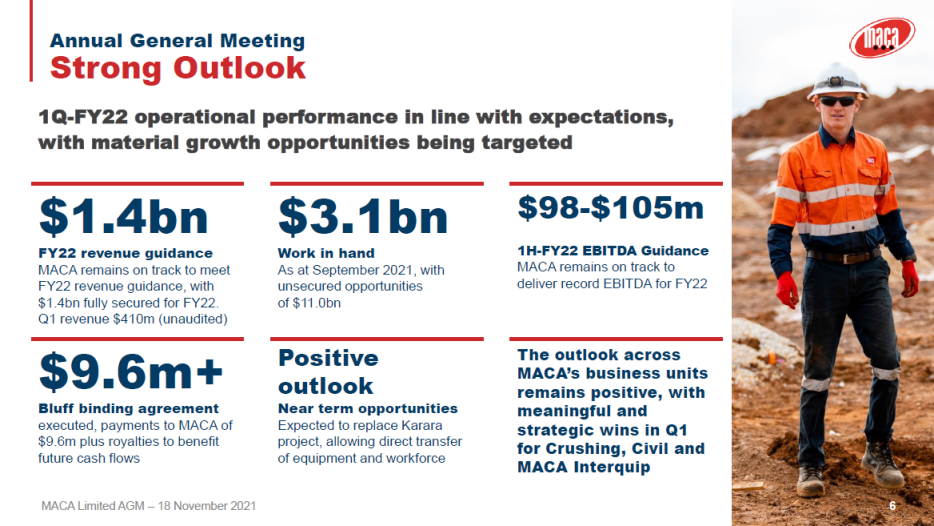

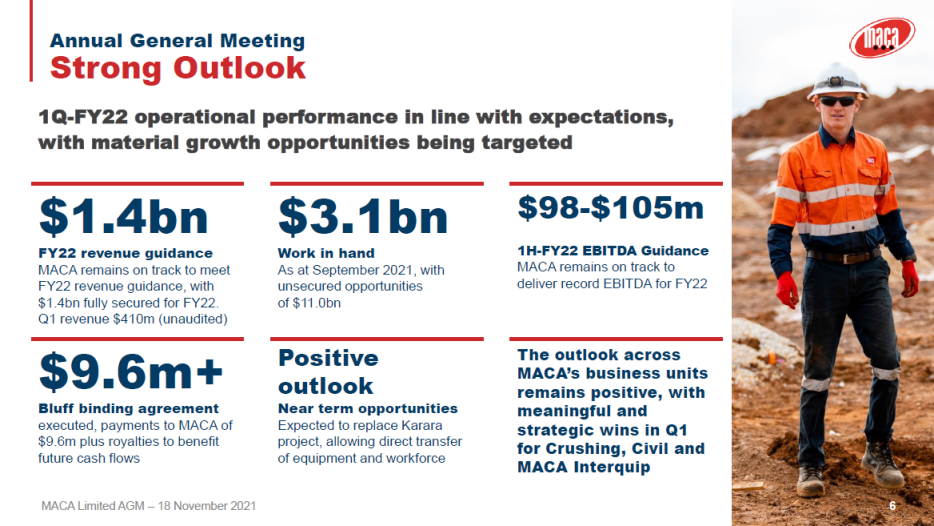

Antwort auf Beitrag Nr.: 69.123.485 von faultcode am 23.08.21 11:53:352021 Annual General Meeting

18th November 2021

...

...

18th November 2021

...

...

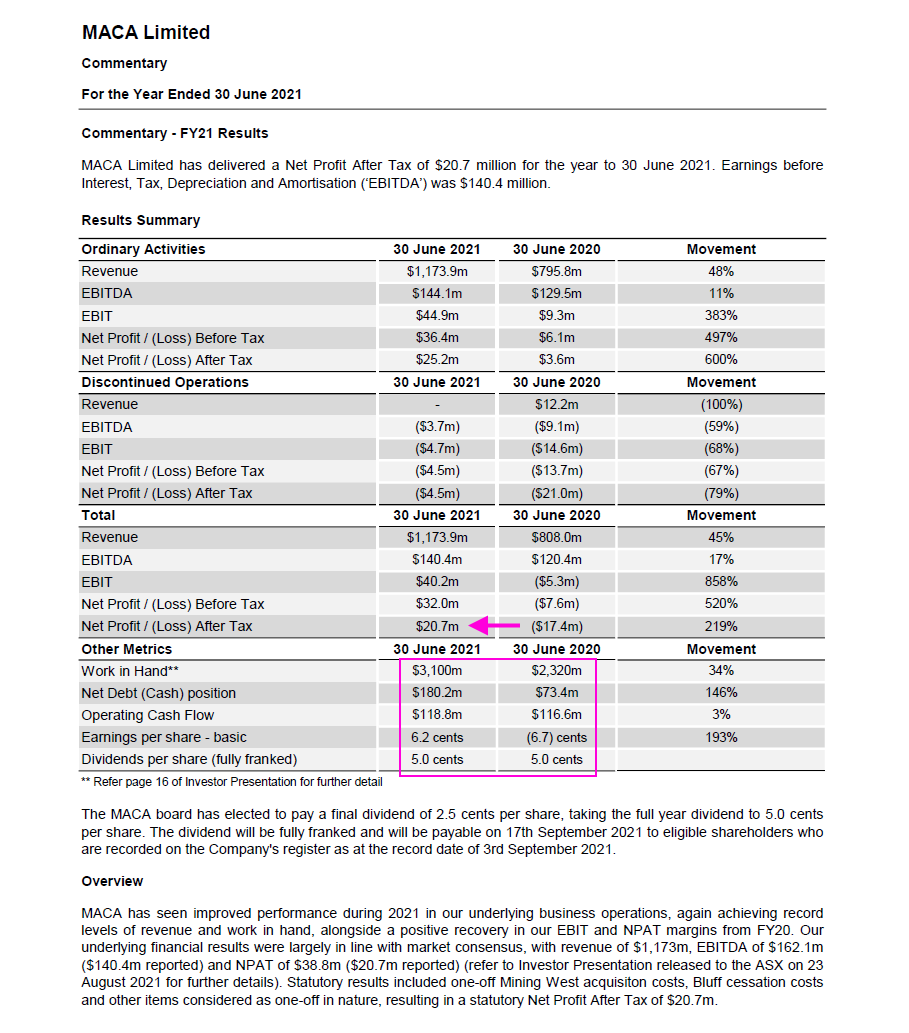

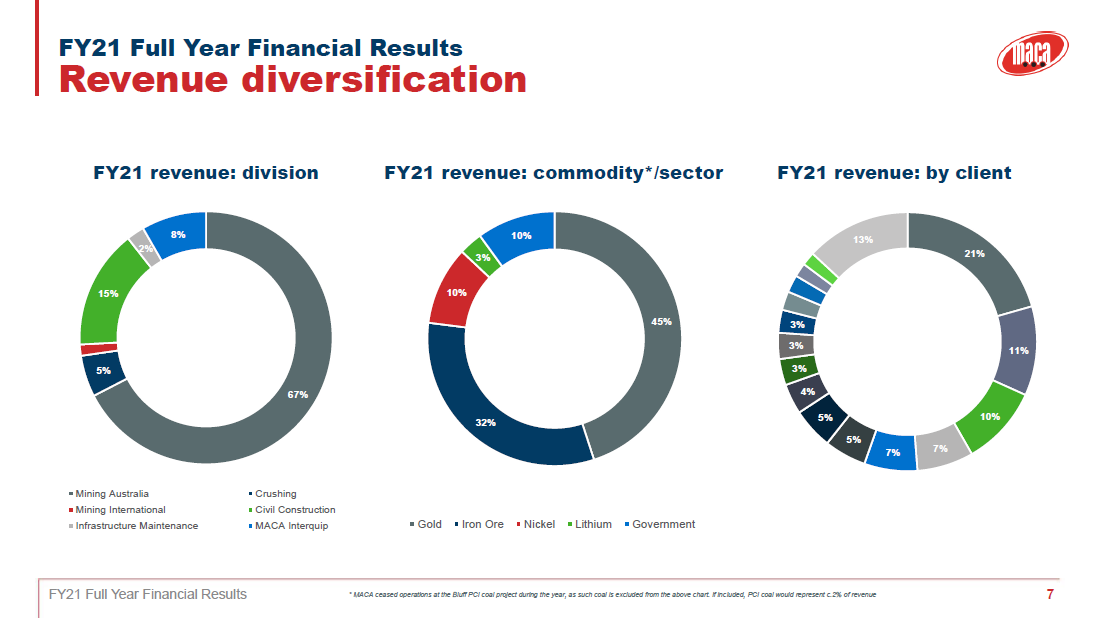

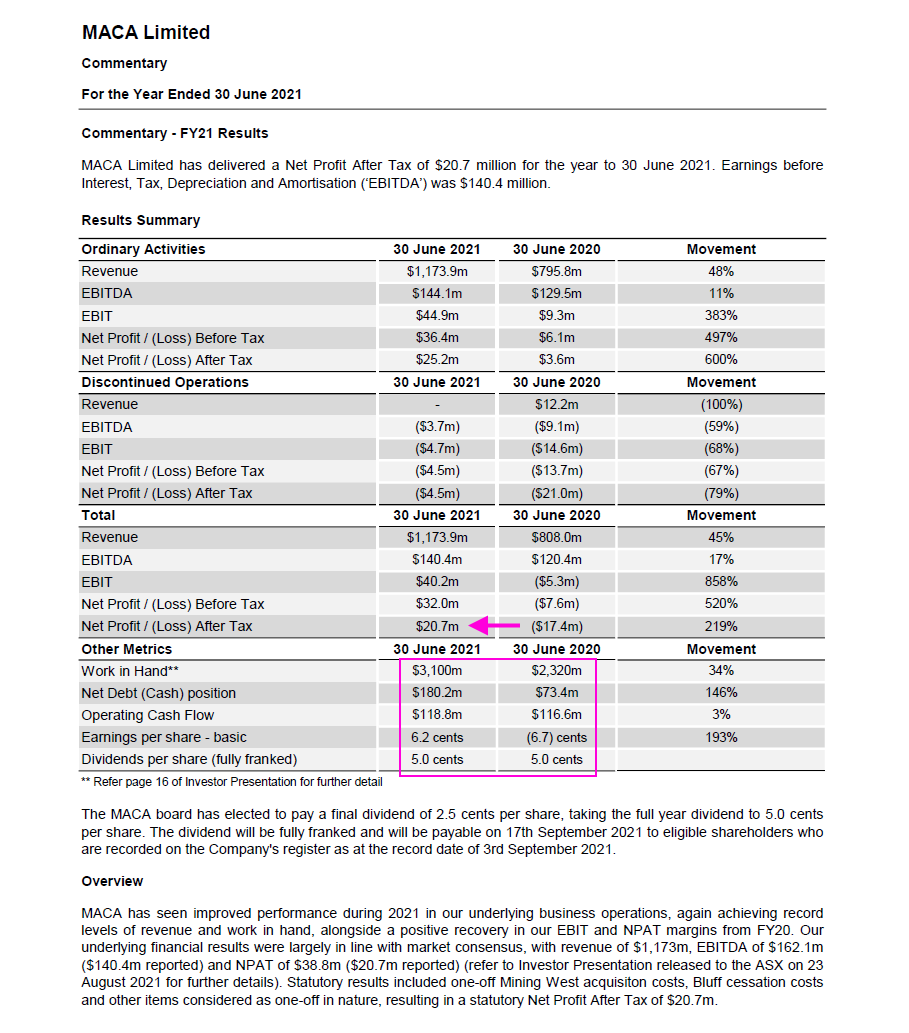

FY2021:

...

...

https://www.maca.net.au/investor-centre/asx-announcements/

=> keine Guidance für FY2022e

...

...

https://www.maca.net.au/investor-centre/asx-announcements/

=> keine Guidance für FY2022e

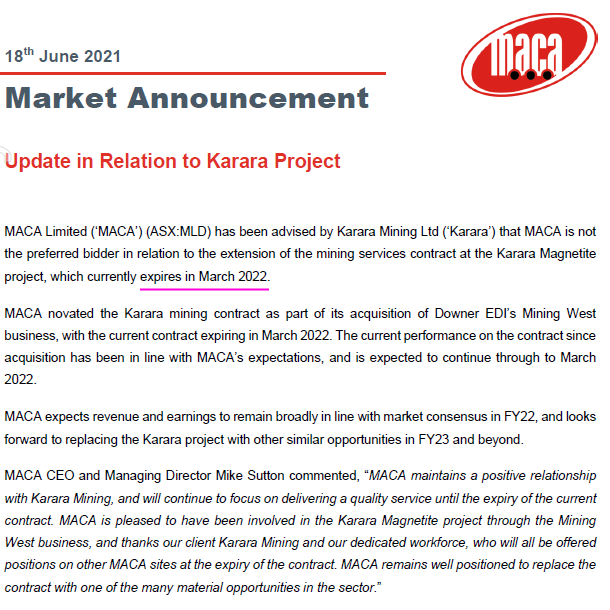

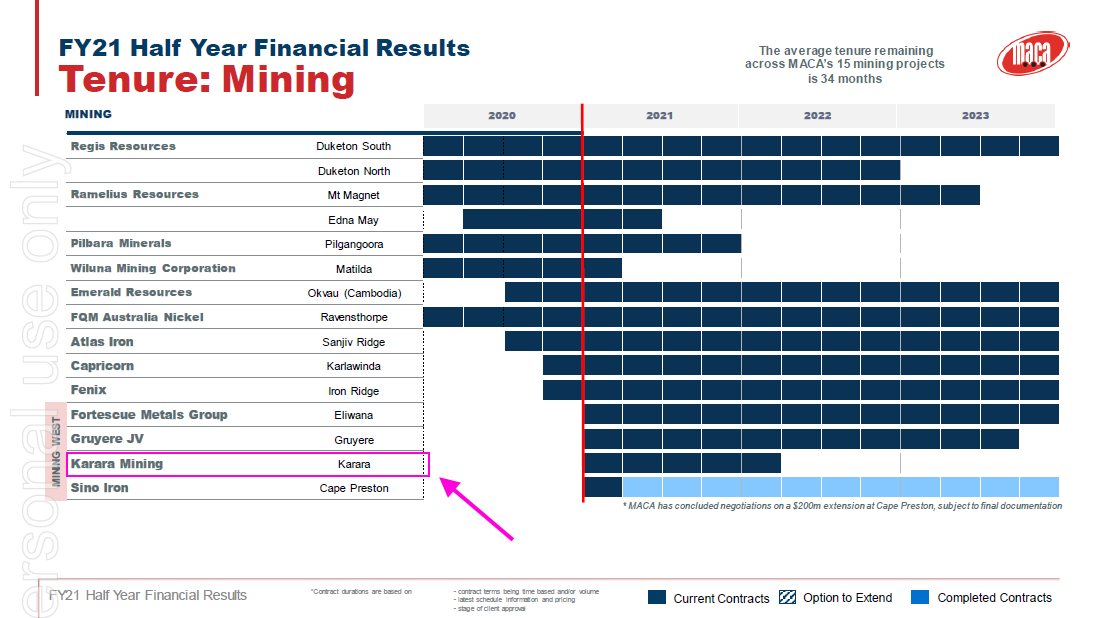

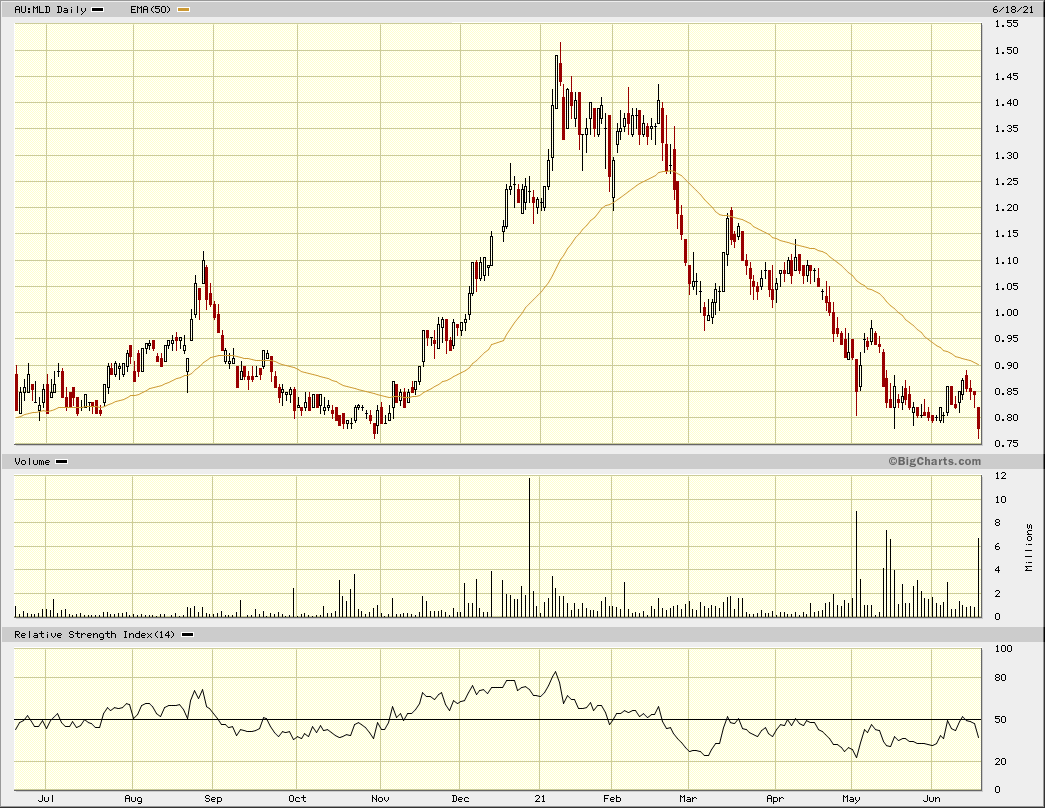

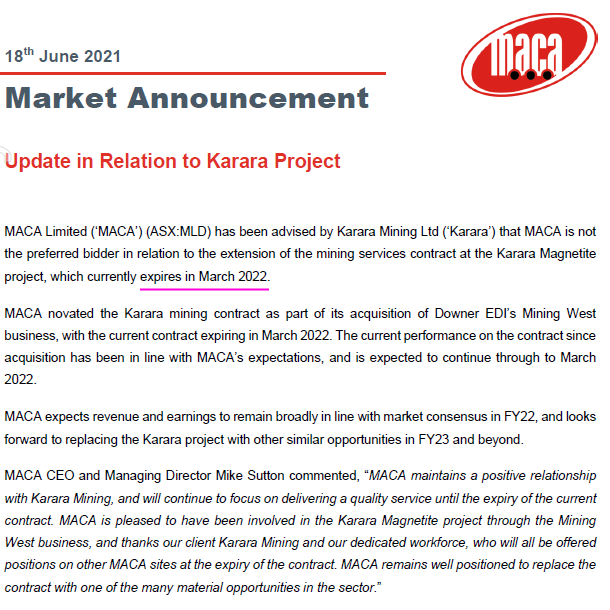

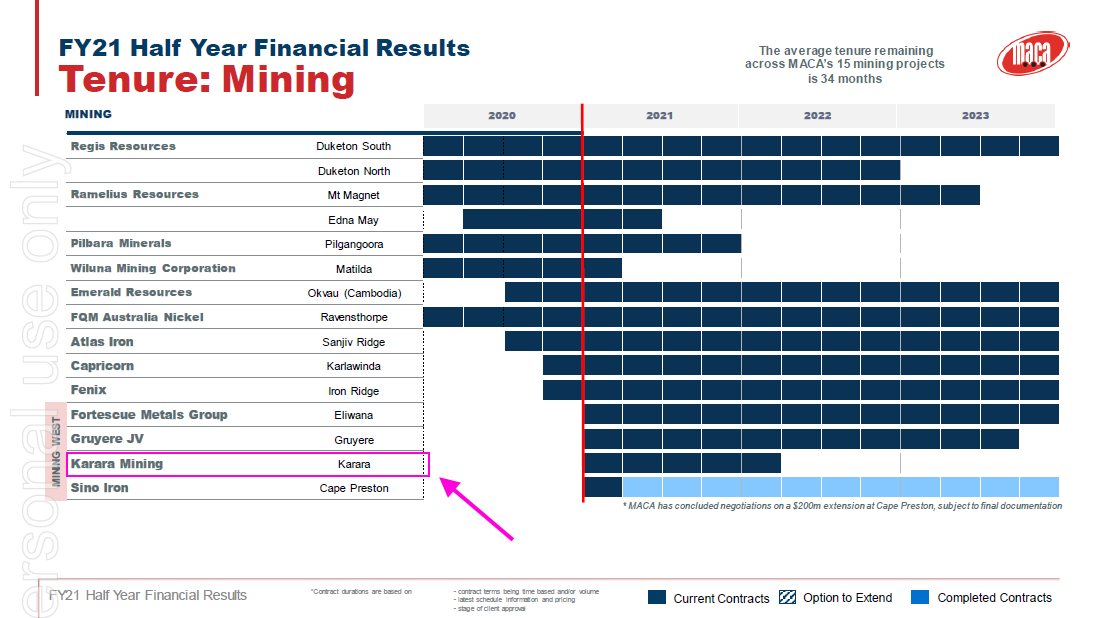

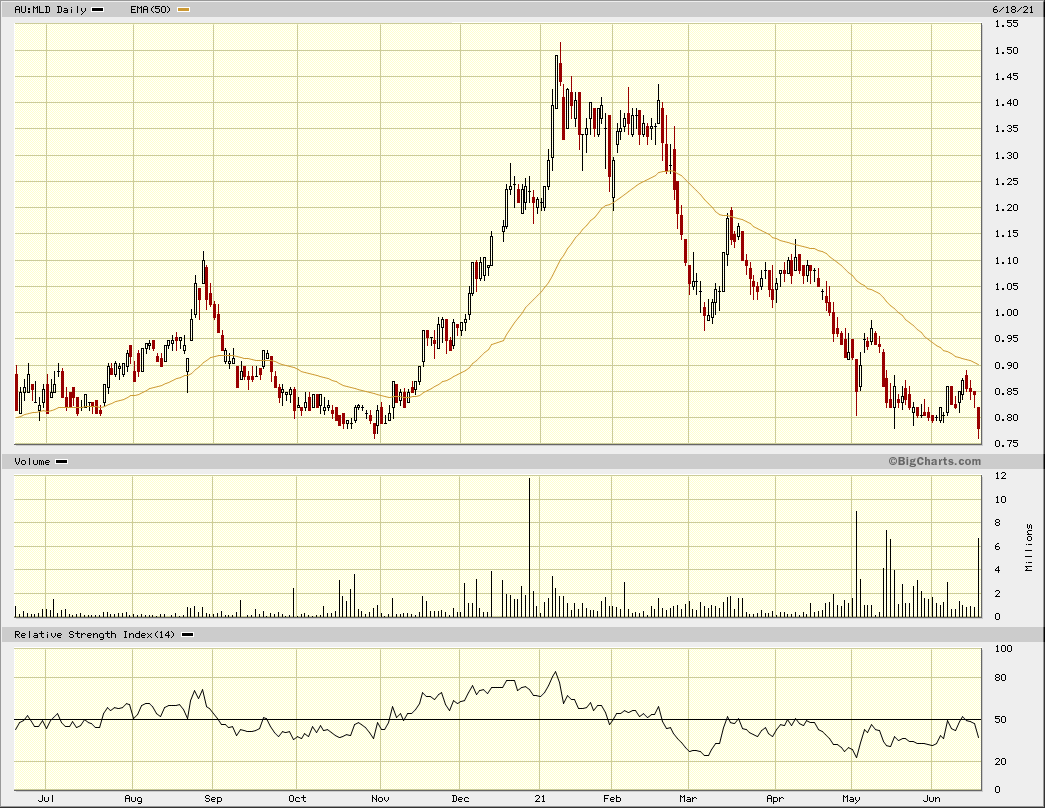

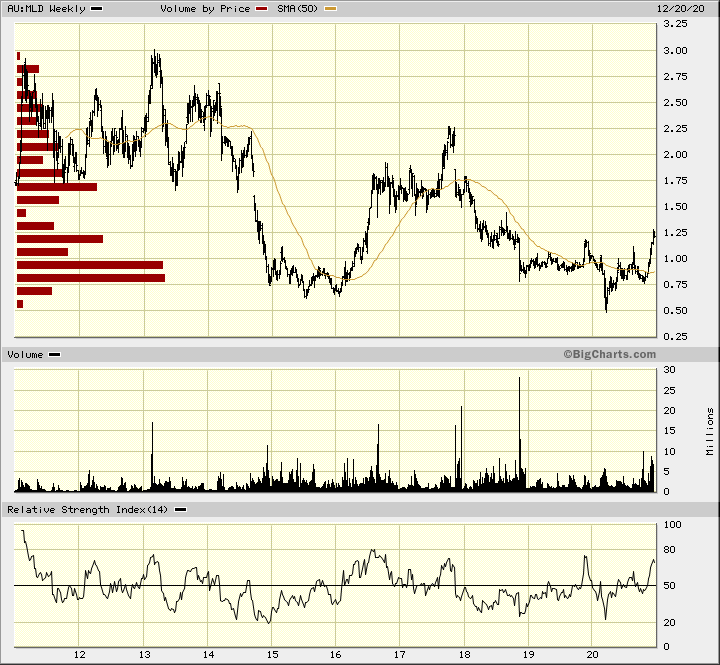

Antwort auf Beitrag Nr.: 66.175.441 von faultcode am 23.12.20 12:03:49diese Übernahme ist mindestens dumm gelaufen, denn einer der 4 Hauptkunden, Karara Mining (eine große Eisenerzmine in WA) hat den Vertrag nicht mehr verlängert:

...

Zwar kann MACA das Personal woanders zur Zeit eher leicht unterbringen bei der derzeitigen Knappheit an Personal, aber nicht das Equipment.

Das ist nämlich sehr groß wie üblich bei Eisenerz und passt eher nicht zum restlichen Portfolio.

Aber vielleicht ist ein guter Verkauf vor Ort bei den derzeitigen Preisen noch möglich.

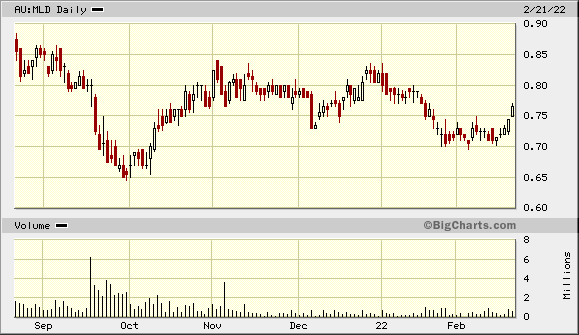

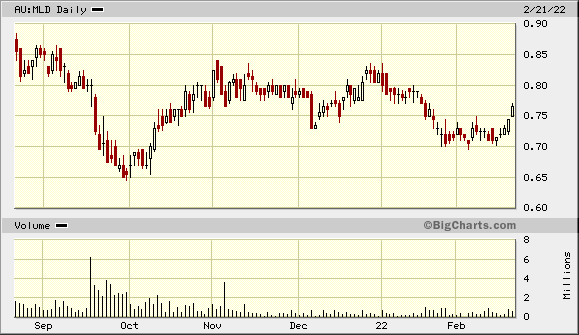

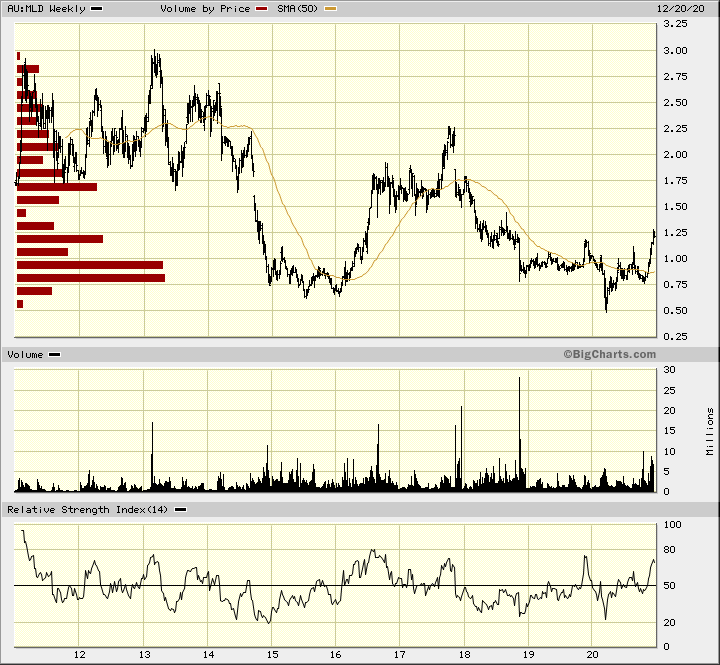

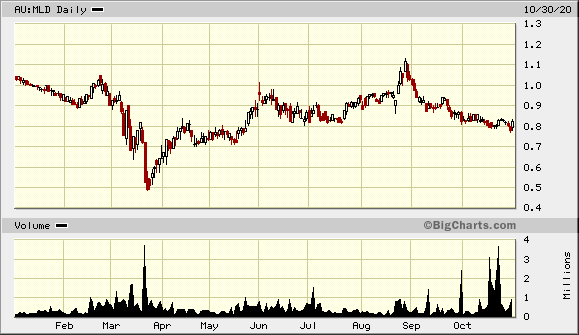

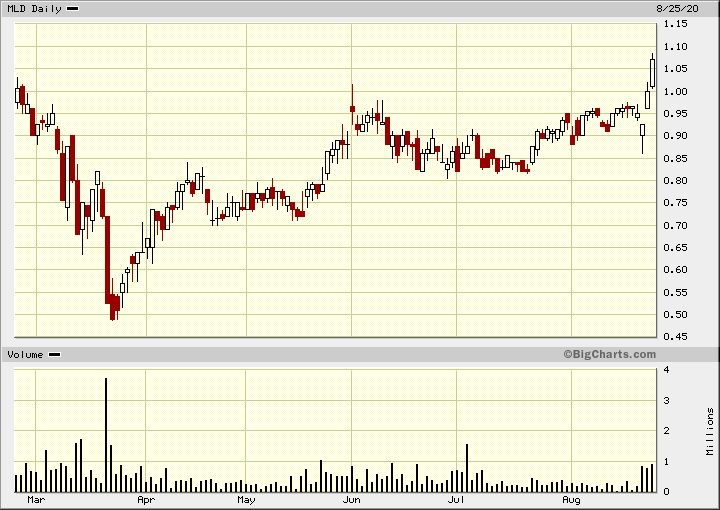

Jedenfalls reagierte der Kurs daraufhin negativ und fiel endgültig auf alte Tiefs zurück:

...

Zwar kann MACA das Personal woanders zur Zeit eher leicht unterbringen bei der derzeitigen Knappheit an Personal, aber nicht das Equipment.

Das ist nämlich sehr groß wie üblich bei Eisenerz und passt eher nicht zum restlichen Portfolio.

Aber vielleicht ist ein guter Verkauf vor Ort bei den derzeitigen Preisen noch möglich.

Jedenfalls reagierte der Kurs daraufhin negativ und fiel endgültig auf alte Tiefs zurück:

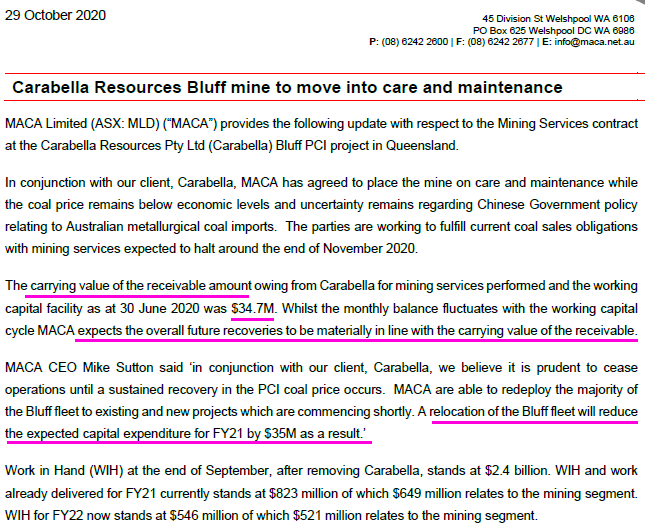

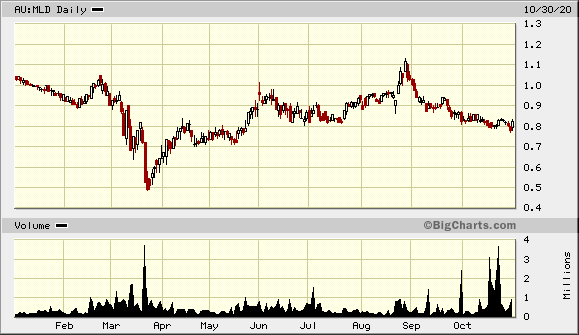

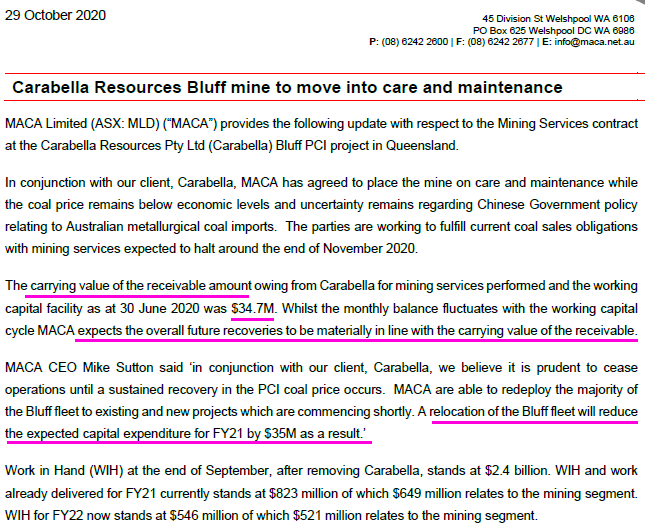

Antwort auf Beitrag Nr.: 66.175.810 von faultcode am 23.12.20 12:24:32MACA mal wieder beim Durchschleppen eines Insolvenz-Kunden

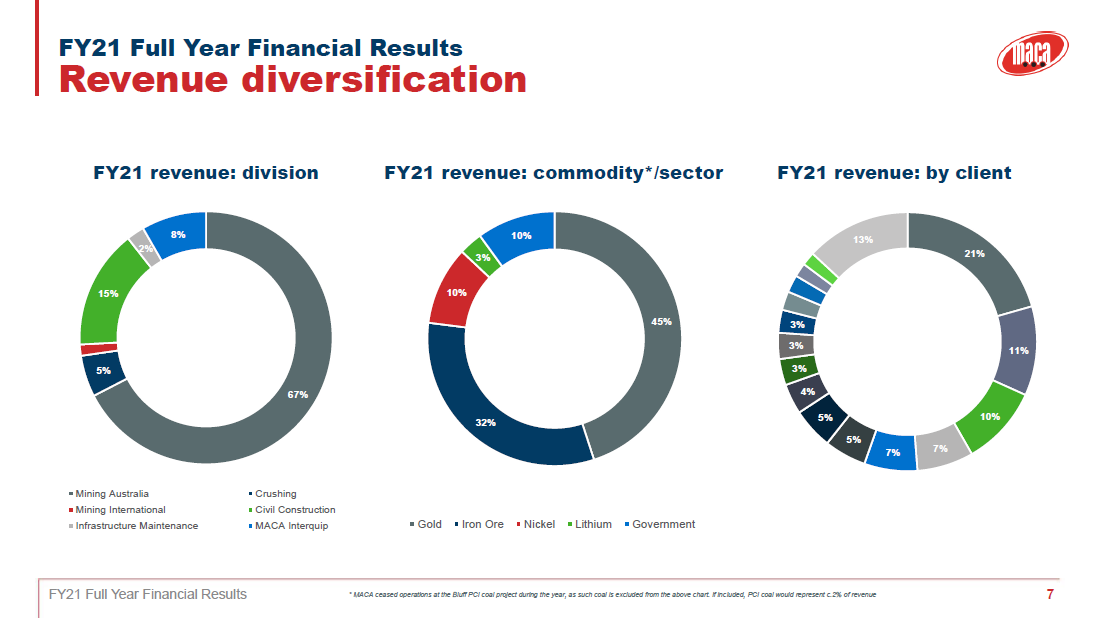

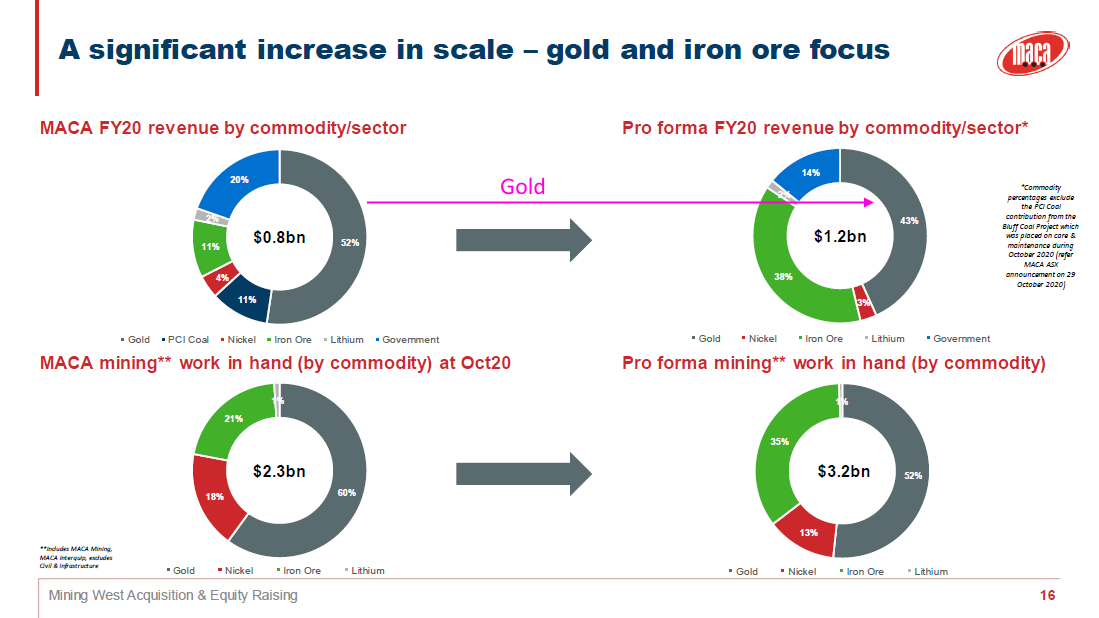

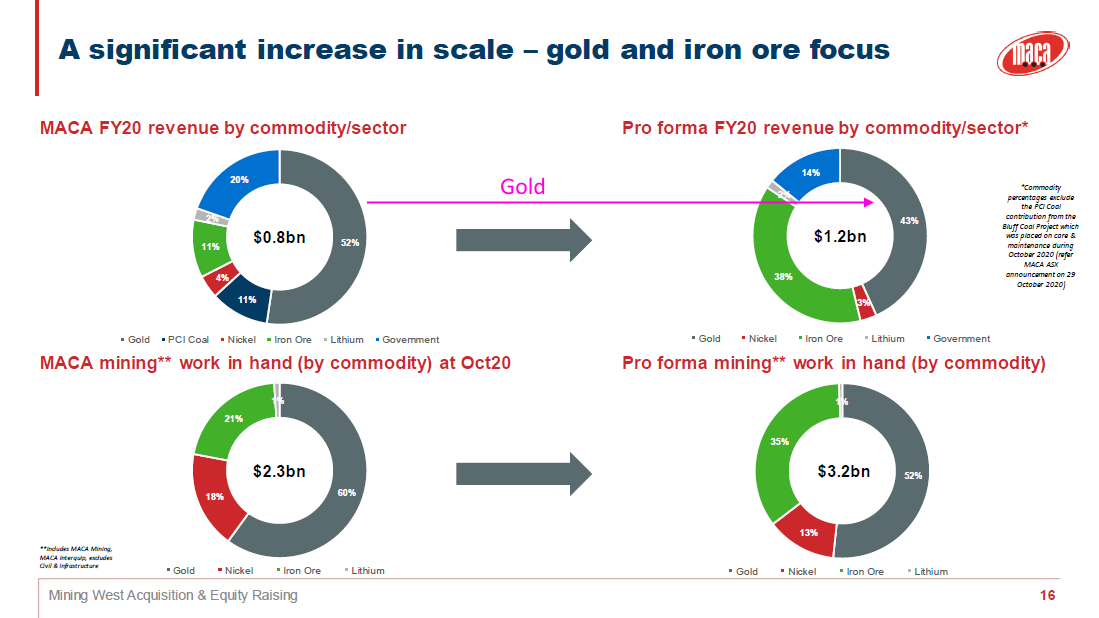

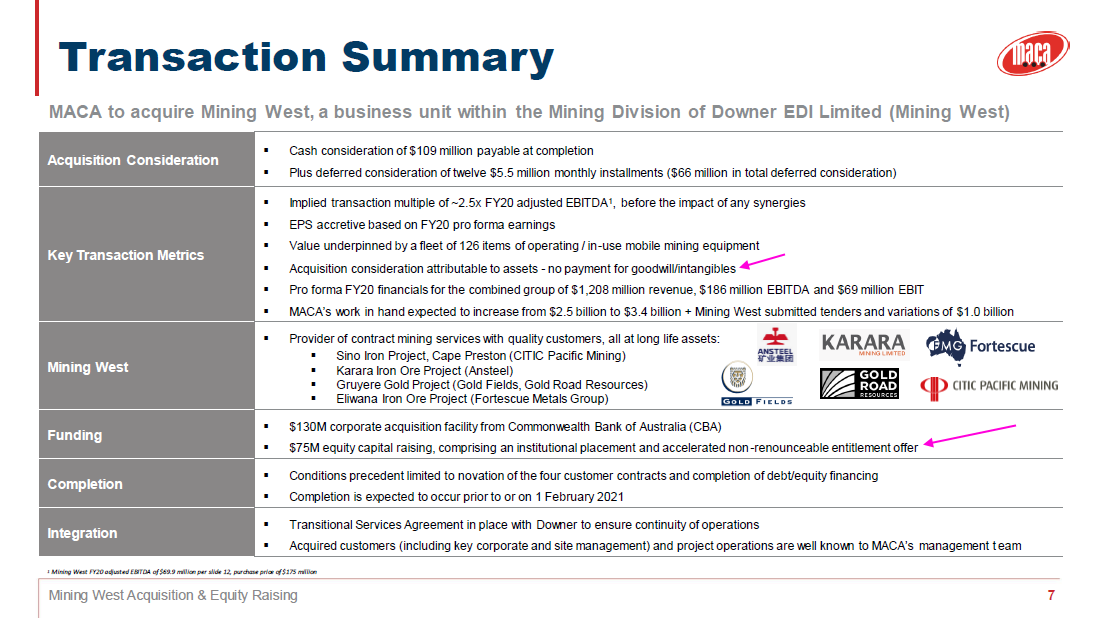

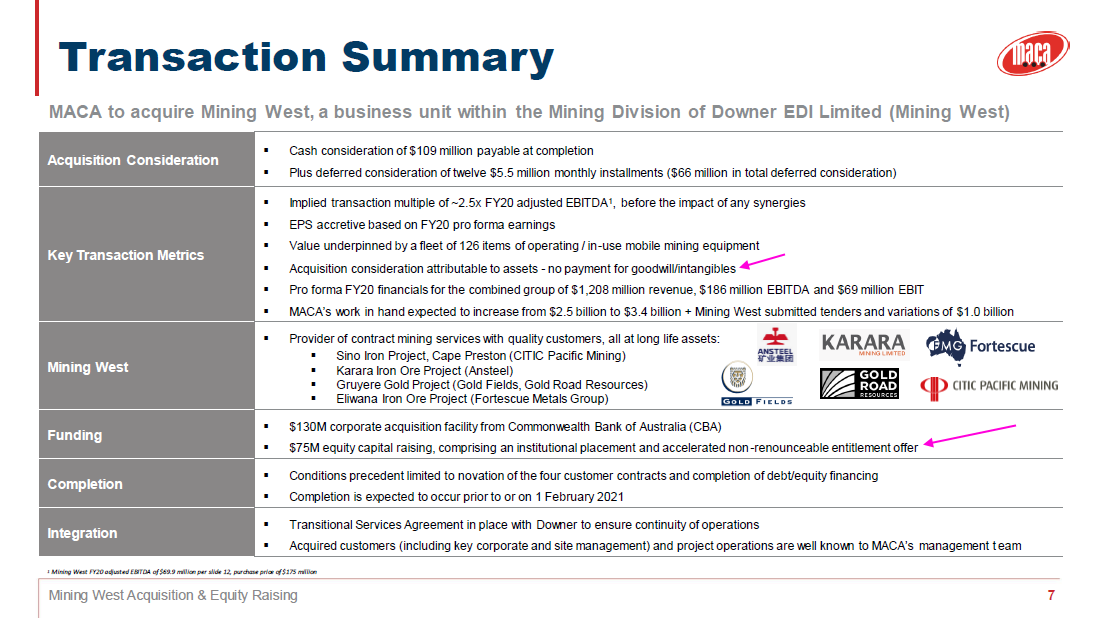

Antwort auf Beitrag Nr.: 64.874.450 von faultcode am 25.08.20 13:18:06man bekommt so mehr Gewicht im Eisenerz-Sektor (Fortescue Metals Group; three long life iron ore projects)

...und dann 10 Folien Risk Factors

...und dann 10 Folien Risk Factors

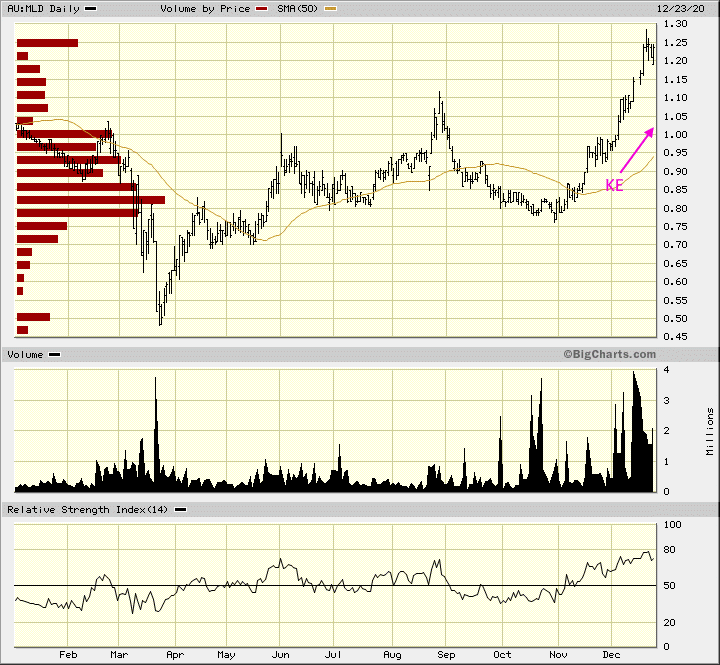

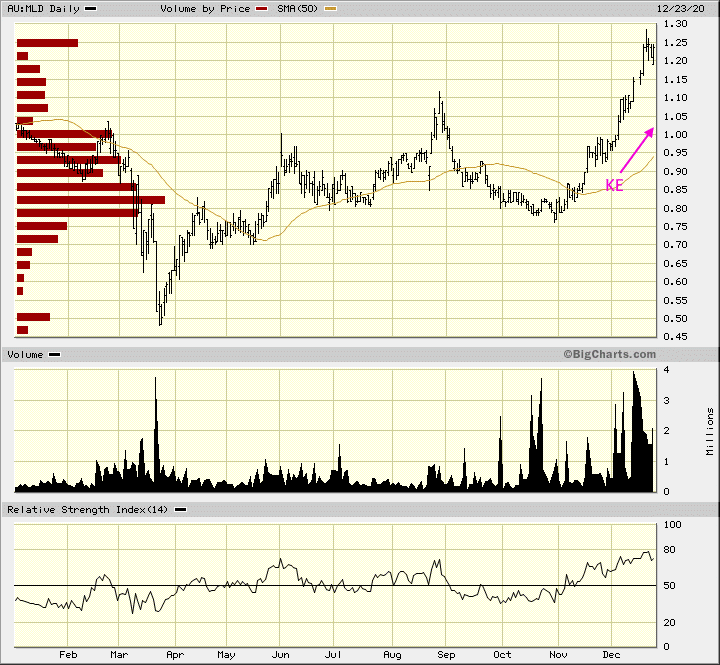

Antwort auf Beitrag Nr.: 65.781.042 von faultcode am 20.11.20 11:28:35KE 8:1 @AUD1.02 wegen der Mining West-Übernahme (a business unit within the Mining Division of Downer EDI Limited):

ich werde dran teilnehmen

15.12.2020

ich werde dran teilnehmen

15.12.2020

Antwort auf Beitrag Nr.: 65.569.685 von faultcode am 02.11.20 13:38:0019th November 2020

2020 ANNUAL GENERAL MEETING – CHAIRMAN AND MANAGING DIRECTOR ADDRESS

Chairman’s Address

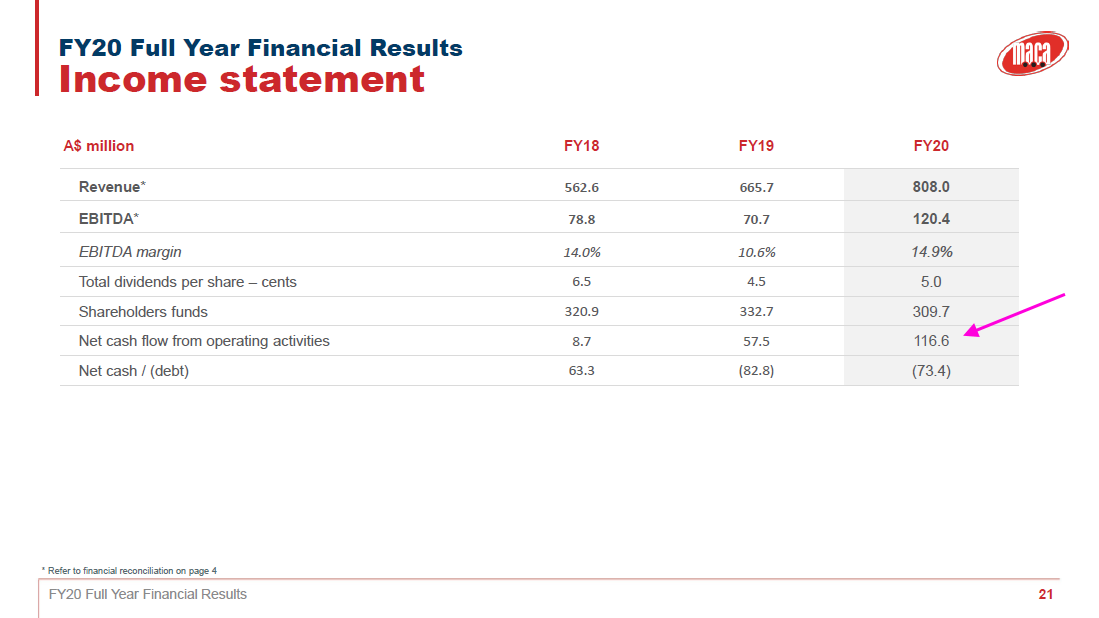

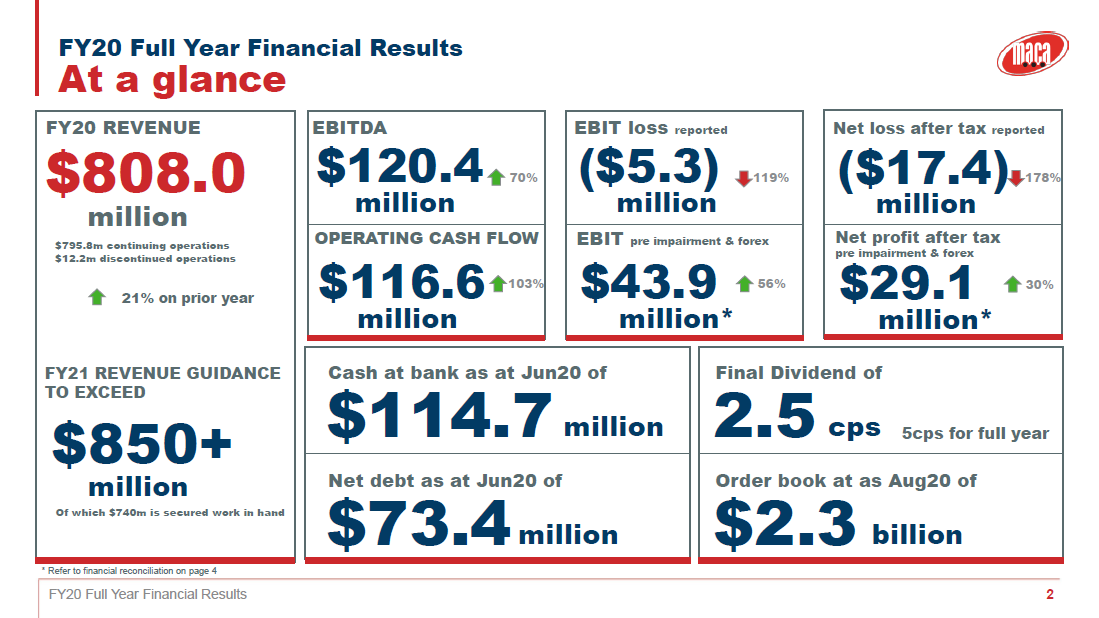

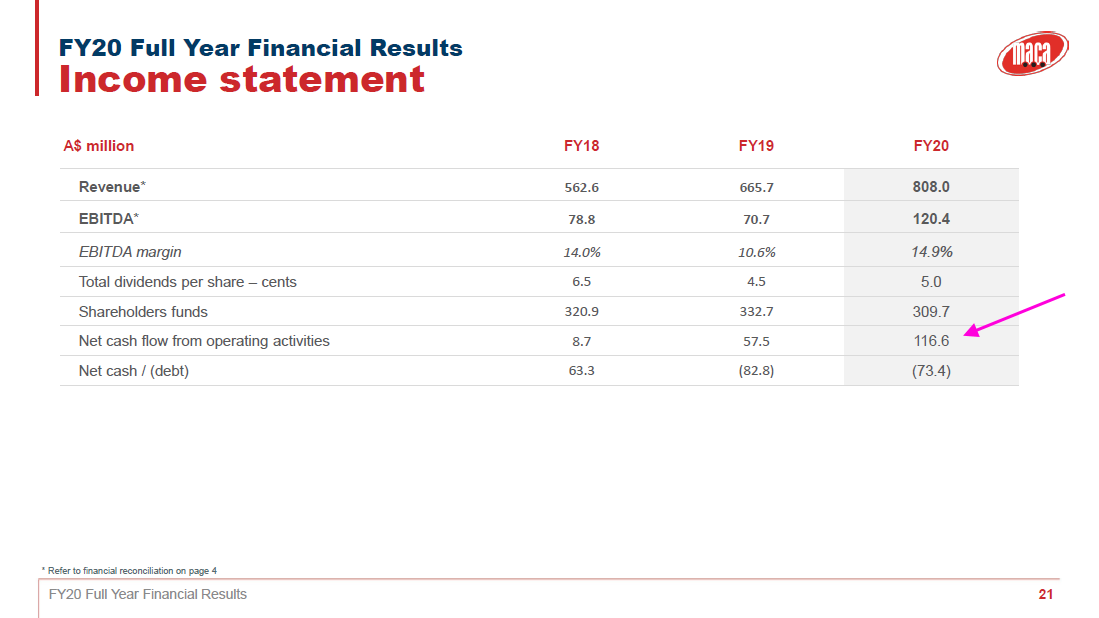

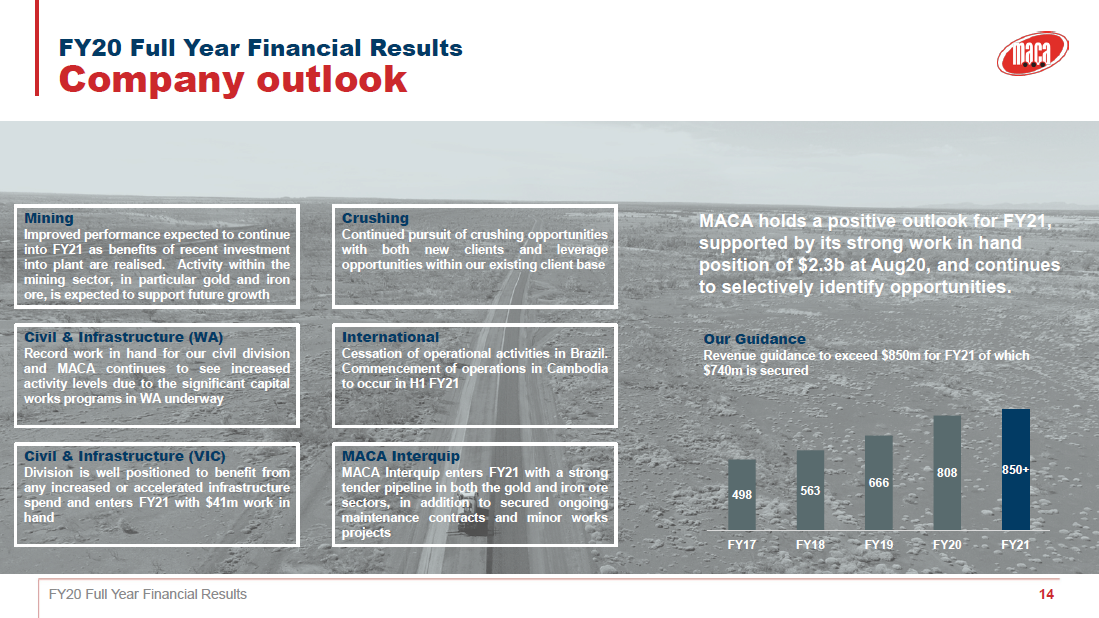

As I noted in this year’s annual report, in FY 2020 MACA has seen improved performance in our underlying business operations, again achieving record levels of revenue and work in hand, alongside a positive recovery in our underlying margins.

...

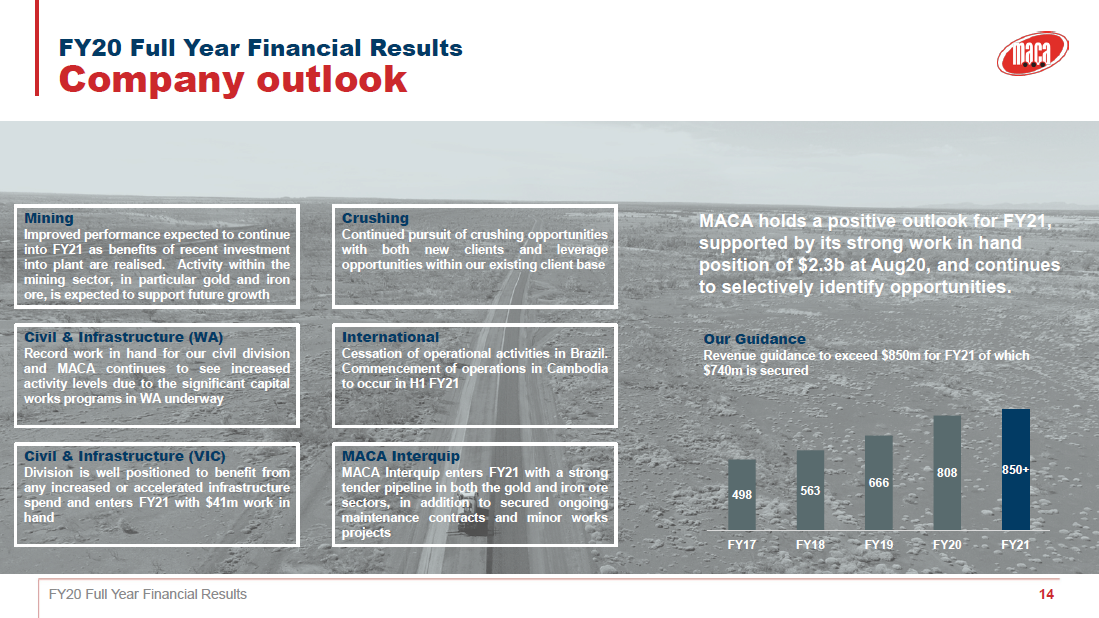

BUSINESS OUTLOOK

MACA holds a positive outlook for FY21, supported by its strong work in hand position of $2.4b at Sep20 and a robust tender pipeline of near-term quality opportunities. We are observing a particularly strong gold and iron ore market, as evidenced by our significant contract wins and extensions in this financial year to date, including:

• Atlas Iron Corunna Downs – Mining

• Ramelius Resources Mount Magnet Extension – Mining

• Capricorn Metals Karlawinda – Mining

• Fenix Resources Iron Ridge – Mining and Crushing

• South West Gateway Alliance (BORR), MACA is a 10% non-owner participant – Civil

• Eastern Ridge Crushing – Crushing

• Red 5 King of the Hills – EPC MACA Interquip and Civil

• Major Road Projects Victoria (“MRPV”) panel works (Golf Links Road) - Civil

...

2020 ANNUAL GENERAL MEETING – CHAIRMAN AND MANAGING DIRECTOR ADDRESS

Chairman’s Address

As I noted in this year’s annual report, in FY 2020 MACA has seen improved performance in our underlying business operations, again achieving record levels of revenue and work in hand, alongside a positive recovery in our underlying margins.

...

BUSINESS OUTLOOK

MACA holds a positive outlook for FY21, supported by its strong work in hand position of $2.4b at Sep20 and a robust tender pipeline of near-term quality opportunities. We are observing a particularly strong gold and iron ore market, as evidenced by our significant contract wins and extensions in this financial year to date, including:

• Atlas Iron Corunna Downs – Mining

• Ramelius Resources Mount Magnet Extension – Mining

• Capricorn Metals Karlawinda – Mining

• Fenix Resources Iron Ridge – Mining and Crushing

• South West Gateway Alliance (BORR), MACA is a 10% non-owner participant – Civil

• Eastern Ridge Crushing – Crushing

• Red 5 King of the Hills – EPC MACA Interquip and Civil

• Major Road Projects Victoria (“MRPV”) panel works (Golf Links Road) - Civil

...

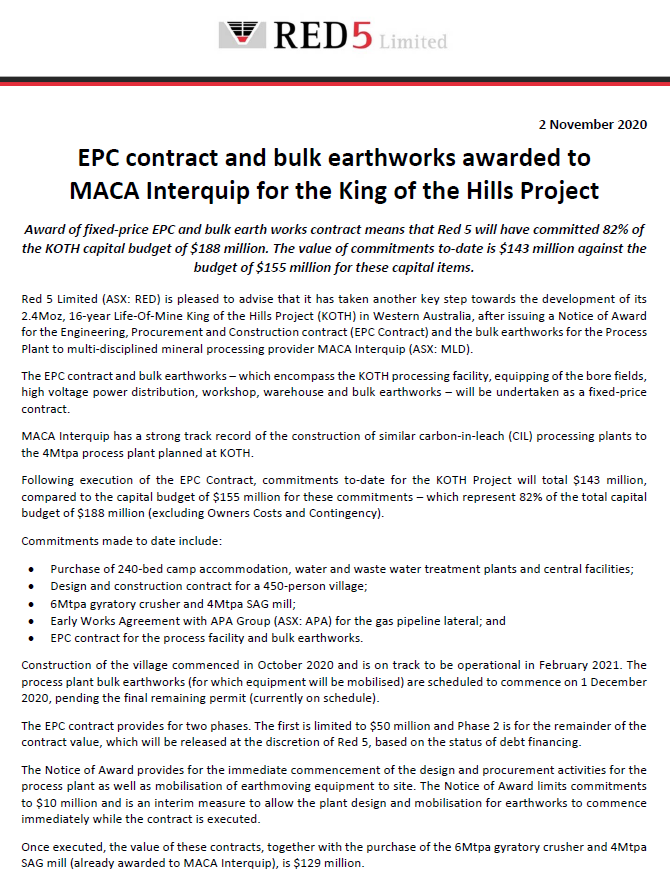

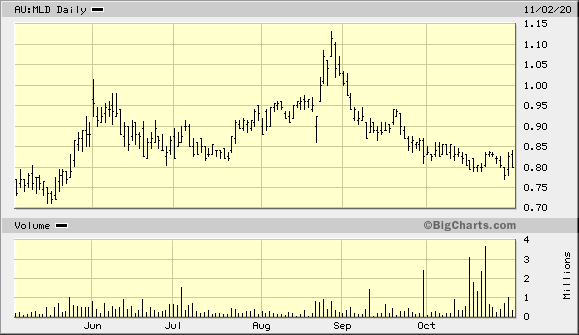

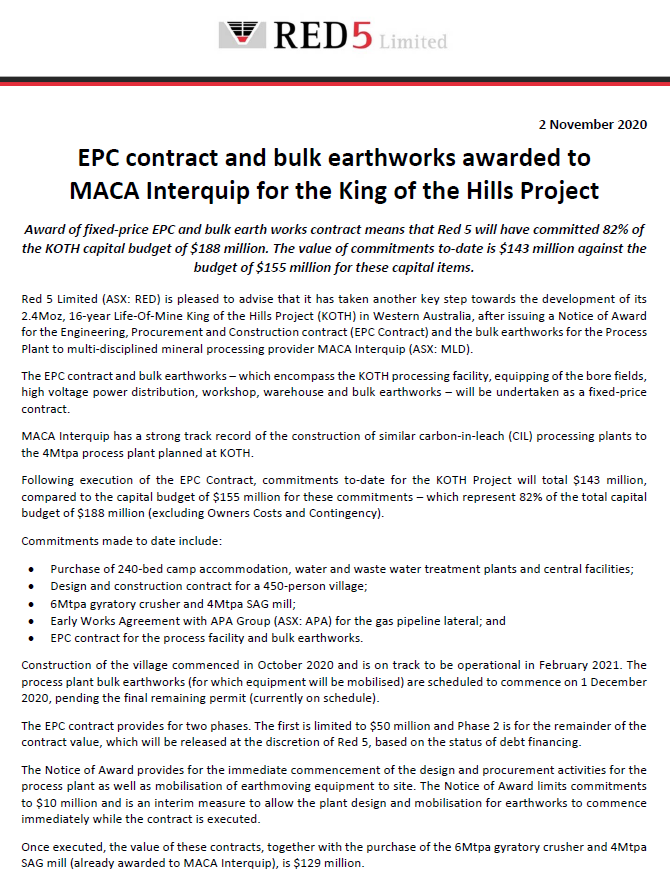

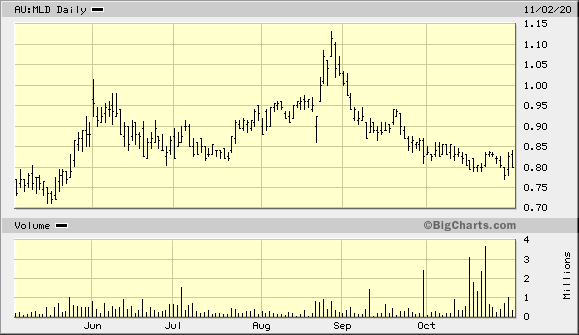

Antwort auf Beitrag Nr.: 65.547.346 von faultcode am 30.10.20 11:37:52EPC-Großauftrag von Red 5 (Gold) -- nur der Markt honoriert es nicht:

...

na ja, halt EPC: hoffentlich geht das gut:

KOTH = King of the Hills, WA

...

na ja, halt EPC: hoffentlich geht das gut:

KOTH = King of the Hills, WA

Antwort auf Beitrag Nr.: 64.874.450 von faultcode am 25.08.20 13:18:06

=> dadurch hält sich der Schaden in Grenzen:

=> dadurch hält sich der Schaden in Grenzen:

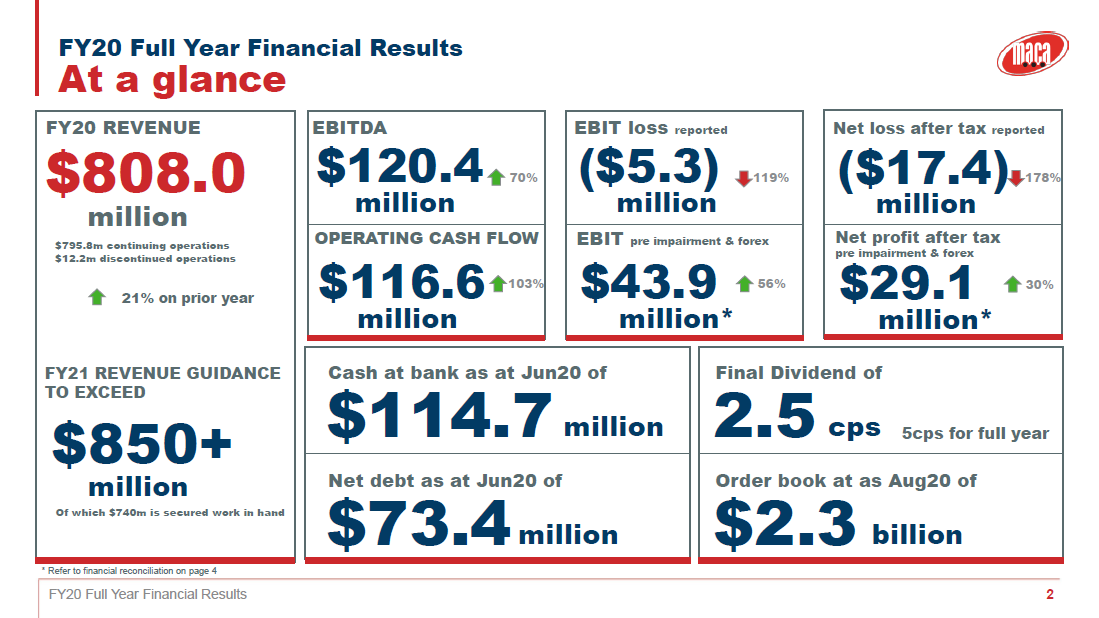

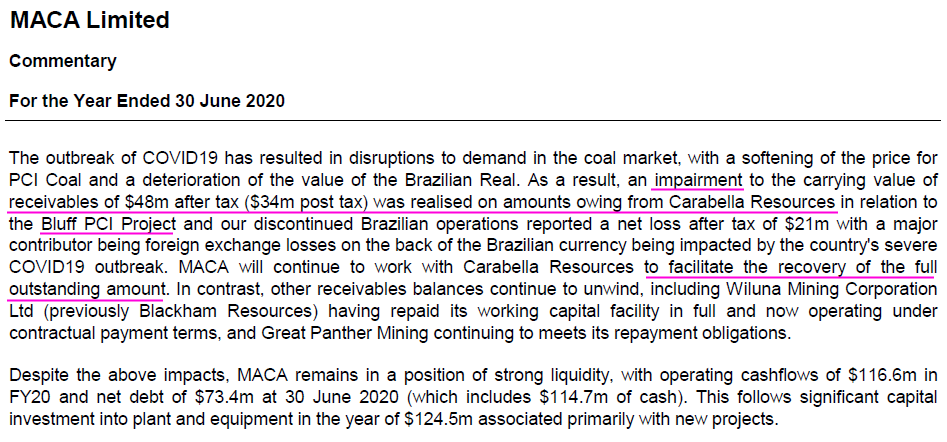

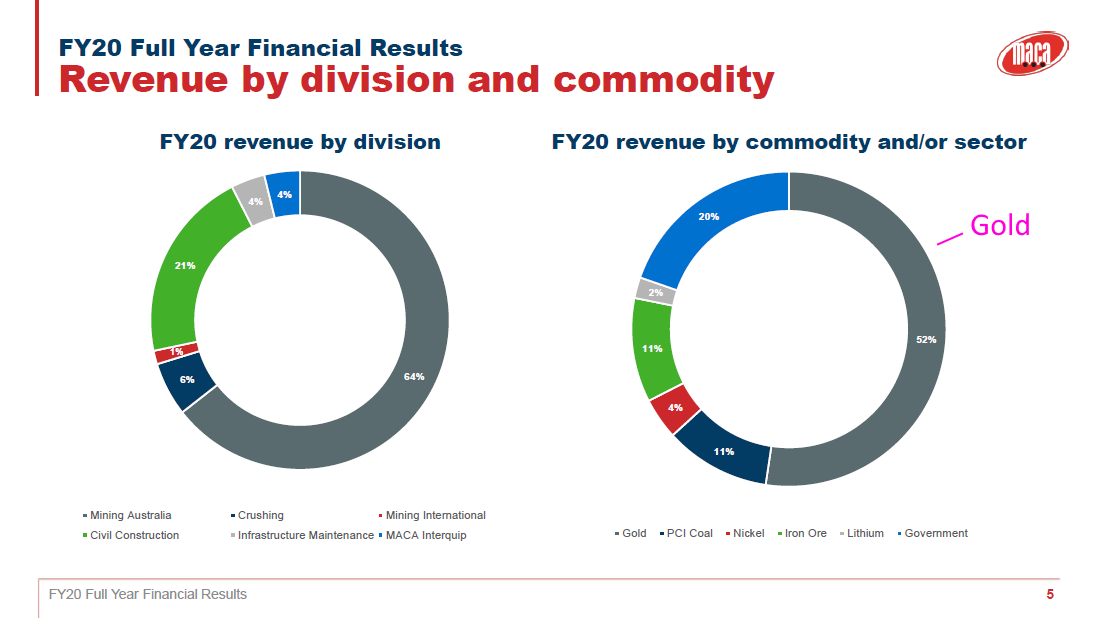

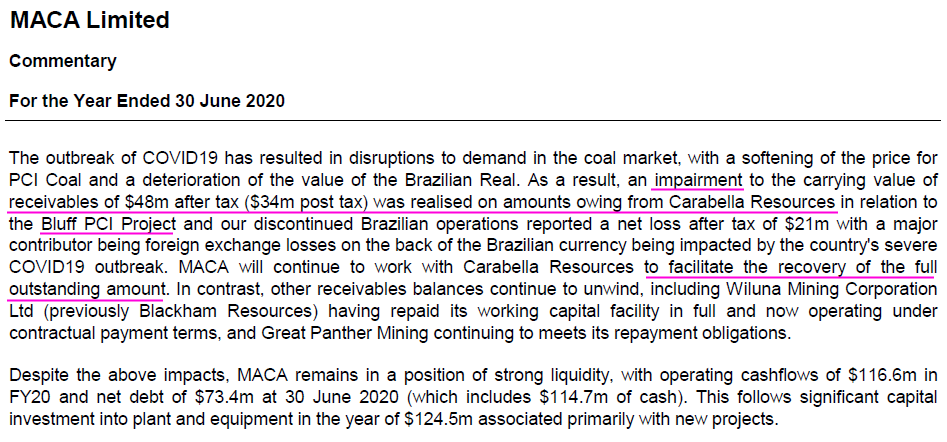

Antwort auf Beitrag Nr.: 62.812.334 von faultcode am 27.02.20 19:46:52AR FY2020 -- 20.6.2020 => gute Zahlen und Aussichten in Summe:

Kohle machte Probleme:

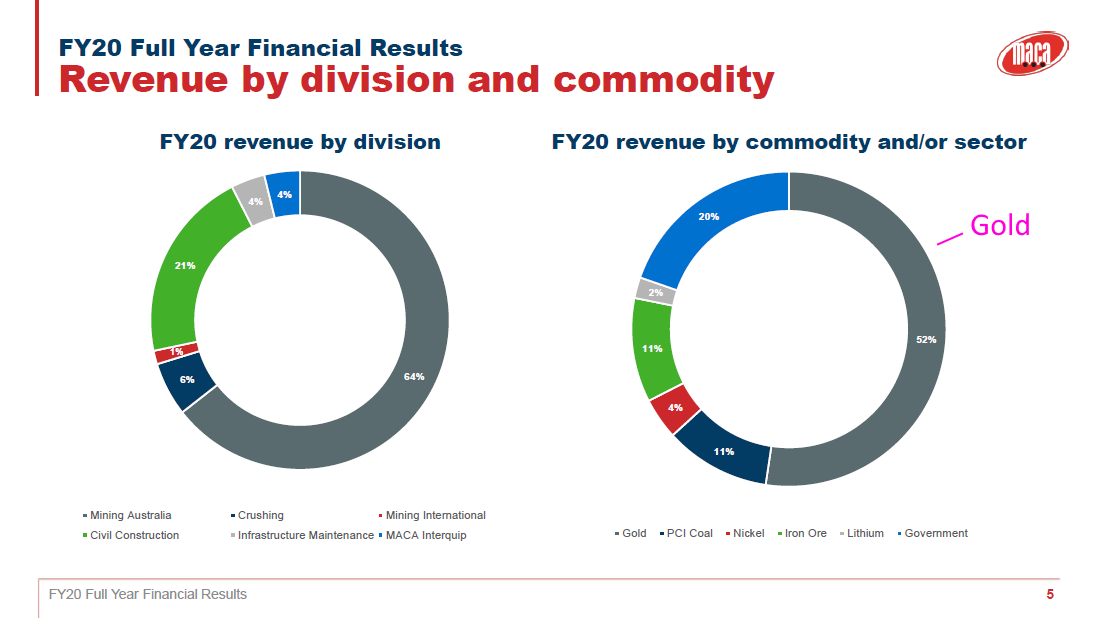

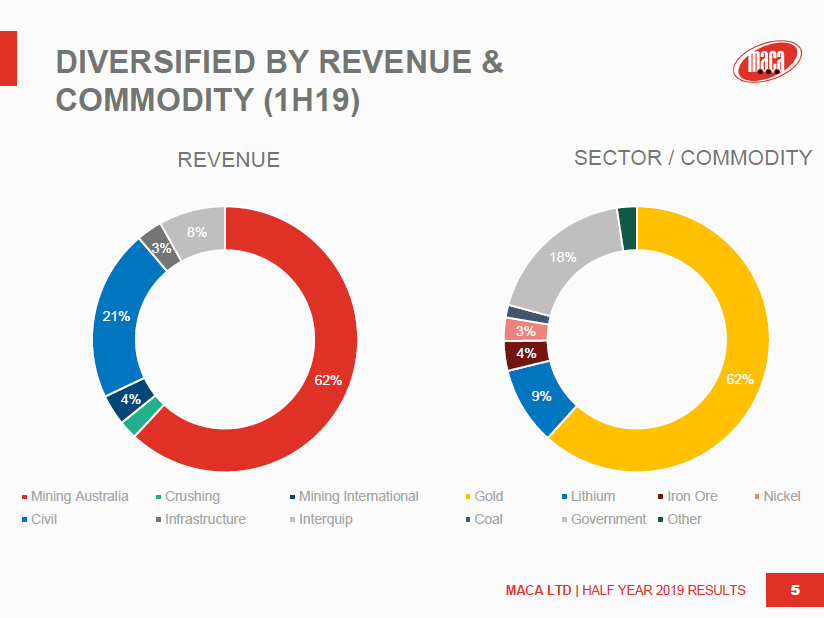

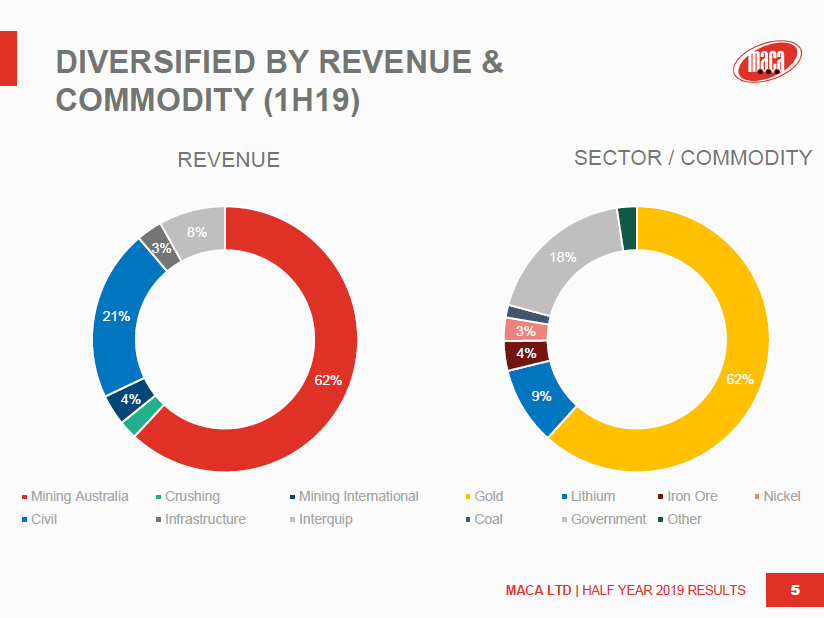

Gold machte 52% vom Umsatz aus:

Fun fact: nachdem der Betrieb in Brasilien eingestellt wurde, will MACA die Anlagen zurück nach Australien bringen 🤔

=> hier könnte man nachdenken warum: Hohe Nachfrage? Lange Lieferzeiten für Ersatz? Warum kein Verkauf in Brasilien?

Auch im AR2020 finde ich keine Begründung dazu.

Fun fact: Australiens größter Spaß-Miner Blackham/Wiluna hat alle Kredite zurückbezahlt und soll nun wieder normal bezahlen.

Ich hoffe, daß das auch so bleibt

Man weiß ja sehr gut, daß auch dort Anspruch und Wirklichkeit mitunter stark auseinanderklaffen...

Kohle machte Probleme:

Gold machte 52% vom Umsatz aus:

Fun fact: nachdem der Betrieb in Brasilien eingestellt wurde, will MACA die Anlagen zurück nach Australien bringen 🤔

=> hier könnte man nachdenken warum: Hohe Nachfrage? Lange Lieferzeiten für Ersatz? Warum kein Verkauf in Brasilien?

Auch im AR2020 finde ich keine Begründung dazu.

Fun fact: Australiens größter Spaß-Miner Blackham/Wiluna hat alle Kredite zurückbezahlt und soll nun wieder normal bezahlen.

Ich hoffe, daß das auch so bleibt

Man weiß ja sehr gut, daß auch dort Anspruch und Wirklichkeit mitunter stark auseinanderklaffen...

Antwort auf Beitrag Nr.: 61.994.843 von faultcode am 22.11.19 20:07:3020 February 2020

Board and Management Changes

MACA Limited (MLD:ASX) (‘MACA’ ‘the Company’) advises the following changes to its management structure and Board.

Resignation of Managing Director and Appointment of new Chief Executive Officer

Mr Chris Tuckwell has advised his intention to resign as Managing Director and Chief Executive Officer of MACA, having served the Company over nearly 11 years of service in these roles. Mr Tuckwell’s resignation will take effect from early March to enable a smooth transition to the incoming Chief Executive Officer.

Effective from 24 February 2020, Mr Mike Sutton will join MACA as Chief Executive Officer. The appointment of Mr Sutton follows an extensive executive search process that has been run by MACA.

Mr Sutton has a bachelor of science in civil engineering and has been Chief Operating Officer at Downer EDI Mining from 2010 until recently, during which time revenues grew from $400 million to $1 billion. Prior to his time there, Mr Sutton worked in various senior operational roles in the mining and civil industries including 13 years at Henry Walker Eltin.

MACA’s Chairman, Mr Andrew Edwards, said “On behalf of the Board of MACA, I would like to extend our sincere thanks to Chris for his efforts and contribution to the Company. During his tenure, MACA has progressed from a private group with revenue of $83 million and total assets of $33 million to the publicly listed company it is today with forecast revenue of $770 million and total assets of $584 million. We wish Chris all the very best for the future.

We are delighted to have attracted someone of Mike’s calibre and standing in the sector to be the new CEO of MACA. The Board is confident that Mike has the appropriate skills to lead MACA’s business through the next phase of its growth as it seeks to take advantage of the many opportunities available with existing and rest of the Board look forward to working closely with him.”

Mr Sutton said “I am delighted to be joining MACA at an exciting period in the company’s development and am keen to see the business grow based on strong relationships and performance.“

The key terms and conditions of Mr Sutton’s appointment are set out in the Attachment to this announcement.

...

Board and Management Changes

MACA Limited (MLD:ASX) (‘MACA’ ‘the Company’) advises the following changes to its management structure and Board.

Resignation of Managing Director and Appointment of new Chief Executive Officer

Mr Chris Tuckwell has advised his intention to resign as Managing Director and Chief Executive Officer of MACA, having served the Company over nearly 11 years of service in these roles. Mr Tuckwell’s resignation will take effect from early March to enable a smooth transition to the incoming Chief Executive Officer.

Effective from 24 February 2020, Mr Mike Sutton will join MACA as Chief Executive Officer. The appointment of Mr Sutton follows an extensive executive search process that has been run by MACA.

Mr Sutton has a bachelor of science in civil engineering and has been Chief Operating Officer at Downer EDI Mining from 2010 until recently, during which time revenues grew from $400 million to $1 billion. Prior to his time there, Mr Sutton worked in various senior operational roles in the mining and civil industries including 13 years at Henry Walker Eltin.

MACA’s Chairman, Mr Andrew Edwards, said “On behalf of the Board of MACA, I would like to extend our sincere thanks to Chris for his efforts and contribution to the Company. During his tenure, MACA has progressed from a private group with revenue of $83 million and total assets of $33 million to the publicly listed company it is today with forecast revenue of $770 million and total assets of $584 million. We wish Chris all the very best for the future.

We are delighted to have attracted someone of Mike’s calibre and standing in the sector to be the new CEO of MACA. The Board is confident that Mike has the appropriate skills to lead MACA’s business through the next phase of its growth as it seeks to take advantage of the many opportunities available with existing and rest of the Board look forward to working closely with him.”

Mr Sutton said “I am delighted to be joining MACA at an exciting period in the company’s development and am keen to see the business grow based on strong relationships and performance.“

The key terms and conditions of Mr Sutton’s appointment are set out in the Attachment to this announcement.

...

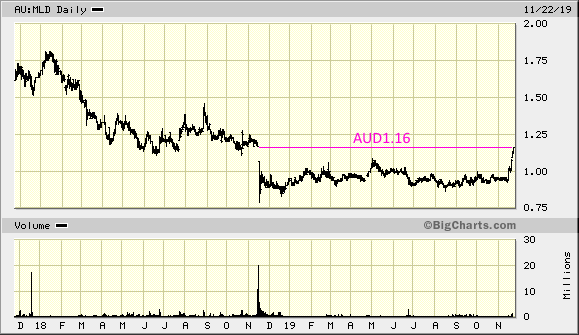

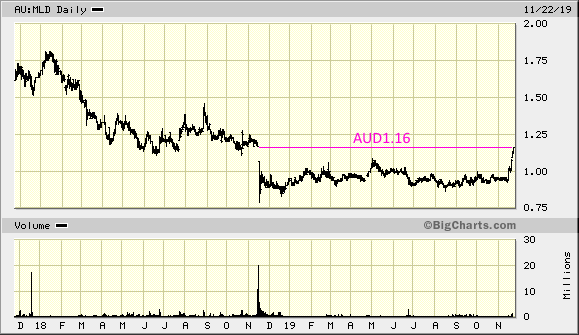

Antwort auf Beitrag Nr.: 61.585.872 von faultcode am 27.09.19 18:16:43Gap wieder zu:

--> Runup seit dem 14./15.11. mit dem optimistischen 2019 ANNUAL GENERAL MEETING – CHAIRMAN AND MANAGING DIRECTOR ADDRESS

=>

...We expect an improved financial performance this year, driven both by revenue growth and a continuation of the improved margins achieved in the second half of FY19.

Group revenue is forecast to increase by approximately 8% to $720 million in FY20, of which over $500 million relates to Mining and Crushing. Importantly, this growth includes a significant, and deliberately pursued, diversification component to provide a broader platform for future success.

Profitability is expected to be weighted slightly towards the second half due to an increased contribution from the Civil and Interquip Divisions.

...

--> Runup seit dem 14./15.11. mit dem optimistischen 2019 ANNUAL GENERAL MEETING – CHAIRMAN AND MANAGING DIRECTOR ADDRESS

=>

...We expect an improved financial performance this year, driven both by revenue growth and a continuation of the improved margins achieved in the second half of FY19.

Group revenue is forecast to increase by approximately 8% to $720 million in FY20, of which over $500 million relates to Mining and Crushing. Importantly, this growth includes a significant, and deliberately pursued, diversification component to provide a broader platform for future success.

Profitability is expected to be weighted slightly towards the second half due to an increased contribution from the Civil and Interquip Divisions.

...

aus dem gefälligen Jahresbericht 2019 (30.6.2019)

OT - jetzt gehen schon australischen Mining services companies direkt ins Minengeschäft  ;

;

also nicht nur indirekt und unfreiwillig, so wie MACA bei Blackham Resources

-->

https://www.adamanresources.com.au/about-us/

=>

Adaman Resources was established in 2017 by the CEOs/Managing Directors of the three independent mining services companies, Nathan Mitchell of Mitchell Group, Danny Sweeney of SMS and Mark Rowsthorn of Rivet.

--> MACA Interquip hat hier einen Auftrag -- man kennt sich schließlich

MACA Interquip (EPC-Leistungen -- Engineering / Procurement / Construction services):

• Adaman Resources Kirkalocka Gold Project --> • 8 months from Feb19, $28m revenue

;

;also nicht nur indirekt und unfreiwillig, so wie MACA bei Blackham Resources

-->

https://www.adamanresources.com.au/about-us/

=>

Adaman Resources was established in 2017 by the CEOs/Managing Directors of the three independent mining services companies, Nathan Mitchell of Mitchell Group, Danny Sweeney of SMS and Mark Rowsthorn of Rivet.

--> MACA Interquip hat hier einen Auftrag -- man kennt sich schließlich

MACA Interquip (EPC-Leistungen -- Engineering / Procurement / Construction services):

• Adaman Resources Kirkalocka Gold Project --> • 8 months from Feb19, $28m revenue

MACA hat Blackham Resources wieder Geld für Aktien gegeben

.

=> mit nun 651,408,220 Aktien ist MACA wahrscheinlich einer der Top-Aktionäre (mit 19.3% der Stimmrechte nach oben)

--> hinzukommen noch ~129m Optionen

--> siehe Meldung vom 20.6.2019:

Working Capital Update

MACA Limited (ASX: MLD) (“MACA”; “The Company”) advises that it has extended a working capital facility of up to $12M to Blackham Resources Limited (ASX: ‘BLK’) (“Blackham”).

The extended Working Capital Facility will be in the form of extended payment terms and is payable by February 2020. The facility will be captured under the Company’s existing security arrangements which cover MACA’s total exposure to Blackham. In consideration for providing the working capital facility MACA will be issued with 265 million fully paid ordinary shares in Blackham at $0.00906 per share being equal to the 5 day VWAP as at the close of trade on 14 June 2019, taking MACA’s interest in Blackham to 19.3%.

As a result of the separate existing loan facility continuing to reduce by $1M per month, MACA’s aggregate exposure is not expected to increase materially. The cashflow impact for MACA for FY19 is expected to be negligible and based on the agreed terms MACA expects a positive cash inflow of circa $20M during FY20.

Operations Director, Geoff Baker, said ‘we believe our continued support of Blackham and the alignment through MACA’s shareholding will result in a positive outcome for both parties as Blackham transitions into what is forecast to be a stronger operating period’.

Separately, MACA is pleased to confirm that its exposure to Beadell Resources (now a wholly owned subsidiary of Great Panther Mining Ltd TSX:GPR and NYSE:GPL) is reducing in line with the previously announced repayment schedule and this is forecast to have a positive cash impact for MACA over the next 12 months...

Antwort auf Beitrag Nr.: 60.105.283 von faultcode am 14.03.19 22:44:57=> ..und MACA nimmt auch an der KE teil (um zu retten, was noch zu retten ist)

21st March 2019

MACA participation in Blackham Capital Raising

MACA Limited (ASX: MLD) (“MACA”) advises that it has supported the fully underwritten $25.8 million Entitlements Issue of Blackham Resources Limited (ASX: ‘BLK’) (“Blackham”).

MACA has agreed to sub-underwrite up to $7.5 million of the Entitlements Issue with MACA’s participation to be applied to a reduction of the trade receivable balance owing to MACA.

21st March 2019

MACA participation in Blackham Capital Raising

MACA Limited (ASX: MLD) (“MACA”) advises that it has supported the fully underwritten $25.8 million Entitlements Issue of Blackham Resources Limited (ASX: ‘BLK’) (“Blackham”).

MACA has agreed to sub-underwrite up to $7.5 million of the Entitlements Issue with MACA’s participation to be applied to a reduction of the trade receivable balance owing to MACA.

Antwort auf Beitrag Nr.: 59.254.114 von faultcode am 20.11.18 02:56:56

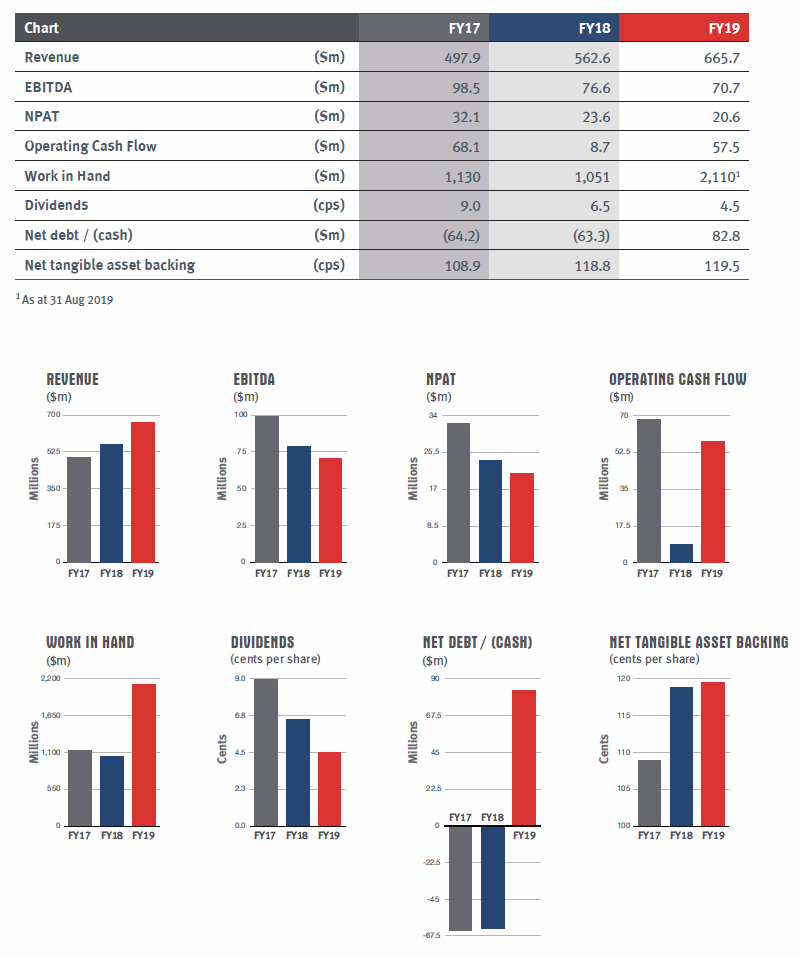

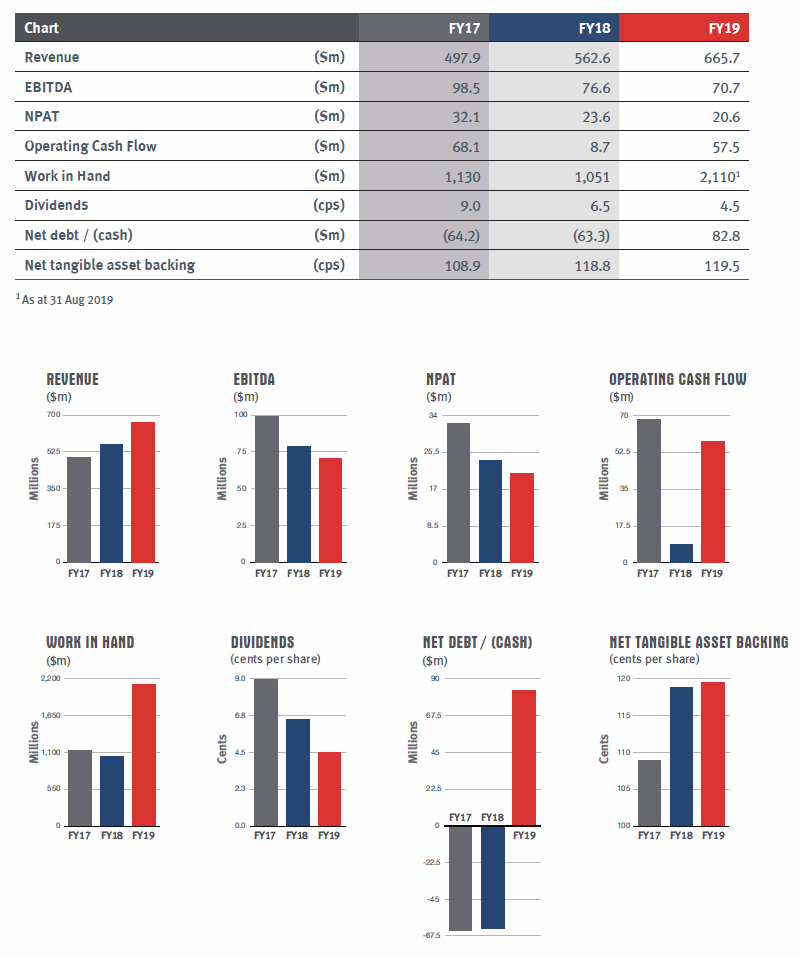

• $27.6m -- EBITDA

• $8.1m -- NPAT (net profit after tax)

• FY19 revenue guidance increased to $640m

• Net debt of $6.5m

• Cash at bank of $71.6m

• Order book of $2.2b as at Feb19

--> allerdings ist (z.B.) die EBITDA-Marge bei den zuletzt stark gestiegenen Umsätzen deutlich unter Druck geraten:

2016H2: 21.5%

2017H2: 13.3%

2018H2: 8.5%

=> die Aktie ist also auch eine Wette darauf, daß sich hier der Trend mal umkehrt

=> MLD schreibt dazu im Ausblick:

Guidance for FY19 (full year):

• Revenue: $640m.

• The second half financial performance is expected to be stronger than that achieved in the first half as a result of improved margins.

__

sonst:

• Great Panther acquisition of Beadell --> Accelerated repayment schedule

Zahlen 2018H2 -- HALF YEAR 2019 RESULTS

• $324m -- REVENUE (up 14% on pcp)• $27.6m -- EBITDA

• $8.1m -- NPAT (net profit after tax)

• FY19 revenue guidance increased to $640m

• Net debt of $6.5m

• Cash at bank of $71.6m

• Order book of $2.2b as at Feb19

--> allerdings ist (z.B.) die EBITDA-Marge bei den zuletzt stark gestiegenen Umsätzen deutlich unter Druck geraten:

2016H2: 21.5%

2017H2: 13.3%

2018H2: 8.5%

=> die Aktie ist also auch eine Wette darauf, daß sich hier der Trend mal umkehrt

=> MLD schreibt dazu im Ausblick:

Guidance for FY19 (full year):

• Revenue: $640m.

• The second half financial performance is expected to be stronger than that achieved in the first half as a result of improved margins.

__

sonst:

• Great Panther acquisition of Beadell --> Accelerated repayment schedule

Antwort auf Beitrag Nr.: 59.254.099 von faultcode am 20.11.18 02:46:55

20th November 2018

Beadell Resources Update

MACA Limited (ASX: MLD) (“MACA”; the “Company”) has reached an agreement (the “Agreement”) with Great Panther Silver Limited (“Great Panther” TSX:GPR NYSE:GPL) in respect of MACA’s outstanding receivable due from Beadell Resources Limited (“Beadell” ASX:BDR).

Great Panther announced a scheme of arrangement (the “Scheme”) to acquire all the issued shares of Beadell on 24th September 2018. Under MACA’s agreement with Beadell as announced by MACA on 22nd June 2018 the amount outstanding becomes due and payable on a change of control of Beadell absent MACA’s consent. MACA has agreed to waive the change of control clause under the Agreement, with the following amendments on implementation of the Scheme (the “Completion Date”):

● Advancement of a March 31, 2019 principal payment of A$3 million to 30 days following the Completion Date;

● Advancement of the start of monthly principal payments of A$1.5 million to April 30, 2019 from July 31, 2019;

● Great Panther will guarantee the A$3 million payment and the subsequent two A$1.5 million payments;

● MACA will have a right to convert an aggregate of A$15 million of the remaining loan outstanding to shares in Great Panther, subject to:

o a maximum of A$5 million each calendar quarter following the Completion Date;

o any amount of the receivable which is converted to Great Panther shares will reduce the outstanding balance of the receivable, with 50% to be applied to reduce the remaining monthly payments on a pro-rata basis;

● Amendment of the provision to provide 30% of the net proceeds from any debt or equity financing as a repayment to MACA such that the percentage is reduced to 10%;

● MACA to receive 10% of the funds of any Great Panther debt or equity issuances, to be applied against the outstanding balance of the receivable; and

● In the case of the exercise of existing warrants, MACA to receive 20% of the funds, to be applied against the outstanding balance of the receivable.

MACA’s consent to the proposed change of control has been granted in consideration that the merger of Great Panther and Beadell will create a financially stronger and operationally diverse precious metals producer thus reducing MACA’s counterparty risk. In addition, MACA will benefit from accelerated terms of repayment. Under the terms agreed, and assuming completion of the Scheme, the current total amount owing is expected to reduce from A$54.7M to A$23.2M within 12 months of the Completion Date.

Reduction to this level includes, and is subject to, successful conversion of A$15 million of the outstanding amount into equity in Great Panther.

Great Panther is a dual (TSX and NYSE American) listed precious metals company with cash on hand of USD$58 million and no debt as at 30 September 2018. On announcement of, and taking into effect the Agreement, the implied pro-forma market capitalisation of Great Panther and Beadell was in excess of A$350 million.

Beadell Resources Update

..und MACA kriegt schon wieder Aktien eines Goldminers --> wird allmählich eine Royalty- oder Hedge Fund-Geschichte

20th November 2018

Beadell Resources Update

MACA Limited (ASX: MLD) (“MACA”; the “Company”) has reached an agreement (the “Agreement”) with Great Panther Silver Limited (“Great Panther” TSX:GPR NYSE:GPL) in respect of MACA’s outstanding receivable due from Beadell Resources Limited (“Beadell” ASX:BDR).

Great Panther announced a scheme of arrangement (the “Scheme”) to acquire all the issued shares of Beadell on 24th September 2018. Under MACA’s agreement with Beadell as announced by MACA on 22nd June 2018 the amount outstanding becomes due and payable on a change of control of Beadell absent MACA’s consent. MACA has agreed to waive the change of control clause under the Agreement, with the following amendments on implementation of the Scheme (the “Completion Date”):

● Advancement of a March 31, 2019 principal payment of A$3 million to 30 days following the Completion Date;

● Advancement of the start of monthly principal payments of A$1.5 million to April 30, 2019 from July 31, 2019;

● Great Panther will guarantee the A$3 million payment and the subsequent two A$1.5 million payments;

● MACA will have a right to convert an aggregate of A$15 million of the remaining loan outstanding to shares in Great Panther, subject to:

o a maximum of A$5 million each calendar quarter following the Completion Date;

o any amount of the receivable which is converted to Great Panther shares will reduce the outstanding balance of the receivable, with 50% to be applied to reduce the remaining monthly payments on a pro-rata basis;

● Amendment of the provision to provide 30% of the net proceeds from any debt or equity financing as a repayment to MACA such that the percentage is reduced to 10%;

● MACA to receive 10% of the funds of any Great Panther debt or equity issuances, to be applied against the outstanding balance of the receivable; and

● In the case of the exercise of existing warrants, MACA to receive 20% of the funds, to be applied against the outstanding balance of the receivable.

MACA’s consent to the proposed change of control has been granted in consideration that the merger of Great Panther and Beadell will create a financially stronger and operationally diverse precious metals producer thus reducing MACA’s counterparty risk. In addition, MACA will benefit from accelerated terms of repayment. Under the terms agreed, and assuming completion of the Scheme, the current total amount owing is expected to reduce from A$54.7M to A$23.2M within 12 months of the Completion Date.

Reduction to this level includes, and is subject to, successful conversion of A$15 million of the outstanding amount into equity in Great Panther.

Great Panther is a dual (TSX and NYSE American) listed precious metals company with cash on hand of USD$58 million and no debt as at 30 September 2018. On announcement of, and taking into effect the Agreement, the implied pro-forma market capitalisation of Great Panther and Beadell was in excess of A$350 million.

Antwort auf Beitrag Nr.: 58.825.814 von faultcode am 28.09.18 16:10:39aus dem AR-Brief gestern:

...We have experienced margin pressure in our core mining division. The tightening labour market has impacted the availability and deployment of equipment which in turn has adversely affected site performance across our projects. We have invested in newer and larger equipment and additional inventories however, due to equipment lead times the benefit of these investments is not expected to be realised until the second half. In addition there have been costs incurred in preparation for extensions and new projects for which we will not realise revenue until the second half...

--> MLD: https://www.asx.com.au/asx/share-price-research/company/MLD

--> letzter Kurs an der ASX: AUD0.870 (= ~-26%)

--> wenn man allerdings annimmt, daß sich entsprechende Umsätze und damit Gewinne (bei diesem eher Low Risk-Wert) nach 2018/19H2 (30.6.!) verlagern, dann kann man immer noch von einem Forward PE < 10 ausgehen (mMn)

--> interessant, und nicht nur für MACA, sondern auch ihren Kunden, wie austr. Gold minern, finde ich besonders diese Aussage:

The tightening labour market

=> das Phänomen, (auch stark) bedingt durch die restriktive Einwanderungspolitik der letzten Jahre, betrifft eben auch andere Rohstoffprojekte in Australien, und damit am Ende die Aktionäre solch stark Australien-fokusierter Unternehmen

--> also Obacht!

...We have experienced margin pressure in our core mining division. The tightening labour market has impacted the availability and deployment of equipment which in turn has adversely affected site performance across our projects. We have invested in newer and larger equipment and additional inventories however, due to equipment lead times the benefit of these investments is not expected to be realised until the second half. In addition there have been costs incurred in preparation for extensions and new projects for which we will not realise revenue until the second half...

--> MLD: https://www.asx.com.au/asx/share-price-research/company/MLD

--> letzter Kurs an der ASX: AUD0.870 (= ~-26%)

--> wenn man allerdings annimmt, daß sich entsprechende Umsätze und damit Gewinne (bei diesem eher Low Risk-Wert) nach 2018/19H2 (30.6.!) verlagern, dann kann man immer noch von einem Forward PE < 10 ausgehen (mMn)

--> interessant, und nicht nur für MACA, sondern auch ihren Kunden, wie austr. Gold minern, finde ich besonders diese Aussage:

The tightening labour market

=> das Phänomen, (auch stark) bedingt durch die restriktive Einwanderungspolitik der letzten Jahre, betrifft eben auch andere Rohstoffprojekte in Australien, und damit am Ende die Aktionäre solch stark Australien-fokusierter Unternehmen

--> also Obacht!

Antwort auf Beitrag Nr.: 58.541.495 von faultcode am 27.08.18 12:30:07

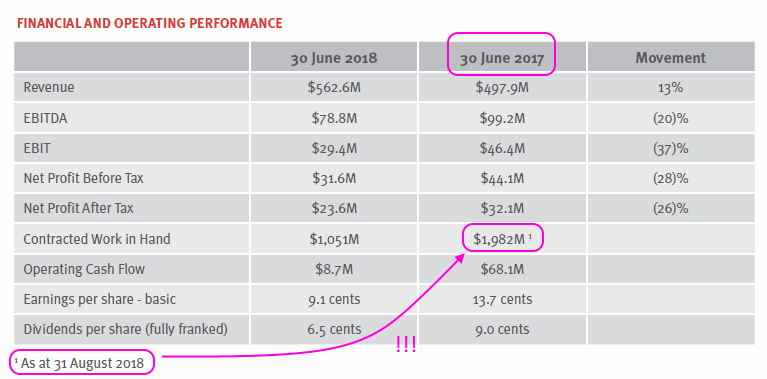

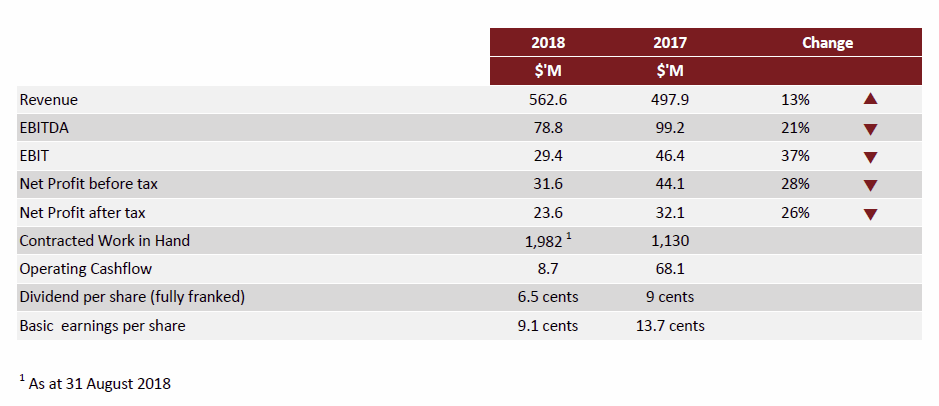

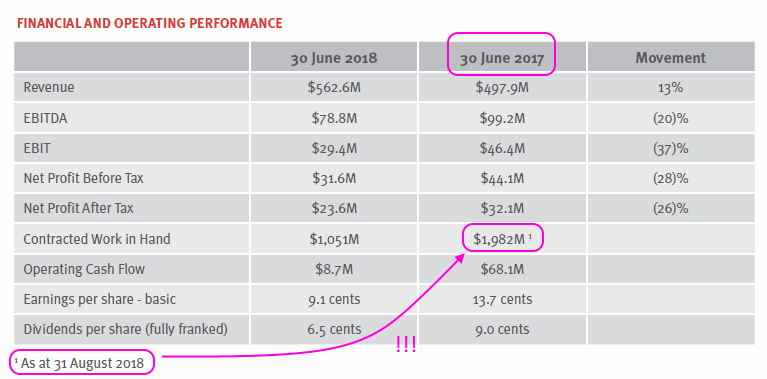

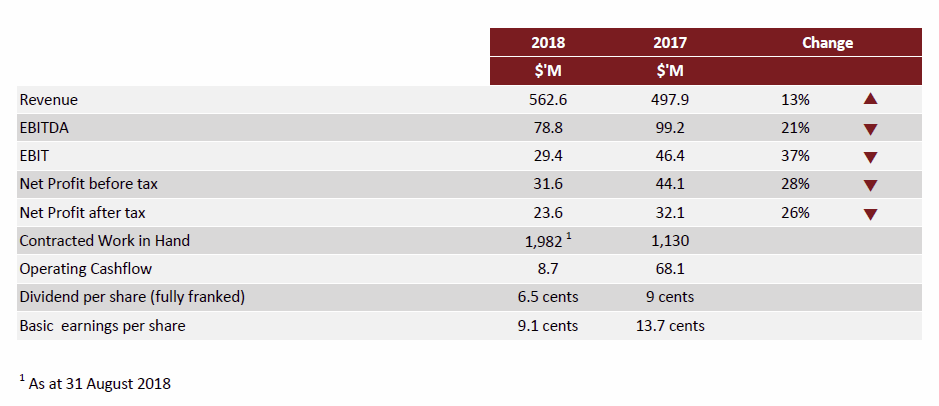

=> da hat sich ein kleiner Fehler eingeschlichen (auch Geschäftsberichte von börsennotierten Unternehmen haben ab und zu Fehler!)

=> richtig lautet es ein paar Seiten später:

=> mit anderen Worten:

• die Contracted Work in Hand hat deutlich zugenommen von 2017 zu 2018!

aus dem AR2018

=> da hat sich ein kleiner Fehler eingeschlichen (auch Geschäftsberichte von börsennotierten Unternehmen haben ab und zu Fehler!)

=> richtig lautet es ein paar Seiten später:

=> mit anderen Worten:

• die Contracted Work in Hand hat deutlich zugenommen von 2017 zu 2018!