Meine kleine Sammlung an Börsenstatistiken (Seite 2)

eröffnet am 02.08.17 21:51:33 von

neuester Beitrag 03.01.24 14:57:17 von

neuester Beitrag 03.01.24 14:57:17 von

Beiträge: 204

ID: 1.258.587

ID: 1.258.587

Aufrufe heute: 6

Gesamt: 23.449

Gesamt: 23.449

Aktive User: 0

ISIN: US78378X1072 · WKN: CG3AA5

5.065,04

PKT

+0,19 %

+9,80 PKT

Letzter Kurs 17.04.24 Citigroup

Neuigkeiten

12:21 Uhr · wallstreetONLINE Redaktion |

07:28 Uhr · wallstreetONLINE Redaktion |

24.04.24 · dpa-AFX |

24.04.24 · dpa-AFX |

24.04.24 · dpa-AFX |

Beitrag zu dieser Diskussion schreiben

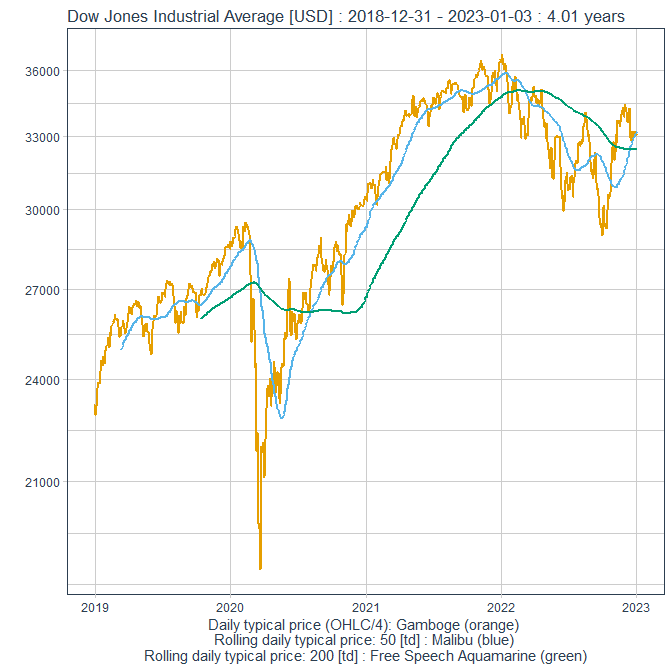

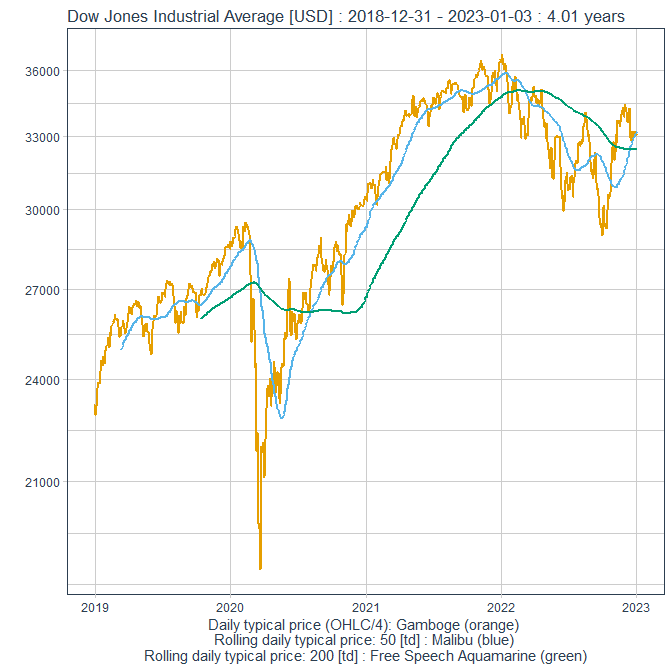

Antwort auf Beitrag Nr.: 59.567.456 von faultcode am 06.01.19 01:15:11Golden cross im DJIA im Dezember 2022:

S&P

S&P 500: "3925 sind in der ersten Woche problemlos möglich"https://www.wallstreet-online.de/nachricht/16384649-wisslers…

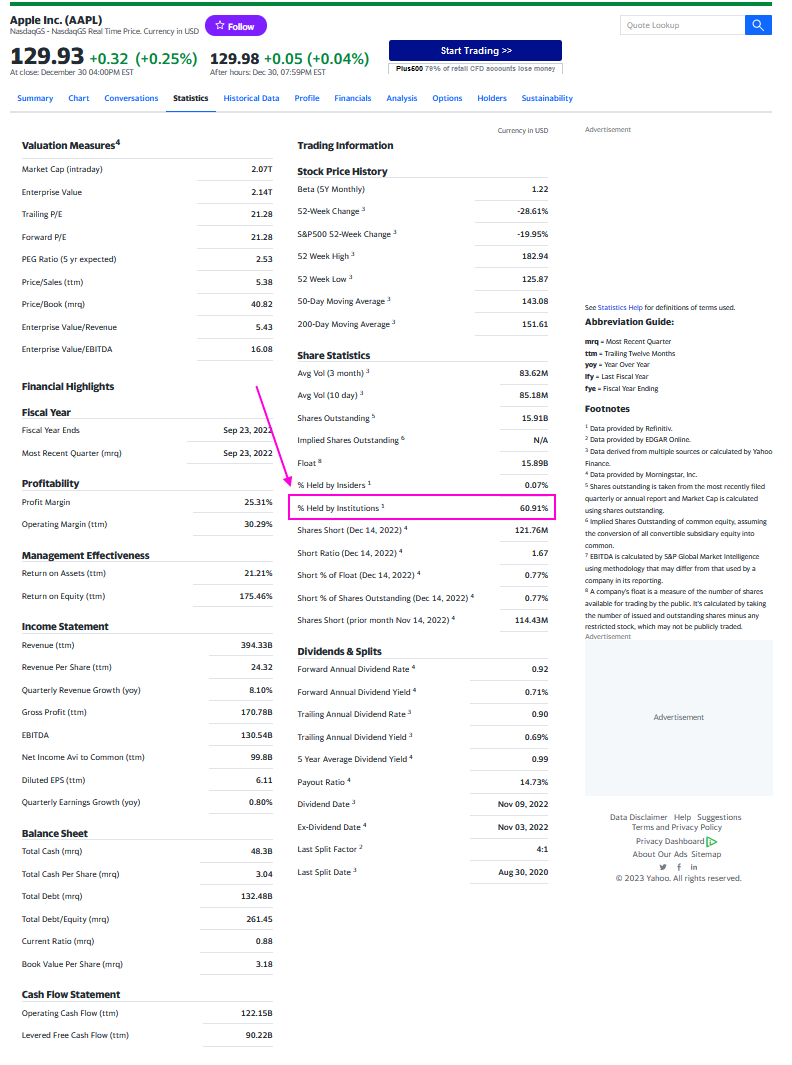

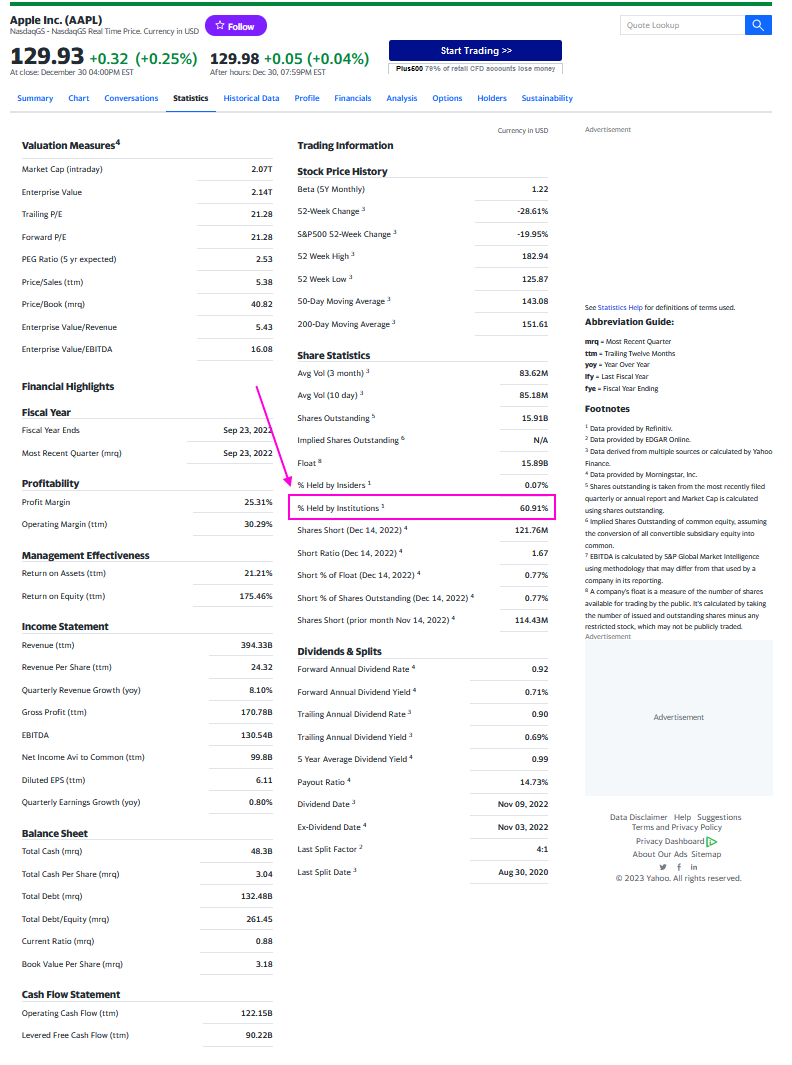

Maschinelles Auslesen von Fundamental-Daten bei Yahoo Finance -- z.B. für alle Komponenten in einem Aktienindex:

https://pastebin.com/uBPPQbpd

--> Python Script, um z.B. auf diese Werte hier zuzugreifen:

...

https://finance.yahoo.com/quote/aapl/key-statistics?p=aapl (*)

also oben für alle NASDAQ100-Komponenten die "% Held by Institutions".

Wie man sieht (stackoverflow.com/...) gibt es dabei heutzutage zwei "Negertricks", so liest man z.B. diese URL (*) eben nicht direkt aus

Früher war sowas (viel) einfacher, aber heutzutage sperren sich viele (populäre, kommerzielle) Webseiten erfolgreich gegen Web scraping, weil ja Refinitiv und Co. auch ein paar Dollar sehen wollen.

nasdaq.com z.B. sperrt sich erfolgreich gegen so ein GET request, zumindest so wie ich es implementierte:

Das Script funktioniert (derzeit) und legt eben eine csv-Datei mit den Ergebnissen zu allen Stock-Symbolen an.

Allerdings sind die dortigen Fundamentaldaten auch mit Vorsicht zu genießen, ich halte sie oftmals auch für falsch. GLOBALFOUNDRIES Inc. (GFS) z.B. steht da mit 103.11%

Bei anderen (NASDAQ100-)Werten erscheint mir diese Angabe als viel zu niedrig, da von den Rohdaten-Lieferanten mMn als viel zu aufwendig zu ermitteln in einem regulären Zyklus.

Aber Daten-Qualität ist ein anderes Thema.

Nebenbei: solche Index-Stock-Symbole kann man einfach manuell bei Investing.com auslesen:

https://www.investing.com/indices/nq-100-components

Diese Symbole könnte man auch zuvor in einer csv-Datei ablegen. Beim NASDAQ100 ändern die sich aber nur regulär jährlich im Dezember, außer bei Sonder-Situationen.

https://pastebin.com/uBPPQbpd

--> Python Script, um z.B. auf diese Werte hier zuzugreifen:

...

https://finance.yahoo.com/quote/aapl/key-statistics?p=aapl (*)

also oben für alle NASDAQ100-Komponenten die "% Held by Institutions".

Wie man sieht (stackoverflow.com/...) gibt es dabei heutzutage zwei "Negertricks", so liest man z.B. diese URL (*) eben nicht direkt aus

Früher war sowas (viel) einfacher, aber heutzutage sperren sich viele (populäre, kommerzielle) Webseiten erfolgreich gegen Web scraping, weil ja Refinitiv und Co. auch ein paar Dollar sehen wollen.

nasdaq.com z.B. sperrt sich erfolgreich gegen so ein GET request, zumindest so wie ich es implementierte:

resp = requests.get(URL, headers=headers)

Das Script funktioniert (derzeit) und legt eben eine csv-Datei mit den Ergebnissen zu allen Stock-Symbolen an.

Allerdings sind die dortigen Fundamentaldaten auch mit Vorsicht zu genießen, ich halte sie oftmals auch für falsch. GLOBALFOUNDRIES Inc. (GFS) z.B. steht da mit 103.11%

Bei anderen (NASDAQ100-)Werten erscheint mir diese Angabe als viel zu niedrig, da von den Rohdaten-Lieferanten mMn als viel zu aufwendig zu ermitteln in einem regulären Zyklus.

Aber Daten-Qualität ist ein anderes Thema.

Nebenbei: solche Index-Stock-Symbole kann man einfach manuell bei Investing.com auslesen:

https://www.investing.com/indices/nq-100-components

Diese Symbole könnte man auch zuvor in einer csv-Datei ablegen. Beim NASDAQ100 ändern die sich aber nur regulär jährlich im Dezember, außer bei Sonder-Situationen.

S&P

Diese fünf Handelstage ruinierten das Börsenjahr 2022https://www.wallstreet-online.de/nachricht/16379416-95-s-p-5…

S&P

Diese 6 Mega-Caps sind für die Hälfte des S&P 500-Wertverlusts verantwortlichhttps://www.wallstreet-online.de/nachricht/16379266-jahr-hor…

ein kontroverses, aber interessantes Papier:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4246321

<The presence of the index fund (or a decrease in the fee charged by the index fund) tends to increase stock market participation and thus increase asset prices and decrease expected returns from investing in the stock market.>

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4246321

<The presence of the index fund (or a decrease in the fee charged by the index fund) tends to increase stock market participation and thus increase asset prices and decrease expected returns from investing in the stock market.>

2022-11

How Many Stocks Should You Own?

https://ndvr.com/journal/how-many-stocks-should-you-own

=> 5 PDF-Seiten:

How Many Stocks Should You Own?

https://ndvr.com/journal/how-many-stocks-should-you-own

=> 5 PDF-Seiten:

23.8.

Julian Robertson, founder of Tiger Management, dies at 90

https://www.msn.com/en-us/money/savingandinvesting/julian-ro…

...

Julian H. Robertson, the founder of Tiger Management LLC and mentor for a generation of hedge fund managers known as “Tiger Cubs,” has died at the age of 90.

Bloomberg reported his death on Tuesday, citing his longtime spokesman, Fraser Seitel.

Robertson built Tiger Management into one of the most successful hedge fund firms, starting with $8 million in assets and growing to more than $21 billion. One expert called him one of the “true founding fathers of the modern hedge fund industry."

Along the way, he mentored a generation of some of the biggest hedge fund stars of our time, including Robert Citrone and Chase Coleman. Notably, Bill Hwang was also a "Tiger Cub" before being criminally charged with securities fraud in April of this year in connection with the far-reaching collapse of his family office, Archegos Capital Management.

Julian Hart Robertson, Jr. was born on June 25, 1932, in Salisbury, North Carolina, a small town located in the state’s Piedmont region.

“It was a wonderful place to grow up. I think everyone should be required to grow up in a small town,” Robertson said in his distinctly southern accent during a 2013 interview with OneWire.

He spent his high school years at boarding school at Episcopal High School in Alexandria, Virginia.

“That was the place that meant the most to me educationally. That and the U.S. Navy,” Robertson told OneWire.

He graduated from the University of North Carolina, Chapel Hill in 1955. While in college, he was a member of the Zeta Psi fraternity.

After college, he served in the Navy for two years before beginning his career on Wall Street as a stockbroker for Kidder, Peabody & Co. By 1974, Robertson was serving as CEO of Webster Management Corporation, the firm’s investment advisory subsidiary.

In 1978, Robertson departed Kidder, Peabody and traveled to New Zealand where he planned to write a novel. He would later become an owner of luxury golf resorts and a vineyard in New Zealand.

“I think I realized what we were doing was the wrong way of investing. We were doing the conventional stuff of 15% bonds, 85% stocks, or something of that nature. I think I realized pretty quickly that what we should be doing — because I ran my account this way — was running a hedge fund,” Robertson told OneWire.

In 1980, at the age of 48, Robertson launched Tiger Management, a long-short equity hedge fund that also moved into global equities, commodities, currencies, and bonds.

“He was a charmer in a southern way, a networker in a New York way; and far from being coldly in control, his mood could swing alarmingly. Tall, confident, and athletic of build, he was a guy’s guy, a jock’s jock, and he hired in his own image,” Sebastian Mallaby wrote in his best-selling book “More Money Than God.”

Aside from stellar investment success, Robertson had a gift for picking the best talent. During his career, Robertson seeded dozens of so-called “Tiger Cubs,” protégé analysts and portfolio managers who would also build some of the most successful hedge fund firms, including Philippe Laffont of Coatue, Chase Coleman of Tiger Global, Lee Ainslie of Maverick, John Griffin of Blue Ridge Capital, Steve Mandel of Lone Pine, and many more.

“The most important things with hedge fund managers [is] that they are smart and that they are honest. Close behind that is probably competitiveness. We really like competitors. Someone who won’t lose, doesn’t lose,” he told OneWire.

In his 2008 book, “Julian Robertson: A Tiger in the Land of Bulls and Bears,” Daniel Strachman wrote of Robertson’s “competitive streak that runs deep in his veins, and he unleashes it not only when he is trading or investing but also in his everyday life, including when he is relaxing on the golf course.”

Robertson, whose roots were in value investing, saw his hedge fund’s performance decline in the late 1990s as internet and tech stocks ripped higher. A critic of high-flying tech stocks, Robertson closed his hedge fund firm and returned money to investors in 2000 right before the dot-com bubble burst.

He continued to operate Tiger Management as a family-office hedge fund, managing his personal fortune. Robertson’s wife of 38 years, Josephine Tucker Robertson, died in 2010 at the age of 67. Her obituary in The New York Times noted that she and her husband were leading supporters of the Central Park Conservancy and Lincoln Center for the Performing Arts.

Julian Robertson, founder of Tiger Management, dies at 90

https://www.msn.com/en-us/money/savingandinvesting/julian-ro…

...

Julian H. Robertson, the founder of Tiger Management LLC and mentor for a generation of hedge fund managers known as “Tiger Cubs,” has died at the age of 90.

Bloomberg reported his death on Tuesday, citing his longtime spokesman, Fraser Seitel.

Robertson built Tiger Management into one of the most successful hedge fund firms, starting with $8 million in assets and growing to more than $21 billion. One expert called him one of the “true founding fathers of the modern hedge fund industry."

Along the way, he mentored a generation of some of the biggest hedge fund stars of our time, including Robert Citrone and Chase Coleman. Notably, Bill Hwang was also a "Tiger Cub" before being criminally charged with securities fraud in April of this year in connection with the far-reaching collapse of his family office, Archegos Capital Management.

Julian Hart Robertson, Jr. was born on June 25, 1932, in Salisbury, North Carolina, a small town located in the state’s Piedmont region.

“It was a wonderful place to grow up. I think everyone should be required to grow up in a small town,” Robertson said in his distinctly southern accent during a 2013 interview with OneWire.

He spent his high school years at boarding school at Episcopal High School in Alexandria, Virginia.

“That was the place that meant the most to me educationally. That and the U.S. Navy,” Robertson told OneWire.

He graduated from the University of North Carolina, Chapel Hill in 1955. While in college, he was a member of the Zeta Psi fraternity.

After college, he served in the Navy for two years before beginning his career on Wall Street as a stockbroker for Kidder, Peabody & Co. By 1974, Robertson was serving as CEO of Webster Management Corporation, the firm’s investment advisory subsidiary.

In 1978, Robertson departed Kidder, Peabody and traveled to New Zealand where he planned to write a novel. He would later become an owner of luxury golf resorts and a vineyard in New Zealand.

“I think I realized what we were doing was the wrong way of investing. We were doing the conventional stuff of 15% bonds, 85% stocks, or something of that nature. I think I realized pretty quickly that what we should be doing — because I ran my account this way — was running a hedge fund,” Robertson told OneWire.

In 1980, at the age of 48, Robertson launched Tiger Management, a long-short equity hedge fund that also moved into global equities, commodities, currencies, and bonds.

“He was a charmer in a southern way, a networker in a New York way; and far from being coldly in control, his mood could swing alarmingly. Tall, confident, and athletic of build, he was a guy’s guy, a jock’s jock, and he hired in his own image,” Sebastian Mallaby wrote in his best-selling book “More Money Than God.”

Aside from stellar investment success, Robertson had a gift for picking the best talent. During his career, Robertson seeded dozens of so-called “Tiger Cubs,” protégé analysts and portfolio managers who would also build some of the most successful hedge fund firms, including Philippe Laffont of Coatue, Chase Coleman of Tiger Global, Lee Ainslie of Maverick, John Griffin of Blue Ridge Capital, Steve Mandel of Lone Pine, and many more.

“The most important things with hedge fund managers [is] that they are smart and that they are honest. Close behind that is probably competitiveness. We really like competitors. Someone who won’t lose, doesn’t lose,” he told OneWire.

In his 2008 book, “Julian Robertson: A Tiger in the Land of Bulls and Bears,” Daniel Strachman wrote of Robertson’s “competitive streak that runs deep in his veins, and he unleashes it not only when he is trading or investing but also in his everyday life, including when he is relaxing on the golf course.”

Robertson, whose roots were in value investing, saw his hedge fund’s performance decline in the late 1990s as internet and tech stocks ripped higher. A critic of high-flying tech stocks, Robertson closed his hedge fund firm and returned money to investors in 2000 right before the dot-com bubble burst.

He continued to operate Tiger Management as a family-office hedge fund, managing his personal fortune. Robertson’s wife of 38 years, Josephine Tucker Robertson, died in 2010 at the age of 67. Her obituary in The New York Times noted that she and her husband were leading supporters of the Central Park Conservancy and Lincoln Center for the Performing Arts.

"Black Swan Indicator" - SP 500 - sauber vorhergesagt

Der"Black Swan Indicator" hat sauber ins Schwarze getroffen:

2021

Should Passive Investors Actively Manage Their Trades?

Sida Li

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3967799

...

VI. Conclusion

In this paper I analyze the trading behaviors of passive-investing ETFs and calculate their transaction costs. I find that 56% of ETFs follow mechanical trading strategies that abruptly rebalance at the closing price of an index reconstitution date, although their trading dates and tickers are both publicly known 5 days before a reconstitution.

These ETFs experience a hefty 67 bps execution shortfall for their trades. This high cost is especially surprising because ETF rebalance trades are generally rule-based and not information-driven. Given these poor execution strategies, these uninformed mechanical traders are paying higher execution costs than informed traders.

Camouflaging either what or when to trade reduces transaction costs for ETFs. Self-indexing ETFs choose to track private indices to hide their trading interests. Opaque ETFs camouflage their rebalancing schedules and use alternative rebalance paces. The savings per trade involved with these two approaches are about 30–34 bps, which translates to about 9.6 bps per year of AUM. If 56% of U.S. ETFs operating in the $3 trillion passive ETF industry are not rebalancing optimally, $1.7 billion in rebalancing costs can be saved with smarter rebalancing strategies.

The optimal order-execution problem is complex for all market participants, so large buy-side institutional traders typically develop complex algorithms to execute their trades. For example, these investors deploy various order-splitting algorithms (Almgren and Chriss 2000, Obizhaeva and Wang 2013, Li and Ye 2021), use sophisticated order types (Li, Ye, and Zheng 2021), or even use atomic clocks (Baldauf and Mollner 2020) to minimize transaction costs and avoid being exploited by front-runners.

I provide evidence that even not-so-complex execution strategies, e.g., simply camouflaging either the timing or the underlying stock of a trade, can lead to considerable execution-cost savings for passive investors.

Should Passive Investors Actively Manage Their Trades?

Sida Li

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3967799

...

VI. Conclusion

In this paper I analyze the trading behaviors of passive-investing ETFs and calculate their transaction costs. I find that 56% of ETFs follow mechanical trading strategies that abruptly rebalance at the closing price of an index reconstitution date, although their trading dates and tickers are both publicly known 5 days before a reconstitution.

These ETFs experience a hefty 67 bps execution shortfall for their trades. This high cost is especially surprising because ETF rebalance trades are generally rule-based and not information-driven. Given these poor execution strategies, these uninformed mechanical traders are paying higher execution costs than informed traders.

Camouflaging either what or when to trade reduces transaction costs for ETFs. Self-indexing ETFs choose to track private indices to hide their trading interests. Opaque ETFs camouflage their rebalancing schedules and use alternative rebalance paces. The savings per trade involved with these two approaches are about 30–34 bps, which translates to about 9.6 bps per year of AUM. If 56% of U.S. ETFs operating in the $3 trillion passive ETF industry are not rebalancing optimally, $1.7 billion in rebalancing costs can be saved with smarter rebalancing strategies.

The optimal order-execution problem is complex for all market participants, so large buy-side institutional traders typically develop complex algorithms to execute their trades. For example, these investors deploy various order-splitting algorithms (Almgren and Chriss 2000, Obizhaeva and Wang 2013, Li and Ye 2021), use sophisticated order types (Li, Ye, and Zheng 2021), or even use atomic clocks (Baldauf and Mollner 2020) to minimize transaction costs and avoid being exploited by front-runners.

I provide evidence that even not-so-complex execution strategies, e.g., simply camouflaging either the timing or the underlying stock of a trade, can lead to considerable execution-cost savings for passive investors.

12:21 Uhr · wallstreetONLINE Redaktion · Waste Management |

07:28 Uhr · wallstreetONLINE Redaktion · SAP |

24.04.24 · dpa-AFX · Boeing |

24.04.24 · dpa-AFX · Boeing |

24.04.24 · dpa-AFX · ASM International |

24.04.24 · wallstreetONLINE Redaktion · DAX |

24.04.24 · wallstreetONLINE Redaktion · Dow Jones |

24.04.24 · dpa-AFX · Advanced Micro Devices |

23.04.24 · dpa-AFX · Danaher |

| Zeit | Titel |

|---|---|

| 23.04.24 | |

| 21.04.24 | |

| 26.03.24 | |

| 14.03.24 | |

| 22.02.24 | |

| 13.02.24 | |

| 13.02.24 | |

| 30.01.24 | |

| 26.01.24 | |

| 22.01.24 |