Aya Gold & Silver - Silberproduzent in Marokko

eröffnet am 31.08.17 19:58:27 von

neuester Beitrag 17.04.24 17:45:33 von

neuester Beitrag 17.04.24 17:45:33 von

Beiträge: 53

ID: 1.260.743

ID: 1.260.743

Aufrufe heute: 0

Gesamt: 4.907

Gesamt: 4.907

Aktive User: 0

ISIN: CA05466C1095 · WKN: A2QAQY · Symbol: 0HE1

9,4400

EUR

-0,16 %

-0,0150 EUR

Letzter Kurs 24.04.24 Tradegate

Neuigkeiten

16.04.24 · globenewswire |

28.03.24 · globenewswire |

26.03.24 · Der Aktionär TV |

22.03.24 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7850 | +38,94 | |

| 0,7950 | +30,33 | |

| 55,80 | +15,41 | |

| 0,7999 | +14,27 | |

| 11,250 | +12,73 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7122 | -9,53 | |

| 4,8380 | -9,71 | |

| 17,310 | -9,98 | |

| 186,20 | -10,48 | |

| 4,2300 | -17,86 |

Beitrag zu dieser Diskussion schreiben

ich meinte nur den zeitraum seit anfang märz!

Antwort auf Beitrag Nr.: 75.632.522 von nicolani am 17.04.24 08:49:40

Nicht nur Tage:

Zitat von nicolani: sieht doch wirklich gut aus, auch die kursentwicklung der letzten tage!

Nicht nur Tage:

sieht doch wirklich gut aus, auch die kursentwicklung der letzten tage!

72moz Silver and 2.1moz Au or 352moz AgEq at 427 g/t AgEq

(implies 4.1moz AuEq @ 5 g/t)

continues to grow and remains open in all directions

Aya Gold & Silver Announces Robust Mineral Resource Estimate at Boumadine

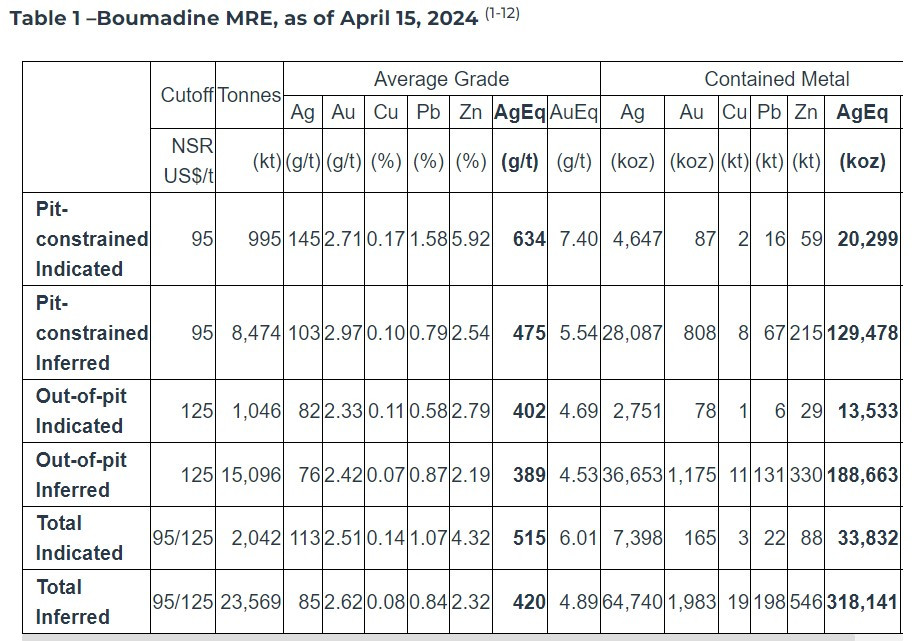

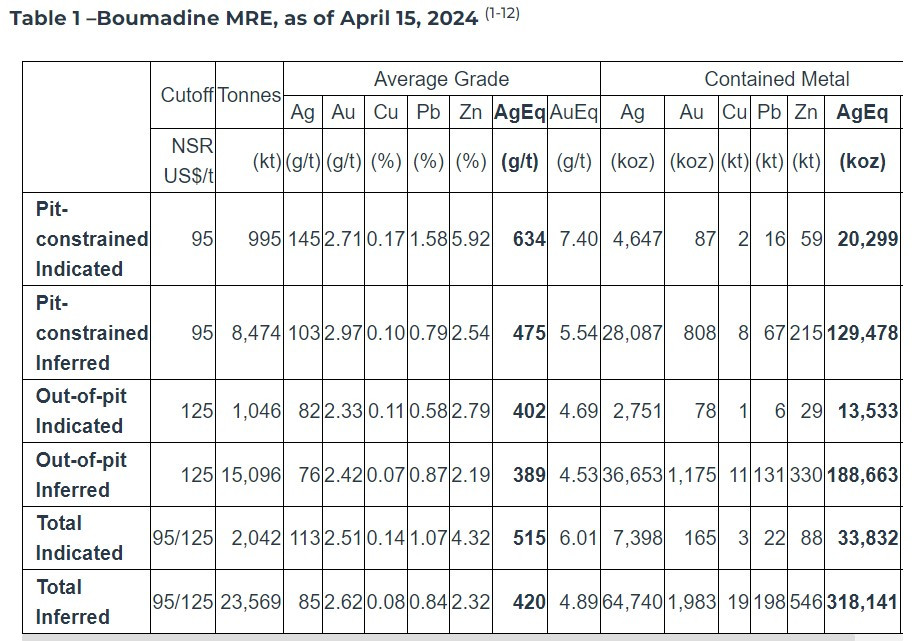

MONTREAL, April 16, 2024 - Aya Gold & Silver Inc. (TSX: AYA) is pleased to announce a Mineral Resource Estimate prepared in accordance with National Instrument 43-101 at its Boumadine Project in the Kingdom of Morocco.

Highlights

- Indicated Mineral Resources of 2.0Mt at 113 g/t Ag, 2.51 g/t Au, 4.32% Zn and 1.07% Pb containing an estimated 7.4 Moz of Ag, 165 koz of Au, 88 kt of Zn and 22 kt of Pb.

- Inferred Mineral Resources of 23.6 Mt at 85g/t Ag, 2.62 g/t Au, 2.32% Zn and 0.84% Pb containing an estimated 64.7 Moz of Ag, 1.98 Moz of Au, 546 kt of Zn and 198 kt of Pb.

- 41% of the Inferred Mineral Resource is pit-constrained and reported above a cut-off net smelter royalty (“NSR”) value of $95/t, and 59% deemed for underground development NSR cut-off value of US$125/t.

- Additional Mineral Resource potential exists to expand the deposit in all directions for future Mineral Resource estimation. Less than 10% of the Boumadine land package has been drilled, and new targets are being generated by the ongoing geophysical airborne survey.

“We are thrilled to announce a Mineral Resource update at Boumadine, which represents a significant milestone for the Corporation,” said Benoit La Salle, President & CEO. “In under two years, we have delivered 72 Moz of silver and 2.1 Moz of Au or 352 Moz AgEq at 427 g/t AgEq in all classifications from a mineralized footprint that continues to grow and remains open in all directions. This result implies presence of 4.1 Moz AuEq at 5 g/t AuEq. Additionally, drilling has focused solely on the mining permit, a small portion of the overall mineralized footprint. We will continue to consolidate the area and aggressively drill the extensions of the main trend with a view to growing the Mineral Resource.

https://www.globenewswire.com/news-release/2024/04/16/286346…

(implies 4.1moz AuEq @ 5 g/t)

continues to grow and remains open in all directions

Aya Gold & Silver Announces Robust Mineral Resource Estimate at Boumadine

MONTREAL, April 16, 2024 - Aya Gold & Silver Inc. (TSX: AYA) is pleased to announce a Mineral Resource Estimate prepared in accordance with National Instrument 43-101 at its Boumadine Project in the Kingdom of Morocco.

Highlights

- Indicated Mineral Resources of 2.0Mt at 113 g/t Ag, 2.51 g/t Au, 4.32% Zn and 1.07% Pb containing an estimated 7.4 Moz of Ag, 165 koz of Au, 88 kt of Zn and 22 kt of Pb.

- Inferred Mineral Resources of 23.6 Mt at 85g/t Ag, 2.62 g/t Au, 2.32% Zn and 0.84% Pb containing an estimated 64.7 Moz of Ag, 1.98 Moz of Au, 546 kt of Zn and 198 kt of Pb.

- 41% of the Inferred Mineral Resource is pit-constrained and reported above a cut-off net smelter royalty (“NSR”) value of $95/t, and 59% deemed for underground development NSR cut-off value of US$125/t.

- Additional Mineral Resource potential exists to expand the deposit in all directions for future Mineral Resource estimation. Less than 10% of the Boumadine land package has been drilled, and new targets are being generated by the ongoing geophysical airborne survey.

“We are thrilled to announce a Mineral Resource update at Boumadine, which represents a significant milestone for the Corporation,” said Benoit La Salle, President & CEO. “In under two years, we have delivered 72 Moz of silver and 2.1 Moz of Au or 352 Moz AgEq at 427 g/t AgEq in all classifications from a mineralized footprint that continues to grow and remains open in all directions. This result implies presence of 4.1 Moz AuEq at 5 g/t AuEq. Additionally, drilling has focused solely on the mining permit, a small portion of the overall mineralized footprint. We will continue to consolidate the area and aggressively drill the extensions of the main trend with a view to growing the Mineral Resource.

https://www.globenewswire.com/news-release/2024/04/16/286346…

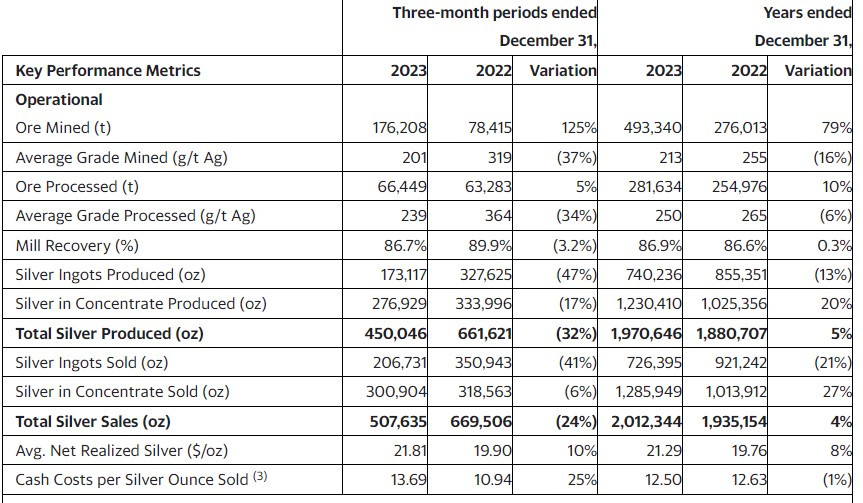

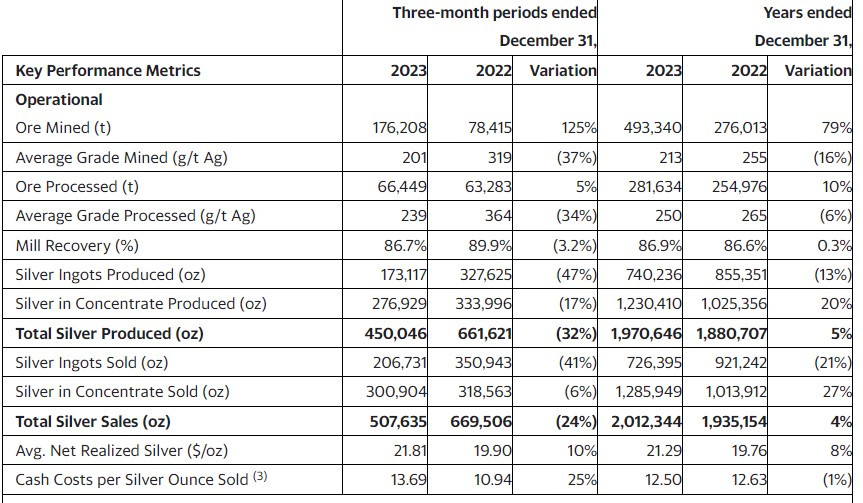

Die head grades sind deutlich gesunken, das könnte den Kursrückgang gestern erklären. Allerdings darf nicht übersehen werden, dass jetzt die open pit mine voll in Produktion gegangen ist:

... 1,109 tpd from underground mining and 243 tpd from the open pit. The open-pit operation started in Q3-2023 and reached 1,035 tpd in December.

Im Dezember gab es auch einen mill shutdown so dass jetzt over 113Kt of ore auf Halde liegen.

Ore Grade Mined

Q4 2023: 201 (g/t Ag)

Q4 2022: 319 (g/t Ag)

-37%

Ore Grade Processed

Q42023: 239 (g/t Ag)

Q4 2022: 364 (g/t Ag)

-34%

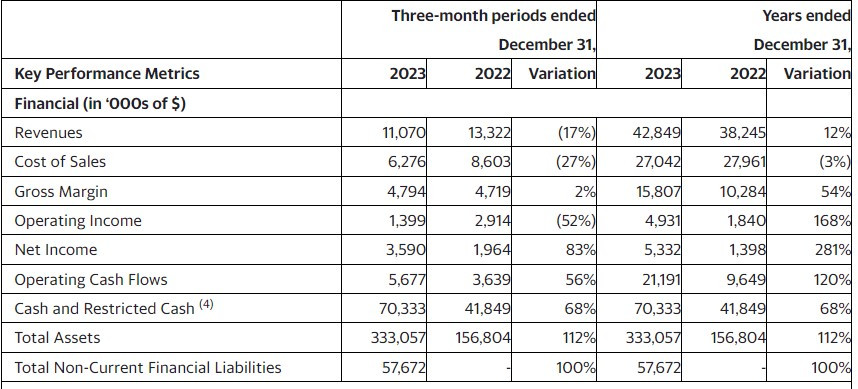

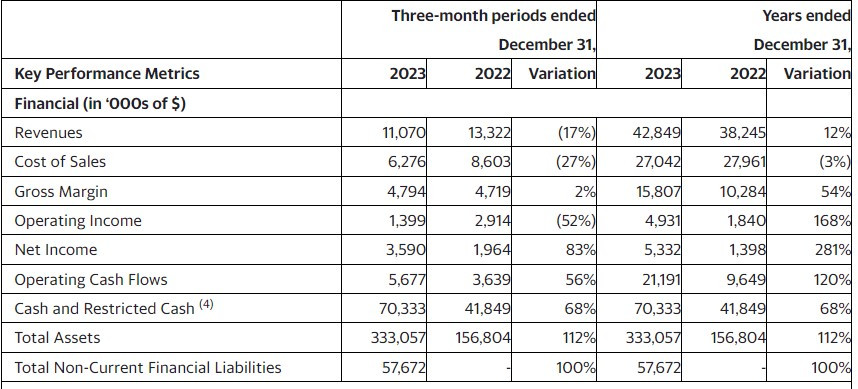

Aya Gold & Silver: Record 2023 Production, Revenue and Operating Cash Flow

MONTREAL, March 28, 2024 - Aya Gold & Silver Inc. (TSX: AYA) is pleased to announce financial and operational results for the fourth quarter and year ended December 31, 2023. All amounts are in US dollars, unless otherwise stated.

2023 Annual Financial & Operational Highlights

- Record silver production of 1,970,646 oz, of which 1,230,410 oz as silver concentrate and 740,236 oz as silver ingots, in 2023.

- Mill average processed grade of 250 g/t Ag was recorded in 2023 compared to 265 g/t Ag in 2022, a decrease of 6%.

- Milling operations averaged 772 tpd in 2023 compared to 699 tpd in 2022, an increase of 10%.

- Average combined mill recovery of 86.9% in 2023 compared to 86.6% in 2022.

- Plant availability reached 91.6% and 95.6% for the flotation and cyanidation plants, respectively.

- Cost of sales of $27,042 (2022 – $27,961) with an average cash cost per silver ounce sold of $12.50/oz in 2023 compared to $12.63/oz in 2022

Kein AISC ausgeworfen!!!

- Revenue from silver sales for 2023 totaled $42,849 (2022 – $38,245), an increase of 12%

representing an average realized price of $21.29 per oz. (2022 - $19.76/oz).

- Operations generated a gross margin of $15,807 in 2023 compared to $10,284 in 2022, an increase of 54%.

- Net income was $5,332 (diluted EPS of $0.04) in 2023, compared to a net of $1,398 (diluted EPS of $0.01) in 2022.

- Robust financial position with $70.3 million of cash, cash equivalents and restricted cash as at December 31, 2023, compared to $41.8 million as at December 31, 2022

Fourth Quarter 2023 Financial & Operational Highlights

- Quarterly silver production of 450,046 oz, comprising 276,929 oz as silver concentrate and 173,117 oz as silver ingots.

- Mill average processed grade of 239 g/t Ag was recorded in Q4-2023 compared to 364 g/t Ag in Q4-2022, a decrease of 34%.

- Milling operations reached 722 tpd, continuing to surpass design capacity of 700 tpd.

- Average combined mill recovery of 86.7% in Q4-2023 compared to 89.9% in Q4-2022, a decrease of 3.2%.

- Plant availabilities reached 86.7% and 96.0% for the flotation and cyanidation plants, respectively.

- Cash flow generated by operating activities of $5,677 in Q4-2023, compared to $3,639 million generated in operating cash flow in Q4-2022.

- Revenue from silver sales totaled $11,070 (Q4-2022 – $13,322) in Q4-2023, a decrease of 17%

representing an average realized price of $21.81 per oz. (Q4-2022 - $19.90/oz).

- Operations generated a gross margin of $4,794, in Q4-2023 compared to $4,719 in Q4-2022, an increase of 2%.

- Net profit was $3,590 (diluted EPS of $0.03) in Q4-2023, compared to net earnings of $1,964 (diluted EPS of $0.02) in Q4-2022.

2024 Outlook and Year So Far

- Successfully completed a C$77.6 million ($57.3 million) bought-deal public financing.

- Drew down $25 million from $100 million project facility for Zgounder Mine expansion, with $85 million disbursed to date.

- 2024 guidance of between 2.6 and 3.2 million oz production at cash cost of between $13.00 and $14.50/oz.

- 2024 exploration budget of $36 million, prioritizing Boumadine (120,000m), Zgounder (15,000m), and Zgounder Regional (10,000m).

https://finance.yahoo.com/news/aya-gold-silver-record-2023-1…

https://ayagoldsilver.com/press-release/aya-gold-announces-2…

... 1,109 tpd from underground mining and 243 tpd from the open pit. The open-pit operation started in Q3-2023 and reached 1,035 tpd in December.

Im Dezember gab es auch einen mill shutdown so dass jetzt over 113Kt of ore auf Halde liegen.

Ore Grade Mined

Q4 2023: 201 (g/t Ag)

Q4 2022: 319 (g/t Ag)

-37%

Ore Grade Processed

Q42023: 239 (g/t Ag)

Q4 2022: 364 (g/t Ag)

-34%

Aya Gold & Silver: Record 2023 Production, Revenue and Operating Cash Flow

MONTREAL, March 28, 2024 - Aya Gold & Silver Inc. (TSX: AYA) is pleased to announce financial and operational results for the fourth quarter and year ended December 31, 2023. All amounts are in US dollars, unless otherwise stated.

2023 Annual Financial & Operational Highlights

- Record silver production of 1,970,646 oz, of which 1,230,410 oz as silver concentrate and 740,236 oz as silver ingots, in 2023.

- Mill average processed grade of 250 g/t Ag was recorded in 2023 compared to 265 g/t Ag in 2022, a decrease of 6%.

- Milling operations averaged 772 tpd in 2023 compared to 699 tpd in 2022, an increase of 10%.

- Average combined mill recovery of 86.9% in 2023 compared to 86.6% in 2022.

- Plant availability reached 91.6% and 95.6% for the flotation and cyanidation plants, respectively.

- Cost of sales of $27,042 (2022 – $27,961) with an average cash cost per silver ounce sold of $12.50/oz in 2023 compared to $12.63/oz in 2022

Kein AISC ausgeworfen!!!

- Revenue from silver sales for 2023 totaled $42,849 (2022 – $38,245), an increase of 12%

representing an average realized price of $21.29 per oz. (2022 - $19.76/oz).

- Operations generated a gross margin of $15,807 in 2023 compared to $10,284 in 2022, an increase of 54%.

- Net income was $5,332 (diluted EPS of $0.04) in 2023, compared to a net of $1,398 (diluted EPS of $0.01) in 2022.

- Robust financial position with $70.3 million of cash, cash equivalents and restricted cash as at December 31, 2023, compared to $41.8 million as at December 31, 2022

Fourth Quarter 2023 Financial & Operational Highlights

- Quarterly silver production of 450,046 oz, comprising 276,929 oz as silver concentrate and 173,117 oz as silver ingots.

- Mill average processed grade of 239 g/t Ag was recorded in Q4-2023 compared to 364 g/t Ag in Q4-2022, a decrease of 34%.

- Milling operations reached 722 tpd, continuing to surpass design capacity of 700 tpd.

- Average combined mill recovery of 86.7% in Q4-2023 compared to 89.9% in Q4-2022, a decrease of 3.2%.

- Plant availabilities reached 86.7% and 96.0% for the flotation and cyanidation plants, respectively.

- Cash flow generated by operating activities of $5,677 in Q4-2023, compared to $3,639 million generated in operating cash flow in Q4-2022.

- Revenue from silver sales totaled $11,070 (Q4-2022 – $13,322) in Q4-2023, a decrease of 17%

representing an average realized price of $21.81 per oz. (Q4-2022 - $19.90/oz).

- Operations generated a gross margin of $4,794, in Q4-2023 compared to $4,719 in Q4-2022, an increase of 2%.

- Net profit was $3,590 (diluted EPS of $0.03) in Q4-2023, compared to net earnings of $1,964 (diluted EPS of $0.02) in Q4-2022.

2024 Outlook and Year So Far

- Successfully completed a C$77.6 million ($57.3 million) bought-deal public financing.

- Drew down $25 million from $100 million project facility for Zgounder Mine expansion, with $85 million disbursed to date.

- 2024 guidance of between 2.6 and 3.2 million oz production at cash cost of between $13.00 and $14.50/oz.

- 2024 exploration budget of $36 million, prioritizing Boumadine (120,000m), Zgounder (15,000m), and Zgounder Regional (10,000m).

https://finance.yahoo.com/news/aya-gold-silver-record-2023-1…

https://ayagoldsilver.com/press-release/aya-gold-announces-2…

es werden weiter folgen!

Aya ist mein erste Silberwert, der sein 52 Hoch überschritten hat:

heute über ein million umsatz in kanada! allerdings ein riesen-trade dabei!

Antwort auf Beitrag Nr.: 75.433.476 von nicolani am 11.03.24 17:45:17

Ich sehe da bei Aya kein Problem, gerade im Vergleich mit der Konkurrenz die sich kaum von ihren 52 Wochen Tiefs erholt haben, steht Aya schon in Reichweite des 52 Wochen Hochs.

AYA.TO

Last 10.68 CAD +0.36 +3.49%

Day Range 10.30 - 10.90

52-Wk Range 6.58 - 11,39

MCap 1.388B

Zitat von nicolani: so langsam könnte hier auch mal bewegung rein kommen!

Ich sehe da bei Aya kein Problem, gerade im Vergleich mit der Konkurrenz die sich kaum von ihren 52 Wochen Tiefs erholt haben, steht Aya schon in Reichweite des 52 Wochen Hochs.

AYA.TO

Last 10.68 CAD +0.36 +3.49%

Day Range 10.30 - 10.90

52-Wk Range 6.58 - 11,39

MCap 1.388B