Goldproduktion in naher Zukunft? - Die letzten 30 Beiträge

eröffnet am 21.02.18 17:51:45 von

neuester Beitrag 21.12.22 17:09:59 von

neuester Beitrag 21.12.22 17:09:59 von

Beiträge: 25

ID: 1.274.706

ID: 1.274.706

Aufrufe heute: 0

Gesamt: 3.253

Gesamt: 3.253

Aktive User: 0

ISIN: AU000000KIN8 · WKN: A1J3NB · Symbol: KIN

0,0670

AUD

-5,63 %

-0,0040 AUD

Letzter Kurs 23.04.24 Sydney

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 30,03 | +17,86 | |

| 16,010 | +17,12 | |

| 0,7999 | +14,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,2100 | -7,80 | |

| 30,60 | -8,38 | |

| 5,5400 | -8,43 | |

| 2,1800 | -9,17 | |

| 4,2300 | -17,86 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 69.084.284 von faultcode am 18.08.21 12:30:53Schade das die rauß geflogen sind.

Antwort auf Beitrag Nr.: 68.917.182 von faultcode am 30.07.21 14:03:22nachdem die Damen und Herren sich nicht meldeten, ist das Teil hier rausgeflogen.

Gut, bei denen zählt offensichtlich nur der Heimatbörsenplatz. Ich werde aber dort (vorerst) nicht zurückkaufen.

Gut, bei denen zählt offensichtlich nur der Heimatbörsenplatz. Ich werde aber dort (vorerst) nicht zurückkaufen.

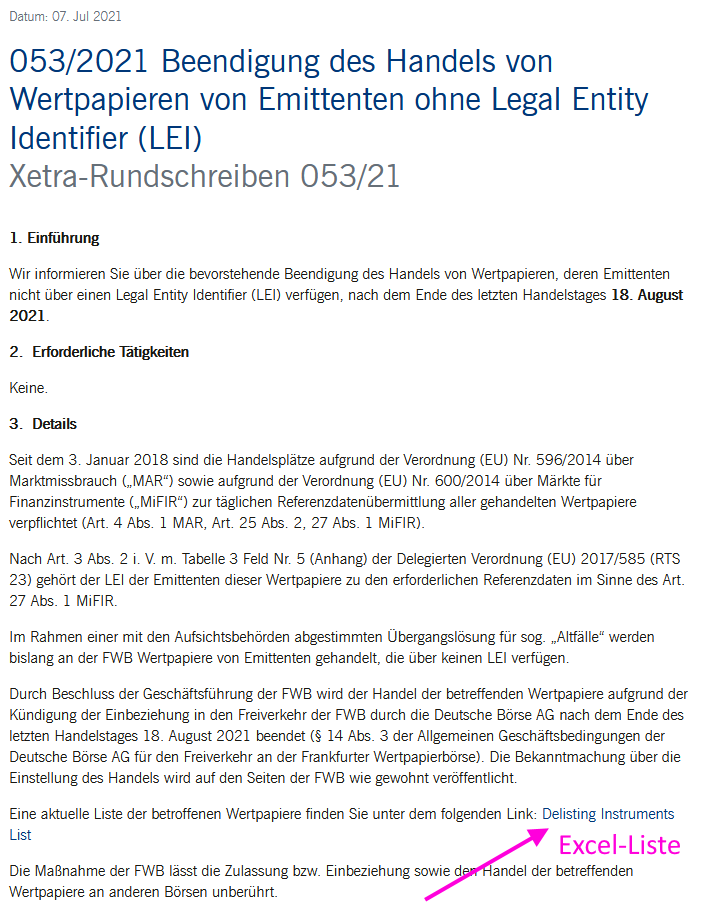

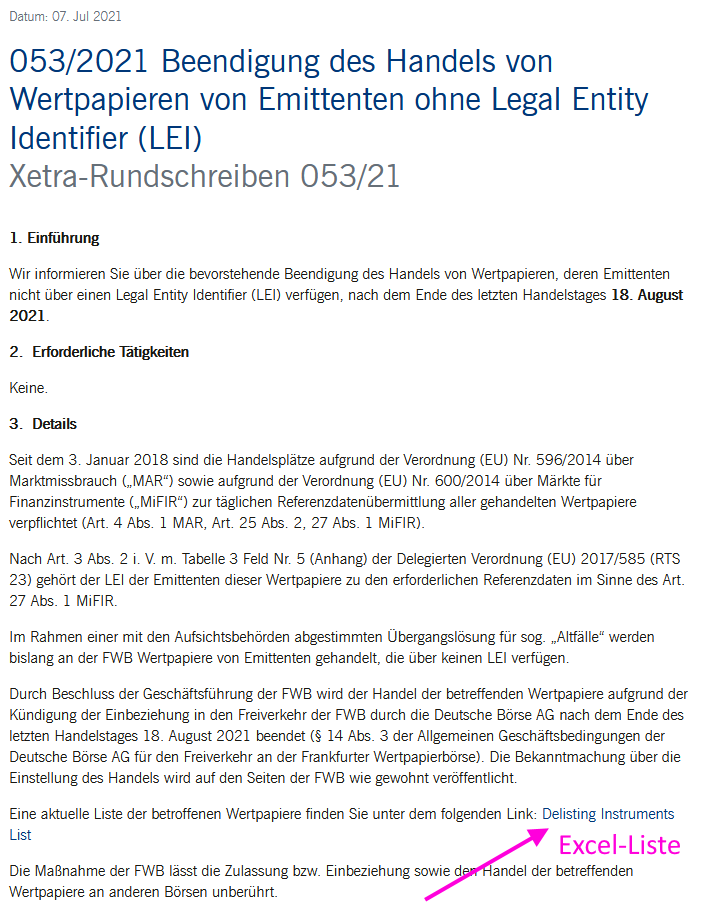

Antwort auf Beitrag Nr.: 68.917.182 von faultcode am 30.07.21 14:03:22https://www.deutsche-boerse-cash-market.com/dbcm-de/newsroom…

hier fehlt auch der LEI = Legal Entity Identifier in Deutschland

=> die Frankfurter Wertpapierbörse will damit den Handel am 18.8.2021 einstellen, da alle Umsätze mit einem LEI weitergemeldet werden müssen

Ich habe Kin Mining eine Email geschrieben, daß sie bitte diese Nummer beantragen: https://www.leinummer.de/

=> die Frankfurter Wertpapierbörse will damit den Handel am 18.8.2021 einstellen, da alle Umsätze mit einem LEI weitergemeldet werden müssen

Ich habe Kin Mining eine Email geschrieben, daß sie bitte diese Nummer beantragen: https://www.leinummer.de/

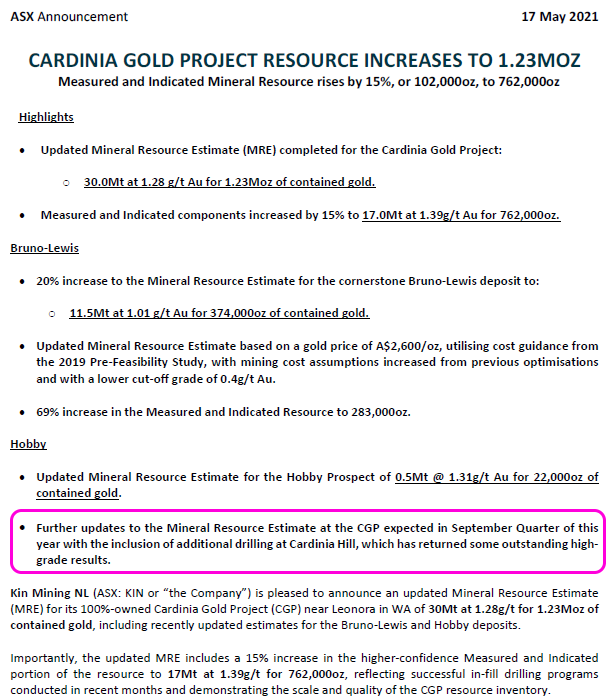

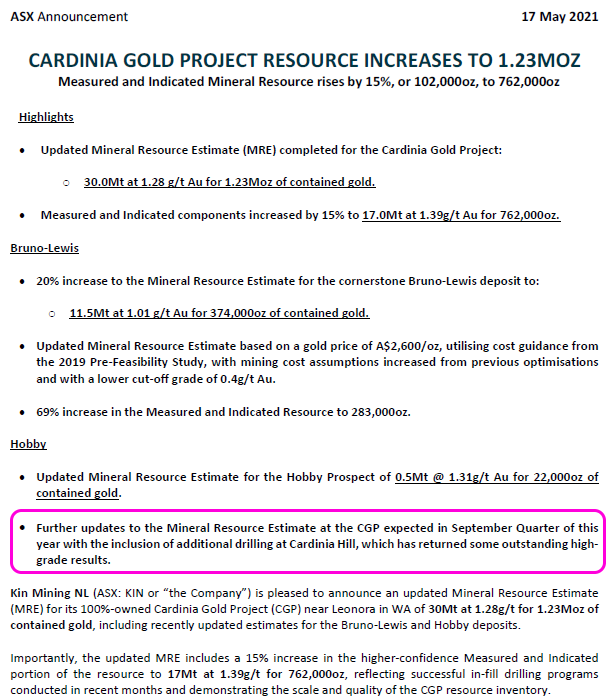

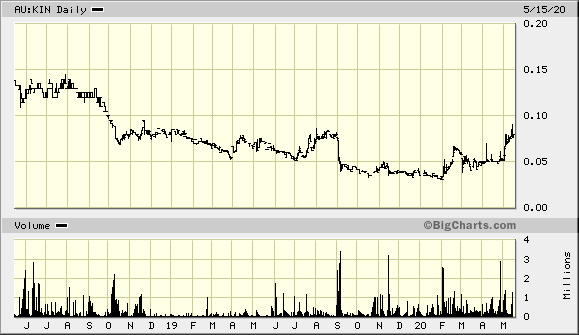

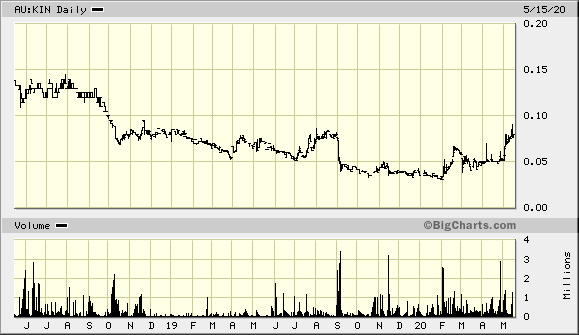

Antwort auf Beitrag Nr.: 66.926.870 von faultcode am 10.02.21 13:02:40dem Markt hat's nicht gefallen:

...

https://www.kinmining.com.au/

=> warten auf September

...

https://www.kinmining.com.au/

=> warten auf September

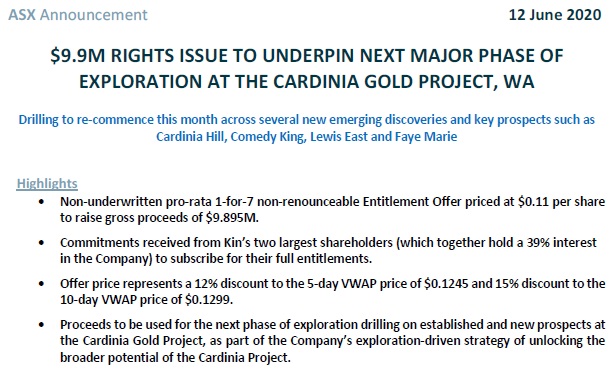

Antwort auf Beitrag Nr.: 65.998.694 von faultcode am 09.12.20 12:06:43erst gab's eine Präsentation und weniger Tage später, also heute, eine KE.

Das hat Geschmäckle:

...

Das hat Geschmäckle:

...

Antwort auf Beitrag Nr.: 64.811.554 von faultcode am 19.08.20 12:16:09Vielen Dank für den Beitrag, ich kann zwar kaum Englisch, darum verstehe ich da nix ,

Aber war das nicht mit allem so Gas, Öl, früher lag es halt auf dem Boden Heute sucht man tiefer.

Darum sagt man ja auch wer sucht der findet, u. je besser der Preis um so mehr suchen.

Viel Glück Ihnen

Aber war das nicht mit allem so Gas, Öl, früher lag es halt auf dem Boden Heute sucht man tiefer.

Darum sagt man ja auch wer sucht der findet, u. je besser der Preis um so mehr suchen.

Viel Glück Ihnen

Antwort auf Beitrag Nr.: 65.084.593 von faultcode am 15.09.20 13:37:06

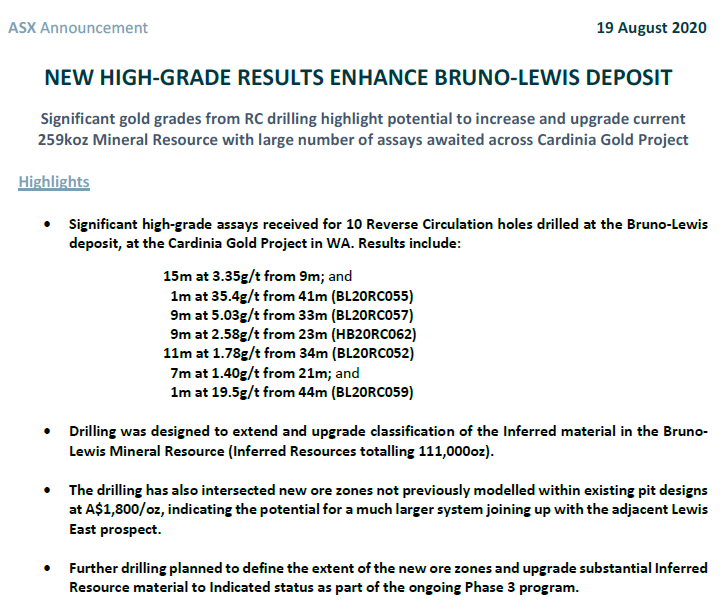

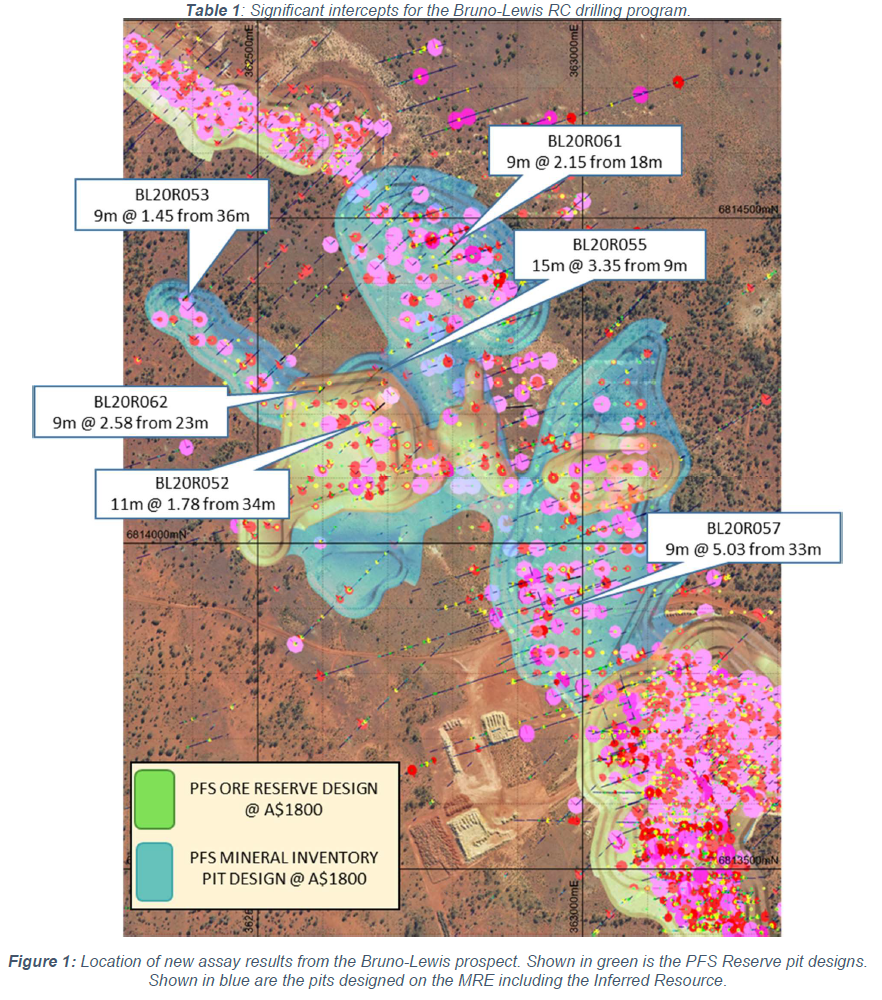

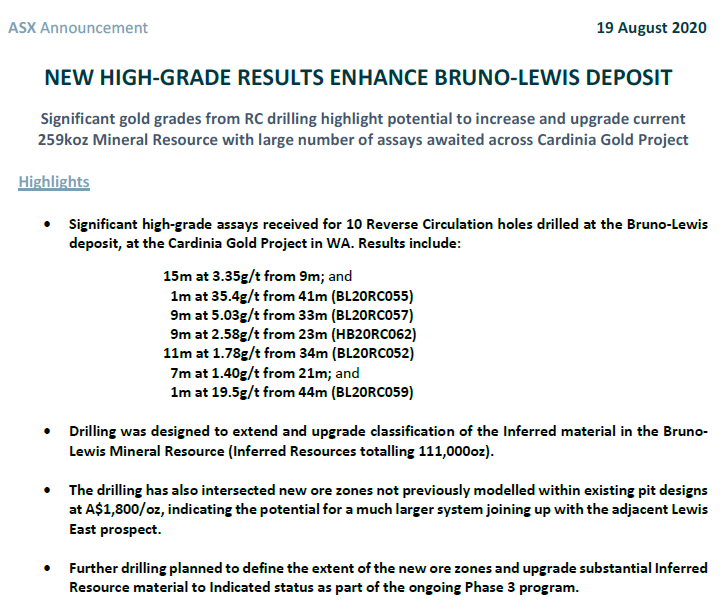

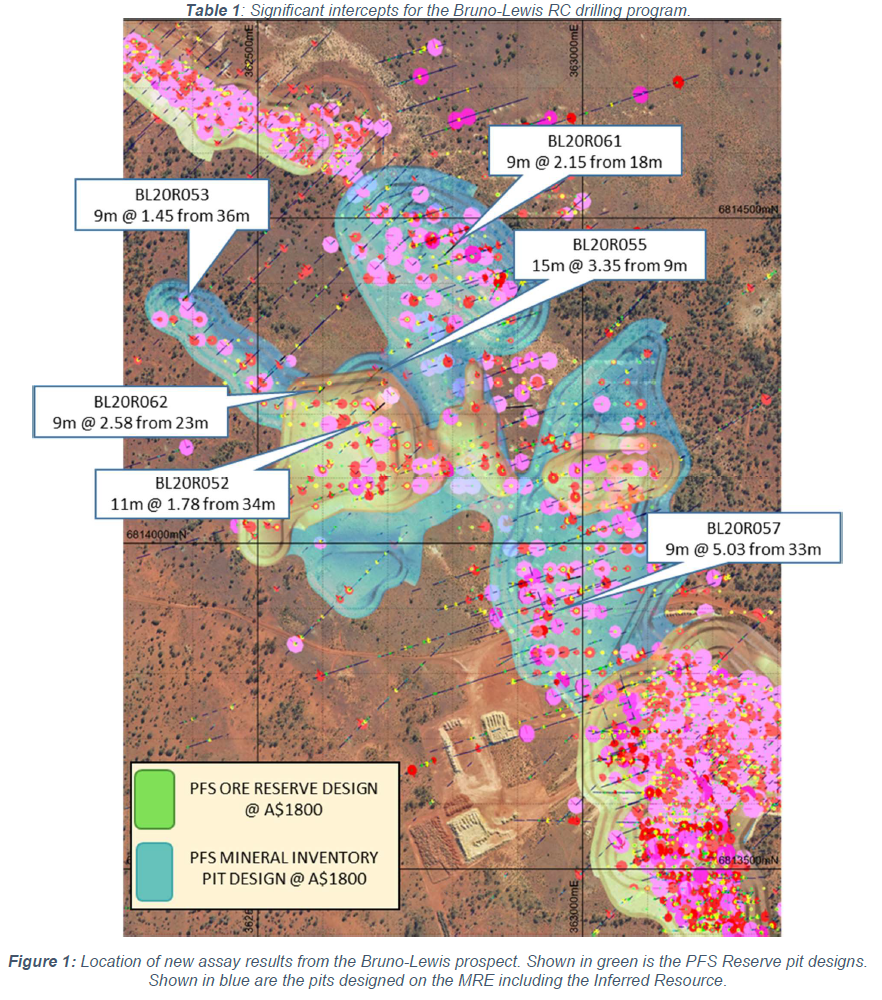

Antwort auf Beitrag Nr.: 64.002.717 von faultcode am 12.06.20 19:59:55da schau her, man findet doch noch mehr Gold (aber eigentlich tut man das ja fast immer  ):

):

...

Tag:

• BRUNO-LEWIS

):

):

...

Tag:

• BRUNO-LEWIS

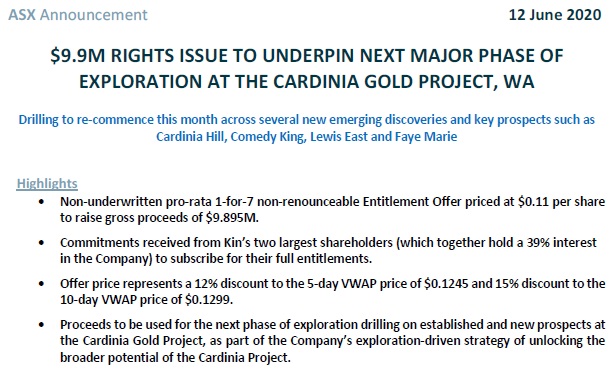

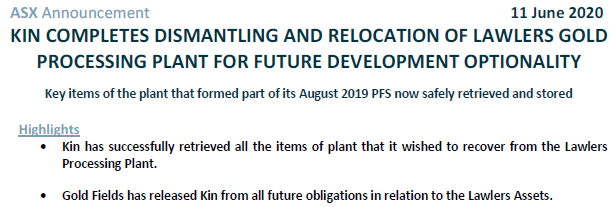

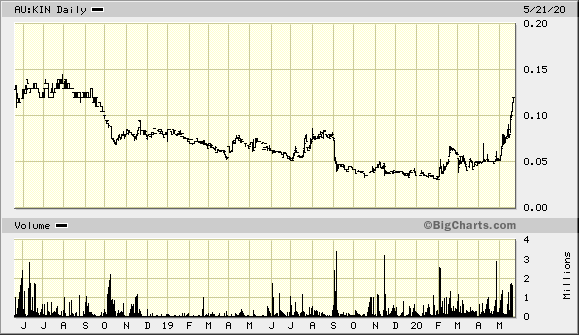

Antwort auf Beitrag Nr.: 63.762.685 von faultcode am 21.05.20 15:00:24in Down Under ist man von dem Teil immer noch ganz angetan - ich ja nicht so:

Mal wieder eine KE, um damit nun endlich den Abbau der Lawlers-Mühle zu finanzieren.

Schreibt man aber so nicht. Erst eine Meldung zum Abbau und dann nur einen Tag später eine Meldung mit KE

Mal wieder eine KE, um damit nun endlich den Abbau der Lawlers-Mühle zu finanzieren.

Schreibt man aber so nicht. Erst eine Meldung zum Abbau und dann nur einen Tag später eine Meldung mit KE

Antwort auf Beitrag Nr.: 63.693.685 von faultcode am 15.05.20 13:26:13neue Präsention: https://www.kinmining.com.au/

=>

Strategic focus has shifted from development (2019 PFS) to exploration targeting new, high-value, higher grade gold discoveries

Air-core and RC drilling in progress – strong upcoming news-flow

Recent drilling has highlighted the potential for a much larger mineralised system at Cardinia.

This is the focus of current and planned exploration.

Allerdings: damit Cash (31 Mar 2020) $2.8M kommt man nicht sehr weit

Meine super-grobe Schätzung für eine RC drilling-Kampagne pro Jahr in WA liegt bei ~A$1.3m. Andere Schätzungen?

=> dazu kommen natürlich noch die Corporate overhead-Kosten

=> also eine KE kommt mMn, aber nicht für die Umsetzung der PFS (das wäre mMn immer noch der pure Wahnsinn), sondern um die weitere Exploration zu finanzieren

=>

Strategic focus has shifted from development (2019 PFS) to exploration targeting new, high-value, higher grade gold discoveries

Air-core and RC drilling in progress – strong upcoming news-flow

Recent drilling has highlighted the potential for a much larger mineralised system at Cardinia.

This is the focus of current and planned exploration.

Allerdings: damit Cash (31 Mar 2020) $2.8M kommt man nicht sehr weit

Meine super-grobe Schätzung für eine RC drilling-Kampagne pro Jahr in WA liegt bei ~A$1.3m. Andere Schätzungen?

=> dazu kommen natürlich noch die Corporate overhead-Kosten

=> also eine KE kommt mMn, aber nicht für die Umsetzung der PFS (das wäre mMn immer noch der pure Wahnsinn), sondern um die weitere Exploration zu finanzieren

1.5.2020

As Harmanis increases his stake, rejuvenated Kin sets out to do a De Grey with de rig

...

https://www.resourcesrisingstars.com.au/news-article/harmani…

Leonora gold explorer/developer Kin Mining is back on the radar after Kerry Harmanis of Jubilee Mines nickel fame took the opportunity presented by Kin’s recent capital raising to increase his stake from 15.2% to 17.1%.

Harmanis is the guy who built Jubilee from a spec stock to the $3.1 billion company that Mick Davis’ Xstrata took over in 2007. To Harmanis’ credit, he has continued to be a supporter of junior explorers ever since.

Kin (ASX:KIN) has been one of those.

It was a high-flyer up until three years ago when a half-baked plan to get its Cardinia gold project in to production fell apart. What was a 40c stock back then got as low as 3c at the start of this year.

Under a new management team there has been a reworking of Cardinia’s mineral resource under a conservative $A2000/oz gold price assumption.

The resource stands at 21mt grading 1.4g/t for 945,000oz which is not bad in itself for a company with a $32m market cap at Thursday’s closing price of 5.2c a share.

Now as its best-forgotten history would suggest, Kin could well consider it makes sense to rush into production to capture the benefits of the near record Aussie gold price.

But what Harmanis and other investors are likely attracted to this time around is Kin’s strategy to step out along the extensive mineralised structures its tenement package cover to make a new game-changing discovery, or at least find higher-grade resource positions to add to the Cardinia story.

It is an appealing strategy, one that has worked to great effect for De Grey Mining (ASX : DEG) in the Pilbara at the behest of Ed Eshuys of Jundee and Bronzewing discovery fame.

Eshuys’ DGO Gold (ASX : DGO), now a 16.5% De Grey shareholder with two board seats, made its first investment in the company back when it was a sub-5c stock and when its main focus was on the development chances of the 1.7Moz resource it had put together at its Mallina project in the Pilbara.

Eshuys was more interested in the potential of De Grey’s 200km strike length of prospective shear zones to host a big new discovery. The exploration focus versus development focus paid off big time, with De Grey unveiling the Hemi discovery earlier this year.

De Grey is now a 35c stock for a market cap of $385m.

Kin is pursuing a similar strategy, which to be fair, it started out on before De Grey got everyone thinking about what can be found in lightly explored areas along strike from a known deposit(s) which, for one reason or another, has hogged the attention at the expensive of potential game-changing exploration.

It was what Kin’s recent $2.64m placement at 4.5c – a then 9.8% premium to the market price – was all about.

Promising results have begun to flow, with Kin recently reporting initial assay results from the Cardinia Hill and Helens East prospects, about 2.5km east of the proposed Cardinia processing plant.

The results confirmed high-grade mineralisation at Cardinia Hill (15m at 4.42g/t from 34m and 17m at 3.29g/t from 10m) and new mineralisation trends between Cardinia Hill and Helens East which historical workings and drilling had previously missed.

Kin managing director Andrew Munckton said the results were some of the best seen to date as “part of our strategy to unlock the broader exploration potential of the Cardinia gold project, highlighting the opportunity to make substantial new gold discoveries outside of the existing mineral resources”.

...

As Harmanis increases his stake, rejuvenated Kin sets out to do a De Grey with de rig

...

https://www.resourcesrisingstars.com.au/news-article/harmani…

Leonora gold explorer/developer Kin Mining is back on the radar after Kerry Harmanis of Jubilee Mines nickel fame took the opportunity presented by Kin’s recent capital raising to increase his stake from 15.2% to 17.1%.

Harmanis is the guy who built Jubilee from a spec stock to the $3.1 billion company that Mick Davis’ Xstrata took over in 2007. To Harmanis’ credit, he has continued to be a supporter of junior explorers ever since.

Kin (ASX:KIN) has been one of those.

It was a high-flyer up until three years ago when a half-baked plan to get its Cardinia gold project in to production fell apart. What was a 40c stock back then got as low as 3c at the start of this year.

Under a new management team there has been a reworking of Cardinia’s mineral resource under a conservative $A2000/oz gold price assumption.

The resource stands at 21mt grading 1.4g/t for 945,000oz which is not bad in itself for a company with a $32m market cap at Thursday’s closing price of 5.2c a share.

Now as its best-forgotten history would suggest, Kin could well consider it makes sense to rush into production to capture the benefits of the near record Aussie gold price.

But what Harmanis and other investors are likely attracted to this time around is Kin’s strategy to step out along the extensive mineralised structures its tenement package cover to make a new game-changing discovery, or at least find higher-grade resource positions to add to the Cardinia story.

It is an appealing strategy, one that has worked to great effect for De Grey Mining (ASX : DEG) in the Pilbara at the behest of Ed Eshuys of Jundee and Bronzewing discovery fame.

Eshuys’ DGO Gold (ASX : DGO), now a 16.5% De Grey shareholder with two board seats, made its first investment in the company back when it was a sub-5c stock and when its main focus was on the development chances of the 1.7Moz resource it had put together at its Mallina project in the Pilbara.

Eshuys was more interested in the potential of De Grey’s 200km strike length of prospective shear zones to host a big new discovery. The exploration focus versus development focus paid off big time, with De Grey unveiling the Hemi discovery earlier this year.

De Grey is now a 35c stock for a market cap of $385m.

Kin is pursuing a similar strategy, which to be fair, it started out on before De Grey got everyone thinking about what can be found in lightly explored areas along strike from a known deposit(s) which, for one reason or another, has hogged the attention at the expensive of potential game-changing exploration.

It was what Kin’s recent $2.64m placement at 4.5c – a then 9.8% premium to the market price – was all about.

Promising results have begun to flow, with Kin recently reporting initial assay results from the Cardinia Hill and Helens East prospects, about 2.5km east of the proposed Cardinia processing plant.

The results confirmed high-grade mineralisation at Cardinia Hill (15m at 4.42g/t from 34m and 17m at 3.29g/t from 10m) and new mineralisation trends between Cardinia Hill and Helens East which historical workings and drilling had previously missed.

Kin managing director Andrew Munckton said the results were some of the best seen to date as “part of our strategy to unlock the broader exploration potential of the Cardinia gold project, highlighting the opportunity to make substantial new gold discoveries outside of the existing mineral resources”.

...

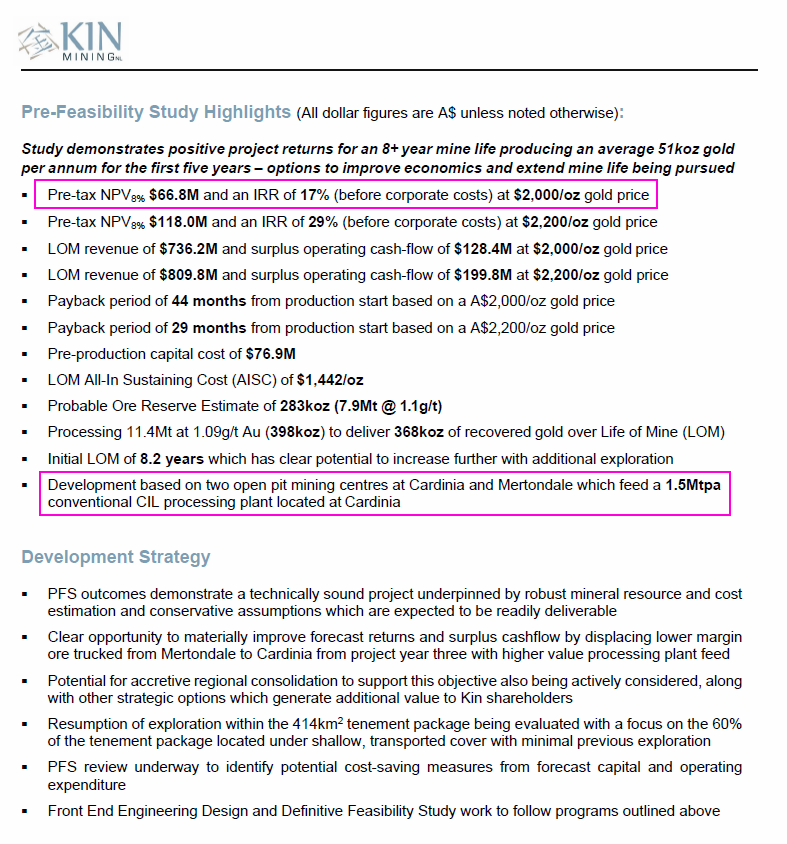

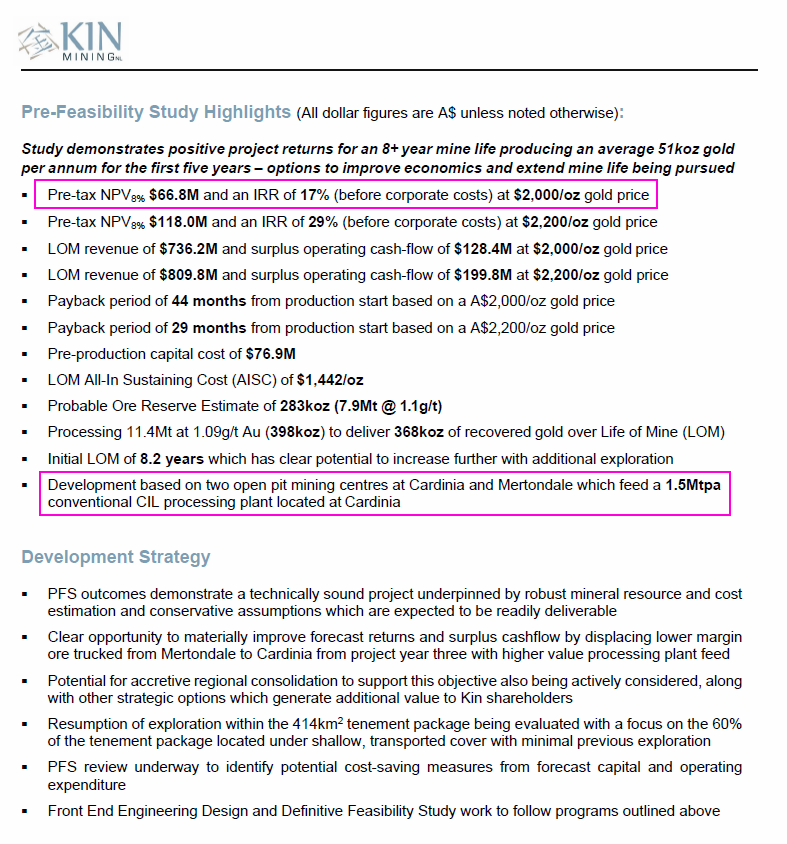

Antwort auf Beitrag Nr.: 61.432.067 von faultcode am 07.09.19 00:08:33..und wie der Titel sagt: das ist erst (wieder) eine PFS

--> also will man wohl auf der jetzigen Grundlage (wieder) Geld haben, um eine DFS anfertigen zu können, und auch neu nachdenken

=> bei aller Kritik, muss man der Unternehmensverwaltung mMn zugute halten, nicht auf Grund der alten DFS in die Vollen gegangen zu sein, und am Ende wirklich vor'm Bankrott zu stehen!

--> wäre nicht der erste Produzent in Australien, der bei klar steigenden Goldpreisen diesen Weg gegangen ist

--> also will man wohl auf der jetzigen Grundlage (wieder) Geld haben, um eine DFS anfertigen zu können, und auch neu nachdenken

=> bei aller Kritik, muss man der Unternehmensverwaltung mMn zugute halten, nicht auf Grund der alten DFS in die Vollen gegangen zu sein, und am Ende wirklich vor'm Bankrott zu stehen!

--> wäre nicht der erste Produzent in Australien, der bei klar steigenden Goldpreisen diesen Weg gegangen ist

Antwort auf Beitrag Nr.: 61.432.007 von faultcode am 06.09.19 23:40:38

-->

a/ seinerzeit (DFS2017) war noch von einer 800ktpa Plant (in Cardinia) die Rede, nun sind's schon fast das doppelte

b/ da wundern mich die lausigen 17% IRR (before corporate costs) bei einem ini.CAPEX von AUD77m (alle $ sind AUD) nicht

c/ hypersaline water --> ist mir neu in Raeside; sind zwar nur 87k (total Resources), aber die sind mMn auch "weg"

--> ist mir neu in Raeside; sind zwar nur 87k (total Resources), aber die sind mMn auch "weg"

--> JORC 2012 Resource (Raeside): 134k oz Au

PFS2019 (2)

-->

a/ seinerzeit (DFS2017) war noch von einer 800ktpa Plant (in Cardinia) die Rede, nun sind's schon fast das doppelte

b/ da wundern mich die lausigen 17% IRR (before corporate costs) bei einem ini.CAPEX von AUD77m (alle $ sind AUD) nicht

c/ hypersaline water

--> ist mir neu in Raeside; sind zwar nur 87k (total Resources), aber die sind mMn auch "weg"

--> ist mir neu in Raeside; sind zwar nur 87k (total Resources), aber die sind mMn auch "weg"--> JORC 2012 Resource (Raeside): 134k oz Au

Antwort auf Beitrag Nr.: 59.549.551 von faultcode am 03.01.19 12:46:32

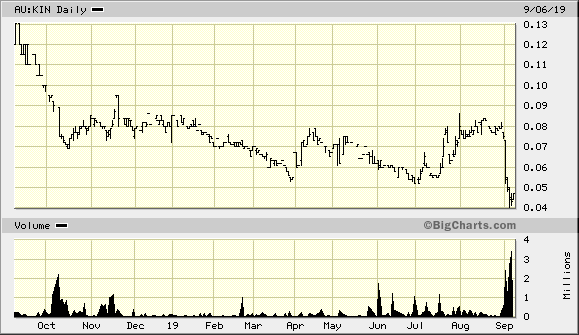

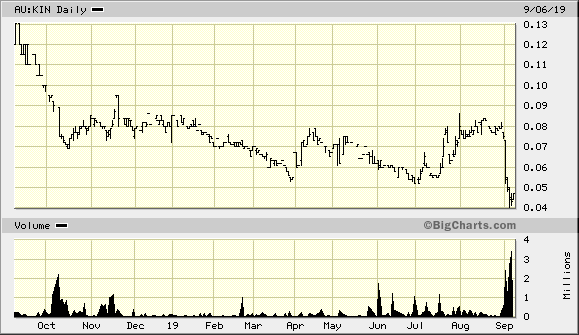

--> schlechtes Zeichen: dem Markt gefällt die PFS2019 überhaupt nicht:

PFS2019 (1)

gutes oder schlechtes Zeichen?--> schlechtes Zeichen: dem Markt gefällt die PFS2019 überhaupt nicht:

Sprott Credit Facility Update

noch vom 24.12.2018 ne Meldung - wie sinnig

Kin modifies agreement with Sprott and completes repayment

-- Kin has completed repayment of the outstanding balance on the Credit Facility

-- Credit Facility remains in place as a potential source of future funding

-- Sprott remains keen to partner with Kin in the Leonora Gold Project

-- Security and Mortgage over LGP tenements reduced

Kin Mining NL (ASX: KIN) is pleased to advise that it has repaid all but US$1 of the senior secured credit facility (Credit Facility) with Sprott Private Resource Lending (Collector) LP (Sprott).

The Credit Facility was formalised on 23 December 2017 with the first drawdown of US$5M occurring on 27 December 2017. Kin repaid US$2M in August 2018 and a further US$1.3M in November 2018. The final repayment of US$1.7M (minus US$1) has now been made.

Repaying the Facility in tranches allowed the Company to utilise its cash in the most effective manner to progress additional drilling and metallurgical work programs at the Helens and Lewis Deposits, undertake the Water Exploration and production bore drilling programs at Bummer Creek and Cardinia Creek and advance the project approvals all required to contribute to the Board’s confidence to restart the construction phase of the Leonora Gold Project (LGP).

Sprott has expressed a desire to remain involved in the LGP and has agreed to leave the Credit Facility structure in place while Kin completes its LGP work programs.

Progress on those programs is ongoing with management confident of satisfactory resolutions to the items being investigated or reviewed.

Importantly, following this payment, all Credit Facility covenants and the majority of secured positions have been removed. The general security and covenants will be reinstated in the event that Kin seeks to recommence drawdowns on the Credit Facility (subject to further due diligence by Sprott).

The royalty of 1.5% NSR on the first 100,000oz of gold produced from the LGP remains in place and is secured by mortgages over a reduced set of tenements associated with the LGP and a general featherweight security....

=> ASX:

=> praktisch kein Volumen mehr

--> gutes oder schlechtes Zeichen?

--> gutes oder schlechtes Zeichen?

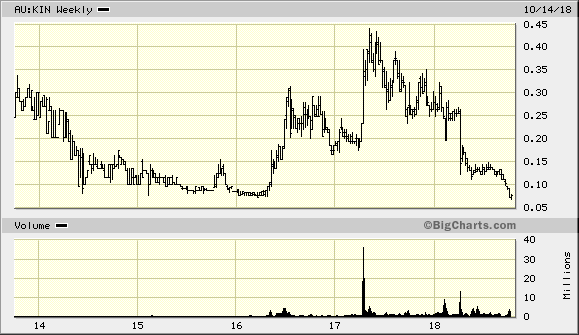

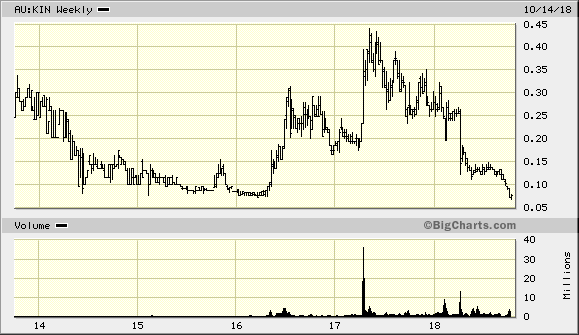

Antwort auf Beitrag Nr.: 59.019.610 von faultcode am 22.10.18 13:14:27

Antwort auf Beitrag Nr.: 57.984.846 von faultcode am 14.06.18 12:44:20

--> neuer Managing Director Andrew Munckton

--> die bisherige Planung war stark lückenhaft und damit viel zu optimistisch

=> alles was nicht ausgeplant ist, ist bei den hohen Kosten heutzutage in WA ein grosses Problem und Risiko

--> interessant zu lesen der Brief vom Chairman Jeremy Kirkwood zur derzeitigen Situation:

12 October 2018

Dear Kin Mining shareholder

On behalf of the Board of Directors of Kin Mining NL (ASX:KIN), I am pleased to present to you the

accompanying offer document in relation to a non‐renounceable rights issue to raise up to A$10.4 million (before costs). I ask that you consider this document carefully and in its entirety.

In summary, Kin shareholders are being offered the opportunity to subscribe for 2 new ordinary Kin shares for every 5 Kin shares held at the record date of 17 October 2018.

The new shares are being offered at a price of $0.08, representing an 11% discount to the last traded price of Kin shares and a 17% discount to the 10‐day Volume Weighted Average Price before the announcement of the rights issue on 9 October 2018.

Pleasingly, the Company has received confirmation from its three major shareholders that they intend to fully participate in the offer. Collectively these shareholders hold 21% of Kin’s total shares on issue.

The capital raising will underpin our continued work programs at our Leonora Gold Project (LGP) in Western Australia which has been reset on a lower risk path to a development decision in 2019.

Shareholders should be aware that the Kin Board took the difficult decision to suspend construction of the LGP in May this year following confirmation the capital costs of the Cardinia Processing Plant would substantially exceed budgeted estimates. This avoided an immediate, significant capital raising at the time which, in any event, may not have been sufficient to complete the LGP as it was planned.

The Kin Board were not prepared to risk shareholder value through proceeding with the LGP in the face of such construction cost and funding uncertainty.

In addition, a review led by our new Managing Director Andrew Munckton identified a number of

opportunities to enhance the long‐term returns from the project. It also highlighted aspects of the project with sufficient uncertainty that they created an unacceptable risk for shareholders had we proceeded with the development in its then form.

These areas include:

1) Mining approvals not currently being in place.

2) An insufficient long‐term water supply to the processing plant.

3) The selection of diesel fuel for power supply (and its price escalation risk) to the exclusion of gas fuelled power.

4) Uncertainty around the Tailings Storage Facility.

5) A lack of confidence in the robustness of the capital and operating cost estimates included in the LGP Definitive Feasibility Study.

Furthermore, we were not in a position to quantify the potential upside of the mine plan being focussed solely on near surface oxide ores as the depth potential of the known deposits had not been tested by drilling. We see this as a key potential value driver in the period ahead.

As we have previously advised shareholders, your Board believes there are no fatal flaws with the project and all of the potential risks identified are capable of being significantly reduced or overcome through a diligent forward work program.

In the five months since the suspension of the LGP development, the Kin Management team has been focused on capturing the project enhancement opportunities and de‐risking the project.

Our clear objective is to deliver the LGP to a far lower risk development decision point in the second half of 2019 to support our objective of being at the forefront of the next wave of profitable Australian gold producers.

The pressure this pathway has created on the Kin share price in the short‐term is as disappointing to your Board as we know it is to our shareholders. But we remain resolute in our belief that greater and more certain long‐term value for Kin shareholders will be created by de‐risking the project through completion of more work on the water, power and tailings

infrastructure, securing key mining and infrastructure approvals, testing the LGP’s known orebodies at depth and advancing our regional exploration targets.

The LGP has a substantial gold endowment of more than 1 million ounces and is located in a strategic gold mining province. The Company has a firm belief this inventory will be increased with more drilling and this will be a key use of proceeds from the entitlement offer. Funds will also be directed towards the full repayment of the Sprott Facility which will leave the business debt free and in a stronger financial position to deliver on our current strategy.

Your Board believes the LGP holds significant value that is not being reflected in the current share price. We are asking shareholders for their support in delivering an enhanced and de‐risked LGP to a development decision in 2019.

I intend to take up my entitlement in full. On behalf of the Company I thank you for your continued support.

Yours sincerely

Jeremy Kirkwood,

Chairman

für längere Zeit tot hier --> 2019H2

..und nun die nächste KE --> über 100m neue Aktien--> neuer Managing Director Andrew Munckton

--> die bisherige Planung war stark lückenhaft und damit viel zu optimistisch

=> alles was nicht ausgeplant ist, ist bei den hohen Kosten heutzutage in WA ein grosses Problem und Risiko

--> interessant zu lesen der Brief vom Chairman Jeremy Kirkwood zur derzeitigen Situation:

12 October 2018

Dear Kin Mining shareholder

On behalf of the Board of Directors of Kin Mining NL (ASX:KIN), I am pleased to present to you the

accompanying offer document in relation to a non‐renounceable rights issue to raise up to A$10.4 million (before costs). I ask that you consider this document carefully and in its entirety.

In summary, Kin shareholders are being offered the opportunity to subscribe for 2 new ordinary Kin shares for every 5 Kin shares held at the record date of 17 October 2018.

The new shares are being offered at a price of $0.08, representing an 11% discount to the last traded price of Kin shares and a 17% discount to the 10‐day Volume Weighted Average Price before the announcement of the rights issue on 9 October 2018.

Pleasingly, the Company has received confirmation from its three major shareholders that they intend to fully participate in the offer. Collectively these shareholders hold 21% of Kin’s total shares on issue.

The capital raising will underpin our continued work programs at our Leonora Gold Project (LGP) in Western Australia which has been reset on a lower risk path to a development decision in 2019.

Shareholders should be aware that the Kin Board took the difficult decision to suspend construction of the LGP in May this year following confirmation the capital costs of the Cardinia Processing Plant would substantially exceed budgeted estimates. This avoided an immediate, significant capital raising at the time which, in any event, may not have been sufficient to complete the LGP as it was planned.

The Kin Board were not prepared to risk shareholder value through proceeding with the LGP in the face of such construction cost and funding uncertainty.

In addition, a review led by our new Managing Director Andrew Munckton identified a number of

opportunities to enhance the long‐term returns from the project. It also highlighted aspects of the project with sufficient uncertainty that they created an unacceptable risk for shareholders had we proceeded with the development in its then form.

These areas include:

1) Mining approvals not currently being in place.

2) An insufficient long‐term water supply to the processing plant.

3) The selection of diesel fuel for power supply (and its price escalation risk) to the exclusion of gas fuelled power.

4) Uncertainty around the Tailings Storage Facility.

5) A lack of confidence in the robustness of the capital and operating cost estimates included in the LGP Definitive Feasibility Study.

Furthermore, we were not in a position to quantify the potential upside of the mine plan being focussed solely on near surface oxide ores as the depth potential of the known deposits had not been tested by drilling. We see this as a key potential value driver in the period ahead.

As we have previously advised shareholders, your Board believes there are no fatal flaws with the project and all of the potential risks identified are capable of being significantly reduced or overcome through a diligent forward work program.

In the five months since the suspension of the LGP development, the Kin Management team has been focused on capturing the project enhancement opportunities and de‐risking the project.

Our clear objective is to deliver the LGP to a far lower risk development decision point in the second half of 2019 to support our objective of being at the forefront of the next wave of profitable Australian gold producers.

The pressure this pathway has created on the Kin share price in the short‐term is as disappointing to your Board as we know it is to our shareholders. But we remain resolute in our belief that greater and more certain long‐term value for Kin shareholders will be created by de‐risking the project through completion of more work on the water, power and tailings

infrastructure, securing key mining and infrastructure approvals, testing the LGP’s known orebodies at depth and advancing our regional exploration targets.

The LGP has a substantial gold endowment of more than 1 million ounces and is located in a strategic gold mining province. The Company has a firm belief this inventory will be increased with more drilling and this will be a key use of proceeds from the entitlement offer. Funds will also be directed towards the full repayment of the Sprott Facility which will leave the business debt free and in a stronger financial position to deliver on our current strategy.

Your Board believes the LGP holds significant value that is not being reflected in the current share price. We are asking shareholders for their support in delivering an enhanced and de‐risked LGP to a development decision in 2019.

I intend to take up my entitlement in full. On behalf of the Company I thank you for your continued support.

Yours sincerely

Jeremy Kirkwood,

Chairman

Antwort auf Beitrag Nr.: 57.541.563 von faultcode am 14.04.18 01:45:39

Begründung:

Dear Shareholder

As announced on 30 May 2018, the Company is undertaking a fully underwritten nonrenounceable rights issue on the basis of one New Share for every three Existing Shares held at an issue price of $0.11 per New Share to raise approximately $8,930,091 before issue costs.

This Offer Document outlines the details of the Offer.

The rights issue is expected to result in the issue of approximately 81,182,644 New Shares in the Company.

The proceeds from the Offer are planned to be used for exploration activities, to repay the Sprott Credit Facility if required (or desired) and if not so determined additional exploration activities, expenses of the Offer and for general working capital purposes.

This will allow the Company to ‘reset’ after the Board’s decision to cease construction of the Leonora Gold Project pending a full review of its costs and design. Together with the ongoing exploration and resource definition, which this Offer helps fund, the review of the Leonora Gold Project will position the Company to recommence construction with a more robust and optimized project.

If you have any queries regarding your entitlement or participation in the upcoming rights issue, please do not hesitate to contact your stockbroker or financial advisor. I commend this rights issue to you and look forward to your continued support as a Shareholder.

Jeremy Kirkwood

Chairman

Capital raise (KE)

werd ich zeichnen, und wenn möglich überbeziehen.Begründung:

Dear Shareholder

As announced on 30 May 2018, the Company is undertaking a fully underwritten nonrenounceable rights issue on the basis of one New Share for every three Existing Shares held at an issue price of $0.11 per New Share to raise approximately $8,930,091 before issue costs.

This Offer Document outlines the details of the Offer.

The rights issue is expected to result in the issue of approximately 81,182,644 New Shares in the Company.

The proceeds from the Offer are planned to be used for exploration activities, to repay the Sprott Credit Facility if required (or desired) and if not so determined additional exploration activities, expenses of the Offer and for general working capital purposes.

This will allow the Company to ‘reset’ after the Board’s decision to cease construction of the Leonora Gold Project pending a full review of its costs and design. Together with the ongoing exploration and resource definition, which this Offer helps fund, the review of the Leonora Gold Project will position the Company to recommence construction with a more robust and optimized project.

If you have any queries regarding your entitlement or participation in the upcoming rights issue, please do not hesitate to contact your stockbroker or financial advisor. I commend this rights issue to you and look forward to your continued support as a Shareholder.

Jeremy Kirkwood

Chairman

besser so, als sich wie so viele ins Aus zu projektieren...

Oh ein Thread - das ist nett

=> hielt sich soweit wacker -- bis zum Trading Halt am 9.4. wg. einem Leonora Gold Project Update: http://www.kinmining.com.au/wp-content/uploads/2013/10/Leono…

=> Projekt kommt so nicht!! --> Kosten unterschätzt in der DFS! --> neue Kapitalerhöhung (AUD11m)

The Board of Directors (Board) of Kin Mining NL (Kin or Company) has taken the decision to curtail construction works on the Leonora Gold Project (LGP), pending a full review of the capital cost and schedule for completion.

This decision has been necessitated by an expected increase in the existing pre-production capital cost estimate for the LGP.

The existing estimate of A$35.4 million was detailed in the Definitive Feasibility Study (DFS) on the LGP completed in October 2017 (see Kin ASX release dated 2 October 2017). Following the recent changes to the composition of Kin's Board, a review process of key aspects of the LGP was commenced pursuant to which it has become apparent that the DFS estimate of pre-production capital costs will need to be adjusted.

If the Company had continued with the development of the LGP the potential scope of increase in capital costs would have given rise to the requirement for a significant equity capital raising to fund the increase, along with expected exploration and corporate costs, during the construction period for the LGP.

The Board wishes to undertake a comprehensive review of the LGP to ensure that, before full project development is resumed, it has a high degree of confidence in key project parameters, cost and time estimates, and a clear and certain funding path in place to complete the LGP.

Accordingly, the Company has engaged Como Engineers as its external and principal consultant to undertake an independent and thorough review of the LGP. Como is to be tasked with generating new cost and time to complete estimates, along with a rigorous implementation plan for the LGP.

The Board will seek to provide shareholders with an update on the progress of this review in the coming weeks.

The Board considers that this course of action is necessary to ensure that a significant equity capital raising is not conducted at a time when the Board cannot be confident of the projected capital cost and schedule to complete the LGP. The Board therefore believes that the interests of all Kin shareholders are best served by the curtailment of construction activities until a comprehensive review of LGP costs and timing can be finalised.

The Board remains confident that the LGP holds significant value. With a delineated resource base of over 1 Moz gold, located within the highly endowed and operationally active Leonora gold region, the LGP possesses considerable economic and strategic value. This course of action is designed to ensure that, when LGP development is fully resumed, shareholder value will be far greater than if the Company had continued down the path it had been pursuing.....

In the interim the Company will continue its targeted exploration programme on the LGP and surrounding areas.

It also plans to complete its search for, and appointment of, a new Managing Director. One of the key tasks of the incoming Managing Director will be close oversight of the review and targeted resumption of full development of the LGP.

Sprott Resource Lending LLC (Sprott), the existing debt provider for the LGP, has been advised of the decision to curtail works on the LGP. Kin is in discussions with Sprott to determine the most effective way forward. The Company has only drawn US$5 million under the Sprott facility and has the option to repay this amount at any time, for an accompanying fee.

In the near term the Company will be seeking to raise approximately A$11 million of new funding.

Together with its existing cash balance of approximately A$7.7 million (as at 9 April 2018), this is expected to enable Kin to fund its current liabilities (including potential repayment, if necessary, of the drawn amount under the Sprott facility), curtailed construction works, review costs, exploration programme and corporate overheads for the next 6 months.

Shareholders will be informed of how this new funding will be sought once these details have been finalised. The Board assures all Kin shareholders that it will seek to structure any proposed equity component of this planned funding in a manner that is as fair and minimally dilutive as possible.

Cash expenditure on LGP development totalled A$5.9 million to 9 April 2018. Further committed expenditure on LGP development are estimated to be A$3.1 million as at 9 April 2018. These committed items include work on CIL tank construction, concrete foundations and bridging steel work that has been running ahead of schedule. Costs related to the decision to enact, and period of, curtailment are being determined...

Hallo wollte einmal kurz diese Minefirma vorstellen weil dort wohl bald die Produktion starten kann was haltet ihr von der Firma?

Presentation

https://www.kinmining.com.au/wp-content/uploads/2013/10/MD-P…

http://www.mining-journal.com/resourcestocks-company-profile…

Presentation

https://www.kinmining.com.au/wp-content/uploads/2013/10/MD-P…

http://www.mining-journal.com/resourcestocks-company-profile…