AKTIEN IM FOKUS: Übernahme von Aetna setzen CVS-Health-Aktien unter Druck (Seite 5) | Diskussion im Forum

eröffnet am 05.03.18 21:49:56 von

neuester Beitrag 02.04.24 18:59:35 von

neuester Beitrag 02.04.24 18:59:35 von

Beiträge: 77

ID: 1.275.619

ID: 1.275.619

Aufrufe heute: 0

Gesamt: 7.704

Gesamt: 7.704

Aktive User: 0

ISIN: US1266501006 · WKN: 859034 · Symbol: CVS

67,77

USD

-1,07 %

-0,73 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

23.04.24 · Aktienwelt360 |

16.04.24 · dpa-AFX |

03.04.24 · wallstreetONLINE Redaktion |

02.04.24 · dpa-AFX |

02.04.24 · dpa-AFX |

Werte aus der Branche Einzelhandel

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10.168,50 | +89,80 | |

| 6,3500 | +27,00 | |

| 6,0900 | +21,07 | |

| 0,6800 | +15,25 | |

| 4,2200 | +9,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,9800 | -12,78 | |

| 20,910 | -12,98 | |

| 0,9825 | -13,82 | |

| 6,0000 | -19,35 | |

| 47,56 | -58,74 |

Beitrag zu dieser Diskussion schreiben

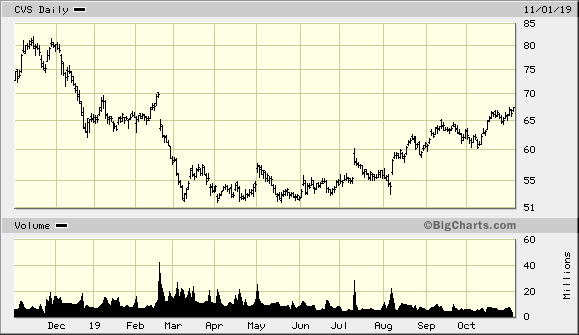

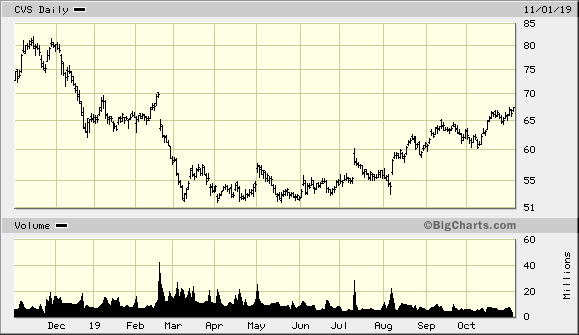

Antwort auf Beitrag Nr.: 61.482.092 von faultcode am 13.09.19 22:16:09die ~USD63-Hürde scheint vorerst genommen worden zu sein, und sollte nun als Unterstützung dienen:

Antwort auf Beitrag Nr.: 61.482.092 von faultcode am 13.09.19 22:16:09

--> und dafür scheint es auch fundamentale Gründe zu geben

https://twitter.com/QTRResearch/status/1173005415174561792

Buy 1, get 1 free

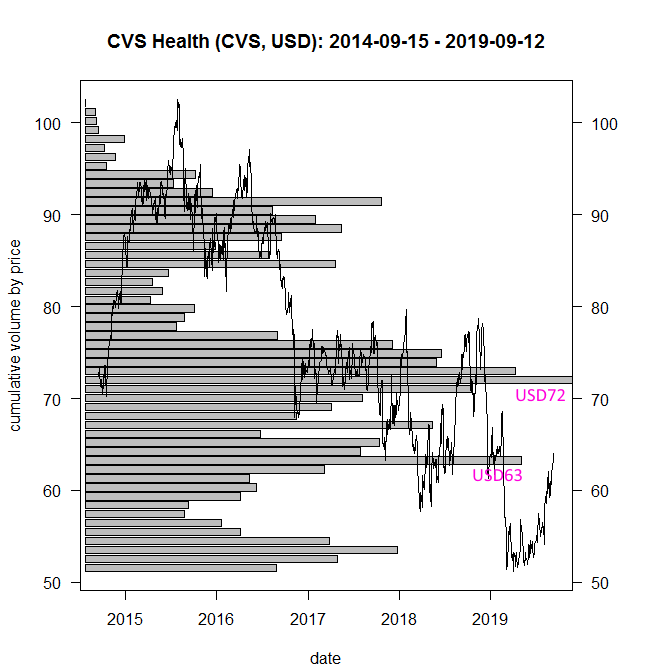

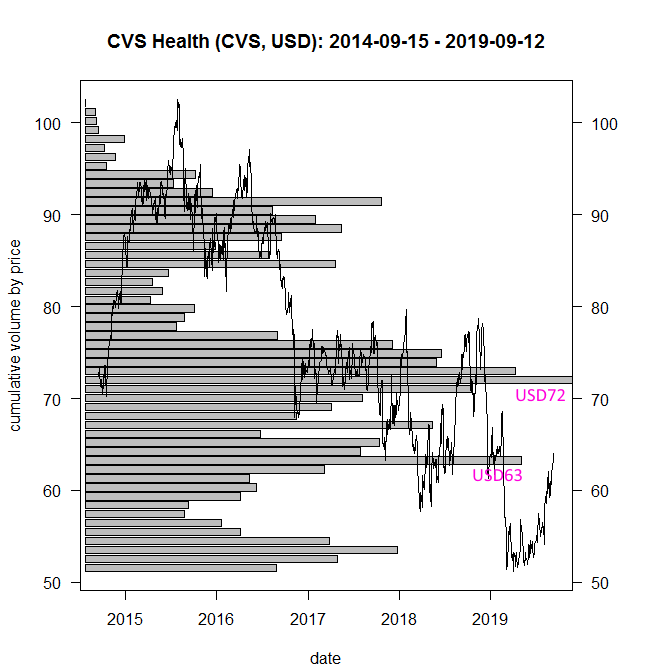

Zitat von faultcode: ...--> bei ~USD63 liegt auch erst einmal ein Brett und bei ~USD72 ist Beton angegossen...

--> und dafür scheint es auch fundamentale Gründe zu geben

https://twitter.com/QTRResearch/status/1173005415174561792

Antwort auf Beitrag Nr.: 61.198.541 von faultcode am 07.08.19 16:26:48"raised 2019 profit forecast" hin oder her, die gemächliche Sektor-Rotation in "Value" kann man hier mMn ganz gut sehen:

--> weil das allerdings (zurecht) unter "Health" läuft, sehe ich bis zur US-Wahl 2020 keinen durchschlagenden Erfolg nach oben

--> bei ~USD63 liegt auch erst einmal ein Brett und bei ~USD72 ist Beton angegossen:

--> weil das allerdings (zurecht) unter "Health" läuft, sehe ich bis zur US-Wahl 2020 keinen durchschlagenden Erfolg nach oben

--> bei ~USD63 liegt auch erst einmal ein Brett und bei ~USD72 ist Beton angegossen:

CVS Health raises 2019 profit forecast after beating quarterly estimates

7.8.https://finance.yahoo.com/news/1-cvs-health-beats-second-112…

=>

...CVS Health Corp raised its full-year profit forecast and posted better-than-expected quarterly results on Wednesday, as higher U.S. prescription drug prices fueled rebates to its core pharmacy benefits business.

...

The pharmacy benefits unit brought in revenue of $34.84 billion in the second quarter, a 4.2% rise, helped by higher prices of branded drugs but the company said it continued to face pressure from high dispensing rates of generic drugs. Analysts on average had expected $34.2 billion, according to estimates compiled by Evercore ISI.

"We think shares will see some relief today," Evercore analyst Ross Muken said, pointing to the higher forecast which comes amid a nationwide crackdown on the dispensing of opioid drugs and investor concerns over potential changes to healthcare policy.

CVS plans to bring more health services to its stores to tackle chronic conditions, one of the goals of combining the country's largest drugstore operator with one of the oldest health insurers.

The unit which houses CVS's health insurance business brought in revenue of $17.4 billion in the quarter, slightly higher than the $17.3 billion analysts had expected.

Same-store sales at the company's front-end stores that sell over-the-counter drugs rose 2.9%, beating estimates of a 1.2% rise, according to three analysts polled by Refinitiv IBES.

Excluding items, CVS earned $1.89 per share, above the average analyst estimate of $1.69, according to IBES data from Refinitiv.

Operating costs rose 24.4% to $60.10 billion, as the company integrated Aetna into its operations.

CVS now expects full-year adjusted earnings per share of $6.89 to $7.00, compared with its previous forecast of $6.75 to $6.90.

The company reported net income of $1.94 billion, or $1.49 per share, for the second quarter ended June 30, compared with a loss of $2.56 billion, or $2.52 per share, a year earlier.

CVS had taken a $3.9 billion goodwill impairment charge related to its Omnicare business in the second quarter of 2018.

Total revenue rose 35.2% to $63.43 billion, ahead of estimates of $62.65 billion...

23.7.

How CVS Makes its Money

https://www.investopedia.com/articles/markets/012315/how-cvs…

...

The Bottom Line

Americans allegedly love freedom and football, but the true national pastime is consuming pharmaceuticals.

Everything from anxiety to restless legs syndrome now has a corresponding pill or injection to alleviate or eradicate the symptoms, and companies like CVS are at the forefront of getting those drugs to users. With the number of medical conditions being newly identified consistently outpacing those being eradicated, the amount of money spent on pharmaceuticals will likely increase—a development that should be resonant music to CVS shareholders.

How CVS Makes its Money

https://www.investopedia.com/articles/markets/012315/how-cvs…

...

The Bottom Line

Americans allegedly love freedom and football, but the true national pastime is consuming pharmaceuticals.

Everything from anxiety to restless legs syndrome now has a corresponding pill or injection to alleviate or eradicate the symptoms, and companies like CVS are at the forefront of getting those drugs to users. With the number of medical conditions being newly identified consistently outpacing those being eradicated, the amount of money spent on pharmaceuticals will likely increase—a development that should be resonant music to CVS shareholders.

CVS begins clinical trials for home-dialysis device

17.7.https://www.marketwatch.com/story/cvs-begins-clinical-trials…

=>

...CVS Health Corp. is making an ambitious move into kidney care, launching a clinical trial for a new home-dialysis device designed by the firm of Dean Kamen, the Segway inventor.

The company is delving into unusual territory for a drugstore and health insurer. The plan will make it a medical-device firm and a provider of dialysis, the complex blood-cleansing procedure vital to patients suffering from kidney failure. CVS holds exclusive U.S. rights to the HemoCare device, which was created by Mr. Kamen’s firm, Deka Research & Development Corp.

CVS will work to capitalize on an initiative announced last week by the Trump administration, which wants to move more dialysis into the home, rather than dialysis centers, where most U.S. patients currently get the procedure.

Dialysis is covered by Medicare, including for patients under the age of 65. The care of patients with end-stage renal disease is a major cost for the program, amounting to around $35 billion in 2016, or roughly 7% of total spending under traditional Medicare.

The Department of Health and Human Services said increased use of home dialysis could reduce costs and “preserve or enhance the quality of care.”...

!

Dieser Beitrag wurde von MadMod moderiert. Grund: bitte jetzt nicht Eigenwerbung übertreiben

Antwort auf Beitrag Nr.: 60.467.324 von faultcode am 02.05.19 00:43:25

https://www.marketwatch.com/story/stocks-of-drug-distributor…

=>

...Shares of drug distributors and pharmacy-benefit-manager owners got a boost on Thursday after the Trump administration said it would be withdrawing its plan to overhaul the rebates that drugmakers give to middlemen in Medicare.

The administration, which is making lowering drug costs for Americans a key priority, had said such a proposal would help drive down the prices people pay for prescription medications. However, that would have been a blow to drug distributors and pharmacy-benefit managers, or PBMs.

PBMs act as middlemen between drugmakers and insurance plans, negotiating discounted prices on branded prescription drugs in the form of a rebate. However, PBMs end up pocketing some of those rebates for themselves. The proposal looked to direct those discounts toward patients instead.

“The rule has been an overhang for... stocks for well over a year,” Evercore ISI’s Ross Muken wrote in a note to clients. “Its withdrawal is positive news for companies in the drug channel with economics tied to higher gross list prices, including PBMs and their parent companies, distributors and pharmacies.”

...

The pulling of the proposal comes after a federal judge on Monday blocked a plan put forth by the Trump administration requiring drugmakers to disclose their drug prices in television ads. It was another part of the president’s plan to lower drug costs.

The administration is still looking at ways to lower those costs. Just last week, the president said he was planning to issue an executive order allowing the U.S. to buy drugs based on the lowest price paid by other developed countries.

Stocks of drug distributors and PBM-owners surge after Trump administration pulls rebate proposal

July 11, 2019 10:42 a.m. EThttps://www.marketwatch.com/story/stocks-of-drug-distributor…

=>

...Shares of drug distributors and pharmacy-benefit-manager owners got a boost on Thursday after the Trump administration said it would be withdrawing its plan to overhaul the rebates that drugmakers give to middlemen in Medicare.

The administration, which is making lowering drug costs for Americans a key priority, had said such a proposal would help drive down the prices people pay for prescription medications. However, that would have been a blow to drug distributors and pharmacy-benefit managers, or PBMs.

PBMs act as middlemen between drugmakers and insurance plans, negotiating discounted prices on branded prescription drugs in the form of a rebate. However, PBMs end up pocketing some of those rebates for themselves. The proposal looked to direct those discounts toward patients instead.

“The rule has been an overhang for... stocks for well over a year,” Evercore ISI’s Ross Muken wrote in a note to clients. “Its withdrawal is positive news for companies in the drug channel with economics tied to higher gross list prices, including PBMs and their parent companies, distributors and pharmacies.”

...

The pulling of the proposal comes after a federal judge on Monday blocked a plan put forth by the Trump administration requiring drugmakers to disclose their drug prices in television ads. It was another part of the president’s plan to lower drug costs.

The administration is still looking at ways to lower those costs. Just last week, the president said he was planning to issue an executive order allowing the U.S. to buy drugs based on the lowest price paid by other developed countries.

Strong Buy wenn Notenbank Zins senkt wegen Handelsstreik imo

FDA Under Pressure, New CBD Rules to be Announced on Friday

https://www.thecannabisinvestor.ca/fda-under-pressure-new-cb… 23.04.24 · Aktienwelt360 · Chevron Corporation |

16.04.24 · dpa-AFX · CVS Health |

03.04.24 · wallstreetONLINE Redaktion · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

07.02.24 · wallstreetONLINE Redaktion · CVS Health |

12.01.24 · dpa-AFX · Boeing |