AKTIEN IM FOKUS: Übernahme von Aetna setzen CVS-Health-Aktien unter Druck - Die letzten 30 Beiträge | Diskussion im Forum

eröffnet am 05.03.18 21:49:56 von

neuester Beitrag 02.04.24 18:59:35 von

neuester Beitrag 02.04.24 18:59:35 von

Beiträge: 77

ID: 1.275.619

ID: 1.275.619

Aufrufe heute: 0

Gesamt: 7.701

Gesamt: 7.701

Aktive User: 0

ISIN: US1266501006 · WKN: 859034 · Symbol: CVS

68,50

USD

-1,62 %

-1,13 USD

Letzter Kurs 02:04:00 NYSE

Meistbewertete Beiträge

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 02.04.24 |

Werte aus der Branche Einzelhandel

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,3500 | +27,00 | |

| 7,4400 | +24,00 | |

| 6,0900 | +21,07 | |

| 2,2700 | +20,11 | |

| 22,000 | +15,79 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,0200 | -16,33 | |

| 10,810 | -16,59 | |

| 2,0000 | -25,92 | |

| 21,850 | -41,20 | |

| 47,56 | -58,74 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 75.552.292 von bpmeister13 am 02.04.24 17:12:22

Bzw. die Zahlungen wurden wie die Konsensschätzung um 3,7% angehoben, aber es wurden von einigen Playern noch eine Zugabe erwartet. (lt. Markus Koch Wall Street)

Zitat von bpmeister13:Zitat von Bronkmaster: So wie heute schon wieder? Oder gibt’s News die CVS direkt betreffen? Kann eigentlich nichts finden…

Zahlungen für Medicare wurden nur bestätigt und nicht angehoben.

Bzw. die Zahlungen wurden wie die Konsensschätzung um 3,7% angehoben, aber es wurden von einigen Playern noch eine Zugabe erwartet. (lt. Markus Koch Wall Street)

Antwort auf Beitrag Nr.: 75.551.998 von Bronkmaster am 02.04.24 16:32:55

Zahlungen für Medicare wurden nur bestätigt und nicht angehoben.

Zitat von Bronkmaster: So wie heute schon wieder? Oder gibt’s News die CVS direkt betreffen? Kann eigentlich nichts finden…

Zahlungen für Medicare wurden nur bestätigt und nicht angehoben.

So wie heute schon wieder? Oder gibt’s News die CVS direkt betreffen? Kann eigentlich nichts finden…

Wird leider wieder mit der Konkurrenz runtergezogen

Antwort auf Beitrag Nr.: 75.126.069 von bpmeister13 am 18.01.24 17:14:56

Videoverlinkung funktiert nicht

Zitat von bpmeister13:Zitat von rokz: News? Schlechte Zahlen bei der Konkurrenz? Finde dazu nichts.

Morgen auch noch Ex-Tag...

steigende Kosten und Ausgaben bei Humana und UnitedHealth.

siehe

Videoverlinkung funktiert nicht

Antwort auf Beitrag Nr.: 75.124.845 von rokz am 18.01.24 14:37:07

steigende Kosten und Ausgaben bei Humana und UnitedHealth.

siehe

Zitat von rokz: News? Schlechte Zahlen bei der Konkurrenz? Finde dazu nichts.

Morgen auch noch Ex-Tag...

steigende Kosten und Ausgaben bei Humana und UnitedHealth.

siehe

News? Schlechte Zahlen bei der Konkurrenz? Finde dazu nichts.

Morgen auch noch Ex-Tag...

Morgen auch noch Ex-Tag...

Außerdem hat CVS eine niedrigere Leistungsbewertung von der staatlichen Krankenversicherung Medicare erhalten.

https://www.nasdaq.com/articles/cvs-health-expects-lower-med…

https://www.nasdaq.com/articles/cvs-health-expects-lower-med…

Übernahmegerüchte von Cano Health Inc. Kenne ich nicht die Firma.

Schlechte Zahlen?

CVS Health Aktie Hold

Unsere Einschätzung zu CVS:Hold

https://aktieninvestor.net/cvs-health-corporation-potentiell…

Waren 4 Jahre Wartezeit. Bin bei knapp 50 E rein kassierte bereits 4x Dividende und erwarte kontinuierliche Kurssteigerungen.

CVS erhöht wieder die Quartalsdividende und zwar von 0,50 $ auf 0,55 $ (+10%) ab Februar. Außerdem wurde ein Aktienrückkaufprogramm i.H.v. 10. Mrd. $ beschlossen. Der Aetna-Kauf scheint damit verdaut zu sein.

Es wird ein gutes Ergebnis erwartet. Eventuell schon Aussagen zur zukünftigen Dividende. Schaun wir mal.

CVS wird das Rennen machen. Mit dem Q3 Ergebnis werden die vorzeitig die Verschuldungsziele erreichen können um ein A oder AA Rating zu erhalten. Damit können die ab Q4 Aktien zurück kaufen und ab Q1 die Dividende erhöhen. Vielleicht sogar deutlich auf 70 oder 80 cent im Quartal.

Bin seit 55 USD dabei und ist für mich eine Langfristanlage mit schöner beständiger Dividende.

Bin seit 55 USD dabei und ist für mich eine Langfristanlage mit schöner beständiger Dividende.

Aktienduell mit der Aktie CVS Health Corp vs Walgreens Boots Alliance - Wer gewinnt das Duell?

Viel Spaß mit meinem Video, in dem Video werden wir zwei Aktien miteinander vergleiche.In dem Vergleich schauen wir uns an wie hoch das Verhältnis von Schulden zu Eigenkapital ist und kann das Eigenkapital die Schulden zurückzahlen.

Wir schauen uns auch die Dividendenerhöhung der letzten Jahre an.

Antwort auf Beitrag Nr.: 68.051.798 von SwedishChef am 04.05.21 18:28:55

Stimmt, jetzt 85,15 , der Knoten ist geplatzt. Bis Herbst 105 $.

Zitat von SwedishChef: Die Zahlen fürs 1. Quartal sind raus und wurden vom Markt gut aufgenommen.

https://investors.cvshealth.com/investors/newsroom/press-rel…

Aktie zur Stunde rund 4% im Plus.

Stimmt, jetzt 85,15 , der Knoten ist geplatzt. Bis Herbst 105 $.

Die Zahlen fürs 1. Quartal sind raus und wurden vom Markt gut aufgenommen.

https://investors.cvshealth.com/investors/newsroom/press-rel…

Aktie zur Stunde rund 4% im Plus.

https://investors.cvshealth.com/investors/newsroom/press-rel…

Aktie zur Stunde rund 4% im Plus.

Haven, the Amazon-Berkshire-JPMorgan venture to disrupt health care, is disbanding after 3 years

Haven, the joint venture formed by three of America’s most powerful companies to lower costs and improve outcomes in health care, is disbanding after three years, CNBC has learned exclusively.The announcement three years ago that the CEOs of Amazon, Berkshire Hathaway and JPMorgan Chase had teamed up to tackle one of the biggest problems facing corporate America – high and rising costs for employee health care – sent shock waves throughout the world of medicine. Shares of healthcare companies tumbled on fears about how the combined might of leaders in technology and finance could wring costs out of the system.

The move to shutter Haven may be a sign of how difficult it is to radically improve American health care, a complicated and entrenched system of doctors, insurers, drug makers and middle men that costs the country $3.5 trillion every year. Last year, Berkshire CEO Warren Buffett seemed to indicate as much, saying that were was no guarantee that Haven would succeed in improving health care.

https://www.cnbc.com/2021/01/04/haven-the-amazon-berkshire-j…

gute Analyse, danke!

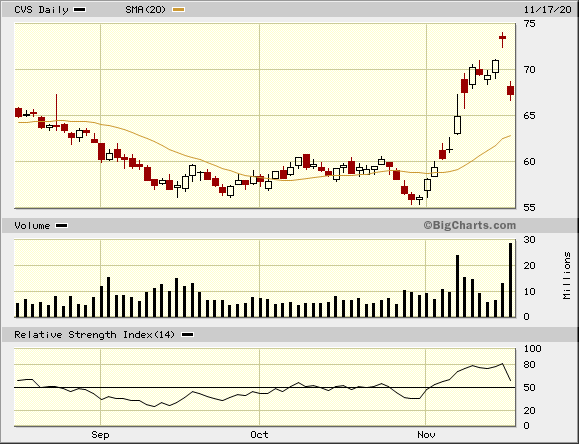

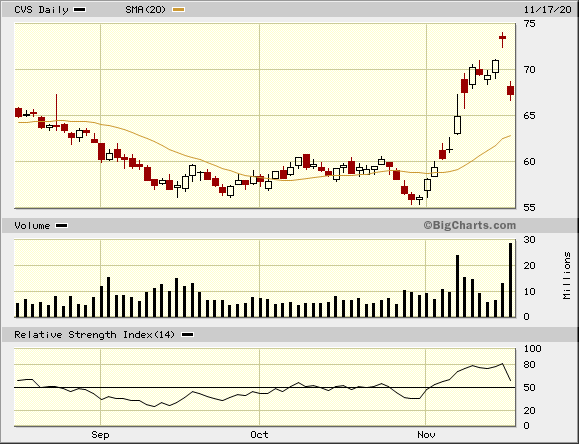

die Aussichten sehe ich dann aber doch etwas positiver. Der Verlauf der letzten Tage zeigt für mich in die Richtung, in die es gehen wird.

Biden und die Corona-Entwicklung werden positive Einflüsse auf den Kursverlauf haben.

Die gegenwärtige Unterbewertung wird sich relativieren und ich sehe charttechnisch Kurse um 80$.

die Aussichten sehe ich dann aber doch etwas positiver. Der Verlauf der letzten Tage zeigt für mich in die Richtung, in die es gehen wird.

Biden und die Corona-Entwicklung werden positive Einflüsse auf den Kursverlauf haben.

Die gegenwärtige Unterbewertung wird sich relativieren und ich sehe charttechnisch Kurse um 80$.

CVS Health Aktie - Aktienanalyse, Dividende, Fairer Preis,Chartanalyse.

Viel Spaß bei meinem Aktienanalyse - Chartanalyse Video mit der Firma CVS Health Corporation, im Video wird auf die Fundamentalanalyse, dem fairen Wert der Aktie und der Charttechnik eingegangen.Bei der Aktienanalyse der Firma CVS Health Corporation wird auf die Bilanz, auf die Dividenden Steigerung, das Eigenkapital und dem Gewinn pro Aktie der letzten vier Jahre eingegangen.

Bei der Chartanalyse der Firma CVS Health Corporation wird auf Unterstützung und Widerstand (Support und Resist) Zonen eingegangen und auf den Trend.

Antwort auf Beitrag Nr.: 65.611.982 von faultcode am 05.11.20 21:59:31und wieder raus -- auf Amazon habe ich keine Lust, auch wenn das Health Insurance-Geschäft das Retail-Geschäft quersubventionieren könnte:

17.11.

CVS and Walgreens Have New Rival in Pharmacy Business: Amazon. The Stocks Are Falling.

https://www.marketwatch.com/articles/cvs-and-walgreens-have-…

...

Shares of the three big pharmacy providers fell Tuesday after e-commerce giant Amazon (ticker: AMZN) unveiled its latest ambition: home delivery of prescription drugs in the U.S., including free, two-day delivery for Prime members. The offering includes a drug savings plan with deep discounts for Prime customers who don’t use insurance.

The move comes two years after Amazon bought PillPack, which delivers pre-sorted daily doses of medications for customers who take multiple drugs a day. That service continues.

“As more and more people look to complete everyday errands from home, pharmacy is an important and needed addition to the Amazon online store,” said Doug Herrington, senior vice president of North American consumer at Amazon.

...

Kam aber nun auch nicht super-überraschend; siehe eben PillPack.

17.11.

CVS and Walgreens Have New Rival in Pharmacy Business: Amazon. The Stocks Are Falling.

https://www.marketwatch.com/articles/cvs-and-walgreens-have-…

...

Shares of the three big pharmacy providers fell Tuesday after e-commerce giant Amazon (ticker: AMZN) unveiled its latest ambition: home delivery of prescription drugs in the U.S., including free, two-day delivery for Prime members. The offering includes a drug savings plan with deep discounts for Prime customers who don’t use insurance.

The move comes two years after Amazon bought PillPack, which delivers pre-sorted daily doses of medications for customers who take multiple drugs a day. That service continues.

“As more and more people look to complete everyday errands from home, pharmacy is an important and needed addition to the Amazon online store,” said Doug Herrington, senior vice president of North American consumer at Amazon.

...

Kam aber nun auch nicht super-überraschend; siehe eben PillPack.

Antwort auf Beitrag Nr.: 65.618.630 von faultcode am 06.11.20 14:07:396.11.

CVS will become the biggest Fortune 500 company to be run by a woman as Karen Lynch becomes CEO

https://news.yahoo.com/cvs-become-biggest-fortune-500-160301…

• CVS Health named Aetna President Karen Lynch as the company's new CEO, effective February 2021.

• Because CVS Health ranks fifth on the Fortune 500, the company will become the largest one led by a woman.

• CVS Health bought Aetna in 2018 for $70 billion.

• Lynch told Business Insider's Lydia Ramsey Pflanzer her vision as Aetna's leader was to help insurance members stay better on top of doctor visits and medicines using CVS Pharmacy or MinuteClinic.

...

CVS will become the biggest Fortune 500 company to be run by a woman as Karen Lynch becomes CEO

https://news.yahoo.com/cvs-become-biggest-fortune-500-160301…

• CVS Health named Aetna President Karen Lynch as the company's new CEO, effective February 2021.

• Because CVS Health ranks fifth on the Fortune 500, the company will become the largest one led by a woman.

• CVS Health bought Aetna in 2018 for $70 billion.

• Lynch told Business Insider's Lydia Ramsey Pflanzer her vision as Aetna's leader was to help insurance members stay better on top of doctor visits and medicines using CVS Pharmacy or MinuteClinic.

...

Antwort auf Beitrag Nr.: 65.611.982 von faultcode am 05.11.20 21:59:31

https://www.marketwatch.com/story/cvs-health-shares-up-3-pre…

https://www.marketwatch.com/story/cvs-health-shares-up-3-pre…

Antwort auf Beitrag Nr.: 62.059.085 von faultcode am 02.12.19 15:46:44wieder rein; habe keine Plünderungen heute gesehen und morgen gibt's die Earnings für's Q3!

Antwort auf Beitrag Nr.: 65.256.073 von dschigiwagi am 01.10.20 20:14:12Ich sehe hier langfristig Potential. Der FCF steigt. Zum 30.6. waren es rund 11 Milliarden FCF. Die Übernahme von Aetna scheint sich nun positiv auszuwirken. In spätestens 2 Jahren erwarte ich persönlich wieder eine dauerhafte Erhöhung der Dividende. Und mit steigendem CF dürfte sich die Steigerung der Div nicht nur im einstelligen Prozentbereich bewegen.

Ich bin da für mich sehr optimistisch.

Ich bin da für mich sehr optimistisch.

Wie seht ihr die momentane Verfassung des Unternehmens, den aktuellen Kurs und die Aussichten. Mir sind Dividenden und Langfristigkeit lieber als irgendwas Richtung Nikola. Auch gerne im Vergleich mit Walgreen...

Interessante Schulter-Kopf-Schulter Formation. Könnte jetzt richtig abgehen Richtung 75 $

Antwort auf Beitrag Nr.: 63.861.695 von faultcode am 01.06.20 14:06:49

Danke für den lustigen Beitrag. Afroamerikaner beklagen sich immer über Benachteiligung sind aber bei jeder Plünderung dabei. Der Floyd war nachweislich voll mit Drogen und sein Verhalten war nicht vorhersehbar. Hätten die Polizisten ihn aus dem Schwitzkasten gelassen hätte er straflos einen der Polizisten umbringen können, weil die hätten ja wissen müssen dass er in Notwehr handle.

Habe mir trotzdem ein paar CVS zugelegt, weil die Story gut ist.

Zitat von faultcode: Nach Sichtung einiger Plünderungs-Videos aus allen möglichen Städten in den USA, natürlich auch Minneapolis–Saint Paul (*), kann ich sagen:

• ein CVS war eigentlich immer dabei, wenn einer vor Ort war/ist

=> nachfragemäßig ist das natürlich ein gutes Zeichen, auch wenn ich natürlich die Plünderungen nicht gutheiße:

16:50

(*) www.youtube.com/watch?v=EwBPW7HVvGQ

Danke für den lustigen Beitrag. Afroamerikaner beklagen sich immer über Benachteiligung sind aber bei jeder Plünderung dabei. Der Floyd war nachweislich voll mit Drogen und sein Verhalten war nicht vorhersehbar. Hätten die Polizisten ihn aus dem Schwitzkasten gelassen hätte er straflos einen der Polizisten umbringen können, weil die hätten ja wissen müssen dass er in Notwehr handle.

Habe mir trotzdem ein paar CVS zugelegt, weil die Story gut ist.

23.04.24 · Aktienwelt360 · Chevron Corporation |

16.04.24 · dpa-AFX · CVS Health |

03.04.24 · wallstreetONLINE Redaktion · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

07.02.24 · wallstreetONLINE Redaktion · CVS Health |

12.01.24 · dpa-AFX · Boeing |