Intercontinental Gold & Metal - 500 Beiträge pro Seite

eröffnet am 10.03.18 15:32:33 von

neuester Beitrag 01.09.20 19:34:01 von

neuester Beitrag 01.09.20 19:34:01 von

Beiträge: 19

ID: 1.276.000

ID: 1.276.000

Aufrufe heute: 0

Gesamt: 739

Gesamt: 739

Aktive User: 0

ISIN: CA4585711068 · WKN: A2H63R

0,0850

CAD

-5,56 %

-0,0050 CAD

Letzter Kurs 04.05.22 TSX Venture

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 16,020 | +17,19 | |

| 29,80 | +16,95 | |

| 0,7999 | +14,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,2100 | -7,80 | |

| 30,60 | -8,38 | |

| 5,5000 | -9,09 | |

| 2,1800 | -9,17 | |

| 4,2300 | -17,86 |

Hallo zusammen,

Ich habe mich entschlossen einen neuen Thread zu eröffnen, da Intercontinental Gold & Metal nicht mehr viel mit der alten Firma Geodex Minerals gemeinsam hat.

Man konzentriert sich auf den Rohstoffhandel, aktuell liegt der Fokus auf Gold aus Artisanal Mining oder kleinen Bergbaubetrieben in Lateinamerika. Die ersten Monate waren im Grunde recht erfolgreich und der Trend setzt sich fort !

Auszug aus dem aktuelle MD&A Bericht

The Company currently generates revenue from sale of purchased gold purchased at a discount from licensed Artisanal and Small Gold Miners (ASGM’s). Additional revenue is generated from foreign exchange and net interest margin on cash balances.

Operational Highlights

During the quarter (November 6, 2017) the Company announced that it had changed its name from Geodex Minerals Ltd. to Intercontinental Gold and Metals Ltd. The company has also changed its ticker symbol from GXM to ICAU.

October 2017 Gold Exports – The Company recorded gold exports of 3,087 ounces versus over 2,367 ounces reported for September 2017.

November 2017 Gold Exports – The Company recorded gold exports of 3,144 ounces versus over 3,087 ounces reported for October 2017.

December 2017 Gold Exports – The Company recorded gold exports of 2,950 ounces versus over 3,144 ounces reported for November 2017.

Gold trading and exports are basically in line with forecast for the period which factored in usual seasonal slowdown of gold purchases during the Christmas holiday season and the onset of the rainy season which occurs between December and March.

Financial Highlights

Three months ended December 31, 2017 compared with three months ended December 31, 2016

Intercontinental Gold’s net loss totaled $121,529 for the three months ended December 31, 2017, with basic and diluted loss per share of $0.01. This compares with a net loss of $185,743 with basic and diluted loss per share of $0.07 for the three months ended December 31, 2016. The decrease of $64,214 in net loss was principally because:

For the three months ended December 31, 2017, the company generated operating revenues of $170,442 versus $nil in the quarter ended December 31 2016, a reversal of consulting fees of $131,143 versus $120,000 recorded in the quarter ended December 31, 2016, offset by;

• i) business development expenses which increased by $114,255,

• ii) office and miscellaneous expense which increased by $69,514,

• iii) shareholder information and investor relations which increased by $63,369 and

• iv) salaries and benefits which increased by $65,280 as compared to three months ended December 31, 2016.

The increase is attributable to the increased level of business activity related to active gold trading, marketing and other consulting services provided by the Company’s consultants related to operations and growth initiatives.

The above increases were partially offset by revenue of derived from gold trading business of $15,404,317 offset by cost of sales of $15,233,875 during the three months ended December 31, 2017.

Quelle: www.sedar.com

Auf dem ersten Blick scheint das wenig spektakulär zu sein, aber man ist ja auch gerade am Anfang und die Marge liegt aktuell bei > 2 %. An der Marge wird sich nicht viel ändern, aber das Volumen der abgewickelten An & Verkäufe ist entscheidend. Es wird bald eine 2 Finanzierungsrunde geben, die anscheinend bei bereits Investierten Gruppen auf großes Interesse stößt. Ich persönlich finde das Konzept äußerst spannend, das Geld wird erst mal nicht für vielleicht sinnlose Probebohrungen etc. ausgegeben, sondern landet direkt aktiv im Rohstoffhandel und wirft eine Marge ab !!!

Vom Prinzip her macht Intercontinental Gold nichts anderes als GlencoreXstrata, nur halt im kleineren Rahmen und in den Anfängen.

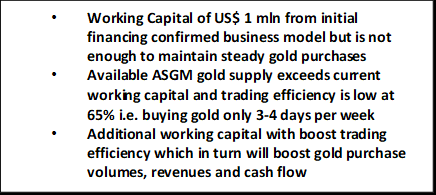

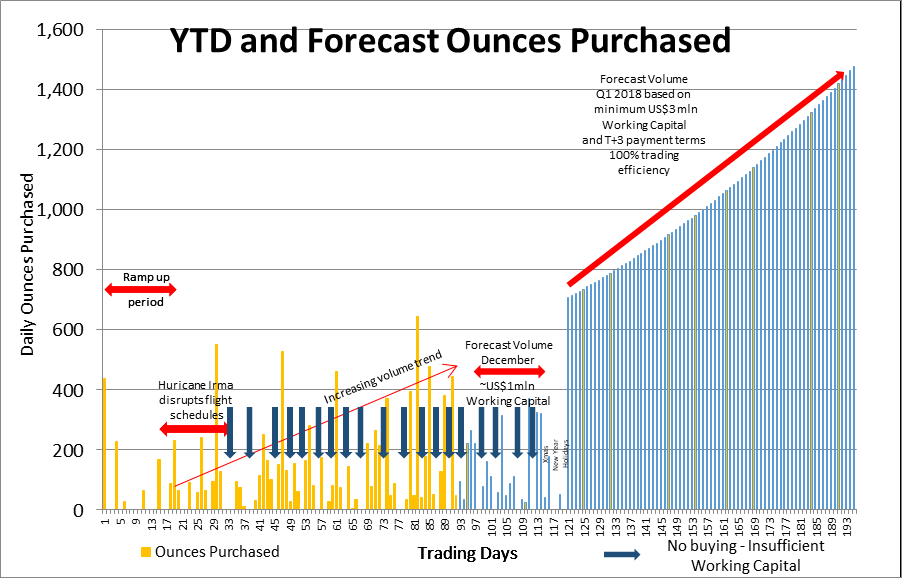

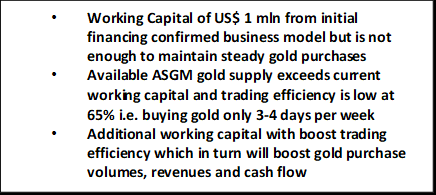

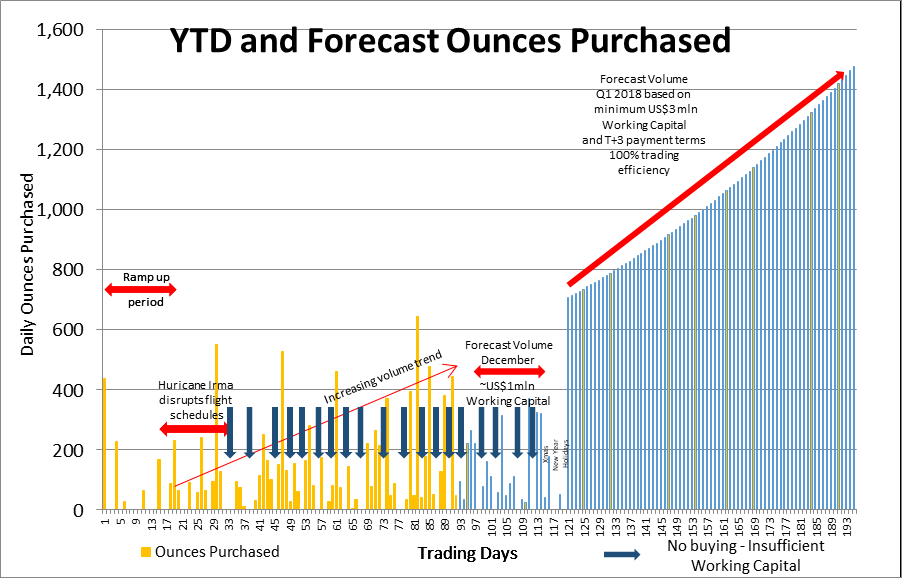

Diese beiden Grafiken hat mir der CEO Gord Glenn zur Verfügung gestellt

Ich hoffe hier mit Leuten zu Diskutieren die das neue Unternehmen genau so interessant finden wie ich. Da die Homepage immer noch nicht auf dem aktuellen Stand ist, ist alles zur Zeit etwas intransparent, aber daran Arbeitet man wohl !!

schönes Wochenende euch allen

Pirat

Ich habe mich entschlossen einen neuen Thread zu eröffnen, da Intercontinental Gold & Metal nicht mehr viel mit der alten Firma Geodex Minerals gemeinsam hat.

Man konzentriert sich auf den Rohstoffhandel, aktuell liegt der Fokus auf Gold aus Artisanal Mining oder kleinen Bergbaubetrieben in Lateinamerika. Die ersten Monate waren im Grunde recht erfolgreich und der Trend setzt sich fort !

Auszug aus dem aktuelle MD&A Bericht

The Company currently generates revenue from sale of purchased gold purchased at a discount from licensed Artisanal and Small Gold Miners (ASGM’s). Additional revenue is generated from foreign exchange and net interest margin on cash balances.

Operational Highlights

During the quarter (November 6, 2017) the Company announced that it had changed its name from Geodex Minerals Ltd. to Intercontinental Gold and Metals Ltd. The company has also changed its ticker symbol from GXM to ICAU.

October 2017 Gold Exports – The Company recorded gold exports of 3,087 ounces versus over 2,367 ounces reported for September 2017.

November 2017 Gold Exports – The Company recorded gold exports of 3,144 ounces versus over 3,087 ounces reported for October 2017.

December 2017 Gold Exports – The Company recorded gold exports of 2,950 ounces versus over 3,144 ounces reported for November 2017.

Gold trading and exports are basically in line with forecast for the period which factored in usual seasonal slowdown of gold purchases during the Christmas holiday season and the onset of the rainy season which occurs between December and March.

Financial Highlights

Three months ended December 31, 2017 compared with three months ended December 31, 2016

Intercontinental Gold’s net loss totaled $121,529 for the three months ended December 31, 2017, with basic and diluted loss per share of $0.01. This compares with a net loss of $185,743 with basic and diluted loss per share of $0.07 for the three months ended December 31, 2016. The decrease of $64,214 in net loss was principally because:

For the three months ended December 31, 2017, the company generated operating revenues of $170,442 versus $nil in the quarter ended December 31 2016, a reversal of consulting fees of $131,143 versus $120,000 recorded in the quarter ended December 31, 2016, offset by;

• i) business development expenses which increased by $114,255,

• ii) office and miscellaneous expense which increased by $69,514,

• iii) shareholder information and investor relations which increased by $63,369 and

• iv) salaries and benefits which increased by $65,280 as compared to three months ended December 31, 2016.

The increase is attributable to the increased level of business activity related to active gold trading, marketing and other consulting services provided by the Company’s consultants related to operations and growth initiatives.

The above increases were partially offset by revenue of derived from gold trading business of $15,404,317 offset by cost of sales of $15,233,875 during the three months ended December 31, 2017.

Quelle: www.sedar.com

Auf dem ersten Blick scheint das wenig spektakulär zu sein, aber man ist ja auch gerade am Anfang und die Marge liegt aktuell bei > 2 %. An der Marge wird sich nicht viel ändern, aber das Volumen der abgewickelten An & Verkäufe ist entscheidend. Es wird bald eine 2 Finanzierungsrunde geben, die anscheinend bei bereits Investierten Gruppen auf großes Interesse stößt. Ich persönlich finde das Konzept äußerst spannend, das Geld wird erst mal nicht für vielleicht sinnlose Probebohrungen etc. ausgegeben, sondern landet direkt aktiv im Rohstoffhandel und wirft eine Marge ab !!!

Vom Prinzip her macht Intercontinental Gold nichts anderes als GlencoreXstrata, nur halt im kleineren Rahmen und in den Anfängen.

Diese beiden Grafiken hat mir der CEO Gord Glenn zur Verfügung gestellt

Ich hoffe hier mit Leuten zu Diskutieren die das neue Unternehmen genau so interessant finden wie ich. Da die Homepage immer noch nicht auf dem aktuellen Stand ist, ist alles zur Zeit etwas intransparent, aber daran Arbeitet man wohl !!

schönes Wochenende euch allen

Pirat

aktuelle Präsentation

Hallo ,ist leider online nicht zu finden, wer interesse hat bitte kurz eine BM dann bekommst Du sie !!

Pirat

NEWS

Intercontinental Gold and Metals Ltd. Closes $2.43 Million Second and Final Tranche Unit Financing andProvides Corporate Update on Strategic Growth Plan

TORONTO, ONTARIO – April 13, 2018 – Intercontinental Gold and Metals Ltd. (TSX-V:ICAU) (the “Company”) is pleased to announce that, further to its press releases dated December 13, 2017, December 22, 2017 and January 5, 2018, the Company has completed the second and final tranche of its previously announced unit financing (the “Offering”) and issued, as a loan bonus in accordance with Policy 5.1 of the TSX Venture Exchange (the “TSXV”), an additional 2,430 units (the “Units”) at a price of $1,000 per Unit for additional gross proceeds of $2,430,000. The aggregate gross proceeds raised pursuant to the Offering was $3,750,000 through the issuance of 3,750 Units. Each Unit consists of: (i) one promissory note in the principal amount of C$1,000 bearing a coupon of 10.0%, payable semi-annually, with a 5-year term (each, a “Note”); (ii) 750 common shares (the “Bonus Shares”); and (iii) 750 common share purchase warrants (the “Bonus Warrants”). Each Bonus Warrant is exercisable for one common share of the Company at a price of $0.20 per common share for a period of five years from the date of issuance.

In connection with the second tranche, certain eligible persons (the “Finders”) were paid a cash commission equal to 6% of the proceeds raised from subscribers introduced to the Company by such Finder and also issued an aggregate of 99,000 broker warrants (the “Broker Warrants”) to such Finders, each Broker Warrant entitling the holder to acquire one common share at a price of $0.20 for a period of five years from the date of issuance.

Proceeds of the Offering will be used for gold trading activities and project development capital for the Company’s current gold trading operations, expansion of gold trading activities into Peru and Brazil, and for general working capital purposes.

...untern Radar

Ahoi,die den Mut hatten hier mit Thread eröffnung einzusteigen gratuliere ich zu den bisherigen Gewinnen.

Es wird aber weitergehen

Intercontinental Gold and Metals Ltd. Announces Normal Course Issuer Bid

Toronto, Ontario--(Newsfile Corp. - May 11, 2018) - Intercontinental Gold and Metals Ltd. (TSXV: ICAU) (the "Company") is pleased to announce today that it intends to proceed with a normal course issuer bid to purchase up to 877,873 of its common shares (the "Bid").

The Company is commencing the Bid because it believes that the current market price of its common shares may not fully reflect the underlying value of the Company's business and future prospects. The Company believes that the repurchase of its common shares for cancellation is in the best interests of its shareholders because the Bid will increase the respective proportionate shareholdings and equity interests in the Company of all remaining shareholders.

As at the date hereof, the Company has 17,557,464 common shares issued and outstanding. The 877,873 common shares that may be purchased by the Company under the Bid represent approximately 5% of the Company's issued and outstanding. The Company received acceptance from the TSX Venture Exchange (the "TSXV") to commence the Bid on May 14, 2018. The Bid will terminate on May 14, 2019, or an earlier date in the event that the number of common shares sought in the Bid has been repurchased. The Company reserves the right to terminate the Bid earlier if it feels appropriate to do so.

All common shares will be purchased on the open market through the facilities of the TSXV, and payment for the common shares will be made in accordance with TSXV policies. The price paid for the common shares will be the prevailing market price at the time of the purchase. Purchases may be suspended at any time, and no purchases will be made other than by means of open market transactions during the term of the Bid.

The Company has engaged Integral Wealth Securities to act as broker through which the Bid will be conducted.

About Intercontinental Gold and Metals Ltd.

Intercontinental Gold and Metals Ltd. is a Next Generation Metals and Mining Company providing leverage to commodity prices, exploration and development success and significant growth potential for our stakeholders. Our physical commodities marketing and trading operations provide insights in global primary supply and demand trends that in turn create a strategic and competitive advantage investment and expansion opportunities on a global basis. The Company generates revenues from the purchases and sales of gold and silver (accounted for as revenue). Cost of sales is measured at the fair value of the precious metals purchased and inventory sold, which is purchased at a competitive discount from licensed artisanal and small gold miners (ASGM) in Latin America (LATAM). ASGM supply supports a sustainable revenue generation model. We are unique being the only publicly listed company servicing the LATAM ASGM market.

ON BEHALF OF THE BOARD OF DIRECTORS

INTERCONTINENTAL GOLD AND METALS LTD.

Gorden Glenn

President & Chief Executive Officer

PDAC 2019

Dear Gold Investor/Analyst/Banker/CEO/CFO/VP-Ex/VP-Op etc.You Are Cordially Invited to Our 2019 PDAC GOLD & SILVER RECEPTIONS

To meet demand and make sure we connect with everyone we are hosting 2 cocktail receptions this year.

Our first GOLD & SILVER Reception will be on Monday March 4th at Louix Louis in the St Regis Hotel (GOLD 1) and our second reception (GOLD 2) will be on Tuesday March 5th at Bymark. Please plan to come out and discuss GOLD & SILVER investing at either venue and learn about the many milestones accomplished in 2018 by Minnova Corp. and Intercontinental Gold and Metals Ltd.

At Minnova Corp., we completed additional drilling in 2018 on strike from the mineable reserves and confirmed the exploration/resource/reserve expansion potential at our PL Mine. This work followed our Positive Feasibility Study release in November 2017. We are in full re-start mode, pending financing, and continue to evaluate financing options to re-start PL. In late 2018 we made a strategic decision to expanded our portfolio with the addition of the La Esperanza project in Peru in late 2018, an untested high grade vein system in a proven mining district in Peru. We now have near term production and exciting discovery potential.

At Intercontinental Gold we completed our first full year of operations in 2018, generated revenue of well over C$100 million, initiated refining operations to produce 9999's gold and silver bullion for export from our LATAM operations. We currently have operations in Bolivia and Peru with sights on Brazil in 2019. ICAU is a unique alternative gold and silver investment with incredible growth potential sourcing gold and silver from licensed artisinal miners in LATAM.

Hope you can join us to learn more about our successes in 2018 and our outlook for 2019 for both MCI.V and ICAU.V

We hope you can make it!Cheers,Hosted by Intercontinental Gold and Metals Ltd.

Intercontinental Gold and Metals Ltd. Reports Gold Trading Revenue of $126.5M and Net Loss of $1.15M for the Nine Month Fiscal Period Ended December 31, 2018

https://www.newsfilecorp.com/release/44428

https://www.newsfilecorp.com/release/44428

Intercontinental Gold and Metals Ltd. Reports First Quarter of 2019 Revenue increase of 443% to $48.9M versus $9.0M in the first quarter of 2018. Net loss for the period decreased by 89% to $0.1M from $0.7M in the first quarter of 2018.

Toronto, Ontario--(Newsfile Corp. - May 31, 2019) - Intercontinental Gold and Metals Ltd. (TSXV: ICAU) (the "Company") a gold and metals trading company, is pleased to announce interim financial results for the first quarter ended March 31, 2019. All amounts are expressed in Canadian dollars unless otherwise noted.

Operating and Financial Highlights - Quarter Ended March 31, 2019

443% Increase in Revenue - Intercontinental Gold reports revenue of $48.9 million ($2.71 per share) for the first quarter of fiscal 2019, compared to $9.0 million ($0.84 per share) in the comparable quarter in 2018.

89% Decrease in Net Loss - The Company's net loss decreased to $76,929 for the quarter ended March 31, 2019, with basic and diluted loss per share of $0.00 versus a net loss of $681,182 with basic and diluted loss per share of $0.06 for the quarter ended March 31, 2018.

551% Increase in Adjusted EBITDA - Adjusted EBITDA for the quarter ended March 31, 2019 was positive $215,365 or $0.01 per share, compared to negative $47,711 or ($0.00) for the quarter ended March 31, 2018

Toronto, Ontario--(Newsfile Corp. - May 31, 2019) - Intercontinental Gold and Metals Ltd. (TSXV: ICAU) (the "Company") a gold and metals trading company, is pleased to announce interim financial results for the first quarter ended March 31, 2019. All amounts are expressed in Canadian dollars unless otherwise noted.

Operating and Financial Highlights - Quarter Ended March 31, 2019

443% Increase in Revenue - Intercontinental Gold reports revenue of $48.9 million ($2.71 per share) for the first quarter of fiscal 2019, compared to $9.0 million ($0.84 per share) in the comparable quarter in 2018.

89% Decrease in Net Loss - The Company's net loss decreased to $76,929 for the quarter ended March 31, 2019, with basic and diluted loss per share of $0.00 versus a net loss of $681,182 with basic and diluted loss per share of $0.06 for the quarter ended March 31, 2018.

551% Increase in Adjusted EBITDA - Adjusted EBITDA for the quarter ended March 31, 2019 was positive $215,365 or $0.01 per share, compared to negative $47,711 or ($0.00) for the quarter ended March 31, 2018

neue Homepage

... endlich ist mal die neue Homepage online, wenn auch noch einige aktualisierungen fehlen :https://www.intercontinentalgold.com/

Präsentation Juli 2019 und Video

https://vimeo.com/347913071https://www.intercontinentalgold.com/site/assets/files/5262/…

NEWS

Intercontinental Gold and Metals Ltd. Reports Record Gold Exports for Q2 2019. Revenue Increases by 157% to $84.4M Versus $29.7M in the Q2 2018. Increasing 2019 Revenue Guidance.

https://web.tmxmoney.com/article.php?newsid=5301086084157946…

Intercontinental Gold and Metals Ltd. Announces Strategic Initiative to Increase Gold Recoveries and Production of Small Gold Miner Clients

TORONTO, ONTARIO – September 4, 2019 – Intercontinental Gold and Metals Ltd. (ICAU:TSXV, GXMLF:OTC US) (the “Company”) a gold refining and commodity trading company, is pleased to announce that it has entered into a Co-Operation Agreement (the ”Agreement”) with PUM Netherlands Senior Experts (“PUM”). The goal of the Agreement is to review the mining and processing techniques and equipment of our Small Gold Mining clientele and where appropriate introduce new equipment and technologies to improve gold recoveries and work environment , health and economic live of the miners and their families The initiative also involves the support of the Federation of Gold Miners (FERRECO) and the Cámara Nacional de Comercio (Bolivian National Chamber of Commerce) with all stakeholders seeking improved operating and living conditions for small miners and their communities. Gorden Glenn, CEO commented “Small gold miner, project scale assistance (advisory, technical or financial), has always been a part of the Company’s longer-term business strategy to grow and secure gold purchase volumes and further penetrate the Bolivian market. Our gold suppliers regularly comment on the operating challenges they face so it only makes sense to introduce a team of experts to review current operations and where appropriate propose changes that could, potentially lead to increased gold production through higher recovery rates. As reported in our most recent Second Quarter Financial Statements our gold export volumes continue to exhibit a strong growth trend. If successful, this strategic initiative has the potential to further boost gold supplier volumes in favour of the Company.”

The key objectives of the Agreement are to review existing mining and processing techniques, introduce new technology to develop operations that ultimately improve the life of small miners, their communities and the environment.

komplette Meldung: https://www.intercontinentalgold.com/site/assets/files/5266/…

Intercontinental Gold and Metals Ltd. Reports Record Gold Exports for Q3 2019. Revenue increased by 286% to $136.0M versus $35.2M in the Q3 2018. Positive Net Income of 0.36M versus a loss of 0.25M in Q3 2018 Increasing 2019 Revenue Guidance.

TORONTO, ONTARIO – November 7, 2019 – Intercontinental Gold and Metals Ltd. (ICAU:TSXV, GXMLF:OTC US) (the “Company”) a gold refining and commodity trading company, is pleased to announce interim financial results for the third quarter ended September 30, 2019. All amounts are expressed in Canadian dollars unless otherwise noted.

Operating and Financial Highlights – Quarter Ended September 30, 2019

145% Increase in Export Volumes – Q3/19 refined gold exports of 69,588 ounces (2,164 kg)

compared to 28,440 ounces (917 kgs) in the comparable quarter of 2018.

286% Increase in Revenue – Q3/19 revenue of $136.0 million ($7.55 per share) compared to $35.2 million ($1.99 per share) in the comparable quarter of 2018.

First Net Profit in Company History – Q3/19 net earnings of $359,557, with basic and diluted net earnings per share of $0.02 versus a net loss of $247,547 with basic and diluted loss per share of $0.02 in the comparable quarter of 2018.

Increase in Adjusted EBITDA – Q3/19 Adjusted EBITDA was positive $547,051 or $0.03 per share compared to negative $5,700 or ($nil) in the comparable quarter of 2018.

Increasing 2019 Revenue Guidance – 2019 Revenue guidance increased to between $340 and $350 million from previous guidance of between $337 million and $347 million.

TORONTO, ONTARIO – November 7, 2019 – Intercontinental Gold and Metals Ltd. (ICAU:TSXV, GXMLF:OTC US) (the “Company”) a gold refining and commodity trading company, is pleased to announce interim financial results for the third quarter ended September 30, 2019. All amounts are expressed in Canadian dollars unless otherwise noted.

Operating and Financial Highlights – Quarter Ended September 30, 2019

145% Increase in Export Volumes – Q3/19 refined gold exports of 69,588 ounces (2,164 kg)

compared to 28,440 ounces (917 kgs) in the comparable quarter of 2018.

286% Increase in Revenue – Q3/19 revenue of $136.0 million ($7.55 per share) compared to $35.2 million ($1.99 per share) in the comparable quarter of 2018.

First Net Profit in Company History – Q3/19 net earnings of $359,557, with basic and diluted net earnings per share of $0.02 versus a net loss of $247,547 with basic and diluted loss per share of $0.02 in the comparable quarter of 2018.

Increase in Adjusted EBITDA – Q3/19 Adjusted EBITDA was positive $547,051 or $0.03 per share compared to negative $5,700 or ($nil) in the comparable quarter of 2018.

Increasing 2019 Revenue Guidance – 2019 Revenue guidance increased to between $340 and $350 million from previous guidance of between $337 million and $347 million.

..Präsentation wurde mit den Daten des Q3 aktualisiert

https://www.intercontinentalgold.com/site/assets/files/5281/…

https://www.intercontinentalgold.com/site/assets/files/5281/…

sehenswertes Interview

Intercontinental Gold and Metals Ltd. Reports Gold Trading Revenue of $321.8M and Net Loss of $0.6M for the Year Ended December 31, 2019

https://www.newsfilecorp.com/release/57600/Intercontinental-…

Operating and Financial Highlights - Quarter Ended and Year Ended December 31, 2019

105% increase in YoY Export Volumes - 2019 refined gold exports of 172,106 ounces (5,385 kg) compared to 84,063 ounces (2,712 kgs) in the comparable twelve month period of 2018. (see Note 1 below)

137% Increase in Revenue - 2019 revenue of $321.8 million ($17.86 per share) compared to $135.5 million ($7.66 per share) in the comparable twelve month period of 2018. (see Note 1 below)

45% Reduction in Net Loss - 2019 net loss of $646,557 or $0.04 per share as compared to a net loss of $1,180,310 or $0.06 per share in the nine month and period ended December 31, 2018.

1923% Increase in Adjusted EBITDA - 2019 Adjusted EBITDA was positive $992,119 or $0.06 per share compared to $49,043 or $nil per share in the nine month and period ended December 31, 2018.

Intercontinental Gold and Metals Ltd. Reports Gold Trading Revenue of $91.9M and Net Loss of $0.4M for the First Quarter Ended March 31, 2020 and Advances Other Growth Initiatives

https://www.sedar.com/DisplayProfile.do?lang=EN&issuerType=0…

Intercontinental Gold and Metals Ltd.: Finanzzahlen Q1 2020

10.07.2020 | 11:39 Uhr | Rohstoff-Welt.de

Intercontinental Gold and Metals Limited veröffentlichte gestern die Finanzergebnisse für das erste Quartal des laufenden Jahres. Die wichtigsten Zahlen im Überblick:

• Export von raffiniertem Gold: 42.192 Unzen, +52% (Q1 2019: 27.742 oz)

• Umsatz: 91,9 Mio. CAD (5,08 CAD je Aktie), +88% (Q1 2019: 48,9 Mio. CAD)

• Nettoverlust: 356.320 CAD (0,02 CAD je Aktie),

• Adjustiertes EBITDA: -132.239 CAD (-0,01 CAD je Aktie)

10.07.2020 | 11:39 Uhr | Rohstoff-Welt.de

Intercontinental Gold and Metals Limited veröffentlichte gestern die Finanzergebnisse für das erste Quartal des laufenden Jahres. Die wichtigsten Zahlen im Überblick:

• Export von raffiniertem Gold: 42.192 Unzen, +52% (Q1 2019: 27.742 oz)

• Umsatz: 91,9 Mio. CAD (5,08 CAD je Aktie), +88% (Q1 2019: 48,9 Mio. CAD)

• Nettoverlust: 356.320 CAD (0,02 CAD je Aktie),

• Adjustiertes EBITDA: -132.239 CAD (-0,01 CAD je Aktie)

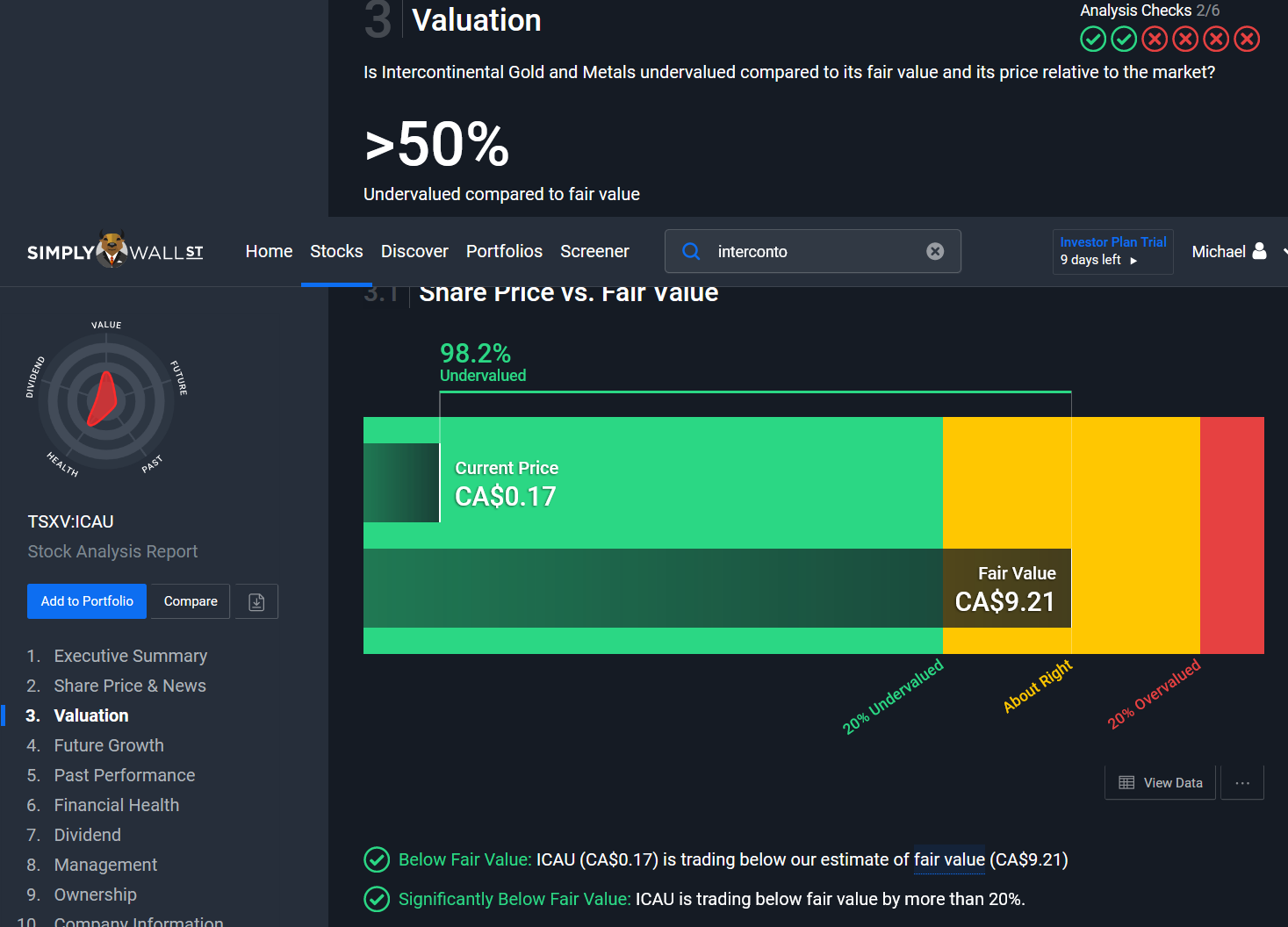

Kursziel <Fair Value>

Infos zur Kalkulation u.a.

https://simplywall.st/stocks/ca/capital-goods/tsxv-icau/inte…

Intercontinental Gold and Metals Ltd. Reports Second Quarter Ended June 30, 2020 Financial Results

https://www.newsfilecorp.com/release/62991/Intercontinental-… Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| 0,00 | |

| -0,53 | |

| +0,19 | |

| +0,21 | |

| +13,33 | |

| -1,50 | |

| 0,00 | |

| +2,00 | |

| -4,20 | |

| -1,70 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 242 | ||

| 91 | ||

| 90 | ||

| 87 | ||

| 57 | ||

| 54 | ||

| 49 | ||

| 49 | ||

| 40 | ||

| 31 |