Newell Brands Announces Agreement with Carl C. Icahn (Seite 2) | Diskussion im Forum

eröffnet am 19.03.18 21:27:49 von

neuester Beitrag 23.04.24 03:15:45 von

neuester Beitrag 23.04.24 03:15:45 von

Beiträge: 64

ID: 1.276.646

ID: 1.276.646

Aufrufe heute: 1

Gesamt: 3.893

Gesamt: 3.893

Aktive User: 0

ISIN: US6512291062 · WKN: 860036 · Symbol: NWL

6,5980

EUR

+0,21 %

+0,0140 EUR

Letzter Kurs 10:33:55 Tradegate

Neuigkeiten

12.04.24 · Business Wire (engl.) |

22.02.24 · Business Wire (engl.) |

16.02.24 · Business Wire (engl.) |

09.02.24 · Business Wire (engl.) |

Werte aus der Branche Konsum

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 34.220,00 | +926,70 | |

| 0,7700 | +32,64 | |

| 21.500,00 | +27,22 | |

| 210,50 | +18,89 | |

| 2,4000 | +14,01 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,900 | -9,85 | |

| 1,5400 | -10,47 | |

| 7,5000 | -11,76 | |

| 8,4500 | -11,98 | |

| 0,5020 | -16,33 |

Beitrag zu dieser Diskussion schreiben

Ähm,

und wo ist hier das positive nachdem die Aktie bei grottenschlechten Ausblick zwischenzeitlich ins positive gedreht hat?

und wo ist hier das positive nachdem die Aktie bei grottenschlechten Ausblick zwischenzeitlich ins positive gedreht hat?

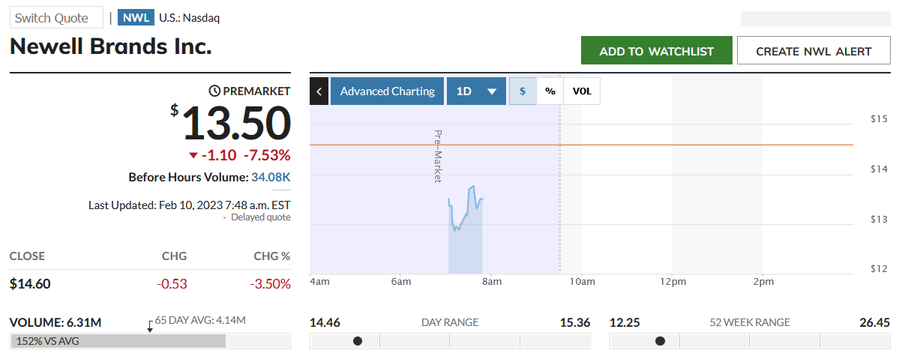

10.2.

Newell Brands Stock Falls on Forecast for First-Quarter Loss. CEO to Retire.

https://www.marketwatch.com/articles/newell-brands-stock-ear…

...

Newell Brands stock was tumbling Friday after the parent of Rubbermaid said it expects a first-quarter loss and provided a disappointing full-year outlook amid a “tough operating environment.”

The company also announced Chief Executive Ravi Saligram would be retiring.

For the current quarter, the fiscal first quarter, Newell (ticker: NWL) said it expects a loss of between 3 cents a share to 6 cents on sales between $1.79 billion to $1.84 billion. That was a big surprise to analysts who expected earnings of 22 cents a share on revenue of $2.04 billion.

The company also expects 2023 earnings to be between 95 cents a share and $1.08 a share. Analysts surveyed by FactSet were expecting full-year earnings of $1.42 a share. Sales guidance of between $8.4 billion to $8.6 billion for the year also was below Wall Street estimates of $9.09 billion.

...

=>

Newell Brands Stock Falls on Forecast for First-Quarter Loss. CEO to Retire.

https://www.marketwatch.com/articles/newell-brands-stock-ear…

...

Newell Brands stock was tumbling Friday after the parent of Rubbermaid said it expects a first-quarter loss and provided a disappointing full-year outlook amid a “tough operating environment.”

The company also announced Chief Executive Ravi Saligram would be retiring.

For the current quarter, the fiscal first quarter, Newell (ticker: NWL) said it expects a loss of between 3 cents a share to 6 cents on sales between $1.79 billion to $1.84 billion. That was a big surprise to analysts who expected earnings of 22 cents a share on revenue of $2.04 billion.

The company also expects 2023 earnings to be between 95 cents a share and $1.08 a share. Analysts surveyed by FactSet were expecting full-year earnings of $1.42 a share. Sales guidance of between $8.4 billion to $8.6 billion for the year also was below Wall Street estimates of $9.09 billion.

...

=>

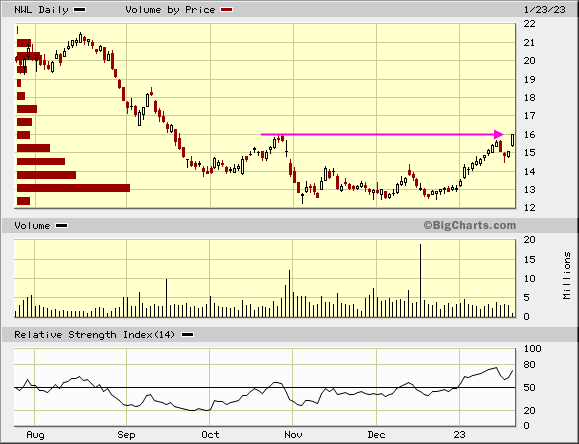

Newell Brands aktuell Top 5 im SP500:

wegen:

Newell Brands to lay off 13% of staff amid restructuring

https://www.marketwatch.com/story/newell-brands-to-lay-off-1…

...

Newell Brands Inc., the parent company of Rubbermaid, Sharpie, and other brands, announced Monday that it planned to cut about 13% of office positions as it looks to reduce costs. The company expects to see annualized pre-tax savings of $220 million to $250 million as the result of its broader restructuring and cost-savings plan.

Newell Brands expects that it will start the layoffs in the first quarter of 2023 and be mostly done by the end of the yer. Newell Brands had 32,000 employees as of Dec. 31, 2021, according to its latest 10-K, which was filed in February 2022.

The company is also moving to consolidate its five operating segments into three. “These actions are a continuation of the simplification agenda that we have driven over the last four years and in response to the difficult macro environment,” Chief Executive Ravi Saligram said in a release.

wegen:

Newell Brands to lay off 13% of staff amid restructuring

https://www.marketwatch.com/story/newell-brands-to-lay-off-1…

...

Newell Brands Inc., the parent company of Rubbermaid, Sharpie, and other brands, announced Monday that it planned to cut about 13% of office positions as it looks to reduce costs. The company expects to see annualized pre-tax savings of $220 million to $250 million as the result of its broader restructuring and cost-savings plan.

Newell Brands expects that it will start the layoffs in the first quarter of 2023 and be mostly done by the end of the yer. Newell Brands had 32,000 employees as of Dec. 31, 2021, according to its latest 10-K, which was filed in February 2022.

The company is also moving to consolidate its five operating segments into three. “These actions are a continuation of the simplification agenda that we have driven over the last four years and in response to the difficult macro environment,” Chief Executive Ravi Saligram said in a release.

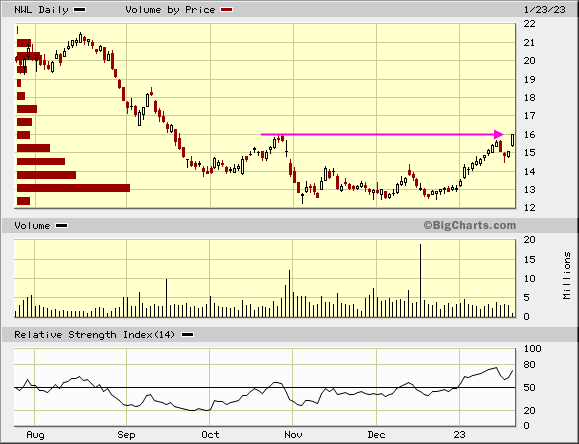

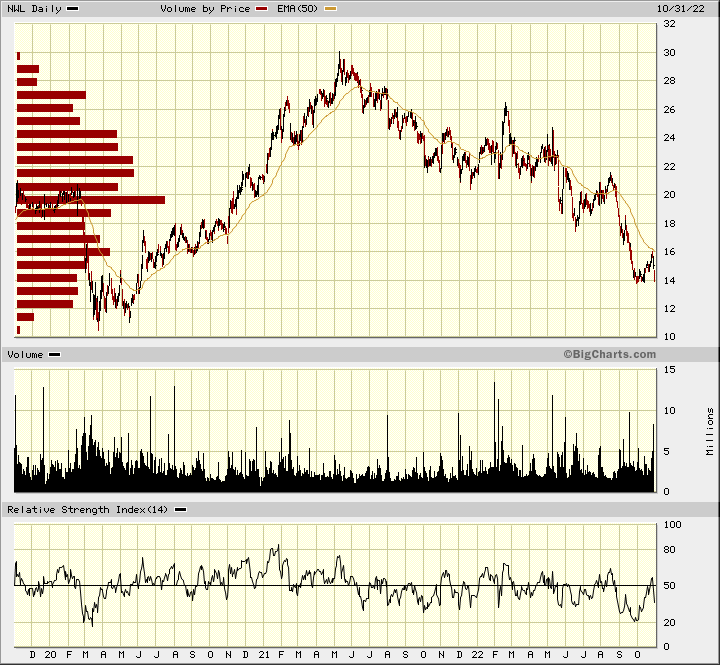

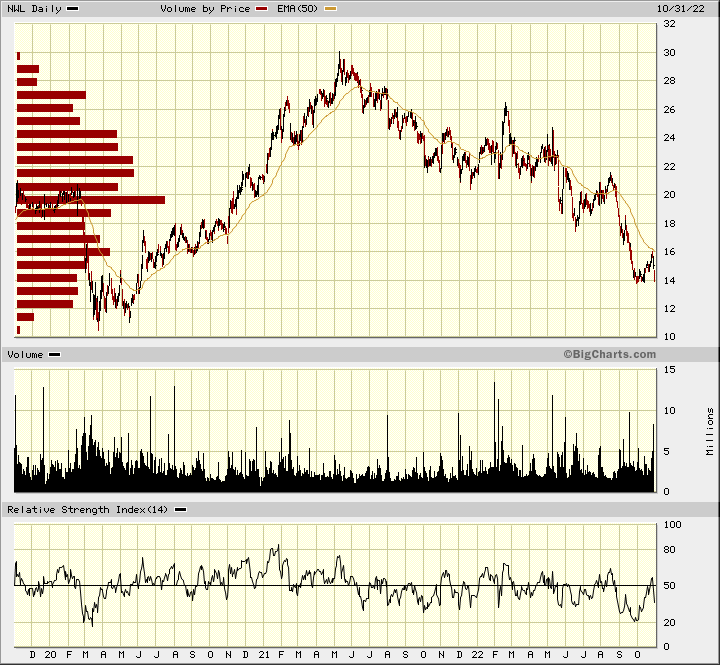

Antwort auf Beitrag Nr.: 72.666.664 von faultcode am 31.10.22 16:01:46cf.

Zitat von faultcode: ...

As October winds down, it’s time to apply a tactic that’s as close to a “sure winner” as you’ll ever find in the stock market: Shop for stock bargains created by tax-loss selling.

Mutual funds have until the end of October to realize losses they need to offset their winners. Buying good names that they annihilate is consistently a winning tactic, particularly in dismal market years like this one. ...

Antwort auf Beitrag Nr.: 72.666.643 von faultcode am 31.10.22 15:57:40nebenbei: diese ganzen News waren ja schon am Freitag, vor Börseneröffnung, bekannt => ich vermute, daß sich ein paar Fonds hier zum 31.10. von dieser Position trennen:

$NWL kommt heute unter die Räder (derzeit SP500-Schlusslicht), allerdings halte ich diese Rücknahme der Q4-Guidance für nicht so wesentlich:

28.10.

Newell Brands Lowers Ceiling of 2022 Sales, Adj EPS Outlook

https://www.marketwatch.com/story/newell-brands-lowers-ceili…

...

Eine Refinanzierung erfolgte ja schon im September:

28.10.

Newell Brands Announces Third Quarter 2022 Results

...

The company strengthened its financial flexibility and refinanced its unsecured revolving credit facility as well as its senior notes due April 2023 (April 2023 notes). In September, the company issued $1.0 billion of senior notes and in October, used the net proceeds, together with available cash, to redeem the April 2023 notes.

...

https://ir.newellbrands.com/

=> I buy this dip:

28.10.

Newell Brands Lowers Ceiling of 2022 Sales, Adj EPS Outlook

https://www.marketwatch.com/story/newell-brands-lowers-ceili…

...

Eine Refinanzierung erfolgte ja schon im September:

28.10.

Newell Brands Announces Third Quarter 2022 Results

...

The company strengthened its financial flexibility and refinanced its unsecured revolving credit facility as well as its senior notes due April 2023 (April 2023 notes). In September, the company issued $1.0 billion of senior notes and in October, used the net proceeds, together with available cash, to redeem the April 2023 notes.

...

https://ir.newellbrands.com/

=> I buy this dip:

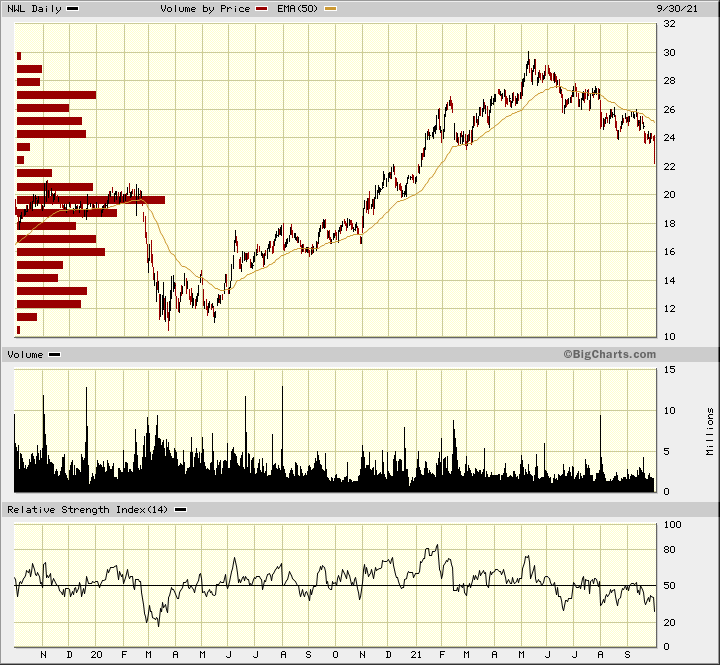

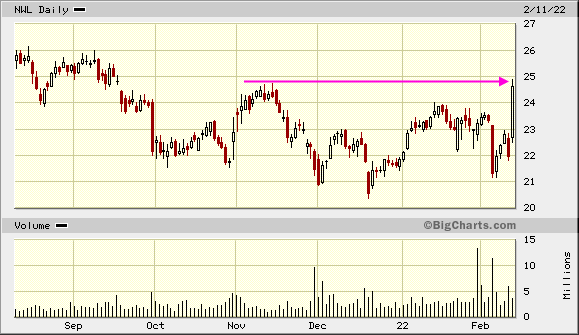

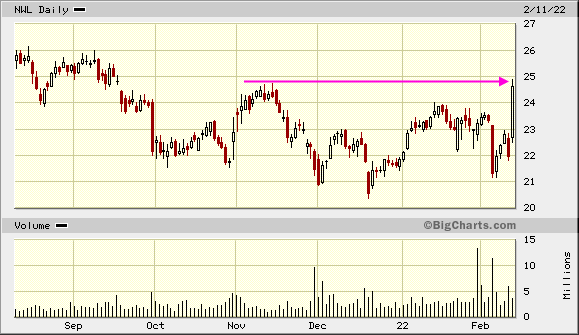

Antwort auf Beitrag Nr.: 69.471.499 von faultcode am 30.09.21 22:13:1911.2.

Newell Brands Sees Lower Sales in 2022, Slightly Higher Adjusted Earnings

https://www.marketwatch.com/story/newell-brands-sees-lower-s…

Newell Brands Inc. said it expects sales to fall in 2022 while normalized earnings are expected to grow slightly.

The consumer-goods conglomerate on Friday posted 2022 sales guidance in the range of $9.93 billion to $10.13 billion on core sales growth coming in somewhere between flat and 2%. The company logged net sales of $10.59 billion for 2021 on core sales growth of 12.5%, it said.

The parent of Yankee Candle, Sharpie pens and Elmer's glue said it expects its normalized operating margin to be between 11.5% and 11.8% for 2022, compared with 9.9% in the fourth quarter of 2021.

That margin is expected to lift adjusted earnings in 2022 to somewhere between $1.85 a share and $1.93 a share, the company said. Newell Brands posted 2021 adjusted earnings per share of $1.82

For the first quarter of 2022, the company said it expects adjusted earnings of 26 cents a share to 28 cents a share on sales of $2.25 billion to $2.30 billion. It expects normalized operating margin to decline to between 8.9% and 9.3%.

...

=>

Newell Brands Sees Lower Sales in 2022, Slightly Higher Adjusted Earnings

https://www.marketwatch.com/story/newell-brands-sees-lower-s…

Newell Brands Inc. said it expects sales to fall in 2022 while normalized earnings are expected to grow slightly.

The consumer-goods conglomerate on Friday posted 2022 sales guidance in the range of $9.93 billion to $10.13 billion on core sales growth coming in somewhere between flat and 2%. The company logged net sales of $10.59 billion for 2021 on core sales growth of 12.5%, it said.

The parent of Yankee Candle, Sharpie pens and Elmer's glue said it expects its normalized operating margin to be between 11.5% and 11.8% for 2022, compared with 9.9% in the fourth quarter of 2021.

That margin is expected to lift adjusted earnings in 2022 to somewhere between $1.85 a share and $1.93 a share, the company said. Newell Brands posted 2021 adjusted earnings per share of $1.82

For the first quarter of 2022, the company said it expects adjusted earnings of 26 cents a share to 28 cents a share on sales of $2.25 billion to $2.30 billion. It expects normalized operating margin to decline to between 8.9% and 9.3%.

...

=>

Nächster ex Dividendentag ist der 29. November. Schauen wir mal wie weit es noch runter geht🤷♂️Werde dann wieder einsteigen.

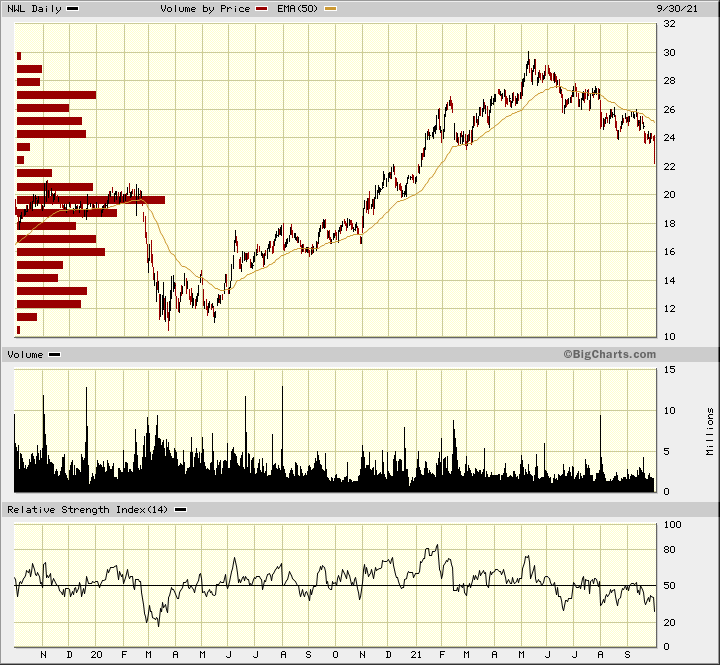

Antwort auf Beitrag Nr.: 68.921.913 von faultcode am 30.07.21 23:26:03

sieht so aus. Zurück auf ~USD20. Bed Bath & Beyond schlug heute ein (-21%):

Zitat von faultcode: mein Eindruck zur Zeit: Sell the news von den Hedge Funds, um Cash für einen ruppigen Herbst zu haben, so auch hier:...

sieht so aus. Zurück auf ~USD20. Bed Bath & Beyond schlug heute ein (-21%):