Newell Brands Announces Agreement with Carl C. Icahn (Seite 4) | Diskussion im Forum

eröffnet am 19.03.18 21:27:49 von

neuester Beitrag 23.04.24 03:15:45 von

neuester Beitrag 23.04.24 03:15:45 von

Beiträge: 64

ID: 1.276.646

ID: 1.276.646

Aufrufe heute: 1

Gesamt: 3.893

Gesamt: 3.893

Aktive User: 0

ISIN: US6512291062 · WKN: 860036 · Symbol: NWL

6,9150

USD

-1,78 %

-0,1250 USD

Letzter Kurs 15:38:18 Nasdaq

Neuigkeiten

12.04.24 · Business Wire (engl.) |

22.02.24 · Business Wire (engl.) |

16.02.24 · Business Wire (engl.) |

09.02.24 · Business Wire (engl.) |

Werte aus der Branche Konsum

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 34.220,00 | +926,70 | |

| 21.500,00 | +27,22 | |

| 210,50 | +18,89 | |

| 2,4000 | +14,01 | |

| 0,5600 | +9,50 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,570 | -9,18 | |

| 11,900 | -9,85 | |

| 1,5400 | -10,47 | |

| 0,5020 | -16,33 | |

| 7,6100 | -51,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 64.612.539 von faultcode am 31.07.20 19:09:05ach so: heute und derzeit Schlusslicht im S&P 500:

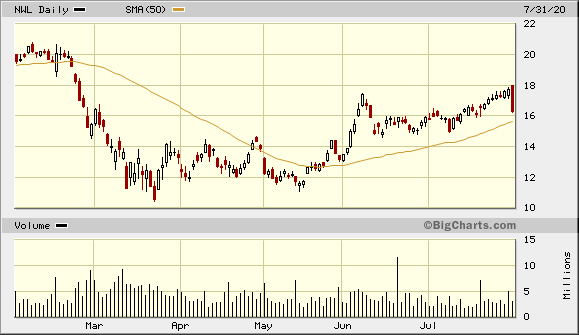

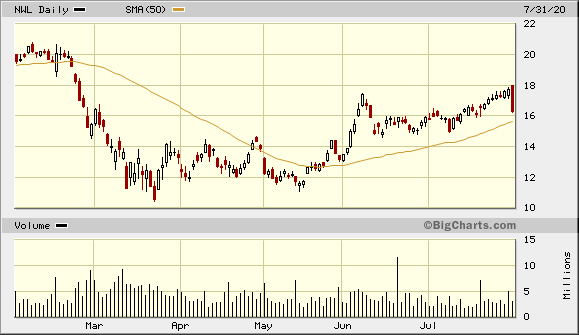

Antwort auf Beitrag Nr.: 63.833.396 von faultcode am 28.05.20 16:39:4031.7.

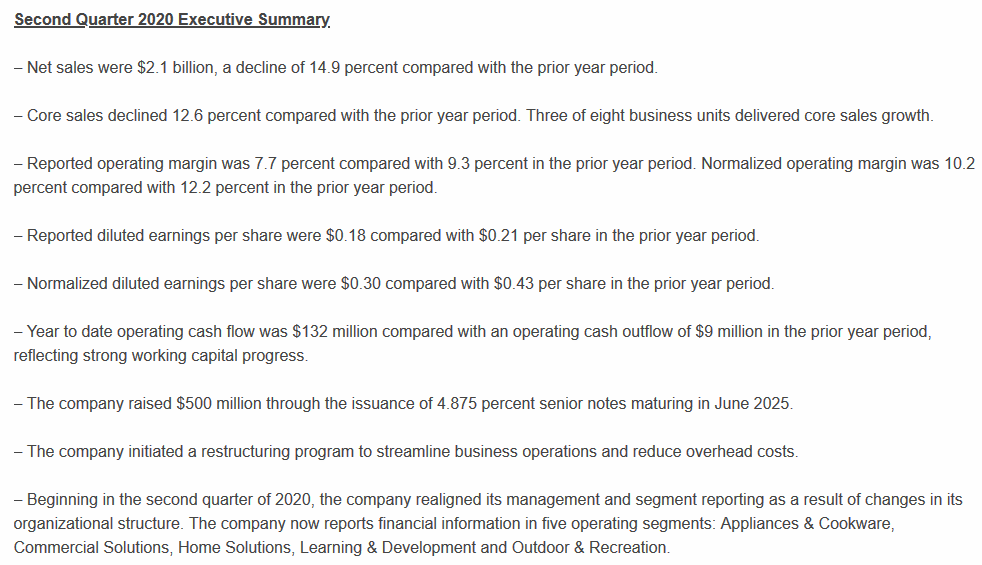

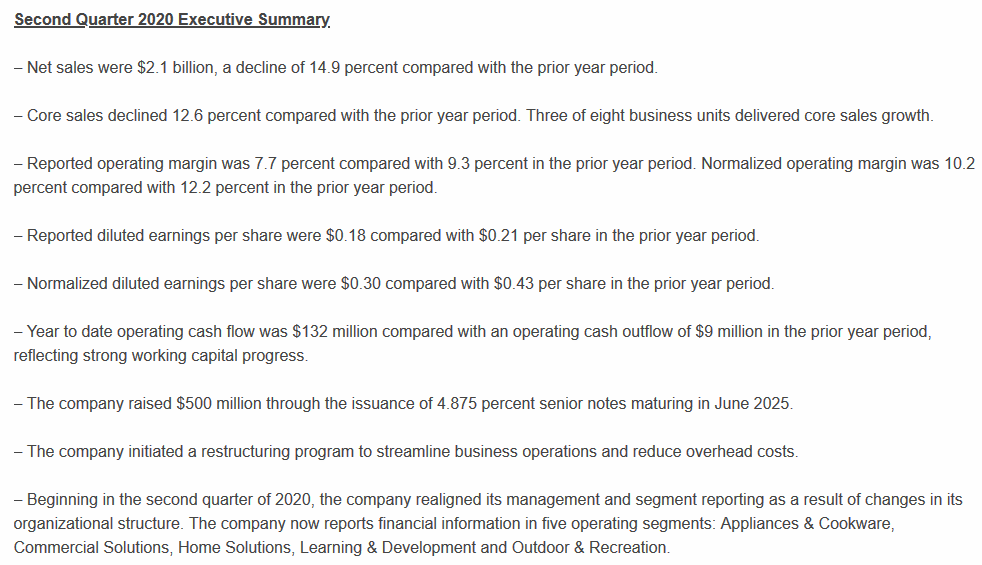

Newell Brands Announces Second Quarter 2020 Results

https://www.businesswire.com/news/home/20200731005128/en/New…

...

"We are encouraged by the current trends of our business, including top line improvement throughout the quarter, very strong consumption patterns in a number of our categories, and the progress we are making against key tenets of our turnaround plan, despite the challenging operating and economic environment caused by the global coronavirus pandemic,” said Ravi Saligram, Newell Brands President and CEO.

“Three of eight business units delivered core growth in the second quarter, eCommerce sales continued to accelerate and the company as a whole delivered modest core sales growth in the month of June. While the macros remain uncertain and difficult, we continue to expect results in the back half of the year to improve relative to the second quarter. We remain confident in our liquidity position and our ability to successfully navigate during these unprecedented times."

Chris Peterson, Chief Financial Officer and President, Business Operations, said, “Newell's second quarter financial results, although negatively impacted by the global pandemic, were ahead of our internal expectations as we saw significant improvement in trends from month to month during the quarter. Supply chain conditions have improved significantly, with all manufacturing and distribution centers currently open. We delivered operational improvements across the enterprise in line with our turnaround plan, including accelerated progress on SKU reduction, Project FUEL productivity savings and overhead cost actions. Cash flow has remained quite strong, with year to date operating cash flow improving $141 million versus our year ago results, reflecting strong progress on working capital initiatives.”

...´

...

Newell Brands Announces Second Quarter 2020 Results

https://www.businesswire.com/news/home/20200731005128/en/New…

...

"We are encouraged by the current trends of our business, including top line improvement throughout the quarter, very strong consumption patterns in a number of our categories, and the progress we are making against key tenets of our turnaround plan, despite the challenging operating and economic environment caused by the global coronavirus pandemic,” said Ravi Saligram, Newell Brands President and CEO.

“Three of eight business units delivered core growth in the second quarter, eCommerce sales continued to accelerate and the company as a whole delivered modest core sales growth in the month of June. While the macros remain uncertain and difficult, we continue to expect results in the back half of the year to improve relative to the second quarter. We remain confident in our liquidity position and our ability to successfully navigate during these unprecedented times."

Chris Peterson, Chief Financial Officer and President, Business Operations, said, “Newell's second quarter financial results, although negatively impacted by the global pandemic, were ahead of our internal expectations as we saw significant improvement in trends from month to month during the quarter. Supply chain conditions have improved significantly, with all manufacturing and distribution centers currently open. We delivered operational improvements across the enterprise in line with our turnaround plan, including accelerated progress on SKU reduction, Project FUEL productivity savings and overhead cost actions. Cash flow has remained quite strong, with year to date operating cash flow improving $141 million versus our year ago results, reflecting strong progress on working capital initiatives.”

...´

...

Antwort auf Beitrag Nr.: 63.285.820 von faultcode am 09.04.20 12:25:02heute ist wieder Ex-dividend Date mit USD0.23 pro Aktie - wie auch schon zuvor.

Bei Kurs ~USD14 und Dividende im Jahr von 4 x USD0.23 ist das eine Rendite von > 6% p.a.

Das Long-Term Debt geht seit 3 Quartale zurück; allerdings steht das ST Debt & Current Portion LT Debt bei knackigen USD765M zum 31.3.2020.

Das sind derzeit, wenn man so will, fast 8 Dividendenzahlungen (bei ~USD100M p.q.).

=> der Markt traut dem Braten hier nicht, zumal ja viele physische Verkaufsstellen in den USA zumachen wegen Chapter 11 und hoher Arbeitslosigkeit.

J.C. Penny, nun in Chapter 11, verkauft z.B. Rubbermaid-Artikel.

Diese Woche hat NWL wieder eine Anleihe begeben über $500M 4.875% notes due 2025: https://seekingalpha.com/news/3576649-newell-brands-to-issue…

...

Net proceeds will be used for general corporate purposes, which may include the repayment of outstanding borrowings under its senior unsecured revolving credit facility and accounts receivable securitization facility, as well as the repayment of near-term public debt at contractual maturities and other uses.

...

=> NWL muss also ihre Accounts receivable zu Geld machen

Sonst könnten die ihre Dividende gar nicht bezahlen

Bei Kurs ~USD14 und Dividende im Jahr von 4 x USD0.23 ist das eine Rendite von > 6% p.a.

Das Long-Term Debt geht seit 3 Quartale zurück; allerdings steht das ST Debt & Current Portion LT Debt bei knackigen USD765M zum 31.3.2020.

Das sind derzeit, wenn man so will, fast 8 Dividendenzahlungen (bei ~USD100M p.q.).

=> der Markt traut dem Braten hier nicht, zumal ja viele physische Verkaufsstellen in den USA zumachen wegen Chapter 11 und hoher Arbeitslosigkeit.

J.C. Penny, nun in Chapter 11, verkauft z.B. Rubbermaid-Artikel.

Diese Woche hat NWL wieder eine Anleihe begeben über $500M 4.875% notes due 2025: https://seekingalpha.com/news/3576649-newell-brands-to-issue…

...

Net proceeds will be used for general corporate purposes, which may include the repayment of outstanding borrowings under its senior unsecured revolving credit facility and accounts receivable securitization facility, as well as the repayment of near-term public debt at contractual maturities and other uses.

...

=> NWL muss also ihre Accounts receivable zu Geld machen

Sonst könnten die ihre Dividende gar nicht bezahlen

Antwort auf Beitrag Nr.: 62.688.430 von faultcode am 15.02.20 00:16:16lass niemals ein gute Gelegenheit ungenutzt verstreichen:

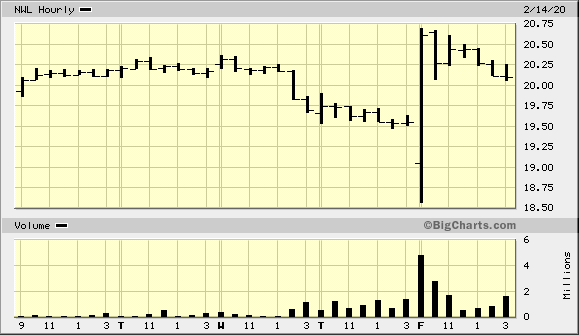

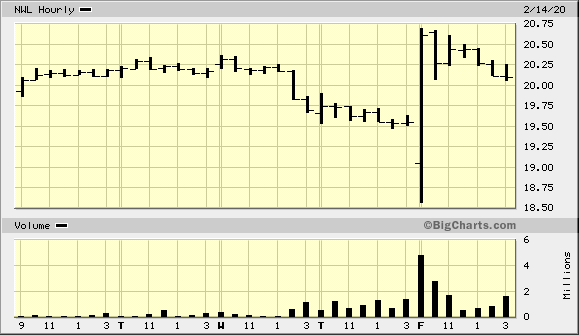

Antwort auf Beitrag Nr.: 61.817.752 von faultcode am 01.11.19 19:05:4414.2.

Sharpie parent Newell Brands earnings top estimates

https://www.marketwatch.com/story/sharpie-parent-newell-bran…

Newell Brands Inc. said Friday it had net income of $793.8 million, or $1.87 a share, in the fourth quarter, up from $183.5 million, or 41 cents a share, in the year-earlier period.

The owner of brands including Paper Mate, Sharpie and Rubbermaid, said adjusted per-share earnings came to 42 cents, ahead of the 37 cents FactSet consensus. Sales fell 3.1% to $2.624 billion from $2.707 billion, also ahead of the FactSet consensus of $2.580 billion.

The company is in the midst of a turnaround plan that has helped its international business return to growth, improved operating margins by 50 basis points and more than doubled free cash flow,

Chief Executive Ravi Saligram said in a statement.

Looking ahead, the company is now expecting 2020 EPS to range from $1.46 to $1.56, compared with a current FactSet consensus of $1.55. For the first quarter, it expects EPS of 5 cents to 8 cents, below the 12 cents FactSet consensus...

--> Ui, ui

ansonsten:

Sharpie parent Newell Brands earnings top estimates

https://www.marketwatch.com/story/sharpie-parent-newell-bran…

Newell Brands Inc. said Friday it had net income of $793.8 million, or $1.87 a share, in the fourth quarter, up from $183.5 million, or 41 cents a share, in the year-earlier period.

The owner of brands including Paper Mate, Sharpie and Rubbermaid, said adjusted per-share earnings came to 42 cents, ahead of the 37 cents FactSet consensus. Sales fell 3.1% to $2.624 billion from $2.707 billion, also ahead of the FactSet consensus of $2.580 billion.

The company is in the midst of a turnaround plan that has helped its international business return to growth, improved operating margins by 50 basis points and more than doubled free cash flow,

Chief Executive Ravi Saligram said in a statement.

Looking ahead, the company is now expecting 2020 EPS to range from $1.46 to $1.56, compared with a current FactSet consensus of $1.55. For the first quarter, it expects EPS of 5 cents to 8 cents, below the 12 cents FactSet consensus...

--> Ui, ui

ansonsten:

Antwort auf Beitrag Nr.: 61.599.520 von faultcode am 30.09.19 18:43:14

https://www.marketwatch.com/story/newell-brands-stock-rallie…

=>

Shares of Newell Brands Inc. rose 2.4% in premarket trading Friday, after the branded consumer products company reported a third-quarter profit. excluding charges, and sales that beat expectations and raised the full-year outlook for both.

The company, which brands include Sharpie, Rubbermaid, Yankee Candle and Graco, reported a net loss that narrowed to $625.8 million, or $1.48 a share, from $7.3 billion, or $15.52 a share, in the year-ago period. Excluding non-recurring items, such as a $635 million impairment charge this year and a $7.8 billion charge last year, adjusted EPS fell to 73 cents from 77 cents, but beat the FactSet consensus of 55 cents.

Sales declined 3.8% to $2.45 billion, but topped the FactSet consensus of $2.43 billion.

For 2019, the company raised its adjusted EPS guidance range to $1.63 to $1.68 from $1.50 to $1.65 and its sales guidance to $9.6 billion to $9.7 billion from $9.1 billion to $9.3 billion...

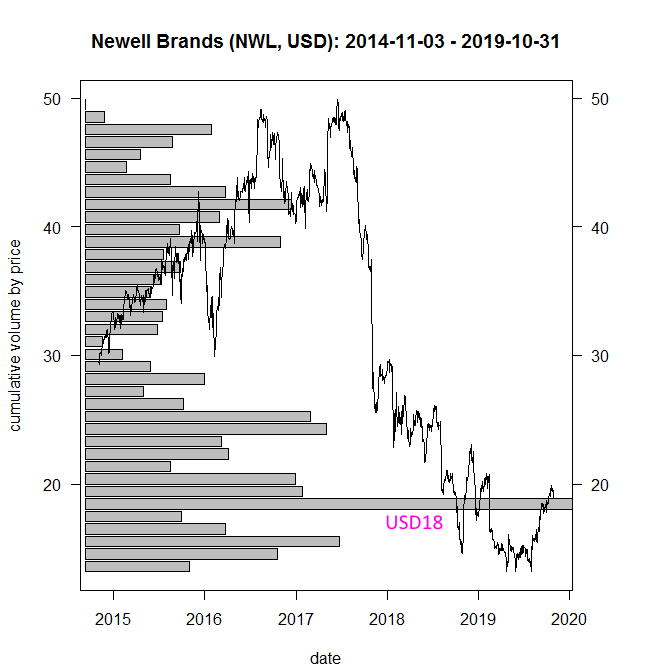

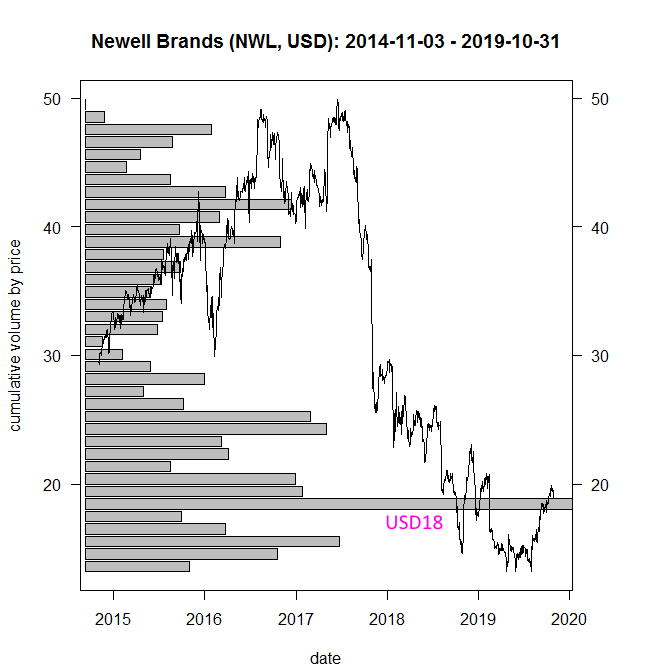

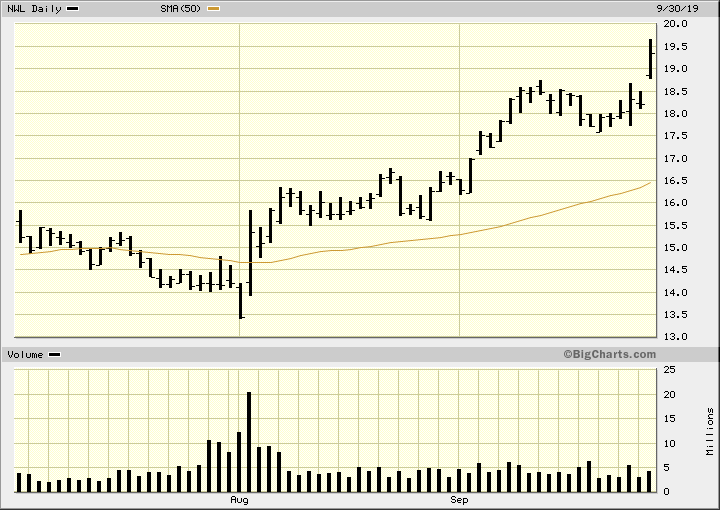

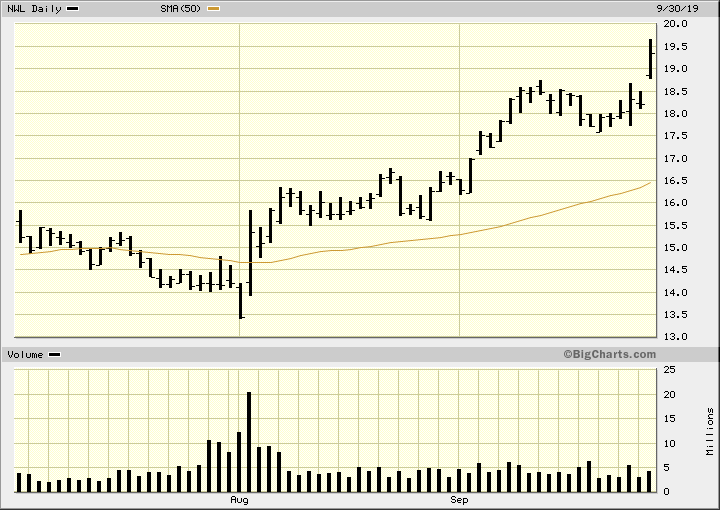

=> damit sollte diese zentrale Hürde von ~USD18 vorerst genommen sein:

Newell Brands' stock rallies after profit and sales fall less than expected, guidance raised => +8%

1.11.https://www.marketwatch.com/story/newell-brands-stock-rallie…

=>

Shares of Newell Brands Inc. rose 2.4% in premarket trading Friday, after the branded consumer products company reported a third-quarter profit. excluding charges, and sales that beat expectations and raised the full-year outlook for both.

The company, which brands include Sharpie, Rubbermaid, Yankee Candle and Graco, reported a net loss that narrowed to $625.8 million, or $1.48 a share, from $7.3 billion, or $15.52 a share, in the year-ago period. Excluding non-recurring items, such as a $635 million impairment charge this year and a $7.8 billion charge last year, adjusted EPS fell to 73 cents from 77 cents, but beat the FactSet consensus of 55 cents.

Sales declined 3.8% to $2.45 billion, but topped the FactSet consensus of $2.43 billion.

For 2019, the company raised its adjusted EPS guidance range to $1.63 to $1.68 from $1.50 to $1.65 and its sales guidance to $9.6 billion to $9.7 billion from $9.1 billion to $9.3 billion...

=> damit sollte diese zentrale Hürde von ~USD18 vorerst genommen sein:

Antwort auf Beitrag Nr.: 61.482.104 von faultcode am 13.09.19 22:19:02kein Expansion Breakout - aber immerhin:

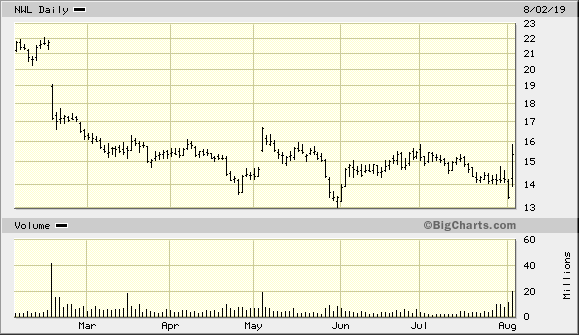

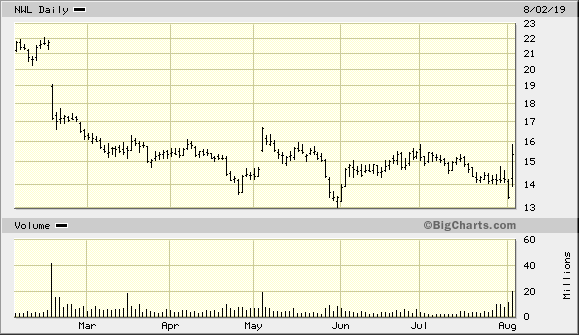

Antwort auf Beitrag Nr.: 61.165.517 von faultcode am 02.08.19 23:13:59

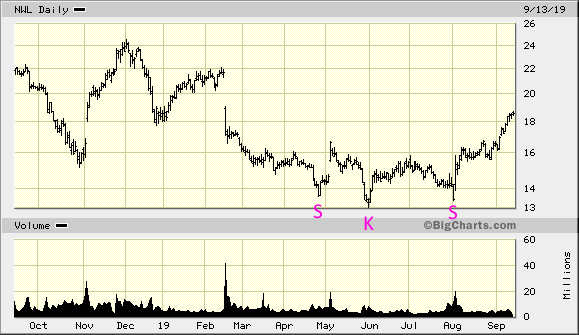

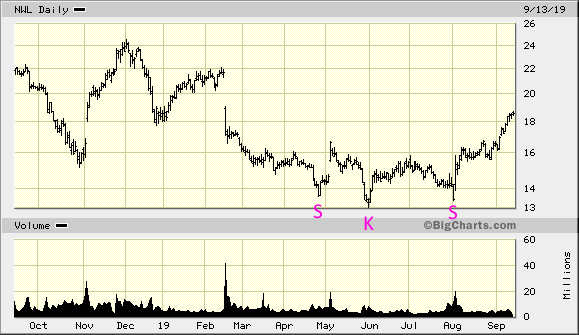

--> die Trendwende (erst einmal) mittels S-K-S-Formation vollzogen:

Zitat von faultcode: ...=> die letzten beiden Male ist der Kurs nach solchen Plus-Sprüngen auch wieder abgetaucht -- und diesmal?..

--> die Trendwende (erst einmal) mittels S-K-S-Formation vollzogen:

Antwort auf Beitrag Nr.: 60.479.513 von faultcode am 03.05.19 13:02:40

https://www.marketwatch.com/story/newell-brands-shares-jump-…

=>

Newell Brands Inc. shares rose 6.3% in premarket trade Friday, after the distributor of consumer goods including Mr. Coffee and Rubbermaid beat profit estimates for the second quarter and raised its sales guidance.

The company said it had net income of $89.8 million, or 21 cents a share, in the quarter, down from $131.7 million, or 27 cents a share, in the year-earlier period.

Adjusted per-share earnings came to 45 cents, well ahead of the 36 cents FactSet consensus.

Sales fell to $2.117 billion from $2.202 billion, just matching the $2.118 billion FactSet consensus.

The company raised its full-year sales guidance to $9.1 billion to $9.3 billion from a prior $8.2 billion to $8.4 billion.

It stuck with its forecast for full-year adjusted EPS of $1.50 to $1.65. The company said it has decided to retain the Rubbermaid Commercial Products business, which was previously included in discontinued operations.

Finally, it has decided to relocate its corporate headquarters to Atlanta, Georgia, to consolidate its operations there. Three of the company' seven operating divisions are already in Atlanta....

=> die letzten beiden Male ist der Kurs nach solchen Plus-Sprüngen auch wieder abgetaucht -- und diesmal?

Newell Brands shares jump premarket after earnings beat and higher sales guidance

+14%https://www.marketwatch.com/story/newell-brands-shares-jump-…

=>

Newell Brands Inc. shares rose 6.3% in premarket trade Friday, after the distributor of consumer goods including Mr. Coffee and Rubbermaid beat profit estimates for the second quarter and raised its sales guidance.

The company said it had net income of $89.8 million, or 21 cents a share, in the quarter, down from $131.7 million, or 27 cents a share, in the year-earlier period.

Adjusted per-share earnings came to 45 cents, well ahead of the 36 cents FactSet consensus.

Sales fell to $2.117 billion from $2.202 billion, just matching the $2.118 billion FactSet consensus.

The company raised its full-year sales guidance to $9.1 billion to $9.3 billion from a prior $8.2 billion to $8.4 billion.

It stuck with its forecast for full-year adjusted EPS of $1.50 to $1.65. The company said it has decided to retain the Rubbermaid Commercial Products business, which was previously included in discontinued operations.

Finally, it has decided to relocate its corporate headquarters to Atlanta, Georgia, to consolidate its operations there. Three of the company' seven operating divisions are already in Atlanta....

=> die letzten beiden Male ist der Kurs nach solchen Plus-Sprüngen auch wieder abgetaucht -- und diesmal?

Newell Brands stock rallies after adjusted profit beats expectations, as Toys 'R' Us headwind wanes

3.5.https://www.marketwatch.com/story/newell-brands-stock-rallie…

=>

...Shares of Newell Brands Inc. rallied 2.7% in premarket trade Friday, after the consumer products company reported first-quarter earnings and sales that topped expectations.

The company, which brands include Paper Mate, Graco and Calphalon, swung to a net loss of $151.2 million, or 36 cents a share, from a profit of $53.3 million, or 11 cents a share, in the same period a year ago.

Excluding non-recurring items, such as charges for the write-down the value of assets businesses held for sale, adjusted EPS fell to 14 cents from 28 cents, but beat the FactSet consensus of 6 cents.

Sales fell 5.5% to $1.71 billion, just above the FactSet consensus of $1.69 billion.

Operating margin swung to positive 0.9% from negative 1.5%.

For the second quarter, the company expects adjusted EPS of 34 cents to 38 cents, below the FactSet consensus of 47 cents, and sales of $2.10 billion to $2.15 billion, surrounding expectations of $2.11 billion.

"As expected, U.S. retailer headwinds associated with the Toys 'R' Us bankruptcy and the Writing industry retailer landscape have begun to moderate as we exit the first quarter, setting up what we believe will be a more constructive environment for the balance of 2019," said Chief Executive Michael Polk...