Sunac China Holdings - 500 Beiträge pro Seite

eröffnet am 06.04.18 09:58:25 von

neuester Beitrag 16.01.19 15:41:48 von

neuester Beitrag 16.01.19 15:41:48 von

Beiträge: 2

ID: 1.277.858

ID: 1.277.858

Aufrufe heute: 0

Gesamt: 683

Gesamt: 683

Aktive User: 0

ISIN: KYG8569A1067 · WKN: A0YF8N · Symbol: SCNR

0,1150

EUR

+0,88 %

+0,0010 EUR

Letzter Kurs 24.04.24 Tradegate

Neuigkeiten

19.09.23 · wallstreetONLINE Redaktion |

Werte aus der Branche Immobilien

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,4800 | +65,73 | |

| 5,6500 | +51,47 | |

| 3,8000 | +51,39 | |

| 1,5300 | +42,99 | |

| 4,9900 | +40,96 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,6400 | -28,28 | |

| 2,0000 | -33,33 | |

| 3,8000 | -33,91 | |

| 2,9600 | -39,09 | |

| 0,7333 | -63,15 |

https://skift.com/2018/03/28/chinas-super-aggressive-sunac-p…

When asked to name some of China’s most successful companies, most people would probably name Alibaba, Tencent, as well as tech success stories like Huawei and ZTE. In travel, companies like China’s three state-owned airlines, Ctrip, and (also state-owned) Jin Jiang hotels may come to mind. As a matter of fact, big corporate in China’s big travel industry is starting to look increasingly big state as “success stories” of yesteryear are suffering immensely under crushing debt obligations and increased government oversight.

Just a couple of years ago, big corporate in China’s burgeoning travel industry would most certainly include companies like HNA, Dalian Wanda, and Anbang. The former, China’s largest private airline, went global and diversified—and fast at that. Dalian Wanda was building tourist attractions like there was no tomorrow, aiming not only to take on Disneyland Shanghai but Disney’s business model as a whole. Anbang, while not explicitly a travel company, made headlines around the world when it acquired New York’s Waldorf Astoria and Strategic Hotels & Resorts.

While these companies aren’t dead, or at least not yet, these companies’ global ambitions— and, in the case of Anbang, tourism ambitions—are already memories of a distant past. If not preoccupied with managing spiraling debt, they’re clashing with regulators both at home and abroad. No time or money for ambitious expansion with all the corporate pressure on paying off creditors and appeasing regulators.

You’d think that the aforementioned companies’ ultimately unsuccessful forays would be a deterrent to other Chinese conglomerates considering a similar debt-fueled expansion. However, you’d be wrong.

Fortunately for troubled companies like HNA, Dalian Wanda, and the arguably even more notorious LeEco, one Chinese company has proven more than willing to pick up divested assets as each company is trying to get their balance sheets in order. That company is Sunac, a Tianjin-based property developer with its registered office in the Cayman Islands. It’s also listed on the Hong Kong Stock Exchange under the ticker SEHK: 1918.

In the last 12 months, Sunac’s valuation has skyrocketed by 200 percent, and up more than double that in the last 18 months.

What do investors see in Sunac that is driving its valuation? According to Toni Ho, an RHB Research analyst quoted in the South China Morning Post, investors like Sunac because it is the only top 10 Chinese developer that still maintains an “aggressive expansion” strategy.

So while HNA, Dalian Wanda, et al. may have failed as companies and failed their investors, investors are still vying for the explosive growth that such companies were able to demonstrate, albeit for a short time. According to the South China Morning Post, the stock is also one of the Hong Kong stocks traded the most by mainland Chinese investors.

Much like its—now less fortunate—peers, Sunac is relying on debt to fuel its expansion. The company’s gearing, i.e., debt-to-equity ratio, stood at 394 percent in the first half of 2017, double that of a year before.

But even beyond it’s strategy of debt-fueled expansion, Sunac bears many similarities to companies like HNA. In fact, Sunac is gobbling up HNA, Dalian Wanda, and LeEco assets in the tourism and entertainment industries as these companies are forced to divest. In the process, Sunac has become China’s most indebted developer, something which one may think would raise red flags among investors.

Another red flag, perhaps, is that Sunac chairman Sun Hongbin was sent to stock exchange-mandated re-education classes in Hong Kong over “failing to apply such degree of skill, care, and diligence required and expected of him” in October last year. Meanwhile, Anbang’s Wu Xiaohui was believed to be in secret detention in China before appearing before a Shanghai court earlier today.

So far so good, however. Despite what may seem like clear red flags, Sunac’s stock remains highly valued, and the company continues its efforts to acquire struggling Chinese companies’ assets with little resistance from regulators. Sunac’s acquisition of 13 of Dalian Wanda’s tourism projects ranks as the second-largest real estate acquisition in China to date, adding to a 2017 tally of 110 billion yuan ($16.6 billion) worth of investments.

While Chinese investors may be happy to have another aggressive high-growth company to invest in, it remains to be seen if Sunac can avoid all the pitfalls its peers all but shunned. Unfortunately, Sunac isn’t only acquiring assets from failing businesses; it’s conducting business like these failed conglomerates did before they, well, failed.

Skift Take

Sunac’s valuation is skyrocketing as it buys up other companies’ assets to fuel its own growth. But will its strategy backfire as debt mounts? And what does all the turnover mean for the travel industry in China?

— Hannah Sampson

When asked to name some of China’s most successful companies, most people would probably name Alibaba, Tencent, as well as tech success stories like Huawei and ZTE. In travel, companies like China’s three state-owned airlines, Ctrip, and (also state-owned) Jin Jiang hotels may come to mind. As a matter of fact, big corporate in China’s big travel industry is starting to look increasingly big state as “success stories” of yesteryear are suffering immensely under crushing debt obligations and increased government oversight.

Just a couple of years ago, big corporate in China’s burgeoning travel industry would most certainly include companies like HNA, Dalian Wanda, and Anbang. The former, China’s largest private airline, went global and diversified—and fast at that. Dalian Wanda was building tourist attractions like there was no tomorrow, aiming not only to take on Disneyland Shanghai but Disney’s business model as a whole. Anbang, while not explicitly a travel company, made headlines around the world when it acquired New York’s Waldorf Astoria and Strategic Hotels & Resorts.

While these companies aren’t dead, or at least not yet, these companies’ global ambitions— and, in the case of Anbang, tourism ambitions—are already memories of a distant past. If not preoccupied with managing spiraling debt, they’re clashing with regulators both at home and abroad. No time or money for ambitious expansion with all the corporate pressure on paying off creditors and appeasing regulators.

You’d think that the aforementioned companies’ ultimately unsuccessful forays would be a deterrent to other Chinese conglomerates considering a similar debt-fueled expansion. However, you’d be wrong.

Fortunately for troubled companies like HNA, Dalian Wanda, and the arguably even more notorious LeEco, one Chinese company has proven more than willing to pick up divested assets as each company is trying to get their balance sheets in order. That company is Sunac, a Tianjin-based property developer with its registered office in the Cayman Islands. It’s also listed on the Hong Kong Stock Exchange under the ticker SEHK: 1918.

In the last 12 months, Sunac’s valuation has skyrocketed by 200 percent, and up more than double that in the last 18 months.

What do investors see in Sunac that is driving its valuation? According to Toni Ho, an RHB Research analyst quoted in the South China Morning Post, investors like Sunac because it is the only top 10 Chinese developer that still maintains an “aggressive expansion” strategy.

So while HNA, Dalian Wanda, et al. may have failed as companies and failed their investors, investors are still vying for the explosive growth that such companies were able to demonstrate, albeit for a short time. According to the South China Morning Post, the stock is also one of the Hong Kong stocks traded the most by mainland Chinese investors.

Much like its—now less fortunate—peers, Sunac is relying on debt to fuel its expansion. The company’s gearing, i.e., debt-to-equity ratio, stood at 394 percent in the first half of 2017, double that of a year before.

But even beyond it’s strategy of debt-fueled expansion, Sunac bears many similarities to companies like HNA. In fact, Sunac is gobbling up HNA, Dalian Wanda, and LeEco assets in the tourism and entertainment industries as these companies are forced to divest. In the process, Sunac has become China’s most indebted developer, something which one may think would raise red flags among investors.

Another red flag, perhaps, is that Sunac chairman Sun Hongbin was sent to stock exchange-mandated re-education classes in Hong Kong over “failing to apply such degree of skill, care, and diligence required and expected of him” in October last year. Meanwhile, Anbang’s Wu Xiaohui was believed to be in secret detention in China before appearing before a Shanghai court earlier today.

So far so good, however. Despite what may seem like clear red flags, Sunac’s stock remains highly valued, and the company continues its efforts to acquire struggling Chinese companies’ assets with little resistance from regulators. Sunac’s acquisition of 13 of Dalian Wanda’s tourism projects ranks as the second-largest real estate acquisition in China to date, adding to a 2017 tally of 110 billion yuan ($16.6 billion) worth of investments.

While Chinese investors may be happy to have another aggressive high-growth company to invest in, it remains to be seen if Sunac can avoid all the pitfalls its peers all but shunned. Unfortunately, Sunac isn’t only acquiring assets from failing businesses; it’s conducting business like these failed conglomerates did before they, well, failed.

Antwort auf Beitrag Nr.: 57.478.187 von R-BgO am 06.04.18 09:58:25

wohl eher nix für mich

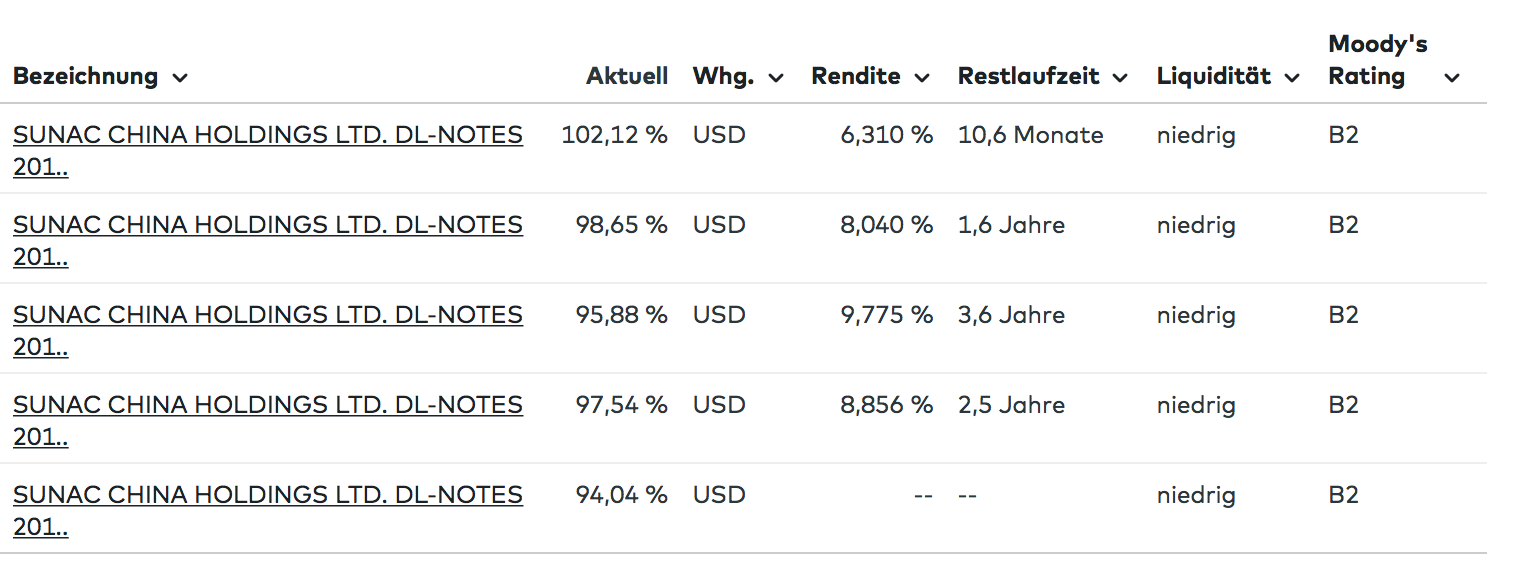

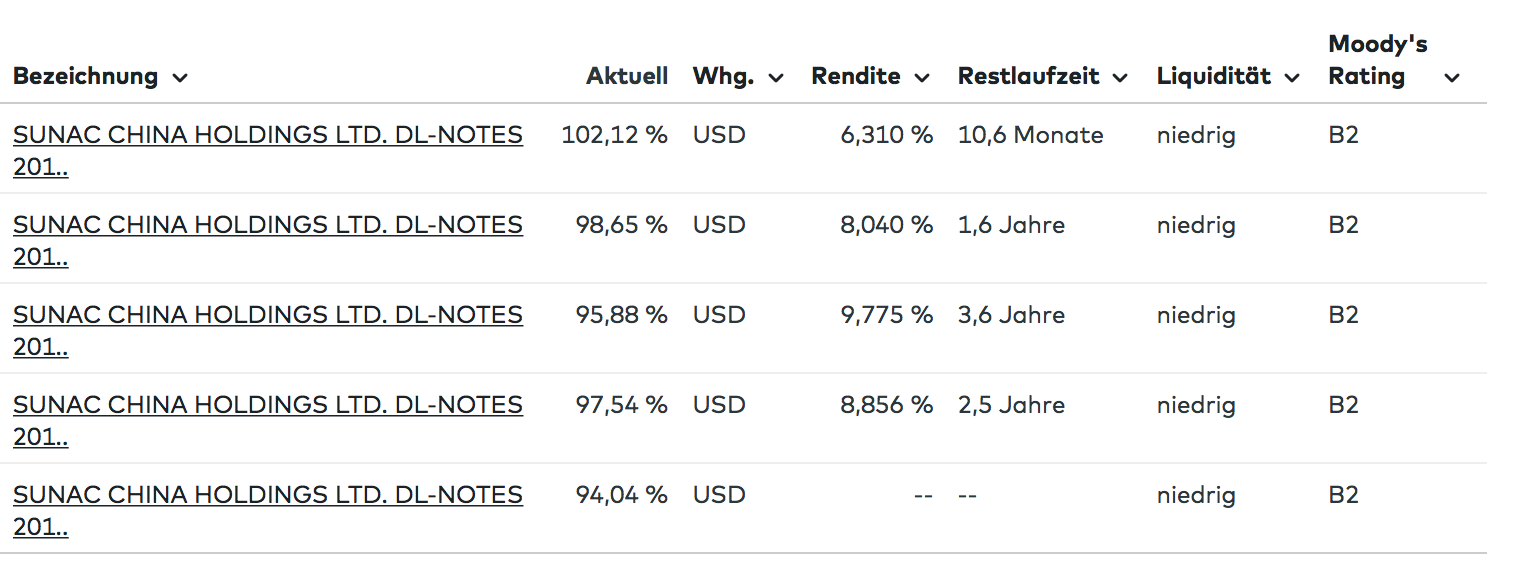

ist ein Dickschiff mit einigen Anleihen:

wohl eher nix für mich

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| 0,00 | |

| -0,56 | |

| -0,50 | |

| -1,32 | |

| +2,49 | |

| -0,37 | |

| -0,02 | |

| -0,42 | |

| -0,90 | |

| +0,24 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 224 | ||

| 136 | ||

| 117 | ||

| 76 | ||

| 43 | ||

| 37 | ||

| 37 | ||

| 34 | ||

| 31 | ||

| 30 |

Sunac China Holdings