Vostok New Ventures - 500 Beiträge pro Seite

eröffnet am 02.05.18 15:45:12 von

neuester Beitrag 02.08.19 10:16:23 von

neuester Beitrag 02.08.19 10:16:23 von

Beiträge: 14

ID: 1.279.431

ID: 1.279.431

Aufrufe heute: 1

Gesamt: 2.133

Gesamt: 2.133

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 34 Minuten | 2801 | |

| vor 49 Minuten | 1775 | |

| vor 33 Minuten | 1478 | |

| vor 33 Minuten | 985 | |

| heute 08:27 | 980 | |

| vor 27 Minuten | 971 | |

| heute 09:56 | 781 | |

| vor 28 Minuten | 707 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.768,61 | -0,03 | 172 | |||

| 2. | 2. | 145,02 | -0,49 | 131 | |||

| 3. | 3. | 2.378,68 | +0,75 | 69 | |||

| 4. | 5. | 6,7020 | +1,64 | 67 | |||

| 5. | 4. | 7,1100 | -3,92 | 56 | |||

| 6. | 6. | 3,7150 | +3,05 | 38 | |||

| 7. | 7. | 0,4019 | -0,02 | 37 | |||

| 8. | 29. | 22,640 | +5,60 | 32 |

...hält als Hauptasset eine Beteiligung an Avito, dem classifieds-Marktführer in Russland;

Idee von der Sohn NY Conference.

Idee von der Sohn NY Conference.

für 74 SEK in Stockholm gekauft

Vostok New Ventures Ltd. Financial Report for the First Quarter 2018

Stockholm, May 15, 2018 (GLOBE NEWSWIRE) --

-Net result for the period was USD 26.24 million (mln) (January 1, 2017–March 31, 2017: 17.33). Earnings per share were USD 0.31 (0.20).

-The net asset value of Vostok New Ventures (“Vostok” or “the Company”) was USD 906.35 mln on March 31, 2018 (December 31, 2017: 879.99), corresponding to USD 10.72 per share (December 31, 2017: 10.40). Given a SEK/USD exchange rate of 8.3596 the values were SEK 7,576.74 mln (December 31, 2017: 7,244.35) and SEK 89.87 (December 31, 2017: 85.65), respectively.

-During the quarter January 1, 2018–March 31, 2018, the group’s net asset value per share in USD increased by 3.1%, mainly driven by the revaluation of Avito and Propertyfinder.

-During the first quarter 2018, Vostok New Ventures made two new investments in student housing platform Housing Anywhere (EUR 3.3 mln) and appointment booking marketplace Booksy (USD 6 mln). Vostok New Ventures has also invested USD 1 mln in El Basharsoft through a convertible note; USD 500k in Vezeeta through a convertible note, USD 1 mln in total in two ventures in Myanmar (USD 500k in the leading job vertical and USD 500k in the leading property vertical in the country) and USD 0.25 mln in Propertyfinder. As part of its liquidity management, Vostok New Ventures lent EUR 4 mln in short-term debt to Marley Spoon, a fast-growing grocery e-commerce company with leading market position in Australia.

-In January 2018, Vostok New Ventures received USD 10.2 mln in dividends from Avito.

-On February 14, 2018, Vostok announced that the Company has received authorization from the Board, valid until December 31, 2018, to repurchase additional SDRs, subject to remaining in compliance with the terms and conditions of the Company’s outstanding bond 2017/2020.

-During the reporting period, the Company repurchased 20,000 SDRs under the Board of Directors’ repurchase authorization of February 14, 2018.

-The number of outstanding shares (SDRs), excluding 1,125,952 repurchased SDRs, at the end of the period was 84,562,357.

Stockholm, May 15, 2018 (GLOBE NEWSWIRE) --

-Net result for the period was USD 26.24 million (mln) (January 1, 2017–March 31, 2017: 17.33). Earnings per share were USD 0.31 (0.20).

-The net asset value of Vostok New Ventures (“Vostok” or “the Company”) was USD 906.35 mln on March 31, 2018 (December 31, 2017: 879.99), corresponding to USD 10.72 per share (December 31, 2017: 10.40). Given a SEK/USD exchange rate of 8.3596 the values were SEK 7,576.74 mln (December 31, 2017: 7,244.35) and SEK 89.87 (December 31, 2017: 85.65), respectively.

-During the quarter January 1, 2018–March 31, 2018, the group’s net asset value per share in USD increased by 3.1%, mainly driven by the revaluation of Avito and Propertyfinder.

-During the first quarter 2018, Vostok New Ventures made two new investments in student housing platform Housing Anywhere (EUR 3.3 mln) and appointment booking marketplace Booksy (USD 6 mln). Vostok New Ventures has also invested USD 1 mln in El Basharsoft through a convertible note; USD 500k in Vezeeta through a convertible note, USD 1 mln in total in two ventures in Myanmar (USD 500k in the leading job vertical and USD 500k in the leading property vertical in the country) and USD 0.25 mln in Propertyfinder. As part of its liquidity management, Vostok New Ventures lent EUR 4 mln in short-term debt to Marley Spoon, a fast-growing grocery e-commerce company with leading market position in Australia.

-In January 2018, Vostok New Ventures received USD 10.2 mln in dividends from Avito.

-On February 14, 2018, Vostok announced that the Company has received authorization from the Board, valid until December 31, 2018, to repurchase additional SDRs, subject to remaining in compliance with the terms and conditions of the Company’s outstanding bond 2017/2020.

-During the reporting period, the Company repurchased 20,000 SDRs under the Board of Directors’ repurchase authorization of February 14, 2018.

-The number of outstanding shares (SDRs), excluding 1,125,952 repurchased SDRs, at the end of the period was 84,562,357.

VOSTOK NEW VENTURES LTD TO LAUNCH A NEW SENIOR UNSECURED BOND ISSUE

Stockholm, June 07, 2018 (GLOBE NEWSWIRE) --

Vostok New Ventures Ltd (the “Company”) has mandated Pareto Securities AB to arrange a new four year senior unsecured bond loan in a minimum amount of SEK 400 million (the “Bonds”).

The Bonds will rank pari passuwith the Company’s existing senior unsecured bonds with ISIN SE0010023390 (the “Existing Bonds”) and are issued for the purpose of increasing the Company’s financial flexibility and diversifying its maturity profile.

As part of the transaction, the largest holder of Existing Bonds has committed to rolling over SEK 150 million of their holding into Bonds. The roll-over will be effectuated at a discount for the Company compared to the last traded price for Existing Bonds. As a consequence of the roll-over, SEK 150 million of Existing Bonds will be cancelled, reducing the outstanding amount under the Existing Bonds to SEK 450 million.

Stockholm, June 07, 2018 (GLOBE NEWSWIRE) --

Vostok New Ventures Ltd (the “Company”) has mandated Pareto Securities AB to arrange a new four year senior unsecured bond loan in a minimum amount of SEK 400 million (the “Bonds”).

The Bonds will rank pari passuwith the Company’s existing senior unsecured bonds with ISIN SE0010023390 (the “Existing Bonds”) and are issued for the purpose of increasing the Company’s financial flexibility and diversifying its maturity profile.

As part of the transaction, the largest holder of Existing Bonds has committed to rolling over SEK 150 million of their holding into Bonds. The roll-over will be effectuated at a discount for the Company compared to the last traded price for Existing Bonds. As a consequence of the roll-over, SEK 150 million of Existing Bonds will be cancelled, reducing the outstanding amount under the Existing Bonds to SEK 450 million.

Antwort auf Beitrag Nr.: 57.928.830 von R-BgO am 07.06.18 09:34:06VOSTOK NEW VENTURES LTD ANNOUNCES SUCCESSFUL PLACEMENT OF A NEW SENIOR UNSECURED BOND LOAN

Stockholm, June 07, 2018 (GLOBE NEWSWIRE) --

Reference is made to a press release by Vostok New Ventures Ltd (the “Company”) made on the morning of 7 June 2018 announcing the launch of a new senior unsecured bond issue (the “Bonds”). As a result of strong investor demand, the books were closed shortly after launch.

The bonds, in an initial amount of SEK 400 million within a frame of SEK 600 million, run with a tenor of four years and will carry a fixed coupon of 6.15 per cent p.a. with interest paid quarterly. The transaction saw strong demand from both existing and new investors and was significantly oversubscribed.

As previously communicated, in conjunction with the transaction the outstanding amount under the Company’s existing bonds with ISIN SE0010023390 will be reduced by SEK 150 million by way of a cancellation of bonds. The cancellation will take place in conjunction with settlement of the Bonds, expected to take place on or about 14 June 2018.

Pareto Securities AB acted as sole bookrunner in conjunction with the bond issue and Gernandt & Danielsson Advokatbyrå acted as legal advisor

Stockholm, June 07, 2018 (GLOBE NEWSWIRE) --

Reference is made to a press release by Vostok New Ventures Ltd (the “Company”) made on the morning of 7 June 2018 announcing the launch of a new senior unsecured bond issue (the “Bonds”). As a result of strong investor demand, the books were closed shortly after launch.

The bonds, in an initial amount of SEK 400 million within a frame of SEK 600 million, run with a tenor of four years and will carry a fixed coupon of 6.15 per cent p.a. with interest paid quarterly. The transaction saw strong demand from both existing and new investors and was significantly oversubscribed.

As previously communicated, in conjunction with the transaction the outstanding amount under the Company’s existing bonds with ISIN SE0010023390 will be reduced by SEK 150 million by way of a cancellation of bonds. The cancellation will take place in conjunction with settlement of the Bonds, expected to take place on or about 14 June 2018.

Pareto Securities AB acted as sole bookrunner in conjunction with the bond issue and Gernandt & Danielsson Advokatbyrå acted as legal advisor

Vostok New Ventures Ltd: Avito AB Trading Statement for the full year period April 1, 2017 – March 31, 2018

Stockholm, June 22, 2018 (GLOBE NEWSWIRE) --

Vostok New Ventures Ltd's ("Vostok New Ventures") largest holding, Avito AB, has today released its trading statement with non-audited figures and key performance indicators for the full year period April 1, 2017 – March 31, 2018.

Avito owns and operates Russia's largest online classifieds website, Avito.ru. During the period all substantial revenues were generated from the Avito.ru website.

The financial year-end of Avito AB was changed from 31 December to 31 March to be coterminous with financial year-end of the Naspers Group.

Key performance indicators for the period April 1, 2017 – March 31, 2018

* Revenues of RUB 16 350 mln (USD 285.5 mln), grew by 29% compared to RUB 12 719 mln (USD 225.6 mln) for the same period previous year.

* Adjusted EBITDA* margin of 59.3% or RUB 9 694 mln (USD 169.28 mln), compared to 56.6% or RUB 7 196 mln (USD 127.64 mln) for the same period previous year.

* Annual unique listers amounted to 23.65 mln and grew by 4.7% compared to 22.59 mln for the same period of the previous year.

Avito provides no guidance on future performance.

Avito has advised us that henceforth it will be issuing trading statements on a bi-annual rather than quarterly basis.

All USD amounts have been translated with the USD/RUB rate 57.2649 as per March 31, 2018 and 56.3779 as per March 31, 2017.

*Adjusted EBITDA means net profit plus (1) depreciation and amortization expenses, (2) share-based compensation expense, (3) finance costs including fair value adjustments of derivative under current office lease agreement (4) income tax expense less (A) finance income and expenses.

Stockholm, June 22, 2018 (GLOBE NEWSWIRE) --

Vostok New Ventures Ltd's ("Vostok New Ventures") largest holding, Avito AB, has today released its trading statement with non-audited figures and key performance indicators for the full year period April 1, 2017 – March 31, 2018.

Avito owns and operates Russia's largest online classifieds website, Avito.ru. During the period all substantial revenues were generated from the Avito.ru website.

The financial year-end of Avito AB was changed from 31 December to 31 March to be coterminous with financial year-end of the Naspers Group.

Key performance indicators for the period April 1, 2017 – March 31, 2018

* Revenues of RUB 16 350 mln (USD 285.5 mln), grew by 29% compared to RUB 12 719 mln (USD 225.6 mln) for the same period previous year.

* Adjusted EBITDA* margin of 59.3% or RUB 9 694 mln (USD 169.28 mln), compared to 56.6% or RUB 7 196 mln (USD 127.64 mln) for the same period previous year.

* Annual unique listers amounted to 23.65 mln and grew by 4.7% compared to 22.59 mln for the same period of the previous year.

Avito provides no guidance on future performance.

Avito has advised us that henceforth it will be issuing trading statements on a bi-annual rather than quarterly basis.

All USD amounts have been translated with the USD/RUB rate 57.2649 as per March 31, 2018 and 56.3779 as per March 31, 2017.

*Adjusted EBITDA means net profit plus (1) depreciation and amortization expenses, (2) share-based compensation expense, (3) finance costs including fair value adjustments of derivative under current office lease agreement (4) income tax expense less (A) finance income and expenses.

aus den Q3 Zahlen die Entwicklung des NAV (aktuell SEK 95.57), der aktuelle Kurs liegt bei ca SEK 70

man kann sich auf deren homepage Präsentation von Gründern aus ihrem Beteiligungsportfolio, etc. anhören...

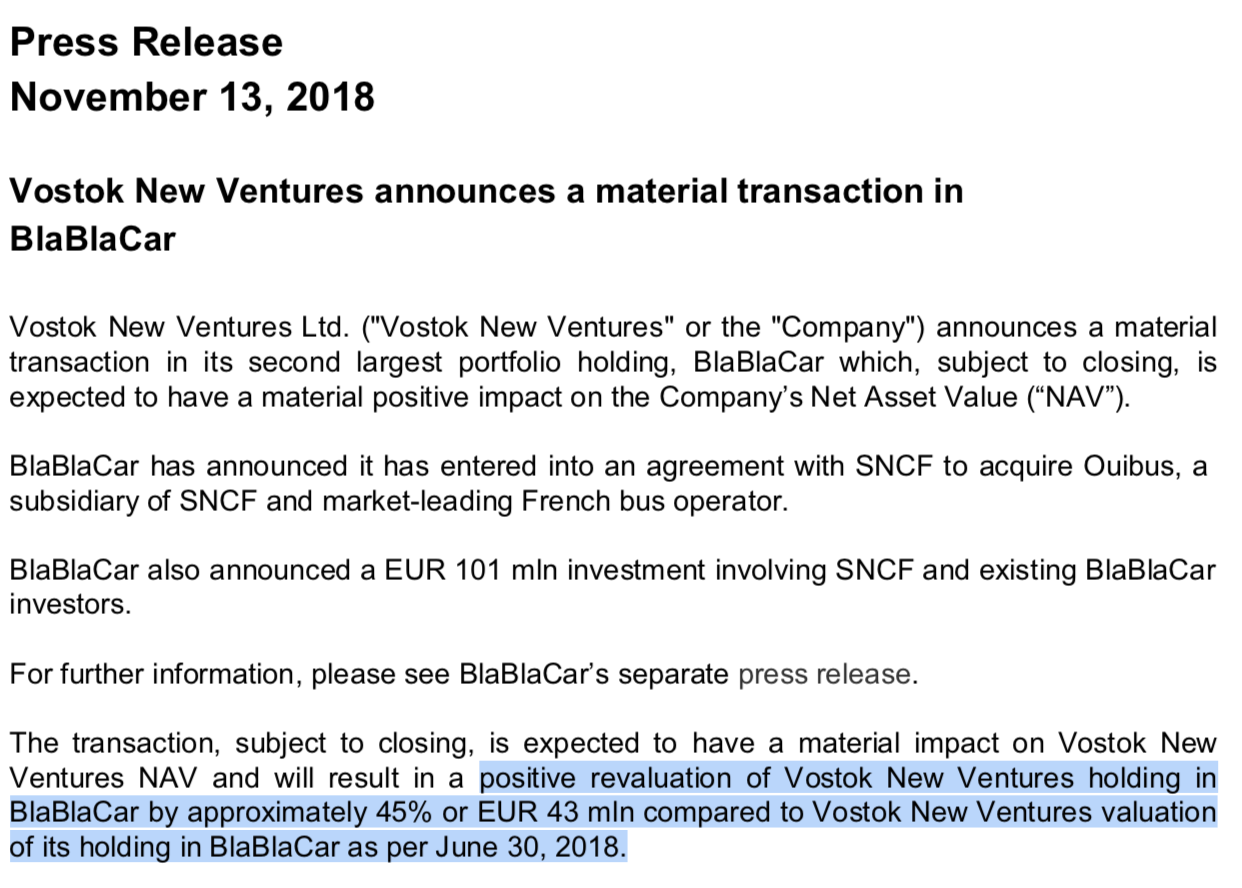

Neben Avito aus Rußland (das mir gar nichts sagt(e), naspers ist auch daran beteiligt) ist die 2. Kernbeteiligung blablacar. für mich überraschend ist Russland der größte Markt von blablacar, mit Buszukauf in zukünftig in direkter Konkurrenz zu flixbus

danke fürs Threadaufmachen von interessanten Unternehmen, R-BgO!

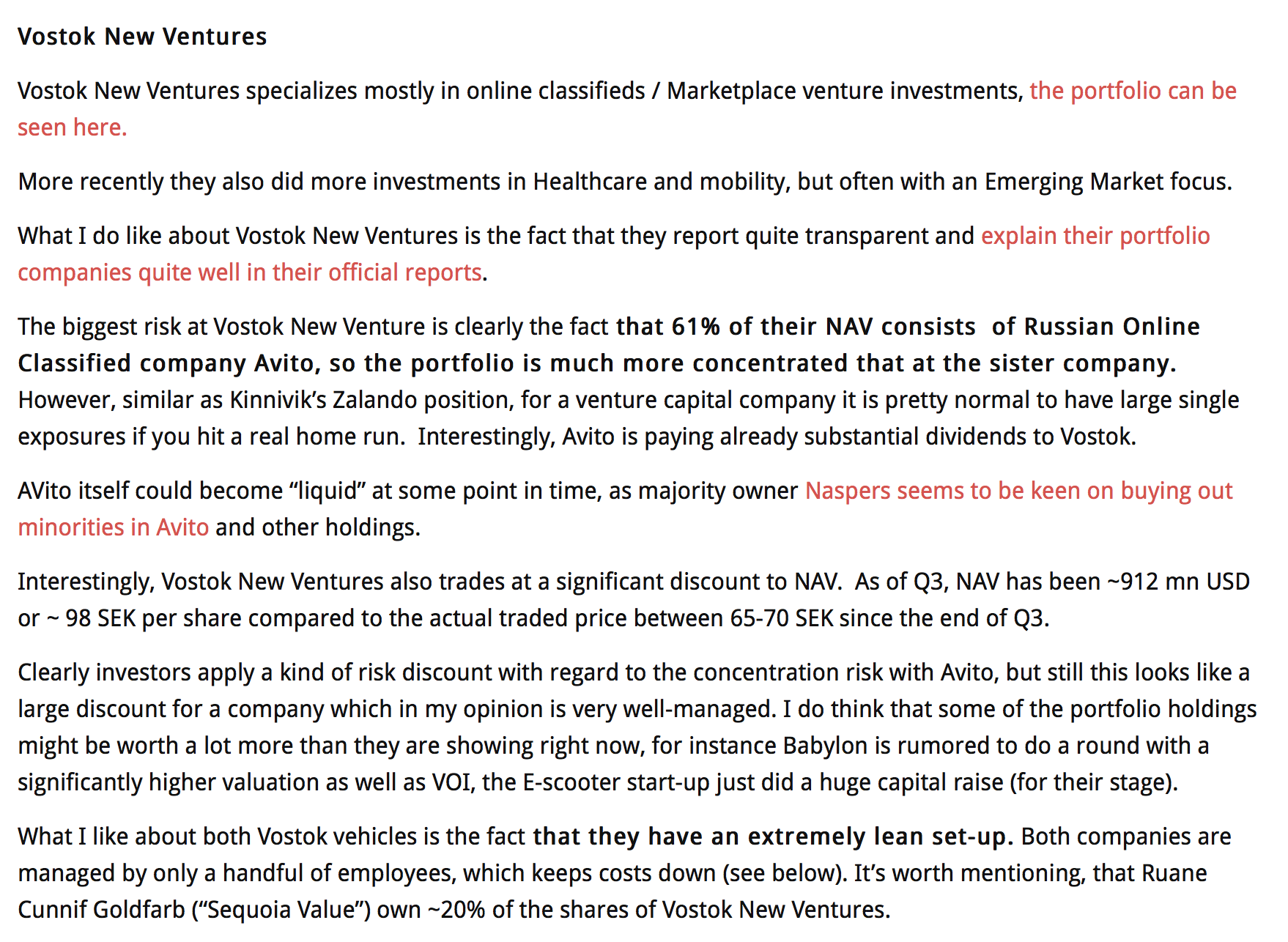

The net asset value of Vostok New Ventures (“Vostok” or “the Company”) was USD 912.20 mln on September 30, 2018 (December 31, 2017: 879.99), corresponding to USD 10.79 per share (December 31, 2017: 10.40). Given a SEK/USD exchange rate of 8.8573 the values were SEK 8,079.60 mln (December 31, 2017: 7,244.35) and SEK 95.57 (December 31, 2017: 85.65), respectively.

- The group’s net asset value per share in USD increased by 3.6% over the period January 1, 2018–September 30, 2018.

- During the quarter July 1, 2018–September 30, 2018, the group’s net asset value per share in USD increased by 2.2%.

man kann sich auf deren homepage Präsentation von Gründern aus ihrem Beteiligungsportfolio, etc. anhören...

Neben Avito aus Rußland (das mir gar nichts sagt(e), naspers ist auch daran beteiligt) ist die 2. Kernbeteiligung blablacar. für mich überraschend ist Russland der größte Markt von blablacar, mit Buszukauf in zukünftig in direkter Konkurrenz zu flixbus

danke fürs Threadaufmachen von interessanten Unternehmen, R-BgO!

The net asset value of Vostok New Ventures (“Vostok” or “the Company”) was USD 912.20 mln on September 30, 2018 (December 31, 2017: 879.99), corresponding to USD 10.79 per share (December 31, 2017: 10.40). Given a SEK/USD exchange rate of 8.8573 the values were SEK 8,079.60 mln (December 31, 2017: 7,244.35) and SEK 95.57 (December 31, 2017: 85.65), respectively.

- The group’s net asset value per share in USD increased by 3.6% over the period January 1, 2018–September 30, 2018.

- During the quarter July 1, 2018–September 30, 2018, the group’s net asset value per share in USD increased by 2.2%.

Antwort auf Beitrag Nr.: 59.221.660 von haowenshan am 15.11.18 12:07:09

peer zu Schibsted, Axel Springer,...

Avito ist Marktführer bei Classifieds in Russland

=> Gelddruckmaschinepeer zu Schibsted, Axel Springer,...

Antwort auf Beitrag Nr.: 59.221.810 von R-BgO am 15.11.18 12:21:56Vostok New Ventures announces that it is about to sell all its shares in Avito for a cash consideration of approx. USD 540 million

Stockholm, Jan. 25, 2019 (GLOBE NEWSWIRE) --

Vostok New Ventures Ltd. ("Vostok New Ventures" or the "Company") today announces that it is engaged in a process to potentially sell its holdings in Avito AB (“Avito”) to NC Europe Holdings B.V. (Naspers Russia Classifieds) for a total consideration of USD 540 million (mln), equivalent of SEK 4,842 mln1.

The potential transaction implies a total equity valuation of Avito of approx. USD 4,000 mln. The transaction is in the final stage with only formalities remaining and is expected to be announced within the next few hours. If realized, the transaction will close imminently.

For Vostok New Ventures, the potential transaction would result in gross proceeds of USD 540 mln or approx. SEK 57.3 per SDR.

The potential transaction would result in a negative impact of approx. -3.9% on Vostok New Ventures Net Asset Value (“NAV”) compared to the reported NAV as per September 30, 2018. The NAV per share following the potential transaction is expected to be approx. USD 10.4 per SDR or SEK 92.9 per SDR, of which 66.3% will represent cash and cash equivalents.

Stockholm, Jan. 25, 2019 (GLOBE NEWSWIRE) --

Vostok New Ventures Ltd. ("Vostok New Ventures" or the "Company") today announces that it is engaged in a process to potentially sell its holdings in Avito AB (“Avito”) to NC Europe Holdings B.V. (Naspers Russia Classifieds) for a total consideration of USD 540 million (mln), equivalent of SEK 4,842 mln1.

The potential transaction implies a total equity valuation of Avito of approx. USD 4,000 mln. The transaction is in the final stage with only formalities remaining and is expected to be announced within the next few hours. If realized, the transaction will close imminently.

For Vostok New Ventures, the potential transaction would result in gross proceeds of USD 540 mln or approx. SEK 57.3 per SDR.

The potential transaction would result in a negative impact of approx. -3.9% on Vostok New Ventures Net Asset Value (“NAV”) compared to the reported NAV as per September 30, 2018. The NAV per share following the potential transaction is expected to be approx. USD 10.4 per SDR or SEK 92.9 per SDR, of which 66.3% will represent cash and cash equivalents.

Antwort auf Beitrag Nr.: 59.713.212 von R-BgO am 25.01.19 17:38:22aja, hab mich gerade gewundert warum der Kurs heute raufging...

Mittlerweile ists durch:

https://globenewswire.com/news-release/2019/01/25/1705615/0/…

The Company can now confirm that the transaction has been completed.

Use of sales proceeds distribution to shareholders and redemption of bonds

With the increased liquidity, the Company intends to distribute approx. USD 236 mln or SEK 25 per SDR to its shareholders, by way of a mandatory redemption program subject to approval by the shareholders at a Special General Meeting which is intended to be held on or around February 14, 2019 (the “SGM”).

Mittlerweile ists durch:

https://globenewswire.com/news-release/2019/01/25/1705615/0/…

The Company can now confirm that the transaction has been completed.

Use of sales proceeds distribution to shareholders and redemption of bonds

With the increased liquidity, the Company intends to distribute approx. USD 236 mln or SEK 25 per SDR to its shareholders, by way of a mandatory redemption program subject to approval by the shareholders at a Special General Meeting which is intended to be held on or around February 14, 2019 (the “SGM”).

heute kam die Gutschrift für die redemption shares,

und die WKN der verbleibenden Vostok hat sich auch geändert; ist nun: A2PB8DW

kennt die aber noch nicht.

kennt die aber noch nicht.Deswegen wist der hier oben angezeigte Kurs veraltet.

Antwort auf Beitrag Nr.: 60.310.327 von R-BgO am 09.04.19 09:17:10Thread: Vostok New Ventures - neue WKN

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 168 | ||

| 122 | ||

| 77 | ||

| 69 | ||

| 68 | ||

| 37 | ||

| 37 | ||

| 32 | ||

| 30 | ||

| 29 |

| Wertpapier | Beiträge | |

|---|---|---|

| 29 | ||

| 28 | ||

| 27 | ||

| 25 | ||

| 24 | ||

| 23 | ||

| 22 | ||

| 19 | ||

| 19 | ||

| 18 |