Keine Unterstützung für ein solches Projekt - Die letzten 30 Beiträge

eröffnet am 13.06.18 19:21:36 von

neuester Beitrag 24.01.24 11:54:23 von

neuester Beitrag 24.01.24 11:54:23 von

Beiträge: 58

ID: 1.282.353

ID: 1.282.353

Aufrufe heute: 0

Gesamt: 23.455

Gesamt: 23.455

Aktive User: 0

ISIN: CA8787422044 · WKN: 858265 · Symbol: TECK.B

44,24

EUR

-1,34 %

-0,60 EUR

Letzter Kurs 19.04.24 Tradegate

Neuigkeiten

05.04.24 · globenewswire |

04.04.24 · globenewswire |

14.03.24 · globenewswire |

22.02.24 · globenewswire |

22.02.24 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,8000 | +17,65 | |

| 0,5500 | +14,61 | |

| 0,8200 | +12,33 | |

| 11,420 | +11,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2100 | -7,63 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 4,2300 | -17,86 | |

| 47,85 | -97,99 |

Beitrag zu dieser Diskussion schreiben

Bin investiert.Klug den gesamten Kohlebereich zu verkaufen und mit den erlösten Milliarden dollar die Kupferprojekte voranzutreiben.

Teck,Freeport Mc und Ivanhohe Minings sind meine Favoriten und werden auf 1-3 Jahre enorme Gewinne machen.Sind im Gegensatz zu Copper Mining

fundamental eher unterbewertet akt.

Teck,Freeport Mc und Ivanhohe Minings sind meine Favoriten und werden auf 1-3 Jahre enorme Gewinne machen.Sind im Gegensatz zu Copper Mining

fundamental eher unterbewertet akt.

14.11.

Glencore kauft Mehrheit des Kohlegeschäfts der kanadischen Teck

https://www.wallstreet-online.de/nachricht/17542484-roundup-…

• Glencore übernimmt 77% von Elk Valley Resources für 6,93 Mrd. US-Dollar.

• Nippon Steel übernimmt 20% von EVR, Posco hält 3%.

• Glencore plant, das Kokskohlegeschäft nach dem Zusammenschluss weiterzuverkaufen.

...

Auf einer 100-Prozent-Basis entspricht dies einem Unternehmenswert von 9 Milliarden Dollar. Glencore zahlt den Preis in bar und erwartet den Abschluss des Deals im dritten Quartal 2024.

...

Weiter bekräftigt Glencore, nach dem Zusammenschluss des eigenen Kohlegeschäfts mit dem von EVR, das gesamte Geschäft weiterzuverkaufen. Als eigenständige Einheit habe das Kokskohlegeschäft bessere Aussichten.

...

Glencore kauft Mehrheit des Kohlegeschäfts der kanadischen Teck

https://www.wallstreet-online.de/nachricht/17542484-roundup-…

• Glencore übernimmt 77% von Elk Valley Resources für 6,93 Mrd. US-Dollar.

• Nippon Steel übernimmt 20% von EVR, Posco hält 3%.

• Glencore plant, das Kokskohlegeschäft nach dem Zusammenschluss weiterzuverkaufen.

...

Auf einer 100-Prozent-Basis entspricht dies einem Unternehmenswert von 9 Milliarden Dollar. Glencore zahlt den Preis in bar und erwartet den Abschluss des Deals im dritten Quartal 2024.

...

Weiter bekräftigt Glencore, nach dem Zusammenschluss des eigenen Kohlegeschäfts mit dem von EVR, das gesamte Geschäft weiterzuverkaufen. Als eigenständige Einheit habe das Kokskohlegeschäft bessere Aussichten.

...

Quebrada Blanca 2 (QB2), Chile:

24.10.

Teck’s Copper Mine Cost Blowout Shows Challenges in Industry

https://finance.yahoo.com/news/teck-copper-mine-cost-blowout…

...

Teck’s Quebrada Blanca 2 expansion is expected to cost an additional $600 million from its previous estimate due to construction delays, the Canadian metals producer said Tuesday in a statement. The company also withdrew its environmental permit application for the project’s mill expansion after regulators recommended against approving the plan. Submitting a revised application will add 12 months to the overall regulatory process, Teck said.

The latest setbacks highlight the challenges facing mine builders while inflation drives up costs and regulators tighten environmental standards. It’s a theme that will become ever more pressing as demand increases for metals like copper, which are crucial to decarbonizing the global economy.

The expansion known as QB2 will now cost $8.6 billion to $8.8 billion to finish, up from an earlier estimate of $8 billion to $8.2 billion. The project is essential to Teck’s push to become a standalone metals producer as part of a sweeping overhaul that involves selling its coal business. The Vancouver-based firm’s share price plunged to its lowest level in 16 months after disclosing the updated cost estimates.

...

24.10.

Teck’s Copper Mine Cost Blowout Shows Challenges in Industry

https://finance.yahoo.com/news/teck-copper-mine-cost-blowout…

...

Teck’s Quebrada Blanca 2 expansion is expected to cost an additional $600 million from its previous estimate due to construction delays, the Canadian metals producer said Tuesday in a statement. The company also withdrew its environmental permit application for the project’s mill expansion after regulators recommended against approving the plan. Submitting a revised application will add 12 months to the overall regulatory process, Teck said.

The latest setbacks highlight the challenges facing mine builders while inflation drives up costs and regulators tighten environmental standards. It’s a theme that will become ever more pressing as demand increases for metals like copper, which are crucial to decarbonizing the global economy.

The expansion known as QB2 will now cost $8.6 billion to $8.8 billion to finish, up from an earlier estimate of $8 billion to $8.2 billion. The project is essential to Teck’s push to become a standalone metals producer as part of a sweeping overhaul that involves selling its coal business. The Vancouver-based firm’s share price plunged to its lowest level in 16 months after disclosing the updated cost estimates.

...

Aktueller Stand zum Einstieg der indischen JSW in die Kohlesparte von Teck:

https://www.mining.com/jsw-steel-slows-process-to-buy-stake-…

https://www.mining.com/jsw-steel-slows-process-to-buy-stake-…

Teck Res.stabil und Freeport Mc. sowie Southern C. gut nach oben.

Noch jemand in KUPFER investiert?

BF

Noch jemand in KUPFER investiert?

BF

1.6.

Teck Struggles to Secure Top Shareholder’s Support on Coal Split

https://finance.yahoo.com/news/teck-struggles-secure-top-sha…

...

Teck Resources Ltd. is struggling to secure the support of top shareholder China Investment Corp., as the Canadian miner studies options to exit its coal business while fending off a takeover bid from Glencore Plc.

Chief Executive Officer Jonathan Price met with CIC representatives last week to solicit feedback after the Chinese sovereign wealth fund failed to back an earlier coal spinoff plan, according to people familiar with the matter.

However, Price did not come away with any assurance that CIC would support a new proposal, said the people, who asked not to be identified discussing private information.

...

Teck Struggles to Secure Top Shareholder’s Support on Coal Split

https://finance.yahoo.com/news/teck-struggles-secure-top-sha…

...

Teck Resources Ltd. is struggling to secure the support of top shareholder China Investment Corp., as the Canadian miner studies options to exit its coal business while fending off a takeover bid from Glencore Plc.

Chief Executive Officer Jonathan Price met with CIC representatives last week to solicit feedback after the Chinese sovereign wealth fund failed to back an earlier coal spinoff plan, according to people familiar with the matter.

However, Price did not come away with any assurance that CIC would support a new proposal, said the people, who asked not to be identified discussing private information.

...

31.5.

Glencore arbeitet an Angebotsnachbesserung für Teck

https://www.wallstreet-online.de/nachricht/16994852-kreise-g…

...

Der Übernahmekampf um das kanadische Bergbauunternehmen Teck durch Glencore geht weiter. Der Schweizer Rohstoffkonzern soll laut Kreisen vor einer Erhöhung seines Angebots stehen. Glencore arbeite an einer möglichen Nachbesserung seiner Offerte, die in den kommenden Wochen bekannt gegeben werden könnte, berichtete die Nachrichtenagentur Bloomberg unter Berufung auf mit der Angelegenheit vertraute Personen. Durch die Angebotserhöhung wolle Glencore Teck an den Verhandlungstisch zwingen.

Das in Vancouver ansässige Unternehmen Teck hatte zuvor ein 22,5 Milliarden US-Dollar (21 Mrd Euro) schweres Angebot von Glencore zur Zusammenlegung der beiden Unternehmen abgelehnt. Teck verfolgte stattdessen seine eigenen Pläne, sein Kupfer- und Kohlegeschäft getrennt zu verkaufen. Im April zog Teck den ursprünglichen Plan zur Trennung der Geschäftsbereiche in letzter Minute allerdings zurück, nachdem die Firma nicht genügend Unterstützung durch die Aktionäre erhalten hatte.

...

Glencore arbeitet an Angebotsnachbesserung für Teck

https://www.wallstreet-online.de/nachricht/16994852-kreise-g…

...

Der Übernahmekampf um das kanadische Bergbauunternehmen Teck durch Glencore geht weiter. Der Schweizer Rohstoffkonzern soll laut Kreisen vor einer Erhöhung seines Angebots stehen. Glencore arbeite an einer möglichen Nachbesserung seiner Offerte, die in den kommenden Wochen bekannt gegeben werden könnte, berichtete die Nachrichtenagentur Bloomberg unter Berufung auf mit der Angelegenheit vertraute Personen. Durch die Angebotserhöhung wolle Glencore Teck an den Verhandlungstisch zwingen.

Das in Vancouver ansässige Unternehmen Teck hatte zuvor ein 22,5 Milliarden US-Dollar (21 Mrd Euro) schweres Angebot von Glencore zur Zusammenlegung der beiden Unternehmen abgelehnt. Teck verfolgte stattdessen seine eigenen Pläne, sein Kupfer- und Kohlegeschäft getrennt zu verkaufen. Im April zog Teck den ursprünglichen Plan zur Trennung der Geschäftsbereiche in letzter Minute allerdings zurück, nachdem die Firma nicht genügend Unterstützung durch die Aktionäre erhalten hatte.

...

28.4.

...Kanadische Opposition will wohl Teck-Übernahme durch Glencore verhindern

https://www.finanzen.net/nachricht/aktien/blockade-gefordert…

...

Eine Übernahme erfordere auch die Zustimmung der kanadischen Regierung. Ein möglicher Deal wäre verehrend für die Gemeinden in der Provinz British Columbia und für alle Kanadier, sagte die Oppositionspartei laut "Wall Street Journal". Zudem seinen tausende Jobs in Gefahr und lokale Lieferketten könnten unterbrochen werden.

Erst Anfang der Woche hatte auch die kanadische Finanzministerin Bedenken für den Kauf geäußert. Sie forderte etwa, dass der Hauptsitz von Teck weiter in Kanada sein soll, um damit die wichtige Mineralienindustrie des Landes zu unterstützen.

...

...Kanadische Opposition will wohl Teck-Übernahme durch Glencore verhindern

https://www.finanzen.net/nachricht/aktien/blockade-gefordert…

...

Eine Übernahme erfordere auch die Zustimmung der kanadischen Regierung. Ein möglicher Deal wäre verehrend für die Gemeinden in der Provinz British Columbia und für alle Kanadier, sagte die Oppositionspartei laut "Wall Street Journal". Zudem seinen tausende Jobs in Gefahr und lokale Lieferketten könnten unterbrochen werden.

Erst Anfang der Woche hatte auch die kanadische Finanzministerin Bedenken für den Kauf geäußert. Sie forderte etwa, dass der Hauptsitz von Teck weiter in Kanada sein soll, um damit die wichtige Mineralienindustrie des Landes zu unterstützen.

...

27.4.

Glencore says takeover bid for Teck Resources still stands

https://uk.news.yahoo.com/glencore-says-takeover-bid-teck-06…

...

Glencore Plc said on Thursday its takeover bid for Teck Resources Ltd still stands, after the Canadian miner scrapped a restructuring plan that would have ended it.

The Swiss mining giant added that it was willing to engage with Teck's board to improve its proposal structure, but would still make an offer directly to shareholders if there was no response.

On Wednesday, the Vancouver-based miner withdrew its plan to split in two, a surprise development just ahead of a key shareholder vote as Glencore circled with a $22.5-billion offer made in March and the promise of a sweeter one.

Teck, which for weeks had defended its plan to separate its copper and coal businesses as a better option for shareholders, could not convince the majority of them.

It chief executive, Jonathan Price, repeated on Wednesday his objection to Glencore's bid, saying he would "not engage in something that is a distraction".

...

Glencore says takeover bid for Teck Resources still stands

https://uk.news.yahoo.com/glencore-says-takeover-bid-teck-06…

...

Glencore Plc said on Thursday its takeover bid for Teck Resources Ltd still stands, after the Canadian miner scrapped a restructuring plan that would have ended it.

The Swiss mining giant added that it was willing to engage with Teck's board to improve its proposal structure, but would still make an offer directly to shareholders if there was no response.

On Wednesday, the Vancouver-based miner withdrew its plan to split in two, a surprise development just ahead of a key shareholder vote as Glencore circled with a $22.5-billion offer made in March and the promise of a sweeter one.

Teck, which for weeks had defended its plan to separate its copper and coal businesses as a better option for shareholders, could not convince the majority of them.

It chief executive, Jonathan Price, repeated on Wednesday his objection to Glencore's bid, saying he would "not engage in something that is a distraction".

...

Wieso verkaufen?

Anglo American,Freeport und Vale haben schon vor etwa 2 Wochen Interesse an der

Kupfersparte signalisiert(siehe Finanznachrichten.de).

Dann geht der Kurs erst richtig hoch unter 37/38 Euro je Aktie verkaufe ich nicht.

Anglo American,Freeport und Vale haben schon vor etwa 2 Wochen Interesse an der

Kupfersparte signalisiert(siehe Finanznachrichten.de).

Dann geht der Kurs erst richtig hoch unter 37/38 Euro je Aktie verkaufe ich nicht.

gibt es eigentlich schon Zahlen, wenn Teck den Spinoff durchzieht. Wie die beiden neuen Aktien dann bewertet werden?

Vermutlich wird es ja daraufhin hinauslaufen. Neue Aktien dann halten oder vorher Teck noch verkaufen.

Preise für Teck werden ja wohn nochmals nach oben gehen durch neues Kaufangebot

Vermutlich wird es ja daraufhin hinauslaufen. Neue Aktien dann halten oder vorher Teck noch verkaufen.

Preise für Teck werden ja wohn nochmals nach oben gehen durch neues Kaufangebot

20.4.

Sumitomo Metal Mining Confirms Support for Teck’s Coal Spinoff

https://uk.finance.yahoo.com/news/sumitomo-metal-mining-conf…

...

Sumitomo Metal Mining Co. said it will back Teck Resources Ltd. in its planned spinoff of coal assets, confirming its earlier support in the face of an alternative takeover proposal from Glencore Plc.

The Japanese company reiterated “its continuous support for Teckʼs plan to create two separate world-class independent companies,” it said in a statement. Teck has already said its main Class A shareholders — of which Sumitomo is one — had committed to voting in favor.

Teck is trying to get backing for a split of the company ahead of a shareholder vote on the proposal on April 26. Glencore has indicated it could raise its $23 billion buyout bid and that it’s willing to put an offer direct to Teck’s shareholders.

Sumitomo directly holds 18.9% of Teck’s Class A shares along with with the Keevil family, as well as 0.1% of Class B shares. It also holds 49% of Temagami Mining, which owns 55% of Teck’s Class A shares.

Sumitomo Metal Mining Confirms Support for Teck’s Coal Spinoff

https://uk.finance.yahoo.com/news/sumitomo-metal-mining-conf…

...

Sumitomo Metal Mining Co. said it will back Teck Resources Ltd. in its planned spinoff of coal assets, confirming its earlier support in the face of an alternative takeover proposal from Glencore Plc.

The Japanese company reiterated “its continuous support for Teckʼs plan to create two separate world-class independent companies,” it said in a statement. Teck has already said its main Class A shareholders — of which Sumitomo is one — had committed to voting in favor.

Teck is trying to get backing for a split of the company ahead of a shareholder vote on the proposal on April 26. Glencore has indicated it could raise its $23 billion buyout bid and that it’s willing to put an offer direct to Teck’s shareholders.

Sumitomo directly holds 18.9% of Teck’s Class A shares along with with the Keevil family, as well as 0.1% of Class B shares. It also holds 49% of Temagami Mining, which owns 55% of Teck’s Class A shares.

19.4.

Glencore Dangles Prospect of Higher Teck Bid As Vote Looms

https://finance.yahoo.com/news/glencore-dangles-prospect-hig…

...

Glencore Plc said it’s willing to raise its bid for Teck Resources Ltd. in the latest attempt to sway shareholders and pressure Teck’s board, with just one week to go before a pivotal vote on the Canadian miner’s future.

The companies have spent the past few weeks in a bruising fight to win over Teck investors, after its board and controlling shareholder publicly rejected Glencore’s proposal. The Swiss commodities giant offered to buy Teck for $23 billion and then create two new companies combining their respective metals and coal businesses.

Teck is pressing ahead instead with an earlier plan to spin off its own coal mines — with an investor vote scheduled for April 26 — while raising the possibility of a sale afterward.

With the prospect of a higher bid, Glencore is hoping to convince enough shareholders to either reject the split or pressure Teck’s board to delay the vote and enter talks. Glencore is prepared to raise its offer, the company said on Wednesday, but believes any improvement should come after discussions with the board.

If Teck still refuses to engage — and if its split does not proceed — then Glencore said it’s willing to put its offer directly to shareholders.

...

Glencore Dangles Prospect of Higher Teck Bid As Vote Looms

https://finance.yahoo.com/news/glencore-dangles-prospect-hig…

...

Glencore Plc said it’s willing to raise its bid for Teck Resources Ltd. in the latest attempt to sway shareholders and pressure Teck’s board, with just one week to go before a pivotal vote on the Canadian miner’s future.

The companies have spent the past few weeks in a bruising fight to win over Teck investors, after its board and controlling shareholder publicly rejected Glencore’s proposal. The Swiss commodities giant offered to buy Teck for $23 billion and then create two new companies combining their respective metals and coal businesses.

Teck is pressing ahead instead with an earlier plan to spin off its own coal mines — with an investor vote scheduled for April 26 — while raising the possibility of a sale afterward.

With the prospect of a higher bid, Glencore is hoping to convince enough shareholders to either reject the split or pressure Teck’s board to delay the vote and enter talks. Glencore is prepared to raise its offer, the company said on Wednesday, but believes any improvement should come after discussions with the board.

If Teck still refuses to engage — and if its split does not proceed — then Glencore said it’s willing to put its offer directly to shareholders.

...

17.4.

Teck’s Controlling Shareholder Says He’s Open to Deals After Planned Split

https://finance.yahoo.com/news/teck-controlling-shareholder-…

...

Teck Resources Ltd.’s controlling shareholder has given his clearest indication yet that the company will be up for sale, but only if investors throw their support behind a plan to split the Canadian miner in half.

Norman Keevil, the 85-year-old magnate who controls Teck through “supervoting” Class A shares, offered investors the prospect of a future deal as the company scrambles to win over investors in the face of a competing proposal from Glencore Plc.

Glencore’s $23 billion offer — to merge the businesses and then create two new companies that mine metal and coal respectively — gained traction toward the end of last week, putting Teck on the back foot. Two influential investor advisory groups came out against Teck’s plan, while Bloomberg reported on Friday that Teck’s largest investor, China Investment Corp., currently favors Glencore’s proposal.

Teck investors will vote on the plan to spin off its coal mines in a little more than a week, and Glencore Chief Executive Officer Gary Nagle has said that the company will keep pursuing a deal if Teck’s investors vote down the restructuring plan.

The Canadian company will be hoping that the chance of a sale or bidding war after the split will convince shareholders it is a better prospect than the Glencore proposal.

“I would support a transaction – whether it be an operating partnership, merger, acquisition, or sale – with the right partner, on the right terms for Teck Metals after separation,” Keevil said in a commentary issued by Teck.

...

Teck’s Controlling Shareholder Says He’s Open to Deals After Planned Split

https://finance.yahoo.com/news/teck-controlling-shareholder-…

...

Teck Resources Ltd.’s controlling shareholder has given his clearest indication yet that the company will be up for sale, but only if investors throw their support behind a plan to split the Canadian miner in half.

Norman Keevil, the 85-year-old magnate who controls Teck through “supervoting” Class A shares, offered investors the prospect of a future deal as the company scrambles to win over investors in the face of a competing proposal from Glencore Plc.

Glencore’s $23 billion offer — to merge the businesses and then create two new companies that mine metal and coal respectively — gained traction toward the end of last week, putting Teck on the back foot. Two influential investor advisory groups came out against Teck’s plan, while Bloomberg reported on Friday that Teck’s largest investor, China Investment Corp., currently favors Glencore’s proposal.

Teck investors will vote on the plan to spin off its coal mines in a little more than a week, and Glencore Chief Executive Officer Gary Nagle has said that the company will keep pursuing a deal if Teck’s investors vote down the restructuring plan.

The Canadian company will be hoping that the chance of a sale or bidding war after the split will convince shareholders it is a better prospect than the Glencore proposal.

“I would support a transaction – whether it be an operating partnership, merger, acquisition, or sale – with the right partner, on the right terms for Teck Metals after separation,” Keevil said in a commentary issued by Teck.

...

Heute aufgestockt!

Jetzt klopfen Vale,Freeport und Anglo American an die Kupfertür von Teck!

Echter Krimi und der Hauptaktionär hat gerade in einem Brief signalisiert,das Fusion bishin

zum Verkauf offen bleiben nach der Stahlkohleabtrennung!

Unter 46/47 Euro wird nicht verkauft.

Jetzt klopfen Vale,Freeport und Anglo American an die Kupfertür von Teck!

Echter Krimi und der Hauptaktionär hat gerade in einem Brief signalisiert,das Fusion bishin

zum Verkauf offen bleiben nach der Stahlkohleabtrennung!

Unter 46/47 Euro wird nicht verkauft.

Glencore proposal is a non starter: Teck CEO

https://www.bnnbloomberg.ca/video/glencore-proposal-is-a-non…

https://www.bnnbloomberg.ca/video/glencore-proposal-is-a-non…

11.4.

Glencore Sweetens Offer for Teck Resources With Cash Component

https://www.bnnbloomberg.ca/glencore-sweetens-offer-for-teck…

...

Glencore Plc has proposed adding a cash element to its previous all-share offer for Teck Resources Ltd., stepping up its pursuit after the Canadian miner rejected an earlier proposal to buy the company and then spin off both their coal businesses.

Glencore is proposing a deal that would give Teck investors 24% of the combined metals-focused business, plus $8.2 billion in cash. The new offer would mean that Teck investors could avoid exposure to Glencore’s thermal coal business, which the Canadian firm has said is less attractive than its steelmaking coal assets.

...

The vote on that plan has been scheduled for April 26, giving both Teck and Glencore a tight window to win over investors. Teck’s dual-class share structure means any takeover bid would need the support of the Keevil family, but the company’s current restructuring plan also requires two-thirds approval from the holders of regular class B shares.

Glencore’s proposal, if successful, would give the company control of Teck’s lucrative copper mines — adding exposure to a critical building block for the green energy transition, while also providing a roadmap for the larger company to exit thermal coal much sooner than it had previously telegraphed.

The biggest miners have been grappling for years over what to do with their coal mines — most have already retreated, while Glencore has held its ground on a plan to operate the mines until they are depleted by 2050. Teck said last week it spent four years deciding what to do with its steelmaking coal business.

...

Glencore Sweetens Offer for Teck Resources With Cash Component

https://www.bnnbloomberg.ca/glencore-sweetens-offer-for-teck…

...

Glencore Plc has proposed adding a cash element to its previous all-share offer for Teck Resources Ltd., stepping up its pursuit after the Canadian miner rejected an earlier proposal to buy the company and then spin off both their coal businesses.

Glencore is proposing a deal that would give Teck investors 24% of the combined metals-focused business, plus $8.2 billion in cash. The new offer would mean that Teck investors could avoid exposure to Glencore’s thermal coal business, which the Canadian firm has said is less attractive than its steelmaking coal assets.

...

The vote on that plan has been scheduled for April 26, giving both Teck and Glencore a tight window to win over investors. Teck’s dual-class share structure means any takeover bid would need the support of the Keevil family, but the company’s current restructuring plan also requires two-thirds approval from the holders of regular class B shares.

Glencore’s proposal, if successful, would give the company control of Teck’s lucrative copper mines — adding exposure to a critical building block for the green energy transition, while also providing a roadmap for the larger company to exit thermal coal much sooner than it had previously telegraphed.

The biggest miners have been grappling for years over what to do with their coal mines — most have already retreated, while Glencore has held its ground on a plan to operate the mines until they are depleted by 2050. Teck said last week it spent four years deciding what to do with its steelmaking coal business.

...

7.4.

... Glencore-Kaufangebot für Teck stößt wohl auf Widerstand von japanischem Großaktionär

https://www.finanzen.net/nachricht/aktien/abspaltung-von-koh…

...

Das milliardenschwere Kaufangebot von Glencore für das kanadische Bergbauunternehmen Teck stößt einem Pressebericht zufolge auf den Widerstand eines weiteren Großaktionärs.

Die japanische Sumitomo Metal Mining habe ein Treffen mit Glencore abgelehnt, auf dem das Übernahmeangebot hätte besprochen werden sollen, berichtete die kanadische Zeitung "Globe and Mail" am Gründonnerstag.

Sumitomo besitzt gemeinsam mit der Keevil-Familie die stimmgewichtigen A-Aktien und damit die Kontrollmehrheit an Teck Resources, wie die Zeitung weiter schrieb. Sumitomo wolle nicht mal mit Glencore reden, sagte ein Keevil-Vertrauter laut dem Blatt. Ohne die Zustimmung der Keevil-Familie und der Japaner sei eine Übernahme von Teck nicht möglich.

...

... Glencore-Kaufangebot für Teck stößt wohl auf Widerstand von japanischem Großaktionär

https://www.finanzen.net/nachricht/aktien/abspaltung-von-koh…

...

Das milliardenschwere Kaufangebot von Glencore für das kanadische Bergbauunternehmen Teck stößt einem Pressebericht zufolge auf den Widerstand eines weiteren Großaktionärs.

Die japanische Sumitomo Metal Mining habe ein Treffen mit Glencore abgelehnt, auf dem das Übernahmeangebot hätte besprochen werden sollen, berichtete die kanadische Zeitung "Globe and Mail" am Gründonnerstag.

Sumitomo besitzt gemeinsam mit der Keevil-Familie die stimmgewichtigen A-Aktien und damit die Kontrollmehrheit an Teck Resources, wie die Zeitung weiter schrieb. Sumitomo wolle nicht mal mit Glencore reden, sagte ein Keevil-Vertrauter laut dem Blatt. Ohne die Zustimmung der Keevil-Familie und der Japaner sei eine Übernahme von Teck nicht möglich.

...

5.4.

Glencore Has Three Weeks to Salvage $23 Billion Teck Bid

https://nz.finance.yahoo.com/news/glencore-three-weeks-keep-…

...

Teck Resources Ltd.’s public rejection of a $23 billion offer from Glencore Plc has fired the starting gun on a three-week countdown for the Swiss commodities giant to keep its proposal alive.

Glencore isn’t actually trying to buy any Teck shares yet. There would be little point, after the company’s controlling investor — Canadian mining patriarch Norman Keevil — made clear he’s not interested in selling. Instead, the future of Glencore’s proposal for now depends on convincing Teck’s other shareholders to reject the company’s current strategy to split into two, at a vote scheduled for April 26.

Ironically, the same dual-class structure that gives Keevil his power through supervoting shares may also provide an opportunity for Glencore. Teck’s plan to separate its base metals and coal businesses will require two-thirds approval from both sets of investors separately — the powerful “A” shares dominated by the Keevil family, as well as the regular “B” shares.

That means shareholders with just a small percentage of the total voting rights could have the power to scupper Teck’s plan and throw its future into question.

Glencore now has three weeks to convince enough Teck investors to oppose the separation in the hopes of bringing Keevil and the board back to the negotiating table. Of course, the Keevil family’s holding will leave it in control regardless of the outcome of the vote. But it will provide a opportunity for the B shareholders to stage a protest should they choose to, leaving Teck without a clear strategy if the split fails.

“Shareholders of Teck have a chance to say they actually think the Glencore deal looks better by voting down the Teck split,” said George Cheveley, a portfolio manager at Ninety One UK Ltd., which holds shares in both companies. “If you vote down the split, you might find that other people then come in.”

...

Glencore Has Three Weeks to Salvage $23 Billion Teck Bid

https://nz.finance.yahoo.com/news/glencore-three-weeks-keep-…

...

Teck Resources Ltd.’s public rejection of a $23 billion offer from Glencore Plc has fired the starting gun on a three-week countdown for the Swiss commodities giant to keep its proposal alive.

Glencore isn’t actually trying to buy any Teck shares yet. There would be little point, after the company’s controlling investor — Canadian mining patriarch Norman Keevil — made clear he’s not interested in selling. Instead, the future of Glencore’s proposal for now depends on convincing Teck’s other shareholders to reject the company’s current strategy to split into two, at a vote scheduled for April 26.

Ironically, the same dual-class structure that gives Keevil his power through supervoting shares may also provide an opportunity for Glencore. Teck’s plan to separate its base metals and coal businesses will require two-thirds approval from both sets of investors separately — the powerful “A” shares dominated by the Keevil family, as well as the regular “B” shares.

That means shareholders with just a small percentage of the total voting rights could have the power to scupper Teck’s plan and throw its future into question.

Glencore now has three weeks to convince enough Teck investors to oppose the separation in the hopes of bringing Keevil and the board back to the negotiating table. Of course, the Keevil family’s holding will leave it in control regardless of the outcome of the vote. But it will provide a opportunity for the B shareholders to stage a protest should they choose to, leaving Teck without a clear strategy if the split fails.

“Shareholders of Teck have a chance to say they actually think the Glencore deal looks better by voting down the Teck split,” said George Cheveley, a portfolio manager at Ninety One UK Ltd., which holds shares in both companies. “If you vote down the split, you might find that other people then come in.”

...

4.4.

Teck Resources Is Said to Be Open to Offers Once Coal Spinoff Is Complete

https://finance.yahoo.com/news/teck-resources-said-open-offe…

...

Teck Resources Ltd. is willing to entertain offers from potential suitors after it finishes the spinoff of its steelmaking coal business, according to people familiar with the matter.

The Canadian miner said Monday it rejected an unsolicited $23 billion proposal from Glencore Plc and will forge ahead with an April 26 shareholder vote on separating its metals and coal divisions. If investors approve, the split is expected to happen by the end of May, with the base metals producer being renamed Teck Metals Corp.

At that point, the Teck board is likely to be open to hearing offers from prospective partners or buyers including Glencore, the people said, asking not to be identified as the matter is private.

The Swiss commodities firm’s offer for Teck, at a 20% premium, is another sign that big mining companies are on the hunt for acquisitions. BHP Group Ltd. and Rio Tinto Plc are also said to be actively looking to increase their copper exposure.

...

Teck Resources Is Said to Be Open to Offers Once Coal Spinoff Is Complete

https://finance.yahoo.com/news/teck-resources-said-open-offe…

...

Teck Resources Ltd. is willing to entertain offers from potential suitors after it finishes the spinoff of its steelmaking coal business, according to people familiar with the matter.

The Canadian miner said Monday it rejected an unsolicited $23 billion proposal from Glencore Plc and will forge ahead with an April 26 shareholder vote on separating its metals and coal divisions. If investors approve, the split is expected to happen by the end of May, with the base metals producer being renamed Teck Metals Corp.

At that point, the Teck board is likely to be open to hearing offers from prospective partners or buyers including Glencore, the people said, asking not to be identified as the matter is private.

The Swiss commodities firm’s offer for Teck, at a 20% premium, is another sign that big mining companies are on the hunt for acquisitions. BHP Group Ltd. and Rio Tinto Plc are also said to be actively looking to increase their copper exposure.

...

Es bleibt spannend:

Analysts eye sweeter deal for Teck as Glencore stresses synergies in call:

https://seekingalpha.com/news/3953877-analysts-eye-sweeter-d…

Analysts eye sweeter deal for Teck as Glencore stresses synergies in call:

https://seekingalpha.com/news/3953877-analysts-eye-sweeter-d…

...

Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK) (“Teck”) today announced that the Board of Directors of Teck has received and unanimously rejected an unsolicited and opportunistic acquisition proposal from Glencore plc, which would see that company acquire Teck and subsequently separate to create two businesses, which would expose Teck shareholders to thermal coal and oil trading.

“The Board is not contemplating a sale of the company at this time. We believe that our planned separation creates a greater spectrum of opportunities to maximize value for Teck shareholders,” said Sheila Murray, Chair of the Board, Teck. “The Special Committee and Board remain confident that the proposed separation into Teck Metals and Elk Valley Resources (EVR) is in the best interests of Teck and all its stakeholders, is a much more compelling transaction and does not limit our optionality going forward.”

“The Glencore proposal would expose Teck shareholders to a large thermal coal business, an oil trading business and significant jurisdictional risk, all of which would negatively impact the value potential of Teck’s business, is contrary to our ESG commitments and would transfer significant value to Glencore at the expense of Teck shareholders,” said Jonathan Price, CEO, Teck.

...

3.4.

Teck Board of Directors Rejects Unsolicited Acquisition Proposal

https://www.wallstreet-online.de/nachricht/16759642-teck-boa…

___

=> meine Annahme: er wird nicht zu einer Übernahme durch Glencore, zumindest nicht als Ganzes, kommen

ABER: dieser Übernahmeversuch zeigt mMn, trotz des Metallurgical coal-Geschäfts (--> "Elk Valley Resources Ltd."-Spin-Off als Idee), daß TECK zur Zeit unterbewertet ist

Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK) (“Teck”) today announced that the Board of Directors of Teck has received and unanimously rejected an unsolicited and opportunistic acquisition proposal from Glencore plc, which would see that company acquire Teck and subsequently separate to create two businesses, which would expose Teck shareholders to thermal coal and oil trading.

“The Board is not contemplating a sale of the company at this time. We believe that our planned separation creates a greater spectrum of opportunities to maximize value for Teck shareholders,” said Sheila Murray, Chair of the Board, Teck. “The Special Committee and Board remain confident that the proposed separation into Teck Metals and Elk Valley Resources (EVR) is in the best interests of Teck and all its stakeholders, is a much more compelling transaction and does not limit our optionality going forward.”

“The Glencore proposal would expose Teck shareholders to a large thermal coal business, an oil trading business and significant jurisdictional risk, all of which would negatively impact the value potential of Teck’s business, is contrary to our ESG commitments and would transfer significant value to Glencore at the expense of Teck shareholders,” said Jonathan Price, CEO, Teck.

...

3.4.

Teck Board of Directors Rejects Unsolicited Acquisition Proposal

https://www.wallstreet-online.de/nachricht/16759642-teck-boa…

___

=> meine Annahme: er wird nicht zu einer Übernahme durch Glencore, zumindest nicht als Ganzes, kommen

ABER: dieser Übernahmeversuch zeigt mMn, trotz des Metallurgical coal-Geschäfts (--> "Elk Valley Resources Ltd."-Spin-Off als Idee), daß TECK zur Zeit unterbewertet ist

Der erste Übernahmeversuch durch Glencore steht an:

https://www.investorsobserver.com/news/stock-update/teck-res…

https://www.investorsobserver.com/news/stock-update/teck-res…

21.2.

Teck’s Mining Breakup Sets the Scene for Copper Takeovers

https://finance.yahoo.com/news/teck-mining-breakup-sets-scen…

...

Teck Resources Ltd.’s move to split its metals and coal operations is likely to attract the attention of some of the world’s biggest mining companies as the industry looks to consolidate amid the energy transition.

The Canadian company confirmed Tuesday that it plans a spinoff that will eventually see Teck split into two independent publicly listed companies: Teck Metals Corp will focus on minerals such as copper, and Elk Valley Resources Ltd., which will operate the metallurgical coal assets.

The move almost certainly makes Teck Metals a takeover target when big mining companies are on the hunt for copper as demand for the wiring metal accelerates and a global shortfall looms. BHP Group, Rio Tinto Group and Glencore Plc are actively looking to grow their copper exposure and have been longtime admirers of Teck’s assets across the Americas, according to people familiar with the situation.

Teck owns four copper mines in South America and Canada that produced 270,000 metric tons last year. The company expects to double copper output after the second phase of its Quebrada Blanca project in Chile ramps up to full capacity by the end of this year.

...

Teck’s Mining Breakup Sets the Scene for Copper Takeovers

https://finance.yahoo.com/news/teck-mining-breakup-sets-scen…

...

Teck Resources Ltd.’s move to split its metals and coal operations is likely to attract the attention of some of the world’s biggest mining companies as the industry looks to consolidate amid the energy transition.

The Canadian company confirmed Tuesday that it plans a spinoff that will eventually see Teck split into two independent publicly listed companies: Teck Metals Corp will focus on minerals such as copper, and Elk Valley Resources Ltd., which will operate the metallurgical coal assets.

The move almost certainly makes Teck Metals a takeover target when big mining companies are on the hunt for copper as demand for the wiring metal accelerates and a global shortfall looms. BHP Group, Rio Tinto Group and Glencore Plc are actively looking to grow their copper exposure and have been longtime admirers of Teck’s assets across the Americas, according to people familiar with the situation.

Teck owns four copper mines in South America and Canada that produced 270,000 metric tons last year. The company expects to double copper output after the second phase of its Quebrada Blanca project in Chile ramps up to full capacity by the end of this year.

...

+9%

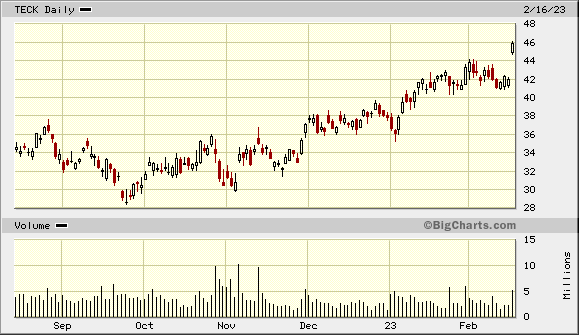

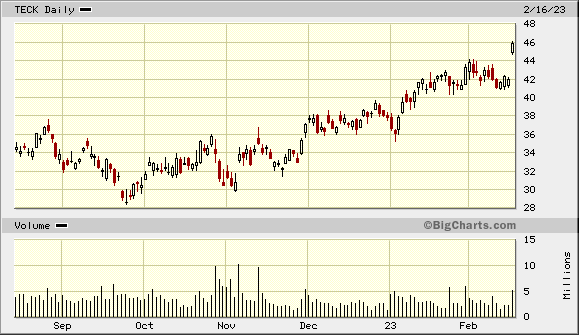

Trading Halt an der NYSE wegen News pending: 2023-02-16, 10:55:58 https://www.nyse.com/trade-halt-current

Wegen Kohle-Divestment?

Trading Halt an der NYSE wegen News pending: 2023-02-16, 10:55:58 https://www.nyse.com/trade-halt-current

Wegen Kohle-Divestment?

Antwort auf Beitrag Nr.: 72.983.296 von Bergfreund am 28.12.22 05:08:02Läuft ebenso wie meine Siliziumaktien Albemarle,Alkem und Uran CAMECO.

Scheint eine richtig Klasse Bergbaubude zusein.

Saubere Bilanz(Versch.etwas hoch) und konzentriert sich verstärkt auf Kupfer und anderen

wichtigen Zukunftsmetallen.

Leider bin ich erst jetzt auf TR gekommen,da dieser Minenwert kaum medial im Scheinwerfer ist.

Steige heute ein.

NF

Saubere Bilanz(Versch.etwas hoch) und konzentriert sich verstärkt auf Kupfer und anderen

wichtigen Zukunftsmetallen.

Leider bin ich erst jetzt auf TR gekommen,da dieser Minenwert kaum medial im Scheinwerfer ist.

Steige heute ein.

NF

Antwort auf Beitrag Nr.: 72.656.678 von faultcode am 28.10.22 17:21:49Hier noch ein Bericht zu diesem Ausstieg aus dem Ölsandgeschäft durch den Verkauf der Anteile an Fort Hills:

https://www.mining.com/teck-exits-oilsands-with-c1bn-sale-of…

https://www.mining.com/teck-exits-oilsands-with-c1bn-sale-of…

Keine Unterstützung für ein solches Projekt