Allianz SE: Oliver Bäte - der neue Joe Ackermann/Deutsche Bank ?

eröffnet am 21.07.18 17:46:32 von

neuester Beitrag 11.11.23 15:06:16 von

neuester Beitrag 11.11.23 15:06:16 von

Beiträge: 127

ID: 1.284.917

ID: 1.284.917

Aufrufe heute: 2

Gesamt: 19.138

Gesamt: 19.138

Aktive User: 0

ISIN: DE0008404005 · WKN: 840400

264,00

EUR

-0,85 %

-2,25 EUR

Letzter Kurs 22:42:56 Lang & Schwarz

Neuigkeiten

| Allianz Aktien jetzt im kostenlosen Demokonto handeln!Anzeige |

06:32 Uhr · dpa-AFX |

23.04.24 · Der Aktionär TV |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 15,000 | +900,00 | |

| 0,6800 | +312,12 | |

| 7,5000 | +50,00 | |

| 25,50 | +42,86 | |

| 1,5100 | +37,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,8500 | -12,04 | |

| 34,28 | -14,02 | |

| 1,5000 | -23,08 | |

| 3,0000 | -24,91 | |

| 0,7500 | -25,00 |

Beitrag zu dieser Diskussion schreiben

Ich war gestern nicht dabei gewesen

Aber schön zu sehen, dass man nicht immer selber nur der Idiot ist.

Am Montag: springen oder nicht springen.

Tja das war irgendwie wieder klar. Und schon zurück auf 223.

Dabei dreht Nasdaq futures grad sogar ins plus

Dabei dreht Nasdaq futures grad sogar ins plus

Running ziel 400€

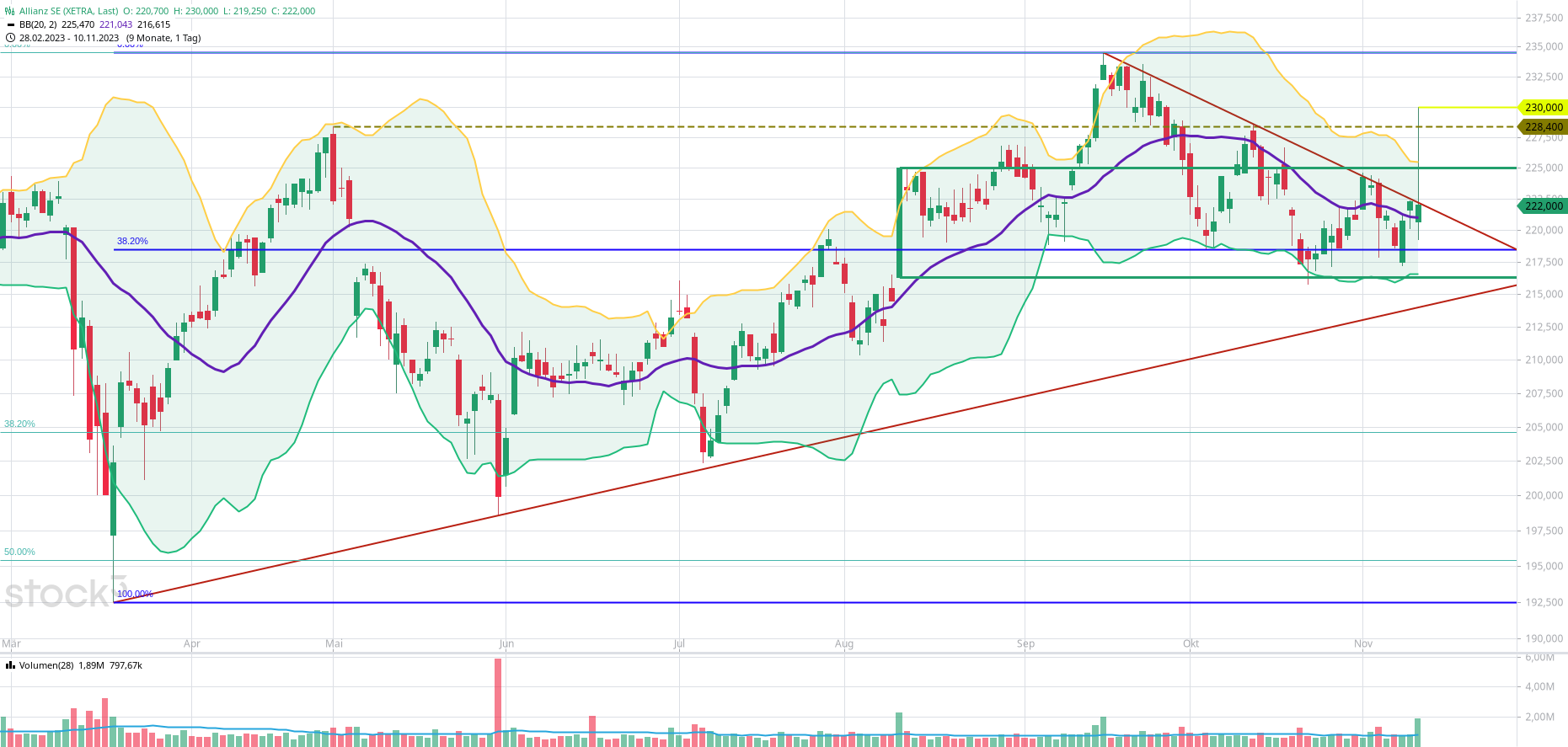

Schaue ich heute morgen, steht da 220 euro, dann sogar 219. also leicht wieder runter nach gestern….

Und jetzt? Wird ALV übernommen?

228 einfach mal so nach Zahlen. Nicht schlecht.

Und jetzt? Wird ALV übernommen?

228 einfach mal so nach Zahlen. Nicht schlecht.

Im Moment wird es für alle eher schwieriger 😩.

Antwort auf Beitrag Nr.: 69.257.103 von faultcode am 07.09.21 12:42:3012.10.

Mängel in der IT: Nach BaFin-Ärger: McKinsey eilt der Allianz zur Hilfe

https://www.wiwo.de/unternehmen/dienstleister/maengel-in-der…

...

Die einst so zahme Bonner Behörde, die seit dem Wirecard-Skandal zum Raufbold geworden ist, hat Deutschlands größten Versicherer in den vergangenen Monaten mal so richtig an die Kandare genommen, die IT-Systeme des Konzerns einer gründlichen Prüfung unterzogen – und ist auch gleich fündig geworden. Die Aufseher sollen Bätes Mannschaft eine ganze Reihe von Versäumnissen in der IT attestiert haben, wie die WirtschaftsWoche bereits im März berichtet hatte. Nun muss der Konzern diese Mängel abarbeiten, und hier kommen die „Meckies“ ins Spiel.

...

Denn: Offenbar kann die Allianz die Mängel zeitnah nicht allein abarbeiten. Deshalb soll McKinsey nun genau dabei unterstützten und darf sich über einen dementsprechend hübschen Auftrag vom Ex-Kollegen Bäte freuen, wie Allianz-Insider berichten.

...

Nicht nur bei der Größe, auch bei der Wahl der McKinsey-Mitarbeiter hat sich die Allianz nicht lumpen lassen: Darunter sollen gar Spezialisten aus der Schweiz und den USA sein, berichten Szenekundige.

...

Der Versicherer will wesentliche Versäumnisse nun bereits bis Ende dieses Jahres abarbeiten. Dabei hatten Bäte und seine Leute eigentlich darauf gehofft, zahlreiche Probleme erst im Laufe des kommenden Jahres abstellen zu müssen. Doch mit dieser Planung war Bonn nicht so richtig zufrieden. Die Aufseher waren über die Mängel derart erbost, dass sie der Allianz angedroht haben sollen, sie könnten von dem Versicherer höhere Kapitalreserven verlangen.

...

Mängel in der IT: Nach BaFin-Ärger: McKinsey eilt der Allianz zur Hilfe

https://www.wiwo.de/unternehmen/dienstleister/maengel-in-der…

...

Die einst so zahme Bonner Behörde, die seit dem Wirecard-Skandal zum Raufbold geworden ist, hat Deutschlands größten Versicherer in den vergangenen Monaten mal so richtig an die Kandare genommen, die IT-Systeme des Konzerns einer gründlichen Prüfung unterzogen – und ist auch gleich fündig geworden. Die Aufseher sollen Bätes Mannschaft eine ganze Reihe von Versäumnissen in der IT attestiert haben, wie die WirtschaftsWoche bereits im März berichtet hatte. Nun muss der Konzern diese Mängel abarbeiten, und hier kommen die „Meckies“ ins Spiel.

...

Denn: Offenbar kann die Allianz die Mängel zeitnah nicht allein abarbeiten. Deshalb soll McKinsey nun genau dabei unterstützten und darf sich über einen dementsprechend hübschen Auftrag vom Ex-Kollegen Bäte freuen, wie Allianz-Insider berichten.

...

Nicht nur bei der Größe, auch bei der Wahl der McKinsey-Mitarbeiter hat sich die Allianz nicht lumpen lassen: Darunter sollen gar Spezialisten aus der Schweiz und den USA sein, berichten Szenekundige.

...

Der Versicherer will wesentliche Versäumnisse nun bereits bis Ende dieses Jahres abarbeiten. Dabei hatten Bäte und seine Leute eigentlich darauf gehofft, zahlreiche Probleme erst im Laufe des kommenden Jahres abstellen zu müssen. Doch mit dieser Planung war Bonn nicht so richtig zufrieden. Die Aufseher waren über die Mängel derart erbost, dass sie der Allianz angedroht haben sollen, sie könnten von dem Versicherer höhere Kapitalreserven verlangen.

...

Was geht die Münchener rück von einem goch aufs nächste, und allianz dümpelt schon wieder südwärts. Aber schnell nochmal den vertrag verlängern, damits package später besser ausfällt. Man o mann, die Probleme werden nicjt weniger bei allianz. Was wird denn abgehakt auf der liste?

04.10.23 10:25:06 50,00 220,05 EUR 11.002,50 EUR Schöner Kursgewinn seit Kauf im Oktober

Jetzt mal in SDAX/MDAX umtauschen ... dort leidet man schwer

Das Einsammeln geht weiter ... die ausgebombten halten sich aber auch gar nicht so schlecht (Stroer z.B.)

VDAX-New Volatilitätsindex 19,3106 +1,49 % +0,2828 war klar es sind zu viele verdrängte Probleme und die poppen hoch

Ölpreis ... das mit den 50 USD für Russland war wohl ein Rohrkrepierer und Quadriert den deutschen Hühnerhaufen

Erst die Keaftwerke abschalten dann 50 Milliarden Subventionen/Kosten für die Betriebe

Inflation steigt deswegen... Also Kaufen was Qualität hat

Jetzt mal in SDAX/MDAX umtauschen ... dort leidet man schwer

Das Einsammeln geht weiter ... die ausgebombten halten sich aber auch gar nicht so schlecht (Stroer z.B.)

VDAX-New Volatilitätsindex 19,3106 +1,49 % +0,2828 war klar es sind zu viele verdrängte Probleme und die poppen hoch

Ölpreis ... das mit den 50 USD für Russland war wohl ein Rohrkrepierer und Quadriert den deutschen Hühnerhaufen

Erst die Keaftwerke abschalten dann 50 Milliarden Subventionen/Kosten für die Betriebe

Inflation steigt deswegen... Also Kaufen was Qualität hat

Glaub ich nicht. Durchschnitsskaufkurs 188. Also in sofern immer noch im pus, plus die dividendenzahlungen.

Mein Punkt ist nur, wann wird die allianz mal den trend durchbrechen.

Und: hab einen Call laufen, der stark im geld war, leider bei 23x des Basiswertes nicht verkauft letzte woche. Ist jetzt noch im plus, natuerlich weit vom high entfernt.

Also nein, sparbuch nichts. Aber ja, besonders geduldig bin ich auch nicht…

Mein Punkt ist nur, wann wird die allianz mal den trend durchbrechen.

Und: hab einen Call laufen, der stark im geld war, leider bei 23x des Basiswertes nicht verkauft letzte woche. Ist jetzt noch im plus, natuerlich weit vom high entfernt.

Also nein, sparbuch nichts. Aber ja, besonders geduldig bin ich auch nicht…

06:32 Uhr · dpa-AFX · Allianz |

22.04.24 · dpa-AFX · Allianz |

22.04.24 · dpa-AFX · Allianz |

21.04.24 · BörsenNEWS.de · Allianz |

21.04.24 · Aktienwelt360 · Allianz |

19.04.24 · BörsenNEWS.de · Allianz |

16.04.24 · wallstreetONLINE Redaktion · Allianz |

13.04.24 · wallstreetONLINE Redaktion · Allianz |

| Zeit | Titel |

|---|---|

| 20:49 Uhr | |

| 23.04.24 | |

| 06.12.23 |