Krisengeschüttelter Generika-Hersteller Teva erneut mit Verlust | Diskussion im Forum

eröffnet am 02.08.18 22:32:56 von

neuester Beitrag 24.07.23 19:37:46 von

neuester Beitrag 24.07.23 19:37:46 von

Beiträge: 42

ID: 1.285.677

ID: 1.285.677

Aufrufe heute: 0

Gesamt: 9.777

Gesamt: 9.777

Aktive User: 0

ISIN: US8816242098 · WKN: 883035 · Symbol: TEV

11,800

EUR

-2,07 %

-0,250 EUR

Letzter Kurs 10:27:08 Tradegate

Neuigkeiten

16.04.24 · Business Wire (engl.) |

16.04.24 · Business Wire (engl.) |

11.04.24 · Business Wire (engl.) |

09.04.24 · Business Wire (engl.) |

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5800 | +922,86 | |

| 1,0400 | +48,57 | |

| 0,5400 | +38,46 | |

| 5,4000 | +27,06 | |

| 21,440 | +23,56 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 24,000 | -20,00 | |

| 28,18 | -32,62 | |

| 100,00 | -37,50 | |

| 3,6400 | -38,62 | |

| 0,5660 | -40,42 |

Beitrag zu dieser Diskussion schreiben

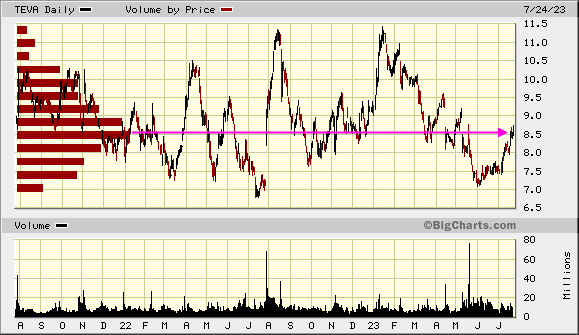

gelingt diesmal beim gefühlt 20sten Mal der endgültige Ausbruch nach oben?

<keine Position>

18.5.

Teva to Slim Down Generic Drug Business in Turnaround Effort. The Stock Is Jumping.

https://www.barrons.com/articles/teva-pharmaceutical-stock-p…

...

Teva Pharmaceutical Industries , one of the world’s largest generic drugmakers, said Thursday it will cut back on its core generic drugs business while focusing on its pipeline of new treatments.

The new corporate strategy, Teva said, aims to deliver a “pivot to growth.” Teva (ticker: TEVA) earnings have dropped steadily over the past decade, to $2.52 per share in 2022 from $5.35 per share in 2013.

...

Debts from the deal crippled the business, and Actavis’s sales of generic opioids in the U.S. made Teva a major target of lawsuits brought by states and local governments over the opioid crisis. Teva is currently finalizing a $4.3 billion settlement of its opioid liabilities. The company has admitted no wrongdoing.

Now, under a new CEO, Teva is looking to turn the page with a new strategy that emphasizes the company’s pipeline of novel therapeutics—and aims to slim down its core generics portfolio to improve that segment’s profit margins. While the pharmaceutical’s generic drugs provide important, inexpensive alternatives to high-price branded medicines, margins in that business can be very thin.

A New York Times report on Wednesday highlighted generic drug shortages, which the report stated are at near-record levels, and have caused the White House and the U.S. Congress to turn their attention to the generic drug market.

In an interview with Barron’s on Thursday afternoon, CEO Richard Francis said any discontinuations of generic products will be done in a way that won’t cause shortages. He suggested that a smaller portfolio of generic drugs would be more resilient to shortages.

“We’d like to think that a manufacturing network, which is designed and set up in a way to sell and manufacture the molecules we really are committed to allows us to create more capacity and flexibility in our supply chain,” Francis said.

At a news conference Thursday morning, Francis had said Teva’s pullback from some generic drugs won’t affect the generic drug supply.

“The reason why these products are low-margin is because there are many manufacturers who are supplying these medicines,” Francis said. “I think when we step out of these markets, we’ll be replaced very quickly by the many other manufacturers who are delivering and supplying these products.”

...

Teva to Slim Down Generic Drug Business in Turnaround Effort. The Stock Is Jumping.

https://www.barrons.com/articles/teva-pharmaceutical-stock-p…

...

Teva Pharmaceutical Industries , one of the world’s largest generic drugmakers, said Thursday it will cut back on its core generic drugs business while focusing on its pipeline of new treatments.

The new corporate strategy, Teva said, aims to deliver a “pivot to growth.” Teva (ticker: TEVA) earnings have dropped steadily over the past decade, to $2.52 per share in 2022 from $5.35 per share in 2013.

...

Debts from the deal crippled the business, and Actavis’s sales of generic opioids in the U.S. made Teva a major target of lawsuits brought by states and local governments over the opioid crisis. Teva is currently finalizing a $4.3 billion settlement of its opioid liabilities. The company has admitted no wrongdoing.

Now, under a new CEO, Teva is looking to turn the page with a new strategy that emphasizes the company’s pipeline of novel therapeutics—and aims to slim down its core generics portfolio to improve that segment’s profit margins. While the pharmaceutical’s generic drugs provide important, inexpensive alternatives to high-price branded medicines, margins in that business can be very thin.

A New York Times report on Wednesday highlighted generic drug shortages, which the report stated are at near-record levels, and have caused the White House and the U.S. Congress to turn their attention to the generic drug market.

In an interview with Barron’s on Thursday afternoon, CEO Richard Francis said any discontinuations of generic products will be done in a way that won’t cause shortages. He suggested that a smaller portfolio of generic drugs would be more resilient to shortages.

“We’d like to think that a manufacturing network, which is designed and set up in a way to sell and manufacture the molecules we really are committed to allows us to create more capacity and flexibility in our supply chain,” Francis said.

At a news conference Thursday morning, Francis had said Teva’s pullback from some generic drugs won’t affect the generic drug supply.

“The reason why these products are low-margin is because there are many manufacturers who are supplying these medicines,” Francis said. “I think when we step out of these markets, we’ll be replaced very quickly by the many other manufacturers who are delivering and supplying these products.”

...

Kåre Schultz -- überschätzt und überbezahlt. Aber die Börse hatte dazu später auch ein klares Votum:

=> ich werte diesen überraschenden Abgang in den "Ruhestand" daher auch weiterhin als ein Negativ-Signal mittelfristig:

21.11.

Teva Appoints Richard Francis As CEO On Retirement Of Kåre Schultz

https://www.finanzen.ch/nachrichten/aktien/teva-appoints-ric…

Der Abbau des Horror-Schuldenstandes geht viel zu langsam vonstatten mMn im Vergleich zum tendenziellen Rückgang bei Umsatz, operativem Ergebnis und MitarbeiterInnen-Anzahl.

=> ich werte diesen überraschenden Abgang in den "Ruhestand" daher auch weiterhin als ein Negativ-Signal mittelfristig:

21.11.

Teva Appoints Richard Francis As CEO On Retirement Of Kåre Schultz

https://www.finanzen.ch/nachrichten/aktien/teva-appoints-ric…

Der Abbau des Horror-Schuldenstandes geht viel zu langsam vonstatten mMn im Vergleich zum tendenziellen Rückgang bei Umsatz, operativem Ergebnis und MitarbeiterInnen-Anzahl.

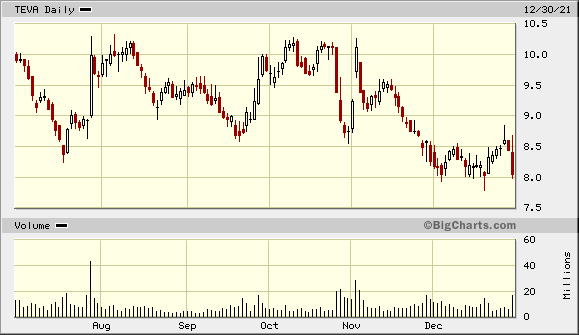

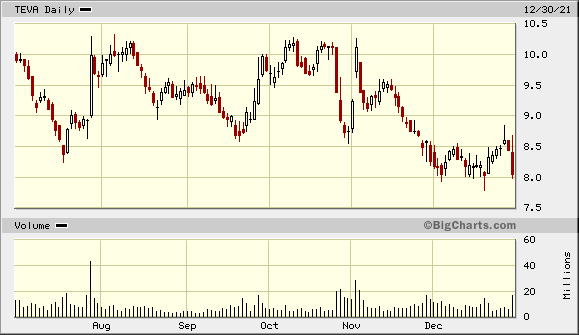

30.12.

Teva's stock swings to a sharp loss after jury finds its U.S. subsidiary violated rights of New Yorkers

https://www.marketwatch.com/story/tevas-stock-swings-to-a-sh…

Shares of Teva Pharmaceutical Industries Ltd. sank 4.6% in afternoon trading Thursday, reversing an earlier gain of as much as 3.1%, after New York Attorney General Letitia James said a jury found that the drug maker's subsidiary Teva Pharmaceuticals USA and violated rights of New Yorkers, as a contributor to the opioid crisis.

James said a subsequent trial will be held to determine how much Teva will be required to pay, which will be added to the up to $1.5 billion that has already been negotiated from different opioid manufacturers and distributors from a lawsuit she filed in March 2019.

Teva responded to the ruling by saying it will "prepare for a swift appeal," and continue to pursue a mistrial. "In NY, the plaintiffs presented no evidence of medically unnecessary prescriptions, suspicious or diverted orders, no evidence of oversupply by the defendants -- or any indication of what volumes were appropriate -- and no causal relationship between Teva's conduct including its marketing and any harm to the public in the state," Teva said in a statement.

...

=>

Teva's stock swings to a sharp loss after jury finds its U.S. subsidiary violated rights of New Yorkers

https://www.marketwatch.com/story/tevas-stock-swings-to-a-sh…

Shares of Teva Pharmaceutical Industries Ltd. sank 4.6% in afternoon trading Thursday, reversing an earlier gain of as much as 3.1%, after New York Attorney General Letitia James said a jury found that the drug maker's subsidiary Teva Pharmaceuticals USA and violated rights of New Yorkers, as a contributor to the opioid crisis.

James said a subsequent trial will be held to determine how much Teva will be required to pay, which will be added to the up to $1.5 billion that has already been negotiated from different opioid manufacturers and distributors from a lawsuit she filed in March 2019.

Teva responded to the ruling by saying it will "prepare for a swift appeal," and continue to pursue a mistrial. "In NY, the plaintiffs presented no evidence of medically unnecessary prescriptions, suspicious or diverted orders, no evidence of oversupply by the defendants -- or any indication of what volumes were appropriate -- and no causal relationship between Teva's conduct including its marketing and any harm to the public in the state," Teva said in a statement.

...

=>

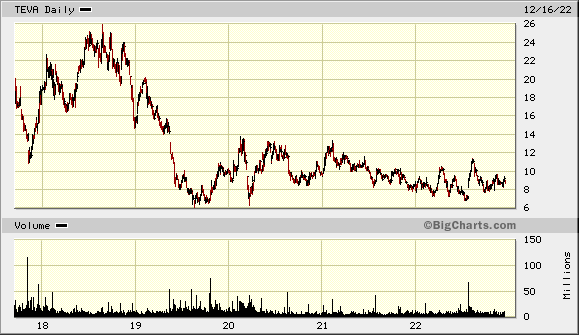

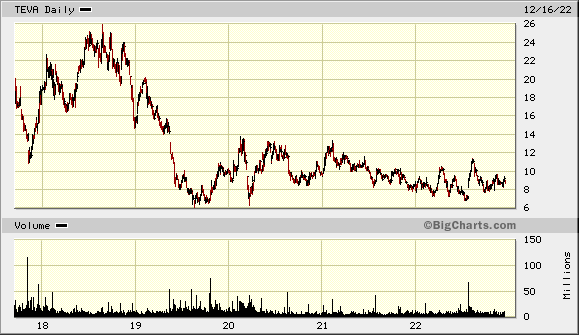

2023 könnte es mit den Anleihen sehr eng werden. Die Refinanzierung aus dem FCF dürfte nicht reichen. HFs setzen da sicher jetzt schon auf eine  Insolvenz

Insolvenz  oder zumindest Panikcrash mit Kursen um 2 USD. Sollte Teva 2023 überstehen sind schnell 30 $ und mehr drin.

oder zumindest Panikcrash mit Kursen um 2 USD. Sollte Teva 2023 überstehen sind schnell 30 $ und mehr drin.

Insolvenz

Insolvenz  oder zumindest Panikcrash mit Kursen um 2 USD. Sollte Teva 2023 überstehen sind schnell 30 $ und mehr drin.

oder zumindest Panikcrash mit Kursen um 2 USD. Sollte Teva 2023 überstehen sind schnell 30 $ und mehr drin.

Ich hab heute mal eine erste Position gekauft. Mal schaun was draus wird. Es gibt ja genug Baustellen. Aber irgendwann muss ja auch mal Licht am Ende des Tunnels sein. Obwohl jeder der länger investiert ist das sicher anders sieht...

Antwort auf Beitrag Nr.: 62.024.501 von faultcode am 27.11.19 13:15:0626.11.2020

EU fines Teva, Cephalon 60.5 mln euros for delaying cheaper drug

https://finance.yahoo.com/news/eu-fines-teva-cephalon-60-114…

...

The European Commission has fined pharmaceutical companies Teva and Cephalon 60.5 million euros ($72.0 million) for agreeing to delay a cheaper generic version of Cephalon's sleep disorder medicine.

The agreement to delay the market entry of modafinil after Cephalon's main patents had expired violate EU antitrust rules and caused substantial harm to EU patients and healthcare systems by keeping its price high, the Commission said on Thursday.

The agreement was concluded so that the illegal action occurred from December 2005 to October 2011, when Teva acquired Cephalon, the Commission said.

...

EU fines Teva, Cephalon 60.5 mln euros for delaying cheaper drug

https://finance.yahoo.com/news/eu-fines-teva-cephalon-60-114…

...

The European Commission has fined pharmaceutical companies Teva and Cephalon 60.5 million euros ($72.0 million) for agreeing to delay a cheaper generic version of Cephalon's sleep disorder medicine.

The agreement to delay the market entry of modafinil after Cephalon's main patents had expired violate EU antitrust rules and caused substantial harm to EU patients and healthcare systems by keeping its price high, the Commission said on Thursday.

The agreement was concluded so that the illegal action occurred from December 2005 to October 2011, when Teva acquired Cephalon, the Commission said.

...

Antwort auf Beitrag Nr.: 62.024.501 von faultcode am 27.11.19 13:15:06was hatte diese Firma nur für ein Management?

Offensichtlich lauter Idioten.

Offensichtlich lauter Idioten.

26.11.

Shares of opioid makers and distributors drop on criminal probe

https://www.marketwatch.com/story/shares-of-opioid-makers-an…

=>

Shares of the companies embroiled in opioid litigation fell in afternoon trading afterThe Wall Street Journal reported the federal government had opened a criminal investigation into some opioid makers and distributors, citing sources.

Six companies have disclosed in regulatory filings that they have received grand-jury subpoenas from the U.S. attorney's office in the Eastern District of New York, according to the report...

TEVA soll auch bei diesen 6 dabei sein laut WSJ:

• AmerisourceBergen

• Amneal

• J&J

• Mallinckrodt

• McKesson

• Teva

Shares of opioid makers and distributors drop on criminal probe

https://www.marketwatch.com/story/shares-of-opioid-makers-an…

=>

Shares of the companies embroiled in opioid litigation fell in afternoon trading afterThe Wall Street Journal reported the federal government had opened a criminal investigation into some opioid makers and distributors, citing sources.

Six companies have disclosed in regulatory filings that they have received grand-jury subpoenas from the U.S. attorney's office in the Eastern District of New York, according to the report...

TEVA soll auch bei diesen 6 dabei sein laut WSJ:

• AmerisourceBergen

• Amneal

• J&J

• Mallinckrodt

• McKesson

• Teva

Antwort auf Beitrag Nr.: 61.419.080 von faultcode am 05.09.19 15:30:18Die institutionellen Anleger haben ihre Anteile an Teva eher aufgestockt. Nur Fidelity ging raus.

Ich denke, dass der Kurs momentan einen Boden bildet. Das mit den Wahlen 2020 ist richtig.

Ich denke, dass der Kurs momentan einen Boden bildet. Das mit den Wahlen 2020 ist richtig.

| Zeit | Titel |

|---|---|

| 09.04.24 |