Drax Group - thermische Energieversorgung in UK - Die letzten 30 Beiträge

eröffnet am 16.10.18 19:42:00 von

neuester Beitrag 08.01.24 12:05:26 von

neuester Beitrag 08.01.24 12:05:26 von

Beiträge: 28

ID: 1.290.666

ID: 1.290.666

Aufrufe heute: 0

Gesamt: 3.146

Gesamt: 3.146

Aktive User: 0

ISIN: GB00B1VNSX38 · WKN: A0MK9W

5,9500

EUR

+3,16 %

+0,1825 EUR

Letzter Kurs 23.04.24 Lang & Schwarz

Neuigkeiten

08.01.24 · dpa-AFX |

01.12.23 · dpa-AFX Analysen |

24.11.23 · globenewswire |

22.11.23 · globenewswire |

Werte aus der Branche Versorger

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8400 | +1.455,56 | |

| 1,7200 | +10,97 | |

| 9,1300 | +10,00 | |

| 4,8300 | +7,33 | |

| 1.288,00 | +6,88 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1.072,40 | -9,88 | |

| 1.032,80 | -10,19 | |

| 28,43 | -10,93 | |

| 14,050 | -11,52 | |

| 490,00 | -18,33 |

Beitrag zu dieser Diskussion schreiben

8.1.

UK government expected to approve billions for Drax’s BECCS plan

https://www.bioenergy-news.com/news/uk-government-expected-t…

...

The UK government is expected to approve a multi-billion-pound CO2 carbon capture scheme that will bolt two carbon capture plants onto Drax's four generating units in North Yorkshire, reported The Telegraph.

Drax said this would help it become the world's first cabon-negative power station, and that it would make the organisation a hub of the UK's first zero-carbon industrial cluster - known as the Zero Carbon Humber - assisting in decarbonising the North of England.

The firm announced it had entered formal talks with the government in March last year, with Drax Group CEO Will Gardiner stating: “With the right engagement from government and swift decision making, Drax stands ready to progress our £2 billion (€2.3 billion) investment programme and deliver this critical project for the UK by 2030.”

...

=>

UK government expected to approve billions for Drax’s BECCS plan

https://www.bioenergy-news.com/news/uk-government-expected-t…

...

The UK government is expected to approve a multi-billion-pound CO2 carbon capture scheme that will bolt two carbon capture plants onto Drax's four generating units in North Yorkshire, reported The Telegraph.

Drax said this would help it become the world's first cabon-negative power station, and that it would make the organisation a hub of the UK's first zero-carbon industrial cluster - known as the Zero Carbon Humber - assisting in decarbonising the North of England.

The firm announced it had entered formal talks with the government in March last year, with Drax Group CEO Will Gardiner stating: “With the right engagement from government and swift decision making, Drax stands ready to progress our £2 billion (€2.3 billion) investment programme and deliver this critical project for the UK by 2030.”

...

=>

21.10.

Drax faces penalty after Canadian biomass plant fails to submit pollution report

https://www.standard.co.uk/news/environment/drax-alberta-ofg…

...

Drax Canada told the PA news agency that the report was not submitted due to an “unintended administrative oversight”.

The company, which receives billions in green subsidies from the UK Government, is currently facing an investigation by the energy regulator Ofgem into the sustainability of the biomass it uses at its wood-burning plant in Yorkshire.

It comes after a BBC panorama investigation alleged that some of the wood comes from primary forests that had been cut down by the company in Canada.

The company was also found to have paid millions to US regulators over claims it exceeded limits on chemicals emissions and VOCs.

...

Drax faces penalty after Canadian biomass plant fails to submit pollution report

https://www.standard.co.uk/news/environment/drax-alberta-ofg…

...

Drax Canada told the PA news agency that the report was not submitted due to an “unintended administrative oversight”.

The company, which receives billions in green subsidies from the UK Government, is currently facing an investigation by the energy regulator Ofgem into the sustainability of the biomass it uses at its wood-burning plant in Yorkshire.

It comes after a BBC panorama investigation alleged that some of the wood comes from primary forests that had been cut down by the company in Canada.

The company was also found to have paid millions to US regulators over claims it exceeded limits on chemicals emissions and VOCs.

...

27.9.

UK Risks Power Supply Crunch in January as Nuclear Plants Halt

The UK’s National Grid Plc is preparing for a possible power crunch in January as several planned nuclear outages coincide with peak winter demand.

https://financialpost.com/pmn/business-pmn/uk-risks-power-su…

...

UK Risks Power Supply Crunch in January as Nuclear Plants Halt

The UK’s National Grid Plc is preparing for a possible power crunch in January as several planned nuclear outages coincide with peak winter demand.

https://financialpost.com/pmn/business-pmn/uk-risks-power-su…

...

Antwort auf Beitrag Nr.: 74.489.400 von faultcode am 15.09.23 18:39:31Shorties:

26.9.

Drax Under Scrutiny From Short Sellers Over Debt Structure

• Shadowfall, GLG Partners and Marshall Wace are shorting Drax

• Analysts increase scrutiny of Drax’s debt arrangements

https://www.bloomberg.com/news/articles/2023-09-26/drax-unde…

...

=>

26.9.

Drax Under Scrutiny From Short Sellers Over Debt Structure

• Shadowfall, GLG Partners and Marshall Wace are shorting Drax

• Analysts increase scrutiny of Drax’s debt arrangements

https://www.bloomberg.com/news/articles/2023-09-26/drax-unde…

...

=>

??

2.8.

UK Carbon Price Set to Halve on Market Reform Concern, Citi Says

UK carbon permit prices are on course to plunge almost 50% amid the government’s “lack of political ambition” to reform the country’s emissions trading system, according to analysts at Citigroup Inc.

https://financialpost.com/pmn/business-pmn/uk-carbon-price-s…

...

The allowances may gravitate toward £22 ($28) a metric ton, the auction reserve price for Britain’s carbon market, Citigroup analysts wrote in a note Wednesday. The pollution rights have already plunged 42% this year to £40.50, which is almost half the level of similar contracts in the European Union market.

...

UK Carbon Price Set to Halve on Market Reform Concern, Citi Says

UK carbon permit prices are on course to plunge almost 50% amid the government’s “lack of political ambition” to reform the country’s emissions trading system, according to analysts at Citigroup Inc.

https://financialpost.com/pmn/business-pmn/uk-carbon-price-s…

...

The allowances may gravitate toward £22 ($28) a metric ton, the auction reserve price for Britain’s carbon market, Citigroup analysts wrote in a note Wednesday. The pollution rights have already plunged 42% this year to £40.50, which is almost half the level of similar contracts in the European Union market.

...

26.4.

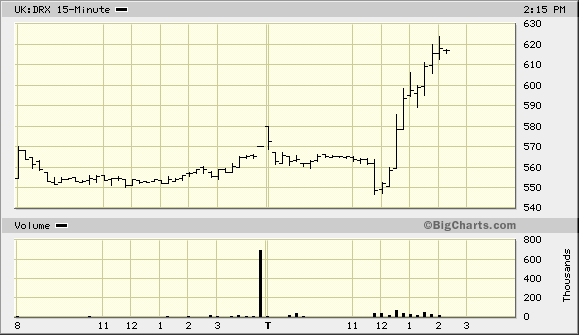

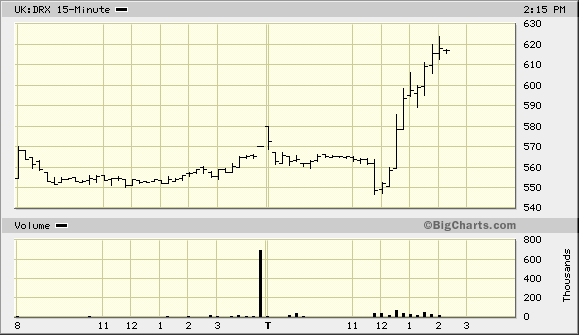

Britain's Drax announces $187 million buyback, lowers annual capex outlook

https://www.msn.com/en-gb/money/other/britains-drax-announce…

...

Drax Group Plc announced a 150 million pound ($186.60 million) share buyback programme and lowered its annual capital expenditure forecast, after it paused further investment in projects to capture and store carbon dioxide in the UK.

The British power generator said on Wednesday it intended to commence the buyback programme in the second quarter and complete it by the end of the year.

The London-listed group's shares were up 4% at 642 pence as of 0740 GMT.

Britain laid out plans last month to boost its energy security and independence through investment in efforts to move towards cleaner, more affordable energy sources including projects to capture and store carbon dioxide.

Drax, however, had paused its planned multi-million pounds investment in the UK's bioenergy with carbon capture and storage (BECCS) project until it gets more clarity over government support.

The group said it expected capital expenditure this year to be in the range of 520 million pounds to 580 million pounds, compared with its prior forecast of 570 million pounds to 630 million pounds.

The group also said it expected annual adjusted core profit to be in line with market expectations.

Britain's Drax announces $187 million buyback, lowers annual capex outlook

https://www.msn.com/en-gb/money/other/britains-drax-announce…

...

Drax Group Plc announced a 150 million pound ($186.60 million) share buyback programme and lowered its annual capital expenditure forecast, after it paused further investment in projects to capture and store carbon dioxide in the UK.

The British power generator said on Wednesday it intended to commence the buyback programme in the second quarter and complete it by the end of the year.

The London-listed group's shares were up 4% at 642 pence as of 0740 GMT.

Britain laid out plans last month to boost its energy security and independence through investment in efforts to move towards cleaner, more affordable energy sources including projects to capture and store carbon dioxide.

Drax, however, had paused its planned multi-million pounds investment in the UK's bioenergy with carbon capture and storage (BECCS) project until it gets more clarity over government support.

The group said it expected capital expenditure this year to be in the range of 520 million pounds to 580 million pounds, compared with its prior forecast of 570 million pounds to 630 million pounds.

The group also said it expected annual adjusted core profit to be in line with market expectations.

21.3.

UK’s Stable Power Supply at Risk as Nuclear and Gas Plants Close

https://www.bloomberg.com/news/articles/2023-03-21/uk-s-stab…

• UK could lose over 6 gigawatts of supply by 2027, Baringa says

• More stable capacity, increased flexibility could help supply

...

The UK is facing a significant shortage of reliable power generation as nuclear, coal and gas plants will close in the years ahead without being replaced.

So-called dispatchable capacity, which can generally be called on at will, is set to fall from 93% to 85% of peak demand levels by 2027, according to consultant Baringa Partners LLP. That’s largely due to the retirement of inefficient fossil-fuel plants and nuclear reactors, as well as a rise in demand because of electrification.

The research, commissioned by Drax Group Plc, shows the danger of the nation’s increasing reliance on intermittent renewable power sources. Already this winter, the nation’s power system flirted with severe shortages as wind generation plunged and emergency measures needed to be taken.

While the UK is set to see a 25 gigawatt increase in intermittent renewable capacity, it still needs stable generation as backup. The UK faces a decline of secure capacity of 4.5-6.3 gigawatts by 2027 and a 4 gigawatt increase in peak demand, according to the Baringa report.

Drax, which generates dispatchable power from its biomass and coal-power station in Yorkshire, has urged the government to back its investment in carbon capture by approving it for a subsidy program, needed for the project to go ahead.

UK’s Stable Power Supply at Risk as Nuclear and Gas Plants Close

https://www.bloomberg.com/news/articles/2023-03-21/uk-s-stab…

• UK could lose over 6 gigawatts of supply by 2027, Baringa says

• More stable capacity, increased flexibility could help supply

...

The UK is facing a significant shortage of reliable power generation as nuclear, coal and gas plants will close in the years ahead without being replaced.

So-called dispatchable capacity, which can generally be called on at will, is set to fall from 93% to 85% of peak demand levels by 2027, according to consultant Baringa Partners LLP. That’s largely due to the retirement of inefficient fossil-fuel plants and nuclear reactors, as well as a rise in demand because of electrification.

The research, commissioned by Drax Group Plc, shows the danger of the nation’s increasing reliance on intermittent renewable power sources. Already this winter, the nation’s power system flirted with severe shortages as wind generation plunged and emergency measures needed to be taken.

While the UK is set to see a 25 gigawatt increase in intermittent renewable capacity, it still needs stable generation as backup. The UK faces a decline of secure capacity of 4.5-6.3 gigawatts by 2027 and a 4 gigawatt increase in peak demand, according to the Baringa report.

Drax, which generates dispatchable power from its biomass and coal-power station in Yorkshire, has urged the government to back its investment in carbon capture by approving it for a subsidy program, needed for the project to go ahead.

13.1.

UK's Drax Fined £6.1 Million for Charging Extreme Energy Prices

UK electricity firm Drax Group Plc agreed to pay a £6.1 million ($7.5 million) fine for breaching its license, after charging the grid operator excessive prices to reduce its power generation.

https://financialpost.com/pmn/business-pmn/uks-drax-fined-6-…

...

The company’s pumped storage subsidiary secured “excessive payments” between 2019 and mid-2022 by entering inflated bids into the system’s balancing mechanism, which aims to fine-tune the country’s supply and demand, regulator Ofgem said in a statement Friday.

...

UK's Drax Fined £6.1 Million for Charging Extreme Energy Prices

UK electricity firm Drax Group Plc agreed to pay a £6.1 million ($7.5 million) fine for breaching its license, after charging the grid operator excessive prices to reduce its power generation.

https://financialpost.com/pmn/business-pmn/uks-drax-fined-6-…

...

The company’s pumped storage subsidiary secured “excessive payments” between 2019 and mid-2022 by entering inflated bids into the system’s balancing mechanism, which aims to fine-tune the country’s supply and demand, regulator Ofgem said in a statement Friday.

...

17.11.

RWE und britische Versorger drehen ins Plus trotz UK-Steuer

https://www.wallstreet-online.de/nachricht/16220525-aktien-f…

...

Eine Sondersteuer auf Übergewinne in Großbritannien mit Erneuerbaren Energien hat die Branche am Donnerstag nur kurz belastet. Die Titel des auch in Großbritannien aktiven RWE -Konzerns drehten nach einem Abschlag von zeitweise zwei Prozent ins Plus mit zuletzt 1,9 Prozent. In noch deutlicherem Maße galt dies für die britischen Branchenwerte Drax, SSE und Centrica , die zuletzt bis zu acht Prozent gewannen. Die Gewinnbesteuerung fiel wohl weniger scharf aus als befürchtet.

Laut dem JPMorgan-Experten Pavan Mahbubani ist die nun erreichte Planbarkeit der Lage eine positive Nachricht für die Energiebranche in Großbritannien. Er selbst sei bislang auch von einer Sondersteuer ausgegangen. Er sieht seine positiven Empfehlungen für die Unternehmen Drax, SSE und Centrica von den Entscheidungen untermauert.

Die Einbeziehung höherer Strompreise und der neuen Steuerpläne implizierten, dass er seine Gewinnschätzungen je Aktie zumindest für SSE und Centrica im zweistelligen Prozentbereich nach oben anpassen müsse.

...

=>

RWE und britische Versorger drehen ins Plus trotz UK-Steuer

https://www.wallstreet-online.de/nachricht/16220525-aktien-f…

...

Eine Sondersteuer auf Übergewinne in Großbritannien mit Erneuerbaren Energien hat die Branche am Donnerstag nur kurz belastet. Die Titel des auch in Großbritannien aktiven RWE -Konzerns drehten nach einem Abschlag von zeitweise zwei Prozent ins Plus mit zuletzt 1,9 Prozent. In noch deutlicherem Maße galt dies für die britischen Branchenwerte Drax, SSE und Centrica , die zuletzt bis zu acht Prozent gewannen. Die Gewinnbesteuerung fiel wohl weniger scharf aus als befürchtet.

Laut dem JPMorgan-Experten Pavan Mahbubani ist die nun erreichte Planbarkeit der Lage eine positive Nachricht für die Energiebranche in Großbritannien. Er selbst sei bislang auch von einer Sondersteuer ausgegangen. Er sieht seine positiven Empfehlungen für die Unternehmen Drax, SSE und Centrica von den Entscheidungen untermauert.

Die Einbeziehung höherer Strompreise und der neuen Steuerpläne implizierten, dass er seine Gewinnschätzungen je Aktie zumindest für SSE und Centrica im zweistelligen Prozentbereich nach oben anpassen müsse.

...

=>

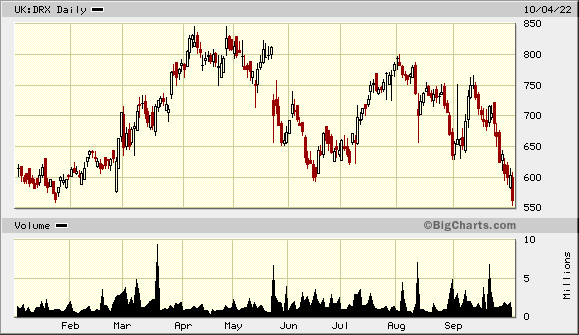

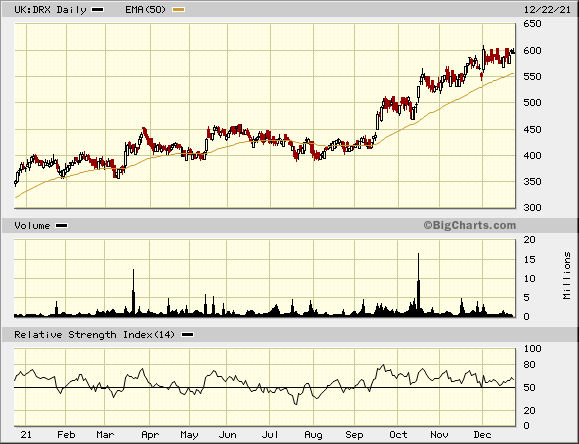

4.10.

UK’s Drax Drops After Panorama Questions Firm’s Forestry Methods

https://financialpost.com/pmn/business-pmn/uks-drax-drops-af…

...

Drax Group Plc shares suffered their biggest intraday drop in nearly two months after BBC Panorama said the UK power firm is cutting down “environmentally important” forests.

The television program aired Monday evening said Drax is chopping down forests in Canada to make wood pellets that are then burned to produce electricity in Britain. That is likely to hurt the investment case for the firm in the near term, said JPMorgan Chase & Co. analyst Pavan Mahbubani.

Drax said ahead of the program that 80% of the material used to make its pellets in Canada is “sawmill residue — sawdust, wood chips and bark left over when the timber is processed.” The rest is waste material collected from forests that would otherwise be burned to reduce the risk of wildfires and disease, it said.

“The forests there are not harvested for biomass, they are harvested for high value timber used in construction,” a spokesperson said in a statement. “People living in and around these forests are best placed to determine how they should be looked after, not the BBC.”

“We believe that the Panorama programme is unhelpful for the Drax story near term, and that the use of wood pellets to generate electricity will continue to be controversial,” JPMorgan’s Mahbubani wrote in a note to clients.

However longer term, the fundamental investment case is unchanged, he said, adding the UK government is likely to remain supportive of biomass and bioenergy with carbon capture and storage. A government biomass strategy that’s due to be published by year-end should be a positive catalyst for the shares, he said, maintaining an overweight rating.

...

=>

UK’s Drax Drops After Panorama Questions Firm’s Forestry Methods

https://financialpost.com/pmn/business-pmn/uks-drax-drops-af…

...

Drax Group Plc shares suffered their biggest intraday drop in nearly two months after BBC Panorama said the UK power firm is cutting down “environmentally important” forests.

The television program aired Monday evening said Drax is chopping down forests in Canada to make wood pellets that are then burned to produce electricity in Britain. That is likely to hurt the investment case for the firm in the near term, said JPMorgan Chase & Co. analyst Pavan Mahbubani.

Drax said ahead of the program that 80% of the material used to make its pellets in Canada is “sawmill residue — sawdust, wood chips and bark left over when the timber is processed.” The rest is waste material collected from forests that would otherwise be burned to reduce the risk of wildfires and disease, it said.

“The forests there are not harvested for biomass, they are harvested for high value timber used in construction,” a spokesperson said in a statement. “People living in and around these forests are best placed to determine how they should be looked after, not the BBC.”

“We believe that the Panorama programme is unhelpful for the Drax story near term, and that the use of wood pellets to generate electricity will continue to be controversial,” JPMorgan’s Mahbubani wrote in a note to clients.

However longer term, the fundamental investment case is unchanged, he said, adding the UK government is likely to remain supportive of biomass and bioenergy with carbon capture and storage. A government biomass strategy that’s due to be published by year-end should be a positive catalyst for the shares, he said, maintaining an overweight rating.

...

=>

11.8.

UK minister questions sustainability of Drax biomass fuel

Kwarteng says shipping wood pellets from Louisiana is costly and ‘doesn’t make any sense’

https://www.ft.com/content/3b18291e-9449-45fd-9517-8edb8433f…

...

The UK’s business secretary has admitted that importing US-made wood pellets to be burnt for energy by power company Drax is not sustainable and “doesn’t make any sense”.

Kwasi Kwarteng also told MPs that the government had not fully investigated the sustainability of burning wood pellets, a type of biomass. He said the Department for Business, Energy and Industrial Strategy had discussed biomass with industry but “we haven’t actually questioned some of the premises” of the sustainability of pellets.

The government has spent millions subsidising the burning of pellets in Drax’s Yorkshire facility over the past decade and the fuel features prominently in the UK’s net zero strategy.

Kwarteng made the comments this week during a meeting with a group of cross-party backbench MPs, who raised concerns about the sustainability of wood pellets, which are described as renewable by Drax.

“There’s no point getting [wood pellets] from Louisiana . . . that isn’t sustainable,” said Kwarteng. Shipping pellets from Louisiana — one of Drax’s sourcing regions in the US — has “a huge cost financially and environmentally . . . [it] doesn’t make any sense to me at all,” he added.

...

UK minister questions sustainability of Drax biomass fuel

Kwarteng says shipping wood pellets from Louisiana is costly and ‘doesn’t make any sense’

https://www.ft.com/content/3b18291e-9449-45fd-9517-8edb8433f…

...

The UK’s business secretary has admitted that importing US-made wood pellets to be burnt for energy by power company Drax is not sustainable and “doesn’t make any sense”.

Kwasi Kwarteng also told MPs that the government had not fully investigated the sustainability of burning wood pellets, a type of biomass. He said the Department for Business, Energy and Industrial Strategy had discussed biomass with industry but “we haven’t actually questioned some of the premises” of the sustainability of pellets.

The government has spent millions subsidising the burning of pellets in Drax’s Yorkshire facility over the past decade and the fuel features prominently in the UK’s net zero strategy.

Kwarteng made the comments this week during a meeting with a group of cross-party backbench MPs, who raised concerns about the sustainability of wood pellets, which are described as renewable by Drax.

“There’s no point getting [wood pellets] from Louisiana . . . that isn’t sustainable,” said Kwarteng. Shipping pellets from Louisiana — one of Drax’s sourcing regions in the US — has “a huge cost financially and environmentally . . . [it] doesn’t make any sense to me at all,” he added.

...

Antwort auf Beitrag Nr.: 71.956.492 von faultcode am 11.07.22 15:08:5326.7.

UK’s Drax Posts Earnings Jump Even as Power Output Declines

https://www.bnnbloomberg.ca/uk-s-drax-posts-earnings-jump-ev…

...

Drax Group Plc posted first-half results that beat expectations by a wide margin as soaring power prices helped lift the UK utility’s income even though it produced less energy.

The generator, which was spared from a UK windfall tax on power generators, saw its biomass generation drop by almost 20% compared with the same period last year, it said in a statement Tuesday. Still, the company reported £225 million ($271 million) in earnings before interest, taxes, depreciation and amortization, which was well above analysts’ consensus.

“It is increasingly obvious with each set of results that Drax is benefiting from the high commodity price environment,” Citigroup Inc. analyst Jenny Ping wrote in a note, adding that she thought that would attract political scrutiny. “We believe the government (whoever in charge) is unlikely to stand by and do nothing to support consumers as energy bills continue to rise into winter.”

...

UK’s Drax Posts Earnings Jump Even as Power Output Declines

https://www.bnnbloomberg.ca/uk-s-drax-posts-earnings-jump-ev…

...

Drax Group Plc posted first-half results that beat expectations by a wide margin as soaring power prices helped lift the UK utility’s income even though it produced less energy.

The generator, which was spared from a UK windfall tax on power generators, saw its biomass generation drop by almost 20% compared with the same period last year, it said in a statement Tuesday. Still, the company reported £225 million ($271 million) in earnings before interest, taxes, depreciation and amortization, which was well above analysts’ consensus.

“It is increasingly obvious with each set of results that Drax is benefiting from the high commodity price environment,” Citigroup Inc. analyst Jenny Ping wrote in a note, adding that she thought that would attract political scrutiny. “We believe the government (whoever in charge) is unlikely to stand by and do nothing to support consumers as energy bills continue to rise into winter.”

...

Antwort auf Beitrag Nr.: 71.927.514 von faultcode am 06.07.22 15:07:37q.e.d.

11.7.

Utility Shares Rise as UK Spares Firms From Windfall Tax

https://finance.yahoo.com/news/utility-shares-rise-uk-spares…

...

A windfall tax on the profits of oil and gas companies, which will be brought before Parliament this week, won’t apply to electricity generators, the prime minister’s spokesman told reporters. Drax Group Plc, SSE Plc and Centrica Plc all rose on the news.

The proposal was seen as jeopardizing billions of pounds of investment in renewable generation, a key part of cutting emissions by 2050. The tax on oil and gas companies was imposed to help pay for support for households struggling with rising energy bills amid the worst cost-of-living crisis for decades.

The move comes as Boris Johnson plans to step down following a revolt by members of his Conservative party. The premier isn’t supposed to make new policy decisions while he’s in a caretaker role.

“There’s no plans to do that in line with convention, so we will continue to evaluate the scale of the profits and take appropriate steps -- but we have no plans to introduce or extend that to that group,” the prime minister’s spokesman Max Blain told reporters.

Drax shares climbed as much as 7.5% to the highest in more than a month, while Centrica advanced as much as 5% and SSE increased 3.9% on the London Stock Exchange.

11.7.

Utility Shares Rise as UK Spares Firms From Windfall Tax

https://finance.yahoo.com/news/utility-shares-rise-uk-spares…

...

A windfall tax on the profits of oil and gas companies, which will be brought before Parliament this week, won’t apply to electricity generators, the prime minister’s spokesman told reporters. Drax Group Plc, SSE Plc and Centrica Plc all rose on the news.

The proposal was seen as jeopardizing billions of pounds of investment in renewable generation, a key part of cutting emissions by 2050. The tax on oil and gas companies was imposed to help pay for support for households struggling with rising energy bills amid the worst cost-of-living crisis for decades.

The move comes as Boris Johnson plans to step down following a revolt by members of his Conservative party. The premier isn’t supposed to make new policy decisions while he’s in a caretaker role.

“There’s no plans to do that in line with convention, so we will continue to evaluate the scale of the profits and take appropriate steps -- but we have no plans to introduce or extend that to that group,” the prime minister’s spokesman Max Blain told reporters.

Drax shares climbed as much as 7.5% to the highest in more than a month, while Centrica advanced as much as 5% and SSE increased 3.9% on the London Stock Exchange.

Antwort auf Beitrag Nr.: 71.666.895 von faultcode am 27.05.22 13:25:196.7.

Resignation of UK’s Sunak Could Sink Power Windfall Tax

https://ampvideo.bnnbloomberg.ca/resignation-of-uk-s-sunak-c…

...

A mooted windfall tax on UK power generators could be delayed or scrapped entirely after Chancellor Rishi Sunak resigned on Tuesday, according to utilities analysts.

“The possibility of a windfall tax on electricity was a Treasury policy, so hopefully Rishi Sunak’s departure will see this misguided policy dropped,” said Investec Plc’s Martin Young in a note Wednesday. The departure could be positive news for shares of Drax Group Plc, Centrica Plc and SSE Plc, he added.

The UK Treasury, which was still considering the policy as recently as mid-June, had been criticized for creating uncertainty in the energy market by dragging its heels on the proposals after reports hit the share prices of generators. Sunak has already set out clear plans for a tax on oil and gas producers, though has since met with industry to discuss their concerns.

Any leadership contest is likely to delay new legislation, “be it windfall taxes or structural reform of the power market,” said Citigroup Inc. analyst Jenny Ping in a note. “It could also change the political narrative all together, for good or bad for the sector.”

...

Resignation of UK’s Sunak Could Sink Power Windfall Tax

https://ampvideo.bnnbloomberg.ca/resignation-of-uk-s-sunak-c…

...

A mooted windfall tax on UK power generators could be delayed or scrapped entirely after Chancellor Rishi Sunak resigned on Tuesday, according to utilities analysts.

“The possibility of a windfall tax on electricity was a Treasury policy, so hopefully Rishi Sunak’s departure will see this misguided policy dropped,” said Investec Plc’s Martin Young in a note Wednesday. The departure could be positive news for shares of Drax Group Plc, Centrica Plc and SSE Plc, he added.

The UK Treasury, which was still considering the policy as recently as mid-June, had been criticized for creating uncertainty in the energy market by dragging its heels on the proposals after reports hit the share prices of generators. Sunak has already set out clear plans for a tax on oil and gas producers, though has since met with industry to discuss their concerns.

Any leadership contest is likely to delay new legislation, “be it windfall taxes or structural reform of the power market,” said Citigroup Inc. analyst Jenny Ping in a note. “It could also change the political narrative all together, for good or bad for the sector.”

...

"Conservatives" in UK:

27.5.

Big Dividend Payers May Be Next After UK Windfall Energy Tax

https://www.bnnbloomberg.ca/big-dividend-payers-may-be-next-…

...

UK Chancellor of the Exchequer Rishi Sunak just slapped a £5 billion ($6.3 billion) levy on energy companies to help fund support for Britons facing a cost-of-living crisis. Other big dividend payers, including miners and consumer-goods firms, could be next.

With the country facing a record squeeze on living standards, public perception of companies that are believed to be over-earning is putting pressure on the government to intervene. Stocks in consumer-sensitive sectors such as food retail and telecoms could also be “vulnerable to increasing political interference,” according to Roger Jones, head of equities at London & Capital.

“It’s possible that other sectors get targeted, given how much pressure the chancellor is under to help out struggling consumers,” said Alexandra Jackson, manager of the Rathbone UK Opportunities Fund. “Last year, the supermarkets were in the frame for a windfall tax because of perceived excess earnings during the pandemic. But the government will be keen to ensure an obvious pattern doesn’t emerge.”

While imposing a windfall tax on the profits of oil and gas producers, Boris Johnson’s government left the door open on applying a similar levy to power generators making “extraordinary profits.” That sent shares of Centrica Plc, SSE Plc and Drax Group Plc slumping on Thursday.

Miners are again expected to make up a large chunk of FTSE 100 dividends this year, with Rio Tinto Plc forecast to be the single biggest paying stock in the index, according to data from AJ Bell. Glencore Plc and Anglo American Plc are also expected to be among the top 10 payers, alongside British American Tobacco Plc, Unilever Plc and AstraZeneca Plc, the data show.

To be sure, other market strategists believe paying high dividends alone won’t be enough to attract levies, with taxes likely to be focused on areas contributing to the surge in inflation to a 40-year high. “I don’t expect a Conservative chancellor to engage in more broad-based windfall taxation,” said James Athey, investment director at abrdn.

Here’s a list of stocks expected to be the 10 biggest contributors to FTSE 100 dividends in 2023, according to Bloomberg data. Figures in parenthesis show the expected contribution as a percentage of the overall amount for the benchmark:

• Shell Plc (8.5%); shares have surged 48% year-to-date

• HSBC Holdings Plc (7.9%); stock +17% YTD

• Rio Tinto (7.8%); shares +16% YTD

• British American Tobacco (7.1%); stock +30% YTD

• Unilever (5.3%); shares -12% YTD

• AstraZeneca (5.0%); stock +22% YTD

• BP Plc (4.8%); shares +32% YTD

• Anglo American (3.4%); stock +26% YTD

• GSK Plc (3.1%); shares +9.2% YTD

• Vodafone Group Plc (2.8%); stock +17% YTD

27.5.

Big Dividend Payers May Be Next After UK Windfall Energy Tax

https://www.bnnbloomberg.ca/big-dividend-payers-may-be-next-…

...

UK Chancellor of the Exchequer Rishi Sunak just slapped a £5 billion ($6.3 billion) levy on energy companies to help fund support for Britons facing a cost-of-living crisis. Other big dividend payers, including miners and consumer-goods firms, could be next.

With the country facing a record squeeze on living standards, public perception of companies that are believed to be over-earning is putting pressure on the government to intervene. Stocks in consumer-sensitive sectors such as food retail and telecoms could also be “vulnerable to increasing political interference,” according to Roger Jones, head of equities at London & Capital.

“It’s possible that other sectors get targeted, given how much pressure the chancellor is under to help out struggling consumers,” said Alexandra Jackson, manager of the Rathbone UK Opportunities Fund. “Last year, the supermarkets were in the frame for a windfall tax because of perceived excess earnings during the pandemic. But the government will be keen to ensure an obvious pattern doesn’t emerge.”

While imposing a windfall tax on the profits of oil and gas producers, Boris Johnson’s government left the door open on applying a similar levy to power generators making “extraordinary profits.” That sent shares of Centrica Plc, SSE Plc and Drax Group Plc slumping on Thursday.

Miners are again expected to make up a large chunk of FTSE 100 dividends this year, with Rio Tinto Plc forecast to be the single biggest paying stock in the index, according to data from AJ Bell. Glencore Plc and Anglo American Plc are also expected to be among the top 10 payers, alongside British American Tobacco Plc, Unilever Plc and AstraZeneca Plc, the data show.

To be sure, other market strategists believe paying high dividends alone won’t be enough to attract levies, with taxes likely to be focused on areas contributing to the surge in inflation to a 40-year high. “I don’t expect a Conservative chancellor to engage in more broad-based windfall taxation,” said James Athey, investment director at abrdn.

Here’s a list of stocks expected to be the 10 biggest contributors to FTSE 100 dividends in 2023, according to Bloomberg data. Figures in parenthesis show the expected contribution as a percentage of the overall amount for the benchmark:

• Shell Plc (8.5%); shares have surged 48% year-to-date

• HSBC Holdings Plc (7.9%); stock +17% YTD

• Rio Tinto (7.8%); shares +16% YTD

• British American Tobacco (7.1%); stock +30% YTD

• Unilever (5.3%); shares -12% YTD

• AstraZeneca (5.0%); stock +22% YTD

• BP Plc (4.8%); shares +32% YTD

• Anglo American (3.4%); stock +26% YTD

• GSK Plc (3.1%); shares +9.2% YTD

• Vodafone Group Plc (2.8%); stock +17% YTD

22.12.

U.K. Households Face £18 Billion Increase in Energy Bills

https://finance.yahoo.com/news/u-k-households-face-18-115934…

...

so ist es:

U.K. Households Face £18 Billion Increase in Energy Bills

https://finance.yahoo.com/news/u-k-households-face-18-115934…

...

so ist es:

Antwort auf Beitrag Nr.: 69.552.129 von faultcode am 09.10.21 14:10:5415.11.

U.K. Power Prices Soar Above £2,000 on Low Winds

https://www.bnnbloomberg.ca/u-k-power-prices-soar-above-2-00…

...

Power prices in the U.K. soared to the second highest level on record on Monday as low wind levels exposed the market to a supply crunch.

Prices for between 5 p.m. and 6 p.m. rose to 2,000.01 pounds per megawatt-hour in the N2EX day-ahead auction for Monday, with wind power generation expected to meet less than a 10th of the demand for that hour. U.K. coal plants were operating at 1.5GW of capacity on Monday morning.

It’s Finally Getting Cold and Europe Doesn’t Have Enough Gas

U.K. gas prices are more than three times as high as at the start of the year, as imports from Russia to Europe slowed, and periods with low wind will increase dependence on very expensive fossil fuel power. Hourly power price has only been higher on Sept. 15 when it rose above 2,500 pounds, and average price for Monday was the highest since Sept. 14.

...

U.K. Power Prices Soar Above £2,000 on Low Winds

https://www.bnnbloomberg.ca/u-k-power-prices-soar-above-2-00…

...

Power prices in the U.K. soared to the second highest level on record on Monday as low wind levels exposed the market to a supply crunch.

Prices for between 5 p.m. and 6 p.m. rose to 2,000.01 pounds per megawatt-hour in the N2EX day-ahead auction for Monday, with wind power generation expected to meet less than a 10th of the demand for that hour. U.K. coal plants were operating at 1.5GW of capacity on Monday morning.

It’s Finally Getting Cold and Europe Doesn’t Have Enough Gas

U.K. gas prices are more than three times as high as at the start of the year, as imports from Russia to Europe slowed, and periods with low wind will increase dependence on very expensive fossil fuel power. Hourly power price has only been higher on Sept. 15 when it rose above 2,500 pounds, and average price for Monday was the highest since Sept. 14.

...

tja Leute, erst zwei Atomkraft-Blöcke abschalten und dann vor dem Winter wundern

7.10.

Risk of UK power cuts this winter has increased, says National Grid

https://www.theguardian.com/environment/2021/oct/07/risk-of-…

...

While factories are not expected to face electricity blackouts, they say they need help with costs. Some of the most energy-intensive industries have issued a plea to the government for financial support to help them cope with soaring energy prices.

They say the cost of electricity could force factory shutdowns, production slowdowns, and switches from gas to more polluting energy sources such as fuel oil, potentially causing embarrassment ahead of the upcoming Cop26 climate conference in Glasgow.

...

While coal has been all but phased out of power generation, gas can still account for more than 50% of supply on windless days when the sun isn’t shining.

...

7.10.

Risk of UK power cuts this winter has increased, says National Grid

https://www.theguardian.com/environment/2021/oct/07/risk-of-…

...

While factories are not expected to face electricity blackouts, they say they need help with costs. Some of the most energy-intensive industries have issued a plea to the government for financial support to help them cope with soaring energy prices.

They say the cost of electricity could force factory shutdowns, production slowdowns, and switches from gas to more polluting energy sources such as fuel oil, potentially causing embarrassment ahead of the upcoming Cop26 climate conference in Glasgow.

...

While coal has been all but phased out of power generation, gas can still account for more than 50% of supply on windless days when the sun isn’t shining.

...

23.9.

Energiekrise -- Kohle-Comeback in Großbritannien

Die Gaspreise in Europa sind rasant gestiegen, das setzt die Stromversorgung in Großbritannien unter Druck. Deswegen werden dort wieder Kohlekraftwerke hochgefahren – und gefährden Boris Johnsons Klimaschutzziele.

https://www.spiegel.de/wirtschaft/service/grossbritannien-dr…

...

Die Anlagen hätten in einer Zeit, »in der das Energiesystem unter erheblichem Druck steht«, eine entscheidende Rolle dabei gespielt, die Stromversorgung im Land aufrechtzuerhalten, erklärte der Energiekonzern Drax.

Der Konzern, der das größte britische Kohlekraftwerk in Yorkshire betreibt, wollte dieses Jahr eigentlich von Kohle auf Biomasse umsteigen. Nun könnte die Kohleverstromung aber fortgesetzt werden, falls dies nötig sei, sagte Drax-Chef Will Gardiner der »Financial Times« sagte.

...

Energiekrise -- Kohle-Comeback in Großbritannien

Die Gaspreise in Europa sind rasant gestiegen, das setzt die Stromversorgung in Großbritannien unter Druck. Deswegen werden dort wieder Kohlekraftwerke hochgefahren – und gefährden Boris Johnsons Klimaschutzziele.

https://www.spiegel.de/wirtschaft/service/grossbritannien-dr…

...

Die Anlagen hätten in einer Zeit, »in der das Energiesystem unter erheblichem Druck steht«, eine entscheidende Rolle dabei gespielt, die Stromversorgung im Land aufrechtzuerhalten, erklärte der Energiekonzern Drax.

Der Konzern, der das größte britische Kohlekraftwerk in Yorkshire betreibt, wollte dieses Jahr eigentlich von Kohle auf Biomasse umsteigen. Nun könnte die Kohleverstromung aber fortgesetzt werden, falls dies nötig sei, sagte Drax-Chef Will Gardiner der »Financial Times« sagte.

...

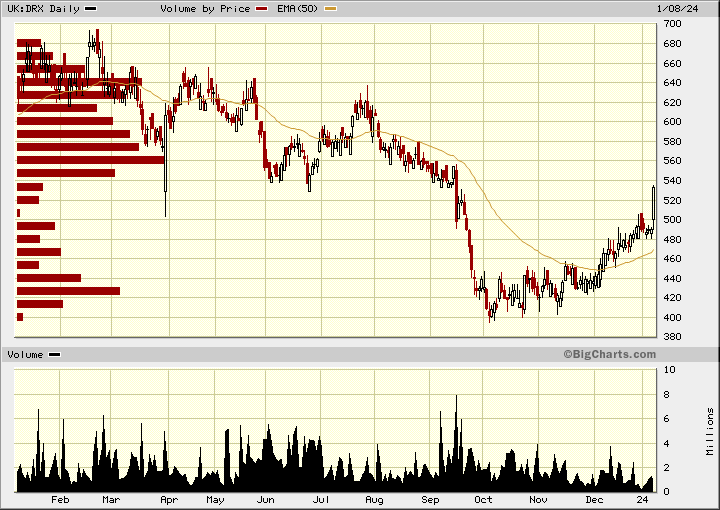

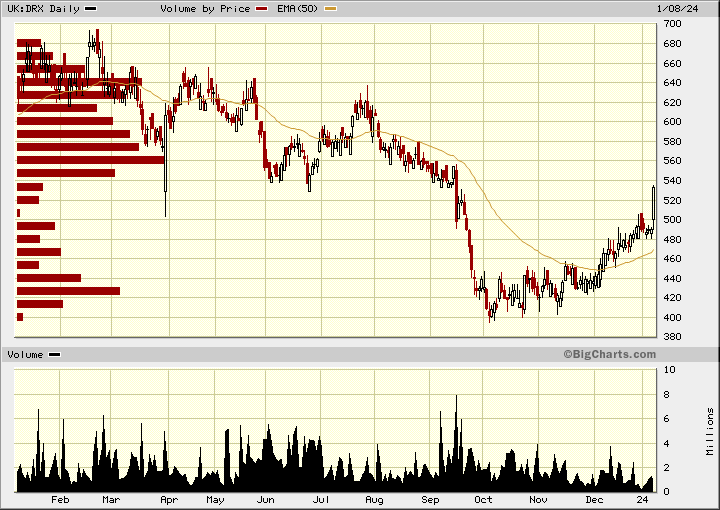

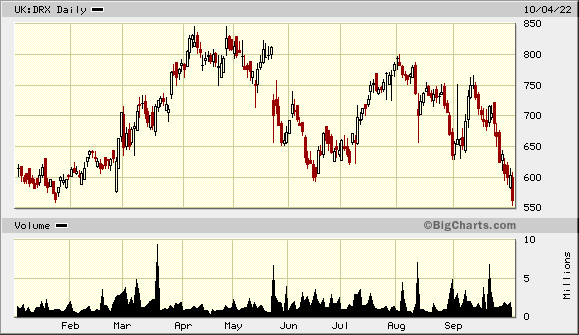

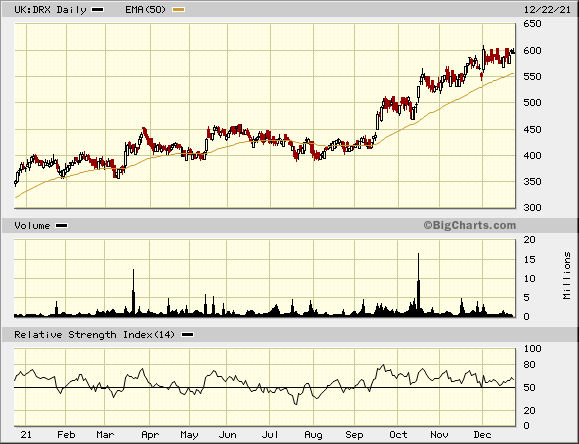

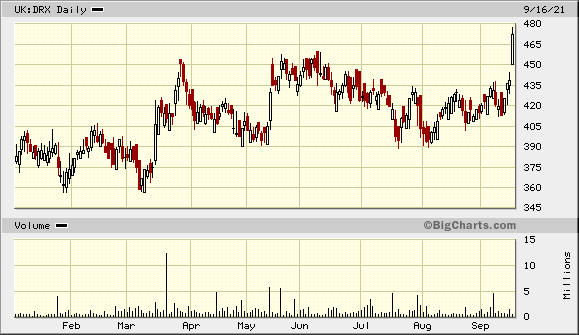

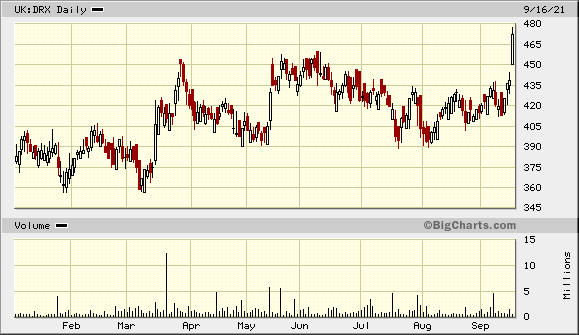

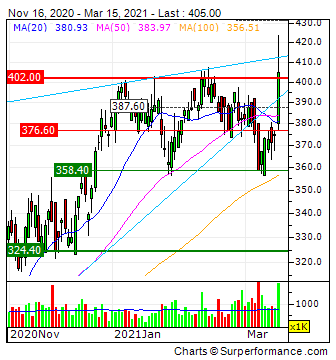

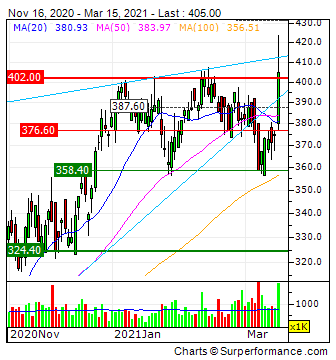

Drax nun sogar mit einem Expansion Breakout in Vorbereitung nachdem Barclays das Kursziel anhob auf 535p = ~EUR6.27:

https://www.proactiveinvestors.co.uk/companies/news/912087/n…

...

Utilities companies Drax PLC (LON : DRAX), SSE PLC (LON : SSE) and National Grid PLC (LON :NG.) offer “considerable potential upside” as the sector invests trillions to achieve ‘net zero’ emissions targets, analysts at Barclays believe.

“We believe the EU’s and UK’s ambitious targets to achieve ‘net zero’ emissions by 2050 are achievable,” Barclays said, “placing utilities at the forefront of a €3.7 trillion investment boom, and making the sector a key beneficiary of the coming industrial revolution.”

...

Reflecting the positive valuation impact for the renewable growth pipelines, the analysts said this drives the significant increase in the Drax share price target to 535p from 333p before and for SSE to 1,650p from the prior 1,300p.

Drax is also expected to enjoy a “major benefit” from strategies to make up carbon shortfalls, including carbon capture and storage (CCS), the potentially “gamechanging” bioenergy carbon capture and storage (BECCS) and from land use, land change and forestry (LULCF).

...

https://www.proactiveinvestors.co.uk/companies/news/912087/n…

...

Utilities companies Drax PLC (LON : DRAX), SSE PLC (LON : SSE) and National Grid PLC (LON :NG.) offer “considerable potential upside” as the sector invests trillions to achieve ‘net zero’ emissions targets, analysts at Barclays believe.

“We believe the EU’s and UK’s ambitious targets to achieve ‘net zero’ emissions by 2050 are achievable,” Barclays said, “placing utilities at the forefront of a €3.7 trillion investment boom, and making the sector a key beneficiary of the coming industrial revolution.”

...

Reflecting the positive valuation impact for the renewable growth pipelines, the analysts said this drives the significant increase in the Drax share price target to 535p from 333p before and for SSE to 1,650p from the prior 1,300p.

Drax is also expected to enjoy a “major benefit” from strategies to make up carbon shortfalls, including carbon capture and storage (CCS), the potentially “gamechanging” bioenergy carbon capture and storage (BECCS) and from land use, land change and forestry (LULCF).

...

Nachtrag:

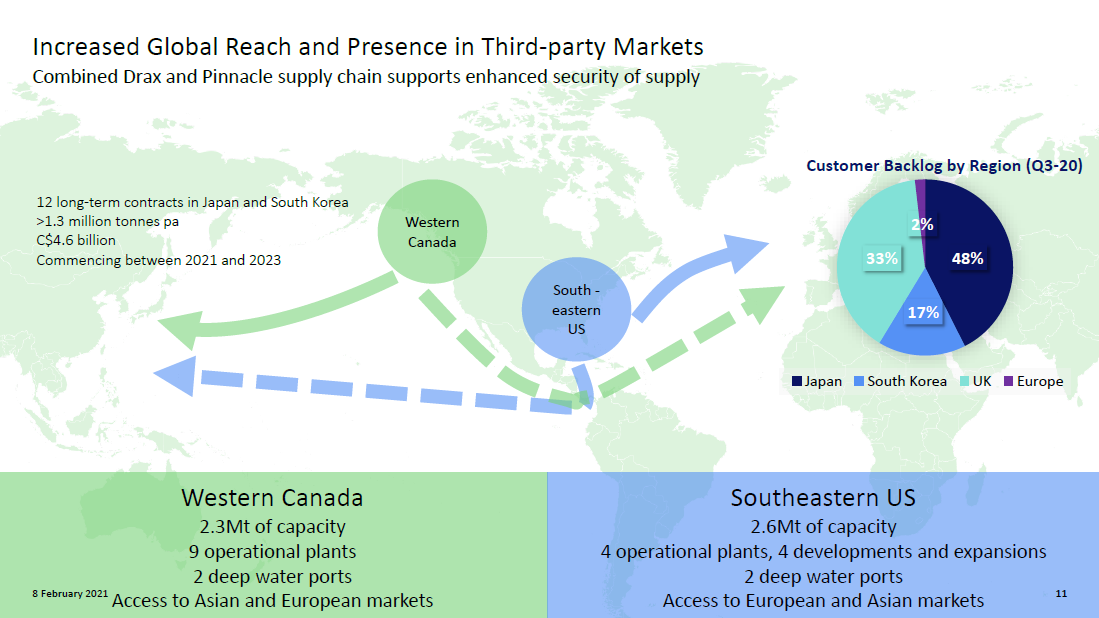

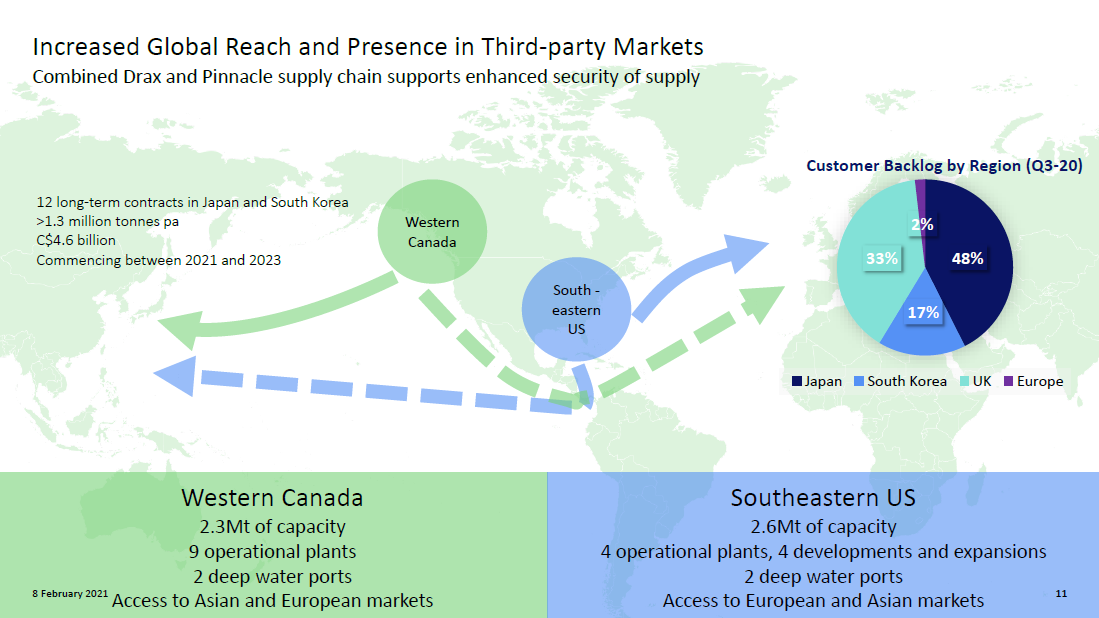

• durch die im April abgeschlossnene Übernahme der Pinnacle Renewable Energy (Kanada) ist der (nach Eigenangaben) weltgrößte Versorger auf der Basis von Biomasse entstanden:

13.4.

Drax Completes Acquisition of Pinnacle Renewable Energy Inc

https://financialpost.com/globe-newswire/drax-completes-acqu…

...

It makes Drax the world’s leading sustainable bioenergy generation and supply business. Drax operates the world’s largest sustainable power station fuelled by bioenergy in the UK, while Pinnacle is a major producer and supplier of good quality compressed wood pellets.

...

...

...

Drax, 2021/2: Proposed Acquisition of Pinnacle Renewable Energy Inc. (Pinnacle)

• durch die im April abgeschlossnene Übernahme der Pinnacle Renewable Energy (Kanada) ist der (nach Eigenangaben) weltgrößte Versorger auf der Basis von Biomasse entstanden:

13.4.

Drax Completes Acquisition of Pinnacle Renewable Energy Inc

https://financialpost.com/globe-newswire/drax-completes-acqu…

...

It makes Drax the world’s leading sustainable bioenergy generation and supply business. Drax operates the world’s largest sustainable power station fuelled by bioenergy in the UK, while Pinnacle is a major producer and supplier of good quality compressed wood pellets.

...

...

...

Drax, 2021/2: Proposed Acquisition of Pinnacle Renewable Energy Inc. (Pinnacle)

Antwort auf Beitrag Nr.: 65.307.257 von faultcode am 07.10.20 12:11:11..und nächster Angriff -- mit "ESG-bewegtem" Geld ("Biomasse"):

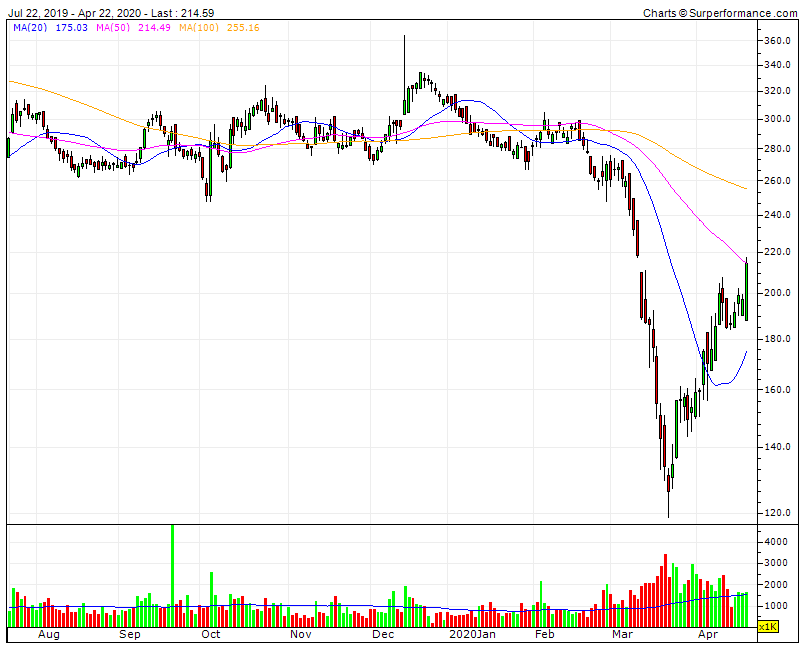

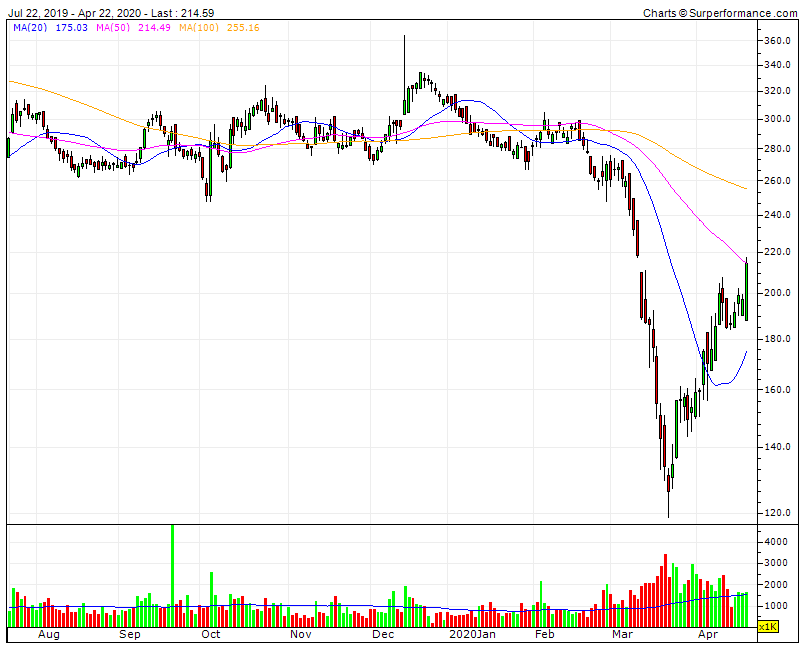

Antwort auf Beitrag Nr.: 63.736.546 von faultcode am 19.05.20 14:19:04Angriff auf das zyklische Post-Corona-Top:

Antwort auf Beitrag Nr.: 63.413.243 von faultcode am 22.04.20 13:50:40Company said energy demand isn’t decreasing

19.5.

Ovo Plans to Cut 2,600 Workers as Online Replaces Human Jobs

https://www.bloomberg.com/news/articles/2020-05-19/ovo-plans…

19.5.

Ovo Plans to Cut 2,600 Workers as Online Replaces Human Jobs

https://www.bloomberg.com/news/articles/2020-05-19/ovo-plans…

22.4.

...UK's Drax sees 60 million pound coronavirus hit, higher bad debts

https://www.marketscreener.com/DRAX-GROUP-PLC-4006894/news/D…

...

British power producer Drax Group has estimated a 60 million pound hit from the coronavirus crisis due to a possible rise in bad debts and lower demand for energy, it said on Wednesday.

The government has ordered sweeping measures to slow the spread of the new coronavirus, shutting down much of the economy and raising the prospect of mass job losses.

"In the customers business, the consequences of (the coronavirus) are only now starting to become visible. It is expected to result in reduced demand and a potential increase in bad debt," Drax said in a statement.

Drax said its customers business, which sells power, gas and energy services to small to medium-sized (SME) companies, is expected to record a full-year adjusted core loss.

Drax has converted four of its six coal power units to using biomass, with the remaining units set to close in 2021.

Power prices have plummeted amid weak demand but Drax said its generation revenues were somewhat protected by strong forward sales and government renewable support schemes.

The company had planned a 230-250 million pound capital investment in its biomass operations for 2020 but said this would be under review and any short-term investment made is likely to be lower.

Drax expects 2020 core profit to be in line with market expectations, despite the hit from the pandemic, and still expects to pay a dividend for 2019 of 9.5 pence a share.

...

=> Drax arbeitet gerade am Schließen des Gaps im März:

...UK's Drax sees 60 million pound coronavirus hit, higher bad debts

https://www.marketscreener.com/DRAX-GROUP-PLC-4006894/news/D…

...

British power producer Drax Group has estimated a 60 million pound hit from the coronavirus crisis due to a possible rise in bad debts and lower demand for energy, it said on Wednesday.

The government has ordered sweeping measures to slow the spread of the new coronavirus, shutting down much of the economy and raising the prospect of mass job losses.

"In the customers business, the consequences of (the coronavirus) are only now starting to become visible. It is expected to result in reduced demand and a potential increase in bad debt," Drax said in a statement.

Drax said its customers business, which sells power, gas and energy services to small to medium-sized (SME) companies, is expected to record a full-year adjusted core loss.

Drax has converted four of its six coal power units to using biomass, with the remaining units set to close in 2021.

Power prices have plummeted amid weak demand but Drax said its generation revenues were somewhat protected by strong forward sales and government renewable support schemes.

The company had planned a 230-250 million pound capital investment in its biomass operations for 2020 but said this would be under review and any short-term investment made is likely to be lower.

Drax expects 2020 core profit to be in line with market expectations, despite the hit from the pandemic, and still expects to pay a dividend for 2019 of 9.5 pence a share.

...

=> Drax arbeitet gerade am Schließen des Gaps im März:

Antwort auf Beitrag Nr.: 58.974.966 von faultcode am 16.10.18 19:42:00auch die Drax Group mit Brexit-Euphorie:

https://www.marketscreener.com/DRAX-GROUP-PLC-4006894/charts…

https://www.marketscreener.com/DRAX-GROUP-PLC-4006894/charts…

bin durch die Übernahme der entsprechenden Aktivitäten von Scottish Power darauf gestossen. Siehe unten.

=> kleiner Versorger, der noch weiterhin profitabel wachsen kann

_______________

Scottish Power Switches to 100% Wind Generation--BBC

Today 1:32 PM ET (Dow Jones)Print

--Energy utility Scottish Power said it plans to use 100% wind power to generate electricity, the BBC reports Tuesday.

--The report came after Scottish Power's parent company, Iberdrola SA (IBE.MC) said it agreed to sell Scottish Power's conventional power generation business in the U.K. to Drax Group PLC's (DRX.LN) Drax Smart Generation Holdco Ltd.

--Scottish Power said it will invest GBP5.2 billion over the next four years into its renewable energy capacity, the report said.

=> kleiner Versorger, der noch weiterhin profitabel wachsen kann

_______________

Scottish Power Switches to 100% Wind Generation--BBC

Today 1:32 PM ET (Dow Jones)Print

--Energy utility Scottish Power said it plans to use 100% wind power to generate electricity, the BBC reports Tuesday.

--The report came after Scottish Power's parent company, Iberdrola SA (IBE.MC) said it agreed to sell Scottish Power's conventional power generation business in the U.K. to Drax Group PLC's (DRX.LN) Drax Smart Generation Holdco Ltd.

--Scottish Power said it will invest GBP5.2 billion over the next four years into its renewable energy capacity, the report said.

Drax Group - thermische Energieversorgung in UK