China Crash (Seite 2)

eröffnet am 26.10.18 15:59:51 von

neuester Beitrag 08.02.24 12:18:20 von

neuester Beitrag 08.02.24 12:18:20 von

Beiträge: 314

ID: 1.291.324

ID: 1.291.324

Aufrufe heute: 2

Gesamt: 40.181

Gesamt: 40.181

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 37 Minuten | 5744 | |

| vor 55 Minuten | 5443 | |

| vor 1 Stunde | 4065 | |

| vor 1 Stunde | 3545 | |

| vor 32 Minuten | 2742 | |

| vor 1 Stunde | 2272 | |

| vor 1 Stunde | 1838 | |

| vor 33 Minuten | 1504 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.136,47 | +1,12 | 216 | |||

| 2. | 2. | 145,61 | +2,51 | 95 | |||

| 3. | 19. | 0,1940 | +6,59 | 79 | |||

| 4. | 3. | 2.328,23 | +0,04 | 63 | |||

| 5. | 9. | 43,20 | -4,42 | 54 | |||

| 6. | 43. | 0,0313 | +95,63 | 42 | |||

| 7. | 17. | 4,7120 | +2,57 | 38 | |||

| 8. | 5. | 753,00 | +5,02 | 30 |

Beitrag zu dieser Diskussion schreiben

6.12.

A $13 Billion Rout Makes HKEX World’s Worst-Performing Bourse

https://news.bloomberglaw.com/capital-markets/a-14-billion-r…

...

Hong Kong is set to close the year as the world’s worst-performing stock market and the city’s exchange operator is emerging as the poster child of this slump.

Hong Kong Exchanges & Clearing Ltd. has plunged 24% this year, the most on a Bloomberg Intelligence gauge of 24 listed global security and commodity bourses. The stock rout has wiped out $13 billion of its market value, putting it behind that of CME Group Inc. and London Stock Exchange Group Plc.

...

___

Counter case: Erst-Posi Sun Hung Kai Properties (WKN = 861270): https://www.wallstreet-online.de/aktien/sun-hung-kai-propert…

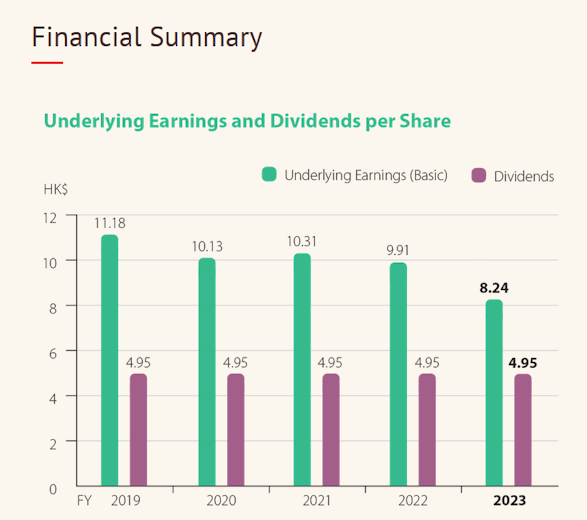

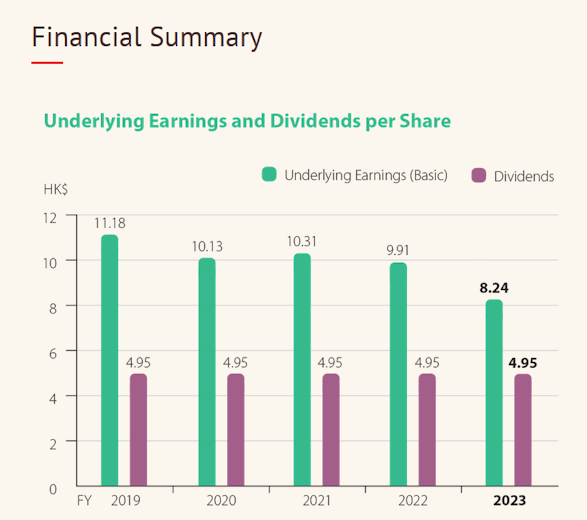

Zahlt eine Dividende (>5% Rendite aktuell), schrumpft allerdings (wie so vieles in Hong Kong derzeit); solide finanziert mMn: https://www.shkp.com/en-US/investor-relations

...

A $13 Billion Rout Makes HKEX World’s Worst-Performing Bourse

https://news.bloomberglaw.com/capital-markets/a-14-billion-r…

...

Hong Kong is set to close the year as the world’s worst-performing stock market and the city’s exchange operator is emerging as the poster child of this slump.

Hong Kong Exchanges & Clearing Ltd. has plunged 24% this year, the most on a Bloomberg Intelligence gauge of 24 listed global security and commodity bourses. The stock rout has wiped out $13 billion of its market value, putting it behind that of CME Group Inc. and London Stock Exchange Group Plc.

...

___

Counter case: Erst-Posi Sun Hung Kai Properties (WKN = 861270): https://www.wallstreet-online.de/aktien/sun-hung-kai-propert…

Zahlt eine Dividende (>5% Rendite aktuell), schrumpft allerdings (wie so vieles in Hong Kong derzeit); solide finanziert mMn: https://www.shkp.com/en-US/investor-relations

...

1.12.

Foreigners Sell China Stocks For Fourth Month in Record Streak

https://finance.yahoo.com/news/foreigners-sell-china-stocks-…

"1984":

30.11.

China Investment Bank Bans Displays of Wealth

https://www.bloomberg.com/news/articles/2023-11-30/china-inv…

• CICC asks analysts to avoid negative macro, market commentary

• Bankers also discouraged from showing off their wealth: memo

...

30.11.

China Investment Bank Bans Displays of Wealth

https://www.bloomberg.com/news/articles/2023-11-30/china-inv…

• CICC asks analysts to avoid negative macro, market commentary

• Bankers also discouraged from showing off their wealth: memo

...

21.11.

China Property Stocks Surge, With Sunac Rallying 27%, After Beijing Picks 50 Firms to Fund

https://finance.yahoo.com/news/chinese-property-bonds-shares…

...

Chinese developers’ bonds gained along with their shares after authorities began drafting a list of 50 real estate firms that would be eligible for a range of financing as Beijing sought to support the embattled property sector.

A Bloomberg gauge of China developer stocks gained as much as 7.6% to head for its biggest advance since September. Sunac China Holdings Ltd., the first major Chinese builder to reach a restructuring agreement, led the sector’s rise as it rallied as much as 27%. Seazen Group Ltd. and Agile Group Holdings Ltd. also climbed.

The so-called white list, which is intended to guide lenders as they weigh support for the industry via bank loans, debt and equity financing, may help alleviate fears of further contagion in China’s property sector. Still, it remains to be seen if the move will halt the industry’s long-running slump given that it does not represent a directive to banks to extend loans to real estate firms.

...

China Property Stocks Surge, With Sunac Rallying 27%, After Beijing Picks 50 Firms to Fund

https://finance.yahoo.com/news/chinese-property-bonds-shares…

...

Chinese developers’ bonds gained along with their shares after authorities began drafting a list of 50 real estate firms that would be eligible for a range of financing as Beijing sought to support the embattled property sector.

A Bloomberg gauge of China developer stocks gained as much as 7.6% to head for its biggest advance since September. Sunac China Holdings Ltd., the first major Chinese builder to reach a restructuring agreement, led the sector’s rise as it rallied as much as 27%. Seazen Group Ltd. and Agile Group Holdings Ltd. also climbed.

The so-called white list, which is intended to guide lenders as they weigh support for the industry via bank loans, debt and equity financing, may help alleviate fears of further contagion in China’s property sector. Still, it remains to be seen if the move will halt the industry’s long-running slump given that it does not represent a directive to banks to extend loans to real estate firms.

...

9.11.

WSJ: More Executives Vanish in China, Casting Chill Over Business Climate

The chief executive at livestreaming company DouYu and the chairman of a pharmaceutical business are the latest to go missing

https://www.wsj.com/world/china/more-executives-vanish-in-ch…

...

WSJ: More Executives Vanish in China, Casting Chill Over Business Climate

The chief executive at livestreaming company DouYu and the chairman of a pharmaceutical business are the latest to go missing

https://www.wsj.com/world/china/more-executives-vanish-in-ch…

...

5.11.

Pimco, JPMorgan Are Gearing Up for Long Winter in China Markets

https://finance.yahoo.com/news/pimco-jpmorgan-gearing-long-w…

...

This was supposed to be the year that China’s economy roared back to life and, in the process, turned the country’s stocks and bonds into must-buys for global investors once again.

Ten months in, the reality is far different. Chinese stocks are among the world’s worst performers, investors are yanking money out of the country at the fastest pace since 2015, and the yuan is hovering around a 16-year low as a real estate crisis ripples through the economy and offsets the momentum gained from the long-awaited pandemic reopening.

The selloff has caught even the most-seasoned investors off guard, forcing them to retool their approach to fit Beijing’s new economic model. Policymakers are no longer pursuing growth at all costs and have little appetite for bailing out ailing property developers; crackdowns have doused entrepreneurial spirit; and the country’s rift with Western nations shows few signs of easing.

Investing in China has never been easy, of course, but money managers now face layers of added complexity that require deft maneuvering. Here’s how some of the biggest investors, along with noted China watchers, are navigating the changed landscape.

...

Pimco, JPMorgan Are Gearing Up for Long Winter in China Markets

https://finance.yahoo.com/news/pimco-jpmorgan-gearing-long-w…

...

This was supposed to be the year that China’s economy roared back to life and, in the process, turned the country’s stocks and bonds into must-buys for global investors once again.

Ten months in, the reality is far different. Chinese stocks are among the world’s worst performers, investors are yanking money out of the country at the fastest pace since 2015, and the yuan is hovering around a 16-year low as a real estate crisis ripples through the economy and offsets the momentum gained from the long-awaited pandemic reopening.

The selloff has caught even the most-seasoned investors off guard, forcing them to retool their approach to fit Beijing’s new economic model. Policymakers are no longer pursuing growth at all costs and have little appetite for bailing out ailing property developers; crackdowns have doused entrepreneurial spirit; and the country’s rift with Western nations shows few signs of easing.

Investing in China has never been easy, of course, but money managers now face layers of added complexity that require deft maneuvering. Here’s how some of the biggest investors, along with noted China watchers, are navigating the changed landscape.

...

27.10.

China Selloff Threatens $27 Billion of ‘Snowball’ Derivatives

https://finance.yahoo.com/news/china-selloff-threatens-27-bi…

...

Another 10% decline in a major Chinese equity gauge may trigger a wave of selling in index futures tied to structured products, adding fresh risks to the slumping stock market.

Investors face losses in complex “snowball” derivatives at maturity when a benchmark falls below a so-called knock-in level. For those tied to the CSI Smallcap 500 Index, the average threshold is 4,865, according to estimates by China International Capital Corp. The gauge traded at around 5,417 as of 9:52 a.m. Friday.

A relentless rout in Chinese stocks has turned the spotlight on the risk of those derivatives, which promise bond-like coupons as long as underlying assets trade within a certain range. Snowballs, similar to autocallables in other countries, gained popularity in 2021 among China’s institutional and wealthy investors and have expanded into a market worth $27 billion. Brokers may rush to liquidate hedging positions once the knock-in level is reached.

...

Must read <sehr lang>:

23.10.

A Reporter at Large

China’s Age of Malaise

Party officials are vanishing, young workers are “lying flat,” and entrepreneurs are fleeing the country. What does China’s inner turmoil mean for the world?

https://www.newyorker.com/magazine/2023/10/30/chinas-age-of-…

...

In addition to the disappearances, the deepening reach of politics is felt throughout daily life.

Early this year, the Party launched a campaign to educate citizens on what Party literature habitually refers to as “Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era.” All manner of institutions—laboratories, asset-management firms, banks, think tanks—are expected to make time for regular lectures, followed by the writing of essays and the taking of tests.

Some business executives report spending a third of the workday on “thought work,” including reading an average of four books a month. A microchip engineer at a university lab told a friend, “Going to meetings every day literally eats away at the time for scientific discoveries.”

...

In the darker scenario, China faces “Japanification”—a shrinking workforce, lost decades of growth. It might avoid that with quick, decisive policy changes, but Cai Xia, who was a professor at the élite Central Party School until she broke ranks and moved abroad, in 2020, told me that mid-level administrators have grown paralyzed by fears of a misstep. “Officials are ‘lying flat,’ ” she said. “If there is no instruction from the top, there will be no action from the bottom.”.

...

As a result, society is not united in its frustrations: “The frustration is fragmented. It’s not collapsing all at one point. There is one bit that is cracking here and another bit cracking there.”

...

23.10.

A Reporter at Large

China’s Age of Malaise

Party officials are vanishing, young workers are “lying flat,” and entrepreneurs are fleeing the country. What does China’s inner turmoil mean for the world?

https://www.newyorker.com/magazine/2023/10/30/chinas-age-of-…

...

In addition to the disappearances, the deepening reach of politics is felt throughout daily life.

Early this year, the Party launched a campaign to educate citizens on what Party literature habitually refers to as “Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era.” All manner of institutions—laboratories, asset-management firms, banks, think tanks—are expected to make time for regular lectures, followed by the writing of essays and the taking of tests.

Some business executives report spending a third of the workday on “thought work,” including reading an average of four books a month. A microchip engineer at a university lab told a friend, “Going to meetings every day literally eats away at the time for scientific discoveries.”

...

In the darker scenario, China faces “Japanification”—a shrinking workforce, lost decades of growth. It might avoid that with quick, decisive policy changes, but Cai Xia, who was a professor at the élite Central Party School until she broke ranks and moved abroad, in 2020, told me that mid-level administrators have grown paralyzed by fears of a misstep. “Officials are ‘lying flat,’ ” she said. “If there is no instruction from the top, there will be no action from the bottom.”.

...

As a result, society is not united in its frustrations: “The frustration is fragmented. It’s not collapsing all at one point. There is one bit that is cracking here and another bit cracking there.”

...

"Common prosperity" hat wieder zugeschlagen:

23.10.

China Rattles Foreign Firms Again With Arrests, Foxconn Probe

https://www.straitstimes.com/business/apple-supplier-foxconn…

...

The Chinese authorities are again shaking the confidence of foreign companies in the country with a series of arrests and an investigation into Foxconn Technology Group, Apple’s most important partner and one of the largest employers in China.

At the weekend, the state media said regulators were conducting tax audits and reviewing land use by Foxconn, the Taiwanese company that makes the vast majority of iPhones at factories in China. Hon Hai Precision Industry, Foxconn’s main listed arm, said it would collaborate with the authorities.

Meanwhile, an executive and two former employees of WPP, one of the world’s biggest advertising companies, have been arrested in China, people familiar with the matter said. Also, the government detained a local employee of a Japanese metals trading company in March, the Nikkei newspaper reported on Sunday. And earlier in October, a court formally charged an employee of Astellas Pharma on suspicion of espionage.

23.10.

China Rattles Foreign Firms Again With Arrests, Foxconn Probe

https://www.straitstimes.com/business/apple-supplier-foxconn…

...

The Chinese authorities are again shaking the confidence of foreign companies in the country with a series of arrests and an investigation into Foxconn Technology Group, Apple’s most important partner and one of the largest employers in China.

At the weekend, the state media said regulators were conducting tax audits and reviewing land use by Foxconn, the Taiwanese company that makes the vast majority of iPhones at factories in China. Hon Hai Precision Industry, Foxconn’s main listed arm, said it would collaborate with the authorities.

Meanwhile, an executive and two former employees of WPP, one of the world’s biggest advertising companies, have been arrested in China, people familiar with the matter said. Also, the government detained a local employee of a Japanese metals trading company in March, the Nikkei newspaper reported on Sunday. And earlier in October, a court formally charged an employee of Astellas Pharma on suspicion of espionage.