Bank of America: 2019 steigt Gold auf 1.400 Dollar, Silber auf maximal 18 Dollar! (Seite 8) | Diskussion im Forum

eröffnet am 12.12.18 15:08:17 von

neuester Beitrag 18.10.23 17:13:51 von

neuester Beitrag 18.10.23 17:13:51 von

Beiträge: 169

ID: 1.294.383

ID: 1.294.383

Aufrufe heute: 0

Gesamt: 7.660

Gesamt: 7.660

Aktive User: 0

ISIN: US0605051046 · WKN: 858388 · Symbol: BAC

35,77

USD

+1,53 %

+0,54 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

16.04.24 · wallstreetONLINE Redaktion |

17.04.24 · PR Newswire (dt.) |

16.04.24 · dpa-AFX |

16.04.24 · dpa-AFX |

16.04.24 · Markus Weingran |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0000 | +500,00 | |

| 1,2900 | +36,33 | |

| 0,6000 | +20,00 | |

| 0,5500 | +18,25 | |

| 3,8600 | +15,57 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,0800 | -11,83 | |

| 9,8500 | -17,92 | |

| 3,20 | -17,95 | |

| 1,5000 | -23,08 | |

| 0,7500 | -25,00 |

Beitrag zu dieser Diskussion schreiben

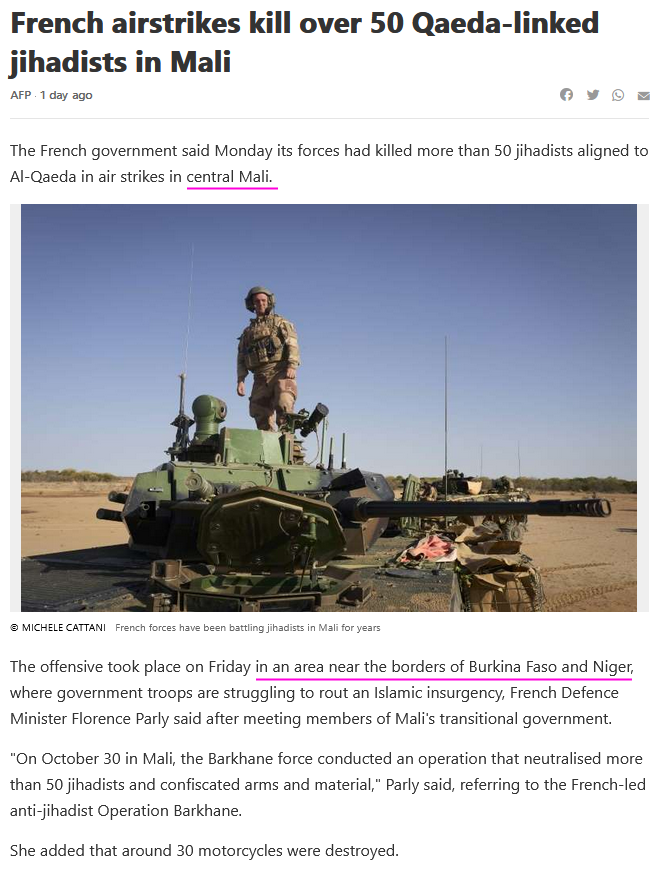

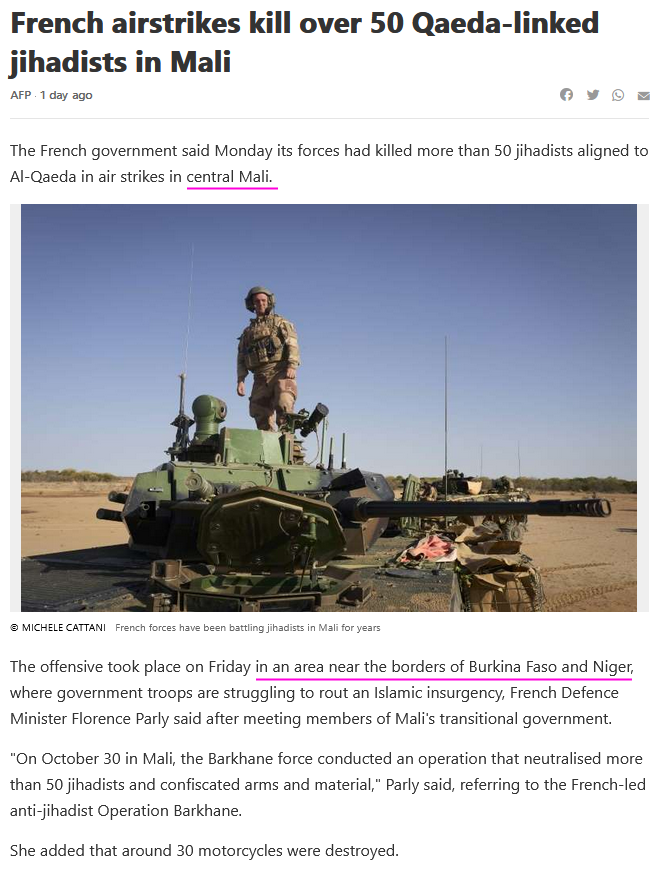

viel Spaß mit (Gold-)Minen-Aktien in Mali:

...

https://www.msn.com/en-us/news/world/french-airstrikes-kill-…

...

https://www.msn.com/en-us/news/world/french-airstrikes-kill-…

Antwort auf Beitrag Nr.: 65.508.664 von faultcode am 27.10.20 13:19:10...

Für Paul Gambles, Geschäftsführer und Mitgründer des Investmentberatungsunternehmens MBMG Group, sind Goldminen-Aktien aktuell eines der besten Investments am Markt, da sie sich in einer guten Position befänden, egal wie die Wahl um das Amt des US-Präsidenten ausgehe.

"Wir glauben, sie würden von einem Stimuluspaket profitieren, aber wir glauben auch, dass sie vom Chaos der US-Präsidentschaftswahl profitieren würden", sagte Gambles in der "CNBC"-Sendung "Squawk Box Europe". Daher habe auch sein Unternehmen jüngst Goldminen-Aktien gekauft und wolle sie "bis weit nach der Wahl" halten.

Für die US-Wahl ergeben sich laut "CNBC" im Wesentlichen drei Szenarien, die alle positiv für den Goldpreis und somit auch für Goldminen-Aktien zu werten seien: Sollte Trump gewinnen und die Demokraten weiterhin die Mehrheit im Repräsentantenhaus besitzen, dessen Abgeordnete ebenfalls am 3. November gewählt werden, dann dürften die Verhandlungen um ein Konjunkturpaket weitergehen.

Sollte Biden gewinnen, wird es ebenfalls ein Stimuluspaket geben, das jedoch größer ausfallen dürfte. In jedem Fall dürfte die US-Regierung - zusätzlich zur Fed - Liquidität bereitstellen und dadurch Sorgen um eine steigende Inflation anheizen, von denen Gold als wertstabile Anlage profitieren würde.

Das dritte von "CNBC" genannte Szenario geht davon aus, dass es zu einem Kopf-an-Kopf-Rennen zwischen Trump und Biden kommen wird. In diesem Fall wäre es möglich, dass Trump seine Drohungen wahr macht und das Wahlergebnis unter dem Vorwand eines möglichen Wahlbetrugs anzweifelt. Die Folge wäre ein langwieriger Disput, der vor dem Obersten Gerichtshof der Vereinigten Staaten landen und für erhebliche Volatilität sowie Abwärtsdruck auf risikobehaftete Anlagen sorgen dürfte. Auch in diesem Szenario würde Gold als sicherer Hafen von dem zu erwartenden Chaos profitieren. Und wenn Gold profitiert, profitieren in aller Regel auch Goldminen-Aktien.

...

30.10.

https://www.finanzen.net/nachricht/aktien/kursgewinne-voraus…

Für Paul Gambles, Geschäftsführer und Mitgründer des Investmentberatungsunternehmens MBMG Group, sind Goldminen-Aktien aktuell eines der besten Investments am Markt, da sie sich in einer guten Position befänden, egal wie die Wahl um das Amt des US-Präsidenten ausgehe.

"Wir glauben, sie würden von einem Stimuluspaket profitieren, aber wir glauben auch, dass sie vom Chaos der US-Präsidentschaftswahl profitieren würden", sagte Gambles in der "CNBC"-Sendung "Squawk Box Europe". Daher habe auch sein Unternehmen jüngst Goldminen-Aktien gekauft und wolle sie "bis weit nach der Wahl" halten.

Für die US-Wahl ergeben sich laut "CNBC" im Wesentlichen drei Szenarien, die alle positiv für den Goldpreis und somit auch für Goldminen-Aktien zu werten seien: Sollte Trump gewinnen und die Demokraten weiterhin die Mehrheit im Repräsentantenhaus besitzen, dessen Abgeordnete ebenfalls am 3. November gewählt werden, dann dürften die Verhandlungen um ein Konjunkturpaket weitergehen.

Sollte Biden gewinnen, wird es ebenfalls ein Stimuluspaket geben, das jedoch größer ausfallen dürfte. In jedem Fall dürfte die US-Regierung - zusätzlich zur Fed - Liquidität bereitstellen und dadurch Sorgen um eine steigende Inflation anheizen, von denen Gold als wertstabile Anlage profitieren würde.

Das dritte von "CNBC" genannte Szenario geht davon aus, dass es zu einem Kopf-an-Kopf-Rennen zwischen Trump und Biden kommen wird. In diesem Fall wäre es möglich, dass Trump seine Drohungen wahr macht und das Wahlergebnis unter dem Vorwand eines möglichen Wahlbetrugs anzweifelt. Die Folge wäre ein langwieriger Disput, der vor dem Obersten Gerichtshof der Vereinigten Staaten landen und für erhebliche Volatilität sowie Abwärtsdruck auf risikobehaftete Anlagen sorgen dürfte. Auch in diesem Szenario würde Gold als sicherer Hafen von dem zu erwartenden Chaos profitieren. Und wenn Gold profitiert, profitieren in aller Regel auch Goldminen-Aktien.

...

30.10.

https://www.finanzen.net/nachricht/aktien/kursgewinne-voraus…

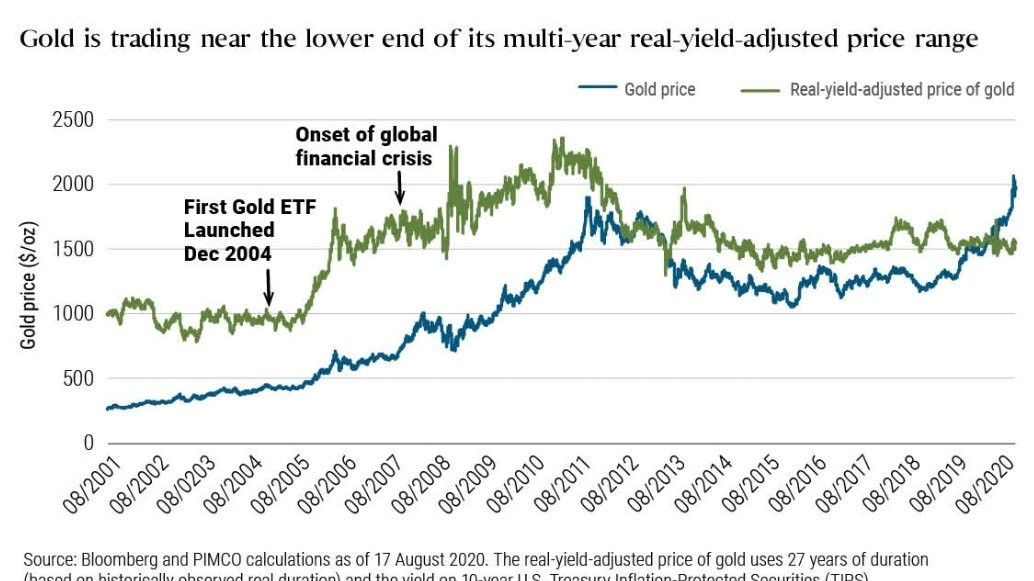

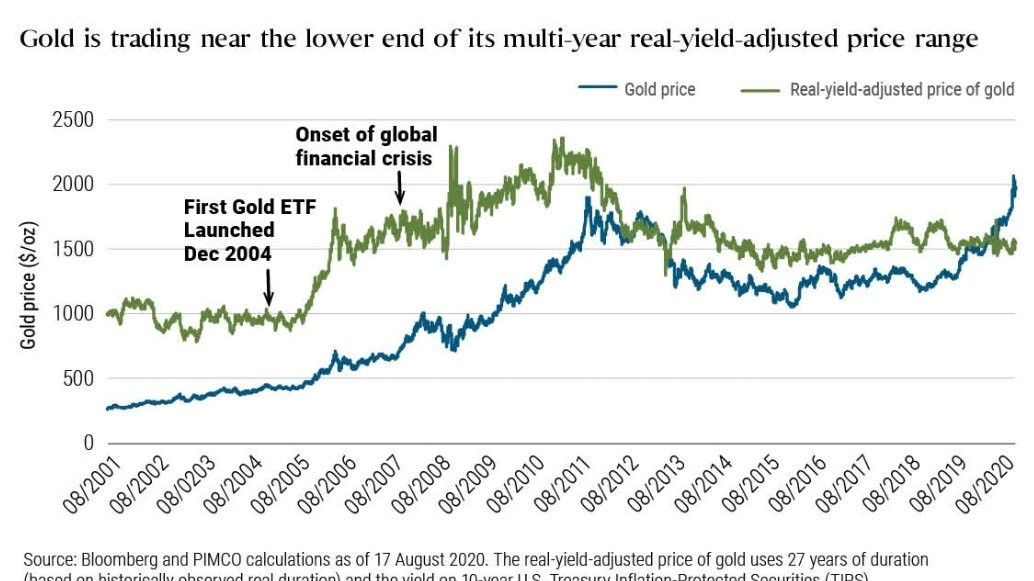

In indizierten Preisen hat Gold immer noch gut Luft nach oben (in USD):

20.10.

Gold mining industry in Ontario during Q2 2020

https://www.kitco.com/commentaries/2020-10-20/Gold-mining-in…

Antwort auf Beitrag Nr.: 64.784.062 von faultcode am 17.08.20 11:37:41..und auch bei sowas - zumindest mittelfristig:

https://www.dailymail.co.uk/news/article-8802641/Bulk-buy-re…

https://www.dailymail.co.uk/news/article-8802641/Bulk-buy-re…

Antwort auf Beitrag Nr.: 64.562.655 von faultcode am 27.07.20 22:39:04

Und heute flog der Rest:

• der Technical Report zu Zimapan, Hidalgo kam heute raus

• Santacruz ist nur Konzentrat-Produzent (Zinc, Lead, Copper; ja, da gibt es viele solche; liegt halt in der Natur der Sache im wahrsten Sinne des Wortes), kein "Silberproduzent" und das wird auch so bleiben

• keine Resourcen; QA/QC-Defizite => das ist halt wirklich nur eine "Mom-and-pop"-Veranstaltung (die man mal vor dem Run mitnehmen kann)

Zitat von faultcode: ...=> das wird sie nun mMn nachholen, und daher gab ich heute ~50% der Position...

Und heute flog der Rest:

• der Technical Report zu Zimapan, Hidalgo kam heute raus

• Santacruz ist nur Konzentrat-Produzent (Zinc, Lead, Copper; ja, da gibt es viele solche; liegt halt in der Natur der Sache im wahrsten Sinne des Wortes), kein "Silberproduzent" und das wird auch so bleiben

• keine Resourcen; QA/QC-Defizite => das ist halt wirklich nur eine "Mom-and-pop"-Veranstaltung (die man mal vor dem Run mitnehmen kann)

Antwort auf Beitrag Nr.: 64.784.062 von faultcode am 17.08.20 11:37:41

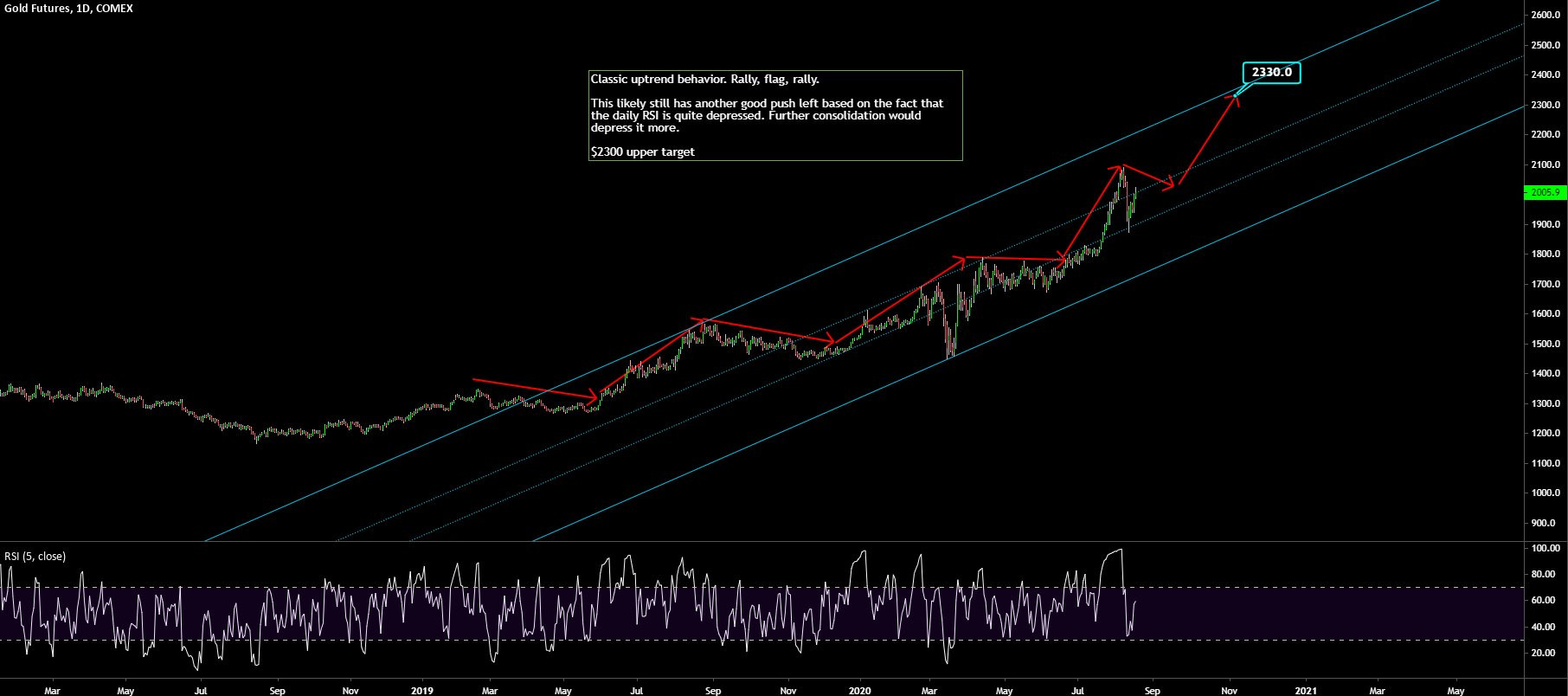

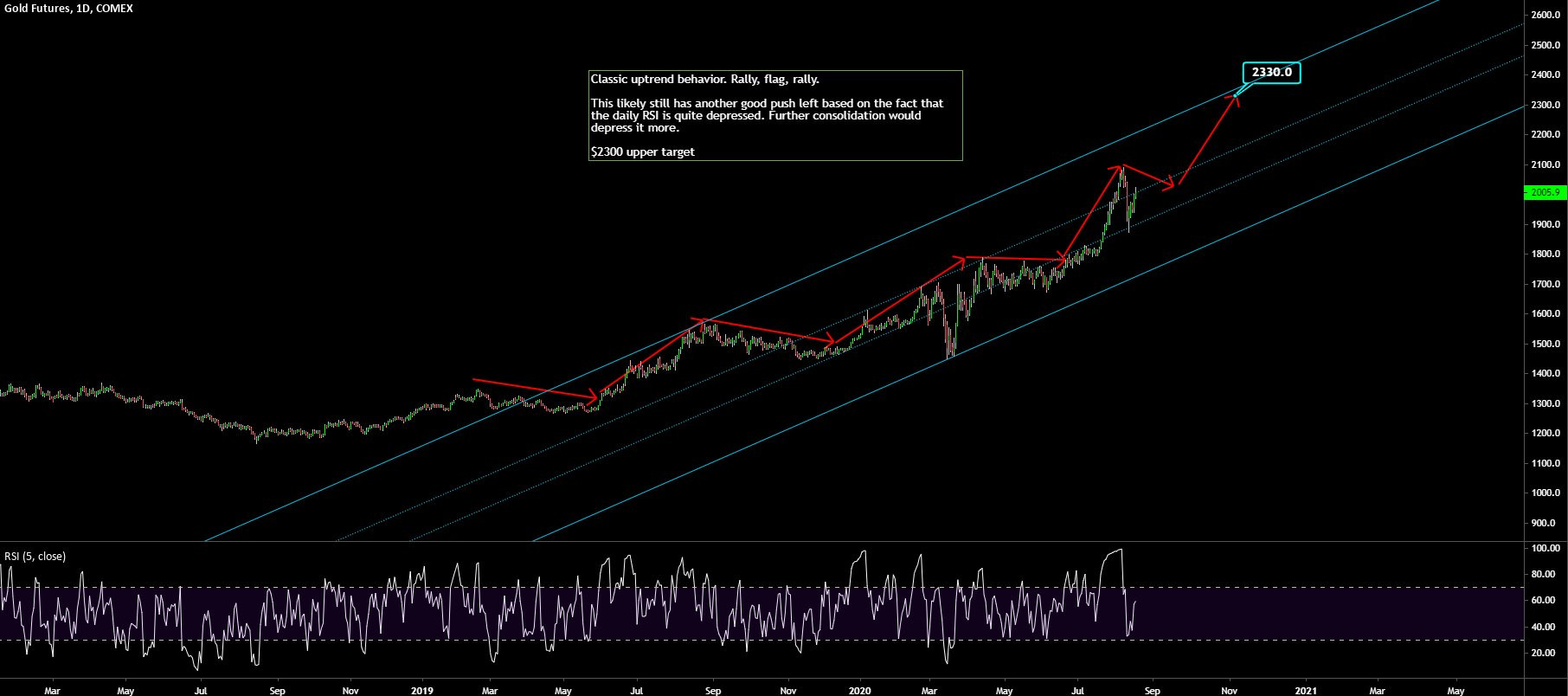

https://twitter.com/AdamMancini4/status/1295794726755540993

https://twitter.com/AdamMancini4/status/1295794726755540993

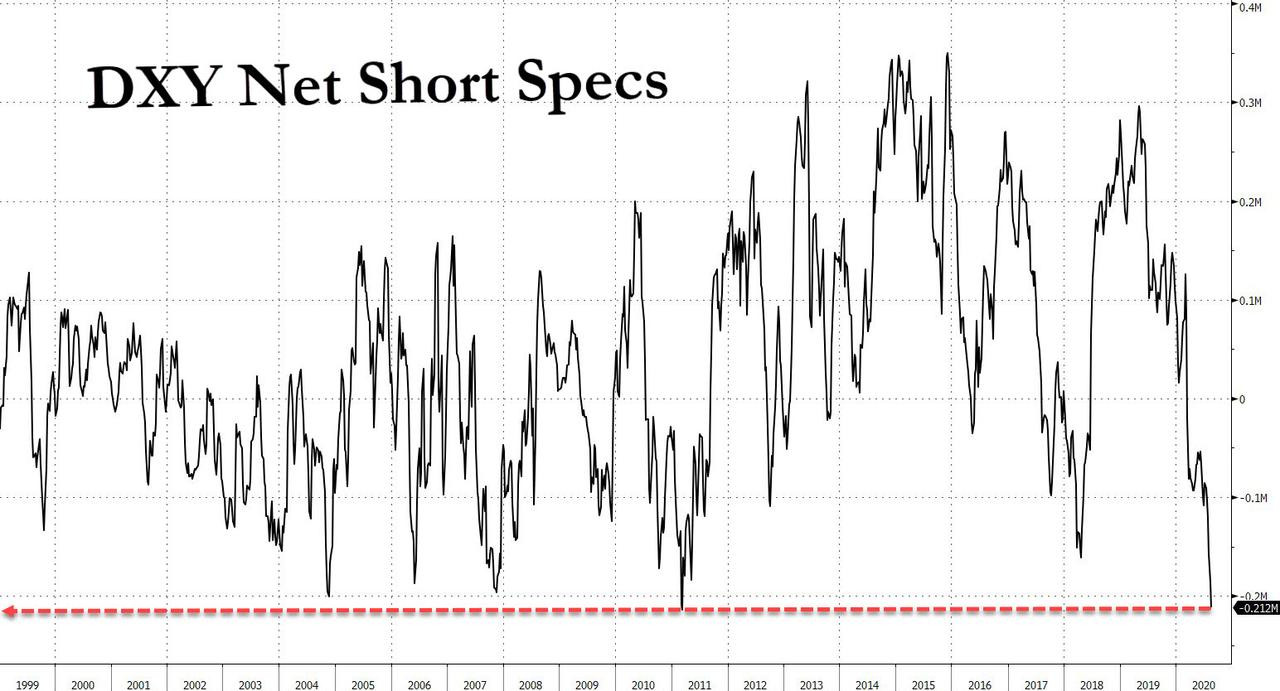

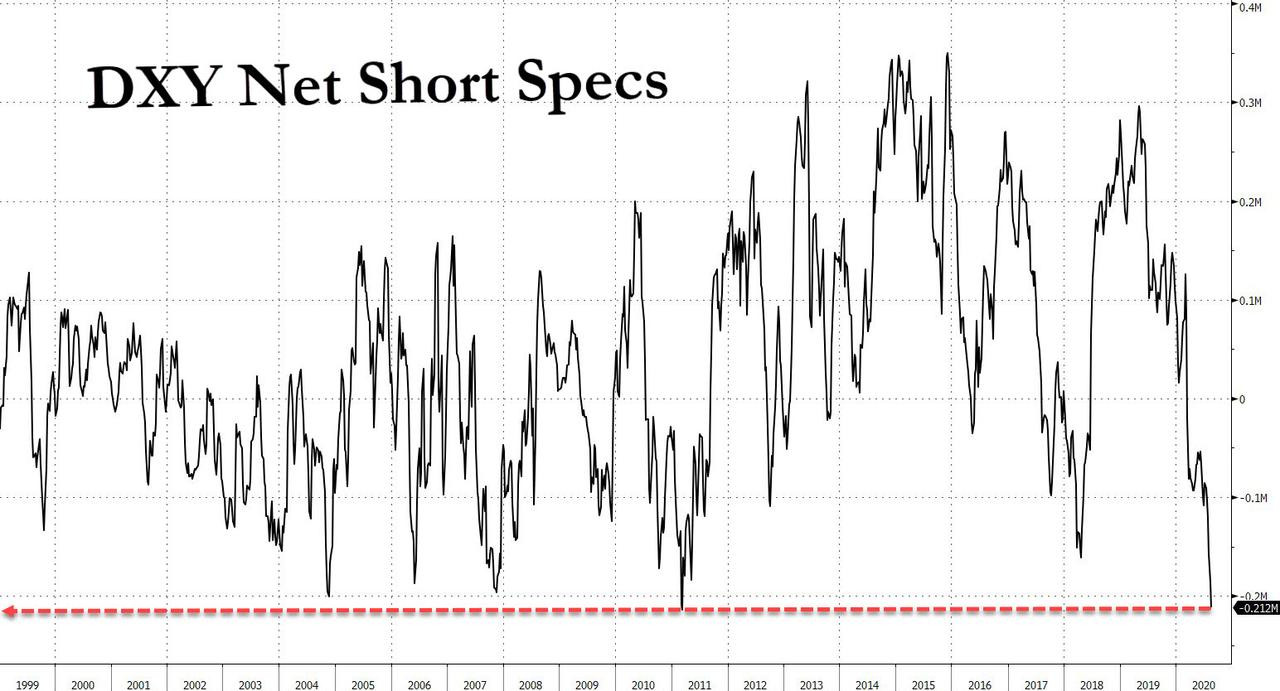

so gesehen müsste indirekt auch der Goldpreis in U.S. dollar wieder fallen:

DXY = U.S. Dollar Index

DXY = U.S. Dollar Index

Antwort auf Beitrag Nr.: 64.770.613 von faultcode am 15.08.20 00:50:30

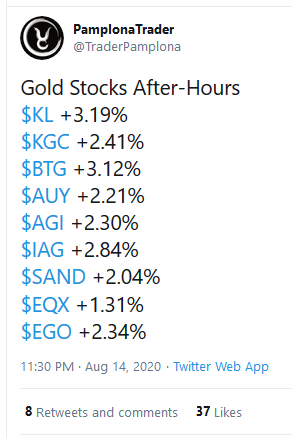

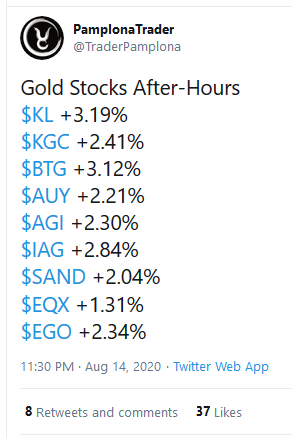

https://twitter.com/TraderPamplona/status/129438583800092262…

https://twitter.com/TraderPamplona/status/129438583800092262…

14.8.

Warren Buffett buys gold

https://www.kitco.com/news/2020-08-14/Warren-Buffett-buys-go…

Long-time precious metal bugaboo, Warren Buffett, loaded up on Barrick Gold (NYSE:GOLD), according to a Berkshire Hathway 13F released today.

Buffett bought just under 21 million shares. Current stake is worth $563 million.

Buffett can move stocks. Barrick traded down 0.59% to $26.99 today. However Barrick shot up after hours when the news broke and hit $29.

The only other resources stock listed within the Berkshire Hathway 13F was Suncor Energy. In fact, Buffett increased his holdings adding 28.45% or 4.25 million shares.

Buffett shed airline stocks, such as United Airlines and American Airlines. He also reduced holdings in financial institutions such as JPMorgan and Wells Farso.

Through the years Buffett hung gold with some of its most memorable and negative epithets. In 1998 he shared his thoughts on gold during a Harvard speech.

“(Gold) gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

During a 2009 CNBC interview, Buffett said the following:

“I have no views as to where it will be, but the one thing I can tell you is it won’t do anything between now and then except look at you. Whereas, you know, Coca-Cola (KO) will be making money, and I think Wells Fargo (WFC) will be making a lot of money, and there will be a lot — and it’s a lot — it’s a lot better to have a goose that keeps laying eggs than a goose that just sits there and eats insurance and storage and a few things like that."

...

17.04.24 · PR Newswire (dt.) · Bank of America |

16.04.24 · dpa-AFX · Morgan Stanley |

16.04.24 · dpa-AFX · Morgan Stanley |

16.04.24 · wO Newsflash · Honeywell International |

16.04.24 · dpa-AFX · Morgan Stanley |

16.04.24 · BörsenNEWS.de · Bank of America |

16.04.24 · dpa-AFX · Beiersdorf |

16.04.24 · dpa-AFX · CVS Health |

16.04.24 · wallstreetONLINE Redaktion · Morgan Stanley |