Global Payments Reports Record Annual Results for 2018 and Establishes 2019 Growth Outlook - Die letzten 30 Beiträge | Diskussion im Forum

eröffnet am 02.03.19 11:05:02 von

neuester Beitrag 03.05.22 08:14:54 von

neuester Beitrag 03.05.22 08:14:54 von

Beiträge: 31

ID: 1.299.265

ID: 1.299.265

Aufrufe heute: 0

Gesamt: 2.015

Gesamt: 2.015

Aktive User: 0

ISIN: US37940X1028 · WKN: 603111 · Symbol: GLO

117,55

EUR

-1,34 %

-1,60 EUR

Letzter Kurs 09:31:13 Tradegate

Neuigkeiten

19.04.24 · Business Wire (engl.) |

17.04.24 · Business Wire (engl.) |

06.03.24 · Business Wire (engl.) |

21.02.24 · Business Wire (engl.) |

21.02.24 · Business Wire (engl.) |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6800 | +312,12 | |

| 0,5300 | +17,78 | |

| 12,300 | +14,37 | |

| 1,7000 | +12,77 | |

| 24,800 | +9,73 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5000 | -23,08 | |

| 3,0000 | -24,91 | |

| 0,7500 | -25,00 | |

| 17,850 | -30,00 | |

| 1,5000 | -90,00 |

Beitrag zu dieser Diskussion schreiben

Erwartungen übertroffen und die Aktie fällt...ey...

Die Zahlen waren zwar gut, der Gesamtmarkt ist jedoch schwach und möchte noch weiter runter.

GPN kann sich zwar halten, liegt jetzt jedoch direkt auf der Unterstützung des Aufwärtstrends.

Hält die Unterstützung nicht, würde ich vorsichtshalber raus gehen und erst mal abwarten wohin die Reise geht.

GPN kann sich zwar halten, liegt jetzt jedoch direkt auf der Unterstützung des Aufwärtstrends.

Hält die Unterstützung nicht, würde ich vorsichtshalber raus gehen und erst mal abwarten wohin die Reise geht.

Zahlen sind gut und entsprechen den Erwartungen. Läuft!

https://s21.q4cdn.com/254933054/files/doc_financials/2021/q4…

https://s21.q4cdn.com/254933054/files/doc_financials/2021/q4…

Antwort auf Beitrag Nr.: 70.071.107 von mazell am 30.11.21 11:07:18Die 116$ sind das letzte Tief aus 2020 und gleichzeitig das 50% Fib.

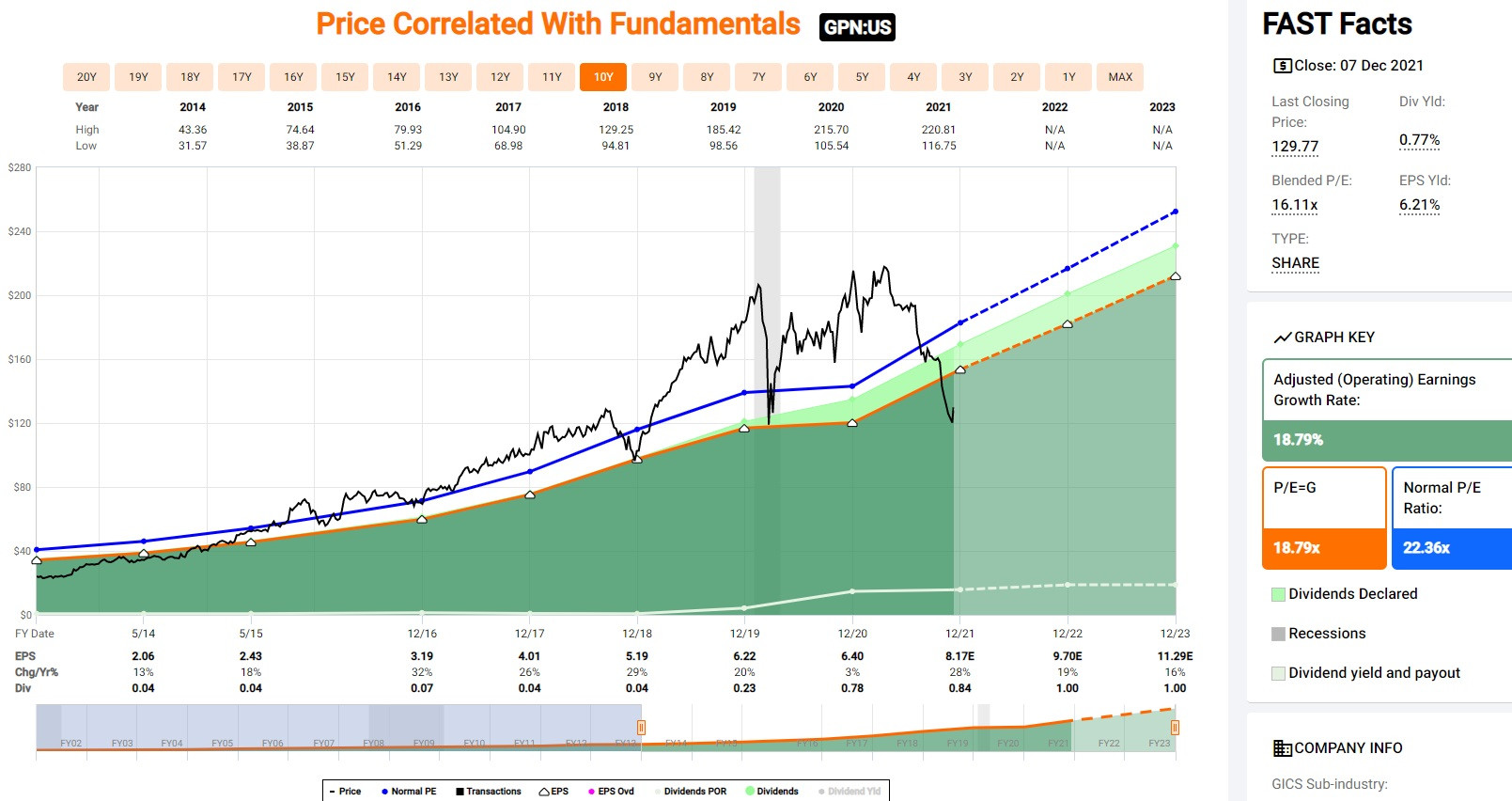

Fundamental sieht's auch gerade günstig aus.

Zeit einzusteigen.

Fundamental sieht's auch gerade günstig aus.

Zeit einzusteigen.

Tja...gute Frage wo die Aktie mal drehen wird.

Also 150 Dollar

ist gut jetzt! Jetzt wird es Zeit das 20-30% nach oben kommen!

super Zahlen und die Aktie fällt, genau wie Fiserv...

Schwer zu sagen, man sollte nicht vergessen, dass die Aktie sehr teuer ist (KGV 110)

Das Wachstum (EBIT und Umsatz) ist ja ziemlich gut, und das bei einem stabile Geschäftsmodell. Glaubt ihr da sind Kurssprünge zu erwarten ?

Coronabedingt ist das 2. Quartal jetzt nicht das allerbeste aber ansonsten läuft die Firma und da wundert es mich das die so rumdümpelt.

Beim 1-Jahreschart hat sich ein Dreieck ausgebildet. Ob das zum Ausbruch nach oben verleitet, bleibt offen.

Antwort auf Beitrag Nr.: 64.248.634 von bernstedter am 01.07.20 10:12:46

Aber die Kursentwicklung stimmt nicht. Daher steige ich beim global aus -leider mit Verlust aber ich traue GP nicht viel zu - und lege anders an. Siehe auch Nvidia. Chart und Forum.

Zitat von bernstedter: bin jetzt seit Vorgestern hier investiert, nachdem auch ich gut Geld verloren habe bei Wirecard...

Habe überlegt ob Fiserv oder GP, am Ende ist es GP geworden da mir hier die Entwicklung von Gewinn und Umsatz besser aussah. Wiederum sah mir Fiserv aber charttechnisch besser aus.

Aber die Kursentwicklung stimmt nicht. Daher steige ich beim global aus -leider mit Verlust aber ich traue GP nicht viel zu - und lege anders an. Siehe auch Nvidia. Chart und Forum.

bin jetzt seit Vorgestern hier investiert, nachdem auch ich gut Geld verloren habe bei Wirecard...

Habe überlegt ob Fiserv oder GP, am Ende ist es GP geworden da mir hier die Entwicklung von Gewinn und Umsatz besser aussah. Wiederum sah mir Fiserv aber charttechnisch besser aus.

Habe überlegt ob Fiserv oder GP, am Ende ist es GP geworden da mir hier die Entwicklung von Gewinn und Umsatz besser aussah. Wiederum sah mir Fiserv aber charttechnisch besser aus.

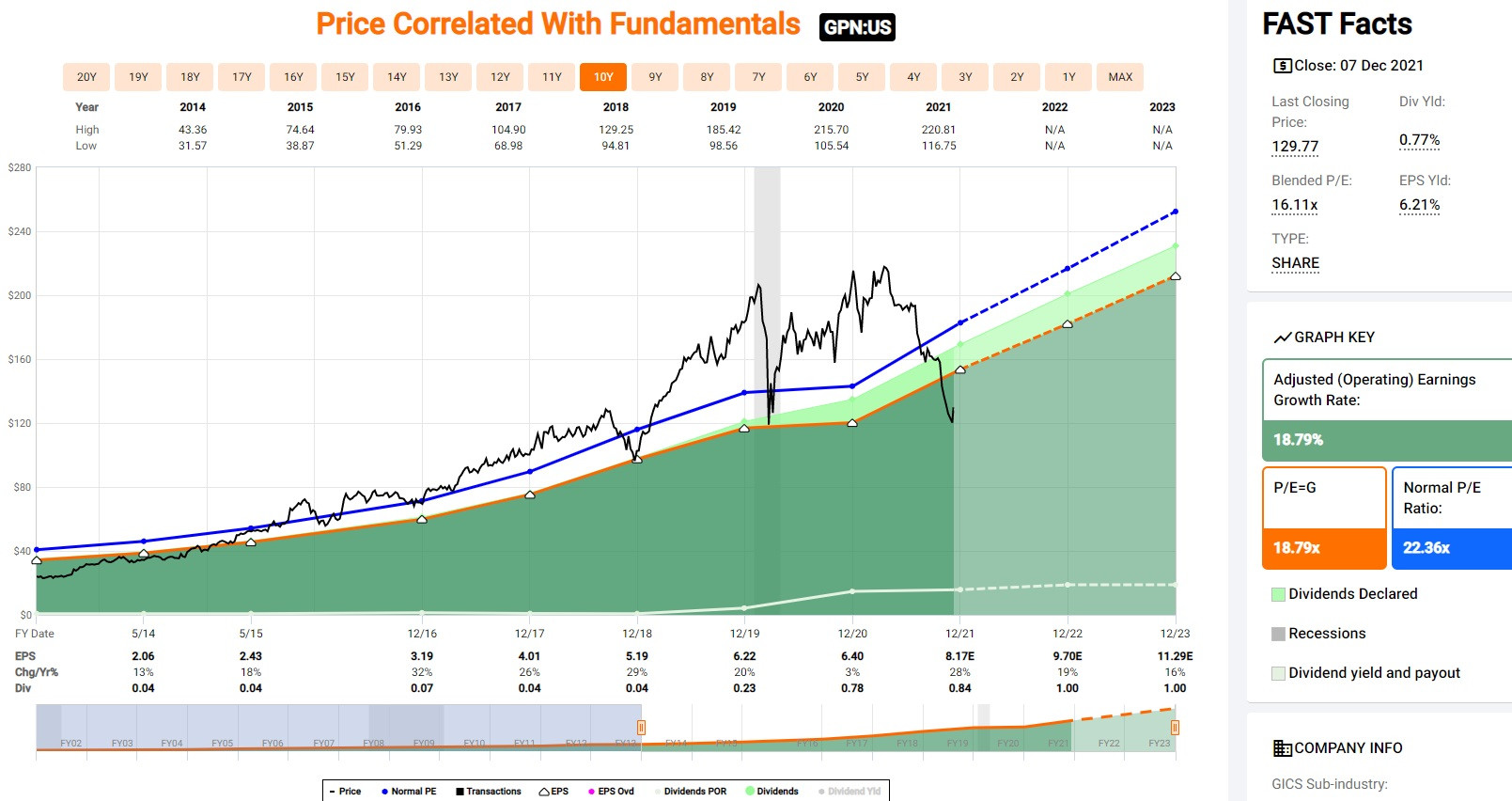

Quelle und weiter unter: https://investors.globalpaymentsinc.com/news-releases/news-r…

"We entered 2020 with our business as healthy as it had ever been in the decade since I have been at Global Payments," said Jeff Sloan, Chief Executive Officer. "In the first quarter, our focus on execution enabled us to meaningfully expand operating margins and grow adjusted earnings per share in the high teens despite the impact of COVID-19, highlighting the importance of scale in payments. We are very grateful to our team members around the world who have continued to provide excellent support to our customers and the communities in which we live and work during this difficult time.”

Sloan continued, "We are delighted that Truist Financial Corporation has selected Global Payments to be its provider of issuer processing services for its combined business. Truist is the sixth largest commercial bank in the United States, serving approximately twelve million consumer households and a full range of business clients with leading market share in many of the most attractive, high growth markets in the country. Truist’s strategy to transform its payments businesses via technology aligns perfectly with our TSYS issuer business and provides further validation of our market leading technologies, products and services and the quality and competitiveness of our team members. We could not be more pleased to welcome Truist to the Global Payments family of partners and launch our new services in the future."

First Quarter 2020 Summary

# GAAP revenues were $1.904 billion, compared to $883 million in the first quarter of 2019; diluted earnings per share were $0.48 compared to $0.71 in the prior year; and operating margin was 12.8%.

# Adjusted net revenue grew to $1.729 billion, compared to $1.725 billion in the first quarter of 2019 on a combined basis.

# Adjusted earnings per share grew 18% to $1.58, compared to $1.34 in the first quarter of 2019.

# Adjusted operating margin of 39.0% expanded 300 basis points on a combined basis.

Global Payments Lowers Q1 Expectations, Removes Full Year Guidance

Atlanta-based Global Payments (GPN) has announced that it is reducing expectations for 1Q20 based on a material slowdown in activity to end the quarter. Furthermore, the company suspended its full year 2020 guidance given uncertainties around the duration and severity of COVID-19.“Adjusting for the updated guidance, our 1Q EPS moves to $1.54 (from $1.67). Our 2020 EPS moves to $6.30 (from $6.85). Our one-year price target moves to $158 (from $168), applying a 25x multiple” commented Rosenblatt Securities’ Kenneth Hill on the news.

To counter some of the headwinds, GPN has, and will continue to, reduce expenses where appropriate. The company expects to provide a more thorough update on its 1Q20 earnings call.

“Starting in mid-March COVID-19 began to impact the company’s results significantly in North America and Europe as governments took actions to encourage social distancing and implement shelter in place directives” GPN told investors.

“The deterioration accelerated toward the end of March as the pandemic spread further and the number of countries and localities adopting restrictive measures meaningfully increased.”

As a result, the company now expects the year-over-year GAAP revenue and GAAP earnings per share trends for the first quarter to be roughly consistent with the fourth quarter of 2019.

Nonetheless, GPN maintains an overall bullish outlook from the Street, with a Strong Buy analyst consensus.

Quelle und weiter unter: https://finance.yahoo.com/news/global-payments-lowers-q1-exp…

2020 Outlook

“We delivered outstanding financial results that exceeded our expectations for both the fourth quarter and the full year 2019,” said Paul Todd, Senior Executive Vice President and Chief Financial Officer. “Based on our strong performance and continuing momentum, we are optimistic about the financial outlook for our business. The company expects full year 2020 adjusted net revenue of $7.68 billion to $7.75 billion, representing growth of 67% to 69%, or 8% to 9% on a combined basis. Annual adjusted operating margin for 2020 is expected to expand by up to 250 basis points on a combined basis and by up to 75 basis points on a reported basis. We expect adjusted earnings per share growth of 20% to 23% over 2019.”Quelle und weiter unter: https://www.marketwatch.com/press-release/global-payments-re…

Global Payments Reports Fourth Quarter and Full Year 2019 Results and Establishes 2020 Growth Outlook

"We delivered one of the finest strategic, operational and financial years in our history in 2019. Our transformational merger with TSYS redefined our industry landscape, creating the worldwide leader in payments technology," said Jeff Sloan, Chief Executive Officer. "Our differentiated focus on software, partnered and owned, omnichannel solutions and faster growth markets generated significant competitive wins and enabled our expansion into new geographies, further validating the distinctiveness of our business model."Sloan added, "Our momentum continued in the fourth quarter of 2019, with growth accelerating as we exceeded our expectations for the quarter and year. Looking forward, we are tremendously excited about the opportunities that will enable us to maintain industry leading growth as a combined company."

Full Year 2019 Summary

GAAP revenues were $4.91 billion, compared to $3.37 billion in 2018; diluted earnings per share were $2.16 compared to $2.84 in the prior year; and operating margin was 16.1%.

Adjusted net revenue [1] grew 48% to $4.59 billion, compared to $3.10 billion in 2018. As previously disclosed, this new non-GAAP revenue convention does not include the addition of network fees.

Adjusted earnings per share grew 20% to $6.22, compared to $5.19 in 2018.

Adjusted operating margin was 39.7%, substantially exceeding our expectations.

Quelle und weiter unter: https://www.marketwatch.com/press-release/global-payments-re…

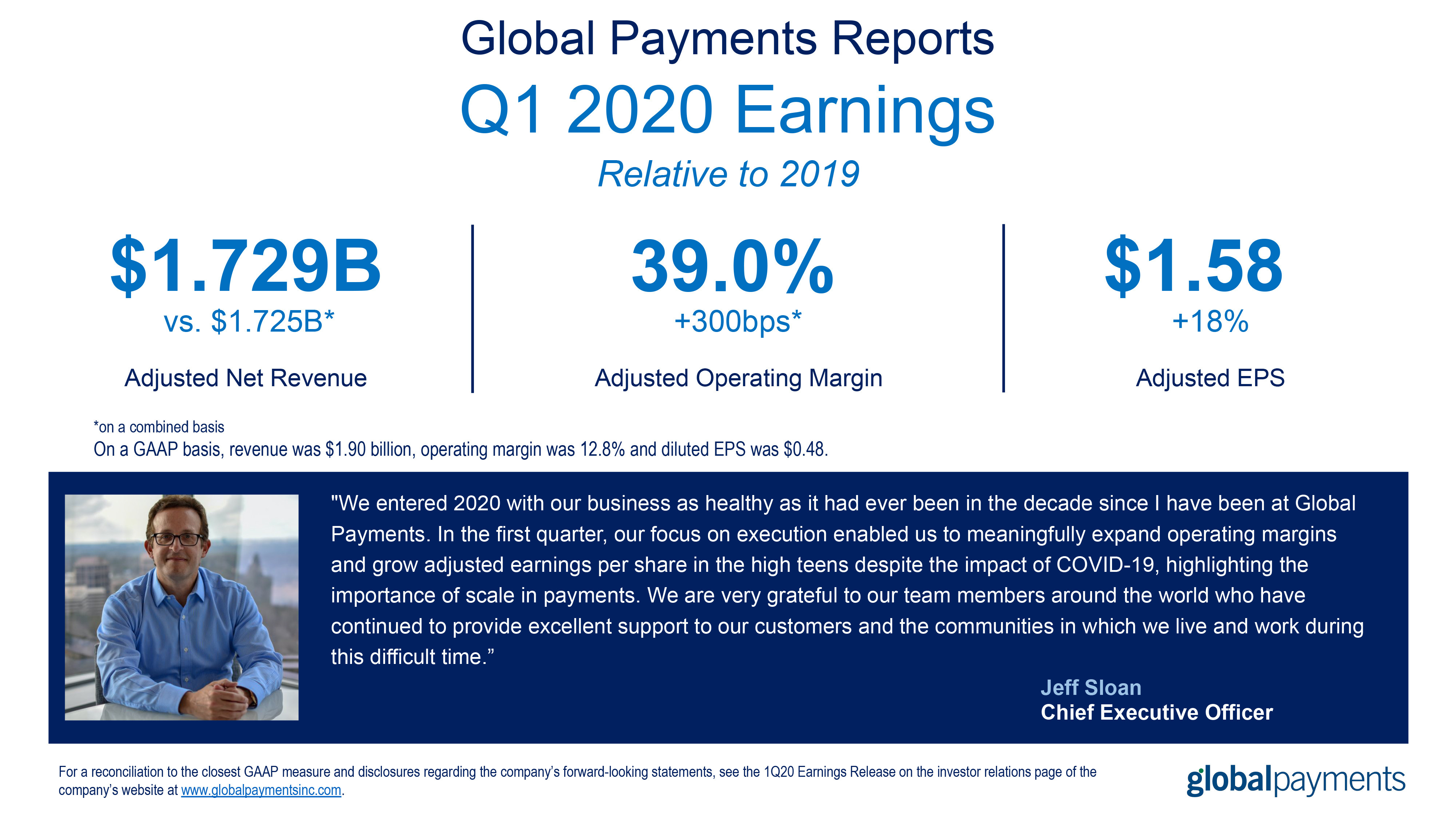

Zusammenfassung 2019

Quelle: finanzen.net

global payments

Quelle: https://www.tradingview.com

#) GPN hat gute Q3 Zahlen gemeldet und den outlook erhöht

#) die Integration von TSYS schreitet erfolgreich voran

#) GPN ist Teil meines wikifolio und gut im Plus

#) GPN erzielt nach einer kleinen Verschnaufpause gerade wieder ein neues ATH nach dem anderen

#) => einfach laufen lassen

Global Payments Announces Strategic Partnership with Desjardins Group in Canada

ATLANTA--(BUSINESS WIRE)--Oct. 31, 2019-- Global Payments Inc. (NYSE: GPN), a leading worldwide provider of payment technology and software solutions, today announced an agreement with Desjardins Group, the leading cooperative financial group in Canada, to acquire its existing merchant acquiring business and portfolio of approximately 40,000 merchants. As part of the transaction, Global Payments will enter into an exclusive 10-year marketing alliance agreement under which Desjardins will refer members to Global Payments for payment technology and acquiring solutions.Desjardins Group is the sixth largest financial institution in Canada by deposits, with approximately 1,000 branches and over 7 million members and clients. Its merchant acquiring business is a leader in Quebec, providing payment solutions to businesses across a wide range of verticals.

Quelle und weiter unter: https://investors.globalpaymentsinc.com/news-releases/news-r…

das läuft einfach, einfach weiterlaufen lassen

Global Payments Increases 2019 Outlook

WASHINGTON (dpa-AFX) - Global Payments Inc. (GPN) increased its 2019 outlook for adjusted earnings per share to a range of $6.12 to $6.20, reflecting growth of 18 percent to 20 percent over 2018. The company now projects adjusted net revenue plus network fees for 2019 to range from $5.60 billion to $5.63 billion, reflecting growth of 41 percent to 42 percent over 2018. Analysts polled by Thomson Reuters expect the company to report profit per share of $6.17, on revenue of $5.51 billion. Analysts' estimates typically exclude special items.

For the third-quarter, adjusted earnings per share grew 18.1 percent to $1.70, compared to $1.44, prior year. On average, 29 analysts polled by Thomson Reuters expected the company to report profit per share of $1.67, for the quarter.

Third-quarter adjusted net revenue plus network fees grew 27.4 percent to $1.306 billion, compared to $1.025 billion in 2018. Analysts expected revenue of $1.16 billion, for the quarter.

Global Payments' Board approved a dividend of $0.195 per share payable December 27, 2019 to shareholders of record as of December 13, 2019.

Shares of Global Payments were up 2% in pre-market trade on Thursday.

WASHINGTON (dpa-AFX) - Global Payments Inc. (GPN) increased its 2019 outlook for adjusted earnings per share to a range of $6.12 to $6.20, reflecting growth of 18 percent to 20 percent over 2018. The company now projects adjusted net revenue plus network fees for 2019 to range from $5.60 billion to $5.63 billion, reflecting growth of 41 percent to 42 percent over 2018. Analysts polled by Thomson Reuters expect the company to report profit per share of $6.17, on revenue of $5.51 billion. Analysts' estimates typically exclude special items.

For the third-quarter, adjusted earnings per share grew 18.1 percent to $1.70, compared to $1.44, prior year. On average, 29 analysts polled by Thomson Reuters expected the company to report profit per share of $1.67, for the quarter.

Third-quarter adjusted net revenue plus network fees grew 27.4 percent to $1.306 billion, compared to $1.025 billion in 2018. Analysts expected revenue of $1.16 billion, for the quarter.

Global Payments' Board approved a dividend of $0.195 per share payable December 27, 2019 to shareholders of record as of December 13, 2019.

Shares of Global Payments were up 2% in pre-market trade on Thursday.

peer group - Vergleich

Quelle: finanzen.net

Global Payments Inc. (NYSE: GPN) today announced results for the second quarter ended June 30, 2019.

"We are pleased to report double digit growth this quarter, an acceleration from terrific first quarter results and further validation of our technology-enabled strategies," said Jeff Sloan, Chief Executive Officer. "We also made substantial progress on our landmark partnership with TSYS announced in May, which we now expect to close as early as the beginning of the fourth quarter." Sloan continued, "Our preliminary integration work with TSYS has reinforced our confidence in the value creation from the transaction, particularly the ability to drive significant revenue enhancements. We believe there are meaningful opportunities that are worldwide in scope across all three of TSYS' business segments. We look forward to a successful closing."....... https://www.wallstreet-online.de/nachricht/11638766-global-p…

Global Payments Reports Results for Second Quarter 2019 and Increases 2019 Outlook

Second Quarter 2019 Summary .

# GAAP revenues were $935.2 million, compared to $833.2 million in the second quarter of 2018; diluted earnings per share

.... were $0.77 compared to $0.68 in the prior year; and operating margin was 23.7% compared to 22.9% in 2018.

# Adjusted net revenue plus network fees grew 13.4% to $1.114 billion, compared to $982.5 million in 2018.

# Adjusted earnings per share grew 17.1% to $1.51, compared to $1.29 in 2018. #

Adjusted operating margin expanded 100 basis points to 32.4%.

Chart - Global Payments Inc.

# "abartiger"  Chart, langfristig betrachtet ...

Chart, langfristig betrachtet ...# neues all-time-high ATH in USA

# MACD dreht gerade wieder nach oben

Global Payment sichert sich neue Kreditlinien im Zuge der Übernahme von Total System Services

Global Payments Establishes New Credit Agreement15.07.2019

Global Payments Inc. (NYSE: GPN), a leading worldwide provider of payment technology and software solutions, successfully closed a new senior unsecured $2 billion term loan and an unsecured $3 billion revolving credit facility on July 9, 2019 in connection with its previously announced merger with Total System Services, Inc. (TSYS). The facilities will be available for borrowing on the date the merger becomes effective and are expected to replace Global Payments’ existing secured credit facilities and TSYS’ unsecured revolving credit facility.

....... https://www.wallstreet-online.de/nachricht/11604865-global-p…

Global Payments could announce $20 billion deal for Total System Services on Tuesday: CNBC

https://www.marketwatch.com/story/global-payments-could-anno…https://www.finanzen.net/nachricht/aktien/total-system-servi…

Global Payments ist Teil meines wikifolios - und liegt mit 15,5% im Plus

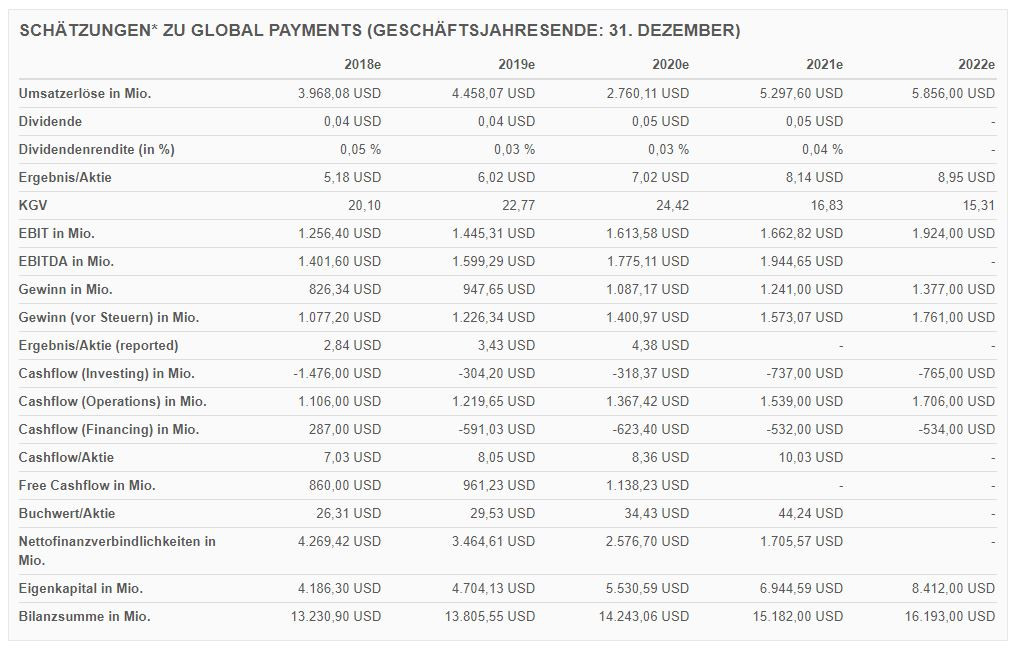

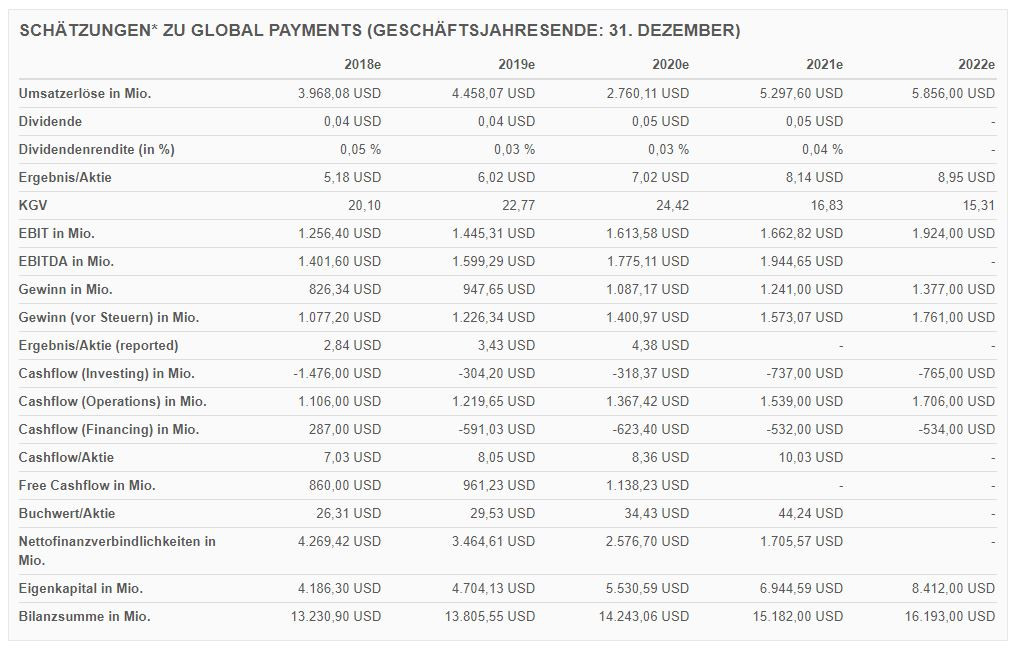

Ergebnis soll steigen die nächsten Jahre ....

Quelle: FactSet - Stand 10.04.2019

weiterführende Informationen unter https://www.mobilepayment.digital/

bzw. in meinem wikifolio ( Link in der Fusszeile )

Ergebnis soll steigen die nächsten Jahre ....

Quelle: FactSet - Stand 10.04.2019

weiterführende Informationen unter https://www.mobilepayment.digital/

bzw. in meinem wikifolio ( Link in der Fusszeile )

Chart läuft wie am Schnürchen

Global Payments Reports Record Annual Results for 2018 and Establishes 2019 Growth Outlook